Exhibit 99.4

| | | | | | | | | | | | | | | | |

| SUMMARY OF CONSOLIDATED BUDGETARY TRANSACTIONS |

| (unaudited data, millions of dollars) |

| | | | | | | | | | | | The Québec Economic Plan – |

| | | April and May | | | | March 2017(1) | |

| | | 2016-2017(2) | | | 2017-2018 | | | Change (%) | | | | 2017-2018 | | | Change (%) | |

| GENERAL FUND | | | | | | | | | | | | | | | | |

| Revenue | | | | | | | | | | | | | | | | |

| Own-source revenue | | 8 956 | | | 9 611 | | | 7.3 | | | | 60 249 | | | 1.8 | |

| Federal transfers | | 3 151 | | | 3 330 | | | 5.7 | | | | 20 053 | | | 7.9 | |

| Total revenue | | 12 107 | | | 12 941 | | | 6.9 | | | | 80 302 | | | 3.3 | |

| Expenditure | | | | | | | | | | | | | | | | |

| Program spending | | –12 008 | | | –12 345 | | | 2.8 | | | | –72 591 | | | 4.1 | |

| Debt service | | –1 282 | | | –1 165 | | | –9.1 | | | | –7 776 | | | 2.3 | |

| Total expenditure | | –13 290 | | | –13 510 | | | 1.7 | | | | –80 367 | | | 3.9 | |

| NET RESULTS OF CONSOLIDATED ENTITIES(3) | | | | | | | | | | | | | | | | |

| Non-budget-funded bodies and special funds(4) | | 413 | | | 294 | | | — | | | | 165 | | | — | |

| Health and social services and education networks(5) | | –2 | | | — | | | — | | | | — | | | — | |

| Generations Fund | | 295 | | | 350 | | | — | | | | 2 488 | | | — | |

| Total consolidated entities | | 706 | | | 644 | | | — | | | | 2 653 | | | — | |

| SURPLUS (DEFICIT) | | –477 | | | 75 | | | — | | | | 2 588 | (6) | | — | |

| Contingency reserve | | — | | | — | | | — | | | | –100 | | | — | |

| BALANCED BUDGET ACT | | | | | | | | | | | | | | | — | |

| Deposits of dedicated revenues in the Generations Fund | | –295 | | | –350 | | | — | | | | –2 488 | | | — | |

| BUDGETARY BALANCE(7) | | –772 | | | –275 | | | — | | | | — | | | — | |

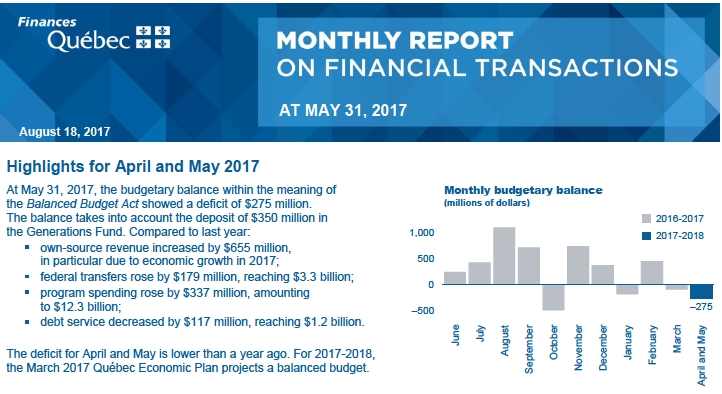

Note to the reader: Reports for 2017-2018

The first report of the 2017-2018 fiscal year presents the financial transactions for the first two months of activity, i.e. April and May 2017.

Subsequent reports will be produced on a monthly basis. The next monthly report, at June 30, 2017, will be published on September 8, 2017.

GENERAL FUND REVENUE

GENERAL FUND REVENUE

At May 31, 2017, revenue totalled $12.9 billion, an increase of $834 million, or 6.9%, compared to May 31, 2016.

This increase is primarily due to growth in personal income tax ($206 million), corporate taxes ($144 million), contributions for health services ($114 million) and revenue from government enterprises ($62 million).

The observed variability of the growth rate by source of revenue is significant at the beginning of the fiscal year, when cumulative amounts are relatively small.

| | | | | | | | | |

| GENERAL FUND REVENUE | | | | | | | | | |

| (unaudited data, millions of dollars) | | | | | | | | | |

| | | | | | April and May | | | | |

| Revenue by source | | 2016-2017(2) | | | 2017-2018 | | | Change (%) | |

| Own-source revenue excluding government enterprises | | | | | | | | | |

| Income and property taxes | | | | | | | | | |

Personal income tax | | 3 007 | | | 3 213 | | | 6.9 | |

Contributions for health services | | 1 063 | | | 1 177 | | | 10.7 | |

Corporate taxes | | 701 | | | 845 | | | 20.5 | |

| Consumption taxes | | 3 212 | | | 3 316 | | | 3.2 | |

| Other sources | | 328 | | | 353 | | | 7.6 | |

| Total own-source revenue excluding government enterprises | | 8 311 | | | 8 904 | | | 7.1 | |

| Revenue from government enterprises | | 645 | | | 707 | | | 9.6 | |

| Total own-source revenue | | 8 956 | | | 9 611 | | | 7.3 | |

| Federal transfers | | | | | | | | | |

| Equalization | | 1 672 | | | 1 847 | | | 10.5 | |

| Health transfers | | 991 | | | 1 007 | | | 1.6 | |

| Transfers for post-secondary education and other social programs | | 271 | | | 273 | | | 0.7 | |

| Other programs | | 217 | | | 203 | | | –6.5 | |

| Total federal transfers | | 3 151 | | | 3 330 | | | 5.7 | |

| TOTAL | | 12 107 | | | 12 941 | | | 6.9 | |

2

GENERAL FUND EXPENDITURE

GENERAL FUND EXPENDITURE

For the first two months of the 2017-2018 fiscal year, General Fund expenditure totalled $13.5 billion, up $220 million in relation to the beginning of the previous fiscal year.

For the period from April to May 2017, program spending rose by $337 million, or 2.8%, reaching $12.3 billion.

| | | | | | | | | |

| GENERAL FUND EXPENDITURE | | | | | | | | | |

| (unaudited data, millions of dollars) | | | | | | | | | |

| | | | | | April and May | | | | |

| Expenditure by mission | | 2016-2017(2) | | | 2017-2018 | | | Change (%) | |

| Program spending | | | | | | | | | |

| Health and Social Services | | 6 141 | | | 6 382 | | | 3.9 | |

| Education and Culture | | 3 153 | | | 3 193 | | | 1.3 | |

| Economy and Environment | | 1 047 | | | 1 032 | | | –1.4 | |

| Support for Individuals and Families | | 1 066 | | | 1 043 | | | –2.2 | |

| Administration and Justice | | 601 | | | 695 | | | 15.6 | |

| Total program spending | | 12 008 | | | 12 345 | | | 2.8 | |

| Debt service | | 1 282 | | | 1 165 | | | –9.1 | |

| TOTAL | | 13 290 | | | 13 510 | | | 1.7 | |

3

CONSOLIDATED ENTITIES

CONSOLIDATED ENTITIES

At May 31, 2017, the results of consolidated entities showed a surplus of $644 million. These results include:

a surplus of $379 million for special funds;

dedicated revenues of $350 million for the Generations Fund;

a deficit of $85 million for non-budget-funded bodies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| DETAILS OF THE TRANSACTIONS OF CONSOLIDATED ENTITIES |

| (unaudited data, millions of dollars) |

| | | April and May 2017 | |

| | | Special funds | | | Generations Fund | | | Specified accounts purpose | | | Transfers (expenditures) related tax system to the | | | Non-budget-funded bodies | | | Health and education networks | (5) | | Total | | | Consolidation adjustments | (8) | | Total | |

| Revenue | | 2 283 | | | 350 | | | 100 | | | 990 | | | 3 820 | | | — | | | 7 543 | | | –4 514 | | | 3 029 | |

| Expenditure | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Expenditure | | –1 526 | | | — | | | –100 | | | –990 | | | –3 807 | | | — | | | –6 423 | | | 4 351 | | | –2 072 | |

Debt service | | –378 | | | — | | | — | | | — | | | –98 | | | — | | | –476 | | | 163 | | | –313 | |

| Subtotal | | –1 904 | | | — | | | –100 | | | –990 | | | –3 905 | | | — | | | –6 899 | | | 4 514 | | | –2 385 | |

| SURPLUS (DEFICIT) | | 379 | | | 350 | | | — | | | — | | | –85 | | | — | | | 644 | | | — | | | 644 | |

4

NET FINANCIAL SURPLUS (REQUIREMENTS)

NET FINANCIAL SURPLUS (REQUIREMENTS)

Net financial requirements reflect the current budgetary balance, as well as the year-over-year change in receipts and disbursements in the course of the government’s transactions.

At May 31, 2017, the consolidated net financial requirements stood at $267 million, an improvement of $688 million over last year.

| | | | | | | | | |

| CONSOLIDATED BUDGETARY AND FINANCIAL TRANSACTIONS |

| (unaudited data, millions of dollars) |

| | | | | | April and May | | | | |

| | | 2016-2017(2) | | | 2017-2018 | | | Change | |

| GENERAL FUND | | | | | | | | | |

| Revenue | | | | | | | | | |

| Own-source revenue | | 8 956 | | | 9 611 | | | 655 | |

| Federal transfers | | 3 151 | | | 3 330 | | | 179 | |

| Total revenue | | 12 107 | | | 12 941 | | | 834 | |

| Expenditure | | | | | | | | | |

| Program spending | | –12 008 | | | –12 345 | | | –337 | |

| Debt service | | –1 282 | | | –1 165 | | | 117 | |

| Total expenditure | | –13 290 | | | –13 510 | | | –220 | |

| NET RESULTS OF CONSOLIDATED ENTITIES(3) | | | | | | | | | |

| Non-budget-funded bodies and special funds(4) | | 413 | | | 294 | | | –119 | |

| Health and social services and education networks(5) | | –2 | | | — | | | 2 | |

| Generations Fund | | 295 | | | 350 | | | 55 | |

| Total consolidated entities | | 706 | | | 644 | | | –62 | |

| SURPLUS (DEFICIT) | | –477 | | | 75 | | | 552 | |

| Consolidated non-budgetary surplus (requirements) | | –478 | | | –342 | | | 136 | |

| CONSOLIDATED NET FINANCIAL SURPLUS (REQUIREMENTS) | | –955 | | | –267 | | | 688 | |

5

Appendix

| | | | |

| MARCH 2017 QUÉBEC ECONOMIC PLAN BUDGET FORECASTS FOR 2017-2018 |

| (millions of dollars) |

| | The Québec Economic Plan – | | | |

| | March 2017 | (1) | Change (%) | |

| Own-source revenue excluding government enterprises | | | | |

| Income and property taxes | | | | |

Personal income tax | 23 687 | | 3.5 | |

Contributions for health services | 7 261 | | 0.3 | |

Corporate taxes | 5 311 | | 6.4 | |

| Consumption taxes | 18 275 | | 2.6 | |

| Other sources | 1 665 | | 0.0 | |

| Total own-source revenue excluding government enterprises | 56 199 | | 2.9 | |

| Revenue from government enterprises | 4 050 | | –11.7 | |

| Total own-source revenue | 60 249 | | 1.8 | |

| Federal transfers | 20 053 | | 7.9 | |

| TOTAL GENERAL FUND REVENUE | 80 302 | | 3.3 | |

| Program spending | | | | |

| Health and Social Services | –36 764 | | 4.2 | |

| Education and Culture | –18 877 | | 4.3 | |

| Economy and Environment | –5 418 | | 2.1 | |

| Support for Individuals and Families | –6 274 | | –0.4 | |

| Administration and Justice | –5 258 | | 10.1 | |

| Total program spending | –72 591 | | 4.1 | |

| Debt service | –7 776 | | 2.3 | |

| TOTAL GENERAL FUND EXPENDITURE | –80 367 | | 3.9 | |

| Net results of consolidated entities | | | | |

| Non-budget-funded bodies and special funds(4) | 165 | | — | |

| Health and social services and education networks(5) | — | | — | |

| Generations Fund | 2 488 | | — | |

| TOTAL CONSOLIDATED ENTITIES | 2 653 | | — | |

| SURPLUS (DEFICIT) | 2 588 | (6) | — | |

| Contingency reserve | –100 | | — | |

| BALANCED BUDGET ACT | | | | |

| Deposits of dedicated revenues in the Generations Fund | –2 488 | | — | |

| BUDGETARY BALANCE(7) | — | | — | |

6

Notes

| (1) | The presentation of the budgetary information in this monthly report is consistent with that of the financial framework for the general fund and consolidated entities as published on page A.15 of The Québec Economic Plan – March 2017. |

| (2) | The 2016-2017 data of the monthly report have been reclassified to account for changes in the 2017-2018 budgetary structure, in particular for the elimination of the Fund to Finance Health and Social Services Institutions. |

| (3) | Details of transactions by type of entity are presented on page 4 of this report. |

| (4) | These results include consolidation adjustments. |

| (5) | The results of the networks are presented according to the modified equity method of accounting. |

| (6) | Surplus excluding the contingency reserve of $100 million. |

| (7) | Budgetary balance within the meaning of the Balanced Budget Act. |

| (8) | Consolidation adjustments include the elimination of program spending from the General Fund. |

The next monthly report, which will present the results at June 30, 2017, will be published on September 8, 2017.

For more information, contact the Direction des communications of the Ministère des Finances at 418 528-7382.

The report is also available on the Ministère des Finances website: www.finances.gouv.qc.ca.

7

GENERAL FUND REVENUE

GENERAL FUND REVENUE