Exhibit 99.1

0 Annual Meeting of Shareholders Company Performance Summary May 20, 2020

1 FORWARD - LOOKING STATEMENT This presentation contains forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the current beliefs and expectations of CBU’s management and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward - looking statements. The following factors, among others, could cause the actual results of CBU’s operations to differ materially from its expectations: the effect of the COVID - 19 pandemic, including the negative impacts and disruptions on CBU’s employees, the communities CBU serves, and the domestic and global economy, which may have an adverse effect on CBU’s business; current and future economic and market conditions, including the effects of declines in housing prices, high unemployment rates, U.S. fiscal debt, budget and tax matters, geopolitical matters, and any slowdown in global economic growth; fiscal and monetary policies of the Federal Reserve Board; the effect of changes in the level of checking or savings account deposits on CBU’s funding costs and net interest margin; future provisions for credit losses on loans and debt securities; changes in nonperforming assets; the effect of a fall in stock market prices on CBU’s fee income businesses, including its employee benefit services, wealth management, and insurance businesses; the successful integration of operations of its acquisitions; competition; changes in legislation or regulatory requirements; and the timing for receiving regulatory approvals and completing pending transactions. For more information about factors that could cause actual results to differ materially from CBU’s expectations, refer to its reports filed with the Securities and Exchange Commission, including the discussion under “Risk Factors” in the Annual Report on Form 10 - K for the year ended December 31, 2019 and the Quarterly Report or Form 10Q for the period ended March 31, 2020, as filed with the Securities and Exchange Commission and available on its website at www.sec.gov. Further, any forward - looking statement speaks only as of the date on which it is made, and CBU undertakes no obligation to update any forward - looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events.

2 COMPANY PROFILE • Successful, growing community bank headquartered outside of Syracuse, New York. • One of the largest community banks based in Upstate New York with approximately $11.8 billion in total assets. • More than 250 customer facilities across Upstate New York, Northeast Pennsylvania, Vermont and Massachusetts. • Dominant market share: 1 st or 2 nd in approximately two - thirds of the towns where we do business • Significant and growing fee based non - banking businesses • Market capitalization of $3.25 billion (at 4/30/20 share price of $62.49)

3 COMPANY STRENGTHS • Track record of superior shareholder returns • Our 12 - year cumulative total return to shareholders is 268% ( 11.5% annualized). This compares to a 12 - year cumulative total return for the KBW Regional Banking Index of 41% (2.9% annualized). (1) • Industry leading dividend record – 27 consecutive years of increases. • Strong asset quality even through the great recession. • Primarily non - urban footprint provides stable, 2% to 5% growth a year . • Focus on smaller, in - footprint customers than our large competitors. • Significant fee based non - banking businesses reduce dependence on net interest income. • Benefit Plans Administration, Wealth Management and Insurance contribute approx. 69% of noninterest income . (1) Total return based on 12 - year historical performance through April 30, 2020 assuming dividend reinvestment. A 12 - year period is illustrated to capture cumulative total returns starting before and through the 2008 - 2009 Financial Crisis.

4 RECENT ACCOMPLISHMENTS • Generated strong operating results in the first quarter of 2020 • Return on Assets – 1.41% • Return on Tangible Equity – 14.52% (1) • Net Interest Margin (NIM) – 3.65% • Operating EPS (2) – $0.77 • Raised our dividend in August 2019 for the 27th consecutive year, retaining our “Dividend Aristocrat“ Status • Completed the acquisition of Kinderhook Bank Corp in Q3 2019 • Entered into a definitive agreement to acquire Steuben Trust Corporation in Q4 2019 • Regularly in the Top 10 of America’s best large banks by Forbes Magazine • Maintained solid asset quality ( 0.09% net charge off ratio for the first quarter of 2020). Part of our operating DNA. (1) Return on Tangible Equity is calculated by dividing Net Income by Average Shareholders’ Equity less average intangible assets , n et of deferred tax on intangible assets. (2) Operating earnings are a non - GAAP measure and exclude one time securities gains and merger related expenses and special charges. Please see Appendix for details.

5 STRATEGIC PROFILE • Consistent business model for over 20 years • Market - leading branch system serving predominantly non - urban markets • Excellent core deposit customer base • Decentralized decision - making and authority • Investment in noninterest revenue businesses • Goal of 10% annual total shareholder return over time • Disciplined growth through organic and acquired opportunities; focused on profitable relationships • Focused on low risk accretive transactions

6 STRATEGY ELEMENT #1 Market - leading Branch/Digital Service Strategy Focused on Core Accounts • Emphasize responsive, local decision - making and customer service and support, and authority at the branch level • Focus on generating and retaining core deposit accounts • Mostly non - urban markets where leadership positions can be earned • Complement market - leading branch system with enhanced digital banking services, including online deposit account opening and loan applications

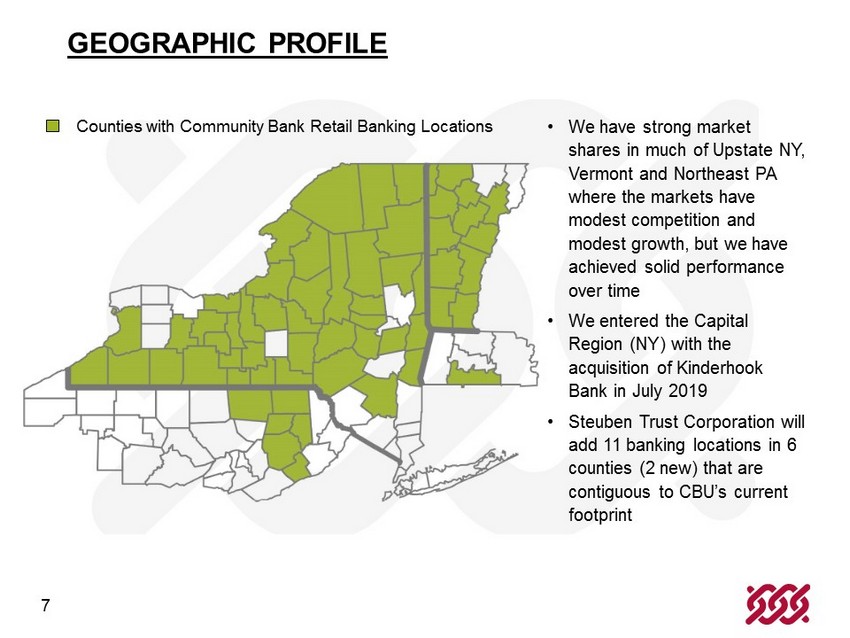

7 GEOGRAPHIC PROFILE Counties with Community Bank Retail Banking Locations • We have strong market shares in much of Upstate NY, Vermont and Northeast PA where the markets have modest competition and modest growth, but we have achieved solid performance over time • We entered the Capital Region (NY) with the acquisition of Kinderhook Bank in July 2019 • Steuben Trust Corporation will add 11 banking locations in 6 counties (2 new) that are contiguous to CBU’s current footprint

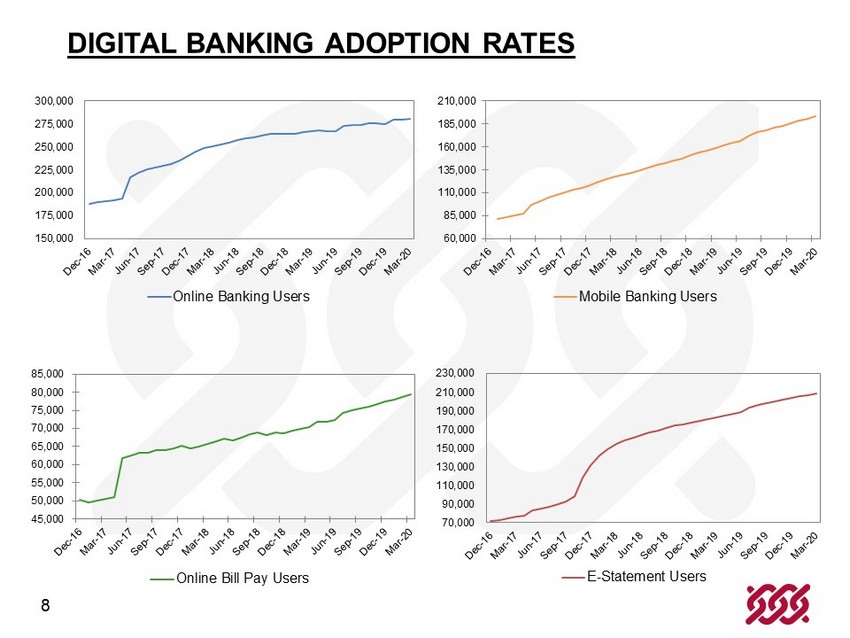

8 DIGITAL BANKING ADOPTION RATES 150,000 175,000 200,000 225,000 250,000 275,000 300,000 Online Banking Users 60,000 85,000 110,000 135,000 160,000 185,000 210,000 Mobile Banking Users 45,000 50,000 55,000 60,000 65,000 70,000 75,000 80,000 85,000 Online Bill Pay Users 70,000 90,000 110,000 130,000 150,000 170,000 190,000 210,000 230,000 E-Statement Users

9 OPERATING AND LENDING STRATEGIES ARE LOCAL AND CONSERVATIVE • Community bank approach to growth ₋ Discipline and focus on our local customers ₋ An in - footprint lender with deep knowledge of our markets ₋ Emphasis on profitable customer relationships across all business lines ₋ Decentralized local decision - marking – branch managers act as local bank presidents • Average loan originations are uniquely granular for an institution of our size ₋ Average Residential Mortgage – $ 111,000 ₋ Average Home Equity – $52,000 ₋ Average Indirect Loan – $20,000 • Average Commercial Loan Relationship of $575,000 • Commercial loan mix is well - diversified

10 STRATEGY ELEMENT #2 Continue to Grow Noninterest Revenues Q1 2020 Results • Banking Services • $18.1 million, 4.0% increase over Q1 2019 ( 1) • Employee Benefit Plan Administration and Trust Services • $25.4 million, 5.5% increase over Q1 2019 • Wealth Management & Insurance • $15.2 million, 6.9% increase over Q1 2019 (1) Excluding securities losses

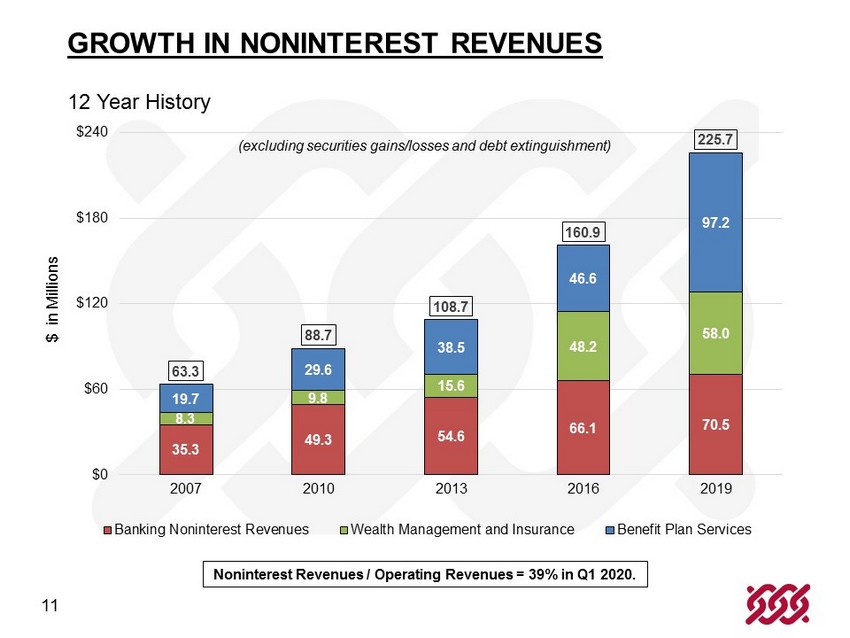

11 GROWTH IN NONINTEREST REVENUES 12 Year History 35.3 49.3 54.6 66.1 70.5 8.3 9.8 15.6 48.2 58.0 19.7 29.6 38.5 46.6 97.2 63.3 88.7 108.7 160.9 225.7 $0 $60 $120 $180 $240 2007 2010 2013 2016 2019 $ in Millions Banking Noninterest Revenues Wealth Management and Insurance Benefit Plan Services Noninterest Revenues / Operating Revenues = 39% in Q1 2020. (excluding securities gains/losses and debt extinguishment)

12 EMPLOYEE BENEFIT PLAN ADMINISTRATION & TRUST SERVICES • Revenue Growth 12 - year CAGR 14.2% (2007 - 2019) ‒ $25.4 million of revenues in Q1 2020, a 5.5% increase over Q1 2019 ‒ $ 97.2 million of revenues in 2019 , a 5.3% increase over 2018 • National administrator of retirement plans, employee benefit plans, fund of funds, and collective investment trusts • 3,800 retirement plans, $70 + billion in trust assets, and more than 450,000 participants • 10 offices across the U.S. and Puerto Rico and 370 employees in 20 states • Breadth of services, depth of creative talent, and financial resources to help clients solve benefit plan challenges without engaging multiple providers

13 EMPLOYEE BENEFIT PLAN ADMINISTRATION & TRUST SERVICES • BPAS Family of Services Plan Administration & Recordkeeping | TPA | Actuarial & Pension | VEBA & HRA/HSA | Fiduciary | AutoRollovers & MyPlanLoan | Healthcare Consulting | Transfer Agency | Fund Administration | Collective Investment Funds • BPAS Subsidiaries Hand Benefits & Trust | NRS Trust Product Administration | Global Trust Company | BPAS Trust Company of Puerto Rico • Specialty Retirement Plan Administration Practices Auto Enrollment Plans | Multiple Employer Plans and Multiple Employer Trusts| Plans with Employer Securities | Puerto Rico Section 1081 Plans | VEBA HRA Plans | Cash Balance Plans | Collective Investment Funds | Fund Administration • One company. One Call .

14 WEALTH MANAGEMENT AND INSURANCE • Revenue Growth 12 - year CAGR 17.6 % ( 2007 – 2019) ‒ $15.2 million of revenues in Q1 2020, a 6.9% increase over Q1 2019 ‒ $58.1 million of revenues in 2019, a 3.5% increase over 2018 • Upstate NY , Northeast PA, Vermont, NYC, and Florida • $7.3 billion in assets under management or administration ‒ Trust Services ‒ Asset Management and Advisory ‒ Insurance Agency ‒ Risk Management Services ‒ Planning

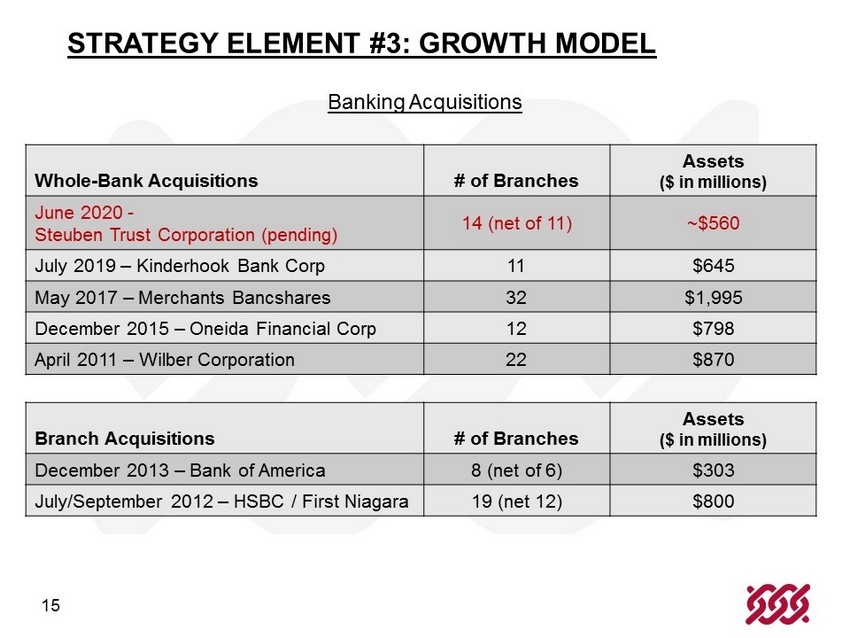

15 STRATEGY ELEMENT #3: GROWTH MODEL Banking Acquisitions Whole - Bank Acquisitions # of Branches Assets ($ in millions) June 2020 - Steuben Trust Corporation (pending) 14 (net of 11) ~$560 July 2019 – Kinderhook Bank Corp 11 $645 May 2017 – Merchants Bancshares 32 $1,995 December 2015 – Oneida Financial Corp 12 $798 April 2011 – Wilber Corporation 22 $870 Branch Acquisitions # of Branches Assets ($ in millions) December 2013 – Bank of America 8 (net of 6) $303 July/September 2012 – HSBC / First Niagara 19 (net 12) $800

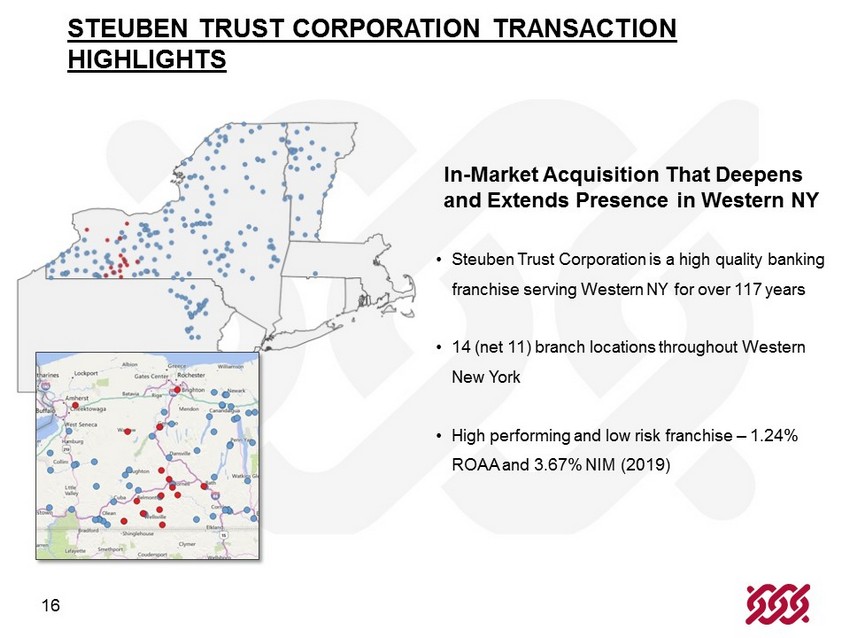

16 STEUBEN TRUST CORPORATION TRANSACTION HIGHLIGHTS • Steuben Trust Corporation is a high quality banking franchise serving Western NY for over 117 years • 14 (net 11) branch locations throughout Western New York • High performing and low risk franchise – 1.24% ROAA and 3.67% NIM (2019) In - Market Acquisition That Deepens and Extends Presence in Western NY

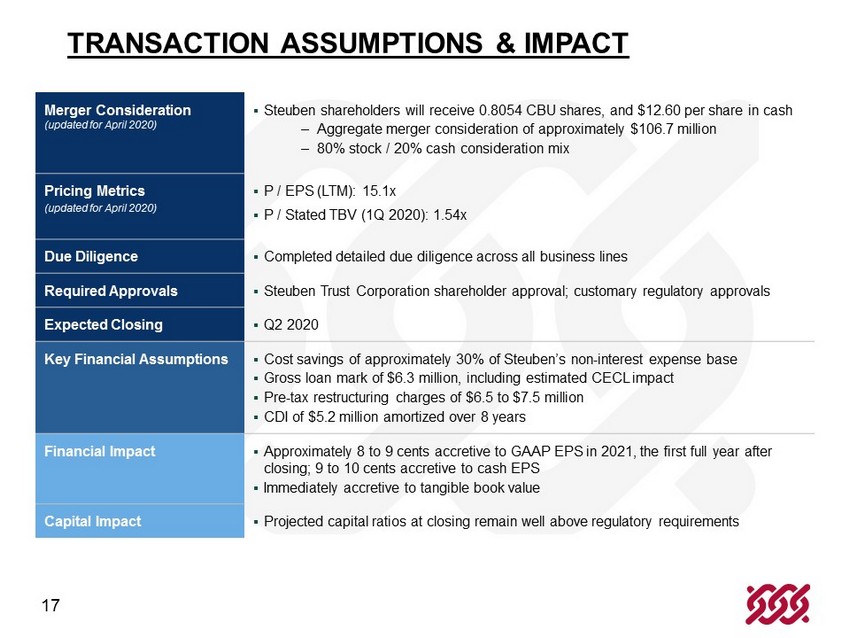

17 TRANSACTION ASSUMPTIONS & IMPACT Merger Consideration (updated for April 2020) ▪ Steuben shareholders will receive 0.8054 CBU shares, and $12.60 per share in cash ‒ Aggregate merger consideration of approximately $106.7 million ‒ 80% stock / 20% cash consideration mix Pricing Metrics (updated for April 2020) ▪ P / EPS (LTM): 15.1x ▪ P / Stated TBV (1Q 2020): 1.54x Due Diligence ▪ Completed detailed due diligence across all business lines Required Approvals ▪ Steuben Trust Corporation shareholder approval; customary regulatory approvals Expected Closing ▪ Q2 2020 Key Financial Assumptions ▪ Cost savings of approximately 30% of Steuben’s non - interest expense base ▪ Gross loan mark of $6.3 million, including estimated CECL impact ▪ Pre - tax restructuring charges of $6.5 to $7.5 million ▪ CDI of $5.2 million amortized over 8 years Financial Impact ▪ Approximately 8 to 9 cents accretive to GAAP EPS in 2021, the first full year after closing; 9 to 10 cents accretive to cash EPS ▪ Immediately accretive to tangible book value Capital Impact ▪ Projected capital ratios at closing remain well above regulatory requirements

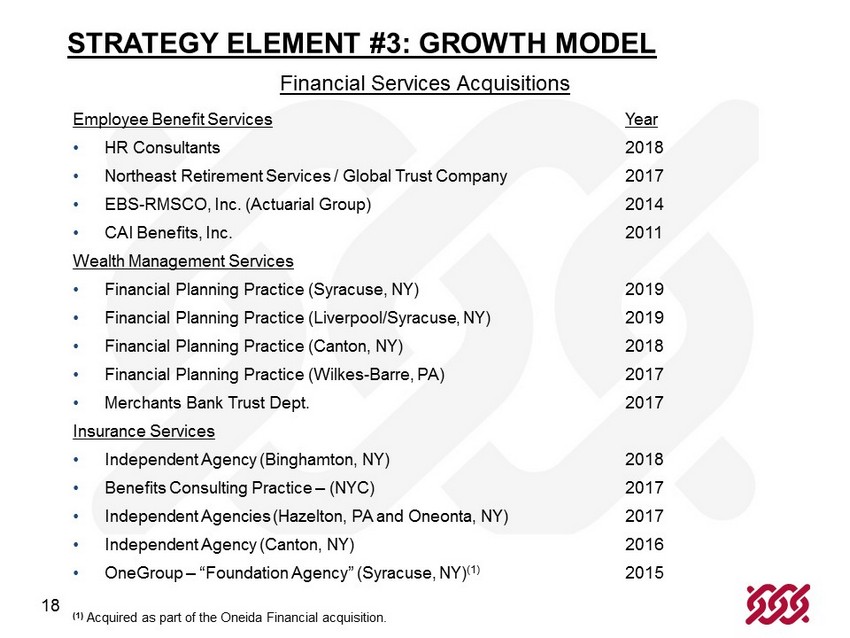

18 STRATEGY ELEMENT #3: GROWTH MODEL Financial Services Acquisitions Employee Benefit Services Year • HR Consultants 2018 • Northeast Retirement Services / Global Trust Company 2017 • EBS - RMSCO, Inc. (Actuarial Group) 2014 • CAI Benefits, Inc. 2011 Wealth Management Services • Financial Planning Practice (Syracuse, NY) 2019 • Financial Planning Practice (Liverpool/Syracuse, NY) 2019 • Financial Planning Practice (Canton, NY) 2018 • Financial Planning Practice (Wilkes - Barre, PA) 2017 • Merchants Bank Trust Dept. 2017 Insurance Services • Independent Agency (Binghamton, NY) 2018 • Benefits Consulting Practice – (NYC) 2017 • Independent Agencies (Hazelton, PA and Oneonta, NY) 2017 • Independent Agency (Canton, NY) 2016 • OneGroup – “Foundation Agency” (Syracuse, NY) (1) 2015 (1 ) Acquired as part of the Oneida Financial acquisition.

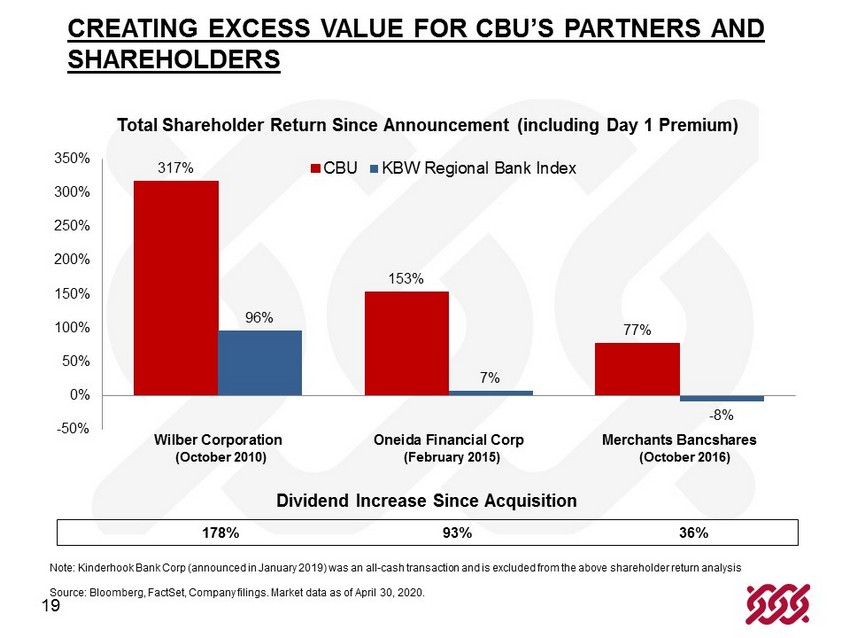

19 CREATING EXCESS VALUE FOR CBU’S PARTNERS AND SHAREHOLDERS Note: Kinderhook Bank Corp (announced in January 2019) was an all - cash transaction and is excluded from the above shareholder re turn analysis Source: Bloomberg, FactSet , Company filings. Market data as of April 30, 2020. Total Shareholder Return Since Announcement (including Day 1 Premium) 178 % 93 % 36% 317% 153% 77% 96% 7% - 8% -50% 0% 50% 100% 150% 200% 250% 300% 350% Wilber Corporation Oneida Financial Corp Merchants Bancshares CBU KBW Regional Bank Index (October 2010) (February 2015) (October 2016) Dividend Increase Since Acquisition

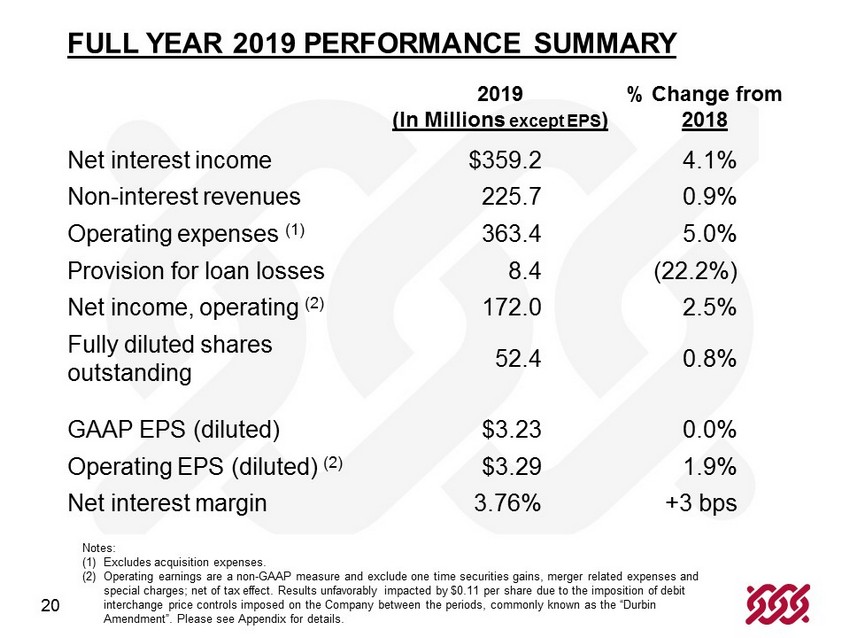

20 FULL YEAR 2019 PERFORMANCE SUMMARY 2019 (In Millions except EPS ) % Change from 2018 Net interest income $359.2 4.1% Non - interest revenues 225.7 0.9% Operating expenses (1) 363.4 5.0% Provision for loan losses 8.4 (22.2%) Net income, operating (2) 172.0 2.5% Fully diluted shares outstanding 52.4 0.8% Operating EPS (diluted) (2) $3.29 1.9% Net interest margin 3.76% +3 bps Notes: (1) Excludes acquisition expenses. (2) Excludes acquisition expenses and unrealized gain/(loss) on equity securities, net of tax effect. Results unfavorably impacted by $0.11 per share due to the imposition of debit interchange price controls imposed on the Company between the periods, commonly known as the “Durbin Amendment”.

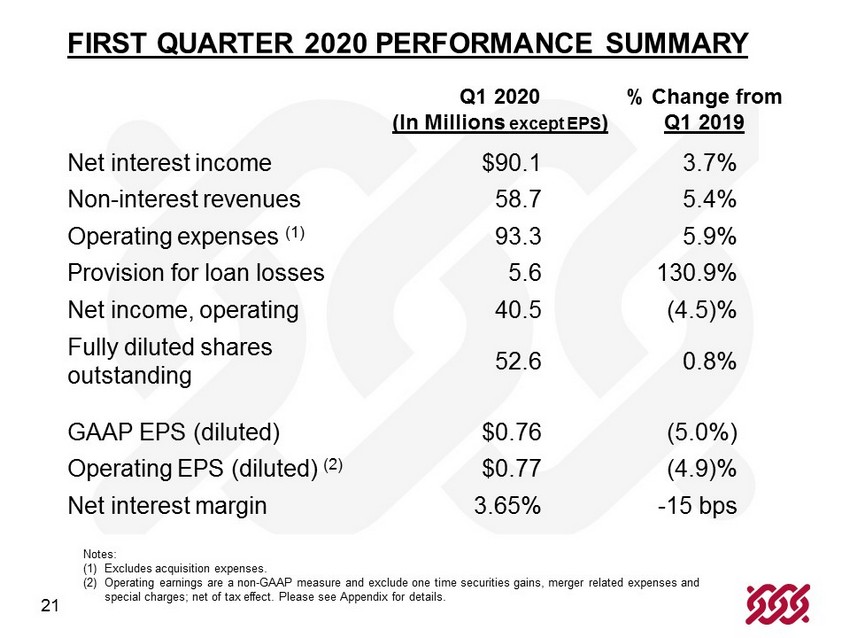

21 FIRST QUARTER 2020 PERFORMANCE SUMMARY Q1 2020 (In Millions except EPS ) % Change from Q1 2019 Net interest income $90.1 3.7% Non - interest revenues 58.7 5.4% Operating expenses (1) 93.3 5.9% Provision for loan losses 5.6 130.9% Net income, operating 40.5 (4.5)% Fully diluted shares outstanding 52.6 0.8% Operating EPS (diluted) $0.77 (4.9)% Net interest margin 3.65% - 15 bps Notes: (1) Excludes acquisition expenses .

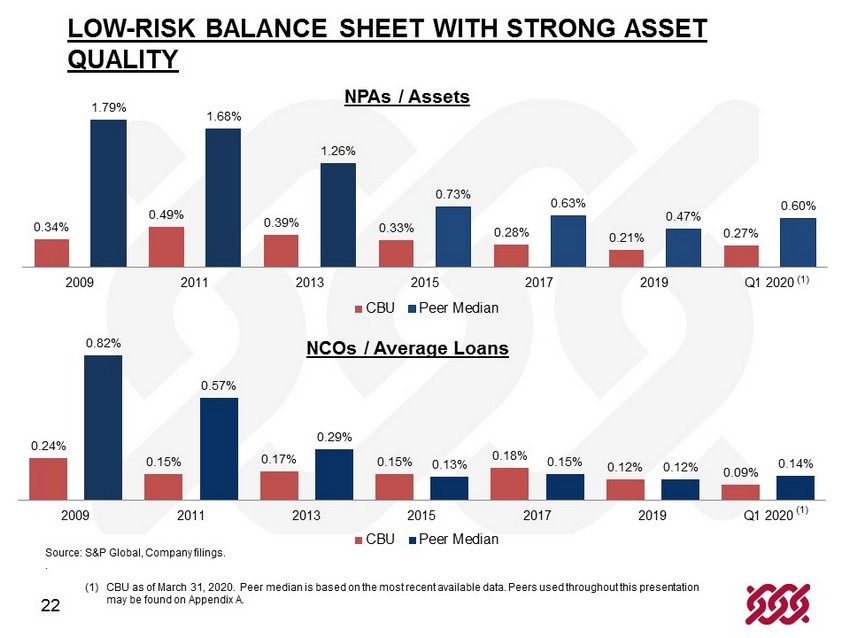

22 LOW - RISK BALANCE SHEET WITH STRONG ASSET QUALITY Source: S&P Global, Company filings. . 0.34% 0.49% 0.39% 0.33% 0.28% 0.21% 0.27% 1.79% 1.68% 1.26% 0.73% 0.63% 0.47% 0.60% 2009 2011 2013 2015 2017 2019 Q1 2020 CBU Peer Median 0.24% 0.15% 0.17% 0.15% 0.18% 0.12% 0.09% 0.82% 0.57% 0.29% 0.13% 0.15% 0.12% 0.14% 2009 2011 2013 2015 2017 2019 Q1 2020 CBU Peer Median NPAs / Assets NCOs / Average Loans (1) CBU as of March 31, 2020. Peer median is based on the most recent available data. Peers used throughout this presentation may be found on Appendix A . (1) (1)

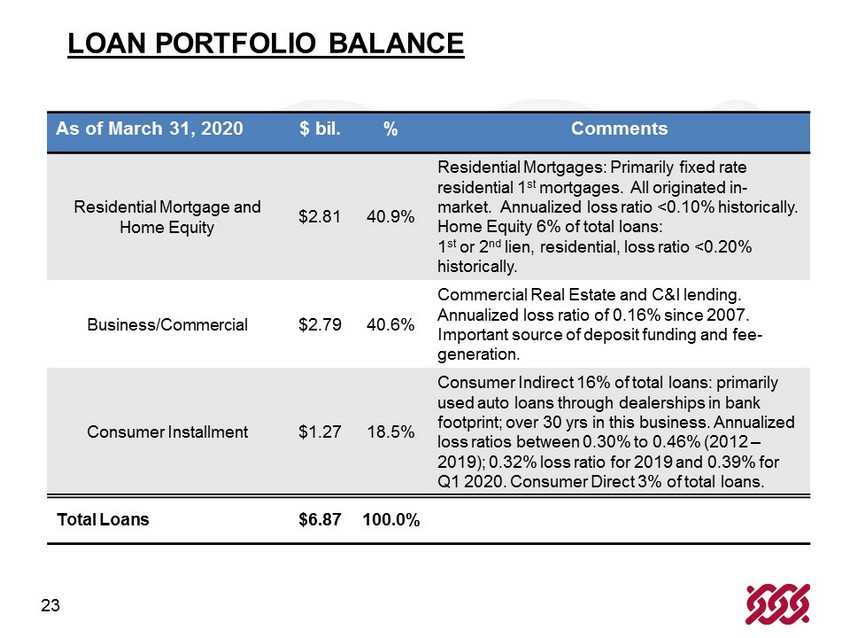

23 LOAN PORTFOLIO BALANCE As of March 31 , 2020 $ bil . % Comments Residential Mortgage and Home Equity $2.81 40.9% Residential Mortgages: Primarily fixed rate residential 1 st mortgages. All originated in - market. Annualized loss ratio <0.10% historically . Home Equity 6% of total loans: 1 st or 2 nd lien, residential, loss ratio <0.20% historically. Business/Commercial $2.79 40.6% Commercial Real Estate and C&I lending. Annualized loss ratio of 0.16% since 2007. Important source of deposit funding and fee - generation. Consumer Installment $ 1.27 18.5% Consumer Indirect 16% of total loans: primarily used auto loans through dealerships in bank footprint; over 30 yrs in this business. Annualized loss ratios between 0.30 % to 0.46% (2012 – 2019); 0.32% loss ratio for 2019 and 0.39% for Q1 2020. Consumer Direct 3% of total loans. Total Loans $6.87 100.0%

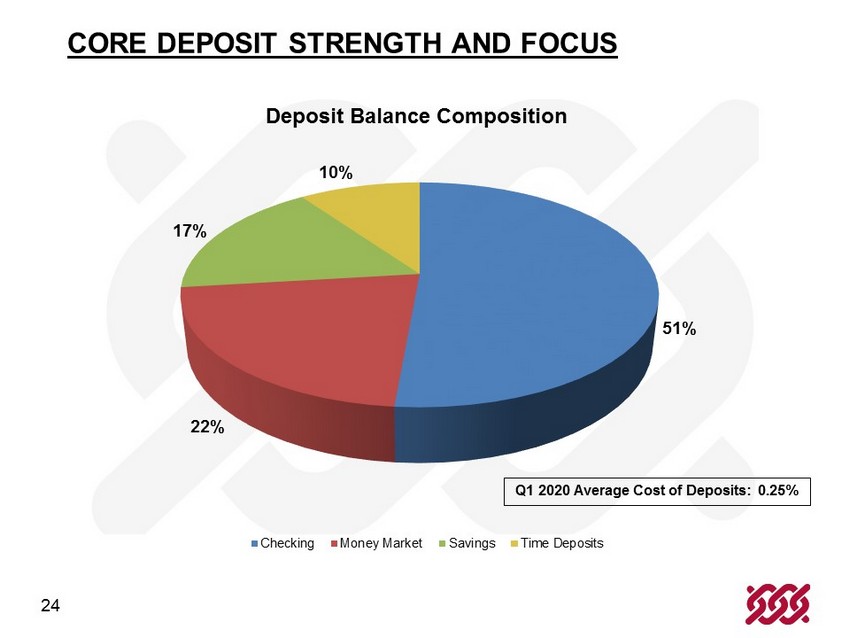

24 CORE DEPOSIT STRENGTH AND FOCUS 51% 22% 17% 10% Deposit Balance Composition Checking Money Market Savings Time Deposits Q1 2020 Average Cost of Deposits: 0.25%

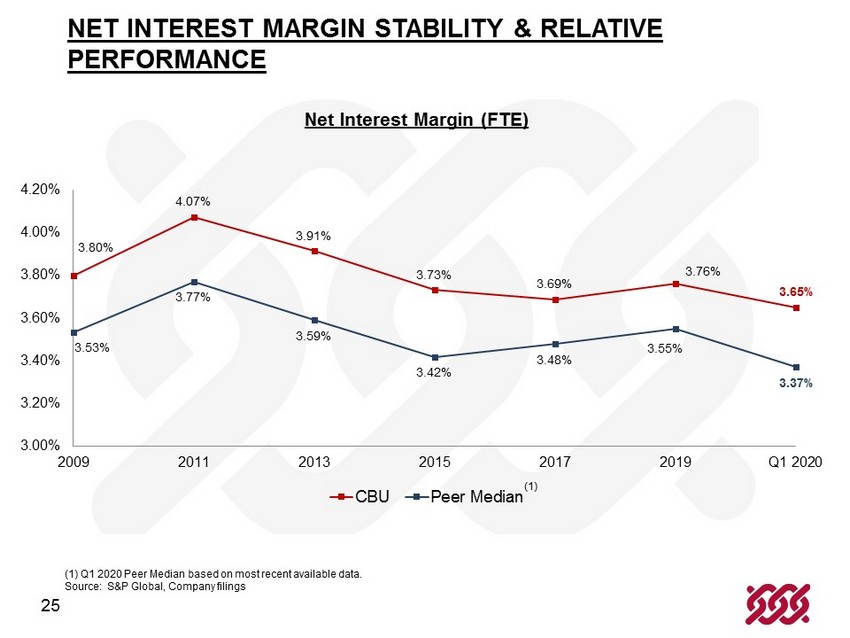

25 NET INTEREST MARGIN STABILITY & RELATIVE PERFORMANCE Net Interest Margin (FTE) (1) Q1 2020 Peer Median based on most recent available data. Source: S&P Global, Company filings 3.80% 4.07% 3.91% 3.73% 3.69% 3.76% 3.65% 3.53% 3.77% 3.59% 3.42% 3.48% 3.55% 3.37% 3.00% 3.20% 3.40% 3.60% 3.80% 4.00% 4.20% 2009 2011 2013 2015 2017 2019 Q1 2020 CBU Peer Median (1)

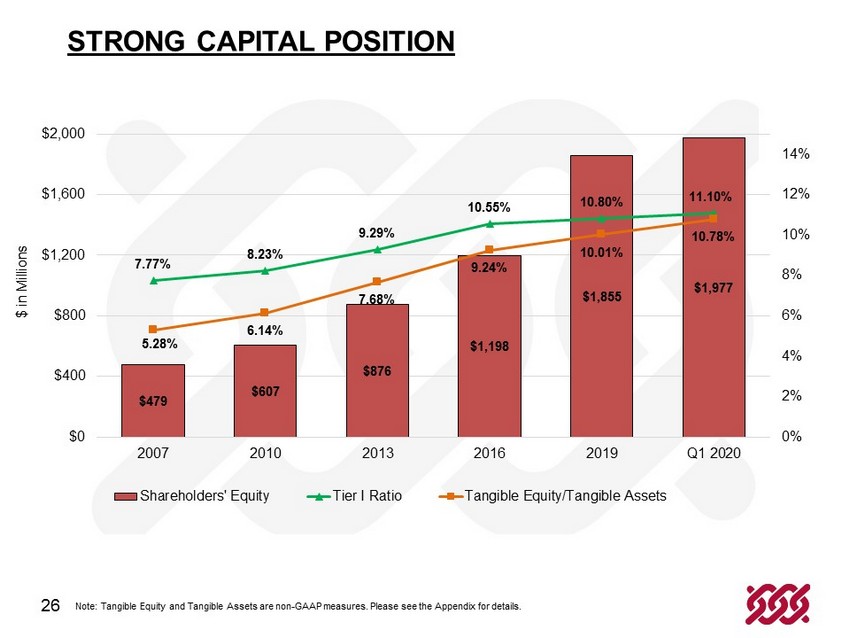

26 $479 $607 $876 $1,198 $1,855 $1,977 7.77% 8.23% 9.29% 10.55% 10.80% 11.10% 5.28% 6.14% 7.68% 9.24% 10.01% 10.78% 0% 2% 4% 6% 8% 10% 12% 14% $0 $400 $800 $1,200 $1,600 $2,000 2007 2010 2013 2016 2019 Q1 2020 $ in Millions Shareholders' Equity Tier I Ratio Tangible Equity/Tangible Assets STRONG CAPITAL POSITION Note: Tangible Equity and Tangible Assets are non - GAAP measures. Please see the Appendix for details.

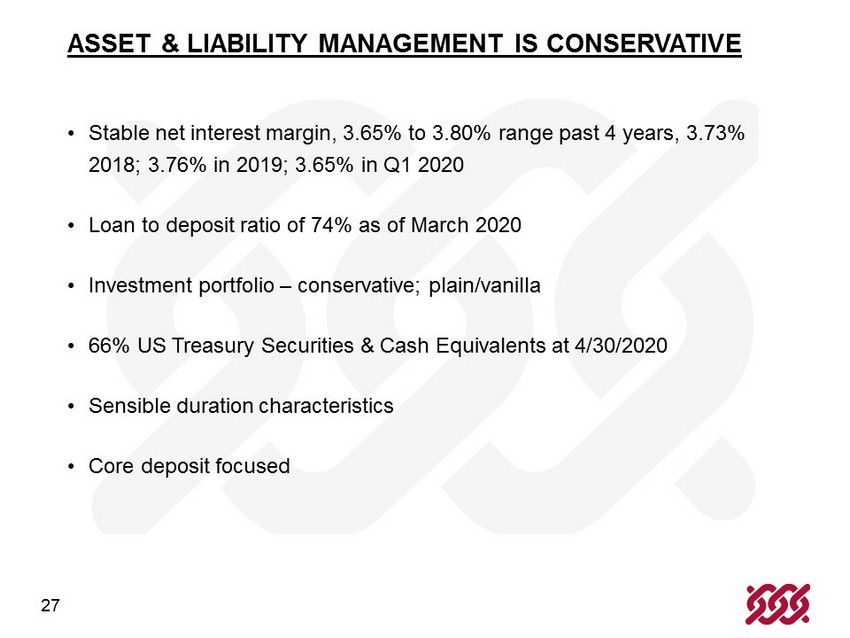

27 ASSET & LIABILITY MANAGEMENT IS CONSERVATIVE • Stable net interest margin, 3.65% to 3.80% range past 4 years, 3.73% 2018; 3.76% in 2019; 3.65% in Q1 2020 • Loan to deposit ratio of 74% as of March 2020 • Investment portfolio – conservative; plain/vanilla • 66% US Treasury Securities & Cash Equivalents at 4/30/2020 • Sensible duration characteristics • Core deposit focused

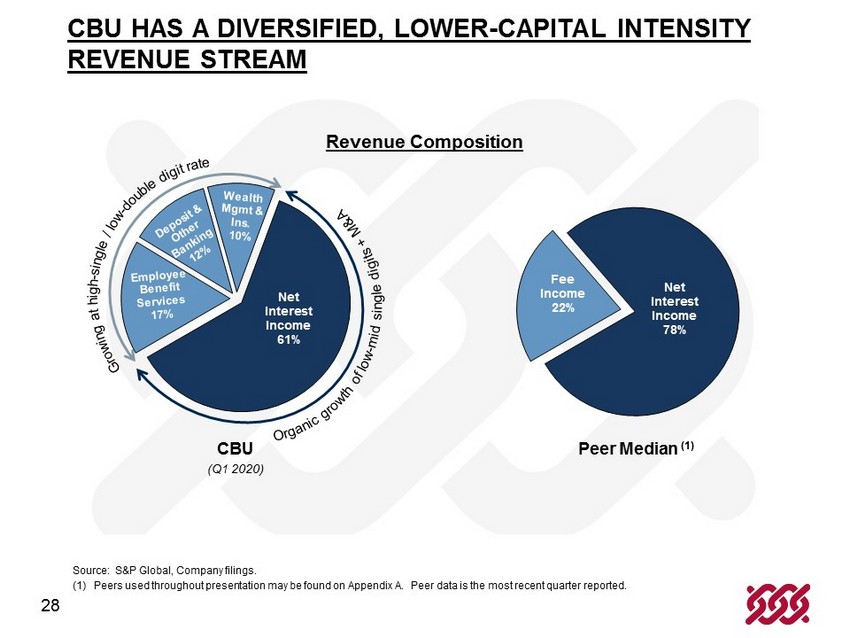

28 CBU HAS A DIVERSIFIED, LOWER - CAPITAL INTENSITY REVENUE STREAM CBU Peer Median ( 1) Revenue Composition Source: S&P Global, Company filings. (1) Peers used throughout presentation may be found on Appendix A. Peer data is the most recent quarter reported. Fee Income 22% Net Interest Income 78% Net Interest Income 61% (Q1 2020)

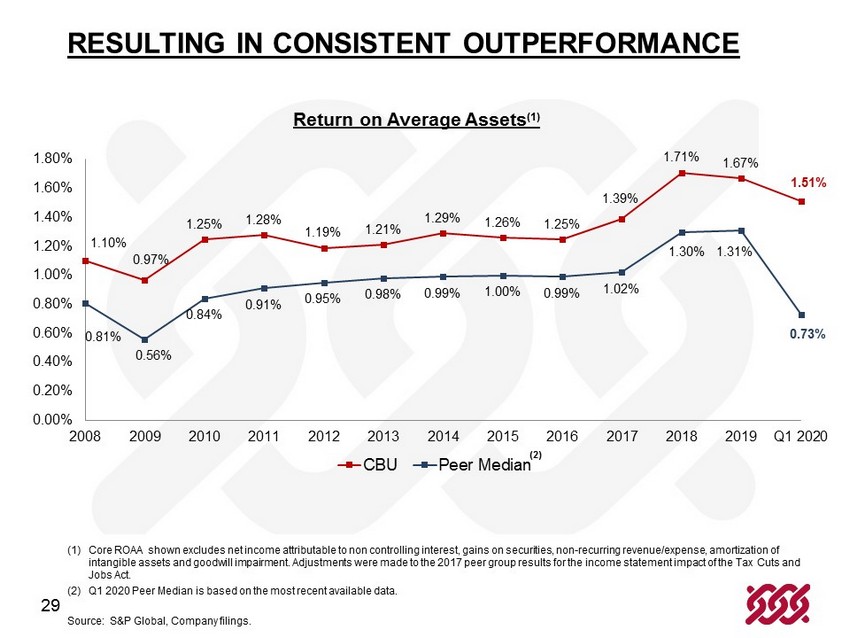

29 RESULTING IN CONSISTENT OUTPERFORMANCE Return on Average Assets (1) (1) Core ROAA shown excludes net income attributable to non controlling interest, gains on securities, non - recurring revenue/expense, amo rtization of intangible assets and goodwill impairment. Adjustments were made to the 2017 peer group results for the income statement impa ct of the Tax Cuts and Jobs Act. (2) Q1 2020 Peer Median is based on the most recent available data. Source: S&P Global, Company filings. 1.10% 0.97% 1.25% 1.28% 1.19% 1.21% 1.29% 1.26% 1.25% 1.39% 1.71% 1.67% 0.81% 0.56% 0.84% 0.91% 0.95% 0.98% 0.99% 1.00% 0.99% 1.02% 1.30% 1.31% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% 1.80% 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Q1 2020 CBU Peer Median 1.51% 0.73% (2)

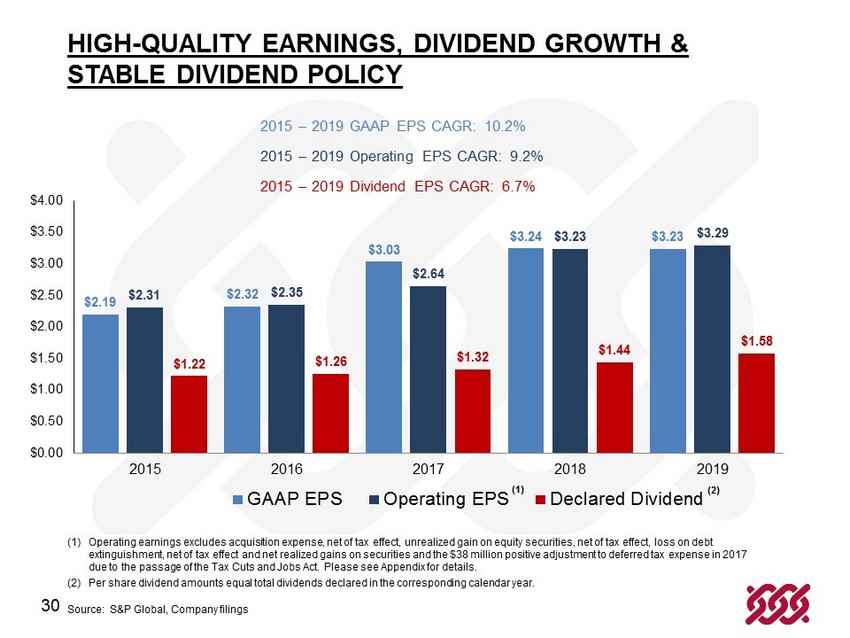

30 HIGH - QUALITY EARNINGS, DIVIDEND GROWTH & STABLE DIVIDEND POLICY (1) Operating earnings excludes acquisition expense, net of tax effect, unrealized gain on equity securities, net of tax effect, loss on debt extinguishment, net of tax effect litigation settlement net of tax effect and net realized gains on securities and the $38 mi lli on positive adjustment to deferred tax expense in 2017 due to the passage of the Tax Cuts and Jobs Act (2) Per share dividend amounts equal total dividends declared in the corresponding calendar year. (2) (1) Source: S&P Global, Company filings $1.30 $1.95 $2.10 $2.08 $2.09 $2.27 $2.31 $2.35 $2.64 $3.23 $3.29 $0.88 $0.94 $1.00 $1.06 $1.10 $1.16 $1.22 $1.26 $1.32 $1.44 $1.58 $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Operating EPS Declared Dividend 2009 – 2019 Operating EPS CAGR: 8.0% 2009 – 2019 Dividend EPS CAGR: 5.0%

31 INVESTMENT MERITS • Community Bank became a member of the S&P 1500 Dividend Aristocrats Index in 2012, signifying that the Company had raised its annual regular cash dividend payment for at least 20 consecutive years (now at 27 years in a row). • Our 12 - year cumulative total return to shareholders is 268% ( 11.5% annualized). This compares to a 12 - year cumulative total return for the KBW Regional Banking Index of 41% (2.9% annualized).* • NYSE - listed company with significant liquidity. • Long - term growth focus. Successful and effective operating strategy. Strong fundamentals with strong asset quality. Superior return to shareholders. * Based on 12 - year historical performance through April 30, 2020, assuming dividend reinvestment.

32 CONSISTENT DIVIDEND FOCUS • Strong Dividend Payment • $1.64 per share annualized • Payout ratio of approximately 50% • Productive Dividend Yield • 2.62% at April 30, 2020 • Outstanding Track Record of Payment Increases • 8% increase in August 2019 • 27 straight years

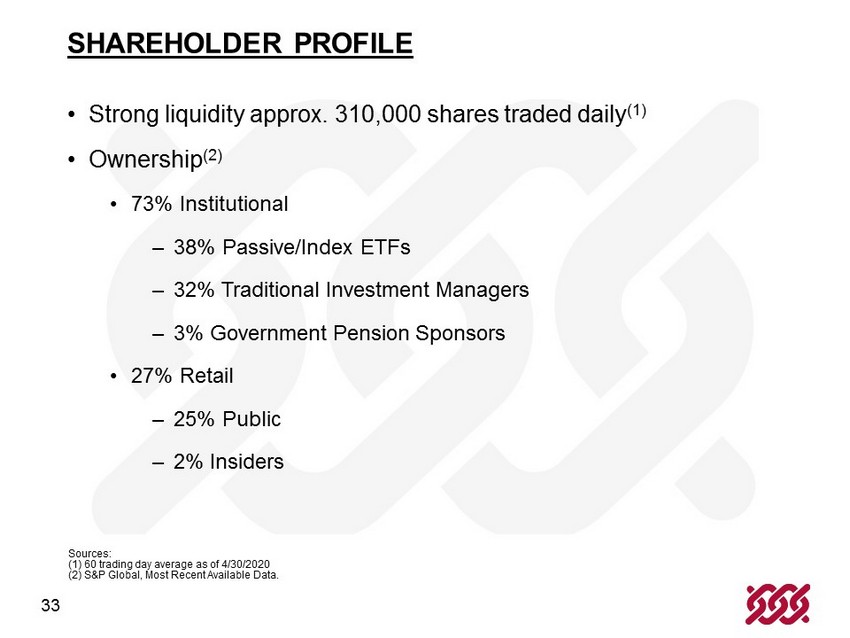

33 SHAREHOLDER PROFILE • Strong liquidity approx. 310,000 shares traded daily (1) • Ownership (2) • 73% Institutional ‒ 38% Passive/Index ETFs ‒ 32% Traditional Investment Managers ‒ 3% Government Pension Sponsors • 27% Retail ‒ 25% Public ‒ 2% Insiders • Sources : (1) 60 trading day average as of 4/30/2020 (2) S&P Global, Most Recent Available Data .

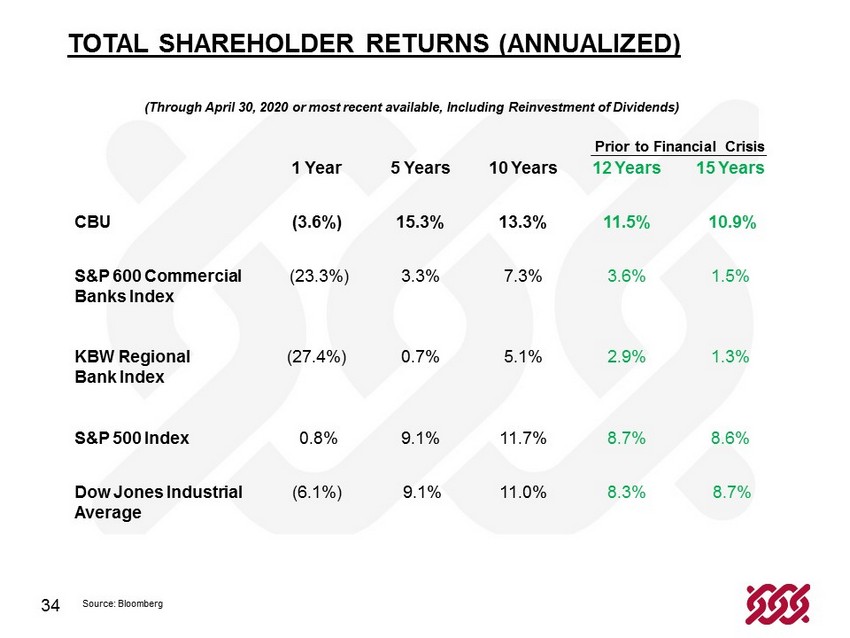

34 TOTAL SHAREHOLDER RETURNS (ANNUALIZED) (Through April 30, 2020 or most recent available, Including Reinvestment of Dividends) 1 Year 5 Years 10 Years 12 Years 15 Years CBU (3.6%) 15.3% 13.3% 11.5% 10 .9% S&P 600 Commercial Banks Index (23.3%) 3.3 % 7.3% 3.6% 1.5% KBW Regional Bank Index (27.4%) 0.7% 5.1% 2.9% 1.3% S&P 500 Index 0.8% 9.1% 11.7% 8.7% 8.6% Dow Jones Industrial Average (6.1%) 9.1% 11.0% 8.3% 8.7% Prior to Financial Crisis Source: Bloomberg

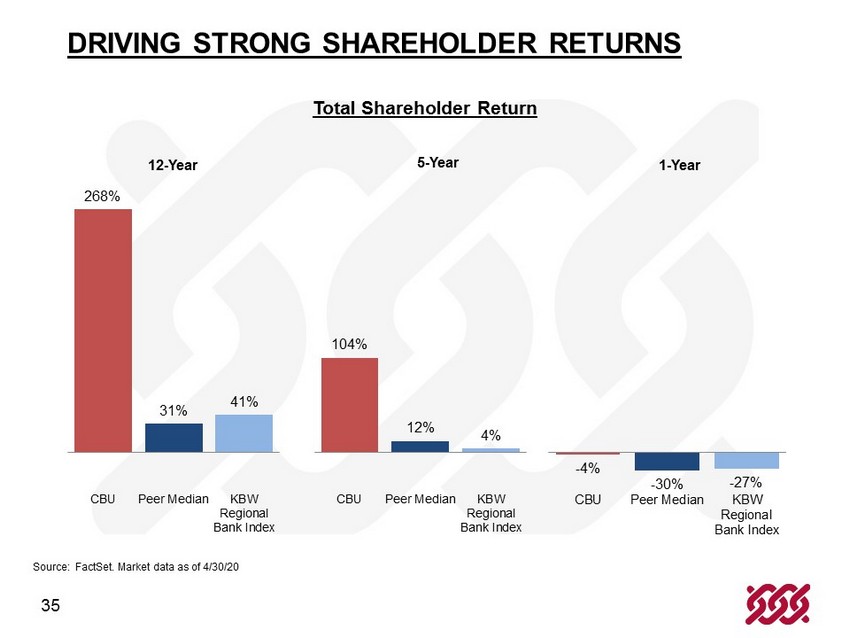

35 DRIVING STRONG SHAREHOLDER RETURNS Total Shareholder Return Source: FactSet . Market data as of 4/30/20 268% 31% 41% CBU Peer Median KBW Regional Bank Index - 4% - 30% - 27% CBU Peer Median KBW Regional Bank Index 1 - Year 12 - Year 5 - Year 104% 12% 4% CBU Peer Median KBW Regional Bank Index

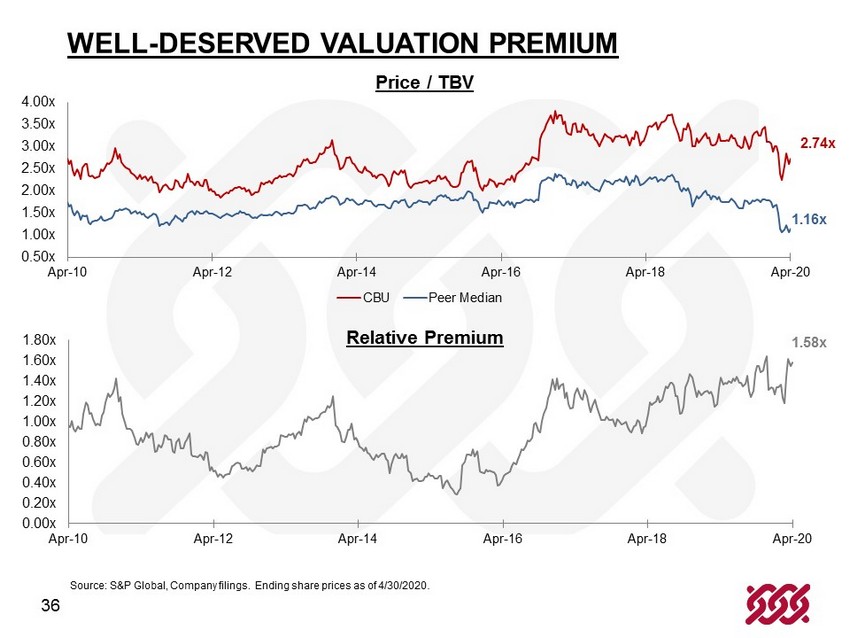

36 0.50x 1.00x 1.50x 2.00x 2.50x 3.00x 3.50x 4.00x Apr-10 Apr-12 Apr-14 Apr-16 Apr-18 Apr-20 CBU Peer Median WELL - DESERVED VALUATION PREMIUM Price / TBV Relative Premium Source: S&P Global, Company filings. Ending share prices as of 4/30/2020 . 2.74x 0.00x 0.20x 0.40x 0.60x 0.80x 1.00x 1.20x 1.40x 1.60x 1.80x Apr-10 Apr-12 Apr-14 Apr-16 Apr-18 Apr-20 1.16x 1.58x

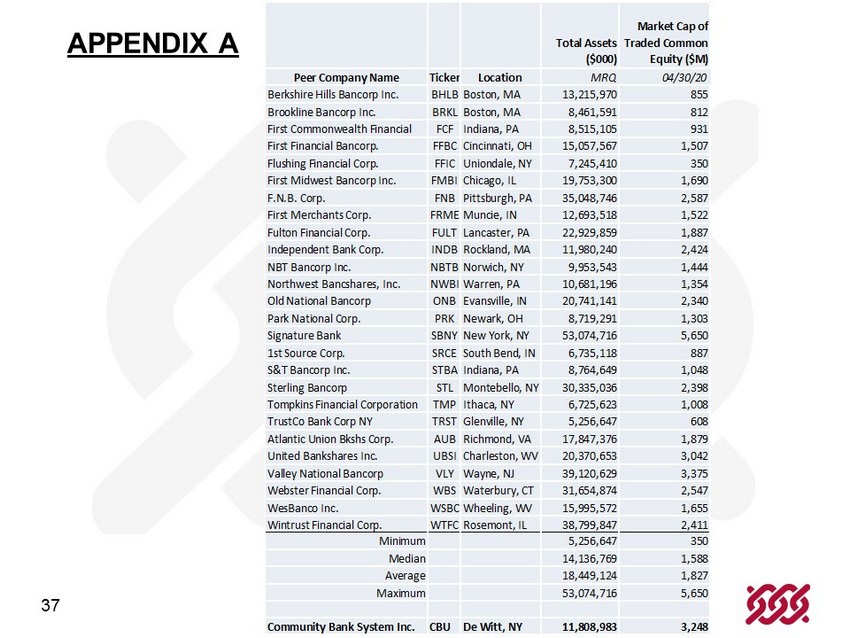

37 APPENDIX A Total Assets ($000) Market Cap of Traded Common Equity ($M) Peer Company Name Ticker Location MRQ 04/30/20 Berkshire Hills Bancorp Inc. BHLBBoston, MA 13,215,970 855 Brookline Bancorp Inc. BRKLBoston, MA 8,461,591 812 First Commonwealth Financial FCF Indiana, PA 8,515,105 931 First Financial Bancorp. FFBC Cincinnati, OH 15,057,567 1,507 Flushing Financial Corp. FFIC Uniondale, NY 7,245,410 350 First Midwest Bancorp Inc. FMBIChicago, IL 19,753,300 1,690 F.N.B. Corp. FNB Pittsburgh, PA 35,048,746 2,587 First Merchants Corp. FRMEMuncie, IN 12,693,518 1,522 Fulton Financial Corp. FULT Lancaster, PA 22,929,859 1,887 Independent Bank Corp. INDBRockland, MA 11,980,240 2,424 NBT Bancorp Inc. NBTBNorwich, NY 9,953,543 1,444 Northwest Bancshares, Inc. NWBIWarren, PA 10,681,196 1,354 Old National Bancorp ONB Evansville, IN 20,741,141 2,340 Park National Corp. PRK Newark, OH 8,719,291 1,303 Signature Bank SBNYNew York, NY 53,074,716 5,650 1st Source Corp. SRCE South Bend, IN 6,735,118 887 S&T Bancorp Inc. STBAIndiana, PA 8,764,649 1,048 Sterling Bancorp STL Montebello, NY 30,335,036 2,398 Tompkins Financial Corporation TMP Ithaca, NY 6,725,623 1,008 TrustCo Bank Corp NY TRST Glenville, NY 5,256,647 608 Atlantic Union Bkshs Corp. AUB Richmond, VA 17,847,376 1,879 United Bankshares Inc. UBSI Charleston, WV 20,370,653 3,042 Valley National Bancorp VLY Wayne, NJ 39,120,629 3,375 Webster Financial Corp. WBS Waterbury, CT 31,654,874 2,547 WesBanco Inc. WSBCWheeling, WV 15,995,572 1,655 Wintrust Financial Corp. WTFCRosemont, IL 38,799,847 2,411 Minimum 5,256,647 350 Median 14,136,769 1,588 Average 18,449,124 1,827 Maximum 53,074,716 5,650 Community Bank System Inc. CBU De Witt, NY 11,808,983 3,248

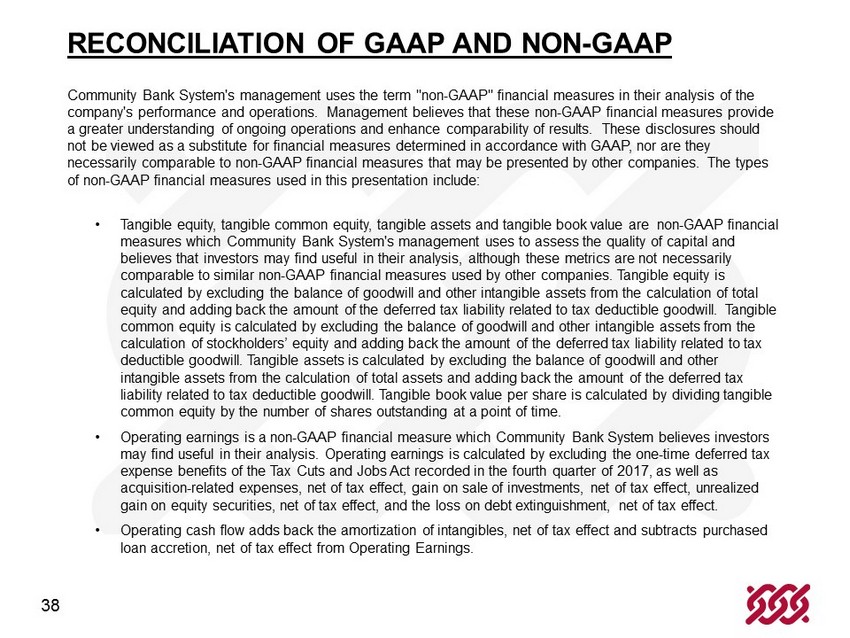

38 RECONCILIATION OF GAAP AND NON - GAAP Community Bank System's management uses the term "non - GAAP" financial measures in their analysis of the company's performance and operations. Management believes that these non - GAAP financial measures provide a greater understanding of ongoing operations and enhance comparability of results. These disclosures should not be viewed as a substitute for financial measures determined in accordance with GAAP, nor are they necessarily comparable to non - GAAP financial measures that may be presented by other companies. The types of non - GAAP financial measures used in this presentation include: • Tangible equity, tangible common equity, tangible assets and tangible book value are non - GAAP financial measures which Community Bank System's management uses to assess the quality of capital and believes that investors may find useful in their analysis, although these metrics are not necessarily comparable to similar non - GAAP financial measures used by other companies. Tangible equity is calculated by excluding the balance of goodwill and other intangible assets from the calculation of total equity and adding back the amount of the deferred tax liability related to tax deductible goodwill. Tangible common equity is calculated by excluding the balance of goodwill and other intangible assets from the calculation of stockholders’ equity and adding back the amount of the deferred tax liability related to tax deductible goodwill. Tangible assets is calculated by excluding the balance of goodwill and other intangible assets from the calculation of total assets and adding back the amount of the deferred tax liability related to tax deductible goodwill. Tangible book value per share is calculated by dividing tangible common equity by the number of shares outstanding at a point of time. • Operating earnings is a non - GAAP financial measure which Community Bank System believes investors may find useful in their analysis. Operating earnings is calculated by excluding the one - time deferred tax expense benefits of the Tax Cuts and Jobs Act recorded in the fourth quarter of 2017, as well as acquisition - related expenses, net of tax effect, gain on sale of investments, net of tax effect, unrealized gain on equity securities, net of tax effect, and the loss on debt extinguishment, net of tax effect. • Operating cash flow adds back the amortization of intangibles, net of tax effect and subtracts purchased loan accretion, net of tax effect from Operating Earnings.

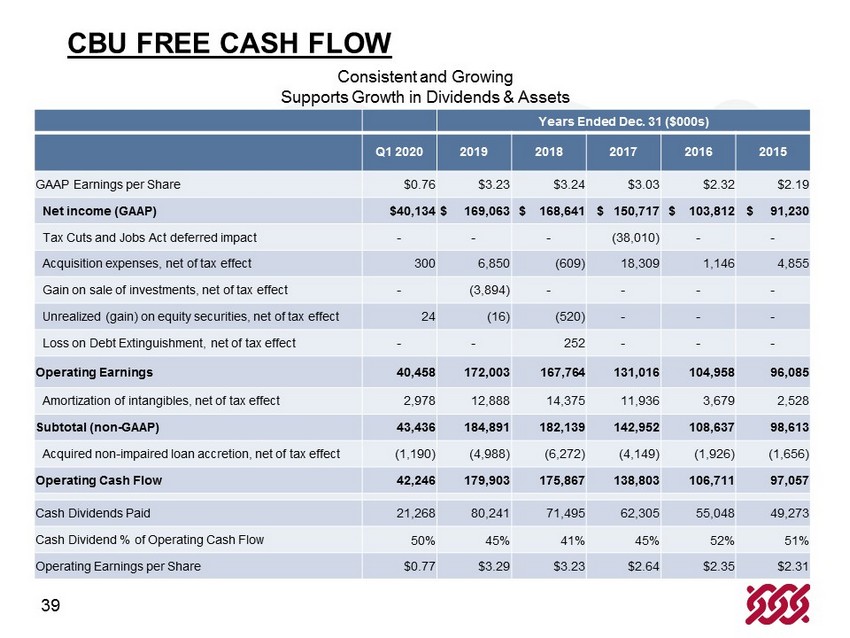

39 CBU FREE CASH FLOW Consistent and Growing Supports Growth in Dividends & Assets Years Ended Dec. 31 ($000s) Q1 2020 2019 2018 2017 2016 2015 Net income (GAAP) $40,134 $ 169,063 $ 168,641 $ 150,717 $ 103,812 $ 91,230 Tax Cuts and Jobs Act deferred impact - - - (38,010) - - Acquisition expenses, net of tax effect 300 6,850 (609) 18,309 1,146 4,855 Gain on sale of investments, net of tax effect - (3,894) - - - - Unrealized (gain) on equity securities, net of tax effect 24 (16) (520) - - - Loss on Debt Extinguishment, net of tax effect - - 252 - - - Operating Earnings 40,458 172,003 167,764 131,016 104,958 96,085 Amortization of intangibles, net of tax effect 2,978 12,888 14,375 11,936 3,679 2,528 Subtotal (non - GAAP) 43,436 184,891 182,139 142,952 108,637 98,613 Acquired non - impaired loan accretion, net of tax effect (1,190) (4,988) (6,272) (4,149) (1,926) (1,656) Operating Cash Flow 42,246 179,903 175,867 138,803 106,711 97,057 Cash Dividends Paid 21,268 80,241 71,495 62,305 55,048 49,273 Cash Dividend % of Operating Cash Flow 50% 45% 41% 45% 52% 51% Operating Earning s per Share $0.77 $3.29 $3.23 $2.64 $2.35 $2.31

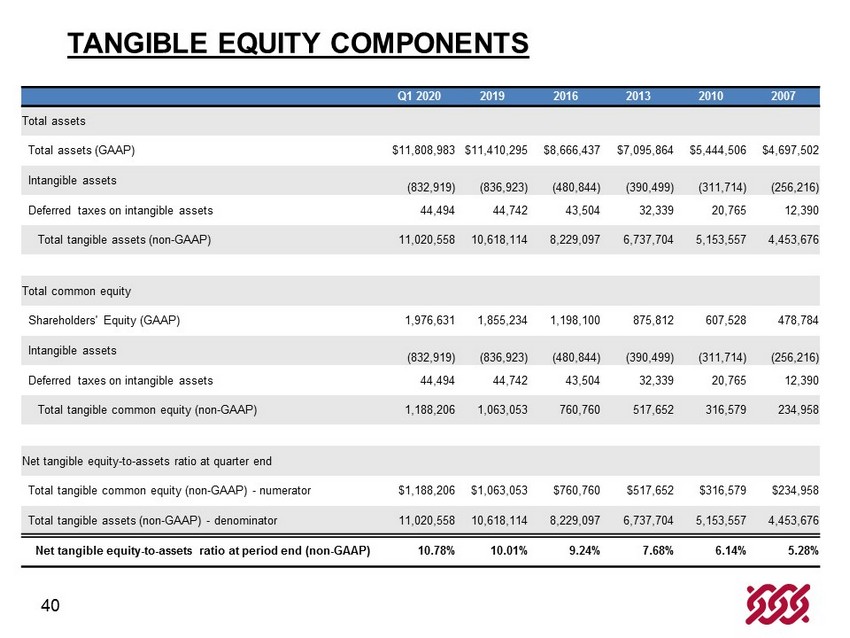

40 TANGIBLE EQUITY COMPONENTS Q1 2020 2019 2016 2013 2010 2007 Total assets Total assets (GAAP) $11,808,983 $11,410,295 $8,666,437 $7,095,864 $5,444,506 $4,697,502 Intangible assets (832,919) (836,923) (480,844) (390,499) (311,714) (256,216) Deferred taxes on intangible assets 44,494 44,742 43,504 32,339 20,765 12,390 Total tangible assets (non - GAAP) 11,020,558 10,618,114 8,229,097 6,737,704 5,153,557 4,453,676 Total common equity Shareholders' Equity (GAAP) 1,976,631 1,855,234 1,198,100 875,812 607,528 478,784 Intangible assets (832,919) (836,923) (480,844) (390,499) (311,714) (256,216) Deferred taxes on intangible assets 44,494 44,742 43,504 32,339 20,765 12,390 Total tangible common equity (non - GAAP) 1,188,206 1,063,053 760,760 517,652 316,579 234,958 Net tangible equity - to - assets ratio at quarter end Total tangible common equity (non - GAAP) - numerator $1,188,206 $1,063,053 $760,760 $517,652 $316,579 $234,958 Total tangible assets (non - GAAP) - denominator 11,020,558 10,618,114 8,229,097 6,737,704 5,153,557 4,453,676 Net tangible equity - to - assets ratio at period end (non - GAAP) 10.78% 10.01% 9.24% 7.68% 6.14% 5.28%

41 COVID - 19 PANDEMIC RESPONSE SUPPLEMENTAL INFORMATION

42 COVID - 19 VIRUS DEVELOPMENTS The World Health Organization declared COVID - 19 virus to be a global pandemic on March 11, 2020. T he rapid spread of the COVID - 19 virus in the United States invoked various Federal and State Authorities to make emergency declarations and issue executive orders to limit the spread of disease. Concerns about the spread of the disease and its anticipated negative impact on economic activity, severely disrupted both domestic and international financial markets. As the COVID - 19 events unfolded throughout the first quarter of 2020, the Company implemented various plans, strategies and protocols to protect its employees, maintain services for customers, assure the functional continuity of its operating systems, controls and processes, and mitigate financial risks posed by changing market conditions. Although there is a high degree of uncertainty around the magnitude and duration of the economic impact of the COVID - 19 pandemic, the Company’s management believes that its financial position, including high levels of capital and liquidity, will allow it to successfully endure the negative economic impacts of the crisis .

43 COMPANY RESPONSE TO COVID - 19 • Appointed an internal task force comprised of the Company’s management to address both operational and financial risks posed by COVID - 19 • Modified branch operations • Branch lobbies available, but on an appointment only basis • Primarily drive thru transactions • Increased emphasis on digital banking platforms • Implemented physical separation of critical operational workforce for Bank and non - Bank financial services subsidiaries • Expanded paid time off and health benefits for employees • Implemented work from home strategy • The majority of the Company’s non - branch and non - critical operational employees are working remotely • S uspended work related travel • Adopted self - quarantine procedures • Implemented enhanced cleaning protocols • Redeployed staff to critical customer service operations to expedite payment deferral requests and Paycheck Protection Program (PPP) lending effort • Assessing return to work protocols and reopening branch offices to the public

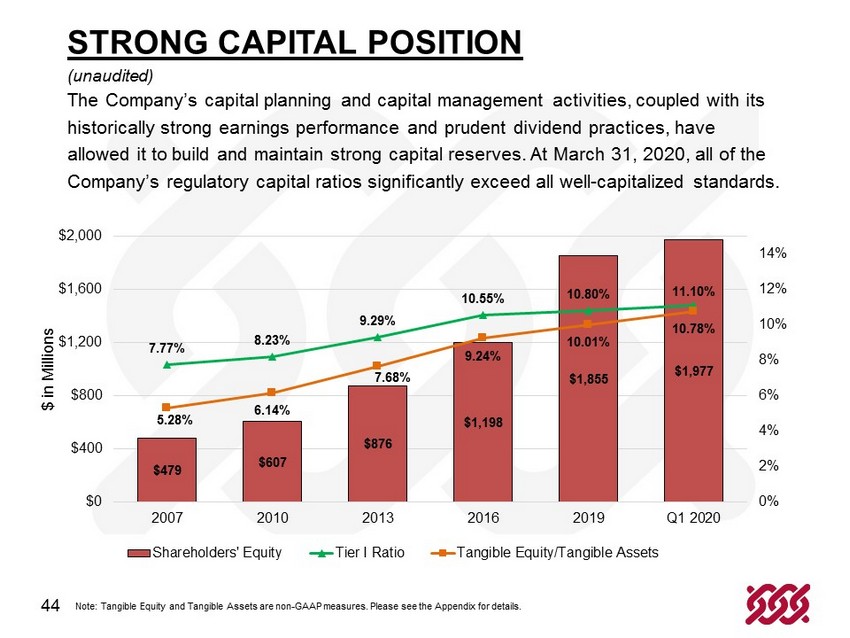

44 $479 $607 $876 $1,198 $1,855 $1,977 7.77% 8.23% 9.29% 10.55% 10.80% 11.10% 5.28% 6.14% 7.68% 9.24% 10.01% 10.78% 0% 2% 4% 6% 8% 10% 12% 14% $0 $400 $800 $1,200 $1,600 $2,000 2007 2010 2013 2016 2019 Q1 2020 $ in Millions Shareholders' Equity Tier I Ratio Tangible Equity/Tangible Assets STRONG CAPITAL POSITION (unaudited) The Company’s capital planning and capital management activities, coupled with its historically strong earnings performance and prudent dividend practices, have allowed it to build and maintain strong capital reserves. At March 31, 2020, all of the Company’s regulatory capital ratios significantly exceed all well - capitalized standards. Note: Tangible Equity and Tangible Assets are non - GAAP measures. Please see the Appendix for details.

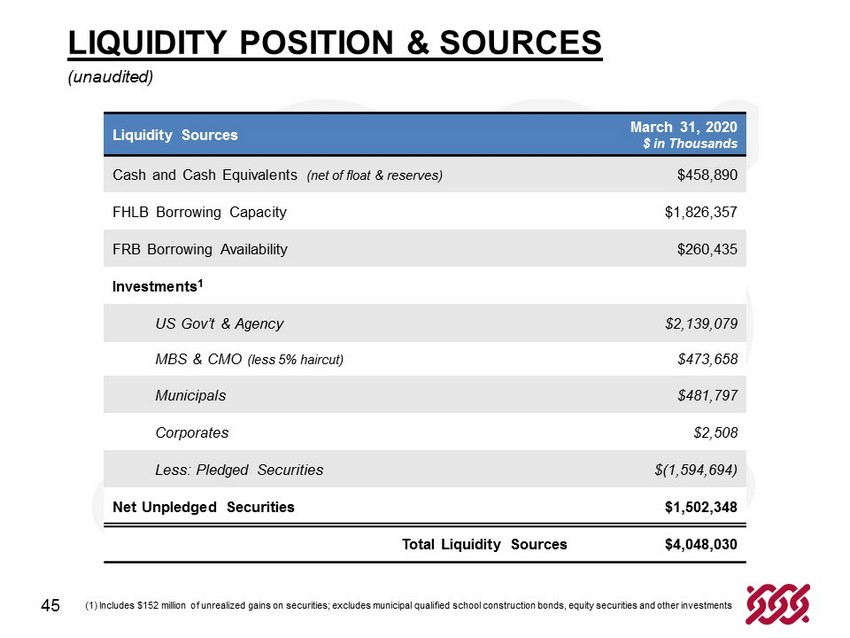

45 Liquidity Sources March 31, 2020 $ in Thousands Cash and Cash Equivalents (net of float & reserves) $458,890 FHLB Borrowing Capacity $1,826,357 FRB Borrowing Availability $260,435 Investments 1 US Gov’t & Agency $2,139,079 MBS & CMO (less 5% haircut ) $473,658 Municipals $481,797 Corporates $2,508 Less: Pledged Securities $(1,594,694) Net Unpledged Securities $1,502,348 Total Liquidity Sources $4,048,030 (1) Includes $152 million of unrealized gains on securities; excludes municipal qualified school construction bonds, equity s ecu rities and other investments LIQUIDITY POSITION & SOURCES (unaudited)

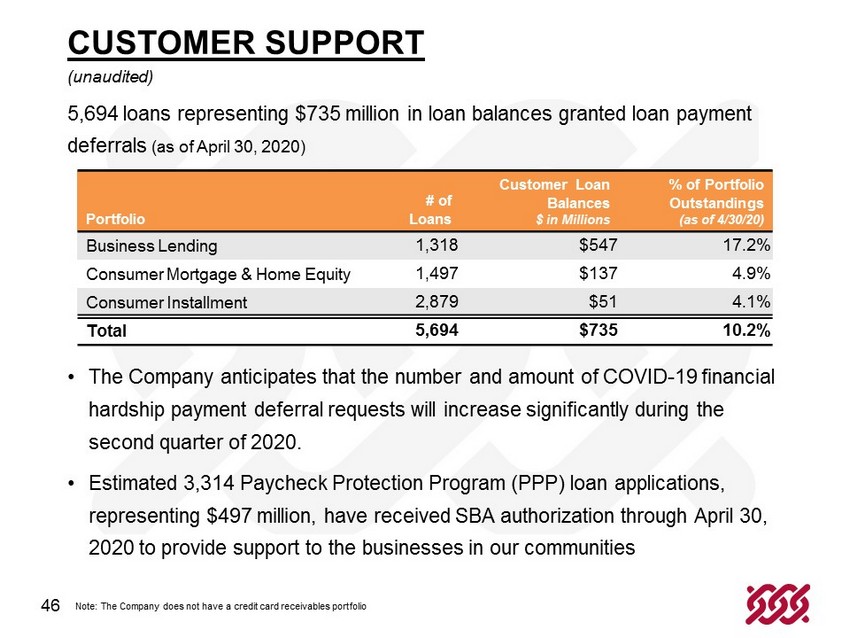

46 5,694 loans representing $735 million in loan balances granted loan payment deferrals (as of April 30, 2020) • The Company anticipates that the number and amount of COVID - 19 financial hardship payment deferral requests will increase significantly during the second quarter of 2020. • Estimated 3,314 Paycheck Protection Program (PPP) loan applications, representing $497 million, have received SBA authorization through April 30, 2020 to provide support to the businesses in our communities Portfolio # of Loans Customer Loan Balances $ in Millions % of P ortfolio Outstandings (as of 4/30/20) Business Lending 1,318 $547 17.2% Consumer Mortgage & Home Equity 1,497 $137 4.9% Consumer Installment 2,879 $51 4.1% Total 5,694 $735 10.2% Note: The Company does not have a credit card receivables portfolio CUSTOMER SUPPORT (unaudited)

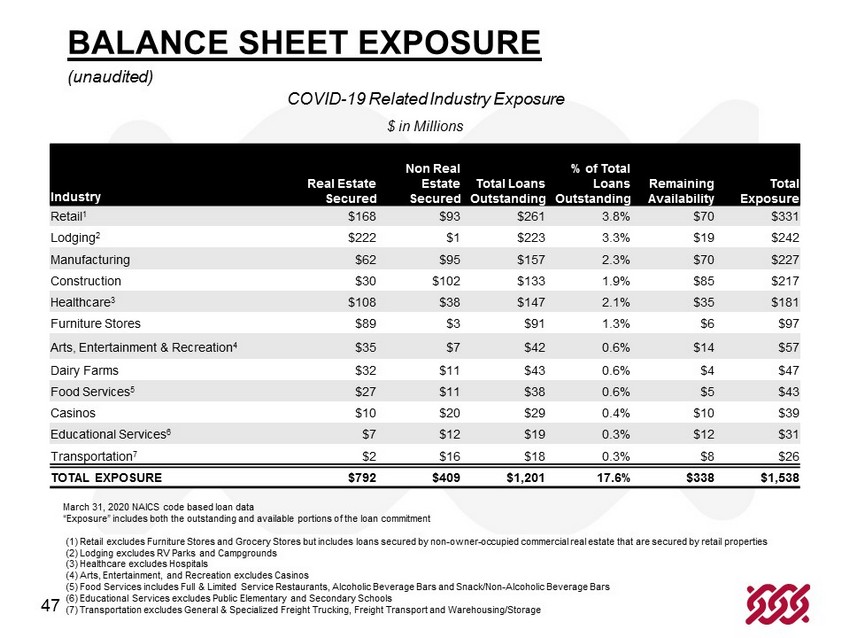

47 COVID - 19 Related Industry Exposure $ in Millions March 31, 2020 NAICS code based loan data “Exposure” includes both the outstanding and available portions of the loan commitment (1) Retail excludes Furniture Stores and Grocery Stores but includes loans secured by non - owner - occupied commercial real estate that are secured by retail properties (2) Lodging excludes RV Parks and Campgrounds (3) Healthcare excludes Hospitals (4) Arts, Entertainment, and Recreation excludes Casinos (5) Food Services includes Full & Limited Service Restaurants, Alcoholic Beverage Bars and Snack/Non - Alcoholic Beverage Bars (6) Educational Services excludes Public Elementary and Secondary Schools (7) Transportation excludes General & Specialized Freight Trucking, Freight Transport and Warehousing/Storage Industry Real Estate Secured Non Real Estate Secured Total Loans Outstanding % of Total Loans Outstanding Remaining Availability Total Exposure Retail 1 $168 $93 $261 3.8% $70 $331 Lodging 2 $222 $1 $223 3.3% $19 $242 Manufacturing $62 $95 $157 2.3% $70 $227 Construction $30 $102 $133 1.9% $85 $217 Healthcare 3 $108 $38 $147 2.1% $35 $181 Furniture Stores $89 $3 $91 1.3% $6 $97 Arts, Entertainment & Recreation 4 $35 $7 $42 0.6% $14 $57 Dairy Farms $32 $11 $43 0.6% $4 $47 Food Services 5 $27 $11 $38 0.6% $5 $43 Casinos $10 $20 $29 0.4% $10 $39 Educational Services 6 $7 $12 $19 0.3% $12 $31 Transportation 7 $2 $16 $18 0.3% $8 $26 TOTAL EXPOSURE $ 792 $ 409 $1,201 17.6% $ 338 $1,538 BALANCE SHEET EXPOSURE (unaudited)

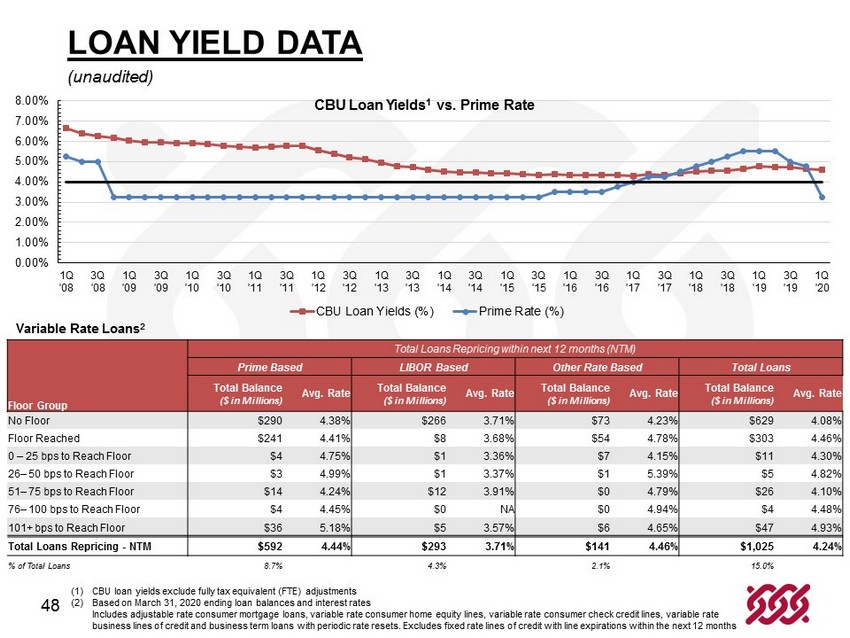

48 (1) CBU loan yields exclude fully tax equivalent (FTE) adjustments (2) Based on March 31, 2020 ending loan balances and interest rates Includes adjustable rate consumer mortgage loans, variable rate consumer home equity lines, variable rate consumer check cred it lines, variable rate business lines of credit and business term loans with periodic rate resets. Excludes fixed rate lines of credit with line exp ira tions within the next 12 months 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 1Q '08 3Q '08 1Q '09 3Q '09 1Q '10 3Q '10 1Q '11 3Q '11 1Q '12 3Q '12 1Q '13 3Q '13 1Q '14 3Q '14 1Q '15 3Q '15 1Q '16 3Q '16 1Q '17 3Q '17 1Q '18 3Q '18 1Q '19 3Q '19 1Q '20 CBU Loan Yields 1 vs. Prime Rate CBU Loan Yields (%) Prime Rate (%) Variable Rate Loans 2 Total Loans Repricing within next 12 months (NTM) Prime Based LIBOR Based Other Rate Based Total Loans Floor Group Total Balance ($ in Millions ) Avg. Rate Total Balance ($ in Millions ) Avg. Rate Total Balance ($ in Millions ) Avg. Rate Total Balance ($ in Millions ) Avg. Rate No Floor $290 4.38% $266 3.71% $73 4.23% $629 4.08% Floor Reached $241 4.41% $8 3.68% $54 4.78% $303 4.46% 0 – 25 bps to Reach Floor $4 4.75% $1 3.36% $7 4.15% $11 4.30% 26 – 50 bps to Reach Floor $3 4.99% $1 3.37% $1 5.39% $5 4.82% 51 – 75 bps to Reach Floor $14 4.24% $12 3.91% $0 4.79% $26 4.10% 76 – 100 bps to Reach Floor $4 4.45% $0 NA $0 4.94% $4 4.48% 101+ bps to Reach Floor $36 5.18% $5 3.57% $6 4.65% $47 4.93% Total Loans Repricing - NTM $ 592 4.44% $293 3.71% $141 4.46% $ 1,025 4.24% % of Total Loans 8.7% 4.3% 2.1% 15.0% LOAN YIELD DATA (unaudited)

49 FUTURE EXPECTATIONS The COVID - 19 crisis is expected to continue to impact the Company’s financial results, as well as demand for its services and products during the second quarter of 2020 and potentially beyond. The short and long - term implications of the COVID - 19 crisis, and related monetary and fiscal stimulus measures, on the Company’s future earnings results, allowance for credit losses, capital reserves, and liquidity are unknown at this time.

50 Investor Relations Contact Mr. Joseph E. Sutaris EVP & Chief Financial Officer Joseph.Sutaris@cbna.com (315) 445 - 7396