A Message from the President of Pear Tree Funds

Pear Tree Axiom Emerging Markets World Equity Fund

September [●], 2023

Dear Shareholder:

At the upcoming shareholder meeting of Pear Tree Axiom Emerging Markets World Equity Fund (“Emerging Markets Fund”), you will be asked to consider the proposed Reorganization of Emerging Markets Fund with and into Pear Tree Polaris International Opportunities Fund (“International Opportunities Fund”). Both funds are separate series of Pear Tree Funds (the “Trust”), although each has its own assets and liabilities. In this proposed merger, shares of Emerging Markets Fund would, in effect, be exchanged for shares of International Opportunities Fund with an equal total net asset value. The exchange is expected to qualify as a tax-free reorganization for U.S. federal income tax purposes.

Pear Tree Advisors, Inc. (the “Manager”), which serves as the investment manager to both Emerging Markets Fund and International Opportunities Fund, is recommending the proposed Reorganization because it believes that it is in the best interests of both funds and their shareholders. The Manager believes that the funds are appropriate merger partners, noting that Emerging Markets Fund and International Opportunities Fund have generally similar investment objectives, with Emerging Markets Fund seeking long-term capital growth and International Opportunities Fund seeking long-term capital appreciation. The Manager also believes that the combined fund would have greater commercial and scale prospects, which would further benefit shareholders.

The Pear Tree Funds’ Trustees have carefully reviewed the terms of the proposed Reorganization, and they have determined to recommend that shareholders of Emerging Markets Fund approve the proposed Reorganization as proposed. Details regarding the terms of the proposed Reorganization, as well as its potential benefits and costs to shareholders, are discussed in the Combined Prospectus/Proxy Statement, which we urge you to review carefully.

If you have questions, please call us at (800) 326-2151 or contact your broker or financial intermediary.

Sincerely,

Willard L. Umphrey

President of Pear Tree Funds

Table of Contents

Notice of a Special Meeting of Shareholders

Combined Prospectus/Proxy Statement

PROXY CARD(S) ENCLOSED

If you have any questions, please contact us at (800) 326-2151 or call your broker or financial intermediary. Please refer to your proxy card for the touchtone voting phone number and web address for voting.

Important Notice Regarding the Availability of Proxy Materials for the Special Shareholder Meeting to be held on October [●], 2023.

The Combined Prospectus/Proxy Statement for this meeting is available at [●]

| 1 | Pear Tree Funds Combined Prospectus/Proxy Statement September __, 2023 |

Notice of a Special Meeting of Shareholders

To the Shareholders of Pear Tree Axiom Emerging Markets World Equity Fund:

This is the formal agenda for a Special Shareholders’ Meeting of Pear Tree Axiom Emerging Markets World Equity Fund (“Emerging Markets Fund”). It tells you what matters will be voted on and provides the time and place of the meeting in case you wish to attend in person.

A Special Meeting of Shareholders of Emerging Markets Fund will be held on October [●], 2023, at [11:00] a.m. Eastern Time, at 55 Old Bedford Road Lincoln, Massachusetts 01773 to consider the following proposal:

| 1. | Approving a Plan of Reorganization providing for the transfer of all of the assets of Pear Tree Axiom Emerging Markets World Equity Fund to Pear Tree Polaris International Opportunities Fund in exchange for the assumption by Pear Tree Polaris International Opportunities Fund of all of the liabilities of Pear Tree Axiom Emerging Markets World Equity Fund, the issuance and delivery of shares of beneficial interest of Pear Tree Polaris International Opportunities Fund, and the distribution of these shares to the shareholders of Pear Tree Axiom Emerging Markets World Equity Fund in complete liquidation of Pear Tree Axiom Emerging Markets World Equity Fund. |

By Deborah H. Kessinger, Clerk, and by the Trustees

John M. Bulbrook, Lead Independent Trustee

William H. Dunlap

Clinton S. Marshall

Willard L. Umphrey

In order for you to be represented at the Emerging Markets Fund’s special shareholder meeting, we urge you to record your voting instructions over the Internet or by telephone or to mark, sign, date, and mail the enclosed proxy card(s) in the postage-paid envelope provided.

September [●], 2023

| 2 | Pear Tree Funds Combined Prospectus/Proxy Statement September __, 2023 |

COMBINED Prospectus/Proxy Statement

[_________], 2023

Acquisition of the assets and assumption of the liabilities of

Pear Tree Axiom Emerging Markets World Equity Fund

A series of Pear Tree Funds

55 Old Bedford Road

Lincoln, Massachusetts 01773

(781) 259-1144

by and in exchange for shares of

Pear Tree Polaris International Opportunities Fund

A series of Pear Tree Funds

55 Old Bedford Road

Lincoln, Massachusetts 01773

(781) 259-1144

This Combined Prospectus/Proxy Statement is a proxy statement for Pear Tree Axiom Emerging Markets World Equity Fund (“Emerging Markets Fund”), and a prospectus for Pear Tree Polaris International Opportunities Fund (“International Opportunities Fund,” and together with Emerging Markets Funds, the “Funds”), each a series of the Pear Tree Funds (the “Trust”), an open-end management investment company. This Combined Prospectus/Proxy Statement and the enclosed proxy card are being mailed to shareholders of Emerging Markets Fund are being mailed to shareholders on or about September [●], 2023. This Combined Prospectus/Proxy Statement contains information you should know before voting on the following proposal. You should read this document carefully and retain it for future reference.

| 1. | Approving a Plan of Reorganization providing for the transfer of all of the assets of Pear Tree Axiom Emerging Markets World Equity Fund to Pear Tree Polaris International Opportunities Fund in exchange for the assumption by Pear Tree Polaris International Opportunities Fund of all of the liabilities of Pear Tree Axiom Emerging Markets World Equity Fund, the issuance and delivery of shares of beneficial interest of Pear Tree Polaris International Opportunities Fund, and the distribution of these shares to the shareholders of Pear Tree Axiom Emerging Markets World Equity Fund in complete liquidation of Pear Tree Axiom Emerging Markets World Equity Fund. |

The proposal will be considered by shareholders who owned shares of Emerging Markets Fund on August 7, 2023 at a meeting of shareholders (the “Meeting”) that will be held [11:00 a.m.] Eastern Time, at the offices of Pear Tree Advisors, Inc. (the “Manager”), the investment manager of both Funds, at 55 Old Bedford Road, Lincoln, Massachusetts 01773.

| 3 | Pear Tree Funds Combined Prospectus/Proxy Statement September __, 2023 |

The Plan of Reorganization (the “Plan”), and the transactions contemplated thereby (collectively, the “Reorganization”), have been approved by the Trustees of the Trust. Under the Plan, shareholders of Ordinary, Institutional and R6 Shares of Emerging Markets Fund would receive Ordinary, Institutional and R6 Shares of Pear Tree Polaris International Opportunities Fund (“International Opportunities Fund,” and together with Emerging Markets Funds, the “Funds”) as of the closing date of the Reorganization. Upon completion of the Reorganization, Emerging Markets Fund would be terminated as a separate series of the Trust and International Opportunities Fund would continue as the surviving fund. The Reorganization is expected to be consummated during the fourth quarter 2023. Failure of any of the conditions to closing as described herein, including approval of the Plan by shareholders of Emerging Markets Fund, could result in the Reorganization not being completed. If the Reorganization is not completed, it is expected that Emerging Markets Fund and International Opportunities Fund would continue to operate as separate series of the Trust.

The Trustees of the Trust have determined, among other things, that the Reorganization is in the best interests of each of Emerging Markets Fund and International Opportunities Fund, and that the interests of each Fund’s shareholders will not be diluted as a result of the Reorganization. For U.S. federal income tax purposes, the Reorganization will be treated as a tax-free reorganization of Emerging Markets Fund into International Opportunities Fund for Emerging Markets Fund shareholders.

The Funds have the same investment manager, but different investment sub-advisers and portfolio managers. The investment objectives of the Funds are substantially similar: Emerging Markets Fund seeks long-term growth of capital and International Opportunities Fund seeks long-term capital appreciation. The Funds also have similar principal investment strategies and risks. Each Fund invests at least 80 percent of its assets in foreign securities, with Emerging Markets Fund investing principally in a diversified portfolio of emerging markets securities, and International Opportunities Fund investing principally in a non-diversified portfolio of securities from foreign developed markets as well as emerging markets. Emerging Markets Fund generally has higher management fees and expense rations than International Opportunities Fund.

In anticipation of the Reorganization, the Manager expects to dispose of approximately [●] percent of Emerging Markets Fund’s current portfolio holdings to align the number of holdings in the portfolio more closely with International Opportunities Fund’s strategy. For a discussion of the tax impact of these sales, please see “Information about the proposed Reorganization—Federal Income Tax Consequences.”

This Combined Prospectus/Proxy Statement sets forth concisely the information about International Opportunities Fund that shareholders of Emerging Markets Fund should know when considering whether to approve the Plan and invest in International Opportunities Fund, and it should be read and retained by investors for future reference.

The following documents have been filed with the Securities and Exchange Commission (the “SEC”) and are incorporated into this Combined Prospectus/Proxy Statement by reference:

| ● | The Statement of Additional Information relating to the Reorganization dated the same date as this Combined Prospectus/Proxy Statement, as supplement to date (the “Merger SAI”) (File No. [●]); |

| ● | The Prospectus and Statement of Additional Information of Pear Tree Funds dated August 1, 2023, as supplemented (File Nos. 333-102055 and 811-03790), which relate to Emerging Markets Fund, as supplement to date; and |

| 4 | Pear Tree Funds Combined Prospectus/Proxy Statement September __, 2023 |

| ● | The Statement of Additional Information of Pear Tree Funds dated August 1, 2023, as supplemented (File Nos. 333-102055 and 811-03790), which relates to International Opportunities Markets Fund, as supplement to date. |

Copies of these documents are available without charge and can be obtained by visiting the Pear Tree Funds’ website at www.peartreefunds.com, by calling Pear Tree Funds, Attention: Transfer Agent toll-free at 1-800-326-2151, or by emailing Pear Tree Funds at info@peartreefunds.com.

Each Fund is subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended (the “1940 Act”), and files reports, proxy materials and other information with the SEC. These reports, proxy materials and other information may be inspected and copied at the Public Reference Room maintained by the SEC. Copies may be obtained, after paying a duplicating fee, by electronic request at publicinfo@sec.gov, or by writing to the Public Reference Branch of the SEC Office of Consumer Affairs and Information Services, 100 F Street, N.E., Washington, D.C. 20549¬0102. In addition, copies of these documents may be viewed online or downloaded from the SEC’s website at www.sec.gov.

investments in either Fund are not bank deposits, are not federally insured, are not guaranteed by any bank or government agency and may lose value. There is no assurance that either Fund will achieve its investment objective.

AS WITH SHARES OF ALL OPEN-END MUTUAL FUNDS, THE SEC HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES OR PASSED ON THE ADEQUACY OF THE DISCLOSURE IN THIS COMBINED PROSPECTUS/INFORMATION STATEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

[Rest of page intentionally left blank]

| 5 | Pear Tree Funds Combined Prospectus/Proxy Statement September __, 2023 |

Appendix A – Plan of Reorganization

| 6 | Pear Tree Funds Combined Prospectus/Proxy Statement September __, 2023 |

At a meeting held on July 25, 2023, the Trustees of Pear Tree Funds (the “Trust”), including all of the trustees who are not “interested persons” of the Trust, as that term is defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended (the “1940 Act”), considered and approved a Plan of Reorganization (the “Plan of Reorganization”) for Pear Tree Axiom Emerging Markets World Equity Fund (“Emerging Markets Fund”).

The Plan of Reorganization generally provides that Emerging Markets Fund would transfer all of its assets to Pear Tree Polaris International Opportunities Fund (“International Opportunities Fund,” and together with Emerging Markets Fund, the “Funds”) in exchange for that number of Ordinary, Institutional, and R6 Shares of International Opportunities Fund equivalent in aggregate net asset value to the aggregate net asset value of the Ordinary, Institutional, and R6 Shares of Emerging Markets Fund outstanding immediately prior to the Closing Date (as described below), and the assumption by International Opportunities Fund of all of Emerging Markets Fund’s stated liabilities. That transfer and exchange would be followed by a distribution of the International Opportunities Fund shares to Emerging Markets Fund’s Ordinary, Institutional, and R6 shareholders so that each Emerging Markets Fund shareholder would receive shares of International Opportunities Fund equivalent to the value of Emerging Markets Fund shares held by such shareholder as of the Valuation Time (as described below).

Unless delayed for any reason, the Valuation Time is expected to occur as of the close of regular trading on the NYSE on November __, 2023, and the Closing Date is expected to occur on the following business day, that is _____ __, 2023. Emerging Markets Fund will then be liquidated and terminated as a separate series of the Trust and International Opportunities Fund will continue as the surviving fund.

As set forth in the Plan of Reorganization, the proposed Reorganization is subject to normal and customary closing conditions as described therein, including approval of the Plan of Reorganization and the transactions contemplated therein (the “Reorganization”) by the shareholders of Emerging Markets Fund. Failure of any of those closing conditions may result in the Reorganization not being completed.

A copy of the Plan of Reorganization is attached to this Combined Prospectus/Information Statement as Appendix A.

The costs associated with the proposed Reorganization are estimated to be approximately $[●]. Each Fund will bear its own costs, which represent fees and expenses, including legal and accounting expenses, portfolio transfer taxes (if any), the costs of printing and mailing this Combined Prospectus/Proxy Statement, proxy solicitation costs, SEC filing fees, and other similar expenses incurred in connection with the consummation of the proposed Reorganization. Joint expenses will be allocated between the Funds as determined by the Manager in its reasonable judgment Each Fund has been accruing anticipated expenses of the Reorganization since [July 26, 2023].

| 7 | Pear Tree Funds Combined Prospectus/Proxy Statement September __, 2023 |

The Trustees unanimously recommend that shareholders of Emerging Markets Fund approve the Plan and the proposed Reorganization

| B. | Comparison Fee Table and Example; Portfolio Turnover |

(i) Fees and Expenses of the Funds

The following table shows the comparative fees and expenses of the Funds as of March 31, 2023 (adjusted to account for changes in fee waiver agreements since that time). The table also reflects the pro forma combined fees for International Opportunities Fund after giving effect to the Reorganization. Neither Fund currently imposes any shareholder fees (i.e., fees paid directly from your investment), such as, sales charges (loads), redemption fees, or exchange fees.

Annual Fund Operating Expenses (expenses that are deducted from fund assets)

| | | Management

Fees | | | Distribution

(12b-1) Fees | | | Other

Expenses | | | Total Annual

Fund

Operating

Expenses | | | Fee Waiver

and/or

Expense Reimbursement | | | Total Annual Fund Operating Expenses after Fee Waiver and/or Expense Reimbursement | |

| Emerging Markets Fund |

| Ordinary Shares | | | 1.00 | % | | | 0.25 | % | | | 0.53 | % | | | 1.78 | % | | | 0.22 | %1 | | | 1.56 | %1 |

| Institutional Shares | | | 1.00 | % | | | None | | | | 0.53 | % | | | 1.53 | % | | | 0.34 | %1,2 | | | 1.19 | %1,2 |

| R6 Shares | | | 1.00 | % | | | None | | | | 0.37 | % | | | 1.37 | % | | | 0.38 | %1,3 | | | 0.99 | %1,3 |

| |

| International Opportunities Fund |

| Ordinary Shares | | | 0.90 | % | | | 0.25 | % | | | 0.45 | % | | | 1.60 | % | | | 0.10 | %4 | | | 1.50 | %4 |

| Institutional Shares | | | 0.90 | % | | | None | | | | 0.48 | % | | | 1.38 | % | | | 0.32 | %4,5,6 | | | 1.06 | %4,5,6 |

| R6 Shares | | | 0.90 | % | | | None | | | | 0.33 | % | | | 1.23 | % | | | 0.24 | %4,7 | | | 0.99 | %4,7 |

| |

| International Opportunities Fund (pro forma combined) |

| Ordinary Shares | | | 0.90 | % | | | 0.25 | % | | | 0.45 | % | | | 1.60 | % | | | 0.10 | %4 | | | 1.50 | %4† |

| Institutional Shares | | | 0.90 | % | | | None | | | | 0.48 | % | | | 1.38 | % | | | 0.32 | %4,5,6 | | | 1.06 | %4,5,6† |

| R6 Shares | | | 0.90 | % | | | None | | | | 0.33 | % | | | 1.23 | % | | | 0.24 | %4,7 | | | 0.99 | %4,7† |

| (1) | The Manager has contractually agreed until July 31, 2024 to waive such portion of the management fees that it would otherwise receive under its agreement with the Trust for serving as investment manager to Emerging Markets Fund, such that the aggregate management fee that the Manager would receive during the waiver period for serving as the investment manager of Emerging Markets Fund would be calculated using (a) an annual rate of 0.78 percent if Emerging Markets Fund’s net assets are up to $300 million, (b) an annual rate of 0.83 percent if Emerging Markets Fund’s net assets are between $300 million and $600 million, and (c) an annual rate of 0.88 percent if Emerging Markets Fund’s net assets are in excess of $600 million. This fee waiver only may be terminated with the approval of the Trustees. The Manager does not have a right to recoup from Emerging Markets Fund amounts that it has waived under that agreement. |

| 8 | Pear Tree Funds Combined Prospectus/Proxy Statement September __, 2023 |

| (2) | The Manager, in its capacity as transfer agent to the Trust, has contractually agreed until July 31, 2024 to waive such portion of the fees that it would otherwise receive for serving as transfer agent under its agreement with the Trust such that the aggregate transfer agent fee with respect to Institutional Shares would be calculated using an annual rate of 0.04 percent of the net assets of Emerging Markets Fund attributable to Institutional Shares. This fee waiver does not apply to Ordinary Shares or R6 Shares. This fee waiver only may be terminated with the approval of the Trustees. The Manager does not have a right to recoup from Emerging Markets Fund amounts that it has waived under that agreement. |

| (3) | The Manager has contractually agreed until July 31, 2024 to reimburse such portion of the expenses of Emerging Markets Fund attributable to R6 Shares such that “Total Annual Fund Operating Expenses after Fee Waiver and/or Expense Reimbursement” with respect to R6 Shares, other than extraordinary expenses, is not greater than 0.99 percent of Emerging Markets Fund’s net assets attributable to R6 Shares. The aggregate expenses of Emerging Markets Fund with respect to Ordinary and Institutional Shares remain unchanged. This fee waiver only may be terminated with the approval of the Trustees. The Manager does not have a right to recoup from Emerging Markets Fund amounts that it has waived or reimbursed under that agreement. |

| (4) | The Manager has contractually agreed until July 31, 2024 to waive such portion of the management fees that it would otherwise receive under its agreement with Pear Tree Funds for serving as investment manager to International Opportunities Fund such that the aggregate management fee that the Manager would receive during the waiver period for serving as the investment manager of International Opportunities Fund would be calculated using an annual rate of 0.80 percent of International Opportunities Fund’s net assets. This fee waiver only may be terminated with the approval of the Trustees. The Manager does not have a right to recoup from International Opportunities Fund amounts that it has waived under that agreement. |

| (5) | The Manager, in its capacity as transfer agent to Pear Tree Funds, has contractually agreed until July 31, 2024 to waive such portion of the fees that it would otherwise receive for serving as transfer agent under its agreement with Pear Tree Funds such that the aggregate transfer agent fee with respect to Institutional Shares would be calculated using an annual rate of 0.04 percent of International Opportunities Fund’s net assets attributable to Institutional Shares. This fee waiver only may be terminated with the approval of the Trustees. This fee waiver does not apply to Ordinary Shares or R6 Shares. The Manager does not have the right to recoup from International Opportunities Fund amounts that it has waived under that agreement. |

| (6) | The Manager has contractually agreed until July 31, 2024 to reimburse International Opportunities Fund with respect to Institutional Shares for a portion of International Opportunities Fund’s net assets attributable to Institutional Shares in an amount equal to 0.10 percent per annum, provided that the amount of such reimbursement for such year shall not exceed the amount of the portion of International Opportunities Fund’s adjusted “Annual Fund Operating Expenses” attributable to Institutional Shares for that year, Adjusted “Annual Fund Operating Expenses” for a year means all International Opportunities Fund operating expenses for the year, other than management fees, distribution and services fees, AFFE and extraordinary expenses. This fee waiver only may be terminated with the approval of the Trustees. The Manager does not have a right to recoup from International Opportunities Fund amounts that it has reimbursed under that agreement. |

| (7) | The Manager has contractually agreed until July 31, 2024 to reimburse such portion of the expenses of International Opportunities Fund attributable to R6 Shares such that “Total Annual Fund Operating Expenses after Fee Waiver and/or Expense Reimbursement” with respect to R6 Shares, other than extraordinary expenses, is not greater than 0.99 percent of International Opportunities Fund’s net assets attributable to R6 Shares. This expense reimbursement agreement does not permit the Manager to recoup any amounts reimbursed by the Manager, and it only may be terminated with the approval of the Trustees. The Manager does not have a right to recoup from International Opportunities Funds amounts that it has waived under that agreement. |

| † | Does not reflect non-recurring expenses related to the proposed Reorganization. If these expenses had been reflected, pro forma other expenses and total annual fund operating expenses would have been the same. |

| 9 | Pear Tree Funds Combined Prospectus/Proxy Statement September __, 2023 |

(ii) Expense Example

The following hypothetical examples are intended to help you compare the cost of investing in one Fund with the cost of investing in the other Fund, as well as in the combined Fund. It assumes that you invest $10,000 in a Fund for the time periods indicated and then, except as indicated, redeem all your shares at the end of those periods. It assumes a 5-percent return on your investment each year and that each Fund’s operating expenses remain the same. Your actual costs may be higher or lower.

Emerging Markets Fund

| | | 1 year | | | 3 years | | | 5 years | | | 10 years | |

| Ordinary Shares | | $ | 159 | | | $ | 539 | | | $ | 944 | | | $ | 2,076 | |

| Institutional Shares | | $ | 121 | | | $ | 450 | | | $ | 802 | | | $ | 1,795 | |

| R6 Shares | | $ | 101 | | | $ | 396 | | | $ | 714 | | | $ | 1,613 | |

International Opportunities Fund

| | 1 year | | | 3 years | | | 5 years | | | 10 years | |

| Ordinary Shares | | $ | 153 | | | $ | 495 | | | $ | 861 | | | $ | 1,892 | |

| Institutional Shares | | $ | 108 | | | $ | 405 | | | $ | 725 | | | $ | 1,630 | |

| R6 Shares | | $ | 101 | | | $ | 367 | | | $ | 653 | | | $ | 1,467 | |

International Opportunities Fund (pro forma combined)

| | 1 year | | | 3 years | | | 5 years | | | 10 years | |

| Ordinary Shares | | $ | 153 | | | $ | 495 | | | $ | 861 | | | $ | 1,892 | |

| Institutional Shares | | $ | 108 | | | $ | 405 | | | $ | 725 | | | $ | 1,630 | |

| R6 Shares | | $ | 101 | | | $ | 367 | | | $ | 653 | | | $ | 1,467 | |

| 10 | Pear Tree Funds Combined Prospectus/Proxy Statement September __, 2023 |

(iii) Portfolio Turnover

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. Those costs, which are not reflected in annual Fund operating expenses or in the example expenses, affect a Fund’s performance. During the fiscal year ended March 31, 2023, each Fund’s portfolio turnover rate was the following percentage of the average value of the Fund’s portfolio:

| | | Percentage of the Average

Value of the Fund’s Portfolio | |

| Emerging Markets Fund | | | 117 | % |

| International Opportunities Fund | | | 57 | % |

| C. | Comparison of Performance |

The historical performance information below gives some indication of the risks associated with an investment in Emerging Markets Fund and International Opportunities Fund by showing each Fund’s performance year to year and over time. Neither Fund applies sales charges. Please remember that past performance is not necessarily an indication of future results.

In addition, the performance information presented below includes periods during which the Funds were managed by different sub-advisers, including different portfolio management teams. Prior to December 8, 2018, Emerging Markets Fund had a different investment sub-adviser and pursued a different investment strategy. The current investment sub-adviser began managing Emerging Markets Fund with the current investment strategy on January 1, 2019. The current investment sub-adviser to International Opportunities Fund began managing the Fund with the current investment strategy on January 1, 2020 after a transition period beginning November 15, 2019. [Monthly performance figures for the Fund are available at https://peartreefunds.com/.]

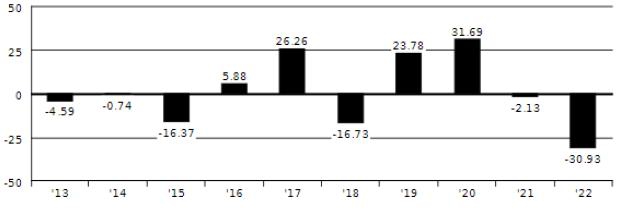

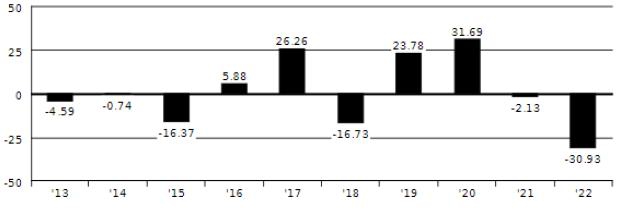

(i) Calendar Year Total Returns – Ordinary Shares

The chart shows year-to-year changes in the net asset value performance of each Fund’s Ordinary shares.

| 11 | Pear Tree Funds Combined Prospectus/Proxy Statement September __, 2023 |

Emerging Markets Fund

During the periods shown in the bar chart, Emerging Markets Fund’s highest return for a quarter was 21.65 percent (quarter ended June 30, 2020), and the lowest return for a quarter was -20.83 percent (quarter ended March 31, 2020).

International Opportunities Fund

During the periods shown in the bar chart, International Opportunities Fund’s highest return for a quarter was 25.73 percent (quarter ended December 31, 2020), and the lowest return for a quarter was -32.88 percent (quarter ended March 31, 2020).

| 12 | Pear Tree Funds Combined Prospectus/Proxy Statement September __, 2023 |

(ii) Average Annual Total Returns (Before and After Tax and Distributions)

| Emerging Markets Fund |

| |

Average Annual Total Returns (for periods ended December 31, 2022) | | 1 Year | | | 5 Years | | | 10 Years | |

| Ordinary Shares (before tax) | | | (30.93 | )% | | | (1.71 | )% | | | (0.29 | )% |

| Ordinary Shares (after tax on distributions) | | | (30.59 | )% | | | (2.07 | )% | | | (0.64 | )% |

| Ordinary Shares (after tax on distributions, with sale) | | | (17.97 | )% | | | (0.94 | )% | | | (0.05 | )% |

| Institutional Shares (before tax) | | | (30.70 | )% | | | (1.34 | )% | | | 0.04 | % |

| R6 Shares (before tax)* | | | (30.56 | )% | | | N/A | | | | N/A | |

| MSCI Emerging Markets Index (reflects no deduction for fees, expenses or taxes)** | | | (19.74 | )% | | | (1.03 | )% | | | 1.81 | % |

| International Opportunities Fund |

| |

Average Annual Total Returns (for periods ended December 31, 2022) | | | 1 year | | | | Since Inception (1-1-2019) | | | | | |

| Ordinary Shares (before tax)a | | | (19.57 | )% | | | 5.40 | % | | | | |

| Ordinary Shares (after tax on distributions) | | | (19.68 | )% | | | 4.36 | % | | | | |

| Ordinary Shares (after tax on distributions, with sale) | | | (11.24 | )% | | | 4.09 | % | | | | |

| Institutional Shares (before tax) | | | (19.08 | )% | | | 5.85 | % | | | | |

| R6 Shares (before tax) | | | (19.19 | )% | | | 5.85 | % | | | | |

| MSCI ACWI ex USA Index (no deduction for fees, expenses or taxes)*** | | | (15.57 | )% | | | 3.72 | % | | | | |

Each Fund’s performance for portions of the periods benefited from agreements with the Manager and its affiliates to waive and/or limit the Fund’s expenses.

| * | R6 Shares commenced operations on December 8, 2018. |

| ** | MSCI Emerging Markets Index is an unmanaged index administered by MSCI Inc. It is intended to capture large- and mid-cap representation across 24 emerging markets countries. |

| *** | MSCI ACWI ex USA Index is an unmanaged index administered by MSCI Inc. It is intended to capture large- and mid-cap representation across 22 of 23 developed markets countries and 24 emerging markets countries. |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state or local taxes or if you hold your shares in a retirement account or in another tax-advantaged arrangement. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns are shown only for Ordinary Shares and after-tax returns for Institutional Shares and R6 Shares may vary.

| 13 | Pear Tree Funds Combined Prospectus/Proxy Statement September __, 2023 |

| D. | Summary of Investment Objectives, Strategies, Risks and Restrictions |

| (i) | Investment Objectives and Principal Investment Strategies |

Emerging Markets Fund has a similar investment objective and principal investment strategy to International Opportunity Fund, with Emerging Markets Fund seeking long-term growth of capital and International Opportunities Fund seeking long-term capital appreciation. Emerging Markets Fund is a “diversified company,” meaning that at least 75 percent of the value of Emerging Markets Fund’s total assets is represented by (a) cash and cash items, including receivables, (b) government securities, (c) securities of other investment companies, and (d) other securities that are limited in respect of any one issuer to an amount (i) not greater in value than 5 percent of the value of the total assets of Emerging Markets Fund and (ii) not more than 10 percent of the outstanding voting securities of the issuer. International Opportunities Fund is not a diversified company, and as a result, its portfolio holdings may be more concentrated in fewer issuers. Both Funds invest primarily in equity securities, with Emerging Markets Fund investing primarily in emerging markets issuers, that is, issuers that are organized under the laws of an emerging markets country, or have their headquarters located in an emerging markets country, or whose shares are traded on an exchange located in an emerging markets country, and International Opportunities Fund investing primarily in equity securities issued by foreign markets issuers, that is, issuers operating in any industry sector that derives at least 50 percent of its gross revenues or profits from goods or services produced in non-U.S. markets or from sales made in non-U.S. markets.

| | Emerging Markets Fund | International Opportunities Fund |

| Investment Objective | Long-term growth of capital. | Long-term capital appreciation. |

| Principal Investment Strategies | Under normal market conditions, Emerging Markets Fund invests at least 80 percent of its net assets (plus borrowings for investment purposes) in equity securities, including American Depositary Receipts (ADRs), warrants and rights, of emerging markets issuers. Emerging Markets Fund generally defines an emerging market issuer as an issuer that is organized under the laws of an emerging markets country, or has its headquarters located in an emerging markets country, or whose shares are traded on an exchange located in an emerging markets country. An emerging market country is a country included in the MSCI Emerging Markets Index. In managing Emerging Markets Fund’s portfolio, its sub-adviser may allocate more than 25 percent of the Fund’s assets among various regions and countries, although the Fund’s principal strategies do not require it to invest such percentages in any specific region or for extended periods. Emerging Markets Fund also may invest in companies of any market capitalization. | Under normal market conditions, International Opportunities Fund invests at least 80 percent of its net assets (plus borrowings for investment purposes) in equity securities issued by foreign markets issuers. A foreign markets issuer is an issuer operating in any industry sector that derives at least 50 percent of its gross revenues or profits from goods or services produced in non-U.S. markets or from sales made in non-U.S. markets. Issuers in which International Opportunities Fund invests may have any market capitalization. Equity securities include common and preferred shares, warrants and other rights derivative of or convertible into common stocks, American Depositary Receipts (ADRs), and Indian participatory notes (generally an interest in a pool of Indian-listed securities that is traded exclusively outside India by non-Indian registered investors), as well as shares of mutual funds and exchange-traded funds (ETFs), each of which invests at least 80 percent of its net assets in similar securities issued by foreign markets issuers. |

| 14 | Pear Tree Funds Combined Prospectus/Proxy Statement September __, 2023 |

| | In managing Emerging Markets Fund’s assets, its sub-adviser primarily uses a bottom-up, fundamental-research investment process. The sub-adviser looks to invest Emerging Markets Fund’s assets in securities of companies that it believes demonstrate better than generally anticipated progress in its key business drivers. Key business drivers are factors that the sub-adviser has determined could significantly impact a company’s short- and long-term financial performance. Valuation is an integral consideration in the sub-adviser’s investment process. The sub-adviser considers a company’s current and expected market valuations in order to evaluate its prospects as a potential investment for Emerging Markets Fund’s portfolio. In determining a company’s expected valuation, as well as evaluating the accuracy of its current market valuation, the sub-adviser typically relies on conventional valuation parameters. Emerging Markets Fund may invest in derivatives (i.e., a security or instrument whose value is determined by reference to the value or the change in value of one or more securities, currencies, indices or other financial instruments) for the purpose of hedging the value of the portfolio or to establish a position in the future. Emerging Markets Fund may hold cash, or it may manage its cash by investing in cash equivalents and money market funds. Emerging Markets Fund is “diversified,” which means that at least 75 percent of the value of Emerging Markets Fund’s total assets is represented by (a) cash and cash items, including receivables, (b) government securities, (c) securities of other investment companies, and (d) other securities that are limited in respect of any one issuer to an amount (i) not greater in value than 5 percent of the value of the total assets of Emerging Markets Fund and (ii) not more than 10 percent of the outstanding voting securities of the issuer. | To manage International Opportunities Fund’s portfolio, its sub-adviser generally seeks to identify more than 30 foreign markets securities that the sub-adviser considers as having the best opportunity for total return. To select specific investments, the sub-adviser is opportunistic, that is, looking for market inefficiencies using a proprietary quantitative investment process focused on bottom-up fundamental research. International Opportunities Fund also may utilize options in an attempt to improve the risk/return profile of International Opportunities Fund’s returns. International Opportunities Fund also may for hedging purposes buy and sell forward foreign currency exchange contracts in connection with its investments. Generally, International Opportunities Fund invests in foreign markets issuers in the countries represented by the MSCI ACWI ex USA Index. As of June 30, 2023, the MSCI ACWI ex USA Index comprised issuers from countries representing 22 developed markets and 24 emerging markets. International Opportunities Fund generally will be invested in issuers in fifteen or more foreign countries and fifteen or more industry sectors. However, International Opportunities Fund may be invested in securities from any country, any industry sector, or of any market capitalization amount. International Opportunities Fund is “non-diversified,” which means that it may invest a higher percentage of its assets in a smaller number of issuers. |

| 15 | Pear Tree Funds Combined Prospectus/Proxy Statement September __, 2023 |

| (ii) | Principal Investment Risks |

The following risks apply to each Fund unless otherwise noted.

Foreign Securities, including Emerging Markets Securities - Financial information concerning foreign issuers may be more limited than information generally available from U.S. issuers or not available. Non-U.S. equity markets in which the Fund invests may have limited liquidity, and be subject to complex rules, arbitrary rules or both. The Fund also may have a limited ability to protect its investment under foreign property and securities laws, and it may have difficulty from time to time converting local currency into U.S. dollars. Moreover, the value of foreign instruments tends to be adversely affected by local or regional political and economic developments, as well as changes in exchange rates. When the Fund sells a foreign currency or foreign currency denominated security, its value may be worth less in U.S. dollars even if the investment increases in value in its local market. The value of a foreign security may change materially at times when U.S. markets are not open for trading.

For emerging market equity securities, these risks tend to be greater than for securities of issuers located in more developed countries. The events that lead to those greater risks include political instability, immature economic and financial institutions, local economies typically dependent on one or several natural resources, local property and securities laws that lack clarity or certainty, generally limited market liquidity, local ownership rules, currency exchange restrictions and restrictions on the repatriation of investment income and capital. Certain emerging markets are closed in whole or part to the direct purchase of equity securities by foreigners. In these markets, the Fund may be able to invest in equity securities solely or primarily through foreign government authorized pooled investment vehicles. These securities could be more expensive because of additional management fees charged by the underlying pools. In addition, such pools may have restrictions on redemptions, limiting the liquidity of the investment.

| 16 | Pear Tree Funds Combined Prospectus/Proxy Statement September __, 2023 |

(Emerging Markets Fund only) Emerging Markets Fund from time to time also may have assets concentrated in a specific geographic region and/or an individual country depending on the country wights of the MSCI Emerging Markets Index, thus exposing Emerging Markets Fund to the specific risks of that region or country.

Opportunistic Stock Investing (International Opportunities Fund only) - Different investment styles periodically come into and fall out of favor with investors, depending on market conditions and investor sentiment. Strategies favoring growth stocks generally are more volatile than the overall stock market. Strategies favoring value stocks typically carry the risk that market prices may never recognize their intrinsic values. As International Opportunities Fund holds stocks focused on growing cash-flow characteristics, from time to time it could underperform other mutual funds that use alternative metrics in their valuation criteria.

Chinese/Hong Kong Securities (Emerging Markets Fund only) - Securities issued by Chinese and Hong Kong companies share many risk characteristics of emerging markets securities. In addition, China’s legal system is, when compared to the U.S.’s, undeveloped. Hong Kong, nominally an autonomous region of China, has experienced political tensions since it ceased to be a British colony. The principal Chinese and Hong Kong stock exchanges generally have listing standards similar to the principal U.S. stock exchanges. The rules that govern public companies in China and Hong Kong, however, are significantly different from those in the U.S., have from time to time been applied arbitrarily by local regulators, and require of issuers significantly less financial transparency.

Active Management Risk (Emerging Markets Fund only) - The sub-adviser’s judgments about the attractiveness, value, or potential appreciation of Emerging Markets Fund’s investments may prove to be incorrect. If the securities selected and strategies employed by Emerging Markets Fund fail to produce the intended results, Emerging Markets Fund could underperform other funds with similar objectives and investment strategies.

Large- and Mid-Capitalization Securities - Securities issued by large- and mid-cap companies tend to be less volatile than securities issued by smaller companies. Larger companies, however, may not be able to attain the high growth rates of successful smaller companies, especially during strong economic periods, and may be unable to respond as quickly to competitive challenges.

Small- and Micro-Capitalization Securities - Investments in small- and micro-capitalization companies typically present greater risks than investments in larger companies because small companies often have limited product lines and few managerial or financial resources. As a result, the performance of the Fund may be more volatile than a fund that invests only in large- and mid-cap stocks.

Growth- and Value-Stock Investing (Emerging Markets Fund) - Growth and value investment styles periodically come into and fall out of favor with investors, depending on market conditions and investor sentiment. As Emerging Markets holds stocks with both growth and value characteristics, from time to time it could underperform stock funds that take a strictly growth or value approach to investing. Growth stocks generally are more volatile than the overall stock market and can have sharp price declines as a result of earnings disappointments. Value stocks typically carry the risk that market prices may never recognize their intrinsic values.

| 17 | Pear Tree Funds Combined Prospectus/Proxy Statement September __, 2023 |

Liquidity Risk - To meet shareholder redemption requests and other cash requirements, the Fund may have to sell certain portfolio securities at times when there may be few, if any, buyers, causing the Fund to accept sale prices below the amounts that had been used by the Fund to determine its net asset value.

Investment Strategies, Generally, and Quantitative Investment Risk (International Opportunities Fund only) - International Opportunities Fund investment strategy is based on assumptions of market and investor behavior. There are risks that those assumptions are incorrect, become outdated, or do not apply to specific market and political events. In those cases, the investment strategy is likely not to operate as anticipated, causing a loss in the value of International Opportunities Fund’s portfolio. The quantitative investment models used to manage International Opportunities Fund’s portfolio may not perform as expected and may underperform the market as a whole. Underperformance by the model may be as a result of the factors used in building the quantitative analytical framework of the model, the weights placed on each factor, the accuracy of historical data supplied by third parties, and changing sources of market returns. International Opportunities Fund’s quantitative investment model is more complex than a typical non-quantitative investment strategy, and thus, may be less predictable in how it may react to specific market or political events.

Risks of Investing in ADRs (International Opportunities Fund only) - The risks of investing in ADRs include the risks of investing in individual U.S. equities, but they also include risks associated with foreign equities, such as fluctuations in foreign currencies and foreign investment risks, primarily political and financial instability, less liquidity, lack of uniform accounting, auditing and financial reporting standards and increased price volatility. In addition, an ADR may not track the price of the underlying foreign security.

Currency and Option Contracts (International Opportunities Fund only) - Currency, forwards and options contracts are subject to the risks inherent in most derivative contracts. In addition, currency contracts also may be subject to national and international political and economic events. Options contracts, including options on futures contracts, also are subject to the risks of a leveraged transaction, that is, a move against International Opportunities Fund’s open position could cause International Opportunities Fund to lose its premium, initial margin and any additional funds deposited to establish or maintain the position, and International Opportunities Fund may be required to deposit a substantial amount of additional market funds on short notice to maintain the position. Under certain market conditions International Opportunities Fund investing in an option contact could lose more than the amount it originally invested. International Opportunities Fund also may find that under certain market conditions, it may be difficult or impossible to liquidate an open option contract.

Forward and Currency Contracts (Emerging Markets Fund only) - Forward and currency contracts are subject to the risks inherent in most derivative contracts. In addition, they also may be subject to certain non-market-based risks that are difficult to predict, such as governmental, trade, fiscal, monetary and exchange control programs and policies. Currency contracts also may be subject to national and international political and economic events. Under certain market conditions, Emerging Markets Fund could lose more than the amount it originally invested. Emerging Markets Fund also may find that under certain market conditions, it may be difficult or impossible to liquidate a position.

| 18 | Pear Tree Funds Combined Prospectus/Proxy Statement September __, 2023 |

Investments in Other Collective Investment Funds (International Opportunities Fund only) - To the extent that International Opportunities Fund invests in mutual funds and ETFs, its investment performance would be directly related to the investment performance of the other funds. International Opportunities Fund also would bear its proportionate share of any management and other fees paid by the other collective investment funds in addition to the investment management and other fees paid by International Opportunities Fund. As a result, shareholders of International Opportunities Fund would be subject to some duplication of fees.

Non-Diversification (International Opportunities Fund only) - International Opportunities Fund is “non-diversified,” As a result, a decline in the value of the securities of one issuer could have a significant negative effect on International Opportunities Fund.

Sector - The Fund may at any one time have significant investments in one or more specific industry sectors to the extent that the Fund’s benchmark is concentrated in specific industry sectors, although the Fund does not have a policy to concentrate in any specific industry sector. To the extent that the Fund has significant investments in a specific sector, it is subject to risk of loss of that sector as a result of adverse economic, business or other developments to that sector, which may be greater than general market risk.

Regional/Country Focus (International Opportunities Fund only) - International Opportunities Fund does not have a policy of investing a significant portion of its assets in any particular region or country. However, to the extent that International Opportunities Fund focuses its investments in a particular geographic region or country, it may be subject to increased currency, political, regulatory and other risks associated with that region or country. As a result, International Opportunities Fund may be subject to greater price volatility and risk of loss than a fund holding more geographically diverse investments.

Derivatives – The fund may engage in a variety of transactions involving derivatives, such as futures, certain foreign currency transactions, options, warrants and swap contracts. Derivatives are financial instruments whose value depends upon, or is derived from, the value of something else, such as one or more underlying investments, pools of investments, indexes or currencies. The Manager may make use of “short” derivatives positions, the values of which typically move in the opposite direction from the price of the underlying investment, pool of investments, index or currency. The Manager may use derivatives both for hedging and non-hedging purposes. For example, the Manager may use derivatives to increase or decrease the Fund’s exposure to long or short-term interest rates (in the U.S. or abroad) or to a particular currency or group of currencies. The Manager may also use derivatives as a substitute for a direct investment in the securities of one or more issuers. However, the Manager may also choose not to use derivatives, based on its evaluation of market conditions or the availability of suitable derivatives. Investments in derivatives may be applied toward meeting a requirement to invest in a particular kind of investment if the derivatives have economic characteristics similar to that investment. The fund’s investment in derivatives may be limited by its intention to qualify as a regulated investment company. In addition, derivatives positions that offset each other may be netted together for purposes of the Fund’s policy on strategic allocation between equity and fixed-income investments.

| 19 | Pear Tree Funds Combined Prospectus/Proxy Statement September __, 2023 |

Derivatives involve special risks and may result in losses. The successful use of derivatives depends on the Manager’s ability to manage these sophisticated instruments. Some derivatives are “leveraged,” which means they provide the Fund with investment exposure greater than the value of the Fund’s investment in the derivatives. As a result, these derivatives may magnify or otherwise increase investment losses to the Fund. The risk of loss from certain short derivatives positions is theoretically unlimited. The value of derivatives may move in unexpected ways due to the use of leverage or other factors, especially in unusual market conditions, and may result in increased volatility.

Other risks arise from the potential inability to terminate or sell derivatives positions. A liquid secondary market may not always exist for the Fund’s derivatives positions. In fact, many over-the-counter instruments (investments not traded on an exchange) will not be liquid. Over-the-counter instruments also involve the risk that the other party to the derivatives transaction will not meet its obligations.

Risks Associated with Markets Generally, Specific Industries and Specific Holdings - The share price of a fund may fall because of weakness in and external shocks to the stock markets, generally, weakness with respect to a particular industry in which the Fund has significant holdings, or weaknesses associated with one or more specific companies in which the Fund may have substantial investments. A fund's investments also may fluctuate significantly in value over short periods of time, causing the Fund's share price to be volatile.

The stock markets generally may decline because of adverse economic and financial developments in the U.S. and abroad. In addition, there is a risk that policy changes by the Federal Reserve and/or other government actors, such as increasing interest rates, could cause increased volatility in financial markets, and higher levels of fund redemptions. Trade barriers and other protectionist trade policies (including those policies adopted by the U.S.) also may have a negative impact on a fund.

Industry or company earnings may deteriorate because of a variety of factors, including maturing product lines, changes in technologies, new competition and changes in management. Such weaknesses typically lead to changes in investor expectations of future earnings and a lack of confidence in current stock prices. Downward pressures on stock prices accelerate if institutional investors, who comprise a substantial portion of the market, also lose confidence in current prices.

The equity holdings of a Fund, which may include common stocks, convertible securities, preferred stocks, warrants and sponsored and unsponsored ADRs, may decline in value because of changes in the price of a particular holding or a broad stock market decline. Common stock ranks below preferred stock and debt securities in claims for dividends and for assets of the company in a liquidation or bankruptcy. The value of a security may decline for a number of reasons that directly relate to the issuer of a security or broader economic or market events including changes in interest rates.

Investment Strategies - Each Fund pursues its investment objective using a specific investment strategy. An investment strategy generally is a set of principles or rules that are designed to assist the Fund in selecting its portfolio securities. For the most part, the principles or rules comprising a fund’s investment strategy involve a tradeoff between principles or rules that are intended to help the Fund consistently increase the value of its portfolio, and principles or rules that are intended to prevent the Fund from losing all or substantially all of its value. For both Funds’ investment strategies, there are risks that a strategy will not perform as anticipated, or that market and other conditions under which the investment strategy is expected to perform as anticipated, will not occur.

| 20 | Pear Tree Funds Combined Prospectus/Proxy Statement September __, 2023 |

Cybersecurity and Technology Risk –. Each Fund, its service providers, and other market participants increasingly depend on complex information technology and communications systems. Those systems are subject to threats and risks, such as theft, misuse, and improper release of confidential or highly sensitive information relating to a fund and/or its shareholders, as well as compromises or failures to systems, networks, devices and applications relating to the operations of the Fund and its service providers. Power outages, natural disasters, equipment malfunctions and processing errors also threaten these systems, as well as market events that occur at a pace that overloads these systems.

Cybersecurity and other operational and technology issues may result in financial losses to the Fund and its shareholders, impede business transactions, violate privacy and other laws, subject the Fund to certain regulatory penalties and reputational damage, and increase compliance costs and expenses. Furthermore, as the Pear Tree Funds’ assets grow, they may become more of a target for cybersecurity threats, such as hackers and malware. Although the Pear Tree Funds have developed processes, risk management systems and business continuity plans designed to reduce these risks, they do not directly control the cybersecurity defenses, operational and technology plans and systems of their service providers, financial intermediaries and companies in which they invest or with which they do business. The Pear Tree Funds and their shareholders could be negatively impacted as a result. Similar types of cybersecurity risks also are present for issuers of securities in which the Pear Tree Funds invest, which could result in material adverse consequences for such issuers, and they may cause a Fund’s investment in such securities to lose value.

Cash Management - From time to time, each Fund will hold some of its assets as cash and/or cash equivalent financial instruments. Any cash or cash equivalent position held by the Fund typically is as a result of un-invested proceeds of a prior investment, un-invested cash received from new subscriptions, or un-invested cash being held to meet anticipated redemptions. Cash equivalent financial instruments include repurchase agreements and interests in money market funds and other investment funds intended for short-term liquid investments. Except when the Fund employs a temporary defensive position or anticipates significant fund redemptions, it is not the policy of the Fund to maintain a significant portion of its assets as cash or cash equivalent financial instruments.

Temporary Defensive Positions - From time to time, each Fund may take temporary defensive positions that are inconsistent with the Fund’s principal investment strategies in attempting to respond to adverse market, economic, political or other conditions. When taking a defensive position, the Fund may not achieve its investment objective.

| (iii) | Disclosure of Portfolio Holdings |

A description of each Funds’ policies and procedures with respect to the disclosure of the portfolio securities is available in the statement of additional information for the Funds, which is incorporated by reference.

| 21 | Pear Tree Funds Combined Prospectus/Proxy Statement September __, 2023 |

| (iv) | Investment Restrictions |

Set forth below is a summary of each Fund’s fundamental investment restrictions. After the Reorganization, the combined Fund will follow the International Opportunities Fund’s current investment restrictions. Fundamental investment restrictions only may be changed by shareholder vote.

| Investment Restriction | Emerging Markets Fund | International Opportunities Fund |

| Short Sales | Make short sales of securities or maintain a short position unless at all times when a short position is open Emerging Markets Fund owns an equal amount of such securities or securities convertible into, or exchangeable without payment of any further consideration for, securities of the same issue as, and equal in amount to, the securities sold short, and unless not more than 10 percent of Emerging Markets Fund’s net assets (taken at current value) is held as collateral for such sales at any one time. Such sales of securities subject to outstanding options would not be made. Emerging Markets Fund may maintain short positions in a stock index by selling futures contracts on that index. | Not Applicable. |

| Senior Securities | Issue senior securities, borrow money or pledge its assets except that Emerging Markets Fund may borrow from a bank for temporary or emergency purposes in amounts not exceeding 10 percent (taken at the lower of cost or current value) of its total assets (not including the amount borrowed) and pledge its assets to secure such borrowings. Emerging Markets Fund will not purchase any additional portfolio securities so long as its borrowings amount to more than 5 percent of its total assets. | Issue senior securities, except to the extent permitted by applicable law, as amended and interpreted or modified from time to time by any regulatory authority having jurisdiction. |

| Affiliated Companies | Purchase or retain securities of any company if, to the knowledge of Emerging Markets Fund, officers and Trustees of the Pear Tree Funds or of the Manager or of the Sub-Adviser of Emerging Markets Fund who individually own more than ½ of 1 percent of the securities of that company together own beneficially more than 5 percent of such securities. | Not Applicable. |

| 22 | Pear Tree Funds Combined Prospectus/Proxy Statement September __, 2023 |

| Real Estate Investments | Buy or sell real estate or interests in real estate, although it may purchase and sell securities which are secured by real estate and securities of companies which invest or deal in real estate. | Invest in real estate except (a) that International Opportunities Fund may invest in securities of issuers that invest in real estate or interests therein, securities that are secured by real estate or interests therein, securities of real estate investment trusts, mortgage-backed securities and other securities that represent a similar indirect interest in real estate; and (b) International Opportunities Fund may acquire real estate or interests therein through exercising rights or remedies with regard to an instrument or security. |

| Underwriting | Act as underwriter except to the extent that, in connection with the disposition of Emerging Markets Fund securities, it may be deemed to be an underwriter under certain provisions of the federal securities laws. | Act as an underwriter, except insofar as International Opportunities Fund technically may be deemed to be an underwriter in connection with the purchase or sale of its portfolio securities. |

| Making Investments for Control | Make investments for the purpose of exercising control or management. | Not Applicable. |

| Joint Trading Accounts | Participate on a joint or joint and several basis in any trading account in securities. | Not Applicable. |

| Puts and Calls | Write, purchase, or sell puts, calls or combinations thereof, except that the Fund may (i) write covered call options with respect to all of its portfolio securities; (ii) purchase put options and call options on widely recognized securities indices, common stock of individual companies or baskets of individual companies in a particular industry or sector; (iii) purchase and write call options on stock index futures and on stock indices; (iv) sell and purchase such options to terminate existing positions. | Not Applicable. |

| 23 | Pear Tree Funds Combined Prospectus/Proxy Statement September __, 2023 |

| Oil, Gas and Other Minerals | Invest in interests in oil, gas or other mineral exploration or development programs, although it may invest in the common stocks of companies that invest in or sponsor such programs. | Not Applicable. |

| Loans | Make loans, except (i) through the purchase of bonds, debentures, commercial paper, corporate notes and similar evidences of indebtedness of a type commonly sold privately to financial institutions, (ii) through repurchase agreements and loans of portfolio securities (limited to 30 percent of the value of Emerging Markets Fund’s total assets). The purchase of a portion of an issue of such securities distributed publicly, whether or not such purchase is made on the original issuance, is not considered the making of a loan. | Make loans, except that International Opportunities Fund may (i) lend portfolio securities in accordance with the Fund’s investment policies, (ii) enter into repurchase agreements, (iii) purchase all or a portion of an issue of publicly distributed debt securities, bank loan participation interests, bank certificates of deposit, bankers’ acceptances, debentures or other securities, whether or not the purchase is made upon the original issuance of the securities, (iv) participate in a credit facility whereby International Opportunities Fund may directly lend to and borrow money from other affiliated Funds to the extent permitted under the 1940 Act or an exemption therefrom, and (v) make loans in any other manner consistent with applicable law, as amended and interpreted or modified from time to time by any regulatory authority having jurisdiction. |

| Industry Concentration | Invest more than 25 percent of the value of its total assets in any one industry. | Concentrate its investments in securities of companies in any particular industry. |

| Investments in Commodities and Derivatives | Invest in commodities or commodity contracts or in puts, calls, or combinations of both, except interest rate futures contracts, options on securities, securities indices, currency and other financial instruments, futures contracts on securities, securities indices, currency and other financial instruments and options on such futures contracts, forward foreign currency exchange contracts, forward commitments, securities index put or call warrants and repurchase agreements entered into in accordance with the Fund’s investment policies. | Invest in commodities or commodity contracts, except that International Opportunities Fund may invest in currency instruments and currency contracts and financial instruments and financial contracts that might be deemed to be commodities and commodity contracts in accordance with applicable law. |

| Borrow Money | Not Applicable. | Borrow money, except on a temporary basis and except to the extent permitted by applicable law, as amended and interpreted or modified from time to time by any regulatory authority having jurisdiction. |

| 24 | Pear Tree Funds Combined Prospectus/Proxy Statement September __, 2023 |

In the opinion of the SEC, investments are concentrated in a particular industry if such investments aggregate more than 25 percent of the Fund’s total assets. When identifying industries for purposes of its concentration policy, the Fund will rely upon available industry classifications. The Funds’ policies on concentration do not apply to investments in U.S. government securities.

All percentage limitations on investments, except the percentage limitations with respect to borrowing in fundamental policy 4 above, will apply at the time of the making of an investment and shall not be considered violated unless an excess or deficiency occurs or exists immediately after and as a result of such investment.

For purposes of fundamental policy 4 above, collateral arrangements with respect to the writing of covered call options and options on index futures and collateral arrangements with respect to margin for a stock index future are not deemed to be a pledge of assets and neither such arrangements nor the purchase or sale of stock index futures or the purchase of related options are deemed to be the issuance of a senior security.

“Invest,” as used in the investment restrictions above, means to purchase or otherwise acquire a financial instrument, or to sell or otherwise dispose of a financial instrument.

| 25 | Pear Tree Funds Combined Prospectus/Proxy Statement September __, 2023 |

| E. | Key Information about the Reorganization |

The following is a summary of key information concerning the proposed Reorganization. Please also refer to the Plan of Reorganization, which is attached to this Combined Prospectus/Information Statement as Appendix A and which includes more detailed information about the Reorganization. The following summary is qualified in its entirety by reference to Appendix A.

| (i) | Summary of the Reorganization |

The shareholders of Emerging Markets Fund are being asked to approve the proposed Reorganization of Emerging Markets Fund into International Opportunities Fund pursuant to the Plan. A copy of the Plan is attached to this Combined Prospectus/Proxy Statement as Appendix A.

Although the terms “merger” and “reorganization” are used for ease of reference, the Reorganization as proposed is structured as a transfer of all of the assets of Emerging Markets Fund to International Opportunities Fund in exchange for the assumption by International Opportunities Fund of all of the stated liabilities of Emerging Markets Fund and for the issuance and delivery to Emerging Markets Fund shares of International Opportunities Fund (the “Acquiring Fund Shares”) equal in aggregate net asset value to the value of the assets transferred to International Opportunities Fund net of the stated liabilities assumed by International Opportunities Fund.

After receipt of the Acquiring Fund Shares, Emerging Markets Fund will distribute the Acquiring Fund Shares to its shareholders, in proportion to their existing shareholdings, in complete liquidation of Emerging Markets Fund, and the legal existence of Emerging Markets Fund will be terminated. Each shareholder of Emerging Markets Fund will receive a number of full and fractional Acquiring Fund Shares equal in value at the date of the exchange to the aggregate value of the shareholder’s Emerging Markets Fund shares.

Before the date of the Reorganization, Emerging Markets Fund will declare a distribution to its shareholders that will have the effect of distributing to its shareholders all of its remaining investment company taxable income (computed without regard to the deduction for dividends paid) and net realized capital gains, if any, through the date of the transfer.

The Trustees have voted to approve the proposed Reorganization and to recommend that shareholders of Emerging Markets Fund also approve the proposed Reorganization. The actions contemplated by the Plan and the related matters described therein will be consummated only if approved by the holders of a majority of the outstanding voting securities of Emerging Markets Fund, as defined in the 1940 Act. For purposes of the 1940 Act, a vote of a majority of the outstanding voting securities of Emerging is the affirmative vote of the lesser of (a) 67 percent or more of the voting securities of Emerging Markets Fund that are present or represented by proxy at the Meeting, if the holders of more than 50 percent of the outstanding voting securities of Emerging Markets Fund are present or represented by proxy at the Meeting, or (b) more than 50 percent of the outstanding voting securities of Emerging Markets Fund.

| 26 | Pear Tree Funds Combined Prospectus/Proxy Statement September __, 2023 |

If shareholders approve the proposed Reorganization, the Manager anticipates that Emerging Markets Fund may sell certain portfolio holdings prior to the Reorganization. These sales, which are anticipated to commence in October 2023 and will not occur unless and until shareholders approve the proposed Reorganization, would result in brokerage commissions and other transaction costs, and may result in the realization of capital gains that would be distributed to shareholders as taxable distributions after reduction by any available capital losses. Please see “- Federal Income Tax Consequences” for information about the expected tax consequences of the proposed Reorganization.

Following the Reorganization, if Emerging Markets Fund has disposed of any portfolio holdings before the Reorganization and has not reinvested them, the Manager anticipates that International Opportunities Fund will incur brokerage commissions and other transaction costs in connection with reinvesting the proceeds of Emerging Markets World Equity Fund’s dispositions. These transaction costs do not alter the Manager’s view that the proposed Reorganization is in the best interests of each fund’s shareholders.

In the event that the proposed Reorganization does not receive the required shareholder approval, Emerging Markets Fund will continue to be managed as a separate series of the Trust in accordance with its current investment objectives and policies, and the Manager would likely request that the Trustees consider such alternatives as may be in the best interests of Emerging Markets Fund’s and International Opportunities Fund’s shareholders, which could include liquidation of Emerging Markets Fund.

| (ii) | Description of the Shares to be Issued |

Full and fractional Ordinary, Institutional and R6 Shares of International Opportunities Fund will be issued to shareholders of Emerging Markets Fund, in accordance with the procedures under the Plan of Reorganization as described above. The Declaration of Trust of the Trust permits the Trustees to issue an unlimited number of shares of beneficial interest of each series within the Trust with no par value per share. Like Emerging Markets Fund, International Opportunities Fund is a series of the Trust that, as of the Closing Date, will consist of Ordinary, Institutional and R6 Shares.

There are no differences between the Ordinary, Institutional and R6 Shares of Emerging Markets Fund, respectively, and the Ordinary, Institutional and R6 Shares of International Opportunities Fund, respectively. Each share of beneficial interest of each series of shares has one vote and shares equally in dividends and distributions when and if declared by a series and in the series’ net assets upon liquidation. All shares, when issued, are fully paid and non-assessable. The shares do not entitle the holder thereof to preference, preemptive, appraisal, conversion or exchange rights, except as the Trustees may determine with respect to any series of shares. Shares do not have cumulative voting rights and, as such, holders of at least 50 percent of the shares voting for Trustees can elect all Trustees and the remaining shareholders would not be able to elect any Trustees. The Trustees may classify or reclassify any unissued shares of either Fund into shares of any series by setting or changing in any one or more respects, from time to time, prior to the issuance of such shares, the preference, conversion or other rights, voting powers, restrictions, limitations as to dividends, or qualifications of such shares. Any such classification or reclassification will comply with the provisions of applicable securities laws. Shareholders of each series vote as a series to change, among other things, a fundamental policy of each such series and to approve the series’ investment management contracts and distribution plans pursuant to Rule 12b-1 of the 1940 Act. Like Emerging Markets Fund, International Opportunities Fund is not required to hold annual meetings of shareholders but will hold special meetings of shareholders when, in the judgment of the Trustees, it is necessary or desirable to submit matters for a shareholder vote.

| 27 | Pear Tree Funds Combined Prospectus/Proxy Statement September __, 2023 |

| (iii) | Trustees’ Considerations Relating to the Proposed Reorganization |

The Trustees of the Trust carefully considered the anticipated benefits and costs of the proposed Reorganization from the perspective of each Fund. Following their review, the Trustees, including the Independent Trustees, determined that the proposed Reorganization would be in the best interests of each Fund and its shareholders and that the interests of existing shareholders of each Fund would not be diluted by the proposed Reorganization. These Trustees approved the Plan and the proposed Reorganization and recommended approval by shareholders of Emerging Markets Fund.

Investment matters. In evaluating the proposed Reorganization, the Trustees analyzed the underlying investment rationale articulated by the Manager. The Trustees noted that the Funds currently have generally similar investment objectives, with Emerging Markets Fund seeking long-term growth of capital and International Opportunities Fund seeking long-term capital appreciation, although the Funds seek to achieve their investment objectives by employing similar, but different, investment strategies.

Performance. The Trustees reviewed the historical investment performance of each Fund and considered that International Opportunities Fund has a stronger performance record than Emerging Markets Fund over the past one-year period ended December 31, 2022 and since its inception on December 31, 2019. Moreover, the Trustees further considered the Manager’s belief that the Reorganization will result in the opportunity for improved performance for Emerging Markets Fund and its shareholders.