PUBLIC

ACCOUNTS

2023-2024 | Consolidated Financial

Statements of the

Gouvernement du Québec |

|

|

Fiscal year ended March 31, 2024

Published in accordance with section 86

of the Financial Administration Act (CQLR, chapter A-6.001)

Public Accounts 2023-2024 - Volume 1

Legal deposit - Bibliothèque et Archives nationales du Québec

October 2024

ISSN 0706-2850 (Print version)

ISSN 1925-1823 (PDF)

© Gouvernement du Québec, 2024

Her Honour the Honourable Manon Jeannotte

Lieutenant Governor of Québec

Parliament Building

Québec

Your Honour,

I am pleased to present you with the Public Accounts of the Gouvernement du Québec for the fiscal year ended March 31, 2024. They are presented in two volumes:

Volume 1 includes the consolidated financial statements of the Gouvernement du Québec audited by the Auditor General of Québec, a financial analysis of these financial statements, the budgetary balance established in accordance with the Balanced Budget Act as well as changes in main trends, including those of the government's consolidated revenue and expenditure and net debt over 10 fiscal years.

Volume 2 includes the report of excess expenditures and other costs of budgetary departments and bodies over appropriations approved by Parliament and the report of special funds' excess expenditures and investments over amounts approved by Parliament as well as detailed information for each department, budgetary body, and special fund.

Respectfully yours,

Eric Girard

Minister of Finance

Québec, October 2024

Mr. Eric Girard

Minister of Finance

Parliament Building

Québec

Dear Minister,

In accordance with the commission entrusted to me, I have the honour of presenting the Public Accounts of the Gouvernement du Québec for the fiscal year ended March 31, 2024. These accounts have been prepared under section 86 of the Financial Administration Act (CQLR, chapter A-6.001), in accordance with the government's accounting policies and the public sector accounting standards.

Respectfully yours,

Lucie Pageau, CPA

Comptroller of Finance

Québec, October 2024

Table of contents

Presentation of the Public Accounts

The Public Accounts 2023-2024 have been prepared by the Comptroller of Finance for the Minister of Finance in accordance with the public sector accounting standards and pursuant to the provisions of section 86 of the Financial Administration Act (CQLR, chapter A-6.001). They are published in two volumes. In addition to these volumes, further information to facilitate an understanding of the public accounts is published on the Ministère des Finances website in the section Public Accounts.

Volume 1 - Consolidated financial statements of the Gouvernement du Québec

Volume 1 presents the results and financial position of the Gouvernement du Québec. The financial operations include those of the National Assembly, of the people it appoints, of the government departments, and of all bodies, funds and enterprises controlled by the government.

Volume 1 presents a financial analysis to increase the usefulness and transparency of these consolidated financial statements. The analysis includes the highlights for the 2023-2024 fiscal year and compares the actual results with both forecast results forecast in the 2023-2024 budget and the 2022-2023 results. It also presents the government's budget balance in compliance with the Balanced Budget Act. Finally, it presents the development of main trends relating to important items in the consolidated financial statements and the outcome of the analysis of 10 indicators.

In accordance with the Auditor General Act (CQLR, chapter V-5.01), the Auditor General of Québec prepares an Independent Auditor's Report included with the government's consolidated financial statements and in which she expresses her opinion on the financial statements.

Volume 2 - Financial information on the Consolidated Revenue Fund: general fund and special funds

Volume 2 presents the financial information on the Consolidated Revenue Fund, which is made up of the general fund and the special funds. This volume is divided into two sections. The first section shows the revenue of government departments and budget-funded bodies, their authorized appropriations, the expenses and other costs charged to each of these appropriations and, lastly, the financial operations of the specified purpose accounts they administer. The second section presents the revenue of the special funds as well as their approved and realized expenses and investments.

Acknowledgements

Preparing the Public Accounts requires the participation and collaboration of many employees from different government departments, funds, bodies, and organizations, from the health and social services, education and higher education networks as well as from government enterprises. We would like to thank all of them for their help in preparing these documents.

ANALYSIS OF THE

CONSOLIDATED

FINANCIAL STATEMENTS

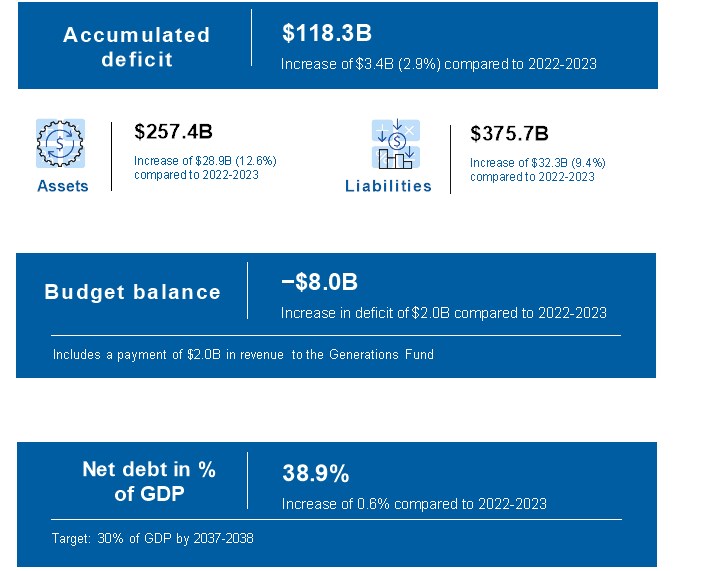

▌ 1. Highlights for fiscal year 2023-2024

Summary of consolidated results

Fiscal year ended March 31, 2024

(millions of dollars, unless otherwise indicated)

| | | | | | Actual results | | | | | | | | | Actual results | | | Change | |

| | | | | | as at | | | Change | | | as at | | | compared with | |

| | | Budget | | | March 31, | | | compared | | | March 31, | | | the 2022-2023 | |

| | | 2023-2024 | (1),(2) | | 2024 | | | with Budget | | | 2023 (3) | | | actual results | |

| | | | | | | | | M$ | | | % | | | (restated) | | | M$ | | | % | |

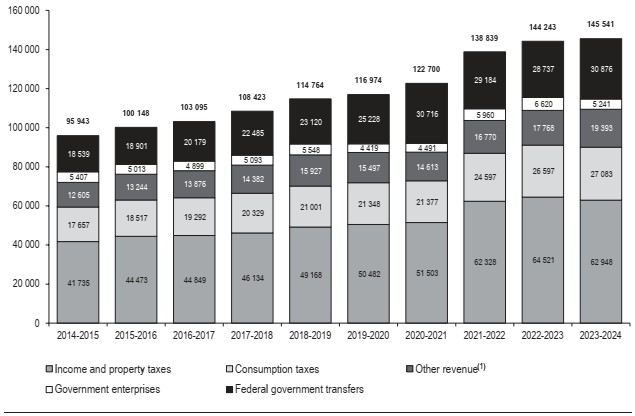

| REVENUE | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

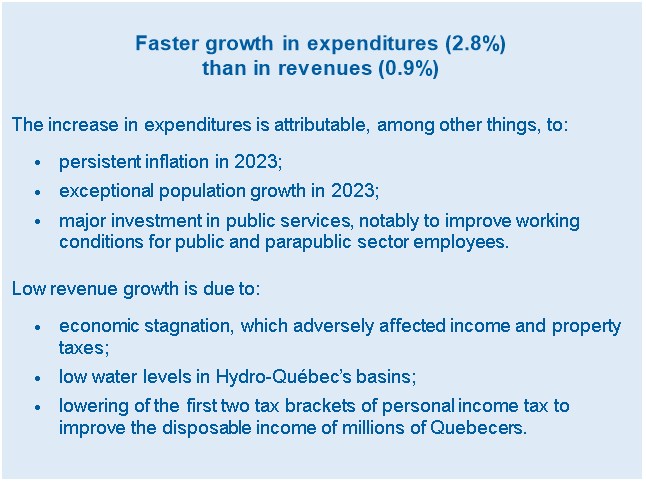

| Income and property taxes | | 65 446 | | | 62 948 | | | (2 498 | ) | | (3.8 | ) | | 64 521 | | | (1 573 | ) | | (2.4 | ) |

| Consumption taxes | | 27 290 | | | 27 083 | | | (207 | ) | | (0.8 | ) | | 26 597 | | | 486 | | | 1.8 | |

| Duties, permits and royalties | | 5 739 | | | 5 888 | | | 149 | | | 2.6 | | | 5 784 | | | 104 | | | 1.8 | |

| Miscellaneous revenue | | 12 707 | | | 13 505 | | | 798 | | | 6.3 | | | 11 984 | | | 1 521 | | | 12.7 | |

| Revenue from government enterprises | | 6 807 | | | 5 241 | | | (1 566 | ) | | (23.0 | ) | | 6 620 | | | (1 379 | ) | | (20.8 | ) |

| Own-source revenue | | 117 989 | | | 114 665 | | | (3 324 | ) | | (2.8 | ) | | 115 506 | | | (841 | ) | | (0.7 | ) |

| Federal government transfers | | 29 742 | | | 30 876 | | | 1 134 | | | 3.8 | | | 28 737 | | | 2 139 | | | 7.4 | |

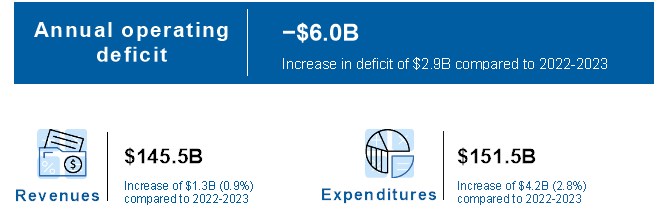

| Total revenue | | 147 731 | | | 145 541 | | | (2 190 | ) | | (1.5 | ) | | 144 243 | | | 1 298 | | | 0.9 | |

| | | | | | | | | | | | | | | | | | | | | | |

| EXPENDITURE | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

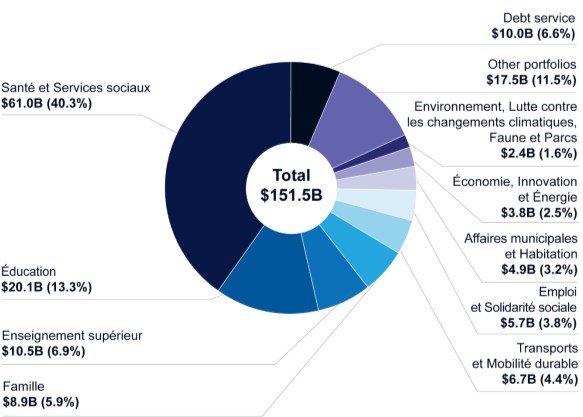

| Santé et Services sociaux | | 59 015 | | | 61 000 | | | 1 985 | | | 3.4 | | | 59 341 | | | 1 659 | | | 2.8 | |

| Éducation | | 20 335 | | | 20 058 | | | (277 | ) | | (1.4 | ) | | 19 511 | | | 547 | | | 2.8 | |

| Enseignement supérieur | | 10 480 | | | 10 476 | | | (4 | ) | | 0.0 | | | 9 655 | | | 821 | | | 8.5 | |

| Famille | | 8 210 | | | 8 917 | | | 707 | | | 8.6 | | | 7 835 | | | 1 082 | | | 13.8 | |

| Transports et Mobilité durable | | 6 957 | | | 6 700 | | | (257 | ) | | (3.7 | ) | | 6 400 | | | 300 | | | 4.7 | |

| Emploi et Solidarité sociale | | 5 322 | | | 5 728 | | | 406 | | | 7.6 | | | 8 983 | | | (3 255 | ) | | (36.2 | ) |

| Affaires municipales et Habitation | | 4 546 | | | 4 914 | | | 368 | | | 8.1 | | | 4 936 | | | (22 | ) | | (0.4 | ) |

| Économie, Innovation et Énergie | | 3 680 | | | 3 830 | | | 150 | | | 4.1 | | | 3 280 | | | 550 | | | 16.8 | |

| Environnement, Lutte contre les changements climatiques, Faune et Parcs | | 2 283 | | | 2 431 | | | 148 | | | 6.5 | | | 1 673 | | | 758 | | | 45.3 | |

| Other portfolios | | 17 564 | | | 17 499 | | | (65 | ) | | (0.4 | ) | | 15 533 | | | 1 966 | | | 12.7 | |

| Sub-total | | 138 392 | | | 141 553 | | | 3 161 | | | 2.3 | | | 137 147 | | | 4 406 | | | 3.2 | |

| Debt service | | 9 464 | | | 9 982 | | | 518 | | | 5.5 | | | 10 222 | | | (240 | ) | | (2.3 | ) |

| Total expenditure | | 147 856 | | | 151 535 | | | 3 679 | | | 2.5 | | | 147 369 | | | 4 166 | | | 2.8 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Provision for contingencies | | 1 500 | | | | | | (1 500 | ) | | (100.0 | ) | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

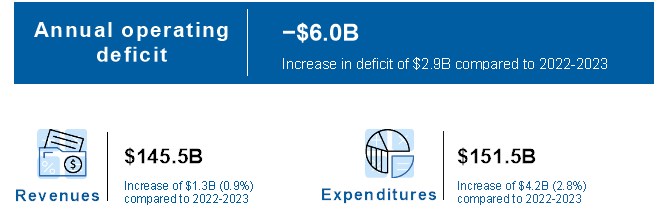

| ANNUAL OPERATING DEFICIT | | (1 625 | ) | | (5 994 | ) | | (4 369 | ) | | ― | | | (3 126 | ) | | (2 868 | ) | | ― | |

| | | | | | | | | | | | | | | | | | | | | | |

(1) These numbers correspond to data presented in Budget 2023-2024 of the Ministère des Finances tabled on March 21, 2023, adjusted to ensure comparability with the expenditures as at March 31, 2024. Details of these reclassifications are presented in Note 3 of the consolidated financial statements.

(2) For the purposes of establishing budget forecasts, certain factors that constitute risk and uncertainty factors do not depend directly on the government but can lead to real results that differ from those anticipated. Such factors are presented in Appendix 1, "Risks and uncertainties".

(3) Certain figures for 2022-2023 have been reclassified for consistency with the presentation adopted as at March 31, 2024.

1. Highlights for fiscal year 2023-2024 (cont'd)

1. Highlights for fiscal year 2023-2024 (cont'd)

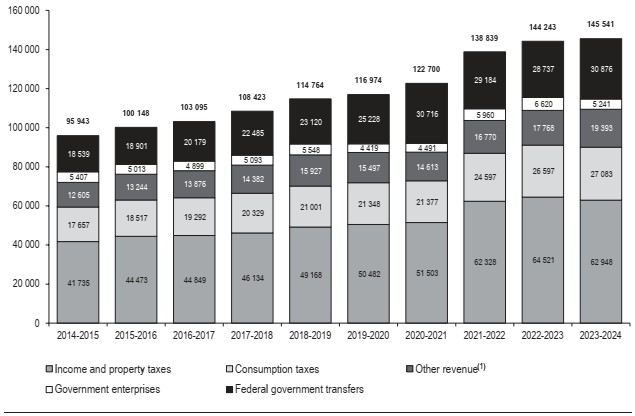

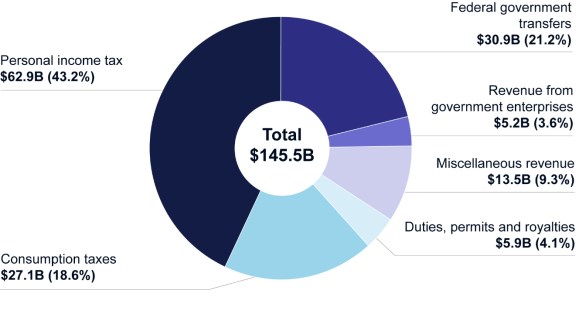

Total revenue as at March 31, 2024

(billions of dollars, percentage of total revenue)

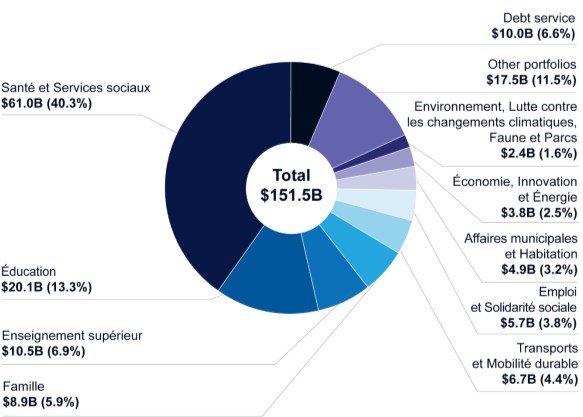

Expenditure as at March 31, 2024

(billions of dollars, percentage of total expenditure)

1. Highlights for fiscal year 2023-2024 (cont'd)

1. Highlights for fiscal year 2023-2024 (cont'd)

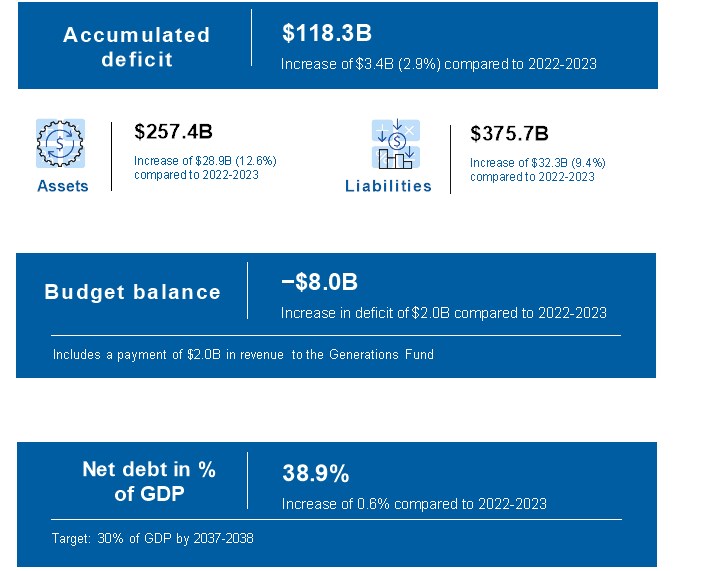

Budget balance

In Budget 2023-2024, tabled on March 21, 2023, the government forecast a deficit of $1 625 million for fiscal 2023-2024 as well as a budgetary deficit of $3 998 million within the meaning of the Balanced Budget Act (CQLR, chapter E-12.00002), taking into account the payment of $2 373 million in dedicated revenue to the Generations Fund.

The consolidated financial statements of the Gouvernement du Québec for the fiscal year ended March 31, 2024 show an annual operating deficit of $5 994 million. Taking into account deposits of revenues dedicated to the Generations Fund of $2 047 million, the budgetary balance withing the meaning of the Balanced Budget Act for the fiscal year ended March 31, 2024 shows a deficit of $8 041 million.

Plan to restore balanced budget

In December 2023, the Balanced Budget Act was modernized to make its administration more flexible and simpler while maintaining the constraint related to budget balance. In keeping with the provisions in the modernized Act, the $6 084-million budget deficit observed for fiscal year 2022-2023 in the Public Accounts tabled in the fall of 2023 obliges the government to present a plan to restore balanced budget not later than the publication of Budget 2025-2026. The plan must present decreasing deficits over a maximum period of five years and make provision for a balanced budget not later than 2029-2030. Moreover, the government must, for the fiscal year preceding the year in which balanced budget is achieved, make provision for a deficit representing 25% or less of the 2022-2023 budget deficit, i.e., a maximum of $1 521 million.

▌ 2. Variance analysis

In accordance with the standards set out by the Public Sector Accounting Board, the financial analysis that accompanies the government's consolidated financial statements compares real results with those in its initial budget, adjusted to take into account some reclassifications,1 as well as those of the previous fiscal year.

______________________________________

1 The budget forecasts for expenditures by portfolios have been reclassified to ensure comparability with actual expenditures recorded as at March 31, 2024. Details of these reclassifications are presented in Note 3 of the consolidated financial statements.

2. Variance analysis (cont'd)

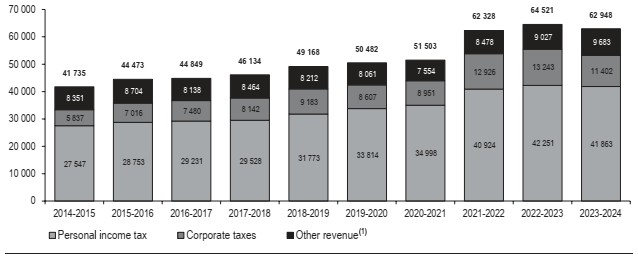

2.1. Own-source revenue

Income and property taxes

Fiscal year ended March 31, 2024

(millions of dollars, unless otherwise indicated)

| | | | | | Actual results | | | Change with | | | Actual results | | | Change with | |

| | | Budget | | | as at | | | 2023-2024 | | | as at | | | 2022-2023 | |

| | | 2023-2024 | | | March 31, 2024 | | | budget | | | March 31, 2023 | | | actual results | |

| | | | | | | | | M$ | | | % | | | | | | M$ | | | % | |

| | | | | | | | | | | | | | | | | | | | | | |

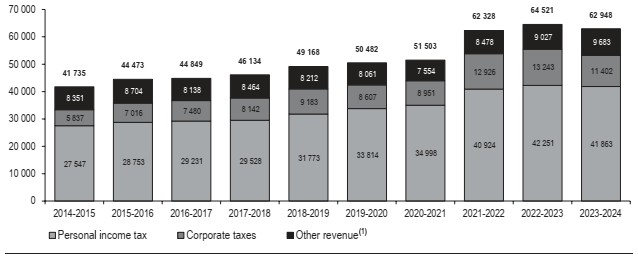

| Personal income tax | | 43 126 | | | 41 863 | | | (1 263 | ) | | (2.9 | ) | | 42 251 | | | (388 | ) | | (0.9 | ) |

| | | | | | | | | | | | | | | | | | | | | | |

| Contributions for health services | | 7 944 | | | 8 533 | | | 589 | | | 7.4 | | | 7 914 | | | 619 | | | 7.8 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Corporate taxes | | 13 192 | | | 11 402 | | | (1 790 | ) | | (13.6 | ) | | 13 243 | | | (1 841 | ) | | (13.9 | ) |

| | | | | | | | | | | | | | | | | | | | | | |

| School property tax | | 1 184 | | | 1 150 | | | (34 | ) | | (2.9 | ) | | 1 113 | | | 37 | | | 3.3 | |

| | | | | | | | | | | | | | | | | | | | | | |

| TOTAL | | 65 446 | | | 62 948 | | | (2 498 | ) | | (3.8 | ) | | 64 521 | | | (1 573 | ) | | (2.4 | ) |

The 2023-2024 forecast of $65 446 million reflected impact on tax revenues of moderate growth of the economic activity in 2023 on tax revenues, mainly as regards personal income tax revenues, which stood at $43 126 million, a slight increase over real results as at March 31, 2023. This forecast was due in particular to growth in household income, which in turn was supported by a robust labour market and by growth in wages and salaries. On the other hand, it also considered the impact of the lowering of the first two tax brackets, which came into force on January 1, 2023. Revenue forecasts related to corporation taxes and health services contributions, which were fairly stable in relation to real results as at March 31, 2023, took into account an expected −4.9% change in the operating surplus in 2023 and 5.3% in 2024, and the impact of the new tax holiday for major investment projects.

The increase in nominal GDP of 3.7% in 2023 exceeded the 2.7% forecast announced in Budget 2023-2024. However, the increase stemmed by and large from persistent inflation in 2023. Indeed, real GDP, which excludes the impact of inflation, fell by 0.4% in relation to the forecast in 2023. It grew by 0.2% as against the 0.6% increase anticipated in Budget 2023-2024. Accordingly, despite the increase in wages and salaries, persistent inflation and the impact of greater-than-anticipated tightening of monetary policy curbed economic activity in 2023. These less favourable than anticipated economic prospects affected income and property taxes, which were 3.8% lower than forecast.

More specifically, personal income tax and corporation tax revenues declined by 2.9% and 13.6% in relation to the budget, and by 0.9% and 13.9% compared with real results as at March 31, 2023.

2. Variance analysis (cont'd)

2.1. Own-source revenue (cont'd)

Income and property taxes (cont'd)

The variation in personal income tax in relation to the budget is attributable in particular to lower-than-anticipated tax revenue in fiscal year 2023-2024, despite the upward adjustment of wages and salaries. This variation is also attributable to less favourable changes in capital gains and the income of individuals in business observed in the wake of the processing of income tax returns for the 2023 taxation year. The reduction in relation to 2022-2023 is mainly due to the downturn in revenues attributable to the lowering on January 1, 2023, of the first two tax brackets by 1 percentage point, and the significant indexation of the taxation system1 pertaining to 2023 (6.44%) and 2024 (5.08%).

As for corporation taxes, the 13.9% reduction in the net operating surplus of corporations largely explains the 13.9% decrease compared with real results as at March 31, 2023, and the 13.6% downward variation in relation to the forecast, mainly because of the economic slowdown and lower prices for raw materials, which affected the prices of natural resource exports.

Furthermore, revenues from health services contributions rose by 7.4% in relation to the budget and by 7.8% in relation to real results as at March 31, 2023. The variations stem mainly from wage and salary gains, which stood at 6.0% in 2023, sustained by labour market dynamism.

______________________________________

1 The statutory indexation of the main parameters of the personal income tax system, namely the various tax brackets, the basic amount and several deductions and tax credits. The indexation rate is determined by the increase in the Québec consumer price index, excluding alcohol, tobacco and recreational cannabis.

2. Variance analysis (cont'd)

2.1. Own-source revenue (cont'd)

Consumption taxes

Fiscal year ended March 31, 2024

(millions of dollars, unless otherwise indicated)

| | | | | | Actual results | | | Change with | | | Actual results | | | Change with | |

| | | Budget | | | as at | | | 2023-2024 | | | as at | | | 2022-2023 | |

| | | 2023-2024 | | | March 31, 2024 | | | budget | | | March 31, 2023 | | | actual results | |

| | | | | | | | | M$ | | | % | | | | | | M$ | | | % | |

| | | | | | | | | | | | | | | | | | | | | | |

| Sales | | 23 505 | | | 23 306 | | | (199 | ) | | (0.8 | ) | | 22 909 | | | 397 | | | 1.7 | |

| Fuel | | 2 081 | | | 2 157 | | | 76 | | | 3.7 | | | 2 157 | | | 0 | | | 0.0 | |

| Tobacco | | 982 | | | 912 | | | (70 | ) | | (7.1 | ) | | 817 | | | 95 | | | 11.6 | |

| Alcoholic beverages | | 635 | | | 618 | | | (17 | ) | | (2.7 | ) | | 635 | | | (17 | ) | | (2.7 | ) |

| Other | | 87 | | | 90 | | | 3 | | | 3.4 | | | 79 | | | 11 | | | 13.9 | |

| | | | | | | | | | | | | | | | | | | | | | |

| TOTAL | | 27 290 | | | 27 083 | | | (207 | ) | | (0.8 | ) | | 26 597 | | | 486 | | | 1.8 | |

The 2023-2024 forecast of $27 290 million reflected notably a growth in household consumption1 compared with the previous year, growth supported among other things by a robust labour market, wage increases, and the support measures announced by different levels of government to help households face inflation. What is more, anticipated consumption tax revenues lagged, especially because of the anticipated downturn in investments in residential construction, stemming from the impact on household budgets of higher interest payments and the increased cost of living.

As at March 31, 2024, revenue from consumption taxes, mainly the Québec sales tax, is slightly below forecasts, with a downward variation of 0.8% due, in particular, to greater-than-anticipated downturn in investments in residential construction.

Compared with actual results as at March 31, 2023, revenue from consumption taxes is up 1.8%. This change is mainly attributable to a 4.7% increase in household consumption in 2023, sustained by population growth, accumulated household savings, the reduction in personal income tax, and wage and salary gains. Higher revenues are partially offset by the mitigating effect of higher interest rates and inflation on household consumption and the slowdown in investments in residential construction, which fell by 14.8% during the same period. Moreover, the increase in the specific tax on tobacco products, came into force in February 2023, is the main factor that explains the $95-million increase in this source of revenue.

______________________________________

1 Household consumption excluding food expenditures and shelter.

2. Variance analysis (cont'd)

2.1. Own-source revenue (cont'd)

Duties, permits and royalties

Fiscal year ended March 31, 2024

(millions of dollars, unless otherwise indicated)

| | | | | | Actual results | | | Change with | | | Actual results | | | Change with | |

| | | Budget | | | as at | | | 2023-2024 | | | as at | | | 2022-2023 | |

| | | 2023-2024 | | | March 31, 2024 | | | budget | | | March 31, 2023 | | | actual results | |

| | | | | | | | | M$ | | | % | | | | | | M$ | | | % | |

| | | | | | | | | | | | | | | | | | | | | | |

| Motor vehicles | | 1 626 | | | 1 744 | | | 118 | | | 7.3 | | | 1 616 | | | 128 | | | 7.9 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Natural resources | | 1 821 | | | 1 594 | | | (227 | ) | | (12.5 | ) | | 2 006 | | | (412 | ) | | (20.5 | ) |

| | | | | | | | | | | | | | | | | | | | | | |

| Greenhouse gas emissions | | 1 353 | | | 1 549 | | | 196 | | | 14.5 | | | 1 267 | | | 282 | | | 22.3 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Other | | 939 | | | 1 001 | | | 62 | | | 6.6 | | | 895 | | | 106 | | | 11.8 | |

| | | | | | | | | | | | | | | | | | | | | | |

| TOTAL | | 5 739 | | | 5 888 | | | 149 | | | 2.6 | | | 5 784 | | | 104 | | | 1.8 | |

The 2023-2024 forecast of $5 739 million, which was comparable to actual results as at March 31, 2023, included a drop in government natural resource royalties, more specifically mining royalties, because of the anticipated downturn in metal prices. On the other hand, revenues from greenhouse gas (GHG) emission rights auction sales were expected to increase. Lastly, the revenue forecast for duties, permits and royalties also considered the impact of capping at 3% the indexation of government user fees.

As at March 31, 2024, revenues from duties, permits and royalties totalling $5 888 million were 2.6% higher than forecast in the budget and 1.8% higher than real results for 2022-2023. The different sources of revenue nonetheless experienced variations that were offset, with the most significant ones pertaining to natural-resource-related revenues and GHG emissions.

Natural resources

Such revenues were $227 million lower than forecast and $412 million below the previous year's figure. The reduction in mining royalties explains the downward variations. Indeed, lower market prices for metals and the significant increase in production costs that certain corporations demanded in the wake of investments depressed mining profits subject to such royalties. The downturn in natural-resource-related revenues is also attributable to reduced revenues from timber sales, due in particular to lower prices for finished products. This decline exceeded the forecast for 2023-2024.

GHG emissions

These revenues exceed the forecast by $196 million and revenues in the preceding year by $282 million. The upturn in relation to the forecast stems mainly from higher-than-anticipated growth in the average price of the units sold. Despite the lower volume of GHG emission rights auction sales compared with 2022-2023, the revenues increased because of higher average prices for the units sold.

2. Variance analysis (cont'd)

2.1. Own-source revenue (cont'd)

Miscellaneous revenue

Fiscal year ended March 31, 2024

(millions of dollars, unless otherwise indicated)

| | | | | | Actual results | | | Change with | | | Actual results | | | Change with | |

| | | Budget | | | as at | | | 2023-2024 | | | as at | | | 2022-2023 | |

| | | 2023-2024 | | | March 31, 2024 | | | budget | | | March 31, 2023 | | | actual results | |

| | | | | | | | | M$ | | | % | | | | | | M$ | | | % | |

| | | | | | | | | | | | | | | | | | | | | | |

| Miscellaneous revenue | | 12 707 | | | 13 505 | | | 798 | | | 6.3 | | | 11 984 | | | 1 521 | | | 12.7 | |

The 2023-2024 forecast of $12 707 million reflected a generalized growth in the various revenues generated by the different organizations that make up the government, particularly revenues of the health and social services, education and higher education networks. Among other things, the forecast took into account an increase in revenues from tuition fees, linked to an expected growth in the higher education clientele, bearing in mind the impact of capping at 3% the indexation of government user fees.

Actual miscellaneous revenue as at March 31, 2024 of $13 505 million exceeds the forecast by 6.3%. This variation is due in particular to higher-than-forecast growth in interest income on tax receivables administered by the Agence du revenu du Québec, growth explained in part by the rise in interest rates. This variation also stems from a higher-than-anticipated increase in the goodwill of bodies in the health and social services, education, and higher education networks attributable, by way of an example, to a stronger-than-anticipated post-pandemic recovery.

Compared to the previous fiscal year's actual results, revenue growth can be broken down as follows (millions of dollars):

| | | Actual results | | | Actual results | | | | | | | |

| | | as at | | | as at | | | | | | | |

| | | March 31, 2024 | | | March 31, 2023 | | | Variance | |

| | | | | | | | | M$ | | | % | |

| | | | | | | | | | | | | |

| Sales of goods and services | | 6 354 | | | 6 242 | | | 112 | | | 1.8 | |

| Health and social services network user contributions | | 1 667 | | | 1 513 | | | 154 | | | 10.2 | |

| Income on accounts receivable and loans | | 1 784 | | | 1 052 | | | 732 | | | 69.6 | |

| Income on investments | | 829 | | | 525 | | | 304 | | | 57.9 | |

| Fines, forfeitures and recoveries | | 1 232 | | | 1 228 | | | 4 | | | 0.3 | |

| Third-party donations | | 1 004 | | | 904 | | | 100 | | | 11.1 | |

| Tuition fees | | 543 | | | 451 | | | 92 | | | 20.4 | |

| Transfers from entities other than the federal government | | 92 | | | 69 | | | 23 | | | 33.3 | |

| | | | | | | | | | | | | |

| TOTAL | | 13 505 | | | 11 984 | | | 1 521 | | | 12.7 | |

2. Variance analysis (cont'd)

2.1. Own-source revenue (cont'd)

Miscellaneous revenue (cont'd)

The overall growth of $1 521 million is mainly the result of the increase relating to health and social services network user contributions, income on accounts receivable and loans as well as income on investments.

Health and social services network user contributions

The $154-million increase is due to the increase in revenues from health and social services institutions, attributable among other things to growth in contributions from non-resident users, and to higher revenues from users of adult residential care in rehabilitation centres and residential and long-term care centres.

Income on accounts receivable and loans

The $732-million increase is mainly due to higher interest income on tax claims administered by the Agence du revenu du Québec, notably due to higher interest rates on accounts receivable.

Income on investments

The $304-million increase is mainly attributable to more significant realized gains in 2023-2024 than in 2022-2023, in particular because of favourable equity market performance.

2. Variance analysis (cont'd)

2.1. Own-source revenue (cont'd)

Revenue from government enterprises

Fiscal year ended March 31, 2024

(millions of dollars, unless otherwise indicated)

| | | | | | Actual results | | | Change with | | | Actual results | | | Change with | |

| | | Budget | | | as at | | | 2023-2024 | | | as at | | | 2022-2023 | |

| | | 2023-2024 | | | March 31, 2024 | | | budget | | | March 31, 2023 | | | actual results | |

| | | | | | | | | M$ | | | % | | | | | | M$ | | | % | |

| | | | | | | | | | | | | | | | | | | | | | |

| Hydro-Québec | | 3 525 | | | 2 027 | | | (1 498 | ) | | (42.5 | ) | | 3 665 | | | (1 638 | ) | | (44.7 | ) |

| Société des alcools du Québec | | 1 459 | | | 1 428 | | | (31 | ) | | (2.1 | ) | | 1 427 | | | 1 | | | 0.1 | |

| Loto-Québec | | 1 498 | | | 1 508 | | | 10 | | | 0.7 | | | 1 597 | | | (89 | ) | | (5.6 | ) |

| Investissement Québec | | 216 | | | 121 | | | (95 | ) | | (44.0 | ) | | (226 | ) | | 347 | | | 153.5 | |

| Other | | 109 | | | 157 | | | 48 | | | 44.0 | | | 157 | | | ― | | | ― | |

| | | | | | | | | | | | | | | | | | | | | | |

| TOTAL | | 6 807 | | | 5 241 | | | (1 566 | ) | | (23.0 | ) | | 6 620 | | | (1 379 | ) | | (20.8 | ) |

The 2023-2024 forecast of $6 807 million reflected a return to normalcy in the anticipated results of Investissement Québec, which fell significantly because of the volatility of rates on the financial markets and the uncertain economic outlook in 2022-2023. The forecasts also reflected a downturn in Hydro-Québec's expected results, stemming from the anticipated reduction in the value of its electricity exports.

Hydro-Québec

The net value of Hydro-Québec's electricity exports fell more markedly than forecast in 2023-2024. This situation is due to the low runoff in the regions where the main basins are located stemming from scarce snow cover at the end of the winter of 2022-2023, lower-than-normal flood waters, and modest summer and fall precipitation in northern Québec. This context led to reduced electricity surpluses for sale in 2023-2024, which explains the 42.5% variation in relation to Budget 2023-2024 and the 44.7% decrease in relation to real results for 2022-2023. Additionally, the government corporation's higher operating expenses exacerbated the reduction in relation to 2022-2023 mainly as a result of more extensive maintenance work aimed at enhancing the quality and reliability of the service.

Investissement Québec

Revenues from Investissement Québec were 44.0% lower than forecast, and 153.5% higher than actual results as at March 31, 2023. The return to normalcy of the expected results did not fully materialize because of financial market volatility and the global context of economic uncertainty. The increase in relation to 2022-2023 is attributable to the unfavourable yields sustained in 2022-2023 in the investments of the venture capital and investment fund portfolio because of the downward spiral of financial markets.

2. Variance analysis (cont'd)

2.2. Federal government transfers

Federal government transfers

Fiscal year ended March 31, 2024

(millions of dollars, unless otherwise indicated)

| | | | | | Actual results | | | Change with | | | Actual results | | | Change with | |

| | | Budget | | | as at | | | 2023-2024 | | | as at | | | 2022-2023 | |

| | | 2023-2024 | | | March 31, 2024 | | | budget | | | March 31, 2023 | | | actual results | |

| | | | | | | | | M$ | | | % | | | | | | M$ | | | % | |

| | | | | | | | | | | | | | | | | | | | | | |

| Equalization | | 14 037 | | | 14 037 | | | ― | | | ― | | | 13 666 | | | 371 | | | 2.7 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Health transfers | | 8 660 | | | 8 714 | | | 54 | | | 0.6 | | | 7 082 | | | 1 632 | | | 23.0 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Transfers for post-secondary education and other social programs | | 1 366 | | | 1 451 | | | 85 | | | 6.2 | | | 1 294 | | | 157 | | | 12.1 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Other programs | | 5 679 | | | 6 674 | | | 995 | | | 17.5 | | | 6 695 | | | (21 | ) | | (0.3 | ) |

| | | | | | | | | | | | | | | | | | | | | | |

| TOTAL | | 29 742 | | | 30 876 | | | 1 134 | | | 3.8 | | | 28 737 | | | 2 139 | | | 7.4 | |

The 2023-2024 forecast of $29 742 million mainly considered an increase in equalization and the Canada Health Transfer (CHT) due to anticipated growth in Canada's nominal GDP. The forecast also included a one-off increase in the CHT, of which Québec's share was estimated at $447 million.

As at March 31, 2024, federal government transfers of $30 876 million exceed forecast by $1 134 million, or 3.8%

This variation is notably attributable to:

a reduction in the value of the Québec special abatement,1 which has led to a greater-than-forecast increase of $168 million in transfers for health and of $103 million in transfers for post-secondary education and other social programs;

higher-than-forecast revenues of $995 million from the "Other programs" category, due in particular to:

- $225 million in unplanned revenues related to the conclusion in November 2023 of the agreement concerning the Housing Accelerator Fund, for a total of $900 million over four years,

- higher-than-anticipated federal government transfer revenues of $194 million for for personal protective equipment (PPE) and other supplies received and used by March 31, 2024,

______________________________________

1 The Québec special abatement (16.5% of federal personal income tax collected in Québec) is subtracted from federal government transfer revenues.

2. Variance analysis (cont'd)

2.2. Federal government transfers (cont'd)

- the completion at a higher-than-anticipated pace of infrastructure projects subject to federal financing, including those financed by the Société de financement des infrastructures locales, in respect of which $290 million more in revenues than anticipated were recorded.

Compared with actual results for 2022-2023, those for 2023-2024 show an increase of $2 139 million, due to the net impact of the following items:

Equalization

The growth of $371 million, or 2.7%, in equalization revenues is explained by the increase in the equalization envelope across Canada, whose growth is linked to that of Canada's nominal GDP.

Health transfers

The $1 632-million increase in health transfers is due in particular to:

$833 million due to the growth of the Canada Health Transfer related to the variation in Canada's nominal GDP;

$124 million in the wake of the reduction in the value of the Québec special abatement, a portion of which is subtracted from the Canada Health Transfer;

$627 million following the conclusion of two new agreements that call for additional funding to support Québec's priorities in the realm of health and long-term care.

Transfers for post-secondary education and other social programs

The $157-million increase is attributable to increases of:

$71 million resulting from the indexation of the Canada Social Transfer;

$86 million following the reduction in the value of the Québec special abatement, a portion of which is deducted from the Canada Social Transfer.

Other programs

The $21-million decrease in transfer revenues for other programs is explained by various changes:

a one-off federal transfer of of $197 million in 2022-2023 to help support public transit authorities in the wake of the pandemic;

a $444-million decrease in federal government transfer revenues related to pandemic-related PPE and other supplies received and used by March 31, 2024.

The decrease is partly offset by:

a $250-million increase in revenues from the asymmetrical childcare agreement signed in 2021-2022 for a period of 5 years;

a $225-million grant stemming from the new agreement pertaining to the Housing Accelerator Fund.

2. Variance analysis (cont'd)

2.3. Comparison of actual and anticipated expenditures

Consolidated expenditure

Fiscal year ended March 31, 2024

(millions of dollars, unless otherwise indicated)

| | | | | | Expenditure | | | | | | | |

| | | Budget | | | as at | | | | | | | |

| | | 2023-2024 | | | March 31, 2024 | | | Variation | |

| | | | | | | | | M$ | | | % | |

| | | | | | | | | | | | | |

| Portfolios expenditure | | 138 392 | | | 141 553 | | | 3 161 | | | 2.3 | |

| | | | | | | | | | | | | |

| Debt services | | 9 464 | | | 9 982 | | | 518 | | | 5.5 | |

| | | | | | | | | | | | | |

| Consolidated expenditure | | 147 856 | | | 151 535 | | | 3 679 | | | 2.5 | |

Portfolio expenditures

Expenditure estimates are established for each portfolio when the budget is prepared. Such estimates, funds are stipulated in the Contingency Fund of the Conseil du trésor et Administration gouvernementale portfolio to notably cover1 unforeseen expenditures under government programs. Accordingly, portfolio expenditures are managed in a comprehensive manner, notably to ensure enhanced budget agility and the sound, efficient management of public funds.

The actual expenditures that the Contingency Fund covers are recorded in the portfolios that benefited from them. This situation can engender variations in relation to the initial budget allocated to certain portfolios when they are absorbed by the amounts budgeted in the Contingency Fund.

Moreover, during the economic and financial update, the spending forecasts for the portfolios may be subject to a revision, as they could also be when the subsequent budget is tabled.

Overall, 2023-2024 portfolio expenditures stand at $141 553 million, i.e., a $3 161 million or 2.3% surplus in relation to the $138 392 million forecast. This discrepancy is due notably to:

higher-than-anticipated expenditures of $610 million in the Santé et Services sociaux portfolio concerning PPE and other supplies;

$1 247 million in higher-than-anticipated compensation expenses related to independent labour in health and social services institutions;

______________________________________

1 The Contingency Fund is also intended to cover expenditures on subsidized infrastructure as well as certain measures announced in the Budget. In the 2023-2024 budget plan, forecasts for these expenditures are included in the portfolios that plan to carry them out.

2. Variance analysis (cont'd)

2.3. Comparison of actual and anticipated expenditures (cont'd)

Portfolio expenditures (cont'd)

- the additional expenditures announced in Update on Québec's Economic and Financial Situation - Fall 2023:

- $265 million in additional emergency assistance granted by the Transports et Mobilité durable portfolio to cover the anticipated deficit of public transit companies,

- $184 million in additional subsidies paid by the Affaires municipales et Habitation portfolio to build 7 500 affordable new public housing units under the Québec Affordable Housing Program and the partnership with the tax-advantaged funds,

- $128 million in higher-than-anticipated financial assistance payments by the Environnement, Lutte contre les changements climatiques, Faune et Parcs portfolio to support climate change adaptation measures;

$285 million in advance payments, announced in the 2024-2025 Budget Plan, made by the Famille portfolio concerning subsidies to the operation of educational childcare services for 2024-2025;

the unforeseen expenditures of $144 million plus interest of the Transports et Mobilité durable portfolio to compensate the owners of taxi permits following a judgment handed down by the court concerning the class action lawsuit launched against the government;

the higher-than-anticipated last-resort financial assistance of $323 million granted by the Emploi et Solidarité sociale portfolio notably caused by a higher-than-anticipated number of beneficiaries and a revision of the indexation of benefits during the year;

higher-than-anticipated subsidies of $308 million by the Affaires municipales et Habitation portfolio granted for municipal infrastructure projects, engendered, in particular, by more extensive-than-anticipated work;

- a higher-than-anticipated increase in the number of applications and the average amount granted for the following tax credits of the Économie, Innovation et Énergie portfolio:

– the investment tax credit, in the higher-than-anticipated amount of $192 million,

– the tax credits for scientific research and experimental development, in the higher-than-anticipated amount of $110 million;

- higher-than-anticipated subsidies of $273 million by the Finances portfolio attributable to the extension of the gasoline tax program and Québec's contribution, the extension which was not known when the budget was prepared.

2. Variance analysis (cont'd)

2.3. Comparison of actual and anticipated expenditures (cont'd)

Portfolio expenditures (cont'd)

Moreover, wage provisions stemming from the government offers submitted and the agreements concluded in the context of the renewal of the collective agreements, more specifically in the Santé et Services sociaux and Éducation portfolios, contributed to the surplus in relation to the forecasts. However, this surplus was offset by the non-realization of expenditures on the order of $651 million in the Éducation portfolio stemming from the strike by school staff in the fall of 2023.

Lastly, the subsidies granted for municipal and collective transportation infrastructure projects were $575 million lower than anticipated for the Transports et Mobilité durable portfolio, mainly because the work completed was less extensive than anticipated.

Debt service

The $518-million surplus in debt service expenditures in relation to the forecast is mainly explained by a higher-than-anticipated increase in interest rates.

Compliance with legislative authorizations

A surplus of consolidated expenditures in relation to those stipulated in the portfolios does not automatically require the approval of appropriations or the issuance by Parliament of additional expenditure authorizations. Indeed, the consolidated expenditures include those of government departments, budgetary organizations, special funds, non-budget-funded bodies and bodies in the health and social services, education and higher education networks. Only the expenditures of government departments, budgetary organizations, and special funds are subject to an annual parliamentary vote. Furthermore, certain expenditures are covered by permanent appropriations granted pursuant to specific statutes or by the appropriations provided in the Contingency Fund.

In 2023-2024, no excess expenditure and other costs were observed in the annual appropriations of the government departments while surpluses of $1 190 million and $652 million, respectively, on the amounts approved were observed in the expenditures and investments of the special funds.

2. Variance analysis (cont'd)

2.4. Comparison of expenditures with those of the preceding year

Santé et services sociaux

Fiscal year ended March 31, 2024

(millions of dollars, unless otherwise indicated)

| | | Expenditure | | | Expenditure | | | | | | | |

| | | as at | | | as at | | | | | | | |

| | | March 31, 2024 | | | March 31, 2023 | | | Variance | |

| | | | | | (restated) | | | M$ | | | % | |

| | | | | | | | | | | | | |

| Transfers | | 8 524 | | | 8 168 | | | 356 | | | 4.4 | |

| | | | | | | | | | | | | |

| Remuneration | | 37 626 | | | 36 490 | | | 1 136 | | | 3.1 | |

| | | | | | | | | | | | | |

| Operating | | 14 713 | | | 14 562 | | | 151 | | | 1.0 | |

| | | | | | | | | | | | | |

| Doubtful accounts and other allowances | | 137 | | | 121 | | | 16 | | | 13.2 | |

| | | | | | | | | | | | | |

| TOTAL | | 61 000 | | | 59 341 | | | 1 659 | | | 2.8 | |

This portfolio includes mainly the activities of the health and social services network institutions and the programs administered by the Régie de l'assurance maladie du Québec. It also includes the expenditures of other health-related government agencies such as Héma-Québec.

The increase of $1 659 million compared with expenditures in 2022-2023 stems essentially from the increase in transfer expenditures, remuneration, and operations.

Transfers

The $356-million increase in transfer expenditures is attributable in particular to:

a $130-million increase attributable to spending growth related to the tax credit for senior assistance and the tax credit for home-support services for seniors;

a $92-million increase in the expenditures of health and social services institutions to support community-based organizations.

Remuneration

The $1 136 million increase in compensation expenses is mainly explained by:

a $549-million increase in expenditures related to wage provisions of health and social services institutions stemming from the government offers submitted and the agreements concluded in the context of the renewal of the collective agreements;

a $643-million increase in costs related to reliance on independent labour in health and social services institutions because of the labour shortage and the increase in the average hourly rate during the fiscal year;

2. Variance analysis (cont'd)

2.4. Comparison of expenditures with those of the preceding year (cont'd)

Santé et services sociaux (cont'd)

- a $450-million increase in the remuneration of general practitioners and specialists because of the increase in the number of medical services rendered and their costs.

These increases are partially offset by a $760-million reduction in expenditures attributable to the incentive pay granted in 2022-2023 in the health and social services institutions.

Operating

The $151-million increase in operating expenditures is attributable to several variations, including:

a $224-million increase in the cost of medicines, mainly those used for cancer treatments;

a $151-million increase in remuneration paid to non-institutional staff, mainly because of higher costs and the purchase of new spaces;

a $56-million increase in maintenance and repair expenditures, a $50-million increase in food costs, and a $100-million increase in medical and surgical supplies, due in particular to inflation;

a $779-million decrease in the consumption of PPE and other supplies.

2. Variance analysis (cont'd)

2.4. Comparison of expenditures with those of the preceding year (cont'd)

Éducation

Fiscal year ended March 31, 2024

(millions of dollars, unless otherwise indicated)

| | | Expenditure | | | Expenditure | | | | | | | |

| | | as at | | | as at | | | | | | | |

| | | March 31, 2024 | | | March 31, 2023 | | | Variance | |

| | | | | | (restated) | | | M$ | | | % | |

| | | | | | | | | | | | | |

| Transfers | | 1 362 | | | 1 095 | | | 267 | | | 24.4 | |

| | | | | | | | | | | | | |

| Remuneration | | 14 236 | | | 14 194 | | | 42 | | | 0.3 | |

| | | | | | | | | | | | | |

| Operating | | 4 449 | | | 4 212 | | | 237 | | | 5.6 | |

| | | | | | | | | | | | | |

| Doubtful accounts and other allowances | | 11 | | | 10 | | | 1 | | | 10.0 | |

| | | | | | | | | | | | | |

| TOTAL | | 20 058 | | | 19 511 | | | 547 | | | 2.8 | |

This portfolio mainly covers the activities of preschool, primary and secondary education institutions. It also includes programs to promote leisure and sports activities, and to manage national parks.

The $547-million increase in expenditures in relation to 2022-2023 stems by and large from the increase in transfer and operating expenditures. While overall compensation expenses did not increase substantially, they nonetheless experienced various fluctuations that were compensated.

Transfers

The $267-million increase in transfer expenditures stems principally from growth in subsidies granted to private educational institutions, especially to consider the indexation of staff wages and to support their infrastructure projects.

Remuneration

The $42-million increase in compensation expenses is mainly due to:

a $341-million increase in expenditures related to wage provisions stemming from the government offers submitted and the agreements concluded to renew the collective agreements;

a $376-million increase in expenditures pertaining to wage progression and the increase in teaching staff in response to rising student numbers.

Both increases are largely offset by the non-realization of $651 million in remuneration expenditures due to the strike by school staff in the fall of 2023.

Operating

The $237-million increase in operating expenditures is attributable, in particular, to the increase in the cost of school transportation, higher expenditures related to building maintenance and sports, cultural, and extracurricular activities, and the leasing of additional space to accommodate higher school enrolments.

2. Variance analysis (cont'd)

2.4. Comparison of expenditures with those of the preceding year (cont'd)

Enseignement supérieur

Fiscal year ended March 31, 2024

(millions of dollars, unless otherwise indicated)

| | | Expenditure | | | Expenditure | | | | | | | |

| | | as at | | | as at | | | | | | | |

| | | March 31, 2024 | | | March 31, 2023 | | | Variance | |

| | | | | | (restated) | | | M$ | | | % | |

| | | | | | | | | | | | | |

| Transfers | | 4 903 | | | 4 597 | | | 306 | | | 6.7 | |

| | | | | | | | | | | | | |

| Remuneration | | 4 209 | | | 3 958 | | | 251 | | | 6.3 | |

| | | | | | | | | | | | | |

| Operating | | 1 324 | | | 1 119 | | | 205 | | | 18.3 | |

| | | | | | | | | | | | | |

| Doubtful accounts and other allowances | | 40 | | | (19 | ) | | 59 | | | (310.5 | ) |

| | | | | | | | | | | | | |

| TOTAL | | 10 476 | | | 9 655 | | | 821 | | | 8.5 | |

This portfolio mainly comprises expenditures on college and university educational institutions. It also includes student financial assistance.

The $821-million increase in expenditures in relation to 2022-2023 stems by and large from the increase in transfer, remuneration, and operating expenditures.

Transfers

The $306-million increase in transfer expenditures is mainly explained by:

a $195-million increase related to the increase in subsidies for private universities, in particular to consider wage indexation in 2023-2024;

a $143-million increase attributable to the impact of a full year of the Québec Perspective Scholarship program introduced in September 2022.

Remuneration

The $251-million increase in compensation expenses is mainly due to the wage provisions stemming from the government's offers submitted and the agreements concluded in the context of the renewal of the collective agreements and wage progression.

Operating

The $205-million increase in operating expenditures in 2023-2024 stems from insignificant variations.

2. Variance analysis (cont'd)

2.4. Comparison of expenditures with those of the preceding year (cont'd)

Famille

Fiscal year ended March 31, 2024

(millions of dollars, unless otherwise indicated)

| | | Expenditure | | | Expenditure | | | | | | | |

| | | as at | | | as at | | | | | | | |

| | | March 31, 2024 | | | March 31, 2023 | | | Variance | |

| | | | | | | | | M$ | | | % | |

| | | | | | | | | | | | | |

| Transfers | | 8 680 | | | 7 627 | | | 1 053 | | | 13.8 | |

| | | | | | | | | | | | | |

| Remuneration | | 134 | | | 117 | | | 17 | | | 14.5 | |

| | | | | | | | | | | | | |

| Operating | | 103 | | | 91 | | | 12 | | | 13.2 | |

| | | | | | | | | | | | | |

| Doubtful accounts and other allowances | | ― | | | ― | | | ― | | | ― | |

| | | | | | | | | | | | | |

| TOTAL | | 8 917 | | | 7 835 | | | 1 082 | | | 13.8 | |

This portfolio mainly includes expenses dedicated to the financing of educational childcare services and financial assistance for families.

Expenditures increased by $1 082 million in relation to 2022-2023, which is essentially attributable to higher transfer expenditures.

Transfers

The $1 053 million increase in transfer expenditures stems chiefly from:

a $566-million increase in the subsidies granted to childcare centres and daycare centres, mainly because of the creation of new spaces in the network and the allocation to the managers of home childcare services of new subsidized spaces;

a $229-million increase in expenditures related to the Family Allowance tax credit resulting from the 6.44% indexation of the credit on January 1, 2023, and 5.08% on January 1, 2024.

2. Variance analysis (cont'd)

2.4. Comparison of expenditures with those of the preceding year (cont'd)

Transport et Mobilité durable

Fiscal year ended March 31, 2024

(millions of dollars, unless otherwise indicated)

| | | Expenditure | | | Expenditure | | | | | | | |

| | | as at | | | as at | | | | | | | |

| | | March 31, 2024 | | | March 31, 2023 | | | Variance | |

| | | | | | (restated) | | | M$ | | | % | |

| | | | | | | | | | | | | |

| Transfers | | 2 565 | | | 2 699 | | | (134 | ) | | (5.0 | ) |

| | | | | | | | | | | | | |

| Remuneration | | 827 | | | 708 | | | 119 | | | 16.8 | |

| | | | | | | | | | | | | |

| Operating | | 3 299 | | | 2 984 | | | 315 | | | 10.6 | |

| | | | | | | | | | | | | |

| Doubtful accounts and other allowances | | 9 | | | 9 | | | ― | | | ― | |

| | | | | | | | | | | | | |

| TOTAL | | 6 700 | | | 6 400 | | | 300 | | | 4.7 | |

This portfolio mainly includes expenditures for the construction, maintenance and operation of road infrastructure, as well as the financing of public transit services. This portfolio also includes expenditures related to the management of the government's fleet of rolling stock, aircrafts and ferry services.

The $300-million increase in expenditures in relation to 2022-2023 is mainly attributable to higher operating expenditures, partially offset by a reduction in transfer expenditures.

Transfers

The $134-million decrease in transfer expenditures is primarily due to the non-recurrence of one-off initiatives in 2022-2023 to support collective transportation and the road network, including:

advance payments of subsidies for collective transportation totalling $500 million in 2022-2023, i.e., $237 million paid to the Réseau de transport de la Capitale, $146 million to the Autorité régionale de transport métropolitain (ARTM), and $117 million to the Société de transport de Laval;

$200 million in selective assistance attributed to the ARTM in 2022-2023 to support the revival of collective transportation;

$197 million in subsidies to support transit companies faced with the repercussions of the COVID-19 pandemic, granted through the Programme d'aide d'urgence au transport collectif des personnes (PAUTCP) pursuant to the Accord sur la relance sécuritaire.

2. Variance analysis (cont'd)

2.4. Comparison of expenditures with those of the preceding year (cont'd)

Transport et Mobilité durable (cont'd)

This decrease is partially offset by:

a $329-million increase in the subsidies granted for municipal infrastructure and collective transportation projects, mainly because of more extensive work carried out than in 2022-2023;

$265 million in additional emergency assistance to offset part of the anticipated deficit in 2024 of transit companies;

$200 million in additional assistance to support the revival of collective transportation.

Operating

The $315-million increase in operating expenditures is mainly due to the recognition of expenditures, i.e., $144 million plus interest, to compensate the owners of taxi permits in the wake of a judgment handed down by the court concerning a class action lawsuit launched against the government.

2. Variance analysis (cont'd)

2.4. Comparison of expenditures with those of the preceding year (cont'd)

Emploi et Solidarité sociale

Fiscal year ended March 31, 2024

(millions of dollars, unless otherwise indicated)

| | | Expenditure | | | Expenditure | | | | | | | |

| | | as at | | | as at | | | | | | | |

| | | March 31, 2024 | | | March 31, 2023 | | | Variance | |

| | | | | | | | | M$ | | | % | |

| | | | | | | | | | | | | |

| Transfers | | 5 018 | | | 8 372 | | | (3 354 | ) | | (40.1 | ) |

| | | | | | | | | | | | | |

| Remuneration | | 503 | | | 442 | | | 61 | | | 13.8 | |

| | | | | | | | | | | | | |

| Operating | | 163 | | | 145 | | | 18 | | | 12.4 | |

| | | | | | | | | | | | | |

| Doubtful accounts and other allowances | | 44 | | | 24 | | | 20 | | | 83.3 | |

| | | | | | | | | | | | | |

| TOTAL | | 5 728 | | | 8 983 | | | (3 255 | ) | | (36.2 | ) |

This portfolio mainly includes expenditures on financial assistance programs for individuals, including last-resort financial assistance and employment assistance programs. Expenditures related to the activities of Services Québec, the Directeur de l'état civil and the Registraire des entreprises, as well as to the administration of the Québec Parental Insurance Plan, are also included in this portfolio.

The $3 255-million decrease in expenditures in relation to 2022-2023 is mainly attributable to a reduction in transfer expenditures.

Transfers

The $3 354 million decrease in transfers is attributable mainly to:

the $3 371 million decrease stemming from the non-recurrence of the one-time amounts granted in 2022-2023 to contend with the rising cost of living;

the $184-million decrease in expenditures pertaining to the allowances granted to individuals participating in labour force training, especially caused by the conclusion of activities related to the Programme pour la requalification et l'accompagnement en technologies de l'information et des communications (PRATIC);

the payment of a one-off envelope of $100 million in 2022-2023 to the Programme de formations de courte durée (COUD) to support businesses encountering recruiting problems.

This reduction is partially offset by a $321-million increase in the costs associated with last-resort financial assistance, attributable to the increase in the clientele stemming, in particular, from an increase in the number of asylum seekers and the annual indexation of benefits. This $321-million increase is also attributable to the impact of a full year of the new Basic Income Program intended for individuals with a persistent severely limited capacity for employment, which stems from the Government Action Plan to Foster Economic Inclusion and Social Participation, which seeks to lift 100 000 individuals out of poverty and increase the income of the poor.

2. Variance analysis (cont'd)

2.4. Comparison of expenditures with those of the preceding year (cont'd)

Affaires municipales et Habitation

Fiscal year ended March 31, 2024

(millions of dollars, unless otherwise indicated)

| | | Expenditure | | | Expenditure | | | | | | | |

| | | as at | | | as at | | | | | | | |

| | | March 31, 2024 | | | March 31, 2023 | | | Variance | |

| | | | | | (restated) | | | M$ | | | % | |

| | | | | | | | | | | | | |

| Transfers | | 4 547 | | | 4 624 | | | (77 | ) | | (1.7 | ) |

| | | | | | | | | | | | | |

| Remuneration | | 132 | | | 117 | | | 15 | | | 12.8 | |

| | | | | | | | | | | | | |

| Operating | | 157 | | | 183 | | | (26 | ) | | (14.2 | ) |

| | | | | | | | | | | | | |

| Doubtful accounts and other allowances | | 78 | | | 12 | | | 66 | | | 550.0 | |

| | | | | | | | | | | | | |

| TOTAL | | 4 914 | | | 4 936 | | | (22 | ) | | (0.4 | ) |

This portfolio mainly includes expenditures on financial support for municipalities, notably for infrastructure, social housing and compensation in lieu of taxes, as well as regional and metropolitan development measures.

The $22-million decrease in expenditures in relation to 2022-2023 is attributable to variations, including a reduction in transfer expenditures.

Transfers

The $77-million decrease in the transfer expenditure in relation to the results of the preceding year is mainly due to:

- a $694-million reduction in the subsidies granted to municipal infrastructure projects, stemming, in particular, from:

– write-downs of $421 million made in 2022-2023 for municipal infrastructure projects in respect of which the work was carried out in previous years,

– $251 million in non-recurrent subsidies granted in 2022-2023 to accelerate the completion and support the purchase and construction of affordable social housing units.

2. Variance analysis (cont'd)

2.4. Comparison of expenditures with those of the preceding year (cont'd)

Affaires municipales et Habitation (cont'd)

This decrease is partially offset by:

$310 million of additional expenditures attributable to the program to share with the municipalities the growth in revenues of 1 point of Québec sales tax;

a $124-million increase due to the AccèsLogis Québec program and the new Québec affordable housing program;

a $92-million increase attributable to the Shelter Allowance Program because of the increase in the number of beneficiary households following the simplification of the financial assistance application process;

$109 million in additional subsidies granted to build affordable social housing units under the partnership with the tax-advantaged funds.

2. Variance analysis (cont'd)

2.4. Comparison of expenditures with those of the preceding year (cont'd)

Économie, Innovation et Énergie

Fiscal year ended March 31, 2024

(millions of dollars, unless otherwise indicated)

| | | Expenditure | | | Expenditure | | | | | | | |

| | | as at | | | as at | | | | | | | |

| | | March 31, 2024 | | | March 31, 2023 | | | Variance | |

| | | | | | | | | M$ | | | % | |

| | | | | | | | | | | | | |

| Transfers | | 3 238 | | | 2 819 | | | 419 | | | 14.9 | |

| | | | | | | | | | | | | |

| Remuneration | | 93 | | | 83 | | | 10 | | | 12.0 | |

| | | | | | | | | | | | | |

| Operating | | 217 | | | 179 | | | 38 | | | 21.2 | |

| | | | | | | | | | | | | |

| Doubtful accounts and other allowances | | 282 | | | 199 | | | 83 | | | 41.7 | |

| | | | | | | | | | | | | |

| TOTAL | | 3 830 | | | 3 280 | | | 550 | | | 16.8 | |

This portfolio mainly includes expenditures dedicated to financing economic development projects, as well as supporting research, innovation and the development of energy resources.

The $550-million increase in expenditures in relation to 2022-2023 stems by and large from the increase in transfer expenditures.

Transfers

The $419-million increase is mainly attributable to an increase in the number of applications and the average amount granted for the following tax credits:

the investment tax credit, in respect of which expenditures rose by $251 million;

the tax credits for scientific research and experimental development, in respect of which expenditures increased by $177 million.

2. Variance analysis (cont'd)

2.4. Comparison of expenditures with those of the preceding year (cont'd)

Environnement, Lutte contre les changements climatiques, Faune et Parcs

Fiscal year ended March 31, 2024

(millions of dollars, unless otherwise indicated)

| | | Expenditure | | | Expenditure | | | | | | | |

| | | as at | | | as at | | | | | | | |

| | | March 31, 2024 | | | March 31, 2023 | | | Variance | |

| | | | | | | | | M$ | | | % | |

| | | | | | | | | | | | | |

| Transfers | | 1 726 | | | 1 083 | | | 643 | | | 59.4 | |

| | | | | | | | | | | | | |

| Remuneration | | 337 | | | 293 | | | 44 | | | 15.0 | |

| | | | | | | | | | | | | |

| Operating | | 364 | | | 293 | | | 71 | | | 24.2 | |

| | | | | | | | | | | | | |

| Doubtful accounts and other allowances | | 4 | | | 4 | | | ― | | | ― | |

| | | | | | | | | | | | | |

| TOTAL | | 2 431 | | | 1 673 | | | 758 | | | 45.3 | |

This portfolio mainly includes expenditures on measures to fight climate change, protect the environment and conserve biodiversity. These expenditures also include the operation of public dams, land management of the State's water domain, and the conservation of wildlife resources and their habitats.

Expenditures in 2023-2024 increased by $758 million in relation to those in the preceding year. This variation is mainly attributable mainly to an increase in transfer expenditures.

Transfers

The $643-million change in transfer expenditures in relation to the results of the preceding year is chiefly attributable to the impacts of the enhancement of the 2030 Plan for a Green Economy announced in Budget 2023-2024, including:

the $278-million increase in subsidies granted under the Drive Electric program because of a significant increase in electric vehicle sales;

the $143-million increase in subsidies granted to Hydro-Québec in particular to carry out five conversion projects on off-grid electricity distribution systems. The subsidies are intended to support the industry in the attainment of carbon neutrality without increasing demand on Hydro-Québec's central system;

the $97-million increase stemming, in particular, from subsidies related to programs that seek to reduce GHG emissions, i.e., ÉcoPerformance, Technoclimat, and Valorisation des rejets thermiques.

2. Variance analysis (cont'd)

2.4. Comparison of expenditures with those of the preceding year (cont'd)

Other portfolios

Fiscal year ended March 31, 2024

(millions of dollars, unless otherwise indicated)

| | | Expenditure | | | Expenditure | | | | | | | |

| | | as at | | | as at | | | | | | | |

| | | March 31, 2024 | | | March 31, 2023 | | | Variance | |

| | | | | | | | | M$ | | | % | |

| | | | | | | | | | | | | |

| Transfers | | 6 803 | | | 5 792 | | | 1 011 | | | 17.5 | |

| | | | | | | | | | | | | |

| Remuneration | | 6 409 | | | 5 994 | | | 415 | | | 6.9 | |

| | | | | | | | | | | | | |

| Operating | | 3 745 | | | 3 383 | | | 362 | | | 10.7 | |

| | | | | | | | | | | | | |

| Doubtful accounts and other allowances | | 542 | | | 364 | | | 178 | | | 48.9 | |

| | | | | | | | | | | | | |

| TOTAL | | 17 499 | | | 15 533 | | | 1 966 | | | 12.7 | |

This group includes the expenditures of 16 other portfolios encompassing programs in the culture, immigration, tourism, and natural resources sectors, and the activities of the judicial system, public security, international relations, legislative power, and central bodies.1

The $1 966-million increase in expenditures in relation to 2022-2023 stems from higher in expenditures in the four categories.

Transfers

The $1 011-million increase in transfers in 2023-2024 results from several variations within the group's portfolios, including:

a $371-million increase in expenditures associated with the tax credit for film production services resulting from a rising number of applications and an increase in the average amount requested. This credit, linked to the Culture et Communications portfolio, seeks to promote shooting in Québec of foreign film productions;

financial assistance totalling $100 million paid to telecommunications firms under the project administered by the Conseil exécutif portfolio to enhance regional cell phone coverage in Québec through the construction of cell phone sites in certain regions.

Remuneration

The $415-million increase in compensation expenditures is due, in particular, to the wage provisions stemming from the government's offers submitted and the agreements concluded in the context of the renewal of the collective agreements.

______________________________________

1 The Ministère des Finances, the Ministère du Conseil exécutif, and the Secrétariat du Conseil du trésor.

2. Variance analysis (cont'd)

2.4. Comparison of expenditures with those of the preceding year (cont'd)

Other portfolios (cont'd)

Operating

The $362-million increase in operating expenditures in 2023-2024 results from insignificant variations within the group's 16 portfolios.

Doubtful accounts and other allowances

The $178-million increase in doubtful account expenditures and other provisions is essentially due to the revision of the estimates of the doubtful account expenditure, attributable to the higher accounts receivable balance compared with 2022-2023.

2. Variance analysis (cont'd)

2.4. Comparison of expenditures with those of the preceding year (cont'd)

Debt service

Fiscal year ended March 31, 2024

(millions of dollars, unless otherwise indicated)

| | | Expenditure

as at

March 31, 2024 | | | Expenditure

as at

March 31, 2023 | | | Variance | |

| | | | | | | | | M$ | | | % | |

| | | | | | | | | | | | | |

| Debt service | | 9 982 | | | 10 222 | | | (240 | ) | | (2.3 | ) |

Debt service mainly comprises interest on the debt and interest on retirement plans liability and other future benefits1 of public and parapublic sector employees. Note 5 in the consolidated financial statements breaks down the composition of debt service.

The $240-million decrease in debt service in relation to 2022-2023 is attributable to:

the $1 235-million increase in investment income of the sinking funds pertaining to borrowings.2 In 2023-2024, the funds recorded losses on the disposal of assets in the context of the management of investment activities below those observed in 2022-2023;

the $560-million increase attributable to the investment income of the funds linked to the pension plans and other employee future benefits. Such revenues reduce the expenditure.

These variations are partially offset by an increase totalling $1 555 million in the other elements comprising debt service, especially because of growth in the average volume of debts contracted on financial markets and higher interest rates.

______________________________________

1 This corresponds to the interest on obligations relating to retirement plans and other future benefits of public and parapublic sector employees, minus the investment income of the Retirement Plans Sinking Fund (RPSF) and the specific funds of the plans.

2 Revenues from the sinking funds pertaining to borrowings are deducted from debt service. They comprise interest generated on the investments and gains and losses on dispositions of assets.

▌ 3. Balanced Budget Act

Budget balance

The Balanced Budget Act (the Act) specifies the calculation of the budget balance and decrees the applicable rules when a budgetary deficit is anticipated or observed. The budget balance corresponds to the annual surplus (deficit) related to the activities from which are deducted the revenues allocated to the Generations Fund.

The Act stipulates that the government cannot provide for a budgetary deficit except under one of the following three specific circumstances:

a catastrophe that significantly affects revenues or expenditures;

a significant deterioration in economic conditions;

changes in the federal transfer programs to the provinces that would reduce the transfer payments paid to the government.

In December 2023, the Act was modernized to enhance its flexibility and simplicity while maintaining the constraint related to budget balance. From this modernization stem, in particular, the abolition of the stabilization reserve and the increase in the threshold of the budgetary deficit beyond which the submission by the government of a plan to restore fiscal balance is required. This threshold stood at $1 billion in the Act prior to its modernization. Henceforth, the government must submit a plan to restore balanced budget when it observes a budgetary deficit higher than the revenues recorded for a given year in the Generations Fund. The plan must be submitted not later than the time of the second Budget Speech given after the presentation of the Public Accounts.

Within the meaning of the modernized Act, the 2022-2023 Public Accounts, published in the fall of 2023, indicated a budgetary deficit of $6 084 million.1 Since this deficit exceeds the revenues allocated to the Generations Fund, which stood at $3 082 million, a plan to restore balanced budget must be presented with the 2025-2026 Budget Speech.

Fiscal year 2023-2024

The budgetary balance for the fiscal year ended March 31, 2024 is a deficit of $8 041 million after taking into account the allocation of $2 047 million to the Generations Fund.

______________________________________

1 The budget balance before use of the stabilization reserve.

3. Balanced Budget Act (cont'd)

Budget balance within the meaning of the Balanced Budget Act

Fiscal year ended March 31, 2024

(millions of dollars)

| | | | | | Actual results | |

| | | Budget | | | as at | |

| | | 2023-2024 | | | March 31, 2024 | |

| | | | | | | |

| Annual deficit | | (1 625 | ) | | (5 994 | ) |

| | | | | | | |

| Revenue of the Generations Fund | | (2 373 | ) | | (2 047 | ) |

| | | | | | | |

| Budget balance | | (3 998 | ) | | (8 041 | ) |

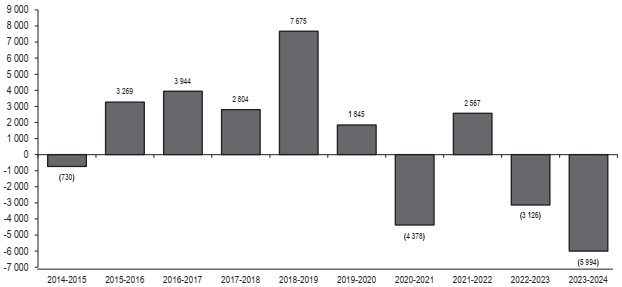

Change in budget balance

(millions of dollars)

Note: In accordance with the Balanced Budget Act, the budgetary balance does not include the retroactive effect of a new CPA Canada standard for years prior to its coming into force. Thus, although the annual surpluses (deficits) were restated to reflect the application of the accounting standard relating to asset revenues and the standard pertaining to public private partnerships, these restatements had no impact on the budgetary balance.

(1) The provisions of the Balanced Budget Act prohibiting budgetary deficits did not apply to these years.

(2) Recourse to the stabilization reserve made it possible to achieve a balanced budget for 2020-2021 and 2021-2022 and to establish the budget deficit at $5 635M for 2022-2023. The budget balance within the meaning of the Balanced Budget Act after the stabilization reserve is presented in Table 1.4 of the financial statistics (page 68).

(3) The stabilization reserve was abrogated in 2023-2024.

3. Balanced Budget Act (cont'd)

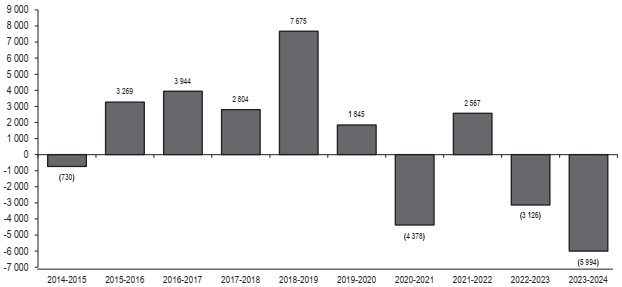

A $725-million budget deficit was recorded in fiscal 2014-2015 in compliance with the Act then in force, since the provisions prohibiting a budget deficit were adopted in 2015-2016. The government's budgetary balances improved continuously from 2014-2015 to 2018-2019, benefiting in particular from a favourable economic situation.

On March 13, 2020, the Québec government declared a health emergency due to the global COVID-19 pandemic. Initiatives implemented to address the crisis and stimulate the economy, combined with the impact of the lockdown and temporary institutional closures, significantly affected the government's financial results for years 2019-2020 to 2021-2022.1 Against this backdrop, to gradually reduce the deficit without curtailing services to Quebecers or a revival of sustainable economic growth, the provisions in the Act that prohibited the recording or anticipation of a budget deficit and those obliging the government to resolve any deficit were suspended for the 2021-2022 to 2022-2023 fiscal years.

In 2022-2023, the budget deficit of $5 635 million2 is mainly due to measures put in place to help Quebecers cope with the rising cost of living in light of high inflation.

Lastly, in 2023-2024, the budget deficit of $8 041 million is attributable to more rapid growth in expenditures (2.8%) than in revenues (0.9%). Sluggish revenue growth is mainly explained by economic stagnation in Québec, which adversely affected income and property taxes, reduced Hydro-Québec exports due to low runoff in its main basins. As for the spending growth, it is attributable to growth in portfolio expenditures (3.2%), stemming notably from persistent inflation in 2023, by higher-than-anticipated population growth and by a major investment in public services, notably to improve working conditions for public and parapublic sector employees.

Generations Fund

The Generations Fund, created under the Act to reduce the debt and establish the Generations Fund, is used exclusively to repay the government's gross debt. The statement of change in the balance of the Generations Fund is presented in Note 12 "Generations Fund" of the consolidated financial statements.

In December 2023, the Act was amended to modify the sources of revenue devoted to the Generations Fund starting in fiscal 2023-2024. Accordingly, revenues stemming from the indexation of the price of heritage pool electricity, mining revenue, an annual amount of $500 million from the specific tax on alcoholic beverages, and amounts relating to the liquidation of unclaimed property were no longer allocated to the Generations Fund.

______________________________________

1 The change in the application of the accounting standard on government transfers also contributed to the budgetary deficit for 2020-2021.

2 The budget balance stood at $6 084 million. As stipulated in the Act prior to its modernization, it was reduced to $5 635 million after the use of the $449 million balance in the stabilization reserve.

3. Balanced Budget Act (cont'd)

Generations Fund (cont'd)

In keeping with the amended Act, the sources of revenue allocated to the Generations Fund are:

the water-power royalties that Hydro-Québec and private power producers pay;

Hydro-Québec's $650-million annual additional contribution drawn from the dividend that Hydro-Québec pays the government;

gifts, bequests, and other contributions received by the Minister of Finance for debt reduction;

revenues form the investment of the funds that make up the Generations Fund.

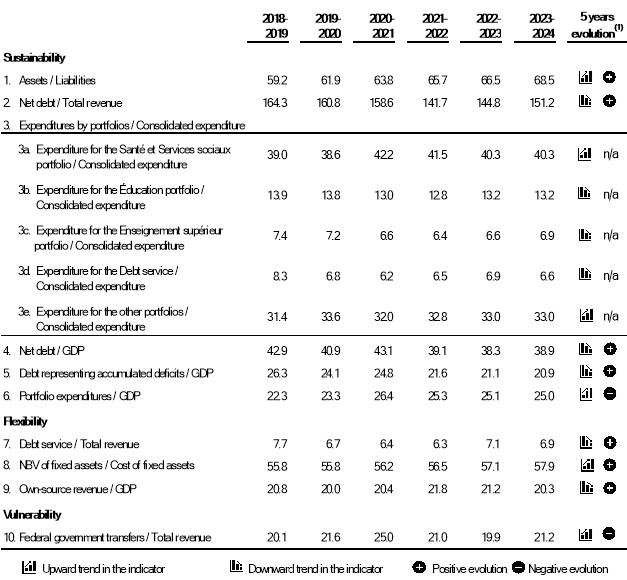

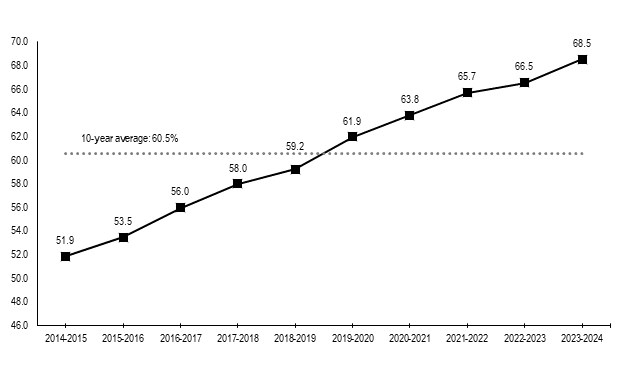

▌ 4. Analysis of main trends

The main trends are established with the financial information from the consolidated financial statements of the Gouvernement du Québec.

Where financial statements have been restated in a subsequent fiscal year, the restated data has been used. In 2023-2024, the accounting changes applied retroactively, presented in Note 3 of the consolidated financial statements, required the restatement of data for previous fiscal years presented in certain charts.

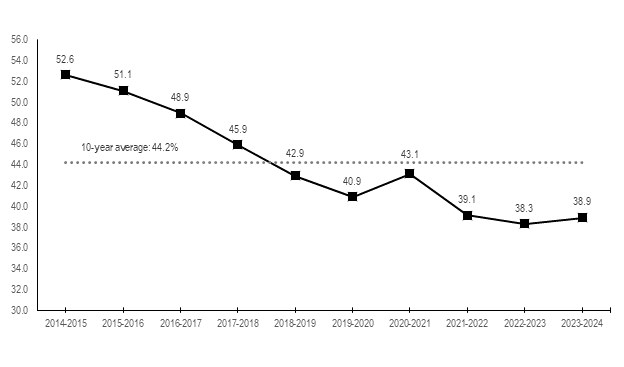

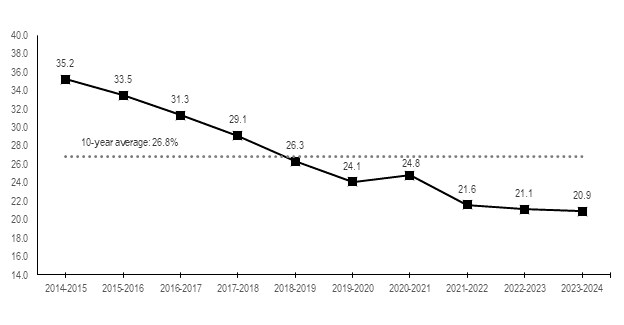

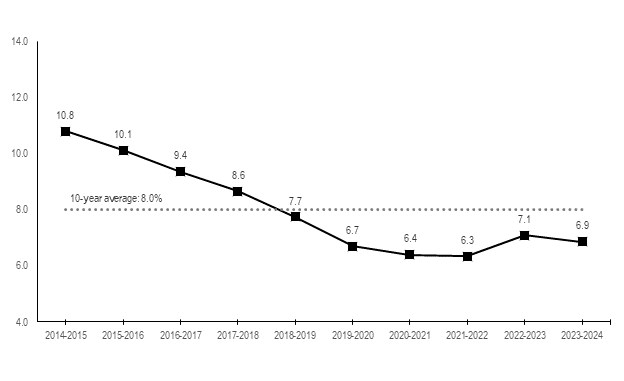

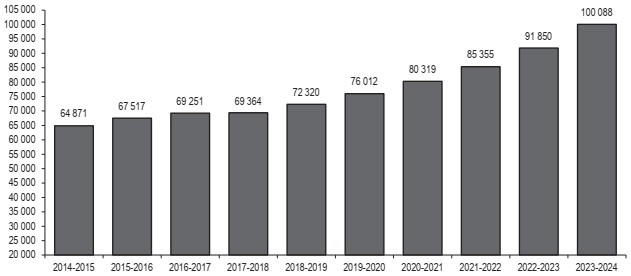

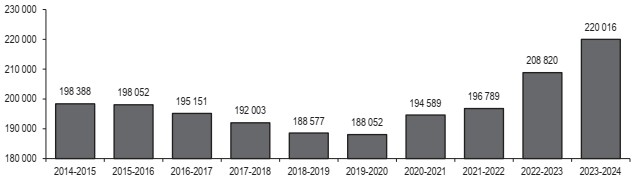

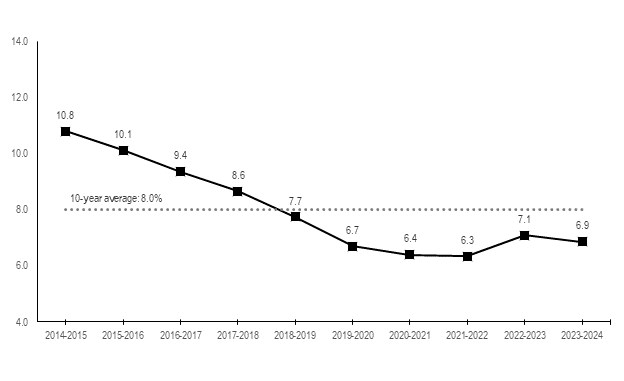

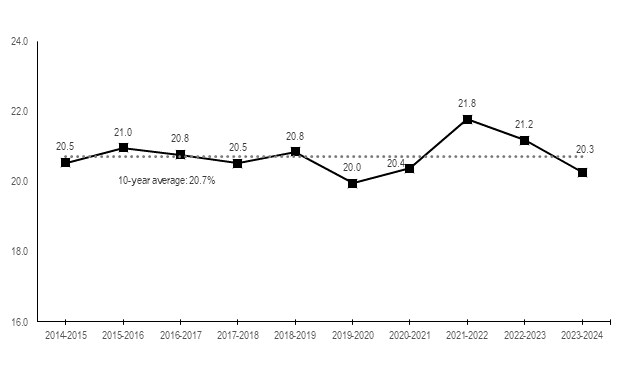

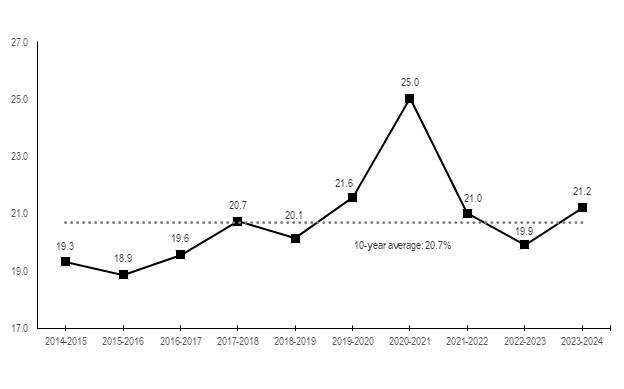

The data presented put into perspective the trends observed over the past 10 years for the following main items:

the annual surplus (deficit);

consolidated revenue by sources;

consolidated expenditures by portfolios;

the net book value of fixed assets;

the government's gross debt.

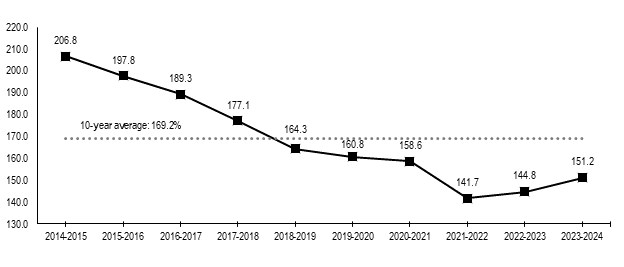

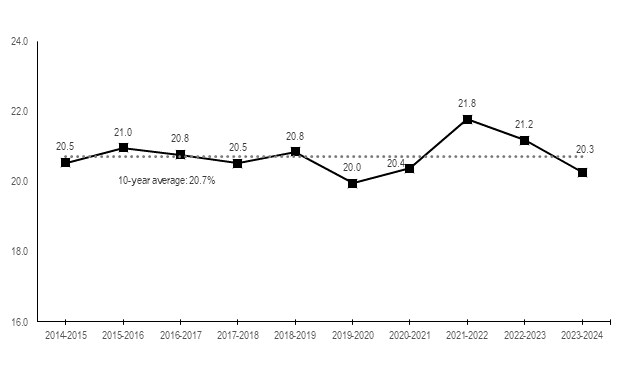

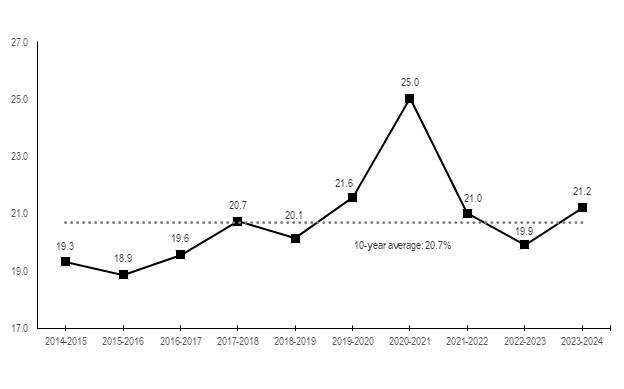

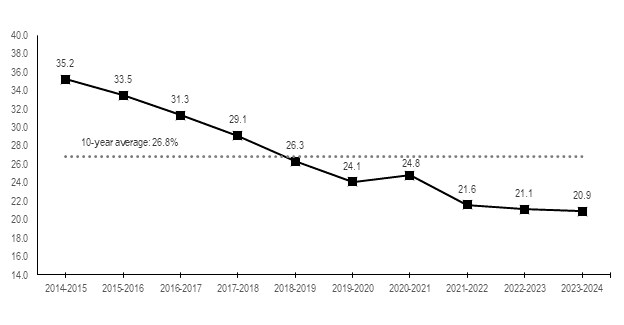

Change in annual surplus (deficit)

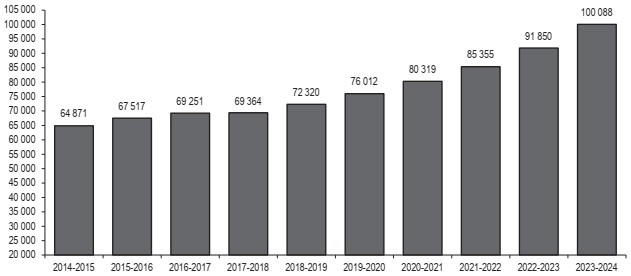

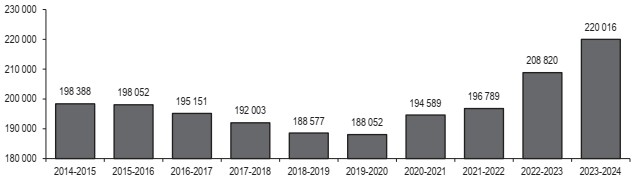

(millions of dollars)