- PAYX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Paychex (PAYX) DEF 14ADefinitive proxy

Filed: 18 Sep 19, 4:29pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| ☒ | Definitive Proxy Statement | |||

| ☐ | Definitive Additional Materials | |||

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |||

Paychex, Inc. | ||||

| (Name of Registrant as Specified In Its Charter) | ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| ||||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| ||||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| ||||

| (5) | Total fee paid: | |||

| ||||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| ||||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| ||||

| (3) | Filing Party:

| |||

| ||||

| (4) | Date Filed:

| |||

| ||||

Proxy Statement | 2019

and Notice of Annual Meeting of Stockholders

The Power of

Simplicity

PAYCHEX®

HR | Payroll | Benefits | Insurance

Our Purpose

We provide our customers the freedom to succeed.

Our Mission

We will be the leading provider of human resource, payroll, and employee benefit services by being an essential partner with businesses across the U.S.

Our Values

We act with uncompromising integrity.

We provide outstanding service and build trusted relationships. We drive innovation in our products and services and continually improve our processes.

We work in partnership and support each other.

We’re personally accountable and deliver on our commitments. We treat each other with respect and dignity.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

WHEN

Thursday, October 17, 2019 10:00 a.m. Eastern Time*

* A continental breakfast will be available from 9:00 a.m. – 10:00 a.m. Eastern Time

WHERE

The Strong One Manhattan Square Rochester, NY 14607

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2019 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON OCTOBER 17, 2019

Paychex, Inc.’s Proxy Statement and Annual Report for the year ended May 31, 2019 are available atwww.paychex.com/investors

| The principal business of the 2019 Annual Meeting of Stockholders (the “Annual Meeting”) will be:

1. To elect nine nominees to the Board of Directors for a one-year term;

2. To hold an advisory vote to approve named executive officer compensation;

3. To ratify the selection of PricewaterhouseCoopers LLP to serve as our independent registered public accounting firm; and

4. To transact such other business as may properly come before the meeting or any adjournment thereof.

Stockholders are cordially invited to attend the Annual Meeting. Stockholders of record at the close of business on August 19, 2019 will be entitled to notice of and to vote at the Annual Meeting and at any adjournments or postponements thereof.

If you are unable to attend the Annual Meeting, you will be able to listen via the internet. We will broadcast the Annual Meeting as a live webcast through our website. Please note that you will not be able to vote or ask questions through the webcast. The webcast will be accessible atwww.paychex.com/investors under Events and Presentations and will remain available for replay for approximately one month following the meeting.

By order of the Board of Directors Stephanie L. Schaeffer Corporate Secretary

September 18, 2019 |

Welcome to the Paychex, Inc. 2019 Annual Meeting

of Stockholders

VOTE YOUR SHARES

HOW TO VOTE

Your vote is very important and we hope that you will attend the Annual Meeting. You are eligible to vote if you were a stockholder of record at the close of business on August 19, 2019. Please read the proxy statement and vote right away using any of the following methods.

Stockholders of Record:

|  |  |  | |||

VOTE BY INTERNET Visit the website listed on your proxy card. | VOTE BY TELEPHONE Call the telephone number listed on your proxy card.

| VOTE BY MAIL Sign, date, and return your proxy card in the enclosed envelope. | VOTE VIA MOBILE DEVICE Scan this QR code. | |||

Make sure to have your proxy card or voting instruction card in hand and follow the instructions.

Beneficial Stockholders:

If you are a beneficial stockholder, you will receive instructions from your bank, broker, or other nominee that you must follow in order for your shares to be voted. Many of these institutions offer telephone and online voting. If you wish to vote in person at the Annual Meeting, you will need to obtain a legal proxy from your bank, broker, or other nominee to present when voting.

|

Proxy Summary

|

|

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider and you should read the entire proxy statement before voting. For more complete information regarding the performance of Paychex, Inc. (the “Company” or “Paychex”) for the fiscal year ended May 31, 2019 (“fiscal 2019”), please review the Company’s Annual Report on Form10-K for fiscal 2019.

Paychex, Inc. 2019 Annual Meeting of Stockholders

| October 17, 2019 10:00 a.m., Eastern Time |  | The Strong, One Manhattan Square, Rochester, New York 14607 |

Meeting Agenda and Voting Matters

| Item | Management Proposal | Board Vote Recommendation | Page Reference (for more detail) | |||

| Proposal 1 | Election of directors for aone-year term | FOR each director nominee | 3 | |||

| Proposal 2 | Advisory vote to approve named executive officer compensation | FOR | 21 | |||

| Proposal 3 | Ratification of the selection of PricewaterhouseCoopers LLP to serve as our independent registered public accounting firm | FOR | 57 | |||

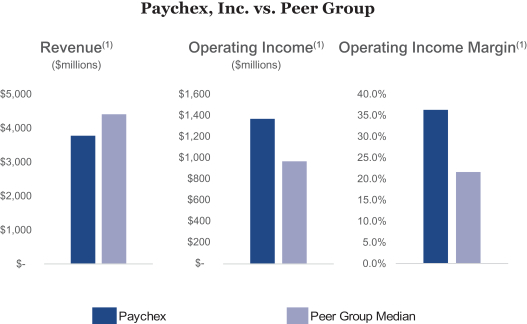

Fiscal 2019 Business Highlights

| For the fiscal year ended May 31, | ||||||||||||

| $ in millions, except per share amounts | 2019 | 2018 As adjusted(1) | % Change | |||||||||

| Total revenue | $ | 3,773 | $ | 3,378 | 12 | % | ||||||

| Operating income | $ | 1,371 | $ | 1,292 | 6 | % | ||||||

| Net income | $ | 1,034 | $ | 994 | 4 | % | ||||||

| Stock price (high/low)(2) | $ | 87.15/$61.64 | $ | 70.25/$54.24 | 24%/14 | % | ||||||

| Stock price as of fiscal year end | $ | 85.79 | $ | 65.58 | 31 | % | ||||||

| (1) | Amounts have been adjusted to reflect the adoption of Accounting Standards Codification (“ASC”) Topic 606, “Revenue from Contracts with Customers” (“ASC Topic 606”). |

| (2) | Based on52-week high and low sale prices as reported on the Nasdaq Global Select Market as of May 31, 2019 and 2018. |

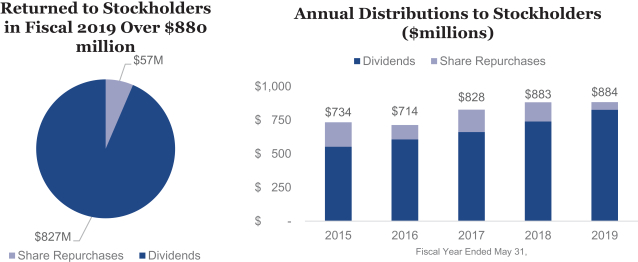

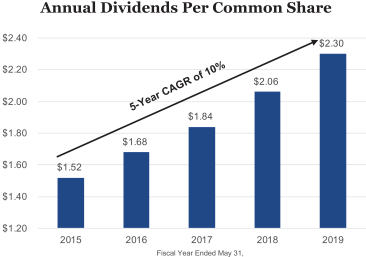

Paychex has focused on returning value to our stockholders and continued with stockholder-friendly actions during fiscal 2019. In May 2019, the Company increased its quarterly dividend by $0.06 per share, or 11%, to $0.62 per share. The Company continued to repurchase its common stock to offset dilution and in fiscal 2019 repurchased 0.7 million shares for $56.9 million.

Paychex, Inc. 2019 Proxy Statement • 1

Proxy Summary

|

|

|

|

|

Pay-for-Performance

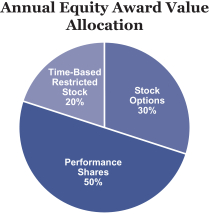

Key features of our executive compensation program that tie compensation to the Company’s performance are:

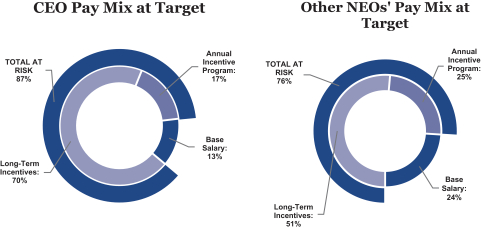

| • | A significant portion of annual compensation is “at risk” based on performance. For the President and Chief Executive Officer (“CEO”), 87% of total target compensation is at risk. On average, for other named executive officers (“NEOs”), 76% of their total target compensation is at risk. |

| • | Variable compensation is comprised of an annual cash incentive program and longer-term equity-based incentives. For the annual cash incentive for fiscal 2019, results for certain performance metrics were above target, resulting in payouts at 129% of target for our CEO and 127% of target for the other NEOs. |

| • | Annual grants of performance shares in July 2017 reached the end of thetwo-year performance period in May 2019. Achievement was at 98% of target. The shares earned are restricted for an additionalone-year period. |

For more information on compensation for our NEOs and how it ties to performance, refer to the Compensation Discussion and Analysis and Named Executive Officer Compensation sections of this proxy statement.

Additional Information

Please refer to the Frequently Asked Questions section beginning on page 60 for important information about proxy materials, voting, annual meeting procedures, company documents, communications, and the deadlines to submit stockholder proposals for the 2020 Annual Meeting of Stockholders. Additionally, questions may be directed to Investor Relations at(800) 828-4411 or by written request to 911 Panorama Trail South, Rochester, NY 14625, Attention: Investor Relations. General information regarding the meeting and links to key documents can be found on our Investor Relations web page atwww.paychex.com/investors.

Paychex, Inc. 2019 Proxy Statement • 2

|

Election of Directors

|

|

Paychex, Inc.

911 Panorama Trail South

Rochester, NY 14625

Paychex, Inc. (“Paychex,” the “Company,” “we,” “our,” or “us”), a Delaware corporation, is furnishing this proxy statement to stockholders in connection with the solicitation of proxies on behalf of the Board of Directors of the Company (the “Board”) for the 2019 Annual Meeting of Stockholders (the “Annual Meeting”). This proxy statement summarizes information concerning the matters to be presented at the Annual Meeting and related information to help stockholders make an informed vote. Distribution of this proxy statement and a form of proxy to stockholders is scheduled to begin on or about September 18, 2019.

| What am I voting on? | Voting Recommendation | |

| Stockholders are being asked to elect nine director nominees for aone-year term. This section includes information about the Board and each director nominee. | The Board recommends a voteFOR each of the nine director nominees.

| |

The Board is elected by the stockholders to oversee the overall success of the Company, review its operational and financial capabilities, and periodically assess its long-term strategic objectives. The Board serves as the ultimate decision-making body of the Company, except for those matters reserved to stockholders. The Board selects and oversees the members of senior management who are charged by the Board with conducting theday-to-day business of the Company. The Board acts as an advisor to senior management and ultimately monitors management’s performance.

Election Process

The Company’sBy-Laws provide for the annual election of directors. TheBy-Laws provide that each director is elected by a majority of the votes cast for the director at any meeting held for the election of directors at which a quorum is present and the director is running unopposed. If a nominee that is an incumbent director does not receive a required majority of the votes cast, the director must offer to tender his or her resignation to the Board. The Governance and Compensation Committee (the “G&C Committee”) then considers such offer and will make a recommendation to the Board on whether to accept or reject the resignation, or whether other action should be taken. The Board will consider the G&C Committee’s recommendation and will determine whether to accept such offer. The Board will disclose its decision and the rationale behind it within 90 days of the certification of the election results.

2019 Nominees for Director

There are nine nominees for election as director, as listed on the following pages. Each of the nominees is a current member of the Board. The nine persons listed have been nominated for election to the Board by the Company’s G&C Committee. The nominees, with the exception of Mr. Golisano and Mr. Mucci, are independent under both the Nasdaq Stock Market (“Nasdaq”) and Securities and Exchange Commission (“SEC”) director independence standards. If elected, each nominee will hold office until his or her successor is elected and has

Paychex, Inc. 2019 Proxy Statement • 3

Election of Directors

|

|

|

|

|

qualified or until his or her earlier resignation or removal. We believe that all of the nominees will be available to serve as a director. However, if any nominee should become unable to serve, the persons named in the enclosed proxy may exercise discretionary authority to vote for substitute nominees proposed by the Board.

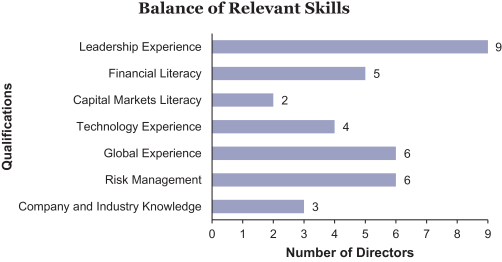

The Board believes that the combination of the various qualifications, skills, and experience of the 2019 director nominees will continue to contribute to an effective and well-functioning Board. We have provided biographical information on each of the nominees. Included within this information, we identify and describe the key experience, qualifications, and skills each director nominee brings to the Board that are important in light of our business and structure.

The Board recommends the election of each of the director nominees identified on the following pages. Unless otherwise directed, the persons named in the enclosed proxy will vote the proxy FOR the election of each of these director nominees.

|

Summary of Director Nominees

Our Board is composed of accomplished professionals, with diverse areas of expertise, who are well-equipped to oversee the success of the business and effectively represent the interests of stockholders. The G&C Committee believes that all directors should: possess the highest personal and professional ethics; share the values of the Company; have relevant experience; be accomplished in their field; and show innovative and sound business judgment. The Board has identified particular qualifications, attributes, skills, and experience that are important to be represented on the Board as a whole, in light of the Company’s business and current needs. The Board believes the combination of the various qualifications, attributes, skills, and experience of the director nominees contribute to a well-functioning and effective Board.

Paychex, Inc. 2019 Proxy Statement • 4

|

Election of Directors

|

|

B. Thomas Golisano

Founder and Chairman of the Board of Paychex, Inc.

| ||||

Age 77

Director since 1979

Board Committees: • Executive

Current Public Company Directorships: • Twinlab Consolidated Holdings, Inc. |

Mr. Golisano founded Paychex in 1971 and is Chairman of the Board of the Company. He served as President and CEO of the Company until October 2004. He serves on the board of trustees of the Rochester Institute of Technology. Mr. Golisano serves on the boards of Cognivue, Inc. and Twinlab Consolidated Holdings, Inc. and serves as a director of numerousnon-profit organizations and private companies. He is founder and member of the board of trustees of the B. Thomas Golisano Foundation.

| |||

SPECIFIC QUALIFICATIONS AND SKILLS: The Board has concluded that Mr. Golisano is qualified to lead the Board due to his relevant executive leadership experience and extensive knowledge of the operations of the Company. These skills were attained through his role of founder and former CEO of Paychex.

| ||||

Thomas F. Bonadio

Founder and Senior Counsel of The Bonadio Group

| ||||

Age 70

Director since 2017

Board Committees: • Audit • Corporate Development Advisory

Current Public Company Directorships: • CurAegis Technologies, Inc. |

Mr. Bonadio is the founder and senior counsel of The Bonadio Group, the largest independent provider of accounting, business advisory, and financial services in New York State outside of Manhattan. Mr. Bonadio has experience serving on community organizations andnot-for-profit boards, as well as publicly traded boards. He is currently a director and chair of the audit committee for CurAegis Technologies, Inc. He also previously served as a director and audit committee chair for Conceptus, Inc., which is now a wholly owned subsidiary of Bayer AH of Germany.

| |||

SPECIFIC QUALIFICATIONS AND SKILLS: The Board has concluded that Mr. Bonadio is qualified to serve as a director of the Company due to his strong background in finance and business, his entrepreneurial experience, and his knowledge of the Certified Public Accountant community. Mr. Bonadio is a successful entrepreneur whose experience building his own business is representative of many clients Paychex serves today. He also brings a high degree of financial literacy obtained from his years in the financial services industry, and his ability to assess financial performance of other companies through the review and understanding of financial statements. This financial expertise is a great benefit to the Board and its committees.

| ||||

Paychex, Inc. 2019 Proxy Statement • 5

Election of Directors

|

|

|

|

|

Joseph G. Doody

Former Vice Chairman of Staples, Inc.

| ||||

Age 67

Director since 2010

Board Committees: • Audit • Investment

Current Public Company Directorships: • Casella Waste Systems, Inc. • Virtusa Corporation |

Mr. Doody retired from Staples, Inc., an office products company, in September 2017. He previously served as Vice Chairman of Staples, Inc. since February 2014. Prior to that, he served as President, North American Commercial, from January 2013 until February 2014, and President, North American Delivery, from March 2002 to January 2013. Mr. Doody has experience serving on other public boards, including Casella Waste Systems, Inc. and Virtusa Corporation. Mr. Doody is a member of the Foundation Board at The College at Brockport.

| |||

SPECIFIC QUALIFICATIONS AND SKILLS: The Board has concluded that Mr. Doody is qualified to serve as a director of the Company due to his significant leadership and international experience. His long tenure in management of a large division of a multinational company enables him to provide our Board with important operational expertise. In addition, his deep knowledge of small- tomedium-sized businesses brings a thorough understanding of the risks and opportunities affecting the Company’s clients and potential clients. Mr. Doody also has extensive experience in strategic planning and business development, which allows him to provide valuable input into the Company’s plans for market growth.

| ||||

David J.S. Flaschen

Investor and Advisor

| ||||

Age 63

Director since 1999

Board Committees: • Audit (Chair) • Investment • Corporate Development Advisory • G&C

Current Public Company Directorships: • Informa PLC (London Stock Exchange) |

Mr. Flaschen is an investor and advisor to a number of private companies providing business, marketing, and information services. Mr. Flaschen is theco-founder of Regrub, LLC, a Smashburger franchisee group in the United States (“U.S.”). From 2005 to 2011, he was a partner with Castanea Partners, a private equity investment firm. Mr. Flaschen is a member of the National Association of Corporate Directors Blue Ribbon Commission on Adaptive Governance for Board Oversight of Disruptive Risks. Mr. Flaschen is also a director/advisor of various private companies. He also serves as a director and member of the audit committee for Informa PLC, a Financial Times Stock Exchange 100 public company which is traded on the London Stock Exchange.

| |||

SPECIFIC QUALIFICATIONS AND SKILLS: The Board has concluded that Mr. Flaschen is qualified to serve as a director of the Company as a result of his extensive executive experience in information and marketing services. Over the course of his career, Mr. Flaschen has worked internationally with a number of businesses, including Thomson Financial and AC Nielsen. He also brings a high degree of financial literacy obtained from his years in the financial services industry, and his ability to assess financial performance of other companies through review and understanding of financial statements.This financial expertiseis a great benefit to the Board and its committees.

| ||||

Paychex, Inc. 2019 Proxy Statement • 6

|

Election of Directors

|

|

Pamela A. Joseph

Former President and Chief Operating Officer of Total System Services, Inc.

| ||||

Age 60

Director since April 2018 (previously served from 2005-2017, reappointed in 2018)

Board Committees: • G&C

Current Public Company Directorships: • TransUnion • Adyen N.V. (Euronext) |

Ms. Joseph served as President, Chief Operating Officer, and Board Member of Total System Services, Inc. (“TSYS”), from May 2016 until September 2017. TSYS offers issuer services and merchant payment acceptance for credit, debit, prepaid, healthcare, and business solutions. Previously, she served as a Vice Chair of U.S. Bancorp Payment Services and Chair of Elavon (formerly NOVA Information Systems, Inc.), a wholly owned subsidiary of U.S. Bancorp, from December 2004 until her retirement in June 2015. U.S. Bancorp Payment Services and Elavon manage and facilitate consumer and corporate card issuing, as well as payment processing. Ms. Joseph serves on the Board of Directors of TransUnion and Adyen N.V., and previously served on the Paychex Board from 2005 until March 2017.

| |||

SPECIFIC QUALIFICATIONS AND SKILLS: The Board has concluded that Ms. Joseph is qualified to serve as a director of the Company due to her extensive executive experience in the financial services and payment industries. Her wealth of technology experience brings insight to the Board and its committees. In addition, her experience with major acquisitions, board experience with the healthcare services field, and international expansion provides valuable input towards the Company’s growth plans.

| ||||

Martin Mucci

President and Chief Executive Officer of Paychex, Inc.

| ||||

Age 59

Director since 2010

Board Committees: • Executive (Chair) • Corporate Development Advisory

Current Public Company Directorships: • None |

Mr. Mucci has served as President and CEO of the Company since September 2010. Mr. Mucci joined the Company in 2002 as Senior Vice President (“SVP”), Operations. Prior to joining Paychex, he held senior level positions with Frontier Communications, a telecommunications company, including President of Telephone Operations and CEO of Frontier Telephone of Rochester, over the course of his20-year career. Mr. Mucci was a member of the Board of Directors of Cbeyond, Inc. until it was purchased by Birch Communications in July 2014. He is a member of the Upstate New York Regional Advisory Board of the Federal Reserve Bank of New York and is a Trustee Emeritus of St. John Fisher College.

| |||

SPECIFIC QUALIFICATIONS AND SKILLS: The Board has concluded that Mr. Mucci is qualified to serve as a director of the Company because he providesday-to-day leadership as the current President and CEO of Paychex, giving him extensive knowledge of the Company, its operations, challenges, and opportunities. In addition, Mr. Mucci’s educational background and senior leadership experience provide him with strong financial literacy.

| ||||

Paychex, Inc. 2019 Proxy Statement • 7

Election of Directors

|

|

|

|

|

Joseph M. Tucci

Founder, Co-Chief Executive Officer, and Co-Chairman of GTY Technology Holdings, Inc.

| ||||

Age 72

Director since 2000

Lead Independent Director

Board Committees: • G&C (Chair) • Executive

Current Public Company Directorships: • Motorola Solutions, Inc. • GTY Technology Holdings, Inc. |

Mr. Tucci is theco-founder of GTY Technology Holdings, Inc., a special purpose acquisitions company founded in September 2016, and is a member of the board of directors. He has been Chairman of Bridge Growth Partners, LLC, a private equity firm based in New York, since October 2016. Mr. Tucci was the former Chairman of the Board of Directors and CEO of EMC Corporation, a provider of data-storage systems. He was EMC’s Chairman from January 2006 and CEO from January 2001 until September 2016, when Dell Technologies acquired the company. He was Chairman of the Board of Directors for VMWare, Inc. from 2007 through September 2016. He serves on the Board of Directors of Motorola Solutions, Inc., and on the boards of various academic and community organizations.

| |||

SPECIFIC QUALIFICATIONS AND SKILLS: The Board has concluded that Mr. Tucci is qualified to serve as a director of the Company due to his extensive executive leadership experience as CEO of EMC Corporation. Mr. Tucci has spent over 40 years in the technology industry in senior roles at large, complex, and global technology companies. His experience leading EMC through a period of dramatic revitalization, growth and market share gains, and new product introductions enables him to share knowledge of the challenges a company faces due to rapid changes in the marketplace.

| ||||

Joseph M. Velli

Retired Financial Services and Technology Executive

| ||||

Age 61

Director since 2007

Board Committees: • Investment (Chair) • Executive • Corporate Development Advisory (Chair) • G&C

Current Public Company Directorships: • Computershare Ltd. (Australian Stock Exchange) • Cognizant Technology Solutions Corp. |

Mr. Velli currently serves on the Board of Directors of Computershare Limited, a global provider of corporate trust, stock transfer, employee share plan, and mortgage servicing services. In December 2017, Mr. Velli was appointed to the Board of Directors of Cognizant Technology Solutions Corp., a multinational corporation that provides information technology services, including digital, technology, consulting, and operations services. He also serves on the Board of Directors of Foreside Financial Group, a private company in the investment management industry. Mr. Velli previously served as Senior Executive Vice President of The Bank of New York and as a member of the Senior Policy Committee. During his22-year tenure with The Bank of New York, Mr. Velli’s responsibilities included heading Global Issuer Services, Global Custody and related Investor Services, Global Liquidity Services, Pension and 401(k) Services, Consumer and Retail Banking, Correspondent Clearing, and Securities Services. Most recently, he served as Chairman and CEO of ConvergEx Group, LLC, a provider of brokerage, software products, and technology services from 2006 to 2013, and continued to serve on the ConvergEx Board until 2014. Mr. Velli served on the Board of Directors of E*TRADE Financial Corporation and E*TRADE Bank until October 2014. Mr. Velli has been a member of the board of trustees for William Paterson University since June 2017. Mr. Velli acts as a Senior Advisor to Lovell Minnick Partners and, from time to time, he provides advisory services to other private equity firms.

| |||

SPECIFIC QUALIFICATIONS AND SKILLS: The Board has concluded that Mr. Velli is qualified to serve as a director of the Company due to his extensive experience with securities servicing, capital markets, business to business, marketing, and mergers and acquisitions matters, as well as his public board experience. He plays a key role in the Board’s discussions of the Company’s investments and liquidity. Mr. Velli has extensive experience with acquisitions and business services, providing valuable insights on potential growth opportunities for the Company.

| ||||

Paychex, Inc. 2019 Proxy Statement • 8

|

Election of Directors

|

|

Kara Wilson

Former Chief Marketing Officer of Rubrik, Inc.

| ||||

Age 49

Director since 2017

Board Committees: • Audit • Corporate Development Advisory

Current Public Company Directorships: • None |

Ms. Wilson was formerly Chief Marketing Officer at Rubrik, Inc., a cloud data management company, a role she held since June 2017. She has over 20 years of experience in drivinggo-to-market strategies for large, medium, and hyper-growthstart-ups. She has held marketing leadership roles with some of the technology industry’s most influential companies, including Cisco Systems, SAP, SuccessFactors, PeopleSoft/Oracle, Okta, and FireEye, Inc. Prior to Rubrik, from October 2016 to June 2017, Ms. Wilson was Executive Vice President and from August 2013 to June 2017, Chief Marketing Officer of cyber security company FireEye, where she helped launch FireEye’s initial public offering and was responsible for the company’s global marketing initiatives including corporate, product, and technical marketing, global communications, and field enablement.

| |||

SPECIFIC QUALIFICATIONS AND SKILLS: The Board has concluded that Ms. Wilson is qualified to serve as a director of the Company due to her extensive experience in drivinggo-to-market strategies for enterprise technology companies. The Board can leverage Ms. Wilson’s marketing experience to help Paychex with the development and execution ofgo-to-market strategies to effectively differentiate the Company in a highly competitive and constantly evolving industry. Ms. Wilson has experience at global companies and can provide insight on any expansion of the Company’s global presence.

| ||||

Paychex, Inc. 2019 Proxy Statement • 9

Director Compensation

|

|

|

|

|

Director compensation is recommended by the G&C Committee and approved by the Board annually in July. The Board’s authority cannot be delegated to another party. The Company’s management does not play a role in setting Board compensation. The Company compensates the independent directors of the Board using a combination of cash and equity-based compensation. Martin Mucci, President and CEO, receives no compensation for his services as a director. Rather, the compensation received by Mr. Mucci in his role as President and CEO is shown in the Fiscal 2019 Summary Compensation Table, contained in the Named Executive Officer Compensation section of this proxy statement.

The table below presents the total compensation received from the Company by all directors except Mr. Mucci for fiscal year ended May 31, 2019 (“fiscal 2019”).

Name (a)

| Fees Earned (b)

| Stock Awards

| Option Awards

| Total

| ||||||||||||||||

B. Thomas Golisano | $ | 326,250 | $ | — | $ | — | $ | 326,250 | ||||||||||||

Thomas F. Bonadio | $ | 98,750 | $ | 77,900 | $ | 78,892 | $ | 255,542 | ||||||||||||

Joseph G. Doody | $ | 98,750 | $ | 77,900 | $ | 78,892 | $ | 255,542 | ||||||||||||

David J.S. Flaschen | $ | 133,250 | $ | 77,900 | $ | 78,892 | $ | 290,042 | ||||||||||||

Phillip Horsley(1) | $ | 23,125 | $ | — | $ | — | $ | 23,125 | ||||||||||||

Grant M. Inman(1) | $ | 28,625 | $ | — | $ | — | $ | 28,625 | ||||||||||||

Pamela A. Joseph(2) | $ | 93,750 | $ | 97,392 | $ | 98,613 | $ | 289,755 | ||||||||||||

Joseph M. Tucci | $ | 113,000 | $ | 77,900 | $ | 78,892 | $ | 269,792 | ||||||||||||

Joseph M. Velli | $ | 109,750 | $ | 77,900 | $ | 78,892 | $ | 266,542 | ||||||||||||

Kara Wilson | $ | 98,750 | $ | 77,900 | $ | 78,892 | $ | 255,542 | ||||||||||||

| (1) | Mr. Horsley and Mr. Inman did not seekre-election at the 2018 Annual Meeting. |

| (2) | Ms. Joseph received a higher amount of stock and option awards to include prorated time from her reappointment date in April 2018 to the grant date of the awards in July 2018. |

Fees Earned or Paid in Cash (Column (b))

The amounts reported in this column reflect the annual cash compensation paid to the directors during fiscal 2019, whether or not such fees were deferred. Annual cash compensation for directors is comprised solely of annual retainers, which are paid in quarterly installments. These retainers are paid for participation on the Board with separate retainers for committee membership. In addition to their committee membership retainers, committee chairs (with the exception of the Executive Committee) receive additional retainers in recognition for their time contributed in preparation for committee meetings.

Approved in July 2018 and effective in October 2018, the annual cash retainer applicable to all independent directors was increased from $80,000 to $85,000, and the annual cash retainer for the G&C Committee Chair was increased from $14,500 to $17,500. Mr. Golisano, who is not an independent director, receives an annual retainer of $335,000, increased from $300,000, for his services as Chairman of the Board, paid in quarterly installments. The Board received competitive market data on director compensation of companies in our compensation peer group (as discussed beginning on page 39, “Peer Group”) from our independent consultants. Based on the G&C Committee’s review of this, it increased these annual retainers to better align total compensation for directors to the median of our Peer Group.

Paychex, Inc. 2019 Proxy Statement • 10

|

Director Compensation

|

|

The annual retainers, applicable to all independent directors, in effect for fiscal years 2019 (effective in October 2018) and 2018 are as follows:

Compensation Element | 2019 | 2018 | ||||||

Annual cash retainer | $ | 85,000 |

| $ | 80,000 |

| ||

Audit Committee member annual retainer | $ | 10,000 |

| $ | 10,000 |

| ||

G&C Committee member annual retainer | $ | 7,500 |

| $ | 7,500 |

| ||

Investment Committee member annual retainer | $ | 5,000 |

| $ | 5,000 |

| ||

Executive Committee member annual retainer | $ | 5,000 |

| $ | 5,000 |

| ||

Corporate Development Advisory Committee member annual retainer | $ | 5,000 |

| $ | 5,000 |

| ||

Audit Committee Chair annual retainer(1) | $ | 22,000 |

| $ | 22,000 |

| ||

G&C Committee Chair annual retainer(1) | $ | 17,500 |

| $ | 14,500 |

| ||

Corporate Development Advisory Committee Chair annual retainer(1) | $ | 2,000 |

| $ | 2,000 |

| ||

Investment Committee Chair annual retainer(1) | $ | 2,000 |

| $ | 2,000 |

| ||

| (1) | The committee chair receives the chair annual retainer in addition to the respective committee member retainer. |

Equity Awards: Stock Awards (Column (c)) and Option Awards (Column (d))

The amounts reported in these columns reflect the grant-date fair value of restricted stock awards and stock option awards, respectively, granted to each independent director, and do not reflect whether the recipient has actually received a financial gain from these awards (such as a lapse in the restrictions on a restricted stock award or by exercising stock options). For fiscal 2019, the equity-based compensation structure for independent directors was increased from a total value of approximately $130,000 per director to a total value of approximately $160,000 per director, with approximately 50% awarded in the form of stock options and 50% in the form of restricted stock. The increase for fiscal 2019 was designed to better align total compensation for directors to the median of our Peer Group. In July 2018, all independent directors, with the exception of Mr. Horsley and Mr. Inman, received an annual equity award under the Paychex, Inc. 2002 Stock Incentive Plan, as amended and restated October 14, 2015 (the “2002 Plan”) as follows:

| Restricted Stock Awards | Option Awards | |||

Grant Date | July 12, 2018 | July 12, 2018 | ||

Exercise Price | N/A | $70.37 | ||

Quantity | 1,107(1) | 8,641(1) | ||

Fair Value(2) | $70.37 | $9.13 | ||

Vesting Schedule | On the first anniversary of the date of grant. | On the first anniversary of the date of grant. | ||

| Certain Restrictions | Shares may not be sold during the director’s tenure as a member of the Board, except as necessary to satisfy tax obligations. | N/A | ||

| Other(3) | Upon the discretion of the Board, unvested shares may be accelerated in whole or in part for certain events including, but not limited to, director retirement. | Unvested options outstanding upon the retirement of a Board member will be canceled. | ||

| (1) | At the grant date, Ms. Joseph received awards of 1,384 shares of restricted stock and 10,801 stock options which include the awards mentioned above plus prorated awards for the time from her reappointment date in April 2018 to the grant date. |

| (2) | The fair value of restricted stock awards is determined based on the closing price of the underlying common stock on the date of grant. The fair value of stock option awards is determined using a Black-Scholes option pricing model. The assumptions used in determining the July 12, 2018 fair value of $9.13 per share for these stock options were: risk-free interest rate of 2.9%; dividend yield of 3.5%; volatility factor of 0.18; and expected option term life of 6.5 years. |

| (3) | Retirement eligibility for this purpose begins at age 55 or older with 10 years of service as a member of the Board. |

Paychex, Inc. 2019 Proxy Statement • 11

Director Compensation

|

|

|

|

|

As of May 31, 2019, each independent director had the following equity awards outstanding:

Director

| Restricted

| Stock

| ||||||||

Thomas F. Bonadio |

| 1,107 |

| 22,660 | ||||||

Joseph G. Doody |

| 1,107 |

| 28,476 | ||||||

David J.S. Flaschen |

| 1,107 |

| 78,023 | ||||||

Pamela A. Joseph |

| 1,384 |

| 45,296 | ||||||

Joseph M. Tucci |

| 1,107 |

| 97,177 | ||||||

Joseph M. Velli |

| 1,107 |

| 97,177 | ||||||

Kara Wilson |

| 1,107 |

| 18,256 | ||||||

Deferred Compensation Plan

We maintain anon-qualified and unfunded deferred compensation plan in which all independent directors are eligible to participate. Directors may elect to defer up to 100% of their Board cash compensation. The Company does not contribute to this plan. Gains and losses are credited based on the participant’s selection of a variety of designated investment choices, which the participant may change at any time. We do not match any participant deferral or guarantee a certain rate of return. The interest rates earned on these investments are not above-market or preferential. Refer to theNon-Qualified Deferred Compensation table and discussion within the Named Executive Officer Compensation section of this proxy statement for a listing of investment funds available to participants and the annual rates of return on those funds. During fiscal 2019, no independent directors deferred compensation under the plan.

Benefits

We reimburse each director for expenses associated with attendance at Board and committee meetings.

Stock Ownership Guidelines

The G&C Committee recommended and the Board approved stock ownership guidelines for our independent directors with a value of six times his or her annual Board retainer, not including any committee or committee chair retainers. The G&C Committee received competitive market data on director compensation of companies in our Peer Group from our independent consultants. Based on the G&C Committee’s review of this information, it increased the stock ownership guidelines from a value of five times his or her annual Board retainer to a value of six times. The ownership guidelines were established to provide long-term alignment with stockholders’ interests. The independent directors are expected to attain the ownership guideline within five years after the later of first becoming a director or the initial adoption of the increased guideline. Directors must hold underlying stock received through restricted stock awards until their service on the Board is complete, with the exception of those shares sold as necessary to satisfy tax obligations. For the purpose of achieving the ownership guideline, restricted stock awarded to the directors is included. All independent directors are currently compliant with the stock ownership guidelines.

Prohibition on Hedging or Speculating In Company Stock

Directors must adhere to strict standards with regards to trading in Paychex stock. Also, the Company prohibits directors from hedging Paychex stock. They may not, among other things:

| • | speculatively trade in Paychex stock; |

| • | short sell any securities of the Company; or |

| • | buy or sell puts or calls on the Company’s securities. |

Paychex, Inc. 2019 Proxy Statement • 12

|

Beneficial Ownership

|

|

Pledging of Company Stock

The Company has a pledging policy for all Paychex directors, officers, and employees. This policy prohibits pledging Company securities as collateral for a loan or a line of credit without obtaining prior Company approval. Approval may be granted when the individual clearly demonstrates the intent and financial capacity to satisfy the obligations without resort to the pledged securities and where the total pledge represents no more than 25% of the pledgor’s beneficial ownership interest in the Company. The Company’s pledging policy is posted on the Company’s website atwww.paychex.com/investors under Corporate Governance & Committees.

The following table contains information, as of July 31, 2019, on the beneficial ownership of the Company’s common stock by:

| • | each principal stockholder known to be a beneficial owner of more than 5% of the Company’s common stock. This includes any “group” as that term is used in Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”); |

| • | each director and nominee for director; |

| • | each of the Company’s NEOs; and |

| • | all directors, NEOs, and executive officers of the Company as a group. |

Under the rules of the SEC, “beneficial ownership” is deemed to include shares for which the individual, directly or indirectly, has or shares voting or disposition power, whether or not they are held for the individual’s benefit, and includes shares that may be acquired within 60 days by exercise of options. This information is based upon reports filed by such persons with the SEC.

Paychex, Inc. 2019 Proxy Statement • 13

Beneficial Ownership

|

|

|

|

|

| Name | Amount of Shares Owned(1) | Non-vested Shares Stock(2) | Stock Options Exercisable by September 29, 2019(3) | Total Shares Beneficially Owned | Percent of Class | ||||||||||||||||||||

Principal Stockholders: | |||||||||||||||||||||||||

B. Thomas Golisano(4),(5),(6) | |||||||||||||||||||||||||

1 Fishers Road | |||||||||||||||||||||||||

Pittsford, NY 14534 | 37,846,344 |

| — |

| — |

| 37,846,344 |

| 10.5 | % | |||||||||||||||

BlackRock Inc.(7) | |||||||||||||||||||||||||

55 East 52nd Street | |||||||||||||||||||||||||

New York, NY 10055 | 34,524,333 |

| — |

| — |

| 34,524,333 |

| 9.5 | % | |||||||||||||||

Vanguard Group Inc.(8) | |||||||||||||||||||||||||

PO Box 2600 V26 | |||||||||||||||||||||||||

Valley Forge, PA 19482-2600 | 26,398,764 |

| — |

| — |

| 26,398,764 |

| 7.3 | % | |||||||||||||||

Directors: | |||||||||||||||||||||||||

B. Thomas Golisano(4),(5),(6) | 37,846,344 |

| — |

| — |

| 37,846,344 |

| 10.5 | % | |||||||||||||||

Thomas F. Bonadio |

| 12,532 |

| 975 |

| 22,660 |

| 36,167 |

| * | * | ||||||||||||||

Joseph G. Doody | 18,639 |

| 975 |

| 28,476 |

| 48,090 |

| * | * | |||||||||||||||

David J.S. Flaschen | 42,244 |

| 975 |

| 78,023 |

| 121,242 |

| * | * | |||||||||||||||

Pamela A. Joseph | 5,762 |

| 975 |

| 33,140 |

| 39,877 |

| * | * | |||||||||||||||

Martin Mucci | 276,535 |

| 58,791 |

| 1,645,410 |

| 1,980,736 |

| * | * | |||||||||||||||

Joseph M. Tucci | 49,867 |

| 975 |

| 97,177 |

| 148,019 |

| * | * | |||||||||||||||

Joseph M. Velli | 31,408 |

| 975 |

| 97,177 |

| 129,560 |

| * | * | |||||||||||||||

Kara Wilson | 2,246 |

| 975 |

| 18,256 |

| 21,477 |

| * | * | |||||||||||||||

Named Executive Officers: | |||||||||||||||||||||||||

Martin Mucci | 276,535 |

| 58,791 |

| 1,645,410 |

| 1,980,736 |

| * | * | |||||||||||||||

Efrain Rivera | 49,716 |

| 12,476 |

| 492,958 |

| 555,150 |

| * | * | |||||||||||||||

Mark A. Bottini | 53,681 |

| 11,129 |

| 343,581 |

| 408,391 |

| * | * | |||||||||||||||

John B. Gibson | 19,525 |

| 13,688 |

| 214,043 |

| 247,256 |

| * | * | |||||||||||||||

Michael E. Gioja | 59,490 |

| 11,129 |

| 148,674 |

| 219,293 |

| * | * | |||||||||||||||

All directors, NEOs, and executive | 38,578,193 |

| 127,848 |

| 3,614,725 |

| 42,320,766 |

| 11.7 | % | |||||||||||||||

| ** | Indicates that percentage is less than 1%. |

| (1) | This column reflects shares held of record and Company shares owned through a bank, broker, or other holder of record. For executive officers, this also includes shares owned through the Paychex, Inc. 401(k) Incentive Retirement Plan (the “401(k) Plan”). |

| (2) | This column includes restricted stock awards to independent directors and executive officers that have not yet vested. Thesenon-vested restricted stock awards have voting and dividend rights, and thus are included in beneficial ownership. |

| (3) | This column includes shares that may be acquired upon exercise of options, which are exercisable on or prior to September 29, 2019. Under SEC rules, shares that may be acquired within 60 days are included in beneficial ownership. |

| (4) | Included in shares beneficially owned for Mr. Golisano are 278,068 shares owned by the B. Thomas Golisano Foundation, of which Mr. Golisano is a member of the foundation’seight-member board of trustees. Mr. Golisano disclaims beneficial ownership of these shares, but does share voting and investment power. |

| (5) | Mr. Golisano has 7,750,295 shares pledged as security. |

| (6) | Included in shares beneficially owned are 59,424 shares held in the name of family members, trusts, or other entities of Mr. Golisano. Mr. Golisano shares voting and investment power of these shares. |

| (7) | Beneficial ownership is based on information as of June 30, 2019, contained in the Form 13F filed with the SEC on August 13, 2019, amended on August 23, 2019, by BlackRock, Inc., including notice that it has, along with certain institutional investment managers for which it is the parent holding company, sole voting power as to 30,387,281 shares and sole dispositive power as to 34,524,333 shares. |

| (8) | Beneficial ownership is based on information as of June 30, 2019, contained in the Form 13F filed with the SEC on August 14, 2019 by Vanguard Group Inc., including notice that it has sole voting power as to 399,171 shares, sole dispositive power as to 25,896,846 shares, shared voting power as to 126,770 shares, and shared dispositive power as to 501,918 shares. |

Paychex, Inc. 2019 Proxy Statement • 14

|

Corporate Governance

|

|

The Board recognizes the fundamental principle that good corporate governance is critical to organizational success and the protection of stockholder value. As such, the Board has adopted a set of Corporate Governance Guidelines as a statement of principles guiding the Board’s conduct. These principles are intended to be interpreted in the context of all applicable laws and the Company’s Restated Certificate of Incorporation,By-Laws, as amended, and other governing documents. A copy of these guidelines can be found on our website at:www.paychex.com/investors under Corporate Governance & Committees.

The Board’s current leadership structure is comprised of:

| • | Chairman of the Board andnon-independent director (Mr. Golisano); |

| • | the President and CEO as anon-independent director (Mr. Mucci); |

| • | an independent director serving as Lead Independent Director (Mr. Tucci); and |

| • | Audit, G&C, Corporate Development Advisory, and Investment committees led by independent directors. |

The Board believes this structure provides a well-functioning and effective balance between strong Company leadership and appropriate safeguards and oversight by independent directors. The Board currently separates the role of Chairman of the Board from the CEO. We believe that the Company is best served by having a Chairman who hasin-depth knowledge of the Company’s operations and the industry, but is not involved in theday-to-day operations of the Company. Mr. Golisano’s extensive experience as founder and former CEO qualifies him to lead the Board, particularly as it focuses on strategic risks and opportunities facing the Company.

Our Lead Independent Director has responsibility for conducting regularly scheduled executive sessions of thenon-management or independent directors and such other responsibilities as the independent directors may assign. Regularly scheduled executive sessions of the members of the Board, without members of management present, are held at each regularly-scheduled Board meeting. As appropriate, matters presented to the Board by the G&C Committee are reviewed and discussed in executive sessions by the independent directors.

The Board and its standing committees that meet regularly conduct performance self-evaluations at least annually to assess the qualifications, attributes, skills, and experience represented on the Board and to determine whether the Board and its committees are functioning effectively.

One of the most important functions of the Board is oversight of risks inherent in the operation of the Company’s business. Senior management is responsible for theday-to-day management of risks facing the Company. The Board implements its risk oversight function both as a whole and through delegation to Board committees. The Board is responsible for ensuring an appropriate culture of risk management exists within the Company, overseeing the Company’s aggregate risk profile, and monitoring how the Company addresses specific risks. The Board receives regular reports from officers on particular risks to the Company, reviews the Company’s strategic plan, and regularly communicates with its committees.

Paychex, Inc. 2019 Proxy Statement • 15

Corporate Governance

|

|

|

|

|

The Board committees, which meet regularly and report back to the full Board, play significant roles in carrying out the risk management function. In general, the committees oversee the following risks:

| Committee | Primary Risk Oversight Area | |

Audit Committee |

• Risk related to financial statement accuracy and reporting;

• Internal controls;

• Legal, regulatory, and compliance risks;

• Information security, technology, privacy and data protection; and

• Other operational and fraud risks.

| |

Investment Committee

|

• Risk related to investing activities.

| |

| G&C Committee | • Risks arising from the Company’s compensation policies and practices for all employees andnon-employee directors; and

• Risk related to governance structure and processes including succession planning, director independence, and related person transactions.

| |

Corporate Development Advisory Committee

| • Risk related to the Company’s acquisition opportunities.

| |

The Audit Committee receives quarterly updates from the Company’s Chief Information Security Officer regarding the Company’s cybersecurity risk management program. These updates include status of current capabilities, ongoing initiatives, as well as the evolving cybersecurity threat landscape.

The G&C Committee regularly reviews the risks and rewards associated with our compensation programs. The programs are designed with features that mitigate risk without diminishing the incentive nature of the compensation. As part of its risk oversight, the G&C Committee conducts an annual assessment of risks arising from the Company’s compensation programs. The G&C Committee reviewed such programs with its independent compensation consultant. The G&C Committee’s assessment included identification of risk with the various forms of compensation, the inherent risk in performance-based compensation metrics, and existing risk mitigation controls. Risk mitigation includes, but is not limited to, the balance of fixed and variable compensation, the balance of short- and long-term compensation, stock ownership guidelines, level of oversight, and controls over financial reporting. Based on this review, the G&C Committee concluded that the Company’s compensation policies and procedures are not reasonably likely to have a material adverse effect on the Company.

Our Corporate Governance Guidelines require that our Board meet at least four times per year. The Board held five meetings in fiscal 2019. To the extent practicable, directors are expected to attend all Board meetings and meetings of the committees on which they serve. During fiscal 2019, the average attendance for the Board and committee meetings was approximately 99%. Each director attended at least 75% or more of the aggregate number of meetings of the Board and of the committees of the Board on which he or she served, where applicable, during fiscal 2019. Directors are expected to attend the Company’s Annual Meetings of Stockholders. All of our then-current directors attended the 2018 Annual Meeting of Stockholders. All directors are independent within the meaning of applicable SEC and Nasdaq director independence standards, with the exception of Mr. Golisano and Mr. Mucci.

Paychex, Inc. 2019 Proxy Statement • 16

|

Corporate Governance

|

|

The Board has established five standing committees with the following responsibilities and director assignments:

Audit Committee

| ||

Committee Members:(1) David J.S. Flaschen (Chair)(2) Thomas F. Bonadio(2) Joseph G. Doody Kara Wilson

6 Meetings in fiscal 2019 |

• Serve as an independent and objective party to monitor the Company’s financial reporting process, internal control system, and financial risk management processes.

• Review the performance and independence of the Company’s independent accountants and internal audit department.

• Provide an open avenue of communication among the independent accountants, financial and senior management, the internal auditors, and the Board.

• Review significant risk exposures and processes to monitor, control, and report such exposures, periodically reporting on such information to the Board.

| |

Executive Committee

| ||

Committee Members: Martin Mucci (Chair) B. Thomas Golisano Joseph M. Tucci Joseph M. Velli

0 Meetings in fiscal 2019

|

• Exercise all the powers and authority of the Board, except as limited by law, between Board meetings and when the Board is not in session. | |

Investment Committee

| ||

Committee Members: Joseph M. Velli (Chair) David J.S. Flaschen(2) Joseph G. Doody

2 Meetings in fiscal 2019

|

• Review the Company’s investment policies and strategies, and the performance of the Company’s investment portfolios.

• Determine that the investment portfolios are managed in compliance with the Company’s established investment policy.

| |

Paychex, Inc. 2019 Proxy Statement • 17

Corporate Governance

|

|

|

|

|

Governance and Compensation Committee

| ||

Committee Members:(3) Joseph M. Tucci (Chair) David J.S. Flaschen(2) Pamela A. Joseph Joseph M. Velli

3 Meetings in fiscal 2019 |

• Evaluate and determine compensation for the CEO and senior executive officers, and recommend director compensation to the Board.

• Provide general oversight with respect to governance of the Board, including periodic review and assessment of corporate governance policies.

• Evaluate compensation policies to determine if they incentivize risks that are reasonably likely to have a material adverse effect on the Company.

• Identify, evaluate, and recommend candidates to be nominated for election to the Board.

• Review annually the independence of directors.

| |

Corporate Development Advisory Committee

| ||

Committee Members: Joseph M. Velli (Chair) Thomas F. Bonadio David J.S. Flaschen(2) Martin Mucci Kara Wilson

4 Meetings in fiscal 2019

|

• Review and provide guidance to management and the Board with respect to the Company’s acquisition or divestiture opportunities, as appropriate, and review related strategy.

• Authority to approve acquisitions or divestitures in accordance with the parameters set by the Board, to the extent permitted by law and the Company’sBy-Laws. | |

| (1) | All members of the Audit Committee, which was established in accordance with Section 3(a)(58)(A) of the Exchange Act, meet the independence, experience, and other applicable Nasdaq listing requirements and applicable SEC rules regarding independence. |

| (2) | Mr. Flaschen and Mr. Bonadio qualify as an “Audit Committee Financial Expert,” as defined by applicable SEC rules. |

| (3) | All members of the G&C Committee meet the Nasdaq independence criteria for compensation committee members and directors overseeing director nominations. |

The Audit, Investment, G&C, and Corporate Development Advisory Committees’ responsibilities are more fully described in each committee’s charter adopted by the Board, which are accessible on the Company’s website atwww.paychex.com/investors under Corporate Governance & Committees.

The G&C Committee is responsible for recommending candidates to the full Board to either fill vacancies or stand for election at each annual meeting of stockholders. The committee follows the Board’s Nomination Policy, which is included in the G&C Committee Charter. The Board does not have a formal policy regarding diversity. However, the Board has determined that it is necessary for the continued success of the Company to ensure that the Board is composed of individuals having a variety of complementary experience, education, training, and relationships relevant to the then-current needs of the Board and the Company.

In evaluating candidates for nomination to the Board, including candidates for nomination recommended by a stockholder, the Nomination Policy requires G&C Committee members to consider the contribution that a candidate for nomination would be expected to make to the Board and the Company. This is based upon the current composition and needs of the Board, and the candidate’s demonstrated business judgment, leadership abilities, integrity, prior experience, education, training, relationships, and other factors that the Board determines relevant. When identifying candidates for nomination to fill vacancies created by the expiration of the term of any incumbent

Paychex, Inc. 2019 Proxy Statement • 18

|

Corporate Governance

|

|

director, the Nomination Policy requires G&C Committee members to determine whether such incumbent director is willing to stand forre-election and, if so, to take into consideration the value to the Board and to the Company of their continuity and familiarity with the Company’s business. The Board has previously used a third-party search firm to identify director candidates and the G&C Committee is authorized by its charter to continue this practice.

The Nomination Policy requires the G&C Committee to consider candidates for nomination to the Board recommended by any reasonable source, including stockholders. Following the Company’s adoption of Amended and Restated By-Laws on May 3, 2019, stockholders who wish to nominate candidates for director must comply with procedures set forth in the By-Laws, including sending timely notice in writing to the Secretary of the Company that includes the information and disclosure required by the By-Laws. For more information, please see the subheading entitled “How Do I Submit a Proposal for Next Year’s Annual Meeting?” in the Frequently Asked Questions section on page 64.

Policy on Transactions with Related Persons

Related persons include our executive officers, directors, director nominees, and holders of more than 5% of the Company’s common stock, as well as their immediate family members. It is generally the Company’s practice to avoid transactions with related persons. However, there may be occasions when a transaction with a related person is in the best interest of the Company. The Company’s policies and procedures for review and approval of related-person transactions appear in the Company’s Standards of Conduct, Conflict of Interest, and Employment of Relatives Standards, which are internally distributed, and in the Company’s Code of Business Ethics and Conduct, which is posted atwww.paychex.com/investors under Corporate Governance & Committees.

Officers are required to disclose any potential conflicts of interest or related person transactions, which include: certain financial interests in or relationships with any supplier, customer, partner, subcontractor, or competitor; and engaging in any activity that could create the appearance of a conflict of interest, including financial involvement or dealings with employees or representatives of the types of entities listed above. Annually, officers and directors complete a Director’s and Officer’s Questionnaire, within which they provide information regarding whether they or any member of their immediate family had any interest in any actual or proposed transaction with Company or any of its subsidiaries where the amount involved exceeded $120,000. The individuals are also asked about any other economic relationships that might be conflicts of interest. The responses are reviewed by our Financial Reporting and Legal Departments to determine if a conflict of interest exists related to any such transaction. For officers, the Company’s Chief Financial Officer (“CFO”) oversees the review of such transactions.

Members of the Board are required to disclose to the Chairman of the Board or the Chair of the G&C Committee any situation that involves, or may reasonably be expected to involve, a conflict of interest with the Company. This includes engaging in any conduct or activities that would impair the Company’s relationship with any person or entity with which the Company has or proposes to enter into a business or contractual relationship.

The Financial Reporting department annually reviews the Company’s listing of related persons for determination of potential related-person transactions that should be disclosed in the Company’s periodic reports to the SEC or under U.S. generally accepted accounting principles (“GAAP”) and SEC rules or proxy materials under SEC rules. The G&C Committee is required to consider all questions of possible conflicts of interest of Board members and executive officers, including review and approval of transactions of the Company in excess of $120,000 in which a director, executive officer, or an immediate family member of a director or executive officer has an interest. The factors considered by the G&C Committee in their review, include: the business objective of the transaction; the individual’s involvement in the transaction; whether the transaction would impact the judgment of the officer or director to act in the best interest of the Company; and any other matters the G&C Committee deems appropriate. For fiscal 2019, no instances of conflict ornon-compliance have occurred. Should a conflict of interest be identified, relevant information and circumstances would be reviewed to determine if action is required relative to continuing the arrangement.

Paychex, Inc. 2019 Proxy Statement • 19

Corporate Governance

|

|

|

|

|

For fiscal 2019, the following transaction in excess of $120,000 was identified and communicated to the G&C Committee:

| • | Mr. Velli, a member of our Board, is also a current board member of Cognizant Technology Solutions Corporation. The Company hadpre-existing relationships with KBACE Technologies, Inc. prior to it being acquired by Cognizant. During fiscal 2019, the Company purchased through negotiated transactions approximately $1.6 million of computer consulting and advisory services from Cognizant. Mr. Velli was not personally involved in the negotiation of these transactions. |

Governance and Compensation Committee Interlocks and Insider Participation

None of the members of the G&C Committee were at any time during fiscal 2019, or at any other time, an officer or employee of the Company. During fiscal 2019, no member of the G&C Committee or Board was an executive officer of another entity on whose Compensation Committee or Board of Directors an executive officer of Paychex served.

Communications with the Board of Directors

The Board has established procedures to enable stockholders and other interested parties to communicate in writing with the Board, including the chair of any standing committee of the Board. Written communications should be clearly marked and mailed to:

Stockholder and Other Interested Parties — Board Communication

Paychex, Inc.

911 Panorama Trail South

Rochester, New York 14625-2396

Attention: Corporate Secretary

In the case of communications intended for committee chairs, the specific committee must be identified. Any such communications that do not identify a standing committee will be forwarded to the Board. The Corporate Secretary will promptly forward all stockholder and other interested party communications to the Board or to the appropriate standing committee of the Board, as the case may be.

The Company has a Code of Business Ethics and Conduct that applies to all of its directors, officers, and employees. The Company requires all of its directors, officers, and employees to adhere to this code in addressing legal and ethical issues that they encounter in the course of doing their work. This code requires our directors, officers, and employees to avoid conflicts of interest, comply with all laws and regulations, conduct business in an honest and ethical manner, and otherwise act with integrity and in the Company’s best interest. All newly hired employees are required to certify that they have reviewed and understand this code. In addition, each year all employees are reminded of and asked to affirmatively acknowledge their obligation to follow the code. The Code of Business Ethics and Conduct is available for review on the Company’s website atwww.paychex.com/investors under Corporate Governance & Committees. The Company intends to disclose any amendment to, or waiver from, a provision of its Code of Business Ethics and Conduct that relates to any element of the code of ethics definition enumerated in Item 406 ofRegulation S-K by posting such information on its website at the address specified above.

Paychex, Inc. 2019 Proxy Statement • 20

|

Say-on-Pay Vote

|

|

| What am I voting on? | Voting Recommendation | |

| Stockholders are being asked to approve, on an advisory basis, the compensation of our NEOs as described in the Compensation Discussion and Analysis (“CD&A”) and the Named Executive Officer Compensation sections of this proxy statement. At the 2018 Annual Meeting of Stockholders, approximately 96% of the total stockholder votes cast were in favor of the Company’s NEO compensation as presented in our 2018 proxy statement. | The Board of Directors recommends a voteFOR the advisory vote approving the NEO compensation, as disclosed in this proxy statement.

| |

We are asking our stockholders to provide advisory approval of the compensation of our NEOs as required by Section 14A of the Exchange Act. This proposal, commonly known as a“say-on-pay” proposal, gives our stockholders an opportunity to express their views on the overall compensation of our NEOs and the philosophy, policies, and practices as described in this proxy statement.Our stockholders are currently given the opportunity to vote, on anon-binding, advisory basis, onsay-on-pay proposals annually, with the next opportunity to vote on such a proposal being the 2020 Annual Meeting of Stockholders. Before you vote, we encourage you to read the CD&A and Named Executive Officer Compensation sections of this proxy statement, which provide detailed information on the Company’s compensation policies and practices, and overall compensation of our NEOs.

Compensation Programs Highlights

Our executive compensation programs are designed to attract, motivate, and retain highly qualified NEOs, who are critical to our success. We strongly believe that our executive compensation — both pay opportunities and pay actually realized — should be tied to Company performance. Under our compensation programs, the NEOs are rewarded for the achievement of specific annual and longer-term strategic and financial goals of the Company. Some key aspects of our compensation programs that you should consider are:

| • | NEO compensation is evaluated and determined by our G&C Committee, which is entirely comprised of independent directors. This committee utilizes the services of an independent consultant to advise them on matters of executive compensation. |

| • | Our executive compensation program is designed to implement core compensation principles, including alignment with stockholders’ interests, long-term value creation, andpay-for-performance. A significant portion of pay is at risk where the amount realized will be dependent on achievement of financial targets or, in the case of certain time-vested equity awards, the value of the Company’s stock. |

| • | A mix of annual and long-term incentive programs creates a balance between short-term and long-term focus, reducing risk in the compensation programs. |

| • | Our equity-based, long-term incentive awards include a mix of options, time-based restricted stock awards, and performance-based awards. |

In addition, we have responsible compensation practices that ensure consistent leadership and decision-making, certain of which are intended to mitigate risk. These include:

| • | Stock ownership guidelines designed to align the directors’ and executives’ long-term financial interests with those of our stockholders. |

Paychex, Inc. 2019 Proxy Statement • 21

Say-on-Pay Vote

|

|

|

|

|

| • | Prohibition of hedging of the Company’s stock for both directors and executive officers. |

| • | Prohibition of pledging Company stock as collateral without prior approval by the Company. |

| • | A long-standing insider trading policy. |

| • | Certain recoupment,non-compete, and other forfeiture provisions within our Annual Officer Performance Incentive Program (the “annual incentive program”) and equity-based compensation agreements. These allow the Company to cancel all or any outstanding portion of equity awards and recoup the gross value of any payouts under the annual incentive program, vested restricted shares, vested performance shares, or profits from exercises of options. |

Results of the 2018Say-on-Pay Vote

At the 2018 Annual Meeting of Stockholders held on October 11, 2018, approximately 96% of the total stockholder votes cast were in favor of the Company’s NEO compensation as presented in our 2018 proxy statement. The G&C Committee considered this favorable outcome and believed it conveyed our stockholders’ support of the committee’s decisions and the existing executive compensation programs. As we evaluated our compensation practices and talent needs throughout fiscal 2019, we remained mindful of the strong support for our compensation policies and practices communicated by our stockholders at the last annual meeting. As a result, the G&C Committee retained the core design of our executive compensation programs as it believes the program continues to attract, retain, and provide appropriate incentive for senior management.

Advisory Vote

The G&C Committee, along with the Board, believe that the policies, procedures, and amounts of compensation discussed here, and described further in this proxy statement, are effective in achieving the desired goals of aligning our executive compensation structure with the interests of our stockholders. To indicate approval of our NEO compensation, a majority of the shares present in person or by proxy and entitled to vote on the proposal at the Annual Meeting must be voted for the proposal.

Thissay-on-pay vote is advisory and therefore is not binding on the Company, the G&C Committee, or our Board. Our Board values the opinions of our stockholders and, to the extent that there is any significant vote against the NEO compensation as disclosed in this proxy statement, we will consider our stockholders’ concerns and the G&C Committee will evaluate whether actions are necessary to address these concerns.

The Board recommends a vote FOR the proposal to approve the NEO compensation on an advisory basis, as

|

Paychex, Inc. 2019 Proxy Statement • 22

|

CD&A

|

|

The CD&A provides you with a description of our executive compensation policies and programs, the decisions made by the G&C Committee regarding executive compensation, and the factors contributing to those decisions. This discussion focuses on the compensation of our NEOs for fiscal 2019, who were:

Name | Title | |

| Martin Mucci | President and Chief Executive Officer (principal executive officer) | |

| Efrain Rivera | Senior Vice President, Chief Financial Officer, and Treasurer (principal financial officer) | |

| Mark A. Bottini | Senior Vice President of Sales | |

| John B. Gibson | Senior Vice President of Service | |

| Michael E. Gioja | Senior Vice President of Information Technology and Product Development | |

Business and Financial Highlights

Our mission is to be the leading provider of human capital management (“HCM”) solutions for payroll, benefits, human resource (“HR”), and insurance services by being an essential partner with America’s businesses. We believe success in this mission will lead to strong, long-term financial performance.

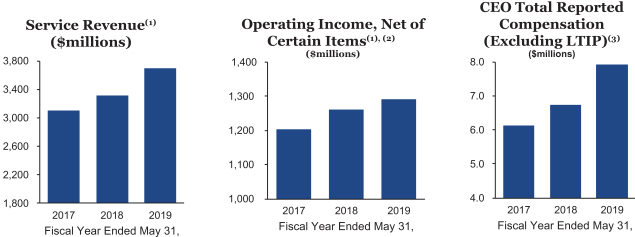

Our executive compensation is tied to financial and operational performance and is intended to drive sustained, long-term increases in stockholder value. We delivered strong financial results for fiscal 2019. Reported financial results for fiscal 2019 and the respective growth percentages compared to the fiscal year ended May 31, 2018 (“fiscal 2018”) were as follows:

For the fiscal year ended May 31, | |||||||||||||||

$ in millions, except per share amounts | 2019 | 2018 As adjusted(1) | % Change | ||||||||||||

Management Solutions revenue | $ | 2,878 | $ | 2,758 |

| 4 | % | ||||||||

PEO and Insurance Services revenue(2) |

| 814 |

| 556 |

| 46 | % | ||||||||

Total service revenue |

| 3,692 |

| 3,314 |

| 11 | % | ||||||||

Interest on funds held for clients |

| 81 |

| 64 |

| 27 | % | ||||||||

Total revenue | $ | 3,773 | $ | 3,378 |

| 12 | % | ||||||||

Operating income | $ | 1,371 | $ | 1,292 |

| 6 | % | ||||||||

Operating income, net of certain items(3) | $ | 1,290 | $ | 1,261 |

| 2 | % | ||||||||

Net income | $ | 1,034 | $ | 994 |

| 4 | % | ||||||||

Adjusted net income(3) | $ | 1,028 | $ | 922 |

| 11 | % | ||||||||

Diluted earnings per share | $ | 2.86 | $ | 2.75 |

| 4 | % | ||||||||

Adjusted diluted earnings per share(3) | $ | 2.84 | $ | 2.55 |

| 11 | % | ||||||||

Operating cash flows | $ | 1,272 | $ | 1,276 |

| 0 | % | ||||||||

| (1) | Amounts have been adjusted to reflect the adoption of ASC Topic 606. |

| (2) | Professional employer organization (“PEO”) and Insurance Services revenue for fiscal 2019 includes the results of Oasis Outsourcing Group Holdings, L.P. (“Oasis”) since its acquisition in December 2018. |