Exhibit 99.4

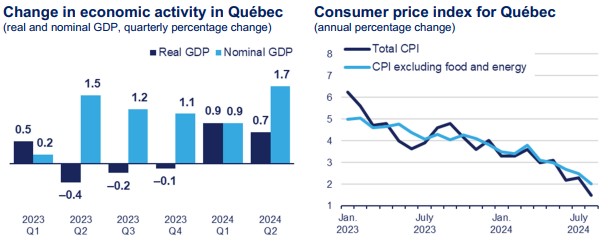

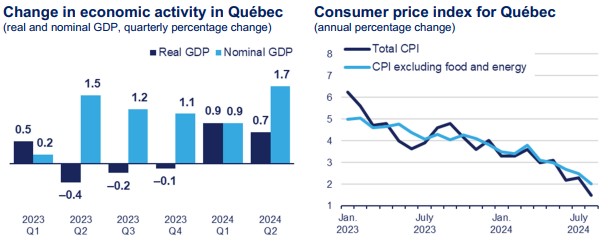

Economic growth is gradually resuming in Québec, with real GDP growth of 0.7% for the first two quarters of 2024 compared with the same period in 2023. Inflation moderated to 1.5% in August 2024, after peaking at 8.0% in June 2022.

Based on the results as at June 30, 2024, on recent changes in economic activity and on currently known factors that will affect the financial framework between now and the end of the fiscal year, the budgetary deficit forecast for 2024-2025 remains unchanged compared with the 2024-2025 budget forecast. It therefore stands at $11.0 billion (1.9% of GDP), after deposits of dedicated revenues in the Generations Fund of $2.2 billion. Moreover, the $1.5 billion contingency reserve included in the financial framework is maintained.

• The deficit related to activities, i.e., before deposits of dedicated revenues in the Generations Fund, stands at $8.8 billion (1.5% of GDP).

Expenditures have been adjusted upwards, due in particular to the preliminary assessment of the cost of the 2024 summer floods and the higher interest rates observed at the beginning of the year. However, these adjustments are offset by an upward adjustment to revenues resulting, in particular, from changes in economic activity and the measures announced in the federal budget of April 2024.

As a result, revenues are expected to reach $150.8 billion for the year as a whole, while expenditures, including the contingency reserve and deposits of dedicated revenues in the Generations Fund, are expected to stand at $161.8 billion.

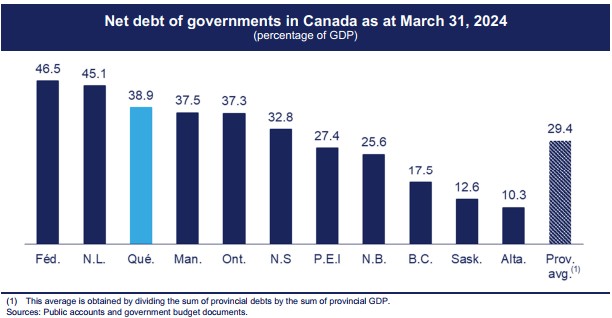

The net debt burden is expected to be 40.2% of GDP as at March 31, 2025, which is 0.1 percentage points lower than forecast in the March 2024 budget, due to the downward adjustment of the debt level at the start of the fiscal year, that is, as at March 31, 2024.

Moreover, since the start of 2024-2025,1 borrowings issued amount to $16.8 billion, or 46% of the forecast financing program.

(1) The contingency reserve, as well as deposits of dedicated revenues in the Generations Fund, are presented under expenditures for illustrative purposes.

| | |

1 Long-term borrowings issued between April 1, 2024 and June 30, 2024. |

Section 1: Recent Developments and Budgetary Outlook in Brief

Recent developments in the economic situation

After stagnating in 2023 (0.2%), economic growth is gradually resuming. For the first two quarters of 2024, compared with the corresponding period in 2023, real GDP recorded a gain of 0.7%.

Since the start of 2024, annual growth in the consumer price index (CPI) has significantly slowed in both Québec and Canada.

• In Québec, annual inflation decelerated to 1.5% in August 2024 (2.0% in Canada), the lowest increase recorded since January 2021.

Due to the slowdown in price growth in Canada, the Bank of Canada has made three consecutive cuts in its policy rate since June 2024, bringing it to 4.25%.

• More cuts are expected in 2024, which should help boost economic growth.

In Québec, nominal GDP grew by 4.8% in the first two quarters of 2024, compared with the same period in 2023 (3.7% in 2023).

Despite the recovery in economic growth observed since the start of 2024, the labour market is moderating. Between August 2023 and August 2024, only 11 600 jobs were created (0.3%). The unemployment rate rose from 4.4% in August 2023 to 5.7% in August 2024.

• Nevertheless, the labour market remains tight. Québec's unemployment rate (5.7% in August) remains one of the lowest among all provinces (6.6% in Canada), and the employment rate for people aged 15 to 64 (76.6% in August) is the highest in the country (74.2% in Canada).

The moderation in the labour market is reflected in wages and salaries, which rose by 5.1% in the first two quarters of 2024 compared with the same period in 2023 (6.0% in 2023). Despite this slowdown, wage growth outpaces inflation in 2024.

High interest rates and the moderation in the job market are affecting household consumption expenditure. The value of household spending grew by 5.1% in the first two quarters of 2024, compared with the corresponding period in 2023 (5.6% in 2023).

The net operating surplus of corporations declined by 0.7% in the first two quarters of 2024. This trend is explained by moderating demand for goods and services, lower prices for natural resource exports, wage gains and high interest rates.

Section 1: Recent Developments and Budgetary Outlook in Brief

Summary of results and financial outlook for 2024-2025

► Results as at June 30, 2024

For the first three months of 2024-2025, the budgetary balance within the meaning of the Balanced Budget Act shows a deficit of $2.6 billion. This represents a deterioration of $2.0 billion compared with the same period last year.

This result is due to the following factors:

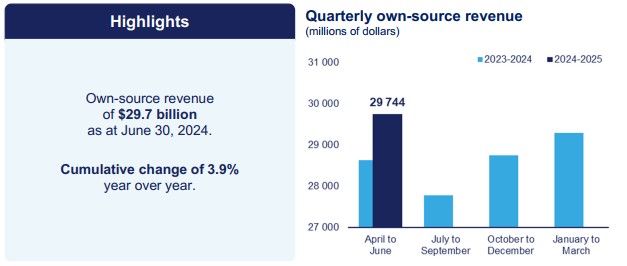

• revenues of $36.9 billion, an increase of 2.9% compared with the same period the previous year. This increase was mainly due to higher tax revenues, reflecting the trend in economic activity, particularly wages and salaries. However, the increase in tax revenues was offset by lower revenues from exports by Hydro-Québec;

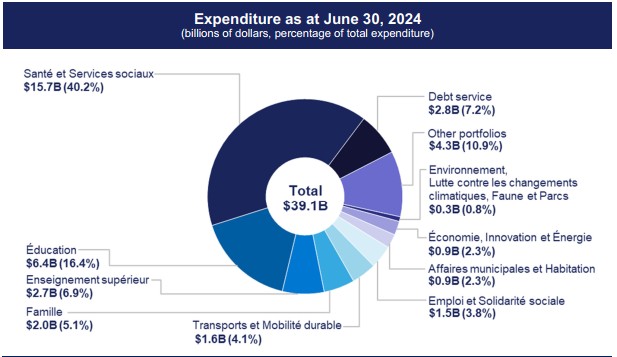

• expenditures of $39.1 billion, representing growth of 8.5% compared with the same period the previous year. This growth is largely attributable to portfolio expenditures (8.1%), notably those for health and social services and education;

• deposits of dedicated revenues in the Generations Fund of $469 million.

► Budgetary outlook for 2024-2025

Based on the results for April to June 2024, on recent changes in economic activity and on currently known factors that will affect the financial framework between now and the end of the fiscal year, the budgetary deficit forecast for 2024-2025 is maintained at $11.0 billion, as presented in the March 2024 budget.

• This deficit includes a contingency reserve of $1.5 billion.

As a result, revenues are expected to reach $150.8 billion, while expenditures, including the contingency reserve and deposits of dedicated revenues in the Generations Fund, are expected to stand at $161.8 billion.

• Revenues have been adjusted upwards by $490 million since the March 2024 budget, and are expected to reach $150.8 billion, representing annual growth of 3.6%.

• Own-source revenue is adjusted upwards by $250 million, due in particular to changes in economic activity and the effect of the harmonization with certain measures proposed in the April 2024 federal budget, including the increase in the capital gains inclusion rate. This increase is partly offset by lower revenues from government enterprises, mainly due to the downward revision of expected returns on Investissement Québec portfolios.

• Federal transfers are adjusted upwards by $240 million due, among other things, to the April 2024 federal budget announcements.

Section 1: Recent Developments and Budgetary Outlook in Brief

• Expenditures are adjusted upwards by $490 million since the March 2024 budget and are expected to stand at $158.1 billion, representing annual growth of 4.3%.

• Portfolio expenditures are adjusted upwards by $300 million to a projected total of $148.1 billion. This increase is due to the preliminary assessment of the cost of the 2024 summer floods.

• Debt service is adjusted upwards by $190 million and is expected to stand at $10.0 billion. This adjustment is mainly due to higher-than-expected interest rates at the beginning of the fiscal year.

• Deposits of dedicated revenues in the Generations Fund remain unchanged and are expected to reach $2.2 billion.

| Summary of results as at June 30, 2024 and budgetary outlook for 2024-2025 |

| (unaudited data, millions of dollars, year-over-year change) |

| | | | Forecast for fiscal 2024-2025 |

| | April to June | | March 2024

budget | | New

estimate(1) |

| | 2023-

2024- | 2024-

2025- | Change

($M) | Change

(%) | | Level

($M) | Change

(%) | | Adjustment

($M) | Level

($M) | Change

(%) |

| Own-source revenue | 28 638 | 29 744 | 1 106 | 3.9 | | 120 904 | 4.7 | | 250 | 121 154 | 5.7 |

| Federal transfers | 7 234 | 7 165 | -69 | −1.0 | | 29 397 | −6.0 | | 240 | 29 637 | −4.0 |

| Total revenue | 35 872 | 36 909 | 1 037 | 2.9 | | 150 301 | 2.4 | | 490 | 150 791 | 3.6 |

| Portfolio expenditures | −33 616 | −36 331 | −2 715 | 8.1 | | −147 815 | 4.6 | | −300 | −148 115 | 4.6 |

| Debt service | −2 424 | −2 755 | −331 | 13.7 | | −9 762 | 1.2 | | −190 | −9 952 | −0.3 |

| Total expenditure | −36 040 | −39 086 | −3 046 | 8.5 | | −157 577 | 4.4 | | −490 | −158 067 | 4.3 |

| Contingency reserve | - | - | - | - | | −1 500 | - | | - | −1 500 | - |

OPERATING

SURPLUS (DEFICIT)(2) | −168 | −2 177 | −2 009 | - | | −8 776 | - | | - | −8 776 | - |

BALANCED

BUDGET ACT | | | | | | | | | | | |

| Deposits of dedicated revenues in the Generations Fund | −483 | −469 | 14 | - | | −2 222 | - | | - | −2 222 | - |

| BUDGETARY BALANCE(3) | −651 | −2 646 | −1 995 | - | | −10 998 | - | | - | −10 998 | - |

(1) The percentage change has been updated on the basis of the 2023-2024 results published in the Public Accounts 2023-2024.

(2) Balance within the meaning of the public accounts.

(3) Budgetary balance within the meaning of the Balanced Budget Act.

► Additional information

The net debt burden is expected to be 40.2% of GDP as at March 31, 2025, which is 0.1 percentage points lower than forecast in the March 2024 budget, due to the downward adjustment of the debt level at the start of the fiscal year, that is, as at March 31, 2024.

Section 2: Detailed Results and Budgetary Outlook

Revenue

Own-source revenue

► Results as at June 30, 2024

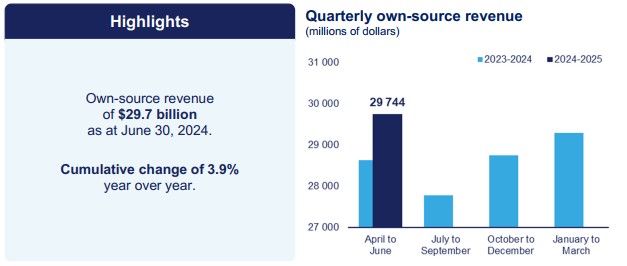

As at June 30, that is, for the first three months of the year 2024-2025, own-source revenue amounted to $29.7 billion. This represents an increase of $1.1 billion (3.9%) compared with the same period last year.

Tax revenue rose by $916 million (4.0%) to $23.6 billion. This increase is mainly due to:

a $828-million increase (8.1%) in personal income tax and a $169-million (8.2%) increase in contributions for health services attributable, in particular, to wages and salaries, which grew by 5.1% in the first two quarters of 2024;

a $13-million increase (0.5%) in corporate tax revenues, linked to a 4.0% rise in exports in the first two quarters of 2024. This effect was partly offset by a 0.7% decrease in net operating surplus of corporations for the same period;

a $12-million increase (4.3%) in school property tax revenues due to changes in local needs funding, which takes into account the anticipated growth in the number of students and in the cost of goods and services financed by school property tax;

a $106-million decrease (−1.4%) in consumption taxes, attributable mainly to an increase in input tax refunds. This effect is partly offset by an increase in revenue due to the 5.1% rise in household consumption for the first two quarters of 2024.

Section 2: Detailed Results and Budgetary Outlook

Other own-source revenue increased by $403 million (8.4%) to $5.2 billion, due to:

a $206-million increase (14.9%) in duties and permits, stemming mainly from higher royalties from natural resources, including forest resources, and higher revenues from the auction of GHG emission allowances;

a $197-million increase (5.7%) in miscellaneous revenues attributable, among other things, to higher revenues from the sale of goods and services and higher interest income related to tax debts administered by Revenu Québec.

Revenue from government enterprises fell by $213 million (−18.9%), to $915 million.

- This change is mainly attributable to a decrease in Hydro Québec's results, mainly due to the drop in its exports stemming from low precipitation in the geographic regions where its main basins are located.

| Own-source revenue |

| (unaudited data, millions of dollars, year-over-year change) |

| | | | Forecast for fiscal 2024-2025 |

| | April to June | | March 2024

budget | | New

estimate(1) |

| | 2023-

2024 | 2024-

2025 | Change

($M) | Change

(%) | | Level

($M) | Change

(%) | | Adjustment

($M) | Level

($M) | Change

(%) |

Income and

property taxes | | | | | | | | | | | |

| - Personal income tax | 10 262 | 11 090 | 828 | 8.1 | | 44 952 | 6.0 | | −400 | 44 552 | 6.4 |

| - Contributions for health services | 2 056 | 2 225 | 169 | 8.2 | | 8 670 | 4.5 | | 100 | 8 770 | 2.8 |

| - Corporate taxes | 2 673 | 2 686 | 13 | 0.5 | | 12 116 | 6.3 | | 750 | 12 866 | 12.8 |

| - School property tax | 279 | 291 | 12 | 4.3 | | 1 310 | 15.2 | | −105 | 1 205 | 4.8 |

| Consumption taxes | 7 426 | 7 320 | −106 | −1.4 | | 27 991 | 3.2 | | - | 27 991 | 3.4 |

| Tax revenue | 22 696 | 23 612 | 916 | 4.0 | | 95 039 | 5.2 | | 345 | 95 384 | 5.9 |

| Duties and permits | 1 387 | 1 593 | 206 | 14.9 | | 5 940 | 1.9 | | - | 5 940 | 0.9 |

| Miscellaneous revenue | 3 427 | 3 624 | 197 | 5.7 | | 14 507 | 2.8 | | - | 14 507 | 7.4 |

| Other own-source revenue | 4 814 | 5 217 | 403 | 8.4 | | 20 447 | 2.5 | | - | 20 447 | 5.4 |

| Total own-source revenue excluding revenue from government enterprises | 27 510 | 28 829 | 1 319 | 4.8 | | 115 486 | 4.7 | | 345 | 115 831 | 5.9 |

| Revenue from government enterprises | 1 128 | 915 | −213 | −18.9 | | 5 418 | 4.3 | | −95 | 5 323 | 1.6 |

| TOTAL | 28 638 | 29 744 | 1 106 | 3.9 | | 120 904 | 4.7 | | 250 | 121 154 | 5.7 |

(1) The percentage change has been updated on the basis of the 2023-2024 results published in the Public Accounts 2023-2024.

Section 2: Detailed Results and Budgetary Outlook

► Budgetary outlook for 2024-2025

Own-source revenue is forecast at $121.2 billion in 2024-2025 (annual growth of 5.7%), an upward revision of $250 million from the March 2024 budget forecast.

• Own-source revenue excluding revenue from government enterprises is revised upwards by $345 million in 2024-2025. This revision is mainly due to:

• the $400-million downward adjustment to personal income tax stemming in particular from the recurrence of less favourable results than anticipated following the processing of tax returns for the 2023 taxation year;

• the $100-million upward adjustment to contributions for health services, attributable in particular to the recurrence of better-than-expected results from source deductions at the end of the 2023-2024 year, taking into account the upward adjustment to wages and salaries of 0.7 percentage points in the first quarter of 2024;

• the $750-million upward adjustment to corporate taxes due to the recurrence of higher-than-expected revenues at the end of 2023-2024, and to the effect of harmonization with certain measures proposed in the April 2024 federal budget, including the increase in the capital gains inclusion rate;

• the $105-million downward adjustment to school property tax revenues resulting from the Québec government's additional contribution, intended to limit the average increase in school tax accounts to 3% for 2024-2025;

• The forecast for revenue from government enterprises has been adjusted downward by $95 million, mainly due to a downward adjustment of expected returns on Investissement Québec portfolios.

Section 2: Detailed Results and Budgetary Outlook

Composition of own-source revenue

Own-source revenue excluding revenue from government enterprises consists mainly of tax revenue, that is personal income tax, contributions for health services, corporate taxes, school property tax and consumption taxes.

- Changes in own-source revenue generally reflect changes in economic activity in Québec and in the tax system.

Own-source revenue also includes other sources of revenue:

- duties and permits, in particular revenue from the carbon market;

- miscellaneous revenue, such as tuition fees and revenues from interest, the sale of goods and services, as well as fines, forfeitures and recoveries.

Government enterprises consist of public corporations that play a commercial role, have managerial autonomy and are financially self-sufficient.

- Revenue from government enterprises corresponds in large part to the net earnings of these enterprises.

Section 2: Detailed Results and Budgetary Outlook

Revenue

Federal transfers

► Results as at June 30, 2024

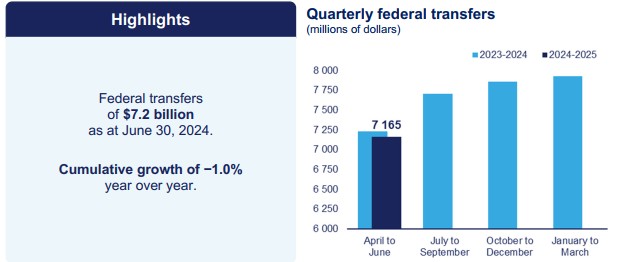

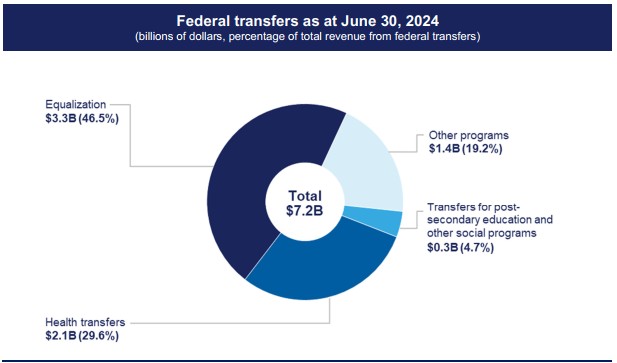

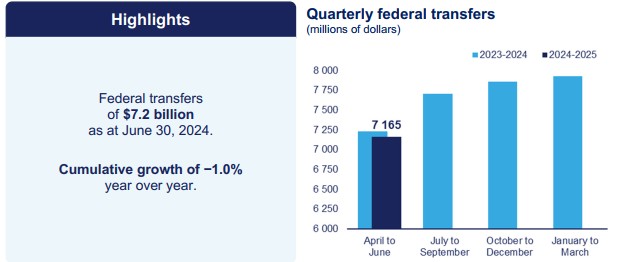

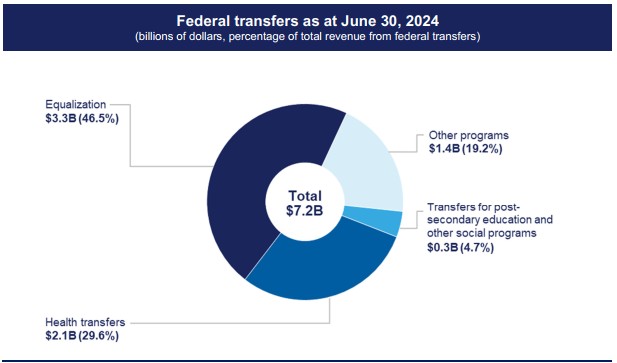

As at June 30, for the first three months of 2024-2025, federal transfers totalled $7.2 billion. This represents a decrease of $69 million (−1.0%) compared with the same period last year. This variation is explained, among other things, by a decrease in equalization resulting from changes made by the federal government to this program as part of its March 2023 budget.

• These changes mainly concern the estimate of provincial fiscal capacity for the non-residential property tax base.

| Federal transfers |

| (unaudited data, millions of dollars, year-over-year change) |

| | | | Forecast for fiscal 2024-2025 |

| | April to June | | March 2024

budget | | New

estimate(1) |

| | 2023-

2024 | 2024-

2025 | Change

($M) | Change

(%) | | Level

($M) | Change

(%) | | Adjustment

($M) | Level

($M) | Change

(%) |

| Equalization | 3 509 | 3 329 | −180 | −5.1 | | 13 316 | −5.1 | | — | 13 316 | −5.1 |

| Health transfers | 2 165 | 2 120 | −45 | −2.1 | | 8 554 | −2.6 | | 51 | 8 605 | −1.3 |

| Transfers for post-secondary education and other social programs | 342 | 338 | −4 | −1.2 | | 1 351 | −6.9 | | −12 | 1 339 | −7.7 |

| Other programs | 1 218 | 1 378 | 160 | 13.1 | | 6 176 | −12.1 | | 201 | 6 377 | −4.5 |

| TOTAL | 7 234 | 7 165 | −69 | −1.0 | | 29 397 | −6.0 | | 240 | 29 637 | −4.0 |

(1) The percentage change has been updated on the basis of the 2023-2024 results published in the Public Accounts 2023-2024.

Section 2: Detailed Results and Budgetary Outlook

► Budgetary outlook for 2024-2025

Federal transfers are expected to reach $29.6 billion (annual variation of −4.0%) in 2024-2025. This represents an upward adjustment of $240 million from the March 2024 budget forecast, due in part to announcements in the April 2024 federal budget.

Composition of federal transfers

Revenue from federal transfers consist of federal government revenues paid to Québec under the Federal-Provincial Fiscal Arrangements Act, in addition to revenues from other programs under bilateral agreements.

These revenues mainly come from:

- the equalization program;

- the Canada Health Transfer (CHT);

- the Canada Social Transfer (CST);

- other programs resulting from agreements with the federal government in various fields (e.g.: immigrant integration, early learning and childcare, labour market and infrastructure).

Section 2: Detailed Results and Budgetary Outlook

Expenditure

Portfolio expenditures and debt service

► Results as at June 30, 2024

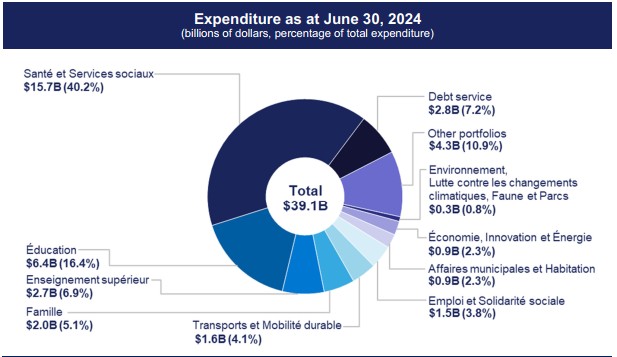

As at June 30, that is, for the first three months of 2024-2025, expenditure totalled $39.1 billion. This represents an increase of $3.0 billion (8.5%) compared with the same period last year.

Portfolio expenditures rose by $2.7 billion (8.1%) to $36.3 billion. In addition to the expected change in costs related to the delivery of public services, the growth observed as at June 30, 2024 can be explained by these factors:

• expenditure in the Santé et Services sociaux portfolio increased by $799 million (5.4%) to $15.7 billion. This increase is due in particular to changes in compensation and expenditures related to drugs and medical and surgical supplies;

• expenditure in the Éducation portfolio increased by $726 million (12.9%) to $6.4 billion. This increase is due in particular to changes in the remuneration of staff at school service centres and school boards, resulting from salary indexations and an increase in the school clientele;

• expenditure in the Éducation supérieure portfolio increased by $148 million (5.8%) to $2.7 billion. This increase was due in particular to changes in the remuneration of higher education staff, resulting from salary indexations;

• expenditure in the Famille portfolio rose by $37 million (1.8%) to $2.0 billion. This increase is due in particular to the increase of the Family Allowance;

• expenditure in the Transports et Mobilité durable portfolio rose by $165 million (11.5%) to $1.6 billion. This increase is due in particular to spending on subsidized local road infrastructure projects;

Section 2: Detailed Results and Budgetary Outlook

• expenditure in the Emploi et Solidarité sociale portfolio rose by $71 million (5.1%) to $1.5 billion. This increase is mainly due to increased spending on last-resort financial assistance programs;

• expenditure in the Affaires municipales et Habitation portfolio rose by $81 million (10.1%) to $883 million. This increase is due in part to higher infrastructure project costs at the beginning of the year compared with the first quarter of 2023-2024;

• expenditure in the Économie, Innovation et Énergie portfolio rose by $187 million (26.7%) to $888 million. This increase is due in particular to the rise in the tax credit for the development of e-business and the tax credit for salaries and wages (R&D);

• expenditure in the Environnement, Lutte contre les changements climatiques, Faune et Parcs portfolio rose by $28 million (8.6%) to $355 million. This increase is due in particular to the costs of the actions of the 2030 Plan for a Green Economy;

• expenditure in other portfolios rose by $473 million (12.3%) to $4.3 billion.

Debt service expenditure rose by $331 million (13.7%) to $2.8 billion. This increase is mainly due to the rise in interest rates at the beginning of the fiscal year, which notably generated losses on the disposal of assets as part of the management of the investment activities of the Sinking Fund for Government Borrowings.

| Expenditure |

| (unaudited data, millions of dollars, year-over-year change) |

| | | | Forecast for fiscal 2024-2025 |

| | April to June | | March 2024

budget | | New

estimate(1) |

| | 2023-

2024 | 2024-

2025 | Change

($M) | Change

(%) | | Level

($M) | | Change

(%) | | Adjustment

($M) | Level

($M) | | Change

(%) |

| Santé et Services sociaux | 14 891 | 15 690 | 799 | 5.4 | | 61 909 | | 4.2 | | - | 61 909 | | 1.5 |

| Éducation | 5 626 | 6 352 | 726 | 12.9 | | 22 364 | | 9.3 | | - | 22 364 | | 11.5 |

| Enseignement supérieur | 2 573 | 2 721 | 148 | 5.8 | | 11 060 | | 3.5 | | - | 11 060 | | 5.6 |

| Famille | 2 002 | 2 039 | 37 | 1.8 | | 8 498 | | −2.6 | | - | 8 498 | | −4.7 |

| Transports et Mobilité durable | 1 435 | 1 600 | 165 | 11.5 | | 6 603 | | 7.5 | | - | 6 603 | | −1.4 |

| Emploi et Solidarité sociale | 1 399 | 1 470 | 71 | 5.1 | | 5 615 | | −2.2 | | - | 5 615 | | −2.0 |

| Affaires municipales et Habitation | 802 | 883 | 81 | 10.1 | | 5 064 | | −4.9 | | - | 5 064 | | 3.1 |

| Économie, Innovation et Énergie | 701 | 888 | 187 | 26.7 | | 3 983 | | −4.4 | | - | 3 983 | | 4.0 |

Environnement, Lutte contre les changements climatiques, Faune

et Parcs | 327 | 355 | 28 | 8.6 | | 2 092 | | −5.7 | | - | 2 092 | | −13.9 |

| Other portfolios | 3 860 | 4 333 | 473 | 12.3 | | 20 627 | (2) | 11.7 | | 300 | 20 927 | (2) | 19.6 |

| Portfolio expenditures | 33 616 | 36 331 | 2 715 | 8.1 | | 147 815 | | 4.6 | | 300 | 148 115 | | 4.6 |

| Debt service | 2 424 | 2 755 | 331 | 13.7 | | 9 762 | | 1.2 | | 190 | 9 952 | | −0.3 |

| TOTAL | 36 040 | 39 086 | 3 046 | 8.5 | | 157 577 | | 4.4 | | 490 | 158 067 | | 4.3 |

(1) The percentage change has been updated on the basis of the 2023-2024 results published in the Public Accounts 2023-2024.

(2) Other portfolios include $600 million for the reallocation of expenditure during the year.

Section 2: Detailed Results and Budgetary Outlook

► Budgetary outlook for 2024-2025

Expenditure is forecast at $158.1 billion in 2024-2025 (annual growth of 4.3%), an upward adjustment of $490 million from the March 2024 budget forecast.

• Portfolio expenditures are adjusted upwards by $300 million and are expected to total $148.1 billion (annual growth of 4.6%). This growth is due to the preliminary assessment of the cost of the 2024 summer floods.

• Debt service is adjusted upwards by $190 million, bringing the total to $10.0 billion, mainly due to higher-than-expected interest rates at the start of the fiscal year. Considering this adjustment and the actual results for 2023-2024, the forecast annual variation is −0.3%.

• In fact, while losses on the disposal of assets were generated in the first quarter as part of the management of the investment activities of the Sinking Fund for Government Borrowings, the observed fall in interest rates will overall generate gains for the remainder of the fiscal year.

Section 2: Detailed Results and Budgetary Outlook

Composition of portfolio expenditures

Portfolio expenditures represent the total resources allocated to the delivery of public services. The government implements programs that are administered directly by government entities such as departments and organizations.

- Programs and entities under a minister’s responsibility constitute a portfolio.

Portfolio expenditures are made up of:

- program expenditures;

- expenditures incurred notably by special funds, non-budget-funded bodies, as well as bodies in the health and social services, education and higher education networks;

- tax-funded expenditures, which consist of refundable tax credits and the expenditure for doubtful accounts associated with tax revenues.

The composition and expenditure level of each portfolio vary according to the nature of the function and programs under the minister’s responsibility. As a result, some portfolios will incur more expenses than others, depending on their mission.

In 2024-2025, there are 24 ministerial portfolios. The three main ones, Santé et Services sociaux, Éducation, and Enseignement supérieur, account for a little more than 64% of annual portfolio expenditures.

Composition of debt service

Debt service represents the sum of interest on direct debt and interest on other employee future benefits liabilities in the public and parapublic sectors.

It depends in particular on the size of the debt and interest rates on financial markets. Each year, the government must devote a portion of its revenues to making interest payments.

Section 3: Additional Information

Debt

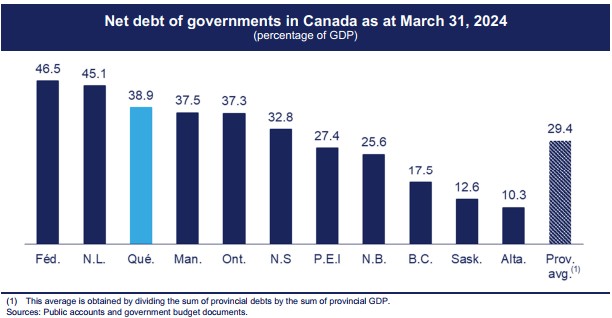

As at March 31, 2025, net debt will stand at $236.7 billion, or 40.2% of GDP. Compared with the March 2024 budget, this represents a downward revision in the debt level of 0.1 percentage points, due to the downward adjustment in the debt level at the beginning of the fiscal year.

| Net debt as at March 31, 2025 |

| (millions of dollars) |

| | March 2024

budget | Adjustment | | New

estimate |

| NET DEBT, BEGINNING OF YEAR | 221 128 | −1 112 | (1) | 220 016 |

| % OF GDP | 39.0 | −0.1 | | 38.9 |

| Budgetary deficit (surplus) | 10 998 | - | | 10 998 |

| Capital investments | 8 208 | - | | 8 208 |

| Accounting adjustments | −341 | - | | −341 |

| Deposits of dedicated revenues in the Generations Fund | −2 222 | - | | −2 222 |

| Total change | 16 643 | - | | 16 643 |

| NET DEBT, END OF YEAR | 237 771 | −1 112 | | 236 659 |

| % OF GDP | 40.3 | −0.1 | | 40.2 |

(1) Despite the higher deficit, net debt as at March 31, 2024 is lower than forecast in the 2024-2025 budget, mainly due to the remeasurement of derivative financial instruments at fair value and gains related to the pension plans of government enterprises. Such provisional gains as at March 31, 2024 engender temporary changes in net debt.

As at March 31, 2024, Québec's net debt-to-GDP ratio will be 38.9%, compared to 29.4% for the provincial average. The government is committed to gradually reducing Québec's net debt to 30% of GDP by fiscal year 2037-2038.

Section 3: Additional Information

Net financial surpluses or requirements

For the period April to June 2024, net financial requirements amount to $8.7 billion and are attributable to:

• the $2.2-billion deficit resulting from the difference between government revenue and expenditure;

• the $1.4-billion financial requirements for investments, loans and advances, stemming in particular from an increase in the consolidation value of government enterprises2 and a rise in loans made by Financement-Québec;

• the $1.0-billion financial requirements related to government capital investments, mainly due to investments of $2.3 billion, notably for the refurbishment and construction of schools and healthcare facilities. These investments are partially offset by amortization expenses of $1.3 billion;2

• the $801-million financial requirement related to the liability for retirement plans and other employee future benefits, resulting from the payment of government employee benefits of $1.8 billion, offset by the net cost of the plans of $1.0 billion;2

• the $2.8-billion in financial requirements from other accounts3 that stem in particular from tax refunds made in 2024-2025 but recognized at the end of 2023-2024;

• the $469-million financial requirement generated by deposits in the Generations Fund.

| Net financial surpluses or requirements |

| (unaudited data, millions of dollars) |

| | April to June |

| | 2023-2024 | 2024-2025 |

| OPERATING SURPLUS (DEFICIT) | −168 | −2 177 |

| Non-budgetary transactions | | |

| Investments, loans and advances | −1 192 | −1 446 |

| Capital investments | −763 | −1 022 |

| Retirement plans and other employee future benefits | −545 | −801 |

| Other accounts(1) | −5 552 | −2 786 |

| Deposits in the Generations Fund | −483 | −469 |

| Total non-budgetary transactions | −8 535 | −6 524 |

| NET FINANCIAL SURPLUSES (REQUIREMENTS) | −8 703 | −8 701 |

(1) The financial surpluses or requirements pertaining to other accounts can vary significantly from one month to the next, in particular according to the time when the government collects or disburses funds related to its activities. For example, when the last day of the month is not a business day, QST remittances are collected at the beginning of the following month, such that the equivalent of two months' remittances can be collected in a given month.

____________________________________

2 These items, which are included in the government's budgetary surplus (deficit), are eliminated in non-budgetary transactions because they have no effect on cash flow.

3 The financial surpluses or requirements pertaining to other accounts can vary significantly from one month to the next, in particular according to the time when the government collects or disburses funds related to its activities. For example, when the last day of the month is not a business day, QST remittances are collected at the beginning of the following month, such that the equivalent of two months' remittances can be collected in a given month.

Section 3: Additional Information

Composition of net financial surpluses or requirements

The government’s revenues and expenditures are established on the accrual basis of accounting.

- Revenues are recognized when earned and expenses when incurred, regardless of when receipts and disbursements occur.

Net financial surpluses or requirements, on the other hand, consist of the difference between receipts and disbursements resulting from government activities. To meet its net financial requirements, the government uses a variety of financing sources, including cash and borrowings.

The various items for net financial requirements represent net receipts and disbursements generated by the government’s loans, interests in its enterprises, and fixed assets, by retirement plans and other employee future benefits, as well as by other accounts.

- This last item includes the payment of accounts payable and the collection of accounts receivable. Deposits in the Generations Fund also result in financial requirements.

Section 3: Additional Information

Financing program and borrowings

The financing program corresponds to long-term borrowings made, in particular, to repay maturing borrowings and to fund the government's capital investments. For 2024-2025, the program amounts to $36.5 billion.4

Since the start of 2024-2025,5 borrowings issued amount to $16.8 billion, or 46% of the forecast program.

• Conventional bonds in Canadian dollars are the main borrowing instrument used.

• Borrowings on foreign markets account for 40% of borrowings issued to date in 2024-2025.

Summary of long-term borrowings issued in 2024-2025 |

Currencies | $million | % |

CANADIAN DOLLAR | | |

Conventional bonds | 9 673 | 57.6 |

Savings products issued by Épargne Placements Québec | 411 | 2.4 |

Green bonds | - | - |

Immigrant investors(1) | - | - |

Subtotal | 10 084 | 60.0 |

OTHER CURRENCIES | | |

U.S. dollar | 5 066 | 30.2 |

Australian dollar | 1 212 | 7.2 |

Swiss franc | 433 | 2.6 |

Subtotal | 6 711 | 40.0 |

TOTAL | 16 795 | 100.0 |

Note: Long-term borrowings issued between April 1, 2024 and June 30, 2024. (1) These borrowings come from sums advanced by immigrant investors. These sums are loaned to the government through Investissement Québec. |

Summary of long-term borrowing repayments in 2024-2025 | |

Currencies | | $million |

CANADIAN DOLLAR | | |

Conventional bonds | | - |

Other | | 139 |

Subtotal | | 139 |

OTHER CURRENCIES | | |

U.S. dollar | | 1 377 |

Euro | | - |

Other | | - |

Subtotal | | 1 337 |

TOTAL | | 1 476 |

Note: Long-term borrowing repayments from April 1 to June 30, 2024. | |

______________________________________________

4 This is the financing program published in the March 2024 budget.

5 Long-term borrowings issued between April 1, 2024 and June 30, 2024.

Appendix 1: Results and budgetary outlook for 2024-2025

| Results and budgetary outlook for 2024-2025 - Budgetary balance |

| (level and adjustment in millions of dollars, percentage change compared to the same period last year) |

| | | | Forecast for fiscal 2024-2025 |

| | April to

June 2024 | | March 2024

budget | | New

estimate(1) |

| | Level

($M) | Change

(%) | | Level

($M) | Change

(%) |

| Adjustment

($M) | Level

($M) | Change

(%) |

| Revenue | | | | | | | | | |

| Own-source revenue | 29 744 | 3.9 | | 120 904 | 4.7 | | 250 | 121 154 | 5.7 |

| Federal transfers | 7 165 | −1.0 | | 29 397 | −6.0 | | 240 | 29 637 | −4.0 |

| Subtotal - Revenue | 36 909 | 2.9 | | 150 301 | 2.4 | | 490 | 150 791 | 3.6 |

| Expenditure | | | | | | | | | |

| Portfolio expenditures | −36 331 | 8.1 | | −147 815 | 4.6 | | −300 | −148 115 | 4.6 |

| Debt service | −2 755 | 13.7 | | −9 762 | 1.2 | | −190 | −9 952 | −0.3 |

| Subtotal - Expenditure | −39 086 | 8.5 | | −157 577 | 4.4 | | −490 | −158 067 | 4.3 |

| Contingency reserve | - | - | | −1 500 | - | | - | −1 500 | - |

| OPERATING SURPLUS (DEFICIT)(2) | −2 177 | - | | −8 776 | - | | - | −8 776 | - |

| BALANCED BUDGET ACT | | | | | | | | | |

Deposits of dedicated revenues

in the Generations Fund | −469 | - | | −2 222 | - | | - | −2 222 | - |

| BUDGETARY BALANCE(3) | −2 646 | - | | −10 998 | - | | - | −10 998 | - |

(1) The percentage change has been updated on the basis of the 2023-2024 results published in the Public Accounts 2023-2024.

(2) Balance within the meaning of the public accounts.

(3) Budgetary balance within the meaning of the Balanced Budget Act

Appendix

Appendix 1: Results and budgetary outlook for 2024-2025 (cont.)

| Results and budgetary outlook for 2024-2025 - Revenue |

| (level and adjustment in millions of dollars, percentage change compared to the same period last year) |

| | | | Forecast for fiscal 2024-2025 |

| | April to

June 2024 | | March 2024

budget | | New

estimate(1) |

| | Level

($M) | Change

(%) | | Level

($M) | Change

(%) | | Adjustment

($M) | Level

($M) | Change

(%) |

| Own-source revenue | | | | | | | | | |

| Income and property taxes | | | | | | | | | |

| - Personal income tax | 11 090 | 8.1 | | 44 952 | 6.0 | | −400 | 44 552 | 6.4 |

| - Contributions for health services | 2 225 | 8.2 | | 8 670 | 4.5 | | 100 | 8 770 | 2.8 |

| - Corporate taxes | 2 686 | 0.5 | | 12 116 | 6.3 | | 750 | 12 866 | 12.8 |

| - School property tax | 291 | 4.3 | | 1 310 | 15.2 | | −105 | 1 205 | 4.8 |

| Consumption taxes | 7 320 | −1.4 | | 27 991 | 3.2 | | - | 27 991 | 3.4 |

| Subtotal - Tax revenue | 23 612 | 4.0 | | 95 039 | 5.2 | | 345 | 95 384 | 5.9 |

| Duties and permits | 1 593 | 14.9 | | 5 940 | 1.9 | | - | 5 940 | 0.9 |

| Miscellaneous revenue | 3 624 | 5.7 | | 14 507 | 2.8 | | - | 14 507 | 7.4 |

| Subtotal - Other own-source revenue | 5 217 | 8.4 | | 20 447 | 2.5 | | - | 20 447 | 5.4 |

| Total own-source revenue excluding revenue from government enterprises | 28 829 | 4.8 | | 115 486 | 4.7 | | 345 | 115 831 | 5.9 |

| Revenue from government enterprises | 915 | −18.9 | | 5 418 | 4.3 | | −95 | 5 323 | 1.6 |

| Total own-source revenue | 29 744 | 3.9 | | 120 904 | 4.7 | | 250 | 121 154 | 5.7 |

| Federal transfers | | | | | | | | | |

| Equalization | 3 329 | −5.1 | | 13 316 | −5.1 | | - | 13 316 | −5.1 |

| Health transfers | 2 120 | −2.1 | | 8 554 | −2.6 | | 51 | 8 605 | −1.3 |

| Transfers for post-secondary education and other social programs | 338 | −1.2 | | 1 351 | −6.9 | | −12 | 1 339 | −7.7 |

| Other programs | 1 378 | 13.1 | | 6 176 | −12.1 | | 201 | 6 377 | −4.5 |

| Subtotal - Federal transfers | 7 165 | −1.0 | | 29 397 | −6.0 | | 240 | 29 637 | −4.0 |

| TOTAL REVENUE | 36 909 | 2.9 | | 150 301 | 2.4 | | 490 | 150 791 | 3.6 |

(1) The percentage change has been updated on the basis of the 2023-2024 results published in the Public Accounts 2023-2024

Appendix

Appendix 1: Results and budgetary outlook for 2024-2025 (cont.)

| Results and budgetary outlook for 2024-2025 - Expenditure |

| (level and adjustment in millions of dollars, percentage change compared to the same period last year) |

| | | | Forecast for fiscal 2024-2025 |

| | April to

June 2024 | | March 2024

budget | | New

estimate(1) |

| | Level

($M) | Change

(%) | | Level

($M) | | Change

(%) | | Adjustment

($M) | Level

($M) | | Change

(%) |

| Portfolio expenditures | | | | | | | | | | | |

| Santé et Services sociaux | 15 690 | 5.4 | | 61 909 | | 4.2 | | - | 61 909 | | 1.5 |

| Éducation | 6 352 | 12.9 | | 22 364 | | 9.3 | | - | 22 364 | | 11.5 |

| Enseignement supérieur | 2 721 | 5.8 | | 11 060 | | 3.5 | | - | 11 060 | | 5.6 |

| Famille | 2 039 | 1.8 | | 8 498 | | −2.6 | | - | 8 498 | | −4.7 |

| Transports et Mobilité durable | 1 600 | 11.5 | | 6 603 | | 7.5 | | - | 6 603 | | −1.4 |

| Emploi et Solidarité sociale | 1 470 | 5.1 | | 5 615 | | −2.2 | | - | 5 615 | | −2.0 |

| Affaires municipales et Habitation | 883 | 10.1 | | 5 064 | | −4.9 | | - | 5 064 | | 3.1 |

| Économie, Innovation et Énergie | 888 | 26.7 | | 3 983 | | −4.4 | | - | 3 983 | | 4.0 |

Environnement, Lutte contre les changements climatiques, Faune

et Parcs | 355 | 8.6 | | 2 092 | | −5.7 | | - | 2 092 | | −13.9 |

| Other portfolios | 4 333 | 12.3 | | 20 627 | (2) | 11.7 | | 300 | 20 927 | (2) | 19.6 |

| Subtotal - Portfolio expenditures | 36 331 | 8.1 | | 147 815 | | 4.6 | | 300 | 148 115 | | 4.6 |

| Debt service | 2 755 | 13.7 | | 9 762 | | 1.2 | | 190 | 9 952 | | −0.3 |

| TOTAL EXPENDITURE | 39 086 | 8.5 | | 157 577 | | 4.4 | | 490 | 158 067 | | 4.3 |

(1) The percentage change has been updated on the basis of the 2023-2024 results published in the Public Accounts 2023-2024.

(2) Other portfolios include $600 million for the reallocation of expenditure during the year.

Appendix

Appendix 2: Change in certain economic variables

| Recent economic indicators in Québec |

| (year-over-year percentage change, unless otherwise indicated) |

| | May

2024 | June

2024 | July

2024 | Aug.

2024 | Quarters of 2024 |

| 2024 |

| Q1 | Q2 | Q3 | Q4 | Fcst. | (1) | Obs. | (2) |

| Real GDP by industry | −0.1 | 0.0 | - | - | 0.8 | 0.7 | - | - | | 0.6 | | 0.8 | |

Job creation

(thousands) | −2.1 | −17.7 | −9.1 | 14.7 | 0.3 | 2.8 | - | - | | 43.8 | | 23.0 | |

Unemployment rate

(per cent) | 5.1 | 5.7 | 5.7 | 5.7 | 4.7 | 5.3 | - | - | | 5.2 | | 5.2 | |

Retail sales

(nominal terms) | 0.0 | −0.2 | 1.5 | - | −1.3 | 0.4 | - | - | | 1.6 | | 1.2 | |

| Consumer price index(3) | 3.1 | 2.2 | 2.3 | 1.5 | 3.4 | 2.7 | - | - | | 2.8 | | 2.8 | |

Housing starts

(thousands) | 59.6 | 55.1 | 44.2 | 50.0 | 50.0 | 51.3 | - | - | | 42.7 | | 49.8 | |

| Real GDP | - | - | - | - | 0.9 | 0.7 | - | - | | 0.6 | | 0.7 | |

GDP

(nominal terms) | - | - | - | - | 0.9 | 1.7 | - | - | | 4.0 | | 4.8 | |

Household consumption

(nominal terms) | - | - | - | - | 1.8 | 1.0 | - | - | | 3.0 | | 5.1 | |

Wages and salaries

(nominal terms) | - | - | - | - | 1.7 | 0.8 | - | - | | 5.1 | | 5.1 | |

Net operating surplus

of corporations

(nominal terms) | - | - | - | - | −3.7 | 5.1 | - | - | | −2.5 | | −0.7 | |

(1) These forecasts correspond to those published in the March 2024 budget.

(2) Cumulative of available periods compared to the same period of the previous year.

(3) Change compared to the previous year.

Sources: Institut de la statistique du Québec, Statistics Canada, and Canada Mortgage and Housing Corporation.

Notes

► Note to the reader

The Report on Québec's Financial Situation provides an overview of the Québec government's financial results. It is prepared with a view to increasing the transparency of public finances and regularly monitoring the achievement of the budgetary balance target for the fiscal year. The financial information presented in the report is not audited and is based on the accounting policies in the government's annual financial statements.

► Consolidated financial information

Consolidated results include the results of all entities that are part of the government's reporting entity, i.e., that are under its control. To determine consolidated results, the government eliminates transactions carried out between entities in the reporting entity. Additional information on the government's financial organization and the funding of public services can be found on pages 14 to 19 of the document titled "Processus et documentation budgétaires : une reddition de comptes sur les finances publiques de l'État" (in French only).

► Publication date of next quarterly report

The Report on Québec's Financial Situation - Second Quarter of 2024-2025 will be published in December 2024.

| | For more information, contact the Direction des communications of the Ministère des Finances at info@finances.gouv.qc.ca. The report is available on the Ministère des Finances website at: www.finances.gouv.qc.ca. |