UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

S & K Famous Brands, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | S & K Famous Brands, Inc. | | |

| | P.O. Box 31800 | | |

| | Richmond, Virginia 23294-1800 | | |

| | | | |

| | Notice of Annual Meeting of Shareholders | | |

| | to be held May 29, 2003 | | |

To the Shareholders of

S & K Famous Brands, Inc.:

Notice is hereby given that the Annual Meeting of Shareholders of S & K Famous Brands, Inc. (the “Company”) will be held at the Sheraton Richmond West Hotel located at 6624 West Broad Street, Richmond, Virginia, at 10:00 a.m., E.D.T., on Thursday, May 29, 2003, for the following purposes:

| | 1. | | To elect eight (8) directors to serve for the ensuing year. |

| | 2. | | To ratify the selection of PricewaterhouseCoopers LLP as independent accountants for the Company for the current year. |

| | 3. | | To transact such other business as may come before the meeting or any adjournments thereof. |

The Board of Directors has fixed the close of business on April 9, 2003, as the record date for the determination of Shareholders entitled to notice and to vote at the meeting and any adjournments thereof.

By Order of the Board of Directors,

/s/ Robert E. Knowles

Robert E. Knowles

Secretary

April 10, 2003

PLEASE FILL IN, SIGN AND DATE THE ACCOMPANYING PROXY AND RETURN IT PROMPTLY IN THE ENCLOSED PREPAID ENVELOPE. IF YOU ATTEND THE MEETING, YOU MAY WITHDRAW YOUR PROXY AND VOTE IN PERSON.

S & K FAMOUS BRANDS, INC.

P.O. BOX 31800

RICHMOND, VIRGINIA 23294-1800

PROXY STATEMENT

Annual Meeting of Shareholders

to be held May 29, 2003

The enclosed proxy is solicited on behalf of the Board of Directors of S & K Famous Brands, Inc. (the “Company”) for use at the Annual Meeting of Shareholders of the Company, to be held May 29, 2003, or any adjournments thereof, for the purposes set forth in this Proxy Statement and the attached Notice of Annual Meeting of Shareholders. This Proxy Statement and related form of proxy are first being mailed to the Shareholders of the Company on or about April 10, 2003.

The close of business on April 9, 2003, has been fixed by the Board of Directors as the record date for determination of Shareholders entitled to notice of and to vote at the meeting. As of the close of business on that date, there were 2,465,806 shares of Common Stock, par value $.50 per share, of the Company (“Common Stock”) outstanding and entitled to vote. Each such share of Common Stock entitles the holder thereof to one vote.

Proxies may be revoked at any time before exercise by written notice to the Company, by submitting a substitute proxy, or by attending the meeting and voting in person. Shares represented by proxies in the form enclosed, if properly executed and returned, will be voted as specified, but when no specification is made, the shares will be voted for the election of the nominees for director named herein and for each of the other proposals described herein.

Except for the election of directors, action on a matter submitted to the shareholders will be approved if the votes cast in favor of the action exceed the votes cast opposing the action. With respect to the election of directors, the eight nominees receiving the greatest number of votes cast for the election of directors will be elected. Presence in person or by proxy of the holders of a majority of the outstanding shares of Common Stock entitled to vote at the meeting will constitute a quorum. Shares for which the holder has elected to abstain or to withhold the proxies’ authority to vote (including broker non-votes) on a matter will count toward a quorum but will have no effect on the action taken with respect to such matter.

The cost of the solicitation of proxies will be borne by the Company. Solicitation will be primarily by mail. However, directors and officers of the Company may also solicit proxies by telephone, electronic or facsimile transmission, or personal interview but will receive no compensation therefor other than their regular salaries. The Company will reimburse banks, brokerage firms and other custodians, nominees and fiduciaries for reasonable out-of-pocket expenses incurred by them in sending proxy material to the beneficial owners of such shares.

The principal executive offices of the Company are located at 11100 West Broad Street, P. O. Box 31800, Richmond,Virginia 23294-1800.

Security Ownership of Certain Beneficial Owners

The table below presents certain information as to the only persons known to the Company to be the beneficial owners of more than 5% of the Common Stock of the Company as of March 24, 2003. Except as otherwise noted, each of the beneficial owners listed below has sole voting and investment power with respect to the shares listed.

Name and Address of Beneficial Owner

| | Amount and Nature of Beneficial Ownership

| | | Percent of Class

|

Stuart C. Siegel P. O. Box 31800 Richmond, VA 23294-1800 | | 416,756 | (1) | | 16.9 |

|

T. Rowe Price Associates, Inc. T. Rowe Price Small-Cap Value Fund, Inc. 100 E. Pratt Street Baltimore, MD 21202 | | 300,300 | (2) | | 12.2 |

|

Franklin Resources, Inc. and related persons One Franklin Parkway San Mateo, CA 94403 Franklin Advisory Services, LLC One Parker Plaza, 16th Floor Fort Lee, NJ 07024 | | 294,500 | (3) | | 11.9 |

|

Dimensional Fund Advisors, Inc. 1299 Ocean Avenue 11th Floor Santa Monica, CA 90401 | | 217,100 | (4) | | 8.8 |

|

Donald W. Colbert P. O. Box 31800 Richmond, VA 23294-1800 | | 136,220 | (5) | | 5.4 |

1

(1) Includes 86,096 shares held in trust for the benefit of Sara E. Rose, David A. Rose and Howard L. Rose, the children of Mr. Siegel’s sister, Judith R. Becker. Stuart C. Siegel is trustee and exercises voting and investment power with respect to these shares.

(2) These shares are owned by T. Rowe Price Small-Cap Value Fund, Inc. (which has sole voting power with respect to all of these shares), which T. Rowe Price Associates, Inc. (“Price Associates”), serves as investment advisor. Price Associates has sole investment power with respect to all of these shares. For purposes of the reporting requirements of the Securities Exchange Act of 1934, Price Associates is deemed to be a beneficial owner of these shares; however, Price Associates expressly disclaims that it is, in fact, the beneficial owner of these shares. The information provided is as of December 31, 2002.

(3) Franklin Resources, Inc. (“FRI”), through its subsidiary, Franklin Advisory Services, LLC (“Franklin”), has sole voting and investment power with respect to all of these shares. Franklin’s beneficial ownership of these shares results from its acting as an investment advisor to one or more investment companies and other managed accounts. Charles B. Johnson and Rupert H. Johnson, Jr. are the principal shareholders of FRI and may be deemed the beneficial owner of securities held by persons and entities advised by FRI’s subsidiaries. Each of FRI, Franklin, Charles B. Johnson and Rupert H. Johnson, Jr. disclaims beneficial ownership of these shares. The information provided is based on a Schedule 13G dated July 9, 2002.

(4)Dimensional Fund Advisors Inc. (“Dimensional”), a registered investment advisor, is deemed to have beneficial ownership of these shares which are held by certain investment companies, trusts and other investment vehicles for which Dimensional serves as investment advisor or manager. Dimensional has sole investment and voting power with respect to all of these shares. Dimensional disclaims beneficial ownership of all such shares. The information provided is as of December 31, 2002.

(5) Includes 65,940 shares subject to options exercisable within 60 days.

Security Ownership of Management

The table below presents certain information as to the beneficial ownership of the Company’s Common Stock by (i) each director and nominee, (ii) each executive officer named in the Summary Compensation Table, and (iii) all executive officers, directors and nominees as a group, as of March 24, 2003. Except as otherwise noted, each of the persons named below has sole voting and investment power with respect to the shares listed.

Name of Beneficial Owner

| | Amount and Nature Of Beneficial Ownership

| | | Percent Of Class

|

Stuart C. Siegel | | 416,756 | (1) | | 16.9 |

Robert L. Burrus, Jr. | | 1,000 | | | * |

Donald W. Colbert | | 136,220 | (2) | | 5.4 |

Stewart M. Kasen | | 95,514 | | | 3.9 |

Andrew M. Lewis | | 1,000 | (3) | | * |

Steven A. Markel | | 25,000 | | | 1.0 |

Troy A. Peery, Jr. | | 1,000 | | | * |

Marshall B. Wishnack | | 1,000 | (4) | | * |

Robert E. Knowles | | 67,019 | (5) | | 2.7 |

Robert F. Videtic | | 14,892 | (6) | | * |

All directors and Executive officers as A group (12 persons) | | 786,057 | (7) | | 30.4 |

(1) See Note 1 under Security Ownership of Certain Beneficial Owners.

(2) Includes 65,940 shares subject to options exercisable within 60 days.

(3) Includes 1,000 shares owned by a trust of which Dr. Lewis and his wife are trustees and as to which Dr. Lewis may be deemed to share voting and investment power.

(4) Includes 1,000 shares owned by a trust of which Mr. Wishnack and his wife are trustees and as to which Mr. Wishnack may be deemed to share voting and investment power.

(5) Includes 3,500 shares owned jointly by Mr. Knowles and his wife as to which Mr. Knowles may be deemed to share voting and investment power. Also includes 31,200 shares subject to options exercisable within 60 days.

(6)Includes 7,860 shares subject to options exercisable within 60 days.

(7) Includes 5,500 shares as to which a director or an executive officer may be deemed to share voting and investment power. Also includes 118,700 shares subject to options exercisable within 60 days.

2

PROPOSAL NO. 1

Election of Directors

General

Eight directors are to be elected to hold office until the next Annual Meeting of Shareholders is held and their successors are elected. All of the nominees were elected at the 2002 Annual Meeting of Shareholders. Under the Company’s Bylaws each of the present directors will hold office until his successor has been elected at the Annual Meeting of Shareholders.

The persons named as proxies in the accompanying proxy intend to vote for the election of only the eight persons named below unless the proxy specifies otherwise. It is expected that each of these nominees will be able to serve, but in the event that any such nominee is unable to serve for any reason (which event is not now anticipated) the proxies will vote the proxy for the remaining nominees and such other person as the Board of Directors may designate.

Information Regarding Nominees

The following table sets forth certain information regarding each nominee.

Nominee

| | Age

| | Director Since

| | Principal Occupation During the Last Five Years

| | Present Positions and Offices with the Company

|

Stuart C. Siegel | | 60 | | 1970 | | Chairman of the Board of Directors of the Company since April 2002; Chairman of the Board of Directors and Chief Executive Officer of the Company prior to April 2002 | | Chairman of the Board

of Directors; Director |

Robert L. Burrus, Jr. | | 68 | | 1979 | | Chairman and partner in the law firm of McGuireWoods LLP, Richmond, Virginia | | Director; Member,

Compensation Committee |

Donald W. Colbert | | 53 | | 1985 | | Vice Chairman and Chief Operating Officer of the Company since April 2002; President and Chief Operating Officer of the Company prior to April 2002 | | Vice Chairman; Chief

Operating Officer; Director |

Stewart M. Kasen | | 63 | | 2002 | | President and Chief Executive Officer of the Company since April 2002; President, Schwarzschild Jewelers between September 2001 and April 2002; Private Investor between November 1999 and August 2001; Chairman, President and Chief Executive Officer of Factory Card Outlet Corp. (“FCO”) between May 1998 and October 1999, FCO filed a petition in bankruptcy in March 1999; Private Investor prior to May 1998 | | President; Chief Executive

Officer; Director |

Andrew M. Lewis, Ph.D. | | 57 | | 1983 | | Associate Professor and Chairman of Mathematics and Applied Mathematics Department, Virginia Commonwealth University (“VCU”) since 2001; Assistant Professor, VCU, prior to 2001 | | Director; Chairman,

Compensation Committee |

Steven A. Markel | | 54 | | 1996 | | Vice Chairman of Markel Corporation, a specialty property and casualty insurer | | Director; Member,

Audit Committee |

Troy A. Peery, Jr. | | 56 | | 1996 | | Private Investor since February 1999; President and Chief Operating Officer of Heilig-Meyers Company (“HMC”), a specialty retailer of home furnishings, until February 1999; HMC filed a petition in bankruptcy in August 2000 | | Director; Member,

Audit and Compensation Committees |

Marshall B. Wishnack | | 56 | | 1992 | | Retired since December 1999; Chairman and Chief Executive Officer of First Union Securities, an investment banking firm, until December 1999 | | Director; Chairman,

Audit Committee |

Robert L. Burrus, Jr. is also a director of CSX Corporation, Concepts Direct, Inc. and Smithfield Foods, Inc.

Stewart M. Kasen is also a director of Markel Corporation, K2, Inc., Department 56, Inc. and The Singer Companies.

Steven A. Markel is also a director of Markel Corporation.

Marshall B. Wishnack is also a director of Land America Financial Group.

3

Certain Relationships and Related Transactions

The Company leases certain premises at 6005 North Crestwood Avenue and the adjacent store at 5918 West Broad Street, Richmond, Virginia, totaling approximately 22,000 square feet, from Yetta Siegel-Flax pursuant to a lease which expires in 2004. The fiscal 2003 rent was $150,000. Yetta Siegel-Flax is the mother of Stuart C. Siegel. The Company operates the store at 5918 West Broad Street and has sublet the 6005 North Crestwood Avenue premises with fiscal 2003 income of $77,000.

The Company believes that the rent and other terms provided in the above lease are fair and reasonable to the Company as a tenant, are comparable to the rental terms for similar properties in the same general locations and are as favorable to the Company as if entered into with an unaffiliated party.

Committees of the Board of Directors

The Committees of the Board of Directors of the Company consists of an Audit Committee and a Compensation Committee.

Messrs. Markel, Peery and Wishnack are the members of the Audit Committee. The Audit Committee’s principal responsibilities include recommending to the Board of Directors the firm of independent accountants to be retained by the Company; reviewing with the Company’s independent accountants the scope and results of their audits; reviewing with the independent accountants and management the Company’s accounting and reporting principles, policies and practices; and reviewing the adequacy of the Company’s accounting and financial controls. This Committee met twice during the fiscal year ended February 1, 2003. Except for Mr. Markel, each of the members of the Audit Committee is independent, as defined under the Nasdaq rules. Mr. Markel is not independent, as defined under the Nasdaq rules, because Mr. Kasen serves on the Compensation Committee of the Board of Directors of Markel Corporation where Mr. Markel is an executive officer. The Company’s Board of Directors has determined that Mr. Markel’s continued membership on the Audit Committee is required by the best interests of the Company and its shareholders in view of the exceptional circumstances that have given rise to the issue, and taking into account the benefit to the Company of the continuity of leadership and experience that Mr. Markel can provide to the Audit Committee.

Messrs. Lewis, Burrus and Peery are the members of the Compensation Committee. The Compensation Committee has responsibility for recommending to the Board of Directors the compensation levels and benefits for directors and officers; administering the Company’s stock incentive and stock purchase loan plans; reviewing the administration of the Company’s savings/profit sharing plan; and advising the Board of Directors and management regarding general personnel policies. This Committee met nine times during the fiscal year ended February 1, 2003.

Attendance

The Board of Directors held six meetings during the fiscal year ended February 1, 2003. All directors attended 93 percent or more of the aggregate number of meetings of the Board and committees of the Board on which they served.

Directors’ Compensation

Each director who is not an employee of the Company is paid a yearly retainer of $3,600 and a fee of $300 for each Board meeting and for each Board committee meeting attended.

Each non-employee director also participates in the Company’s Stock Deferral Plan for Outside Directors. Under this plan, at the end of every three-month period, each director receives shares of Company Stock with a market value of $1,000. Payment of the shares is deferred for income tax purposes into a trust until the director’s retirement from the Board of Directors.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s directors, executive officers and persons who own more than 10% of the Company’s Common Stock to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of the Company’s Common Stock and to provide copies of such reports to the Company. Based solely on a review of the copies of such reports furnished to the Company and written representations that no other reports were required to be filed during the fiscal year ended February 1, 2003, the Company believes that all of its officers, directors and beneficial owners of greater than 10% of its Common Stock have complied with all applicable filing requirements.

4

EXECUTIVE COMPENSATION

The table below summarizes certain information relating to compensation during the three fiscal years ended February 1, 2003, of the chief executive officer and four other most highly compensated executive officers of the Company.

Summary Compensation Table

| | | | | | | | | Long Term Compensation

| | |

| | | | | Annual Compensation

| | Awards

| | Payouts

| | |

Name and Principal Position

| | Fiscal Year Ended

| | Salary ($)

| | Bonus ($)

| | Restricted Stock Award(s) ($)

| | Securities Underlying Options/SARs (#)

| | LTIP Payouts ($)

| | All Other Compensation(1) ($)

|

Stuart C. Siegel Chairman of the Board | | 2003 2002 2001 | | 418,000 508,000 499,400 | | 136,800 0 113,200 | | 0 0 0 | | 0 0 0 | | 0 0 0 | | 204,400 184,300 166,500 |

|

Donald W. Colbert Vice Chairman and COO | | 2003 2002 2001 | | 350,000 367,000 357,600 | | 97,100 0 58,500 | | 0 0 0 | | 0 0 20,300 | | 0 0 0 | | 57,400 40,500 53,500 |

|

Stewart M. Kasen President and CEO | | 2003 | | 256,000 | | 109,400 | | 0 | | 0 | | 0 | | 500 |

|

Robert E. Knowles Executive VP and CFO, Secretary and Treasurer | | 2003 2002 2001 | | 215,000 215,000 210,000 | | 46,100 0 28,100 | | 0 0 0 | | 0 0 10,300 | | 0 0 0 | | 30,900 21,500 28,100 |

|

Robert F. Videtic Senior VP | | 2003 2002 2001 | | 138,000 138,000 127,700 | | 26,100 0 15,700 | | 0 0 0 | | 0 0 3,000 | | 0 0 0 | | 2,600 1,100 2,900 |

(1) Includes Company contributions under the Employees’ Savings/Profit Sharing Plan, the net value of the benefit to the named executives of the portion of the premiums paid by the Company under the Split Dollar Life Insurance Plan and amounts of interest forgiven under the stock purchase loan plans. During the fiscal year ended February 1, 2003, (i) Company contributions allocated under the Employees’ Savings/Profit Sharing Plan to Messrs. Siegel, Colbert, and Knowles were $1,800 each and to Messrs. Kasen and Videtic were $500 and $1,200, respectively; (ii) the dollar values of the benefit of premiums paid until July 31, 2002 by the Company (using an eight percent interest rate) under the Split Dollar Life Insurance Plan for Messrs. Siegel, Colbert and Knowles were $200,800, $43,800, and $23,300, respectively; and (iii) amounts of interest forgiven under the stock purchase loan plans for Messrs. Siegel, Colbert, Knowles, and Videtic were $1,800, $11,800, $5,800 and $1,400, respectively.

The following table sets forth information with respect to options exercised during the fiscal year ended February 1, 2003 and the number and value of options held at the end of such fiscal year for each of the executive officers for whom information is given in the Summary Compensation Table.

Aggregated Option/SAR Exercises in Last Fiscal Year and FY-End Option/SAR Values (1)

| | | | | | | Number of Securities Underlying Unexercised Options/SARs at FY-End (#)

| | Value of Unexercised In-the-Money Options/SARs at FY-End(2) ($)

|

| | | Shares Acquired on Exercise (#)

| | Value Realized ($)

| | Exercisable/ Unexercisable

| | Exercisable/ Unexercisable

|

Stuart C. Siegel | | 0 | | $ | 0 | | 0/0 | | 0/0 |

Donald W. Colbert | | 80,200 | | $ | 224,000 | | 65,940/27,060 | | 80,087/60,260 |

Stewart M. Kasen | | 0 | | $ | 0 | | 0/0 | | 0/0 |

Robert E. Knowles | | 44,500 | | $ | 124,300 | | 31,200/13,400 | | 39,264/30,372 |

Robert F. Videtic | | 0 | | $ | 0 | | 7,860/3,640 | | 12,704/8,737 |

| (1) | | No SARs have been granted to or exercise by any employee. |

| (2) | | Difference between fair market value and exercise price at fiscal year end. |

5

1995 and 2000 Stock Purchase Loan Plans

In 1995 and 2000, the Company adopted, with shareholder approval, Stock Purchase Loan Plans under which the Compensation Committee may approve loans to officers and other key management employees of the Company for the purpose of acquiring shares of the Company’s Common Stock. The plans are intended to attract and retain key employees and to provide incentives for management to achieve the Company’s current and long-term strategic goals. Pursuant to the 1995 plan, the Compensation Committee authorized and the Company made an aggregate of $1.5 million in loans in 1995 to a total of 17 officers (the “1995 Loan Program”). An aggregate of 214,275 shares of Common Stock were purchased pursuant to the 1995 Loan Program. Pursuant to the 1995 plan, the Compensation Committee also authorized and the Company made an aggregate of $1.5 million in loans in 1999 to a total of 16 officers (the “1999 Loan Program”). An aggregate of 175,812 shares of Common Stock were purchased pursuant to the 1999 Loan Program.

As required by the Sarbanes-Oxley Act of 2002, effective July 30, 2002, no new loans will be made under the stock purchase loan plans to executive officers. Existing loans to executive officers will continue in accordance with their terms in effect on July 30, 2002.

Each outstanding loan has a term of seven years but becomes due and payable up to one year following a termination of the participant’s employment. A loan may be prepaid without penalty at any time and is subject to mandatory repayments equal to a specified percentage of any net annual cash bonus paid to the participant. The loans bear interest, compounded annually, at a rate equal to the Applicable Federal Rate rounded upward to the nearest 0.25%. The interest rate, which is currently 3¼% for the 1999 Loan Program, will be adjusted annually for changes in the Applicable Federal Rate. Each loan is secured by a pledge to the Company of the shares of Common Stock acquired with the loan proceeds. The shares are subject to additional restrictions on transfer which lapse as to one-third of the shares on each of the second, third and fifth anniversaries of the date of the loan. These restrictions do not apply to certain transfers such as those to family members for tax or estate planning purposes.

The loan programs allow participants to achieve forgiveness of all or a portion of the interest accruing on a loan during a fiscal year (a “Performance Period”) based on the Company’s achievement of the performance goals established by the Compensation Committee for such Performance Period. If a participant’s employment is terminated due to death or disability or a termination by the Company without cause within two years following a change of control, all interest accrued during the then current Performance Period as well as all future interest will be forgiven. A participant who retires at or after normal retirement age will be entitled to a prorated amount of any interest forgiveness otherwise achieved for such Performance Period. Otherwise, a participant must still be employed by the Company at the end of a Performance Period to be eligible for forgiveness of any interest accrued during such Performance Period.

The loan programs also permit up to 25% of the principal amount of a participant’s loan to be forgiven dependent upon the participant’s continued employment with the Company and retention of the shares acquired with the loan proceeds. If the participant remains continuously employed by the Company through the seventh anniversary of the date of the loan, a portion of the loan principal will be forgiven equal to 25% of the original principal amount multiplied by the ratio which the number of shares retained on the seventh anniversary bears to the number of shares originally acquired. Certain types of transfers, such as those to family members for tax or estate planning purposes, will not cause a reduction in the amount of loan principal forgiven. If the participant’s employment is terminated prior to the seventh anniversary of the loan due to death or disability or a termination by the Company without cause within two years following a change of control, the participant will be entitled to principal forgiveness on the terms described above. A participant who retires at or after normal retirement age will be entitled to a prorated amount of such principal forgiveness based on the portion of the seven year period during which the participant was employed. Otherwise, a participant must still be employed on the seventh anniversary of the loan to be eligible for any forgiveness of loan principal.

The loans made pursuant to the 1995 Loan Program were repaid in May 2002. Under the terms of the loans, 25% of the original loan principal amount multiplied by the ratio which the number of shares retained bears to the number of shares originally acquired was forgiven for officers who remained continuously employed through such date. The amount of loan principal forgiven for executive officers was Siegel—$97,700, Colbert—$93,000, Knowles—$40,900, Videtic—$3,700 and Wirick—$18,700. The following table shows, for each participating executive officer, the aggregate number of shares of Common Stock acquired with the proceeds of loans under the plan, the maximum amount of indebtedness outstanding since February 3, 2002 and the aggregate amount of all indebtedness outstanding as of March 24, 2003.

6

Name

| | Number Of Shares Purchased

| | Maximum Outstanding Since Feb. 3, 2002($)

| | Outstanding as of March 24, 2003 ($)

|

Siegel | | 55,857 | | 350,000 | | 0 |

Colbert | | 101,200 | | 894,700 | | 492,200 |

Knowles | | 47,386 | | 421,700 | | 246,300 |

Videtic | | 9,174 | | 79,400 | | 70,600 |

Wirick | | 17,746 | | 164,700 | | 72,500 |

Deferred Compensation Agreements

The Company has deferred compensation agreements with each of Messrs. Siegel, Colbert and Knowles. These agreements provide for specified payments if the executive has been employed by the Company for at least 10 years. Full benefits commence on the executive’s normal retirement date (generally, age 65). If the executive terminates employment after his early retirement date (generally, age 55) but before his normal retirement date, the benefits are reduced by 5% per year for each year by which payment starts before his normal retirement date. The benefits are payable on a monthly basis for life and are guaranteed for 10 years if the executive dies. The guaranteed payments after death are payable to the executive’s beneficiary. The annual amount of the normal retirement benefits payable under the agreements for Messrs. Colbert and Knowles is $81,257 and $41,953, respectively. Mr. Siegel’s agreement provides for an annual benefit of $66,495 on the terms described above based on a normal retirement date of age 55. Mr. Siegel is also entitled to a supplemental annual benefit of $64,723, payable for 20 years commencing upon his termination of employment at or after reaching age 65. If Mr. Siegel terminates employment after age 60 but before age 65, the supplemental benefit is reduced by 5% per year for each year by which payment commences before age 65. No supplemental benefit was payable if Mr. Siegel terminated employment before age 60. In certain cases, the present value of the benefits under the foregoing agreements (calculated using an 8% discount rate) may be paid to the executive, or following the executive’s death to his beneficiary, in a lump sum or other manner.

REPORT OF THE COMPENSATION COMMITTEE

The Compensation Committee, which is composed of three non-management directors of the Company, sets executive compensation levels and establishes and administers short-term and long-term incentive programs. The Committee believes that the most effective executive compensation program provides incentives to achieve both current and longer-term strategic goals of the Company, with the ultimate objective of enhancing shareholder value. The Company’s compensation package for its executive officers consists of base salary, annual performance-based bonuses, stock option grants and the opportunity to acquire shares of Common Stock under the Company’s Stock Purchase Loan Plan.

Each year, the Committee reviews proposals submitted by the Chief Executive Officer with respect to senior executives’ (other than the Chief Executive Officer’s) annual salary, performance goals and bonuses for the following year as well as achievements for the prior year, performance targets under the Stock Purchase Loan Plan, and stock option grants. In evaluating these proposals, the Committee considers (1) the individual executive officer’s performance and level of contribution, including evaluations by the Chief Executive Officer with respect to other executive officers, (2) the Company’s performance during the last fiscal year in relation to its financial goals, and (3) whether the proposals are consistent with the Committee’s policies on executive compensation.

The Committee believes that a significant portion of an executive’s total compensation should be subject to Company and individual performance criteria. Base salary amounts are generally set at the levels believed by the Committee to be necessary to attract and retain qualified individuals when considered along with the performance based components of the Company’s compensation package. In view of the above and due to the transition occurring in senior management and because the Company did not meet certain performance goals during fiscal 2002, the Committee determined that base salaries for executive officers continuing in the same position should not be increased.

The Company’s annual bonus plan provides incentives to achieve current strategic goals of the Company and to maximize individual performance. At the beginning of each year, the Committee sets threshold, target and maximum bonus amounts for each executive officer. Consistent with the Company’s compensation philosophy, these potential bonus amounts are set at a significant percentage of the executive officer’s salary for such year, typically between 6% and 72%. For two of the executive officers continuing in the same positions, the bonus percentages were the same for fiscal 2003 as were for fiscal 2002. For one executive officer continuing in the same position, the bonus percentages were slightly increased for fiscal 2003. However, the potential threshold, target and maximum dollar amounts

7

that could be paid to that executive remained the same for fiscal 2003 as they were for fiscal 2002. The determination of the amount of the bonus, if any, to be paid is made after the end of the year by the Committee based on the degree to which the Company has achieved the performance goals established by the Committee, measured primarily by earnings per share and partially by return on equity for senior executive officers for fiscal 2003. For other executive officers, the officer’s individual performance and level of contribution during the previous year are also considered. If the minimum, target or maximum goals are met, the executive officer may receive the threshold, target or maximum bonus amount respectively, depending on the Committee’s evaluation of the executive’s individual performance. Similarly, if the Company’s actual performance for a year falls between any of these goals, the executive officer may receive a prorated portion of the next highest bonus amount. In some cases, the Committee may adjust the bonus percentages and performance targets during the fiscal year on a prospective basis. The Company’s return on equity did not reach the threshold level and earnings per share for fiscal 2003 were between the minimum and target goals resulting in bonus payouts at the appropriate percentages to executive officers. In addition to the awards paid under the annual bonus plan, due to the teamwork, confidence and willingness to focus on creating shareholder value displayed by management during the year when certain management responsibilities were effectively transitioned from Mr. Siegel to Mr. Kasen, the Committee approved a bonus to Company officers and management in the total aggregate amount of $27,500.

Grants of incentive awards to the Company’s executive officers under the 1999 Stock Incentive Plan provide incentives to achieve the Company’s long-term performance objectives. The Committee determines whether a grant will be made to an executive officer, and if so in what amount, based primarily on the Committee’s subjective evaluation of the executive officer’s potential contribution to the Company’s future success, the level of incentive already provided by the number and terms of the executive officer’s existing incentive awards and the market price of the Company’s Common Stock. During fiscal 2003, no incentive awards were made to executive officers.

Under the 1995 Stock Purchase Loan Plan, an aggregate of $1.5 million in loans were made by the Company in 1995 to the executive officers and other key management employees to acquire an aggregate of 214,275 shares (the “1995 Loan Program”). During 1999, the Committee approved an additional $1.5 million in loans that executive officers and other key management employees used to acquire an aggregate of 175,812 shares (the “1999 Loan Program”). The 1995 and 1999 Loan Programs allow participants to achieve forgiveness of all or a portion of the interest on the loans based upon the Company’s achievement of performance goals established by the Committee. In May 2002, the remaining amounts due under the 1995 Loan Program were paid off by the Company’s executive officers. Due to passage of the Sarbanes-Oxley Act of 2002, new loans under the Stock Purchase Loan Plans will not be available to any executive officers.

For each loan program, minimum, target and maximum earnings per share goals were established which could result in forgiveness of 25%, 50% or 100%, respectively, of the loan interest accruing during fiscal 2003, with the amount being forgiven prorated for performance that fell between any of the goals. The performance criterion and the targets for fiscal 2003 were the same as those established for purposes of the Company’s annual bonus plan. The Company’s performance was between the minimum and target goals and the appropriate amount of the loan interest accruing in fiscal 2003 was forgiven. The loan programs also permit up to 25% of the principal amount of a participant’s loan to be forgiven dependent upon the participant’s continued employment with the Company and based on the amount of stock acquired under the program which the participant has retained. A more detailed description of the loan programs appears elsewhere in the Proxy Statement. The Committee believes that the programs, by encouraging management’s acquisition and retention of the Company’s Common Stock and by tying interest forgiveness to Company performance, provide incentives for management to achieve both the Company’s long-term performance objectives and its current strategic goals.

In April 2002, Mr. Kasen replaced Mr. Siegel as the Company’s Chief Executive Officer of the Company. Mr. Siegel has continued as the Company’s Chairman and provides assistance to senior management during the transitioning of his responsibilities to Mr. Kasen. For his continued services with the Company, the Committee determined that for fiscal 2003 Mr. Siegel should receive a base salary of $384,400 and his potential bonus would be set at threshold, target and maximum amounts of 24%, 48% and 95%, respectively of his base salary. The Company’s return on equity did not meet the threshold level and earnings per share for fiscal 2003 were between the minimum and target goals so that a 33%

8

bonus was paid to Mr. Siegel under the annual bonus program. Mr. Siegel did not borrow under the 1999 Loan Program and therefore was not eligible for any principal or interest forgiveness under that program.

Mr. Siegel also participates in the Company’s deferred compensation program. The Committee has determined that the total Company-provided retirement benefits for Mr. Siegel are projected to be at the median level for chief executive officers based on earlier survey data from a broad range of companies. A more detailed description of these retirement benefits appears elsewhere in the Proxy Statement.

As a founder of the Company, the Committee believes Mr. Siegel adds valuable insight and experience in managing the Company and will continue to be an integral and highly valued member of the management team. However, it is the Committee’s intent that as Mr. Siegel’s day-to-day responsibilities decrease over the coming years the total compensation paid to him from the Company will decline relative to other members of senior management.

The Committee determined the compensation for Mr. Kasen, the Company’s new President and Chief Executive Officer, for fiscal 2003 in a manner consistent with the guidelines and policies described above for senior executive officers. The Committee set Mr. Kasen’s annual salary at $350,000 with annual bonus targets at 25%, 40% and 60% of base salary for meeting the threshold, target and maximum goals described above. The Company’s return on equity did not meet the threshold level and earnings per share for fiscal 2003 were between the minimum and target goals so that a 29% bonus was paid to Mr. Kasen under the annual bonus program. Mr. Kasen does not participate in the 1999 Loan Program.

Section 162(m) of the Internal Revenue Code of 1986, as amended, imposes a $1,000,000 individual limit on the amount of compensation that will be deductible by the Company with respect to each of the Chief Executive Officer and the four other most highly compensated executive officers. Performance-based compensation that meets certain requirements will not be subject to the deduction limit. The Committee, with the assistance of the Company’s legal counsel, has reviewed the impact of Section 162(m) on the Company and believed it was unlikely that the compensation paid to any executive officer during fiscal 2003 would exceed the limit. The Committee will continue to monitor the impact of the Section 162(m) limit and to assess alternatives for avoiding loss of tax deductions in future years to the extent that the alternatives would be consistent with the Committee’s compensation philosophy and in the best interests of the Company. Messrs. Lewis and Perry have been appointed as a subcommittee to act on matters where qualification of compensation as performance-based is appropriate.

Compensation Committee

Andrew M. Lewis, Chairman

Robert L. Burrus, Jr.

Troy A. Peery, Jr.

Compensation Committee Interlocks and Insider Participation

Mr. Burrus, a member of the Compensation Committee, is Chairman and a partner in the law firm of McGuireWoods LLP, which has served as counsel to the Company on a regular basis since 1979.

The Company’s Chief Executive Officer, Mr. Kasen, serves on the Compensation Committee of the Board of Directors of Markel Corporation. Mr. Markel, a member of the Company’s Board of Directors, is Vice Chairman of Markel Corporation.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee of the Board of Directors (the “Audit Committee”) is composed of three directors and operates under a written charter adopted by the Board of Directors on May 18, 2000, and annually reassessed and updated, as needed, in accordance with applicable rules of the Securities and Exchange Commission and Nasdaq.

Management is responsible for the Company’s internal controls and the financial reporting process. The independent auditors are responsible for performing an independent audit of the Company’s financial statements in accordance with generally accepted auditing standards and issuing a report thereon. The Audit Committee’s primary responsibility is to monitor and oversee these processes. The Audit Committee also recommends to the Board of Directors the selection of the Company’s independent auditors.

In this context, the Audit Committee has reviewed and discussed the Company’s audited financial statements with both management and the independent auditors. The Audit Committee also discussed with the independent auditors matters required of auditors to be discussed by Statement on Auditing Standards No. 61 (“Communication with Audit Committees”). The Company’s independent auditors also provided to the

9

Audit Committee the written disclosures and the letter required by Independence Standards Board Standard No. 1 (“Independence Discussions with Audit Committees”), and the Audit Committee discussed with the independent auditors their independence.

Based on the review and discussions described in this report, and subject to the limitations on its role and responsibilities described below and in its charter, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended February 1, 2003 for filing with the Securities and Exchange Commission.

The members of the Audit Committee are not experts in accounting or auditing and rely without independent verification on the information provided to them and on the representations made by management and the independent auditors. Accordingly, the Audit Committee’s oversight does not provide an independent basis to determine that the Company’s financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America or that the audit of the Company’s financial statements by PricewaterhouseCoopers LLP has been carried out in accordance with generally accepted auditing standards.

Audit Committee

Marshall B. Wishnack, Chairman

Steven A. Markel

Troy A. Peery, Jr.

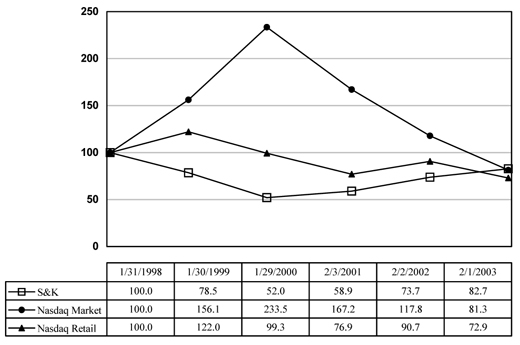

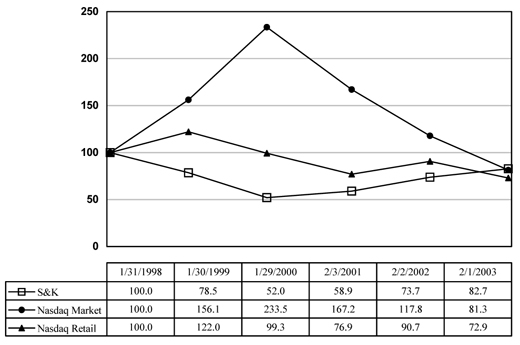

PERFORMANCE GRAPH

Set forth below is a line graph comparing the yearly percentage change in the cumulative total return on the Company’s Common Stock with the cumulative total return of companies in the Nasdaq Market Value Index for U. S. companies and the Nasdaq Retail Trade Index for the period of five years commenced on January 31, 1998, and ended on February 1, 2003.

Media General Financial Services supplied the data for the Company and the Nasdaq Market Value Index. Center for Research in Security Prices (CRSP) supplied the data for the Nasdaq Retail Trade Index.

10

PROPOSAL NO. 2

Ratification of Selection of Accountants

Upon the recommendation and approval of the Audit Committee, the Board of Directors has approved the selection of PricewaterhouseCoopers LLP as independent public accountants to audit the financial statements of the Company for the fiscal year ending January 31, 2004. This selection is being presented to the shareholders for their ratification at the Annual Meeting of Shareholders. The firm of PricewaterhouseCoopers LLP is considered well qualified. Representatives of PricewaterhouseCoopers LLP are expected to be present at the Annual Meeting of Shareholders with an opportunity to make a statement if they desire to do so and are expected to be available to respond to appropriate questions from shareholders.

Audit Fees. The Company paid PricewaterhouseCoopers LLP $87,100 in aggregate fees for the fiscal 2003 annual audit and for review of the Company’s financial statements included in its Form 10-Qs for the 2003 fiscal year.

Financial Information Systems Design and Implementation Fees. The Company paid PricewaterhouseCoopers LLP no fees for information technology services for fiscal 2003.

All Other Fees. The Company paid Pricewaterhouse Coopers LLP $9,750 for all other services, including tax-related services for fiscal 2003 and an audit of a benefit plan.

The Audit Committee considered whether and determined that the auditor’s provision of non-audit services was compatible with maintaining the auditor’s independence.

The Board of Directors recommends a vote FOR the ratification of the selection of PricewaterhouseCoopers LLP as independent public accountants to audit the financial statements of the Company for the fiscal year ending January 31, 2004, and proxies solicited by the Board of Directors will be so voted unless shareholders specify a different choice. If the shareholders do not ratify the selection of PricewaterhouseCoopers LLP, the selection of independent public accountants will be reconsidered by the Board of Directors.

OTHER MATTERS

The Board of Directors knows of no other matters which are likely to be brought before the meeting; however, if any other matters are properly brought before the meeting, the persons named in the enclosed proxy or their substitutes will vote in accordance with their best judgments on such matters.

SHAREHOLDER PROPOSALS FOR

2004 MEETING

Proposals of Shareholders intended to be included in the Proxy Statement for the 2004 annual meeting must be received by the Company at its principal executive offices no later than December 12, 2003. Any such proposal must meet the applicable requirements of the Securities Exchange Act of 1934 and the rules and regulations thereunder.

With respect to shareholder proposals not included in the Company’s Proxy Statement for the 2004 annual meeting, the persons named in the Board of Directors’ proxy for such meeting will be entitled to exercise the discretionary voting power conferred by such proxy under the circumstances specified in Rule 14a-4(c) under the Securities Exchange Act of 1934 including with respect to proposals received by the Company after February 26, 2004.

By Order of the Board of Directors,

/s/ Robert E. Knowles

Robert E. Knowles

Secretary

April 10, 2003

11

S & K FAMOUS BRANDS, INC.

PROXY

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned, revoking all previous proxies, hereby appoints Robert E. Knowles and Joseph A. Marchman, and each of them with full power of substitution to each, proxies (and if the undersigned is a proxy, substitute proxies) and attorneys to represent the undersigned at the Annual Meeting of Shareholders of S & K Famous Brands, Inc., to be held at the Sheraton Richmond West Hotel located at 6624 West Broad Street, Richmond, Virginia, at 10:00 a.m., E.D.T., on May 29, 2003, and at any and all adjournments thereof, and to vote as designated on the reverse side, all of the Common Shares of S & K Famous Brands, Inc., par value $.50 per share, held of record by the undersigned on April 9, 2003, as fully as the undersigned could do if personally present.

FOR ALL NOMINEES LISTED BELOW | | WITHHOLD AUTHORITY |

(except as marked to the contrary) | | (to vote for all nominees listed below) |

| | | |

¨ | | ¨ |

(Instruction: To withhold authority to vote for any individual, strike a line through the nominee’s name in the list provided below.)

S. Siegel, R. Burrus, D. Colbert, S. Kasen, A. Lewis, S. Markel, T. Peery, M. Wishnack

| 2. | | PROPOSAL TO RATIFY THE SELECTION OF PricewaterhouseCoopers LLP as the independent accountants of the Company. |

¨ FOR ¨ AGAINST ¨ ABSTAIN

| 3. | | In their discretion, the proxies are authorized to vote upon such other business as may properly come before the meeting or any adjournment thereof. |

This proxy when properly executed will be voted in the manner directed herein by the undersigned shareholder. If no direction is made, this proxy will be voted FOR proposals 1 and 2.

Receipt of the Secretary’s Notice of and the related Proxy Statement for the Annual Meeting of Shareholders to be held on May 29, 2003, is hereby acknowledged.

Please sign exactly as name appears below. When shares are held by two or more persons as joint tenants, any of such persons may sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in full corporate name by president or other authorized officer. If a partnership, please sign in partnership name by authorized person.

Dated , 2003

|

|

Shareholder’s Signature if held jointly |

Please mark, sign, date and return the proxy card promptly using the enclosed envelope.