- CTAS Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEFA14A Filing

Cintas (CTAS) DEFA14AAdditional proxy soliciting materials

Filed: 7 Jan 25, 10:16am

Exhibit 99.2

Cintas + UniFirst Built to Get Businesses of All Sizes Ready for the Workday January 7, 2025

Forward Looking Statements This document contains statements that constitute "forward - looking statements" within the meaning of the federal securities laws . All statements other than statements regarding historical facts, including, without limitation, statements regarding our current expectations, estimates and projections about our industry, our business or a transaction with UniFirst Corporation (“UniFirst”), are forward - looking statements. We caution investors that any forward - looking statements are subject to risks and uncertainties that may cause actual results and future trends to differ materially from those matters expressed in or implied by such forward - looking statements. Investors are cautioned not to place undue reliance on forward - looking statements. Among the risks and uncertainties that could cause actual results to differ from those described in forward - looking statements are the following: the risk that a transaction with UniFirst may not be consummated; the risk that a transaction with UniFirst may be less accretive than expected, or may be dilutive, to Cintas’ earnings per share, which may negatively affect the market price of Cintas common shares; the possibility that Cintas and UniFirst will incur significant transaction and other costs in connection with a potential transaction, which may be in excess of those anticipated by Cintas; the risk that Cintas may fail to realize the benefits expected from a transaction; the risk that the combined company may be unable to achieve anticipated synergies or that it may take longer than expected to achieve those synergies; the risk that any announcements relating to, or the completion of, a transaction could have adverse effects on the market price of Cintas common shares; and the risk related to any unforeseen liability and future capital expenditure of Cintas related to a transaction. For additional factors affecting the business of Cintas, refer to Part I – Item 1A. Risk Factors of our Annual Report on Form 10 - K for the fiscal year ended May 31, 2024 (the “2024 10 - K”), and other filings with the U.S. Securities and Exchange Commission (the “SEC”). Important Information for Investors and Security Holders This document relates to a proposal which Cintas has made for an acquisition of UniFirst. In furtherance of this proposal and subject to future developments, Cintas may file one or more registration statements, proxy statements, tender offer statements or other documents with the SEC. This document is not a substitute for any proxy statement, registration statement, tender offer statement or other document Cintas may file with the SEC in connection with the proposed transaction. Investors and security holders of Cintas are urged to read the proxy statement(s), registration statement, tender offer statement and/or other documents filed with the SEC carefully in their entirety if and when they become available as they will contain important information about the proposed transaction . Any definitive proxy statement(s) (if and when available) will be mailed to stockholders of Cintas, as applicable . Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by Cintas through the website maintained by the SEC at http : //www . sec . gov . No Offer or Solicitation ; Participants in the Solicitation This document shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. This document is neither a solicitation of a proxy nor a substitute for any proxy statement or other filing that may be made with the SEC. Nonetheless, Cintas and its directors and certain of its executive officers may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of Cintas is set forth in its proxy statement for its 2024 annual meeting of shareholders (the “2024 Proxy Statement”), which was filed with the SEC on September 19, 2024 and is available here . Information about the directors and executive officers of Cintas, their ownership of Cintas common stock, and Cintas’ transactions with related persons is set forth in the sections entitled “Election of Directors”, “Board Diversity”, “Board’s Roles and Responsibilities”, “Board Committees and Meetings”, “Nonemployee Director Compensation for Fiscal 2024”, “Fiscal 2024 Director Compensation Table”, “Compensation Committee Report”, “Executive Compensation”, “Compensation Discussion and Analysis”, “Fiscal 2024 Summary Compensation Table”, “Grants of Plan - Based Awards for Fiscal 2024”, “Outstanding Equity Awards at Fiscal 2024 Year - End”, “Option Exercises and Stock Vested for Fiscal 2024”, “Nonqualified Deferred Compensation for Fiscal 2024”, “Potential Payments upon Termination, Retirement or Change in Control”, “CEO Pay Ratio”, “Pay Versus Performance”, “Approval, on an Advisory Basis, of Named Executive Officer Compensation”, “Approval of the Cintas Corporation 2016 Amended and Restated Equity and Incentive Compensation Plan”, “Principal Shareholders”, “Security Ownership of Director Nominees and Executive Officers”, and “Related Party Transactions” of the 2024 Proxy Statement. Information about the directors and executive officers of Cintas, their ownership of Cintas common stock, and Cintas’ transactions with related persons is also set forth in the sections entitled “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” of the 2024 10 - K, which was filed with the SEC on July 25, 2024 and is available here . To the extent holdings of Cintas common stock by the directors and executive officers of Cintas have changed from the amounts of Cintas common stock held by such persons as reflected in the 2024 Proxy Statement and 2024 10 - K, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC, including: the Form 4s filed by Robert Coletti on December 11, 2024 and November 1, 2024 , Joseph Scaminace on November 1, 2024 , Karen Carnahan on November 1, 2024 , Melanie Barstad on November 1, 2024 , Martin Mucci on November 1, 2024 , Beverly Carmichael on November 1, 2024 , and Ronald Tysoe on November 1, 2024 . Free copies of these documents may be obtained as described above. Any information concerning UniFirst contained in this document has been taken from, or based upon, publicly available information . Although Cintas does not have any information that would indicate that any information contained in this document that has been taken from such documents is inaccurate or incomplete, Cintas does not take any responsibility for the accuracy or completeness of such information . To date, Cintas has not had access to the books and records of UniFirst . 2 Forward - Looking Statements

Creating Value for Customers, Employees & Shareholders 3 Combination would enable Cintas and UniFirst to better support customers. Amplifies and accelerates benefits of ongoing investments in technology Combines businesses with complementary strengths Better positioned to participate in large and growing market opportunity Enhances position among broad, diverse and well capitalized companies in an increasingly competitive market for workwear and facility solutions Offers compelling financial benefits, including from operating cost synergies

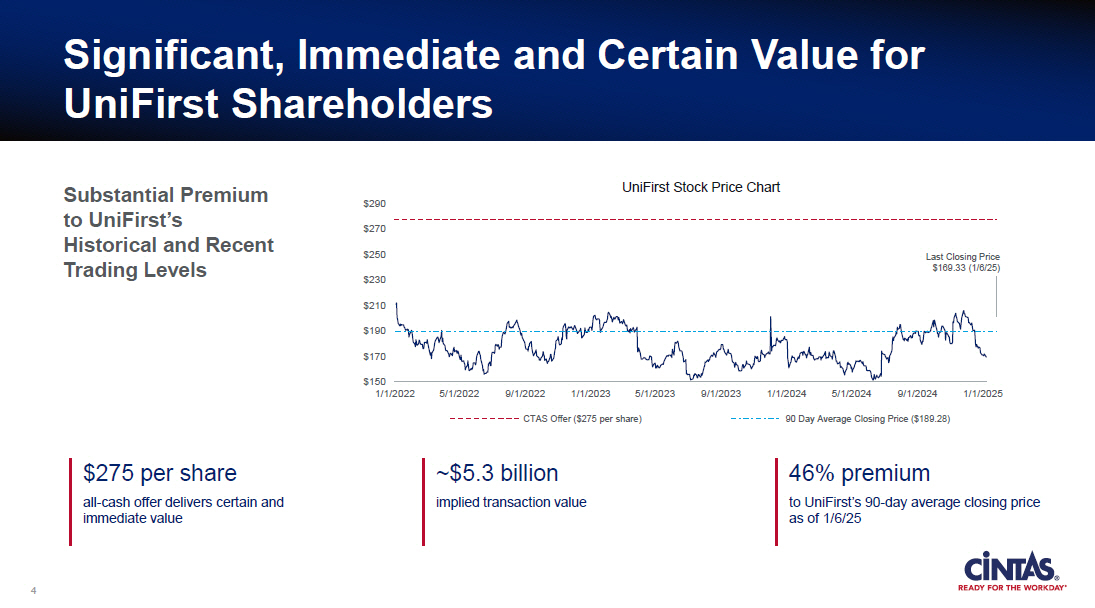

Significant, Immediate and Certain Value for UniFirst Shareholders $210 $190 $170 $ 2 30 $ 2 50 $ 2 70 $ 2 90 $150 1 / 3 /2 0 2 2 5/3/2022 9/3/2022 1/3/2023 5 / 3 /2 0 2 3 1 / 3 /2 0 2 5 9/3/2023 1/3/2024 5/3/2024 9/3/2024 90 Day Average Closing Price ($189.20) CTAS Offer ($275 per share) La s t - C losing $171.28 (1/3/25) Substantial Premium to UniFirst’s Historical and Recent Trading Levels $275 per share all - cash offer delivers certain and immediate value ~$5.3 billion implied transaction value [X]% premium to UniFirst’s 90 - day average closing price as of 1/6/25 UniFirst Stock Price Chart CALLOUTS TO BE UPDATED TO 1/6 CLOSE PRIOR TO RELEASE 4

Proposed Transaction Details 5 ▪ Cintas to acquire all outstanding common and class B shares of UniFirst for $275 per share in cash ▪ Cintas has indicated a willingness to engage in discussions to explore potential additional sources of value as well as alternative consideration mixes (cash and stock) Financial Terms ▪ Compelling strategic fit with shared priorities to enhance service for customers ▪ Better positioned to serve 16 million businesses in the US and Canada ▪ Accelerates benefit of combined companies’ investments in technology and creates opportunities to leverage shared infrastructure and route networks ▪ Cintas would welcome UniFirst employees and ensure opportunities to develop and prosper within Cintas, as it does for all of its employee - partners Strategic Benefits ▪ Expected to generate annual run - rate operating cost synergies of at least $375 million within 4 years of completion Significant Synergies ▪ Cintas is confident in the path through regulatory review and closing ▪ Not subject to any financing contingencies or approval by Cintas shareholders — Cash consideration would be financed from Cintas cash on hand, committed lines of credit and/or other available sources of financing Path to Completion

Combined Company Better Positioned Within Large, Growing, Competitive Market Cintas + UniFirst ▪ Innovative, more complete solution and comprehensive value proposition for businesses of all sizes. ▪ Well - positioned to capitalize on strong buying motivations of image, safety, cleanliness and compliance. ▪ Better able to meet the challenges posed by continued and increasing competition from much larger and better - capitalized companies focused on increasing their garment and facility solutions and investing in last mile fleets. Highly - Fragmented Market with Tremendous Opportunity for Greater Participation and Growth Businesses in US and Canada Cintas & UniFirst wearers today Cintas & UniFirst customers today Workers in US and Canada 16M 6 < 8 M < 2 M 180M+

Amplified Benefits of Investment in Technology Accelerates UniFirst’s ERP implementation Amplifies Cintas’ ongoing investments in solutions for customers and tools for employee - partners Applies Cintas’ proven technology - supported operational excellence to broader footprint Simplifies combined company’s ways of working, empowers our employee - partners, and elevates the customer experience 7

Strong Financial Foundation with Significant Synergy Opportunity Strong balance sheet provides flexibility to invest in strategic priorities and pursue new growth opportunities 1. Expect to realize synergies within 4 years of completion. 2. Assumes all - cash transaction. At least $375M Expected Operating Cost Synergies 1 2.5x Pro Forma Net Leverage at Close 2 8

Delivers strong benefits to all stakeholders, including Cintas and UniFirst’s shareholders, customers and employee - partners Clear Path to Completion To be funded by cash on hand, committed lines of credit and/or other available sources Cintas has engaged leading regulatory counsel and a leading economics consulting group to conduct extensive regulatory due diligence Cintas is confident that all regulatory approvals can be obtained in due course to permit closing the transaction Cintas has a proven track record of successfully integrating and building on acquisitions. 9

Cintas’ Public Proposal Follows Consistent Lack of Engagement Second time in nearly three years that UniFirst has refused to engage on an extremely compelling offer 10 FEBRUARY 7, 2022 Cintas presents indication of interest to acquire UniFirst for $255/share (the "Prior Proposal"); UniFirst offers no substantive engagement NOVEMBER 8, 2024 Cintas submits Proposal to acquire UniFirst for $275/share; requests response by November 22 NOVEMBER 22, 2024 UniFirst requests more time to review Cintas’ proposal via phone call NOVEMBER 25, 2024 Cintas reiterates proposal and makes request to meet in person during the week of December 2; requests response by November 27 NOVEMBER 27, 2024 UniFirst sends letter rejecting the Proposal DECEMBER 3, 2024 Cintas reiterates Proposal; requests in - person meeting including discussion about potential sources of value that will allow Cintas to increase its offer; requests response by December 6 DECEMBER 9, 2024 UniFirst again sends letter rejecting the Proposal DECEMBER 20, 2024 Cintas reiterates proposal; again requests in - person meeting and notes willingness to increase its Proposal, discuss ways to preserve the UniFirst legacy; requests response by January 3

Cintas is Prepared to Engage and Move Toward a Transaction Immediately ▪ We expect to have limited and specific confirmatory due diligence requirements. Diligence ▪ We would work towards signing and announcing a definitive agreement in January 2025. Timing ▪ Cintas has engaged leading regulatory counsel and is confident in the path through regulatory review and closing. Cintas is prepared to have our counsel immediately engage with UniFirst and its counsel to discuss the extensive work Cintas has done to date (including a leading economics consulting group) on the regulatory front and our path to closing of the transaction. Regulatory ▪ Proposal is not subject to any financing condition and any cash consideration would be financed from cash on hand, committed lines of credit and/or other available sources of financing. Financing ▪ Cintas Board of Directors supports the proposed transaction and approval by Cintas shareholders is not required. Certainty 11