| | |

OMB APPROVAL |

OMB Number: | | 3235-0570 |

| |

Expires: | | Nov. 30, 2005 |

|

Estimated average burden |

hours per response: | | 5.0 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-3793

Strong Opportunity Fund, Inc., on behalf

of Strong Advisor Select Fund,

Strong Advisor U.S. Small/Mid Cap Growth Fund,

Strong Endeavor Fund and Strong Opportunity Fund

(Exact name of registrant as specified in charter)

| | |

| P.O. Box 2936 Milwaukee, WI | | 53201 |

| (Address of principal executive offices) | | (Zip code) |

John W. Widmer, Strong Capital Management, Inc.

P.O. Box 2936 Milwaukee, WI 53201

(Name and address of agent for service)

Registrant’s telephone number, including area code: (414) 359-3400

Date of fiscal year end: December 31

Date of reporting period: December 31, 2004

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. (S) 3507.

Item 1. Reports to Shareholders

ANNUAL REPORT | December 31, 2004

Strong

Advisor Equity

Funds

| | |

Strong Advisor Common Stock Fund Strong Advisor Mid Cap Growth Fund Strong Advisor Small Cap Value Fund Strong Advisor U.S. Value Fund Strong Advisor Endeavor Large Cap Fund Strong Advisor Focus Fund Strong Advisor International Core Fund Strong Advisor Select Fund Strong Advisor Technology Fund Strong Advisor U.S. Small/Mid Cap Growth Fund Strong Advisor Utilities and Energy Fund Strong Advisor Large Company Core Fund | | |

ANNUAL REPORT | December 31, 2004

Strong

Advisor Equity

Funds

On May 26, 2004, Strong Financial Corporation (“SFC”) announced that it reached a definitive agreement with Wells Fargo & Company (“Wells Fargo”) for Wells Fargo to acquire certain assets of SFC and certain of its affiliates, including the Advisor. On December 10, 2004, and on December 22, 2004, shareholders of the Strong Funds met and approved 1) the reorganization of each Strong Fund into a Wells Fargo Advantage Fund (“Reorganization”), and 2) interim investment advisory agreements between the Strong Funds and Wells Fargo Funds Management, LLC and certain sub-advisors (“Interim Agreements”). The Interim Agreements became effective January 1, 2005. The Reorganization of the Funds is expected to occur on or about April 11, 2005.

Table of Contents

Market Update From Dick Weiss

January 1, 2004, to December 31, 2004

It’s indisputable: When it comes to the stock market, resolution brings results.

We saw this clearly at the tail end of 2004. The market as a whole had wandered aimlessly for the first 10 months of the year, spooked by uncertainty over the outcome of a contentious U.S. Presidential Election and our continuing involvement in Iraq. With George W. Bush’s reelection in November, the market surged, driven by the knowledge that there would be no change of administration in Washington and the U.S. commitment to democratize Iraq would continue.

One issue that currently weighs on the markets is inflation. There was tremendous inflation at the raw material level in both 2003 and 2004, but it has not shown up in any marked degree in the Consumer Price Index (CPI). The most obvious example occurred in the energy sector, where oil rose well above $50 per barrel. Historically, that sort of spike in oil prices would have dramatically (and negatively) impacted the average American’s financial affairs. This time, however, it did not.

Why? Because rather than pass on those increasing raw material costs to customers, most companies chose to take the hit themselves, largely because demand seemed soft. It seems to me that the tricky question is whether companies will continue to absorb higher prices for raw materials (thus depressing profit margins) or, rather, pass those costs along to the public.

In any event, it’s clear that there’s a lot more inflation in the system than is reflected in the CPI. Hence, it’s become a matter of how that inflation will be managed — and by whom.

It’s also worth noting that there are deflationary pressures afoot in the world’s economy today. China, absorbing millions of new workers into its labor pool, is exporting cheap goods around the globe. The United States is the destination for a disproportionate share of that production, and the Chinese are financing our purchases. For the moment, that practice has helped to prop up the U.S. dollar. In the long run, it has unsettling implications.

As we look at 2005, there are a lot of moving parts out there — inflation, deflation, Iraq, China, the ups-and-downs of the U.S. dollar, and the mind-boggling developments in technology with their transformative effects on both our corporate and personal lives. Rapidly aging populations in Europe and China will cause seismic demographic shifts that we believe will have a long-term, dramatic effect on the world economy and markets.

Thanks for your continued investment.

Richard T. Weiss

Strong Financial Corporation

Strong Advisor Common Stock Fund

Continuing the previous year’s bull market, the U.S. stock market posted another positive year in 2004. The Strong Advisor Common Stock Fund’s Class Z shares gained 9.96% for the 12 months ending December 31, 2004. This result trailed that of the Fund’s broad-based benchmark, the Russell Midcap Index, which returned 20.22% during the same period.

A growing economy and higher rates

Strong consumer spending continued to carry the economy during 2004, while corporate spending gradually strengthened. The Federal Reserve continued to raise interest rates gradually during the period — exemplifying its confidence in the economy’s underlying strength. The Fed initiated five separate quarter-percentage-point rate hikes between June 30 and the end of the year.

We positioned the Strong Advisor Common Stock Fund with an expectation for higher rates and an aggressive economic recovery in 2004. The market rose only modestly for the first two-thirds of the year, as uncertainty surrounded the outcome of the U.S. presidential election and energy costs continued to rise. However, in the year’s fourth quarter, after the election ended in decisive fashion and energy prices began declining, the stock market rallied and ended the year on a very positive note.

Choosing stocks for the portfolio

The Strong Advisor Common Stock Fund uses a private market methodology to build its portfolio of securities. In other words, our investment process leads us to evaluate companies’ competitive strengths, assets, and financial position. We synthesize this information to gauge the value an independent buyer would pay for the entire company, and then we look for stocks to buy that are trading at a discount to that value.

This process attracted us to the Internet sector, especially in companies helping to rejuvenate the advertising business. We believed that Internet advertising companies would benefit from the rising economy as well as take market share from traditional advertising businesses.

DoubleClick was an investment based on this thesis. After the Internet “bubble” burst several years ago, the stock represented a compelling opportunity for value investors attracted to its reasonable price. After the company changed its business model several times in 2003, we concluded that DoubleClick’s acquisitions would complement positive trends we forecasted for Internet stocks in 2004.

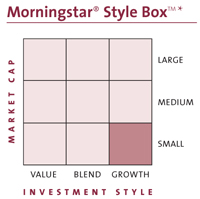

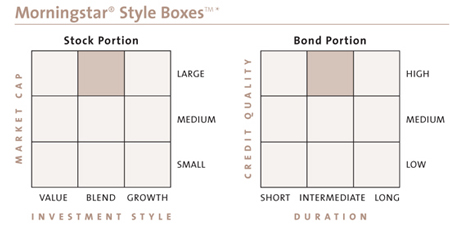

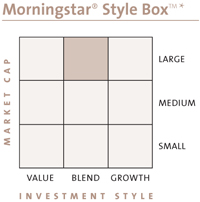

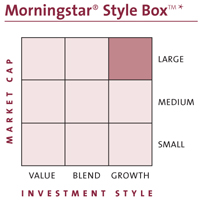

Morningstar® Style Box™ *

Despite a favorable operating environment in 2004, DoubleClick faced challenges in integrating several of its acquisitions. Also, the company’s core ad-serving technology could not withstand pricing pressure from its competition. In the last quarter of 2004, the company announced intentions to explore strategic opportunities to increase shareholder value. Against this backdrop, DoubleClick was a disappointing performer for the Fund during the period. More helpful for performance was the Fund’s overweight position in energy stocks, which generally enjoyed very strong results. In 2004 we saw record-high energy prices, caused principally by a combination of a strengthening global economy and tightening crude oil and natural gas supplies. As energy companies increased their production to take advantage of the higher prices, the number of drilling rigs worldwide increased significantly.

One energy stock we owned during the period was Noble Corporation, which has one of the world’s most diverse fleets of offshore rigs. As drilling activity increased, the utilization rates of the rigs also increased, allowing Noble Corporation to receive higher day rates. Energy analysts expect that the financial leverage from the increased drilling activity may be fully realized in 2005, for which earnings estimates are more than 80% above 2004 levels. This anticipated future financial strength caused Noble Corporation’s stock price to appreciate nearly 40% during 2004.

What lies ahead?

Our outlook for 2005 depends on several factors, including the pressure of inflation, the dollar’s resilience to large trade and fiscal deficits, and the need for more rapid economic growth from countries outside of the United States. Consumer spending is starting to drop off slightly, but we expect that increased corporate spending and lower fuel costs should support the continued economic recovery.

The Fund is expected to reorganize into the Wells Fargo Advantage Common Stock Fund, the successor to the Strong Advisor Common Stock Fund, on or about April 11, 2005.

We appreciate your trust in our investment expertise and are committed to providing you with positive long-term performance. Best wishes for a happy, healthy, and profitable 2005.

Richard T. Weiss

Portfolio Co-Manager

Ann M. Miletti

Portfolio Co-Manager

| * | The Morningstar Style Box™ reflects a fund’s investment strategy. For equity funds, the vertical axis shows the market capitalization of the stocks owned and the horizontal axis shows investment style (value, blend, or growth). |

Mention of specific securities in this report is not indicative of whether the Fund may make additional purchases of, sell all or a portion of, or continue to hold those securities.

2

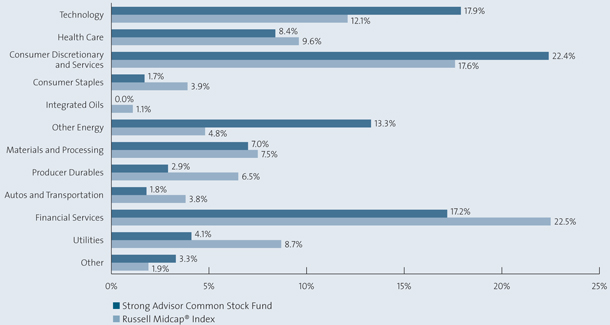

Fund Highlights

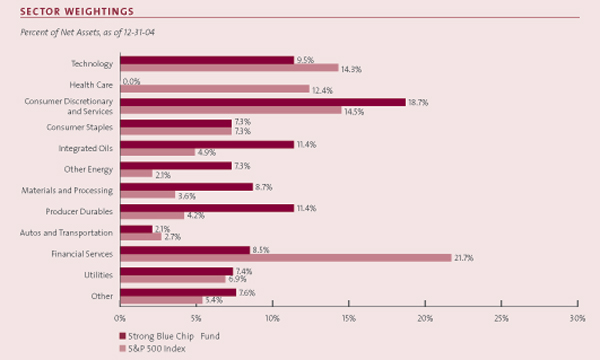

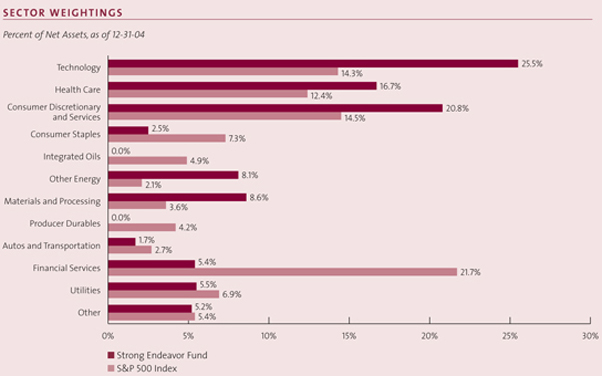

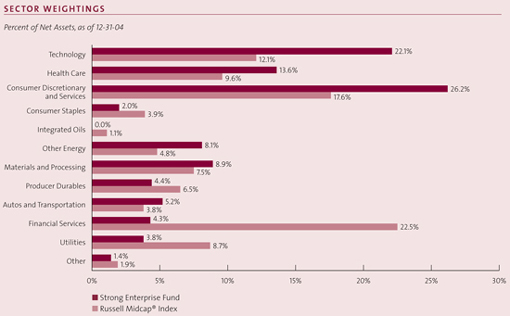

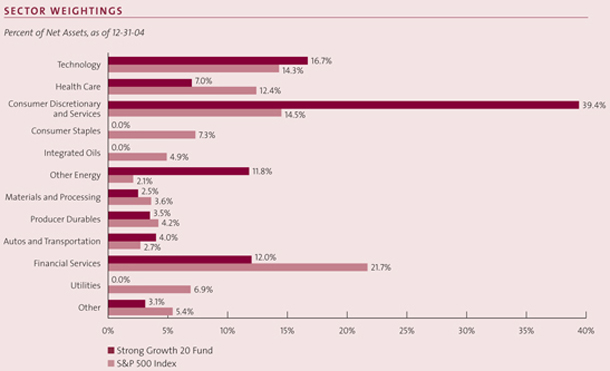

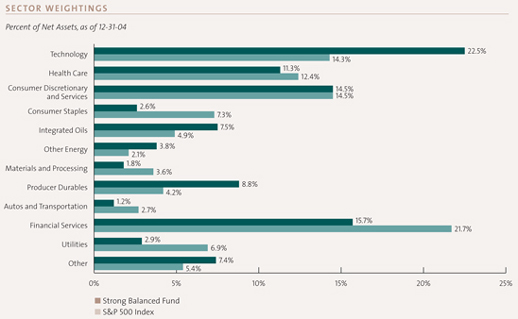

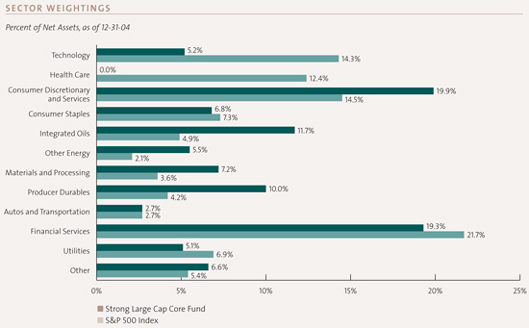

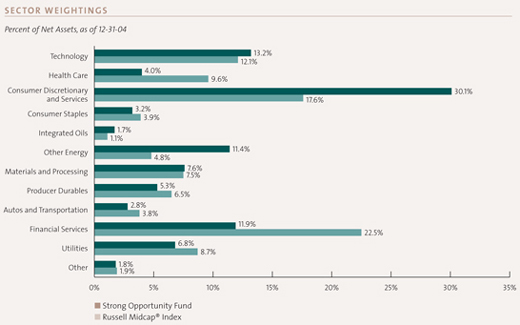

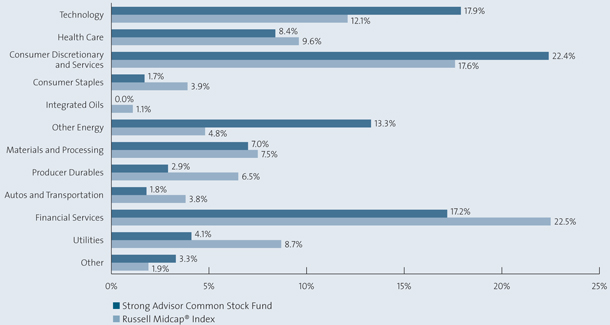

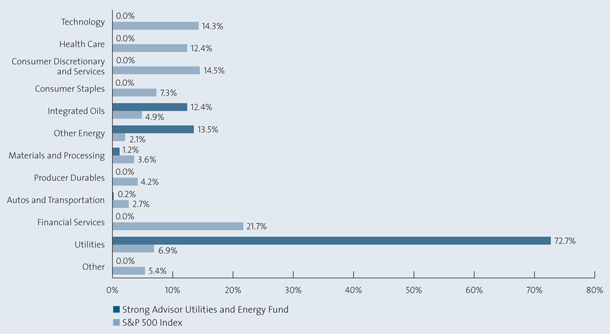

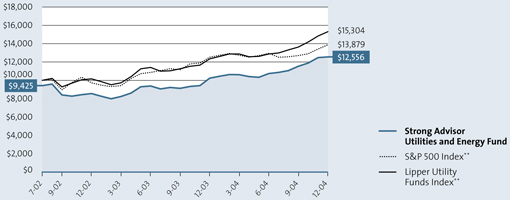

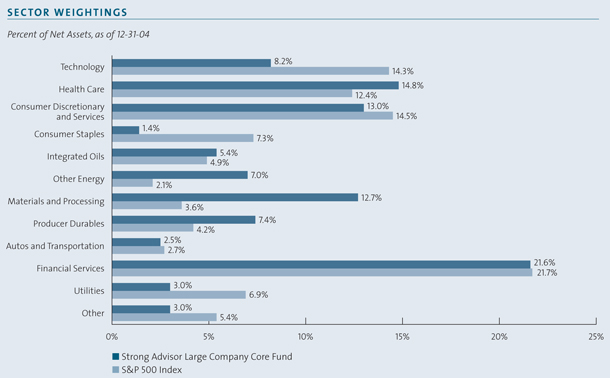

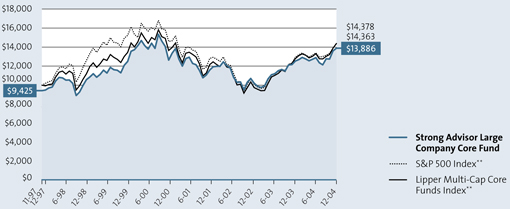

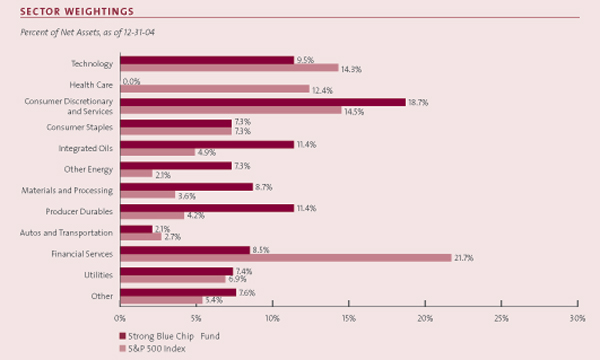

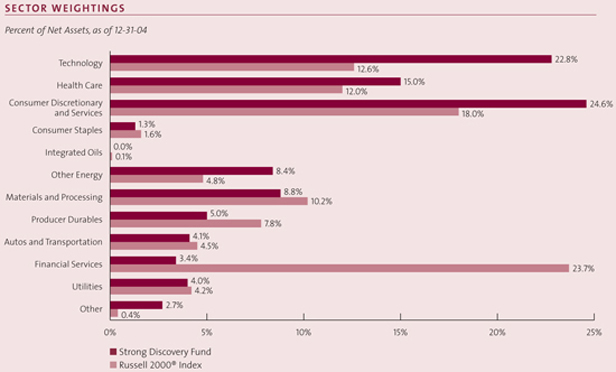

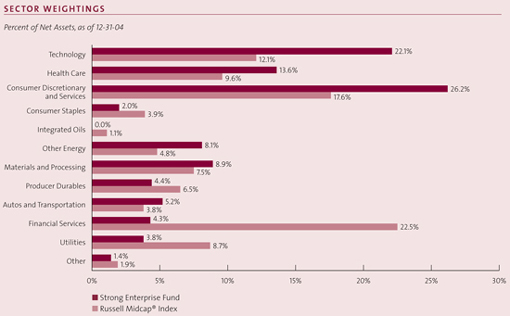

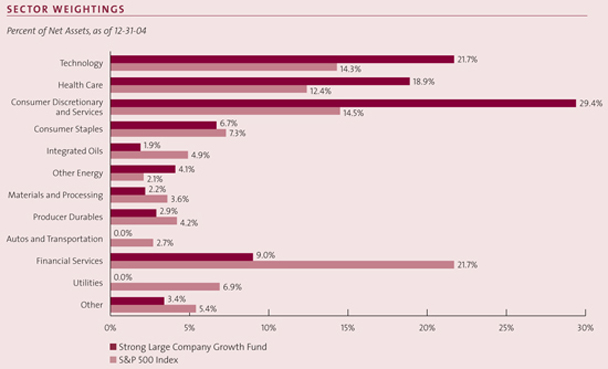

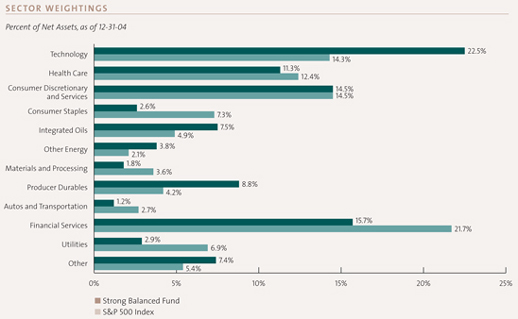

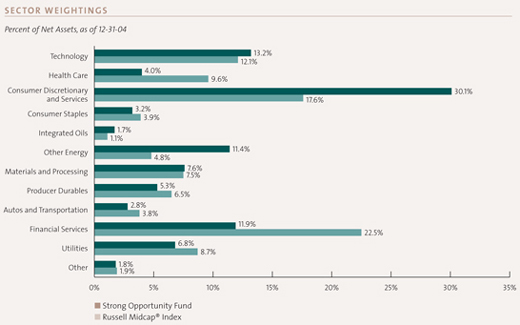

Sector Weightings

Percent of Net Assets, as of 12-31-04

| | |

| Source: Frank Russell Company via FactSet | | |

Fund Highlights are continued on next page.

3

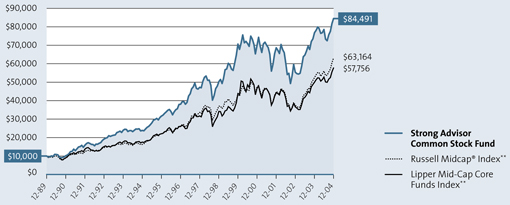

Strong Advisor Common Stock Fund

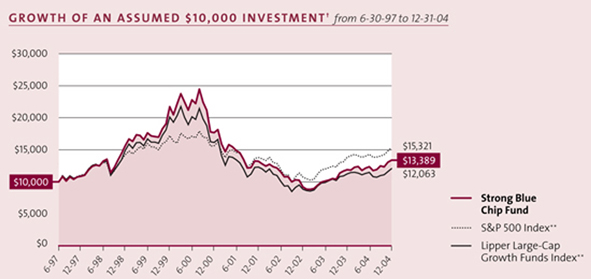

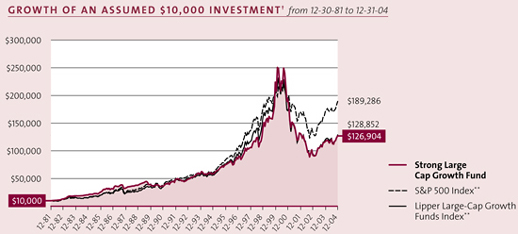

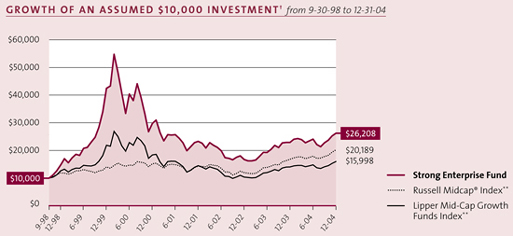

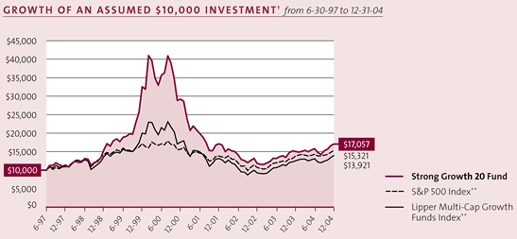

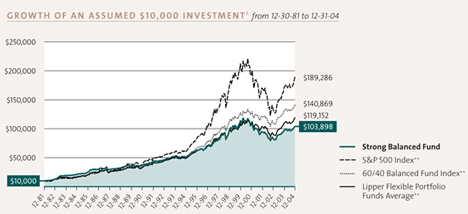

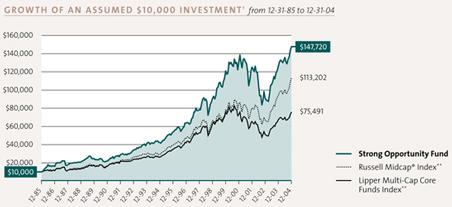

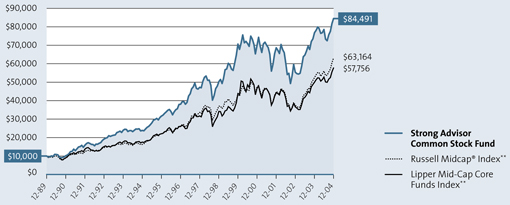

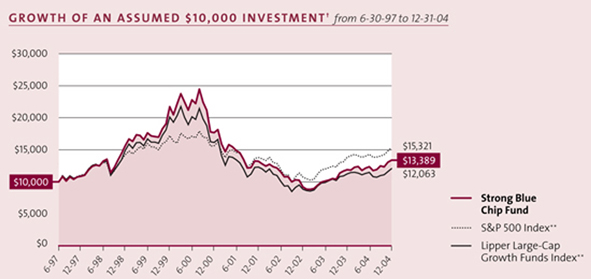

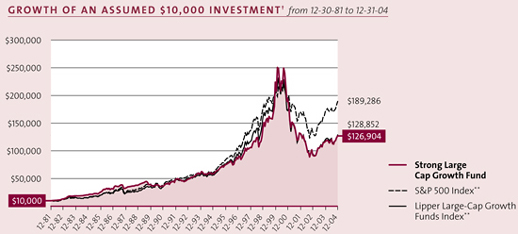

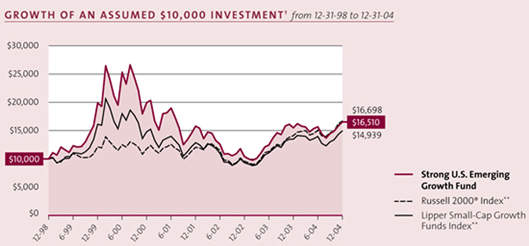

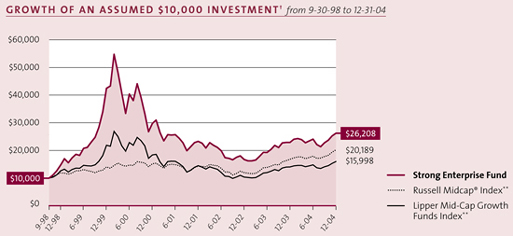

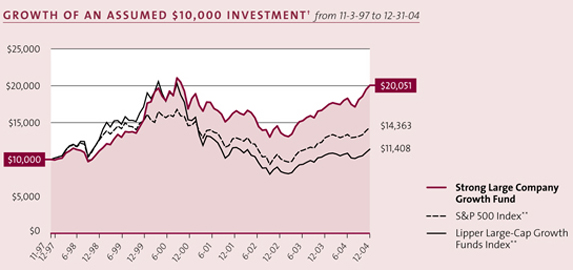

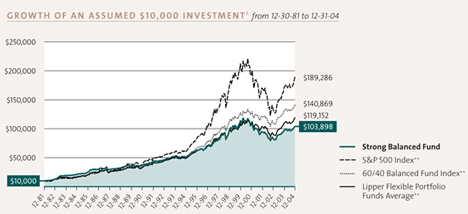

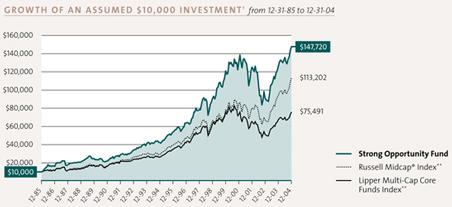

Growth of an Assumed $10,000 Investment†

From 12-29-89 to 12-31-04

Performance is historical and does not guarantee future results. Investment returns and principal value will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most recent month-end performance.

| † | This graph, provided in accordance with SEC regulations, compares a $10,000 investment in the Fund, made at its inception, with the performance of the Russell Midcap® Index and the Lipper Mid-Cap Core Funds Index. Results include the reinvestment of all dividends and capital gains distributions. The graph and the Average Annual Total Returns table do not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. This graph is based on Class Z shares only; performance for other classes will vary due to differences in fee structures. |

Definitions:

| ** | The Russell Midcap® Index measures the performance of the 800 smallest companies in the Russell 1000 Index, which represent approximately 26% of the total market capitalization of the Russell 1000 Index. The Lipper Mid-Cap Core Funds Index is the average of the 30 largest funds in the Lipper Mid-Cap Core Funds Category. Source of the Russell Index data is Standard & Poor’s Micropal. Source of the Lipper Index data is Lipper. |

It is not possible to invest directly in an index.

Top Holdings

Percent of Net Assets, as of 12-31-04

| | | |

Noble Corporation | | 2.5 | % |

Burlington Resources, Inc. | | 2.3 | % |

Cablevision Systems New York Group Class A | | 2.2 | % |

Apache Corporation | | 2.1 | % |

Mentor Graphics Corporation | | 1.8 | % |

Lonza Group AG | | 1.8 | % |

Smith International, Inc. | | 1.8 | % |

Pactiv Corporation | | 1.8 | % |

City National Corporation | | 1.7 | % |

EOG Resources, Inc. | | 1.7 | % |

| | |

|

|

| Top Ten | | 19.7 | % |

| | |

|

|

Holdings vary. More complete holdings are available at www.Strong.com.

Percentage Restrictions: The Fund’s prospectus and statement of additional information may describe restrictions on the percentage of a particular type or quality of security in which the Fund may invest (“Percentage Restrictions”). Percentage Restrictions apply at the time the Fund purchases a security. Circumstances subsequent to the purchase of the security, such as a change in: (1) the Fund’s assets (e.g., due to cash inflows and redemptions), (2) the market value of the security, or (3) the pricing, liquidity, or rating of the security, may cause the Fund to exceed or fall short of the Percentage Restriction. If this happens, the Fund’s continued holding of the security will not constitute a violation of the Percentage Restriction.

4

Average Annual Total Returns

As of 12-31-04

| | | |

Class A1,2

| | | |

1-year | | 3.37 | % |

5-year | | 2.14 | % |

10-year | | 12.44 | % |

Since Fund Inception (12-29-89) | | 14.45 | % |

| | | |

Class A, excluding sales load

| | | |

1-year | | 9.67 | % |

5-year | | 3.36 | % |

10-year | | 13.11 | % |

Since Fund Inception (12-29-89) | | 14.90 | % |

| | | |

Class B1,2

| | | |

1-year | | 3.89 | % |

5-year | | 2.32 | % |

10-year | | 12.66 | % |

Since Fund Inception (12-29-89) | | 14.62 | % |

| | | |

Class C1,2

| | | |

1-year | | 7.84 | % |

5-year | | 2.68 | % |

10-year | | 12.48 | % |

Since Fund Inception (12-29-89) | | 14.30 | % |

| | | |

Class Z1,3

| | | |

1-year | | 9.96 | % |

5-year | | 3.64 | % |

10-year | | 13.47 | % |

Since Fund Inception (12-29-89) | | 15.28 | % |

Performance is historical and does not guarantee future results. Investment returns and principal value will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most recent month-end performance.

Fee Waivers:

| 1 | From time to time, the Fund’s advisor and/or administrator has waived fees and/or absorbed Fund expenses, which has resulted in higher returns. As of 12-31-04, there are waivers and/or absorptions in effect for all share classes. |

Performance:

| 2 | Average annual total returns reflect the effect of the maximum sales charge of 5.75% for Class A, the applicable contingent deferred sales charge of 5.00% in year 1 and eliminated after year 6 for Class B, and the applicable contingent deferred sales charge of 1.00% and eliminated after 12 months for Class C. The performance of the Class A, B, and C shares is based on the performance of the Fund’s Class Z shares (formerly Retail Class shares) prior to 11-30-00. The performance of the Class A shares is restated to reflect the load and the different expenses of the Class A shares, as applicable. The performance of the Class B shares is restated to reflect the contingent deferred sales charge and the different expenses of the Class B shares, as applicable. The performance of the Class C shares is restated to reflect the contingent deferred sales charge and the different expenses of the Class C shares, as applicable. |

Please consult a prospectus for information about all share classes.

From time to time, the Fund’s performance was significantly enhanced through investments in initial public offerings (IPOs). In addition, the effect of IPOs purchased when the Fund’s asset base was small may have been magnified. Given these circumstances, you should not expect that such enhanced returns can be consistently achieved. Please consider this before investing.

General:

| 3 | The Class Z shares are closed to new accounts, though the Fund may continue to offer its shares to certain company-sponsored retirement plans, institutional investors meeting specific eligibility requirements, and other limited groups as described in the prospectus. |

Top Ten Industries

Percent of Net Assets, as of 12-31-04

| | | |

Oil & Gas — United States Exploration & Production | | 6.1 | % |

Media — Cable TV | | 6.1 | % |

Electronics — Semiconductor Manufacturing | | 5.3 | % |

Insurance — Property/Casualty/Title | | 4.1 | % |

Oil & Gas — Drilling | | 4.0 | % |

Medical/Dental — Services | | 2.7 | % |

Retail — Department Stores | | 2.6 | % |

Computer — IT Services | | 2.4 | % |

Medical — Biomedical/Biotechnology | | 2.4 | % |

Medical — Products | | 2.4 | % |

| | |

|

|

| Top Ten | | 38.1 | % |

| | |

|

|

Risks: Stock funds should only be considered for long-term goals as values fluctuate in response to the activities of individual companies and general market and economic conditions. Investment strategies that concentrate in particular market segments or fewer securities tend to increase the total risk of an investment (relative to the broader market). This Fund is exposed to the following specific risks: growth-style investing risk and small- and medium-company risk. Consult the Fund’s prospectus for additional information on these and other risks.

5

Strong Advisor Mid Cap Growth Fund

Recording its second consecutive year of positive double-digit returns, the Strong Advisor Mid Cap Growth Fund Class Z shares recorded a gain of 18.41% during 2004. Though the fund performed well, it fell short of the 20.22% return registered by the broad-based Russell Midcap Index.

During 2004, mid-cap value stocks outperformed mid-cap growth stocks by a wide margin, continuing a pattern we have seen for four of the last five years. This worked against our ability to beat the Russell Midcap Index, which includes both growth and value stocks. Other sources of weakness compared with the benchmark included Fund holdings in generic drug, homebuilding, and biotechnology stocks.

Positive contributors to the Fund’s performance came most noticeably from the consumer discretionary sector, including names such as Starbucks, Harman International, and Station Casinos. Energy was another area of strength for the Fund, led by outstanding performance from Ultra Petroleum, a fast-growing exploration and production company. Other standout positive contributors were Puerto Rican bank, Doral Financial, and technology leaders Apple Computer and Marvell Technology.

Capitalizing on strong, sustainable growth

We believe earnings and revenue growth are critical factors in determining stock price movements. Thus, our research process is centered around finding companies with the prospects for robust and sustainable growth in earnings and revenue. To find that growth, we use thorough, hands-on research, emphasizing the potential profitability of a company’s business model and management’s track record in successfully executing its strategy. We then combine that company-specific analysis with our assessment of macroeconomic, secular, and technical trends to form a decision about whether to invest in a particular stock.

For example, several months ago, we purchased shares of Ultra Petroleum because we believed it had tremendous potential profitability — extremely high production growth combined with the industry’s lowest cost structure. Our conclusion was that Ultra Petroleum’s high production growth rate was likely to continue for several more years, driven by the strength of its drilling prospects and management’s solid track record. Finally, an investment in Ultra Petroleum made sense given the team’s positive overall outlook for crude oil and natural gas prices. Ultra Petroleum was up 95% in 2004 and was one of the Fund’s largest holdings as of December 31, 2004.

Morningstar® Style Box™*

The importance of effective selling criteria

Deciding when to sell a stock is just as important as deciding when to buy. Our selling criteria are essentially the opposite of our buying criteria. We may sell a stock when we see a deterioration in its fundamental qualities that causes us to become suspicious about the company’s prospective growth profile or the potential profitability of its business model. Examples of events that can trigger this suspicion are questionable earnings reports, new competitive threats, changes in the economy, or changes in management personnel.

In July of 2004, following its latest quarterly earnings report, we began selling shares of eResearch Technology, which provides software and consulting services to help companies streamline the Food and Drug Administration approval process. For the first time in several quarters, eResearch failed to post earnings that were higher than analysts’ estimates. Also, the growth in backlog of orders, a leading indicator of future growth, slowed dramatically. Our instincts to get more cautious proved accurate. In the following weeks and months, eResearch management guided analysts’ forecasts lower for the remainder of 2004 and for 2005. After falling as low as $10.70 in October, the stock finished the year at $15.85, down sharply from our initial sales in the mid $20s.

Looking ahead

As we begin 2005, our outlook for the next several months remains positive, as we expect the economy to benefit from continued low interest rates and inflation. This environment should allow for solid growth in corporate profits, which is typically beneficial to stock prices. We plan to continue to seek out the fastest-growing companies we can identify that we believe fit within the framework of our investment process.

Effective February 18, 2005, Jerome “Cam” Philpott, CFA, and Stuart Roberts of Wells Capital Management Incorporated will become the Portfolio Co-Managers of the Fund. In addition, the Fund is expected to reorganize into the Wells Fargo Advantage Mid Cap Growth Fund on or about April 11, 2005.

It has been my pleasure being the Fund’s Portfolio Manager over the last year and a half. Thank you for your investment in the Strong Advisor Mid Cap Growth Fund.

Brandon Nelson

Portfolio Manager

| * | The Morningstar Style Box™ reflects a fund’s investment strategy. For equity funds, the vertical axis shows the market capitalization of the stocks owned and the horizontal axis shows investment style (value, blend, or growth). |

Mention of specific securities in this report is not indicative of whether the Fund may make additional purchases of, sell all or a portion of, or continue to hold those securities.

6

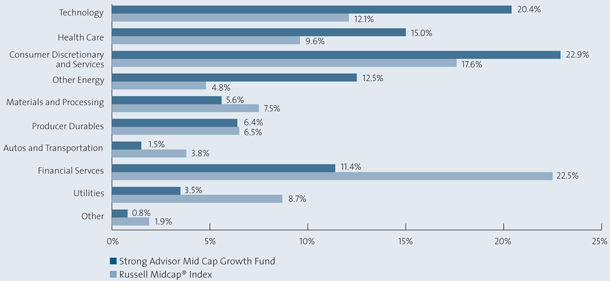

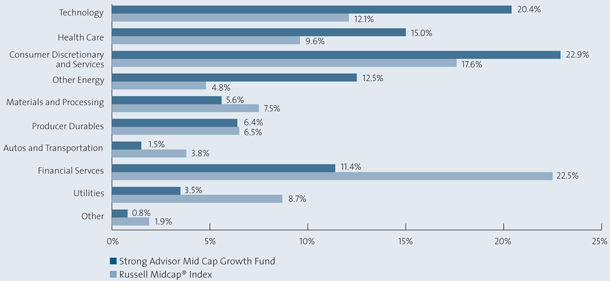

Fund Highlights

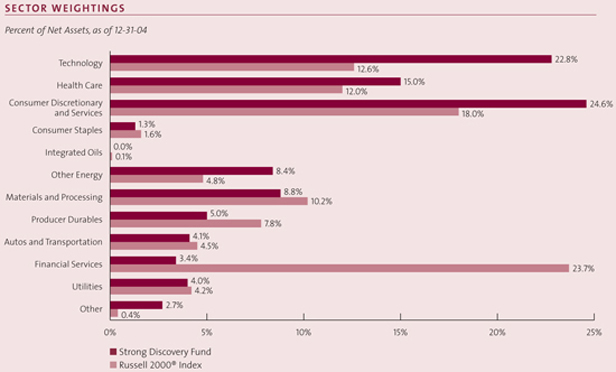

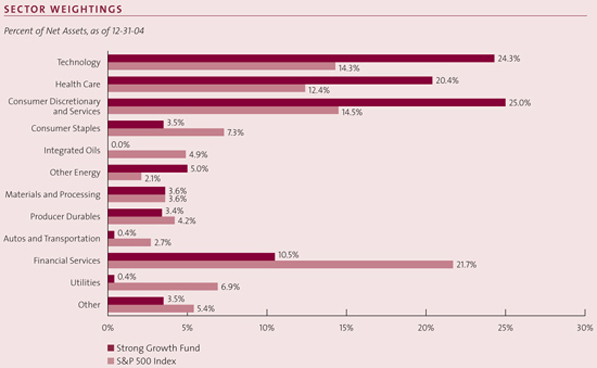

Sector Weightings

Percent of Net Assets, as of 12-31-04

Source: Frank Russell Company via FactSet

Fund Highlights are continued on next page.

7

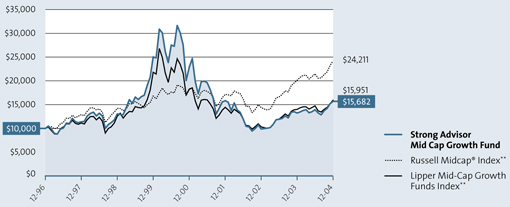

Strong Advisor Mid Cap Growth Fund

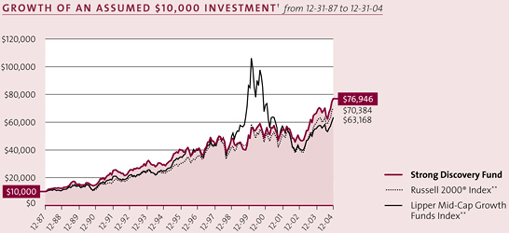

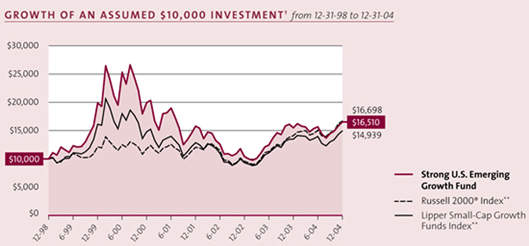

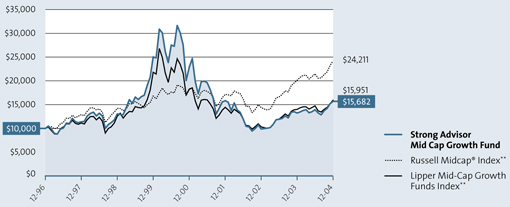

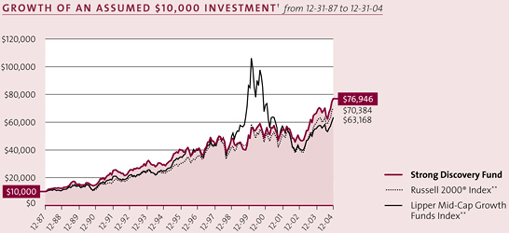

Growth of an Assumed $10,000 Investment†

From 12-31-96 to 12-31-04

Performance is historical and does not guarantee future results. Investment returns and principal value will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most recent month-end performance.

| † | This graph, provided in accordance with SEC regulations, compares a $10,000 investment in the Fund, made at its inception, with the performance of the Russell Midcap® Index and the Lipper Mid-Cap Growth Funds Index. Results include the reinvestment of all dividends and capital gains distributions. The graph and the Average Annual Total Returns table do not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. This graph is based on Class Z shares only; performance for other classes will vary due to differences in fee structures. |

Definitions:

| ** | The Russell Midcap® Index measures the performance of the 800 smallest companies in the Russell 1000 Index, which represent approximately 26% of the total market capitalization of the Russell 1000 Index. The Lipper Mid-Cap Growth Funds Index is the average of the 30 largest funds in the Lipper Mid-Cap Growth Funds Category. Source of the Russell Index data is Standard & Poor’s Micropal. Source of the Lipper Index data is Lipper. |

It is not possible to invest directly in an index.

Top Holdings

Percent of Net Assets, as of 12-31-04

| | | |

Ultra Petroleum Corporation | | 3.6 | % |

Doral Financial Corporation | | 3.3 | % |

Starbucks Corporation | | 3.1 | % |

Apple Computer, Inc. | | 2.8 | % |

Marvell Technology Group, Ltd. | | 2.7 | % |

Station Casinos, Inc. | | 2.5 | % |

Cognizant Technology Solutions Corporation Class A | | 2.4 | % |

Sierra Health Services, Inc. | | 2.4 | % |

Marriott International, Inc. Class A | | 2.1 | % |

Alliance Data Systems Corporation | | 2.0 | % |

| | |

|

|

| Top Ten | | 26.9 | % |

| | |

|

|

Holdings vary. More complete holdings are available at www.Strong.com.

Percentage Restrictions: The Fund’s prospectus and statement of additional information may describe restrictions on the percentage of a particular type or quality of security in which the Fund may invest (“Percentage Restrictions”). Percentage Restrictions apply at the time the Fund purchases a security. Circumstances subsequent to the purchase of the security, such as a change in: (1) the Fund’s assets (e.g., due to cash inflows and redemptions), (2) the market value of the security, or (3) the pricing, liquidity, or rating of the security, may cause the Fund to exceed or fall short of the Percentage Restriction. If this happens, the Fund’s continued holding of the security will not constitute a violation of the Percentage Restriction.

8

Average Annual Total Returns

As of 12-31-04

| | | |

Class A1,2

| | | |

1-year | | 11.58 | % |

5-year | | -10.00 | % |

Since Fund Inception (12-31-96) | | 4.87 | % |

| | | |

Class A, excluding sales load

| | | |

1-year | | 18.43 | % |

5-year | | -8.93 | % |

Since Fund Inception (12-31-96) | | 5.65 | % |

| | | |

Class B1,2

| | | |

1-year | | 12.71 | % |

5-year | | -10.12 | % |

Since Fund Inception (12-31-96) | | 5.07 | % |

| | | |

Class C1,2

| | | |

1-year | | 16.71 | % |

5-year | | -9.51 | % |

Since Fund Inception (12-31-96) | | 5.07 | % |

| | | |

Class Z1,3

| | | |

1-year | | 18.41 | % |

5-year | | -8.93 | % |

Since Fund Inception (12-31-96) | | 5.79 | % |

Performance is historical and does not guarantee future results. Investment returns and principal value will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most recent month-end performance.

Fee Waivers:

| 1 | From time to time, the Fund’s advisor and/or administrator has waived fees and/or absorbed Fund expenses, which has resulted in higher returns. As of 12-31-04, there are waivers and/or absorptions in effect for all share classes. |

Performance:

| 2 | Average annual total returns reflect the effect of the maximum sales charge of 5.75% for Class A, the applicable contingent deferred sales charge of 5.00% in year 1 and eliminated after year 6 for Class B, and the applicable contingent deferred sales charge of 1.00% and eliminated after 12 months for Class C. The performance of the Class A, B, and C shares is based on the performance of the Fund’s Class Z shares (formerly Retail Class shares) prior to 11-30-00. The performance of the Class A shares is restated to reflect the load and the different expenses of the Class A shares, as applicable. The performance of the Class B shares is restated to reflect the contingent deferred sales charge and the different expenses of the Class B shares, as applicable. The performance of the Class C shares is restated to reflect the contingent deferred sales charge and the different expenses of the Class C shares, as applicable. |

Please consult a prospectus for information about all share classes.

From time to time, the Fund’s performance was significantly enhanced through investments in initial public offerings (IPOs). In addition, the effect of IPOs purchased when the Fund’s asset base was small may have been magnified. Given these circumstances, you should not expect that such enhanced returns can be consistently achieved. Please consider this before investing.

General:

| 3 | The Class Z shares are closed to new accounts, though the Fund may continue to offer its shares to certain company-sponsored retirement plans, institutional investors meeting specific eligibility requirements, and other limited groups as described in the prospectus. |

Top Ten Industries

Percent of Net Assets, as of 12-31-04

| | | |

Oil & Gas — United States Exploration & Production | | 8.4 | % |

Medical — Health Maintenance Organizations | | 6.8 | % |

Financial Services — Miscellaneous | | 5.6 | % |

Electronics — Semiconductor Manufacturing | | 4.3 | % |

Leisure — Gaming/Equipment | | 3.5 | % |

Leisure — Hotels & Motels | | 3.4 | % |

Computer — IT Services | | 3.3 | % |

Finance — Mortgage & Related Services | | 3.3 | % |

Retail — Restaurants | | 3.1 | % |

Telecommunications — Wireless Services | | 3.1 | % |

| | |

|

|

| Top Ten | | 44.8 | % |

| | |

|

|

Risks: Stock funds should only be considered for long-term goals as values fluctuate in response to the activities of individual companies and general market and economic conditions. Investment strategies that concentrate in particular market segments or fewer securities tend to increase the total risk of an investment (relative to the broader market). This Fund is exposed to the following specific risks: small- and medium-company risk. Consult the Fund’s prospectus for additional information on these and other risks.

9

Strong Advisor Small Cap Value Fund

The U.S. equity markets fluctuated for much of 2004 before turning in a strong rally in the fourth quarter. Despite rising interest rates, investors were cheered in part by an incumbent winning the U.S. presidential race and crude oil prices easing from their all-time highs. For the 12 months ending December 31, 2004, the Strong Advisor Small Cap Value Fund’s Class Z shares returned 20.09% versus the 18.33% return of its benchmark, the Russell 2000 Index.

Small-capitalization value stocks outperformed their large-and mid-cap counterparts during the period. In fact, small-cap value was one of the top-performing asset classes in 2004. What’s more, the Russell 2000 Index, which includes both value and growth stocks from the small-cap sector, reached record highs during the year and has outperformed the S&P 500 Index, which is dominated by large-cap stocks, for six years in a row.

The small-cap value asset class contains many stocks that are underfollowed, undervalued, and underloved. Our team employs a qualitative and quantitative screening process, followed by fundamental research, which allows only companies that meet our high standards to become holdings in the Fund.

Industrials, materials, and energy aided performance

The industrials and materials sectors added value to the Fund. Within industrials, stocks in construction and engineering, along with commercial services and supplies, performed well and were among the top contributors for the period. Meanwhile, chemical names aided performance in the materials sector. PolyOne Corporation, a specialty polymer manufacturer, was a strong performer from sales of its resin products. On the other hand, despite a solid rally in metals and mining stocks in the third quarter, the Fund experienced a pullback in many of these names during the fourth quarter. However, we continued to have conviction in these stocks, as we believed they could add significant value to the Fund over the long term.

The energy sector — in which the Fund remained overweighted compared to the benchmark during the period — also contributed to performance. Several energy equipment and services names, as well as oil and gas securities, were top contributors to performance. Range Resources was a top performer for the energy sector as the oil services and natural gas firm reported higher than expected natural gas reserves. Range Resources is an independent oil and gas company operating in the Southwest, Gulf Coast and Appalachian regions of the United States. In addition, Global Industries, an offshore oil pipeline services firm, was a strong contributor. Global has the largest fleet of service vessels available in the Gulf of Mexico. Many of our energy holdings have been long-term positions for the Fund. While some of these stocks lost ground near the end of the year as energy prices retreated from their October highs, we believed the valuations of the Fund’s energy holdings remained attractive. Investors’ concerns about energy supplies, coupled with international political unrest and high global demand, led us to maintain a positive outlook for this sector throughout 2004.

Morningstar® Style Box™ *

Late in the year, the Fund’s consumer discretionary stocks began moving up, with commercial services and retailers leading performance. The Fund owned well known, yet underfollowed, stocks such as American Eagle Outfitters, Stamps.com, and Circuit City Stores, all of which contributed to performance.

Technology and financials disappointed

The technology sector slightly detracted from the Fund’s performance for the year. Some technology names rebounded near year end after a difficult third quarter. Software and computer stocks, in particular, produced solid returns and helped performance compared with the benchmark. However, some semiconductor stocks were hit hard at the end of the fourth quarter, namely Cirrus Logic, a multimedia chipmaker for the consumer entertainment industry (DVDs, televisions, digital home theater systems), as well as solutions for automotive and industrial applications. We believed that many technology holdings became overvalued during the year, and therefore we were selective in this area, as we have been for several years.

The Fund also underperformed the benchmark in the financials sector. We remained cautious about this area, especially the banking industry, in which the Fund was significantly underweighted compared to the benchmark. Given the rising interest-rate environment, we believed traditional banks might experience downward pressure on their profit margins. We continued to look for companies with the ability to increase revenue growth while possessing underlying fundamentals that met our stringent criteria. Select names within the insurance industry illustrated this point. Versus the benchmark, the Fund maintains a lower concentration of real estate securities, specifically REITs. Due to this underweighting, the Fund underperformed in this area for the year.

Looking ahead

Despite significant outperformance by the small-cap value asset class during the past six years, we believe many opportunities still exist. While valuations in some groups such as technology and financials appear overextended, we remain alert for pullbacks that could present opportunities for adding to positions in which we have conviction. Meanwhile, our outlook on energy remains constructive, and we continue to maintain larger investments in the sector based on our belief that certain industries in it offer the potential for strong and sustainable earnings growth.

The Fund is expected to reorganize into the Wells Fargo Advantage Small Cap Value Fund, the successor to the Strong Advisor Small Cap Value Fund, on or about April 11, 2005.

Thank you for your investment in the Strong Advisor Small Cap Value Fund.

I. Charles Rinaldi

Portfolio Manager

| * | The Morningstar Style Box™ reflects a fund’s investment strategy. For equity funds, the vertical axis shows the market capitalization of the stocks owned and the horizontal axis shows investment style (value, blend, or growth). |

Mention of specific securities in this report is not indicative of whether the Fund may make additional purchases of, sell all or a portion of, or continue to hold those securities.

10

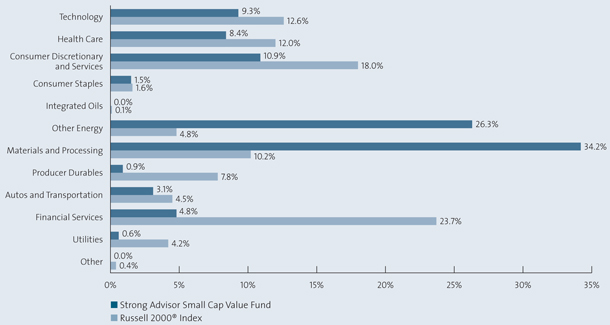

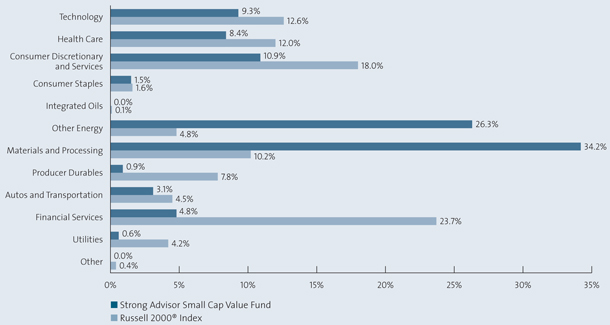

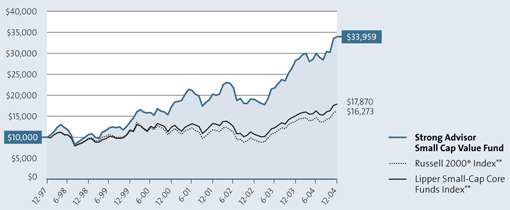

Fund Highlights

Sector Weightings

Percent of Net Assets, as of 12-31-04

| | |

| Source: Frank Russell Company via FactSet | | |

| |

| | | Fund Highlights are continued on next page. |

11

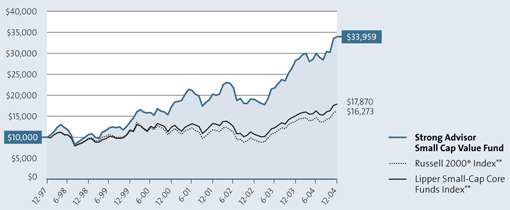

Strong Advisor Small Cap Value Fund

Growth of an Assumed $10,000 Investment†

From 12-31-97 to 12-31-04

Performance is historical and does not guarantee future results. Investment returns and principal value will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most recent month-end performance.

| † | This graph, provided in accordance with SEC regulations, compares a $10,000 investment in the Fund, made at its inception, with the performance of the Russell 2000® Index and the Lipper Small-Cap Core Funds Index. Results include the reinvestment of all dividends and capital gains distributions. The graph and the Average Annual Total Returns table do not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. This graph is based on Class Z shares only; performance for other classes will vary due to differences in fee structures. |

Definitions:

| ** | The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index. The Lipper Small-Cap Core Funds Index is the average of the 30 largest funds in the Lipper Small-Cap Core Funds Category. Source of the Russell Index data is Standard & Poor’s Micropal. Source of the Lipper Index data is Lipper. |

It is not possible to invest directly in an index.

Top Holdings

Percent of Net Assets, as of 12-31-04

| | | |

Range Resources Corporation | | 4.2 | % |

Chicago Bridge & Iron Company NV | | 3.0 | % |

Forest Oil Corporation | | 2.7 | % |

Glamis Gold, Ltd. | | 2.6 | % |

Global Industries, Ltd. | | 2.2 | % |

United States Steel Corporation | | 2.0 | % |

Apex Silver Mines, Ltd. | | 1.9 | % |

UNOVA, Inc. | | 1.8 | % |

Steel Dynamics, Inc. | | 1.6 | % |

Beverly Enterprises, Inc. | | 1.6 | % |

| | |

|

|

| Top Ten | | 23.6 | % |

| | |

|

|

Holdings vary. More complete holdings are available at www.Strong.com.

Percentage Restrictions: The Fund’s prospectus and statement of additional information may describe restrictions on the percentage of a particular type or quality of security in which the Fund may invest (“Percentage Restrictions”). Percentage Restrictions apply at the time the Fund purchases a security. Circumstances subsequent to the purchase of the security, such as a change in: (1) the Fund’s assets (e.g., due to cash inflows and redemptions), (2) the market value of the security, or (3) the pricing, liquidity, or rating of the security, may cause the Fund to exceed or fall short of the Percentage Restriction. If this happens, the Fund’s continued holding of the security will not constitute a violation of the Percentage Restriction.

12

Average Annual Total Returns

As of 12-31-04

| | | |

Class A1,2

| | | |

1-year | | 13.00 | % |

5-year | | 18.47 | % |

Since Fund Inception (12-31-97) | | 17.83 | % |

| | | |

Class A, excluding sales load

| | | |

1-year | | 19.89 | % |

5-year | | 19.88 | % |

Since Fund Inception (12-31-97) | | 18.83 | % |

| | | |

Class B1,2

| | | |

1-year | | 13.95 | % |

5-year | | 18.88 | % |

Since Fund Inception (12-31-97) | | 18.83 | % |

| | | |

Class C1,2

| | | |

1-year | | 18.00 | % |

5-year | | 19.13 | % |

Since Fund Inception (12-31-97) | | 18.15 | % |

| | | |

Class Z1,3

| | | |

1-year | | 20.09 | % |

5-year | | 20.10 | % |

Since Fund Inception (12-31-97) | | 19.08 | % |

Performance is historical and does not guarantee future results. Investment returns and principal value will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most recent month-end performance.

Fee Waivers:

| 1 | From time to time, the Fund’s advisor and/or administrator has waived fees and/or absorbed Fund expenses, which has resulted in higher returns. As of 12-31-04, there are waivers and/or absorptions in effect for all share classes. |

Performance:

| 2 | Average annual total returns reflect the effect of the maximum sales charge of 5.75% for Class A, the applicable contingent deferred sales charge of 5.00% in year 1 and eliminated after year 6 for Class B, and the applicable contingent deferred sales charge of 1.00% and eliminated after 12 months for Class C. The performance of the Class A, B, and C shares is based on the performance of the Fund’s Class Z shares (formerly Retail Class shares) prior to 11-30-00. The performance of the Class A shares is restated to reflect the load and the different expenses of the Class A shares, as applicable. The performance of the Class B shares is restated to reflect the contingent deferred sales charge and the different expenses of the Class B shares, as applicable. The performance of the Class C shares is restated to reflect the contingent deferred sales charge and the different expenses of the Class C shares, as applicable. |

Please consult a prospectus for information about all share classes.

From time to time, the Fund’s performance was significantly enhanced through investments in initial public offerings (IPOs). In addition, the effect of IPOs purchased when the Fund’s asset base was small may have been magnified. Given these circumstances, you should not expect that such enhanced returns can be consistently achieved. Please consider this before investing.

General:

| 3 | The Class Z shares are closed to new accounts, though the Fund may continue to offer its shares to certain company-sponsored retirement plans, institutional investors meeting specific eligibility requirements, and other limited groups as described in the prospectus. |

Top Ten Industries

Percent of Net Assets, as of 12-31-04

| | | |

Oil & Gas — United States Exploration & Production | | 12.2 | % |

Oil & Gas — Field Services | | 8.9 | % |

Metal Ores — Gold/Silver | | 8.8 | % |

Steel — Producers | | 5.6 | % |

Oil & Gas — Drilling | | 3.7 | % |

Building — Heavy Construction | | 3.0 | % |

Insurance — Property/Casualty/Title | | 2.8 | % |

Commercial Services — Security/Safety | | 2.7 | % |

Commercial Services — Staffing | | 2.4 | % |

Medical — Nursing Homes | | 2.4 | % |

| | |

|

|

| Top Ten | | 52.5 | % |

| | |

|

|

Risks: Stock funds should only be considered for long-term goals as values fluctuate in response to the activities of individual companies and general market and economic conditions. Investment strategies that concentrate in particular market segments or fewer securities tend to increase the total risk of an investment (relative to the broader market). This Fund is exposed to the following specific risks: value-style investing risk and small-company risk. Consult the Fund’s prospectus for additional information on these and other risks.

13

Strong Advisor U.S. Value Fund

The Strong Advisor U.S. Value Fund outperformed its broad-based index, the S&P 500 Index for the year ended December 31, 2004. The Fund’s Class Z shares returned 14.11%, while the S&P 500 Index returned 10.87%.

The first half of 2004 delivered high-energy prices, robust economic data, and solid corporate profits. However, the third quarter was sluggish due to fears that the economy had hit a soft spot. Employment numbers, which were weak in the early stages of the third quarter, turned positive in the final month, which encouraged investors. After the presidential elections in November, we observed a powerful rally in share prices, a resurgence of positive economic data, and a decline in energy prices. The persistence of these positive indicators supported a consensus that a market rally could be sustainable, amid growing concerns over a weaker U.S. dollar, rising interest rates, and a prolonged rebuilding effort in Iraq.

Finding “the right company at the right price”

Our disciplined investment process focuses on finding the right company at the right price at the right time. We spend virtually all of our time and effort on bottom-up, fundamental stock research. Individual stock selection, not sector allocation, drives the Fund’s performance. During the period, stock selection was particularly strong in financials, utilities, and information technology. The strength of stocks this year, particularly in the fourth quarter, was driven by the optimism of not only shareholders but also corporate managers. Merger-and-acquisition activity heated up significantly, and the Fund owned a number of stocks involved in this trend. Bank One, Charter One Financial, Cox Communications, Provident Financial Group, Public Service Enterprise Group, and SOLA International all received takeover bids, directly benefiting our performance.

The Fund’s sector weightings are the direct result of our individual company selections, rather than top-down, macroeconomic considerations. That said, the portfolio benefited this year from having a significant presence in energy, industrial, and utility sectors. As the year progressed, we shifted some energy exposure from exploration and production (E&P) to oil services — for example, Cooper Cameron — amid the euphoric sentiment created by industry consolidation in the E&P group. Moreover, as industrials moved to all-time highs during the year, we moved to an underweighting, compared to the benchmark, in this sector. Within utilities, where we also took profits but remained largely invested throughout the year, electric utility holdings such as First Energy and TXU were standout performers.

Morningstar® Style Box™ *

Investments in insurance

Our stance on financial stocks, which was to sell bank stocks into strength and to buy insurance stocks into weakness, has been relatively unchanged for several years and served us well during 2004. Financials have been consistent market performers over this period, never falling out of favor. In fact, financials delivered record earnings and traded at record high prices. One of the primary reasons that value indices have performed so much better than growth indices over the last five years has been the strength in financials. Overall, we significantly reduced financials into 2004’s strength. Within financials, we continued to overweight insurance compared to the benchmark, with names like Loews and SAFECO aiding performance.

The Fund benefited from having fewer investments in the very weak technology sector. Despite the sector’s weakness, we were able to take advantage of some specific opportunities and were rewarded for this selectivity through the performance of software giant Microsoft and semiconductor maker Texas Instruments.

Our consumer discretionary stocks proved to be drags on performance. Lack of exposure to faster-growing industries such as Internet and catalog retailing detracted from performance. We continued to believe our larger holdings in this sector, Clear Channel Communications and Reader’s Digest Association, represented exceptional value and added to both during the year.

As in 2003, the year saw considerable weakness in the U.S. dollar, a condition that is typically more beneficial for larger companies, as they are more likely to be exporters and can therefore benefit from stronger currencies abroad. Despite this, small caps outperformed again in 2004. After six years of underperformance, we believe it is reasonable for investors in large-cap stocks to expect them to play “catch-up” in 2005 and beyond.

Focusing on out-of-favor stocks

We will continue to keep our heads down and our eyes open, seeking out companies with solid assets, manageable debt levels, and credible management teams. We will work to buy the stocks of these companies at attractive prices — which often come when they are temporarily out of favor with investors. Discipline and patience, along with a strong focus on risk management, continue to be hallmarks of our management style.

The Fund is expected to reorganize into the Wells Fargo Advantage U.S. Value Fund, the successor to the Strong Advisor U.S. Value Fund, on or about April 11, 2005.

Thank you for your investment in the Strong Advisor U.S. Value Fund.

Robert J. Costomiris

Portfolio Manager

| * | The Morningstar Style Box™ reflects a fund’s investment strategy. For equity funds, the vertical axis shows the market capitalization of the stocks owned and the horizontal axis shows investment style (value, blend, or growth). |

Mention of specific securities in this report is not indicative of whether the Fund may make additional purchases of, sell all or a portion of, or continue to hold those securities.

14

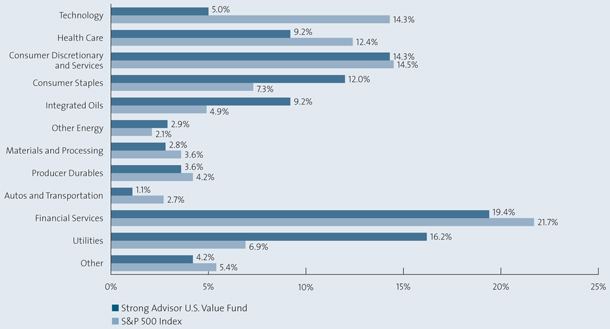

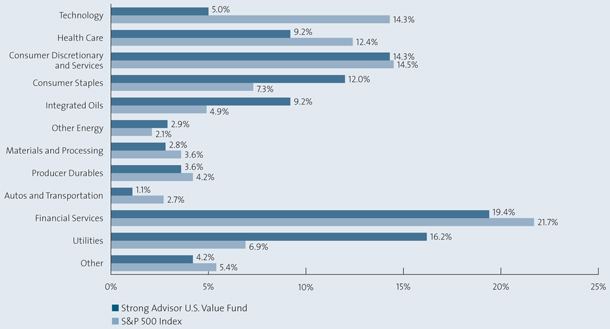

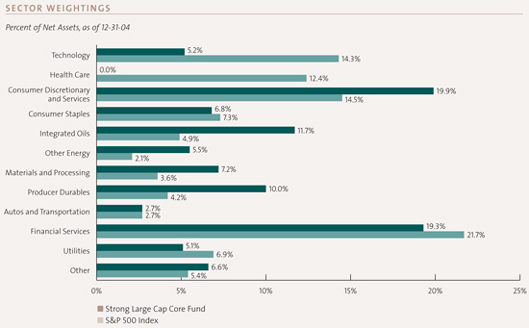

Fund Highlights

Sector Weightings

Percent of Net Assets, as of 12-31-04

| | |

| Source: Frank Russell Company via FactSet | | |

| |

| | | Fund Highlights are continued on next page. |

15

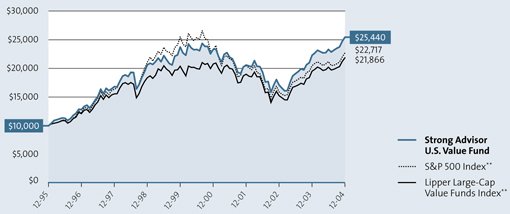

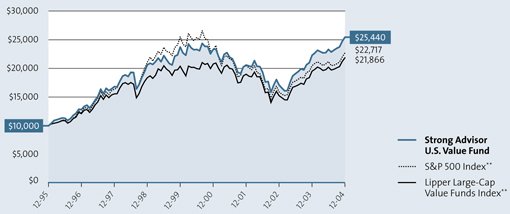

Strong Advisor U.S. Value Fund

Growth of an Assumed $10,000 Investment†

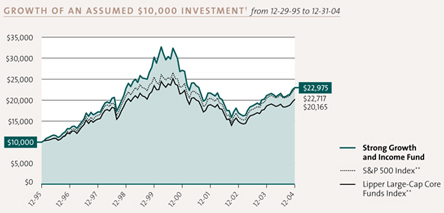

From 12-29-95 to 12-31-04

Performance is historical and does not guarantee future results. Investment returns and principal value will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most recent month-end performance.

| † | This graph, provided in accordance with SEC regulations, compares a $10,000 investment in the Fund, made at its inception, with the performance of the S&P 500 Index and the Lipper Large-Cap Value Funds Index. Results include the reinvestment of all dividends and capital gains distributions. The graph and the Average Annual Total Returns table do not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. This graph is based on Class Z shares only; performance for other classes will vary due to differences in fee structures. |

Definitions:

| ** | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market value weighted index (stock price times number of shares outstanding), with each stock’s weight in the Index proportionate to its market value. The Lipper Large-Cap Value Funds Index is the average of the 30 largest funds in the Lipper Large-Cap Value Funds Category. Source of the S&P Index data is Standard & Poor’s Micropal. Source of the Lipper Index data is Lipper. |

It is not possible to invest directly in an index.

Top Holdings

Percent of Net Assets, as of 12-31-04

| | | |

Exxon Mobil Corporation | | 5.3 | % |

General Electric Company | | 3.5 | % |

Comcast Corporation Class A | | 3.2 | % |

Bristol-Myers Squibb Company | | 2.6 | % |

ImClone Systems, Inc. | | 2.6 | % |

Del Monte Foods Company | | 2.4 | % |

Kraft Foods, Inc. Class A | | 2.2 | % |

The Kroger Company | | 2.2 | % |

Clear Channel Communications, Inc. | | 2.1 | % |

Cooper Cameron Corporation | | 2.0 | % |

| | |

|

|

| Top Ten | | 28.1 | % |

| | |

|

|

Holdings vary. More complete holdings are available at www.Strong.com.

Percentage Restrictions: The Fund’s prospectus and statement of additional information may describe restrictions on the percentage of a particular type or quality of security in which the Fund may invest (“Percentage Restrictions”). Percentage Restrictions apply at the time the Fund purchases a security. Circumstances subsequent to the purchase of the security, such as a change in: (1) the Fund’s assets (e.g., due to cash inflows and redemptions), (2) the market value of the security, or (3) the pricing, liquidity, or rating of the security, may cause the Fund to exceed or fall short of the Percentage Restriction. If this happens, the Fund’s continued holding of the security will not constitute a violation of the Percentage Restriction.

16

Average Annual Total Returns

As of 12-31-04

| | | |

Class A1,2

| | | |

1-year | | 7.50 | % |

5-year | | 0.18 | % |

Since Fund Inception (12-29-95) | | 10.01 | % |

| | | |

Class A, excluding sales load

| | | |

1-year | | 14.08 | % |

5-year | | 1.38 | % |

Since Fund Inception (12-29-95) | | 10.74 | % |

| | | |

Class B1,2

| | | |

1-year | | 8.20 | % |

5-year | | 0.28 | % |

Since Fund Inception (12-29-95) | | 10.10 | % |

| | | |

Class C1,2

| | | |

1-year | | 12.15 | % |

5-year | | 0.67 | % |

Since Fund Inception (12-29-95) | | 10.00 | % |

| | | |

Class K1,2

| | | |

1-year | | 14.53 | % |

5-year | | 1.81 | % |

Since Fund Inception (12-29-95) | | 11.18 | % |

| | | |

Class Z1,3

| | | |

1-year | | 14.11 | % |

5-year | | 1.40 | % |

Since Fund Inception (12-29-95) | | 10.93 | % |

Performance is historical and does not guarantee future results. Investment returns and principal value will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most recent month-end performance.

Fee Waivers:

| 1 | From time to time, the Fund’s advisor and/or administrator has waived fees and/or absorbed Fund expenses, which has resulted in higher returns. As of 12-31-04, there are waivers and/or absorptions in effect for all share classes. |

Performance:

| 2 | Average annual total returns reflect the effect of the maximum sales charge of 5.75% for Class A, the applicable contingent deferred sales charge of 5.00% in year 1 and eliminated after year 6 for Class B, and the applicable contingent deferred sales charge of 1.00% and eliminated after 12 months for Class C. The performance of the Class A, B, and C shares is based on the performance of the Fund’s Class Z shares (formerly Retail Class shares) prior to 11-30-00. The performance of the Class A shares is restated to reflect the load and the different expenses of the Class A shares, as applicable. The performance of the Class B shares is restated to reflect the contingent deferred sales charge and the different expenses of the Class B shares, as applicable. The performance of the Class C shares is restated to reflect the contingent deferred sales charge and the different expenses of the Class C shares, as applicable. The performance of Class K shares prior to 12-31-01, is based on the Fund’s Class Z shares’ performance. |

Please consult a prospectus for information about all share classes.

General:

| 3 | The Class Z shares are closed to new accounts, though the Fund may continue to offer its shares to certain company-sponsored retirement plans, institutional investors meeting specific eligibility requirements, and other limited groups as described in the prospectus. |

Top Ten Industries

Percent of Net Assets, as of 12-31-04

| | | |

Oil & Gas — International Integrated | | 8.2 | % |

Diversified Operations | | 6.4 | % |

Food — Miscellaneous Preparation | | 6.0 | % |

Medical — Biomedical/Biotechnology | | 5.3 | % |

Utility — Electric Power | | 5.0 | % |

Media — Radio/TV | | 4.6 | % |

Telecommunications — Services | | 4.6 | % |

Banks — Money Center | | 4.4 | % |

Media — Cable TV | | 3.4 | % |

Medical — Ethical Drugs | | 3.2 | % |

| | |

|

|

| Top Ten | | 51.1 | % |

| | |

|

|

Risks: Stock funds should only be considered for long-term goals as values fluctuate in response to the activities of individual companies and general market and economic conditions. Investment strategies that concentrate in particular market segments or fewer securities tend to increase the total risk of an investment (relative to the broader market). This Fund is exposed to value-style investing risk. Consult the Fund’s prospectus for additional information on this and other risks.

17

Strong Advisor Endeavor Large Cap Fund

The U.S. stock market delivered a second consecutive year of gains to investors in 2004. The economy grew in fits and starts, making equity returns volatile, with much of the year’s gain being produced in the fourth quarter. For the year ended December 31, 2004, the Strong Advisor Endeavor Large Cap Fund’s Class A shares returned 8.79% (15.38% when excluding the initial sales charge), compared to its broad-based benchmark, the S&P 500 Index, which advanced 10.87%. The Fund performed well against its benchmark, as it focused on companies with the strongest fundamentals and avoided many of the period’s highly publicized disappointments.

The year tested investors, as gains in the equity market were limited for much of the year by uncertainty about the presidential election, uneven job growth, increasing energy prices, rising short-term interest rates, a declining dollar, and continued turmoil in Iraq. Despite these trends, the economy continued to expand, and many companies experienced healthy profit growth that supported higher stock prices.

Investigative approach to investing

Throughout the year we executed on our intensive research process of “surrounding the company” in order to generate competitive returns for our shareholders. We attempt to delve deeply into each company through financial statement analysis, conversations with management and channel checks of suppliers, customers and competitors. By utilizing this encompassing model, we are often able to identify companies that have the potential to produce a great deal of value relative to the required investment. Moreover, the process tends to provide us with comprehensive knowledge regarding each of the Fund’s holdings.

Equally important is the fact that our team encourages an environment open to dissent. Within this environment, portfolio managers and analysts constantly challenge each individual investment. Every question presented requires the investment to further justify its position within the Fund. This is a well-established and respected practice of all team members that should continue to assist us in assessing the risk and reward of every investment.

Holdings that outperformed

Due to the concerns about oil supply relative to growing demand, companies that produce energy and those that make equipment to recover energy performed well. One of these was Canadian Natural Resources, a premier exploration and production company with substantial potential for production growth from its Horizon oil sands project, located in Alberta, Canada. Horizon is expected to come on line in 2008 and has been estimated to be capable of producing up to six billion barrels of oil over about 40 years. In addition to its Alberta operations, the company has holdings in the North Sea and West Africa.

Morningstar® Style Box™ *

Another top performer for the year was Yahoo!. One of the key drivers for this online media company was an increase in online advertising. During the period, online media represented almost 15% of total media consumption by consumers and continued to gain market share. However, only 3% to 5% of total advertising dollars were spent online. If recent trends persist, this gap could start to close next year. Yahoo!’s competitive advantages are its breadth of offerings to advertisers, its global reach, and its breadth of product offerings on wireline and wireless devices.

Despite solid fundamental results, the Fund’s holding in Teva Pharmaceuticals underperformed in 2004 due to investors’ concern regarding future competition in both the branded and generic pharmaceutical businesses. We believe this negative sentiment will prove misguided and we continue to hold the stock. In 2005, we hope to see confirmation of our positive fundamental outlook for the generic industry, numerous new product launches for Teva, and stable market share trends for Teva’s largest branded product, Copaxone.

Outlook for 2005

As we enter 2005, we are optimistic that the economy will continue to strengthen, driven by accelerating enterprise, capital spending, and a resultant growth in earnings. The market remains constructive, climbing a “wall of worry” reflecting investors’ concerns about the health of the consumer, fading fiscal stimulus, record budget and trade deficits, a falling dollar, and uncertain employment growth.

Companies today have record levels of free cash flow but thus far have been reluctant to invest in large-scale projects. Consequently, we have seen a huge build-up in liquidity, with corporate debt levels at fifty-year lows. Historically rising corporate profits and cash flows have led to accelerating capital investment. For this reason, we believe that most of the capital spending cycle and inventory build-up is yet to come.

In addition, we will pay close attention to the levels of job creation, long-term interest rates and the resulting impact on the U.S. dollar. As always, we will continue to carefully select holdings for the Fund, emphasizing companies possessing unique and strong fundamentals.

The Fund is expected to reorganize into the Wells Fargo Advantage Endeavor Large Cap Fund, the successor to the Strong Advisor Endeavor Large Cap Fund, on or about April 11, 2005.

Thank you for your continued investment in the Strong Advisor Endeavor Large Cap Fund. We appreciate the trust you have placed in us.

Thomas J. Pence

Portfolio Manager

| * | The Morningstar Style Box™ reflects a fund’s investment strategy. For equity funds, the vertical axis shows the market capitalization of the stocks owned and the horizontal axis shows investment style (value, blend, or growth). |

Mention of specific securities in this report is not indicative of whether the Fund may make additional purchases of, sell all or a portion of, or continue to hold those securities.

18

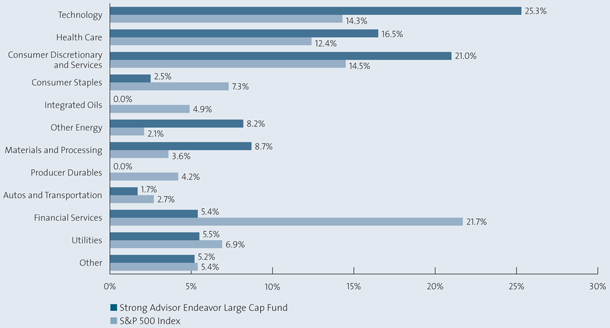

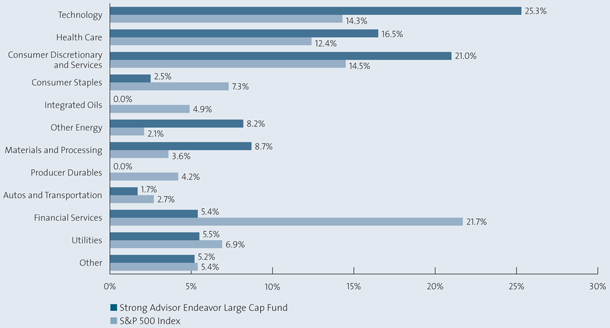

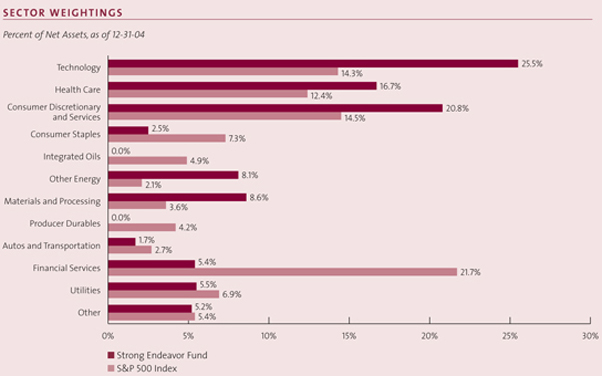

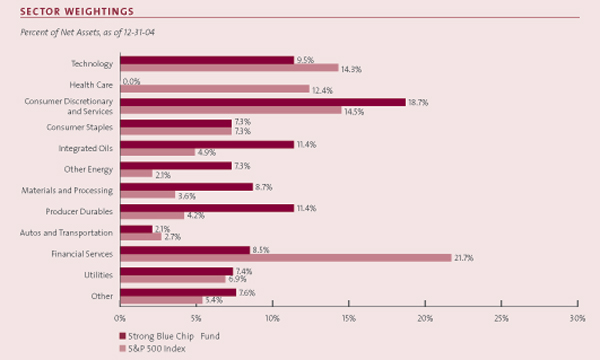

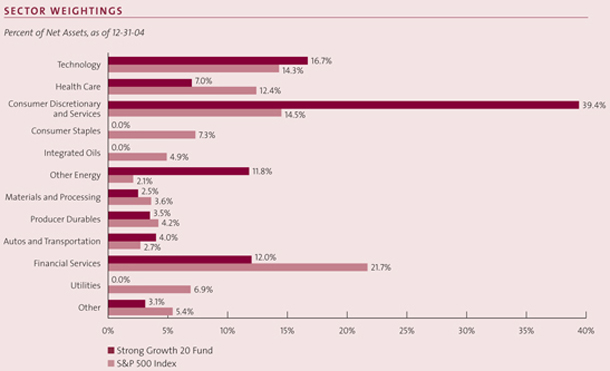

Fund Highlights

Sector Weightings

Percent of Net Assets, as of 12-31-04

Source: Frank Russell Company via FactSet

Fund Highlights are continued on next page.

19

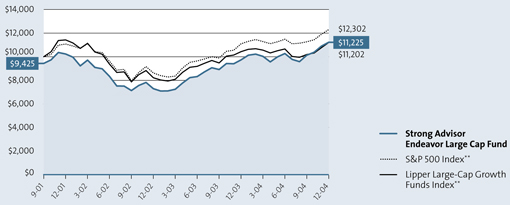

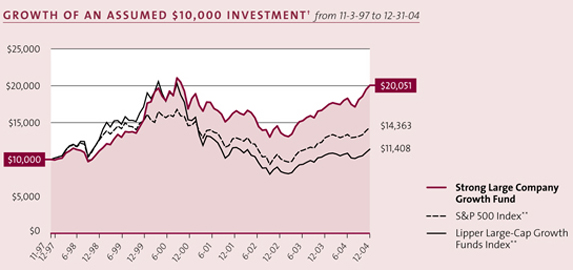

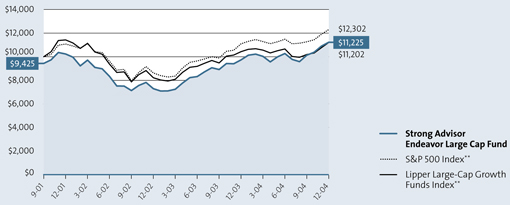

Strong Advisor Endeavor Large Cap Fund

Growth of an Assumed $10,000 Investment†

From 9-28-01 to 12-31-04

Performance is historical and does not guarantee future results. Investment returns and principal value will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most recent month-end performance.

| † | This graph, provided in accordance with SEC regulations, compares a $10,000 investment in the Fund, made at its inception, with the performance of the S&P 500 Index and the Lipper Large-Cap Growth Funds Index. Results include the reinvestment of all dividends and capital gains distributions. The graph and the Average Annual Total Returns table do not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. This graph is based on Class A shares only and reflects the effect of the maximum sales charge of 5.75%; performance for other share classes will vary due to differences in fee structures and sales charges. |

Definitions:

| ** | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market value weighted index (stock price times number of shares outstanding), with each stock’s weight in the Index proportionate to its market value. The Lipper Large-Cap Growth Funds Index is the average of the 30 largest funds in the Lipper Large-Cap Growth Funds Category. Source of the S&P 500 Index data is Standard & Poor’s Micropal. Source of the Lipper Index data is Lipper. |

It is not possible to invest directly in an index.

Top Holdings

Percent of Net Assets, as of 12-31-04

| | | |

Yahoo! Inc. | | 5.1 | % |

Sprint Corporation | | 4.6 | % |

WellPoint, Inc. | | 4.1 | % |

EMC Corporation | | 3.8 | % |

General Electric Company | | 3.7 | % |

Dell, Inc. | | 3.5 | % |

Phelps Dodge Corporation | | 2.9 | % |

Oracle Systems Corporation | | 2.7 | % |

Texas Instruments, Inc. | | 2.6 | % |

Halliburton Company | | 2.6 | % |

| | |

|

|

| Top Ten | | 35.6 | % |

| | |

|

|

Holdings vary. More complete holdings are available at www.Strong.com.

Percentage Restrictions: The Fund’s prospectus and statement of additional information may describe restrictions on the percentage of a particular type or quality of security in which the Fund may invest (“Percentage Restrictions”). Percentage Restrictions apply at the time the Fund purchases a security. Circumstances subsequent to the purchase of the security, such as a change in: (1) the Fund’s assets (e.g., due to cash inflows and redemptions), (2) the market value of the security, or (3) the pricing, liquidity, or rating of the security, may cause the Fund to exceed or fall short of the Percentage Restriction. If this happens, the Fund’s continued holding of the security will not constitute a violation of the Percentage Restriction.

20

Average Annual Total Returns

As of 12-31-04

| | | |

Class A1,2

| | | |

1-year | | 8.79 | % |

3-year | | 1.14 | % |

Since Fund Inception (9-28-01) | | 3.61 | % |

| | | |

Class A, excluding sales load

| | | |

1-year | | 15.38 | % |

3-year | | 3.17 | % |

Since Fund Inception (9-28-01) | | 5.51 | % |

| | | |

Class B1,2

| | | |

1-year | | 9.44 | % |

3-year | | 1.30 | % |

Since Fund Inception (9-28-01) | | 4.06 | % |

| | | |

Class C1,2

| | | |

1-year | | 13.44 | % |

3-year | | 2.58 | % |

Since Fund Inception (9-28-01) | | 4.90 | % |

Performance is historical and does not guarantee future results. Investment returns and principal value will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most recent month-end performance.

Fee Waivers:

| 1 | From time to time, the Fund’s advisor and/or administrator has waived fees and/or absorbed Fund expenses, which has resulted in higher returns. As of 12-31-04, there are waivers and/or absorptions in effect for all share classes. |

Performance:

| 2 | Average annual total returns include the effect of the maximum sales charge of 5.75% for Class A, the applicable contingent sales charge of 5.00% in year 1 and eliminated after year 6 for Class B, and the applicable contingent deferred sales charge of 1.00% and eliminated after 12 months for Class C. |

Please consult a prospectus for information about all share classes.

Top Ten Industries

Percent of Net Assets, as of 12-31-04

| | | |

Medical — Products | | 6.9 | % |

Electronics — Semiconductor Manufacturing | | 6.6 | % |

Telecommunications — Wireless Equipment | | 5.3 | % |

Internet — Content | | 5.1 | % |

Diversified Operations | | 5.1 | % |

Telecommunications — Services | | 4.6 | % |

Medical — Health Maintenance Organizations | | 4.1 | % |

Computer — Manufacturers | | 3.9 | % |

Computer — Data Storage | | 3.8 | % |

Metal Ores — Miscellaneous | | 2.9 | % |

| | |

|

|

Top Ten | | 48.3 | % |

| | |

|

|

Risks: Stock funds should only be considered for long-term goals as values fluctuate in response to the activities of individual companies and general market and economic conditions. Investment strategies that concentrate in particular market segments or fewer securities tend to increase the total risk of an investment (relative to the broader market). This Fund is exposed to growth-style investing risk. Consult the Fund’s prospectus for additional information on this and other risks.

21

Strong Advisor Focus Fund

For the year ended December 31, 2004, the Strong Advisor Focus Fund’s Class A shares delivered a very strong return of 11.16% in 2004 (18.03% when excluding the initial sales charge). This bested the S&P 500 Index, the Fund’s broad-based benchmark, which returned 10.87% including reinvested dividends.

Four broad trends dominated 2004. First, the economy experienced continued robust corporate earnings growth. Second, long-term interest rates surprised most market prognosticators by finishing the year lower than where they started. Third, political uncertainty was alleviated by the clean George W. Bush victory, unmarred by any terrorist events or procedural troubles. This, we believe, gave the market the spark of confidence needed to ignite the subsequent fourth-quarter rally. The fourth trend in evidence during 2004 was another year of dominance by value stocks over growth stocks. The Fund performed well in this “value” environment by concentrating on finding and investing in the stocks of companies that exemplified the theme of dominant business models generating dynamic market share growth.

Searching for “share-gainers”

Our investment process emphasizes security selection as the main determinant of our portfolio construction. We focus our research on what we call “share-gainers” — that is, those companies that have developed business models that allow them not only to grow faster than the underlying economy but to do so in a sustainable fashion. Moreover, the Fund was populated with industry leaders, regardless of their size, as these companies often have sustainable advantages over their competition. A key driver of the Fund’s returns was our analysts’ ability to identify companies with growth prospects that were underestimated by the market. To be clear, it is not only the rate of growth that is important, but also how long we expect that growth to last.

One other factor that helped contribute to the Fund’s returns was our sell discipline. If we begin to suspect that a security’s underlying fundamentals are not performing in line with or better than our expectations, we generally trim or sell the position. Strong growth stocks often receive premium valuations, but that premium can collapse if the market suddenly becomes skeptical about the company’s future prospects.

Morningstar® Style Box™*

Google outperforms

Internet search engine provider Google was an addition to the Fund in 2004 that exemplified our process. Our fundamental research identified Google as an attractive investment opportunity. We recognized that Google was not only benefiting from increased usage of the Internet, but also from the movement of advertisers’ dollars away from traditional media to the Internet. Moreover, the returns its business model generated were some of the best we found in any sector of the economy.

Outlook for 2005

In the latter half of the year, the yield curve flattened considerably, as the Fed kept raising short-term interest rates, while long-term rates stayed about where they were. To us, this signaled the bond market’s perception that economic growth may slow in the coming months. If the economy does in fact decelerate, it would make finding rapidly growing companies more difficult. Nevertheless, we are confident that our focus on share-gainers can help us find good growth opportunities in a wide variety of economic environments.

Effective January 1, 2005, John S. Dale, CFA, and Gary E. Nussbaum, CFA, of Peregrine Capital Management, Inc., became the Portfolio Co-Managers of the Fund. In addition, the Fund is expected to reorganize into the Wells Fargo Advantage Large Company Growth Fund on or about April 11, 2005.

It has been my pleasure in being the Fund’s Portfolio Manager over the last year and a half. Thank you for your investment in the Strong Advisor Focus Fund.

Thomas C. Ognar

Portfolio Manager

| * | The Morningstar Style Box™ reflects a fund’s investment strategy. For equity funds, the vertical axis shows the market capitalization of the stocks owned and the horizontal axis shows investment style (value, blend, or growth). |

Mention of specific securities in this report is not indicative of whether the Fund may make additional purchases of, sell all or a portion of, or continue to hold those securities.

22

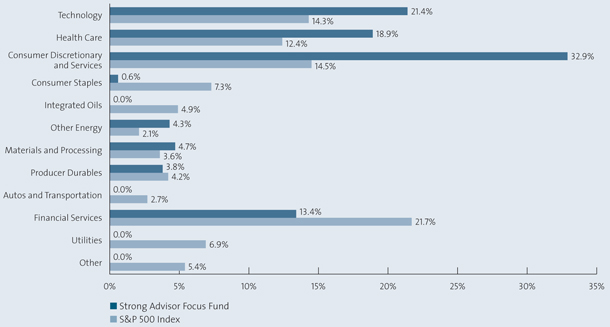

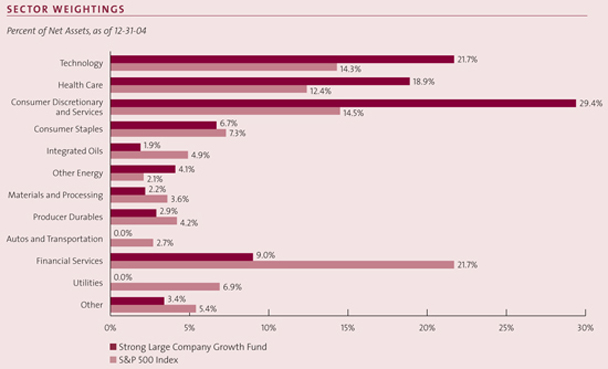

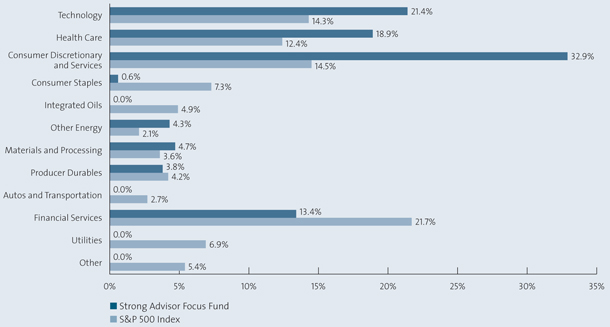

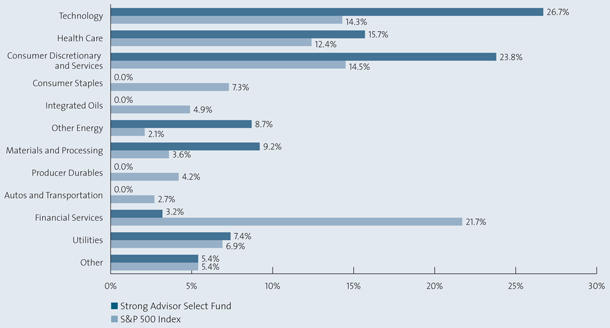

Fund Highlights

Sector Weightings

Percent of Net Assets, as of 12-31-04

Source: Frank Russell Company via FactSet

Fund Highlights are continued on next page.

23

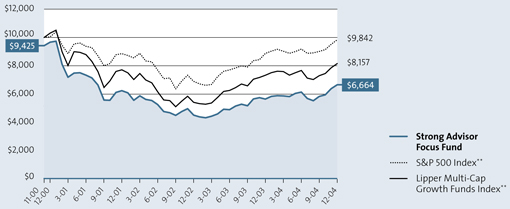

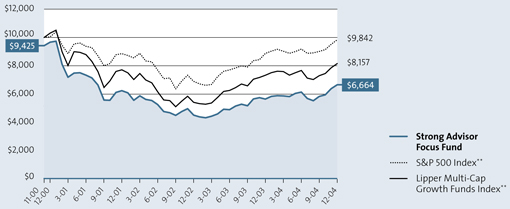

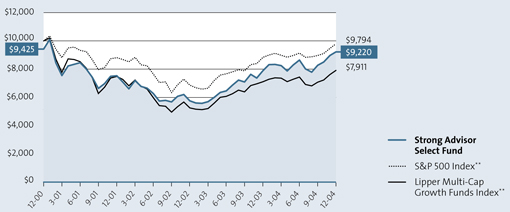

Strong Advisor Focus Fund

Growth of an Assumed $10,000 Investment†

From 11-30-00 to 12-31-04

Performance is historical and does not guarantee future results. Investment returns and principal value will fluctuate, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most recent month-end performance.

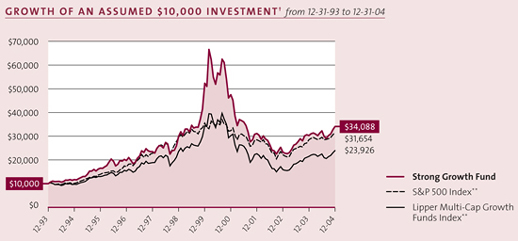

| † | This graph, provided in accordance with SEC regulations, compares a $10,000 investment in the Fund, made at its inception, with the performance of the S&P 500 Index and the Lipper Multi-Cap Growth Funds Index. Results include the reinvestment of all dividends and capital gains distributions. The graph and the Average Annual Total Returns table do not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. This graph is based on Class A shares only and reflects the effect of the maximum sales charge of 5.75%; performance for other classes will vary due to differences in fee structures and sales charges. |

Definitions:

| ** | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market value weighted index (stock price times number of shares outstanding), with each stock’s weight in the Index proportionate to its market value. The Lipper Multi-Cap Growth Funds Index is the average of the 30 largest funds in the Lipper Multi-Cap Growth Funds Category. Source of the S&P Index data is Standard & Poor’s Micropal. Source of the Lipper Index data is Lipper. |

It is not possible to invest directly in an index.

Top Holdings

Percent of Net Assets, as of 12-31-04

| | | |

eBay, Inc. | | 7.4 | % |

Dell, Inc. | | 6.7 | % |

PETCO Animal Supplies, Inc. | | 6.7 | % |

First Marblehead Corporation | | 6.1 | % |

Digital River, Inc. | | 4.8 | % |

Gilead Sciences, Inc. | | 4.4 | % |

PETsMART, Inc. | | 4.4 | % |

Hughes Supply, Inc. | | 4.1 | % |

St. Jude Medical, Inc. | | 3.7 | % |

Kinetic Concepts, Inc. | | 3.6 | % |

| | |

|

|

Top Ten | | 51.9 | % |

| | |

|

|

Holdings vary. More complete holdings are available at www.Strong.com.

Percentage Restrictions: The Fund’s prospectus and statement of additional information may describe restrictions on the percentage of a particular type or quality of security in which the Fund may invest (“Percentage Restrictions”). Percentage Restrictions apply at the time the Fund purchases a security. Circumstances subsequent to the purchase of the security, such as a change in: (1) the Fund’s assets (e.g., due to cash inflows and redemptions), (2) the market value of the security, or (3) the pricing, liquidity, or rating of the security, may cause the Fund to exceed or fall short of the Percentage Restriction. If this happens, the Fund’s continued holding of the security will not constitute a violation of the Percentage Restriction.

24

Average Annual Total Returns

As of 12-31-04

| | | |

Class A1,2

| | | |

1-year | | 11.16 | % |

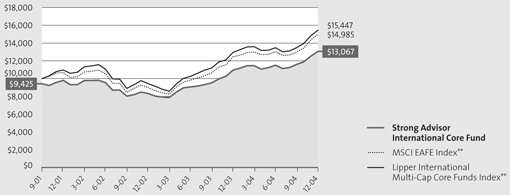

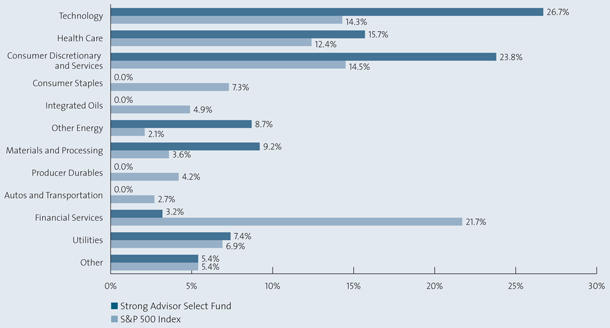

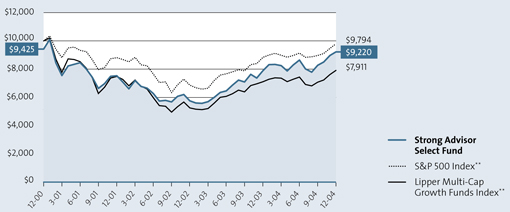

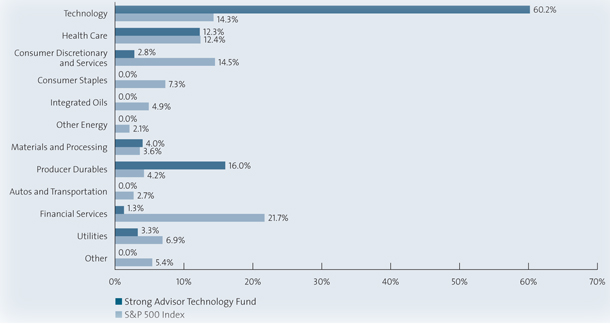

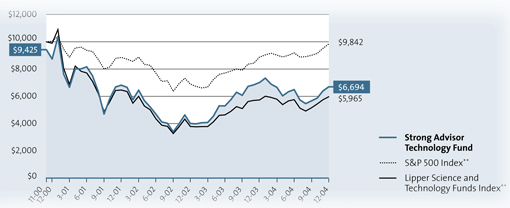

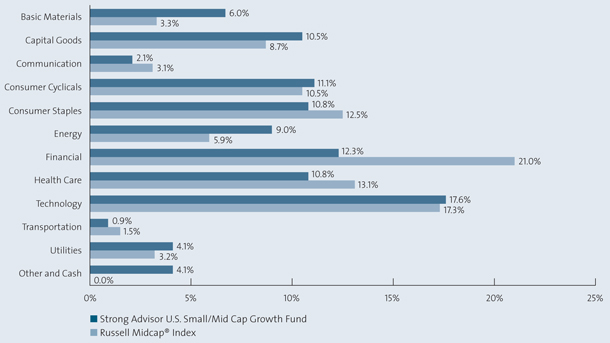

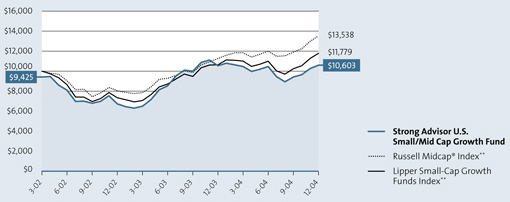

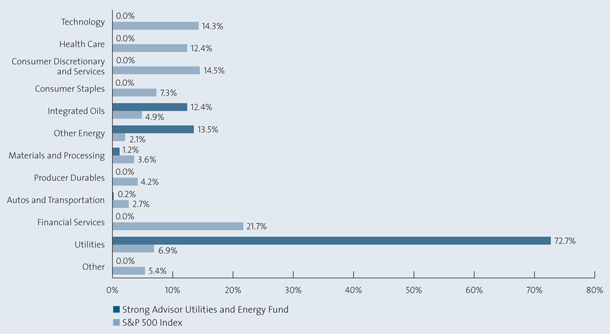

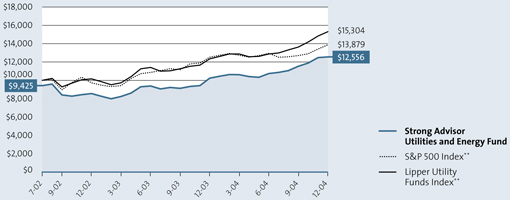

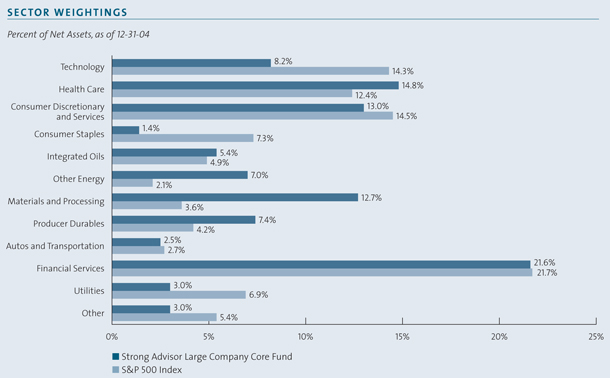

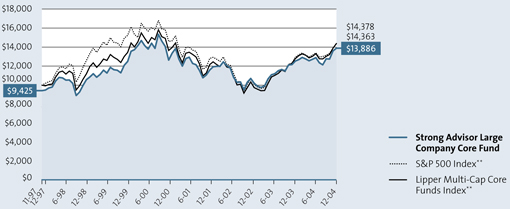

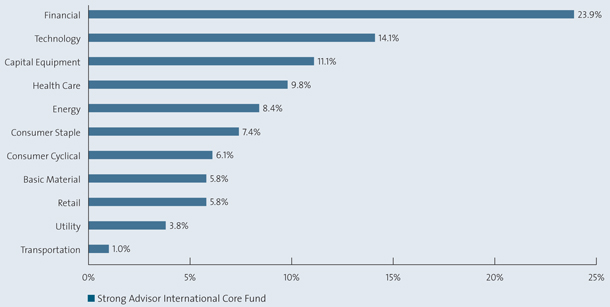

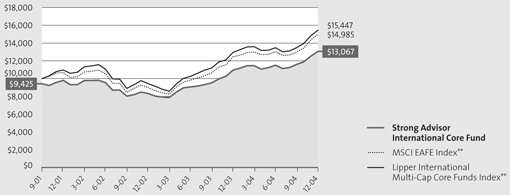

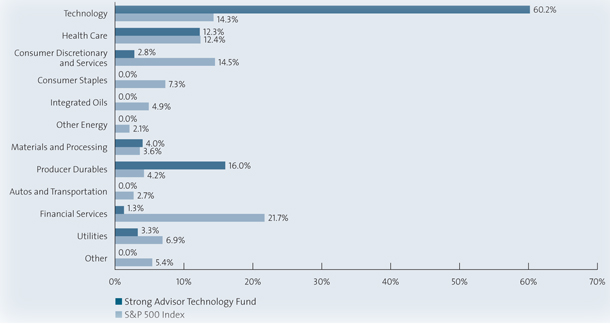

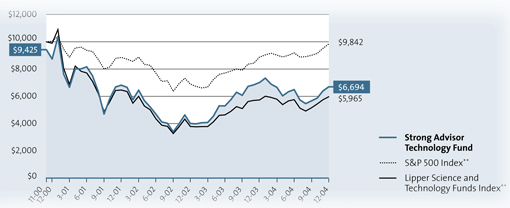

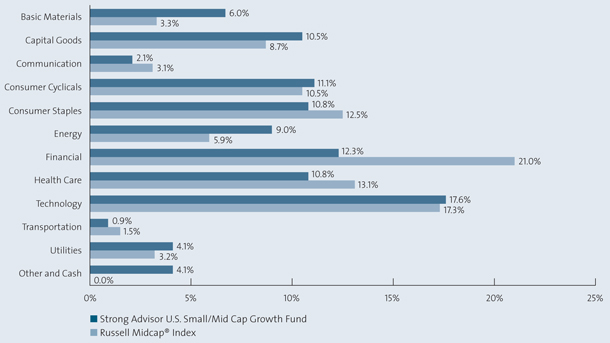

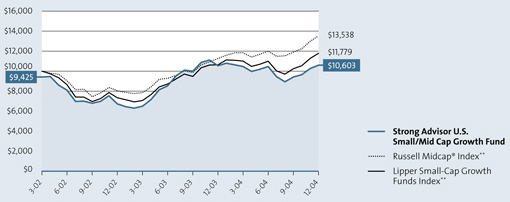

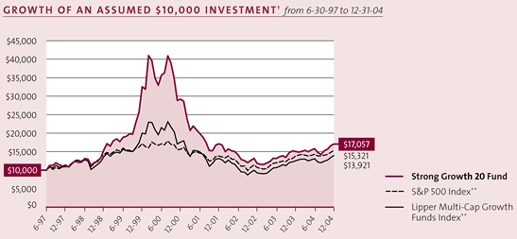

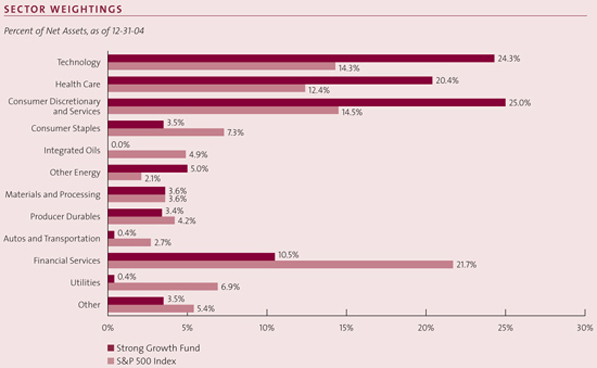

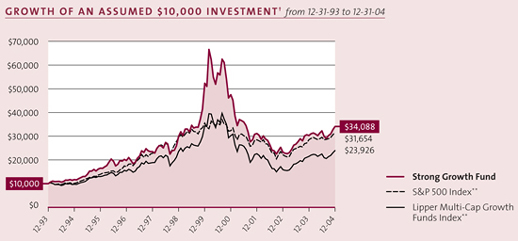

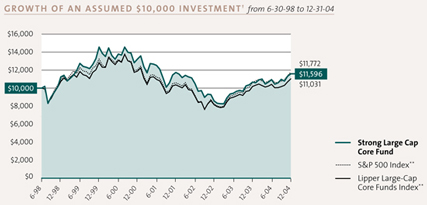

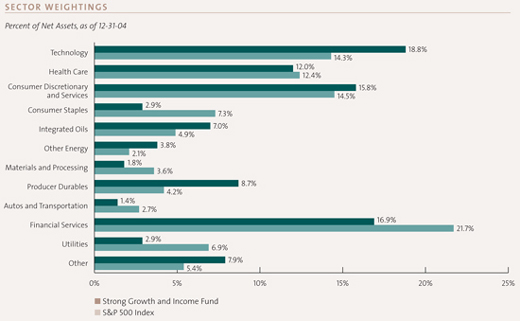

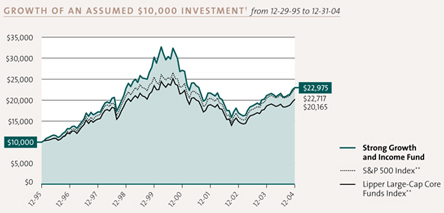

3-year | | 0.24 | % |