Exhibit 99.4

Message from the minister of finance

Mr. François Paradis

President of the National Assembly

Hôtel du Parlement

Québec (Québec) G1A 1A4

Dear Mr. Paradis,

I am pleased to send you the Pre-election Report on the State of Québec’s Public Finances – August 2022, in accordance with the Act respecting the Ministère des Finances.

| — | In April 2015, the National Assembly passed legislative provisions mandating the Minister of Finance to publish a pre-election report on the state of public finances, prior to fixed-date general elections. |

| — | The Auditor General Act mandates the Auditor General of Québec to prepare a report giving its opinion on the plausibility of the forecasts and assumptions in the pre-election report published by the Minister of Finance. The Auditor General of Québec’s conclusion, which is provided herewith, is based on data available as at July 8, 2022. |

The Pre-election Report on the State of Québec’s Public Finances – August 2022 is based on the financial framework of the Québec Budget Plan – March 2022, to which the necessary adjustments were made to take into account the most recent information.

Given the uncertain context, the Pre-election Report on the State of Québec’s Public Finances – August 2022 is based on balanced economic forecasts and a prudent financial framework.

Despite the strong economic recovery since 2021 and continued growth in 2022, Québec is not immune to economic slowdowns resulting from the high inflation of recent months and interest rate hikes, or to possible jolts in the global pandemic situation.

| — | For this reason, the financial framework is based on balanced economic forecasts that incorporate both upward and downward risks. It includes a provision for economic risks and other support and recovery measures of $10.0 billion and growing deposits in the Generations Fund over the forecast horizon. |

The financial framework includes the measures announced in the Québec Budget Plan – March 2022. It also takes into account:

| — | a balanced approach combining sound management of public finances with stable and predictable funding of the government’s main missions; |

| — | Growth in revenue reflects Québec’s good economic health. The funding of expenditures corresponds to the cost of the services announced. |

| — | the continuity of high levels of investment in public infrastructure and the continued reduction of the debt burden. |

| | | Message from the

Minister of Finance | 1 |

For 2022-2023 to 2026-2027, the financial framework provides for approximately $2.3 billion in improvements annually, compared to the Québec Budget Plan – March 2022.

| — | Despite current uncertainties, the budgetary balance deficit now stands at $1.9 billion in 2026-2027. |

| — | Excluding the provision for economic risks and other support and recovery measures, the budgetary balance within the meaning of the Balanced Budget Act, that is, after deposits of dedicated revenues in the Generations Fund, is achieved over the entire horizon of the financial framework. |

Québec relies on a diversified and resilient economy as well as on sound public finances that allow it to cope with the volatility of global economic activity.

Lastly, the Pre-election Report on the State of Québec’s Public Finances – August 2022 provides citizens with a financial framework that constitutes a reference point on the eve of the next general elections in Québec.

Sincerely,

Eric Girard

Minister of Finance

Québec, August 2022

2 | Pre-election Report on the State of Québec’s

Public Finances – August 2022 | | |

STATEMENT CONCERNING THE RESPONSIBILITY

OF THE MINISTÈRE DES FINANCES

The Pre-election Report on the State of Québec’s Public Finances – August 2022 was prepared by the Ministère des Finances pursuant to the Act respecting the Ministère des Finances. The financial framework in the report is based on the data published in the Québec Budget Plan – March 2022 and takes into account the most recent available financial data, as at July 8, 2022.1

The Ministère des Finances is responsible for the information in the report. As required under the law, the report includes:

| — | economic forecasts and assumptions; |

| — | the projected components of the government’s financial framework; |

| — | expenditure forecasts prepared in collaboration with the Chair of the Conseil du trésor, broken down by field of State activity; |

| — | the reports required under section 15 of the Balanced Budget Act and section 11 of the Act to reduce the debt and establish the Generations Fund. |

The economic forecasts for Québec take into account a number of external and internal factors, such as:

| — | the economic situation of Québec’s main trading partners; |

| — | monetary policies and financial markets; |

| — | Québec’s domestic demand; |

| — | the underlying impacts of the health situation, including supply chain disruptions; |

| — | uncertainties related to the Russian invasion of Ukraine. |

As for the revenue and expenditure forecasts, they are based on assumptions pertaining to the evolution of the Québec economy that take into account, in particular, the external and internal factors mentioned above, as well as assumptions regarding the change in federal transfers and the cost of government services.

Economic forecast as well as revenue and expenditure forecasts include the measures and programs that are to be implemented by the government.

The financial impacts of the new accounting standards that come into effect on April 1, 2022 or April 1, 2023, have not been included in the consolidated forecasts of the Québec government’s revenue, expenditure, and debt over the budgetary horizon, as they are not significant or cannot be estimated as of the date of the report.2

The budgetary balance and debt data are established based on the definitions in the Balanced Budget Act and the Act to reduce the debt and establish the Generations Fund.

| 1 | Unless otherwise indicated, this document is based on financial information available as at July 8, 2022. In addition, the budgetary data presented for 2021-2022 are preliminary estimates and those for subsequent years are forecasts. |

| 2 | Accounting standards effective April 1, 2022 or April 1, 2023 are presented in Appendix 4. |

| | | Statement Concerning the Responsibility

of the Ministère des Finances | 3 |

The forecasts presented in this report are underpinned by reasonable, plausible assumptions that reflect best practices, particularly those recommended by international organizations such as the Organisation for Economic Co-operation and Development (OECD).

Finally, I would like to thank the department’s staff for their hard work and cooperation in completing this exercise.

Julie Gingras

Deputy Minister of Finance

Québec, August 2022

4 | Pre-election Report on the State of Québec’s

Public Finances – August 2022 | | |

ASSURANCE REPORT OF THE AUDITOR GENERAL OF QUÉBEC ON THE 2022 PRE-ELECTION REPORT

To the National Assembly of Québec,

I have performed an assurance review engagement on the plausibility of the assumptions and forecasts presented in the attached pre-election report, prepared by the Minister of Finance. My work involved examining, in all material aspects, the assumptions made and the financial framework forecasts for the following three fiscal years: 2022-2023, 2023-2024 and 2024-2025. The audit of the consolidated financial statements of the Gouvernement du Québec for the 2021-2022 fiscal year was underway at the time of my work; therefore, I do not express any conclusion on these data, presented in the pre-election report.

As the forecasts are based on assumptions about future events, the actual results will be different from the information presented in the pre-election report, and differences could be significant. Thus, I do not express any conclusion on the likelihood that the forecasts will materialize.

In accordance with the Auditor General Act, I report that I have received all the information, reports and explanations requested to express my conclusion.

Conclusion of the Auditor General’s review

Based on the procedures implemented and the evidence obtained, as of July 8, 2022, the assumptions made and forecasts related to the financial framework and debt for the 2022-2023, 2023-2024 and 2024-2025 fiscal years are plausible, in all material respects and according to the objective and the criteria set by the Auditor General.

Auditor General’s comments

Without detracting from my conclusion, I would like to make the following comments:

Very high level of uncertainty about the economic situation

First, for 2022-2023, the margins of prudence of $2.2 billion in the pre-election report include $2 billion in planned spending, primarily related to COVID-19, which should instead be presented as portfolio expenditures. As a result, the margins for 2022-2023 actually amount to $0.2 billion, which I deem reasonable. Otherwise, as certain expenditures may not be made within the prescribed deadlines, and more persistent inflation could have a positive temporary impact on revenues, an additional surplus could emerge, and the budget balance deficit could improve accordingly.

Second, there is currently a very high level of uncertainty regarding the economic situation. Given this high degree of uncertainty, I have deemed it appropriate to include significant margins of prudence of $2.4 billion in 2023-2024 and $2.25 billion in 2024-2025. However, I have been unable to assess whether these margins are sufficient or excessive. The use of margins will depend primarily on whether economic risks, such as a recession, materialize and if so, to what extent. If economic risks do not materialize, and as some expenditures may not be made within the prescribed deadlines, the surplus for the government’s consolidated financial statement purposes could be higher than expected, and the budget balance deficit could improve accordingly.

| | | Assurance report of the Auditor General

of Québec on the 2022 pre-election report | 5 |

Third, to illustrate the impacts of unusually high uncertainty, it would have been useful, following the example of other institutions, to present an alternative scenario that estimates the potential impact posed by the materialization of the major risks on Québec’s economic outlook and the financial framework. Indeed, the information contained in the pre-election report is limited to presenting an estimate of the potential impacts of a recession on nominal GDP growth and own-source revenue based on an average of recent recessions (box on page 14 of the pre-election report).

The Auditor General of Quebec’s detailed analysis of the Pre-Election report

In addition to this report, I have prepared a report entitled The Auditor General of Québec’s detailed analysis of the Pre-Election report 2022, in which I explain in detail my work and the bases for my conclusion, and present additional information necessary for the reader to fully assess the assumptions and forecasts in the pre-election report. This detailed report also contains various comments on the presentation of information in the pre-election report, as well as the objective and criteria used to assess this presentation. It will be available on the Auditor General’s website.

Responsibility of the Ministère des Finances

Under the Act respecting the Ministère des Finances, the Minister must prepare and publish, prior to the general election that follows the expiry of a Legislature, a pre-election report on the state of Québec’s public finances. This responsibility includes making assumptions and forecasts that are deemed plausible.

Responsibility of the Auditor General

My responsibility is to review the plausibility of the assumptions and forecasts presented in the pre-election report, as of July 8, 2022, based on the procedures I have implemented and the evidence I have obtained with regard to the objective and criteria I have deemed suitable. This objective and these criteria are provided below. I must also indicate whether I received all the information and documents requested. I conducted the engagement in accordance with Canadian Standards on Assurance Engagements 3001: Direct Engagements. This standard requires me to plan and perform the engagement so as to obtain assurance that is meaningful in the circumstances.

| Objective | | Assessment criteria |

| Determine whether the budget assumptions and forecasts used to develop the financial framework and debt presented in the pre-election report are plausible. | | – The assumptions used are justified and constitute a reasonable basis for establishing forecasts. – The forecasts reflect the selected assumptions. – The assumptions and forecasts take into account the most recent financial information and the latest government orientations and decisions. – The forecasts are established in accordance with Canadian accounting standards in the public sector. |

Because of the purpose of the review engagement, which focuses on forecasts, the nature of the implemented procedures is different from what is done in audit engagements, and the level of assurance obtained is thus lower.

The implemented procedures therefore rely on my judgment. These include, to the extent deemed appropriate, analysis of the budget process, requests for information, cross-referencing of documents or reconciliation with supporting documents, analytical procedures, assessment of the estimation methods used and the Ministère des Finance’s economic forecasting models, review of sensitivity calculations and analyses. Finally, the consultation of public finance specialists and economists, including econometric analysts, form an integral part of the procedures.

6 | Pre-election Report on the State of Québec’s

Public Finances – August 2022 | | |

The Auditor General’s independence and quality control

The Auditor General complied with the relevant ethical requirements and code of ethics that are applicable to the practice of public accounting and related to assurance engagements, published by various professional accounting bodies, which are based on the fundamental principles of integrity, objectivity, professional competence and due care, confidentiality and professional behaviour. The Auditor General applies the Canadian Standard on Quality Control 1, Quality Control for Firms that Perform Audits and Reviews of Financial Statements, and Other Assurance Engagements and accordingly maintains a comprehensive quality control system that includes documented policies and procedures for compliance with ethical requirements, professional standards and applicable legal and regulatory requirements.

Guylaine Leclerc, FCPA Auditor

Auditor General of Québec

Québec, August 8, 2022

| | | Assurance report of the Auditor General

of Québec on the 2022 pre-election report | 7 |

Pre-election report on the state of Québec’s

public finances

10 | Pre-election Report on the State of Québec’s

Public Finances – August 2022 | | |

Highlights

Québec’s financial situation is based on balanced economic forecasts,3 that is, on the most likely scenario, and a prudent financial framework.

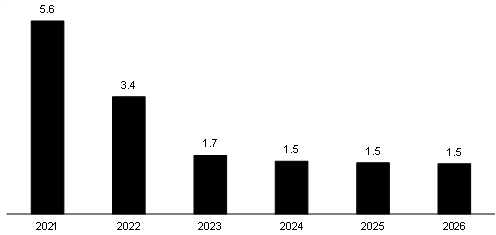

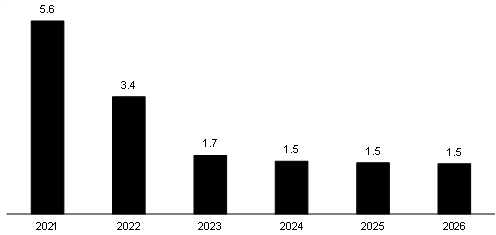

| — | Québec’s economy recovered in 2021. After a historic decline of 5.5% in 2020, real gross domestic product (GDP) grew by 5.6%. |

| — | Economic activity will continue to grow despite the risks inherent to the forecast scenario. |

The economic forecast scenario incorporates the uncertainties and risks related to the particular context in which Québec is evolving.

The economic forecasts for 2022 assume an increase in Québec’s real GDP (+3.4%) similar to that expected on average by private sector forecasters (+3.2%).4

| — | The additional own-source revenue resulting from the favourable revision of economic indicators will make it possible to finance: |

| — | the entire cost of renewing existing programs. In fact, there are no remaining shortfall for portfolio expenditures; |

| — | the anticipated increase in costs related to the delivery of public services; |

| — | annual investments provided for in the Québec Infrastructure Plan (QIP). |

| — | The financial framework includes increasing deposits in the Generations Fund over the forecast horizon, stable and predictable financing of government actions, and government decisions made since the 2022-2023 budget. |

| — | Although the government is not shielded from the uncertainties that could affect its financial framework, it does not foresee economic slowdowns of the magnitude of those resulting from a recession in the short term. However, should economic slowdowns occur, the provisions in the financial framework will be adequate to deal with it. |

| — | The financial framework includes a provision for economic risks and other support and recovery measures totaling $10.0 billion between 2022-2023 and 2026-2027. |

Excluding the provision for economic risks and other support and recovery measures, the budgetary balance within the meaning of the Balanced Budget Act, that is, after deposits of dedicated revenues in the Generations Fund, is achieved over the entire horizon of the financial framework.

| — | The Act to reduce the debt and establish the Generations Fund stipulates that, for fiscal 2025-2026, the gross debt must not exceed 45% of GDP while the debt representing accumulated deficits must not exceed 17% of GDP. These two objectives are currently expected to be met if the risks of a recession do not materialize. |

| 3 | The Ministère des Finances’ economic forecast is balanced. It incorporates both upward and downward risks. |

| 4 | Based on the Ministère des Finances survey as at June 21, 2022, which includes the forecasts of 11 private sector institutions. |

| q | Québec’s economic outlook |

Table 1 shows a summary of the main indicators of the economic outlook.

TABLE 1

Québec’s economic outlook

(annual average, percentage change, unless otherwise indicated)

| | | 2021 | | | 2022 | | | 2023 | | | 2024 | | | 2025 | | | 2026 | |

| Output | | | | | | | | | | | | | | | | | | | | | | | | |

| Real GDP | | | 5.6 | | | | 3.4 | | | | 1.7 | | | | 1.5 | | | | 1.5 | | | | 1.5 | |

| Nominal GDP | | | 12.5 | | | | 9.6 | | | | 3.8 | | | �� | 3.6 | | | | 3.5 | | | | 3.5 | |

| Nominal GDP (billions of dollars) | | | 505.1 | | | | 553.6 | | | | 574.4 | | | | 595.3 | | | | 616.4 | | | | 638.0 | |

| Components of GDP (in real terms) | | | | | | | | | | | | | | | | | | | | | | | | |

| Final domestic demand | | | 5.7 | | | | 3.8 | | | | 1.5 | | | | 1.2 | | | | 1.3 | | | | 1.1 | |

| – Household consumption | | | 5.8 | | | | 5.3 | | | | 2.3 | | | | 1.5 | | | | 1.5 | | | | 1.5 | |

| – Government spending and investment | | | 4.9 | | | | 2.6 | | | | 0.6 | | | | 0.8 | | | | 1.1 | | | | 0.1 | |

| – Residential investment | | | 12.7 | | | | -2.6 | | | | -3.0 | | | | -0.2 | | | | 0.2 | | | | 0.3 | |

| – Non-residential business investment | | | 3.3 | | | | 4.9 | | | | 3.6 | | | | 2.1 | | | | 2.1 | | | | 2.2 | |

| Exports | | | 4.6 | | | | 2.1 | | | | 3.0 | | | | 2.7 | | | | 2.6 | | | | 2.2 | |

| Imports | | | 8.8 | | | | 4.2 | | | | 2.1 | | | | 1.7 | | | | 2.2 | | | | 1.3 | |

| Labour market | | | | | | | | | | | | | | | | | | | | | | | | |

| Population (thousands) | | | 8 604 | | | | 8 687 | | | | 8 763 | | | | 8 830 | | | | 8 891 | | | | 8 942 | |

| Population aged 15 and over (thousands) | | | 7 099 | | | | 7 153 | | | | 7 224 | | | | 7 289 | | | | 7 348 | | | | 7 399 | |

| Jobs (thousands) | | | 4 269 | | | | 4 397 | | | | 4 447 | | | | 4 473 | | | | 4 496 | | | | 4 518 | |

| Job creation (thousands) | | | 169.4 | | | | 128.0 | | | | 49.5 | | | | 26.2 | | | | 23.5 | | | | 21.7 | |

| Unemployment rate (per cent) | | | 6.1 | | | | 4.2 | | | | 3.9 | | | | 3.8 | | | | 3.7 | | | | 3.6 | |

| Other economic indicators (in nominal terms) | | | | | | | | | | | | | | | | | | | | | | | | |

| Household consumption | | | 9.2 | | | | 11.2 | | | | 5.1 | | | | 3.2 | | | | 3.3 | | | | 3.3 | |

| – Excluding food products and housing | | | 11.1 | | | | 13.2 | | | | 5.2 | | | | 3.1 | | | | 3.2 | | | | 3.1 | |

| Housing starts (thousands of units) | | | 68.0 | | | | 64.6 | | | | 58.3 | | | | 52.9 | | | | 50.1 | | | | 48.5 | |

| Residential investment | | | 29.8 | | | | 6.2 | | | | -0.5 | | | | 1.8 | | | | 2.3 | | | | 2.4 | |

| Non-residential business investment | | | 7.2 | | | | 11.1 | | | | 5.6 | | | | 3.3 | | | | 3.9 | | | | 4.1 | |

| Wages and salaries | | | 9.4 | | | | 10.7 | | | | 4.0 | | | | 3.1 | | | | 3.2 | | | | 3.1 | |

| Household income | | | 7.6 | | | | 6.8 | | | | 2.4 | | | | 3.3 | | | | 3.4 | | | | 3.2 | |

| Net operating surplus of corporations | | | 16.8 | | | | -4.6 | | | | 0.2 | | | | 5.8 | | | | 4.0 | | | | 3.8 | |

| Consumer price index | | | 3.8 | | | | 6.5 | | | | 3.2 | | | | 2.0 | | | | 1.9 | | | | 1.9 | |

| – Excluding food and energy | | | 3.0 | | | | 4.4 | | | | 3.3 | | | | 2.1 | | | | 2.1 | | | | 2.1 | |

| GDP per capita (in $) | | | 58 701 | | | | 63 727 | | | | 65 546 | | | | 67 420 | | | | 69 329 | | | | 71 341 | |

| Per capita disposable income (in $) | | | 34 849 | | | | 36 160 | | | | 35 930 | | | | 36 867 | | | | 37 839 | | | | 38 845 | |

Sources: Institut de la statistique du Québec, Statistics Canada, Canada Mortgage and Housing Corporation and Ministère des Finances du Québec.

12 | Pre-election Report on the State of Québec’s

Public Finances – August 2022 | | |

Table 2 shows the detailed multi-year financial framework.

TABLE 2

Financial framework from 2021-2022 to 2026-2027

(millions of dollars)

| | | 2021-

2022- | | | 2022-

2023- | | | 2023-

2024- | | | 2024-

2025- | | | 2025-

2026- | | | 2026-

2027- | | | 2021-

2027(1) | |

| Revenue | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Personal income tax | | | 41 285 | | | | 43 414 | | | | 45 272 | | | | 46 660 | | | | 48 519 | | | | 50 278 | | | | | |

| Contributions for health services | | | 7 367 | | | | 7 784 | | | | 7 964 | | | | 8 187 | | | | 8 393 | | | | 8 603 | | | | | |

| Corporate taxes | | | 12 927 | | | | 11 925 | | | | 11 867 | | | | 12 803 | | | | 13 536 | | | | 14 131 | | | | | |

| School property tax | | | 1 081 | | | | 1 048 | | | | 1 106 | | | | 1 187 | | | | 1 251 | | | | 1 299 | | | | | |

| Consumption taxes | | | 24 673 | | | | 27 345 | | | | 28 140 | | | | 29 006 | | | | 29 743 | | | | 30 475 | | | | | |

| Duties and permits | | | 6 049 | | | | 5 518 | | | | 5 494 | | | | 5 544 | | | | 5 678 | | | | 5 810 | | | | | |

| Miscellaneous revenue | | | 10 902 | | | | 11 629 | | | | 12 450 | | | | 13 061 | | | | 13 483 | | | | 14 051 | | | | | |

| Government enterprises | | | 5 967 | | | | 6 207 | | | | 6 688 | | | | 7 040 | | | | 6 713 | | | | 6 994 | | | | | |

| Own-source revenue | | | 110 251 | | | | 114 870 | | | | 118 981 | | | | 123 488 | | | | 127 316 | | | | 131 641 | | | | | |

| % change | | | 20.0 | | | | 4.2 | | | | 3.6 | | | | 3.8 | | | | 3.1 | | | | 3.4 | | | | 6.2 | |

| Federal transfers | | | 29 141 | | | | 29 600 | | | | 29 631 | | | | 29 921 | | | | 31 813 | | | | 32 345 | | | | | |

| % change | | | –5.1 | | | | 1.6 | | | | 0.1 | | | | 1.0 | | | | 6.3 | | | | 1.7 | | | | 0.9 | |

| Total revenue | | | 139 392 | | | | 144 470 | | | | 148 612 | | | | 153 409 | | | | 159 129 | | | | 163 986 | | | | | |

| % change | | | 13.7 | | | | 3.6 | | | | 2.9 | | | | 3.2 | | | | 3.7 | | | | 3.1 | | | | 5.0 | |

| Expenditure | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Portfolio expenditures | | | –118 272 | | | | –128 154 | | | | –134 472 | | | | –138 370 | | | | –144 246 | | | | –147 959 | | | | | |

| % change | | | 11.4 | | | | 8.4 | | | | 4.9 | | | | 2.9 | | | | 4.2 | | | | 2.6 | | | | 5.7 | |

| Debt service | | | –8 619 | | | | –10 189 | | | | –9 000 | | | | –9 888 | | | | –9 990 | | | | –10 808 | | | | | |

| % change | | | 12.1 | | | | 18.2 | | | | –11.7 | | | | 9.9 | | | | 1.0 | | | | 8.2 | | | | 5.8 | |

| Total expenditure | | | –126 891 | | | | –138 343 | | | | –143 472 | | | | –148 258 | | | | –154 236 | | | | –158 767 | | | | | |

| % change | | | 11.5 | | | | 9.0 | | | | 3.7 | | | | 3.3 | | | | 4.0 | | | | 2.9 | | | | 5.7 | |

| Expenditure associated with COVID-19 support and recovery measures | | | –9 178 | | | | –2 355 | | | | –462 | | | | –18 | | | | — | | | | — | | | | | |

Provision for economic risks

and other support and recovery measures | | | — | | | | –2 000 | | | | –2 000 | | | | –2 000 | | | | –2 000 | | | | –2 000 | | | | | |

| SURPLUS | | | 3 323 | | | | 1 772 | | | | 2 678 | | | | 3 133 | | | | 2 893 | | | | 3 219 | | | | | |

| BALANCED BUDGET ACT | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Deposits of dedicated revenues

in the Generations Fund | | | –3 617 | | | | –3 428 | | | | –3 955 | | | | –4 546 | | | | –4 800 | | | | –5 163 | | | | | |

BUDGETARY BALANCE BEFORE USE OF THE STABILIZATION

RESERVE | | | –294 | | | | –1 656 | | | | –1 277 | | | | –1 413 | | | | –1 907 | | | | –1 944 | | | | | |

| Use of the stabilization reserve | | | 294 | | | | 927 | | | | — | | | | — | | | | — | | | | — | | | | | |

| BUDGETARY BALANCE(2) | | | — | | | | –729 | | | | –1 277 | | | | –1 413 | | | | –1 907 | | | | –1 944 | | | | | |

Note: Totals may not add due to rounding.

| (1) | Average annual growth rate, corresponding to the geometric average over six years, from 2021-2022 to 2026-2027. |

| (2) | Budgetary balance within the meaning of the Balanced Budget Act, after use of the stabilization reserve. |

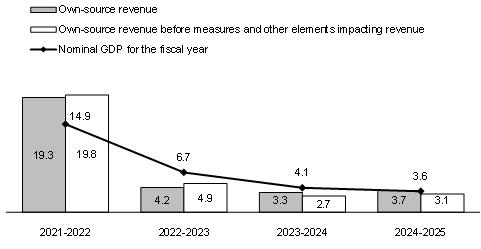

| Potential effects of a recession on the financial framework |

Like several advanced economies, Québec is not immune to an economic and financial recession. The COVID-19 pandemic, the expansionary fiscal policies of governments, the synchronized rebound in global demand, and Russia’s invasion of Ukraine have led to a significant increase in inflation. As a result, central banks have begun to tighten monetary policy and reduce the size of their balance sheets. The persistence of inflation and the possibility that central banks may have to rise interest rates above the equilibrium neutral rates to reduce inflation substantially increase the risk of a recession. Data on the economic situation in Québec is currently favourable. However, if a recession were to occur in Québec, it could have repercussions on the financial framework, causing revenue to decline and expenditure to increase.

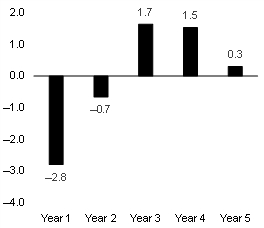

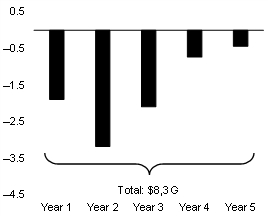

In Québec, analysis of historical data indicates that a medium-sized recession could result in a revision to nominal GDP growth of −2.8 percentage points in the first year of the shock and −0.7 percentage points in the following year relative to a baseline scenario. Because of the economic recovery that typically follows a slowdown, nominal GDP growth would be revised upward for the subsequent three years. After these five years, nominal GDP growth would return to a pre-recession level. Such an economic slowdown could have different repercussions on the financial framework.

| – | The government’s own-source revenue could decrease, primarily revenues whose tax bases depend on different economic parameters such as wages and salaries, the net operating surplus of corporations or household consumption. For example, revenue could decline by approximately $8.3 billion over a five-year period, before returning to a level comparable to what was expected before the recession. |

| – | Expenditure could increase, particularly for certain programs that offer financial assistance to individuals and businesses, for example last-resort financial assistance or assistance programs for small- and medium-sized businesses, as needs increase during times of economic difficulty. The implementation of new support measures and economic recovery initiatives, among other things, could also have an upward impact on expenditure. |

The financial framework incorporates a provision for economic risks and other support and recovery measures designed to manage unforeseen events affecting public finances. This provision, which totals $10.0 billion over five years, could be used to counter the effects of a potential recession.

| Nominal GDP growth adjustment | | Adjustment to own-source revenue(1) |

| (percentage points) | | (billions of dollars) |

| | | (1) Own-source revenue excluding revenue from government enterprises. |

14 | Pre-election Report on the State of Québec’s

Public Finances – August 2022 | | |

| 1. | Economic and financial forecasts |

| 1.1 | Changes in Québec’s situation |

The Québec economy recovered in 2021. After a historic decline of 5.5% in 2020, real GDP grew by 5.6%.

| — | In 2021, economic growth was stronger in Québec than in Canada (+4.5%). |

Economic activity will continue to grow despite the risks inherent in the forecast scenario.

| — | With the recovery period having been completed quickly in 2021, the economy will evolve closer to its potential over the next few years. |

| — | Real GDP increases of 3.4% in 2022 and 1.7% in 2023 are expected. |

| — | From 2024 to 2026, average annual growth is expected to stand at 1.5%. |

CHART 1

Economic growth in Québec |

| (real GDP, percentage change) |

| Sources: | Institut de la statistique du Québec, Statistics Canada and Ministère des Finances du Québec. |

| | | Economic and

Financial Forecasts | 15 |

| q | Contribution of factors to real GDP growth |

The increase in real GDP is based on the following elements:

| — | growth in the pool of potential workers, specifically the change in the population aged 15 to 64; |

| — | improvement in the employment rate, that is, the total number of people employed relative to the population aged 15 to 64; |

| — | productivity growth, that is, the change in output per job. |

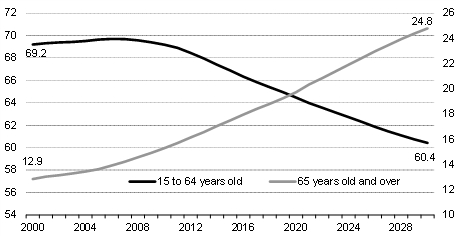

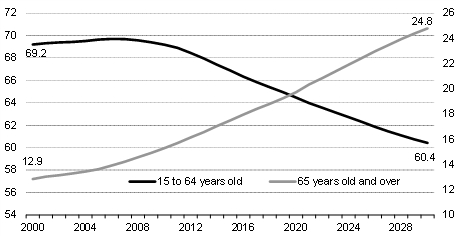

Because of the aging population, the contribution of the potential labour pool to economic growth will be limited.

In addition, labour shortages will limit the gains that can still be made in terms of improving the employment rate.

Therefore, in a context of demographic aging and labour shortage, productivity gains are the main factor that will support Québec’s economic growth over the next few years.

Moreover, growth in real GDP per capita is expected to continue over the next few years at a slightly higher rate than that recorded between 2009 and 2018, despite demographic aging.

TABLE 3

Contribution of economic growth factors in Québec

| (average annual percentage change and contribution in percentage points) |

| | | 2009- 2018 | | | 2019 | | | 2020 | | | 2021 | | | 2022 | | | 2023 | | | 2024 | | | 2025 | | | 2026 | |

| Real GDP | | | 1.5 | | | | 2.8 | | | | -5.5 | | | | 5.6 | | | | 3.4 | | | | 1.7 | | | | 1.5 | | | | 1.5 | | | | 1.5 | |

| Growth factors (contribution) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Potential labour pool(1) | | | 0.2 | | | | 0.4 | | | | -0.1 | | | | –0.2 | | | | –0.1 | | | | 0.2 | | | | 0.1 | | | | 0.0 | | | | –0.1 | |

| Employment rate(2) | | | 0.7 | | | | 1.6 | | | | -4.8 | | | | 4.4 | | | | 3.1 | | | | 0.9 | | | | 0.5 | | | | 0.5 | | | | 0.6 | |

| Productivity(3) | | | 0.7 | | | | 0.7 | | | | -0.7 | | | | 1.4 | | | | 0.4 | | | | 0.6 | | | | 1.0 | | | | 1.0 | | | | 1.0 | |

| REAL GDP PER CAPITA | | | 0.7 | | | | 1.6 | | | | -6.3 | | | | 5.3 | | | | 2.5 | | | | 0.8 | | | | 0.8 | | | | 0.8 | | | | 0.9 | |

Note: Totals may not add due to rounding.

| (1) | Population aged 15 to 64. |

| (2) | The employment rate corresponds to the total number of workers in proportion to the population aged 15 to 64. |

| (3) | Productivity as measured by real GDP per job. |

Sources: Institut de la statistique du Québec, Statistics Canada and Ministère des Finances du Québec.

16 | Pre-election Report on the State of Québec’s

Public Finances – August 2022 | | |

Population aging can be defined as a change in the balance between age groups, combining a decrease in the proportion of the population aged 15 to 64 in the total population with an increase in the proportion of people aged 65 and over.

| — | The demographic weight of the population aged 15 to 64 is therefore expected to fall from 64.0% of the total population in 2021 to 60.4% in 2030. |

| — | Conversely, the proportion of the population aged 65 and over in the total population is expected to increase from 20.3% in 2021 to 24.8% in 2030. |

However, the population aged 15 to 64 is the main pool of potential workers.

| — | The decrease in its demographic weight limits the possible increase in the active population and increases pressures on the labour market and on production. |

| — | As a result, employers are faced with recruitment difficulties while economic activity continues to grow. |

CHART 2

Demographic weight of different age groups

(proportion of certain age groups in the total population, in per cent)

Sources: Institut de la Statistique du Québec, Statistics Canada and Ministère des Finances du Québec.

| | | Economic and

Financial Forecasts | 17 |

| ■ | State of the labour market |

The Québec labour market must deal with the challenge of labour availability. Indeed, some businesses are having difficulty hiring staff.

| — | In the first quarter of 2022, there were just over 224 000 unfilled positions in Québec, that is, approximately 96 000 more positions than in the first quarter of 2020. This is an increase of 74.7% in two years. |

| — | The vacancy rate, which is the number of vacant positions as a percentage of all vacant or occupied positions, is increasing. It rose to 5.8% in the first quarter of 2022, compared to 3.4% in the first quarter of 2020. |

In addition, Québec has fewer potential workers who can fill available positions.

| — | For example, in the first quarter of 2020, Québec had 2.3 unemployed individuals per vacant job. |

| — | In the first quarter of 2022, the ratio declined to 1.0 unemployed individual. |

In the coming months, employers will continue to face recruitment challenges as economic activity continues to grow.

| — | Nevertheless, the effects of the labour shortage could be mitigated by business productivity gains, an increase in the participation rate, and the effect of government measures to increase the graduation and training of the workforce. |

TABLE 4

Change in the number of vacancies and unemployed individuals in Québec

| (number of vacancies and unemployed individuals in units, vacancy rate in per cent) |

| | | 1st quarter

of 2020 | | | 1st quarter

of 2022 | | | Difference(1) | |

| Number of vacancies | | | 128 410 | | | | 224 370 | | | | 95 960 | |

| Vacancy rate(2) | | | 3.4 | | | | 5.8 | | | | 2.4 | |

| Number of unemployed individuals | | | 291 700 | | | | 230 500 | | | | –61 200 | |

| NUMBER OF UNEMPLOYED INDIVIDUALS PER VACANCY | | | 2.3 | | | | 1.0 | | | | –1.2 | |

Note: Data are not seasonally adjusted. It is recommended to compare quarterly data with those from a corresponding quarter.

| (1) | Actual differences may not correspond to those shown due to rounding. |

| (2) | Number of vacancies as a percentage of all jobs, either filled or vacant. |

Sources: Statistics Canada and Ministère des Finances du Québec.

18 | Pre-election Report on the State of Québec’s

Public Finances – August 2022 | | |

After increasing by 12.5% in 2021, nominal GDP is expected to grow by 9.6% in 2022, 3.8% in 2023 and 3.6% on average annually from 2024 to 2026.

This nominal GDP growth will stem from the combined impact of the increase in real economic activity and the GDP deflator, which measures price changes in the overall economy.

| — | Real GDP is expected to increase by 3.4% in 2022, 1.7% in 2023 and 1.5% for the years 2024 to 2026, a level closer to its potential. |

| — | The GDP deflator is projected to rise by 6.0% in 2022 and 2.0% on average for the years 2023 to 2026. |

| — | In 2022, the increase in prices of Québec exported goods, particularly aluminum, metals and ores prices, will lead to an improvement in the terms of trade (+1.0%). |

| — | In addition, growth in the consumer price index (CPI) is expected to accelerate to 6.5%. On net, the GDP deflator is expected to grow by 6.0%. |

TABLE 5

GDP growth in Québec

| (percentage change) |

| | | 2021 | | | 2022 | | | 2023 | | | 2024 | | | 2025 | | | 2026 | |

| Real GDP | | | 5.6 | | | | 3.4 | | | | 1.7 | | | | 1.5 | | | | 1.5 | | | | 1.5 | |

| Prices – GDP deflator | | | 6.5 | | | | 6.0 | | | | 2.0 | | | | 2.1 | | | | 2.0 | | | | 2.0 | |

| – CPI | | | 3.8 | | | | 6.5 | | | | 3.2 | | | | 2.0 | | | | 1.9 | | | | 1.9 | |

| – Terms of trade | | | 4.9 | | | | 1.0 | | | | –0.3 | | | | 0.8 | | | | 0.3 | | | | 0.2 | |

| NOMINAL GDP | | | 12.5 | | | | 9.6 | | | | 3.8 | | | | 3.6 | | | | 3.5 | | | | 3.5 | |

Note: Totals may not add due to rounding.

Sources: Institut de la statistique du Québec, Statistics Canada and Ministère des Finances du Québec.

| | | Economic and

Financial Forecasts | 19 |

| q | Private sector five-year economic outlook |

The Ministère des Finances’ forecasts incorporate the uncertainties and risks inherent in the particular context in which Québec is evolving. They are balanced, meaning that they incorporate both upward and downward risks.

| — | In 2022, the Ministère des Finances forecasts an increase in economic activity (+3.4%), slightly higher to that expected on average by private sector forecasters (+3.2%). |

| — | The Ministère des Finances’ forecast incorporates the official economic accounts statistics that were released on June 28, 2022 by the Institut de la statistique du Québec. According to these estimates, the economic growth in Québec was very strong in the first quarter of 2022. However, the private sector forecast survey was completed on June 21, 2022. Therefore, the forecasts do not take into account this update for the beginning of 2022. |

| — | In 2023, the Ministère des Finances estimates that the increase in economic activity (+1.7%) will be equivalent to that expected on average by private sector forecasters (+1.7%). |

Moreover, over a five-year horizon, that is, from 2022 to 2026:

| — | the expected average growth is 1.9% for real GDP, equivalent to that expected by the private sector (+1.9%); |

| — | the average annual increase expected is 4.8% for nominal GDP, which is greater than that expected by the private sector (+4.5%). |

| — | The stronger-than-expected increase in nominal GDP in the first quarter of 2022 accounts for the difference between the Ministère des Finances’ forecast and the private sector average for the year 2022 as a whole and the five-year forecast. From 2023 onward, the anticipated annual growth rates are similar to those of the private sector. |

TABLE 6

Economic outlook for Québec – Comparison with the private sector

(real GDP, percentage change)

| | | 2021 | | | 2022 | | | 2023 | | | 2024 | | | 2025 | | | 2026 | | | Average

2022-2026 | |

| Real GDP | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| – Ministère des Finances du Québec | | | 5.6 | | | | 3.4 | | | | 1.7 | | | | 1.5 | | | | 1.5 | | | | 1.5 | | | | 1.9 | |

| – Private sector average | | | 6.1 | | | | 3.2 | | | | 1.7 | | | | 1.6 | | | | 1.6 | | | | 1.5 | | | | 1.9 | |

| Prices – GDP deflator | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| – Ministère des Finances du Québec | | | 6.5 | | | | 6.0 | | | | 2.0 | | | | 2.1 | | | | 2.0 | | | | 2.0 | | | | 2.8 | |

| – Private sector average | | | 6.6 | | | | 5.1 | | | | 2.2 | | | | 1.9 | | | | 1.9 | | | | 1.9 | | | | 2.6 | |

| Nominal GDP | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| – Ministère des Finances du Québec | | | 12.5 | | | | 9.6 | | | | 3.8 | | | | 3.6 | | | | 3.5 | | | | 3.5 | | | | 4.8 | |

| – Private sector average | | | 12.8 | | | | 8.3 | | | | 3.9 | | | | 3.5 | | | | 3.5 | | | | 3.4 | | | | 4.5 | |

Sources: Ministère des Finances du Québec and Ministère des Finances du Québec survey as at June 21, 2022, which includes the forecasts of 11 private sector institutions.

20 | Pre-election Report on the State of Québec’s

Public Finances – August 2022 | | |

| 1.2 | Assumptions, risks and sensitivity analysis |

The Ministère des Finances establishes the economic forecast taking into account a number of external and internal factors that influence Québec’s economic outlook.

The assumptions of the Ministère des Finances forecasts are based on various external factors, including changes in the economic situation of Québec’s main trading partners, monetary policies, financial markets, oil prices and the evolution of the pandemic worldwide.

| ■ | Economic situation of Québec’s main trading partners |

The Québec economy is open to the world, so economic activity is affected by the economic situation of Québec’s main trading partners.

| — | In Canada, real GDP growth is expected to reach 3.8% in 2022, 2.3% in 2023 and 1.7% per year from 2024 to 2026. These are higher growth rates than those recorded in Québec. |

| — | In 2021, the economic recovery was stronger in Québec (+5.6%) than in Canada (+4.5%). |

| ‒ | In fact, the rebound in real GDP in Canada in 2021 was held back by several one-time events such as the forest fires in western Canada and the floods in British Columbia. In addition, the global shortage of microchips has forced the temporary closure of some automobile manufacturing plants in Ontario. |

| ‒ | Thus, the recovery period, which will continue into 2022 in Canada, will result in greater economic growth than in Québec. |

| — | In the United States, growth is expected to reach 2.8% in 2022, 1.8% in 2023, 1.9% in 2024, 1.9% in 2025 and 1.8% in 2026. |

| — | Global economic activity is expected to stand at 3.1% in 2022, 3.1% in 2023, 3.3% in 2024 and 3.2% in 2025 and 2026. |

TABLE 7

Economic growth

(real GDP, percentage change)

| | | 2021 | | | 2022 | | | 2023 | | | 2024 | | | 2025 | | | 2026 | |

| Québec | | | 5.6 | | | | 3.4 | | | | 1.7 | | | | 1.5 | | | | 1.5 | | | | 1.5 | |

| Ontario(1) | | | 4.3 | | | | 3.8 | | | | 2.3 | | | | — | | | | — | | | | — | |

| Canada | | | 4.5 | | | | 3.8 | | | | 2.3 | | | | 1.7 | | | | 1.7 | | | | 1.7 | |

| United States | | | 5.7 | | | | 2.8 | | | | 1.8 | | | | 1.9 | | | | 1.9 | | | | 1.8 | |

| World | | | 6.1 | | | | 3.1 | | | | 3.1 | | | | 3.3 | | | | 3.2 | | | | 3.2 | |

| (1) | For 2022 and 2023, this is a Ministère des Finances du Québec survey as at June 21, 2022, which includes the forecasts of 9 private sector institutions. |

Sources: Institut de la statistique du Québec, Ontario Ministry of Finance, Statistics Canada, International Monetary Fund, IHS Markit, Datastream, Bloomberg, Eurostat and Ministère des Finances du Québec.

| | | Economic and

Financial Forecasts | 21 |

| ■ | Monetary policies and financial markets |

§ Policy interest rate in the United States and Canada

The Bank of Canada has raised its policy interest rate by 225 basis points since March 2022, to 2.50% in July 2022.5 The policy interest rate had remained at 0.25% since March 2020, that is, since the beginning of the pandemic.

| — | Against a backdrop of strong inflationary pressures, the Canadian policy interest rate is expected to be raised by a total of 250 basis points in 2022. This will bring it to 2.75% by the end of 2022, which is in the top half of the Bank of Canada’s neutral rate estimate range (between 2% and 3%). In addition, the Bank of Canada began reducing the size of its balance sheet in April 2022. |

The U.S. Federal Reserve has raised its policy interest rate by 150 basis points since March 2022, bringing it to the 1.50%-1.75% range in June 2022. The Federal Reserve has signaled that it will make several additional rate hikes this year in response to high inflation.

| — | As such, the U.S. policy interest rate is expected to be raised by a total of 275 basis points in 2022. This would put it within the 2.75%-3.00% range at the end of this year. The Federal Reserve’s balance sheet reduction, which began in June 2022, will be in addition to the interest rate hikes. |

§ Bond yields

Since late 2021, bond yields have risen sharply in the majority of advanced economies, with the Canadian 10-year yield exceeding 3% during the spring of 2022. This increase is primarily due to a recalibration of financial market expectations regarding the pace of policy interest rate increases.

| — | Bond yields are projected to increase slightly over the next few quarters. They are expected to move downward during 2023 with the expected moderation in financial market expectations of future policy interest rate changes. |

§ Canadian dollar

The Canadian dollar has generally fluctuated within a range of 78 to 80 U.S. cents since the beginning of 2022.

| — | The Canadian currency is expected to continue to move near these levels over the next few quarters as the Bank of Canada and the U.S. Federal Reserve are expected to tighten monetary policy at roughly the same pace. |

| — | Moreover, episodes of volatility in the financial markets could support the U.S. dollar at the expense of the Canadian dollar, among others. |

| 5 | The financial forecast for the pre-election report was completed on July 8, 2022, prior to the Bank of Canada’s announcement of July 13, 2022. |

| 22 | Pre-election Report on the State of Québec’s

Public Finances – August 2022 | | |

Oil prices have risen sharply since the end of 2021, when the price of West Texas Intermediate (WTI) rose from an average of US$71 per barrel in December 2021 to an average of US$114 in June 2022.

| — | Oil prices were already benefiting from a supply deficit in the global market. The war in Ukraine and concerns about global oil supply have further supported prices in recent months. |

Oil prices remain high but are expected to begin a gradual decline in the second half of 2022 with the anticipated increase in production from countries outside the Organization of the Petroleum Exporting Countries (OPEC).

| — | Nonetheless, there is still considerable uncertainty about the evolution of oil prices. |

TABLE 8

Canadian financial markets

(average annual percentage rates, unless otherwise indicated, end-of-year data in brackets)

| | | 2021 | | | 2022 | | | 2023 | | | 2024 | | | 2025 | | | 2026 | |

| | | | 0.3 | | | | 1.6 | | | | 2.8 | | | | 2.8 | | | | 2.8 | | | | 2.8 | |

| Overnight rate target | | | (0.3 | ) | | | (2.8 | ) | | | (2.8 | ) | | | (2.8 | ) | | | (2.8 | ) | | | (2.8 | ) |

| | | | 0.1 | | | | 1.6 | | | | 2.7 | | | | 2.7 | | | | 2.7 | | | | 2.7 | |

| 3-month Treasury bill | | | (0.2 | ) | | | (2.7 | ) | | | (2.7 | ) | | | (2.7 | ) | | | (2.7 | ) | | | (2.7 | ) |

| | | | 1.4 | | | | 2.9 | | | | 3.1 | | | | 3.0 | | | | 3.0 | | | | 3.0 | |

| 10-year bond | | | (1.5 | ) | | | (3.3 | ) | | | (3.0 | ) | | | (3.0 | ) | | | (3.0 | ) | | | (3.0 | ) |

| | | | 79.7 | | | | 79.0 | | | | 79.9 | | | | 80.0 | | | | 80.0 | | | | 80.0 | |

| Canadian dollar (in U.S. cents) | | | (78.5 | ) | | | (79.5 | ) | | | (80.0 | ) | | | (80.0 | ) | | | (80.0 | ) | | | (80.0 | ) |

| | | | 1.25 | | | | 1.27 | | | | 1.25 | | | | 1.25 | | | | 1.25 | | | | 1.25 | |

| U.S. dollar (in Canadian dollar) | | | (1.27 | ) | | | (1.26 | ) | | | (1.25 | ) | | | (1.25 | ) | | | (1.25 | ) | | | (1.25 | ) |

| | | | 71 | | | | 104 | | | | 94 | | | | 87 | | | | 79 | | | | 71 | |

| Brent crude oil (in U.S. dollars per barrel) | | | (74 | ) | | | (100 | ) | | | (90 | ) | | | (84 | ) | | | (76 | ) | | | (69 | ) |

| | | | 68 | | | | 100 | | | | 90 | | | | 83 | | | | 75 | | | | 68 | |

| WTI crude oil (in U.S. dollars per barrel) | | | (71 | ) | | | (96 | ) | | | (86 | ) | | | (80 | ) | | | (72 | ) | | | (66 | ) |

| | | | 54 | | | | 87 | | | | 77 | | | | 69 | | | | 61 | | | | 54 | |

| WCS crude oil (in U.S. dollars per barrel) | | | (55 | ) | | | (83 | ) | | | (73 | ) | | | (66 | ) | | | (58 | ) | | | (52 | ) |

Sources: Statistics Canada, Bloomberg and Ministère des Finances du Québec.

| ■ | Factors internal to the Québec economy |

Economic forecasts are based on the determination of the elements of aggregate domestic demand as well as the external sector. The latter reflects, among other things, the ability of Québec businesses to take advantage of demand from Québec’s main trading partners.

Moreover, the situation of the labour market is a determining factor in the evolution of the Québec economy.

| | | Economic and

Financial Forecasts | 23 |

Domestic demand consists of the sum of the following components:

| — | household consumption expenditure; |

| — | non-residential business investment; |

| — | expenditure on goods and services and governments’ investments. |

Following growth of 5.7% in real terms in 2021, domestic demand is forecast to progress to 3.8% in 2022 and 1.5% in 2023. Thereafter, growth will decelerate to 1.2% in 2024, 1.3% in 2025 and 1.1% in 2026.

| § | Household consumption expenditure |

Following a gain of 5.8% in real terms in 2021, household consumption expenditure is forecast to grow to 5.3% in 2022, 2.3% in 2023 and 1.5% annually from 2024 to 2026.

| — | In the short term, the withdrawal of health measures will encourage spending on services. In addition, households will continue to spend the savings accumulated since the beginning of the pandemic, which will support their spending. Furthermore, wages and salaries will increase, supported by the robust labour market and the labour shortage. |

| — | However, prices, especially for gasoline, remain high, but should gradually slow down in the second half of 2022. |

| — | Also, rising interest rates will limit the volume of goods and services consumed by households. |

In 2021, residential investment grew by 12.7% in real terms to a record $33.2 billion. After this record year, residential investment is expected to decline by 2.6% in 2022 and 3.0% in 2023. Despite these declines, the level of investment will remain high from a historical perspective. From 2024 to 2026, residential investment is expected to grow by an average of 0.1% annually.

| — | In the short term, the decline in affordability due to rising house prices and mortgage interest rates as well as stricter mortgage rules will help to moderate the residential market. |

| — | However, some elements will continue to support economic activity in this sector. In particular, the inventory of unsold new properties is low, which will support residential construction. In addition, a strong labour market and a pickup in immigration will continue to support housing demand. |

| § | Non-residential business investment |

After a 3.3% growth in 2021, non-residential business investment is expected to grow by 4.9% in 2022 and 3.6% in 2023. Growth in this type of investment will slow to 2.1% in 2024, 2.1% in 2025 and 2.2% in 2026.

| 24 | Pre-election Report on the State of Québec’s

Public Finances – August 2022 | | |

Different factors will drive the increase in non-residential business investment, including:

| — | rising demand, which will put pressure on production capacity; |

| — | the labour shortage, which will encourage entrepreneurs to invest in machinery and equipment in order to increase their productivity and automate production; |

| — | the transition to a low-carbon economy, which will have a positive impact on business expenditure; |

| — | the digital shift in the economy, which will boost spending on intellectual property products. |

| § | Expenditure on goods and services and governments’ investments |

After growing by 4.7% in 2021, the value of governments’ investments is expected to increase by 9.5% in 2022 and 3.7% in 2023. Growth will continue over the next few years (+0.8% in 2024 and +0.4% in 2025) before declining by 0.4% in 2026. The value of governments investments in Québec is therefore expected to reach $23.8 billion in nominal terms in 2026.

| — | In particular, investments under the 2022-2032 QIP6 will amount to $142.5 billion, of which $80 billion is planned for the first five years, that is, from 2022-2023 to 2026-2027. |

| — | In addition, the federal government’s Investing in Canada Infrastructure Program and the high levels of investment planned in Québec’s major municipalities, including Montréal, Québec and Laval, will also support the growth in investments. |

Through their purchases of goods and services, the various levels of government will also contribute to the growth in economic activity.

| ■ | Job creation, unemployment and the workforce |

After an annual increase of 169 400 jobs in 2021, job creation will continue in the next few years.

| — | In 2022, 128 000 jobs will be created (+3.0%), then 49 500 in 2023 (+1.1%), 26 200 in 2024 (+0.6%), 23 500 in 2025 (+0.5%) and 21 700 in 2026 (+0.5%). |

Job creation will be driven by continued economic growth. In addition, the lifting of most public health restrictions will result in job gains in the industries that were hit the hardest by the pandemic. However, the labour shortage will slow the pace of hiring in the coming years.

The strong demand for labour will result in a decline in the unemployment rate, which is expected to fall from an average of 6.1% in 2021 to 4.2% in 2022, 3.9% in 2023, 3.8% in 2024, 3.7% in 2025 and 3.6% in 2026.

Despite the positive outlook for the labour market, the aging of the population is limiting the growth of the labour force and increasing pressures on the labour market and production.

| 6 | The 2022-2032 Québec Infrastructure Plan is available at:

www.tresor.gouv.qc.ca/fileadmin/PDF/budget_depenses/22-23/6-Quebec_Infrastructure_Plan.pdf. |

| | | Economic and

Financial Forecasts | 25 |

Following an increase of 4.6% in 2021 in real terms, export growth is expected to reach 2.1% in 2022, 3.0% in 2023, 2.7% in 2024, 2.6% in 2025, and 2.2% in 2026.

| — | Exports will benefit from an increase in external demand, particularly in the United States. |

| — | Québec will also benefit from a recovery in tourism activities, which will fuel growth in international service exports. |

Import growth is expected to reach 4.2% in 2022, 2.1% in 2023, 1.7% in 2024, 2.2% in 2025 and 1.3% in 2026.

| — | This reflects continued growth in domestic demand, particularly household consumption and investment in machinery and equipment. In addition, imports will be stimulated by a rebound in travel spending by Quebecers. |

In the short term, however, supply chain disruptions will continue to weigh on the external sector. In addition, Russia’s invasion of Ukraine will limit global trade.

| 26 | Pre-election Report on the State of Québec’s

Public Finances – August 2022 | | |

| q | Risks and sensitivity analysis for economic forecasts |

The financial market and economic forecasts are based on several assumptions. Associated with some of these are risks that could affect the global economic and financial scenario and the anticipated developments in the Québec economy.

Since the publication of the Québec Budget Plan – March 2022, the risk of a recession has increased due to rising prices and interest rates. However, the probability of a recession occurring in Québec in the coming quarters remains relatively moderate.

Moreover, the risks outlined in the Québec Budget Plan – March 2022, remain present.7

| — | Given the Québec economy’s high degree of openness to trade, Québec’s economic variables could be influenced by several external factors, such as: |

| — | high inflation that persists longer than expected; |

| — | monetary tightening at a different rate than expected; |

| — | continued supply chain disruptions; |

| — | a different evolution of oil prices; |

| — | a sharper-than-expected slowdown in the Chinese economy; |

| — | the pandemic’s evolution on a global scale. |

| — | Other risks or events are internal. They could lead to changes in certain economic variables in Québec that are different from what was anticipated, such as: |

| — | a faster and more pronounced adjustment in the real estate sector in Québec and Canada; |

| — | a slower-than-expected recovery in international immigration; |

Economic forecasts take into account certain elements of uncertainty. The realization of these uncertainties may lead to different results than those forecast.

| ■ | Sensitivity of Québec’s GDP to external variables |

The Québec economy is characterized by a high degree of openness to trade. Therefore, Québec’s economic variables are influenced by several external factors.

| — | The most important ones are related to the economic activity of Québec’s main trading partners, namely the United States and the Canadian provinces. |

| 7 | The main risks that could influence the economic forecast scenario are presented in the Québec Budget Plan – March 2022, pages H.59 to H.62. |

| | | Economic and

Financial Forecasts | 27 |

| ■ | Impacts of external variables on the Québec economy |

The results of a sensitivity analysis conducted with a structural vector autoregression model8 on the basis of historical data show that a 1% variation in U.S. real GDP entails on average a change of 0.45% in Québec’s real GDP.

| — | The maximum effect is felt two quarters later. |

Moreover, this model shows that a 1% variation in Ontario’s real GDP gives rise on average to a change of 0.42% in Québec’s real GDP.

| — | The maximum effect is felt one quarter later. |

Ontario is the Canadian province with which Québec has the most commercial ties, in addition to having a similar economic structure.

In 2018, exports to Ontario accounted for 59% of Québec’s interprovincial exports. Also, the effects measured for Ontario and the United States are not additive.

TABLE 9

Impact of external shocks on Québec’s real

GDP growth rate

| External shocks of 1% | Maturity(1)

(quarters) | Impact on Québec’s real GDP

(percentage point) | |

| U.S. real GDP | 2 | 0.45 | |

| Ontario real GDP | 1 | 0.42 | |

| (1) | Maturity corresponds to the number of quarters needed to record the greatest impact on Québec’s real GDP, presented in the right-hand column. |

Sources: Institut de la statistique du Québec, Statistics Canada, Ontario Ministry of Finance, IHS Markit, Bloomberg and Ministère des Finances du Québec.

| 8 | This is an econometric technique used to estimate, from a large number of observations, the extent to which fluctuations in one economic variable influence another. |

| 28 | Pre-election Report on the State of Québec’s

Public Finances – August 2022 | | |

| 1.3 | Main adjustments since March 2022 |

Overall, from 2022 to 2026, the economic forecasts underlying the financial framework in the pre-election report are comparable to those in the Québec Budget Plan − March 2022.

| — | Economic growth in Québec is expected to reach 3.4% in 2022 and 1.7% in 2023. |

| — | For 2022, this is an upward adjustment of 0.7 percentage points from the March 2022 forecast. The year 2023, on the other hand, has been adjusted downward (−0.3 percentage points from March 2022). The growth forecast for 2024 to 2026 remains unchanged. |

The Ministère des Finances’ growth forecasts in the pre-election report are similar to those of the private sector. In June 2022, the private sector revised its economic forecast from the March 2022 forecast.

| — | In June 2022, private sector economists anticipated, on average, an increase in real GDP of 3.2% for 2022. This is an upward revision of 0.1 percentage points compared to what they had forecast in March 2022. |

| — | Remember that this forecast is similar to that of the Ministère des Finances (+3.4%). |

| — | Also in June 2022, private sector economists anticipated an increase in real GDP of 1.7% for 2023, which represents a downward adjustment of 0.8 percentage points to what they had forecast in March 2022. |

| — | This forecast is equivalent to that of the Ministère des Finances (+1.7%). |

TABLE 10

Economic outlook according to the Ministère des Finances du Québec and the private sector

(real GDP, percentage change)

| | | 2021 | | | 2022 | | | 2023 | | | 2024 | | | 2025 | | | 2026 | | | Average 2022-2026 | |

| Ministère des Finances du Québec | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| – 2022-2023 budget | | | 6.3 | | | | 2.7 | | | | 2.0 | | | | 1.5 | | | | 1.5 | | | | 1.5 | | | | 1.8 | |

| – 2022 pre-election report | | | 5.6 | | | | 3.4 | | | | 1.7 | | | | 1.5 | | | | 1.5 | | | | 1.5 | | | | 1.9 | |

| Private sector average | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| – March 2022(1) | | | 6.2 | | | | 3.1 | | | | 2.5 | | | | 1.7 | | | | 1.5 | | | | 1.6 | | | | 2.1 | |

| – June 2022(2) | | | 6.1 | | | | 3.2 | | | | 1.7 | | | | 1.6 | | | | 1.6 | | | | 1.5 | | | | 1.9 | |

Note: Totals may not add due to rounding.

| (1) | Ministère des Finances du Québec survey as at March 8, 2022, which includes the forecasts of 11 private sector institutions. |

| (2) | Ministère des Finances du Québec survey as at June 21, 2022, which includes the forecasts of 11 private sector institutions. |

| Source: | Ministère des Finances du Québec. |

| | | Economic and

Financial Forecasts | 29 |

| 2.1 | Multi-year budgetary outlook |

The Pre-election Report on the State of Québec’s Public Finances – August 2022 presents the revenue and expenditure outlook for the Québec government until 2026-2027.

Revenue amounts to $144.5 billion in 2022-2023, with growth of 3.6%. It will reach 2.9% in 2023-2024.

| — | From 2021-2022 to 2026-2027, the annual growth in own-source revenue will reach 6.2% on average. |

Total expenditure9 amounts to $138.3 billion in 2022-2023, with growth of 9.0%.10 It will reach 3.7% in 2023-2024.

| — | From 2021-2022 to 2026-2027, the annual growth in expenditure will reach 5.7% on average. |

The change in revenue and expenditure takes into account the fiscal measures and budgetary initiatives that have been announced since the 2022-2023 budget.

Expenditure associated with COVID-19 support and recovery measures totals $2.4 billion in 2022-2023.

| — | The cost of these temporary measures, which fade as of 2023-2024, is presented separately from expenditure to isolate their cyclical impact on the growth in expenditure. |

The financial framework includes a provision for economic risks and other support and recovery measures totalling $2.0 billion per year as of 2022-2023.

| — | These provisions cover various risks that could affect the expenditure or revenue forecast in the financial framework, such as increased expenditures and debt service due to inflation and rising interest rates, or a decline in revenue related to the economic consequences of the ongoing war in Ukraine or the changing epidemiological situation of COVID-19. |

Based on the requirements of the Balanced Budget Act, the budget balance before use of the stabilization reserve shows a deficit of less than $2.0 billion between 2022-2023 and 2026-2027.

| — | Excluding the provision for economic risks and other support and recovery measures, the budgetary balance, after deposits of dedicated revenues in the Generations Fund, is achieved over the entire horizon of the financial framework. |

| 9 | Expenditure before taking into account expenditure associated with COVID-19 support and recovery measures. |

| 10 | Compared with the 2022-2023 budget, this growth is higher by 4.2 percentage points. This is primarily due to lower-than-expected expenditures in 2021-2022. |

TABLE 11

Financial framework from 2021-2022 to 2026-2027

(millions of dollars)

| | | 2021-

2022- | | | 2022-

2023- | | | 2023-

2024- | | | 2024-

2025- | | | 2025-

2026- | | | 2026-

2027- | | | 2021-

2027(1) | |

| Revenue | | | | | | | | | | | | | | | | | | | | | |

| Personal income tax | | | 41 285 | | | | 43 414 | | | | 45 272 | | | | 46 660 | | | | 48 519 | | | | 50 278 | | | | | |

| Contributions for health services | | | 7 367 | | | | 7 784 | | | | 7 964 | | | | 8 187 | | | | 8 393 | | | | 8 603 | | | | | |

| Corporate taxes | | | 12 927 | | | | 11 925 | | | | 11 867 | | | | 12 803 | | | | 13 536 | | | | 14 131 | | | | | |

| School property tax | | | 1 081 | | | | 1 048 | | | | 1 106 | | | | 1 187 | | | | 1 251 | | | | 1 299 | | | | | |

| Consumption taxes | | | 24 673 | | | | 27 345 | | | | 28 140 | | | | 29 006 | | | | 29 743 | | | | 30 475 | | | | | |

| Duties and permits | | | 6 049 | | | | 5 518 | | | | 5 494 | | | | 5 544 | | | | 5 678 | | | | 5 810 | | | | | |

| Miscellaneous revenue | | | 10 902 | | | | 11 629 | | | | 12 450 | | | | 13 061 | | | | 13 483 | | | | 14 051 | | | | | |

| Government enterprises | | | 5 967 | | | | 6 207 | | | | 6 688 | | | | 7 040 | | | | 6 713 | | | | 6 994 | | | | | |

| Own-source revenue | | | 110 251 | | | | 114 870 | | | | 118 981 | | | | 123 488 | | | | 127 316 | | | | 131 641 | | | | | |

| % change | | | 20.0 | | | | 4.2 | | | | 3.6 | | | | 3.8 | | | | 3.1 | | | | 3.4 | | | | 6.2 | |

| Federal transfers | | | 29 141 | | | | 29 600 | | | | 29 631 | | | | 29 921 | | | | 31 813 | | | | 32 345 | | | | | |

| % change | | | –5.1 | | | | 1.6 | | | | 0.1 | | | | 1.0 | | | | 6.3 | | | | 1.7 | | | | 0.9 | |

| Total revenue | | | 139 392 | | | | 144 470 | | | | 148 612 | | | | 153 409 | | | | 159 129 | | | | 163 986 | | | | | |

| % change | | | 13.7 | | | | 3.6 | | | | 2.9 | | | | 3.2 | | | | 3.7 | | | | 3.1 | | | | 5.0 | |

| Expenditure | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Portfolio expenditures | | | –118 272 | | | | –128 154 | | | | –134 472 | | | | –138 370 | | | | –144 246 | | | | –147 959 | | | | | |

| % change | | | 11.4 | | | | 8.4 | | | | 4.9 | | | | 2.9 | | | | 4.2 | | | | 2.6 | | | | 5.7 | |

| Debt service | | | –8 619 | | | | –10 189 | | | | –9 000 | | | | –9 888 | | | | –9 990 | | | | –10 808 | | | | | |

| % change | | | 12.1 | | | | 18.2 | | | | –11.7 | | | | 9.9 | | | | 1.0 | | | | 8.2 | | | | 5.8 | |

| Total expenditure | | | –126 891 | | | | –138 343 | | | | –143 472 | | | | –148 258 | | | | –154 236 | | | | –158 767 | | | | | |

| % change | | | 11.5 | | | | 9.0 | | | | 3.7 | | | | 3.3 | | | | 4.0 | | | | 2.9 | | | | 5.7 | |

| Expenditure associated with COVID-19 support and recovery measures | | | –9 178 | | | | –2 355 | | | | –462 | | | | –18 | | | | — | | | | — | | | | | |

Provision for economic risks

and other support and recovery measures | | | — | | | | –2 000 | | | | –2 000 | | | | –2 000 | | | | –2 000 | | | | –2 000 | | | | | |

| SURPLUS | | | 3 323 | | | | 1 772 | | | | 2 678 | | | | 3 133 | | | | 2 893 | | | | 3 219 | | | | | |

| BALANCED BUDGET ACT | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Deposits of dedicated revenues

in the Generations Fund | | | –3 617 | | | | –3 428 | | | | –3 955 | | | | –4 546 | | | | –4 800 | | | | –5 163 | | | | | |

BUDGETARY BALANCE BEFORE USE OF THE STABILIZATION

RESERVE | | | –294 | | | | –1 656 | | | | –1 277 | | | | –1 413 | | | | –1 907 | | | | –1 944 | | | | | |

| Use of the stabilization reserve | | | 294 | | | | 927 | | | | — | | | | — | | | | — | | | | — | | | | | |

| BUDGETARY BALANCE(2) | | | — | | | | –729 | | | | –1 277 | | | | –1 413 | | | | –1 907 | | | | –1 944 | | | | | |

Note: Totals may not add due to rounding.

| (1) | Average annual growth rate, corresponding to the geometric mean over six years, from 2021-2022 to 2026-2027. |

| (2) | Budgetary balance within the meaning of the Balanced Budget Act after use of the stabilization reserve. |

| 32 | Pre-election Report on the State of Québec’s

Public Finances – August 2022 | | |

TABLE 12

Main variables of Québec’s financial framework

| | Variables |

| REVENUE | |

Own-source revenue excluding revenue

from government enterprises | |

| – Personal income tax | – Wages and salaries – Employment insurance – Pension income – Self-employed income – Capital gains – Interest income |

| – Contributions for health services | – Wages and salaries |

| – Corporate taxes | – Net operating surplus of corporations – Gross operating surplus of corporations – CPI |

| – Sales tax | – Consumption excluding food products and housing – Residential investment |

– Specific taxes (fuel, tobacco products

and alcoholic beverages) | – Per capita household disposable income – CPI – Gas prices |

Own-source revenue from government

enterprises | |

| – Hydro-Québec | – Normal winter temperatures, CPI and volume price of energy on external markets |

| – Loto-Québec | – Consumption patterns of customers |

| – Société des alcools du Québec | – Consumption patterns of customers |

| – Société québécoise du cannabis | – Consumption patterns of customers |

| – Investissement Québec | – Economic situation and anticipated returns on investment projects |

| Revenue from federal transfers | |

| – Equalization | – Canada’s nominal GDP – Population of the provinces – Basic federal tax – Corporate taxable income – Revenue from natural resources |

| – Health transfers | – Canada’s nominal GDP – Population of the provinces – Basic federal tax |

– Transfers for post-secondary education

and other social programs | – Population of the provinces – Basic federal tax |

| – Other programs | – Agreements with the federal government (e.g., labour market

agreements and infrastructure agreements) |

| EXPENDITURE | – Budgetary policy directions, including budgetary measures – Program renewal costs: ▪ demographics ▪ prices (inflation, salary increases for government employees) |

| DEBT SERVICE | – Debt level – Interest rate – Returns on the Retirement Plans Sinking Fund (RPSF) |

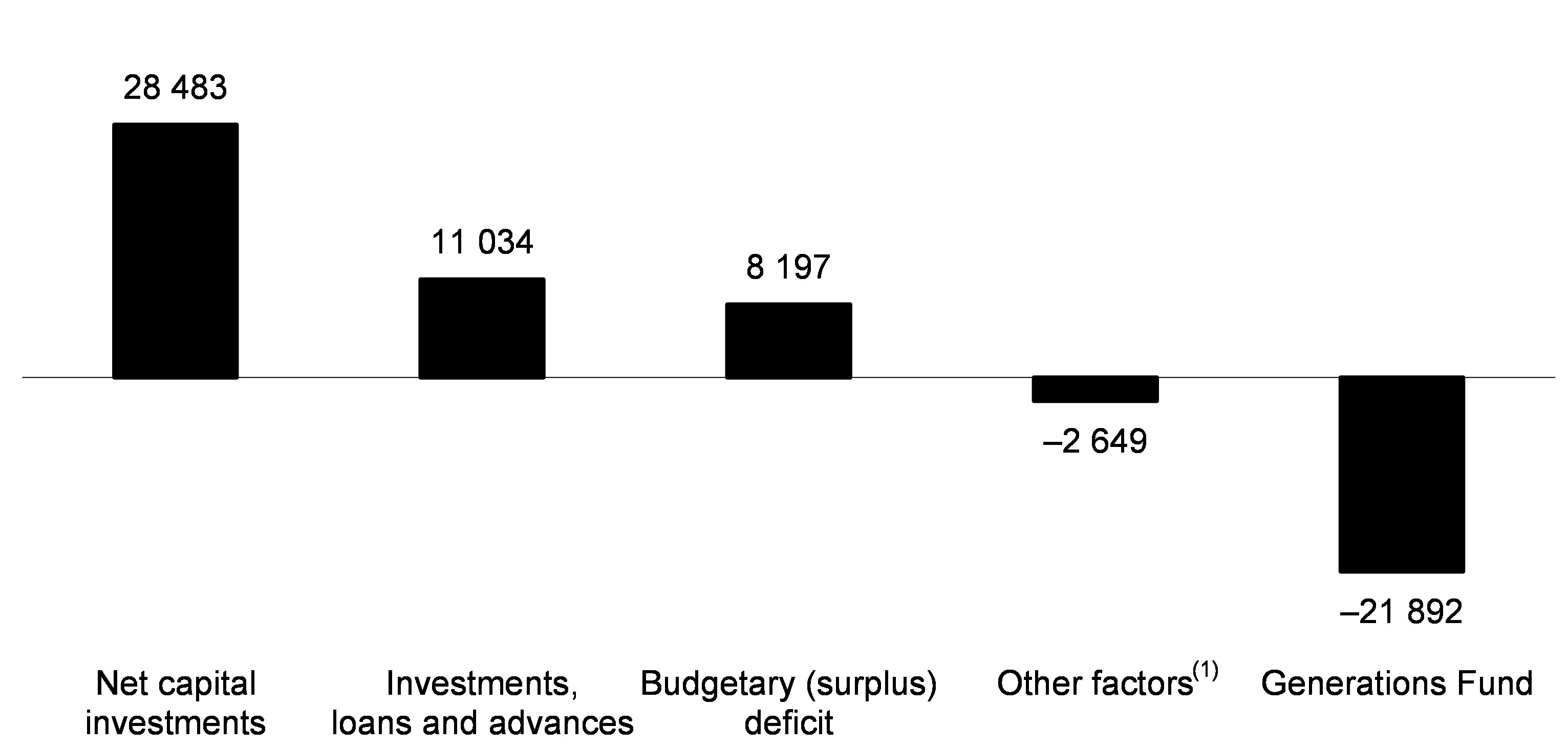

| DEBT | – Budgetary balance – Capital investments – Loans, investments and advances – Deposits made annually in the Generations Fund |

| INFRASTRUCTURE | – Québec Infrastructure Plan (QIP) |

| 2.3 | Assumptions, risks and margins for prudence |

The Ministère des Finances’ forecasts rely on economic and budgetary assumptions. For example, Québec’s real GDP forecast takes into account certain external factors, such as the economic growth of Québec’s major trading partners, exchange rates and oil prices, and internal factors, such as changes in domestic demand.

Certain risks are associated with taking into account these assumptions. The sensitivity analysis is carried out to evaluate the impact of those risks on the forecasts and to present the estimated repercussions of a variation in any of the assumptions used to establish the financial framework.

Tables 13 and 14 provide the assumptions related to the financial framework as well as the risks and their effects.

TABLE 13

Main assumptions of Québec’s financial framework

| | Assumptions |

| ECONOMIC GROWTH | – Moderation of domestic demand growth, including: ▪ expected deceleration in growth of household consumption expenditure and non-residential business investment ▪ slowdown in residential sector activity ▪ maintenance of a high level of investment by governments – The vigour of the labour market will continue, but aging demographics will add to pressures on employment and the unemployment rate – Slowdown in export and import growth – Additional hike in policy interest rate in Canada and the U.S. by the end of 2022 – Rise in U.S. and Canadian bond yields – Canadian dollar remains near 80 U.S. cents – Decrease in oil prices starting in the second half of 2022 – Moderation in global economic growth in 2022 and 2023 relative to 2021 – Tightening of monetary policy in several advanced economies to combat high inflation |

| 34 | Pre-election Report on the State of Québec’s

Public Finances – August 2022 | | |

| q | Risks and sensitivity analysis |

TABLE 14

Main risks to Québec’s financial position

| | Risks | Estimated impact in 2022-2023 | Page ref. |

| Financial framework | Economic variables | | |

| | Impact of external variables

on the Québec economy | | |

| | – Variation of 1 percentage point

in the U.S. real GDP | Impact of 0.45 percentage points

on Québec’s real GDP | 28 |

| | – Variation of 1 percentage point

in Ontario’s real GDP | Impact of 0.42 percentage points

on Québec’s real GDP | 28 |

| | Own-source revenue | | |

| | Global slowdown | | |

| | – Variation of 1 percentage point in

Québec’s nominal GDP growth (equivalent to a 1 percentage point variation in the CPI growth) | Impact of $1.0 billion on own-source revenue(1) | 52 |

| | – Typical recession | Impact of $8.3 billion on own-source revenue(1) | |

| | Government enterprises | | |

| | – Variation of 1 °C in winter temperatures compared to normal temperatures | Impact of $120 million(2) on

Hydro-Québec’s net earnings | 53 |

| | Federal transfers | | |

| | – Variation of 0.1 percentage point in the proportion of Québec’s population in Canada | Impact of $200 million on federal transfers | 58 |

| Expenditure | Portfolio expenditures | | |

| | – Variation of 1 percentage point

in the total population | Impact of $1 020 million on expenditure | 72 |

– Additional variation of 1 percentage

point in costs related to technology

in the health sector | Impact of $385 million on expenditure | 70 |

– Variation of 1 percentage point

in general level of prices | Impact of $570 million on expenditure | 72 |

Public capital investment completion

rate for a given year (5% difference) | Impact of $82 million per year on

expenditure (depreciation and interest) | |

| Environmental disaster | Undetermined impact | |

| Unforeseen expenditure under government programs | Undetermined impact | |

| Debt service | | | |

| | – Variation of 1 percentage point

in interest rates(3) | Impact of $553 million on expenditure | 74 |

| – Variation of 1 percentage point in returns on the Retirement Plans Sinking Fund (RPSF)(4) | Impact of $30 million on expenditure | 74 |

| (1) | Own-source revenue excluding revenue from government enterprises. |

| (2) | Estimated impact for 2023. |

| (3) | Ultimately, in the fifth year, the impact of a greater-than-expected variation in interest rates of 1 percentage point would result in a variation in debt service of over $1.8 billion. |

| (4) | Ultimately, in the fifth year, the impact of a variation of 1 percentage point in returns on the RPSF would result in a variation in debt service of $178 million. |

The multi-year expenditure target is put into perspective with the cost of renewing government programs to control the existing annual gap, if any.11

If the multi-year portfolio expenditure target is below government program renewal costs, priorities must be established and choices involving measures to control spending, either by a reallocation or an increase in the expenditure target, could be implemented to reduce, even eliminate, the shortfall to be offset.

Based on the financial framework of the 2022-2023 budget and the adjustments that have been made since then, the gap between government program renewal costs and the expenditure target is non-existent for the next three years.

TABLE 15

Shortfall for portfolio expenditures

(millions of dollars)

| | | | 2022-2023 | | | | 2023-2024 | | | | 2024-2025 | |

| Cost of renewing government programs | | | 128 154 | | | | 134 472 | | | | 138 370 | |

| Portfolio expenditure target | | | 128 154 | | | | 134 472 | | | | 138 370 | |

| SHORTFALL TO BE RESOLVED | | | — | | | | — | | | | — | |

|

| 11 | Additional information on the management of gaps between the cost of renewing government programs and the multi-year expenditure target is presented in the assumptions for portfolio expenditures on pages 65 and 66. |

| 36 | Pre-election Report on the State of Québec’s

Public Finances – August 2022 | | |

The provisions built into the financial framework total $11.8 billion by 2026-2027. These provisions cover risks that could influence the financial framework and thus respond to either an unanticipated decline in revenue or an unanticipated growth in expenditure.

The financial framework includes a provision of $2.0 billion in 2022-2023 to mitigate potential economic risks and fund additional support and recovery measures that may be required. The inclusion of such a provision is necessary due to the current economic, public health, and geopolitical risks.

| — | Indeed, the geopolitical tensions arising from the war in Ukraine represent one factor that could influence global economic developments, particularly in Europe, as well as changes in energy and food prices. |