QuickLinks -- Click here to rapidly navigate through this document

EXHIBIT 13

ELEVEN YEAR FINANCIAL SUMMARY

(In thousands except per share and percentage data)

Years Ended May 31

| | 1992

| | 1993

| | 1994

| | 1995

| | 1996

| | 1997

| | 1998

| | 1999

| | 2000

| | 2001

| | 2002

| | 10-Year

Compd

Growth

| |

|---|

| Revenue | | $ | 621,041 | | 711,663 | | 803,009 | | 929,534 | | 1,103,492 | | 1,261,899 | | 1,476,945 | | 1,751,568 | | 1,901,991 | | 2,160,700 | | 2,271,052 | | 13.8 | %(3) |

| Net Income | | $ | 45,744 | | 54,956 | | 67,141 | | 85,413 | | 98,956 | | 118,557 | | 133,654 | | 138,939 | | 193,387 | | 222,451 | | 234,251 | | 17.7 | % |

| Pro Forma Net Income(1) | | $ | 45,151 | | 53,374 | | 64,459 | | 80,752 | | 94,151 | | 112,763 | | 128,704 | | 138,939 | | 193,387 | | 222,451 | | 234,251 | | 17.9 | % |

| Basic EPS | | $ | 0.31 | | 0.36 | | 0.44 | | 0.55 | | 0.64 | | 0.75 | | 0.83 | | 0.84 | | 1.16 | | 1.32 | | 1.38 | | 16.1 | % |

| Diluted EPS | | $ | 0.31 | | 0.35 | | 0.43 | | 0.55 | | 0.63 | | 0.75 | | 0.82 | | 0.82 | | 1.14 | | 1.30 | | 1.36 | | 15.9 | % |

| Pro Forma Basic EPS(1) | | $ | 0.30 | | 0.35 | | 0.42 | | 0.52 | | 0.61 | | 0.72 | | 0.80 | | 0.84 | | 1.16 | | 1.32 | | 1.38 | | 16.5 | % |

| Pro Forma Diluted EPS(1) | | $ | 0.30 | | 0.35 | | 0.41 | | 0.51 | | 0.60 | | 0.71 | | 0.79 | | 0.82 | | 1.14 | | 1.30 | | 1.36 | | 16.3 | % |

| Dividends Per Share | | $ | 0.04 | | 0.05 | | 0.06 | | 0.07 | | 0.09 | | 0.10 | | 0.12 | | 0.15 | | 0.19 | | 0.22 | | 0.25 | | 20.1 | % |

| Total Assets | | $ | 501,769 | | 634,197 | | 700,872 | | 816,508 | | 996,046 | | 1,101,182 | | 1,305,400 | | 1,407,818 | | 1,581,342 | | 1,752,224 | | 2,519,234 | | 17.5 | % |

| Shareholders' Equity | | $ | 273,501 | | 324,562 | | 409,053 | | 481,654 | | 553,701 | | 650,603 | | 756,795 | | 871,423 | | 1,042,876 | | 1,231,315 | | 1,423,759 | | 17.9 | % |

| Return on Average Equity | | | 17.8 | % | 17.8 | % | 17.6 | % | 18.1 | % | 18.2 | % | 18.7 | % | 18.8 | %(2) | 20.1 | %(2) | 20.2 | % | 19.6 | % | 17.6 | % | | |

| Long-Term Debt | | $ | 122,372 | | 158,311 | | 132,929 | | 164,332 | | 237,550 | | 227,799 | | 307,633 | | 283,581 | | 254,378 | | 220,940 | | 703,250 | | | |

- Note:

- Results prior to March 24, 1999, have been restated to include Unitog Company.

Results prior to April 8, 1998, have also been restated to include Uniforms To You Companies.

- (1)

- Results for 1998 and prior years were adjusted on a pro forma basis to reflect the true tax impact of Uniforms To You as if it had been reported as a C Corporation prior to the merger with Cintas.

- (2)

- Return on average equity before one-time items.

- (3)

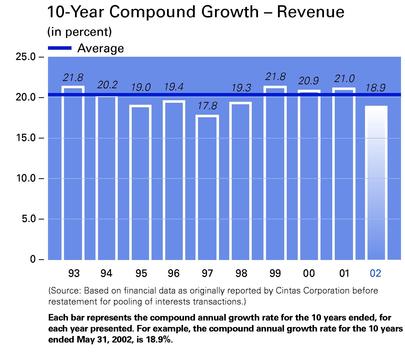

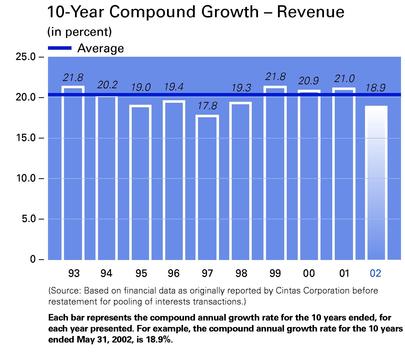

- Represents the 10-year compound annual growth rate based on revenue as restated for pooling of interests transactions noted above. Please refer to the graph below for the 10-year compound annual growth rates in revenue based on financial data, as originally reported by Cintas Corporation, before restatement for pooling of interests transactions.

1

CONSOLIDATED STATEMENTS OF INCOME

(In thousands except per share data)

Years Ended May 31

| | 2002

| | 2001

| | 2000

| |

|---|

| Revenue: | | | | | | | | | | |

| | Rentals | | $ | 1,753,368 | | $ | 1,610,606 | | $ | 1,424,892 | |

| | Other services | | | 517,684 | | | 550,094 | | | 477,099 | |

| | |

| |

| |

| |

| | | | 2,271,052 | | | 2,160,700 | | | 1,901,991 | |

| Costs and expenses (income): | | | | | | | | | | |

| | Cost of rentals | | | 953,352 | | | 896,539 | | | 807,301 | |

| | Cost of other services | | | 360,330 | | | 367,894 | | | 315,138 | |

| | Selling and administrative expenses | | | 580,469 | | | 529,063 | | | 456,628 | |

| | Interest income | | | (5,636 | ) | | (4,369 | ) | | (4,742 | ) |

| | Interest expense | | | 10,952 | | | 15,119 | | | 15,907 | |

| | |

| |

| |

| |

| | | | 1,899,467 | | | 1,804,246 | | | 1,590,232 | |

| | |

| |

| |

| |

| Income before income taxes | | | 371,585 | | | 356,454 | | | 311,759 | |

| Income taxes | | | 137,334 | | | 134,003 | | | 118,372 | |

| | |

| |

| |

| |

| Net income | | $ | 234,251 | | $ | 222,451 | | $ | 193,387 | |

| | |

| |

| |

| |

| Basic earnings per share | | $ | 1.38 | | $ | 1.32 | | $ | 1.16 | |

| | |

| |

| |

| |

| Diluted earnings per share | | $ | 1.36 | | $ | 1.30 | | $ | 1.14 | |

| | |

| |

| |

| |

| Dividends declared and paid per share | | $ | .25 | | $ | .22 | | $ | .19 | |

| | |

| |

| |

| |

See accompanying notes.

2

CONSOLIDATED BALANCE SHEETS

(In thousands except share data)

As of May 31

| | 2002

| | 2001

| |

|---|

| Assets | | | | | | | |

| Current assets: | | | | | | | |

| | Cash and cash equivalents | | $ | 40,628 | | $ | 73,724 | |

| | Marketable securities | | | 44,458 | | | 36,505 | |

| | Accounts receivable, principally trade, less allowance of $9,229 and $8,765, respectively | | | 283,234 | | | 244,450 | |

| | Inventories | | | 193,821 | | | 214,349 | |

| | Uniforms and other rental items in service | | | 280,936 | | | 242,172 | |

| | Prepaid expenses | | | 10,173 | | | 8,470 | |

| | |

| |

| |

| Total current assets | | | 853,250 | | | 819,670 | |

| Property and equipment, at cost, net | | | 778,402 | | | 702,132 | |

| Goodwill | | | 678,598 | | | 123,753 | |

| Other assets | | | 208,984 | | | 106,669 | |

| | |

| |

| |

| | | $ | 2,519,234 | | $ | 1,752,224 | |

| | |

| |

| |

| Liabilities and Shareholders' Equity | | | | | | | |

| Current liabilities: | | | | | | | |

| | Accounts payable | | $ | 60,393 | | $ | 42,495 | |

| | Accrued compensation and related liabilities | | | 29,004 | | | 35,140 | |

| | Accrued liabilities | | | 131,705 | | | 81,548 | |

| | Income taxes: | | | | | | | |

| | | Current | | | 11,791 | | | 13,412 | |

| | | Deferred | | | 61,372 | | | 57,703 | |

| | Long-term debt due within one year | | | 18,369 | | | 20,605 | |

| | |

| |

| |

| Total current liabilities | | | 312,634 | | | 250,903 | |

| Long-term debt due after one year | | | 703,250 | | | 220,940 | |

| Deferred income taxes | | | 79,591 | | | 49,066 | |

| Shareholders' equity: | | | | | | | |

| | Preferred stock, no par value: 100,000 shares authorized, none outstanding | | | — | | | — | |

| | Common stock, no par value: 425,000,000 shares authorized, 169,930,290 and 169,370,563 shares issued and outstanding, respectively | | | 66,508 | | | 62,409 | |

| | Retained earnings | | | 1,365,136 | | | 1,174,330 | |

| | Other accumulated comprehensive loss: | | | | | | | |

| | | Foreign currency translation | | | (4,863 | ) | | (5,424 | ) |

| | | Unrealized loss on derivatives | | | (3,022 | ) | | — | |

| | |

| |

| |

| Total shareholders' equity | | | 1,423,759 | | | 1,231,315 | |

| | |

| |

| |

| | | $ | 2,519,234 | | $ | 1,752,224 | |

| | |

| |

| |

See accompanying notes.

3

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY

(In thousands)

| | Common Stock

| |

| | Other

Accumulated

Comprehensive

Income (Loss)

| |

| |

|---|

| | Retained

Earnings

| | Total

Shareholders'

Equity

| |

|---|

| | Shares

| | Amount

| |

|---|

| Balance at May 31, 1999 | | 166,424 | | $ | 49,974 | | $ | 825,268 | | $ | (3,819 | ) | $ | 871,423 | |

| Net income | | — | | | — | | | 193,387 | | | — | | | 193,387 | |

| Equity adjustment for foreign currency translation | | — | | | — | | | — | | | (493 | ) | | (493 | ) |

| | | | | | | | | | | | | |

| |

| Comprehensive income | | | | | | | | | | | | | | 192,894 | |

| | | | | | | | | | | | | |

| |

| Dividends | | — | | | — | | | (31,249 | ) | | — | | | (31,249 | ) |

| Effects of acquisitions | | 1,419 | | | 825 | | | 5,044 | | | — | | | 5,869 | |

| Stock options exercised net of shares surrendered | | 439 | | | 3,399 | | | — | | | — | | | 3,399 | |

| Tax benefit resulting from exercise of employee stock options | | — | | | 540 | | | — | | | — | | | 540 | |

| | |

| |

| |

| |

| |

| |

| Balance at May 31, 2000 | | 168,282 | | | 54,738 | | | 992,450 | | | (4,312 | ) | | 1,042,876 | |

| | |

| |

| |

| |

| |

| |

| Net income | | — | | | — | | | 222,451 | | | — | | | 222,451 | |

| Equity adjustment for foreign currency translation | | — | | | — | | | — | | | (1,112 | ) | | (1,112 | ) |

| | | | | | | | | | | | | |

| |

| Comprehensive income | | | | | | | | | | | | | | 221,339 | |

| | | | | | | | | | | | | |

| |

| Dividends | | — | | | — | | | (37,173 | ) | | — | | | (37,173 | ) |

| Effects of acquisitions | | 459 | | | (11 | ) | | (3,398 | ) | | — | | | (3,409 | ) |

| Stock options exercised net of shares surrendered | | 630 | | | 5,992 | | | — | | | — | | | 5,992 | |

| Tax benefit resulting from exercise of employee stock options | | — | | | 1,690 | | | — | | | — | | | 1,690 | |

| | |

| |

| |

| |

| |

| |

| Balance at May 31, 2001 | | 169,371 | | | 62,409 | | | 1,174,330 | | | (5,424 | ) | | 1,231,315 | |

| | |

| |

| |

| |

| |

| |

| Cumulative effect of accounting change for SFAS 133, net of tax | | — | | | — | | | — | | | (44 | ) | | (44 | ) |

| Net income | | — | | | — | | | 234,251 | | | — | | | 234,251 | |

| Equity adjustment for foreign currency translation | | — | | | — | | | — | | | 561 | | | 561 | |

| Change in fair value of derivatives | | — | | | — | | | — | | | (2,978 | ) | | (2,978 | ) |

| | | | | | | | | | | | | |

| |

| Comprehensive income | | | | | | | | | | | | | | 231,834 | |

| | | | | | | | | | | | | |

| |

| Dividends | | — | | | — | | | (42,454 | ) | | — | | | (42,454 | ) |

| Effects of acquisitions | | 137 | | | — | | | (991 | ) | | — | | | (991 | ) |

| Stock options exercised net of shares surrendered | | 422 | | | 3,247 | | | — | | | — | | | 3,247 | |

| Tax benefit resulting from exercise of employee stock options | | — | | | 852 | | | — | | | — | | | 852 | |

| | |

| |

| |

| |

| |

| |

| Balance at May 31, 2002 | | 169,930 | | $ | 66,508 | | $ | 1,365,136 | | $ | (7,885 | ) | $ | 1,423,759 | |

| | |

| |

| |

| |

| |

| |

See accompanying notes.

4

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

Years Ended May 31

| | 2002

| | 2001

| | 2000

| |

|---|

| Cash flows from operating activities: | | | | | | | | | | |

| | Net income | | $ | 234,251 | | $ | 222,451 | | $ | 193,387 | |

| | Adjustments to reconcile net income to net cash provided by (used in) operating activities: | | | | | | | | | | |

| | | Depreciation | | | 101,215 | | | 90,239 | | | 78,516 | |

| | | Amortization of deferred charges | | | 18,810 | | | 21,850 | | | 20,997 | |

| | | Deferred income taxes | | | 20,629 | | | 8,459 | | | 17,379 | |

| | | Change in current assets and liabilities, net of acquisitions of businesses: | | | | | | | | | | |

| | | | Accounts receivable | | | 3,162 | | | (16,486 | ) | | (19,259 | ) |

| | | | Inventories | | | 31,731 | | | (48,693 | ) | | (22,976 | ) |

| | | | Uniforms and other rental items in service | | | (27,257 | ) | | (28,471 | ) | | (14,425 | ) |

| | | | Prepaid expenses | | | 1,330 | | | (1,160 | ) | | (938 | ) |

| | | | Accounts payable | | | 3,345 | | | (10,107 | ) | | (600 | ) |

| | | | Accrued compensation and related liabilities | | | (12,696 | ) | | 6,666 | | | 2,270 | |

| | | | Accrued liabilities | | | 4,534 | | | (4,011 | ) | | (8,889 | ) |

| | | | Income taxes payable | | | (1,621 | ) | | 6,221 | | | 12,570 | |

| | |

| |

| |

| |

| Net cash provided by operating activities | | | 377,433 | | | 246,958 | | | 258,032 | |

| Cash flows from investing activities: | | | | | | | | | | |

| | Capital expenditures | | | (107,284 | ) | | (147,444 | ) | | (161,432 | ) |

| | Proceeds from sale or redemption of marketable securities | | | 157,419 | | | 61,609 | | | 112,908 | |

| | Purchase of marketable securities | | | (165,372 | ) | | (40,474 | ) | | (98,233 | ) |

| | Acquisitions of businesses, net of cash acquired | | | (732,227 | ) | | (30,535 | ) | | (24,982 | ) |

| | Proceeds from divestiture of certain facilities | | | — | | | 1,400 | | | 25,722 | |

| | Other | | | (1,882 | ) | | (5,965 | ) | | (10,921 | ) |

| | |

| |

| |

| |

| Net cash used in investing activities | | | (849,346 | ) | | (161,409 | ) | | (156,938 | ) |

| Cash flows from financing activities: | | | | | | | | | | |

| | Proceeds from issuance of long-term debt | | | 640,245 | | | 230 | | | 140,739 | |

| | Repayment of long-term debt | | | (160,612 | ) | | (33,634 | ) | | (177,651 | ) |

| | Stock options exercised | | | 3,247 | | | 5,992 | | | 3,399 | |

| | Dividends paid | | | (42,454 | ) | | (37,173 | ) | | (31,249 | ) |

| | Other | | | (1,609 | ) | | 578 | | | 47 | |

| | |

| |

| |

| |

| Net cash provided by (used in) financing activities | | | 438,817 | | | (64,007 | ) | | (64,715 | ) |

| Net (decrease) increase in cash and cash equivalents | | | (33,096 | ) | | 21,542 | | | 36,379 | |

| Cash and cash equivalents at beginning of year | | | 73,724 | | | 52,182 | | | 15,803 | |

| | |

| |

| |

| |

| Cash and cash equivalents at end of year | | $ | 40,628 | | $ | 73,724 | | $ | 52,182 | |

| | |

| |

| |

| |

See accompanying notes.

5

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Amounts in thousands except per share and share data)

1. SIGNIFICANT ACCOUNTING POLICIES

Business description.Cintas Corporation (Cintas) classifies its businesses into two operating segments: Rentals and Other Services. The Rentals operating segment designs and manufactures corporate identity uniforms which it rents, along with other items, to its customers. The Other Services operating segment involves the design, manufacture and direct sale of uniforms to its customers, as well as the sale of ancillary services including sanitation supplies, first aid products and services and cleanroom supplies. All of these services are provided throughout the United States and Canada to businesses of all types—from small service and manufacturing companies to major corporations that employ thousands of people.

Principles of consolidation.The consolidated financial statements include the accounts of Cintas and its subsidiaries. Intercompany balances and transactions have been eliminated.

Use of estimates.The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Financial results could differ from those estimates.

Cash and cash equivalents.Cintas considers all highly liquid investments with a maturity of three months or less, at date of purchase, to be cash equivalents.

Inventories.Inventories are valued at the lower of cost (first-in, first-out) or market. Substantially all inventories represent finished goods.

Uniforms and other rental items in service.These items are valued at cost less amortization, calculated using the straight-line method. Uniforms in service (other than cleanroom and flame resistant garments) are amortized over their useful life of eighteen months. Other rental items including shop towels, mats, cleanroom garments, flame resistant garments, linens and hygiene dispensers are amortized over their useful lives of eight to forty-eight months.

Property and equipment.Depreciation is calculated using the straight-line method over the following estimated useful lives, in years:

| Buildings and Improvements | | 5 to 40 |

| Equipment | | 3 to 10 |

| Leasehold Improvements | | 2 to 5 |

Long-lived assets.When events or circumstances indicate that the carrying amount of long-lived assets may not be recoverable, the estimated future cash flows (undiscounted) are compared to the carrying amount of the assets. If the estimated future cash flows are less than the carrying amount of the assets, an impairment loss is recorded. The impairment loss is measured by comparing the fair value of the assets with their carrying amounts. Fair value is determined by discounted cash flows or appraised values, as appropriate. Long-lived assets that are held for disposal are reported at the lower of the carrying amount or the fair value, less estimated costs related to disposition.

Other assets.Other assets consist primarily of service contracts and noncompete and consulting agreements obtained through the acquisition of businesses, which are amortized by use of the straight-line method over the estimated lives of the agreements, which are generally three to twelve years.

Accrued liabilities.Accrued liabilities consist primarily of insurance, medical and profit sharing obligations and legal and environmental contingencies. These are recorded when it is probable that a liability has occurred and the amount of the liability can be reasonably estimated.

Stock options.Cintas applies the provisions of Accounting Principles Board Opinion No. 25,Accounting for Stock Issued to Employees. Accordingly, no compensation expense has been reflected in the financial statements as the exercise price of options granted to employees is equal to the fair market value of Cintas' common stock on the date of grant. Cintas has adopted the disclosure-only provisions of Statement of Financial Accounting Standards No. 123 (SFAS 123),Accounting for Stock Based Compensation.

6

Derivatives and hedging activities.Effective June 1, 2001, Cintas adopted Statement of Financial Accounting Standards No. 133 (SFAS 133),Accounting for Derivatives and Hedging Activities, as amended. This standard requires the recognition of all derivatives on the balance sheet at fair value and recognition of the resulting gains or losses as adjustments to earnings or other comprehensive income. The adoption of this new standard resulted in a cumulative effect of change in accounting principle of $44 recorded in other comprehensive loss to reflect the interest rate swaps described in Note 5.

Cintas formally documents all relationships between hedging instruments and hedged items, as well as its risk management objective and strategy for undertaking various hedge transactions. Cintas' hedging activities are transacted only with highly-rated institutions, reducing the exposure to credit risk in the event of nonperformance.

Cintas uses derivatives for both cash flow hedging and fair value hedging purposes. For derivative instruments that hedge the exposure of variability in short-term interest rates, designated as cash flow hedges, the effective portion of the net gain or loss on the derivative instrument is reported as a component of other comprehensive income and reclassified into earnings in the same period or periods during which the hedged transaction affects earnings. For the ineffective portion of the hedge, gains or losses are charged to earnings in the current period. For derivative instrumentsthat hedge the exposure to changes in the fair value of certain fixed rate debt, designated as fair value hedges, the effective portion of the net gain or loss on the derivative instrument, as well as the offsetting gain or loss on the fixed rate debt attributable to the hedged risk, are recorded in current period earnings.

Cintas uses interest rate swap and lock agreements as hedges against variability in short-term interest rates. These agreements effectively convert a portion of the floating rate debt to a fixed rate basis, thus reducing the impact of interest rate changes on future interest expense. Cintas uses the Hypothetical Derivative Method for assessing the effectiveness of these swaps. The effectiveness of these swaps is reviewed at least every fiscal quarter. Cintas will also periodically use reverse interest rate swap agreements to convert a portion of fixed rate debt to a floating rate basis, thus hedging for changes in the fair value of the fixed rate debt being hedged. Cintas has determined that the interest rate swap agreement referenced in Note 5, designated as a fair value hedge, qualifies for treatment under the short-cut method of measuring effectiveness. Under the provisions of SFAS 133, this hedge is determined to be perfectly effective and there is no requirement to periodically evaluate effectiveness.

Revenue recognition.Rental revenue is recognized when services are performed and other services revenue is recognized when products are shipped and the title and risks of ownership pass to the customer. Cintas also establishes an estimate of allowances for uncollectible accounts when revenue is recorded.

Fair value of financial instruments.The following methods and assumptions were used by Cintas in estimating the fair value of financial instruments:

Cash and cash equivalents. The amounts reported approximate market value.

Marketable securities. The amounts reported are at cost, which approximates market value. Market values are based on quoted market prices.

Long-term debt. The amounts reported are at a carrying value which approximates market value. Market values are determined using similar debt instruments currently available to Cintas that are consistent with the terms, interest rates and maturities.

Reclassification.Certain prior year amounts have been reclassified to conform with current year presentation.

Other accounting pronouncements.In August 2001, the Financial Accounting Standards Board issued Statement of Financial Accounting Standards No. 144 (SFAS 144),Accounting for the Impairment or Disposal of Long-Lived Assets. SFAS 144 addresses significant issues relating to the implementation of Statement of Financial Accounting Standards No. 121 (SFAS 121),Accounting for the Impairment of Long-Lived Assets and for Long-Lived Assets to Be Disposed Of, and develops a single accounting model, based on the framework established in SFAS 121 for long-lived assets to be disposed of by sale, whether such assets are or are not deemed to be a business. SFAS 144 also modifies the accounting and disclosure rules for discontinued operations. Effective June 1, 2002, Cintas adopted SFAS 144 and it did not have a material effect on the financial statements.

7

2. MARKETABLE SECURITIES

All marketable securities are comprised of debt securities and classified as available-for-sale. Realized gains and losses and declines in value determined to be other than temporary on available-for-sale securities are included in interest income. The cost of the securities sold is based on the specific identification method. Interest on securities classified as available-for-sale is included in interest income.

The following is a summary of marketable securities:

| | 2002

| | 2001

|

|---|

| | Cost

| | Estimated

Fair Value

| | Cost

| | Estimated

Fair Value

|

|---|

| Obligations of state and political subdivisions | | $ | 41,447 | | $ | 41,540 | | $ | 32,171 | | $ | 32,468 |

| U.S. Treasury securities and obligations of U.S. government agencies | | | 881 | | | 851 | | | 600 | | | 600 |

| Other debt securities | | | 2,130 | | | 2,130 | | | 3,734 | | | 3,794 |

| | |

| |

| |

| |

|

| | | $ | 44,458 | | $ | 44,521 | | $ | 36,505 | | $ | 36,862 |

| | |

| |

| |

| |

|

The gross realized gains on sales of available-for-sale securities totaled $585, $64 and $54 for the years ended May 31, 2002, 2001 and 2000, and the gross realized losses totaled $95, $21 and $130, respectively. Net unrealized gains are $63 and $357 at May 31, 2002 and 2001, respectively.

The cost and estimated fair value of debt securities at May 31, 2002, by contractual maturity, are shown below. Expected maturities will differ from contractual maturities because the issuers of the securities may have the right to prepay the obligations without prepayment penalties.

| | Cost

| | Estimated

Fair Value

|

|---|

| Due in one year or less | | $ | 17,703 | | $ | 17,798 |

| Due after one year through three years | | | 24,453 | | | 24,454 |

| Due after three years | | | 2,302 | | | 2,269 |

| | |

| |

|

| | | $ | 44,458 | | $ | 44,521 |

| | |

| |

|

3. PROPERTY AND EQUIPMENT

| | 2002

| | 2001

|

|---|

| Land | | $ | 64,823 | | $ | 54,743 |

| Buildings and improvements | | | 388,695 | | | 326,512 |

| Equipment | | | 674,969 | | | 589,945 |

| Leasehold improvements | | | 10,653 | | | 12,124 |

| Construction in progress | | | 72,523 | | | 74,609 |

| | |

| |

|

| | | | 1,211,663 | | | 1,057,933 |

| Less: accumulated depreciation | | | 433,261 | | | 355,801 |

| | |

| |

|

| | | $ | 778,402 | | $ | 702,132 |

| | |

| |

|

4. GOODWILL AND OTHER ASSETS

As of June 1, 2001, Cintas adopted Statement of Financial Accounting Standards No. 142 (SFAS 142),Goodwill and Other Intangible Assets, which addresses the financial accounting and reporting standards for the acquisition of intangible assets outside of a business combination and for goodwill and other intangible assets subsequent to their acquisition. This accounting standard requires that goodwill be separately disclosed from other intangible assets in the balance sheet, and no longer be amortized, but tested for impairment on a periodic basis. The provisions of this accounting standard also require the completion of a transitional impairment test within six months of adoption, with any impairments identified treated as a cumulative effect of a change in accounting principle.

8

Cintas completed the transitional and the annual goodwill impairment tests as required by SFAS 142. Based on the results of the impairment tests, Cintas was not required to recognize an impairment of goodwill. Cintas will continue to perform future impairment tests as required by SFAS 142.

In accordance with SFAS 142, Cintas discontinued the amortization of goodwill effective June 1, 2001. A reconciliation of previously reported net income and earnings per share to the amounts adjusted for the exclusion of goodwill amortization, net of the related income tax effect, follows:

| | 2002

| | 2001

| | 2000

|

|---|

| Reported net income | | $ | 234,251 | | $ | 222,451 | | $ | 193,387 |

| Add: goodwill amortization, net of tax | | | — | | | 3,328 | | | 2,362 |

| | |

| |

| |

|

| Adjusted net income | | $ | 234,251 | | $ | 225,779 | | $ | 195,749 |

| | |

| |

| |

|

| Reported basic earnings per share | | $ | 1.38 | | $ | 1.32 | | $ | 1.16 |

| Add: goodwill amortization, net of tax per basic share | | | — | | | .02 | | | .01 |

| | |

| |

| |

|

| Adjusted basic earnings per share | | $ | 1.38 | | $ | 1.34 | | $ | 1.17 |

| | |

| |

| |

|

| Reported diluted earnings per share | | $ | 1.36 | | $ | 1.30 | | $ | 1.14 |

| Add: goodwill amortization, net of tax per diluted share | | | — | | | .02 | | | .01 |

| | |

| |

| |

|

| Adjusted diluted earnings per share | | $ | 1.36 | | $ | 1.32 | | $ | 1.15 |

| | |

| |

| |

|

Changes in the carrying amount of goodwill for the year ended May 31, 2002, by operating segment, are as follows:

| | Rentals

| | Other

Services

| | Total

|

|---|

| Balance as of June 1, 2001 | | $ | 110,030 | | $ | 13,723 | | $ | 123,753 |

| Goodwill acquired during the period | | | 535,415 | | | 19,430 | | | 554,845 |

| | |

| |

| |

|

| Balance as of May 31, 2002 | | $ | 645,445 | | $ | 33,153 | | $ | 678,598 |

| | |

| |

| |

|

As required by Statement of Financial Accounting Standards No.141 (SFAS 141), Business Combinations, (see Note 8), intangible assets that do not meet the criteria for recognition apart from goodwill must be reclassified. As a result of Cintas' analysis, no reclassifications to goodwill were required as of June 1, 2001.

Information regarding Cintas' other assets follows:

As of May 31, 2002

| | Carrying

Amount

| | Accumulated

Amortization

| | Net

|

|---|

| Service contracts | | $ | 226,023 | | $ | 67,494 | | $ | 158,529 |

| Noncompete and consulting agreements | | | 61,742 | | | 41,792 | | | 19,950 |

| Other | | | 31,111 | | | 606 | | | 30,505 |

| | |

| |

| |

|

| Total | | $ | 318,876 | | $ | 109,892 | | $ | 208,984 |

| | |

| |

| |

|

As of May 31, 2001

| | Carrying

Amount

| | Accumulated

Amortization

| | Net

|

|---|

| Service contracts | | $ | 118,241 | | $ | 61,810 | | $ | 56,431 |

| Noncompete and consulting agreements | | | 63,519 | | | 42,334 | | | 21,185 |

| Other | | | 29,887 | | | 834 | | | 29,053 |

| | |

| |

| |

|

| Total | | $ | 211,647 | | $ | 104,978 | | $ | 106,669 |

| | |

| |

| |

|

9

Amortization expense was $18,810, $21,850 and $20,997 for the years ended May 31, 2002, 2001 and 2000, respectively. Estimated amortization expense, excluding any future acquisitions, for each of the next five years is $27,528, $23,925, $21,722, $20,854 and $19,579, respectively.

5. LONG-TERM DEBT

| | 2002

| | 2001

|

|---|

| Secured and unsecured term notes due through 2003 at an average rate of 9.98% | | $ | 5,500 | | $ | 7,500 |

| Unsecured term notes due through 2026 at an average rate of 5.59% | | | 492,697 | | | 54,348 |

| Unsecured notes due through 2009 at an average rate of 2.44% | | | 207,272 | | | 160,156 |

| Industrial development revenue bonds due through 2026 at an average rate of 3.24% | | | 11,691 | | | 14,489 |

| Other | | | 4,459 | | | 5,052 |

| | |

| |

|

| | | | 721,619 | | | 241,545 |

| Less: amounts due within one year | | | 18,369 | | | 20,605 |

| | |

| |

|

| | | $ | 703,250 | | $ | 220,940 |

| | |

| |

|

Debt in the amount of $21,650 is secured by assets with a carrying value of $26,297 at May 31, 2002. Cintas has letters of credit outstanding at May 31, 2002 approximating $39,603. Maturities of long-term debt during each of the next five years are $18,369, $218,853, $10,401, $7,347 and $4,056, respectively.

Interest expense is net of capitalized interest of $594, $1,468 and $1,257 for the years ended May 31, 2002, 2001 and 2000, respectively. Interest paid, net of amount capitalized, was $11,017, $15,194 and $16,773 for the years ended May 31, 2002, 2001 and 2000, respectively.

Cintas has a commercial paper program supported by a $300 million long-term credit facility. As of May 31, 2002, $190 million in commercial paper was outstanding.

Cintas uses interest rate swap and lock agreements as hedges against variability in short-term interest rates. These agreements effectively convert a portion of our floating rate debt to a fixed rate basis, thus reducing the impact of interest rate changes on future interest expense. During fiscal 2001, and again in the second quarter of fiscal 2002, Cintas entered into interest rate swap agreements that effectively converted a portion of our floating rate debt to a fixed rate basis for a period of two years. Approximately 20%, or $50 million, of outstanding floating rate debt was designated as the hedged items covered by interest rate swap agreements at May 31, 2002. Cintas has entered into two interest rate swap agreements. The first agreement totals $10 million, expires in March 2003 and allows Cintas to pay an effective interest rate of approximately 4.76%. The second agreement totals $40 million, expires in September 2003 and allows Cintas to pay an effective interest rate of approximately 4.02%.

Cintas has also entered into a reverse interest rate swap agreement to protect the debt against changes in the fair value due to changes in the benchmark interest rate. The reverse interest rate swap agreement utilized by Cintas effectively modifies Cintas' exposure to interest risk by converting Cintas' fixed rate debt to floating rate. This agreement involves the receipt of fixed rate amounts in exchange for floating rate interest payments over the life of the agreementwithout an exchange of underlying principal amount. The mark-to-market values of both the fair value hedging instruments and the underlying debt obligations are equal and recorded as offsetting gains and losses in other comprehensive income. The fair value hedge is 100% effective. As a result, there is no impact to earnings due to hedge ineffectiveness.The reverse interest rate swap agreement totals $125 million, expires in June 2007 and allows Cintas to receive an effective interest rate of approximately 5.13% and pay an interest rate based on LIBOR.

10

6. LEASES

Cintas conducts certain operations from leased facilities and leases certain equipment. Most leases contain renewal options for periods from one to ten years. The lease agreements provide for increases in rentals if the options are exercised based on increases in certain price level factors or prearranged increases. It is anticipated that expiring leases will be renewed or replaced. The minimum rental payments under noncancelable lease arrangements for each of the next five years and thereafter are $14,923, $12,039, $9,603, $8,201, $6,426 and $10,674, respectively. Rent expense under operating leases during the years ended May 31, 2002, 2001 and 2000 was $18,377, $17,063 and $16,949, respectively.

7. INCOME TAXES

| | 2002

| | 2001

| | 2000

|

|---|

| Income taxes consist of the following components: | | | | | | | | | |

| | Current: | | | | | | | | | |

| | | Federal | | $ | 105,027 | | $ | 111,408 | | $ | 88,842 |

| | | State and local | | | 11,849 | | | 14,135 | | | 12,151 |

| | |

| |

| |

|

| | | | 116,876 | | | 125,543 | | | 100,993 |

| | Deferred | | | 20,458 | | | 8,460 | | | 17,379 |

| | |

| |

| |

|

| | | $ | 137,334 | | $ | 134,003 | | $ | 118,372 |

| | |

| |

| |

|

| | 2002

| | 2001

| | 2000

| |

|---|

| Reconciliation of income tax expense using the statutory rate and actual income tax expense is as follows: | | | | | | | | | | |

| | | Income taxes at the U.S. federal statutory rate | | $ | 129,979 | | $ | 124,760 | | $ | 109,109 | |

| | | State and local income taxes, net of federal benefit | | | 8,786 | | | 9,710 | | | 9,727 | |

| | | Other | | | (1,431 | ) | | (467 | ) | | (464 | ) |

| | |

| |

| |

| |

| | | $ | 137,334 | | $ | 134,003 | | $ | 118,372 | |

| | |

| |

| |

| |

The components of deferred income taxes included on the balance sheets are as follows:

| | 2002

| | 2001

| |

|---|

| Deferred tax assets: | | | | | | | |

| | Employee benefits | | $ | 4,411 | | $ | 4,177 | |

| | Allowance for bad debts | | | 3,180 | | | 2,519 | |

| | Inventory obsolescence | | | 10,757 | | | 10,064 | |

| | Insurance and contingencies | | | 8,476 | | | 7,397 | |

| | Other | | | 10,727 | | | 4,214 | |

| | |

| |

| |

| | | | 37,551 | | | 28,371 | |

Deferred tax liabilities: |

|

|

|

|

|

|

|

| | In service inventory | | | 96,843 | | | 84,579 | |

| | Property | | | 53,362 | | | 50,078 | |

| | Intangibles | | | 21,973 | | | (6,123 | ) |

| | Other | | | 6,336 | | | 6,606 | |

| | |

| |

| |

| | | | 178,514 | | | 135,140 | |

| | |

| |

| |

| Net deferred tax liability | | $ | 140,963 | | $ | 106,769 | |

| | |

| |

| |

Income taxes paid were $120,553, $112,307 and $85,509 for the years ended May 31, 2002, 2001 and 2000, respectively.

U.S. income taxes of $1,750, net of foreign tax credits, have not been provided for on a cumulative total of approximately $28,500 of undistributed earnings for certain non-U.S. subsidiaries as of May 31, 2002. Cintas intends to reinvest these earnings indefinitely in operations outside the United States.

11

8. ACQUISITIONS

In June 2001, the Financial Accounting Standards Board issued Statement of Financial Accounting Standards No. 141 (SFAS 141),Business Combinations, which eliminates the pooling of interests method of accounting for all business combinations initiated after June 30, 2001, and addresses the initial recognition and measurement of goodwill and other intangible assets acquired in a business combination. Cintas adopted this accounting standard for business combinations initiated after June 30, 2001.

During the years ended May 31, 2002, 2001 and 2000, Cintas completed numerous acquisitions, one of which was significant. On May 13, 2002, Cintas acquired 100% of Omni Services, Inc. (Omni) from Filuxel S.A. for a price of $660,000 (less a $3,000 adjustment for environmental issues and $929 in assumed debt). Certain Omni locations and all corporate functions will be integrated into existing Cintas operations, allowing Cintas to service the Omni customer base more cost effectively. This additional customer base will also allow for additional cross-selling opportunities among other Cintas products. Omni's operating results for the period from May 13, 2002 through May 31, 2002 have been included in Cintas' consolidated results.

The total cash paid to acquire Omni was $656,071. Per the terms of the agreement, this price will be adjusted slightly for changes in working capital as reflected in the final closing balance sheet. Following is the preliminary purchase price allocation for the Omni acquisition:

| | Preliminary Purchase Price Allocation

|

|---|

| Assets: | | | |

| Current assets | | $ | 58,923 |

| Property and equipment | | | 62,529 |

| Goodwill | | | 501,534 |

| Other assets | | | 103,961 |

| | |

|

| | | $ | 726,947 |

| | |

|

| Liabilities: | | | |

| Current liabilities | | $ | 51,822 |

| Deferred taxes | | | 18,737 |

| Long-term debt due after one year | | | 317 |

| | |

|

| | | $ | 70,876 |

| | |

|

| Total purchase price | | $ | 656,071 |

| | |

|

At the time of acquisition, management approved a plan to integrate certain Omni facilities into existing Cintas operations. Included in the purchase price allocation is a restructuring charge of approximately $36 million, which includes approximately $6 million in severance-related costs for corporate and field employees and $30 million in asset write-downs and lease cancellation costs. Cintas expects to incur these costs within the first year of acquisition.

The pro forma information presented below assumes that Omni had been acquired at the beginning of fiscal 2001 and includes the effect of intangible amortization and the impact on interest expense due to the significant change in Cintas' capital structure. This is presented for informational purposes only, and is not necessarily indicative of the financial position or financial results which may be attained in the future, including synergies that may be achieved.

| | 2002

| | 2001

|

|---|

| Net revenues | | $ | 2,575,331 | | $ | 2,489,786 |

| Net income | | $ | 237,966 | | $ | 226,009 |

| Basic earnings per share | | $ | 1.40 | | $ | 1.34 |

| Diluted earnings per share | | $ | 1.38 | | $ | 1.32 |

For all acquisitions accounted for as purchases, including insignificant acquisitions (33 businesses), the purchase price paid for each has been allocated to the fair value of the assets acquired and liabilities assumed. The following summarizes the aggregate purchase price for all businesses acquired, with the exception of Omni, which have been accounted for as purchases:

12

| | 2002

| | 2001

|

|---|

| Fair value of assets acquired | | $ | 92,627 | | $ | 32,286 |

| Liabilities assumed and incurred | | | 8,630 | | | 2,379 |

| | |

| |

|

| Total cash paid for acquisitions | | $ | 83,997 | | $ | 29,907 |

| | |

| |

|

The results of operations for the acquired businesses are included in the consolidated statements of income from the dates of acquisition. The pro forma revenue, net income and earnings per share information relating to acquired businesses, with the exception of Omni, are not presented because they are not significant.

9. DEFINED CONTRIBUTION PLANS

Cintas' Partners' Plan is a non-contributory profit sharing plan and ESOP for the benefit of substantially all U.S. Cintas employees who have completed one year of service. The plan also includes a 401(k) savings feature covering substantially all employees. The amount of contributions to the profit sharing plan and ESOP, as well as the matching contribution to the 401(k), are made at the discretion of Cintas. Total contributions, including Cintas' matching contributions, were $19,283, $18,385 and $15,600 for the years ended May 31, 2002, 2001 and 2000, respectively.

Cintas also has a non-contributory deferred profit sharing plan (DPSP), which covers substantially all Canadian employees. In addition, a registered retirement savings plan (RRSP) is offered to those employees. The amount of contributions to the DPSP, as well as the matching contribution to the RRSP, are made at the discretion of Cintas. Total contributions were $786, $577 and $480 for the years ended May 31, 2002, 2001 and 2000, respectively.

As a result of previous mergers and acquisitions, Cintas also sponsored contributory thrift plans covering certain salaried and clerical employees and certain employees subject to collective bargaining agreements. Under the provisions of these thrift plans, employees are permitted to contribute a maximum of 6% of their earnings and Cintas makes matching contributions of 25% to 50%. Employees may make additional unmatched contributions to these plans of up to 9% of their earnings. Cintas' contributions to these thrift plans were $0, $355 and $596 for the years ended May 31, 2002, 2001 and 2000, respectively.

10. EARNINGS PER SHARE

Earnings per share are computed in accordance with Statement of Financial Accounting Standards No. 128,Earnings per Share. The basic computations are computed based on the weighted average number of common shares outstanding during each period. The diluted computations reflect the potential dilution that could occur if stock options were exercised into common stock, under certain circumstances, that then would share in the earnings of Cintas.

The following table represents a reconciliation of the shares used to calculate basic and diluted earnings per share for the respective years:

| | 2002

| | 2001

| | 2000

|

|---|

| Numerator: | | | | | | | | | |

| | Net income | | $ | 234,251 | | $ | 222,451 | | $ | 193,387 |

| | |

| |

| |

|

| Denominator: | | | | | | | | | |

| | Denominator for basic earnings per share—

weighted average shares (000's) | | | 169,713 | | | 168,779 | | | 167,067 |

| | Effect of dilutive securities—

employee stock options (000's) | | | 2,531 | | | 2,850 | | | 2,920 |

| | |

| |

| |

|

| | Denominator for diluted earnings per share—

adjusted weighted average shares and assumed conversions (000's) | | | 172,244 | | | 171,629 | | | 169,987 |

| | |

| |

| |

|

| Basic earnings per share | | $ | 1.38 | | $ | 1.32 | | $ | 1.16 |

| | |

| |

| |

|

| Diluted earnings per share | | $ | 1.36 | | $ | 1.30 | | $ | 1.14 |

| | |

| |

| |

|

On January 18, 2000, the Board of Directors approved a three-for-two common stock split effective March 7, 2000. All share and per share information have been adjusted to retroactively reflect the effect of this stock split for all periods presented.

13

11. STOCK BASED COMPENSATION

Under the stock option plan adopted by Cintas in fiscal 2000, Cintas may grant officers and key employees incentive stock options and/or non-qualified stock options to purchase an aggregate of 9,000,000 shares of Cintas' common stock. Options are granted at the fair market value of the underlying common stock on the date of grant and generally vest and become exercisable at the rate of 20% per year commencing five years after grant, so long as the holder remains an employee of Cintas.

As part of the Unitog acquisition in March 1999, Cintas retained a non-qualified stock option plan for certain Unitog employees. The exercise price of the options granted under this plan is the fair market value at date of grant and the options vest ratably over four years and expire ten years after the date of grant. Certain provisions of the plan required immediate vesting and a cash settlement, as opposed to the issuance of common stock, upon termination of the option holders' employment prior to March 24, 2000.

The information presented in the following table relates primarily to stock options granted and outstanding under either the plan adopted in fiscal 2000 or under similar plans:

| | Shares

| | Weighted Average

Exercise Price

|

|---|

| Outstanding May 31, 1999 (623,280 shares exercisable) | | 5,921,177 | | $ | 17.46 |

| | Granted | | 760,825 | | | 41.39 |

| | Cancelled | | (249,575 | ) | | 25.72 |

| | Exercised | | (493,736 | ) | | 10.71 |

| | |

| |

|

| Outstanding May 31, 2000 (671,391 shares exercisable) | | 5,938,691 | | | 20.74 |

| | Granted | | 691,500 | | | 42.88 |

| | Cancelled | | (241,175 | ) | | 30.87 |

| | Exercised | | (662,823 | ) | | 11.03 |

| | |

| |

|

| Outstanding May 31, 2001 (555,544 shares exercisable) | | 5,726,193 | | | 24.11 |

| | Granted | | 823,750 | | | 47.32 |

| | Cancelled | | (171,600 | ) | | 30.64 |

| | Exercised | | (517,246 | ) | | 11.93 |

| | |

| |

|

| Outstanding May 31, 2002 (674,595 shares exercisable) | | 5,861,097 | | $ | 28.31 |

| | |

| |

|

The following table summarizes the information related to stock options outstanding at May 31, 2002:

| |

| | Outstanding Options

| | Exercisable Options

|

|---|

Range of

Exercise Prices

| | Number

Outstanding

| | Average

Remaining

Option

Life

| | Weighted

Average

Exercise

Price

| | Number

Exercisable

| | Weighted

Average

Exercise

Price

|

|---|

| $ | 8.42—$16.83 | | 1,888,729 | | 2.98 | | $ | 13.24 | | 573,469 | | $ | 11.58 |

| | 17.25— 23.54 | | 1,258,225 | | 5.09 | | | 22.90 | | 63,595 | | | 18.36 |

| | 24.38— 41.96 | | 1,236,993 | | 6.70 | | | 36.32 | | 35,968 | | | 28.98 |

| | 42.19— 53.19 | | 1,477,150 | | 8.72 | | | 45.46 | | 1,563 | | | 42.24 |

| | | |

| |

| |

| |

| |

|

| $ | 8.42—$53.19 | | 5,861,097 | | 5.67 | | $ | 28.31 | | 674,595 | | $ | 13.22 |

| | | |

| |

| |

| |

| |

|

At May 31, 2002, 7,528,050 shares of common stock are reserved for future issuance under the 2000 plan.

14

Pro forma information regarding earnings and earnings per share is required by SFAS 123 and has been determined as if Cintas had accounted for its stock options granted subsequent to May 31, 1995, under the fair value method of SFAS 123. The weighted average fair value of stock options granted during fiscal 2002, 2001 and 2000 was $22.65, $21.40 and $21.29, respectively. The fair value of these options was estimated at the date of grant using a Black-Scholes option-pricing model with the following weighted-average assumptions:

| | 2002

| | 2001

| | 2000

| |

|---|

| Risk free interest rate | | 4.75 | % | 5.50 | % | 6.25 | % |

| Dividend yield | | .50 | % | .50 | % | .50 | % |

| Expected volatility of Cintas' common stock | | 34 | % | 34 | % | 32 | % |

| Expected life of the option in years | | 9 | | 9 | | 9 | |

The Black-Scholes option-pricing model was developed for use in estimating the fair value of traded options which have no vesting restrictions and are freely transferable. In addition, option valuation models require the input of highly subjective assumptions including the expected stock price volatility. Because Cintas' options have characteristics significantly different from those of traded options and because changes in the subjective input assumptions can materially affect the fair value estimate, in Cintas' opinion existing models do not necessarily provide a reliable single measure of the fair value of its stock options.

For purposes of pro forma disclosure, the estimated fair value of the options is amortized to expense over the options' vesting period. Cintas' pro forma information is as follows:

| | 2002

| | 2001

| | 2000

|

|---|

| Net income: | | | | | | | | | |

| | As reported | | $ | 234,251 | | $ | 222,451 | | $ | 193,387 |

| | Pro forma for SFAS 123 | | $ | 229,466 | | $ | 218,665 | | $ | 190,386 |

Earnings per share: |

|

|

|

|

|

|

|

|

|

| | Pro forma basic earnings per share for SFAS 123 | | $ | 1.35 | | $ | 1.30 | | $ | 1.14 |

| | Pro forma diluted earnings per share for SFAS 123 | | $ | 1.33 | | $ | 1.27 | | $ | 1.12 |

The effects of providing pro forma disclosure are not representative of earnings to be reported for future years.

12. LITIGATION AND ENVIRONMENTAL MATTERS

Cintas is subject to legal proceedings and claims arising from the ordinary course of its business, including personal injury, customer contract and employment claims. In the opinion of management, the aggregate liability, if any, with respect to such actions will not have a material adverse effect on the financial position or results of operations of Cintas.

In acquiring Unitog in March 1999, Cintas became a potentially responsible party, and thus faces the possibility of joint and several liability under the Comprehensive Environmental Response, Compensation and Liability Act (CERCLA) in connection with alleged environmental contamination in an area near a rental facility in Tempe, Arizona. This facility, located near the South Indian Bend Wash (SIBW) Federal Superfund site, has been tested for soil and groundwater contamination. Soil testing at Cintas' facility detected volatile organic compounds, and Cintas promptly took steps to remediate the contamination. Groundwater testing in the area of Cintas' property has detected a very low level of volatile organic compound contamination. The United States Environmental Protection Agency (EPA) in March 1999 issued a Record of Decision to the effect that groundwater contamination in the vicinity of Cintas' plant does not warrant remediation at this time. Instead, the low levels of groundwater contamination near Cintas' facility will be monitored and allowed to attenuate naturally. The Record of Decision requires active groundwater remediation in other parts of the SIBW site, which are believed to be unrelated to Cintas. According to the Record of Decision, the EPA estimates that the 30 year net present value of costs to be incurred to remediate and monitor groundwater contamination at the SIBW site is $22,000. It is possible that the EPA will attempt to recover from the potentially responsible parties the costs it has incurred to date with respect to the SIBW site as well as the costs it expects to incur going forward. To date, no specific claim has been asserted against Cintas. Thus it is not possible at this time to estimate Cintas' loss exposure, if any, with respect to this matter.

15

As part of the Agreement and Plan of Merger dated January 9, 1999 between Unitog and Cintas, Cintas performed environmental testing at nine previously untested Unitog laundry facilities. The testing resulted in the discovery of soil and groundwater contamination at certain of these sites. As a result of all of the environmental matters noted above, Cintas recorded a charge to operating expense of $5,000 during the third quarter of fiscal 1999 to reflect its current estimate of the additional costs to be incurred relative to these sites. At May 31, 2002, Cintas has an undiscounted liability of $3,970 for these environmental matters.

As part of the acquisition of Omni, Cintas performed environmental testing at ten previously untested Omni laundry facilities. The testing resulted in the discovery of soil and groundwater contamination at certain of these sites. Cintas estimated that remedial action would cost approximately $9 million to clean up these sites, which Cintas has accrued as a liability as of the date of the acquisition of Omni. Under its agreement to acquire Omni, Cintas has agreed to pay for any remedial action, up to the first $5 million, and the parties agreed that remedial costs of $3 million would be treated as a purchase price adjustment and credited to Cintas.

Cintas is party to additional litigation, none of which is expected to have a material impact on operating results. This litigation includes lawsuits challenging the legality of certain ancillary charges on invoices. The estimated liability, if any, relating to these lawsuits has not been determined, but is not expected to have a material adverse effect on results. In addition, a class action suit was filed in the State of California alleging that Cintas violated the California overtime pay laws applicable to its service sales representatives, which Cintas believed to be exempt employees. Management of Cintas has established estimated accruals to the extent that liabilities exist for such matters and believes that any liability in excess of amounts accrued will not have a material impact on the financial statements.

13. SEGMENT INFORMATION

Cintas classifies its businesses into two operating segments: Rentals and Other Services. The Rentals operating segment designs and manufactures corporate identity uniforms which it rents, along with other items, to its customers. The Other Services operating segment involves the design, manufacture and direct sale of uniforms to its customers, as well as the sale of ancillary services including sanitation supplies, first aid products and services and cleanroom supplies. All of these services are provided throughout the United States and Canada to businesses of all types—from small service and manufacturing companies to major corporations that employ thousands of people.

Information as to the operations of Cintas' different business segments is set forth below based on the distribution of products and services offered. Cintas evaluates performance based on several factors of which the primary financial measures are business segment revenue and income before income taxes. The accounting policies of the business segments are the same as those described in the Significant Accounting Policies (Note 1).

May 31, 2002

| | Rentals

| | Other

Services

| | Corporate

| | Total

| |

|---|

| Revenue | | $ | 1,753,368 | | $ | 517,684 | | $ | — | | $ | 2,271,052 | |

| | |

| |

| |

| |

| |

| Gross margin | | $ | 800,016 | | $ | 157,354 | | $ | — | | $ | 957,370 | |

| Selling and administrative expenses | | | 450,276 | | | 129,132 | | | 1,061 | | | 580,469 | |

| Interest income | | | — | | | — | | | (5,636 | ) | | (5,636 | ) |

| Interest expense | | | — | | | — | | | 10,952 | | | 10,952 | |

| | |

| |

| |

| |

| |

| Income before income taxes | | $ | 349,740 | | $ | 28,222 | | $ | (6,377 | ) | $ | 371,585 | |

| | |

| |

| |

| |

| |

| Depreciation and amortization | | $ | 103,586 | | $ | 16,439 | | $ | — | | $ | 120,025 | |

| | |

| |

| |

| |

| |

| Capital expenditures | | $ | 98,938 | | $ | 8,346 | | $ | — | | $ | 107,284 | |

| | |

| |

| |

| |

| |

| Total assets | | $ | 2,144,544 | | $ | 289,604 | | $ | 85,086 | | $ | 2,519,234 | |

| | |

| |

| |

| |

| |

16

May 31, 2001

| | Rentals

| | Other

Services

| | Corporate

| | Total

| |

|---|

| Revenue | | $ | 1,610,606 | | $ | 550,094 | | $ | — | | $ | 2,160,700 | |

| | |

| |

| |

| |

| |

| Gross margin | | $ | 714,067 | | $ | 182,200 | | $ | — | | $ | 896,267 | |

| Selling and administrative expenses | | | 390,992 | | | 137,362 | | | 709 | | | 529,063 | |

| Interest income | | | — | | | — | | | (4,369 | ) | | (4,369 | ) |

| Interest expense | | | — | | | — | | | 15,119 | | | 15,119 | |

| | |

| |

| |

| |

| |

| Income before income taxes | | $ | 323,075 | | $ | 44,838 | | $ | (11,459 | ) | $ | 356,454 | |

| | |

| |

| |

| |

| |

| Depreciation and amortization | | $ | 95,957 | | $ | 16,132 | | $ | — | | $ | 112,089 | |

| | |

| |

| |

| |

| |

| Capital expenditures | | $ | 133,786 | | $ | 13,658 | | $ | — | | $ | 147,444 | |

| | |

| |

| |

| |

| |

| Total assets | | $ | 1,362,298 | | $ | 279,697 | | $ | 110,229 | | $ | 1,752,224 | |

| | |

| |

| |

| |

| |

May 31, 2000

| | Rentals

| | Other

Services

| | Corporate

| | Total

| |

|---|

| Revenue | | $ | 1,424,892 | | $ | 477,099 | | $ | — | | $ | 1,901,991 | |

| | |

| |

| |

| |

| |

| Gross margin | | $ | 617,591 | | $ | 161,961 | | $ | — | | $ | 779,552 | |

| Selling and administrative expenses | | | 338,887 | | | 116,907 | | | 834 | | | 456,628 | |

| Interest income | | | — | | | — | | | (4,742 | ) | | (4,742 | ) |

| Interest expense | | | — | | | — | | | 15,907 | | | 15,907 | |

| | |

| |

| |

| |

| |

| Income before income taxes | | $ | 278,704 | | $ | 45,054 | | $ | (11,999 | ) | $ | 311,759 | |

| | |

| |

| |

| |

| |

| Depreciation and amortization | | $ | 86,270 | | $ | 13,243 | | $ | — | | $ | 99,513 | |

| | |

| |

| |

| |

| |

| Capital expenditures | | $ | 129,838 | | $ | 31,594 | | $ | — | | $ | 161,432 | |

| | |

| |

| |

| |

| |

| Total assets | | $ | 1,214,318 | | $ | 257,202 | | $ | 109,822 | | $ | 1,581,342 | |

| | |

| |

| |

| |

| |

14. QUARTERLY FINANCIAL DATA (UNAUDITED)

The following is a summary of the results of operations for each of the quarters within the years ended May 31, 2002 and 2001:

May 31, 2002

| | First

Quarter

| | Second

Quarter

| | Third

Quarter

| | Fourth

Quarter

|

|---|

| Revenue | | $ | 564,600 | | $ | 557,148 | | $ | 545,491 | | $ | 603,813 |

| Gross margin | | $ | 237,277 | | $ | 235,198 | | $ | 229,340 | | $ | 255,555 |

| Net income | | $ | 56,540 | | $ | 57,985 | | $ | 55,584 | | $ | 64,142 |

| Basic earnings per share | | $ | .33 | | $ | .34 | | $ | .33 | | $ | .38 |

| Diluted earnings per share | | $ | .33 | | $ | .34 | | $ | .32 | | $ | .37 |

| Weighted average number of shares outstanding (000's) | | | 169,528 | | | 169,726 | | | 169,786 | | | 169,876 |

May 31, 2001

| | First

Quarter

| | Second

Quarter

| | Third

Quarter

| | Fourth

Quarter

|

|---|

| Revenue | | $ | 521,959 | | $ | 539,052 | | $ | 536,723 | | $ | 562,966 |

| Gross margin | | $ | 217,265 | | $ | 223,377 | | $ | 219,916 | | $ | 235,709 |

| Net income | | $ | 50,849 | | $ | 56,533 | | $ | 54,910 | | $ | 60,159 |

| Basic earnings per share | | $ | .30 | | $ | .34 | | $ | .32 | | $ | .36 |

| Diluted earnings per share | | $ | .30 | | $ | .33 | | $ | .32 | | $ | .35 |

| Weighted average number of shares outstanding (000's) | | | 168,366 | | | 168,660 | | | 168,890 | | | 169,206 |

17

15. SUPPLEMENTAL GUARANTOR INFORMATION

On May 13, 2002, Cintas completed the acquisition of Omni for approximately $656,000. For the twelve months ended January 31, 2002, Omni had total revenue of approximately $300,000. The purchase price for Omni was funded with $450,000 in long-term notes, $100,000 of borrowings under a commercial paper program and approximately $106,000 in cash. The $450,000 in long-term notes consist of $225,000 with five-year maturities at an interest rate of 51/8% and $225,000 with ten-year maturities at an interest rate of 6%.

Effective June 1, 2000, Cintas reorganized its legal structure and created Cintas Corporation No. 2 (Corp. 2) as its indirectly, wholly-owned principal operating subsidiary. Cintas and its wholly-owned, direct and indirect domestic subsidiaries, other than Corp. 2, will unconditionally guarantee, jointly and severally, debt of Corp. 2. As allowed by SEC rules, the following condensed consolidating financial statements are provided as an alternative to filing separate financial statements of the guarantors. Each of the subsidiaries presented in the condensed consolidating financial statements has been fully consolidated in Cintas' financial statements. The condensed consolidating financial statements should be read in conjunction with the financial statements of Cintas and notes thereto of which this note is an integral part.

Condensed consolidating financial statements for Cintas, Corp. 2, the subsidiary guarantors and non-guarantors are presented below:

CONDENSED CONSOLIDATING INCOME STATEMENT

Year Ended May 31, 2002

| | Cintas

Corporation

| | Corp. 2

| | Subsidiary

Guarantors

| | Non -

Guarantors

| | Eliminations

| | Cintas

Corporation

Consolidated

| |

|---|

| Revenue: | | | | | | | | | | | | | | | | | | | |

| | Rentals | | $ | — | | $ | 1,289,261 | | $ | 382,184 | | $ | 82,096 | | $ | (173 | ) | $ | 1,753,368 | |

| | Other services | | | — | | | 896,807 | | | 181,217 | | | 22,434 | | | (582,774 | ) | | 517,684 | |

| | Equity in net income of affiliates | | | 234,251 | | | — | | | — | | | — | | | (234,251 | ) | | — | |

| | |

| |

| |

| |

| |

| |

| |

| | | | 234,251 | | | 2,186,068 | | | 563,401 | | | 104,530 | | | (817,198 | ) | | 2,271,052 | |

| Costs and expenses (income): | | | | | | | | | | | | | | | | | | | |

| | Cost of rentals | | | — | | | 789,092 | | | 226,452 | | | 48,024 | | | (110,216 | ) | | 953,352 | |

| | Cost of other services | | | — | | | 680,366 | | | 129,561 | | | 16,919 | | | (466,516 | ) | | 360,330 | |

| | Selling and administrative expenses | | | — | | | 596,112 | | | (38,864 | ) | | 27,034 | | | (3,813 | ) | | 580,469 | |

| | Interest income | | | — | | | (5,042 | ) | | (385 | ) | | (209 | ) | | — | | | (5,636 | ) |

| | Interest expense | | | — | | | 48,616 | | | (37,617 | ) | | (47 | ) | | — | | | 10,952 | |

| | |

| |

| |

| |

| |

| |

| |

| | | | — | | | 2,109,144 | | | 279,147 | | | 91,721 | | | (580,545 | ) | | 1,899,467 | |

| Income before income taxes | | | 234,251 | | | 76,924 | | | 284,254 | | | 12,809 | | | (236,653 | ) | | 371,585 | |

| Income taxes | | | — | | | 12,319 | | | 120,452 | | | 4,563 | | | — | | | 137,334 | |

| | |

| |

| |

| |

| |

| |

| |

| Net income | | $ | 234,251 | | $ | 64,605 | | $ | 163,802 | | $ | 8,246 | | $ | (236,653 | ) | $ | 234,251 | |

| | |

| |

| |

| |

| |

| |

| |

18

CONDENSED CONSOLIDATING INCOME STATEMENT

Year Ended May 31, 2001

| | Cintas

Corporation

| | Corp. 2

| | Subsidiary

Guarantors

| | Non -

Guarantors

| | Eliminations

| | Cintas

Corporation

Consolidated

| |

|---|

| Revenue: | | | | | | | | | | | | | | | | | | | |

| | Rentals | | $ | — | | $ | 1,188,257 | | $ | 356,184 | | $ | 66,308 | | $ | (143 | ) | $ | 1,610,606 | |

| | Other services | | | — | | | 961,260 | | | 172,736 | | | 8,997 | | | (592,899 | ) | | 550,094 | |

| | Equity in net income of affiliates | | | 222,451 | | | — | | | — | | | — | | | (222,451 | ) | | — | |

| | |

| |

| |

| |

| |

| |

| |

| | | | 222,451 | | | 2,149,517 | | | 528,920 | | | 75,305 | | | (815,493 | ) | | 2,160,700 | |

| Costs and expenses (income): | | | | | | | | | | | | | | | | | | | |

| | Cost of rentals | | | — | | | 751,096 | | | 217,907 | | | 40,288 | | | (112,752 | ) | | 896,539 | |

| | Cost of other services | | | — | | | 718,262 | | | 120,694 | | | 5,693 | | | (476,755 | ) | | 367,894 | |

| | Selling and administrative expenses | | | — | | | 588,237 | | | (71,151 | ) | | 20,469 | | | (8,492 | ) | | 529,063 | |

| | Interest income | | | — | | | (3,619 | ) | | (2,585 | ) | | (337 | ) | | 2,172 | | | (4,369 | ) |

| | Interest expense | | | — | | | 15,211 | | | (505 | ) | | 413 | | | — | | | 15,119 | |

| | |

| |

| |

| |

| |

| |

| |

| | | | — | | | 2,069,187 | | | 264,360 | | | 66,526 | | | (595,827 | ) | | 1,804,246 | |

| Income before income taxes | | | 222,451 | | | 80,330 | | | 264,560 | | | 8,779 | | | (219,666 | ) | | 356,454 | |

| Income taxes | | | — | | | 30,760 | | | 100,532 | | | 2,711 | | | — | | | 134,003 | |

| | |

| |

| |

| |

| |

| |

| |

| Net income | | $ | 222,451 | | $ | 49,570 | | $ | 164,028 | | $ | 6,068 | | $ | (219,666 | ) | $ | 222,451 | |

| | |

| |

| |

| |

| |

| |

| |

CONDENSED CONSOLIDATING INCOME STATEMENT

Year Ended May 31, 2000

| | Cintas

Corporation

| | Corp. 2

| | Subsidiary

Guarantors

| | Non -

Guarantors

| | Eliminations

| | Cintas

Corporation

Consolidated

| |

|---|

| Revenue: | | | | | | | | | | | | | | | | | | | |

| | Rentals | | $ | — | | $ | — | | $ | 1,366,660 | | $ | 58,261 | | $ | (29 | ) | $ | 1,424,892 | |

| Other services | | | — | | | — | | | 986,699 | | | 4,387 | | | (513,987 | ) | | 477,099 | |

| | Equity in net income of affiliates | | | 193,387 | | | — | | | — | | | — | | | (193,387 | ) | | — | |

| | |

| |

| |

| |

| |

| |

| |

| | | | 193,387 | | | — | | | 2,353,359 | | | 62,648 | | | (707,403 | ) | | 1,901,991 | |

| Costs and expenses (income): | | | | | | | | | | | | | | | | | | | |

| | Cost of rentals | | | — | | | — | | | 869,879 | | | 36,453 | | | (99,031 | ) | | 807,301 | |

| | Cost of other services | | | — | | | — | | | 717,390 | | | 2,047 | | | (404,299 | ) | | 315,138 | |

| | Selling and administrative expenses | | | — | | | — | | | 443,657 | | | 22,883 | | | (9,912 | ) | | 456,628 | |

| | Interest income | | | — | | | — | | | (6,689 | ) | | (283 | ) | | 2,230 | | | (4,742 | ) |

| | Interest expense | | | — | | | — | | | 15,032 | | | 876 | | | (1 | ) | | 15,907 | |

| | |

| |

| |

| |

| |

| |

| |

| | | | — | | | — | | | 2,039,269 | | | 61,976 | | | (511,013 | ) | | 1,590,232 | |

| Income before income taxes | | | 193,387 | | | — | | | 314,090 | | | 672 | | | (196,390 | ) | | 311,759 | |

| Income taxes | | | — | | | — | | | 116,007 | | | 2,365 | | | — | | | 118,372 | |

| | |

| |

| |

| |

| |

| |

| |

| Net income | | $ | 193,387 | | $ | — | | $ | 198,083 | | $ | (1,693 | ) | $ | (196,390 | ) | $ | 193,387 | |

| | |

| |

| |

| |

| |

| |

| |

19

CONDENSED CONSOLIDATING BALANCE SHEET

Year Ended May 31, 2002

| | Cintas

Corporation

| | Corp. 2

| | Subsidiary

Guarantors

| | Non -

Guarantors

| | Eliminations

| | Cintas

Corporation

Consolidated

|

|---|

| Assets | | | | | | | | | | | | | | | | | | |

| Current assets: | | | | | | | | | | | | | | | | | | |

| | Cash and cash equivalents | | $ | — | | $ | 22,440 | | $ | 5,011 | | $ | 13,177 | | $ | — | | $ | 40,628 |

| | Marketable securities | | | — | | | 42,472 | | | — | | | 1,986 | | | — | | | 44,458 |

| | Accounts receivable, net | | | — | | | 225,364 | | | 70,720 | | | 782 | | | (13,632 | ) | | 283,234 |

| | Inventories | | | — | | | 182,858 | | | 14,899 | | | 5,539 | | | (9,475 | ) | | 193,821 |

| | Uniforms and other rental items in service | | | — | | | 210,409 | | | 71,251 | | | 13,101 | | | (13,825 | ) | | 280,936 |

| | Prepaid expenses | | | — | | | 7,421 | | | 1,995 | | | 760 | | | (3 | ) | | 10,173 |

| | |

| |

| |

| |

| |

| |

|

| Total current assets | | | — | | | 690,964 | | | 163,876 | | | 35,345 | | | (36,935 | ) | | 853,250 |

| Property and equipment, at cost, net | | | — | | | 637,882 | | | 108,258 | | | 32,262 | | | — | | | 778,402 |

| Goodwill | | | — | | | 104,140 | | | 566,748 | | | 7,710 | | | — | | | 678,598 |

| Other assets | | | 966,397 | | | 55,571 | | | 905,353 | | | 106,180 | | | (1,824,517 | ) | | 208,984 |

| | |

| |

| |

| |

| |

| |

|

| | | $ | 966,397 | | $ | 1,488,557 | | $ | 1,744,235 | | $ | 181,497 | | $ | (1,861,452 | ) | $ | 2,519,234 |

| | |

| |

| |

| |

| |

| |

|

| Liabilities and Shareholders' Equity | | | | | | | | | | | | | | | | | | |

| Current liabilities: | | | | | | | | | | | | | | | | | | |

| | Accounts payable | | $ | (465,247 | ) | $ | (58,727 | ) | $ | 531,544 | | $ | 14,842 | | $ | 37,981 | | $ | 60,393 |

| | Accrued compensation and related liabilities | | | — | | | 23,441 | | | 4,508 | | | 1,055 | | | — | | | 29,004 |

| | Accrued liabilities | | | — | | | 137,236 | | | 476 | | | 6,820 | | | (1,036 | ) | | 143,496 |

| | Deferred income taxes | | | — | | | 1,737 | | | 58,020 | | | 1,615 | | | — | | | 61,372 |

| | Long-term debt due within one year | | | — | | | 16,315 | | | 2,126 | | | 117 | | | (189 | ) | | 18,369 |

| | |

| |

| |

| |

| |

| |

|

| Total current liabilities | | | (465,247 | ) | | 120,002 | | | 596,674 | | | 24,449 | | | 36,756 | | | 312,634 |

| Long-term debt due after one year | | | — | | | 710,728 | | | (23,499 | ) | | 48,111 | | | (32,090 | ) | | 703,250 |

| Deferred income taxes | | | — | | | 7,251 | | | 70,239 | | | 2,101 | | | — | | | 79,591 |

| Total shareholders' equity | | | 1,431,644 | | | 650,576 | | | 1,100,821 | | | 106,836 | | | (1,866,118 | ) | | 1,423,759 |

| | |

| |

| |

| |

| |

| |

|

| | | $ | 966,397 | | $ | 1,488,557 | | $ | 1,744,235 | | $ | 181,497 | | $ | (1,861,452 | ) | $ | 2,519,234 |

| | |

| |

| |

| |

| |

| |

|

20

CONDENSED CONSOLIDATING BALANCE SHEET

Year Ended May 31, 2001

| | Cintas

Corporation

| | Corp. 2

| | Subsidiary

Guarantors

| | Non -

Guarantors

| | Eliminations

| | Cintas

Corporation

Consolidated

|

|---|

| Assets | | | | | | | | | | | | | | | | | | |

| Current assets: | | | | | | | | | | | | | | | | | | |

| | Cash and cash equivalents | | $ | — | | $ | 57,629 | | $ | 8,792 | | $ | 7,303 | | $ | — | | $ | 73,724 |

| | Marketable securities | | | — | | | 35,055 | | | — | | | 1,450 | | | — | | | 36,505 |

| | Accounts receivable, net | | | — | | | 157,895 | | | 89,082 | | | 10,343 | | | (12,870 | ) | | 244,450 |

| | Inventories | | | — | | | 202,773 | | | 14,564 | | | 3,088 | | | (6,076 | ) | | 214,349 |

| | Uniforms and other rental items in service | | | — | | | 189,026 | | | 57,800 | | | 10,168 | | | (14,822 | ) | | 242,172 |

| | Prepaid expenses | | | — | | | 6,170 | | | 1,827 | | | 476 | | | (3 | ) | | 8,470 |

| | |

| |

| |

| |

| |

| |

|

| Total current assets | | | — | | | 648,548 | | | 172,065 | | | 32,828 | | | (33,771 | ) | | 819,670 |

| Property and equipment, at cost, net | | | — | | | 546,578 | | | 127,148 | | | 28,406 | | | — | | | 702,132 |

| Goodwill | | | — | | | 71,913 | | | 51,550 | | | 290 | | | — | | | 123,753 |

| Other assets | | | 1,427,562 | | | 245,980 | | | 713,033 | | | 39,492 | | | (2,319,398 | ) | | 106,669 |

| | |

| |

| |

| |

| |

| |

|

| | | $ | 1,427,562 | | $ | 1,513,019 | | $ | 1,063,796 | | $ | 101,016 | | $ | (2,353,169 | ) | $ | 1,752,224 |

| | |

| |

| |

| |

| |

| |

|

| Liabilities and Shareholders' Equity | | | | | | | | | | | | | | | | | | |

| Current liabilities: | | | | | | | | | | | | | | | | | | |

| | Accounts payable | | $ | 190,823 | | $ | 89,451 | | $ | (294,324 | ) | $ | 17,296 | | $ | 39,249 | | $ | 42,495 |

| | Accrued compensation and related liabilities | | | — | | | 27,055 | | | 6,907 | | | 1,178 | | | — | | | 35,140 |

| | Accrued liabilities | | | — | | | 129,144 | | | (35,578 | ) | | 2,694 | | | (1,300 | ) | | 94,960 |

| | Deferred income taxes | | | — | | | 50,748 | | | 5,350 | | | 1,605 | | | — | | | 57,703 |

| | Long-term debt due within one year | | | — | | | 17,328 | | | 3,450 | | | 1 | | | (174 | ) | | 20,605 |

| | |

| |

| |

| |

| |

| |

|

| Total current liabilities | | | 190,823 | | | 313,726 | | | (314,195 | ) | | 22,774 | | | 37,775 | | | 250,903 |

| Long-term debt due after one year | | | — | | | 227,231 | | | 5,733 | | | 20,286 | | | (32,310 | ) | | 220,940 |

| Deferred income taxes | | | — | | | 41,444 | | | 6,714 | | | 908 | | | — | | | 49,066 |

| Total shareholders' equity | | | 1,236,739 | | | 930,618 | | | 1,365,544 | | | 57,048 | | | (2,358,634 | ) | | 1,231,315 |

| | |

| |

| |

| |

| |

| |

|

| | | $ | 1,427,562 | | $ | 1,513,019 | | $ | 1,063,796 | | $ | 101,016 | | $ | (2,353,169 | ) | $ | 1,752,224 |

| | |

| |

| |

| |

| |

| |

|

21

CONDENSED CONSOLIDATING STATEMENT OF CASH FLOWS

Year Ended May 31, 2002

| | Cintas

Corporation

| | Corp. 2

| | Subsidiary

Guarantors

| | Non -

Guarantors

| | Eliminations

| | Cintas

Corporation

Consolidated

| |

|---|

| Cash flows from operating activities: | | | | | | | | | | | | | | | | | | | |

| Net income | | $ | 234,251 | | $ | 64,605 | | $ | 163,802 | | $ | 8,246 | | $ | (236,653 | ) | $ | 234,251 | |

| Adjustments to reconcile net income to net cash provided by (used in) operating activities: | | | | | | | | | | | | | | | | | | | |

| | Depreciation | | | — | | | 66,885 | | | 29,789 | | | 4,541 | | | — | | | 101,215 | |

| | Amortization of deferred charges | | | — | | | 10,795 | | | 6,267 | | | 1,748 | | | — | | | 18,810 | |

| | Deferred income taxes | | | — | | | (96,769 | ) | | 116,195 | | | 1,203 | | | — | | | 20,629 | |

| | Changes in current assets and liabilities, net of acquisitions of businesses: | | | | | | | | | | | | | | | | | | | |

| | | Accounts receivable | | | — | | | (28,735 | ) | | 18,906 | | | 12,229 | | | 762 | | | 3,162 | |

| | | Inventories | | | — | | | 30,105 | | | 59 | | | (1,832 | ) | | 3,399 | | | 31,731 | |

| | | Uniforms and other rental items in service | | | — | | | (10,463 | ) | | (13,189 | ) | | (2,608 | ) | | (997 | ) | | (27,257 | ) |

| | | Prepaid expenses | | | — | | | 1,730 | | | (167 | ) | | (233 | ) | | — | | | 1,330 | |

| | | Accounts payable | | | — | | | (160,208 | ) | | 169,662 | | | (4,841 | ) | | (1,268 | ) | | 3,345 | |

| | | Accrued compensation and related liabilities | | | — | | | (10,153 | ) | | (2,420 | ) | | (123 | ) | | — | | | (12,696 | ) |

| | | Accrued liabilities | | | — | | | (32,381 | ) | | 31,819 | | | 3,211 | | | 264 | | | 2,913 | |

| | |

| |

| |

| |

| |

| |

| |