Exhibit 99.2

Annual Meeting April 25, 2023 F&M TRUST Franklin Financial Services Corporation

Call to Order G. Warren Elliott F&M TRUST Franklin Financial Services Corporation

Invocation Pam Johns F&M TRUST Franklin Financial Services Corporation

Minutes of Last Meeting G. Warren Elliott F&M TRUST Franklin Financial Services Corporation

Forward Looking Statements In order to help you to better understand the business of the Company – where we have been and where we want to go – my remarks today (and those of other Company officers who will speak or respond to questions) will include forward looking statements relating to anticipated financial performance, future operating results, business prospects, new products, and similar matters. These statements represent our best judgment, based upon present circumstances and the information now available to us, of what we think may occur in the future – and, of course, it is possible that actual results may differ materially from those we envision today. For a more complete discussion on the subject of forward looking statements, including a list of some of the risk factors that might adversely affect operating results, I refer you to section 1A entitled “Risk Factors” which appears in our annual report on Form 10-K as filed with the Securities and Exchange Commission (SEC). F&M TRUST Franklin Financial Services Corporation

Introduction G. Warren Elliott F&M TRUST Franklin Financial Services Corporation

Board of Directors G. Warren Elliott Chairman of the Board Timothy (Tim) G. Henry President & CEO F&M TRUST Franklin Financial Services Corporation

Board of Directors Martin R. Brown Kevin W. Craig Gregory A. Duffey F&M TRUST Franklin Financial Services Corporation

Board of Directors Daniel J. Fisher Allan E. Jennings, Jr. Stanley J. Kerlin F&M TRUST Franklin Financial Services Corporation

Board of Directors Donald H. Mowery Kimberly M. Rzomp Gregory I. Snook F&M TRUST Franklin Financial Services Corporation

Nick Bybel Partner, Bybel Rutledge LLP Zoe Clayton Assistant Corporate Secretary – Judge of Elections Ian Kandray CPA, Crowe Warren Hurt Vice President and Chief Investment Officer F&M TRUST Franklin Financial Services Corporation

Chairman Comments G. Warren Elliott F&M TRUST Franklin Financial Services Corporation

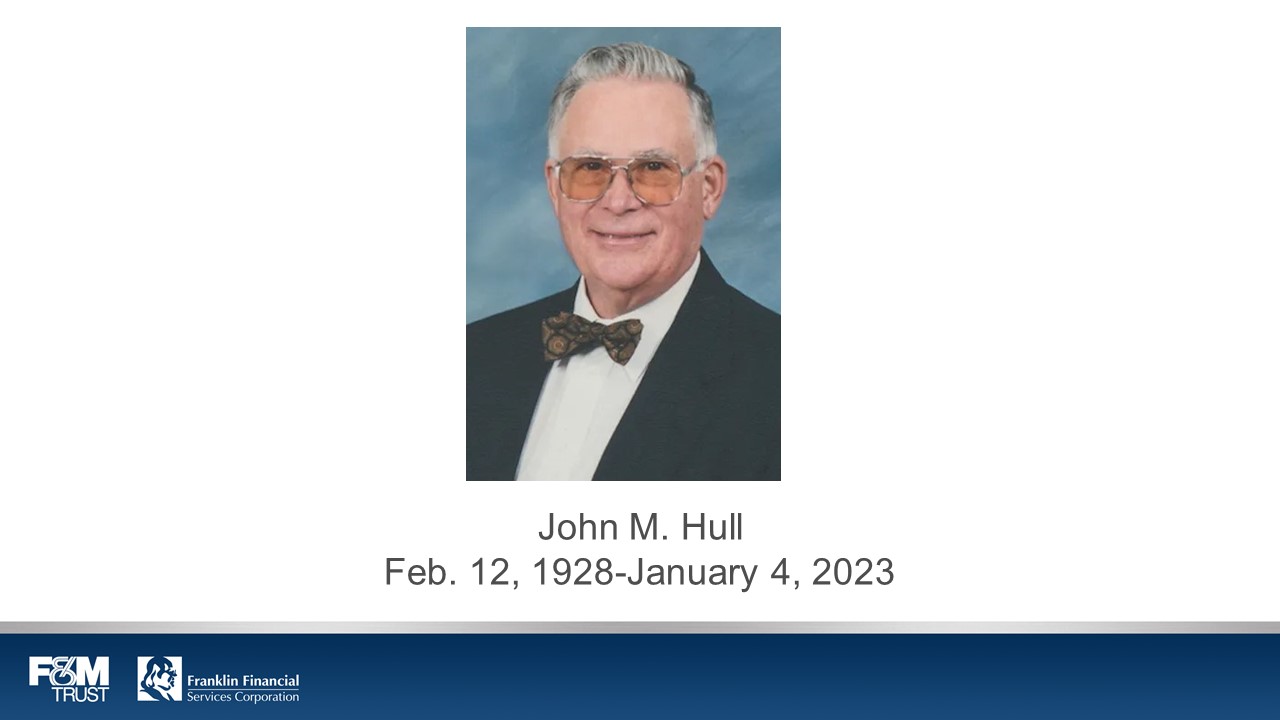

John M. Hull Feb. 12, 1928-January 4, 2023 F&M TRUST Franklin Financial Services Corporation

G. Warren Elliott Chairman of the Board F&M TRUST Franklin Financial Services Corporation

F&M TRUST Franklin Financial Services Corporation

G. Warren Elliott Chairman of the Board F&M TRUST Franklin Financial Services Corporation

F&M TRUST Franklin Financial Services Corporation

G. Warren Elliott Chairman of the Board F&M TRUST Franklin Financial Services Corporation

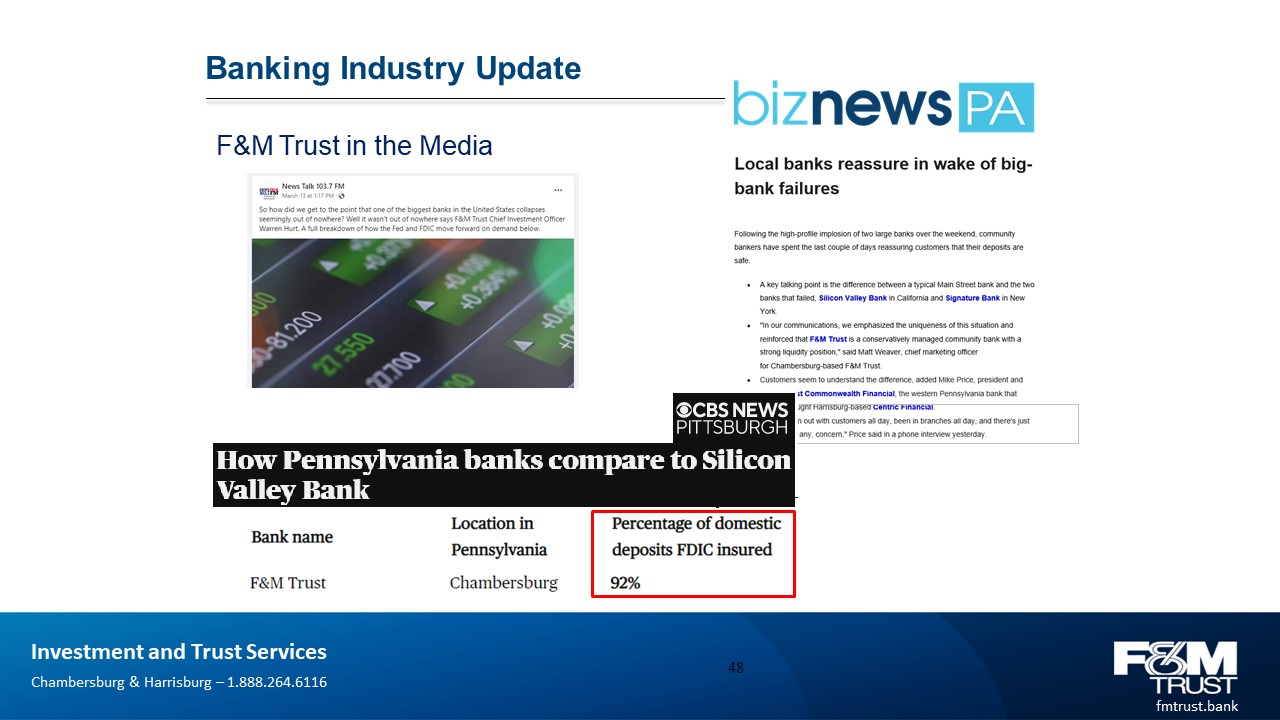

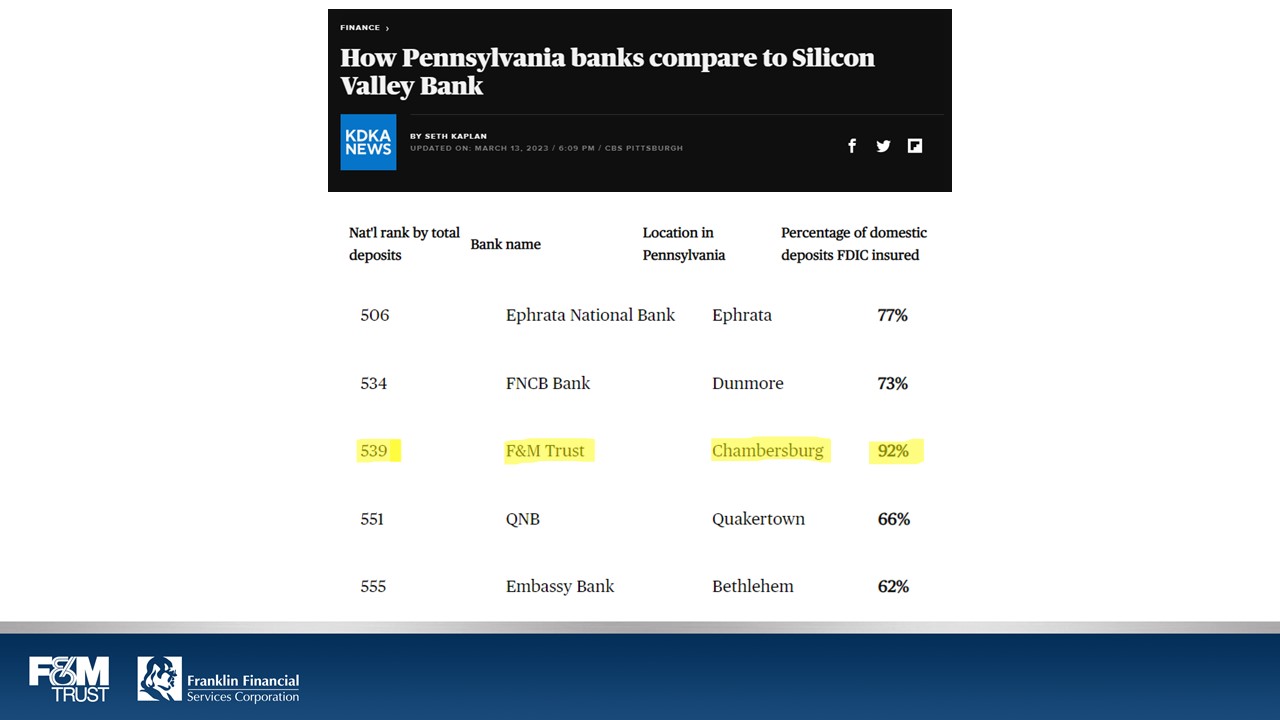

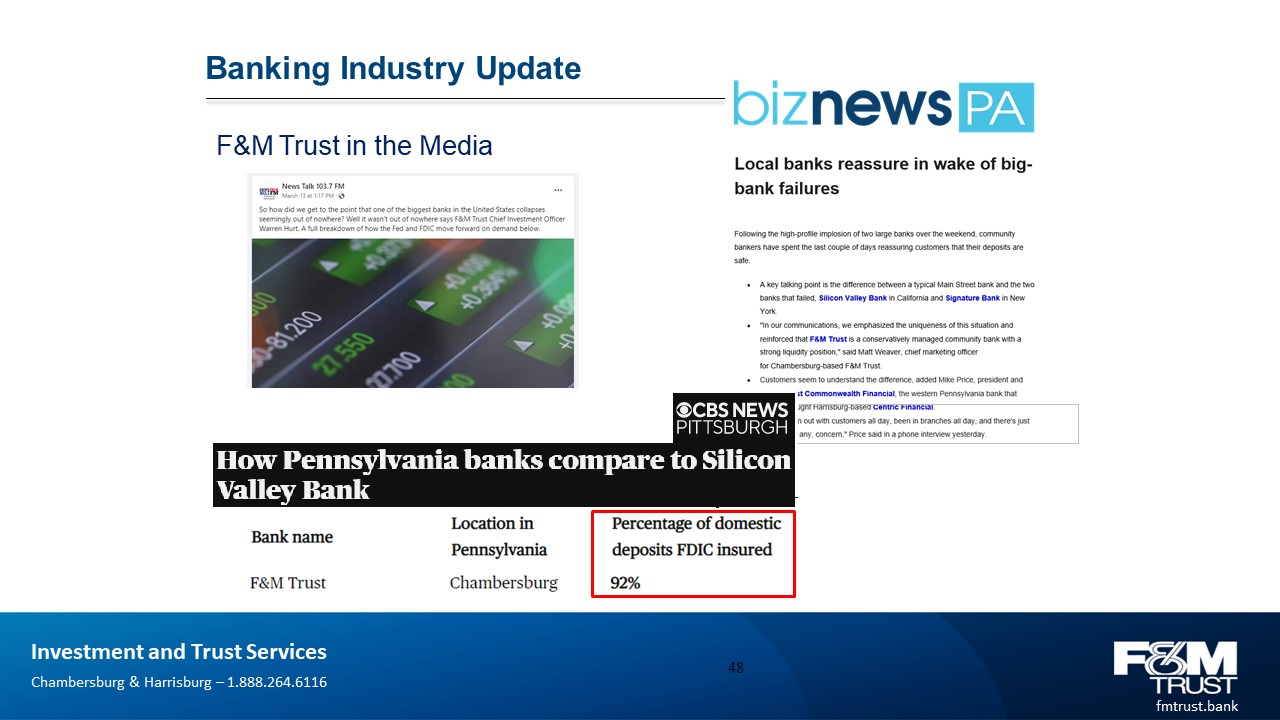

FINANCE > How Pennsylvania banks compare to Silicon Valley Bank KDKA NEWS BY SETH KAPLAN UPDATED ON: MARCH 13. 2023 / 6:09 PM / CBS PITTSBURGH Nat'l rank by total deposits Bank name Location in Percentage of domestic Pennsylvania deposits FDIC insured 506 Ephrata National Bank Ephrata 77% 534 FNCB Bank Dunmore 73% 539 F&M Trust Chambersburg 92% 551 QNB Quakertown 66% 555 Embassy Bank Bethlehem 62% F&M TRUST Franklin Financial Services Corporation

G. Warren Elliott Chairman of the Board F&M TRUST Franklin Financial Services Corporation

Franklin Financial Services Corporation F&M TRUST As a valued shareholder of Franklin Financial Services Corporation, you are cordially invited to join the Board of Directors and Senior Leadership for an opportunity to exchange information and learn more about the company’s vision for the future. Light refreshments, beer and wine will be provided. THRUSDAY JANUARY 19 5:00 to 6:30pm 2023 F&M 'Trust Community Room 1500 Mitterhouse Drive Chambersburg, PA 17201 Kindly R SVP by Thursday, January 12, 2023 to Zoe Clayton zoe.clayton@f-mtrust.com or (717) 261-3551 F&M TRUST Franklin Financial Services Corporation

F&M TRUST Franklin Financial Services Corporation

F&M TRUST Franklin Financial Services Corporation

G. Warren Elliott Chairman of the Board F&M TRUST Franklin Financial Services Corporation

F&M TRUST Franklin Financial Services Corporation

Election of Directors G. Warren Elliott F&M TRUST Franklin Financial Services Corporation

G. Warren Elliott Timothy G. Henry Stanley J. Kerlin Kimberly M. Rzomp F&M TRUST Franklin Financial Services Corporation

Say-On-Pay Vote G. Warren Elliott F&M TRUST Franklin Financial Services Corporation

Say-On-Frequency Vote G. Warren Elliott F&M TRUST Franklin Financial Services Corporation

Ratification of Auditors G. Warren Elliott F&M TRUST Franklin Financial Services Corporation

Polls Open G. Warren Elliott F&M TRUST Franklin Financial Services Corporation

Economic Review & Outlook Warren Hurt, Chief Investment Officer F&M TRUST Franklin Financial Services Corporation

Economic Review and Outlook Headlines: 2022 – A Uniquely Challenging Year Investment and Trust Services Chambersburg & Harrisburg - 1.888.264.6116 F&M TRUST Franklin Financial Services Corporation

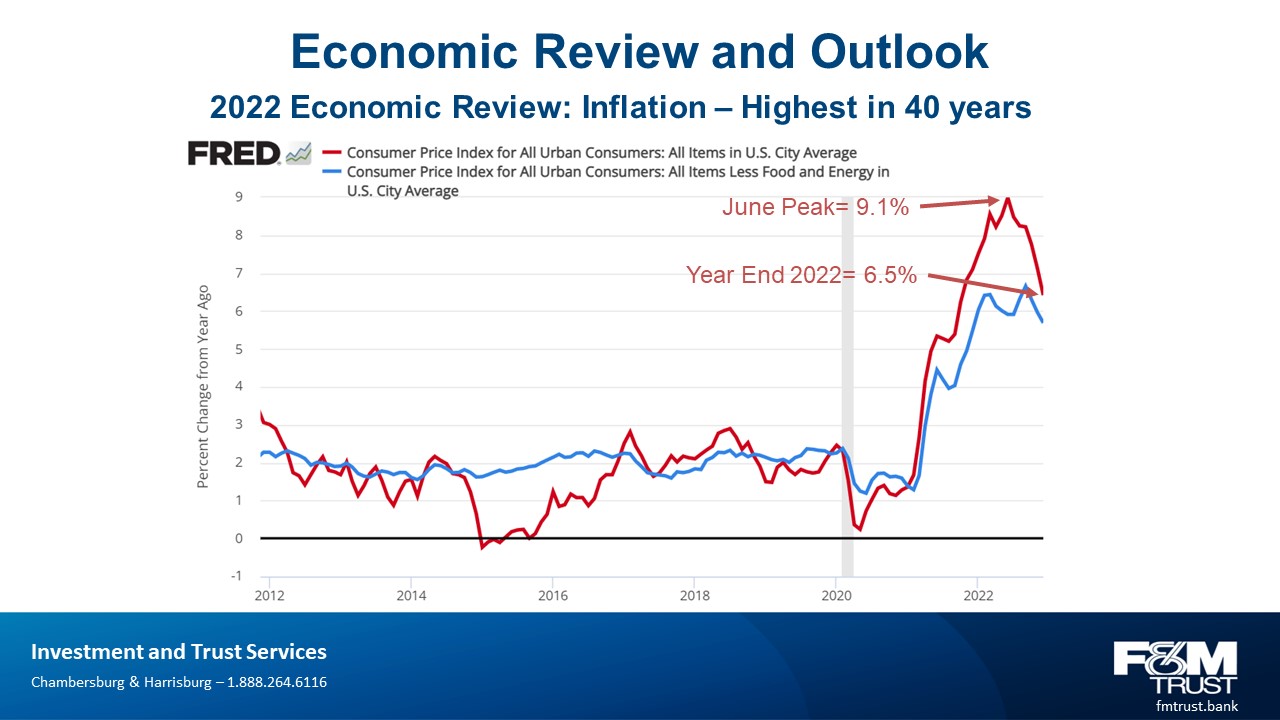

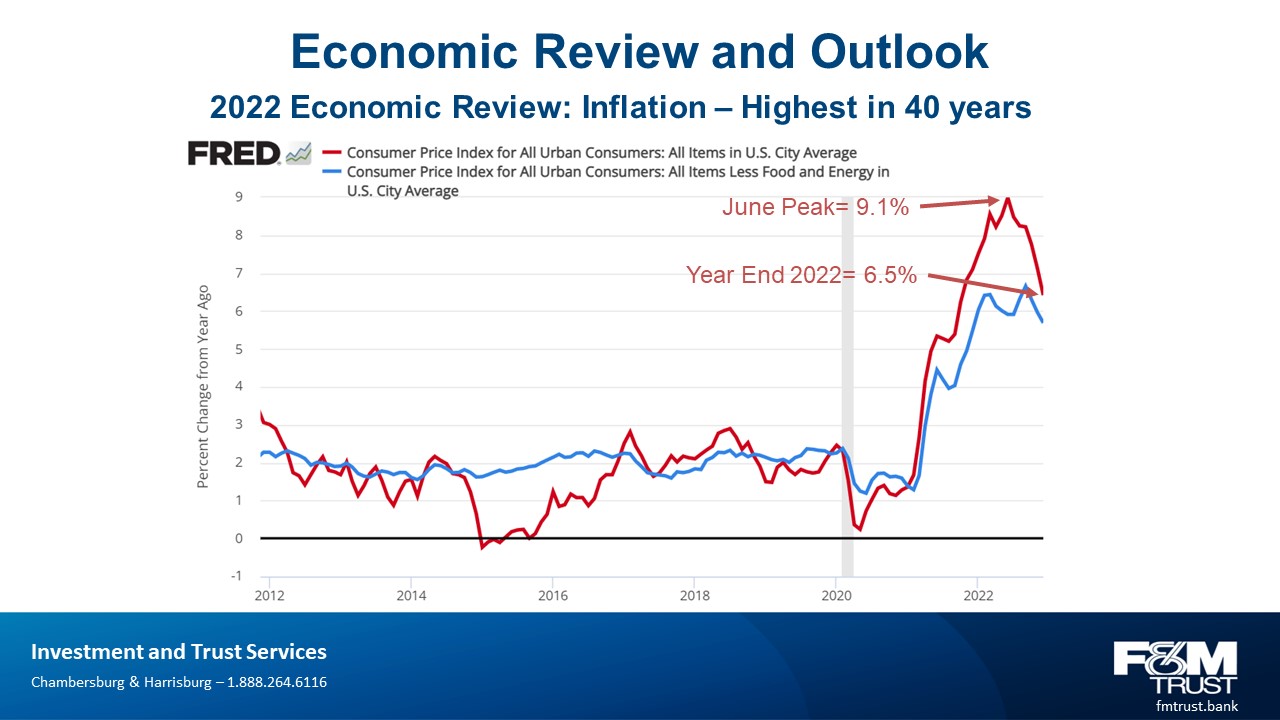

Economic Review and Outlook 2022 Economic Review: Inflation – Highest in 40 years FRED^ Q Consumer Price Index for All Urban Consumers: All Items in U.S. City Average Consumer Price Index for All Urban Consumers: All Items Less Food and Energy in U.S. City Average _ _ _ _ . June Peak= 9.1% Year End 2022= 6.5% F&M TRUST Franklin Financial Services Corporation

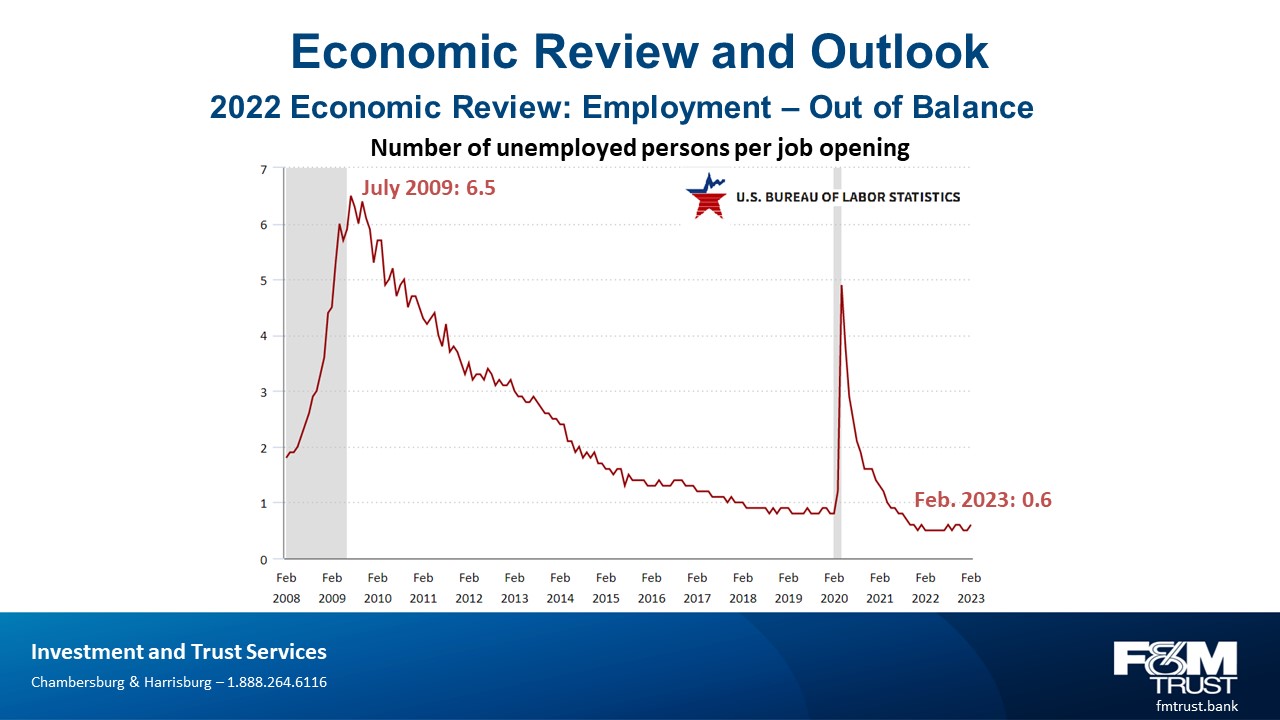

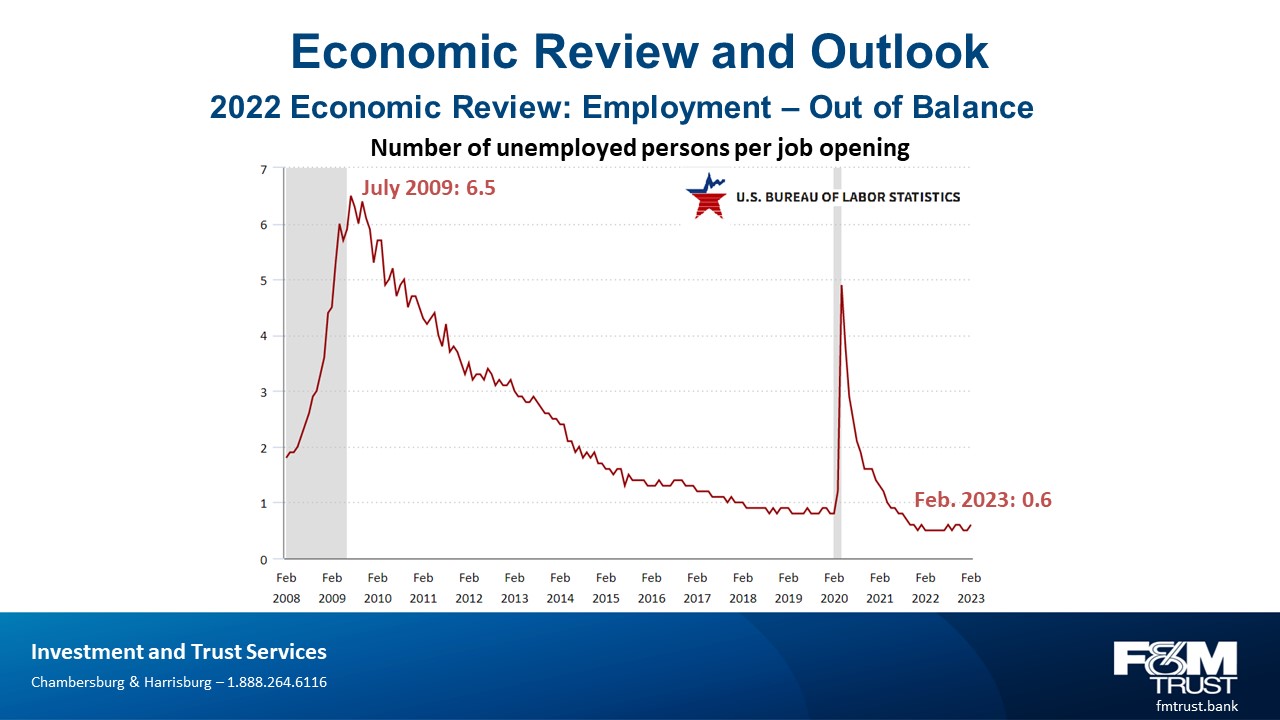

Economic Review and Outlook 2022 Economic Review: Employment – Out of Balance Number of unemployed persons per job opening July 2009: 6.5 U.S. BUREAU OF LABOR STATISTICS Feb. 2023:0.6 F&M TRUST Franklin Financial Services Corporation

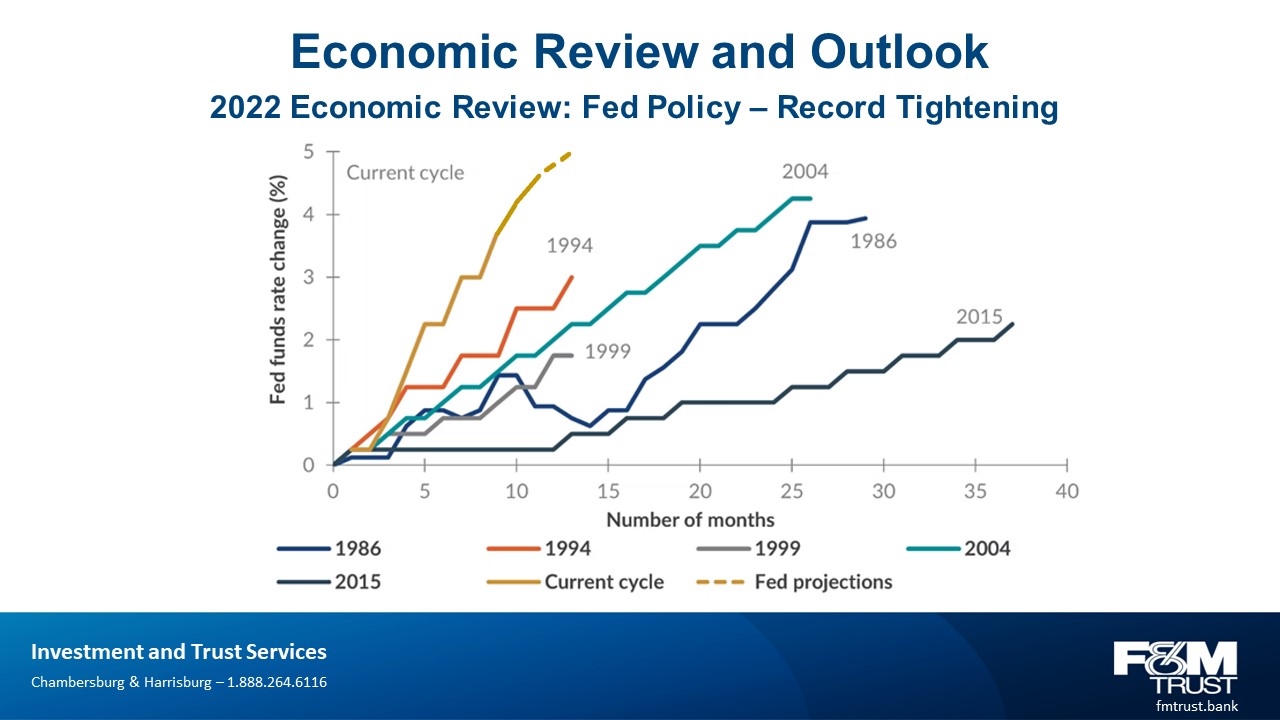

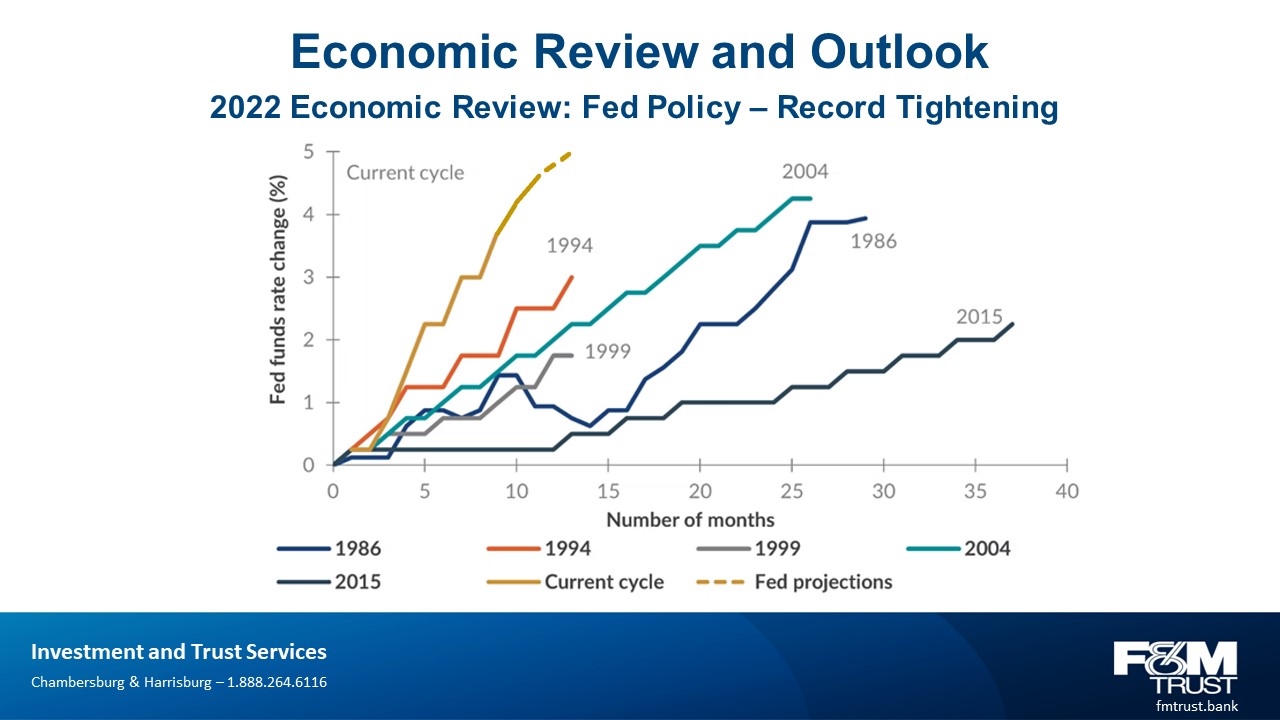

Economic Review and Outlook 2022 Economic Review: Fed Policy – Record Tightening Current cycle 1994 1999 2004 1986 2015 1986 1994 1999 2004 2015 Current cycle Fed projections F&M TRUST Franklin Financial Services Corporation��

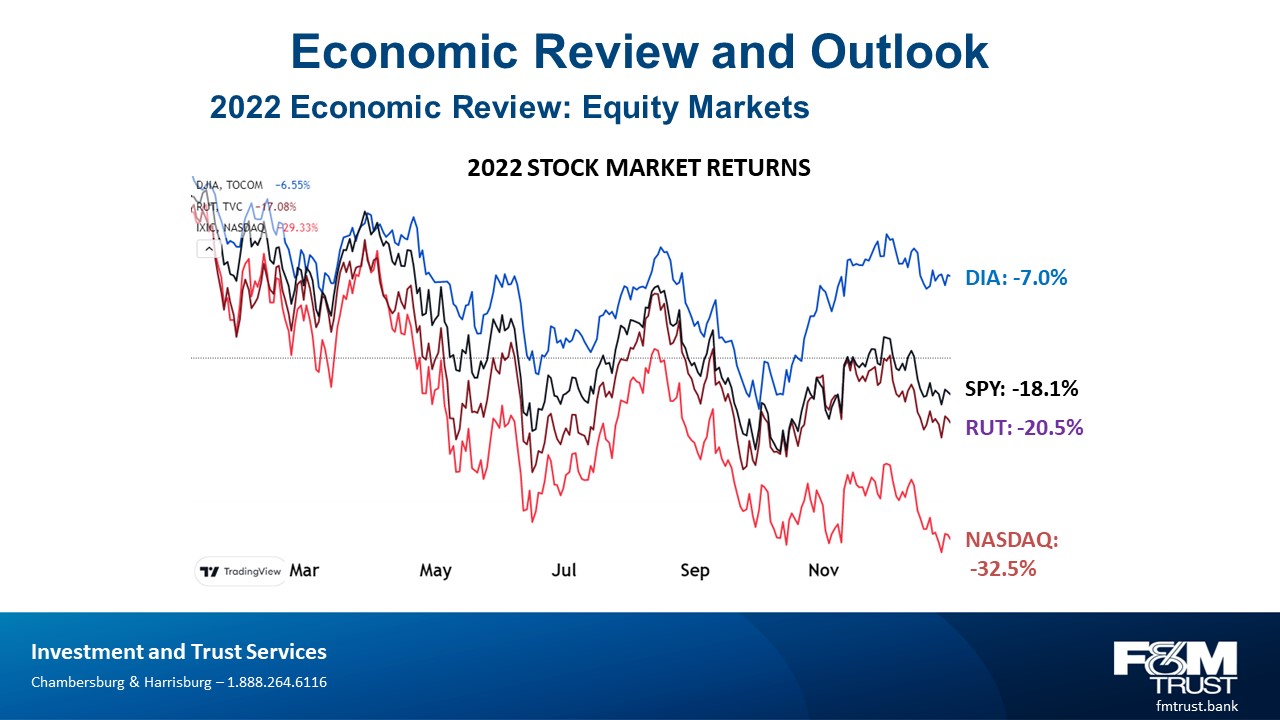

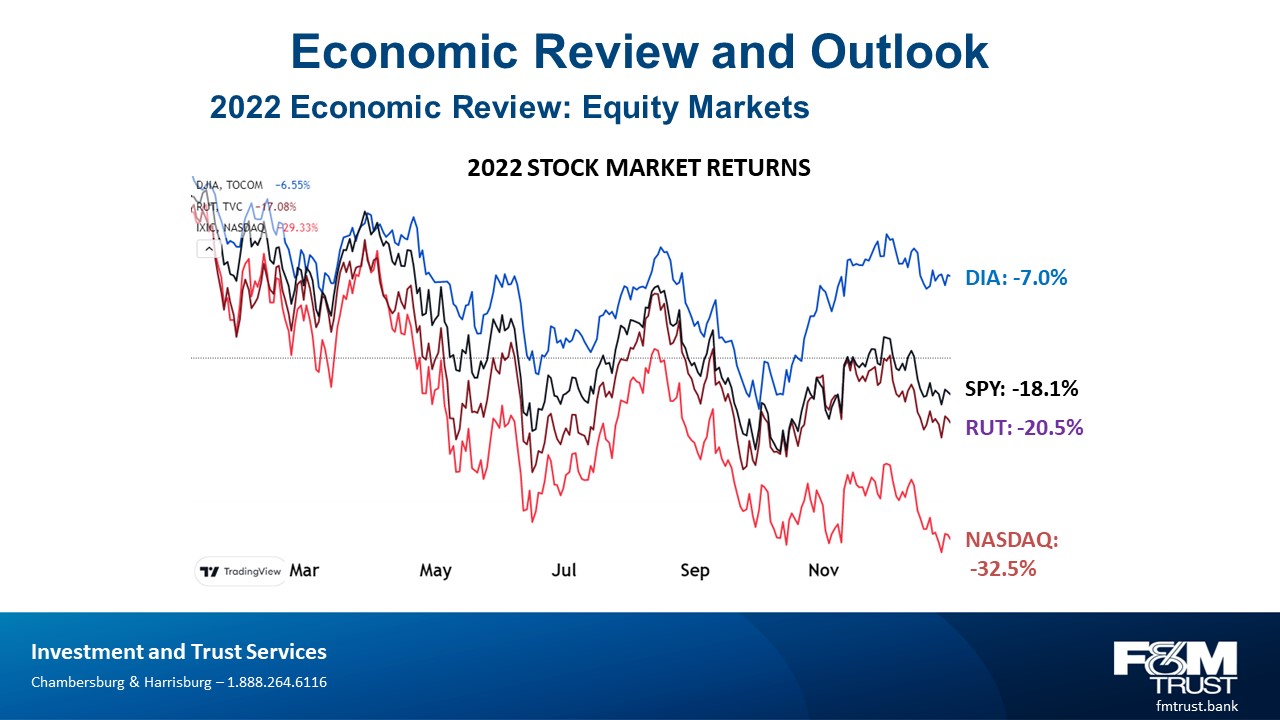

Economic Review and Outlook 2022 Economic Review: Equity Markets 2022 STOCK MARKET RETURNS DIA: -7.0% SPY: -18.1% RUT: -20.5% NASDAQ: -32.5% F&M TRUST Franklin Financial Services Corporation

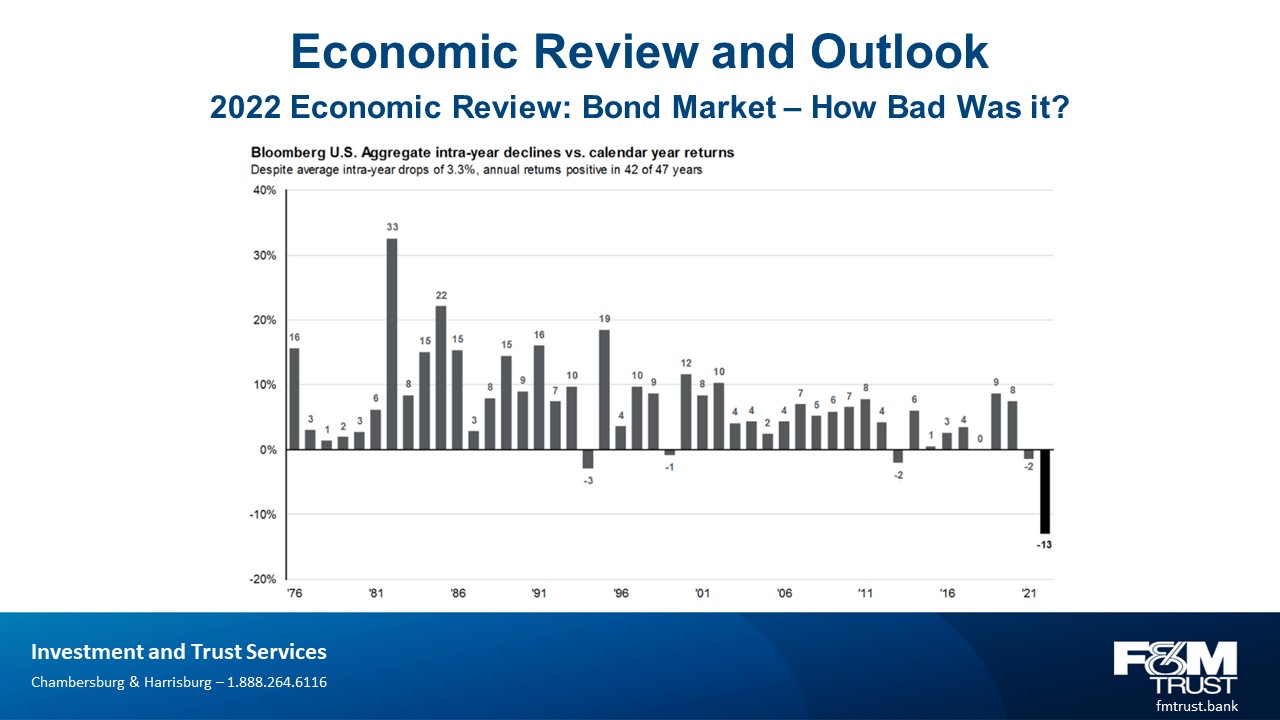

Economic Review and Outlook 2022 Economic Review: Bond Markets – Worst Year Ever? F&M TRUST Franklin Financial Services Corporation

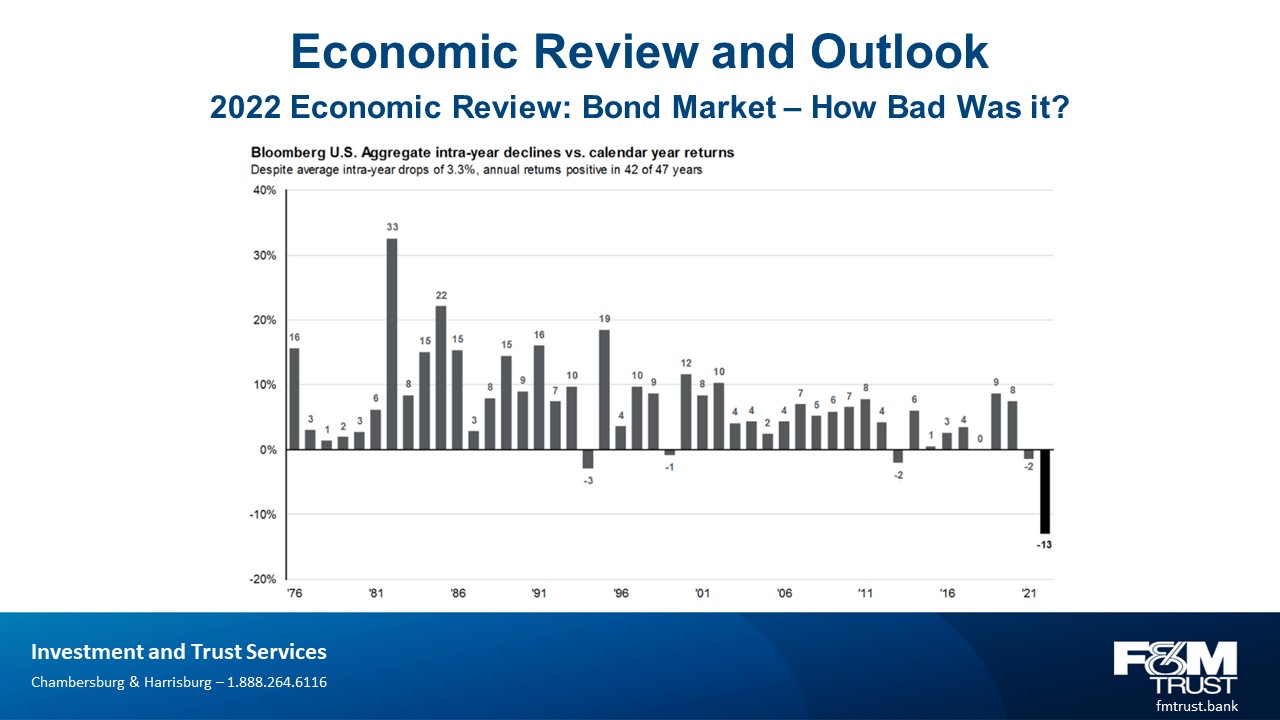

Economic Review and Outlook 2022 Economic Review: Bond Market – How Bad Was it? Bloomberg U.S. Aggregate intra-year declines vs. calendar year returns Despite average intra-year drops of 3.3%. annual returns positive in 42 of 47 years 16 3 1 2 3 6 33 8 15 22 15 3 8 15 9 16 7 10 -3 19 4 10 9 -1 12 8 10 4 4 2 4 7 5 6 7 8 4 -2 6 1 3 4 0 9 8 -2 -13 F&M TRUST Franklin Financial Services Corporation

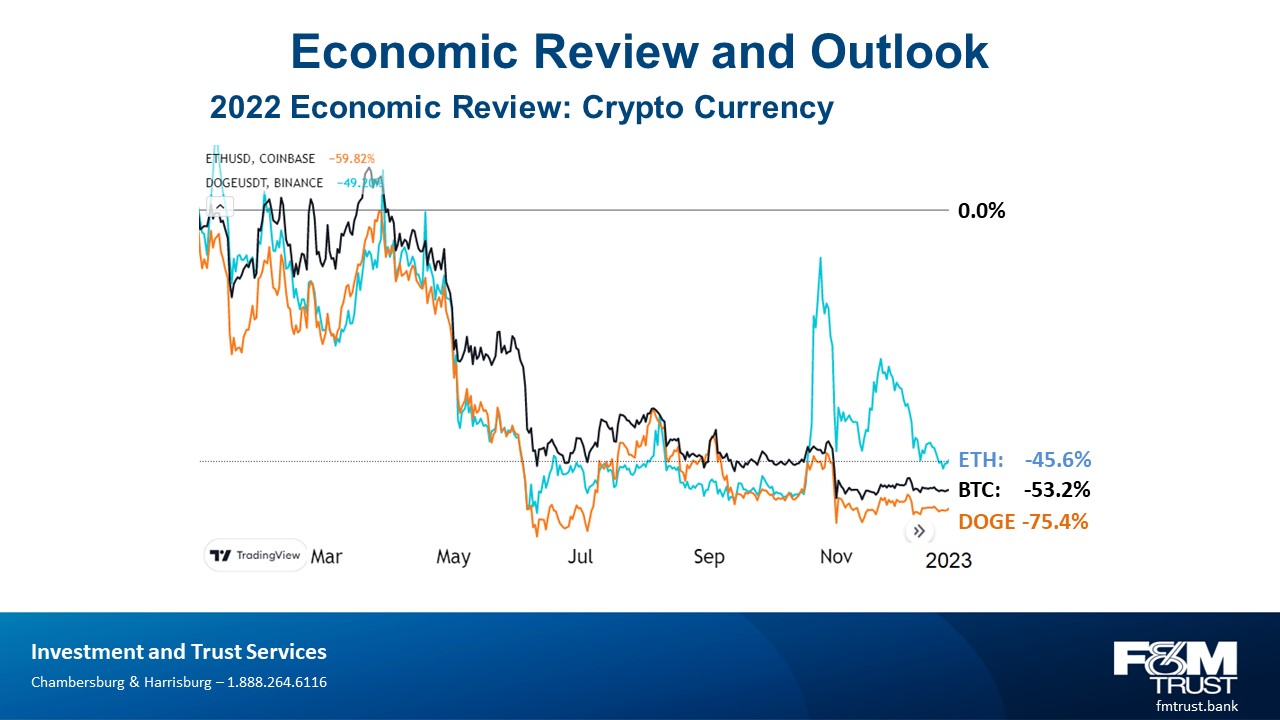

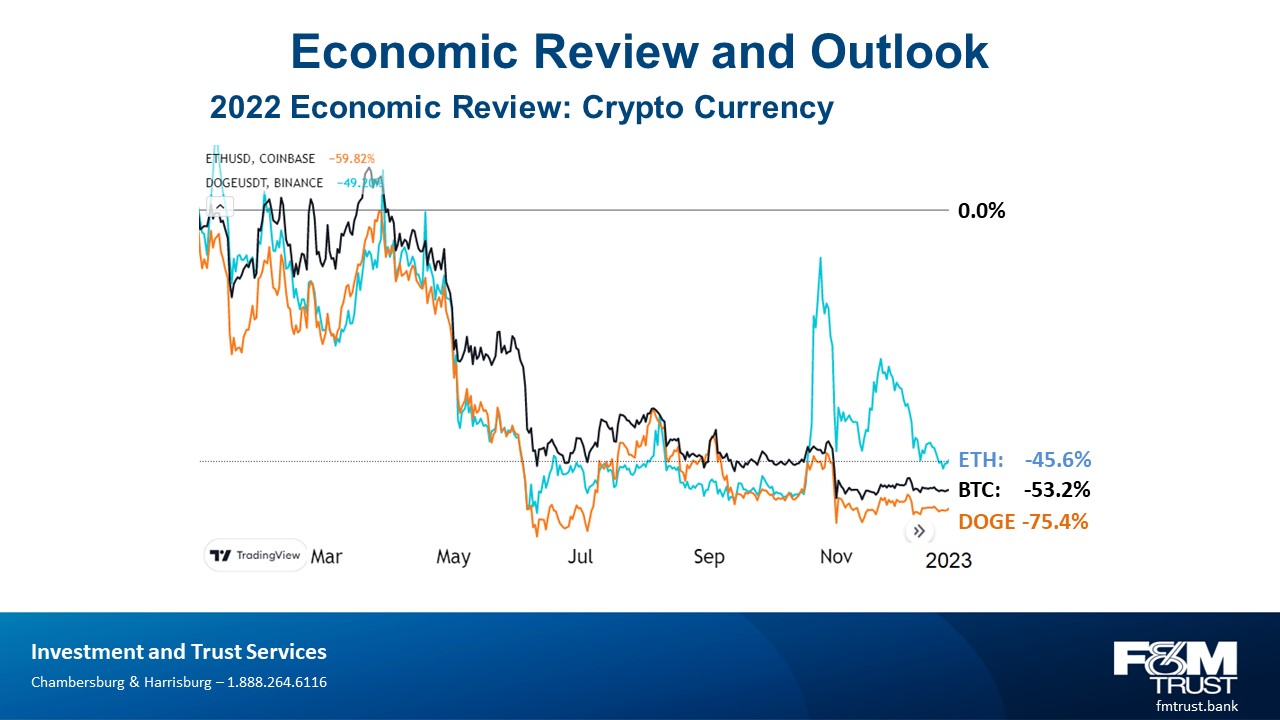

Economic Review and Outlook 2022 Economic Review: Crypto Currency 0.0% ETH: -45.6% BTC: -53.2% DOGE -75.4% F&M TRUST Franklin Financial Services Corporation

Economic Review and Outlook 2022 Review: Vacation – ”Let’s go to Yellowstone” - Day 1 F&M TRUST Franklin Financial Services Corporation

Economic Review and Outlook 2022 Review: Vacation – ”Let’s go to Yellowstone” - Day 3 WEATHER Yellowstone-area floods strand visitors and residents, prompt evacuations June 14, 2022 4:14 PM ET F&M TRUST Franklin Financial Services Corporation

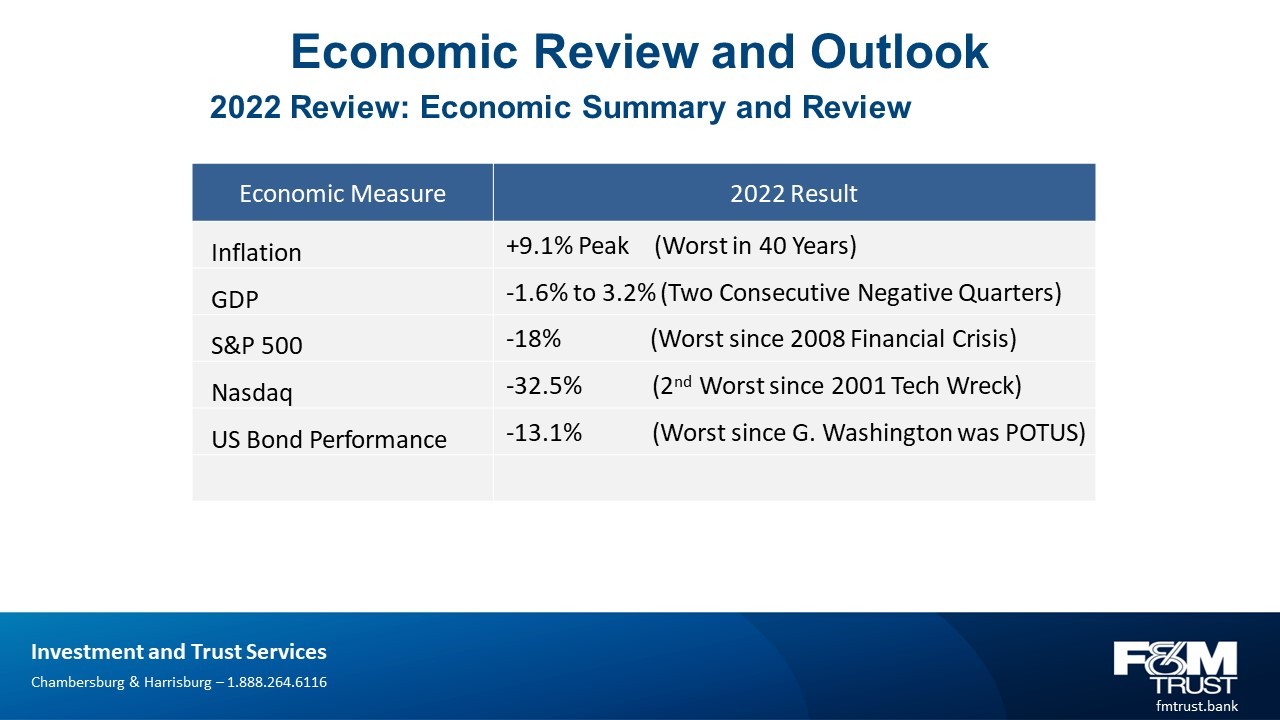

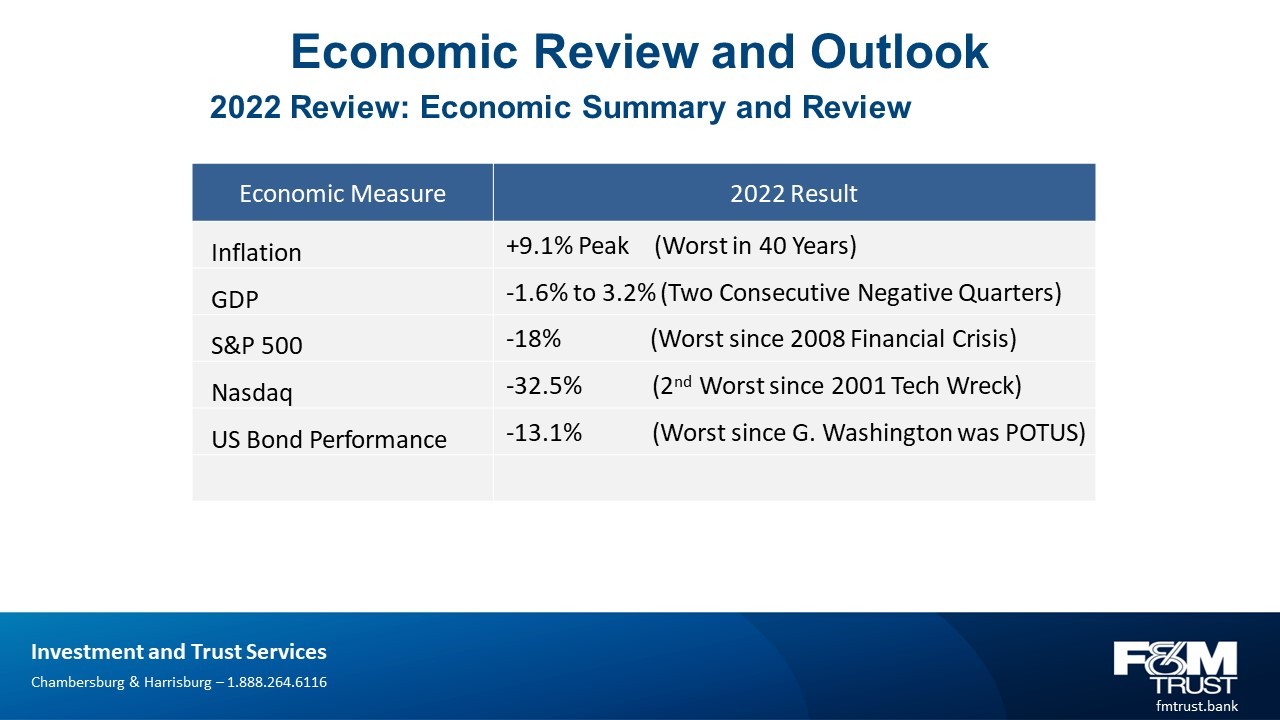

Economic Review and Outlook 2022 Review: Economic Summary and Review Economic Measure 2022 Result Inflation +9.1% Peak (Worst in 40 Years) GDP -1.6% to 3.2% (Two Consecutive Negative Quarters) S&P 500 -18% (Worst since 2008 Financial Crisis) Nasdaq -32.5% (2nd Worst since 2001 Tech Wreck) US Bond Performance -13.1% (Worst since G. Washington was POTUS) F&M TRUST Franklin Financial Services Corporation

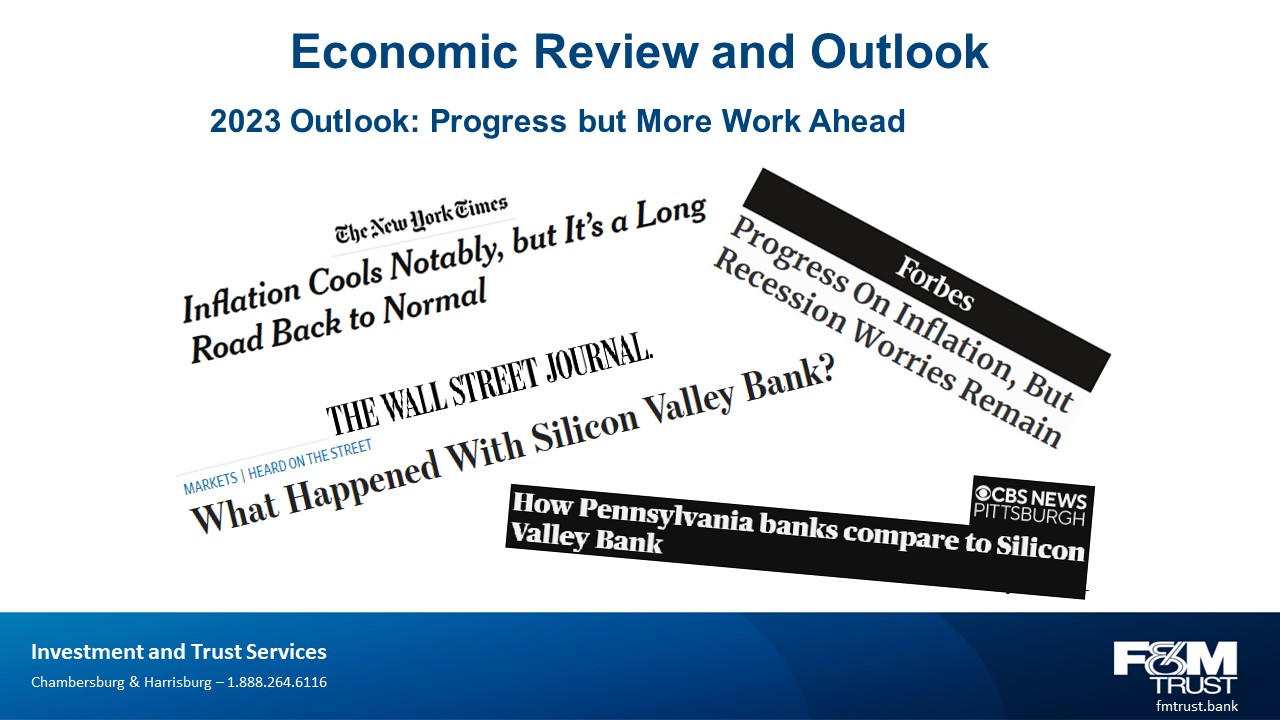

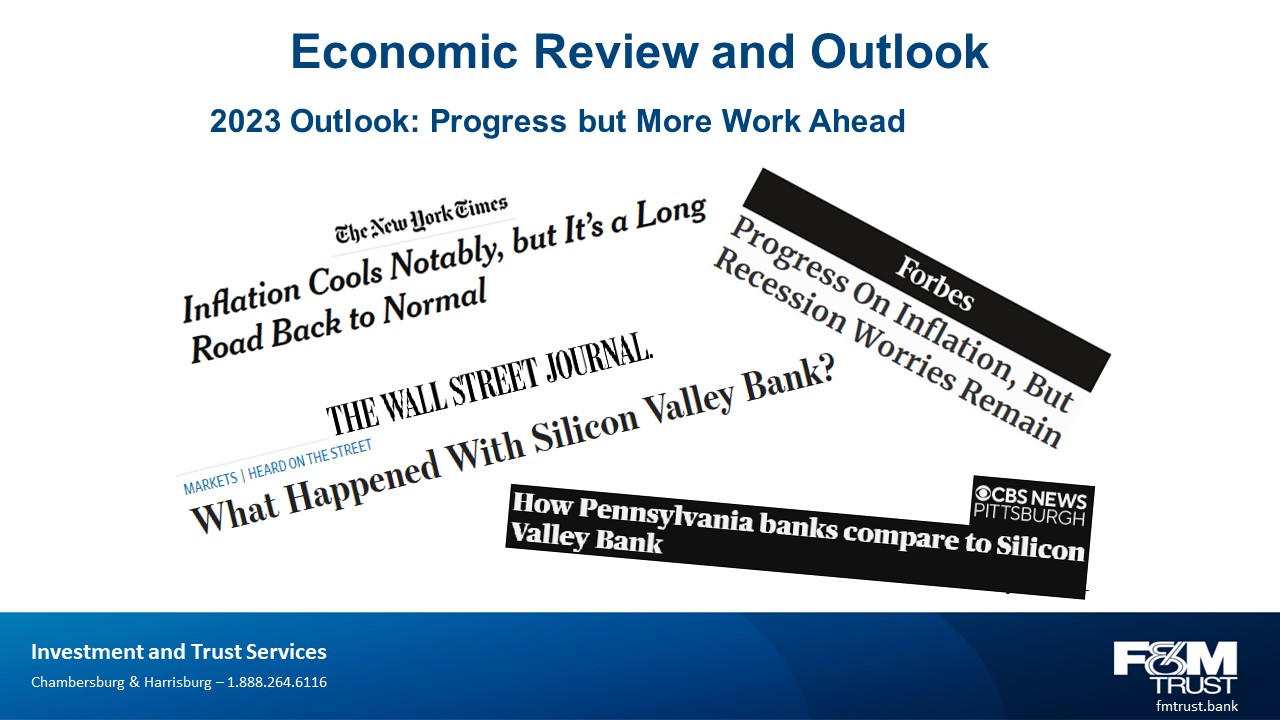

Economic Review and Outlook 2023 Outlook: Progress but More Work Ahead F&M TRUST Franklin Financial Services Corporation

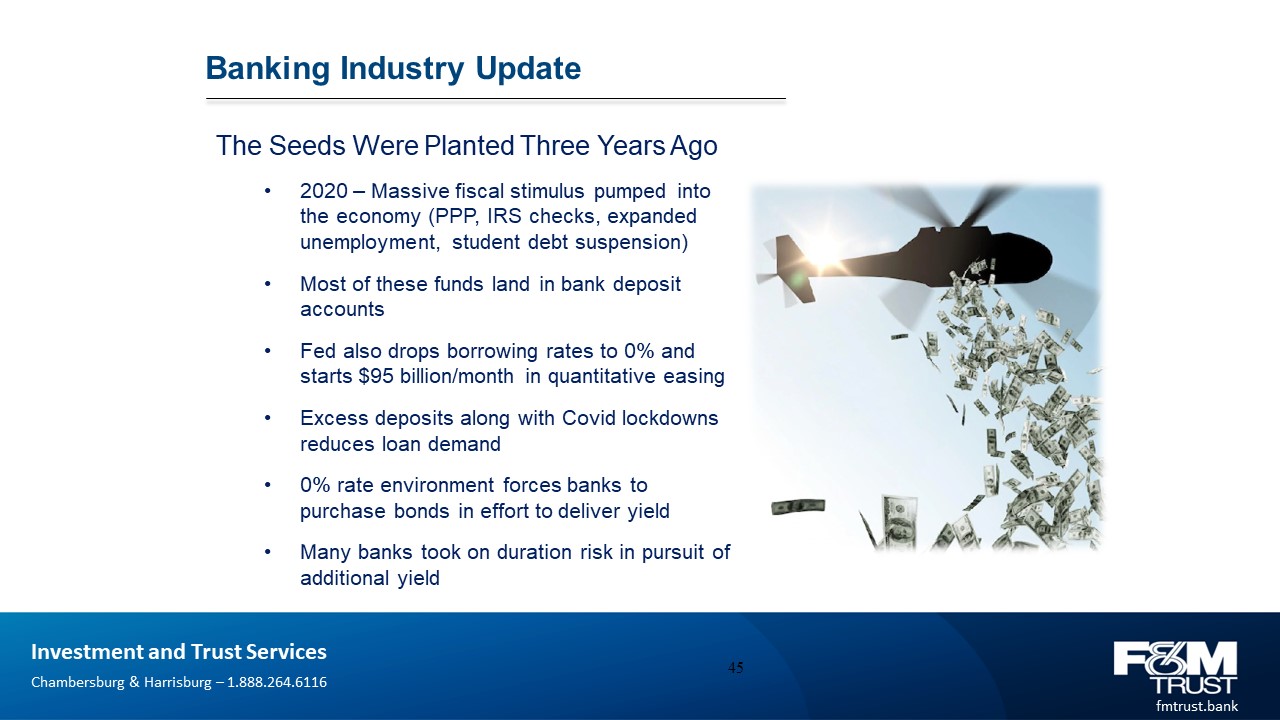

Banking Industry Update The Seeds Were Planted Three Years Ago 2020 – Massive fiscal stimulus pumped into the economy (PPP, IRS checks, expanded unemployment, student debt suspension) Most of these funds land in bank deposit accounts Fed also drops borrowing rates to 0% and starts $95 billion/month in quantitative easing Excess deposits along with Covid lockdowns reduces loan demand 0% rate environment forces banks to purchase bonds in effort to deliver yield Many banks took on duration risk in pursuit of additional yield F&M TRUST Franklin Financial Services Corporation

Banking Industry Update How We Got Here: 2022 – Aggressive Fed Policy Stresses the Economy $7 trillion in new liquidity delivered into a supply constrained economy delivers predictable inflation Fed calls it “transitory” – their reaction is too late and too timid (25bp first hike) Behind the curve, Fed raises 475bp in less than a year 475bp rate hike + long duration bonds = significant capital erosion All banks suffer some level of capital erosion Bank risk depends upon deposit stability, available liquidity and capital position THE RATE HIKES WILL CONTINUE UNTIL SOMETHING BREAKS F&M TRUST Franklin Financial Services Corporation

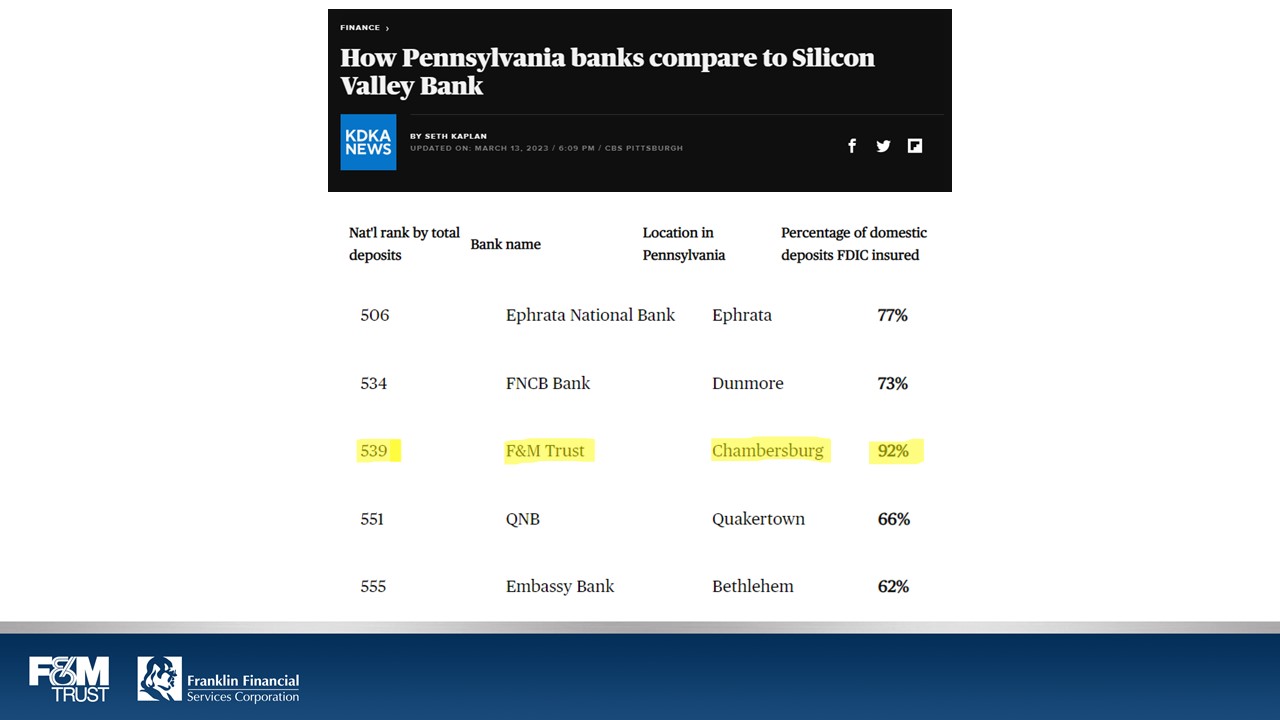

Banking Industry Update How We Got Here: Silicon Valley Bank (SVB) – Built to Fail 94% of SVB deposits were uninsured by FDIC insurance Attempted to raise $2.25 billion in preferred and common equity capital but failed. Lack of capital spooked uninsured depositors, triggering mass withdraws Only 2.1% of SVB’s $26 billion in “available for sale” assets were hedged in March 2023. SVB had hedges on “available for sale” assets but unwound $11 billion in swaps to book a 2022 gain F&M TRUST Franklin Financial Services Corporation

Banking Industry Update F&M Trust in the Media 1X News Talk 103.7 FM March 13 at 1:17 PM 0 • •• So how did we get to the point that one of the biggest banks in the United States collapses seemingly out of nowhere? Well it wasn't out of nowhere says F&M Trust Chief Investment Officer Warren Hurt. A full breakdown of how the Fed and FDIC move forward on demand below. biznews Local banks reassure in wake of big- bank failures Following the high-profile implosion of two large banks over the weekend, community bankers have spent the last couple of days reassuring customers that their deposits are safe . A key talking point is the difference between a typical Mam Street bank and the two banks that failed Silicon Valley Bank m California and Signature Bank in New Yode • *ln our communications, we emphasized the uniqueness of this situation and reinforced that FAM Trust is a conservatively managed community bank with a strong liquidity position,- said Matt Weaver, chief marketing officer for Chambersburg-based FAM Trust • Customers seem to understand the difference, added Mike Price, president and CEO of First Commonwealth Financial the western Pennsylvania bank that recently bought Harrisburg-based Centric Financial— 1 have been out with customers an day. been in branches all day. and there’s just very kttle. if any. concern.* Price said In a phone interview yesterday ISCBS NEWS How Pennsylvania banks compare to Silicon Valley Bank Bank name Location in Percentage of domestic Pennsylvania deposits FDIC insured F&M Trust Chambersburg 92% F&M TRUST Franklin Financial Services Corporation

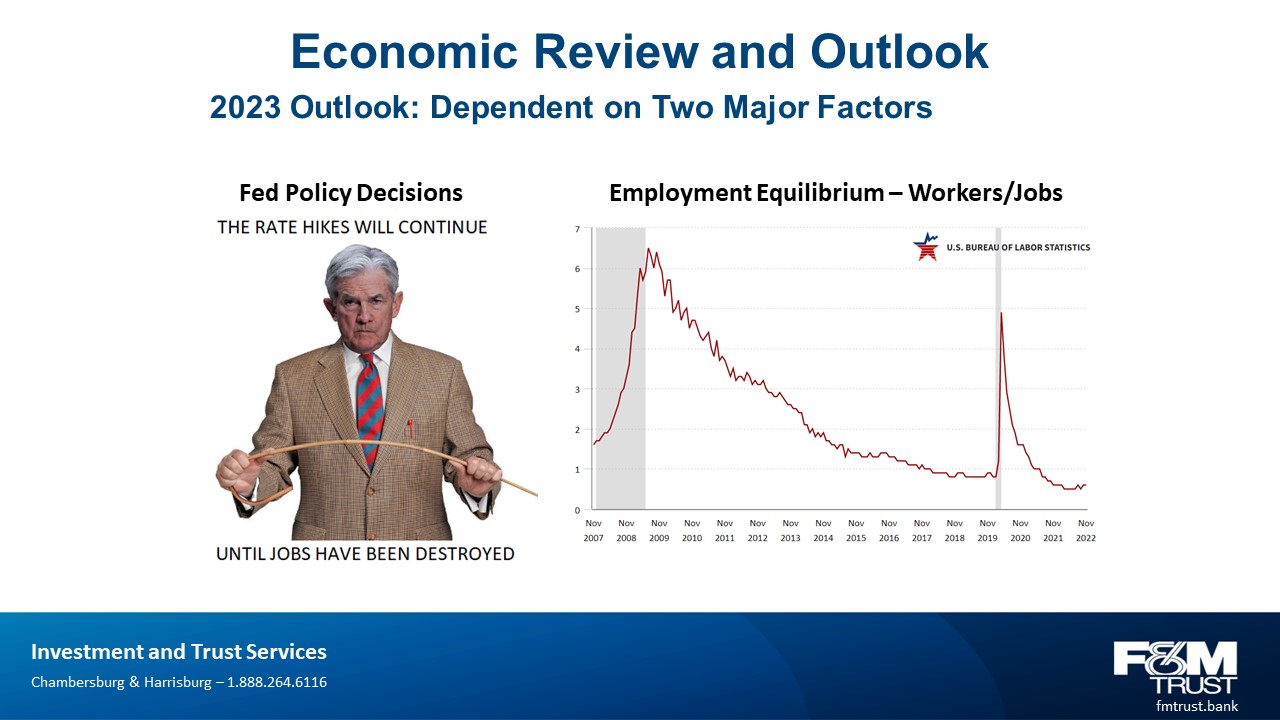

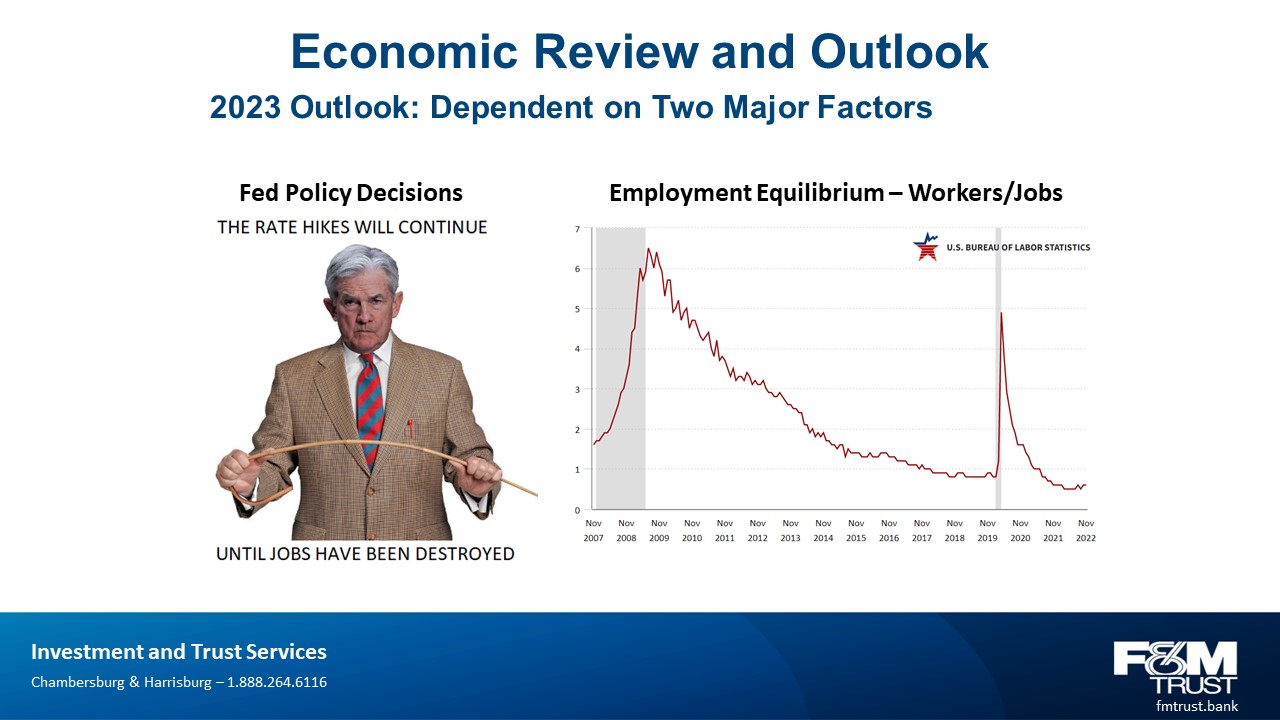

Economic Review and Outlook 2023 Outlook: Dependent on Two Major Factors Fed Policy Decisions THE RATE HIKES WILL CONTINUE UNTIL JOBS HAVE BEEN DESTORYED Employment Equilibrium – Workers/Jobs U.S. BUREAU OF LABOR STATISTICS F&M TRUST Franklin Financial Services Corporation

Economic Review and Outlook 2023 Economic Outlook: Fed Policy CHANGE IN US TREASURY YIELD CURVE F&M TRUST Franklin Financial Services Corporation

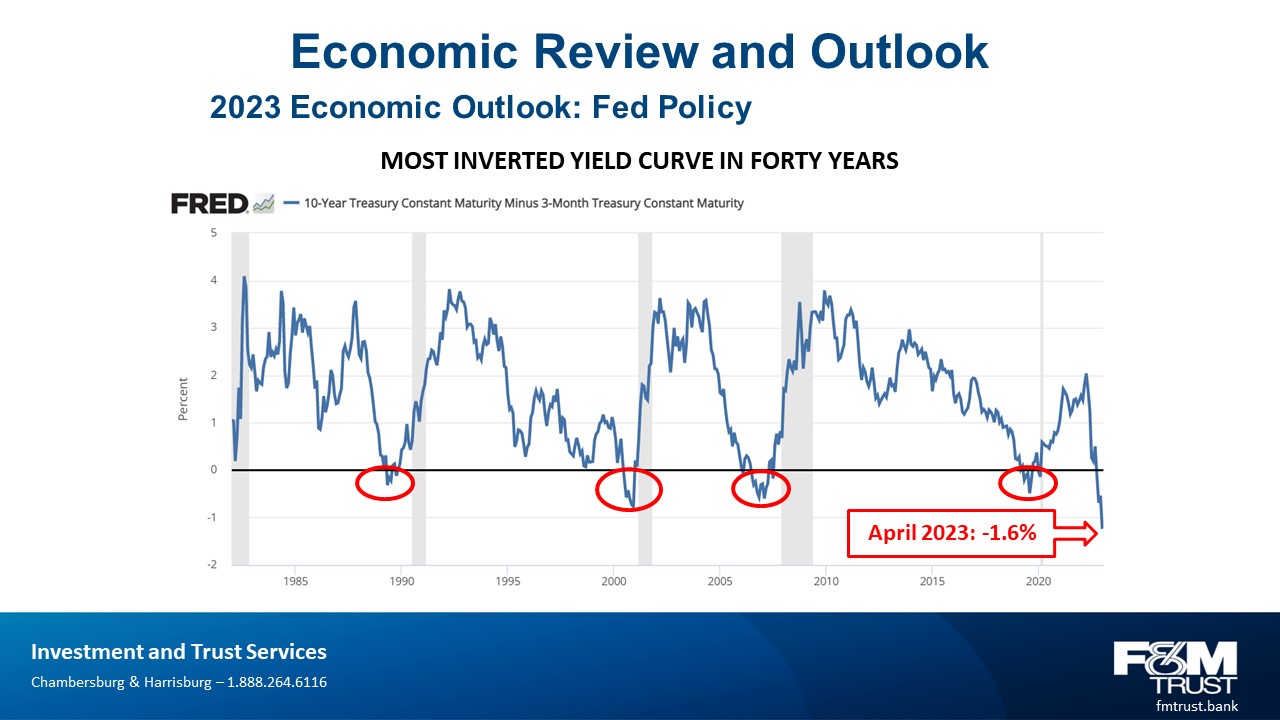

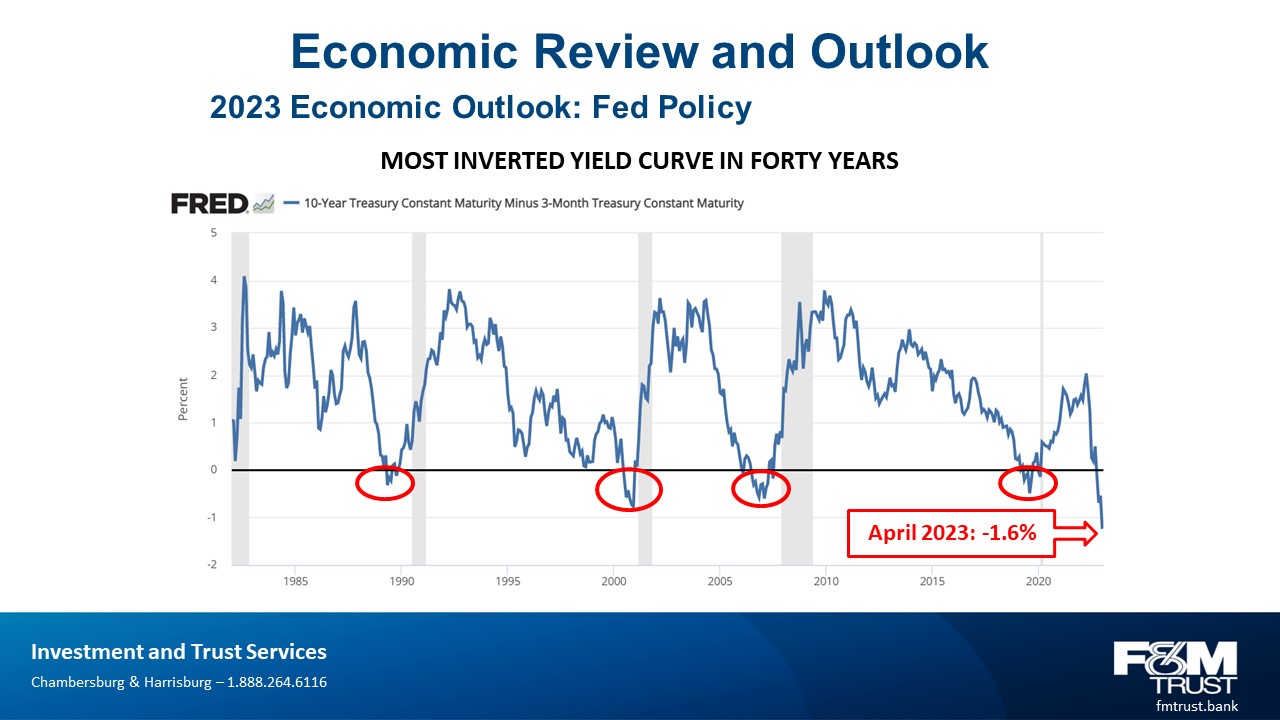

Economic Review and Outlook 2023 Economic Outlook: Fed Policy MOST INVERTED YIELD CURVE IN FORTY YEARS FRED^ — 10-Year Treasury Constant Maturity Minus 3-Month Treasury Constant Maturity April 2023: -1.6% F&M TRUST Franklin Financial Services Corporation

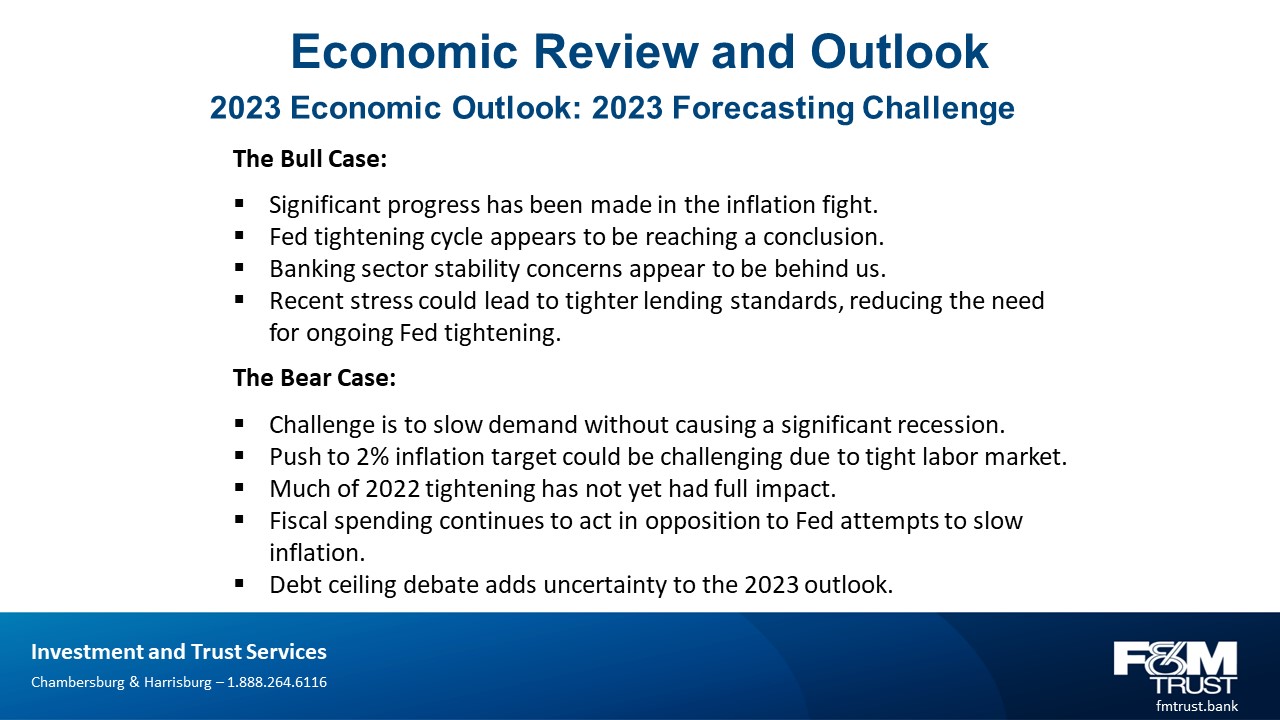

Economic Review and Outlook 2023 Economic Outlook: 2023 Forecasting Challenge The Bull Case: Significant progress has been made in the inflation fight. Fed tightening cycle appears to be reaching a conclusion. Banking sector stability concerns appear to be behind us. Recent stress could lead to tighter lending standards, reducing the need for ongoing Fed tightening. The Bear Case: Challenge is to slow demand without causing a significant recession. Push to 2% inflation target could be challenging due to tight labor market. Much of 2022 tightening has not yet had full impact. Fiscal spending continues to act in opposition to Fed attempts to slow inflation. Debt ceiling debate adds uncertainty to the 2023 outlook. F&M TRUST Franklin Financial Services Corporation

Financial Overview Mark R. Hollar, Chief Financial Officer F&M TRUST Franklin Financial Services Corporation

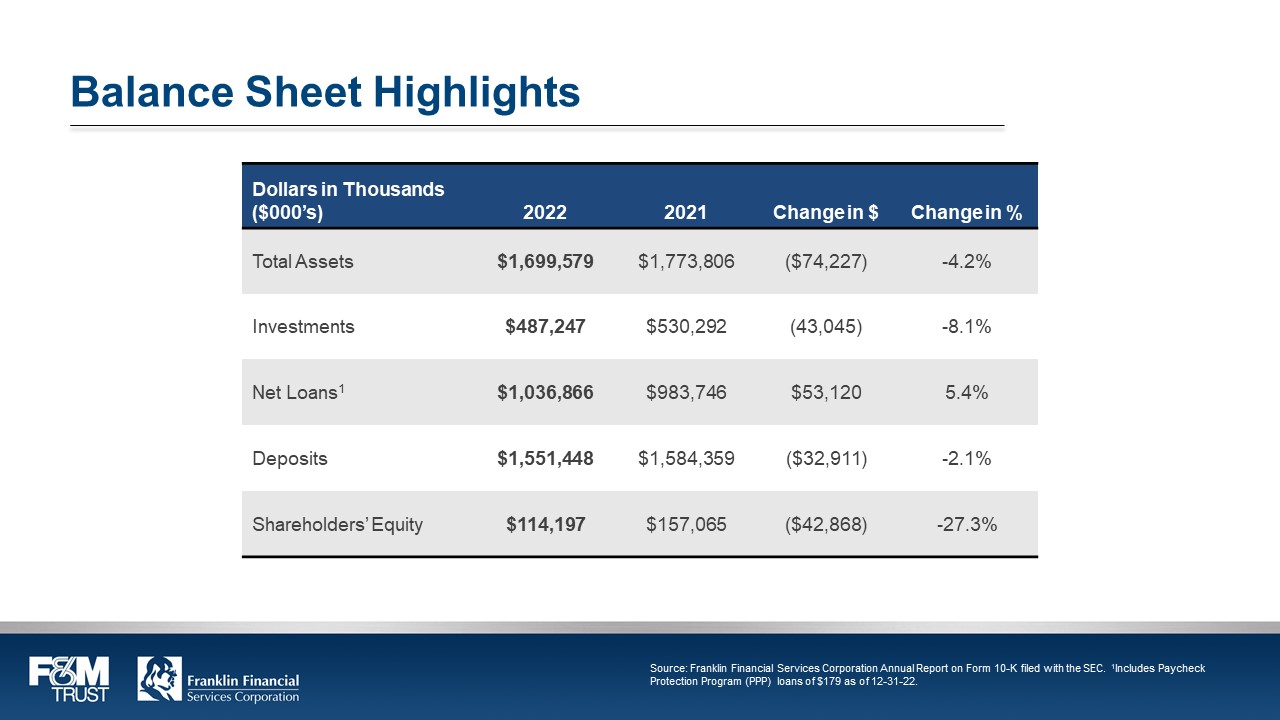

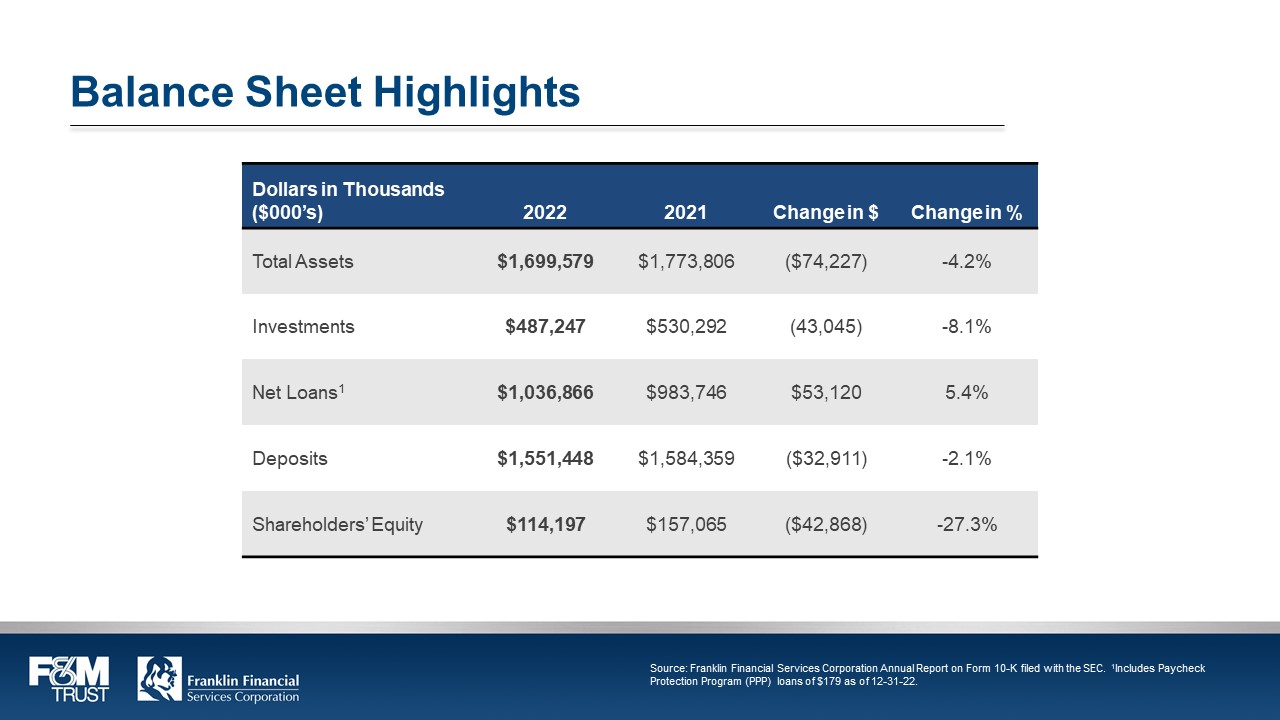

Balance Sheet Highlights Dollars in Thousands ($000’s) 2022 2021 Change in $ Change in % Total Assets $1,699,579 $1,773,806 ($74,227) -4.2% Investments $487,247 $530,292 (43,045) -8.1% Net Loans1 $1,036,866 $983,746 $53,120 5.4% Deposits $1,551,448 $1,584,359 ($32,911) -2.1% Shareholders’ Equity $114,197 $157,065 ($42,868) -27.3% F&M TRUST Franklin Financial Services Corporation Source: Franklin Financial Services Corporation Annual Report on Form 10-K filed with the SEC. 1Includes Paycheck Protection Program (PPP) loans of $179 as of 12-31-22.

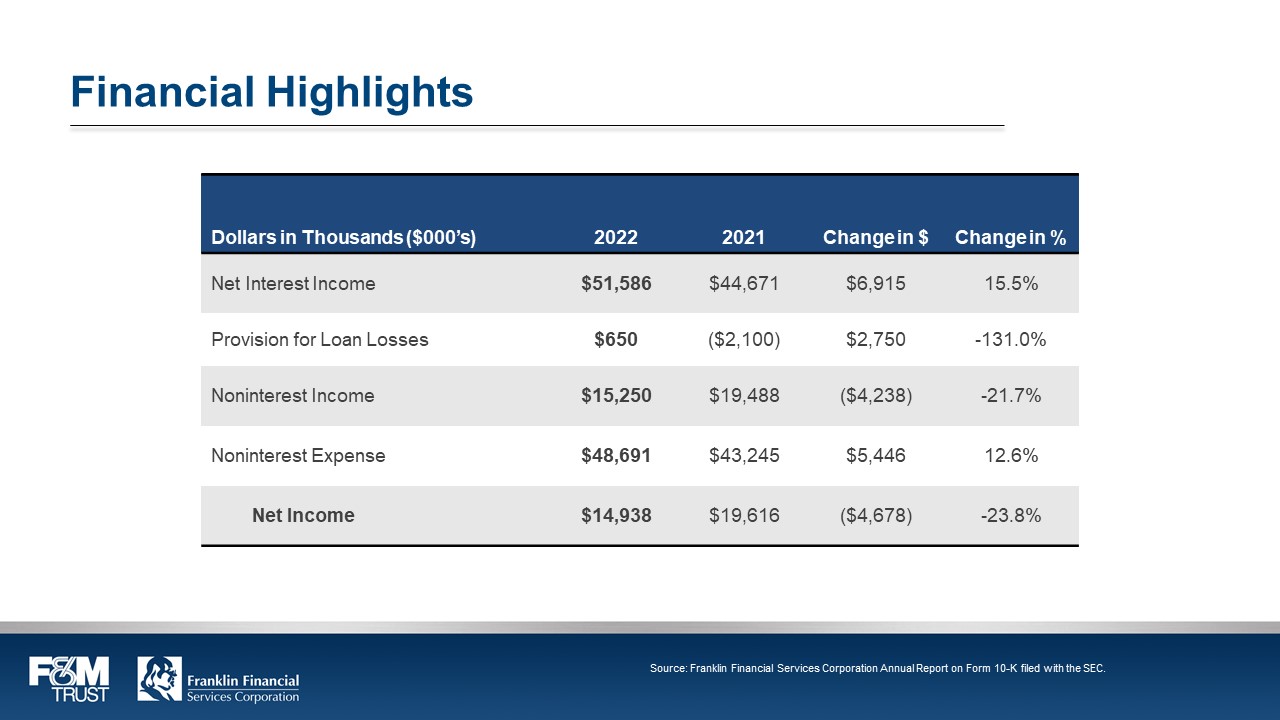

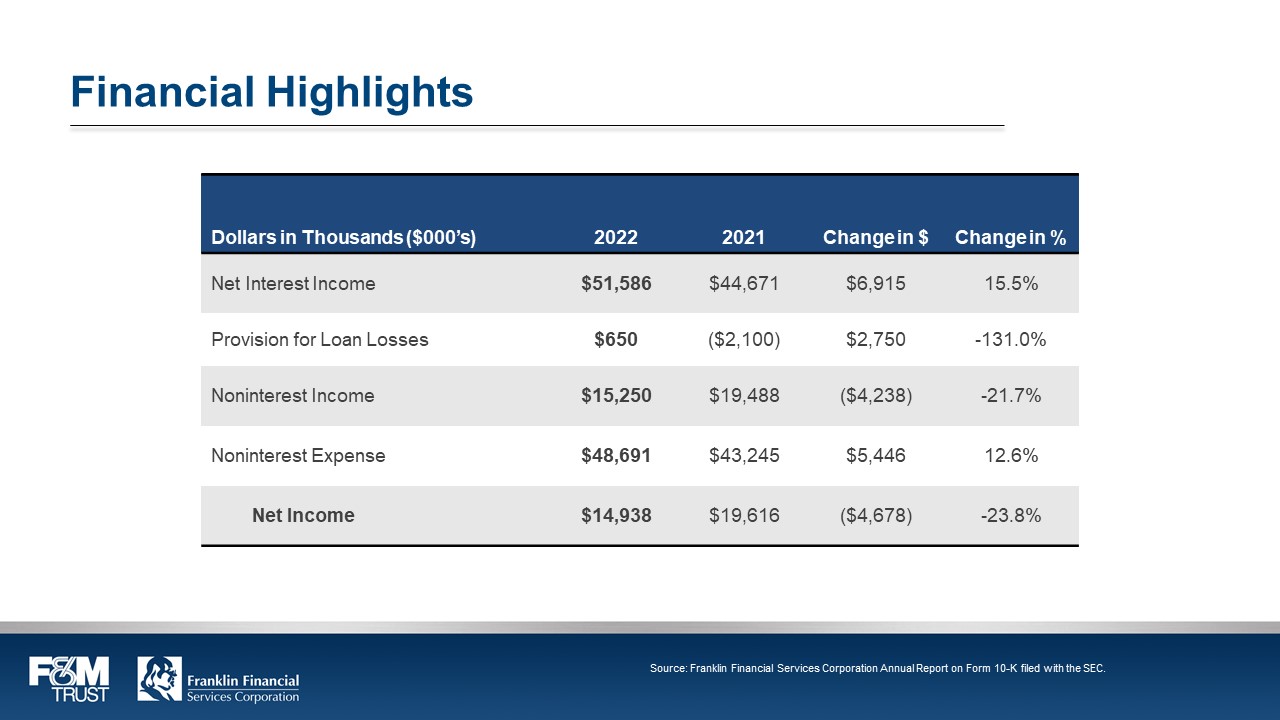

Financial Highlights Dollars in Thousands ($000’s) 2022 2021 Change in $ Change in % Net Interest Income $51,586 $44,671 $6,915 15.5% Provision for Loan Losses $650 ($2,100) $2,750 -131.0% Noninterest Income $15,250 $19,488 ($4,238) -21.7% Noninterest Expense $48,691 $43,245 $5,446 12.6% Net Income $14,938 $19,616 ($4,678) -23.8% F&M TRUST Franklin Financial Services Corporation Source: Franklin Financial Services Corporation Annual Report on Form 10-K filed with the SEC.

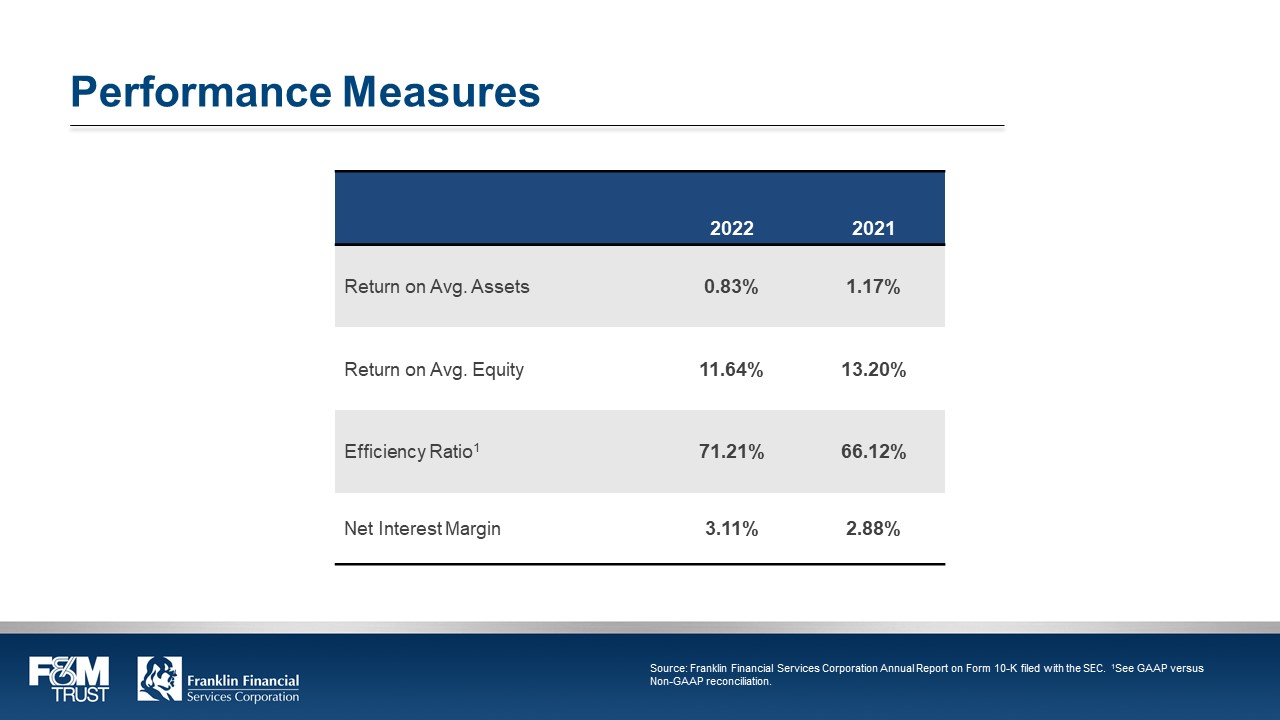

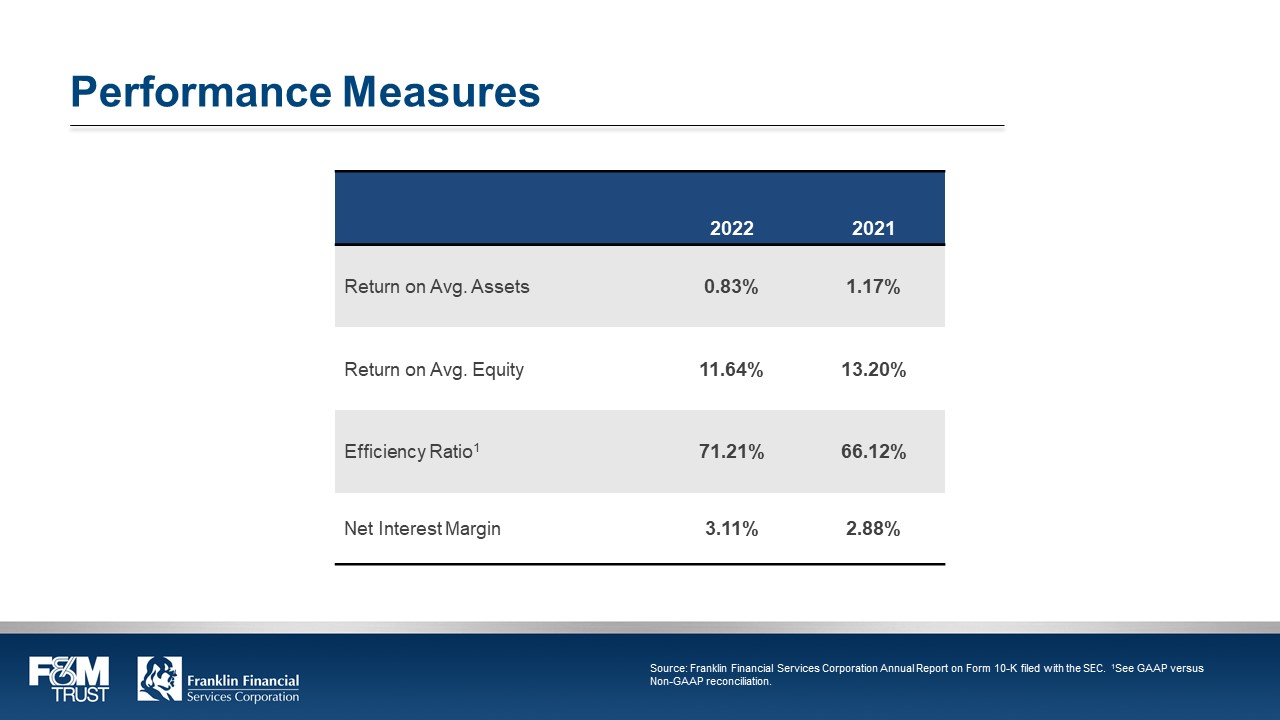

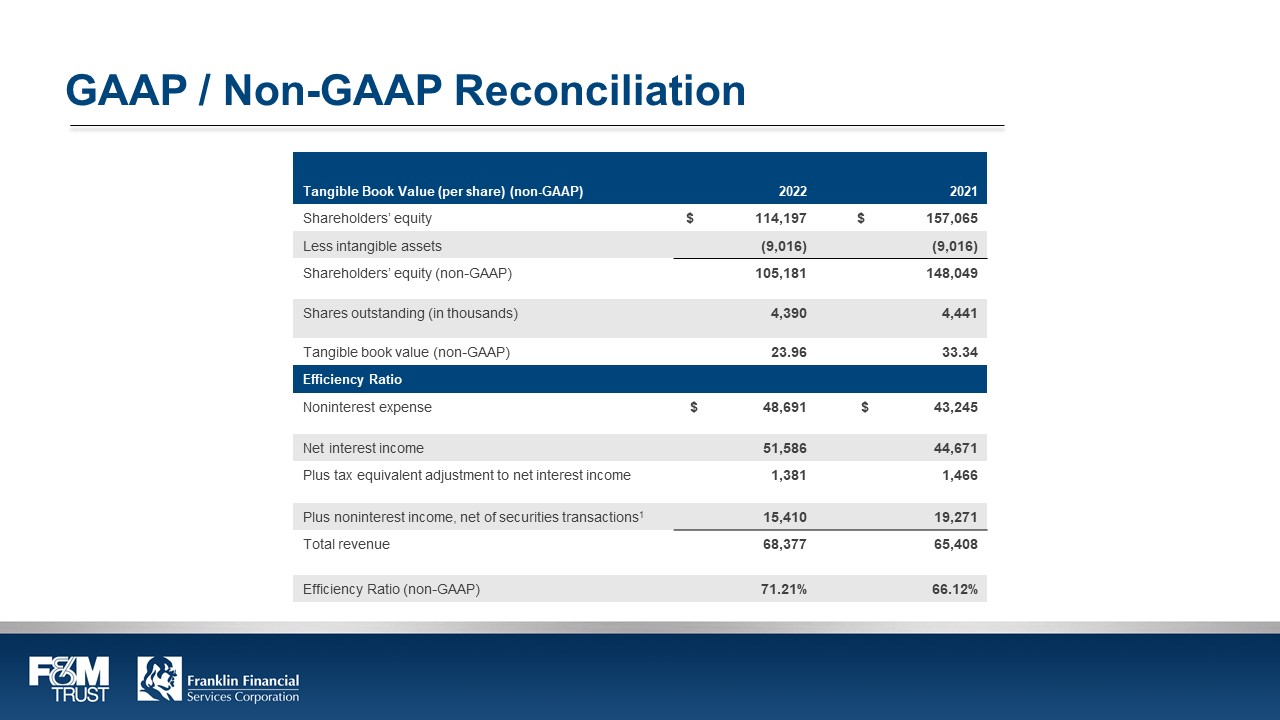

Performance Measures 2022 2021 Return on Avg. Assets 0.83% 1.17% Return on Avg. Equity 11.64% 13.20% Efficiency Ratio1 71.21% 66.12% Net Interest Margin 3.11% 2.88% F&M TRUST Franklin Financial Services Corporation Source: Franklin Financial Services Corporation Annual Report on Form 10-K filed with the SEC. 1See GAAP versus Non-GAAP reconciliation.

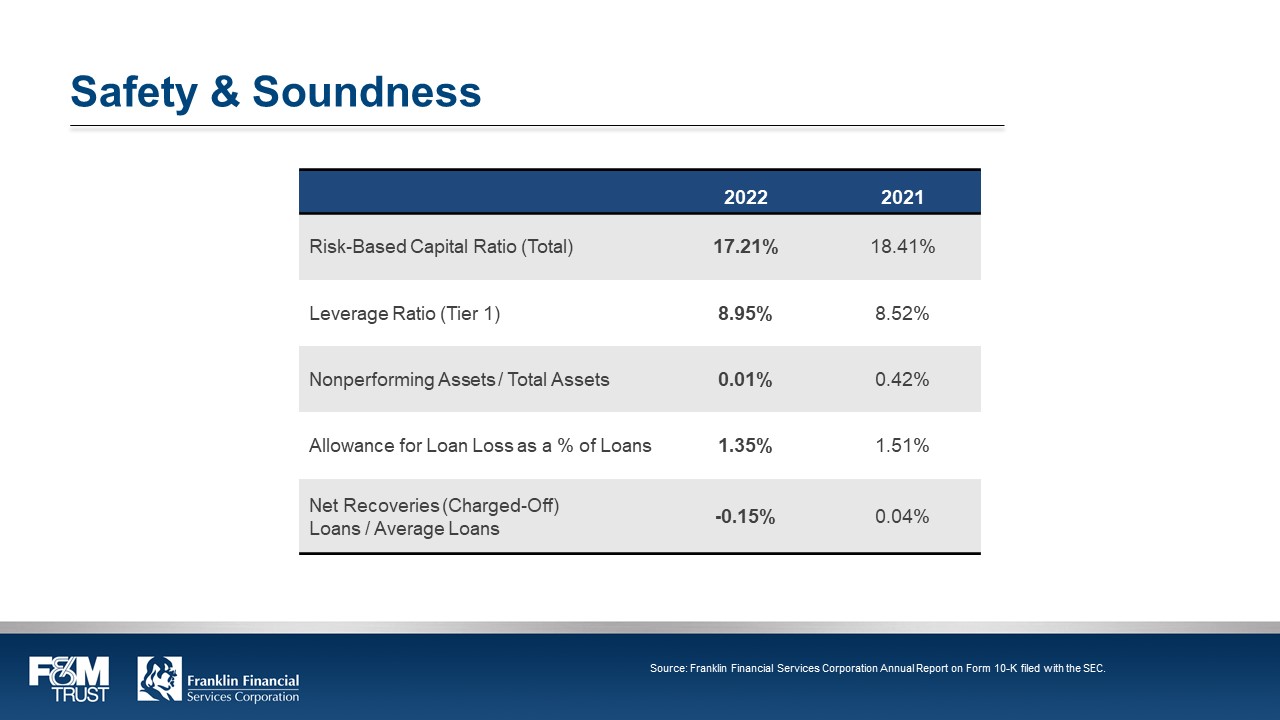

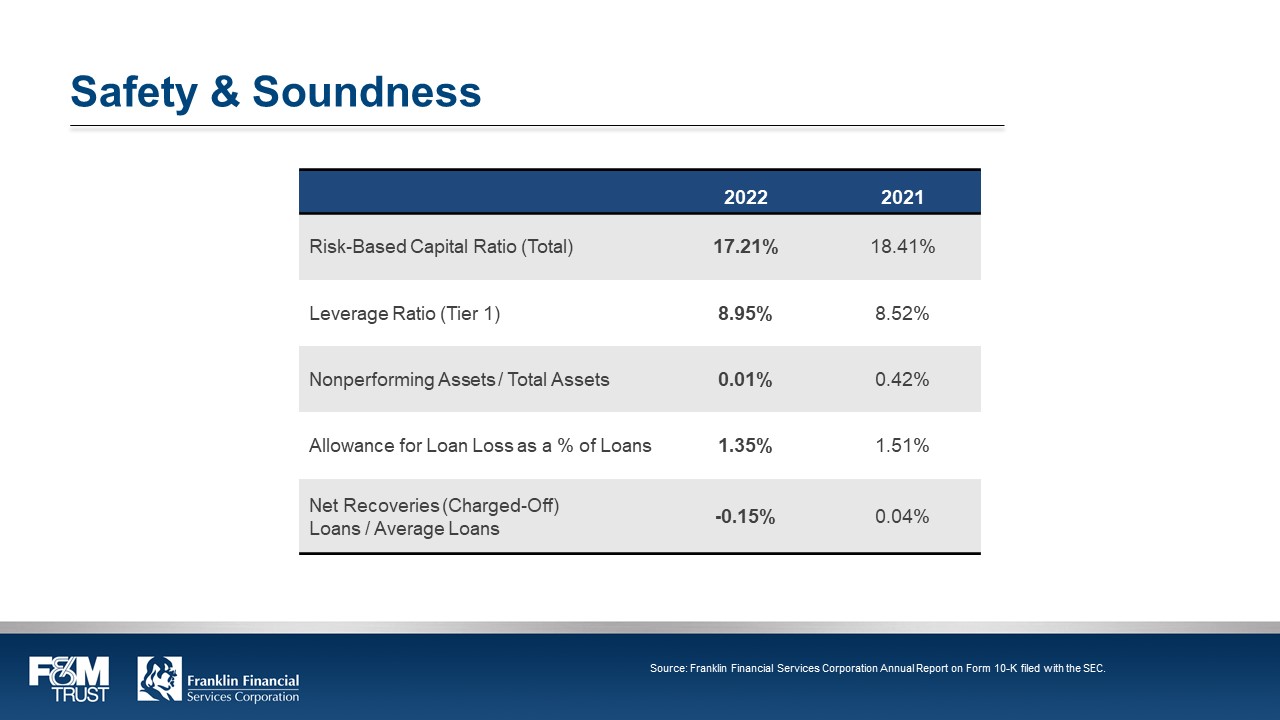

Safety & Soundness 2022 2021 Risk-Based Capital Ratio (Total) 17.21% 18.41% Leverage Ratio (Tier 1) 8.95% 8.52% Nonperforming Assets / Total Assets 0.01% 0.42% Allowance for Loan Loss as a % of Loans 1.35% 1.51% Net Recoveries (Charged-Off) Loans / Average Loans -0.15% 0.04% F&M TRUST Franklin Financial Services Corporation Source: Franklin Financial Services Corporation Annual Report on Form 10-K filed with the SEC.

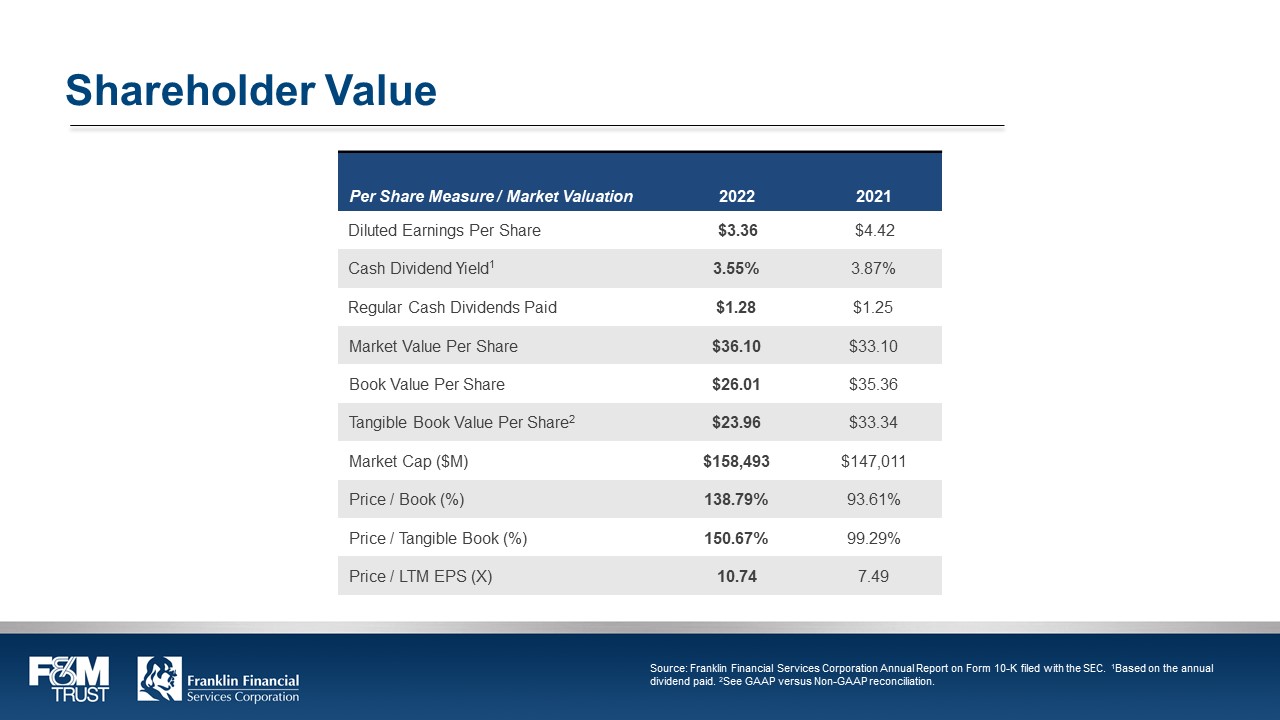

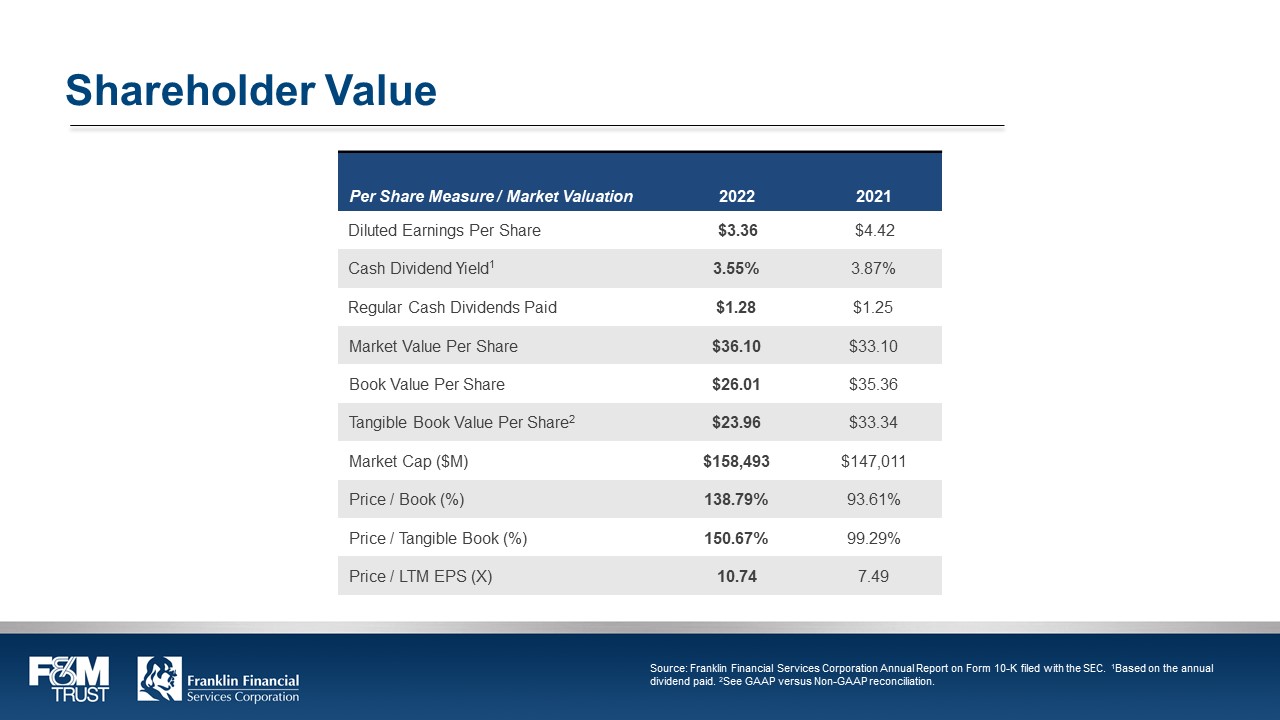

Shareholder Value Per Share Measure / Market Valuation 2022 2021 Diluted Earnings Per Share $3.36 $4.42 Cash Dividend Yield1 3.55% 3.87% Regular Cash Dividends Paid $1.28 $1.25 Market Value Per Share $36.10 $33.10 Book Value Per Share $26.01 $35.36 Tangible Book Value Per Share2 $23.96 $33.34 Market Cap ($M) $158,493 $147,011 Price / Book (%) 138.79% 93.61% Price / Tangible Book (%) 150.67% 99.29% Price / LTM EPS (X) 10.74 7.49 F&M TRUST Franklin Financial Services Corporation Source: Franklin Financial Services Corporation Annual Report on Form 10-K filed with the SEC. 1Based on the annual dividend paid. 2See GAAP versus Non-GAAP reconciliation.

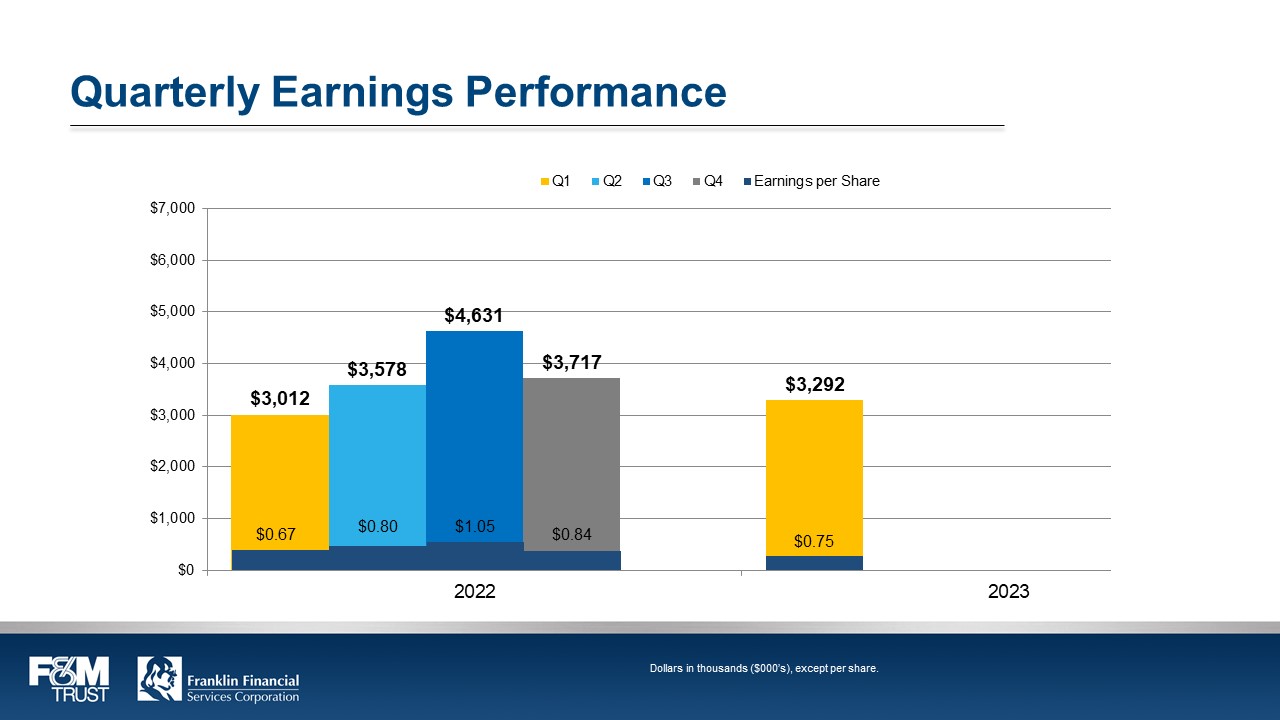

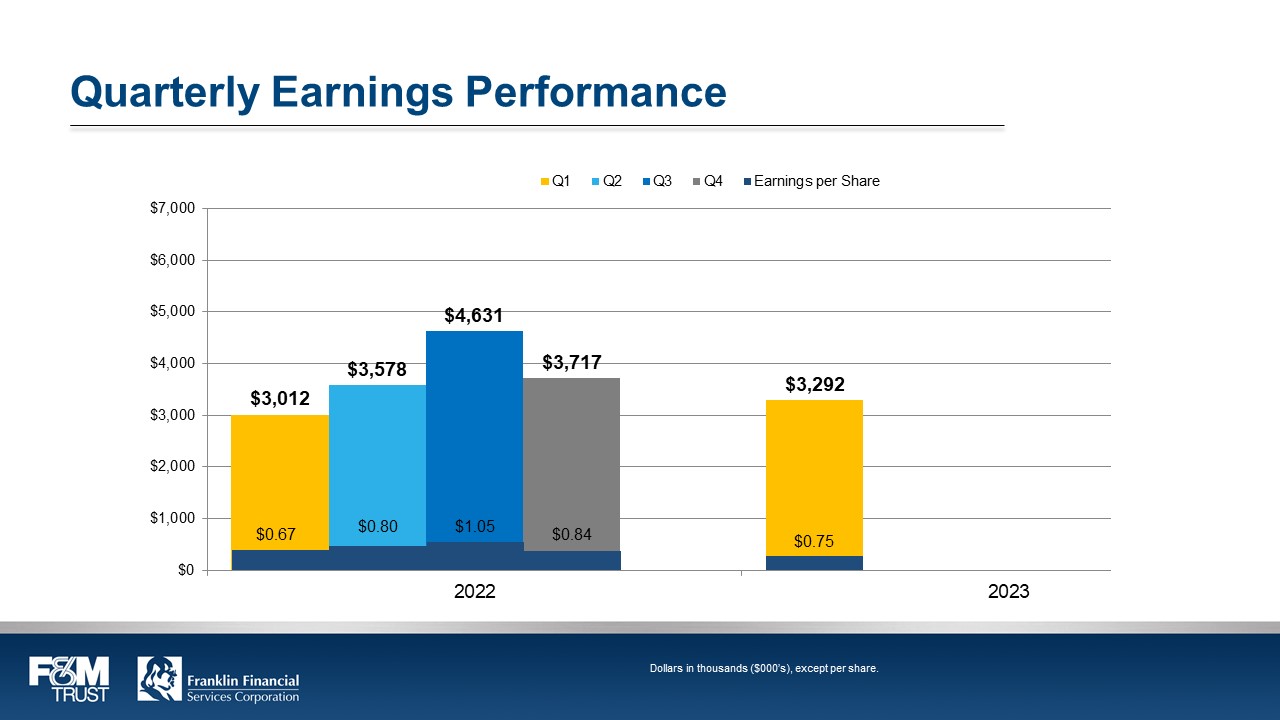

Quarterly Earnings Performance Q1 Q2 Q3 Q4 Earnings per Sahre $3,012 $3,578 $4,631 $3,717 $3,292 $0.67 $0.80 $1.05 $0.84 $0.75 2022 2023 F&M TRUST Franklin Financial Services Corporation Dollars in thousands ($000’s), except per share.

President & CEO Comments Timothy (Tim) G. Henry F&M TRUST Franklin Financial Services Corporation

Timothy (Tim) G. Henry President & CEO F&M TRUST Franklin Financial Services Corporation

Questions Timothy (Tim) G. Henry F&M TRUST Franklin Financial Services Corporation

Polls Closed G. Warren Elliott F&M TRUST Franklin Financial Services Corporation

Report by Judge of Election Zoe R. Clayton F&M TRUST Franklin Financial Services Corporation

Announcement G. Warren Elliott F&M TRUST Franklin Financial Services Corporation

Thank You G. Warren Elliott F&M TRUST Franklin Financial Services Corporation

Meeting Adjourned F&M TRUST Franklin Financial Services Corporation

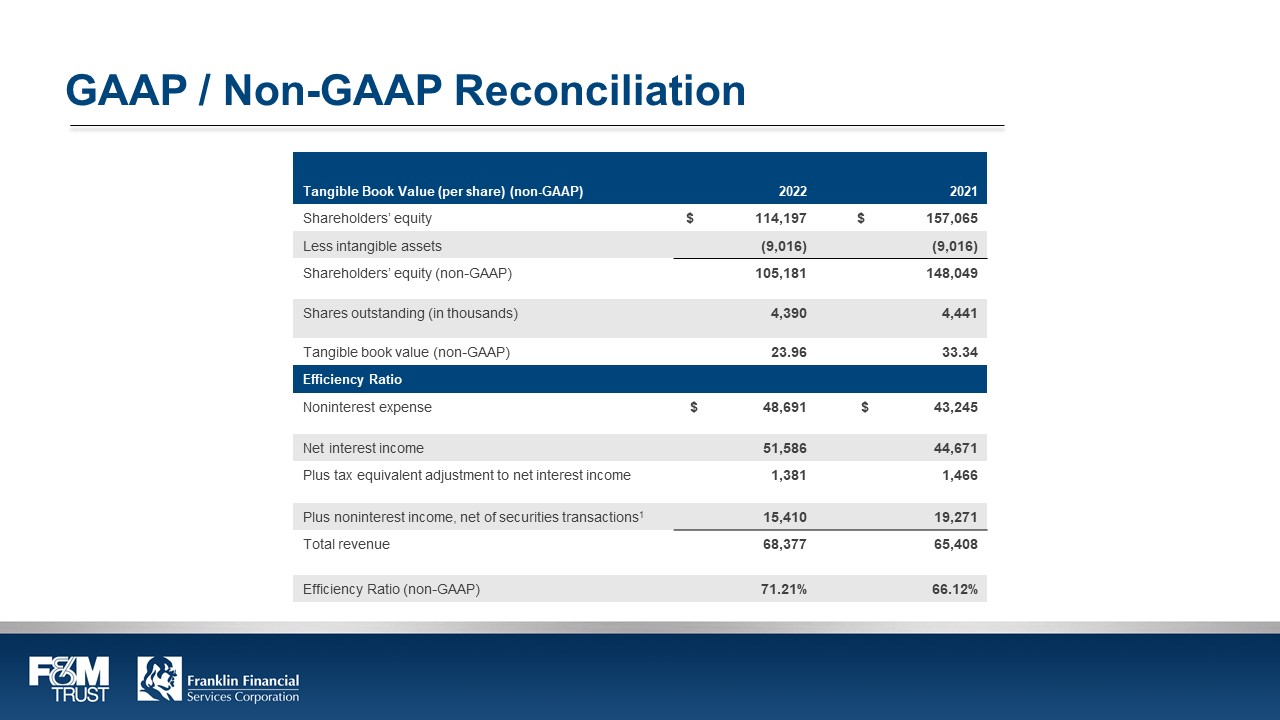

GAAP / Non-GAAP Reconciliation Tangible Book Value (per share) (non-GAAP) 2022 2021 Shareholders’ equity $ 114,197 $ 157,065 Less intangible assets (9,016) (9,016) Shareholders’ equity (non-GAAP) 105,181 148,049 Shares outstanding (in thousands) 4,390 4,441 Tangible book value (non-GAAP) 23.96 33.34 Efficiency Ratio Noninterest expense $ 48,691 $ 43,245 Net interest income 51,586 44,671 Plus tax equivalent adjustment to net interest income 1,381 1,466 Plus noninterest income, net of securities transactions1 15,410 19,271 Total revenue 68,377 65,408 Efficiency Ratio (non-GAAP) 71.21% 66.12% F&M TRUST Franklin Financial Services Corporation