| | |

OMB APPROVAL |

OMB Number: | | 3235-0570 |

| |

Expires: | | Nov. 30, 2005 |

|

Estimated average burden |

hours per response: | | 5.0 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-3793

Strong Opportunity Fund, Inc., on behalf of Strong Advisor Select Fund, Strong Advisor U.S. Small/Mid Cap Growth Fund, Strong Endeavor Fund and Strong Opportunity Fund

(Exact name of registrant as specified in charter)

| | |

| P.O. Box 2936 Milwaukee, WI | | 53201 |

| (Address of principal executive offices) | | (Zip code) |

Richard Smirl, Strong Capital Management, Inc.

P.O. Box 2936 Milwaukee, WI 53201

(Name and address of agent for service)

Registrant’s telephone number, including area code: (414) 359-3400

Date of fiscal year end: December 31

Date of reporting period: June 30, 2004

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. (S) 3507.

Item 1. Reports to Shareholders

Semiannual Report | June 30, 2004

Strong

Advisor Equity

Funds

| | |

| Strong Advisor Common Stock Fund | | |

| |

| Strong Advisor Mid Cap Growth Fund | | |

| |

| Strong Advisor Small Cap Value Fund | | |

| |

| Strong Advisor U.S. Value Fund | | |

| |

| Strong Advisor Endeavor Large Cap Fund | | |

| |

| Strong Advisor Focus Fund | | |

| |

| Strong Advisor International Core Fund | | |

| |

| Strong Advisor Select Fund | | |

| |

| Strong Advisor Technology Fund | | |

| |

| Strong Advisor U.S. Small/Mid Cap Growth Fund | | |

| |

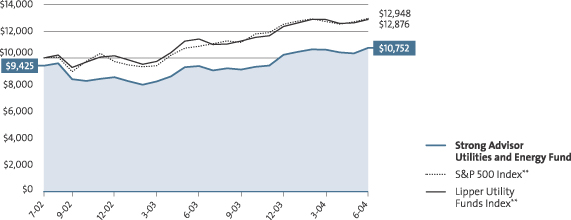

| Strong Advisor Utilities and Energy Fund | | |

| |

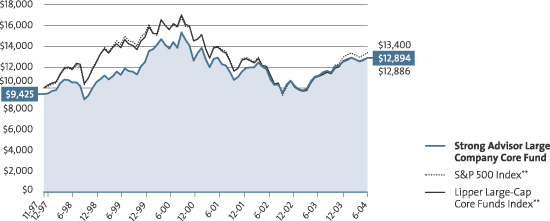

| Strong Advisor Large Company Core Fund | | |

Semiannual Report | June 30, 2004

Strong

Advisor Equity

Funds

Table of Contents

Market Update From Dick Weiss

January 1, 2004, to June 30, 2004

Uncertainty is the Enemy

In our last report back in January, the overall U.S. economy displayed definite signs of strengthening — job growth was gaining momentum, and consumer confidence was on the rise. There was some muffled muttering about deflation, but it lacked enough conviction to cause alarm. All in all, it looked like a relatively promising picture.

Six months out, things seem not quite so sanguine. Fears of inflation have replaced the whispers of deflation, and the Federal Reserve has begun what doubtless will be a series of rate hikes well into 2005. While the overall economy has exceeded expectations, the good news on that front has not been sufficient to overshadow a host of uncertainties in the military and political worlds.

Before we address those uncertainties, let’s devote a moment to the topic of inflation. In the history of markets, there seems to be a point at which a rising rate of inflation causes the market’s price-to-earnings ratios to contract. Historically, that point would be around seven percent. While it seems highly unlikely that the inflation rate is going to get anywhere near that mark in the foreseeable future, there is some suggestion that nowadays, because of the way the Consumer Price Index is calculated, that number could be closer to five percent. If that is indeed a more realistic calculation, it’s possible that we could hit five percent inflation and a negative impact on stock valuations.

In my estimation though, the prospect for serious inflation pales in comparison to other uncertainties currently plaguing the market (e.g., the outcome of the U.S. presidential race this fall and the continuing political fallout surrounding Iraq).

With regard to the War on Terrorism and the issue of Iraq, investors are faced every day with news that can give them pause. While the war seems to be on track, the outcome in Iraq is dependent on how rapidly that nation can defeat the insurgents and restore the rule of law now that the Iraqis themselves have taken charge. We believe that expectations may be too low in that regard.

On the political front, the market seemed to peak around the moment when Democratic candidate Senator John Kerry pulled even with President George W. Bush in the polls. Nothing makes the prospects for economic prosperity harder to decipher than a presidential race featuring two candidates with widely differing views on virtually every issue domestically and internationally. For the stock market, that spells uncertainty with a capital U.

We believe stock valuations today are neither cheap, nor particularly overvalued based upon earnings projections for 2005. They are, rather, sort of stuck somewhere in the middle. In order for stocks to start moving in a positive direction, the market needs an injection of confidence. So the relevant question becomes, in short: What needs to happen in order to inspire that sense of confidence?

The answer? In a word — clarity.

On the inflation front, we anticipate clarity will not come for some time. We expect the Federal Reserve will continue to raise rates until it gets ahead of the inflation curve. It’s unclear just how many hikes and of what magnitude will accomplish that. Nonetheless, if inflationary fears were the single biggest element of uncertainty out there today, we would feel confident that the problem could be contained.

The fate of Iraq and the outcome of the presidential election loom larger and seem far more complicated. If the public perceives that progress is being made in Iraq and democracy will indeed triumph, the market will likely anticipate the reelection of President Bush. If the daily diagnosis on Iraq is less favorable, the political uncertainty weighing on the market will continue for the next several months.

Notwithstanding all the ambiguity, we are beginning to see corners of the market where good values are emerging. Energy has been one of the more promising areas and should continue to benefit from strong fundamentals. Even in the areas of the technology sector, where we believe stocks have been chronically overvalued, values have begun to return to earth. There are even some computer software companies that look attractive to us.

In order for stocks to start moving in a positive direction, the market needs an injection of confidence.

In stock-picker parlance, what we have today is a market of individual stocks rather than — as we saw in 2003 — a rising stock market. In the former, money is a lot harder to make; in the latter, the rising tide seems to lift all issues almost indiscriminately.

We believe the market should continue this year’s trend, which is a much more value- and fundamentals-oriented market. Make no mistake: this is not a “story” market where people dream about distant possibilities and, on the strength of those illusions, stocks soar to 100 times earnings. This is a market where, if you do your homework and stick to what is real rather than imagined, we think you can discover common stocks worth owning.

Given all the uncertainty that exists in the world, there are practical limits to just how high the market can go. But with an economy that continues to show strength and interest rates still on the low side, there are also practical limits to how low the market can go. That environment should favor professional investors who exhibit good discipline in both their buy and sell decisions.

One final piece of practical advice: when uncertainty is the order of the day, resist doing anything dramatic with your money. Sometimes the “muddle-through” approach proves best.

…if you do your homework and stick to what is real rather than imagined, we think you can uncover common stocks worth owning.

|

Richard T. Weiss |

Vice Chairman |

Strong Financial Corporation |

Strong Advisor Common Stock Fund

We entered 2004 hopeful that the equity market would benefit from an improving economy and that the companies the Strong Advisor Common Stock Fund holds would outperform the broader market. Although we are disappointed that the Fund is lagging the market through the first half of the year, we remain confident in our private market value (PMV) process and the Fund’s ability to outperform over the long term. For the six months ended June 30, 2004, the Fund’s Class Z shares returned 2.26%, compared with a 6.67% return for our broad-based benchmark, the Russell Midcap Index.

Uncertain environment hurt results

The market has been clouded with uncertainty throughout the first part of the year. There are many signs that the economy continues to be strong, yet the conflict in Iraq, rising interest rates, and high fuel prices have caused the equity markets to trade in a narrow range. We had a sizable overweighting, relative to the benchmark, in the energy sector, which posted strong returns over the period.

The Fund was hurt over the period by its overweighting in the media and technology sectors. These are two areas in which there have been mixed signals, rather than clear signs of growth. Within media, our long-standing positions in cable television stocks had a disappointing first half due to market concerns of increasing competition from satellite and telecom companies. Weakness among our technology positions resulted from concerns over the viability of the tech upturn, which impacted even some of our niche companies in the space.

An intensive research process

The Fund’s over- and under-weightings relative to the benchmark are the result of where our investment process finds value in the market. A key step in this process is determining a PMV for a company we are considering — that is, determining the price we would be willing to pay if we were acquiring the whole company. We look for companies whose current stock valuations are between 50% and 60% of their PMV.

We spend much of our time talking to and visiting with the management teams of the companies we own or in which we are interested in investing. These conversations help us to understand the company, its management strategy, and the industry in which it competes.

An example of private market value at work

American Eagle Outfitters is one example of a stock that we bought late in 2003 based on our PMV approach. This teen apparel retailer had experienced mediocre financial performance for the past several years in the face of a crowded field chasing the same fickle teen customer. Through a comprehensive qualitative and quantitative analysis of the company, we established a PMV in the mid 20’s for the stock. In November 2003, the company announced a management reorganization and communicated a new product strategy that appeared to offer a catalyst for future growth. At that time, the stock was near $15, or 60% of our PMV. Given the combination of a future catalyst and appropriate stock price, we made an investment. Sales for Christmas 2003 were less disappointing than had been expected, and spring 2004 sales were quite strong.

As it appeared the company’s new strategy was working, earnings estimates for American Eagle rose. Our estimate of the company’s PMV also increased as its financial results improved. By early April, the company reported strong March sales and our PMV for the company’s stock had risen to over $30 for 2005. The actual stock price had risen to $28, a gain of 71% for the year — and 90% of our new PMV. Given that the stock’s price was very close to our estimate of its full value, we decided to sell the stock at that time. Three months later, at the end of the second quarter, the stock’s price was still below $29. Thus, we would have gained very little by continuing to hold the stock, and by selling it we gave the Fund the benefit of three months in which we were able to redirect those assets toward more advantageous opportunities.

Optimism tempered by uncertainty

We remain optimistic about the economy and the equity market in general, though one certainty we have is that the uncertain environment will continue throughout 2004. There are many questions on the economic, international, and political front, but unfortunately, no quick answers.

While we wait, we will remain focused on the factors we can control: sticking to our time-tested investment style, diversifying the Fund within industry groups to manage our risk, and striving to bring you investment results that we will be proud of.

We thank you for your continued investment and confidence in the Strong Advisor Common Stock Fund.

| | |

Richard T. Weiss | | Ann M. Miletti |

Portfolio Co-Manager | | Portfolio Co-Manager |

2

Fund Highlights

Average Annual Total Returns

As of 6-30-04

| | | |

Class A1

| | | |

1-year | | 14.25 | % |

5-year | | 3.91 | % |

10-year | | 11.92 | % |

Since Fund Inception (12-29-89) | | 14.42 | % |

| |

Class A, excluding sales load

| | | |

1-year | | 21.22 | % |

5-year | | 5.15 | % |

10-year | | 12.59 | % |

Since Fund Inception (12-29-89) | | 14.89 | % |

| |

Class B1

| | | |

1-year | | 15.25 | % |

5-year | | 4.15 | % |

10-year | | 12.16 | % |

Since Fund Inception (12-29-89) | | 14.60 | % |

| |

Class C1

| | | |

1-year | | 19.25 | % |

5-year | | 4.49 | % |

10-year | | 11.98 | % |

Since Fund Inception (12-29-89) | | 14.30 | % |

| |

Class Z2

| | | |

1-year | | 21.45 | % |

5-year | | 5.45 | % |

10-year | | 12.95 | % |

Since Fund Inception (12-29-89) | | 15.28 | % |

Performance is historical and does not guarantee future results. Investment returns and principal value will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most recent month-end performance.

Risks: Stock funds should only be considered for long-term goals as values fluctuate in response to the activities of individual companies and general market and economic conditions.

Because smaller companies often have narrower markets and limited financial resources, investments in these stocks present more risk than investments in those of larger, more established companies.

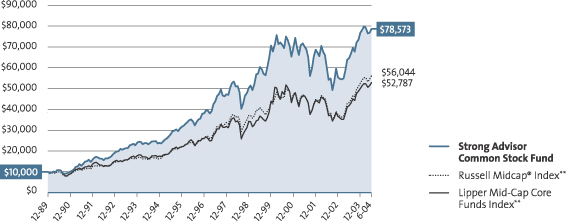

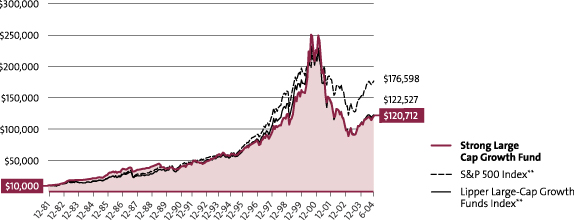

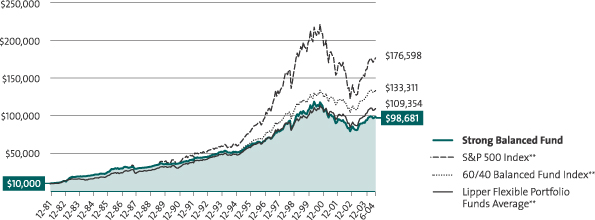

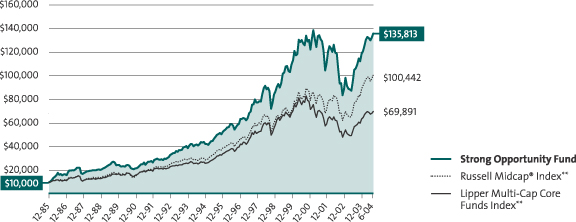

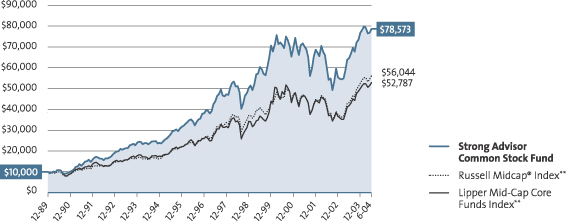

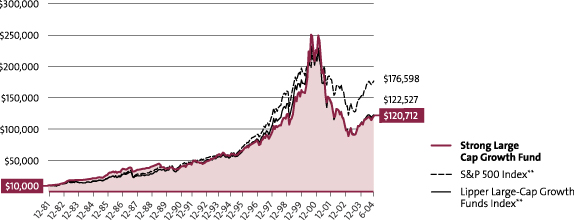

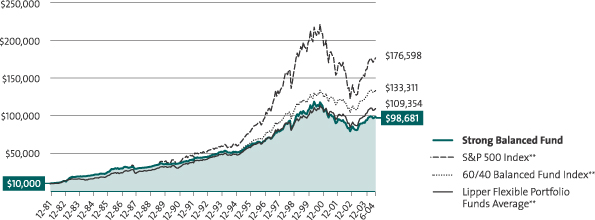

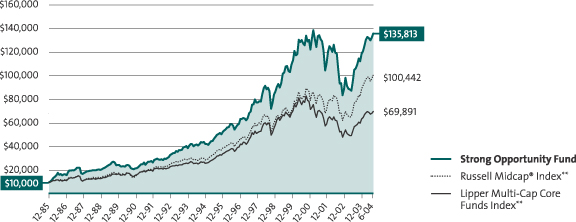

Growth of an Assumed $10,000 Investment†

from 12-29-89 to 6-30-04

Mention of specific securities in this report is not indicative of whether the Fund may make additional purchases of, sell all or a portion of, or continue to hold those securities.

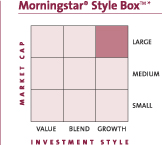

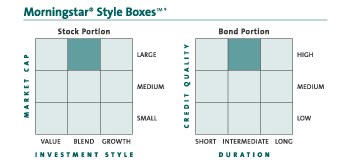

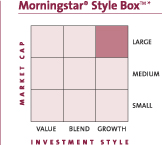

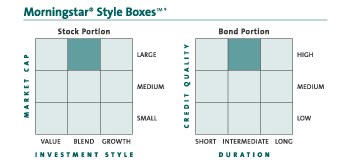

| * | The Morningstar Style BoxTM reveals a fund’s investment strategy. For equity funds, the vertical axis shows the market capitalization of the stocks owned and the horizontal axis shows investment style (value, blend, or growth). |

| † | This graph, provided in accordance with SEC regulations, compares a $10,000 investment in the Fund, made at its inception, with the performance of the Russell Midcap® Index and the Lipper Mid-Cap Core Funds Index. Results include the reinvestment of all dividends and capital gains distributions. The graph and the Average Annual Total Returns table do not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. This graph is based on Class Z shares only; performance for other classes will vary due to differences in fee structures. |

Performance Information: 1Load-adjusted performance reflects the effect of the maximum sales charge of 5.75% for Class A, the applicable contingent deferred sales charge of 5.00% in year 1 and eliminated after year 6 for Class B, and the applicable contingent deferred sales charge of 1.00% and eliminated after 12 months for Class C. The performance of the Class A, B, and C shares is based on the performance of the Fund’s Class Z shares (formerly Retail Class shares) prior to 11-30-00. The performance of the Class A shares is restated to reflect the load and the different expenses of the Class A shares, as applicable. The performance of the Class B shares is restated to reflect the contingent deferred sales charge, the different expenses of the Class B shares, and the conversion to Class A shares after eight years, as applicable. The performance of the Class C shares is restated to reflect the contingent deferred sales charge and the different expenses of the Class C shares, as applicable. Please consult a prospectus for information about all share classes.

From time to time, the Fund’s performance was significantly enhanced through investments in initial public offerings (IPOs). In addition, the effect of IPOs purchased when the Fund’s asset base was small may have been magnified. Given these circumstances, you should not expect that such enhanced returns can be consistently achieved. Please consider this before investing.

Fee Waivers: From time to time, the Fund’s advisor and/or administrator has waived fees and/or absorbed Fund expenses, which has resulted in higher returns. As of 6-30-04, there are waivers and/or absorptions in effect.

Percentage Restrictions: The Fund’s prospectus and statement of additional information may describe restrictions on the percentage of a particular type or quality of security in which the Fund may invest (“Percentage Restrictions”). Percentage Restrictions apply at the time the Fund purchases a security. Circumstances subsequent to the purchase of the security, such as a change in: (1) the Fund’s assets (e.g., due to cash inflows and redemptions); (2) the market value of the security; or (3) the pricing, liquidity, or rating of the security, may cause the Fund to exceed or fall short of the Percentage Restriction. If this happens, the Fund’s continued holding of the security will not constitute a violation of the Percentage Restriction.

General: 2The Class Z shares are closed to new accounts, though the Fund may continue to offer its shares to certain company-sponsored retirement plans, institutional investors meeting specific eligibility requirements, and other limited groups as described in the prospectus.

Definitions: **The Russell Midcap® Index measures the performance of the 800 smallest companies in the Russell 1000 Index, which represent approximately 26% of the total market capitalization of the Russell 1000 Index. The Lipper Mid-Cap Core Funds Index is the average of the 30 largest funds in the Lipper Mid-Cap Core Funds Category. Source of the Russell Index data is Standard & Poor’s Micropal. Source of the Lipper Index data is Lipper. It is not possible to invest directly in an index.

3

Strong Advisor Mid Cap Growth Fund

For the first six months of 2004, growth stocks participated in the stock market’s modest upward move. The Strong Advisor Mid Cap Growth Fund was no exception, with the Class Z shares recording a return of 5.31% for the six months ended June 30, 2004. This figure did, however, lag the return of the Fund’s broad-based benchmark, the Russell Midcap Index, which returned 6.67% over the same period. For the six months, the value style of investing slightly outperformed the Fund’s growth style.

Sectors driving performance

Positive contributors to the Fund’s performance came from the energy and consumer sectors of the market. Energy stocks benefited from a strong pricing environment in the face of rising fuel costs. Performance within the consumer area was particularly strong among the Internet, education, and retail industries.

Holdings that were weaker for the Fund came primarily from the health care and technology sectors. Within health care, generic drug stocks were particularly hit hard; over the course of the six months, the environment for some of these companies held by the Fund became more competitive. Weakness among technology stocks was most notable within the software and communications industries.

Studying companies closely

We believe that earnings and revenue growth are key factors in determining stock prices. Therefore, we focus a great deal of our stock-selection process on finding stocks that are experiencing — or have solid potential to experience — above-average growth in revenue and earnings. While identifying stocks that are experiencing this growth is essential, what matters even more in our investment strategy is determining which companies have growth trends that are sustainable versus those which will only be short-lived.

To sort out the long-term winners from the disappointments, we employ thorough, hands-on research. We specifically focus on a company’s history of success in executing its strategy and the potential profitability of its business model. We also carefully consider whether the company’s strategy and operations mesh well with our overall economic view and if it is being helped or hurt by any broader secular trends.

eResearch is a company that met the previously mentioned criteria — and it proved to be an excellent holding for the Fund during the first six months of the year. eResearch sells technology that digitizes clinical data for pharmaceutical, biotechnology, and medical device companies looking to get government approval for their products. We were attracted to eResearch because we recognized its element of sustainable, above average growth, driven mostly by government guidance to digitize certain types of clinical data. We met with management on several occasions and were impressed with their positioning within the industry as well as their outstanding execution history.

When we decide to sell a stock, our decision-making criteria are essentially the opposite of our buying criteria. We may sell a stock when we see deterioration in its fundamental qualities that may threaten the sustainability of a company’s existing or prospective growth. Conditions that could give us grounds for concern may include, but are not limited to, changes we see in the economy, a new competitive threat, or a change in management personnel or direction.

Our approach to the second half

Our outlook for the next few months remains upbeat. We anticipate that interest rates and inflation will both remain relatively low and that growth in jobs and corporate earnings are likely to remain at healthy levels. We will, however, expect to be carefully monitoring these factors. The outcome of the presidential election in November could have important investment implications, so we anticipate closely watching developments on that front. In the meantime, we intend to continue to seek out the fastest-growing companies that we believe fit within the framework of our investment process.

We thank you for your continued investment in the Strong Advisor Mid Cap Growth Fund.

|

Brandon Nelson |

Portfolio Manager |

4

Fund Highlights

Average Annual Total Returns

As of 6-30-04

| | | |

Class A1

| | | |

1-year | | 10.56 | % |

5-year | | –4.55 | % |

Since Fund Inception (12-31-96) | | 3.58 | % |

| |

Class A, excluding sales load

| | | |

1-year | | 17.28 | % |

5-year | | –3.42 | % |

Since Fund Inception (12-31-96) | | 4.41 | % |

| |

Class B1

| | | |

1-year | | 11.34 | % |

5-year | | –4.51 | % |

Since Fund Inception (12-31-96) | | 3.82 | % |

| |

Class C1

| | | |

1-year | | 15.34 | % |

5-year | | –4.04 | % |

Since Fund Inception (12-31-96) | | 3.82 | % |

| |

Class Z2

| | | |

1-year | | 17.14 | % |

5-year | | –3.40 | % |

Since Fund Inception (12-31-96) | | 4.54 | % |

Performance is historical and does not guarantee future results. Investment returns and principal value will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most recent month-end performance.

Risks: Stock funds should only be considered for long-term goals as values fluctuate in response to the activities of individual companies and general market and economic conditions.

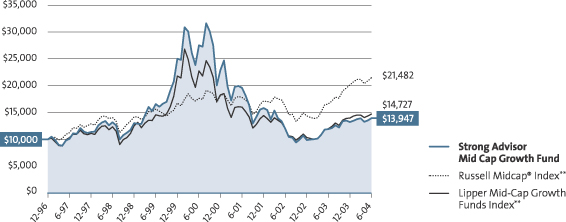

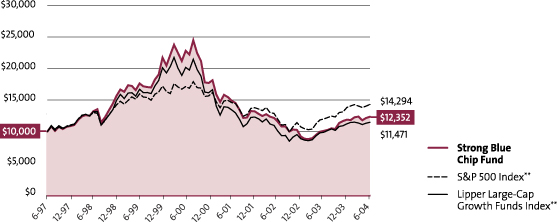

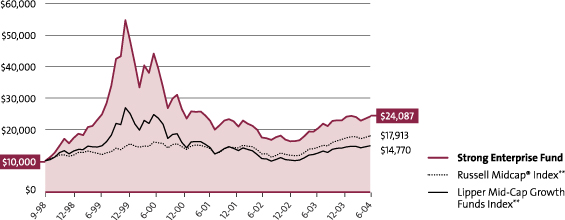

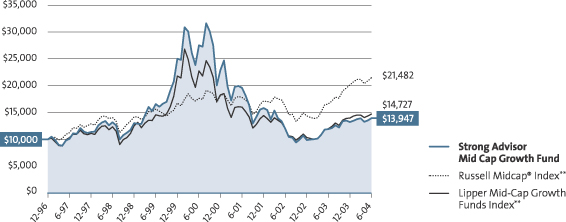

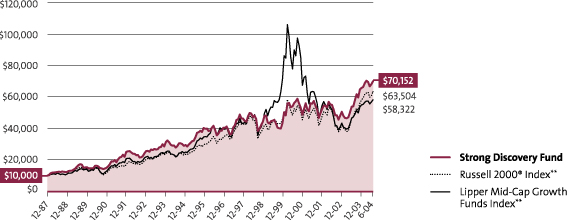

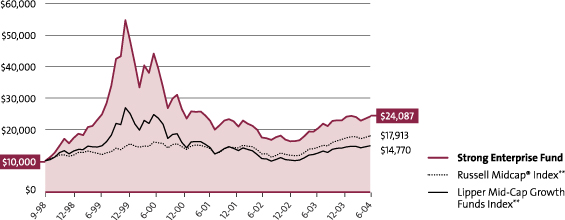

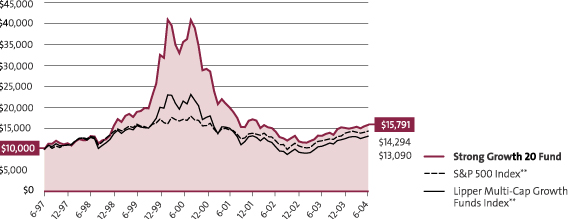

Growth of an Assumed $10,000 Investment†

from 12-31-96 to 6-30-04

Mention of specific securities in this report is not indicative of whether the Fund may make additional purchases of, sell all or a portion of, or continue to hold those securities.

| * | The Morningstar Style BoxTM reveals a fund’s investment strategy. For equity funds, the vertical axis shows the market capitalization of the stocks owned and the horizontal axis shows investment style (value, blend, or growth). |

| † | This graph, provided in accordance with SEC regulations, compares a $10,000 investment in the Fund, made at its inception, with the performance of the Russell Midcap® Index and the Lipper Mid-Cap Growth Funds Index. Results include the reinvestment of all dividends and capital gains distributions. The graph and the Average Annual Total Returns table do not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. This graph is based on Class Z shares only; performance for other classes will vary due to differences in fee structures. |

Performance Information: 1Load-adjusted performance reflects the effect of the maximum sales charge of 5.75% for Class A, the applicable contingent deferred sales charge of 5.00% in year 1 and eliminated after year 6 for Class B, and the applicable contingent deferred sales charge of 1.00% and eliminated after 12 months for Class C. The performance of the Class A, B, and C shares is based on the performance of the Fund’s Class Z shares (formerly Retail Class shares) prior to 11-30-00. The performance of Class A shares is restated to reflect the load and the different expenses of the Class A shares, as applicable. The performance of the Class B and Class C shares are restated to reflect the contingent deferred sales charge and the different expenses of the Class B and Class C shares, as applicable. Please consult a prospectus for information about all share classes.

From time to time, the Fund’s performance was significantly enhanced through investments in initial public offerings (IPOs). In addition, the effect of IPOs purchased when the Fund’s asset base was small may have been magnified. Given these circumstances, you should not expect that such enhanced returns can be consistently achieved. Please consider this before investing.

Fee Waivers: From time to time, the Fund’s advisor and/or administrator has waived fees and/or absorbed Fund expenses, which has resulted in higher returns. As of 6-30-04, there are waivers and/or absorptions in effect.

Percentage Restrictions: The Fund’s prospectus and statement of additional information may describe restrictions on the percentage of a particular type or quality of security in which the Fund may invest (“Percentage Restrictions”). Percentage Restrictions apply at the time the Fund purchases a security. Circumstances subsequent to the purchase of the security, such as a change in: (1) the Fund’s assets (e.g., due to cash inflows and redemptions); (2) the market value of the security; or (3) the pricing, liquidity, or rating of the security, may cause the Fund to exceed or fall short of the Percentage Restriction. If this happens, the Fund’s continued holding of the security will not constitute a violation of the Percentage Restriction.

General: 2The Class Z shares are closed to new accounts, though the Fund may continue to offer its shares to certain company-sponsored retirement plans, institutional investors meeting specific eligibility requirements, and other limited groups as described in the prospectus.

Definitions: **The Russell Midcap® Index measures the performance of the 800 smallest companies in the Russell 1000 Index, which represent approximately 26% of the total market capitalization of the Russell 1000 Index. The Lipper Mid-Cap Growth Funds Index is the average of the 30 largest funds in the Lipper Mid-Cap Growth Funds Category. Source of the Russell Index data is Standard & Poor’s Micropal. Source of the Lipper Index data is Lipper. It is not possible to invest directly in an index.

5

Strong Advisor Small Cap Value Fund

The Strong Advisor Small Cap Value Fund Class Z rose 6.01% during the six months ending June 30, 2004. The performance fell short of the Fund’s broad-based benchmark, the Russell 2000 Index, which had a return of 6.76% during the same time span.

Stock selection in sectors such as health care, industrials, and energy helped lead to the Fund’s year-to-date performance. In health care, two particularly strong contributors to results were US Oncology, which delivers cancer-treatment services to health care providers, and Beverly Enterprises, an elder care company that owns and operates 373 facilities in the U.S. and has been aggressively reorganizing its business by shedding unprofitable properties.

An overweighted position in energy stocks also helped returns, with companies such as Range Resources Corporation benefiting from rising prices and increased production. The oil and gas explorer, primarily located in the southwest and Gulf Coast, reported improved net income. Our investment team believes the portfolio’s energy stocks are undervalued, and therefore, anticipate improved performance in the latter half of 2004.

The less-successful performance from certain names in the materials and financials sectors counterbalanced those positive results. Much of the Fund’s underperformance in materials happened in the second quarter of 2004, when we saw particularly sluggish results from metals and mining stocks. We believe, however, that many of our metals and mining holdings are undervalued and could rebound in the second half of the year.

In the processing sector, despite excellent end-market demand, shares of GrafTech International underperformed because sharply higher costs for energy and petroleum-based raw materials caused some moderation in 2004 earnings expectations. However, supply for GrafTech’s graphite electrodes remains tight and the prospects for further price increases in 2005 are good. Also, shares of Apex Silver Mines and other metals-related companies faltered, in response to news that China was increasing interest rates and, therefore, throttling back demand for resources and raw materials. Contrary to this, we believe that China’s action should help to maintain more sustainable growth in demand for raw material inputs, for a longer period of time than might otherwise be the case.

At the end of the period, we remained significantly underweighted in the financials area because we believed that many of these stocks, especially banks, could face a difficult business environment if interest rates continue to rise. The interest rate hike at the end of June caused pressure on financial firms with interest rate exposure. In a rising rate environment, traditional banks and mortgage companies tend to experience reduced profitability.

Quantitative and fundamental analysis

In managing the Fund, we follow a multidimensional screening process. We use quantitative analysis to narrow the field but spend most of our time on fundamental research. In particular, we try to identify some dynamics for change that are not already reflected in the price of the stocks. This can be a new management team, new business plan, a new product, industry consolidation, or any number of other developments that could favorably influence a company’s prospects.

Future challenges

Equity markets are likely to be challenged by a variety of factors, including geopolitics and the continued threat of terrorism, the prospect of further interest-rate hikes from the Federal Reserve Board, and the November presidential election. We do, however, believe the Fund is well positioned to perform favorably in this type of market climate. Many of the sectors that have added value to the Fund in the past, such as energy and materials, could be poised to perform well in the upcoming market environment because of their low valuations relative to their peers. We also are looking for small caps to continue to outperform, as we believe that they remain underrepresented in most investors’ portfolios.

Thank you for your investment in the Strong Advisor Small Cap Value Fund.

|

I. Charles Rinaldi |

Portfolio Manager |

6

Fund Highlights

Average Annual Total Returns

As of 6-30-04

| | | |

Class A1

| | | |

1-year | | 29.74 | % |

5-year | | 17.99 | % |

Since Fund Inception (12-31-97) | | 17.08 | % |

| |

Class A, excluding sales load

| | | |

1-year | | 37.66 | % |

5-year | | 19.40 | % |

Since Fund Inception (12-31-97) | | 18.15 | % |

| |

Class B1

| | | |

1-year | | 31.64 | % |

5-year | | 18.45 | % |

Since Fund Inception (12-31-97) | | 17.47 | % |

| |

Class C1

| | | |

1-year | | 35.57 | % |

5-year | | 18.68 | % |

Since Fund Inception (12-31-97) | | 17.49 | % |

| |

Class Z2

| | | |

1-year | | 37.88 | % |

5-year | | 19.64 | % |

Since Fund Inception (12-31-97) | | 18.41 | % |

Performance is historical and does not guarantee future results. Investment returns and principal value will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most recent month-end performance.

Risks: Stock funds should only be considered for long-term goals as values fluctuate in response to the activities of individual companies and general market and economic conditions.

Because smaller companies often have narrower markets and limited financial resources, investments in these stocks present more risk than investments in those of larger, more established companies.

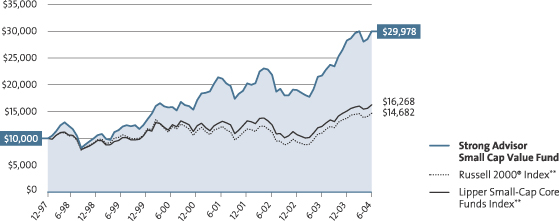

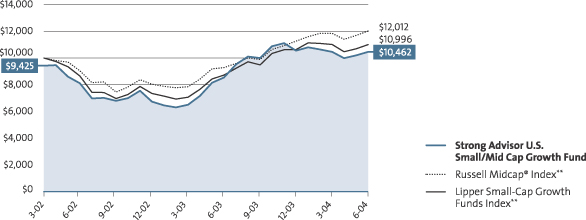

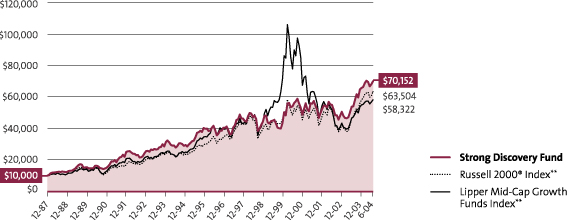

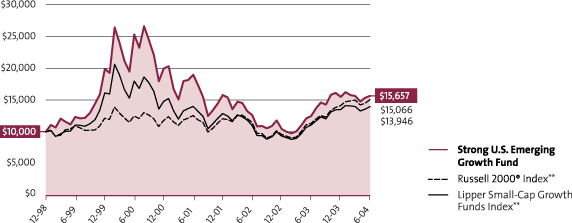

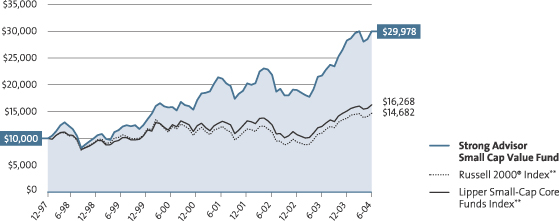

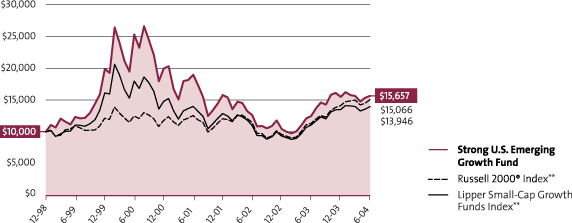

Growth of an Assumed $10,000 Investment†

from 12-31-97 to 6-30-04

Mention of specific securities in this report is not indicative of whether the Fund may make additional purchases of, sell all or a portion of, or continue to hold those securities.

| * | The Morningstar Style BoxTM reveals a fund’s investment strategy. For equity funds, the vertical axis shows the market capitalization of the stocks owned and the horizontal axis shows investment style (value, blend, or growth). |

| † | This graph, provided in accordance with SEC regulations, compares a $10,000 investment in the Fund, made at its inception, with the performance of the Russell 2000® Index and the Lipper Small-Cap Core Funds Index. Results include the reinvestment of all dividends and capital gains distributions. The graph and the Average Annual Total Returns table do not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. This graph is based on Class Z shares only; performance for other classes will vary due to differences in fee structures. |

Performance Information: 1Load-adjusted performance reflects the effect of the maximum sales charge of 5.75% for Class A, the applicable contingent deferred sales charge of 5.00% in year 1 and eliminated after year 6 for Class B, and the applicable contingent deferred sales charge of 1.00% and eliminated after 12 months for Class C. The performance of the Class A, B, and C shares is based on the performance of the Fund’s Class Z shares (formerly Retail Class shares) prior to 11-30-00. The performance of the Class A shares is restated to reflect the load and the different expenses of the Class A shares, as applicable. The performance of the Class B and Class C shares are restated to reflect the contingent deferred sales charge and the different expenses of the Class B and Class C shares, as applicable. Please consult a prospectus for information about all share classes.

From time to time, the Fund’s performance was significantly enhanced through investments in initial public offerings (IPOs). In addition, the effect of IPOs purchased when the Fund’s asset base was small may have been magnified. Given these circumstances, you should not expect that such enhanced returns can be consistently achieved. Please consider this before investing.

Fee Waivers: From time to time, the Fund’s advisor and/or administrator has waived fees and/or absorbed Fund expenses, which has resulted in higher returns. As of 6-30-04, there are waivers and/or absorptions in effect.

Percentage Restrictions: The Fund’s prospectus and statement of additional information may describe restrictions on the percentage of a particular type or quality of security in which the Fund may invest (“Percentage Restrictions”). Percentage Restrictions apply at the time the Fund purchases a security. Circumstances subsequent to the purchase of the security, such as a change in: (1) the Fund’s assets (e.g., due to cash inflows and redemptions); (2) the market value of the security; or (3) the pricing, liquidity, or rating of the security, may cause the Fund to exceed or fall short of the Percentage Restriction. If this happens, the Fund’s continued holding of the security will not constitute a violation of the Percentage Restriction.

General: 2The Class Z shares are closed to new accounts, though the Fund may continue to offer its shares to certain company-sponsored retirement plans, institutional investors meeting specific eligibility requirements, and other limited groups as described in the prospectus.

Definitions: **The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index. The Lipper Small-Cap Core Funds Index is the average of the 30 largest funds in the Lipper Small-Cap Core Funds Category. Source of the Russell Index data is Standard & Poor’s Micropal. Source of the Lipper Index data is Lipper. It is not possible to invest directly in an index.

7

Strong Advisor U.S. Value Fund

The Strong Advisor U.S. Value Fund was able to outperform its broad-based index, the S&P 500 Index, during the past six months. The Fund’s Class Z shares returned 4.57%, while the S&P 500 Index returned 3.44%.

For the first half of 2004, most sectors of the stock market performed positively, thanks to an improving economy and better company fundamentals. Both trends proved more influential than the negative influences of higher interest rates, higher oil prices, and continued terrorist threats. Against this backdrop, small-cap stocks outperformed mid-cap stocks, and mid caps outperformed large caps. Also, value stocks outperformed their growth counterparts during the past six months. Because the market tended to favor value stocks, and because we were willing to own mid-cap stocks not generally found in the S&P 500, the Fund was able to beat its benchmark.

“At the right price and at the right time”

In managing the Strong Advisor U.S. Value Fund, our philosophy is to buy “the right company at the right price and at the right time.” Using this philosophy, we spend the majority of our management time and effort conducting thorough company-by-company research. Such a process served us well during the past six months, as a significant portion of the Fund’s gains could be attributed to the strength of our individual stock selection — especially in the financial sector and, more specifically, the insurance industry.

Although the Fund’s sector weightings are generated not by design, but as a direct result of the individual companies we choose for the portfolio, in hindsight we can detect some interesting trends from the past six months. For example, we see that the Fund was most significantly underweighted in the information technology and financial sectors. We pared back our technology weighting starting in 2003, when we believed that investors were becoming excessively optimistic about the sector’s growth potential and bidding up valuations to unwarranted levels. This underweighting helped the Fund’s performance during the first half of 2004 after tech stocks significantly underperformed the broad market during the year.

Meanwhile, we de-emphasized the companies in the financial sector because of our belief that very few investments in this area of the market offered compelling valuations. For example, regional banks enjoyed strong performance during the bear market of 2001 and 2002 and kept pace during the 2003 bull market. As a result, it has become more difficult to find attractively valued companies in this space. In addition, Fund holdings Bank One, Charter One Financial, and Provident Financial Group all were acquired or agreed to be acquired during the past six months. These acquisitions helped performance, as well as caused our weighting in bank stocks to decline further.

Value in utilities

Our bottom-up stock selection approach also generated an increased emphasis on utility stocks during the past six months. We saw the utility sector as one of the few attractively valued parts of the market. Furthermore, the sector was currently unpopular with many investors, who were concerned about rising interest rates — a concern we believe is overstated — and generally more interested in chasing higher-risk, higher-reward-potential names.

We also decreased the Fund’s weighting in energy stocks. As the period progressed and many of the energy holdings in the portfolio approached intrinsic value, we trimmed our position in the sector. Also contributing to this decision was our belief that oil and natural gas prices had risen faster than their long-term fundamentals warranted.

Focused on value

After the stock market’s impressive performance in 2003, it has become increasingly difficult to find companies available at attractive valuations. In keeping with our management philosophy, we will continue to conduct rigorous research to attempt to find the right companies at the right price and the right time. We believe that our emphasis on attractively valued stocks, as well as our focus on managing the portfolio’s risk, will continue to serve our shareholders well in 2004 and beyond.

Thank you for your investment in the Strong Advisor U.S. Value Fund.

|

| Robert J. Costomiris |

Portfolio Manager |

8

Fund Highlights

Average Annual Total Returns

As of 6-30-04

| | | |

Class A1

| | | |

1-year | | 15.11 | % |

5-year | | –0.29 | % |

Since Fund Inception (12-29-95) | | 9.50 | % |

| |

Class A, excluding sales load

| | | |

1-year | | 22.17 | % |

5-year | | 0.90 | % |

Since Fund Inception (12-29-95) | | 10.27 | % |

| |

Class B1

| | | |

1-year | | 16.14 | % |

5-year | | –0.19 | % |

Since Fund Inception (12-29-95) | | 9.60 | % |

| |

Class C1

| | | |

1-year | | 20.12 | % |

5-year | | 0.22 | % |

Since Fund Inception (12-29-95) | | 9.55 | % |

| |

Class K1

| | | |

1-year | | 22.60 | % |

5-year | | 1.32 | % |

Since Fund Inception (12-29-95) | | 10.70 | % |

| |

Class Z2

| | | |

1-year | | 22.13 | % |

5-year | | 0.96 | % |

Since Fund Inception (12-29-95) | | 10.47 | % |

Performance is historical and does not guarantee future results. Investment returns and principal value will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most recent month-end performance.

Risks: Stock funds should only be considered for long-term goals as values fluctuate in response to the activities of individual companies and general market and economic conditions.

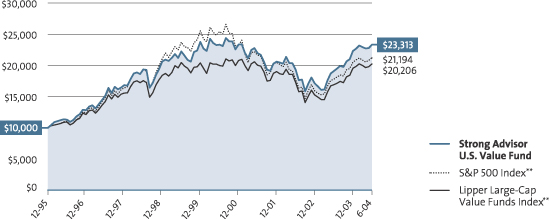

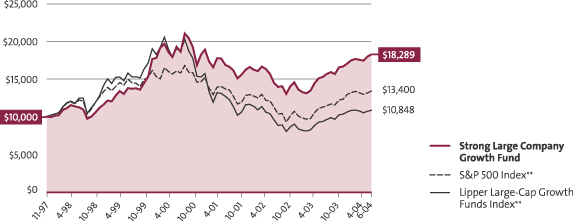

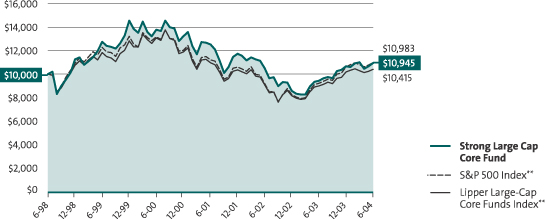

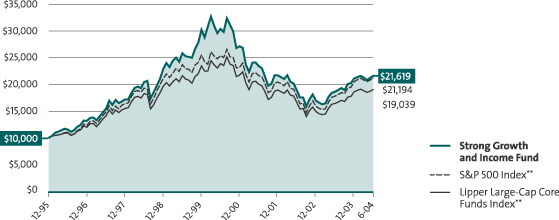

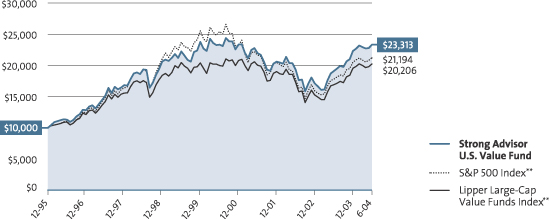

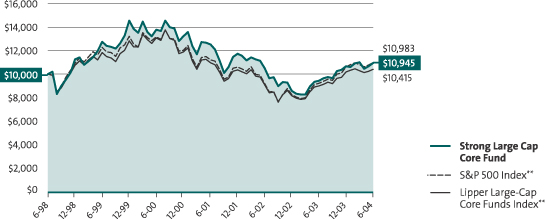

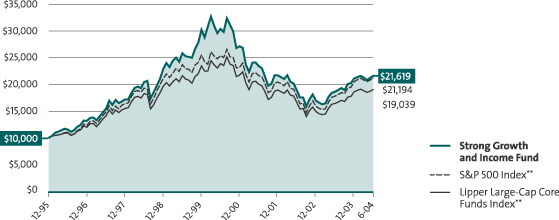

Growth of an Assumed $10,000 Investment†

from 12-29-95 to 6-30-04

Mention of specific securities in this report is not indicative of whether the Fund may make additional purchases of, sell all or a portion of, or continue to hold those securities.

| * | The Morningstar Style BoxTM reveals a fund’s investment strategy. For equity funds, the vertical axis shows the market capitalization of the stocks owned and the horizontal axis shows investment style (value, blend, or growth). |

| † | This graph, provided in accordance with SEC regulations, compares a $10,000 investment in the Fund, made at its inception, with the performance of the S&P 500 Index (“S&P 500”) and the Lipper Large-Cap Value Funds Index. Results include the reinvestment of all dividends and capital gains distributions. The graph and the Average Annual Total Returns table do not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. This graph is based on Class Z shares only; performance for other classes will vary due to differences in fee structures. |

Performance Information: 1Load-adjusted performance reflects the effect of the maximum sales charge of 5.75% for Class A, the applicable contingent deferred sales charge of 5.00% in year 1 and eliminated after year 6 for Class B, and the applicable contingent deferred sales charge of 1.00% and eliminated after 12 months for Class C. The performance of the Class A, B, and C shares is based on the performance of the Fund’s Class Z shares (formerly Retail Class shares) prior to 11-30-00. The performance of the Class A shares is restated to reflect the load and the different expenses of the Class A shares. The performance of the Class B and Class C shares are restated to reflect the contingent deferred sales charge and the different expenses of the Class B and Class C shares, as applicable. The performance of Class K shares prior to December 31, 2001, is based on the Fund’s Class Z shares’ performance.

Please consult a prospectus for information about all share classes.

Fee Waivers: From time to time, the Fund’s advisor and/or administrator has waived fees and/or absorbed Fund expenses, which has resulted in higher returns. As of 6-30-04, there are waivers and/or absorptions in effect.

Percentage Restrictions: The Fund’s prospectus and statement of additional information may describe restrictions on the percentage of a particular type or quality of security in which the Fund may invest (“Percentage Restrictions”). Percentage Restrictions apply at the time the Fund purchases a security. Circumstances subsequent to the purchase of the security, such as a change in: (1) the Fund’s assets (e.g., due to cash inflows and redemptions); (2) the market value of the security; or (3) the pricing, liquidity, or rating of the security, may cause the Fund to exceed or fall short of the Percentage Restriction. If this happens, the Fund’s continued holding of the security will not constitute a violation of the Percentage Restriction.

General: 2The Class Z shares are closed to new accounts, though the Fund may continue to offer its shares to certain company-sponsored retirement plans, institutional investors meeting specific eligibility requirements, and other limited groups as described in the prospectus.

Definitions: **The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market value weighted index (stock price times number of shares outstanding), with each stock’s weight in the Index proportionate to its market value. The Lipper Large-Cap Value Funds Index is the average of the 30 largest funds in the Lipper Large-Cap Value Funds Category. Source of the S&P Index data is Standard & Poor’s Micropal. Source of the Lipper Index data is Lipper.

It is not possible to invest directly in an index.

9

Strong Advisor Endeavor Large Cap Fund

During the first half of 2004, the Strong Advisor Endeavor Large Cap Fund Class A gained 5.56%, outpacing its broad-based benchmark, the S&P 500 Index, which rose 3.44%. The Fund was positioned to take advantage of the continued strength in economic and corporate profit growth. As a result, the Fund’s return was heavily influenced by solid stock picking among health care, industrial, and information technology sectors.

“Surrounding” our investments

Our approach to portfolio management relies on the careful selection of individual securities through collaborative research. We strive to “surround” each company that we consider for investment. In other words, our team of portfolio managers and analysts interviews not only the companies’ management, but also its competitors, suppliers, and customers. We want to acquire unique insights to support — or reject, in the cases of companies that do not meet our strict requirements — our investment thesis for each individual stock.

Our investment process also emphasizes financial analysis, including a careful review of corporate income statements, as well as the assets on corporate balance sheets. We believe that a company’s balance sheet provides the best way to forecast that business’s future results. We are especially interested in determining the sources of revenue and earnings. We also pay close attention to cash flow and how much investment will be required to generate future cash flow and earnings growth.

Opportunities in Teva and Tyco

Applying our approach, we reviewed a number of potential investment opportunities in the health care sector during the period. As our research progressed, we became concerned about the lack of new products forthcoming by many large-cap pharmaceutical companies, as well as about the considerable number of drugs due to lose their patent protection in the near future. Accordingly, we maintained little exposure to these “name-brand” pharmaceutical businesses. Instead we built a position in Teva Pharmaceutical, the world’s leading developer and manufacturer of generic drugs as well as a supplier of a growing line of branded drugs.

We believe Teva has an outstanding competitive position, as the company dominates the generic drug market in the United States. In addition, Teva’s management team has shown a consistent ability to execute its business strategy, made evident by the company’s track record of stable and diversified earnings. Furthermore, Teva has an impressive pipeline of upcoming products, with over 80 applications for new drugs pending regulatory approval in the U.S. alone. The company also has shown success with its branded drug offerings, such as Copaxone, well on its way to becoming the leading treatment for multiple sclerosis in the United States. Thanks to these strong business trends, Teva has been able to produce solid revenue and earnings growth, and the stock was a significant contributor to the Fund’s performance during the past six months.

We used a similarly careful analysis to increase our position in Tyco International, a company recently beset by a number of questions about its accounting and corporate governance practices. As we started evaluating Tyco after the company installed a new senior management team, we began to see evidence of a significant cultural and financial transformation. Thanks to its new leadership, Tyco has moved from a struggling organization into a company that is increasingly recognized for its impressive cash-flow-generation potential. We grew confident in Tyco’s ability to generate growth through its market-leading positions in health care, fire and security products, and electronics. During the past six months, our position in this stock provided a strong contribution to the Fund’s returns.

Market shift ahead?

We are looking for the second half of 2004 to be a more challenging environment for the market than the first half was. As corporate profits continue to grow, the rate of growth will eventually slow down as companies find it more difficult to surpass prior results. Also, the expectation for further increases in interest rates will place a cap on equity valuations — leaving only limited additional upside potential, in our view. In this environment, we expect the market to begin to reward higher-quality companies with highly predictable earnings and recurring revenues.

Thank you for your investment in the Strong Advisor Endeavor Large Cap Fund. We sincerely appreciate the trust you have placed in us.

|

| Thomas J. Pence |

Portfolio Manager |

10

Fund Highlights

Average Annual Total Returns

As of 6-30-04

| | | |

Class A1

| | | |

1-year | | 16.41 | % |

Since Fund Inception (9-28-01) | | 0.97 | % |

| |

Class A, excluding sales load

| | | |

1-year | | 23.58 | % |

Since Fund Inception (9-28-01) | | 3.17 | % |

| |

Class B1

| | | |

1-year | | 17.86 | % |

Since Fund Inception (9-28-01) | | 1.20 | % |

| |

Class C1

| | | |

1-year | | 21.86 | % |

Since Fund Inception (9-28-01) | | 2.60 | % |

Performance is historical and does not guarantee future results. Investment returns and principal value will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most recent month-end performance.

Risks: Stock funds should only be considered for long-term goals as values fluctuate in response to the activities of individual companies and general market and economic conditions.

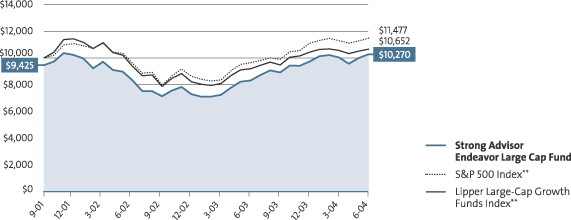

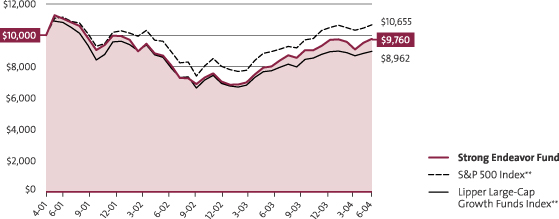

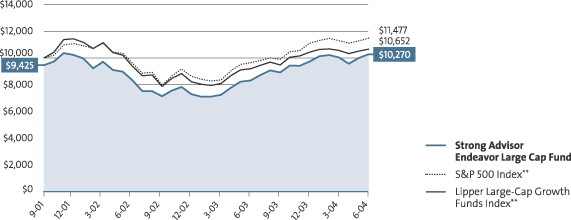

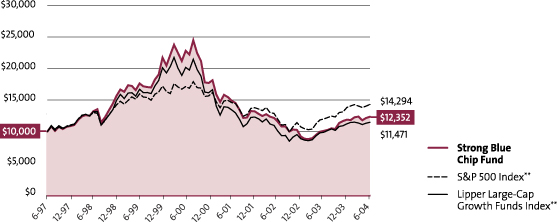

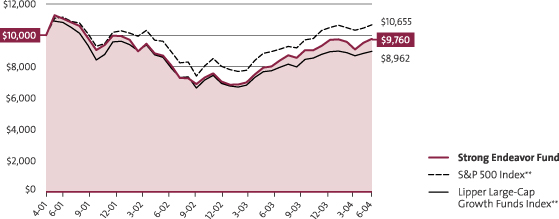

Growth of an Assumed $10,000 Investment†

from 9-28-01 to 6-30-04

Mention of specific securities in this report is not indicative of whether the Fund may make additional purchases of, sell all or a portion of, or continue to hold those securities.

| * | The Morningstar Style BoxTM reveals a fund’s investment strategy. For equity funds, the vertical axis shows the market capitalization of the stocks owned and the horizontal axis shows investment style (value, blend, or growth). |

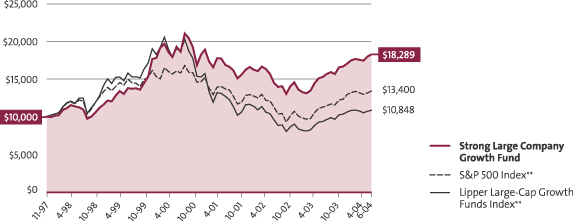

| † | This graph, provided in accordance with SEC regulations, compares a $10,000 investment in the Fund, made at its inception, with the performance of the S&P 500 Index (“S&P 500”) and the Lipper Large-Cap Growth Funds Index. Results include the reinvestment of all dividends and capital gains distributions. The graph and the Average Annual Total Returns table do not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. This graph is based on Class A shares only and reflects the effect of the maximum sales charge of 5.75%; performance for other share classes will vary due to differences in fee structures and sales charges. |

Performance Information: 1Load-adjusted performance reflects the effect of the maximum sales charge of 5.75% for Class A, the applicable contingent sales charge of 5.00% in year 1 and eliminated after year 6 for Class B, and the applicable contingent deferred sales charge of 1.00% and eliminated after 12 months for Class C. Please consult a prospectus for information about all share classes.

Fee Waivers: From time to time, the Fund’s advisor and/or administrator has waived fees and/or absorbed Fund expenses, which has resulted in higher returns. As of 6-30-04, there are waivers and/or absorptions in effect.

Percentage Restrictions: The Fund’s prospectus and statement of additional information may describe restrictions on the percentage of a particular type or quality of security in which the Fund may invest (“Percentage Restrictions”). Percentage Restrictions apply at the time the Fund purchases a security. Circumstances subsequent to the purchase of the security, such as a change in: (1) the Fund’s assets (e.g., due to cash inflows and redemptions); (2) the market value of the security; or (3) the pricing, liquidity, or rating of the security, may cause the Fund to exceed or fall short of the Percentage Restriction. If this happens, the Fund’s continued holding of the security will not constitute a violation of the Percentage Restriction.

Definitions: **The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market value weighted index (stock price times number of shares outstanding), with each stock’s weight in the Index proportionate to its market value. The Lipper Large-Cap Growth Funds Index is the average of the 30 largest funds in the Lipper Large-Cap Growth Funds Category. Source of the S&P 500 Index data is Standard & Poor’s Micropal. Source of the Lipper Index data is Lipper.

It is not possible to invest directly in an index.

11

Strong Advisor Focus Fund

The Strong Advisor Focus Fund Class A has had a very good start to 2004, returning 8.85% versus 3.44% for the S&P 500 Index, its broad-based benchmark.

Taking advantage of a dynamic market

��

The strongest impact on the market during the first half of the year was continued greater-than-anticipated corporate earnings growth. The other main variable influencing the market during the first half of the year was the anticipation of the Federal Reserve’s reversal of its current accommodative short-term interest rate stance. We feel the portfolio is positioned for this occurrence.

The Fund continued to have allocations in economically sensitive sectors such as technology and in specific long-term growth opportunities tied to the consumer. Moreover, as a hybrid of these two sectors, we have positions in stocks with dynamic growth prospects based on business models tied to the Internet. Within the health care sector, we have found some exciting individual stocks, but have found many of the larger-capitalization stocks to have lackluster growth prospects.

While value styles did outperform growth in the period, we were able to benefit from opportunistic investments in equities of high-quality, fast-growing growth stocks.

Research nets new stocks

Stock-specific, proprietary research continues to be at the heart of our portfolio process. We devote many hours to screening for the fastest growing public companies in the economy that also seem to have the best chances for sustained growth. Once we identify these companies on paper, we hit the phones and the road to accumulate data from meetings and conversations with the companies themselves, their customers, their suppliers, and their competitors.

Sometimes a better investment idea comes from this confirmatory research than the original stock idea that generated the analysis. Once a stock makes it into the portfolio this process doesn’t halt, it is dynamic. We constantly research to recheck our theses, while taking into account the opportunity cost of not owning other growth stocks. We do not ignore the macros as they can provide strong headwinds or tailwinds to company specific growth. We also monitor our portfolio risk on many levels including sector allocations.

PETsMART is a good example of the fruits of this process. The company is addressing a growth area in the economy; consumer expenditures on pets. It is also taking market share within its category and its growth opportunities have been continually underestimated. Furthermore, while doing research on PETsMART’s growth potential and the duration of that growth, we have found other exciting growth stocks to add to the portfolio, including Tractor Supply Company.

Looking ahead

Our near-term outlook can be described as optimistic. While we expect short-term interest rates to rise to a more historic level, we are encouraged that the yield curve remains steep, signaling the market’s expectations for continued economic growth. Within this pretext, there are plenty of exciting opportunities to invest in growth stocks. We thank you for your continued support and investment.

|

| Thomas C. Ognar |

Portfolio Manager |

12

Fund Highlights

Average Annual Total Returns

As of 6-30-04

| | | |

Class A1

| | | |

1-year | | 18.12 | % |

3-year | | –7.62 | % |

Since Fund Inception (11-30-00) | | –12.71 | % |

| |

Class A, excluding sales load

| | | |

1-year | | 25.38 | % |

3-year | | –5.76 | % |

Since Fund Inception (11-30-00) | | –11.26 | % |

| |

Class B1

| | | |

1-year | | 19.85 | % |

3-year | | –7.78 | % |

Since Fund Inception (11-30-00) | | –12.97 | % |

| |

Class C1

| | | |

1-year | | 23.85 | % |

3-year | | –6.24 | % |

Since Fund Inception (11-30-00) | | –11.80 | % |

Performance is historical and does not guarantee future results. Investment returns and principal value will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most recent month-end performance.

Risks: Stock funds should only be considered for long-term goals as values fluctuate in response to the activities of individual companies and general market and economic conditions.

The Fund is nondiversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund. Therefore, the Fund is more exposed to individual stock volatility and market pressure than a fully diversified fund.

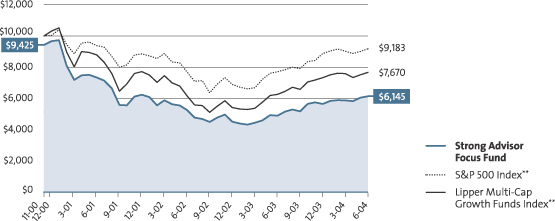

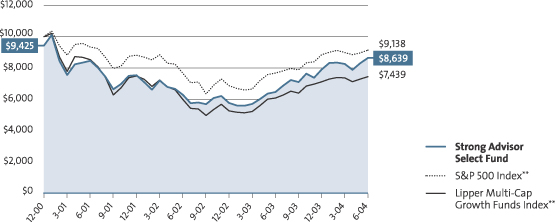

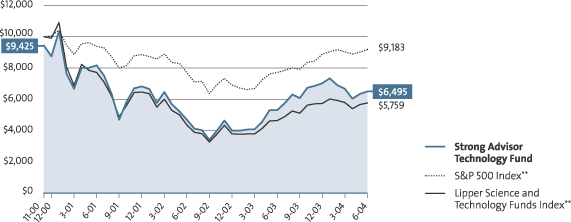

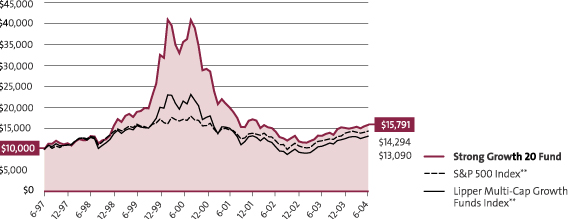

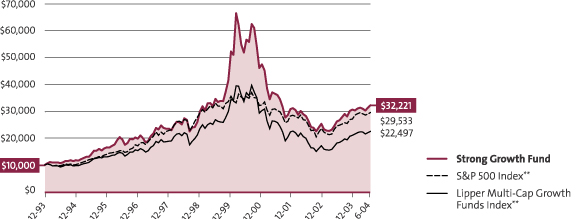

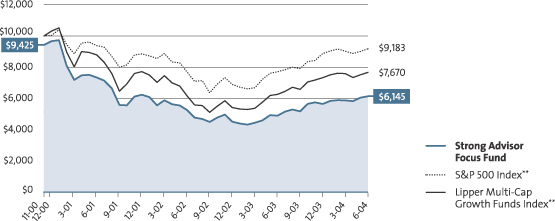

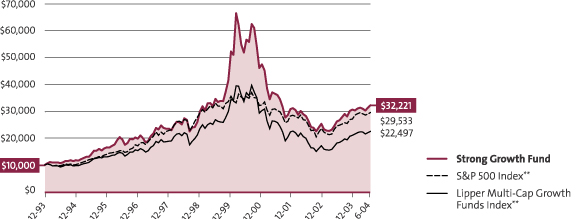

Growth of an Assumed $10,000 Investment†

from 11-30-00 to 6-30-04

Mention of specific securities in this report is not indicative of whether the Fund may make additional purchases of, sell all or a portion of, or continue to hold those securities.

| * | The Morningstar Style BoxTM reveals a fund’s investment strategy. For equity funds, the vertical axis shows the market capitalization of the stocks owned and the horizontal axis shows investment style (value, blend, or growth). |

| † | This graph, provided in accordance with SEC regulations, compares a $10,000 investment in the Fund, made at its inception, with the performance of the S&P 500 Index (“S&P 500”) and the Lipper Multi-Cap Growth Funds Index. Results include the reinvestment of all dividends and capital gains distributions. The graph and the Average Annual Total Returns table do not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. This graph is based on Class A shares only and reflects the effect of the maximum sales charge of 5.75%; performance for other classes will vary due to differences in fee structures and sales charges. |

Performance Information: 1Load-adjusted performance reflects the effect of the maximum sales charge of 5.75% for Class A, the applicable contingent deferred sales charge of 5.00% in year 1 and eliminated after year 6 for Class B, and the applicable contingent deferred sales charge of 1.00% and eliminated after 12 months for Class C. Please consult a prospectus for information about all share classes.

Fee Waivers: From time to time, the Fund’s advisor and/or administrator has waived fees and/or absorbed Fund expenses, which has resulted in higher returns. As of 6-30-04, there are waivers and/or absorptions in effect.

Percentage Restrictions: The Fund’s prospectus and statement of additional information may describe restrictions on the percentage of a particular type or quality of security in which the Fund may invest (“Percentage Restrictions”). Percentage Restrictions apply at the time the Fund purchases a security. Circumstances subsequent to the purchase of the security, such as a change in: (1) the Fund’s assets (e.g., due to cash inflows and redemptions); (2) the market value of the security; or (3) the pricing, liquidity, or rating of the security, may cause the Fund to exceed or fall short of the Percentage Restriction. If this happens, the Fund’s continued holding of the security will not constitute a violation of the Percentage Restriction.

Definitions: **The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market value weighted index (stock price times number of shares outstanding), with each stock’s weight in the Index proportionate to its market value. The Lipper Multi-Cap Growth Funds Index is the average of the 30 largest funds in the Lipper Multi-Cap Growth Funds Category. Source of the S&P Index data is Standard & Poor’s Micropal. Source of the Lipper Index data is Lipper. It is not possible to invest directly in an index.

13

Strong Advisor International Core Fund

The Strong Advisor International Core Fund Class A returned 5.11% during the six months ended June 30, 2004. This result modestly beat the Fund’s benchmark, the MSCI EAFE Index, which returned 4.56% during the same time frame.

This relative outperformance can primarily be attributed to strong results from some of the Fund’s large holdings. As global investors became more risk-averse in the first half of 2004, they increasingly favored high-quality, defensive growth stocks. Those investments that did best tended to have consistent sales and earnings growth, strong balance sheets, and strong leadership — the same types of qualities we favor for the portfolio. Among the names that met these criteria and helped our performance during the past six months were Tesco, the United Kingdom-based food retailer; Essilor, a French optical-supplies manufacturer; Canon, the Japanese imaging solutions giant; and Autoliv, a Swedish maker of automotive-safety equipment.

These positive results were partially counterbalanced by weakness in the Fund’s country allocation. In particular, the Fund was hurt by exposure to Brazilian and South African metals and mining stocks, which fell sharply in response to commodity prices correcting from recent peaks. Overweight positions in Hong Kong and Singapore also detracted from performance, although the underweight exposure to the U.K. market did help results.

Change in investor sentiment

World stock market performance was mixed during the past six months, reflecting a shift from the “risk seeking” investor attitude in 2003. The first quarter of 2004 was characterized by continued optimism surrounding global economic expansion and corporate earnings growth. Asia — especially China and Japan — was the prime beneficiary of this sentiment.

During the second quarter, however, investors grew increasingly sensitive to geopolitical and economic risks. Continued tensions in the Middle East, high oil prices, and early signs of a slowdown in China dampened stock investors’ enthusiasm. Against this backdrop, Europe’s markets posted the stronger returns, while Asian stock markets tumbled as investors sold securities to lock in profits.

Asian opportunities

During the past year, Asia, especially China, has been a key region for global investors. China’s fast-growing economy has led to strong demand for goods and services, and the country’s low-cost manufacturing base and growing “middle class” of consumers has generated strong export growth from such countries as Japan and Germany. It also has generated new sources of demand for the world’s major multinational companies.

Although the Fund had no direct investment in China, it did benefit from its economic growth by owning companies such as Japan’s Komatsu, a construction-equipment firm that supplies heavy machinery for China’s infrastructure development needs. We also had previously identified the metals and mining sector as a beneficiary of China’s demand for raw materials, leading to positions in companies including Australia-based BHP Billiton and Brazil-based Companhia Vale do Rio Doce (CVRD).

China’s high growth potential, however, comes with a high degree of risk. It was reasonable to assume that China’s economy would eventually slow down — as it did late in the period — and that companies and markets supplying the country would feel an eventual negative impact. In response to this concern, we reduced our holdings in Komatsu and eliminated our U.K.-based Anglo American position.

Japan was an important factor for the Fund’s performance during the past six months. Among the world’s largest stock markets, Japan’s turned in the best performance during the period, even after a second quarter correction. After a decade-long recession, the country’s economy has been enjoying a strong recovery as consumer and business spending, along with export growth, have increased. The Fund’s holdings in Japan were balanced among large exporters such as Toyota Motor and Hitachi, companies tied to increases in consumer spending such as department stores Hankyu and Daimaru, and economically sensitive industrials including Kansai Paint and East Japan Railway.

Moderate returns ahead?

Stocks are expected to deliver moderate returns in 2004, against a backdrop of continued economic expansion and moderate inflation. At current levels, global equities appear reasonably valued. Further gains are likely to come if corporate earnings can meet or exceed realistic investor expectations. In this environment, we continue to favor companies showing improved profitability and with the best prospects for increased sales growth. We also are favoring those companies offering investors an attractive valuation relative to their history and their competitors.

Thank you for your investment in the Strong Advisor International Core Fund.

| | |

| Stacey Ho | | Katherine Schapiro |

Portfolio Co-Manager | | Portfolio Co-Manager |

14

Fund Highlights

Average Annual Total Returns

As of 6-30-04

| | | |

Class A1,2

| | | |

1-year | | 19.56 | % |

Since Fund Inception (9-28-01) | | 5.23 | % |

| |

Class A, excluding sales load

| | | |

1-year | | 26.90 | % |

Since Fund Inception (9-28-01) | | –11.26 | % |

| |

Class B1,2

| | | |

1-year | | 22.08 | % |

Since Fund Inception (9-28-01) | | 6.19 | % |

| |

Class C1,2

| | | |

1-year | | 26.27 | % |

Since Fund Inception (9-28-01) | | 7.50 | % |

Performance is historical and does not guarantee future results. Investment returns and principal value will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most recent month-end performance.

Risks: Stock funds should only be considered for long-term goals as values fluctuate in response to the activities of individual companies and general market and economic conditions.

An investment in this Fund entails the special risks of international investing, including currency exchange fluctuation, government regulations, and the potential for political and economic instability. The Fund’s share price is expected to be more volatile than that of a U.S.-only fund. These risks are generally intensified for investments in emerging markets.

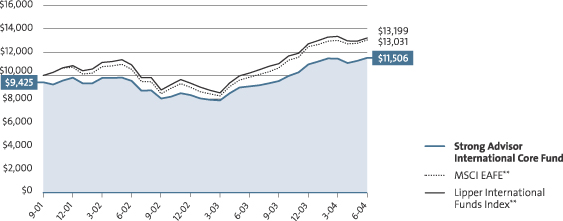

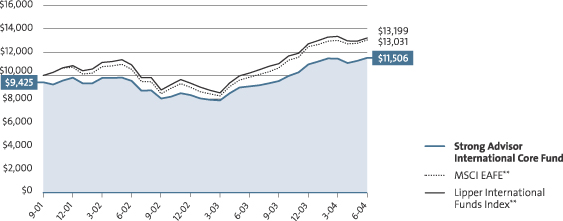

Growth of an Assumed $10,000 Investment†

from 9-28-01 to 6-30-04

Mention of specific securities in this report is not indicative of whether the Fund may make additional purchases of, sell all or a portion of, or continue to hold those securities.

| * | The Morningstar Style BoxTM reveals a fund’s investment strategy. For equity funds, the vertical axis shows the market capitalization of the stocks owned and the horizontal axis shows investment style (value, blend, or growth). |

| † | This graph, provided in accordance with SEC regulations, compares a $10,000 investment in the Fund, made at its inception, with the performance of the Morgan Stanley Capital International Europe, Australasia, and Far East Index (“MSCI EAFE”) and the Lipper International Funds Index. Results include the reinvestment of all dividends and capital gains distributions. The graph and the Average Annual Total Returns table do not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. This graph is based on Class A shares only and reflects the effect of the maximum sales charge of 5.75%; performance for other share classes will vary due to differences in fee structures and sales charges. |

Performance Information: 1Load-adjusted performance reflects the effect of the maximum sales charge of 5.75% for Class A, the applicable contingent sales charge of 5.00% in year 1 and eliminated after year 6 for Class B, and the applicable contingent deferred sales charge of 1.00% and eliminated after 12 months for Class C.

2 The Fund’s Class A, B, and C shares have a redemption fee of 1.00% against shares that are held 30 calendar days or fewer after purchase. Performance data does not reflect the deduction of this fee, which, if reflected, would reduce the performance.

Please consult a prospectus for information about all share classes.

Fee Waivers: From time to time, the Fund’s advisor and/or administrator has waived fees and/or absorbed Fund expenses, which has resulted in higher returns. As of 6-30-04, there are waivers and/or absorptions in effect.

Percentage Restrictions: The Fund’s prospectus and statement of additional information may describe restrictions on the percentage of a particular type or quality of security in which the Fund may invest (“Percentage Restrictions”). Percentage Restrictions apply at the time the Fund purchases a security. Circumstances subsequent to the purchase of the security, such as a change in: (1) the Fund’s assets (e.g., due to cash inflows and redemptions); (2) the market value of the security; or (3) the pricing, liquidity, or rating of the security, may cause the Fund to exceed or fall short of the Percentage Restriction. If this happens, the Fund’s continued holding of the security will not constitute a violation of the Percentage Restriction.

Definitions: **The MSCI EAFE® Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the U.S. and Canada. The Lipper International Funds Index is the average of the 30 largest funds in the Lipper International Funds Category. These funds invest assets in securities with primary trading markets outside of the United States. Source of the MSCI EAFE Index data is Standard & Poor’s Micropal. Source of the Lipper Index data is Lipper. It is not possible to invest directly in an index.

15

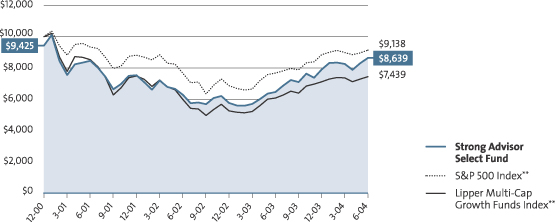

Strong Advisor Select Fund

During the first half of 2004, the Strong Advisor Select Fund Class A gained 9.45%, decisively outpacing its broad-based benchmark, the S&P 500 Index, which rose 3.44%. As the profit recovery continued, the Fund was positioned in holdings that delivered strong earnings growth relative to the broad market. Specifically, the Fund benefited from very strong security selection within health care, consumer discretionary, and information technology sectors.

Careful research and financial analysis

Our approach to portfolio management relies on the careful selection of individual securities through collaborative research. We strive to “surround” each company that we consider for investment. In other words, our team of portfolio managers and analysts interviews not only the companies’ management, but also their competitors, suppliers, and customers. We want to acquire unique insights to support — or reject, in the cases of companies that fail to meet our strict requirements — our investment thesis for each individual stock. The Fund takes particular advantage of this process, as we limit the number of portfolio holdings to what we believe are our best 30 to 40 investment ideas.

Our investment process also emphasizes financial analysis, including a careful review of corporate income statements, as well as the assets on corporate balance sheets. We believe that analyzing a company’s balance sheet provides the best way to forecast the business’s future results. We are especially interested in determining the sources of a company’s revenue and earnings. We also pay close attention to cash flow and how much investment will be required to generate future cash flow and earnings growth.

Opportunities in Yahoo! and Tyco

Applying our approach, we built a position in Yahoo!, a provider of Internet consumer and business services. Yahoo!’s business strength is driven by branded advertising. Our research led us to conclude that many companies plan to increase advertising spending in the near future. Furthermore, corporations appear to be particularly attracted to Internet advertising, especially since consumers now view 15% of their media content online. More and more advertisers, in fact, have been looking to the Internet as an effective alternative to traditional television advertising, which has been hurt by declining ratings and the proliferation of digital video recorders.

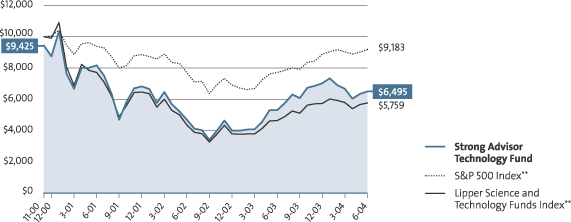

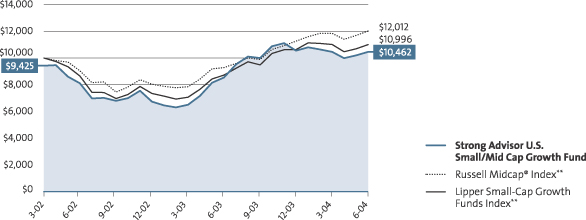

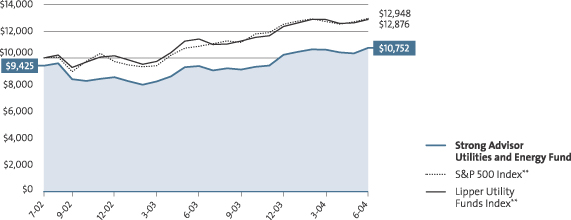

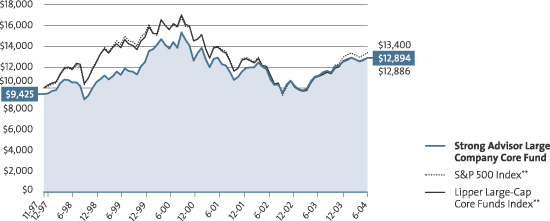

At the time of our research, we saw Yahoo! as very well positioned to take advantage of this shift in advertising spending. With 40% of Internet users using Yahoo!’s search function, the company enjoys strong brand recognition and a large user base. Yahoo! also is beginning to realize the benefit of offering a full suite of advertising products, including increasingly lucrative “paid search” advertising. Finally, we believed Yahoo! could continue to benefit from growth opportunities overseas; the company has been investing heavily to enter and take market share from less-sophisticated, regional Internet portals.