EXHIBIT 99.1

DESCRIPTION

This description of Québec is dated as of June 3, 2010 and appears as

Exhibit 99.1 to Québec’s Annual Report on Form 18-K to the U.S. Securities

and Exchange Commission for the fiscal year ended March 31, 2010.

The delivery of this document at any time does not imply that the information is correct as of any time subsequent to its date. This document (other than as part of a prospectus contained in a registration statement filed under the U.S. Securities Act of 1933) does not constitute an offer to sell or the solicitation of an offer to buy any securities of Québec.

Table of Contents

| | |

| | | Page |

Foreign Exchange | | 2 |

Summary | | 3 |

Québec | | 6 |

Overview | | 6 |

Constitutional Framework | | 6 |

Government | | 7 |

Native Peoples | | 7 |

Economy | | 9 |

Economic Developments in 2009 | | 9 |

Economic Structure | | 10 |

Free Trade Agreements | | 15 |

Government Finances | | 17 |

Financial Administration | | 17 |

2009-2010 Preliminary Results | | 21 |

2010-2011 Budget | | 21 |

Consolidated Revenue Fund Revenue | | 24 |

Consolidated Revenue Fund Expenditure | | 27 |

Government Employees and Collective Unions | | 28 |

Consolidated Non-Budgetary Transactions | | 30 |

Government Enterprises and Agencies | | 32 |

Enterprises Included in the Government’s Reporting Entity | | 34 |

Agencies Which Conduct Fiduciary Transactions That Are Not Included in the Government’s Reporting Entity | | 37 |

Public Sector Debt | | 37 |

Government Debt | | 39 |

Guaranteed Debt | | 41 |

Funded Debt of the Municipal Sector and Other Institutions | | 41 |

Government’s Commitments | | 42 |

Where You Can Find More Information | | 43 |

Forward-Looking Statements | | 44 |

Supplementary Information | | 45 |

Foreign Exchange

Canada maintains a floating exchange rate for the Canadian dollar in order to permit the rate to be determined by market forces without intervention except as required to maintain orderly conditions. Annual average noon spot exchange rates for the major foreign currencies in which debt of Québec is denominated, expressed in Canadian dollars, are shown below.

| | | | | | | | | | | | | | |

Foreign Currency | | 2006 | | 2007 | | 2008 | | 2009 | | 2010(1) |

| | | | | |

United States Dollar | | $ | 1.1341 | | $ | 1.0748 | | $ | 1.0660 | | $ | 1.1420 | | $1.0330 |

Japanese Yen | | | 0.0098 | | | 0.0091 | | | 0.0104 | | | 0.0122 | | 0.0113 |

Swiss Franc | | | 0.9050 | | | 0.8946 | | | 0.9840 | | | 1.0505 | | 0.9624 |

Pound Sterling | | | 2.0886 | | | 2.1487 | | | 1.9617 | | | 1.7804 | | 1.5868 |

New Zealand Dollar | | | 0.7368 | | | 0.7892 | | | 0.7547 | | | 0.7193 | | 0.7308 |

Mexican Pesos | | | 0.1041 | | | 0.0983 | | | 0.0959 | | | 0.0845 | | 0.0817 |

Australian Dollar | | | 0.8543 | | | 0.8982 | | | 0.9002 | | | 0.8969 | | 0.9317 |

Euro | | | 1.4237 | | | 1.4691 | | | 1.5603 | | | 1.5855 | | 1.3944 |

Hong Kong Dollar | | | 0.1460 | | | 0.1377 | | | 0.1369 | | | 0.1473 | | 0.1330 |

| (1) | Monthly average through the end of May 2010. |

Source: Bank of Canada.

In this document, unless otherwise specified or the context otherwise requires, all dollar amounts are expressed in Canadian dollars. The fiscal year of Québec ends March 31. “Fiscal 2010” and “2009-2010” refer to the fiscal year ended March 31, 2010, and, unless otherwise indicated, “2009” means the calendar year ended December 31, 2009. “Fiscal 2011” and “2010-2011” refer to the fiscal year that will end on March 31, 2011. Other fiscal and calendar years are referred to in a corresponding manner. Any discrepancies between the amounts listed and their totals in the tables included in this document are due to rounding.

- 2 -

Summary

The information below is qualified in its entirety by the detailed information provided elsewhere in this document.

Economy

| | | | | | | | | | | | | | | |

| | | 2005 | | 2006 | | 2007 | | 2008 | | 2009 |

| | | (dollar amounts in millions) |

GDP at current market prices | | $ | 272,049 | | $ | 282,220 | | $ | 297,384 | | $ | 302,225 | | $ | 300,869 |

% change – GDP in chained 2002 dollars (1) | | | 1.8% | | | 1.7% | | | 2.8% | | | 1.0% | | | -1.4% |

Personal income | | $ | 226,140 | | $ | 236,629 | | $ | 249,700 | | $ | 258,449 | | $ | 261,591 |

Capital expenditures | | | $49,470 | | | $51,809 | | | $57,055 | | | $60,118 | | | $60,508 |

International exports of goods | | | $70,992 | | | $73,177 | | | $69,920 | | | $71,023 | | | $58,174 |

Population at July 1 (in thousands) | | | 7,582 | | | 7,632 | | | 7,687 | | | 7,753 | | | 7,829 |

Unemployment rate | | | 8.3% | | | 8.0% | | | 7.2% | | | 7.2% | | | 8.5% |

Consumer Price Index - % change | | | 2.3% | | | 1.7% | | | 1.6% | | | 2.1% | | | 0.6% |

Average exchange rate (US$ per C$) | | | 0.83 | | | 0.88 | | | 0.93 | | | 0.94 | | | 0.88 |

Consolidated Financial Transactions (2)

| | | | | | | | | | | | | | | |

| | | Fiscal year ending March 31 | |

| | | 2007 | | | 2008 | | | 2009 | | | Preliminary

Results

2010 (3) | | | Budget

Forecast

2011(4) | |

| | | (dollar amounts in millions) | |

| | | | | |

Consolidated Revenue Fund: | | | | | | | | | | | | | | | |

Own-source revenue | | $49,651 | | | $49,464 | | | $48,893 | | | $47,421 | | | $50,152 | |

Federal transfers (5) | | 11,015 | | | 13,629 | | | 14,023 | | | 15,229 | | | 15,325 | |

| | | | | | | | | | | | | | | |

Total revenue | | 60,666 | | | 63,093 | | | 62,916 | | | 62,650 | | | 65,477 | |

| | | | | |

Program spending | | (51,734 | ) | | (54,826 | ) | | (58,550 | ) | | (60,769 | ) | | (62,561 | ) |

Debt service | | (7,039 | ) | | (7,021 | ) | | (6,504 | ) | | (6,154 | ) | | (6,980 | ) |

| | | | | | | | | | | | | | | |

Total expenditure | | (58,773 | ) | | (61,847 | ) | | (65,054 | ) | | (66,923 | ) | | (69,541 | ) |

Contingency reserve | | — | | | — | | | — | | | (300 | ) | | (300 | ) |

| | | | | | | | | | | | | | | |

Net results of Consolidated Revenue Fund | | 1,893 | | | 1,246 | | | (2,138 | ) | | (4,573 | ) | | (4,364 | ) |

Net results of consolidated entities | | 100 | | | 404 | | | 880 | | | 598 | | | 750 | |

| | | | | | | | | | | | | | | |

| | | | | |

Surplus (deficit) within the meaning of the public accounts | | 1,993 | | | 1,650 | | | (1,258 | ) | | (3,975 | ) | | (3,614 | ) |

| | | | | |

Revenue of the Generations Fund | | (584 | ) | | (449 | ) | | (587 | ) | | (715 | ) | | (892 | ) |

Stabilization reserve (6) | | (1,300 | ) | | (1,201 | ) | | 1,845 | | | 433 | | | — | |

| | | | | | | | | | | | | | | |

Consolidated budgetary balance within the meaning of the Balanced Budget Act | | 109 | | | 0 | | | 0 | | | (4,257 | ) | | (4,506 | ) |

| | | | | |

Deposit of dedicated revenues in the Generations Fund (7) | | 584 | | | 449 | | | 587 | | | 715 | | | 892 | |

| | | | | | | | | | | | | | | |

| | | | | |

Consolidated budgetary balance | | 693 | | | 449 | | | 587 | | | (3,542 | ) | | (3,614 | ) |

| | | | | |

Consolidated non-budgetary requirements | | (3,453 | ) | | (1,156 | ) | | (1,117 | ) | | (3,488 | ) | | (3,365 | ) |

| | | | | | | | | | | | | | | |

| | | | | |

Consolidated net financial requirements (8) | | $(2,760 | ) | | $(707 | ) | | $(530 | ) | | $(7,030 | ) | | $(6,979 | ) |

| | | | | | | | | | | | | | | |

- 3 -

Funded Debt of Public Sector (net of sinking fund balances)

| | | | | | | | | | |

| | | As of March 31 |

| | | Unadjusted

2006(9) | | 2007 | | 2008 | | 2009 | | Preliminary

Results

2010(10) |

| | | (dollar amounts in millions)(11) |

| | | | | |

Government Funded Debt | | | | | | | | | | |

Borrowings – Government | | $81,995 | | $109,714 | | $112,507 | | $124,549 | | $125,826 |

Borrowings – to finance Government Enterprises | | 2,646 | | 31 | | 25 | | 221 | | 218 |

Borrowings – to finance Municipal Bodies (12) | | 2,604 | | | | | | | | |

Government Guaranteed Debt (13) | | 41,947 | | 32,674 | | 32,399 | | 36,668 | | 36,385 |

Municipal Sector Debt | | 15,669 | | 16,409 | | 17,321 | | 18,639 | | 19,538 |

Other Institutions | | 4,040 | | 2,023 | | 1,552 | | 931 | | 649 |

| | | | | | | | | | |

Public Sector Funded Debt (14) | | $148,901 | | $160,851 | | $163,804 | | $181,008 | | $182,616 |

| | | | | | | | | | |

| | | | | |

Per capita ($) | | $19,639 | | $21,076 | | $21,309 | | $23,344 | | $23,326 |

| | | | | |

As a percentage of (15) | | | | | | | | | | |

GDP | | 54.7% | | 57.0% | | 55.1% | | 59.9% | | 60.4% |

| | | | | |

Personal income | | 65.8% | | 68.0% | | 65.6% | | 70.0% | | 70.7% |

| (1) | Adjusted for the effects of inflation in the currency from year to year. |

| (2) | The categories set forth reflect the presentation of the 2010-2011 Budget. |

| (3 ) | The Preliminary Results 2010 are based on financial information presented as at March 31, 2010 in the 2010-2011 Budget which was tabled on March 30, 2010. These preliminary results are subject to change. |

| (4) | Includes the impact of the Plan to Restore Fiscal Balance (see “Government Finances – 2010-2011 Budget”). |

| (5 ) | Federal transfers are presented on an accrual basis (see “ Government Finances – Financial Administration”). |

| (6 ) | A negative amount indicates an allocation to the reserve and a positive amount, a use of the reserve. |

| (7 ) | The Generations Fund was created in June 2006 by the adoption of the Act to reduce the debt and establish the Generations Fund and is a separate entity from the Consolidated Revenue Fund. This law establishes the fund as a permanent tool for reducing the debt burden. In addition, it stipulates that the monies accumulated in the Generations Fund are dedicated exclusively to repaying the debt. |

| (8 ) | The Consolidated net financial requirements for Fiscal 2010 and Fiscal 2011 take into account the budgetary and non-budgetary transactions of the health and social services and education networks. |

| (9 ) | The figures for Fiscal 2006 have not been restated in accordance with the accounting reform implemented in Fiscal 2007, which resulted in the consolidation of additional entities into the Government reporting entity. |

| (10) | The Preliminary Results 2010 are based on financial information presented as at March 31, 2010 in the 2010-2011 Budget which was tabled on March 30, 2010, as revised. These preliminary results are subject to change. |

| (11 ) | Canadian dollar equivalent at the dates indicated for loans in foreign currencies after taking into account currency swap agreements and foreign exchange forward contracts. |

| (12 ) | Following the accounting reform implemented in Fiscal 2007, the Borrowings – to finance Municipal Bodies are reclassified in the Borrowings – Government. |

| (13 ) | Represents mainly debt of Hydro-Québec. |

| (14 ) | Includes debt covered by the Government’s commitments (see “Public Sector Debt- Government Commitments”). |

| (15) | Percentages are based upon the prior calendar year’s GDP and Personal income. |

- 4 -

- 5 -

Québec

Overview

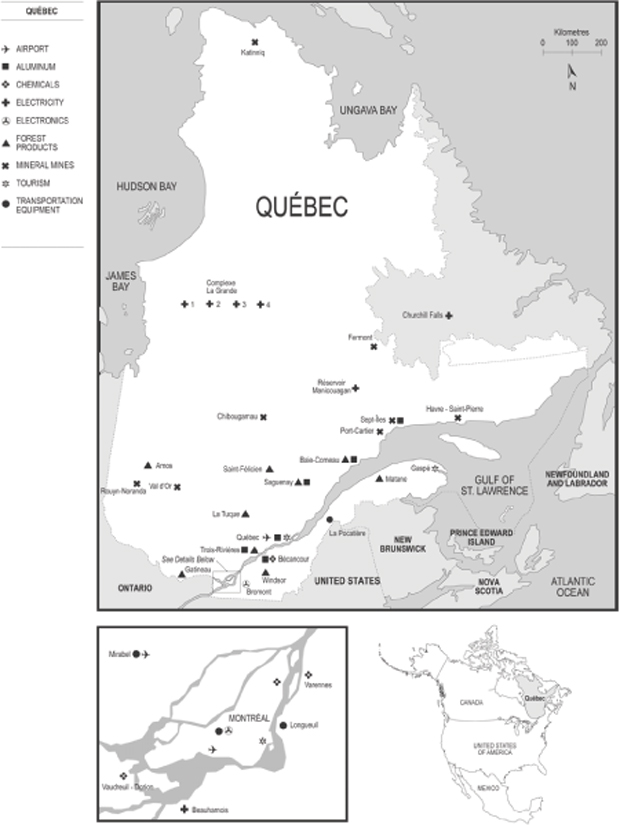

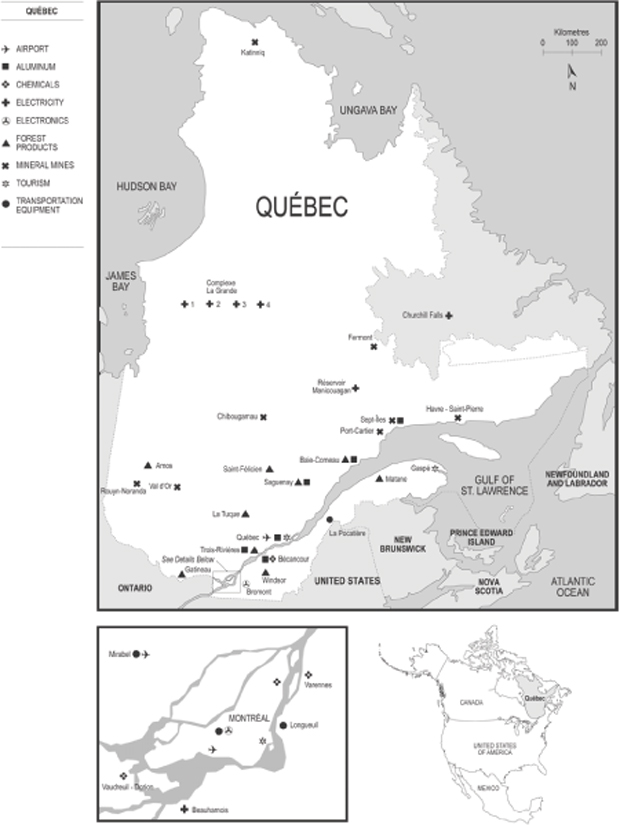

Québec is the largest by area of the ten provinces in Canada (1,541,000 square kilometers or 594,860 square miles, representing 15.4% of the geographical area of Canada) and the second largest by population (7.9 million, representing 23.2% of the population of Canada, as of January 2010).

Québec has a modern, developed economy, in which the service sector contributed 75.6%, the manufacturing industry 16.2%, the construction industry 6.1% and the primary sector 2.1% of real GDP at basic prices in chained 2002 dollars in 2009. The leading manufacturing industries in Québec are food products, primary metal products (including aluminum smelting), transportation equipment products (including aircraft and motor vehicles and associated parts), petroleum and coal products, chemical products, paper products and fabricated metal products. Québec also has significant hydroelectric resources, generating 33.0% of the electricity produced in Canada in 2009.

Montréal and Ville de Québec, the capital of Québec, are the centers of economic activity. Montréal is one of the main industrial, commercial and financial centers of North America and is Canada’s second largest urban area as measured by population. Montréal is also Canada’s largest port, situated on the St. Lawrence River, which provides access to the Atlantic Ocean and the inland navigation system of the Great Lakes.

French is the official language of Québec and is spoken by approximately 95% of its population.

Constitutional Framework

Canada is a federation of ten provinces and three federal territories, with a constitutional division of responsibilities between the federal and provincial governments as set out in The Constitution Acts, 1867 to 1982 (the “Constitution”).

Under the Constitution, each provincial government has exclusive authority to raise revenue for provincial purposes through direct taxation within its territorial limits. Each provincial government also has exclusive authority to regulate education, health, social services, property and civil rights, natural resources, municipal institutions and, generally, to regulate all other matters of a purely local or private nature in its province, and to regulate and raise revenue from the exploration, development, conservation and management of natural resources.

The federal parliament is empowered to raise revenue by any method or system of taxation and generally has authority over matters or subjects not assigned exclusively to the provinces. It has exclusive authority over the regulation of trade and commerce, currency and coinage, banks and banking, national defense, naturalization and aliens, postal services, navigation and shipping, and bills of exchange, interest and bankruptcy.

The Constitution Act, 1982 (the “Constitution Act”), enacted by the parliament of the United Kingdom, provides, among other things, that amendments to the Constitution be effected in Canada according to an amending formula. The Constitution Act also includes various modifications to the Constitution. The Constitution Act came into effect in 1982 notwithstanding the opposition of the National Assembly of Québec (the “National Assembly”) and the government of Québec (the “Government”) to certain clauses relating to provincial jurisdiction and the terms of the amending formula.

The Parti Québécois, which has as its principal objective the sovereignty of Québec, formed the Government from September 1994 to April 14, 2003. During its term in office, the Parti Québécois tabled in the National Assembly a Bill entitled An Act respecting the future of Québec (the “Act”), which provided that upon receipt of a favorable vote in a referendum, the Act would be enacted and Québec would proclaim its sovereignty following a formal offer to Canada of a treaty of economic and political partnership. In November 1995, a slight majority of Québec citizens (50.6%) voted against the Act.

The Supreme Court of Canada decided in August 1998, on a reference from the federal government in which Québec did not participate, that (i) under the Constitution, Québec may not secede unilaterally without negotiation with the other parties in the Canadian Confederation within the existing constitutional framework; (ii) under international law, Québec has no right to secede unilaterally from Canada; (iii) nonetheless, the clear repudiation by the people of Québec of the existing constitutional order and the clear expression of a desire to pursue secession would oblige the other provinces and the federal government to negotiate in accordance with constitutional principles, and Québec would also have to negotiate in accordance with such principles; and (iv) if Québec were to so negotiate but face unreasonable intransigence from the other parties, it would be more likely to be recognized than if it did not itself act according to constitutional principles in the negotiations.

- 6 -

The Québec Liberal Party, a federalist party, won a third consecutive mandate at the general election in December 2008. It currently forms the Government in the National Assembly. With regard to the constitutional issue, the Québec Liberal Party pursues a policy that emphasizes the values of Canadian federalism. In particular, its platform is focused on strengthening Québec’s place within the federation, on forming new alliances with the other provinces and on promoting intergovernmental cooperation.

Government

Legislative power in Québec is exercised by the Parliament of Québec, which is comprised of the Lieutenant-Governor, who is appointed by the Governor General in Council of Canada, and the National Assembly. The National Assembly consists of 125 members elected by popular vote from single member districts. According to constitutional practice, the leader of the party with the largest number of elected members becomes Prime Minister and forms the Government.

Executive power in Québec is vested in the Lieutenant-Governor acting with, or on the recommendation of, the Conseil exécutif, which consists of the Prime Minister and the Cabinet (Conseil des ministres). The Conseil exécutif is accountable to the National Assembly.

The current National Assembly consists of 66 members of the Québec Liberal Party, 50 members of the Parti québécois, 4 members of the Action Démocratique du Québec, 1 member of Québec solidaire, 3 independents and 1 seat is vacant. Members are elected for a term of five years, subject to earlier dissolution of the National Assembly by the Lieutenant-Governor upon the recommendation of the Prime Minister or following the Government’s defeat on a vote of no confidence. The mandate of the current Government extends through the next election, which must be called no later than December 2013.

Native Peoples

Various aboriginal communities in Québec have initiated legal actions to have the existence of their ancestral rights (including aboriginal title) recognized and obtain damages and interest as compensation for alleged infringements of their rights. The ancestral rights of aboriginal people are recognized under section 35 of the Constitution. Taken as a whole, aboriginal people are claiming $15.9 billion in damages and interest through these actions.

Included among these legal actions are three claims for damages and interest filed as part of efforts to contest the validity of the provisions of the 1975 James Bay and Northern Québec Agreement (the “JBNQA”). The effect of that agreement was to extinguish all aboriginal claims, rights, titles and interests, regardless of their nature, in respect of the territory covered by the JBNQA.

| | • | | In the first of these actions (The Betsiamites Band et al. v. Attorney-General of Québec et al. (Superior Court, no 500-17-010685-035)) (Betsiamites II), which was filed in December 2003, the Betsiamites and the Innu First Nation of Betsiamites are claiming the invalidity of the provisions of the James Bay and Northern Quebec Native Claims Settlement Act, S.C. 1977, c. 32, and of the Act respecting the agreement concerning James Bay and Northern Québec, S.Q. 1976, c. 46 that are alleged to have infringed on the ancestral rights of the Innu of Betsiamites, by extinguishing their rights over the territory covered by the JBNQA. They also claim full enjoyment of their ancestral rights over this territory that they consider to be their ancestral territory and damages of some $75 million for loss of such enjoyment for more than 25 years. Alternatively, they claim the right to fair compensation that they estimate at $250 million if the court should conclude that their ancestral rights were extinguished by the provincial and federal statutes in question. Québec intends to contest this claim. |

| | • | | The second of these legal actions concerns the community of Uashat-Maliotenam (The Innu Takuikan Uashat Mak Mani-Utenam Band et al. v. Attorney-General of Québec et al. (Superior Court, no 200-17-004196-036)) (Uashat II). Under this action, also filed in December 2003, the Innu of Uashat-Maliotenam are asking the Court to declare that they hold ancestral rights and aboriginal title over the traditional territory they claim. In their suit, they maintain, in relation to the portion of the traditional territory they claim that is covered by the JBNQA, never to have consented to any extinguishing of their rights over this territory and they allege that the Québec and Canadian governments as well as Hydro-Québec failed in their fiduciary obligation by allowing, through action or inaction, infringements on their aboriginal title and their ancestral rights arising from industrial development and development of natural resources. They are claiming from the defendants compensation in the amount of $1.5 billion. The Innu of Uashat-Maliotenam also claim an accounting regarding the money collected for building structures, installations and equipment on the traditional territory they claim, an account of the administration of the assets thereon, as well as the creation of a constructive trust on the structures, equipment and installations of |

- 7 -

| | the defendants. Further to an agreement reached by the parties, this legal action was suspended until June 2010. The suspension was lifted by the court on January 27, 2009. Québec intends to contest this claim. |

| | • | | The third of these legal actions was filed in January 2004 by the Atikamekw (the Atikamekw Band of Opiticiwan et al. v. Attorney-General of Québec et al. (Superior Court, no 500-17-018678-030)). The Atikamekw are asking the Court to declare that the Native Claims Settlement Act, which implements the JBNQA, did not extinguish the “native, ancestral or aboriginal claims, rights, titles and interests” they may hold in the portion of the territory they claim and that is located on the territory covered by the JBNQA. Alternatively, the Atikamekw are claiming compensation of $300 million for the unilateral extinguishment of their claims, titles, rights and interests over the territory mentioned above. By agreement of the parties, this legal action has been suspended until April 2012. |

Other actions for damages and interest have been filed by aboriginal communities to obtain compensation for alleged infringements of their rights. Two of these actions were filed by the Innu Nation of Betsiamites (also known under the name Pessamit).

| | • | | In the first such action, filed in 1998 (The Innu Nation of Pessamit et al. v. Attorney-General of Québec et al. (Superior Court, no 500-05-039472-988)) (Betsiamites I), the Betsiamites are seeking a court declaration that the Innu of this community hold aboriginal title and ancestral rights over an immense territory on the Côte-Nord. In addition, the Betsiamites initially claimed $500 million, with interest, for damages caused to the territory by the construction of hydroelectric facilities in the late 1960s and early 1970s and want Hydro-Québec to be ordered to turn over to the Innu of Betsiamites a portion of the revenue from the production of electrical power by these facilities. In November 2006, the Innus of Pessamit re-activated an action that was filed in 1998 against the Attorney-General of Canada, the Attorney-General of Québec and Hydro-Québec seeking judicial recognition of their aboriginal rights and title over certain areas of land in Québec where Hydro-Québec’s Manicouagan-Outardes hydroelectric facilities are located. The Innus intend to seek various orders including an award for damages against Canada, Québec and Hydro-Québec, jointly and severally, in an amount of $10.8 billion. In addition, the Innus of Pessamit are claiming compensatory annual payments of $657 million from Hydro-Québec. Québec and Hydro-Québec intend to contest this claim. |

| | • | | The second such legal action by the Betsiamites (The First Nation of Pessamit et al. v. Attorney-General of Québec et al. (Superior Court, no 500-17-028743-055)) (Betsiamites IV) was filed in December 2005. This action covers the portion of the traditional territory they claim (50 000 km2 of 138 000 km2) on which forest development has been carried out since the mid-19th century. This legal action impleads the 27 forest products companies that hold at least one timber supply and forest management agreement (TSFMA) on the traditional territory claimed by the Betsiamites. In this lawsuit, the Betsiamites seek confirmation that: 1) they hold aboriginal title and ancestral rights over their traditional territory; 2) forest development of this territory was authorized illegally; 3) the Government was not entitled to collect revenues from such development; and 4) the Forest Act cannot apply to the traditional territory of the Betsiamites. Lastly, the Betsiamites are claiming damages and interest of $1 billion against the Attorneys-General of Québec and of Canada for infringement of enjoyment of their ancestral rights and $2.1 billion against the Attorney-General of Québec for breach of their right to develop the forest resource. On September 30, 2006, the Betsiamites amended this legal action, adding a claim for the payment of $50 million in damages and interest against the Attorney-General of Québec and a forest company for logging activities carried out on René-Levasseur Island. Québec intends to contest this claim. |

In December 1996, Philomène and Georges McKenzie, of the community of Uashat-Maliotenam near Sept-Îles, filed a motion for a declaratory judgment to have declared, in favor and on behalf of their families, an aboriginal title and ancestral rights, including for hunting, fishing and trapping on the land they claim as their traditional lands (Philomène McKenzie et al. v. Attorney-General of Québec et al. (Superior Court, no 500-05-027983-962)) (Uashat I). The territory claimed covers roughly 1,600 km2 and is located north of Sept-Îles. In addition, they are asking that any mining project be subject to their consent. They are also asking for a permanent injunction against any project located on the territory they claim and the work resulting from it. The claimants are also demanding $7 million in damages and interest. This case remained latent from 1997 until the spring of 2007, when the announcement of the Lac Bloom project gave new impetus to the dispute. On April 13, 2007, the claimants served notice announcing an amendment to their petition, adding ten new claimants and raising the land area on which ancestral rights and aboriginal title are claimed from 1,600 km2 to 16,679 km2. The amount of damages claimed has also risen from $7 million to $350 million.

On May 7, 2010, the Innus of Uashat and Mani-Utenam (the « Uashaunnuat ») filed a motion before the Superior Court of Québec seeking an interlocutory injunction against the Attorney-General of Canada, the Attorney-General of Québec and Hydro-Quebec regarding, amongst other issues, the proposed construction of transmission lines to connect the Romaine River hydroelectric complex to the Hydro-Quebec grid which, according to the Uashaunnuat, is being undertaken in violation of their ancestral rights on their alleged ancestral territory. In addition, the Uashaunnuat are raising various procedural claims relating to the environmental review conducted with respect to this project. Construction of this project began in 2009 and the commissioning of the first generating station is presently scheduled for late 2014. The Attorney-General of Québec, representing the interests of Québec, and Hydro-Quebec intend to contest this motion.

- 8 -

Economy

Economic Developments in 2009

Canada. Gross domestic product (“GDP”) adjusted for inflation in chained 2002 dollars (“real GDP”), as published in the National Economic Accounts on May 31, 2010, decreased at a rate of 2.5% in 2009, compared with an increase of 0.5% in 2008. This decrease was mainly attributable to business investment and net international exports. Final domestic demand decreased by 1.8% in 2009, compared to an increase of 2.8% in 2008. Real consumer spending increased by 0.4% in 2009, compared to a 2.9% increase in 2008. International exports decreased by 14.2% in volume and by 22.2% in value in 2009 compared with a decrease of 4.6% and an increase of 5.5%, respectively, in 2008. International imports decreased by 13.9% in volume and by 13.8% in value in 2009 compared with increases of 1.2% and 6.7%, respectively, in 2008.

Non-residential investment decreased by 19.9% in 2009, due in particular to a 20.3% decrease in machinery and equipment. Residential investment decreased by 8.2% in 2009, due to a 29.4% decrease in housing starts. Government investment increased by 15.0% in 2009. Government expenditure on goods and services increased by 3.5% in 2009.

The Consumer Price Index (“CPI”) increased by 0.3% in 2009. Overall employment decreased by 1.6% in 2009, while the unemployment rate increased to 8.3% from 6.1% in 2008.

Québec. Real GDP as published in the Québec Economic Accounts on March 26, 2010 decreased by 1.4% in 2009, compared to an increase of 1.0% in 2008. Final domestic demand increased slightly by 0.1% in real terms in 2009, compared to 3.3% in 2008. Real consumer spending increased by 0.6% in 2009, compared to an increase of 3.3% in 2008. International exports decreased by 14.9% in volume and by 19.0% in value in 2009, compared with a decrease of 3.4% and an increase of 1.3%, respectively, in 2008. International imports decreased by 10.9% in volume and by 13.8% in value in 2009, compared with increases of 1.6% and 9.6%, respectively, in 2008.

The value of non-residential investment increased by 6.4% in 2009, with an 18.9% increase in the public sector, offsetting a 14.4% decrease in the private sector. The value of residential investment increased by 3.4% in 2009.

The CPI increased by 0.6% in 2009. Overall employment decreased by 1.0% in 2009, while the unemployment rate increased to 8.5% from 7.2% in 2008.

- 9 -

Table 1

Main Economic Indicators of Québec (1)

| | | | | | | | | | | | |

| | | 2005 | | 2006 | | 2007 | | 2008 | | 2009 | | Compound Annual

Rate of Growth

2004-2009 |

| | | (dollar amounts in millions, except for per capita amounts) | | |

GDP | | | | | | | | | | | | |

At current market prices | | $272,049 | | $282,220 | | $297,384 | | $302,225 | | $300,869 | | |

| | 3.5% | | 3.7% | | 5.4% | | 1.6% | | -0.4% | | 2.7% |

In chained 2002 dollars | | $255,569 | | $259,853 | | $267,033 | | $269,665 | | $265,959 | | |

| | 1.8% | | 1.7% | | 2.8% | | 1.0% | | -1.4% | | 1.2% |

Per capita | | $33,706 | | $34,050 | | $34,738 | | $34,780 | | $33,972 | | |

| | 1.2% | | 1.0% | | 2.0% | | 0.1% | | -2.3% | | 0.4% |

Personal income | | $226,140 | | $236,629 | | $249,700 | | $258,449 | | $261,591 | | |

| | 3.8% | | 4.6% | | 5.5% | | 3.5% | | 1.2% | | 3.7% |

Per capita | | $29,826 | | $31,007 | | $32,483 | | $33,333 | | $33,414 | | |

| | 3.1% | | 4.0% | | 4.8% | | 2.6% | | 0.2% | | 2.9% |

Capital expenditures | | $49,470 | | $51,809 | | $57,055 | | $60,118 | | $60,508 | | |

| | -0.6% | | 4.7% | | 10.1% | | 5.4% | | 0.6% | | 4.0% |

Value of manufacturers’ shipments | | $139,556 | | $145,580 | | $146,152 | | $148,930 | | $128,357 | | |

| | 3.6% | | 4.3% | | 0.4% | | 1.9% | | -13.8% | | -1.0% |

Retail trade | | $82,456 | | $86,505 | | $90,406 | | $94,806 | | $93,740 | | |

| | 5.1% | | 4.9% | | 4.5% | | 4.9% | | -1.1% | | 3.6% |

| | |

| | | (in thousands of persons) | | |

Population (at July 1) | | 7,582 | | 7,632 | | 7,687 | | 7,753 | | 7,829 | | |

| | 0.6% | | 0.7% | | 0.7% | | 0.9% | | 1.0% | | 0.8% |

Labor force | | 4,053 | | 4,094 | | 4,150 | | 4,185 | | 4,199 | | |

| | 0.7% | | 1.0% | | 1.4% | | 0.8% | | 0.3% | | 0.9% |

Employment | | 3,717 | | 3,765 | | 3,852 | | 3,882 | | 3,844 | | |

| | 1.0% | | 1.3% | | 2.3% | | 0.8% | | -1.0% | | 0.9% |

Unemployment rate (level in percentage) | | 8.3% | | 8.0% | | 7.2% | | 7.2% | | 8.5% | | |

| | |

| | | (2002 = 100) | | |

CPI | | 106.9 | | 108.7 | | 110.4 | | 112.7 | | 113.4 | | |

| | 2.3% | | 1.7% | | 1.6% | | 2.1% | | 0.6% | | 1.6% |

| (1) | Unless otherwise indicated, percentages are percentage changes from the previous year. |

Sources: Institut de la statistique du Québec and Statistics Canada.

Economic Structure

In 2009, Québec accounted for 20.7% of Canada’s real GDP. The services sector accounted for 75.6% of Québec’s real GDP, compared with 22.3% for the secondary sector and 2.1% for the primary sector. Québec’s economy is influenced by developments in the economies of its major trading partners, especially the United States, which is Québec’s largest export market. In 2009, the value of exports (including to other Canadian provinces) represented 44.5% of Québec’s GDP.

- 10 -

The following table shows the contribution of each sector to real GDP, which includes net taxes (taxes less subsidies) paid on factors of production. GDP is a measure of value added (the total value of goods delivered and services rendered less the cost of materials and supplies, fuel and electricity).

Table 2

Real Gross Domestic Product by Sector at Basic Prices in Chained 2002 Dollars(1)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | % of Total 2008 | | | | | % of Total 2009 | |

| | | 2005 | | 2006 | | 2007 | | 2008 | | Québec | | | Canada | | | 2009 | | Québec | | | Canada | |

| |

| | | (dollar amounts in millions) | |

Primary Sector: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

Agriculture, forestry, fishing and hunting | | | $4,734 | | | $4,636 | | | $4,530 | | | $4,353 | | 1.8 | % | | 2.2 | % | | | $4,181 | | 1.7 | % | | 2.1 | % |

Mining and oil and gas extraction | | | 990 | | | 969 | | | 1,046 | | | 1,054 | | 0.4 | | | 4.6 | | | | 1,064 | | 0.4 | | | 4.3 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 5,724 | | | 5,605 | | | 5,576 | | | 5,407 | | 2.2 | | | 6.8 | | | | 5,245 | | 2.1 | | | 6.4 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

Secondary Sector: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Manufacturing | | | 47,084 | | | 45,688 | | | 45,245 | | | 43,930 | | 17.6 | | | 13.9 | | | | 39,816 | | 16.2 | | | 12.7 | |

Construction | | | 12,706 | | | 12,604 | | | 14,083 | | | 14,727 | | 5.9 | | | 6.1 | | | | 15,117 | | 6.1 | | | 5.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 59,790 | | | 58,292 | | | 59,328 | | | 58,657 | | 23.5 | | | 20.0 | | | | 54,933 | | 22.3 | | | 18.5 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

Service Sector: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Community, business and personal services | | | 59,767 | | | 61,012 | | | 62,794 | | | 64,317 | | 25.8 | | | 24.6 | | | | 65,310 | | 26.5 | | | 25.3 | |

Finance, insurance and real estate | | | 39,608 | | | 41,000 | | | 42,370 | | | 43,348 | | 17.4 | | | 20.1 | | | | 44,391 | | 18.0 | | | 21.1 | |

Wholesale and retail trade | | | 27,187 | | | 28,615 | | | 29,934 | | | 30,749 | | 12.3 | | | 11.9 | | | | 30,338 | | 12.3 | | | 11.7 | |

Governmental services | | | 15,155 | | | 15,637 | | | 15,945 | | | 16,369 | | 6.6 | | | 5.7 | | | | 16,771 | | 6.8 | | | 6.0 | |

Transportation and warehousing | | | 10,392 | | | 10,554 | | | 10,741 | | | 10,791 | | 4.3 | | | 4.7 | | | | 10,473 | | 4.2 | | | 4.7 | |

Information and cultural services | | | 9,094 | | | 9,447 | | | 9,707 | | | 9,908 | | 4.0 | | | 3.7 | | | | 9,850 | | 4.0 | | | 3.8 | |

Other utility services | | | 9,511 | | | 9,506 | | | 9,905 | | | 9,882 | | 3.9 | | | 2.5 | | | | 9,597 | | 3.8 | | | 2.5 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 170,714 | | | 175,771 | | | 181,396 | | | 185,364 | | 74.3 | | | 73.2 | | | | 186,730 | | 75.6 | | | 75.1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Real GDP | | $ | 236,228 | | $ | 239,668 | | $ | 246,300 | | $ | 249,428 | | 100.0 | % | | 100.0 | % | | $ | 246,908 | | 100.0 | % | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | North American Industrial Classification System (NAICS) in chained 2002 dollars. For the chained 2002 dollars, the aggregate amounts are not equal to the sums of their components. |

Source: Statistics Canada.

Primary Sector. In 2009, the primary sector, which includes agriculture, forestry, fishing and hunting, and mining and oil and gas extraction, contributed 2.1% of real GDP and accounted for 2.3% of employment in Québec. Québec’s forests, covering 1,140,000 square kilometers, or 440,000 square miles, are among its most important natural resources. Québec’s logging operations were estimated to have produced approximately 0.826 billion cubic feet of timber in 2009, generating revenue of $1.372 billion from sales to domestic and foreign customers. In 2009, there was a reduction in timber production due to a decrease in demand for lumber and wood products (the value of shipments decreased by 17.6% and the value of exports by 29.8%).

In mining and oil and gas extraction, which represented 20.3% of the primary sector in 2009, production is concentrated mainly in iron ore, gold, nickel, stone, cement, zinc and copper. In 2009, the value of mineral production amounted to $6.2 billion.

Secondary Sector. In 2009, the secondary sector, which consists of the manufacturing and construction industries, contributed 22.3% of real GDP and accounted for 19.3% of employment in Québec. In terms of real GDP, the construction industry recorded a 2.6% increase in 2009 over 2008, with a strong increase in non-residential construction, offsetting a 9.4% decrease in housing starts. Real GDP in manufacturing decreased by 9.4% in 2009, with a 7.0% employment decrease in that industry, reflecting an 18.1% decrease in international exports of goods. The strong decline in manufacturing real GDP may be explained by slumping world demand which affected the purchasing power of Québec’s commercial partners, particularly the United States. The manufacturing industries that were most affected are clothing (-19.5% in real GDP and -16.6% in employment), plastics and rubber products (-18.9% in real GDP and -11.1% in employment), primary textile and textile products (-17.9% in real GDP and -15.7% in employment), computer and electronic products (-17.3% in real GDP and -11.3% in employment) and machinery (-15.1% in real GDP and -7.5% in employment). The total value of manufacturers’ shipments decreased by 13.8% to $128.4 billion in 2009, representing 26.0% of total Canadian shipments. The value of shipments of primary metals decreased by 31.3% in 2009, due to slumping world demand. Durable goods

- 11 -

accounted for 56.2% of manufacturing real GDP and 55.9% of manufacturing employment. The leading manufacturing industries in Québec are food products, primary metal products (including aluminum smelting), transportation equipment products (including aircraft and motor vehicles and associated parts), petroleum and coal products, chemical products, paper products and fabricated metal products. As a result of its competitive advantage in low-cost electricity production, Québec is one of the world’s leading producers of aluminum.

Table 3

Value of Manufacturers’ Shipments (1)

| | | | | | | | | | | | | | | | | | | | | |

| | | 2005 | | 2006 | | 2007 | | 2008 | | % of Total

2008 | | | 2009 | | % of Total

2009 | |

| |

| | | (dollar amounts in millions) | |

Food | | | $14,786 | | | $16,416 | | | $16,687 | | | $17,909 | | 12.0 | % | | | $18,985 | | 14.8 | % |

Primary metals | | | 15,731 | | | 20,722 | | | 21,774 | | | 22,118 | | 14.8 | | | | 15,192 | | 11.8 | |

Transportation equipment | | | 16,234 | | | 16,278 | | | 16,304 | | | 17,790 | | 11.9 | | | | 14,785 | | 11.5 | |

Petroleum and coal | | | 13,430 | | | 14,212 | | | 14,652 | | | 17,587 | | 11.8 | | | | 13,906 | | 10.8 | |

Chemicals | | | 9,712 | | | 10,389 | | | 10,482 | | | 9,441 | | 6.3 | | | | 9,118 | | 7.1 | |

Paper | | | 10,536 | | | 10,895 | | | 9,951 | | | 10,089 | | 6.8 | | | | 8,831 | | 6.9 | |

Fabricated metals | | | 7,259 | | | 7,399 | | | 8,098 | | | 8,431 | | 5.7 | | | | 7,070 | | 5.5 | |

Machinery | | | 5,226 | | | 5,495 | | | 6,034 | | | 6,145 | | 4.1 | | | | 5,379 | | 4.2 | |

Wood | | | 8,561 | | | 8,350 | | | 7,217 | | | 6,510 | | 4.4 | | | | 5,324 | | 4.2 | |

Plastics and rubber | | | 6,416 | | | 6,751 | | | 6,369 | | | 5,914 | | 4.0 | | | | 4,865 | | 3.8 | |

Beverage and tobacco | | | 3,411 | | | 3,120 | | | 3,486 | | | 3,406 | | 2.3 | | | | 3,457 | | 2.7 | |

Electrical equipment | | | 3,489 | | | 3,809 | | | 3,655 | | | 3,670 | | 2.5 | | | | 3,457 | | 2.7 | |

Other (2) | | | 24,766 | | | 21,746 | | | 21,445 | | | 19,919 | | 13.4 | | | | 17,988 | | 14.0 | |

| | | | | | | | | | | | | | | | | | | | | |

| | $ | 139,556 | | $ | 145,580 | | $ | 146,152 | | $ | 148,930 | | 100.0 | % | | $ | 128,357 | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | |

| (1) | North American Industrial Classification System (NAICS). |

| (2) | Including notably clothing, primary textile and textile products and computer and electronic products. |

Source: Statistics Canada.

Service Sector. The service sector includes a wide range of activities such as community, business and personal services, finance, insurance and real estate, wholesale and retail trade, governmental services, transportation and warehousing, information and cultural services and other utility services. In 2009, the service sector contributed 75.6% of real GDP and accounted for 78.4% of employment in Québec.

In terms of real GDP, increases in the service sector in 2009 occurred in governmental services (2.5%), finance, insurance and real estate (2.4%) and community, business and personal services (1.5%). However, real GDP decreased in transportation and warehousing (-2.9%), other utility services (-2.9%), wholesale and retail trade (-1.3%) and information and cultural services (-0.6%).

Due to Québec’s large territory, transportation facilities are essential to the development of its economy. Water transportation is provided mainly through the St. Lawrence River Seaway. Approximately 27.8% of all international tonnage handled in Canadian ports in 2007 (the most recent year for which information is available) passed through Québec’s shipping facilities. Highway, rail and air transportation systems service the populated areas, with higher concentrations in the metropolitan areas of Montréal and Ville de Québec.

The financial sector includes large Canadian and foreign financial institutions, Québec’s cooperative institutions and Government financial intermediary enterprises and fiduciary agencies, including the Caisse de dépôt et placement du Québec (the “Caisse”) which is one of the largest institutional fund managers in North America.

Capital Expenditures. In 2009, the value of capital expenditures by the private and public sectors increased by 0.6% in Québec. Total capital expenditures increased as a result of a 3.5% increase in residential investment, offsetting a 0.8% decrease in non-residential investment. Non-residential investment decreased by 6.5% in the private sector, offsetting an 18.9% increase in the public sector. The 2008-2013 Québec Infrastructure Plan is the primary cause of the strong increase in public sector investment.

- 12 -

The decrease in non-residential investment resulted in large part from decreases in manufacturing (-24.0%), wholesale and retail trade (-23.9%), finance, insurance and real estate operators (-15.7%), mining and oil and gas extraction (-13.6%), transportation and warehousing (-8.7%), business services, accommodation and other services (-6.6%) and agriculture, forestry, fishing and hunting (-5.4%). These decreases were partially offset by increases in governmental, educational, health and social services (18.8%), information, cultural and other utilities (11.3%) and construction (0.8%).

Table 4

Private and Public Sectors Capital Expenditures in Québec (1)

| | | | | | | | | | | | | | | | | | | | | |

| | | 2005 | | 2006 | | 2007 | | 2008 | | % of Total

2008 | | | 2009 | | % of Total

2009 | |

| | | (dollar amounts in millions) | |

| | | | | | | |

Non-residential Investment: | | | | | | | | | | | | | | | | | | | | | |

Governmental, educational, health and social services | | | $7,735 | | | $8,076 | | | $9,672 | | $ | 11,863 | | 19.7 | % | | $ | 14,099 | | 23.3 | % |

Information, cultural and other utilities | | | 5,787 | | | 5,479 | | | 6,302 | | | 6,743 | | 11.2 | | | | 7,507 | | 12.4 | |

Finance, insurance and real estate operators | | | 5,969 | | | 7,203 | | | 6,877 | | | 5,331 | | 8.9 | | | | 4,493 | | 7.4 | |

Manufacturing | | | 4,124 | | | 4,047 | | | 3,878 | | | 4,123 | | 6.9 | | | | 3,134 | | 5.2 | |

Business services, accommodation and other services | | | 2,065 | | | 2,068 | | | 2,309 | | | 2,757 | | 4.6 | | | | 2,575 | | 4.3 | |

Wholesale and retail trade | | | 2,384 | | | 2,480 | | | 3,018 | | | 3,369 | | 5.5 | | | | 2,564 | | 4.2 | |

Transportation and warehousing | | | 1,808 | | | 1,994 | | | 2,533 | | | 2,501 | | 4.2 | | | | 2,284 | | 3.8 | |

Mining and oil and gas extraction | | | 724 | | | 984 | | | 1,505 | | | 1,754 | | 2.9 | | | | 1,516 | | 2.5 | |

Construction | | | 1,104 | | | 1,136 | | | 884 | | | 889 | | 1.5 | | | | 896 | | 1.5 | |

Agriculture, forestry, fishing and hunting | | | 692 | | | 678 | | | 804 | | | 858 | | 1.4 | | | | 812 | | 1.3 | |

| | | | | | | | | | | | | | | | | | | | | |

| | $ | 32,392 | | $ | 34,144 | | $ | 37,781 | | $ | 40,188 | | 66.8 | % | | $ | 39,880 | | 65.9 | % |

Residential Investment | | | 17,078 | | | 17,665 | | | 19,274 | | | 19,930 | | 33.2 | | | | 20,628 | | 34.1 | |

| | | | | | | | | | | | | | | | | | | | | |

| | $ | 49,470 | | $ | 51,809 | | $ | 57,055 | | $ | 60,118 | | 100.0 | % | | $ | 60,508 | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Private sector | | $ | 37,464 | | $ | 39,372 | | $ | 43,016 | | $ | 43,204 | | 71.9 | % | | $ | 40,405 | | 66.8 | % |

Public sector | | | 12,006 | | | 12,437 | | | 14,039 | | | 16,914 | | 28.1 | | | | 20,103 | | 33.2 | |

| | | | | | | | | | | | | | | | | | | | | |

| | $ | 49,470 | | $ | 51,809 | | $ | 57,055 | | $ | 60,118 | | 100.0 | % | | $ | 60,508 | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | |

| (1) | North American Industrial Classification System (NAICS). |

Source: Statistics Canada.

Exports and Imports. In 2009, Québec’s exports of goods and services totaled $133.8 billion of which $77.0 billion (57.5%) were international exports and $56.8 billion (42.5%) were inter-provincial exports. Québec’s international exports represented 17.6% of Canada’s total exports. Québec’s imports of goods and services totaled $159.4 billion of which $97.5 billion (61.2%) were international imports and $61.9 billion (38.8%) were inter-provincial imports. Québec’s international imports represented 21.0% of Canada’s total imports. In 2009, Québec’s external sector (as defined under the Provincial Economic Accounts of Statistics Canada) registered an overall deficit of $25.6 billion, a net result of a deficit of $20.6 billion on international trade and a deficit of $5.0 billion on inter-provincial trade. In 2008, Québec registered an overall deficit of $21.3 billion, a net result of a deficit of $18.2 billion on international trade and a deficit of $3.1 billion on inter-provincial trade. The deficit in 2009 reflects mainly the impact of a strong Canadian dollar on international trade and a major reduction in global trade. A strong Canadian dollar resulted in lower Canadian dollar prices for export goods that are normally traded in U.S. dollars, which put an additional downward pressure on the value of exports in the context of a global recession. The value of imports showed a smaller decrease mainly because of a domestic economy which was less affected by the global recession. Imports were also stimulated by a decline in Canadian dollar prices of imports resulting from a strong Canadian dollar.

International exports of goods originating from Québec, calculated by the Institut de la statistique du Québec from data on Canada’s total exports of goods, were $58.2 billion for 2009, compared with $71.0 billion for 2008, representing a decrease of 18.1%. In 2009, decreases occurred in the value of exports of copper and alloys (-40.8%), aluminum and alloys (-36.2%), electronic products (-30.9%), tools and other equipment (-25.9%), newsprint and printing paper (-24.3%), scientific equipment (-23.6%), motor vehicles and associated parts (-20.3%), machinery (-9.2%) and paperboard and other paper (-2.5%). These decreases were partially offset by increases in the value of exports of chemical products (0.7%) and aircraft and associated parts (0.2%).

- 13 -

The United States is Québec’s principal international export market, accounting for 69% of the international exports of goods in 2009.

Table 5

Québec’s International Exports of Goods

| | | | | | | | | | | | | | | | |

| | | 2005 | | 2006 | | 2007 | | 2008 | | % of Total

2008 | | | 2009 | | % of Total

2009 | |

| | | (dollar amounts in millions) | |

| | | | | | | |

Aircraft and associated parts | | $9,560 | | $9,010 | | $9,446 | | $8,983 | | 12.6 | % | | $9,000 | | 15.5 | % |

Aluminum and alloys | | 5,888 | | 7,880 | | 8,034 | | 7,615 | | 10.7 | | | 4,860 | | 8.3 | |

Chemical products | | 2,897 | | 3,059 | | 3,293 | �� | 3,182 | | 4.5 | | | 3,205 | | 5.5 | |

Newsprint and printing paper | | 4,055 | | 4,107 | | 3,543 | | 3,809 | | 5.3 | | | 2,883 | | 5.0 | |

Machinery | | 2,484 | | 2,533 | | 2,609 | | 2,826 | | 4.0 | | | 2,545 | | 4.4 | |

Scientific equipment | | 1,354 | | 1,675 | | 1,852 | | 2,408 | | 3.4 | | | 1,840 | | 3.2 | |

Tools and other equipment | | 2,265 | | 2,122 | | 2,094 | | 2,007 | | 2.8 | | | 1,488 | | 2.6 | |

Copper and alloys | | 1,504 | | 2,812 | | 2,286 | | 2,463 | | 3.5 | | | 1,459 | | 2.5 | |

Electronic products | | 4,894 | | 3,903 | | 2,468 | | 2,057 | | 2.9 | | | 1,421 | | 2.4 | |

Motor vehicles and associated parts | | 2,091 | | 2,341 | | 1,814 | | 1,547 | | 2.2 | | | 1,233 | | 2.1 | |

Paperboard and other paper | | 1,315 | | 1,300 | | 1,245 | | 1,253 | | 1.8 | | | 1,222 | | 2.1 | |

Other goods | | 32,685 | | 32,435 | | 31,236 | | 32,873 | | 46.3 | | | 27,018 | | 46.4 | |

| | | | | | | | | | | | | | | | |

Total | | $70,992 | | $73,177 | | $69,920 | | $71,023 | | 100.0 | % | | $58,174 | | 100.0 | % |

| | | | | | | | | | | | | | | | |

Source: Institut de la statistique du Québec.

Table 6

Québec’s International Imports of Goods

| | | | | | | | | | | | | | | | | | | | | |

| | | 2005 | | 2006 | | 2007 | | 2008 | | % of Total

2008 | | | 2009 | | % of Total

2009 | |

| | | (dollar amounts in millions) | |

| | | | | | | |

Mineral fuels, mineral oils, bituminous substances and mineral waxes | | $ | 16,992 | | $ | 18,392 | | $ | 18,142 | | $ | 22,236 | | 25.4 | % | | $ | 12,855 | | 18.3 | % |

Motor vehicles, trailers, bicycles, motorcycles and other similar vehicles | | | 10,673 | | | 11,297 | | | 11,785 | | | 11,422 | | 13.0 | | | | 9,175 | | 13.1 | |

Nuclear reactors, boilers, machinery and mechanical appliances | | | 9,264 | | | 8,909 | | | 7,636 | | | 8,194 | | 9.4 | | | | 7,300 | | 10.4 | |

Electrical or electronic machinery and equipment | | | 7,913 | | | 7,213 | | | 5,980 | | | 5,754 | | 6.6 | | | | 5,235 | | 7.4 | |

Pharmaceutical products | | | 2,266 | | | 2,704 | | | 2,138 | | | 2,179 | | 2.5 | | | | 3,419 | | 4.9 | |

Aircraft and spacecraft | | | 2,140 | | | 2,172 | | | 3,894 | | | 3,611 | | 4.1 | | | | 2,514 | | 3.6 | |

Optical, medical, photographic, scientific and technical instrumentation | | | 1,602 | | | 1,658 | | | 1,749 | | | 1,951 | | 2.2 | | | | 1,859 | | 2.6 | |

Inorganic chemicals and compounds of precious metals and radioactive elements | | | 1,568 | | | 1,958 | | | 2,001 | | | 2,562 | | 2.9 | | | | 1,823 | | 2.6 | |

Plastics and articles thereof | | | 1,674 | | | 1,716 | | | 1,736 | | | 1,936 | | 2.2 | | | | 1,735 | | 2.5 | |

Rubber and articles thereof | | | 671 | | | 743 | | | 822 | | | 1,388 | | 1.6 | | | | 1,396 | | 2.0 | |

Pearls, precious stones or metals, coins and jewelry | | | 723 | | | 1,333 | | | 1,826 | | | 1,936 | | 2.2 | | | | 1,377 | | 2.0 | |

Other goods | | | 21,787 | | | 22,780 | | | 23,125 | | | 24,408 | | 27.9 | | | | 21,499 | | 30.6 | |

| | | | | | | | | | | | | | | | | | | | | |

Total | | $ | 77,273 | | $ | 80,876 | | $ | 80,835 | | $ | 87,577 | | 100.0 | % | | $ | 70,187 | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | |

Source: Institut de la statistique du Québec.

- 14 -

Table 7

Selected Trade Indicators for Québec

| | | | | | | | | | | | | | | |

| | | 2005 | | 2006 | | 2007 | | 2008 | | 2009 |

| | | (dollar amounts in millions) |

| | | | | |

Exports of Goods and Services | | $ | 144,380 | | $ | 150,101 | | $ | 152,688 | | $ | 155,088 | | $ | 133,822 |

Exports to other countries | | | 91,057 | | | 93,352 | | | 93,770 | | | 94,975 | | | 76,963 |

Exports of goods to other countries | | | 79,075 | | | 80,884 | | | 81,239 | | | 82,319 | | | 65,292 |

Exports of services to other countries | | | 11,982 | | | 12,468 | | | 12,531 | | | 12,656 | | | 11,671 |

Exports to other provinces | | | 53,324 | | | 56,749 | | | 58,919 | | | 60,113 | | | 56,859 |

Exports of goods to other provinces | | | 31,931 | | | 33,179 | | | 34,088 | | | 34,869 | | | 31,734 |

Exports of services to other provinces | | | 21,392 | | | 23,571 | | | 24,831 | | | 25,244 | | | 25,125 |

| | | | | |

Ratio of Exports to Nominal GDP | | | 53.1% | | | 53.2% | | | 51.3% | | | 51.3% | | | 44.5% |

| | | | | |

Imports of Goods and Services | | $ | 152,054 | | $ | 158,219 | | $ | 163,964 | | $ | 176,344 | | $ | 159,459 |

Imports from other countries | | | 94,870 | | | 99,080 | | | 103,206 | | | 113,153 | | | 97,568 |

Imports of goods from other countries | | | 83,075 | | | 86,820 | | | 90,527 | | | 100,120 | | | 84,697 |

Imports of services from other countries | | | 11,795 | | | 12,260 | | | 12,679 | | | 13,033 | | | 12,871 |

Imports from other provinces | | | 57,184 | | | 59,140 | | | 60,759 | | | 63,192 | | | 61,890 |

Imports of goods from other provinces | | | 31,760 | | | 32,068 | | | 31,930 | | | 33,546 | | | 30,792 |

Imports of services from other provinces | | | 25,424 | | | 27,071 | | | 28,829 | | | 29,646 | | | 31,098 |

Sources: Institut de la statistique du Québec and Statistics Canada.

Labor Force. In 2009, the labor force was estimated at 4.2 million persons, an increase of 0.3% from 2008. The labor force participation rate for 2009 was estimated at 65.2% in Québec, compared with 67.3% in Canada. Total employment decreased by 1.0% in 2009 in Québec, compared to a 1.6 % decrease in Canada. The unemployment rate in Québec increased from 7.2% in 2008 to 8.5% in 2009, compared with an increase from 6.1% to 8.3% in Canada for the same period.

Energy. Of the total energy consumed in Québec in 2007 (the most recent year for which information is available), energy derived from electricity accounted for 39.9 %, oil for 37.7 %, natural gas for 13.1 %, biomass for 8.6 % and coal for 0.9%.

Québec generates approximately one-third of all electricity produced in Canada and is one of the largest producers of hydroelectricity in the world. In 2009, approximately 97% of all electricity produced in Québec was from hydroelectric installations. More than 45 000 megawatts (“MW”) of hydroelectric capacity (including the capacity of independent producers and the firm capacity currently available from Churchill Falls (Labrador) Corporation Limited) have been or are in the process of being developed. Of the total electricity produced in Québec in 2009, 16.0 % (based on sales volume) was exported to the United States and to other Canadian provinces, compared with 14.0 % in 2008.

Free Trade Agreements

Canada is a member of the World Trade Organization (“WTO”) and has also signed other trade agreements in order to promote commerce with economic partners. In 1989, the United States and Canada entered into a free trade agreement (“FTA”), which has led to the gradual elimination of tariffs on goods and services between the two countries and to the liberalization of trade in several sectors including the energy sector. The FTA provides for a binding binational review of domestic determinations in antidumping and countervailing duty cases and for binational arbitration of disputes between Canada and the United States as to either’s compliance with the FTA or with the rules of the WTO. In 1994, Canada, the United States and Mexico signed a similar free trade agreement, the North American Free Trade Agreement (“NAFTA”),

- 15 -

which resulted, with a few exceptions, in the gradual elimination by 2003 of tariffs on goods and services among Canada, the United States and Mexico. In April 1998, negotiations were undertaken between countries of the Americas (North, Central and South) to reach a new trade agreement by January 1, 2005 (Free Trade Area of the Americas or “FTAA”). Although the January 1, 2005 deadline was not met, parties to the negotiations of the FTAA have reaffirmed their commitment to pursue such negotiations in the future. Canada and the European Union have begun negotiations regarding a free trade agreement in 2010, with the aim of reaching an agreement in 2011. Canada has also entered into bilateral free trade agreements in 1997 with Chile and Israel, in 2000 with Costa Rica and in 2009 with Peru and the member states of the European Free Trade Association (Norway, Switzerland, Iceland and Liechtenstein). In March 2010, Canada tabled legislation for the implementation of the free trade agreements signed with Columbia and Jordan, which will come into effect on dates to be determined. On May 14, 2010, Canada and Panama signed a free-trade agreement which is expected to come into effect once legislation has been adopted in both countries. On February 12, 2010, Canada and the United States signed the Agreement on Government Procurement which, notably, provides Canadians with permanent access to U.S. state and local government procurement commitments in exchange for permanent U.S. access to Canadian provincial and territorial procurement contracts in accordance with the WTO Government Procurement Agreement.

Softwood Dispute. In April 2001, a coalition of American lumber producers and various labor unions filed a petition with the U.S. Department of Commerce (“DoC”) and the U.S. International Trade Commission (“ITC”) alleging that softwood lumber imports from Canada were subsidized by the federal and provincial governments. As a result, in early 2002, the DoC and the ITC established countervailing duties (“CVD”) and antidumping duties (“AD”) on softwood lumber imports. The Government and the federal government have consistently denied these allegations, and the federal government and the Canadian lumber industry challenged the U.S. measures under NAFTA and WTO agreements. A NAFTA panel and a WTO panel have issued various rulings in connection with these challenges, to which DoC and ITC have responded. Over this period, the rates of CVD and AD have changed several times, and the combined rates have varied from 10.8% to 27.22%. On December 6, 2005, as a result of an administrative review, the combined rate dropped to 10.8%, representing a CVD rate of 8.7% and an AD rate of 2.1%. The U.S. government and Canada subsequently entered into a Softwood Lumber Agreement that came into effect on October 12, 2006 (“SLA”).

Under the terms of the SLA, Canadian lumber exports from provinces covered by the dispute are subject to an export charge only (Option A) or an export charge plus volume restraint (Option B) if the prevailing monthly price of lumber (as defined in the SLA) drops below US$355 per thousand board feet. The total volume of permitted exports, which takes into account anticipated demand in the United States, is allocated to the concerned provinces. Provincial quotas are calculated on the basis of the share of lumber exports over the period from April 1, 2001 to December 31, 2005.

Québec’s choice of Option B involves:

| • | | no charge and no volume restraint, if the price of lumber is over US$355; |

| • | | a 2.5% export charge and Québec’s volume cannot exceed a share of 34% of expected U.S. consumption for the month, if the price of lumber is between US$336 and US$355; |

| • | | a 3% export charge and Québec’s volume cannot exceed a share of 32% of expected U.S. consumption for the month, if the price of lumber is between US$316 and US$335; |

| • | | a 5% export charge and Québec’s volume cannot exceed a share of 30% of expected U.S. consumption for the month, if the price of lumber is US$315 or below. |

From July 2006 until recently, the reference price index (Random Lengths Framing Lumber Composite) remained below US$315. The reference price index for the month of May 2010 was US$325 and for the month of June 2010 was US$361.

Unless terminated by either party, the SLA is to remain in force through 2013 and may be renewed for an additional 2 year period.

In accordance with the dispute resolution mechanism of the SLA, the United States initiated arbitration proceedings in the London Court of International Arbitration (“LCIA”) in August 2007. The United States alleged Canada’s breach of the SLA due to its failure to: (1) adequately calculate the export measures based on the adjusted expected U.S. consumption of lumber; and (2) impose the agreed-upon export measures beginning in January 2007. In addition, the United States alleged that Canada, through its provincial governments of Québec and Ontario, had breached the SLA by providing grants and other benefits that circumvent Canada’s commitments under the SLA. In particular, Québec’s Forest Management Measures program and $425 Million Forest Sector Financing Envelope were alleged to violate the SLA’s anti-circumvention provision. On February 18, 2008, Canada formally denied that it violated any provisions of the SLA and stated that such financing envelope was part of Investment Québec’s loan and loan guarantee programs used by all sectors of the Québec economy and had been in operation for over 20 years.

- 16 -

In its decision of March 3, 2008, the LCIA concluded that Canada did not breach the SLA with respect to the calculation of the export measures, but did breach the SLA by failing to impose such export measures as of January 1, 2007. The remedial phase relating to the March 3, 2008 decision ran from May 29, 2008 to a final remedy hearing on September 22-24, 2008. On February 23, 2009, following the remedy hearings, the LCIA issued its decision on the cure of the breach which requires Canada to collect additional 10% ad valorem export charge on softwood lumber shipments from the concerned regions for a total remedy amount of $68.26 million (including interest of $4.36 million). All other claims raised in the arbitration were dismissed.

In response to this decision and taking into account the hearings on the breach, Canada tendered US$34 million plus interest to the United States on March 27, 2009 as a means of curing the breach. The United States did not accept Canada’s tender. Instead, the United States has imposed a compensatory charge of 10% that went into effect on April 15, 2009. This charge will remain in effect until the United States has collected US$54.8 million. Canada pursued arbitration to challenge this charge, but was unsuccessful.

The proceedings, which began in July 2009 and are ongoing, relate to the United States’ allegation that the Ontario and Québec programs circumvent Canada’s SLA commitments. According to the January 21, 2010 Procedural Order No. 6, the LCIA has mandated the experts representing Canada and the United States to confer and present jointly, if possible, a report estimating the yearly benefits of each of the provincial programs for Ontario and Québec. On the basis of these estimates, the experts are to calculate the reduction or offset of the Export Measures as defined in the SLA. The joint report is now scheduled to be presented to the LCIA no later than June 30, 2010. The LCIA’s decision on this part of the dispute is expected before the end of 2010.

Government Finances

Financial Administration

The Minister of Finance is responsible for the general administration of the Government’s finances. The Financial Administration Act and the Balanced Budget Act govern the management of public monies of Québec and the Public Administration Act governs the management of financial, human, physical and information resources of the Administration.

Since January 2007, the Minister of Finance also manages the Generations Fund. This fund was established in June 2006 pursuant to the Act to reduce the debt and establish the Generations Fund, in order to reduce the Government’s debt burden.

The Conseil exécutif issues Orders in Council that authorize the Minister of Finance to enter into financial contracts, including those related to borrowings by the Government. The Conseil du trésor determines the accounting policies.

The accounts of the Government are kept on a modified accrual basis. The fiscal year of the Government ends March 31. The Auditor General of Quebec is responsible for the auditing of the consolidated financial statements of the Government and reporting annually to the National Assembly. All revenues and monies over which the Parliament has power of appropriation form the Consolidated Revenue Fund of Québec. The Budget and appropriations from the Consolidated Revenue Fund and consolidated entities are published at the beginning of each fiscal year.

In 2007, the Government undertook a major reform of its accounting policies in order to fully comply with Canadian generally accepted accounting principles (GAAP) applicable to the public sector. In this regard, the Government’s reporting entity includes, as of April 1, 2006, the financial results of public health and social services institutions, school boards and CEGEPs (Collège d’enseignement général et professionnel), as well as the Université du Québec and its branches. Consolidated entities are thus presented in three separate groups: the non-budget-funded bodies and special funds, the health and social services and education networks, and the Generations Fund.

The accounts of the Consolidated Revenue Fund and the other entities included in the Government’s reporting entity, with the exception of Government enterprises, are consolidated line by line in the financial statements.

- 17 -

As of Fiscal 2010, the transactions of the health and social services and education networks are presented line-by-line, whereas in previous years only the net financial results were incorporated into Government’s financial statements.

Transactions are classified as “budgetary”, “non-budgetary” or “financing”:

| • | | budgetary transactions include: |

With respect to the Consolidated Revenue Fund:

| | • | | revenue consisting of taxes, duties and permits, net results from Government enterprises1, transfers from the federal government and miscellaneous sources; and |

| | • | | expenditure consisting of operating expenditures for goods and services which include, among other things, transfer payments, remuneration and debt service. |

With respect to consolidated entities2:

| | • | | the net result of their self-generated revenues less their expenditures offset by transfers from the Consolidated Revenue Fund. |

| • | | non-budgetary transactions include changes in the balances of investments, loans and advances made by the Government, particularly to its own enterprises, changes in net fixed assets made by the Government, changes in the retirement plans liability and changes in other accounts. As of Fiscal 2010, non-budgetary transactions related to the health and social services and education networks are being consolidated line-by-line for the first time. Over the past two years, they have been shown separately under the item “net investment in the networks.” |

| • | | financing transactions include changes in cash position, changes in net borrowings, changes in the retirement plans sinking fund and funds dedicated to employee’s future benefits and changes in the Generations Fund. |

The Balanced Budget Act is designed to ensure that, on multi-year basis, the Government maintains a balanced budget. Any sum that exceeds the budgetary balance or surplus objectives determined by the Act (an “Overrun”) by less than $1 billion in a fiscal year must be offset by the Government in the next fiscal year. If an Overrun exceeding $1 billion stems from any of the exceptional circumstances defined in the Act, the Government may exceed the deficit objective for more than one year, but must offset the Overrun over a maximum period of five years.

This Act also provides for a stabilization reserve fund that facilitates the Government’s multi-year budget planning. The stabilization fund is made up of surpluses for each fiscal year and its purpose is to enable multi-year planning of the Government’s financial framework. It is used primarily to maintain a balanced budget and, secondarily, for payment of sums into the Generations Fund.

In 2009, final figures showed that expenditure exceeded revenue by $1,258 million. By drawing from the stabilization reserve, the deficit was reduced from $1,258 million to zero for the purposes of the Balanced Budget Act. According to the 2010-2011 Budget, the budgetary balance within the meaning of the Balanced Budget Act is expected to be in deficit by $4.3 billion for Fiscal 2010 and by $4.5 billion for Fiscal 2011.

These budgetary deficits for Fiscal 2010 and Fiscal 2011 are authorized under the Balanced Budget Act as amended pursuant to the Act to amend the Balanced Budget Act and various legislative provisions concerning the implementation of the accounting reform, which came into force on September 21, 2009. The amendments to the Balanced Budget Act were first proposed by the Government in its 2009-2010 Budget tabled in March 2009. The main objective of these amendments is to ensure an expedient return to economic growth by implementing economic measures that will support the economy and promote employment during the recession which affected Québec as a result of the 2008 international financial crisis.

The amended Balanced Budget Act further provides that :

| | • | | the Government must present definitive objectives for decreasing budgetary deficits for Fiscal 2012 and Fiscal 2013 at the latest in the 2011-2012 Budget Speech; |

| 1 | Government enterprises are separate legal entities that have the authority to enter into contracts in their own name and to act before the courts. Their main activity is the sale of goods or the delivery of services to individuals or to organizations not included in the Government’s reporting entity. |

| 2 | Consolidated entities are those entities required to report to the National Assembly for the management of their operations and for the use of their financial resources. They include non-budget-funded bodies and special funds that pursue objectives complementary to governmental programs but exclude Government enterprises. They include also the vast majority of organizations of the Government’s health and social services and education networks and the Generations Fund. From an administrative and accounting point of view, consolidated entities are under the direct control of the Government and form entities distinct from the Consolidated Revenue Fund. |

- 18 -

| | • | | the revenue and expenditures established in accordance with the Government’s accounting policies must be balanced for Fiscal 2014. |

The amended Balanced Budget Act also implements a reform of the accounting practices of the Government that provides for the full consolidation of financial information from bodies in the health and social services and educational networks with that of the Government.

The Government fully subscribes to the objectives of the Balanced Budget Act, which has applied to it since 1996. In the financial framework of the 2010-2011 Budget, the Government implemented measures designed to restore, if the economy recovers as expected, a balanced budget by Fiscal 2014.

The following table summarizes the consolidated financial transactions of the Government for the three years ended March 31, 2009, the preliminary results for Fiscal 2010 and the budget forecast for Fiscal 2011.

- 19 -

Table 8

Summary of Consolidated Financial Transactions (1)

| | | | | | | | | | | | | | | |

| | | Year ending March 31 | |

| | | 2007 | | | 2008 | | | 2009 | | | Preliminary

Results

2010(2) (3) | | | Budget

Forecast

2011 (3) (4) | |

| | | (dollar amounts in millions) | |

| | | | | |

Budgetary transactions of the Consolidated Revenue Fund | | | | | | | | | | | | | | | |

| | | | | |

Own-source revenue | | $49,651 | | | $49,464 | | | $48,893 | | | $47,421 | | | $50,152 | |

Federal transfers | | 11,015 | | | 13,629 | | | 14,023 | | | 15,229 | | | 15,325 | |

| | | | | | | | | | | | | | | |

Total revenue | | 60,666 | | | 63,093 | | | 62,916 | | | 62,650 | | | 65,477 | |

| | | | | |

Program spending | | (51,734 | ) | | (54,826 | ) | | (58,550 | ) | | (60,769 | ) | | (62,561 | ) |

Debt service | | (7,039 | ) | | (7,021 | ) | | (6,504 | ) | | (6,154 | ) | | (6,980 | ) |

| | | | | | | | | | | | | | | |

Total expenditure | | (58,773 | ) | | (61,847 | ) | | (65,054 | ) | | (66,923 | ) | | (69,541 | ) |

| | | | | | | | | | | | | | | |

| | | | | |

Contingency reserve | | — | | | — | | | — | | | (300 | ) | | (300 | ) |

| | | | | | | | | | | | | | | |

| | | | | |

Net results of Consolidated Revenue Fund | | 1,893 | | | 1,246 | | | (2,138 | ) | | (4,573 | ) | | (4,364 | ) |

| | | | | |

Net results of consolidated entities | | 100 | | | 404 | | | 880 | | | 598 | | | 750 | |

| | | | | | | | | | | | | | | |

Surplus (deficit) within the meaning of the public accounts | | 1,993 | | | 1,650 | | | (1,258 | ) | | (3,975 | ) | | (3,614 | ) |

| | | | | |

Revenue of the Generations Fund | | (584 | ) | | (449 | ) | | (587 | ) | | (715 | ) | | (892 | ) |

| | | | | |

Stabilization reserve (5) | | (1,300 | ) | | (1,201 | ) | | 1,845 | | | 433 | | | — | |

| | | | | | | | | | | | | | | |

| | | | | |

Consolidated budgetary balance within the meaning of the Balanced Budget Act | | 109 | | | 0 | | | 0 | | | (4,257 | ) | | (4,506 | ) |

Deposit of dedicated revenues in the Generations Fund (6) | | 584 | | | 449 | | | 587 | | | 715 | | | 892 | |

| | | | | | | | | | | | | | | |

| | | | | |

Consolidated budgetary balance | | 693 | | | 449 | | | 587 | | | (3,542 | ) | | (3,614 | ) |

| | | | | |

Consolidated non-budgetary transactions(7) | | | | | | | | | | | | | | | |

Investments, loans and advances | | (2,213 | ) | | (2,658 | ) | | (1,086 | ) | | (496 | ) | | (1,281 | ) |

Fixed assets | | (1,177 | ) | | (1,457 | ) | | (2,297 | ) | | (4,599 | ) | | (4,653 | ) |

Net investments in the networks (8) | | (1,002 | ) | | (487 | ) | | (622 | ) | | — | | | — | |

Retirement plans | | 2,559 | | | 2,458 | | | 2,274 | | | 2,410 | | | 2,667 | |

Other accounts (9) | | (1,676 | ) | | 988 | | | 614 | | | (803 | ) | | (98 | ) |

Consolidated non-budgetary requirements | | (3,453 | ) | | (1,156 | ) | | (1,117 | ) | | (3,488 | ) | | (3,365 | ) |

| | | | | | | | | | | | | | | |

Consolidated net financial requirements | | $(2,760 | ) | | $(707 | ) | | $(530 | ) | | $(7,030 | ) | | $(6,979 | ) |

| | | | | | | | | | | | | | | |

| | | | | |

Consolidated financing transactions | | | | | | | | | | | | | | | |

Change in cash position (10) | | (3,284 | ) | | 2,965 | | | (4,639 | ) | | 4,136 | | | 3,855 | |

Net borrowings (11) | | 11,076 | | | 3,286 | | | 10,806 | | | 6,212 | | | 6,718 | |

Retirement plans’ sinking fund (12) and funds dedicated to employee’s future benefits (13) | | (4,448 | ) | | (4,895 | ) | | (4,918 | ) | | (2,355 | ) | | (2,133 | ) |

Generations Fund (6) | | (584 | ) | | (649 | ) | | (719 | ) | | (715 | ) | | (892 | ) |

| | | | | | | | | | | | | | | |

| | | | | |

Total consolidated financing transactions | | $2,760 | | | $707 | | | $530 | | | $7,278 | | | $7,548 | |

| | | | | | | | | | | | | | | |

| ( 1 ) | The categories set forth reflect the presentation of the 2010-2011 Budget. |

| (2) | The Preliminary Results 2010 are based on financial information presented as at March 31, 2010 in the 2010-2011 Budget which was tabled on March 30, 2010. These preliminary results are subject to change. |

| ( 3 ) | The net financial requirements in the 2010-2011 Budget take into account the budgetary and non-budgetary transactions of the health and social services and education networks for fiscal years 2010 and 2011. |

| ( 4 ) | Includes the impact of the Plan to Restore Fiscal Balance (see “Government Finances – 2010-2011 Budget”) |

| ( 5 ) | A negative amount indicates an allocation to the reserve and a positive amount, a use of the reserve. |