EXHIBIT 99.1

DESCRIPTION

This description of Québec is dated as of June 6, 2011 and appears as Exhibit 99.1

to Québec’s Annual Report on Form 18-K to

the U.S. Securities and Exchange Commission for the fiscal year ended

March 31, 2011.

The delivery of this document at any time does not imply that the information is correct as of any time subsequent to its date. This document (other than as part of a prospectus contained in a registration statement filed under the U.S. Securities Act of 1933) does not constitute an offer to sell or the solicitation of an offer to buy any securities of Québec.

Table of Contents

Foreign Exchange | 3 |

| |

Summary | 4 |

| |

Québec | 7 |

| |

Overview | 7 |

| |

Constitutional Framework | 7 |

| |

Government | 8 |

| |

Native Peoples | 8 |

| |

Economy | 11 |

| |

Economic Developments in 2010 | 11 |

| |

Economic Structure | 14 |

| |

Free Trade Agreements | 20 |

| |

Government Finances | 24 |

| |

Financial Administration | 24 |

| |

2010-2011 Preliminary Results | 28 |

| |

2011-2012 Budget | 29 |

| |

Consolidated Revenue Fund Revenue | 31 |

| |

Consolidated Revenue Fund Expenditure | 33 |

| |

Government Employees and Collective Unions | 36 |

| |

Consolidated Non-Budgetary Transactions | 37 |

| |

Government Enterprises and Agencies | 40 |

| |

Enterprises Included in the Government’s Reporting Entity | 42 |

| |

Agencies Which Conduct Fiduciary Transactions That Are Not Included in the Government’s Reporting Entity | 45 |

| |

Public Sector Debt | 47 |

| |

Government Debt | 49 |

| |

Guaranteed Debt | 51 |

| |

Funded Debt of the Municipal Sector and Other Institutions | 52 |

| |

Government’s Commitments | 53 |

| |

Where You Can Find More Information | 53 |

| |

Forward-Looking Statements | 54 |

| |

Supplementary Information | 55 |

- 2 -

FOREIGN EXCHANGE

Canada maintains a floating exchange rate for the Canadian dollar in order to permit the rate to be determined by market forces without intervention except as required to maintain orderly conditions. Annual average noon spot exchange rates for the major foreign currencies in which debt of Québec is denominated, expressed in Canadian dollars, are shown below.

| | | | | | | | | | |

Foreign Currency | | 2007 | | 2008 | | 2009 | | 2010 | | 2011(1) |

| | | | | | | | | | |

| | | | | | | | | | |

United States Dollar | | 1.0748 | | 1.0660 | | 1.1420 | | 1.0299 | | 0.9767 |

| | | | | | | | | | |

Japanese Yen | | 0.0091 | | 0.0104 | | 0.0122 | | 0.0118 | | 0.0119 |

| | | | | | | | | | |

Swiss Franc | | 0.8946 | | 0.9840 | | 1.0505 | | 0.9896 | | 1.0639 |

| | | | | | | | | | |

Pound Sterling | | 2.1487 | | 1.9617 | | 1.7804 | | 1.5918 | | 1.5785 |

| | | | | | | | | | |

New Zealand Dollar | | 0.7892 | | 0.7547 | | 0.7193 | | 0.7430 | | 0.7524 |

| | | | | | | | | | |

Mexican Pesos | | 0.0983 | | 0.0959 | | 0.0845 | | 0.0816 | | 0.0820 |

| | | | | | | | | | |

Australian Dollar | | 0.8982 | | 0.9002 | | 0.8969 | | 0.9470 | | 1.0038 |

| | | | | | | | | | |

Euro | | 1.4691 | | 1.5603 | | 1.5855 | | 1.3661 | | 1.3643 |

| | | | | | | | | | |

Hong Kong Dollar | | 0.1377 | | 0.1369 | | 0.1473 | | 0.1326 | | 0.1255 |

| | | | | | | | | | |

(1) Monthly average through the end of May 2011.

Source: Bank of Canada.

In this document, unless otherwise specified or the context otherwise requires, all dollar amounts are expressed in Canadian dollars. The fiscal year of Québec ends March 31. “Fiscal 2011” and “2010-2011” refer to the fiscal year ended March 31, 2011, and, unless otherwise indicated, “2010” means the calendar year ended December 31, 2010. “Fiscal 2012” and “2011-2012” refer to the fiscal year that will end on March 31, 2012. Other fiscal and calendar years are referred to in a corresponding manner. Any discrepancies between the amounts listed and their totals in the tables included in this document are due to rounding. |

- 3 -

SUMMARY

The information below is qualified in its entirety by the detailed information provided elsewhere in this document.

Economy

(dollar amounts in millions)

| | | | | | | | | | |

| | 2006 | | 2007 | | 2008 | | 2009 | | 2010 |

| | | | | | | | | | |

| | | | | | | | | | |

GDP at current market prices | | 282,505 | | 295,928 | | 302,748 | | 303,747 | | 317,773 |

| | | | | | | | | | |

% change – GDP in chained 2002 dollars(1) | | 1.8% | | 2.1% | | 1.1% | | -0.3% | | 2.8% |

| | | | | | | | | | |

Personal income | | 236,642 | | 249,883 | | 260,059 | | 263,213 | | 272,527 |

| | | | | | | | | | |

Capital expenditures | | 51,809 | | 57,055 | | 60,118 | | 58,858 | | 64,144 |

| | | | | | | | | | |

International exports of goods | | 73,177 | | 69,798 | | 70,760 | | 58,031 | | 59,205 |

| | | | | | | | | | |

Population at July 1 (in thousands) | | 7,632 | | 7,687 | | 7,751 | | 7,828 | | 7,907 |

| | | | | | | | | | |

Unemployment rate | | 8.1% | | 7.2% | | 7.2% | | 8.5% | | 8.0% |

| | | | | | | | | | |

Consumer Price Index – % change | | 1.7% | | 1.6% | | 2.1% | | 0.6% | | 1.2% |

| | | | | | | | | | |

Average exchange rate (US$ per C$) | | 0.88 | | 0.93 | | 0.94 | | 0.88 | | 0.97 |

| | | | | | | | | | |

Consolidated Financial Transactions(2)

Fiscal year ending March 31

(dollar amounts in millions)

| | | | | | | | | | |

| | 2008 | | 2009 | | 2010 | | Preliminary

Results

2011(3) (4) | | Budget

Forecast

2012 |

| | | | | | | | | | |

| | | | | | | | | | |

Consolidated Revenue Fund | | | | | | | | | | |

| | | | | | | | | | |

Own-source revenue | | 49,464 | | 48,773 | | 47,994 | | 46,925 | | 50,336 |

| | | | | | | | | | |

Federal transfers(5) | | 13,629 | | 14,023 | | 15,161 | | 15,451 | | 15,039 |

| | | | | | | | | | |

Total revenue | | 63,093 | | 62,796 | | 63,155 | | 62,376 | | 65,375 |

| | | | | | | | | | |

Program spending | | (54,826) | | (58,550) | | (61,579) | | (59,819) | | (61,284) |

| | | | | | | | | | |

Debt service | | (7,021) | | (6,504) | | (6,117) | | (6,934) | | (7,794) |

| | | | | | | | | | |

Total expenditure | | (61,847) | | (65,054) | | (67,696) | | (66,753) | | (69,078) |

| | | | | | | | | | |

Contingency reserve | | — | | — | | — | | (300) | | (300) |

| | | | | | | | | | |

Net results of Consolidated Revenue Fund | | 1,246 | | (2,258) | | (4,541) | | (4,677) | | (4,003) |

| | | | | | | | | | |

Net results of consolidated entities | | 404 | | 1,007 | | 1,601 | | 1,209 | | 1,143 |

| | | | | | | | | | |

Surplus (deficit) within the meaning of the public accounts | | 1,650 | | (1,251) | | (2,940) | | (3,468) | | (2,860) |

| | | | | | | | | | |

Revenue of the Generations Fund | | (449) | | (587) | | (725) | | (732) | | (940) |

| | | | | | | | | | |

Stabilization reserve(6) | | (1,201) | | 1,845 | | 433 | | — | | — |

| | | | | | | | | | |

Accounting modifications | | — | | — | | 58 | | — | | — |

| | | | | | | | | | |

Consolidated budgetary balance within the meaning of the Balanced Budget Act | | 0 | | 7 | | (3,174) | | (4,200) | | (3,800) |

| | | | | | | | | | |

Deposit of dedicated revenues in the Generations Fund(7) | | 449 | | 587 | | 725 | | 732 | | 940 |

| | | | | | | | | | |

Consolidated budgetary balance | | 449 | | 594 | | (2,449) | | (3,468) | | (2,860) |

| | | | | | | | | | |

Consolidated non-budgetary requirements | | (1,156) | | (1,124) | | (2,269) | | (3,002) | | (4,674) |

- 4 -

| | | | | | | | | | |

Consolidated net financial requirements(8) | | (707) | | (530) | | (4,718) | | (6,470) | | (7,534) |

Funded Debt of Public Sector (net of sinking fund balances)

As of March 31

(dollar amounts in millions) (9)

| | | | | | | | | | |

| | Unadjusted(10)

2007 | | Unadjusted(10)

2008 | | Unadjusted(10)

2009 | | 2010 | | Preliminary

Results

2011(4) |

| | | | | | | | | | |

| | | | | | | | | | |

Government Funded Debt | | | | | | | | | | |

| | | | | | | | | | |

Borrowings – Government | | 109,714 | | 112,507 | | 124,549 | | 126,731 | | 139,035 |

| | | | | | | | | | |

Borrowings – to finance Government Enterprises | | 31 | | 25 | | 221 | | 217 | | 855 |

| | | | | | | | | | |

Government Guaranteed Debt(11) | | 32,674 | | 32,399 | | 36,668 | | 36,385 | | 37,723 |

| | | | | | | | | | |

Municipal Sector Debt | | 16,409 | | 17,321 | | 18,639 | | 19,538 | | 20,307 |

| | | | | | | | | | |

Other Institutions | | 2,023 | | 1,552 | | 931 | | 1,055 | | 817 |

| | | | | | | | | | |

Public Sector Funded Debt(12) | | 160,851 | | 163,804 | | 181,008 | | 183,926 | | 198,737 |

| | | | | | | | | | |

Per capita ($) | | 21,076 | | 21,309 | | 23,353 | | 23,496 | | 25,134 |

| | | | | | | | | | |

As a percentage of GDP(13) | | 56.9% | | 55.4% | | 59.8% | | 62.2% | | 65.6% |

| | | | | | | | | | |

Personal income | | 68.0% | | 65.6% | | 69.6% | | 73.6% | | 76.4% |

(1) | Adjusted for the effects of inflation in the currency from year to year. |

(2) | The categories set forth reflect the presentation of the 2011-2012 Budget. |

(3) | As of Fiscal 2011, the 2011-2012 Budget incorporates the implementation of the Land Transportation Network Fund (FORT) and the Tax Administration Fund (FRAF). The creation of these two funds does not affect the Government’s budgetary balance. However, it modifies the level of own-source revenue, program spending and net results of consolidated entities (see “Government Finances – Financial Administration”). |

(4) | The Preliminary Results 2011 are based on financial information presented as at March 31, 2011 in the 2011-2012 Budget which was tabled on March 17, 2011. These preliminary results are subject to change. |

(5) | Federal transfers are presented on an accrual basis (see “Government Finances – Financial Administration”). |

(6) | A negative amount indicates an allocation to the reserve and a positive amount, a use of the reserve. |

(7) | The Generations Fund was created in June 2006 by the adoption of the Act to reduce the debt and establish the Generations Fund and is a separate entity from the Consolidated Revenue Fund. This law establishes the fund as a permanent tool for reducing the debt burden. In addition, it stipulates that the sums accumulated in the Generations Fund are dedicated exclusively to repaying the debt. |

(8) | Since Fiscal 2010, the Consolidated net financial requirements take into account the budgetary and non-budgetary transactions of the health and social services and education networks. |

(9) | Canadian dollar equivalent at the dates indicated for loans in foreign currencies after taking into account currency swap agreements and foreign exchange forward contracts. |

(10) | Starting in 2009-2010, reflects the line-by-line consolidation of the results of network institutions with those of the Government.. The figures for Fiscal 2007 to Fiscal 2009 have not been restated. |

(11) | Represents debt of Hydro-Québec. |

(12) | The figures for Fiscal 2007 to Fiscal 2009 have not been restated on a line-by-line consolidated basis. Figures for Fiscal 2010 and Fiscal 2011 represent debt of the universities other than the Université du Québec and its constituents. |

(13) | Includes debt covered by the Government’s commitments (see “Public Sector Debt - Government Commitments”). |

(14) | Percentages are based upon the prior calendar year’s GDP and Personal income. |

| |

- 5 -

- 6 -

QUÉBEC

Overview

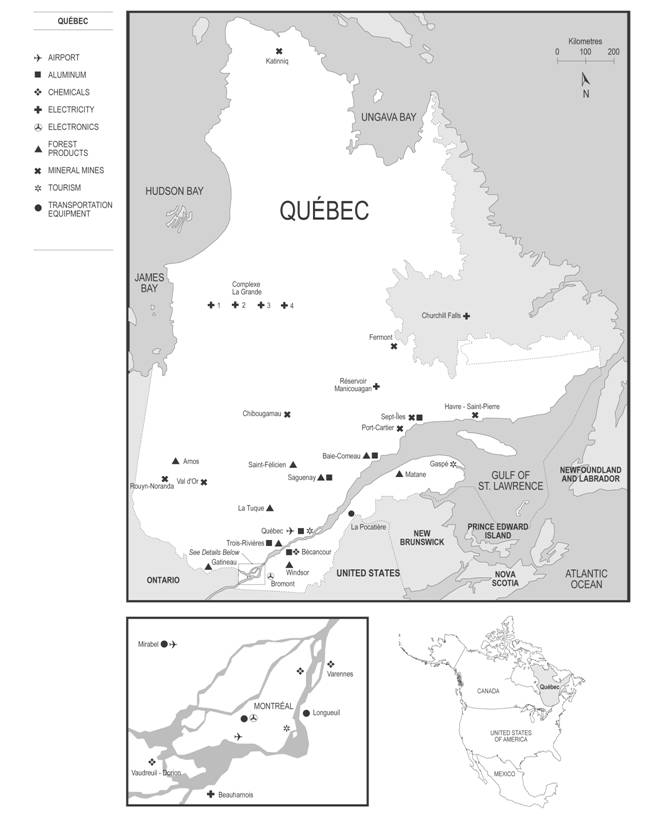

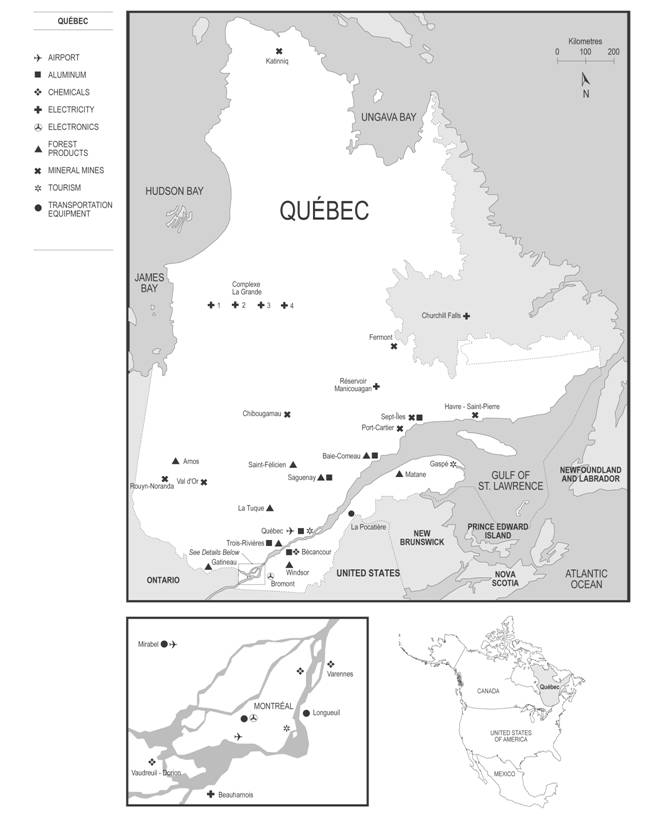

Québec is the largest by area of the ten provinces in Canada (1,541,000 square kilometers or 594,860 square miles, representing 15.4% of the geographical area of Canada) and the second largest by population (7.9 million, representing 23.2% of the population of Canada, as of January 2011). The population of Québec increased on average by 0.8% per year since 2006. In the same period, the population of Canada increased on average by 1.1%.

Québec has a modern, developed economy, in which the service sector contributed 75.6%, the manufacturing industry 16.3%, the construction industry 5.9% and the primary sector 2.2% of real GDP at basic prices in chained 2002 dollars in 2010. The leading manufacturing industries in Québec are food products, primary metal products (including aluminum smelting), petroleum and coal products, transportation equipment products (including aircraft and motor vehicles and associated parts), chemical products, paper products and fabricated metal products. Québec also has significant hydroelectric resources, generating 32.0% of the electricity produced in Canada in 2010.

Montréal and Ville de Québec, the capital of Québec, are the centers of economic activity. Montréal is one of the main industrial, commercial and financial centers of North America and is Canada’s second largest urban area as measured by population. Port of Montréal, situated on the St. Lawrence River, is Canada’s second largest port in terms of operating revenues and provides access to the Atlantic Ocean and the inland navigation system of the Great Lakes.

French is the official language of Québec and is spoken by approximately 95% of its population.

Constitutional Framework

Canada is a federation of ten provinces and three federal territories, with a constitutional division of responsibilities between the federal and provincial governments as set out in The Constitution Acts, 1867 to 1982 (the “Constitution”).

Under the Constitution, each provincial government has exclusive authority to raise revenue for provincial purposes through direct taxation within its territorial limits. Each provincial government also has exclusive authority to regulate education, health, social services, property and civil rights, natural resources, municipal institutions and, generally, to regulate all other matters of a purely local or private nature in its province, and to regulate and raise revenue from the exploration, development, conservation and management of natural resources.

The federal parliament is empowered to raise revenue by any method or system of taxation and generally has authority over matters or subjects not assigned exclusively to the provinces. It has exclusive authority over the regulation of trade and commerce, currency and coinage, banks and banking, national defense, naturalization and aliens, postal services, navigation and shipping, and bills of exchange, interest and bankruptcy.

The Constitution Act, 1982 (the “Constitution Act”), enacted by the parliament of the United Kingdom, provides, among other things, that amendments to the Constitution be effected in Canada according to an amending formula. The Constitution Act also includes various modifications to the Constitution. The Constitution Act came into effect in 1982 notwithstanding the opposition of the National Assembly of Québec (the “National Assembly”) and the government of Québec (the “Government”) to certain clauses relating to provincial jurisdiction and the terms of the amending formula.

- 7 -

The Parti Québécois, which has as its principal objective the sovereignty of Québec, formed the Government from September 1994 to April 14, 2003. During its term in office, the Parti Québécois tabled in the National Assembly a Bill entitled An Act respecting the future of Québec (the “Act”), which provided that upon receipt of a favorable vote in a referendum, the Act would be enacted and Québec would proclaim its sovereignty following a formal offer to Canada of a treaty of economic and political partnership. In November 1995, a slight majority of Québec citizens (50.6%) voted against the Act.

The Supreme Court of Canada decided in August 1998, on a reference from the federal government in which Québec did not participate, that (i) under the Constitution, Québec may not secede unilaterally without negotiation with the other parties in the Canadian Confederation within the existing constitutional framework; (ii) under international law, Québec has no right to secede unilaterally from Canada; (iii) nonetheless, the clear repudiation by the people of Québec of the existing constitutional order and the clear expression of a desire to pursue secession would oblige the other provinces and the federal government to negotiate in accordance with constitutional principles, and Québec would also have to negotiate in accordance with such principles; and (iv) if Québec were to so negotiate but face unreasonable intransigence from the other parties, it would be more likely to be recognized than if it did not itself act according to constitutional principles in the negotiations.

The Québec Liberal Party, a federalist party, won a third consecutive mandate at the general election in December 2008. It currently forms the Government in the National Assembly. With regard to the constitutional issue, the Québec Liberal Party pursues a policy that emphasizes the values of Canadian federalism. In particular, its platform is focused on strengthening Québec’s place within the federation, on forming new alliances with the other provinces and on promoting intergovernmental cooperation.

Government

Legislative power in Québec is exercised by the Parliament of Québec, which is comprised of the Lieutenant-Governor, who is appointed by the Governor General in Council of Canada, and the National Assembly. The National Assembly consists of 125 members elected by popular vote from single member districts. According to constitutional practice, the leader of the party with the largest number of elected members becomes Prime Minister and forms the Government.

Executive power in Québec is vested in the Lieutenant-Governor acting with, or on the recommendation of, the Conseil exécutif, which consists of the Prime Minister and the Cabinet (Conseil des ministres). The Conseil exécutif is accountable to the National Assembly.

The current National Assembly consists of 65 members of the Québec Liberal Party, 49 members of the Parti québécois, 4 members of the Action Démocratique du Québec, 1 member of Québec solidaire and 6 independents. Members are elected for a term of five years, subject to earlier dissolution of the National Assembly by the Lieutenant-Governor upon the recommendation of the Prime Minister or following the Government’s defeat on a vote of no confidence. The mandate of the current Government extends through the next election, which must be called no later than December 2013.

Native Peoples

Various aboriginal communities in Québec have initiated legal actions to have the existence of their ancestral rights (including aboriginal title) recognized and obtain damages and interest as compensation for alleged infringements of their rights. The ancestral rights of aboriginal people are recognized under section 35 of the Constitution. Taken as a whole, aboriginal people are claiming $15.9 billion in damages and interest through these actions.

- 8 -

Included among these legal actions are three claims for damages and interest filed as part of efforts to contest the validity of a provision of the 1975 James Bay and Northern Québec Agreement (the “JBNQA”). The effect of that provision was to extinguish all aboriginal claims, rights, titles and interests, regardless of their nature, in respect of the territory covered by the JBNQA.

q In the first action (The Betsiamites Band et al. v. Attorney-General of Québec, the Attorney-General of Canada and Hydro-Quebec (Superior Court, no 500-17-010685-035)) (Betsiamites II), which was filed in December 2003, the Innu First Nation of Betsiamites (the “Betsiamites”) is claiming the invalidity of the provisions of the James Bay and Northern Quebec Native Claims Settlement Act, S.C. 1977, c. 32, and of the Act respecting the agreement concerning James Bay and Northern Québec, S.Q. 1976, c. 46 that are alleged to have infringed on the ancestral rights of the Betsiamites, by extinguishing their rights over the territory covered by the JBNQA. The Betsiamites also claim full enjoyment of their ancestral rights over this territory that they consider to be their ancestral territory and damages of some $75 million for loss of such enjoyment for more than 25 years. Alternatively, they claim the right to fair compensation that they estimate at $250 million if the court should conclude that their ancestral rights were extinguished by the provincial and federal statutes in question. Québec and Hydro-Québec intend to contest this claim.

q The second action concerns the community of Uashat-Maliotenam (The Innu of Takuikan Uashat Mak Mani-Utenam Band et al. v. Attorney-General of Québec, the Attorney-General of Canada and Hydro-Québec. (Superior Court, no 200-17-004196-036)) (Uashat II). In this action, also filed in December 2003, representatives of the Innus of Takuikan Uashat instituted an action against seeking judicial recognition of their aboriginal rights and of their unextinguished Indian title over certain areas of land in Québec. Plaintiffs, who claim not to be parties to the JBNQA, allege that the JBNQA and certain federal and provincial laws are illegal, unconstitutional and not binding upon them. They seek various orders, including rendering of accounts and revenue sharing for the unlawful use and management of the lands, notably in respect of hydroelectric facilities on these lands, and awarding damages against Canada, Québec and Hydro-Québec, jointly and severally, in an amount of up to $1.5 billion (subject to further increase). In June 2005, as requested by the parties, the Québec Superior Court suspended the legal action for five years. However, on January 27, 2009, at the request of the Attorney-General of Canada, the suspension of the proceedings was lifted and the case has been reactivated. Québec and Hydro-Québec intend to contest this claim.

q The third action was filed in January 2004 by the Atikamekw (the Atikamekw Band of Opiticiwan et al. v. Attorney-General of Québec, the Attorney-General of Canada and Hydro-Québec (Superior Court, no 500-17-018678-030)). The Atikamekw are asking the Court to declare that the Native Claims Settlement Act, which implements the JBNQA, did not extinguish the “native, ancestral or aboriginal claims, rights, titles and interests” they may hold in the portion of the territory they claim and that is located on the territory covered by the JBNQA. Alternatively, the Atikamekw are claiming compensation of $300 million for the unilateral extinguishment of their claims, titles, rights and interests over the territory mentioned above. By agreement of the parties, this legal action has been suspended until April 2012.

Three other legal actions seeking damages and interest have been filed by aboriginal communities to obtain compensation for alleged infringements of their rights over territories not covered by the JBNQA.

q In the first action, filed in 1998 (The Innu Nation of Pessamit et al. v. Attorney-General of Québec , the Attorney-General of Canada and Hydro-Québec (Superior Court, no 500-05-039472-988) (Betsiamites I), the Betsiamites are seeking a court declaration that they hold aboriginal title and ancestral rights over an immense territory on the Quebec North Shore, including the area where Hydro-Québec’s Manicouagan-Outardes hydro-electric installations are located. In addition, the Betsiamites initially are claiming $500 million, with interest, for damages caused to the territory by the construction of hydroelectric facilities in the late 1960s and early 1970s. They are also demanding that Hydro-

- 9 -

Québec be ordered to turn over to the Betsiamites a portion of the revenue from the production of electrical power by these facilities. In November 2006, the Betsiamites reinstated the legal action. Québec and Hydro-Québec intend to contest this claim.

q The second action (The First Nation of Pessamit et al. v. Attorney-General of Québec, the Attorney-Generall of Canada (Superior Court, no 500-17-028743-055)) (Betsiamites IV) was filed by the Betsiamites in December 2005. This action covers the portion of the traditional territory they claim (50,000 km2 of 138,000 km2) on which forest development has been carried out since the mid-19th century. This legal action impleads the 27 forest products companies that hold at least one timber supply and forest management agreement (TSFMA) on the traditional territory claimed by the Betsiamites. In this lawsuit, the Betsiamites seek confirmation that: 1) they hold aboriginal title and ancestral rights over their traditional territory; 2) forest development of this territory was authorized illegally; 3) the Government was not entitled to collect revenues from such development; and 4) the Forest Act cannot apply to the traditional territory of the Betsiamites. Lastly, the Betsiamites are claiming damages and interest of $1 billion against Québec and Canada for infringement of enjoyment of their ancestral rights and $2.1 billion against Québec for breach of their right to develop the forest resource. On September 30, 2006, the Betsiamites amended this legal action, adding a claim for the payment of $50 million in damages and interest against Québec and a forest company for logging activities carried out on René-Levasseur Island. Québec intends to contest this claim.

q In the third action, the Uashaunnuat filed a motion before the Superior Court of Québec in May 2010 (The Innus of Takuikan Uashat Mak Mani-Utenam Band v. Attorney-General of Québec, Attorney-General of Canada and Hydro-Québec (Superior Court, no 500-17-050868-093) seeking an interlocutory injunction against the Attorney-General of Canada, the Attorney-General of Québec and Hydro-Québec regarding, among other things, Hydro-Québec’s proposed construction of transmission lines to connect the Romaine River hydroelectric complex to Hydro-Québec’s grid which, according to the Uashaunnuat, is being undertaken in violation of their ancestral rights on their alleged ancestral territory. In addition, the Uashaunnuat are raising various procedural claims relating to the environmental review conducted with respect to this project. Construction of this project began in 2009 and the commissioning of the first generating station is presently scheduled for late 2014. In mid-January 2011, Hydro-Québec and the claimants entered into an agreement in principle regarding these claims. This agreement, which was likely to result in the discontinuance of proceedings, was submitted to the members of the Uashaunnuat for approval in a referendum held April 15, 2011. The members voted 59.2% against the draft agreement. Proceedings in this action are suspended until September 1st, 2011 at which time the parties are to advise the court of their intentions.

In December 1996, Philomène and Georges McKenzie, of the community of Uashat-Maliotenam near Sept-Îles, filed a motion for a declaratory judgment to have declared, in favor and on behalf of their families, an aboriginal title and ancestral rights, including for hunting, fishing and trapping on the land they claim as their traditional lands (Philomène McKenzie et al. v. Attorney-General of Québec et al. (Superior Court, no 500-05-027983-962)) (Uashat I). The territory claimed covers roughly 1,600 km2 and is located north of Sept-Îles. In addition, they are asking that any mining project be subject to their consent. They are also asking for a permanent injunction against any project located on the territory they claim and the work resulting from it. The claimants are also demanding $7 million in damages and interest. This case remained latent from 1997 until the spring of 2007, when the announcement of the Lac Bloom project (a mining project near Fermont Québec) gave new impetus to the dispute. On April 13, 2007, the claimants served notice announcing an amendment to their petition, adding ten new claimants and raising the land area on which ancestral rights

- 10 -

and aboriginal title are claimed from 1,600 km2 to 16,679 km2. The amount of damages claimed has also risen from $7 million to $350 million.

ECONOMY

Economic Developments in 2010

Canada. Gross domestic product (“GDP”) adjusted for inflation in chained 2002 dollars (“real GDP”), as published in the National Economic Accounts on May 30, 2011, increased at a rate of 3.2% in 2010, compared with a decrease of 2.8% in 2009. This increase was mainly attributable to consumer spending and business investment. Final domestic demand increased by 4.5% in 2010, compared to a decrease of 2.1% in 2009. Real consumer spending increased by 3.3% in 2010, compared to a 0.4% increase in 2009. International exports increased by 6.4% in volume and by 8.8% in value in 2010 compared with decreases of 13.8% and 21.9%, respectively, in 2009. International imports increased by 13.1% in volume and by 9.3% in value in 2010 compared with decreases of 13.4% and 13.6%, respectively, in 2009.

Non-residential investment increased by 7.3% in 2010, due in particular to a 11.8% increase in machinery and equipment. Residential investment increased by 10.2% in 2010, due to a 27.4% increase in housing starts. Government investment increased by 17.9% in 2010. Government expenditure on goods and services increased by 2.4% in 2010.

The Consumer Price Index (“CPI”) increased by 1.8% in 2010. Overall employment increased by 1.4% in 2010, while the unemployment rate decreased to 8.0% from 8.3% in 2009.

Québec. Real GDP as published in the Québec Economic Accounts on March 24, 2011, increased at a rate of 2.8% in 2010, compared to a decrease of 0.3% in 2009. Final domestic demand increased by 4.5% in real terms in 2010, compared to a 0.6% increase in 2009. Real consumer spending increased by 3.7% in 2010, compared to an increase of 0.9% in 2009. International exports decreased by 0.8% in volume and increased by 1.6% in value in 2010, compared with decreases of 11.5% and 16.4%, respectively, in 2009. International imports increased by 7.7% in volume and by 6.9% in value in 2010, compared with decreases of 10.9% and 12.6%, respectively, in 2009.

The value of non-residential investment increased by 5.0% in 2010, with increases of 9.6% in the public sector and 0.7% in the private sector. The value of residential investment increased by 17.0% in 2010.

The CPI increased by 1.2% in 2010. Overall employment increased by 1.7% in 2010, while the unemployment rate decreased to 8.0% from 8.5% in 2009.

Plan Nord

On May 9th 2011, the Government launched, under its Plan Nord a 25-year program, for the long-term economic, social and environmental development of Northern Québec.

The territory covered by the Plan Nord includes almost 1.2 million km2, or approximately 72% of the area of Québec, and has substantial undeveloped hydroelectric, mining and forestry potential.

- 11 -

As part of the initial five-year plan covering 2011-2016, investments of $1.6 billion are expected to be made, consisting of $1,191 million for infrastructure development, $382 million for social measures and $52 million to fund the Société du Plan Nord and prospecting activities among foreign investors. The Government intends to allocate $500 million over the next five years for the negotiation of equity interests in future projects. This sum would be administered by Investissement Québec.

- 12 -

Table 1

Main Economic Indicators of Québec(1)

(dollar amounts in millions, except for per capita amounts)

| | 2006 | | 2007 | | 2008 | | 2009 | | 2010 | | Compound

Annual Rate

of Growth

2005-2010 | |

GDP | | | | | | | | | | | | | |

At current market prices | | 282,505 | | 295,928 | | 302,748 | | 303,747 | | 317,773 | | | |

| | 3.8% | | 4.8% | | 2.3% | | 0.3% | | 4.6% | | 3.2% | |

In chained 2002 dollars | | 260,033 | | 265,585 | | 268,406 | | 267,477 | | 274,953 | | | |

| | 1.8% | | 2.1% | | 1.1% | | -0.3% | | 2.8% | | 1.5% | |

Per capita | | 34,073 | | 34,548 | | 34,627 | | 34,168 | | 34,772 | | | |

| | 1.1% | | 1.4% | | 0.2% | | -1.3% | | 1.8% | | 0.6% | |

Personal income | | 236,642 | | 249,883 | | 260,059 | | 263,213 | | 272,527 | | | |

| | 4.6% | | 5.6% | | 4.1% | | 1.2% | | 3.5% | | 3.8% | |

Per capita | | 31,008 | | 32,505 | | 33,550 | | 33,623 | | 34,465 | | | |

| | 4.0% | | 4.8% | | 3.2% | | 0.2% | | 2.5% | | 2.9% | |

Capital expenditures | | 51,809 | | 57,055 | | 60,118 | | 58,858 | | 64,144 | | | |

| | 4.7% | | 10.1% | | 5.4% | | -2.1% | | 9.0% | | 5.3% | |

Value of manufacturers’ shipments | | 145 580 | | 143 894 | | 147 003 | | 126 289 | | 132 116 | | | |

| | 4.3% | | -1.2% | | 2.2% | | -14.1% | | 4.6% | | -1.1% | |

Retail trade | | 86,505 | | 90,406 | | 94,806 | | 93,740 | | 99,631 | | | |

| | 4.9% | | 4.5% | | 4.9% | | -1.1% | | 6.3% | | 3.9% | |

| | | | | | | | | | | | | |

| | (In thousands of persons) | | | |

Population (at July 1) | | 7,632 | | 7,687 | | 7,751 | | 7,828 | | 7,907 | | | |

| | 0.7% | | 0.7% | | 0.8% | | 1.0% | | 1.0% | | 0.8% | |

Labor Force | | 4,070 | | 4,133 | | 4,183 | | 4,204 | | 4,254 | | | |

| | 0.9% | | 1.5% | | 1.2% | | 0.5% | | 1.2% | | 1.1% | |

Participation rate (level in percentage) | | 60.1% | | 60.9% | | 61.0% | | 59.8% | | 60.2% | | | |

Employment | | 3,743 | | 3,834 | | 3,880 | | 3,848 | | 3,915 | | | |

| | 1.1% | | 2.4% | | 1.2% | | -0.8% | | 1.7% | | 1.1% | |

Unemployment rate (level in percentage) | | 8.1% | | 7.2% | | 7.2% | | 8.5% | | 8.0% | | | |

| | | | | | | | | | | | | |

| | (2002 = 100) | | | |

CPI | | 108.7 | | 110.4 | | 112.7 | | 113.4 | | 114.8 | | | |

| | 1.7% | | 1.6% | | 2.1% | | 0.6% | | 1.2% | | 1.4% | |

| | | | | | | | | | | | | |

(1) Unless otherwise indicated, percentages are percentage changes from the previous year.

Sources: Institut de la statistique du Québec and Statistics Canada.

- 13 -

Economic Structure

In 2010, Québec accounted for 20.8% of Canada’s real GDP. The services sector accounted for 75.6% of Québec’s real GDP, compared with 22.2% for the secondary sector and 2.2% for the primary sector. Québec’s economy is influenced by developments in the economies of its major trading partners, especially the United States, which is Québec’s largest export market. In 2010, the value of exports (including to other Canadian provinces) represented 44.6% of Québec’s GDP.

The following table shows the contribution of each sector to real GDP, which includes net taxes (taxes less subsidies) paid on factors of production. GDP is a measure of value added (the total value of goods delivered and services rendered less the cost of materials and supplies, fuel and electricity).

Table 2

Real Gross Domestic Product by Sector at Basic Prices in Chained 2002 Dollars(1)

(dollar amounts in millions)

| | | | | | | | | | % of Total 2009 | | | | % of Total 2010 | |

| | 2006 | | 2007 | | 2008 | | 2009 | | Québec | | Canada | | 2010 | | Québec | | Canada | |

| | | | | | | | | | | | | | | | | | | |

Primary Sector | | | | | | | | | | | | | | | | | | | |

Agriculture, forestry, fishing and hunting | | 4,623 | | 4,606 | | 4,422 | | 4,372 | | 1.8 | | 2.2 | | 4,566 | | 1.8 | | 2.2 | |

Mining and oil and gas extraction | | 974 | | 1,006 | | 1,037 | | 1,049 | | 0.4 | | 4.3 | | 1,118 | | 0.4 | | 4.4 | |

| | | | | | | | | | | | | | | | | | | |

| | 5,597 | | 5,612 | | 5,459 | | 5,421 | | 2.2 | | 6.5 | | 5,684 | | 2.2 | | 6.6 | |

| | | | | | | | | | | | | | | | | | | |

Secondary Sector | | | | | | | | | | | | | | | | | | | |

Manufacturing | | 45,950 | | 45,391 | | 43,939 | | 40,500 | | 16.4 | | 12.7 | | 41,215 | | 16.3 | | 12.9 | |

Construction | | 12,629 | | 13,338 | | 14,112 | | 14,125 | | 5.7 | | 5.8 | | 14,984 | | 5.9 | | 6.1 | |

| | | | | | | | | | | | | | | | | | | |

| | 58,579 | | 58,729 | | 58,051 | | 54,625 | | 22.1 | | 18.5 | | 56,199 | | 22.2 | | 19.0 | |

| | | | | | | | | | | | | | | | | | | |

Service Sector | | | | | | | | | | | | | | | | | | | |

Community, business and personal services | | 61,019 | | 62,203 | | 63,926 | | 64,944 | | 26.4 | | 25.2 | | 66,437 | | 26.2 | | 24.8 | |

Finance, insurance and real estate | | 41,040 | | 42,344 | | 43,197 | | 44,379 | | 18.0 | | 21.0 | | 45,615 | | 18.0 | | 20.9 | |

Wholesale and retail trade | | 28,522 | | 29,676 | | 30,440 | | 30,197 | | 12.2 | | 11.7 | | 31,299 | | 12.4 | | 11.8 | |

Governmental services | | 15,672 | | 15,942 | | 16,401 | | 17,001 | | 6.9 | | 6.1 | | 17,443 | | 6.9 | | 6.1 | |

Transportation and warehousing | | 10,574 | | 10,877 | | 10,891 | | 10,791 | | 4.4 | | 4.7 | | 11,285 | | 4.5 | | 4.7 | |

Other utility services | | 9,498 | | 10,072 | | 9,973 | | 9,749 | | 3.9 | | 2.5 | | 9,778 | | 3.8 | | 2.4 | |

Information and cultural services | | 9,308 | | 9,474 | | 9,627 | | 9,622 | | 3.9 | | 3.8 | | 9,673 | | 3.8 | | 3.7 | |

| | | | | | | | | | | | | | | | | | | |

| | 175,633 | | 180,588 | | 184,455 | | 186,683 | | 75.7 | | 75.0 | | 191,530 | | 75.6 | | 74.4 | |

| | | | | | | | | | | | | | | | | | | |

Real GDP | | 239,809 | | 244,929 | | 247,965 | | 246,729 | | 100.0 | | 100.0 | | 253,413 | | 100.0 | | 100.0 | |

| | | | | | | | | | | | | | | | | | | |

(1) North American Industrial Classification System (NAICS) in chained 2002 dollars. For the chained 2002 dollars, the aggregate amounts are not equal to the sums of their components.

Source: Statistics Canada.

Primary Sector. In 2010, the primary sector, which includes agriculture, forestry, fishing and hunting, and mining and oil and gas extraction, contributed 2.2% of real GDP and accounted for 2.1% of employment in

- 14 -

Québec. Québec’s forests, covering 1,140,000 square kilometers, or 440,000 square miles, are among its most important natural resources. Québec’s logging operations were estimated to have produced approximately 0.822 billion cubic feet of timber in 2010, generating revenue of $1.413 billion from sales to domestic and foreign customers. In 2010, there was a small reduction in timber production but higher prices translated into higher revenues (the value of shipments increased by 9.5% and the value of exports by 9.9%).

In mining and oil and gas extraction, which represented 19.7% of the primary sector in 2010, production is concentrated mainly in iron ore, gold, nickel, zinc, stone, cement and copper. In 2010, the value of mineral production amounted to $6.8 billion.

Secondary Sector. In 2010, the secondary sector, which consists of the manufacturing and construction industries, contributed 22.2% of real GDP and accounted for 18.7% of employment in Québec. In terms of real GDP, the construction industry recorded a 6.1% increase in 2010 over 2009, with a strong increase in residential construction which came in large part from the 18.3% increase in housing starts. Real GDP in manufacturing increased by 1.8% in 2010, although employment decreased by 6.1% in that industry. Higher demand from Québec’s trading partners, particularly the United States, contributed to the increase in manufacturing real GDP. The manufacturing industries that showed the strongest growth are chemical products (10.2% in real GDP and -0.2% in employment), clothing (9.8% in real GDP and -8.6% in employment), wood products (9.4% in real GDP and -0.5% in employment), plastics and rubber products (8.7% in real GDP and 4.5% in employment) and non-metallic mineral products (8.0% in real GDP and 3.2% in employment). In some other manufacturing industries, the demand was still depressed. The manufacturing industries that showed the strongest decline are computers and electronic products (-14.9% in real GDP and -1.8% in employment), textiles (-9.1% in real GDP and -2.6% in employment) and transportation equipment (-8.3% in real GDP and -6.8% in employment). The value of shipments of primary metals increased by 27.5% in 2010, due to higher world demand. Durable goods accounted for 55.5% of manufacturing real GDP and 56.4% of manufacturing employment. The leading manufacturing industries in Québec are food products, primary metal products (including aluminum smelting), petroleum and coal products, transportation equipment products (including aircraft and motor vehicles and associated parts), chemical products, paper products and fabricated metal products. As a result of its competitive advantage in low-cost electricity production, Québec is one of the world’s leading producers of aluminum.

- 15 -

Value of Manufacturers’ Shipments(1) |

(dollar amounts in millions) |

|

| | 2006 | | 2007 | | 2008 | | 2009 | | % of Total

2009 | | 2010 | | % of Total

2010 |

| | | | | | | | | | | | | | |

Food | | 16,416 | | 16,496 | | 17,839 | | 18,991 | | 15.0 | | 19,467 | | 14.7 |

Primary metals | | 20,722 | | 21,472 | | 21,877 | | 15,121 | | 12.0 | | 19,283 | | 14.6 |

Petroleum and coal | | 14,212 | | 14,651 | | 17,552 | | 13,890 | | 11.0 | | 14,839 | | 11.2 |

Transportation equipment | | 16,278 | | 16,168 | | 17,758 | | 14,554 | | 11.5 | | 12,585 | | 9.5 |

Chemicals | | 10,389 | | 10,086 | | 9,233 | | 8,614 | | 6.8 | | 9,635 | | 7.3 |

Paper | | 10,895 | | 9,857 | | 9,989 | | 8,851 | | 7.0 | | 8,758 | | 6.6 |

Fabricated metals | | 7,399 | | 8,068 | | 8,389 | | 7,005 | | 5.5 | | 7,060 | | 5.3 |

Wood | | 8,350 | | 6,730 | | 6,114 | | 5,072 | | 4.0 | | 5,555 | | 4.2 |

Plastics and rubber | | 6,751 | | 6,502 | | 6,015 | | 4,940 | | 3.9 | | 5,485 | | 4.2 |

Machinery | | 5,495 | | 6,025 | | 6,081 | | 5,493 | | 4.3 | | 5,475 | | 4.1 |

Beverage and tobacco | | 3,120 | | 3,499 | | 3,387 | | 3,421 | | 2.7 | | 3,478 | | 2.6 |

Electrical equipment | | 3,809 | | 3,651 | | 3,635 | | 3,444 | | 2.7 | | 3,439 | | 2.6 |

Others | | 21,746 | | 20,690 | | 19,134 | | 16,892 | | 13.4 | | 17,058 | | 12.9 |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | 145,580 | | 143,894 | | 147,003 | | 126,289 | | 100.0 | | 132,116 | | 100.0 |

| | | | | | | | | | | | | | |

(1) North American Industrial Classification System (NAICS).

(2) Including notably non-metallic minerals, furniture and printing.

Source: Statistics Canada.

Service Sector. The service sector includes a wide range of activities such as community, business and personal services, finance, insurance and real estate, wholesale and retail trade, governmental services, transportation and warehousing, other utility services and information and cultural services. In 2010, the service sector contributed 75.6% of real GDP and accounted for 78.3% of employment in Québec.

In terms of real GDP, there were increases in all industries in the service sector in 2010. Transportation and warehousing increased by 4.6%, wholesale and retail trade increased by 3.6%, finance, insurance and real estate increased by 2.8%, governmental services increased by 2.6%, community, business and personal services increased by 2.3%, information and cultural services increased by 0.5% and other utility services increased by 0.3%.

Due to Québec’s large territory, transportation facilities are essential to the development of its economy. Water transportation is provided mainly through the St. Lawrence River Seaway. Approximately 28.6% of all international tonnage handled in Canadian ports in 2009 (the most recent year for which information is available) passed through Québec’s shipping facilities. Highway, rail and air transportation systems service the populated areas, with higher concentrations in the metropolitan areas of Montréal and Ville de Québec.

The financial sector includes large Canadian and foreign financial institutions, Québec’s cooperative institutions and Government financial intermediary enterprises and fiduciary agencies, including the Caisse de dépôt et placement du Québec (the “Caisse”) which is one of the largest institutional fund managers in North America.

Capital Expenditures. In 2010, the value of capital expenditures by the private and public sectors increased by 9.0% in Québec. Total capital expenditures increased as a result of a 17.0% increase in residential investment and a 5.0% increase in non-residential investment. Non-residential investment increased by

- 16 -

9.6% in the public sector and by 0.7% in the private sector. The 2008-2013 Québec Infrastructure Plan is the primary cause of the strong increase in public sector investment.

The increase in non-residential investment resulted in large part from increases in mining and oil and gas extraction (23.8%), transportation and warehousing (10.6%), governmental, educational, health and social services (7.1%), construction (6.9%), information, cultural and other utilities (5.3%), business services, accommodation and other services (3.0%), wholesale and retail trade (2.7%) and agriculture, forestry, fishing and hunting (1.1%). These increases were partially offset by decreases in manufacturing (-8.0%) and finance, insurance and real estate operators (-1.4%).

Private and Public Sectors Capital Expenditures in Québec(1) |

(dollar amounts in millions) |

|

| | 2006 | | 2007 | | 2008 | | 2009 | | % of Total

2009 | | 2010 | | % of Total

2010 |

| | | | | | | | | | | | | | |

Non-residential Investment: | | | | | | | | | | | | | | |

Governmental, educational, health and social services | | 8,076 | | 9,672 | | 11,863 | | 13,277 | | 22.6 | | 14,226 | | 22.2 |

Information, cultural and other utilities | | 5,479 | | 6,303 | | 6,743 | | 7,299 | | 12.4 | | 7,687 | | 12.0 |

Finance, insurance and real estate operators | | 7,203 | | 6,877 | | 5,331 | | 4,125 | | 7.0 | | 4,068 | | 6.3 |

Transportation and warehousing | | 1,994 | | 2,533 | | 2,501 | | 2,904 | | 4.9 | | 3,211 | | 5.0 |

Manufacturing | | 4,047 | | 3,878 | | 4,123 | | 3,094 | | 5.3 | | 2,847 | | 4.4 |

Business services, accommodation and other services | | 2,068 | | 2,309 | | 2,757 | | 2,677 | | 4.5 | | 2,758 | | 4.3 |

Wholesale and retail trade | | 2,480 | | 3,018 | | 3,369 | | 2,635 | | 4.5 | | 2,705 | | 4.2 |

Mining and oil and gas extraction | | 984 | | 1,505 | | 1,754 | | 1,790 | | 3.0 | | 2,216 | | 3.5 |

Construction | | 1,136 | | 884 | | 889 | | 945 | | 1.6 | | 1,011 | | 1.6 |

Agriculture, forestry, fishing and hunting | | 678 | | 804 | | 858 | | 758 | | 1.3 | | 766 | | 1.2 |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | 34,144 | | 37,780 | | 40,188 | | 39,504 | | 67.1 | | 41,495 | | 64.7 |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Residential Investment | | 17,665 | | 19,274 | | 19,930 | | 19,354 | | 32.9 | | 22,649 | | 35.3 |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | 51,809 | | 57,054 | | 60,118 | | 58,858 | | 100.0 | | 64,144 | | 100.0 |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Private sector | | 39,372 | | 43,015 | | 43,204 | | 39,709 | | 67.5 | | 43,151 | | 67.3 |

Public sector | | 12,437 | | 14,039 | | 16,914 | | 19,149 | | 32.5 | | 20,993 | | 32.7 |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | 51,809 | | 57,054 | | 60,118 | | 58,858 | | 100.0 | | 64,144 | | 100.0 |

| | | | | | | | | | | | | | |

(1) North American Industrial Classification System (NAICS).

Source: Statistics Canada.

Labor Force. In 2010, the labor force was estimated at 4.3 million persons, an increase of 1.2% from 2009. The labor force participation rate for 2010 was estimated at 65.4% in Québec, compared with 67.0% in Canada. Total employment increased by 1.7% in 2010 in Québec, compared to a 1.4% increase in Canada. The unemployment rate in Québec decreased from 8.5% in 2009 to 8.0% in 2010, compared with a decrease from 8.3% to 8.0% in Canada for the same period.

Energy. Of the total energy consumed in Québec in 2008 (the most recent year for which information is available), energy derived from electricity accounted for 41.6%, oil for 38.2%, natural gas for 10.7%, biomass for 8.5% and coal for 1.0%.

Québec generates approximately one-third of all electricity produced in Canada and is one of the largest producers of hydroelectricity in the world. In 2010, approximately 97.2% of all electricity produced in Québec was from hydroelectric installations. More than 46,000 megawatts (“MW”) of hydroelectric capacity (including the capacity of independent producers and the firm capacity currently available from Churchill Falls (Labrador) Corporation Limited) have been or are in the process of being developed. Of the total electricity produced in Québec in 2010, 13.5% (based on sales volume) was exported to the United States and to other Canadian provinces, compared with 16.0% in 2009.

Exports and Imports. In 2010, Québec’s exports of goods and services totaled $141.6 billion of which $81.1 billion (57.3%) were international exports and $60.5 billion (42.7%) were inter-provincial exports. Québec’s international exports represented 17.0% of Canada’s total exports. Québec’s imports of goods and services totaled $168.9 billion of which $105.7 billion (62.6%) were international imports and $63.2 billion (37.4%) were inter-provincial imports. Québec’s international imports represented 20.8% of Canada’s total imports. In 2010, Québec’s external sector (as defined under the Provincial Economic Accounts of Statistics Canada) registered an overall deficit of $27.3 billion, a net result of a deficit of $24.6 billion on international trade and a deficit of $2.7 billion on inter-provincial trade. In 2009, Québec

- 17 -

registered an overall deficit of $19.4 billion, a net result of a deficit of $19.1 billion on international trade and a deficit of $0.3 billion on inter-provincial trade. The deficit in 2010 reflects mainly the impact of a strong Canadian dollar on international trade and a surge in oil prices. Despite a slight drop in volume of exports, value increased as a result of higher prices. On the other hand, the value of imports was boosted by a strong domestic economy and a surge in oil prices. Imports, excluding crude oil, were also stimulated by a decline in Canadian dollar prices of imports resulting from a strong Canadian dollar.

Québec’s international exports of goods are diversified: aircraft and associated parts have the largest export share, accounting for 12.6% of the total Aluminum and alloys exports rank second with 10.4%, and chemicals products are next with 5.4%. International exports of goods originating from Québec, calculated by the Institut de la statistique du Québec from data on Canada’s total exports of goods, were $59.2 billion for 2010 compared with $58.0 billion in 2009, an increase of 2.0%. Increases occurred in the value of exports of copper and alloys (33.0%), aluminum and alloys (26.7%), lumber and wood products (9.9%) and chemical products (0.5%). These increases were partially offset by decreases in the value of exports of aircraft and associated parts (-15.7%), electronic products (-9.3%), newsprint and printing paper (-8.3%), tools and other equipment (-6.0%), scientific equipment (-4.6%), machinery (-1.7%) and motor vehicles and associated parts (-0.7%).

The United States is Québec’s principal international export market, accounting for 67.8% of international exports of goods in 2010. The balance of international exports is broadly distributed: Europe (15.2%), Asia excluding Middle-East (7.5%), Middle-East (2.7%), and the rest of world (6.8%). From 2000 to 2010, the share of international exports to destinations other than the United States more than doubled, rising from 14.5% to 32.2%.

Québec’s International Exports of Goods |

(dollar amounts in millions) |

|

| | 2006 | | 2007 | | 2008 | | 2009 | | % of Total

2009 | | 2010 | | % of Total

2010 |

| | | | | | | | | | | | | | |

Aircraft and associated parts | | 9,010 | | 9,350 | | 8,824 | | 8,873 | | 15.3 | | 7,478 | | 12.6 |

Aluminum and alloys | | 7,880 | | 8,034 | | 7,615 | | 4,860 | | 8.4 | | 6,156 | | 10.4 |

Chemical products | | 3,059 | | 3,293 | | 3,182 | | 3,205 | | 5.5 | | 3,220 | | 5.4 |

Newsprint and printing paper | | 4,107 | | 3,543 | | 3,809 | | 2,883 | | 5.0 | | 2,644 | | 4.5 |

Machinery | | 2,533 | | 2,597 | | 2,825 | | 2,531 | | 4.4 | | 2,487 | | 4.2 |

Copper and alloys | | 2,812 | | 2,286 | | 2,463 | | 1,459 | | 2.5 | | 1,940 | | 3.3 |

Scientific equipement | | 1,675 | | 1,852 | | 2,408 | | 1,840 | | 3.2 | | 1,755 | | 3.0 |

Tools and other equipment | | 2,122 | | 2,094 | | 2,007 | | 1,488 | | 2.6 | | 1,398 | | 2.4 |

Electronic products | | 3,903 | | 2,468 | | 2,057 | | 1,421 | | 2.4 | | 1,288 | | 2.2 |

Lumber and wood products | | 3,064 | | 2,328 | | 1,620 | | 1,137 | | 2.0 | | 1,249 | | 2.1 |

Motor vehicles and associated parts | | 2,341 | | 1,814 | | 1,547 | | 1,229 | | 2.1 | | 1,220 | | 2.1 |

Other goods(1) | | 30,671 | | 30,140 | | 32,403 | | 27,107 | | 46.7 | | 28,369 | | 47.9 |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Total | | 73,177 | | 69,798 | | 70,760 | | 58,031 | | 100.0 | | 59,205 | | 100.0 |

| | | | | | | | | | | | | | |

(1) The other goods category represents diverse products or product groups from a broad range of industrial and manufacturing sectors, such as plastics, wood pulp and electricity.

Source: Institut de la statistique du Québec.

- 18 -

Québec’s International Imports of Goods |

(dollar amounts in millions) |

|

| | 2006 | | 2007 | | 2008 | | 2009 | | % of Total

2009 | | 2010 | | % of Total

2010 |

| | | | | | | | | | | | | | |

Mineral fuels, mineral oils, bituminous substances and mineral waxes | | 18,392 | | 18,143 | | 22,237 | | 12,853 | | 18.3 | | 15,871 | | 20.9 |

Motor vehicles, trailers, bicycles, motorcycles and other similar vehicles | | 11,297 | | 11,786 | | 11,424 | | 9,176 | | 13.1 | | 10,929 | | 14.4 |

Nuclear reactors, boilers, machinery and mechanical appliances | | 8,909 | | 7,627 | | 8,202 | | 7,306 | | 10.4 | | 6,969 | | 9.2 |

Electrical or electronic machinery and equipment | | 7,213 | | 5,984 | | 5,758 | | 5,239 | | 7.5 | | 5,662 | | 7.5 |

Pharmaceutical products | | 2,704 | | 2,139 | | 2,179 | | 3,419 | | 4.9 | | 2,841 | | 3.7 |

Aircraft and spacecraft | | 2,172 | | 3,894 | | 3,612 | | 2,514 | | 3.6 | | 2,174 | | 2.9 |

Pearls, precious stones or metals, coins and jewelry | | 1,333 | | 1,826 | | 1,936 | | 1,376 | | 2.0 | | 2,161 | | 2.9 |

Inorganic chemicals and compounds or precious metals and radioactive elements | | 1,958 | | 2,011 | | 2,562 | | 1,822 | | 2.6 | | 2,027 | | 2.7 |

Plastics and articles thereof | | 1,716 | | 1,736 | | 1,934 | | 1,737 | | 2.5 | | 1,903 | | 2.5 |

Optical, medical, photographic, scientific and technical instrumentation | | 1,658 | | 1,750 | | 1,951 | | 1,860 | | 2.6 | | 1,837 | | 2.4 |

Rubber and articles thereof | | 743 | | 822 | | 1,388 | | 1,396 | | 2.0 | | 1,531 | | 2.0 |

Other goods(1) | | 22,780 | | 23,148 | | 24,409 | | 21,498 | | 30.6 | | 21,927 | | 28.9 |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Total | | 80,876 | | 80,866 | | 87,592 | | 70,198 | | 100.0 | | 75,832 | | 100.0 |

| | | | | | | | | | | | | | |

(1) The other goods category represents diverse products or product groups from a broad range of industrial and manufacturing sectors, such as furniture and stuffed furnishings, lamps and illuminated signs, prefabricated buildings and woven clothing.

Source: Institut de la statistique du Québec.

- 19 -

Selected Trade Indicators for Québec |

(dollar amounts in millions) |

|

| | 2006 | | 2007 | | 2008 | | 2009 | | 2010 |

| | | | | | | | | | |

Exports of Goods and Services | | 150,559 | | 154,174 | | 157,764 | | 139,127 | | 141,636 |

Exports to other countries | | 93,579 | | 94,224 | | 95,475 | | 79,837 | | 81,130 |

Exports of goods to other countries | | 80,955 | | 81,424 | | 82,536 | | 67,738 | | 68,594 |

Exports of services to other countries | | 12,624 | | 12,799 | | 12,940 | | 12,099 | | 12,536 |

Exports to other provinces | | 56,980 | | 59,951 | | 62,289 | | 59,288 | | 60,506 |

Exports of goods to other provinces | | 33,533 | | 34,644 | | 36,057 | | 33,419 | | 33,822 |

Exports of services to other provinces | | 23,447 | | 25,308 | | 26,232 | | 25,870 | | 26,684 |

| | | | | | | | | | |

Ratio of Exports to Nominal GDP | | 53.3% | | 52.1% | | 52.1% | | 45.8% | | 44.6% |

| | | | | | | | | | |

Imports of Goods and Services | | 158,332 | | 165,107 | | 176,223 | | 158,522 | | 168,944 |

Imports from other countries | | 99,130 | | 103,175 | | 113,114 | | 98,917 | | 105,717 |

Imports of goods from other countries | | 86,332 | | 89,538 | | 99,171 | | 84,963 | | 91,111 |

Imports of services from other countries | | 12,798 | | 13,637 | | 13,944 | | 13,954 | | 14,606 |

Imports from other provinces | | 59,202 | | 61,931 | | 63,109 | | 59,605 | | 63,226 |

Imports of goods from other provinces | | 32,345 | | 32,030 | | 32,331 | | 29,052 | | 31,077 |

Imports of services from other provinces | | 26,858 | | 29,901 | | 30,779 | | 30,554 | | 32,149 |

| | | | | | | | | | |

Balance of Goods and Services | | -7,773 | | -10,932 | | -18,459 | | -19,396 | | -27,308 |

Balance with other countries | | -5,551 | | -8,952 | | -17,638 | | -19,081 | | -24,587 |

Balance with other provinces | | -2,222 | | -1,980 | | -820 | | -317 | | -2,720 |

| | | | | | | | | | |

Sources: Institut de la statistique du Québec and Statistics Canada.

Free Trade Agreements

Canada is a member of the World Trade Organization (“WTO”) and has also signed other trade agreements in order to promote commerce with economic partners. In 1989, the United States and Canada entered into a free trade agreement (“FTA”), which has led to the gradual elimination of tariffs on goods and

- 20 -

services between the two countries and to the liberalization of trade in several sectors including the energy sector. The FTA provides for a binding binational review of domestic determinations in antidumping and countervailing duty cases and for binational arbitration of disputes between Canada and the United States as to either’s compliance with the FTA or with the rules of the WTO. In 1994, Canada, the United States and Mexico signed a similar free trade agreement, the North American Free Trade Agreement (“NAFTA”), which resulted, with a few exceptions, in the gradual elimination by 2003 of tariffs on goods and services among Canada, the United States and Mexico.

In April 1998, negotiations were undertaken between countries of the Americas (North, Central and South) to reach a new trade agreement by January 1, 2005 (Free Trade Area of the Americas or “FTAA”). Although the January 1, 2005 deadline was not met, parties to the negotiations of the FTAA have reaffirmed their commitment to pursue such negotiations in the future. Canada and the European Union have begun negotiations regarding a free trade agreement in 2010, with the aim of reaching an agreement in 2011. Canada has also entered into bilateral free trade agreements in 1997 with Chile and Israel, in 2002 with Costa Rica and in 2009 with Peru and the member states of the European Free Trade Association (Norway, Switzerland, Iceland and Liechtenstein). In March 2010, Canada tabled legislation for the implementation of the free trade agreement signed with Jordan. Which is expected to be reintroduced by the new majority government in the next session. On May 14, 2010, Canada and Panama signed a free-trade agreement which is expected to come into effect once legislation has been adopted in both countries. On June 30, 2010, Canada completed its domestic approval process for the Canada-Colombia Free Trade Agreement. Once Colombia has completed its process, the two parties can decide when the agreement will enter into force. During late 2010 and early 2011, Canada initiated free trade negotiations with India, Ukraine, Turkey and Morocco.

On February 12, 2010, Canada and the United States signed the Agreement on Government Procurement which, notably, provides Canadians with permanent access to U.S. state and local government procurement commitments in exchange for permanent U.S. access to Canadian provincial and territorial procurement contracts in accordance with the WTO Government Procurement Agreement.

Softwood Lumber Dispute. In April 2001, a coalition of American lumber producers and various labor unions filed a petition with the U.S. Department of Commerce (“DoC”) and the U.S. International Trade Commission (“ITC”) alleging that softwood lumber imports from Canada were subsidized by the federal and provincial governments. As a result, in early 2002, the DoC and the ITC established countervailing duties (“CVD”) and antidumping duties (“AD”) on softwood lumber imports. The Quebec Government and the federal government have consistently denied these allegations, and the federal government and the Canadian lumber industry challenged the U.S. measures under NAFTA and WTO agreements. A NAFTA panel and a WTO panel have issued various rulings in connection with these challenges, to which the DoC and the ITC responded. Between 2002 and 2006, the rates of CVD and AD changed several times, and the combined rates varied from 10.8% to 27.22%. On December 6, 2005, as a result of an administrative review, the combined rate dropped to 10.8%, representing a CVD rate of 8.7% and an AD rate of 2.1%. The U.S. and Canada subsequently entered into the Softwood Lumber Agreement of 2006 which came into force on October 12, 2006 (“SLA”). Under the terms of the SLA, Canadian lumber exports from provinces covered by the dispute are subject to an export charge only (Option A) or an export charge plus volume restraint (Option B) if the prevailing monthly price of lumber (as defined in the SLA) drops below US$355 per thousand board feet. The total volume of permitted exports, which takes into account anticipated demand in the United States, is allocated to the provinces in question. Provincial quotas are calculated on the basis of the share of lumber exports over the period from April 1, 2001 to December 31, 2005.

Québec chose Option B, which involves:

- 21 -

q | no charge and no volume restraint, if the prevailing monthly price of lumber is over US$355; |

| |

q | a 2.5% export charge and Québec’s volume cannot exceed a share of 34% of expected U.S. consumption for the month, if the prevailing monthly price of lumber is between US$336 and US$355; |

| |

q | a 3% export charge and Québec’s volume cannot exceed a share of 32% of expected U.S. consumption for the month, if the prevailing monthly price of lumber is between US$316 and US$335; |

| |

q | a 5% export charge and Québec’s volume cannot exceed a share of 30% of expected U.S. consumption for the month, if the prevailing monthly price of lumber is US$315 or below. |

With the exception of the months of May, June and July 2010, the prevailing monthly price (based on the Random Lengths Framing Lumber Composite) has remained below US$315 since July 2006. During the months of May, June and July of 2010, the prevailing monthly prices were US$325, US$361 and US$316 respectively.

Unless terminated by either party, the SLA is to remain in force through 2013 and may be renewed for an additional 2 year period. In accordance with the dispute resolution mechanism of the SLA, the United States initiated arbitration proceedings in the London Court of International Arbitration (“LCIA”) in August 2007. The United States alleged Canada’s breach of the SLA due to its failure to: (1) adequately calculate the export measures based on the adjusted expected U.S. consumption of lumber; and (2) impose the agreed-upon export measures beginning in January 2007.

In a March 2008 decision, the LCIA concluded that Canada did not breach the SLA with respect to the calculation of the export measures, but did breach the SLA by failing to impose such export measures as of January 1, 2007. In February 2009, following remedy hearings, the LCIA issued its decision on the cure of the breach which requires Canada to collect an additional 10% ad valorem export charge on softwood lumber shipments from the concerned regions for a total remedy amount of $68.26 million. All other claims raised in the arbitration were dismissed.

In response to this decision and taking into account the hearings on the breach, Canada tendered US$34 million plus interest to the United States on March 27, 2009 as a means of curing the breach. The United States did not accept Canada’s tender. Instead, the United States has imposed a compensatory import charge of 10% that went into effect on April 15, 2009. Canada pursued arbitration to challenge this import charge, but was unsuccessful. On August 31, 2010, the U.S. ceased collecting the 10% compensatory import charge and, by agreement, Canada began collecting a compensatory export charge which will remain in effect until the combined amounts collected by the United States and Canada have reached $68.26 million.

In January 2008, the United States initiated arbitration proceedings in the LCIA, alleging that Canada, through its provincial governments of Québec and Ontario, had breached the SLA by providing grants and other benefits that circumvent Canada’s commitments under the SLA. In a January, 2011 decision, the Tribunal found that, out of the eight Québec programs alleged by the U.S. to breach the SLA, five were in compliance and three were in breach. The Tribunal ordered Canada to impose an additional compensatory export charge of 2.6% on softwood lumber exports from Québec to the U.S. This charge will continue to be collected until the end of the SLA.

In January 2011, the United States again initiated arbitration proceedings in the LCIA, alleging that Canada, through the provincial government of British Columbia, had breached the SLA by under-pricing lumber cut

- 22 -

from government owned forests in British Columbia and sold to Canadian lumber producers. Canada denies the allegations. The proceedings are ongoing.

- 23 -

GOVERNMENT FINANCES

Financial Administration

The Minister of Finance is responsible for the general administration of the Government’s finances. The Financial Administration Act and the Balanced Budget Act govern the management of public monies of Québec and the Public Administration Act governs the management of financial, human, physical and information resources of the Administration.

Since January 2007, the Minister of Finance also manages the Generations Fund. This fund was established in June 2006 pursuant to the Act to reduce the debt and establish the Generations Fund, in order to reduce the Government’s debt burden.

The Conseil exécutif issues Orders in Council that authorize the Minister of Finance to enter into financial contracts, including those related to borrowings by the Government. The Conseil du trésor determines the accounting policies.

The accounts of the Government are kept on a modified accrual basis. The fiscal year of the Government ends March 31. The Auditor General of Québec is responsible for the auditing of the consolidated financial statements of the Government and reporting annually to the National Assembly. All monies received or collected from any source over which the Parliament has power of appropriation form the Consolidated Revenue Fund of Québec. The Budget and appropriations from the Consolidated Revenue Fund and consolidated entities are published at the beginning of each fiscal year.

In 2007, the Government undertook a major reform of its accounting policies in order to fully comply with Canadian generally accepted accounting principles (GAAP) applicable to the public sector. In this regard, the Government’s reporting entity includes, as of April 1, 2006, the financial results of public health and social services institutions, school boards and CEGEPs (Collège d’enseignement général et professionnel), as well as the Université du Québec and its branches. Consolidated entities are thus presented in three separate groups: the non-budget-funded bodies and special funds, the health and social services and education networks, and the Generations Fund.

As of Fiscal 2010, the transactions of the health and social services and education networks are presented line-by-line, whereas in previous years only the net financial results were incorporated into Government’s financial statements.

In the 2010-2011 Budget, the Government announced the creation of the following special funds to better manage certain governmental activities:

q the Land Transportation Network Fund (FORT), financed by the fuel tax, as well as driver’s licence and registration fees, will be allocated to funding the Government’s investments in road and public transit infrastructure. The FORT replaces the Fonds de conservation et d’amélioration du réseau routier, and a number of smaller specialized funds;

q the Tax Administration Fund (FRAF), financed out of tax revenues, will be used to fund the Agence du revenu du Québec. The statute creating the Agence du revenu du Québec stipulates that the Agency will be responsible for the collection of taxes, and that henceforth, the allowance for doubtful accounts will be accounted for by applying it against budgetary revenue.

The expenditures of FORT and FRAF will henceforth be excluded from the Government’s program spending and accounted for under the special funds.

- 24 -

The creation of these two funds does not affect the Government’s budgetary balance. However, it modifies the level of own-source revenue, program spending and net results of consolidated entities.

The accounts of the Consolidated Revenue Fund and the other entities included in the Government’s reporting entity, with the exception of Government enterprises, are consolidated line by line in the financial statements.

Transactions are classified as “budgetary”, “non-budgetary” or “financing”:

q budgetary transactions include:

With respect to the Consolidated Revenue Fund:

· revenue consisting of taxes, duties and permits, net results from Government enterprises1, transfers from the federal government and miscellaneous sources; and

· expenditure consisting of operating expenditures for goods and services which include, among other things, transfer payments, remuneration and debt service.

With respect to consolidated entities2:

· the net result of their self-generated revenues less their expenditures offset by transfers from the Consolidated Revenue Fund.

q non-budgetary transactions include changes in the balances of investments, loans and advances made by the Government, particularly to its own enterprises, changes in net fixed assets made by the Government, changes in the retirement plans liability and changes in other accounts. As of Fiscal 2010, non-budgetary transactions related to the health and social services and education networks are consolidated line-by-line; in previous years they were shown separately under the item “net investment in the networks.”

q financing transactions include changes in cash position, changes in net borrowings, changes in the retirement plans sinking fund and funds dedicated to employee’s future benefits and changes in the Generations Fund.

The Balanced Budget Act is designed to ensure that, on multi-year basis, the Government maintains a balanced budget. Any sum that exceeds the budgetary balance or surplus objectives determined by the Act (an “Overrun”) by less than $1 billion in a fiscal year must be offset by the Government in the next fiscal year. If an Overrun exceeding $1 billion stems from any of the exceptional circumstances defined in the Act,

1 Government enterprises are separate legal entities that have the authority to enter into contracts in their own name and to act before the courts. Their main activity is the sale of goods or the delivery of services to individuals or to organizations not included in the Government’s reporting entity.

2 Consolidated entities are those entities required to report to the National Assembly for the management of their operations and for the use of their financial resources. They include non-budget-funded bodies and special funds that pursue objectives complementary to governmental programs but exclude Government enterprises. They include also the vast majority of organizations of the Government’s health and social services and education networks and the Generations Fund. From an administrative and accounting point of view, consolidated entities are under the direct control of the Government and form entities which are not part of the Consolidated Revenue Fund.

- 25 -

the Government may exceed the deficit objective for more than one year, but must offset the Overrun over a maximum period of five years.

This Act also provides for a stabilization reserve fund that facilitates the Government’s multi-year budget planning. The stabilization fund is made up of the surplus for any fiscal year and its purpose is to enable multi-year planning of the Government’s financial framework. It is used primarily to maintain a balanced budget and, secondarily, for payment of sums into the Generations Fund.

In Fiscal 2010, final figures showed that expenditures exceeded revenues by $2.9 billion and the budgetary balance, within the meaning of the Balanced Budget Act, amounts to a deficit of $3.2 billion. According to the 2011-2012 Budget, the budgetary balance within the meaning of the Balanced Budget Act is expected to be in deficit by $4.2 billion for Fiscal 2011 and by $3.8 billion for Fiscal 2012.

The budgetary deficits for Fiscal 2010 through Fiscal 2012 are authorized under the Balanced Budget Act as amended pursuant to the Act to amend the Balanced Budget Act and various legislative provisions concerning the implementation of the accounting reform, which came into force on September 21, 2009. The main objective of the amendments is to ensure an expedient return to economic growth by implementing economic measures that will support the economy and promote employment during the recession which affected Québec as a result of the 2008 international financial crisis.

The amended Balanced Budget Act further provides that:

q the Government must meet definitive objectives for decreasing budgetary deficits for Fiscal 2012 and Fiscal 2013; the objectives are established in the 2011-2012 Budget;

q the revenue and expenditures established in accordance with the Government’s accounting policies must be balanced for Fiscal 2014.

The following table summarizes the consolidated financial transactions of the Government for the three years ended March 31, 2010, the preliminary results for Fiscal 2011 and the budget forecast for Fiscal 2012.

- 26 -

Table 8 Summary of Consolidated Financial Transaction(1)

Year ending March 31 (dollar amounts in millions) |

| | 2008 | | 2009 | | 2010 | | Preliminary

Results

2011(2)(3) | | Budget

Forecast

2012 |

| | | | | | | | | | |

Budgetary transactions of the Consolidated Revenue Fund | | | | | | | | | | |

| | | | | | | | | | |

Own-source revenue | | 49,464 | | 48,773 | | 47,994 | | 46,925 | | 50,336 |

| | | | | | | | | | |

Federal transfers | | 13,629 | | 14,023 | | 15,161 | | 15,451 | | 15,039 |

| | | | | | | | | | |

Total revenue | | 63,093 | | 62,796 | | 63,155 | | 62,376 | | 65,375 |

| | | | | | | | | | |

| | | | | | | | | | |

Program spending | | (54,826) | | (58,550) | | (61,579) | | (59,819) | | (61,284) |

| | | | | | | | | | |

Debt service | | (7,021) | | (6,504) | | (6,117) | | (6,934) | | (7,794) |

| | | | | | | | | | |

Total expenditure | | (61,847) | | (65,054) | | (67,696) | | (66,753) | | (69,078) |

| | | | | | | | | | |

Contingency reserve | | — | | — | | — | | (300) | | (300) |

| | | | | | | | | | |

Net results of Consolidated Revenue Fund | | 1,246 | | (2,258) | | (4,541) | | (4,677) | | (4,003) |

| | | | | | | | | | |

Net results of consolidated entities | | 404 | | 1007 | | 1,601 | | 1,209 | | 1,143 |

| | | | | | | | | | |

Surplus(deficit) within the meaning of the public accounts | | 1,650 | | (1,251) | | (2,940) | | (3,468) | | (2,860) |

| | | | | | | | | | |

Revenue of the Generations Fund | | (449) | | (587) | | (725) | | (732) | | (940) |

| | | | | | | | | | |

Stabilization reserve(4) | | (1,201) | | 1,845 | | 433 | | — | | — |

| | | | | | | | | | |

Accounting modifications | | — | | — | | 58 | | — | | — |

| | | | | | | | | | |

Consolidated budgetary balance within the meaning of the Balanced Budget Act | | 0 | | 7 | | (3,174) | | (4,200 | ) | (3,800) |

| | | | | | | | | | |

Deposit of dedicated revenues in the Generations Fund(5) | | 449 | | 587 | | 725 | | 732 | | 940 |

| | | | | | | | | | |

Consolidated budgetary balance | | 449 | | 594 | | (2,449) | | (3,468 | ) | (2,860) |

| | | | | | | | | | |

| | | | | | | | | | |

Consolidated non-budgetary transaction(6) | | | | | | | | | | |

| | | | | | | | | | |

Investments, loans and advances | | (2,658) | | (966) | | (2,009) | | (1,622) | | (2,024) |

| | | | | | | | | | |

Fixed assets | | (1,457) | | (2,448) | | (4,226) | | (5,094) | | (4,222) |

| | | | | | | | | | |

Net investments in the networks | | (487) | | (622) | | — | | — | | — |

| | | | | | | | | | |

Retirement plans | | 2,458 | | 2,274 | | 2,612 | | 3,364 | | 2,720 |

| | | | | | | | | | |

Other accounts(7) | | 988 | | 638 | | 1,354 | | 350 | | (1,148) |

| | | | | | | | | | |