May 28, 2024 Nordson Corporation Acquires Atrion Corporation Market leader in single-use proprietary medical infusion and niche cardiovascular technologies Exhibit 99.2

Agenda End Market Summary Fit with Nordson Atrion Product Portfolio Transaction Summary Nordson Announces Agreement to Acquire Atrion Corporation Sundaram Nagarajan President and Chief Executive Officer Lara Mahoney Vice President, Investor Relations Stephen Shamrock Chief Accounting Officer Stephen Lovass EVP, Medical & Fluid Solutions Segment Dan Hopgood EVP & Chief Financial Officer

Forward-Looking Statements This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements present current forecasts and estimates of future events. These statements do not strictly relate to historical or current results and can be identified by words such as “anticipate,” “appear,” “assume,” “believe,” “estimate,” “expect,” “forecast,” “intend,” “likely,” “may,” “plan,” “project,” “seek,” “should,” “strategy,” “will,” “can,” “could,” “predict,” “future,” “potential,” “look,” “build,” “focus,” “create,” “work,” “continue,” “target,” “poised,” “advance,” “drive,” “aim,” “approach,” “seek,” “schedule,” “position,” “pursue,” “progress,” “budget,” “outlook,” “trend,” “guidance,” “commit,” “on track,” “objective,” “goal,” “opportunity,” “ambitions,” “aspire” and variations of negatives of such terms or variations thereof. Other words and terms of similar meaning or import in connection with any discussion of future plans, actions, events or operating, financial or other performance identify forward-looking statements. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements regarding the Agreement and the Transaction, including the expected time period to consummate the Transaction, the anticipated benefits (including synergies) of the Transaction and integration and transition plans, opportunities, anticipated future performance, expected share buyback programs and expected dividends. All such forward-looking statements are based upon current plans, estimates, expectations and ambitions that are subject to risks, uncertainties, assumptions and other factors, many of which are beyond the control of Atrion and Nordson, that could cause actual results to differ materially from the results projected in such forward-looking statements. These risks, uncertainties, assumptions and other factors include, without limitation: statements regarding the expected timing and structure of the Transaction; the ability of the parties to complete the Transaction; the expected benefits of the Transaction, such as improved operations, enhanced revenues and cash flow, synergies, growth potential, market profile, business plans, expanded portfolio and financial strength; the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the Transaction; the ability of Nordson to successfully integrate the operations of Atrion and to achieve expected synergies, cost reductions and/or productivity improvements, including the risk that problems may arise which may result in the combined company not operating as effectively and efficiently as expected; the occurrence of any event, change or other circumstances that could give rise to the termination of the Agreement; the possibility that Atrion’s shareholders may not approve the Transaction; the risk that the anticipated tax treatment of the Transaction is not obtained; the risk that the parties may not be able to satisfy the conditions to the Transaction in a timely manner or at all; risks related to disruption of management time from ongoing business operations due to the Transaction; the risk that any announcements relating to the Transaction could have adverse effects on the market price of Atrion’s or Nordson’s common shares; the risk that the Transaction and its announcement could have an adverse effect on the parties’ business relationships and businesses generally, including the ability of Atrion and Nordson to retain customers and retain and hire key personnel and maintain relationships with their suppliers and customers, and on their operating results and businesses generally; unexpected future capital expenditures; potential litigation relating to the Transaction that could be instituted against Atrion and/or Nordson or their respective directors and/or officers; third party contracts containing material consent, anti-assignment, transfer or other provisions that may be related to the Transaction which are not waived or otherwise satisfactorily resolved; the competitive ability and position of Nordson following completion of the Transaction; legal, economic and regulatory conditions; and any assumptions underlying any of the foregoing; demand for Atrion and Nordson products; industry and economic conditions including, but not limited to, supply chain disruptions, recessionary conditions, inflationary pressures, interest rate and financial market volatility and the viability of banks and other financial institutions; availability and cost of energy and raw materials; levels of global industrial production; competitive and pricing factors; relationships with key customers and customer concentration in certain areas; issues related to acquisitions, divestitures and joint ventures or expansions; various events that could disrupt operations, including climate change, weather conditions and storm activity such as droughts, floods, avalanches and earthquakes, cybersecurity attacks, security threats and governmental response to them, and technological changes; legislation and related regulations or interpretations, in the United States or elsewhere; domestic and international economic and political conditions, policies or other governmental actions, as well as war, political unrest, civil disturbance and acts of terror; changes to tariff, trade or investment policies or laws or trade agreements; changes in tax law; uninsured losses, including those from natural disasters, catastrophes, pandemics, theft or sabotage; environmental, product-related or other legal and regulatory unforeseen or unknown liabilities, proceedings or actions; research and development activities and intellectual property protection; issues involving implementation and protection of information technology systems; foreign exchange and commodity price fluctuations; levels of indebtedness; liquidity and the availability and cost of credit; rating agency actions and Atrion’s and Nordson’s ability to access short- and long-term debt markets on a timely and affordable basis; the level of fixed costs required to run Atrion’s and Nordson’s businesses; levels of goodwill or other indefinite-lived intangible assets; labor disputes or shortages, changes in labor costs and labor difficulties; effects of industry, market, economic, legal or legislative, political or regulatory conditions outside of Atrion’s or Nordson’s control; and other factors detailed from time to time in Atrion’s and Nordson’s SEC filings. All forward-looking statements in this communication should be considered in the context of the risks and other factors described above and in the specific factors discussed under the heading “Risk Factors” in both Atrion’s and Nordson’s most recent Annual Report on Form 10-K filed with the SEC, in each case as these risk factors are amended or supplemented by subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, which will be incorporated by reference into the Proxy Statement. Atrion’s reports that are filed with the SEC are available on Atrion’s website at https://atrioncorp.com/investor-relations/ and on the SEC’s website at http://www.sec.gov, and Nordson’s reports that are filed with the SEC are available on Nordson’s website at https://investors.nordson.com/overview/default.aspx and on the SEC website at http://www.sec.gov. Any forward-looking statements speak only as of the date the statement is made and neither Atrion nor Nordson undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. It is not possible to identify all of the risks, uncertainties and other factors that may affect future results. In light of these risks and uncertainties, the forward-looking events and circumstances discussed herein may not occur and actual results may differ materially from those anticipated or implied in the forward-looking statements. Accordingly, readers are cautioned not to place undue reliance on any forward-looking statements. Additional Information for Investors and Security Holders

Secular Growth Drivers = Attractive Medical End Markets Aging of the population / Rising chronic health conditions Increasing healthcare spending and procedure volumes Increasing adoption of minimally-invasive surgical techniques Continued innovation and medical OEM outsourcing

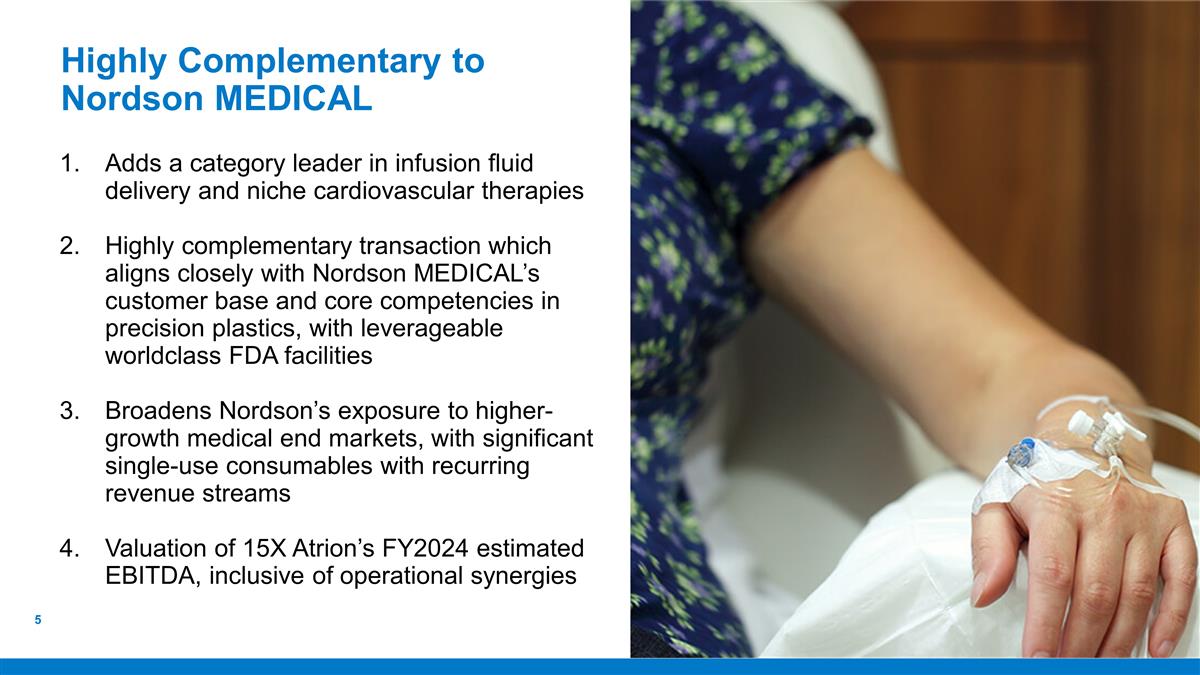

Highly Complementary to Nordson MEDICAL Adds a category leader in infusion fluid delivery and niche cardiovascular therapies Highly complementary transaction which aligns closely with Nordson MEDICAL’s customer base and core competencies in precision plastics, with leverageable worldclass FDA facilities Broadens Nordson’s exposure to higher-growth medical end markets, with significant single-use consumables with recurring revenue streams Valuation of 15X Atrion’s FY2024 estimated EBITDA, inclusive of operational synergies

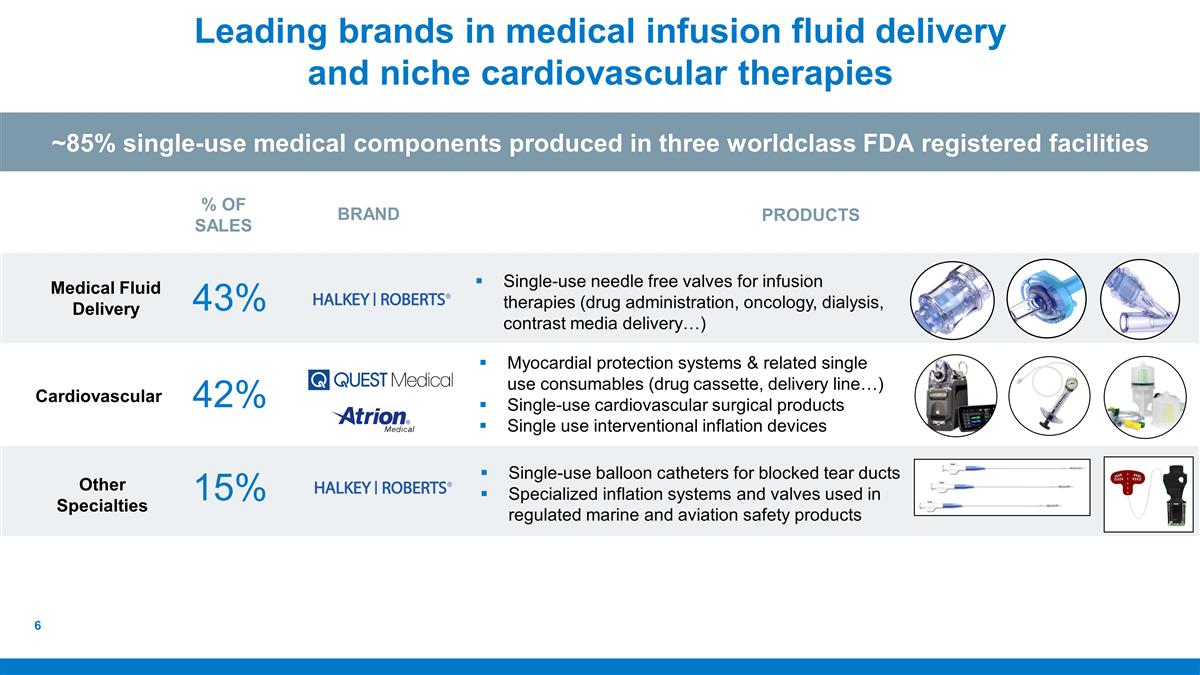

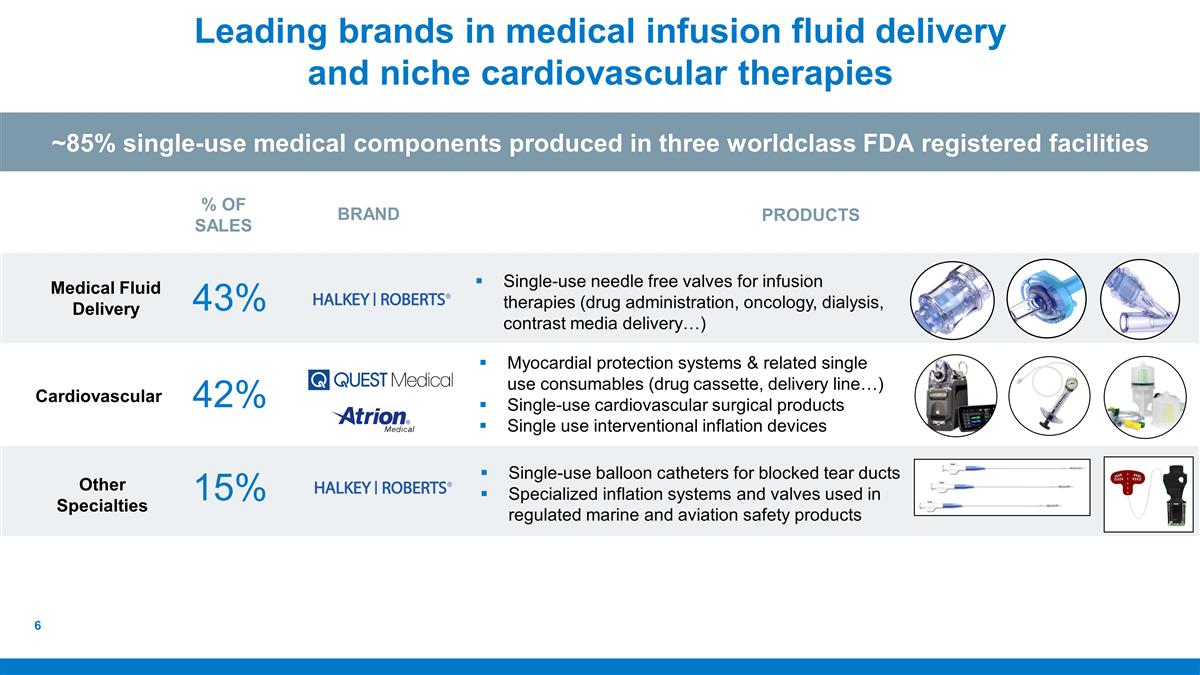

43% Single-use needle free valves for infusion therapies (drug administration, oncology, dialysis, contrast media delivery…) Medical Fluid Delivery % OF SALES BRAND Other Specialties Leading brands in medical infusion fluid delivery and niche cardiovascular therapies ~85% single-use medical components produced in three worldclass FDA registered facilities 15% Cardiovascular 42% PRODUCTS Single-use balloon catheters for blocked tear ducts Specialized inflation systems and valves used in regulated marine and aviation safety products Myocardial protection systems & related single use consumables (drug cassette, delivery line…) Single-use cardiovascular surgical products Single use interventional inflation devices

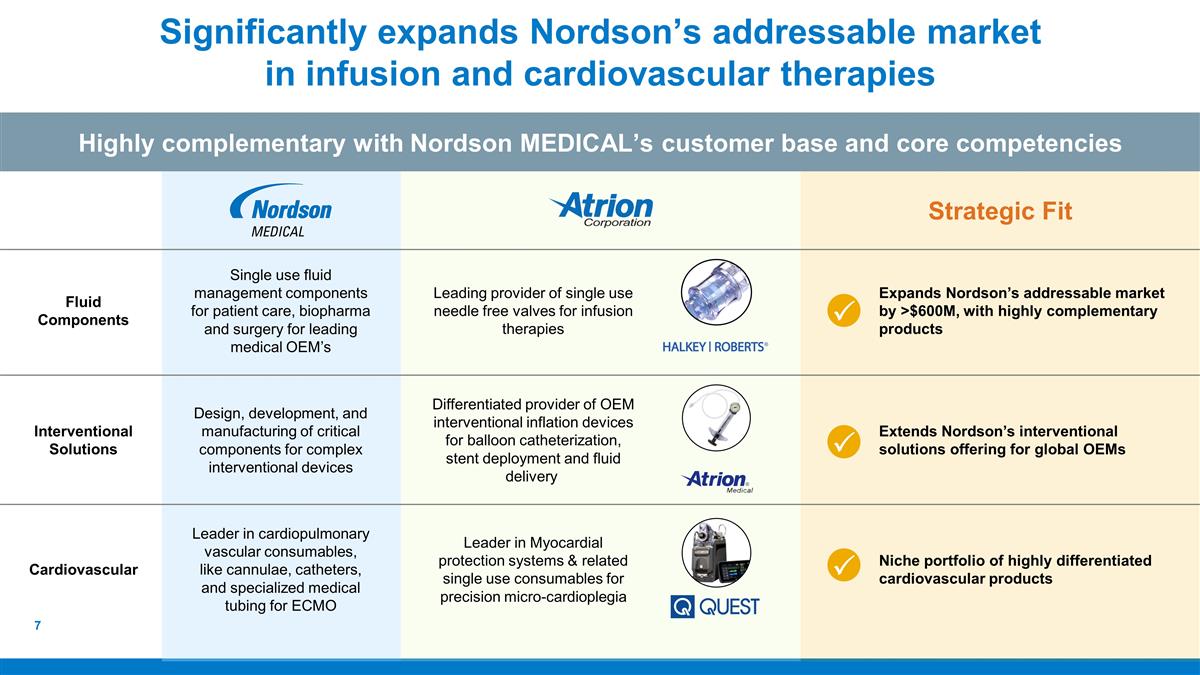

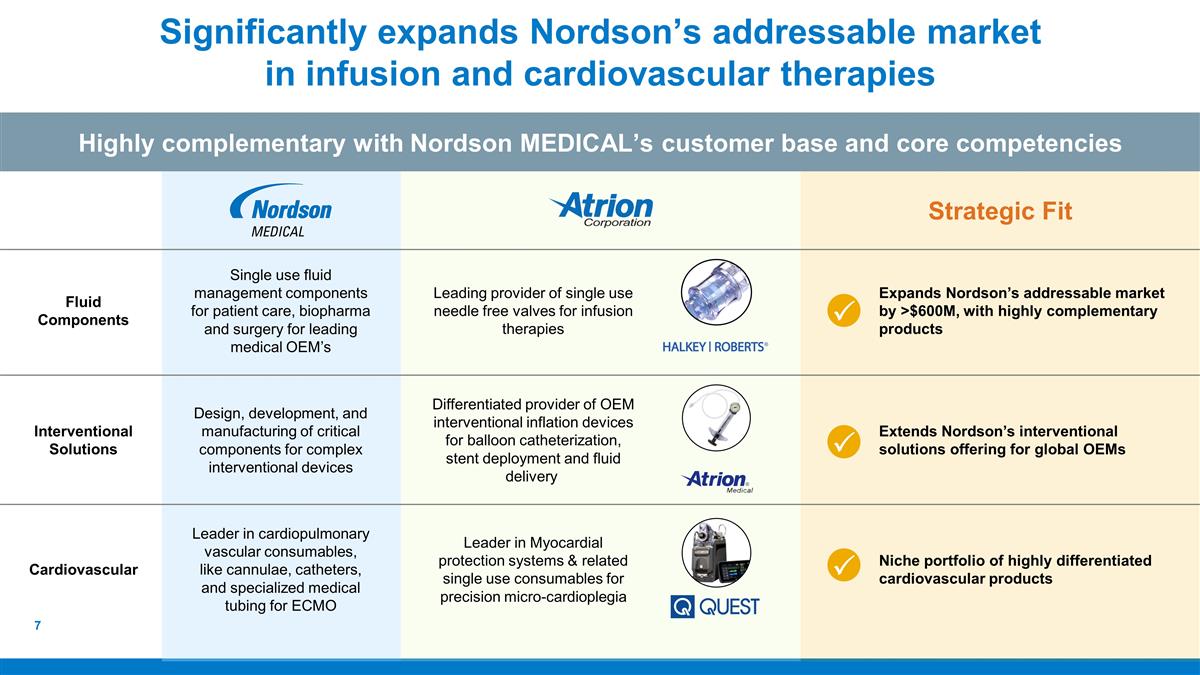

Significantly expands Nordson’s addressable market in infusion and cardiovascular therapies Highly complementary with Nordson MEDICAL’s customer base and core competencies Fluid Components Single use fluid management components for patient care, biopharma and surgery for leading medical OEM’s Leading provider of single use needle free valves for infusion therapies Expands Nordson’s addressable market by >$600M, with highly complementary products Interventional Solutions Design, development, and manufacturing of critical components for complex interventional devices Differentiated provider of OEM interventional inflation devices for balloon catheterization, stent deployment and fluid delivery Extends Nordson’s interventional solutions offering for global OEMs Cardiovascular Leader in cardiopulmonary vascular consumables, like cannulae, catheters, and specialized medical tubing for ECMO Leader in Myocardial protection systems & related single use consumables for precision micro-cardioplegia Niche portfolio of highly differentiated cardiovascular products Strategic Fit P P P

Worldclass FDA registered facilities in FL, TX & AL Provides capacity for future Nordson MEDICAL growth Complemented by Nordson MEDICAL footprint in EU & Asia FDA registered design & manufacturing spaces Highly skilled organization which can leverage NBS Next Strong patent portfolio & product pipeline Strong skills & expertise in medical automation Opportunity for leveraging Nordson NBS Next growth framework to deliver operational synergies Skilled engineering and technical teams; 498 active and pending patents Attractive installed base conversion opportunity with next generation Myocardial Protection System Future product pipeline opportunities NBS Next supports operational improvement and future growth

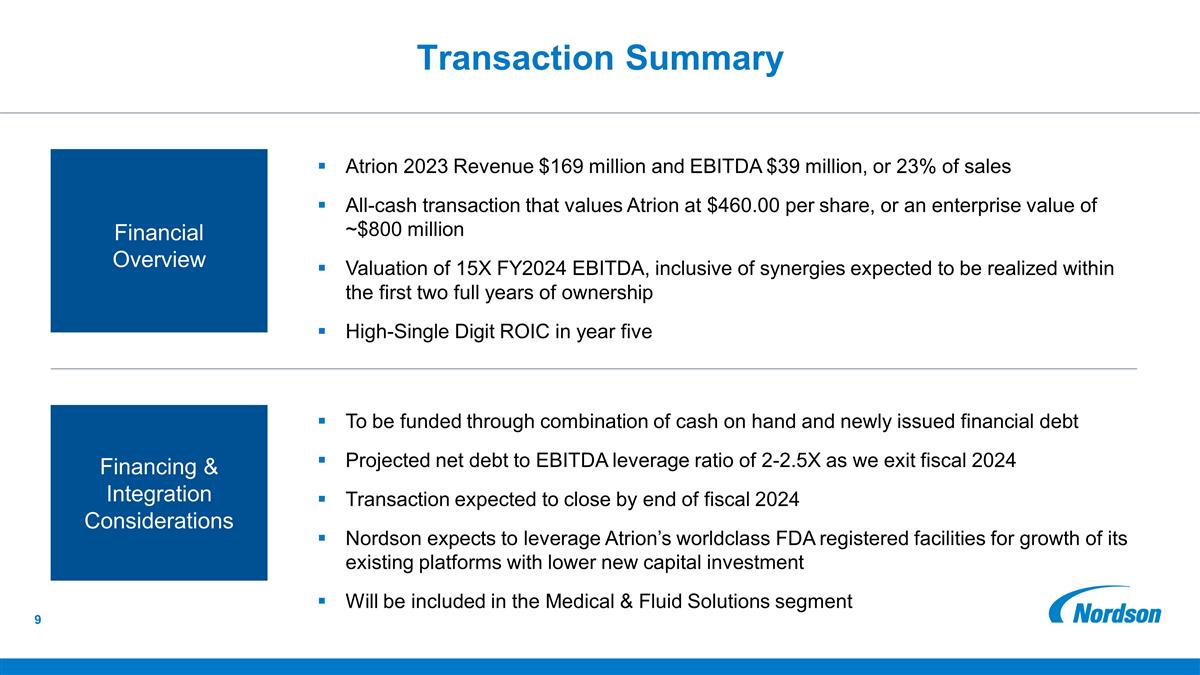

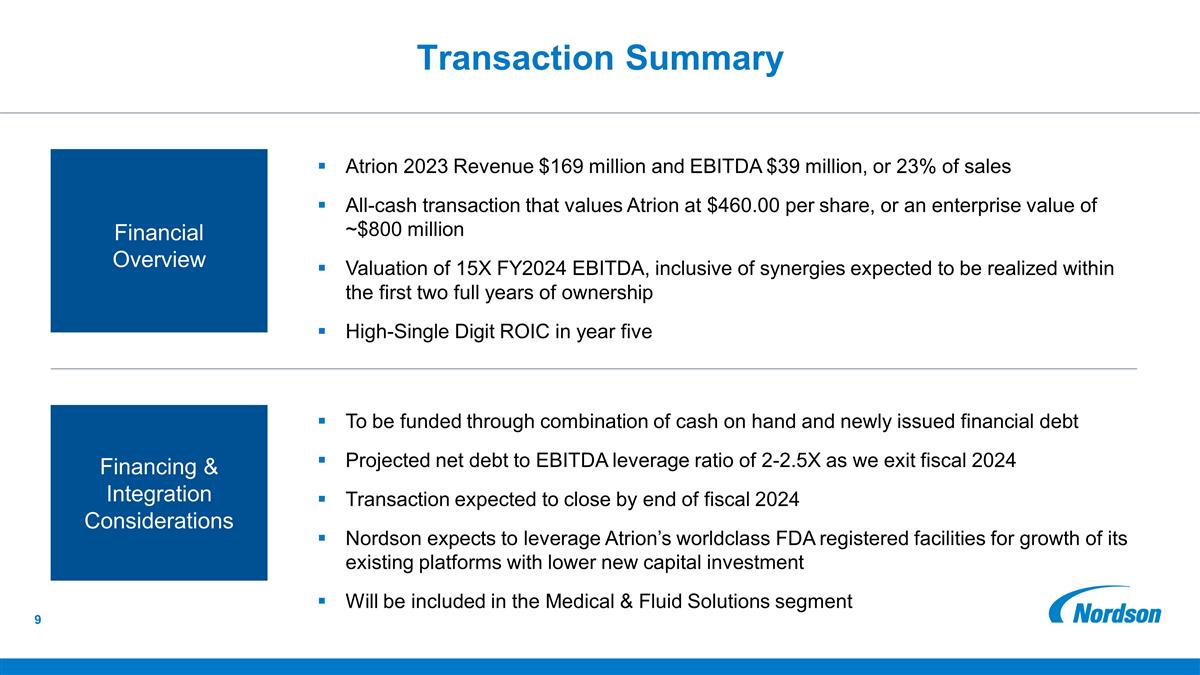

Transaction Summary Financial Overview Financing & Integration Considerations Atrion 2023 Revenue $169 million and EBITDA $39 million, or 23% of sales All-cash transaction that values Atrion at $460.00 per share, or an enterprise value of ~$800 million Valuation of 15X FY2024 EBITDA, inclusive of synergies expected to be realized within the first two full years of ownership High-Single Digit ROIC in year five To be funded through combination of cash on hand and newly issued financial debt Projected net debt to EBITDA leverage ratio of 2-2.5X as we exit fiscal 2024 Transaction expected to close by end of fiscal 2024 Nordson expects to leverage Atrion’s worldclass FDA registered facilities for growth of its existing platforms with lower new capital investment Will be included in the Medical & Fluid Solutions segment

Questions & Answers

Additional Information and Where to Find It Atrion Corporation (“Atrion”) expects to file with the Securities and Exchange Commission (“SEC”) and furnish to its stockholders a proxy statement on Schedule 14A (the “Proxy Statement”), as well as other relevant documents regarding the transactions contemplated by the Agreement and Plan of Merger (the “Agreement”), dated as of May 28, 2024, by and among Atrion, Nordson Corporation (“Nordson”), and Alpha Medical Merger Sub, Inc. (the “Transaction”). The information to be included in the preliminary Proxy Statement will not be complete and may be changed. After filing its definitive Proxy Statement with the SEC, Atrion will mail its definitive Proxy Statement and a proxy card to Atrion’s stockholders entitled to vote at a special meeting relating to the Transaction, seeking their approval of the applicable Transaction-related proposals. The Proxy Statement will contain important information about the Transaction and related matters. This communication is not a substitute for the Proxy Statement Atrion plans to file with the SEC in connection with the Transaction. INVESTORS AND SECURITY HOLDERS OF ATRION ARE URGED TO READ CAREFULLY AND IN THEIR ENTIRETY THE PROXY STATEMENT WHEN IT BECOMES AVAILABLE, AS WELL AS OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTION OR INCORPORATED BY REFERENCE INTO THE PROXY STATEMENT, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO SUCH DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT ATRION, NORDSON, THE TRANSACTION AND THE OTHER TRANSACTIONS CONTEMPLATED BY THE AGREEMENT THAT HOLDERS OF ATRION’S SECURITIES SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING VOTING. Investors and security holders will be able to obtain free copies of the Proxy Statement and other documents filed with the SEC when available without charge through the website maintained by the SEC at www.sec.gov or, in the case of documents filed by Atrion, from Atrion’s website https://atrioncorp.com/investor-relations/ or, in the case of documents filed by Nordson, by directing a request to Lara Mahoney, Vice President, Investor Relations and Corporate Communications at lara.mahoney@nordson.com, or by calling (440) 204-9985, or from Nordson’s website https://investors.nordson.com/overview/default.aspx. Participants in the Solicitation Atrion, Nordson and certain of their respective directors, executive officers and employees may be deemed to be participants in the solicitation of proxies from Atrion’s stockholders in connection with the Transaction. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of proxies in connection with the Transaction, including a description of their direct or indirect interests in the Transaction, by security holdings or otherwise, will be set forth in the Proxy Statement(s) and other relevant materials related to the Transaction when they are filed with the SEC. Information regarding Atrion’s directors and executive officers is contained in the sections entitled “Election of Directors” and “Securities Ownership” included in Atrion’s proxy statement for the 2024 annual meeting of stockholders, which was filed with the SEC on April 9, 2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/701288/000110465924044922/tm242747d4_def14a.htm) and in the section entitled “Directors, Executive Officers and Corporate Governance” included in Atrion’s Annual Report on Form 10-K for the year ended December 31, 2023, which was filed with the SEC on February 29, 2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/701288/000165495424002411/atri_10k.htm). Information regarding Nordson’s directors and executive officers is contained in the sections entitled “Election of Directors” and “Security Ownership of Nordson Common Shares by Certain Beneficial Owners and Management” included in Nordson’s proxy statement for its 2024 annual meeting of stockholders, filed with the SEC on January 19, 2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/72331/000119312524010767/d482491ddef14a.htm), in the section entitled “Information About Our Executive Officers” included in Nordson’s Annual Report on Form 10-K for the year ended October 31, 2023, which was filed with the SEC on December 20, 2023 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/72331/000007233123000242/ndsn-20231031.htm), in Nordson’s Form 8-K filed on August 24, 2023 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000072331/000007233123000150/ndsn-20230823.htm), in Nordson’s Form 8-K filed on January 16, 2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000072331/000007233124000019/ndsn-20240116.htm), in Nordson’s Form 8-K filed on February 14, 2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000072331/000007233124000030/ndsn-20240214.htm), and in Nordson’s Form 8-K filed on April 23, 2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000072331/000007233124000057/ndsn-20240423.htm). To the extent holdings of Nordson securities by the directors and executive officers of Nordson have changed from the amounts of securities of Nordson held by such persons as reflected therein, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. These documents can be obtained free of charge from the sources indicated above. Additional Information for Investors and Security Holders

This presentation contains references to non-GAAP financial information. Although these are non-GAAP measures, we believe that they are useful to an investor in evaluating the company performance for the period presented. These non-GAAP definitions include: EBITDA is defined as operating profit plus certain adjustments, such as severance, fees and non-cash inventory charges associated with acquisitions, plus depreciation and amortization. Return on Invested Capital is defined as adjusted operating profit after tax as a percentage of the sum of average debt (net of cash) plus average shareholders’ equity. Net debt is defined as total long-term debt less cash and cash equivalents. Amounts may be rounded. See the Nordson's earnings release for the second quarter ended April 30, 2024, for a reconciliation of the non-GAAP measures Adjusted Operating Profit and EBITDA. Appendix Non-GAAP Definitions