|  |

Community Bank System, Inc. and Oneida Financial Corp. Announce

Signing of Definitive Merger Agreement

| · | Combined #4 Market Share in Syracuse MSA |

| · | Attractive Deployment of Shareholder Capital |

| · | Over 50% Premium to ONFC Shareholders and Significant per Share Cash Earnings Accretion to CBU Shareholders |

SYRACUSE, NY and ONEIDA, NY – February 24, 2015 -- Community Bank System, Inc. (NYSE: CBU) and Oneida Financial Corp. (NASDAQ: ONFC) today announced the signing of a definitive agreement pursuant to which Community Bank System, Inc. will acquire Oneida Financial Corp., parent company of Oneida Savings Bank in Oneida, NY, for approximately $142 million in Community Bank System, Inc. stock and cash, or $20 per share. Under the terms of the agreement, shareholders of Oneida Financial Corp. can elect to receive either 0.5635 shares of Community Bank System, Inc. common stock or $20.00 in cash for each share of Oneida Financial Corp. common stock they hold, subject to an overall 60% stock and 40% cash split. The merger agreement has been unanimously approved by the board of directors of both companies.

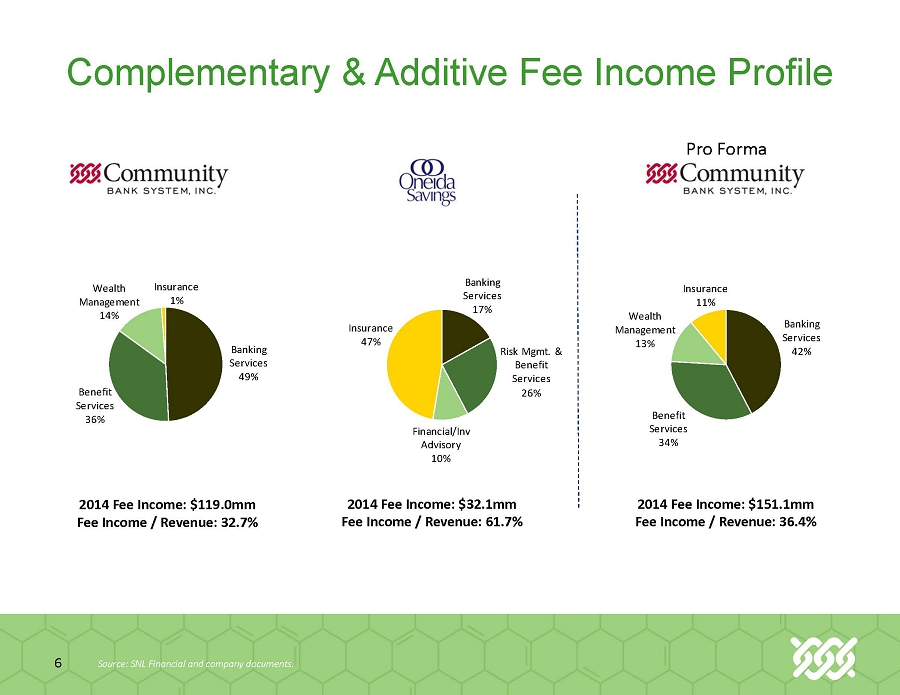

The merger will combine two institutions with a long history of community-focused service and will result in the creation of the fourth largest institution by market share in the Syracuse, New York metropolitan statistical area (MSA). In addition, Oneida Financial Corp.’s significant insurance, benefits administration, and wealth management businesses will meaningfully strengthen and complement Community Bank System, Inc.’s existing non-banking service capacity. Oneida Financial Corp. has total assets of nearly $800 million, deposits of $690 million, and 12 banking offices across Madison and Oneida Counties.

“We are very excited to be partnering with Oneida Financial Corp. to further extend and strengthen our Central New York service area,” said Community Bank System, Inc. President & Chief Executive Officer Mark E. Tryniski. “Oneida Financial Corp. has a leading market presence in Madison County, attractive share in Oneida County, and has built impressive businesses in insurance, benefits, and wealth management. Even more important to us, Oneida Financial Corp. has an impeccable history of service to its customers and its communities, and a culture that aligns very well with that of Community Bank System, Inc.”

Michael R. Kallet, Chairman and Chief Executive Officer of Oneida Financial Corp. commented, “This is an ideal opportunity for Oneida Financial Corp. to partner with a true community bank that has been nationally recognized for its financial strength and exceptional customer service. Their focus on customers and communities is identical to ours, and our customers will benefit from an expanded network of branch locations and ATM’s, and broader product and service offerings.” Mr. Kallet continued, “We are pleased with the attractive market premium our shareholders will be receiving, in addition to a greater dividend and substantial market liquidity. Community Bank System, Inc. has an impressive history of creating shareholder value through both earnings and dividend growth.”

Community Bank System, Inc. expects the transaction to be accretive in 2015 excluding merger costs, and approximately $0.07 per share accretive to 2016 GAAP earnings and $0.11 per share accretive to 2016 cash earnings.

The merger agreement provides for Michael Kallet and Eric Stickels from Oneida Financial Corp. to be added to the Board of Directors of Community Bank System, Inc. The merger is expected to close in July 2015 and is subject to approval by the shareholders of Oneida Financial Corp. and required regulatory approvals.

RBC Capital Markets, LLC acted as exclusive financial advisor to Community Bank System, Inc. and Bond Schoeneck & King, PLLC acted as its legal advisor. Keefe, Bruyette & Woods, A Stifel Company acted as exclusive financial advisor to Oneida Financial Corp. and rendered a fairness opinion and Luse Gorman, P.C. acted as its legal advisor.

About Community Bank System, Inc.

Community Bank System, Inc. operates more than 190 customer facilities across Upstate New York and Northeastern Pennsylvania through its banking subsidiary, Community Bank, N.A. With assets of approximately $7.5 billion, the DeWitt, N.Y. headquartered company is among the country's 150 largest financial institutions. In addition to a full range of retail and business banking services, Community Bank System, Inc. offers comprehensive financial planning and wealth management services and operates a full service insurance agency providing personal and business insurance products. Community Bank System, Inc.'s Benefit Plans Administrative Services, Inc. subsidiary is a leading provider of employee benefits administration and trust services, and actuarial and consulting services to customers on a national scale. Community Bank System, Inc. is listed on the New York Stock Exchange and its stock trades under the symbol CBU. For more information about Community Bank System, Inc. visit www.communitybankna.com or http://ir.communitybanksystem.com.

About Oneida Financial Corp.

Oneida Financial Corp. reported total assets at December 31, 2014 of $798.2 million and stockholders' equity of $95.8 million. Oneida Financial Corp.'s wholly owned subsidiaries include The Oneida Savings Bank, a New York State chartered FDIC insured stock savings bank; State Bank of Chittenango, a state chartered limited-purpose commercial bank; OneGroup NY, Inc. (formerly Bailey & Haskell Associates, Inc.), an insurance, risk management and employee benefits company; and Oneida Wealth Management, Inc., a financial and investment advisory firm. Oneida Savings Bank was established in 1866 and operates twelve full-service banking offices in Madison and Oneida counties. For more information, visit Oneida Financial Corp.'s website at www.oneidafinancial.com.

Additional Information about the Merger

In connection with the proposed merger, Community Bank System, Inc. will file with the Securities and Exchange Commission (SEC) a Registration Statement on Form S-4 that will include a Proxy Statement of Oneida Financial Corp., as well as other relevant documents concerning the proposed transaction. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval.Stockholders of Oneida Financial Corp. are urged to read the registration statement and proxy statement/prospectus and the other relevant materials filed with the SEC when they become available because they will contain important information about the proposed transaction.

A free copy of the proxy statement/prospectus, when available, as well as other filings containing information about Oneida Financial Corp. and Community Bank System, Inc., may be obtained at the SEC’s Internet site (http://www.sec.gov). You will also be able to obtain these documents, when available, free of charge from Oneida Financial Corp. at http://www.oneidafinancial.com/ under the heading

“Investor Relations” and then “Documents” or from Community Bank System, Inc. by accessing its website at www.communitybankna.com under the heading of “Investor Relations” and then “SEC Filings & Annual Report.” Copies of the proxy statement/prospectus can also be obtained, free of charge and when available, by directing a request to Oneida Financial Corp., 182 Main Street, Oneida, New York 13421, Attention: Investor Relations, Telephone: (315) 363-2000 or to Community Bank System, Inc., 5790 Widewaters Parkway, DeWitt, New York 13214, Attention: Investor Relations, Telephone: (315) 445-2282.

Oneida Financial Corp. and Community Bank System, Inc. and certain of their respective directors and executive officers may be deemed to participate in the solicitation of proxies from the stockholders of Oneida Financial in connection with the proposed merger. Information about the directors and executive officers of Oneida Financial Corp. and their ownership of Oneida Financial Corp. common stock is set forth in the proxy statement for its 2014 annual meeting of stockholders, as filed with the SEC on Schedule 14A on March 25, 2014. Information about the directors and executive officers of Community Bank System, Inc. and their ownership of Community Bank System, Inc. common stock is set forth in the proxy statement for its 2014 annual meeting of shareholders, as filed with the SEC on Schedule 14A on April 4, 2014. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the proxy statement/prospectus regarding the proposed merger when it becomes available. Free copies of this document when available may be obtained as described in the preceding paragraph.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The following factors, among others listed in the Companies’ Form 10-K filings, could cause the actual results of the Companies’ operations to differ materially from the Companies’ expectations: the successful integration of operations of its acquisitions; competition; changes in economic conditions, interest rates and financial markets; and changes in legislation or regulatory requirements. The Companies do not assume any duty to update forward-looking statements.

For further information contact:

Community Bank System, Inc.

Scott A. Kingsley, (315) 445-3121

E.V.P. and Chief Financial Officer

or

Oneida Financial Corp.

Eric E. Stickels, (315) 366-3702

President and Chief Operating Officer

FEBRUARY 2015Acquisition of Oneida Financial Corp.

FEBRUARY 2015Acquisition of Oneida Financial Corp.

Forward-Looking Statement & Additional InformationThis presentation contains certain “forward?looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements about Community Bank System’s long?term goals, financial condition, results of operations, earnings, levels of net loan charge?offs and nonperforming assets, interest rate exposure and profitability. You can identify these forward?looking statements by use of such words as “estimate,” “project,” “believe,” “intend,” “anticipate,” “plan,” “seek,” “expect,” and other similar expressions.Forward?looking statements are subject to significant risks, assumptions and uncertainties, including, among other things, the following important factors that could affect the actual outcome of future events: • risks related to credit quality, interest rate sensitivity and liquidity; • the strength of the U.S. economy in general and the strength of the local economies where Community Bank System conducts its business; • the effect of, and changes in, monetary and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System; • inflation, interest rate, market and monetary fluctuations; • the timely development of new products and services and customer perception of the overall value thereof (including, but not limited to, features, pricing and quality) compared to competing products and services; • the success of marketing efforts in attracting or retaining customers; • competition from providers of products and services that compete with Community Bank System’s businesses; • changes in consumer spending, borrowing and savings habits; • technological changes and implementation and cost/financial risks with respect to transitioning to new computer and technology based systems involving large multi?year contracts; • any acquisitions or mergers that might be considered or consummated by Community Bank System and the costs and factors associated therewith, including differences in the actual financial results of the acquisition or merger compared to expectations and the realization of anticipated cost savings and revenue enhancements; • Community Bank System’s ability to maintain and increase market share and control expenses; • the nature, timing and effect of changes in banking regulations or other regulatory or legislative requirements affecting Community Bank System’s respective businesses, including changes in laws and regulations concerning taxes, accounting, banking, securities and other aspects of the financial services industry, specifically the Dodd?Frank Wall Street Reform and Consumer Protection Act of 2010; and • changes in Community Bank System’s organization, compensation and benefit plans and in the availability of, and compensation levels for, employees in its geographic markets.You should refer to Community Bank System’s periodic and current reports filed with the Securities and Exchange Commission for further information on other factors that could cause actual results to be significantly different from those expressed or implied by these forward?looking statements.In connection with the proposed merger, Community Bank System, Inc. will file with the Securities and Exchange Commission (SEC) a Registration Statement on Form S?4 that will include a Proxy Statement of Oneida Financial Corp., as well as other relevant documents concerning the proposed transaction. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. Stockholders of Oneida Financial Corp. are urged to read the registration statement and proxy statement/prospectus and the other relevant materials filed with the SEC when they become available because they will contain important information about the proposed transaction.A free copy of the proxy statement/prospectus, when available, as well as other filings containing information about Oneida Financial Corp. and Community Bank System, Inc., may be obtained at the SEC’s Internet site (http://www.sec.gov). You will also be able to obtain these documents, when available, free of charge from Oneida Financial Corp. at http://www.oneidafinancial.com/ under the heading “Investor Relations” and then “Documents” or from Community Bank System, Inc. by accessing its website at www.communitybankna.com under the heading of “Investor Relations” and then “SEC Filings & Annual Report.” Copies of the proxy statement/prospectus can also be obtained, free of charge and when available, by directing a request to Oneida Financial Corp., 182 Main Street, Oneida, New York 13421, Attention: Investor Relations, Telephone: (315) 363?2000 or to Community Bank System, Inc., 5790 Widewaters Parkway, DeWitt, New York 13214, Attention: Investor Relations, Telephone: (315) 445?2282.Oneida Financial Corp. and Community Bank System, Inc. and certain of their respective directors and executive officers may be deemed to participate in the solicitation of proxies from the stockholders of Oneida Financial in connection with the proposed merger. Information about the directors and executive officers of Oneida Financial Corp. and their ownership of Oneida Financial Corp. common stock is set forth in the proxy statement for its 2014 annual meeting of stockholders, as filed with the SEC on Schedule 14A on March 25, 2014. Information about the directors and executive officers of Community Bank System, Inc. and their ownership of Community Bank System, Inc. common stock is set forth in the proxy statement for its 2014 annual meeting of shareholders, as filed with the SEC on Schedule 14A on April 4, 2014. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the proxy statement/prospectus regarding the proposed merger when it becomes available. Free copies of this document when available may be obtained as described in the preceding paragraph.

Forward-Looking Statement & Additional InformationThis presentation contains certain “forward?looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements about Community Bank System’s long?term goals, financial condition, results of operations, earnings, levels of net loan charge?offs and nonperforming assets, interest rate exposure and profitability. You can identify these forward?looking statements by use of such words as “estimate,” “project,” “believe,” “intend,” “anticipate,” “plan,” “seek,” “expect,” and other similar expressions.Forward?looking statements are subject to significant risks, assumptions and uncertainties, including, among other things, the following important factors that could affect the actual outcome of future events: • risks related to credit quality, interest rate sensitivity and liquidity; • the strength of the U.S. economy in general and the strength of the local economies where Community Bank System conducts its business; • the effect of, and changes in, monetary and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System; • inflation, interest rate, market and monetary fluctuations; • the timely development of new products and services and customer perception of the overall value thereof (including, but not limited to, features, pricing and quality) compared to competing products and services; • the success of marketing efforts in attracting or retaining customers; • competition from providers of products and services that compete with Community Bank System’s businesses; • changes in consumer spending, borrowing and savings habits; • technological changes and implementation and cost/financial risks with respect to transitioning to new computer and technology based systems involving large multi?year contracts; • any acquisitions or mergers that might be considered or consummated by Community Bank System and the costs and factors associated therewith, including differences in the actual financial results of the acquisition or merger compared to expectations and the realization of anticipated cost savings and revenue enhancements; • Community Bank System’s ability to maintain and increase market share and control expenses; • the nature, timing and effect of changes in banking regulations or other regulatory or legislative requirements affecting Community Bank System’s respective businesses, including changes in laws and regulations concerning taxes, accounting, banking, securities and other aspects of the financial services industry, specifically the Dodd?Frank Wall Street Reform and Consumer Protection Act of 2010; and • changes in Community Bank System’s organization, compensation and benefit plans and in the availability of, and compensation levels for, employees in its geographic markets.You should refer to Community Bank System’s periodic and current reports filed with the Securities and Exchange Commission for further information on other factors that could cause actual results to be significantly different from those expressed or implied by these forward?looking statements.In connection with the proposed merger, Community Bank System, Inc. will file with the Securities and Exchange Commission (SEC) a Registration Statement on Form S?4 that will include a Proxy Statement of Oneida Financial Corp., as well as other relevant documents concerning the proposed transaction. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. Stockholders of Oneida Financial Corp. are urged to read the registration statement and proxy statement/prospectus and the other relevant materials filed with the SEC when they become available because they will contain important information about the proposed transaction.A free copy of the proxy statement/prospectus, when available, as well as other filings containing information about Oneida Financial Corp. and Community Bank System, Inc., may be obtained at the SEC’s Internet site (http://www.sec.gov). You will also be able to obtain these documents, when available, free of charge from Oneida Financial Corp. at http://www.oneidafinancial.com/ under the heading “Investor Relations” and then “Documents” or from Community Bank System, Inc. by accessing its website at www.communitybankna.com under the heading of “Investor Relations” and then “SEC Filings & Annual Report.” Copies of the proxy statement/prospectus can also be obtained, free of charge and when available, by directing a request to Oneida Financial Corp., 182 Main Street, Oneida, New York 13421, Attention: Investor Relations, Telephone: (315) 363?2000 or to Community Bank System, Inc., 5790 Widewaters Parkway, DeWitt, New York 13214, Attention: Investor Relations, Telephone: (315) 445?2282.Oneida Financial Corp. and Community Bank System, Inc. and certain of their respective directors and executive officers may be deemed to participate in the solicitation of proxies from the stockholders of Oneida Financial in connection with the proposed merger. Information about the directors and executive officers of Oneida Financial Corp. and their ownership of Oneida Financial Corp. common stock is set forth in the proxy statement for its 2014 annual meeting of stockholders, as filed with the SEC on Schedule 14A on March 25, 2014. Information about the directors and executive officers of Community Bank System, Inc. and their ownership of Community Bank System, Inc. common stock is set forth in the proxy statement for its 2014 annual meeting of shareholders, as filed with the SEC on Schedule 14A on April 4, 2014. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the proxy statement/prospectus regarding the proposed merger when it becomes available. Free copies of this document when available may be obtained as described in the preceding paragraph.

Oneida Financial OverviewLoansConst. 1%C&I 14%Other 13%1?4 Family 48%SyracuseCRE 21%Multi? Family 3%Deposits2014 Total: $371 mm Yield: 4.28%Non?interest bearing dep.Key Statistics (1)Jumbo CDs 4% 9%CBU (182 branches) ONFC (12 branches)Year Founded 1866Total Assets $798 million ROAA (%) 0.66% NPAs / Assets 0.07% Fee Income / Revenue 62% Average Branch Size $57 millionRetail CDs 12%2014 Total: $689 mm Cost: 0.39%Interest bearing dep. (ex?CDs) 75%Source: SNL Financial and company documents. Loan and deposit composition based on regulatory data. 3 (1) At or for the year ended December 31, 2014.

Oneida Financial OverviewLoansConst. 1%C&I 14%Other 13%1?4 Family 48%SyracuseCRE 21%Multi? Family 3%Deposits2014 Total: $371 mm Yield: 4.28%Non?interest bearing dep.Key Statistics (1)Jumbo CDs 4% 9%CBU (182 branches) ONFC (12 branches)Year Founded 1866Total Assets $798 million ROAA (%) 0.66% NPAs / Assets 0.07% Fee Income / Revenue 62% Average Branch Size $57 millionRetail CDs 12%2014 Total: $689 mm Cost: 0.39%Interest bearing dep. (ex?CDs) 75%Source: SNL Financial and company documents. Loan and deposit composition based on regulatory data. 3 (1) At or for the year ended December 31, 2014.

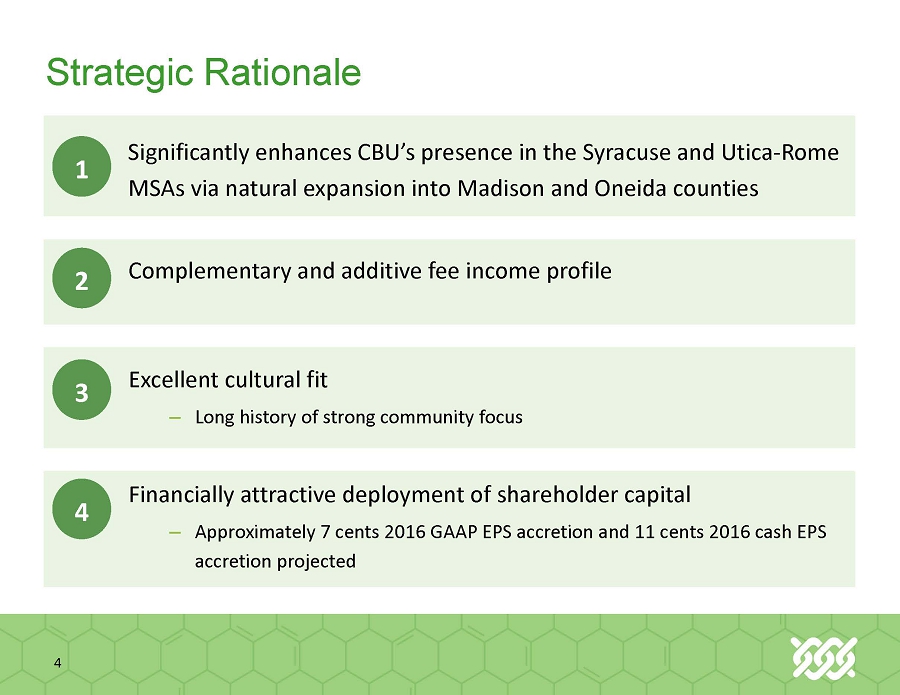

Strategic RationaleSignificantly enhances CBU’s presence in the Syracuse and Utica?Rome 1 MSAs via natural expansion into Madison and Oneida counties2 Complementary and additive fee income profile3 Excellent cultural fit – Long history of strong community focusFinancially attractive deployment of shareholder capital 4 – Approximately 7 cents 2016 GAAP EPS accretion and 11 cents 2016 cash EPS accretion projected4

#4 Bank in the Syracuse, NY MSARank InstitutionNumber of BranchesDeposits ($mm)Market Share1 M&T Bank Corp. 30 $2,714.1 24.0%2 KeyCorp 26 1,739.4 15.43 Bank of America Corp. 12 963.7 8.5Community Bank System + Oneida Financial 16 $914.5 8.1%4 JPMorgan Chase & Co. 13 862.7 7.65 First Niagara Finl Group 14 802.2 7.16 NBT Bancorp Inc. 21 724.0 6.47 Oneida Financial Corp. 8 $722.0 6.4%8 Solvay Bank Corp. 9 660.2 5.89 Pathfinder Bancorp Inc. 17 531.2 4.710 Geddes FS&LA 2 413.5 3.711 Berkshire Hills Bancorp Inc. 2 317.9 2.812 Royal Bank of Scotland Group 9 292.4 2.613 Fulton Savings Bank 7 238.6 2.114 Community Bank System Inc. 8 $192.5 1.7%15 Seneca FS&LA 3 104.0 0.9Source: SNL Financial. 5 Deposit and market share data as of June 30, 2014.

Complementary & Additive Fee Income ProfilePro FormaWealth Management 14%Benefit ServicesInsurance 1%Banking Services 49%Insurance 47%Banking Services 17%Risk Mgmt. & Benefit Services 26%Wealth Management 13%Insurance 11%Banking Services 42%36%Financial/Inv Advisory 10%Benefit Services 34%2014 Fee Income: $119.0mm Fee Income / Revenue: 32.7%2014 Fee Income: $32.1mm Fee Income / Revenue: 61.7%2014 Fee Income: $151.1mm Fee Income / Revenue: 36.4%6 Source: SNL Financial and company documents.

Transaction Overview & ImpactMerger Consideration:? Oneida shareholders have the right to receive 0.5635x CBU shares or $20.00 in cash• Approximately $20.00 per share (1) or ~$142 million in aggregate• Stock / cash election subject to overall ~60% stock / 40% cash splitDue Diligence: ? Completed detailed due diligence across all business linesBoard Representation: ? Michael Kallet and Eric Stickels to join CBU Board of DirectorsRequired Approvals:? Oneida Financial Corp. shareholder approval ? Customary regulatory approvalsExpected Closing: ? Third quarter of 2015Key Financial Assumptions:? Cost savings of approximately $8.0 million in 2016 (~16%) ? Gross loan mark of $5.3 million equal to 150% of loan loss reserves ? Pre?tax restructuring charge of $12 million ? CDI of $5.6 million amortized over 10 years ? Additional customer intangibles of $16.0 million, amortized over 10 years ? Further potential synergies identified but not included in financial analysisPricing Metrics:? P / LTM EPS: 20.6x / 12.3x with fully phased?in cost saves (2) ? P / Stated TBV: 2.00x • Oneida’s Insurance, Benefits & Wealth Management businesses are significant revenue generators with virtually no tangible capital requirementFinancial Impact:? Approximately 7 cents GAAP EPS accretive starting in 2016 ? Approximately 11 cents cash EPS accretive in 2016 ? TBV earnback of approximately five years(1) Based on CBU 10?day volume weighted average price of $35.49 on February 20, 2015. 7 (2) LTM EPS adjusted for non?recurring non?cash pension expense of $1.7 million.