UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14A-6(E) (2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to Section 240.14a-12

| | |

| FRANKLIN FINANCIAL SERVICES CORPORATION | |

| (Name of Registrant as Specified In Its Charter) | |

| | |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |

Payment of Filing Fee (Check the appropriate box):

| | |

| | |

☑ | No fee required |

☐ | Fee paid previously with preliminary materials. |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) |

| | |

FRANKLIN FINANCIAL SERVICES CORPORATION

1500 Nitterhouse Drive

P.O. Box 6010

Chambersburg, PA 17201-6010

(717) 264-6116

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD APRIL 25, 2023

TO THE SHAREHOLDERS OF FRANKLIN FINANCIAL SERVICES CORPORATION:

Notice is hereby given that, pursuant to the call of its directors, the regular Annual Meeting of Shareholders of FRANKLIN FINANCIAL SERVICES CORPORATION, Chambersburg, Pennsylvania, will be held on Tuesday, April 25, 2023, at 9:00 a.m. at The Orchards Restaurant, 1580 Orchard Drive, Chambersburg, Pennsylvania for the purpose of considering and voting upon the following matters:

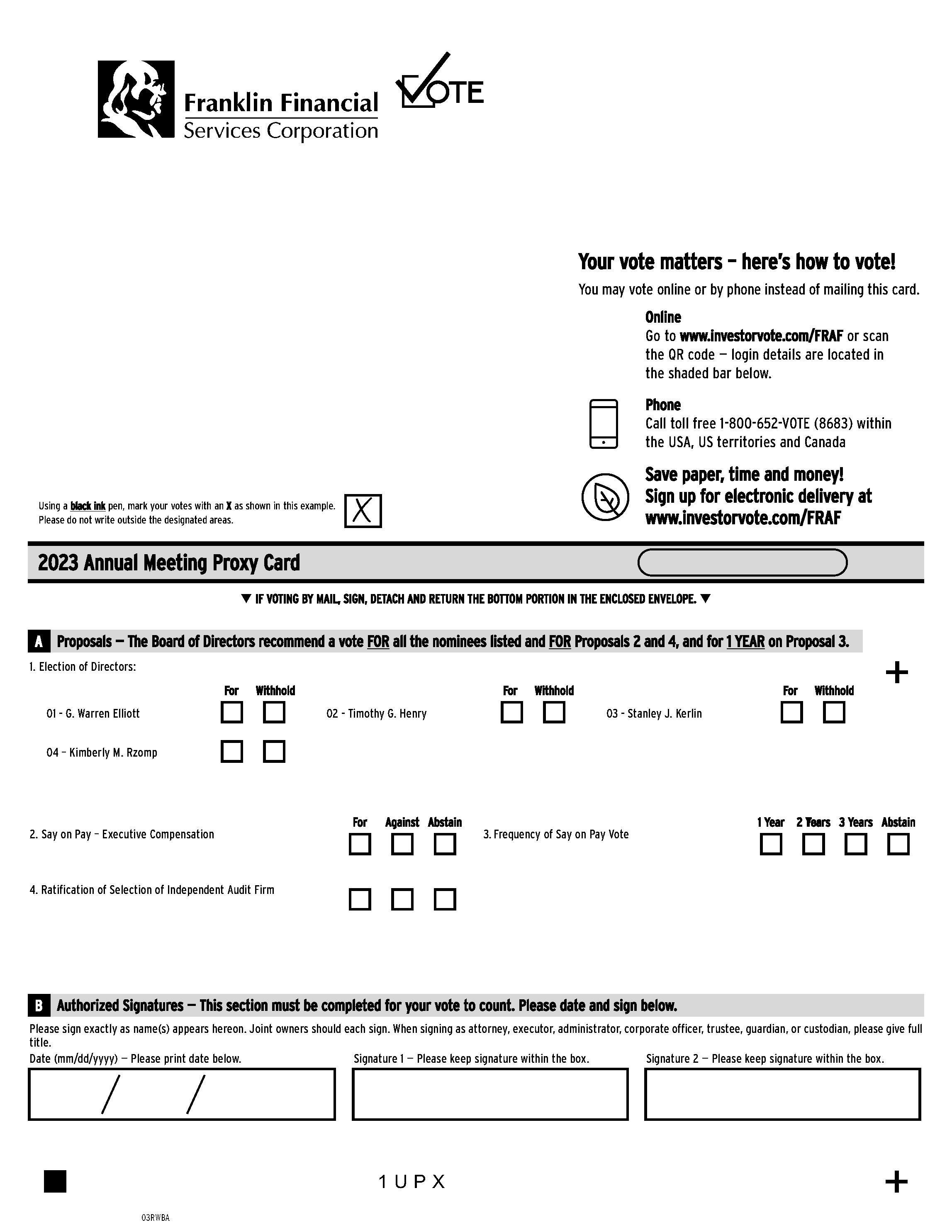

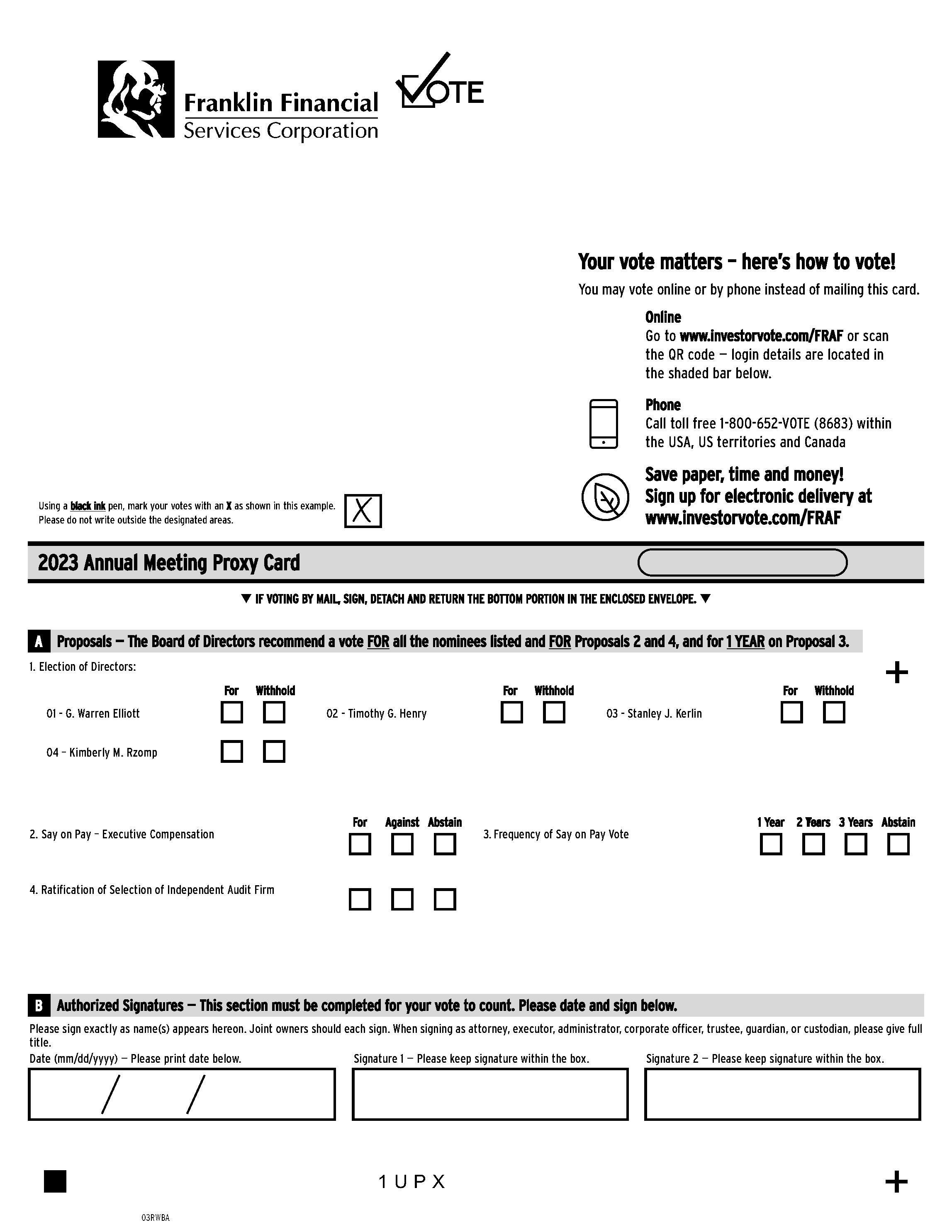

1. ELECTION OF DIRECTORS. To elect the four nominees identified in the accompanying Proxy Statement as directors to Class A for three-year terms and until their successors are elected and qualified.

2. SAY-ON-PAY. To provide a non-binding advisory vote approving the compensation paid to our named executive officers in 2022.

3. SAY-ON-PAY FREQUENCY. To provide a non-binding advisory vote on the frequency of holding the Say-On-Pay vote.

4. RATIFICATION OF THE SELECTION OF AUDITORS. To ratify the Audit Committee’s selection of Crowe LLP as Franklin Financial’s independent registered public accounting firm for 2023.

5. OTHER BUSINESS. To consider other business, if any, as may properly be brought before the meeting and any adjournments thereof.

Only those shareholders of record at the close of business on March 6, 2023 shall be entitled to notice of and to vote at the Annual Meeting.

This Notice of Annual Meeting of Shareholders and the accompanying proxy statement, annual report and proxy card are being mailed to shareholders on or about March 21, 2023.

You may vote by completing and returning the enclosed Proxy Card, internet, or by phone following the instructions provided on the Proxy Card.

| |

| BY ORDER OF THE BOARD OF DIRECTORS |

|

|

| MARK R. HOLLAR, Executive Vice President, Treasurer and Chief Financial Officer |

| |

Enclosures

March 21, 2023

TABLE OF CONTENTS

GENERAL INFORMATION

On or about March 21, 2023, we mailed to our shareholders the Proxy Statement, the Notice of Annual Meeting of Shareholders, Annual Report and proxy card.

Date, Time and Place of Meeting

The Annual Meeting of the shareholders of Franklin Financial Services Corporation (hereinafter, "Franklin Financial" or the "Corporation") will be held Tuesday, April 25, 2023 at 9:00 a.m. at The Orchards Restaurant, 1580 Orchard Drive, Chambersburg, Pennsylvania.

Who is entitled to vote?

Only shareholders of record at the close of business on March 6, 2023 are entitled to notice of and to vote at the meeting.

What proposals are to be voted on and how does the Board recommend I vote?

Shareholders will be asked to consider and vote upon the following matters at the Annual Meeting:

| | |

| Proposals | Board Recommendation |

(1) | The election of four (4) directors to Class A for the term of three (3) years and until their successors are elected and qualified. | The Board recommends you vote FOR the proposal. |

(2) | To provide a non-binding advisory vote on the compensation paid to our named executive officers in 2022 as disclosed in this proxy statement (“Say-On-Pay”). | The Board recommends you vote FOR the proposal. |

(3) | To approve the frequency of the Say-On-Pay vote. | The Board recommends you vote FOR holding the Say-On-Pay vote annually. |

(4) | To ratify the Audit Committee’s selection of Crowe LLP as Franklin Financial’s independent registered public accounting firm for 2023. | The Board recommends you vote FOR the proposal. |

How do I vote?

You may vote by completing and returning the enclosed Proxy Card, by internet, or by phone following the instructions provided on the Proxy Card.

Solicitation of Proxies

This Proxy Statement is furnished in connection with the solicitation of proxies, in the accompanying form, by the Board of Directors of Franklin Financial for use at the Annual Meeting and any adjournments thereof.

The expense of soliciting proxies will be borne by Franklin Financial. In addition to the use of the mail and the Internet, the directors, officers, and employees of Franklin Financial and of any subsidiary may, without additional compensation, solicit proxies personally or by telephone.

Farmers and Merchants Trust Company of Chambersburg (hereinafter, "F&M Trust") is a wholly owned subsidiary of Franklin Financial. This Proxy Statement, while prepared in connection with the Annual Meeting of Shareholders of Franklin Financial, contains certain information relating to F&M Trust which will be identified where appropriate.

Revocability and Voting of Proxies

The execution and return of the enclosed proxy will not affect a shareholder's right to attend the virtual meeting and to vote at the meeting. Any proxy given pursuant to this solicitation may be revoked by delivering written notice of revocation to Amanda M. Ducey, Corporate Secretary of Franklin Financial, at any time before the proxy is voted at the meeting. Unless revoked, any proxy given pursuant to this solicitation will be voted at the meeting in accordance with the instructions thereon of the shareholder giving the proxy. In the absence of instructions, all proxies will be voted:

|

FOR the election of the four (4) nominees identified in this Proxy Statement as directors to Class A for three-year terms; |

FOR approval of the compensation paid to our named executive officers in 2022 as disclosed in this proxy statement (Say-on-Pay); |

FOR holding the Say-On-Pay vote annually; and |

FOR the ratification of the Audit Committee’s selection of Crowe LLP as Franklin Financial’s independent registered public accounting firm for 2023. |

The enclosed proxy confers upon the persons named as proxies therein discretionary authority to vote the shares represented thereby on all matters that may come before the meeting in addition to the scheduled items of business, including unscheduled shareholder proposals and matters incident to the conduct of the meeting. Although the Board of Directors knows of no other business to be presented, in the event any other matters are brought before the meeting, the shares represented by any proxy given pursuant to this solicitation will be voted in accordance with the recommendations of the Board of Directors of Franklin Financial.

Shares held for the account of shareholders who participate in the Dividend Reinvestment Plan will be voted in accordance with the instructions of each shareholder as set forth in his proxy. If a shareholder who participates in the Dividend Reinvestment Plan does not return a proxy, the shares held for his account under the Dividend Reinvestment Plan will not be voted.

Voting of Shares and Principal Holders Thereof

At the close of business on March 6, 2023, Franklin Financial had issued and outstanding 4,398,878 shares of common stock. There is no other class of stock outstanding.

A majority of the outstanding shares of common stock present in person or by proxy will constitute a quorum for the conduct of business at the Annual Meeting. Each share is entitled to one vote on all matters submitted to a vote of the shareholders. In the case of the election of directors, the three candidates receiving the highest number of votes shall be elected directors of Franklin Financial. Accordingly, in the absence of a contested election, votes withheld from a particular nominee or nominees, abstentions and broker non-votes will not influence the outcome of the election. A majority of the votes cast by shareholders present in person or by proxy and entitled to vote at a meeting at which a quorum is present is required to approve each of the other proposals. Abstentions and broker non-votes will not be treated as votes cast and, therefore, will have no effect on whether or not a proposal is approved.

To the knowledge of Franklin Financial, no person owned of record or beneficially on December 31, 2022 more than five percent (5%) of the outstanding shares of common stock of Franklin Financial, except as shown:

| | | | | | | | |

Name and Address of Beneficial Owner | | Shares Owned | | Percent of Total Common Shares | | | | |

| | | | | | | | |

FourthStone LLC * | | 313,109 | | 7.13% | | | | |

575 Maryville Centre Dr. Suite 110 | | | | | | | | |

Saint Louis, MO 63141 | | | | | | | | |

| | | | | | | | |

*Based on information reported in a Schedule 13F, filed with the Securities and Exchange Commission on February 14, 2023 |

Shares Held in Street Name

If your shares are held in "street name" by your bank or broker or other intermediary, you will receive voting instructions from your intermediary which you must follow in order for your shares to be voted in accordance with your directions. Many intermediaries permit their clients to vote via the internet or by telephone. Whether or not internet or telephone voting is available, you may vote your shares by returning the voting instruction card which you will receive from your intermediary.

Shareholder Proposals

Pursuant to Rule 14a-8 promulgated by the Securities and Exchange Commission (hereafter, the "SEC") and Section 2.4 of the Bylaws of Franklin Financial, shareholder proposals intended to be presented at the 2023 Annual Meeting of the shareholders of Franklin Financial must be received at the executive offices of Franklin Financial no earlier than October 18, 2023, and no later than November 17, 2023, in order to be eligible for inclusion in the proxy statement and proxy form to be prepared by Franklin Financial in connection

with the 2024 Annual Meeting. A shareholder proposal which does not satisfy the notice and other requirements of SEC Rule 14a-8 and the Bylaws of Franklin Financial is not required to be included in Franklin Financial’s proxy statement and proxy form and may not be presented at the 2022 Annual Meeting. All shareholder proposals should be sent to:

Franklin Financial Services Corporation

Attention: President

P.O. Box 6010

Chambersburg, PA 17201-6010.

Availability of Proxy Materials for the Shareholders Meeting to Be Held on April 25, 2023

This Proxy Statement, the form of proxy and the 2022 Annual Report to Shareholders are available at:

www.edocumentview.com/fraf

CORPORATE GOVERNANCE POLICIES, PRACTICES AND PROCEDURES

Franklin Financial is and always has been committed to the highest ideals in the conduct of its business and to observing sound corporate governance policies, practices and procedures.

In order to comply with the requirements of the Sarbanes-Oxley Act and related SEC rules and regulations, Franklin Financial has taken a number of actions which are intended to strengthen and improve its commitment to sound corporate governance. These actions include the following:

The Board of Directors has adopted formal Corporate Governance Guidelines, a copy of which is posted on Franklin Financial's website at www.franklinfin.com.

The Board of Directors has adopted a Conflicts of Interest Policy for Directors and Executive Officers that focuses on issues of ethical business conduct relating to conflicts of interest, which is contained in the Code of Ethics policy and is posted on Franklin Financial’s website at www.franklinfin.com.

The Board of Directors has adopted a Code of Ethics Applicable to Senior Executives addressing the integrity of Franklin Financial’s periodic reports filed with the Securities and Exchange Commission and other public communications, and compliance with all applicable governmental rules and regulations, as required by the Sarbanes-Oxley Act and related SEC rules and regulations, which is posted on Franklin Financial’s website at www.franklinfin.com.

The Board of Directors has adopted written charters for its Audit, Compensation and Personnel, and Nominating and Corporate Governance Committees, copies of which are posted on Franklin Financial's website at www.franklinfin.com.

Pursuant to the terms of its Corporate Governance Guidelines, Franklin Financial’s "independent directors" meet at least quarterly in executive session (i.e., without the presence of the Chief Executive Officer or other members of Franklin Financial's management).

|

PROPOSAL 1 - ELECTION OF DIRECTORS |

General Information

The Bylaws of Franklin Financial provide that the Board of Directors shall consist of not less than five nor more than twenty-five persons and that the directors shall be classified with respect to the time they shall severally hold office by dividing them into three classes, each consisting as nearly as possible of one-third of the number of the whole Board of Directors. The Bylaws further provide that the directors of each class shall be elected for a term of three years so that the term of office of one class of directors shall expire in each year. Finally, the Bylaws provide that the number of directors in each class of directors shall be determined by the Board of Directors.

A majority of the Board of Directors may increase the number of directors between meetings of shareholders. Any vacancy occurring in the Board of Directors, whether due to an increase in the number of directors, resignation, retirement, death, or any other reason, may be filled by appointment by the remaining directors. Any director who is appointed to fill a vacancy shall hold office until a successor director is duly elected by the shareholders at the next Annual Meeting at which directors in this class are elected.

Franklin Financial’s Bylaws provide for the mandatory retirement of directors at the end of the calendar year in which a director reaches age 75. The Corporate Governance Guidelines provide that no director may be nominated to a new term if they would be age 75 or older at the time of election.

The Board of Directors has determined that the Board shall consist of eleven (11) directors. There are four (4) directors whose terms of office will expire at the 2023 Annual Meeting, and seven (7) continuing directors whose terms of office will expire at the 2024 or 2025 Annual Meeting.

The Board of Directors has nominated the following persons for election to the Board of Directors at the 2023 Annual Meeting to the class and for the term specified below:

CLASS A

For a Term of Three Years

G. Warren Elliott Timothy G. Henry Stanley J. Kerlin Kimberly M. Rzomp

In the event that any of the foregoing nominees are unable to accept nomination or election, the shares represented by any proxy given pursuant to this solicitation will be voted in favor of such other persons as the Board of Directors of Franklin Financial may recommend. The Board of Directors, however, has no reason to believe that any of its nominees will be unable to accept nomination or to serve as a director if elected.

|

The Board of Directors recommends you vote FOR the election of the four (4) director nominees. |

Nominations for Election of Directors

In accordance with Section 3.5 of the Bylaws of Franklin Financial, any shareholder of record entitled to vote for the election of directors who is a shareholder on the record date and on the date of the meeting at which directors are to be elected may nominate a candidate for election to the Board of Directors, provided that the shareholder has given proper written notice of the nomination, which notice must contain certain prescribed information and must be delivered to the President of Franklin Financial not less than 90 days nor more than 120 days prior to the anniversary date of the immediately preceding annual meeting. The Chairman of the meeting must determine whether a nomination has been made in accordance with the requirements of the Bylaws and, if he determines that a nomination is defective, such nomination and any votes cast for the nominee shall be disregarded.

Shareholders may also recommend qualified persons for consideration by the Nominating and Corporate Governance Committee to be included in Franklin Financial's proxy materials as a nominee of the Board of Directors. A shareholder who wishes to make such a recommendation must submit their recommendation in writing addressed to:

Chairman of the Board

Franklin Financial Services Corporation

P.O. Box 6010

Chambersburg, Pennsylvania 17201-6010.

The recommendation must include the proposed nominee's name and qualifications and must be delivered not less than 120 days prior to the anniversary date of the immediately preceding annual meeting.

Nominating and Corporate Governance Committee Process for the Selection and Evaluation of Nominees

Franklin Financial's Board of Directors has adopted a Job Description identifying the qualifications expected of a member of the Board of Directors and the criteria to be applied by the Nominating and Corporate Governance Committee in evaluating candidates who will be recommended to the Board of Directors as nominees for election to the Board. A candidate must possess good business judgment and must be free of any relationship which would compromise their ability to properly perform the duties of a director. A candidate must have sufficient financial background and experience to be able to read and understand financial statements and to evaluate financial performance. A candidate should have proven leadership skills and management experience and should be actively involved in the community served by Franklin Financial and its subsidiaries. A candidate must be willing and able to commit the time and attention necessary to actively participate in Board affairs. In addition, a candidate must be a person of integrity and sound character. Although the Nominating and Corporate Governance Committee does not have a policy with regard to considering diversity in identifying nominees for director, the Committee does consider whether a candidate’s age, background, skills and experience will compliment or supplement those of other members of the Board of Directors in order to achieve an appropriate balance and diversity of such qualities and characteristics.

The Nominating and Corporate Governance Committee uses a variety of methods for identifying and evaluating potential nominees for election to the Board of Directors. The Nominating and Corporate Governance Committee regularly assesses the appropriate size of the Board and whether any vacancies on the Board are expected due to retirement or otherwise. In the event that a vacancy is anticipated or otherwise arises, the Nominating and Corporate Governance Committee typically considers and interviews several potential candidates for appointment to fill the vacancy. Candidates may come to the attention of the Nominating and Corporate Governance Committee through current Board members, shareholders and other persons. These candidates are evaluated by the Nominating and Corporate Governance Committee and may be considered at any time during the year. In evaluating potential nominees, the Nominating and Corporate Governance Committee seeks to achieve a balance of knowledge, skills and experience on the Board. The Nominating and Corporate Governance Committee has not engaged third party consultants in connection with the identification or evaluation of potential nominees.

The Nominating and Corporate Governance Committee will consider persons recommended by shareholders as potential nominees for election to the Board of Directors, provided that recommendations are made in accordance with the procedures described above under the caption "Nominations for Election of Directors." A potential nominee who is recommended by a shareholder will be evaluated by the Nominating and Corporate Governance Committee in the same fashion as other persons who are considered by the Committee as potential candidates for election to the Board of Directors.

Board Diversity

In compliance with Nasdaq listing rules, the following chart shows the diversity of the Board as reported for 2023 and 2022.

| | | | | | | | | |

Board Diversity Matrix as of February 23, 2023 |

| | | | | | | | | |

Total Number of Directors | 11 | | | | | | | | |

| | | Female | | Male | | Non-Binary | | Did Not Disclose Gender |

Part I: Gender Identity | | | | | | | | | |

Directors | | | 1 | | 10 | | - | | - |

Part II: Demographic Background | | | | | | | | | |

African American or Black | | | - | | - | | - | | - |

Alaskan Native or American Indian | | | - | | - | | - | | - |

Asian | | | - | | - | | - | | - |

Hispanic or Latinx | | | - | | - | | - | | - |

Native Hawaiian or Pacific Islander | | | - | | - | | - | | - |

White | | | 1 | | 10 | | - | | - |

Two or More Races or Ethnicities | | | - | | - | | - | | - |

LGBTQ+ | | | - | | - | | - | | - |

Did Not Disclose Demographic Background | | | | | | | | | |

| | | | | | | | | |

Board Diversity Matrix as of July 25, 2022 |

| | | | | | | | | |

Total Number of Directors | 10 | | | | | | | | |

| | | Female | | Male | | Non-Binary | | Did Not Disclose Gender |

Part I: Gender Identity | | | | | | | | | |

Directors | | | 1 | | 9 | | - | | - |

Part II: Demographic Background | | | | | | | | | |

African American or Black | | | - | | - | | - | | - |

Alaskan Native or American Indian | | | - | | - | | - | | - |

Asian | | | - | | - | | - | | - |

Hispanic or Latinx | | | - | | - | | - | | - |

Native Hawaiian or Pacific Islander | | | - | | - | | - | | - |

White | | | 1 | | 8 | | - | | - |

Two or More Races or Ethnicities | | | - | | - | | - | | - |

LGBTQ+ | | | - | | - | | - | | - |

Did Not Disclose Demographic Background | | | | | | 1 | | | |

Director Independence

The Board of Directors has determined that each director is an "independent director," as such term is defined in the NASDAQ Stock Market Rules except for Timothy G. Henry, President and CEO, Franklin Financial Services Corporation and Farmers and Merchants Trust Company. In determining the directors’ independence, the Board considered loan transactions between the Bank and the directors, their family members and businesses with whom they are associated, as well as any contributions made to non-profit organizations with whom they are associated.

Information about Nominees and Continuing Directors

Information concerning the four (4) persons nominated for election to Class A of the Board of Directors of Franklin Financial at the 2023 Annual Meeting and concerning the seven (7) continuing directors follows.

CLASS A DIRECTORS (Term expires 2023)

|

G. Warren Elliott – Chairman of the Board – Age 68 |

Year Became Director: 1991 Chairman of the Board since 2012 Vice Chairman of the Board 2010-2011 Committees: Asset-Liability, Audit, Enterprise Risk, Executive (Chair), Nominating and Corporate Governance, Compensation and Personnel (Chair), Strategic Independent Director |

Mr. Elliott graduated with honors with a B.A. in Public Administration and an M.S. in Public Administration from Shippensburg University in 1976 and 1977 respectively. He is a Distinguished Alumnus of Shippensburg University and in 2014 he was presented an honorary Doctoral degree in Public Service. He is also a Distinguished Alumnus and Centennial Fellow of Penn State Mont Alto. Mr. Elliott is currently President of Cardinal Crossings, Inc. and CCI Properties, LLC, municipal government consulting and real estate investment firms. From 1991 to 1995 he served as an adjunct faculty member at Shippensburg University teaching state and local government. Mr. Elliott also served Franklin County as a Commissioner for many years and as Chairman of the Board of Commissioners from 1996 to 2007. Mr. Elliott has been recognized by a number of civic organizations with awards. Mr. Elliott has served and continues to serve on the boards of numerous organizations within the Corporation’s trade area. He also serves as a member of the Chesapeake Bay Commission and the Atlantic State Marine Fisheries Commission. The Board of Directors values Mr. Elliott’s considerable knowledge regarding county and local government, his entrepreneurial experience with business and sales, as well as the leadership skills he has developed through his service in Franklin County government and civic service. |

|

Timothy G. Henry – President and CEO Franklin Financial – Age 64 |

Year Became Director: 2016 |

Mr. Henry joined Franklin Financial and F&M Trust as President and as a Director on February 1, 2016. He became Chief Executive Officer on July 1, 2016. Mr. Henry received a bachelor’s degree in dairy science from the Pennsylvania State University and an MBA from St. Joseph’s University in Philadelphia. Mr. Henry has had a career of more than 30 years in the banking industry in central Pennsylvania and the Hagerstown and Frederick, Maryland areas. He has extensive experience in managing branch networks, lending and private banking. He served as Chief Executive Officer of Centra Bank, a start-up in Hagerstown, and as a senior officer of BlueRidge Bank, a start-up in Frederick, where he gained significant experience in risk management, compliance and operations. Most recently, Mr. Henry served for three years as Susquehanna Bank’s Commercial Executive for its Washington County, Maryland region. The Pennsylvania Banking Code requires that a bank president be a member of the bank’s board of directors. In addition, the Board believes that it is important that the President serve as a Director so that the President may interact with his fellow Directors on a peer to peer basis. The Board of Directors values Mr. Henry’s depth and breadth of experience in the banking industry. |

|

Stanley J. Kerlin – Age 69 |

Year Became Director: 2006 Committees: Asset-Liability (Chair), Enterprise Risk, Executive, Trust Independent Director |

Mr. Kerlin graduated Cum Laude with a B.A. Degree in History from Elizabethtown College in 1976 and a J.D. Degree from Dickinson School of Law in 1979. Mr. Kerlin has engaged in the active practice of law for over 35 years and has owned and operated his own law practice as both a partner and a sole practitioner. Mr. Kerlin is active in his church and in several community and political organizations within the Corporation's Fulton and Huntingdon County market area. Mr. Kerlin's knowledge of business and management provide valuable insight to the Board. The Board of Directors values Mr. Kerlin’s perspective as a lawyer and community leader in the Corporation’s Fulton and Huntingdon County market area. |

|

Kimberly M. Rzomp – Age 66 |

Year Became Director: 2019 Committees: Asset-Liability, Audit, Enterprise Risk, Strategic, Trust Independent Director |

Ms. Rzomp graduated from Lycoming College in 1978 with a B.A. in Economics and Business Administration and Shippensburg University in 1987 with an M.B.A. Ms. Rzomp is the former (retired) Chief Financial Officer for Summit Health, a $600 million non-profit health care system located in south-central Pennsylvania. WellSpan Health acquired Summit Health in 2018 at which time the Franklin Region became known as WellSpan SummitHealth. Summit Health is comprised of two acute care hospitals, Chambersburg and Waynesboro Hospitals, a cancer care center, and a medical group of 250 providers. In her role, she was the primary corporate officer for Board committees including Finance, Audit and Compliance, and Investment. She was a voting member of Summit Physician Services Board of Directors, and Treasurer for all Boards of Summit Health. Ms. Rzomp was a former volunteer Board member for the Shook Home and United Way of Franklin County. Ms. Rzomp’s knowledge of business and management, financial operations, auditing and compliance, financial planning, and risk management is valuable to the Board. |

CLASS C DIRECTORS (Term expires 2024)

|

Kevin W. Craig – Age 58 |

Year Became Director: 2020 Committees: Audit, Asset-Liability, Enterprise Risk, Nominating and Corporate Governance, Strategic Independent Director |

Mr. Craig graduated with a B.S. in Accounting from the Pennsylvania State University in 1987. After graduation he worked for Ernst & Young where he received his certified public accounting license (currently inactive). Mr. Craig is the CEO of Pro-Cut Construction Services, Inc., a regional concrete sawing and drilling contractor. He is the former owner of DriveKore, Inc., a regional construction tool and fastener supply company. His career spans over 30 years, beginning as a CPA at Ernst and Young and then holding CFO positions at several venture capital backed companies before purchasing DriveKore, Inc. in 1999. He is currently the Vice President and member of the Board of Governors of the West Shore Country Club in Camp Hill, PA. The Board of Directors values Mr. Craig’s accounting and business expertise and his insights pertaining to the construction industry and privately held businesses. He is a lifelong resident of Central Pennsylvania and is an active business and community leader. |

|

Daniel J. Fisher – Age 66 |

Year Became Director: 2010 Committees: Audit, Nominating and Corporate Governance (Chair), Compensation and Personnel, Strategic, Executive Independent Director |

Mr. Fisher graduated from Muhlenberg College with a B.A. in Business Administration in 1978 and from Lehigh University with a MS in Management Science in 1986. Mr. Fisher retired as President and CEO of D. L. Martin Company on June 30, 2017 and remains active on its Board, and as an Operations Consultant. Mr. Fisher also serves on the Board of Managers of Alliance Elevator Systems, Greencastle, PA. He also holds a minority position and serves on the Board of Structural Elements, Hagerstown, MD. The Board of Directors values Mr. Fisher’s manufacturing background and experience. Mr. Fisher is active in his community and the Corporation’s Franklin County market area, where he has served and continues to serve on various boards. |

|

Donald H. Mowery – Age 71 |

Year Became Director: 2010 Committees: Enterprise Risk (Chair), Audit, Nominating and Corporate Governance, Executive Independent Director |

Mr. Mowery is managing partner of RSM Associates, LP, a real estate development firm focusing on the development of business centers and industrial parks. Additionally, he is the third-generation former owner and CEO of R. S. Mowery & Sons, Inc., a regional contractor founded in 1925. His career in the construction and real estate development industries spans over 48 years, beginning as a laborer in 1968 and advancing through various positions over the years. Mr. Mowery received a B.S. in Civil Engineering in 1974 from Drexel University. He has completed post-baccalaureate studies in engineering and construction management at the Pennsylvania State University. Mr. Mowery is a Registered Professional Engineer. Mr. Mowery's business and leadership expertise provide our Board with valuable insights, particularly pertaining to the construction industry, real estate development, and family businesses. As a life-long resident of the area, Mr. Mowery is a well-known and respected member of the community, which provides positive exposure for the Corporation in the market area that he represents. |

CLASS B DIRECTORS (Term expires 2025)

|

Martin R. Brown – Age 71 |

Year Became Director: 2006 Committees: Audit, Executive, Compensation and Personnel, Trust (Chair) Independent Director |

Mr. Brown graduated with honors from the Pittsburgh Institute of Mortuary Science in 1973. He is a licensed Pennsylvania Funeral Director who assists with the operation of three family-owned funeral homes within the Corporation’s Fulton and Huntingdon County market area. Additionally, Mr. Brown is President of M.R. Brown Management, Inc. where he is the managing general partner of Sandy Ridge Express convenience store, Sandy Ridge A&W Restaurant and Marymart Family LP, which owns Sandy Ridge Station Mall. Along with his wife, Mr. Brown is the owner of the Sandy Ridge Market, a full-service grocery store located at the Sandy Ridge Station Mall. Mr. Brown has served and continues to serve on the boards of organizations within the Corporation's Fulton and Huntingdon County market area. The Board of Directors values Mr. Brown's entrepreneurial background and business management experience and his status as a business leader in the Corporation’s Fulton and Huntingdon County market area. |

|

Gregory A. Duffey – Age 64 |

Year Became Director: 2015 Committees: Asset-Liability, Nominating and Corporate Governance, Trust, Strategic (Chair), Executive Independent Director |

Mr. Duffey is President of CFPM Insurance, a division of Blue Ridge Risk Partners. Mr. Duffey began his career in the insurance business in 1980 after attending Shippensburg University. The Board of Directors values Mr. Duffey’s experience as a business and community leader. For more than forty years, Mr. Duffey has been very active in the Corporation’s Franklin County market area having served on the boards or in leadership positions of non-profit and community development organizations. |

|

Allan E. Jennings, Jr. – Age 73 |

Year Became Director: 2002 Committees: Asset-Liability, Audit (Chair), Enterprise Risk, Executive, Compensation and Personnel, Strategic Independent Director |

Mr. Jennings graduated with honors from Lehigh University in 1971 with a B.S. in Industrial Engineering. He was President and CEO of Jennings Automotive, Inc. (dba Jennings Chevrolet Buick GMC) from 1986 to 2021. He currently serves as Vice President and Consultant of Jennings Automotive. Mr. Jennings is a former director and past Chairman of the Pennsylvania Automotive Association and the Chambersburg Area Development Corporation. He currently serves as a Director and Treasurer of the Pennsylvania Automotive Association Charitable Foundation. The Board of Directors values Mr. Jennings' entrepreneurial background and business experience, including his knowledge of sales and marketing, and his leadership in the automotive industry. His participation on local boards provides valuable information relative to the Franklin County market area. |

Mr. |

Gregory I. Snook – Age 65 |

Year Became Director: 2022 Committees: Compensation and Personnel, Trust Independent Director |

Mr. Snook has been the President and CEO of the Washington County Industrial Foundation (CHIEF), an organization which helps develop real estate for the purpose of enhancing economic and community development for business and industrial expansion in Washington County, since 2011. He is the Executive Director of the Alice Virginia and David W. Fletcher Foundation, which provides aid and encouragement to charitable organizations. Mr. Snook has served on the Hagerstown Community College Board of Trustees since 2007, is a member of the Washington County Chamber of Commerce and served as President of the Board of County Commissioners of Washington County from 1990-2006. He also previously served as Chairman of the Board of Trustees of the Meritus Medical Center and currently services on Meritus Medical School of Osteopathic Medicine. Mr. Snook attended Hagerstown Community College and is a graduate of Leadership Maryland. As a lifelong resident of Washington County, Maryland, Mr. Snook brings to the Board a wealth of experience and knowledge and is active in various committees and community organizations. The Board values his understanding of board governance and strong business acumen. |

|

Common Stock Ownership of Directors, Nominees and Executive Officers

The following table includes information concerning shares of Franklin Financial common stock beneficially owned by directors, nominees, and the executive officers who are named in the Summary Compensation Table appearing elsewhere in this Proxy Statement and by all directors and executive officers as a group. There are no family relationships between or among any of the Corporation's executive officers, directors or nominees.

| | | | | | | | | | | |

| | Shares of Stock | | | | | | | | | Percentage of Total |

| | of Franklin Financial | | | | | | | | | Outstanding Shares |

Name | | Beneficially Owned (1) | | | Restricted Stock (2) | | Stock Options (2) | | Total | | as of 12/31/2022 (3) |

| | | | | | | | | | | |

Martin R. Brown | | 6,501 | | | 500 | | - | | 7,001 | | |

Steven D. Butz | | 1,828 | | | 1,752 | | 10,718 | | 14,298 | | |

Kevin W. Craig | | 15,564 | | | 300 | | - | | 15,864 | | |

Gregory A. Duffey | | 10,159 | | | 500 | | - | | 10,659 | | |

G. Warren Elliott | | 10,777 | | | 1,000 | | - | | 11,777 | | |

Daniel J. Fisher | | 22,569 | | | 500 | | - | | 23,069 | | |

Timothy G. Henry | | 11,152 | | | 3,146 | | 6,594 | | 20,892 | | |

Mark R. Hollar | | 6,903 | | | 1,752 | | 11,605 | | 20,260 | | |

Allan E. Jennings, Jr. | | 21,407 | (4) | | 500 | | - | | 21,907 | | |

Stanley J. Kerlin | | 36,865 | (5) | | 500 | | - | | 37,365 | | |

Donald H. Mowery | | 53,011 | (6) | | 500 | | - | | 53,511 | | 1.21% |

Kimberly M. Rzomp | | 5,228 | | | 300 | | - | | 5,528 | | |

Gregory I. Snook | | 844 | | | - | | - | | 844 | | |

| | | | | | | | | | | |

All Directors and Executive Officers as a Group (19 Persons) | | 274,830 | | 6.26% |

_____________________

(1)Beneficial ownership of shares of the common stock of Franklin Financial is determined in accordance with SEC Rule 13d-3, which provides that a person shall be deemed to own any stock with respect to which he, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise has or shares: (i) voting power, which includes the power to vote or to direct the voting of the stock, or (ii) investment power, which includes the power to dispose or to direct the disposition of the stock. A person is also deemed to own any stock which he has the right to acquire within 60 days through the exercise of an option or conversion right, through the revocation of a trust or similar arrangement, or otherwise. Unless otherwise stated, each director and executive officer has sole voting and investment power with respect to the shares shown above or holds the shares jointly with his or her spouse.

(2)Includes restricted stock and options issued under the 2019 Omnibus Stock Incentive Plan (Stock Plan) and options issued under the Employee Stock Purchase Plan as reported in the Outstanding Equity Award table.

(3)Unless otherwise stated, the number of shares shown represents less than one percent of the total number of shares of common stock outstanding.

(4)Includes 14,731 shares held in the name of Mr. Jennings’ spouse.

(5)Includes 7,080 shares held by Mr. Kerlin as co-trustee of the Kerlin Family Trust and 22,059 shares with respect to which Mr. Kerlin holds power of attorney.

(6)All shares held by an entity controlled by Mr. Mowery.

Meetings of the Board of Directors

Franklin Financial's Corporate Governance Guidelines provide that directors are expected to attend meetings of the Board of Directors, meetings of the committees on which they serve, and the annual meeting of shareholders. The Boards of Directors of the Corporation and of F&M Trust met a total of 57 times, including 21 board meetings and 36 committee meetings, during 2022. All

directors attended 75% or more of the aggregate number of meetings of the Boards of Directors and of the various committees of the Board of Directors on which they served, and all directors attended the annual meeting of shareholders in 2022.

2022 Director Compensation

Director compensation, including fees and other forms of compensation are set annually by the Compensation and Personnel Committee.

The following table sets forth the components of compensation for non-employee directors for 2022.

| | | |

Board Fees | | 2022 |

Board Chair Annual Retainer | | $ | 40,000 |

Annual Board Retainer - Franklin Financial | | $ | 15,600 |

Annual Board Retainer - F&M Trust | | $ | 19,400 |

Audit Committee Chair Annual Retainer | | $ | 8,500 |

Committee Chair Annual Retainer | | $ | 3,250 |

Franklin Financial Meeting fee | | $ | 1,000 |

Committee Meeting Fee (Franklin Financial or F&M Trust) | | $ | 750 |

The following table provides certain summary information concerning the total compensation paid or accrued by Franklin Financial and F&M Trust in 2022 to each non-employee member of the Board of Directors.

DIRECTOR COMPENSATION

| | | | | | | | | |

| | | Fees Earned | | | | | | |

| | | or Paid in | | | Stock | | | |

Name | | | Cash (1) | | | Awards (2) | | | Total |

Martin R. Brown | | $ | 63,750 | | $ | 16,660 | | $ | 80,410 |

Kevin W. Craig | | | 58,000 | | | 9,996 | | | 67,996 |

Gregory A. Duffey | | | 64,750 | | | 16,660 | | | 81,410 |

G. Warren Elliott | | | 102,750 | | | 33,320 | | | 136,070 |

Daniel J. Fisher | | | 60,000 | | | 16,660 | | | 76,660 |

Allan E. Jennings, Jr. | | | 67,500 | | | 16,660 | | | 84,160 |

Stanley J. Kerlin | | | 63,000 | | | 16,660 | | | 79,660 |

Donald H. Mowery | | | 57,000 | | | 16,660 | | | 73,660 |

Kimberly M. Rzomp | | | 65,250 | | | 9,996 | | | 75,246 |

Gregory I. Snook (3) | | | - | | | - | | | - |

_____________________

(1)The amount reported is the aggregate dollar value of all fees earned (even if deferred) or paid in cash for services as a director in 2021, including annual retainer fees, committee and/or chairmanship fees and meeting fees.

(2)The amounts reported in this column reflect the dollar amount of the compensation expense to be recognized in accordance with FASB ASC Topic 718 in connection with awards of restricted stock. As of December 31, 2022 each director had 500 shares of restricted stock outstanding except for Mr. Craig and Ms. Rzomp who each had 300 shares of restricted stock outstanding and Mr. Elliott who had 1,000 shares of restricted stock outstanding.

(3)Mr. Snook was appointed as a Director in December 2022.

Director fees payable by F&M Trust are eligible to be deferred pursuant to the Farmers and Merchants Trust Company of Chambersburg Directors’ Deferred Compensation Plan (the “Director Deferred Compensation Plan”). Participation in the Director Deferred Compensation Plan is voluntary and each participant may elect each year to defer all or a portion of their F&M Trust director’s retainer. Each participant directs the investment of their own account among various publicly available mutual funds designated by the Bank’s Investment and Trust Services department. Growth of each participant’s account is a result of investment performance and is not the result of an interest factor or interest formula established by the participant or the Bank. The balance in such director’s deferred benefit account is payable to a designated beneficiary within 60 days upon the first to occur of the director’s retirement from the Board or death. The director may select a lump sum payout or may elect to receive a payout over a period of up to five years. Director Brown elected to defer $19,400 in 2022 and is the only director who made such an election in 2022.

At the 2019 Annual Meeting of Shareholders, the Directors recommended, and the shareholders approved the Stock Plan which was effective February 28, 2020, the date it was adopted by the Board of Directors. The Stock Plan allows for the award of various types of equity compensation to be awarded to directors as a component of long-term compensation. Each year, under the terms of the Stock Plan, the Compensation and Personnel Committee establishes two distinct performance criteria: (1) net income versus budget, and (2) return on equity (ROE) compared to a defined peer group performance. Performance is measured as: “Threshold”, “Target”, and “Outstanding” against the performance criteria.

The following illustrates the Stock Plan structure for the Board of Directors:

| | | | | | | | |

| | | | Performance Level Goals |

Performance Criteria | | Criterion Weighting | | Threshold | | Target | | Outstanding |

| | | | | | | | |

Net Income v. Budget | | 60% | | 95%-99% of budget | | 100%-110% of budget | | > 110% of budget |

| | | | | | | | |

ROE Peer Performance | | 40% | | 95%-99% of peer | | 100%-110% of peer | | > 110% of peer |

The number of shares available for award to Directors is based upon the participants role on the Board of Directors and the type of stock award (e.g., restricted stock, incentive stock options) being granted. Based on 2021 results, the Corporation achieved the Outstanding goal for the net income criteria and the Outstanding goal for the ROE criteria. As a result, a Stock Plan award of 4,600 shares (in the form of Restricted Stock) for the Board of Directors was approved by the Compensation and Personnel Committee and was awarded in 2022. The following shows the number of shares of restricted stock available for award and the number of shares awarded to the Board of Directors in 2022 for the 2021 performance results. These shares will fully vest in one year.

| | | | | | | | |

| | Shares Available for Award | | Shares Awarded |

Position | | Threshold | | Target | | Outstanding | | Per Director |

Board Chair | | 330 | | 660 | | 1,000 | | 1,000 |

Committee Chairs | | 165 | | 330 | | 500 | | 500 |

Directors | | 100 | | 200 | | 300 | | 300 |

BOARD STRUCTURE AND COMMITTEES

Leadership of the Board of Directors is placed in an independent Chairman. The Board performs its risk management oversight role through its committee structure. In addition to the Audit, Nominating and Corporate Governance, and Compensation and Personnel committees described below, the Board also has Asset-Liability, Strategic Initiative, Enterprise Risk Management, Executive, and Trust committees. An independent director chairs each of these committees. Board members are selected to serve on committees where it is believed their knowledge and experience will be most beneficial to the Corporation. Each board committee meets at least quarterly.

The following table shows the current committee structure of Franklin Financial and F&M Trust.

| | | | | | | | | | | | | | | | | |

| Franklin Financial | | F&M Trust |

| | | | | | | | | | | | | | | | | |

| | | | | Nominating & | | | | | | | | | | | | |

| Asset- | | | | Corporate | | Compensation | | | | | | | | Enterprise | | |

| Liability | | Audit | | Governance | | & Personnel | | Strategic | | Executive | | Trust | | Risk | | Executive |

| | | | | | | | | | | | | | | | | |

Martin R. Brown | | | X | | | | X | | | | X | | Chair | | | | X |

Kevin W. Craig | X | | X | | X | | | | X | | | | | | X | | |

Gregory A. Duffey | X | | | | X | | | | Chair | | X | | X | | | | X |

G. Warren Elliott | X | | X | | X | | Chair | | X | | Chair | | | | X | | Chair |

Daniel J. Fisher | | | X | | Chair | | X | | X | | X | | | | | | X |

Allan E. Jennings, Jr. | X | | Chair | | | | X | | X | | X | | | | X | | X |

Stanley J. Kerlin | Chair | | | | | | | | | | X | | X | | X | | X |

Donald H. Mowery | | | X | | X | | | | | | X | | | | Chair | | X |

Kimberly Rzomp | X | | X | | | | | | X | | | | X | | X | | |

Gregory I. Snook | | | | | | | X | | | | | | X | | | | |

X Member

| |

Audit Committee | |

Chair: Allan E. Jennings, Jr. Members: Martin R. Brown Kevin W. Craig G.Warren Elliott Daniel J. Fisher Donald H. Mowery Kimberly M. Rzomp Meetings in 2022: 4 | The Audit Committee assists the Board of Directors in fulfilling its responsibilities in providing oversight over the integrity of Franklin Financial's financial statements, Franklin Financial's compliance with applicable legal and regulatory requirements and the performance of Franklin Financial's internal audit function. The Audit Committee is responsible for the appointment, compensation, oversight and termination of Franklin Financial's independent auditors and regularly evaluates the independent auditors' independence from Franklin Financial and Franklin Financial's management. The Audit Committee reviews and approves the scope of the annual audit and is also responsible for, among other things, reporting to the Board on the results of the annual audit and reviewing the financial statements and related financial and nonfinancial disclosures included in Franklin Financial's Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. The Audit Committee also reviews Franklin Financial's disclosure controls and procedures and internal controls. The Audit Committee prepares the Audit Committee Report for inclusion in the annual proxy statement and oversees investigations into complaints concerning accounting and auditing matters. The Audit Committee also meets periodically with Franklin Financial's independent auditors and with Franklin Financial's internal auditors outside of the presence of management and has authority to retain outside legal, accounting and other professionals to assist it in meeting its responsibilities. The Audit Committee operates under a charter adopted by the Board of Directors, which is posted on Franklin Financial's website at www.franklinfin.com. All members of the Audit Committee were at all times during 2022 “independent directors” as such term is defined by the rules of the Nasdaq Stock Market. The Audit Committee has designated Ms. Rzomp as its “audit committee financial expert” as such term is defined in the Sarbanes-Oxley Act and applicable SEC rules and regulations. |

| |

Nominating and Corporate Governance Committee | |

Chair: Daniel J. Fisher Members: Kevin W. Craig Gregory A. Duffey G. Warren Elliott Donald H. Mowery Meetings in 2022: 3 | The Nominating and Corporate Governance Committee is responsible, among other things, for recommending to the Board of Directors persons to be nominated for election to the Board, persons to be appointed to fill vacancies on the Board and persons to be elected as officers of the Board. The Nominating and Corporate Governance Committee operates under a charter adopted by the Board of Directors, which is posted on Franklin Financial's website at www.franklinfin.com. All members of the Nominating Committee were at all times during 2022 “independent directors” as such term is defined by the rules of the Nasdaq Stock Market. |

| |

Compensation and Personnel Committee | |

Chair: G. Warren Elliott Members: Martin R. Brown Daniel J. Fisher Allan E. Jennings, Jr. Gregory I. Snook Meetings in 2022: 5 | The Compensation and Personnel Committee assists the Board of Directors in fulfilling its responsibilities in providing oversight over Franklin Financial's compensation policies and procedures. The Compensation and Personnel Committee is responsible for reviewing and approving senior officer compensation, for evaluating the President and Chief Executive Officer, for overseeing the administration of the Corporation's compensation program generally as it affects all other officers and employees, for administering the Corporation's incentive compensation programs (including the Stock Plan), for approving and overseeing the administration of the Corporation's employee benefits programs, for providing insight and guidance to management with respect to employee compensation generally, and for reviewing and making recommendations to the Board with respect to director compensation. The Committee operates under a charter adopted by the Board of Directors, which is posted on Franklin Financial's website at www.franklinfin.com. All members of the Compensation and Personnel Committee were at all times during 2022 "independent directors" as such term is defined by the rules of the Nasdaq Stock Market. |

Compensation Committee Interlocks and Insider Participation

No member of the Compensation and Personnel Committee is an employee or former employee of Franklin Financial or F&M Trust. There were no compensation committee “interlocks” at any time during 2022, which in general terms means that no executive officer or director of Franklin Financial served as a director or member of the compensation committee of another entity at the same time as an executive officer of such other entity served as a director of Franklin Financial.

EXECUTIVE COMPENSATION

The Compensation and Personnel Committee of the Corporation's Board of Directors administers the Corporation's executive compensation program. The Corporation currently has ten (10) senior officers, including the President and Chief Executive Officer. The Compensation and Personnel Committee, which is composed entirely of independent directors, is responsible for reviewing and approving senior officer compensation, for evaluating the President and Chief Executive Officer, for overseeing the administration of the Corporation's compensation program generally as it affects all other officers and employees, for administering the Corporation's incentive compensation programs (including the Stock Plan), for approving and overseeing the administration of the Corporation's employee benefits programs, for providing insight and guidance to management with respect to employee compensation generally, and for reviewing and making recommendations to the Board with respect to director compensation.

The Compensation and Personnel Committee operates under a charter adopted by the Board of Directors. The Committee annually reviews the adequacy of its charter and recommends changes to the Board for approval. The Committee meets at scheduled times during the year and on an "as necessary" basis, The Chairman of the Compensation and Personnel Committee reports on Committee activities and makes Committee recommendations at meetings of the Board of Directors.

The Compensation and Personnel Committee believes that executive compensation should be tied to individual performance, should vary with the Corporation's performance in achieving its financial and non-financial objectives, and should be structured so as to be closely aligned with the interests of the Corporation's shareholders. The Committee also believes that the compensation package of each senior officer should include an at-risk, performance-based component and that this component should increase as an officer's authority and responsibility increase. The Committee's philosophy is reflected in the Corporation's compensation objectives for its senior officers, which are as follows:

·Create a merit-based, pay for performance incentive-driven system which is linked to the Corporation’s financial results and other factors that directly and indirectly influence shareholder value;

·Establish a compensation system that enables the Corporation to attract and retain talented executives who are motivated to advance the interests of the Corporation's shareholders; and

·Provide a total compensation package that is fair in relation to the compensation practices of comparable financial institutions.

The elements of total compensation paid by the Corporation to its senior officers, including the Chief Executive Officer (the "CEO") and the other executive officers (collectively, together with the CEO, the “Named Executive Officers”) identified in the Summary Compensation Table following this discussion, include:

Base salary;

Short-term incentive compensation in the form of cash awards granted under the Corporation’s Senior Management Annual Incentive Plan;

Long-term incentive compensation in the form of stock options granted under the Corporation’s Stock Plan;

Benefits under the Corporation’s retirement plan; and

Benefits under the Corporation’s health and welfare benefits plans.

Base Salary

The base salaries of the Named Executive Officers are reviewed by the Compensation and Personnel Committee annually in December of each year, as well as at the time of any promotion or significant change in job responsibilities. Base salaries for our senior officers are established based upon the scope of their responsibilities, taking into account compensation paid by comparable financial institutions for similar positions.

Short-Term Incentive Compensation

In 2020, the Corporation adopted the Senior Management Annual Incentive Plan (the "Incentive Plan") for purposes of linking a portion of the compensation of its senior officers, including the Named Executive Officers, to the success of the Corporation in meeting certain financial targets which are established annually by the Compensation and Personnel Committee. Each year, under the terms of the Incentive Plan, the Committee establishes four distinct performance criteria: (1) net income versus budget, (2) return on equity (ROE) compared to peer group performance, (3) individual performance goal, and (4) a discretionary award. Performance criteria one

and two are set at the same goal for each participant in the Incentive Plan while criteria three and four are managed by the Board (for the CEO) or the CEO (for other Named Executive Officers) and are unique to each participant.

Each performance criterion is weighted differently depending on the position, but in a manner where the total weighting equals 100%. A performance level goal is then defined for each performance criterion defined as “Threshold”, “Target” and “Outstanding” An incentive award defined as a percent of salary is then defined for “Threshold”, “Target” and “Outstanding” performance results. The payout opportunities vary by position due to the different level of incentive award percentage assigned to the position and the criteria weighting. Payouts can range from 0% to 50% of salary, based on position and the achievement level of each performance criterion. In the first quarter of 2023 the Committee reviewed the results of the 2022 performance criteria. For 2022, the Corporation achieved the Outstanding goal for the net income criteria and did not meet a goal for the ROE criteria. The Committee also reviewed the individual performance goal and the discretionary award for each Named Executive Officer. The Incentive Plan awards earned by the Chief Executive and the other Named Executive Officers for 2022 are reported in the Summary Compensation Table and will be paid out in 2023.

The following illustrates the Incentive Plan structure for the Chief Executive Officer and the other Named Executive Officers:

| | | | | | | | |

Timothy G. Henry | | | | Performance Level Goals and Payout Opportunity as Percent of Salary |

Performance Criteria | | Criterion Weighting | | Threshold | | Target | | Outstanding |

| | | | | | | | |

Net Income v. Budget | | 35% | | 95%-99% of budget (15%) | | 100%-110% of budget (30%) | | > 110% of budget (50%) |

ROE Peer Performance | | 35% | | 95%-99% of peer (15%) | | 100%-110% of peer (30%) | | > 110% of peer (50%) |

Individual Goals | | 15% | | 15% | | 30% | | 50% |

Discretionary | | 15% | | 15% | | 30% | | 50% |

| | 100% | | | | | | |

| | | | | | | | |

| | | | | | | | |

Mark R. Hollar | | | | Performance Level Goals and Payout Opportunity as Percent of Salary |

Performance Criteria | | Criterion Weighting | | Threshold | | Target | | Outstanding |

| | | | | | | | |

Net Income v. Budget | | 35% | | 95%-99% of budget (10%) | | 100%-110% of budget (20%) | | > 110% of budget (35%) |

ROE Peer Performance | | 25% | | 95%-99% of peer (10%) | | 100%-110% of peer (20%) | | > 110% of peer (35%) |

Individual Goals | | 25% | | 10% | | 20% | | 35% |

Discretionary | | 15% | | 10% | | 20% | | 35% |

| | 100% | | | | | | |

| | | | | | | | |

| | | | | | | | |

Steven D. Butz | | | | Performance Level Goals and Payout Opportunity as Percent of Salary |

Performance Criteria | | Criterion Weighting | | Threshold | | Target | | Outstanding |

| | | | | | | | |

Net Income v. Budget | | 20% | | 95%-99% of budget (10%) | | 100%-110% of budget (20%) | | > 110% of budget (35%) |

ROE Peer Performance | | 20% | | 95%-99% of peer (10%) | | 100%-110% of peer (20%) | | > 110% of peer (35%) |

Individual Goals | | 40% | | 10% | | 20% | | 35% |

Discretionary | | 20% | | 10% | | 20% | | 35% |

| | 100% | | | | | | |

Long-Term Incentive Compensation

At the 2019 Annual Meeting of Shareholders, the Directors recommended, and the shareholders approved the Stock Plan to be effective February 28, 2020, the date it was approved by the Board of Directors. The Stock Plan allows for the award of various types of equity compensation to be awarded to key officers as a component of long-term compensation. Each year, under the terms of the Stock Plan, the Committee establishes two distinct performance criteria: (1) net income versus budget, and (2) return on equity compared to peer group performance. Performance is measured as: “Threshold”, “Target”, and “Outstanding” against the performance criteria. The following illustrates the Stock Plan stock structure for the Chief Executive Officer and the other Named Executive Officers:

| | | | | | | | |

| | | | Performance Level Goals |

Performance Criteria | | Criterion Weighting | | Threshold | | Target | | Outstanding |

| | | | | | | | |

Net Income v. Budget | | 60% | | 95%-99% of budget | | 100%-110% of budget | | > 110% of budget |

| | | | | | | | |

ROE Peer Performance | | 40% | | 95%-99% of peer | | 100%-110% of peer | | > 110% of peer |

The number of shares available for award is based upon the participant’s position in the Corporation and the type of stock award (e.g., restricted stock, incentive stock options) being granted. Based on 2021 results, the Corporation achieved the Outstanding goal for the net income criteria and the Outstanding goal for the ROE Peer Performance goal. As the result, a Stock Plan award (in the form of Restricted Stock) for the Chief Executive Officer and other Named Executive Officers was approved by Compensation and Personnel Committee and was awarded in 2022. One-third of the shares will vest each year over a three-year period. The following illustrates the number of restricted stock shares available for award and the number of shares awarded in 2022 to the Chief Executive Officer and the other Named Executive Officers:

| | | | | | | | |

| | Shares Available for Award | | |

| | Threshold | | Target | | Outstanding | | Shares Awarded |

Timothy G. Henry | | 825 | | 1,650 | | 2,000 | | 2,000 |

Mark R. Hollar | | 275 | | 825 | | 1,238 | | 1,238 |

Steven D. Butz | | 275 | | 825 | | 1,238 | | 1,238 |

At the Corporation’s annual meeting of shareholders held in 2021, the shareholders approved the compensation paid to our Named Executive Officers (as defined below) in a non-binding advisory vote by a majority of the votes cast. In consideration, in part, of that vote, the Compensation and Personnel Committee did not make any material changes to its salary compensation policies, procedures or practices for 2022.

Compensation Tables and Additional Compensation Disclosure

Total Compensation

The following table provides certain summary information concerning total compensation paid or accrued by Franklin Financial and F&M Trust to Timothy G. Henry, the President and Chief Executive Officer of Franklin Financial, Mark R. Hollar, Executive Vice President and Chief Financial Officer of Franklin Financial, and to the most highly compensated executive officer other than Messrs. Henry and Hollar whose total compensation in 2022 exceeded $100,000.

SUMMARY COMPENSATION TABLE

15000*.55 | | | | | | | | | | | | |

| | | | | | | | Non-Equity | | | | |

| | | | | | | | Incentive | | | | |

Name and | | | | | | Stock | | Plan | | All Other | | |

Principal | | | | Salary | | Awards | | Compensation | | Compensation | | Total |

Position | | Year | | (1) | | (2) | | (3) | | (4) | | |

| | | | $ | | $ | | $ | | $ | | $ |

| | | | | | | | | | | | |

Timothy G. Henry | | 2022 | | 459,368 | | 79,848 | | 121,733 | | 28,419 | | 689,368 |

President & Chief | | 2021 | | 438,334 | | 22,655 | | 219,167 | | 21,573 | | 701,729 |

Executive Officer | | | | | | | | | | | | |

| | | | | | | | | | | | |

Mark R. Hollar | | 2022 | | 259,852 | | 51,156 | | 52,797 | | 22,993 | | 386,798 |

Executive Vice President | | 2021 | | 243,412 | | 7,552 | | 76,066 | | 17,438 | | 344,468 |

Chief Financial Officer | | | | | | | | | | | | |

| | | | | | | | | | | | |

Steven D. Butz | | 2022 | | 217,718 | | 51,156 | | 39,850 | | 15,957 | | 324,681 |

Senior Vice President | | 2021 | | 208,702 | | 7,552 | | 54,263 | | 10,435 | | 280,952 |

| | | | | | | | | | | | |

_____________________

(1)The amounts reported in this column consist of base salary earned during the indicated year.

(2)The amounts reported in this column reflect the dollar amount of the compensation expense to be recognized in accordance with FASB ASC Topic 718 in connection with awards of restricted stock.

(3)The amounts reported in this column consist of cash payouts earned in the indicated year in respect of the Corporation's performance for that year under the Senior Management Annual Incentive Plan, a non-equity incentive compensation plan.

(4)The components of all other compensation are reported in the All Other Compensation table that follows.

ALL OTHER COMPENSATION TABLE

| | | | | | | | | | | | |

| | | | | | | | NonQualified | | Perquisites | | |

| | | | Company Contributions | | Split Dollar Life | | Pension | | and Other | | |

Name | | Year | | to 401(k) Plan | | Insurance Premium | | Contribution | | Compensation | | Total |

| | | | $ | | $ | | $ | | $ | | $ |

Timothy G. Henry | | 2022 | | 21,050 | | - | | - | | 7,369 | (1) | 28,419 |

| | 2021 | | 14,250 | | - | | - | | 7,323 | (1) | 21,573 |

| | | | | | | | | | | | |

Mark R. Hollar | | 2022 | | 18,793 | | 908 | | 3,292 | | - | | 22,993 |

| | 2021 | | 13,771 | | 762 | | 2,905 | | - | | 17,438 |

| | | | | | | | | | | | |

Steven D. Butz | | 2022 | | 15,957 | | - | | - | | - | | 15,957 |

| | 2021 | | 10,435 | | - | | - | | - | | 10,435 |

| | | | | | | | | | | | |

(1)Value of personal use of company car.

PAY VERSUS PERFORMANCE

The following table presents the compensation considered to be actually paid to the Principle Executive Officer (PEO), Mr. Henry and the average compensation paid to the other non-PEO Named Executive Officers (Other NEOs), collectively as compared to the compensation reported in the Summary Compensation Table for the years presented.

| | | | | | | | | | | | |

| | | | | | | | | | Value of Initial Fixed $100 Investment Based On: |

| | Summary Compensation Table Total for PEO | | Compensation Actually Paid to PEO | | Average Summary Compensation Table Total for Non-PEO and NEOs | | Average Summary Compensation Actually Paid for Non-PEO and NEOs | | Total Shareholder Return | | Net Income |

| | (1) | | (2) | | (3) | | (4) | | (5) | | (6) |

Year | | $ | | $ | | $ | | $ | | $ | | $ 000's |

2022 | $ | 689,368 | $ | 717,306 | $ | 355,740 | $ | 395,011 | $ | 113.46 | $ | 14,938 |

| | | | | | | | | | | | |

2021 | | 701,729 | | 763,348 | | 312,710 | | 366,509 | | 127.88 | | 19,616 |

(1) Compensation as reported in the Summary Compensation Table for the PEO Timothy G. Henry, for the years indicated.

(2) Compensation actually paid to the PEO calculated each year and reflects the respective amounts set forth in column (1) of the table above, adjusted as set forth in the table below, as determined in accordance with SEC rules.

| | | | | | |

| | 2022 | | 2021 |

Summary Compensation Table Total | | $ | 689,368 | | $ | 701,729 |

Adjustments: | | | | | | |

Less: amounts reported under the "Stock Awards" column in the Summary Compensation Table | | | (79,848) | | | (22,655) |

Plus: fair value of awards granted during the year that remain unvested as of year end | | | 72,200 | | | 28,963 |

Plus: fair value of awards granted during the year that vested during the year | | | 12,788 | | | - |

Change in fair value of outstanding and unvested awards from prior years still outstanding at covered year-end | | | 22,868 | | | 28,240 |

Change in fair value for awards granted in prior years that vested in the covered year | | | (70) | | | 72 |

Compensation Actually Paid | | $ | 717,306 | | $ | 736,349 |

(3) The average of the total compensation reported in the Summary Compensation Table for the Other NEOs. Included in the average figures shown for both 2022 and 2021 are Messrs. Hollar and Butz.

(4) Average compensation actually paid to the Other NEOs is calculated in each year reflects the respective amounts set forth in column (3) of the table above, adjusted as set forth in the table below, as determined in accordance with SEC rules.

| | | | | | |

| | 2022 | | 2021 |

Summary Compensation Table Total | | $ | 355,740 | | $ | 312,710 |

Adjustments: | | | | | | |

Less: amounts reported under the "Stock Awards" column in the Summary Compensation Table | | | (51,156) | | | (7,552) |

Plus: fair value of awards granted during the year that remain unvested as of year end | | | 44,692 | | | 9,103 |

Plus: fair value of awards granted during the year that vested during the year | | | 9,591 | | | - |

Change in fair value of outstanding and unvested awards from prior years still outstanding at covered year-end | | | 36,178 | | | 51,429 |

Change in fair value for awards granted in prior years that vested in the covered year | | | (33) | | | 820 |

Compensation Actually Paid | | $ | 395,012 | | $ | 366,510 |

(5) Total shareholder return shows the value at year-end assuming the investment of $100 on the last day of the previous calendar year and the reinvestment of dividends during the year

(6) Net income of the Corporation for the reported year.

Relationship Between Compensation Actually Paid and Performance Measures

The following table shows the relationship between the compensation actually paid to total shareholder return and net income as measured by the percentage change in each from 2021 to 2022.

| | | | | | |

| | Average | | | | |

| | Summary | | | | |

Compensation | | Compensation | | Total | | |

Actually Paid | | Actually Paid | | Shareholder | | |

to PEO | | to Non-PEO | | Return | | Net Income |

-2.6% | | 7.8% | | -11.3% | | -23.8% |

Outstanding Stock Option

and Other Equity Awards at Fiscal Year End

The following table provides certain information with respect to the executive officers named in the Summary Compensation Table appearing above concerning stock and equity awards which were outstanding on December 31, 2022.

OUTSTANDING EQUITY AWARDS (1)

| | | | | | | | | | | | | |

| | | | | Option Awards | | | | |

| | | | | Number of | | | | | | | | |

| | | | | Securities | | | | | | Stock Awards |

| | | | | Underlying | | | | | | Number of | | Fair Market |

| | | | | Unexercised | | Option | | Option | | Shares That | | Value of Shares |

| | | | | Options | | Exercise | | Expiration | | Have Not | | That Have |

Name | | Grant Date | | Exercisable (#)(2) | | Price ($) | | Date | | Vested (#) | | Not Vested ($)(3) |

| | | | | | | | | | | | | |

Timothy G. Henry | | 2/23/2017 | (ISO) | | 2,900 | | 30.00 | | 2/23/2027 | | | | |

| | 2/22/2018 | (ISO) | | 2,927 | | 34.10 | | 2/22/2028 | | | | |

| | 7/1/2022 | (ESPP) | | 767 | | 28.73 | | 6/30/2023 | | | | |

| | 3/21/2020 | (RS) | | | | | | | | 596 | | 21,516 |

| | 3/1/2021 | (RS) | | | | | | | | 550 | | 19,855 |

| | 3/1/2022 | (RS) | | | | | | | | 2,000 | | 72,200 |

| | | | | | | | | | | | | |

Mark R. Hollar | | 2/26/2015 | (ISO) | | 2,250 | | 22.05 | | 2/26/2025 | | | | |

| | 2/25/2016 | (ISO) | | 3,000 | | 21.27 | | 2/25/2026 | | | | |

| | 2/23/2017 | (ISO) | | 3,000 | | 30.00 | | 2/23/2027 | | | | |

| | 2/22/2018 | (ISO) | | 2,927 | | 34.10 | | 2/22/2028 | | | | |

| | 7/1/2022 | (ESPP) | | 428 | | 28.73 | | 6/30/2023 | | | | |

| | 3/1/2020 | (RS) | | | | | | | | 330 | | 11,913 |

| | 3/1/2021 | (RS) | | | | | | | | 184 | | 6,642 |

| | 3/1/2022 | (RS) | | | | | | | | 1,238 | | 44,692 |

| | | | | | | | | | | | | |

Steven D. Butz | | 2/26/2015 | (ISO) | | 2,250 | | 22.05 | | 2/26/2025 | | | | |

| | 2/25/2016 | (ISO) | | 2,700 | | 21.27 | | 2/25/2026 | | | | |

| | 2/23/2017 | (ISO) | | 2,700 | | 30.00 | | 2/23/2027 | | | | |

| | 2/22/2018 | (ISO) | | 2,700 | | 34.10 | | 2/22/2028 | | | | |

| | 7/1/2021 | (ESPP) | | 368 | | 28.73 | | 6/30/2023 | | | | |

| | 3/1/2020 | (RS) | | | | | | | | 330 | | 11,913 |

| | 3/1/2021 | (RS) | | | | | | | | 184 | | 6,642 |

| | 3/1/2022 | (RS) | | | | | | | | 1,238 | | 44,692 |

(1)Awards reflect Incentive Stock Options (ISO) and restricted stock (RS) granted under the Stock Plan, and options granted under the Employee Stock Purchase Plan (ESPP), as indicated.

(2)Reflects the number of shares of stock underlying unexercised options that are exercisable as of December 31, 2022.

(3)Calculated using the December 31, 2022 closing price of $36.10 per share.

The following table shows the vesting schedule for the restricted stock awards to the Named Executive Officers:

| | | | | | | | |

| | Restricted Shares Vesting on: |

Name | | March 1, 2023 | | March 1, 2024 | | March 1, 2025 | | Total |

Timothy G. Henry | | 1,537 | | 942 | | 667 | | 3,146 |

Mark R. Hollar | | 834 | | 505 | | 413 | | 1,752 |

Steven D. Butz | | 834 | | 505 | | 413 | | 1,752 |

Employment Agreements And Potential Payments

Upon Termination Or Change In Control

The Company and F&M Trust entered into employment agreements (each, an “Employment Agreement” and together, the “Employment Agreements”) with Timothy G. Henry, President and Chief Executive Officer of the Company and F&M Trust, Mark R. Hollar, Executive Vice President, Chief Financial Officer and Treasurer of the Company and F&M Trust, and Steven D. Butz, Senior Vice President - Chief Commercial Services Officer of F&M Trust on March 1, 2022 (each an “Executive”).

The initial term of the Employment Agreement for Messrs. Henry, Hollar and Butz is three (3) years beginning on March 1, 2022. Each Employment Agreement shall automatically renew for an additional one (1) year term on each the anniversary date unless notice to terminate is given by either party at least one hundred and eighty (180) days prior to the anniversary date of the Employment Agreement. If proper notice to terminate is given, each Employment Agreement shall expire two (2) years after the next anniversary date. The Employment Agreements may be terminated (a) by the Company with or without Cause (as defined in the Employment Agreements), (b) by the Executive with or without Good Reason (as defined in the Employment Agreements) or (c) as a result of retirement or Disability (as defined in the Employment Agreements).

Under the Employment Agreements, the Executives are entitled to receive the following compensation and benefits in connection with their services as an executive officer: annual base salary which may be increased from time-to-time, consideration for bonuses each year as provided for under short- and long-term incentive plans approved by the Company, paid time off and participation in employee benefit plans. In addition, Mr. Henry will be provided with a Company vehicle and payment of certain club membership dues.

The Employment Agreements provide for severance benefits in the event that the Executive’s employment is terminated: (a) by the Company or F&M Trust without Cause or by the Executive for Good Reason prior to a Change in Control (as defined in the Employment Agreements) or (b) by the Company or F&M Trust without Cause after a Change in Control. In the event the Executive’s employment is terminated by the Company or F&M Trust without Cause or by the Executive for Good Reason prior to a Change in Control, the Executives will be entitled to receive the following compensation and benefits: (a) F&M Trust shall pay Executive an amount equal to the Executive’s remaining Annual Base Salary (as defined in the Employment Agreements) that would otherwise be due and payable under the Employment Agreement to the Executive for the remaining employment period, minus applicable taxes and withholdings, payable in equal monthly installments over the remaining employment period, and (b) for a period of up to two (2) years Executive shall receive a continuation of all life, disability, medical insurance and other normal health and welfare benefits.