Your Way Quarterly Fall 2021 Franklin Financial Services Corporation F&M TRUST ONE Billion MORE THAN A BILLION REASONS Our Assets Under Management portfolio continues to grow and work reliably for clients. There’s a good reason for that. Maybe more than 1 billion good reasons. see PAGE 6 2 TIM TALK Notes from the President 4 INVESTOR NEWS 3rd Quarter Review 5 CLIENT PROFILE Keystone Ford 6 BANK NEWS More Than a Billion Reasons 7 LEADING THE WAY New Hires & Promotions 8 HELPFUL WAYS In Our Community Bank i n g D one Your Way® ■ 1.888.264.6116 ■ fmtrust.bank

TIMTALK SHAREHOLDER UPDATE Marking a Major Milestone on Our Way Back to Normal Timothy (Tim) G. Henry President & CEO Q4 Franklin Financial reported consolidated earnings of $5.9 million for the third quarter ended September 30, 2021, compared to $3.5 million for the third quarter ended September 30, 2020, and $5.3 million for the second quarter of 2021. Our strong third-quarter financial performance marked a continuation of our move back to “normal” as we saw strong fee income generated by our Residential Mortgage and Investment & Trust teams. The quarter also saw the sale of our current company headquarters and the early stages of renovations at our future headquarters on Nitterhouse Drive in Chambersburg, a move that was dictated by the current and anticipated growth of the bank. Our Investment & Trust team continues to help customers meet their retirement financial goals and recently reached a significant milestone of managing more than $1 billion in assets. We did so by establishing long-term relationships between customers and advisors who understand them on a personal level. Additional information can be found on page 6. Giving back to our communities continues to be a focus for the company. As part of our annual Banktoberfest celebration, we recently donated more than 600 cases of nonperishable items to a pair of food pantries in Shippensburg that serve more than 1,000 residents of Franklin and Cumberland counties each month. You can read more about our contribution on page 8. As we near the end of 2021 and look ahead to what we hope is a prosperous 2022, I thank you for your continued support and trust. Sincerely yours, Timothy G. Henry President & CEO Franklin Financial Services Corporation and F&M Trust 2 Your Way Quarterly

Imagine. Build. Flex. With big purchases in mind, it helps to have real flexibility with financing. The FlexLOC® Home Equity Line is ideal for homeowners who want to manage expenses with greater control. Use FlexLOC® as a refillable line of credit with a variable interest rate, or lock in a portion at a set interest rate and term, just like a regular loan. It’s up to you! Get details and apply at your favorite F&M Trust office soon. That’s just Banking Done Your Way®. FlexLoc Home Equity Line Fall 2021 3

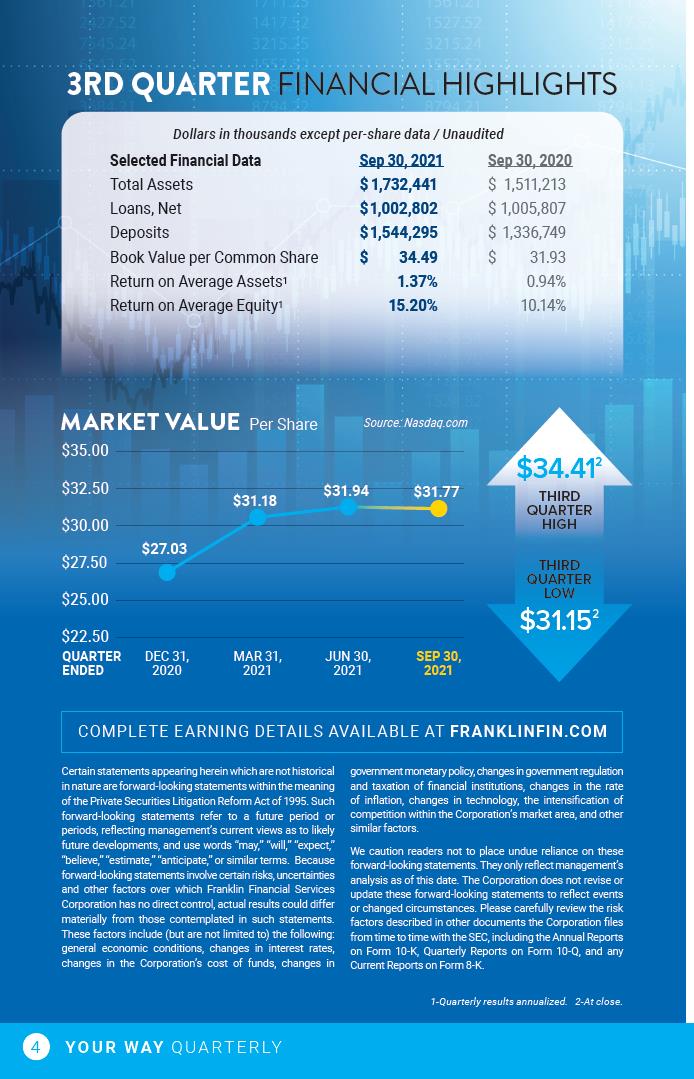

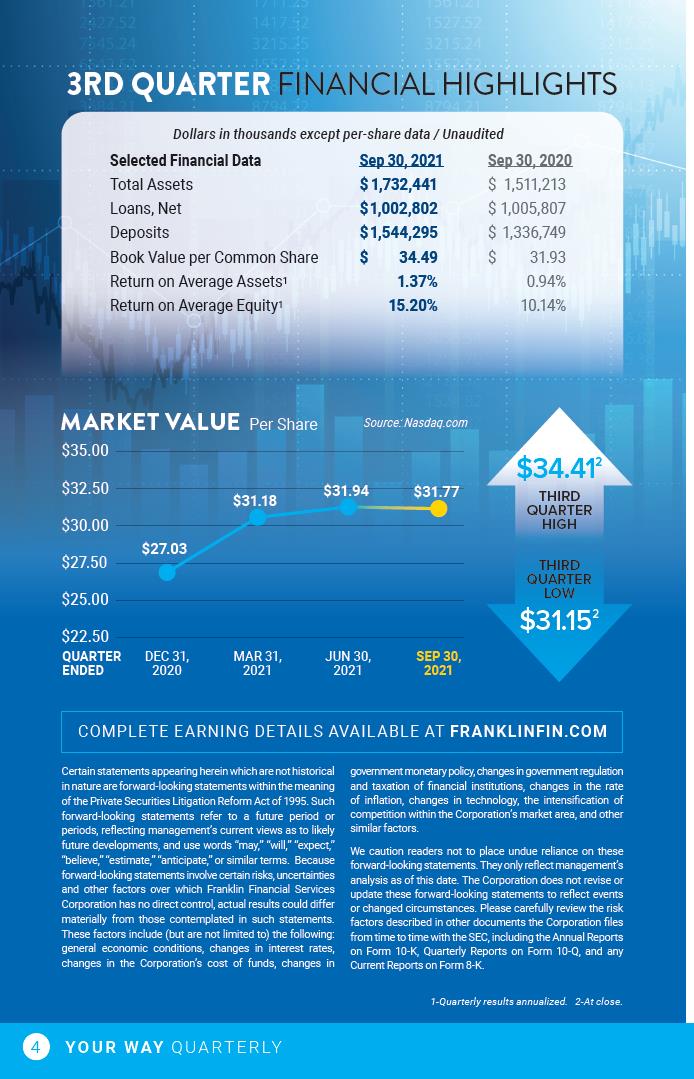

3RD QUARTER FINANCIAL HIGHLIGHTS Dollars in thousands except per-share data / Unaudited Selected Financial Data Sep 30, 2021 Sep 30, 2020 Total Assets $ 1,732,441 $ 1,511,213 Loans, Net $ 1,002,802 $ 1,005,807 Deposits $ 1,544,295 $ 1,336,749 Book Value per Common Share $ 34.49 $ 31.93 Return on Average Assets1 1.37% 0.94% Return on Average Equity1 15.20% 10.14% MARKET VALUE Per Share Source: Nasdaq.com $35.00 $32.50 $30.00 $27.50 $25.00 $22.50 Quarter Ended Dec 31, 2020 Mar 31, 2021 Jun 30, 2021 Sep 30, 2021 $27.03 $31.18 $31.94 31.77 DEC 31, 2020 MAR 31, 2021 JUN 30, 2021 SEP 30, 2021$34.412 THIRD QUARTER HIGH THIRD QUARTER LOW $31.152 COMPLETE EARNING DETAILS AVAILABLE AT FR ANKLINFIN.COM Certain statements appearing herein which are not historical in nature are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements refer to a future period or periods, reflecting management’s current views as to likely future developments, and use words “may,” “will,” “expect,” “believe,” “estimate,” “anticipate,” or similar terms. Because forward-looking statements involve certain risks, uncertainties and other factors over which Franklin Financial Services Corporation has no direct control, actual results could differ materially from those contemplated in such statements. These factors include (but are not limited to) the following: general economic conditions, changes in interest rates, changes in the Corporation’s cost of funds, changes in government monetary policy, changes in government regulation and taxation of financial institutions, changes in the rate of inflation, changes in technology, the intensification of competition within the Corporation’s market area, and other similar factors. We caution readers not to place undue reliance on these forward-looking statements. They only reflect management’s analysis as of this date. The Corporation does not revise or update these forward-looking statements to reflect events or changed circumstances. Please carefully review the risk factors described in other documents the Corporation files from time to time with the SEC, including the Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and any Current Reports on Form 8-K. $31.94 $31.18 $31.77 1-Quarterly results annualized. 2-At close. 4 YOUR WAY QUARTERLY

CLIENT PROFILE Clayton Black, Owner Keystone Ford A FINE-TUNED RELATIONSHIP Keystone Ford Chambersburg | Franklin County When Clayton Black and the team at Keystone Ford went searching for a financial institution back in 2004, they wanted a hometown bank with whom they could build a relationship – one that would understand the local economy. “I feel like F&M Trust does that,” says Black. Black, who was the General Manager at that time, began building a relationship with Commercial Services Market Manager Phil Pantano. “It was amazing when Phil came on, because he was just all about getting to know everything about our business, and he made me feel he truly cared from the very beginning.” Black goes on to say, “He really tries to find what we need and gets it done. Our relationship with Phil and F&M Trust is one of the strongest you can ask for in business.” Black purchased the dealership in 2019, and he credits part of his ability to do that to F&M Trust. “They believe in me because of the relationship we built. They trusted how I ran the dealership as General Manager, and they knew the same performance and standards would be maintained when I became the owner.” As Keystone Ford continues to grow, their relationship with F&M Trust will grow as well. Now that’s Banking Done Your Way®. Clint Castellar, General Sales Manager; Clayton Black, Owner; Doug Bard, Parts and Service Director “ F&M Trust believes in me because of the relationship we built.” Clayton Black Owner, Keystone Ford FALL 2021 5

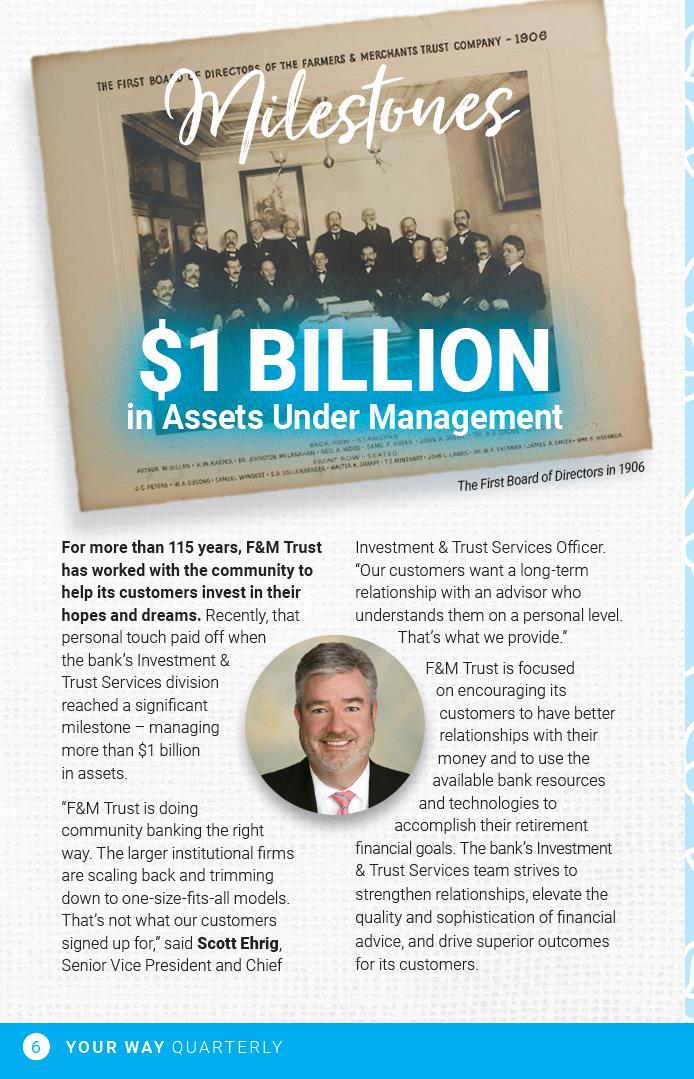

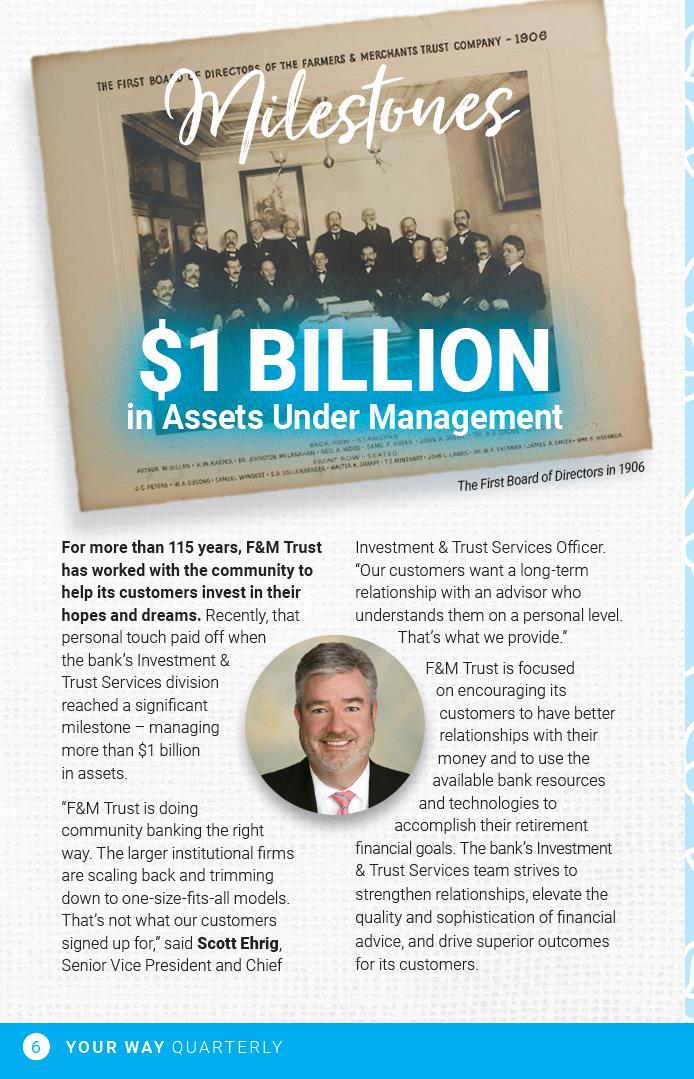

Milestones $1 BILLION in Assets Under Management The First Board of Directors in 1906 For more than 115 years, F&M Trust has worked with the community to help its customers invest in their hopes and dreams. Recently, that personal touch paid off when the bank’s Investment & Trust Services division reached a significant milestone – managing more than $1 billion in assets. “F&M Trust is doing community banking the right way. The larger institutional firms are scaling back and trimming down to one-size-fits-all models. That’s not what our customers signed up for,” said Scott Ehrig, Senior Vice President and Chief Investment & Trust Services Officer. “Our customers want a long-term relationship with an advisor who understands them on a personal level. That’s what we provide.” F&M Trust is focused on encouraging its customers to have better relationships with their money and to use the available bank resources and technologies to accomplish their retirement financial goals. The bank’s Investment & Trust Services team strives to strengthen relationships, elevate the quality and sophistication of financial advice, and drive superior outcomes for its customers. 6 YOUR WAY QUARTERLY

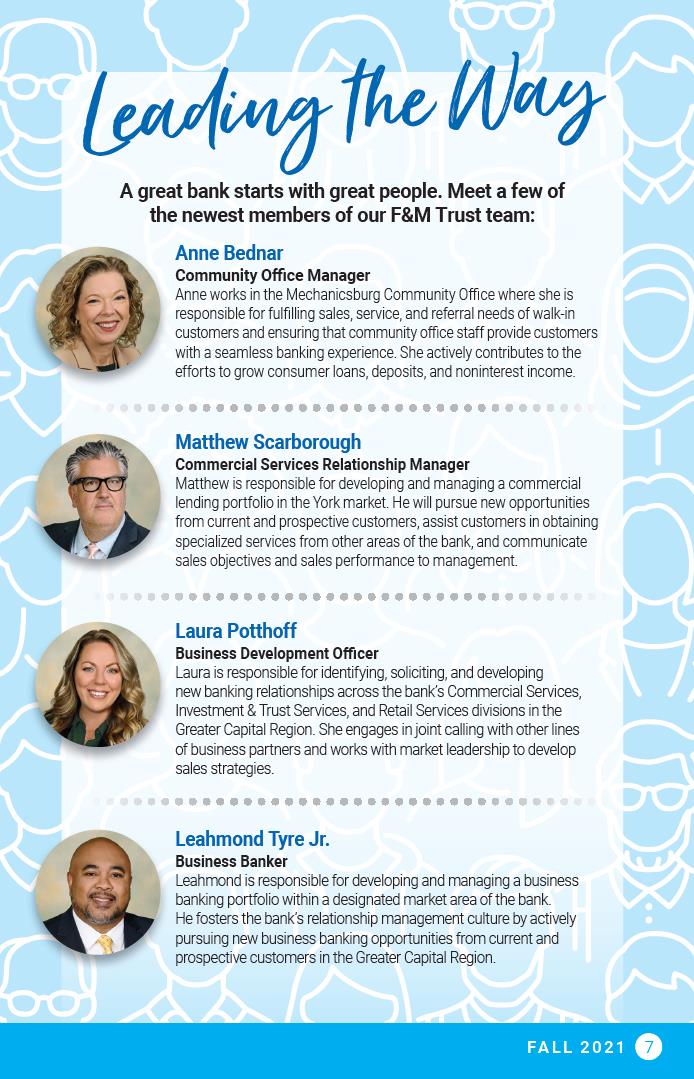

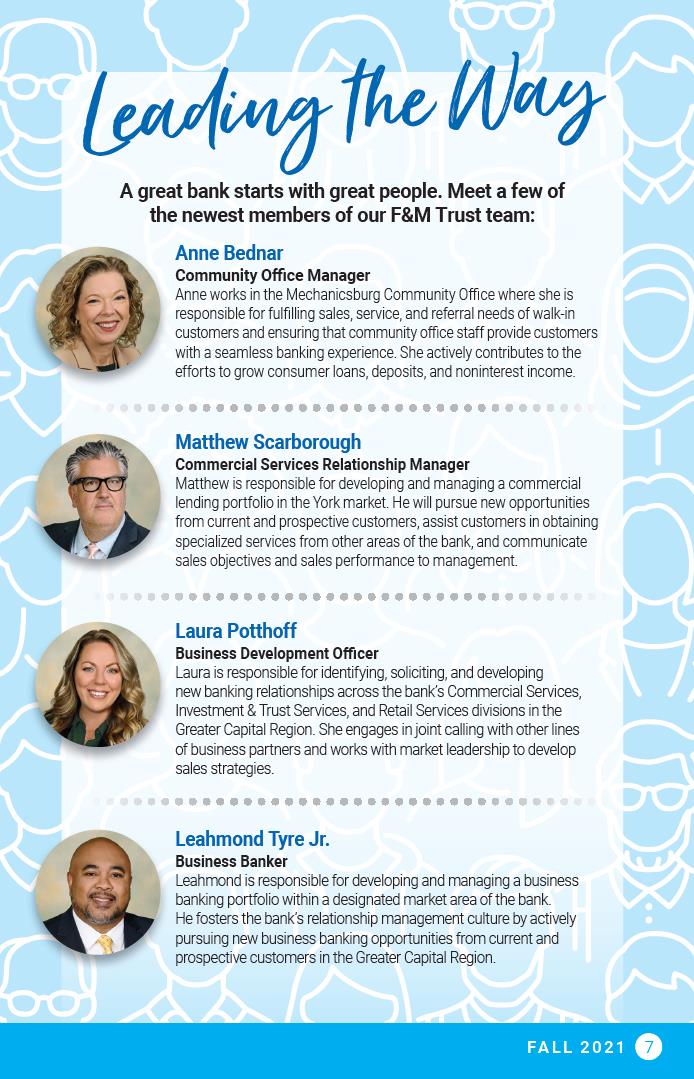

Leading the W ay A great bank starts with great people. Meet a few of the newest members of our F&M Trust team: Anne Bednar Community Office Manager Anne works in the Mechanicsburg Community Office where she is responsible for fulfilling sales, service, and referral needs of walk-in customers and ensuring that community office staff provide customers with a seamless banking experience. She actively contributes to the efforts to grow consumer loans, deposits, and noninterest income. Matthew Scarborough Commercial Services Relationship Manager Matthew is responsible for developing and managing a commercial lending portfolio in the York market. He will pursue new opportunities from current and prospective customers, assist customers in obtaining specialized services from other areas of the bank, and communicate sales objectives and sales performance to management. Laura Potthoff Business Development Officer Laura is responsible for identifying, soliciting, and developing new banking relationships across the bank’s Commercial Services, Investment & Trust Services, and Retail Services divisions in the Greater Capital Region. She engages in joint calling with other lines of business partners and works with market leadership to develop sales strategies. Leahmond Tyre Jr. Business Banker Leahmond is responsible for developing and managing a business banking portfolio within a designated market area of the bank. He fosters the bank’s relationship management culture by actively pursuing new business banking opportunities from current and prospective customers in the Greater Capital Region. FALL 2021 7

Helpful Ways IN OUR COMMUNITY: SHIPPENSBURG FOOD PANTRIES F&M Trust donates truckload of food to Shippensburg pantries. As part of its annual Banktoberfest community service effort, F&M Trust delivered more than 600 cases of nonperishable food items to King’s Kettle and Shippensburg Produce and Outreach. Each month, the Shippensburg pantries combine to serve more than 1,000 residents of Franklin and Cumberland counties who are facing food insecurity issues. “Across the country, local pantries are fighting to stem the tide of food insecurity, and we are pleased to support these organizations as they meet the needs of residents in Franklin and Cumberland counties,” said Tim Henry, President and CEO of F&M Trust. In its 27th year of operation, King’s Kettle serves about 400 families each month at its North Fayette Street pantry. “It’s a tremendous blessing. We can’t begin to thank F&M Trust enough,” said Rhonda Wells, Co-Director of King’s Kettle. The donation included 120 cases of soup, 100 cases of beans, 100 cases of vegetables, 90 cases of pasta and rice, 80 cases of canned meat and chili, 60 cases of macaroni and cheese, and 60 cases of tomato paste. Shippensburg Produce and Outreach was founded in 2008 and serves more than 600 families each month. “All of us at SPO are grateful for the generous donation of food which will benefit families in our community,” said Karen DeShong, SPO Board President. Nearly 12 percent of the population in Franklin and Cumberland counties – more than 44,000 people – faces food insecurity issues. Banking Done Your Way 1.888.264.6116 fmtrust.bank