UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

MESA LABORATORIES, INC.

| (Name of registrant as specified in its charter) | |||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check all boxes that apply):

☒ | No fee required. |

☐ | Fee paid previously with preliminary materials. |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

MESA LABORATORIES, INC.

12100 West Sixth Avenue

Lakewood, Colorado 80228

Telephone: (303) 987-8000

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO THE SHAREHOLDERS OF MESA LABORATORIES, INC.:

We invite you to the Annual Meeting of Shareholders (“Annual Meeting”) of Mesa Laboratories, Inc. (“we”, “our”, the “Company”, or “Mesa”), which will be held on Friday, August 26, 2022 at 9:00 a.m. Mountain Time at our corporate headquarters at 12100 West Sixth Avenue, Lakewood, Colorado 80228.

Shareholders will consider and act on the following matters:

| 1. | To elect the seven director nominees named in the accompanying Proxy Statement; | |

2. | To approve, on a non-binding advisory basis, the compensation of our named executive officers; | |

3. | To ratify the appointment of Plante & Moran, PLLC as our independent registered public accounting firm for the year ending March 31, 2023; | |

4. | To hold a non-binding, advisory vote regarding the frequency of voting on the compensation paid to the Company's named executive officers; and | |

| 5. | To transact such other business as may properly come before the meeting or any postponements or adjournments thereof. |

Only holders of our common stock at the close of business on July 1, 2022 will be entitled to notice of and to vote at this Annual Meeting, and any postponements or adjournments thereof.

Please vote your shares by signing and returning your proxy card, using telephone or internet voting, or at the Annual Meeting. This will assure that your shares will be voted, whether or not you attend the Annual Meeting. You may attend the Annual Meeting and vote in person even if you have previously granted a proxy.

By Order of the Board of Directors

/s/ Gary M. Owens

| Gary M. Owens | July 14, 2022 |

Chief Executive Officer

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON AUGUST 26, 2022

The Mesa Laboratories, Inc. Proxy Statement, Proxy Card and Annual Report on Form 10-K for the fiscal year ended March 31, 2022 ("fiscal year 2022") are available to view on the internet at: www.edocumentview.com/MLAB or www.mesalabs.com.

ANNUAL MEETING OF SHAREHOLDERS

To Be Held Friday, August 26, 2022 at 9:00 a.m. Mountain Time

Solicitation of Proxy

The accompanying proxy is solicited on behalf of the Board of Directors of Mesa Laboratories, Inc. (“we”, “our”, the “Company”, or “Mesa”) for use during the Annual Meeting of Shareholders (“Annual Meeting”) of the Company to be held on Friday, August 26, 2022 at 9:00 a.m. Mountain Time and at any adjournment. In addition to the use of the mails, proxies may be solicited on the Company’s behalf by our Directors and employees by mail, telephone, email or in person. We may also request brokerage houses, nominees, custodians and fiduciaries to forward the soliciting material to the beneficial owners of our common stock and will reimburse such persons for forwarding such material. We will bear the cost of this solicitation of proxies. Such costs are expected to be nominal. Proxy solicitation will commence with the mailing of this Proxy Statement on or about July 14, 2022.

Execution and return of the enclosed proxy will not affect a shareholder’s right to attend the meeting and to vote in person. Any shareholder executing a proxy retains the right to revoke it at any time prior to exercise at the meeting. A proxy may be revoked by delivery of written notice of revocation to the Secretary of the Company at or prior to the meeting, by timely execution and delivery of a later proxy or by voting the shares in person at the meeting. A proxy, when executed and not revoked, will be voted in accordance with the instructions thereon. In the absence of specific instructions, proxies will be voted by the person named in the proxy in accordance with the recommendations of the Board on all matters presented in this Proxy Statement and as they may determine in their best judgment with respect to any other matters properly presented for a vote at the Annual Meeting.

The enclosed proxy provides a method for shareholders to withhold authority to vote for any one or more of the nominees for director while granting authority to vote for the remaining nominees. The names of all nominees are listed on the proxy. If you wish to grant authority to vote for all nominees, check the box marked “FOR”. If you wish to withhold authority to vote for all nominees, check the box marked “WITHHOLD”. If you wish your shares to be voted for some nominees and not for one or more of the others, check the box marked “FOR” and indicate the name(s) of the nominee(s) for whom you are withholding the authority to vote by writing the name(s) of such nominee(s) on the proxy in the space provided.

Meeting format

We will hold the Annual Meeting in person and will observe appropriate COVID protocols and health and safety procedures. Attendees will be required to adhere to physical distancing and other requirements consistent with orders of public health authorities. Attendees who are not fully vaccinated must wear facial coverings.

Stockholders of record and beneficial owners; broker non-votes

If your shares are registered directly in your name with our transfer agent, you are considered the “stockholder of record” of those shares, and this Proxy Statement and related materials have been sent directly to you. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the “beneficial owner” of such shares held in “street name,” and the proxy materials have been forwarded to you by your broker, bank or other nominee. As the beneficial owner, you have the right to direct your broker, bank or other nominee how to vote your shares by using the voting instruction card included in the mailing or by following the instructions for submitting your voting instructions by telephone or on the Internet.

Broker non-votes occur when a nominee holding shares for a beneficial owner returns a properly executed or otherwise submitted proxy but has not received voting instructions from the beneficial owner, and such nominee does not possess discretionary authority on one or more proposals with respect to such shares. Brokers are not allowed to exercise their voting discretion with respect to the approval of matters which are considered “non-routine” under applicable rules without specific instructions from the beneficial owner. Of the proposals to be considered at the Annual Meeting, only Proposal 3 is considered "routine" for the purposes of these rules. Broker non-votes will not have any effect on the outcome of voting on the matters to be considered at the Annual Meeting.

Attending the Annual Meeting

To attend the Annual Meeting, you must be a shareholder on the close of business on the record date of July 1, 2022. Please note that the use of cameras and other recording devices will not be allowed at the Annual Meeting. Beneficial owners must obtain a legal proxy from their broker, bank or nominee prior to the Annual Meeting in order to vote in person.

Who can vote

If you were a shareholder of record of our common stock at the close of business on July 1, 2022, the record date for the Annual Meeting, you are entitled to vote in advance of the Annual Meeting using the 16-digit control number that appears on the proxy card or the instructions that accompanied the proxy materials. If you were a beneficial owner of our common stock held in street name on the record date, please check the voting instruction card provided by your broker, bank or other nominee to see what voting options are available and the procedures to be followed. On each matter to be voted on, you may cast one vote for each share of common stock you hold. As of July 1, 2022, there were 5,297,001 shares of common stock outstanding and entitled to vote.

Purpose of the Meeting

As stated in the Notice of Annual Meeting of Shareholders accompanying this Proxy Statement, the business to be conducted and the matters to be considered and acted upon at the meeting are as follows:

| 1. | To elect the seven director nominees named in this Proxy Statement; |

2. | To approve, on a non-binding advisory basis, the compensation of our named executive officers; |

3. | To ratify the appointment of Plante & Moran, PLLC as our independent registered public accounting firm for the year ending March 31, 2023; |

4. | To hold a non-binding, advisory vote regarding the frequency of voting on the compensation paid to the Company's named executive officers; and |

5. | To transact such other business as may properly come before the meeting or any postponements or adjournments thereof. |

Our voting securities consist solely of shares of common stock, no par value per share.

The record date for shareholders entitled to notice of and to vote at the meeting is the close of business on July 1, 2022, at which time we had 5,297,001 shares of common stock outstanding; all shares are entitled to vote at the meeting. Shareholders are entitled to one vote, in person or by proxy, for each share of common stock held in their name on the record date.

A majority of the outstanding shares of the Company entitled to vote, represented in person or by proxy, shall constitute a quorum at the Annual Meeting. Broker non-votes and abstentions will be counted as present for determining whether a quorum is present.

Questions and Answers About This Proxy Statement

The following responses to certain questions do not purport to be a complete statement of the information in this Proxy Statement and are qualified by the more complete information set forth hereinafter.

Who is asking for my vote?

The Board of Directors (the "Board") of the Company is sending this Proxy Statement, the attached Notice of Annual Meeting of Shareholders and the enclosed proxy card on or about July 14, 2022 to you and all of our other shareholders of record as of the close of business on July 1, 2022. The Board is soliciting your vote for the Annual Meeting.

Who is eligible to vote?

Shareholders of record who own shares of our common stock at the close of business on July 1, 2022 are eligible to vote. Each share of common stock is entitled to one vote.

Might the Annual Meeting be adjourned?

We do not intend to seek adjournment of the Annual Meeting unless we have insufficient votes to satisfy a quorum (which requires the presence of at least a majority of the outstanding shares). If that circumstance exists, we will consider the advisability of proposing adjournment to a specific time and place. If the meeting is adjourned, we will make a public announcement.

Why did you send me this document?

This document is a Proxy Statement. It provides you with information you should review before voting on the items listed in the Notice of Annual Meeting of Shareholders. You are receiving these proxy materials because you have the right to vote on these important items concerning your investment in Mesa.

How do I vote?

Shareholders of record: All shareholders of record may vote by written proxy card or in person at the Annual Meeting. Joint owners must each sign the proxy card. All shareholders of record may also vote by touchtone telephone using the toll-free telephone number on the notice or proxy card, or through the internet using the procedures and instructions described on the Notice or Proxy Card.

Beneficial Owners: Shares Registered in the Name of a Broker, Bank, or Other Nominee If you were a beneficial owner at the close of business on the record date, please check the voting instruction card provided by your broker, bank or other nominee to see what voting options are available and the procedures to be followed. You may not vote your shares in person at the Annual Meeting unless you obtain a “legal proxy” from your broker, bank, or other nominee who is the stockholder of record with respect to your shares.

When and where will the Annual Meeting be held?

The Annual Meeting will be held at our corporate offices at 12100 West Sixth Avenue, Lakewood, Colorado 80228 (telephone 303-987-8000), on Friday, August 26, 2022 at 9:00 a.m. Mountain Time.

How does the Board of Directors recommend that I vote?

The Board of Directors recommends that shareholders vote FOR the election of all the nominees listed in the proxy statement, FOR Proposals 2 and 3, and, with respect to Proposal 4, for annual future say-on-pay votes for Proposal 4.

How can I obtain more information about Mesa?

We have included an Annual Report to Shareholders with this Proxy Statement that contains additional information about Mesa. In addition, information is available on our website at www.mesalabs.com and through the EDGAR filings maintained by the Securities and Exchange Commission at www.sec.gov. Neither the Annual Report to Shareholders nor our website is incorporated into this Proxy Statement and they are not to be considered a part of the soliciting material.

BENEFICIAL Ownership of equity securities of the company

The following table sets forth the number of shares of our common stock owned beneficially as of June 24, 2022 (unless otherwise noted), by each person known by the Company to have owned beneficially more than five percent of such shares then outstanding, by each of our executive officers and directors, and by all of our executive officers and directors as a group. This information gives effect to securities deemed outstanding pursuant to Rule 13d-3(d)(1) under the Securities Exchange Act of 1934, as amended (the "Exchange Act"). As far as is known, no person owns beneficially more than five percent of the outstanding shares of common stock as of June 24, 2022 except as set forth below. The percentage of beneficial ownership shown in the below table is based on 5,296,516 outstanding shares of common stock as of June 24, 2022.

Name of Beneficial Owner | Number of Shares Beneficially Owned | Percent of Class (1) | Notes |

Beneficial holders of 5% or more of outstanding common stock | |||

| BlackRock, Inc. | 920,887 | 17.4% | Based solely on a report on Schedule 13G/A filed on January 27, 2022. The address of BlackRock, Inc. is 55 East 52nd Street New York, NY 10055. |

| Conestoga Capital Advisors, LLC | 541,578 | 10.2% | Based solely on a report on Schedule 13G/A filed on January 10, 2022. The address of Conestoga Capital Advisors, LCC is 550 E. Swedesford Rd. Suite 120 Wayne, PA 19087. |

| The Vanguard Group | 337,028 | 6.4% | Based solely on a report on Schedule 13G/A filed on February 10, 2022. The address of The Vanguard Group is 100 Vanguard Blvd. Malvern, PA 19355 |

| Royce & Associates, LP | 342,738 | 6.5% | Based solely on a report on Schedule 13G/A filed on January 25, 2022. The address of Royce & Associates, LP is 745 Fifth Avenue, New York, NY 10151 |

| Invesco Ltd. | 275,652 | 5.2% | Based solely on a report on Schedule 13G/A filed on February 10, 2022. The address of Invesco Ltd. is 1555 Peachtree Street NE, Suite 1800, Atlanta, GA 30309 |

Directors and named executive officers | |||

| John J. Sullivan Ph.D. (2) | 73,794 | 1.4% | |

| Gary M. Owens | 55,538 | * | |

| John Sakys | 36,378 | * | |

| Greg DiNoia | 15,773 | * | |

| Brian Archbold | 4,104 | * | |

| John Schmieder | 73,976 | 1.4% | |

| Evan C. Guillemin | 34,770 | * | |

Jennifer Alltoft | 1,215 | * | |

Shannon M. Hall | 756 | * | |

| Shiraz S. Ladiwala | 405 | * | |

| Tony Tripeny | - | * | |

All executive officers and directors as a group (10 in number) | 296,709 | 5.5% |

| (1) | For purposes of calculating each person’s or group’s percentage ownership, shares of common stock issuable pursuant to the terms of stock options or restricted stock units exercisable or vesting within 60 days after June 24, 2022 are included as outstanding and beneficially owned for that person or group, but are not treated as outstanding for the purpose of computing the percentage ownership of any other person or group. |

| (2) | Includes 30,000 shares held indirectly through a trust. | |

* | Represents less than 1 percent of the outstanding Mesa Labs common stock. |

Section 16(a) Beneficial Ownership Reporting Compliance

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires our directors, executive officers and persons who own more than five percent of a registered class of our equity securities to file with the SEC initial reports of ownership and reports of changes in ownership of our common stock. Officers, directors and greater than five percent shareholders are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file. To our knowledge, for the years ended March 31, 2022 and March 31, 2021, all required reports were filed on a timely basis under Section 16(a) of the Exchange Act.

ELECTION OF DIRECTORS

THE BOARD OF DIRECTORS RECOMMENDS TO THE SHAREHOLDERS THAT THEY VOTE “FOR” THE ELECTION OF THE NOMINEES, NAMED BELOW.

At the Annual Meeting, seven directors are to be elected. Each of the seven director nominees elected at the Annual Meeting will commence their term at the end of the Annual Meeting. Their terms will expire at the next annual meeting of the Company’s shareholders, and when a successor has been elected and qualified, or until such director’s earlier resignation or removal.

Shares represented by properly executed proxies will be voted, in the absence of contrary indication or revocation by the shareholder granting such proxy, in favor of the election of the persons named below as directors. The person named as proxy in the enclosed proxy has been designated by management and intends to vote for the election to the Board of the persons named below, each of whom is now a director of the Company. If any such nominee is unable to serve as a director, it is intended that the shares represented by the proxies will be voted, in the absence of contrary indication, for any substitute nominee that the Nominating and Governance Committee may designate. Management knows of no reason why any nominee would be unable to serve. The information presented herein with respect to the nominees was obtained in part from the nominee and in part from the records of the Company.

Re-election of each nominee for director requires that such nominee receive a plurality of the votes cast FOR his or her election. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

Election of Directors

At the Annual Meeting, shareholders will vote on the seven nominees, all of whom are incumbent members of the Board. Each director nominee has consented to serve if elected.

There are no family relationships among our directors, or between our directors and executive officers.

The Board of Directors recommends a vote FOR the election of each of the director nominees.

Information about Board of Directors Nominees

The table below sets forth biographical information and qualifications for all of our director nominees and the positions held by each as of March 31, 2022. The age of each director is as of March 31, 2022. In addition to the specific qualifications, skills and experience described below, each incumbent director has demonstrated a strong work ethic and dedication to Mesa Labs, including coming prepared to meetings, supporting our strategic vision while asking constructive questions and challenging management in a productive way, and otherwise providing valuable oversight of our business on behalf of our shareholders. We also believe that each director, through their personal accomplishments and in their service to Mesa Labs, has demonstrated high integrity, strong intellectual acumen, solid business judgment, and strategic vision.

As shown below in our Board Diversity Matrix, two of our eight directors (25%) are females, one of our eight directors (13%) identified ethnic diversity, and one of our eight directors (13%) is LGBTQ+.

Board Diversity Matrix (As of July 14, 2022) | ||

Female | Male | |

Total Number of Directors | 8 | |

Part I: Gender Identity | ||

Directors | 2 | 6 |

Part II: Demographic Background | ||

Asian | 1 | |

White | 2 | 5 |

LGBTQ+ | 1 | |

Unless otherwise indicated, no director has held any other directorships for the past five years.

Directors Standing for Re-Election | ||

John J. Sullivan

Chairman of the Board of Directors

Age: 69

Director Since: 2009 | Background: | Qualifications: |

Gary M. Owens

President and Chief Executive Officer

Age: 54

Director Since: 2017 | Background: | Qualifications: |

John B. Schmieder

Director

Age: 53

Director Since: 2015 | Background: | Qualifications: Mr. Schmieder brings knowledge in finance, accounting, and a keen business expertise to our Board. |

Jennifer S. Alltoft

Director

Age: 53

Director Since: 2020 | Background: | Qualifications: |

Shannon M. Hall

Director

Age: 53

Director Since: 2020 | Background: | Qualifications: |

Shiraz S. Ladiwala

Director

Age: 56

Director Since: 2021 | Background: Shiraz Ladiwala was appointed as a director on September 1, 2021. During his 24 year career with Thermo Fisher Scientific, Mr. Ladiwala held various, progressive leadership roles in the areas of corporate strategy and development and business operations, including Senior Vice President of Strategy and Corporate Development and General Manager of Asia/ Pacific from 2013 until his retirement in August 2021. He received a bachelor’s degree in commerce from the University of Bombay and a Master of Business Administration from the University of Michigan Ross School of Business.

| Qualifications: Mr. Ladiwala has extensive experience building a world class life sciences company. He brings his significant corporate strategic development experience, extensive knowledge of the life sciences, bioproduction and diagnostics industries, and a background in international business operations. Mr. Ladiwala has a leadership style characterized by cultural adaptability, strong business acumen, and financial knowledge. |

Tony Tripeny

Director

Age: 63

Director Since: 2022 | Background: Tony Tripeny was appointed as a director on June 23, 2022. Throughout his 36 years with Corning, Incorporated, Mr. Tripeny held various, progressive leadership roles in the areas of corporate accounting and finance, including Senior Vice President, Corporate Controller and Principal Accounting Officer and was appointed Executive Vice President, Chief Financial Officer in 2018, prior to his retirement in May 2022. He received a bachelor’s degree in economics from the University of Pennsylvania’s Wharton School of Business. | Qualifications: Mr. Tripeny has significant corporate accounting and finance experience, extensive knowledge of the manufacturing, engineering, and life sciences industries, as well as expertise in international financial operations. |

Director Nomination Process

In evaluating potential director candidates, the Nominating and Governance Committee considers the appropriate balance of experience, skills and characteristics required of the Board, and seeks to ensure that at least a majority of the directors are independent under the applicable Nasdaq rules. The Nominating and Governance Committee selects director nominees based on their personal and professional integrity, depth and breadth of relevant professional accomplishments, expertise relevant to our growth strategy, ability to make independent analytical inquiries, understanding of our business, willingness to devote adequate attention and time to duties of the Board, and such other criteria as are deemed relevant by the Nominating and Governance Committee. The Board may retain an executive recruiting firm to assist in identifying, evaluating and conducting due diligence on potential director candidates. Consistent with the policy of the Company, the Nominating and Governance Committee will strive to develop a Board that is diverse and inclusive regarding gender, race and ethnicity. The Board is committed to actively seeking to include highly qualified women and individuals from minority groups in the pool from which new director candidates are selected. Each recruiting firm retained by the Board is instructed to specifically focus on identifying candidates who, in addition to having particular skills and experience, also would add to the diversity of the Board. In identifying potential director candidates, the Nominating and Governance Committee may rely on recommendations made by current directors and officers. Additionally, the Nominating and Governance Committee will consider candidates recommended by shareholders on the same basis as candidates recommended by other parties. The Nominating and Governance Committee believes that the backgrounds and qualifications of the directors, considered as a group, should provide a diverse mix of experience, knowledge, and skills.

CORPORATE GOVERNANCE AND BOARD COMMITTEES

The Board of Directors and management regularly review best practices in corporate governance and modify our corporate governance policies and practices as warranted.

Governance at Mesa | |

Board Functions and Responsibilities | ● Mesa's corporate powers are exercised by or under the authority of, and the business and affairs of the corporation managed under the direction of, the Board of Directors. The Board oversees the CEO and the other senior management in the competent and ethical operation of Mesa and assures that the long-term interests of shareholders are being served. ● The Board, with the assistance of management, reviews corporate strategies and establishes broad corporate policies, although it is not generally involved in day-to-day operating details. ● The Board meets regularly throughout the year to review significant developments affecting the Company and to act upon matters requiring Board approval. It also holds special meetings as required from time to time when important matters arise. |

Board Independence | ● Under applicable Nasdaq requirements, we are required to have a majority of independent directors, and all of the members of the Audit Committee, the Compensation Committee, and the Nominating and Governance Committee must be independent. ● The Board has affirmatively determined that each of the following individuals who served on the Board during fiscal year 2022 is an “independent director” as such term is defined in Nasdaq Listing Rule 5605: David M. Kelly, John B. Schmieder, Evan C. Guillemin, Jennifer S. Alltoft, Shannon M. Hall, Shiraz S. Ladiwala, and R. Tony Tripeny. Dr. Sullivan was a Mesa employee within the last three years and therefore is not "independent." ● The Board has also affirmatively determined that each member of each standing committee of the Board is independent. ● Our Board reviews the independence of our directors to determine whether any relationships, transactions or arrangements involving any director or any family member or affiliate of a director may be deemed to compromise the director’s independence from us. Based on that review, the Board determined that none of our directors has any relationships, transactions or arrangements that would compromise his or her independence. Mr. Owens is not an “independent director” because he is our employee; Dr. Sullivan is not an "independent director" because he was an employee of Mesa until January 1, 2021. ● There are no family relationships among the Named Executive Officers (“NEOs”), directors or any person chosen to become a director or executive officer. |

| Board Diversity | ● The Board is committed to maintaining a suite of directors who bring a wide array of qualifications, skills and attributes to our Board. ● The Board believes that its membership should reflect a diversity of experience, gender, race, ethnicity, and age. |

Lead Independent Director | ● In the event the Board Chair is not an independent director, the independent directors may choose to elect, by majority vote, a “Lead Independent Director.” We previously had, but do not currently have, a Lead Independent Director. |

Active Board Refreshment | ● Directors terms are not staggered: Directors are elected at each Annual Meeting and serve a until the next Annual Meeting and a successor is duly elected and qualified or their earlier resignation or removal. ● 50% of the director nominees have joined the Board within the last five years. ● We have a balanced mix of short- and long-tenured non-executive directors, with an average director tenure of 6 years. |

No Overboarding | ● None of our directors have commitments on other Boards that would interfere with their ability to provide their full attention to the affairs of our Board. ● Currently, four of our directors serve on no other boards, and two of our directors serve on one other board (all private companies). |

Risk Management | ● It is a key responsibility of the members of our senior management team to identify, assess and manage the Company’s exposure to risk. ● Our Board provides oversight of the risk management process and monitors our overall risk profile. In its risk oversight role, our Board has the responsibility to satisfy itself that the risk management processes designed and implemented by management are appropriate and functioning as designed. ● The Board receives frequent reports from management of our financial performance, changes in and composition of consolidated balance sheet accounts, quality assurance program effectiveness, enterprise risk management, product liability risks and status of relationships with all business constituencies including customers, employees, suppliers and government entities. ● The Board routinely reviews our material litigation threats, product/market strategies, and operational activities. ● Board committees assist the Board in fulfilling its oversight responsibilities in certain areas of risk, including environmental, social, and governance ("ESG") oversight, which is the primarily the responsibility of the Nominating and Governance Committee. ● Our Audit Committee assists our Board in fulfilling its oversight responsibilities with respect to risk management in the following areas: ◦oversees legal and regulatory compliance; ◦discusses with management and the independent auditors guidelines and policies with respect to risk assessment and risk management; ◦reviews our major financial risk exposures and the steps management has taken to monitor and control these exposures; ◦monitors certain key risks on a regular basis throughout the fiscal year, such as risk associated with internal control over financial reporting and liquidity risk; ◦ monitors compliance with disclosure controls and procedures; and ◦established and maintains an anonymous whistleblower hotline to encourage early reporting of accounting irregularities or other violations of our codes of ethics. ● We also have a separate independent hotline that employees can call administered by Employers Council. |

Minimum Equity Ownership Guidelines | ● Within five years after his/her first election to the Board, each non-employee director must acquire and continue to own shares of the Company's common stock with a minimum then-current market value of at least three times the director's total annual compensation. |

Board Self-Evaluation | ● The Board conducts an annual self-assessment process coordinated by the Nominating and Governance Committee, including individual director assessments. |

Accountability | ● The Board met seven times during fiscal year 2022. Each director attended all of the Board meetings, and at least 75% of the regular and special meetings of the committees on which they serve, either in person or telephonically. ● Directors are required to prepare for each meeting by reviewing materials distributed in advance. ● In fiscal year 2021, our Board adopted Governance Guidelines. These principles address items such as the qualifications and responsibilities of our directors and director candidates and corporate governance policies and standards applicable to us in general. ● We do not have a shareholder rights plan / poison pill. |

Succession Planning | ● The Board of Directors has primary responsibility for executive succession planning, while the Nominating and Governance Committee, in conjunction with the Board Chair, is responsible for Board member succession planning. |

Director Orientation and Development | ● Orientation and training programs are established for new directors to familiarize them with Mesa's products, markets, and organization, along with corporate governance issues. ● Additional training is provided for directors in leadership roles. ● A continuing education program for all directors has been established to keep Board members abreast of best practices in corporate governance and emerging business trends. |

Code of Ethics | ● We have a Code of Business Conduct and Ethics (the “Code of Ethics”) that applies to all of our employees and directors. ● The Code of Ethics contains written standards that are designed to deter wrongdoing and includes provisions regarding ethical conduct, conflicts of interest, proper disclosure in all public communications, compliance with all applicable governmental laws, rules and regulations, and the prompt reporting of violations of the Code of Ethics and accountability for adherence to the Code of Ethics. ● A copy of the Code of Ethics is available on our website at https://investors.mesalabs.com/governance. ● Based on information submitted by the directors and executive officers, none of our directors or executive officers is involved in, or has been involved in, legal proceedings during the past ten years that are material to an evaluation of the ability or integrity of any such director or executive officer. |

Corporate Sustainability

Our quality control and calibration products and solutions are used globally to protect the integrity of processes and ensure safety. By delivering the highest caliber products and services possible to a broad range of industries and applications, we are committed to protecting society and individuals. In alignment with the value we bring to our customers, we believe that conducting our business by sustaining the environment, supporting our local communities, embracing diversity and inclusion, and adhering to a strong culture of compliance and ethics will positively impact our customers, stockholders, employees, community, and the environment. The following highlights some ESG accomplishments and initiatives.

Our Commitment to ESG |

Manufacturing Quality Health and Safety | ● Our manufacturing facilities are certified to the ISO 13485 or ISO/IEC 17025 standards. | ||||

Strategy Planning | ● Management develops and maintains a robust strategic planning process including corporate development. ● The Board provides input and approves management's strategic development plans and regularly reviews progress against strategic plans as well as overseeing financial outcomes. | ||||

Health and Safety | ● We are committed to employee safety and health with our safety management program, safety training, and policies for handling hazardous materials. ● Safety is a key performance indicator which is discussed during daily meetings by manufacturing employees. We develop and enforce preventative safety measures. ● In the current COVID-19 environment, we have taken additional steps to ensure the safety of all employees and at times during the fiscal year, based on health and safety recommendations from local and federal authorities, have enforced appropriate measures as necessary at each of our physical locations. | ||||

| Environmental Sustainability | ● Our operations largely consist of light assembly and calibration of instruments which inherently results in a relatively low carbon output across our facilities. ● We undertook renovations to our Lakewood, Colorado facility over the past two fiscal years and are in the process of planning to move into a new, environmentally-conscious, leased space in Uppsala, Sweden. We plan to select environmentally-conscious options, including energy efficient LED lighting, energy efficient windows, and high efficiency sanitary equipment. ● We continuously evaluate our energy consumption in all of our facilities and pursue options to reduce our environmental impact through reduced energy consumption, including sourcing carbon free energy in our Uppsala, Sweden facility. ● We offer hybrid and fully-remote options to most of our commercial, product development, and administrative positions, reducing the environmental impact of employees commuting to the nearest office. ● We have evaluated energy consumption in our facilities and utilize our continuous improvement approach, The Mesa Way, to review opportunities to reduce our environmental impact as a regular part of our improvement initiatives. ● All of our facilities have recycling programs to further reduce waste and limit our negative impact on the environment. | ||||

Diversity and Inclusion | ● We are committed to fostering and promoting a globally diverse, inclusive, and fully participative work environment where all sources of talent and ideas for improvement are equally valued and engaged. ● We are dedicated to the principles of equal employment opportunity. We prohibit unlawful discrimination against applicants or employees extending our policies and protections beyond those statutorily required. ● Our management is dedicated to ensuring the fulfillment of these policies with respect to hiring, placement, promotion, transfer, demotion, layoff, termination, recruitment advertising, pay (and other forms of compensation), training, and general treatment during employment. ● Two directors are female and one is LGBTQ+, together representing 43% of the non-executive board of director nominees. ● We require recruiters working with us to present candidates in the spirit of diversity and inclusion. | ||||

Employee Engagement | ● As part of The Mesa Way, We Always Learn. We ensure that improvements are sustained, enabling us to raise performance expectations and repeat the cycle of improvement. This strengthens our team by providing continual learning opportunities for our employees and helps us to become an employer of choice in our communities. ● Employee-led and company-sanctioned groups of those who share similar interests that also promote ESG goals including exercise groups and an annual victory garden contest. ● We utilize employee survey tools to solicit feedback on topics related to our culture and other drivers of engagements (recognition, leadership, etc.). Feedback received is discussed by the executive staff team and action plans are created to respond to feedback where appropriate. ● For the fiscal year ending March 31, 2023 ("fiscal year 2023"), we plan to continue to expand our internal training, professional development and employee engagement programs. | ||||

Community Investment and Engagement | ● We have an employee-led culture committee that includes representation from employees of all levels and across several Mesa locations. In fiscal year 2022, the culture committee engaged in local giveback and community efforts including, among the initiatives, making and donating masks and face shields using our 3-D printers, and donating to food banks. ● Our Bozeman facility contracts with Reach, Inc. to employ adults with developmental disabilities to reprocess our MIST media tubes by emptying them out and cleaning them. In addition to supporting the community, this avoids disposing of the glass vials. | ||||

Data Security and Privacy | ● We maintain privacy policies, management oversight, accountability structures and technology processes designed to protect privacy and personal data. ● We maintain a data security program, including regular reports to the Board. | ||||

| ESG Governance | ● A cross-functional working group formed in fiscal year 2022 is comprised of members of the Board and management to spearhead ESG planning, strategy, and execution. ● Our Nominating and Governance Committee has primary Board responsibility for oversight of our ESG program. ● Strong focus on corporate governance with best practices in corporate governance (see Governance at Mesa on page 8). | ||||

Executive Sessions

Our independent directors met in executive session without management present at the end of each regularly-scheduled Board meeting during fiscal year 2022. At regularly scheduled meetings of the Audit Committee, executive sessions are held at the end of each meeting, with only the Committee members or the Committee members and their advisors present, to discuss any topics the Committee members deem necessary or appropriate. The Compensation Committee meets frequently without any members of management present.

Committees of the Board of Directors

Our Board has three standing committees: (1) the Audit Committee, (2) the Compensation Committee, and (3) the Nominating and Corporate Governance Committee, each composed entirely of persons the Board has determined to be independent as described above. Each Committee operates pursuant to a written charter (which is reviewed annually and reassessed for adequacy) adopted by our Board, which sets forth the Committee’s role and responsibilities and provides for an annual evaluation of its performance. The charters of all three standing committees are available on the Investors page of our corporate website at https://investors.mesalabs.com/governance. In addition to the committees mentioned above, the Board may convene special committees to consider various other matters as they arise.

Audit Committee

Pursuant to its charter, the Audit Committee assists the Board in overseeing (i) the financial statements and audits of the Company, (ii) our compliance with financial reporting requirements, (iii) the independence and performance of our internal and external auditors, (iv) the integrity of our financial statements and systems of internal control, and (v) implementation and effectiveness of our disclosure controls and procedures. The committee also acts to ensure open lines of communication among our independent auditors, accountants, internal audit function and financial management. The Audit Committee charter further requires the Audit Committee to, among other things:

| ● | Review the annual audited consolidated financial statements with management and the independent auditors and determine whether to recommend to the Board that they be included in our Annual Report on Form 10-K; | |

| ● | Review proposed major changes to our auditing and accounting principles and practices; | |

| ● | Review and evaluate our system of internal control; | |

| ● | Review significant financial reporting issues raised by management or the independent auditors; | |

| ● | Approve the compensation of the independent auditors for annual audit and quarterly review work, and pre-approve audit and permitted non-audit services provided by our independent auditors; | |

| ● | Review the qualifications, independence and performance of the independent auditors, who report directly to the Audit Committee; | |

| ● | Review quarterly earnings releases and financial statements; and | |

| ● | Establish procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters as well as the confidential and anonymous submission by our employees of concerns regarding questionable accounting or auditing matters. |

In performing its functions, the Audit Committee acts only in an oversight capacity and necessarily relies on the work and assurance of the Company's management and independent auditors which, in their reports, express opinions on the fair presentation of the Company's financial statements and the effectiveness of the Company's internal control over financial reporting. The Committee regularly holds executive sessions with the audit partner for continued assessment of the performance, effectiveness and independence of the independent audit firm.

The Audit Committee held four meetings during fiscal year 2022. The members of the Audit Committee are Messrs. Guillemin (Chairperson) and Schmieder and Ms. Alltoft. Messrs. Guillemin and Schmieder and Ms. Alltoft were present at each meeting held. Our Board has determined that each is “independent” for audit committee purposes as that term is defined by the rules of the SEC and Nasdaq, and that each has sufficient knowledge of financial and auditing matters to serve on the audit committee. Our board of directors has designated Mr. Evan Guillemin as an “audit committee financial expert,” as defined under the applicable rules of the SEC.

Compensation Committee

Pursuant to its charter, the Compensation Committee assists the Board in fulfilling its oversight responsibilities over the compensation of executive officers and administration of our compensation and benefit plans. In accordance with its charter, the Compensation Committee determines the compensation of our Chief Executive Officer based on an evaluation of his performance, and approves the compensation level of our other executive officers following an evaluation of their performance and recommendation by the Chief Executive Officer. The Compensation Committee met seven times during fiscal year 2022. Six of the seven meetings were attended by all members of the committee.

The Compensation Committee charter also grants the Compensation Committee the authority to: review and make recommendations to the Board with respect to the establishment of any new incentive compensation and equity-based plans; review and approve the terms of written employment agreements and post-service arrangements for executive officers; recommend compensation to be paid to our outside directors; review disclosures to be filed with the SEC and distributed to our shareholders regarding executive compensation and recommend to the Board the filing of such disclosures; assist the Board with its functions relating to our compensation and benefits programs generally; and other administrative matters with regard to our compensation programs and policies. The Compensation Committee may delegate any of its functions and powers to its subcommittees or the Chief Executive Officer or any other executive officer or employee of the Company if the Compensation Committee determines that such delegation is necessary or appropriate, unless such delegation would be contrary to the intent of the Board, our Bylaws or Articles of Incorporation, or applicable law or Nasdaq rules.

The Compensation Committee has also been appointed by the Board to administer the Mesa Laboratories, Inc. 2021 Equity Plan (the "2021 Equity Plan”) and to make awards under the 2021 Equity Plan, including as described below under the heading "Compensation Discussion and Analysis." The Compensation Committee has for several years, including in fiscal year 2022, delegated its authority under the plan to our Chief Executive Officer to make grants to non-executive officer level employees, within limitations specified by the committee.

The Compensation Committee retained Pay Governance LLC (“Pay Governance”), an independent executive compensation consulting firm, to provide the Compensation Committee with advice regarding compensation matters for fiscal year 2022. All of the fees paid to Pay Governance were in connection with the firm’s work on executive compensation matters on behalf of the Compensation Committee; no fees were paid to the firm for any other work. Pay Governance was retained with the Compensation Committee, and the committee determined that the firm’s service to Mesa did not and does not give rise to any conflict of interest, and considers Pay Governance to have sufficient independence from our Company and executive officers to allow it to offer objective advice.

The Board has determined that each member of the committee qualifies as a “Non-Employee Director” under SEC Rule 16b-3 and as an “Outside Director” under Section 162(m) of the Internal Revenue Code. Our Chief Executive Officer and/or other officers, upon request, may attend selected meetings of the Compensation Committee. No member of the Compensation Committee nor any organization of which any member of the committee is an officer or director received any payments from us fiscal year 2022, other than the payments disclosed under the heading “– Director Compensation” below.

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee as of the end of fiscal year 2022 were Ms. Hall (Chairperson) and Messrs. Guilleman, Kelly, and Ladiwala. No member of the Compensation Committee was, during fiscal year 2022, a Mesa officer or employee or had a business relationship with or conducted any transactions with us that are required to be disclosed under Item 404 of SEC Regulation S-K, and no such member has ever served as an officer at Mesa. During fiscal year 2022, none of our executive officers served as a director or member of the compensation committee (or other committee serving an equivalent function) of any other entity whose executive officers served on our Compensation Committee or the Board.

Nominating and Governance Committee

The Nominating and Governance Committee assists the Board in identifying qualified individuals to become members of the Board, oversees, reviews and where appropriate, makes recommendations concerning the Company’s corporate governance guidelines, and conducts an annual self-assessment of the Board performance. The Nominating and Governance Committee met two times during fiscal year 2022. The members of the Nominating and Governance Committee during fiscal year 2022 were Mr. Schmieder (Chairperson), Ms. Alltoft, and Ms. Hall.

How to Contact the Board of Directors

Shareholders and other interested parties may communicate with one or more members of the Board of Directors by writing to all or any of the following: Audit Committee Chairman, Compensation Committee Chairman or Nominating and Governance Committee Chairman, c/o Corporate Secretary, Mesa Laboratories, Inc., 12100 West Sixth Avenue, Lakewood, CO 80228.

The following table reflects the compensation program for our directors, which was approved by the Board during fiscal year 2022 upon a recommendation from the Compensation Committee.

Non-Employee Director Compensation | Retainer (1) | Annual Restricted Stock Units (2) | ||||||

Annual Director Retainer: | $ | 50,000 | $ | 115,000 | ||||

Committee Chair Retainer: | ||||||||

Audit | 10,000 | - | ||||||

Compensation | 10,000 | - | ||||||

Nominating and Governance | 10,000 | - | ||||||

Chairperson of the Board | 45,000 | - | ||||||

(1) | Retainers have historically been paid quarterly in cash, with total annual payments as follows: $50,000 annual director retainer; $10,000 for chair of audit, compensation or nominating and governance committee; and $45,000 for chairperson of the board. Dr. Sullivan elected to receive cash for his retained in the first quarter of fiscal year 2022 and RSUs in lieu of cash for the second, third, and fourth quarter of fiscaly year 2022. Mr. Ladiwala elected to receive his retainer in the form of RSUs for fiscal year 2022. Due to uncertainty related to COVID-19 the Compensation Committee proposed, and the Board of Directors approved, that all of the Board compensation for August 2021 through May 2022 would be issued in the form of RSUs, including all retainers. Historically, including in fiscal year 2022, RSUs valued at $115,000 have been granted in addition to retainers. | |

(2) | RSUs represents the right to receive shares of our common stock upon vesting. RSUs are granted to non-employee directors annually. The number of shares subject to the award is based on the closing price of our common stock on the grant date, less the present value of dividends expected to be paid during the vesting period. The awards typically vest in full on the first anniversary of the grant date. |

The Compensation Committee of the Board reviews and makes recommendations to the Board on compensation provided to non-employee directors at least annually, as required by its charter. In fiscal year 2022, the retainer for the Chariman of the Board of Directors was increased from $20,000 per year to $45,000 per year. The Compensation Committee of the Board of Directors elected to increase the retainer for the Chairman of the Board position to be in line with what peer companies pay for the position. Directors who are full time employees of Mesa Labs do not receive compensation for their services as directors. Directors are also reimbursed for expenses incurred in connection with their service as directors, including travel expenses for Board and committee meetings.

The compensation paid to each non-employee director who served during fiscal year 2022 is set forth below.

Name | Fees Earned or Paid in Cash ($) | Stock Awards ($) (1) | All Other Compensation ($) | Total ($) | ||||||||||||

(a) | (b) | (c) | (g) | (h) | ||||||||||||

John Sullivan | 17,500 | 210,200 | - | 227,700 | ||||||||||||

Evan C. Guillemin | 60,000 | 115,116 | - | 175,116 | ||||||||||||

John Schmieder | 60,000 | 115,116 | - | 175,116 | ||||||||||||

David M. Kelly (2) | 57,500 | 115,116 | - | 172,616 | ||||||||||||

Jennifer S. Alltoft | 50,000 | 115,116 | - | 165,116 | ||||||||||||

Shannon M. Hall | 52,500 | 115,116 | - | 167,616 | ||||||||||||

Shiraz S. Ladiwala | - | 124,230 | - | 124,230 | ||||||||||||

(1) | Reflects the grant date fair value under FASB Topic 718 of RSUs awarded to each director. Each of Dr. Sullivan, Messrs. Guillemin, Schmeider, Kelly, and Mses. Alltoft and Hall received an annual non-employee director RSU award covering 431 shares on September 1, 2021. In addition, Dr. Sullivan's retainer for Board participation for the second, third, and fourth quarter of fiscal year 2022 was also paid in the form of 356 RSUs, which were awarded on September 1, 2021. The grant date fair value of those RSUs was $267.09 per unit, the closing price of our stock on September 1, 2021, less the present value of expected dividends not received during the vesting period. Mr. Ladiwala received an annual non-employee director RSU award covering 282 shares on November 15, 2021. In addition, Mr. Ladiwala's retainer for Board participation was paid in the form of 123 RSUs, which were awarded on November 15, 2021. The grant date fair value of those RSUs was $306.74 per unit, the closing price of our stock on November 15, 2021, less the present value of expected dividends not received during the vesting period. The RSUs awarded on September 1, 2021 vest on the first anniversary of the grant date, and the awards granted on November 15, 2021 vest on August 15, 2022, subject to the director’s continued service as a director through the vesting date. As of March 31, 2022, Dr. Sullivan held 847 unvested RSUs, Messrs. Guillemin, Kelly, and Schmieder, each held 491 unvested RSUs, Mses. Alltoft and Hall each held 431 unvested RSUs, and Mr. Ladiwala held 405 unvested RSUs. | |

| (2) | Mr. Kelly retired from the Board effective April 3, 2022 and will retain the director RSU award granted September 1, 2021, which will continue to vest on the original schedule according to the retiree provisions of the 2021 Equity Plan. | |

Note: | No stock options were granted to members of the Board of Directors during fiscal year 2022. The aggregate number of options held by each director from previous years' grants as of March 31, 2022 was as follows: |

Name of Director | Aggregate Number of Stock Options Owned as of March 31, 2022 |

John Sullivan (a) | 25,219 |

Evan C. Guillemin | 2,770 |

John B. Schmieder | 2,021 |

David M. Kelly | 569 |

| Shannon Hall | - |

| Jennifer S. Alltoft | - |

| Shiraz S. Ladiwala | - |

(a) | Dr. Sullivan was awarded 450 stock options as a director, with the remainder awarded as an employee of Mesa. |

Stock Ownership Guidelines

During fiscal year 2021, we adopted stock ownership guidelines that state that within five years after their first election to the Board, each non-employee director shall acquire and continue to own, at a minimum, a number of shares of Company common stock having a then-current market value of at least three times the director's current total annual retainer. Each of Dr. Sullivan and Messrs. Evan Guillemin, Schmieder, and Kelly met the stock ownership guidelines in fiscal 2022, while each of the remaining directors were still in their grace period.

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis describes the objectives and principles underlying our executive compensation programs, outlines the material elements of the compensation of our executive officers, and explains the Compensation Committee’s determinations as to the actual compensation of our executive officers for fiscal year 2022. In addition, this Compensation Discussion and Analysis is intended to put into perspective the tables and related narratives regarding the compensation of our named executive officers that appear following this section.

Named Executive Officers

In addition to Gary Owens, our Chief Executive Officer, whose biography is included in the Nominees for Director section above, our executive officers as of March 31, 2022 were as follows:

Information about our Executive Officers | |

John Sakys | |

Greg DiNoia | |

Brian Archbold

Senior Vice President of Continuous Improvement

| |

Compensation Philosophy

The Compensation Committee directly supervises our executive compensation program for our named executive officers identified above (our "NEOs"). The Compensation Committee has designed a compensation program for NEOs to attract, retain and motivate talent in our competitive market environment while focusing the executive team and the Company on the creation of long-term value for our shareholders. The Compensation Committee has the authority to engage outside consultants or purchase compensation surveys, if needed, for evaluation of executive compensation levels.

We have designed our compensation programs for our NEOs to:

● | attract and retain high performing and experienced executives; | |

● | motivate and reward executives whose knowledge, skills and performance are critical to our success; | |

| ● | be performance based, with variable pay constituting a significant portion of total compensation; | |

● | align the interests of our executives and shareholders by motivating executives to increase shareholder value; | |

● | foster a shared commitment among executives by coordinating their goals; | |

| ● | avoid incentive compensation designs that may lead to excessive risk taking; | |

| ● | be competitive with companies in our peer group; and | |

● | motivate our executives to manage our business to meet our short-term and long-term objectives and reward them for meeting these objectives. |

The Committee also believes it must maintain flexibility in establishing compensation practices to allow it to address compensation trends, competitive issues, business needs, industry and the broader economic environment, and special situations that will be encountered in the recruitment, retention, and promotion of employees. Therefore, the compensation practices approved by the Committee will likely vary from year to year and from person to person, depending on the particular circumstances.

Components of Compensation

Our executive compensation program is comprised of three primary components:

Base Salary |

Short-Term Incentive Plan (Annual Cash Bonus) | Equity Compensation (Stock Options, Performance Share Units, Restricted Stock Units) | ||||

Role in Total Compensation | Provides fixed compensation and helps attract and retain executive talent. | Rewards our executives based on their performance relative to the Company’s annual key performance metrics and individual performance goals. | Aligns the incentives for our executive officers with the interests of our shareholders and rewards our executives for creating shareholder value. | |||

Determination | Determined based on the importance of the executive’s position within the Company, the experience of the executive, and external market data. | Determined under our Company’s management bonus plan, which provides for target bonus amounts based on external market data approved by the Compensation Committee, and with actual payouts based on achievement against revenues and profit growth goals established by the Compensation Committee at the beginning of each year, adjusted for individual performance. | Number and type of awards is determined based on the executive’s position within the Company, external market data, and individual performance. |

The total compensation package reflects our “Pay for Performance” philosophy, which couples employee rewards with the interests of our shareholders. We believe strongly that retention and motivation of successful employees is in the long-term interest of our shareholders.

2022 Compensation Actions

Below are some of the changes to executive compensation for fiscal year 2022:

Individual Executive Performance

Cash payment under the short-term incentive plan was adjusted based on each executive's performance against their individual goals, including the CEO.

Long-Term Incentive Awards

Long-term equity compensation was made in the form of stock options, PSUs, and RSUs for fiscal year 2022. Our CEO received 74% of his equity compensation in PSUs, 18% in RSUs, and 9% in stock options, while our other NEOs received 65% of their equity compensation in RSUs and 35% in stock options. The vesting period for stock options is a three year graded vesting term.

Company Performance Overview for the Fiscal Year Ended March 31, 2022

Our Company made significant progress toward our long-term goals during fiscal year 2022:

● | We continued to develop and implement The Mesa Way, which is our customer-centric, lean-based system for continuously improving and operating a set of high-margin, niche businesses. | |

| ● | We acquired Agena Bioscience, Inc., the largest acquisition in our company’s history, on October 20, 2021. | |

● | Revenues increased 38% to $184.3 million, the highest in our Company’s history. | |

● | Non-GAAP adjusted operating income (“AOI”)(1) increased 5% to $37.9 million. | |

● | Organic revenues growth increased 13%. | |

| ● | We achieved 74% gross profit as a percentage of revenues in our Sterilization and Disinfection Control division, our largest reportable segment. |

(1) | AOI, or adjusted operating income, is a non-GAAP measure defined as operating income plus the non-cash impact of amortization of intangible assets acquired in a business combination, and stock-based compensation. AOI for the fiscal years ended March 31, 2022 and 2021 was calculated as follows: |

Year Ended | ||||||||||

March 31, | ||||||||||

2022 | 2021 | |||||||||

Operating income (GAAP) | $ | 4,702 | $ | 12,358 | ||||||

Amortization of intangible assets acquired in a business combination | 21,806 | 14,513 | ||||||||

Stock-based compensation expense | 11,391 | 9,268 | ||||||||

Adjusted operating income (non-GAAP) | $ | 37,899 | $ | 36,139 | ||||||

Compensation Best Practices

We believe our executive compensation program is competitive, is aligned with current governance trends, and contains stockholder-friendly features as outlined below:

● | Pay for Performance – A significant portion of our NEO pay is performance-based. | |

● | No golden parachute excise tax gross-ups. | |

● | All members of the Compensation Committee are independent directors. | |

● | We use external benchmarking for compensation decisions. | |

● | We use independent compensation consultants where appropriate. | |

● | No executive-only retirement plans. | |

● | No excessive executive perks. |

Setting Executive Officer Compensation

The Compensation Committee researches compensation levels by investigating compensation data from comparable companies, purchasing third party compensation surveys or engaging compensation consultants. For fiscal year 2022, the data used was provided by Pay Governance. The acquired data is evaluated by the Compensation Committee and is one factor used to establish compensation plans for our NEOs, in addition to discussions with representatives from Pay Governance. Compensation decisions for the upcoming fiscal year are typically made at a meeting of the Compensation Committee shortly after the end of each fiscal year. Once final financial and operational results for the year are available, the Compensation Committee is able to assess the performance of the NEOs.

Benchmarking

To help establish competitive compensation levels, the Compensation Committee examined executive compensation survey data from Pay Governance, including base salaries, short-term and long-term incentive compensation, and total cash compensation. The survey data was tailored to include only those U.S. public companies in the medical equipment and device and life science tools and diagnostics segments with revenues averaging approximately $200 million per year. This included companies that produce both medical devices and general electronic instruments, along with consumable supplies. The data from this analysis was used by the Compensation Committee as one factor in determining compensation levels for base salary and total compensation.

Compensation benchmarking also takes into account compensation data disclosed in the peers’ proxy statements. Based on Pay Governance's recommendation, the Compensation Committee used the following peer group for fiscal year 2022 compensation decisions:

| ● | Azenta, Inc. | |

| ● | Bio-Techne Corporation | |

● | Cardiovascular Systems, Inc. | |

● | Cryoport, Inc. | |

| ● | Haemonetics Corporation | |

● | Heska | |

● | Ligand Pharmaceuticals Icorporated | |

● | Meridian Bioscience, Inc. | |

● | NEOGEN | |

● | NeoGenomics, Inc. | |

● | Repligen Corporation |

Determination of Target Compensation

The Compensation Committee targets total compensation levels to be competitive with comparable companies in terms of size (as measured by revenues and market capitalization), our industry segments and geographic locations. However, we do not target compensation at a specific percentile level.

The Compensation Committee’s consideration of the primary elements of compensation (base salary, Short-Term Incentive Plan, and equity compensation) for all NEOs is based upon a combination of common criteria and measures applicable to all of the officers, as well as individual goals and objectives applicable specifically to each officer. For fiscal 2022, the Compensation Committee considered and applied a number of measures to evaluate the named executive officers, including:

● | Consolidated Company financial performance; |

● | Prior individual performance and compensation; |

● | The complexity and scope of the responsibilities of the NEO’s position, as well as any changes to such responsibilities; |

● | The NEO’s overall experience, as well as experience at Mesa Labs; |

● | Market and survey data provided by our compensation consultant; |

● | In the case of the CEO, the Committee’s evaluation of individual performance; |

● | In the case of the other NEOs, the CEO’s assessment and recommendations regarding individual performance. |

As CEO, Mr. Owens has the broadest complexity and scope of responsibilities, as he oversees all aspects of our operations. Our other NEOs report directly to Mr. Owens. Individual performance against performance targets will vary among the NEOs.

Individual goals and objectives varied for each named executive officer based on his area of responsibility. Although these goals and objectives are all considered important, they are not assigned any particular weight for incentive compensation purposes. In fiscal year 2022:

● | Mr. Owens’ individual goals and objectives related to acquisitions, integration of past acquisitions, legal and regulatory compliance, customer relations, product quality, employee relations and retention, organizational development, safety performance, process improvement, investor relations, revenues and adjusted operating income growth. |

● | Mr. Sakys’ individual goals and objectives related to financial reporting and compliance, working capital initiatives, financing initiatives, investor relations, cost management, regulatory compliance, acquisitions integration, employee relations and retention, business strategy initiatives, and revenues and adjusted operating income growth. |

● | Mr. DiNoia’s individual goals and objectives related to bookings growth, establishment of commercial presence with respect to acquisitions, business unit financial performance, business unit organizational leadership, customer relations, employee relations and retention, new product introductions, quality leadership, and revenues and adjusted operating income growth. |

● | Mr. Archbold’s individual goals and objectives related to acquisitions and divestitures and integration, supply chain continuity, business unit financial performance, business unit organizational leadership, customer relations, employee relations and retention, service quality leadership, and revenues and adjusted operating income growth. |

The Compensation Committee believes that our underlying executive compensation program appropriately reflects annual financial performance and rewards and motivates behaviors that can create long-term shareholder value. For fiscal year 2022, the Compensation Committee evaluated the performance of the named executive officers, applying in each case the common criteria and measures and individual goals and objectives described above, as well as the Company’s actual performance against the targeted financial performance for payment of incentive compensation, making adjustments at its discretion. As a result, the Committee approved the fiscal year 2022 compensation described in the following pages for each of the named executive officers.

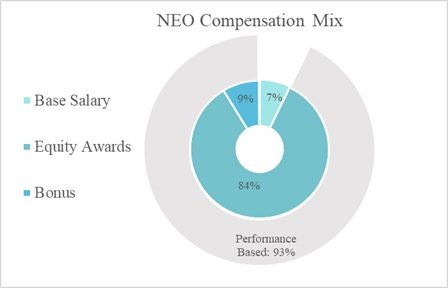

Compensation Mix

The following chart illustrates our "Pay for Performance" philosophy, which heavily weights targeted compensation toward performance-based pay elements.

Base Salaries

We pay a base salary to compensate our executive officers for services rendered during the year and to provide them with income regardless of our stock price performance, which helps avoid incentives to create short-term stock price fluctuations and mitigates the impact of forces beyond our control such as general economic and stock market conditions.

As of March 31, 2022, the annualized base salary of each of our NEOs was as follows:

Executive | 2021 Cash Base Salary (as of March 31, 2021) | 2021 Grant Date Fair Value of RSU Salary Replacement (As of March 31, 2021)(1) | 2021 Total Salary (as of March 31, 2021) | 2022 Cash Base Salary (as of March 31, 2022) | 2021 to 2022 Increase Salary (2) |

Gary Owens | $510,000 | $90,211 | $600,211 | $620,000 | 3% |

John Sakys | $336,600 | $37,428 | $374,028 | $390,000 | 4% |

Greg DiNoia | $307,156 | $34,330 | $341,486 | $341,285 | - |

| Brian Archbold | $250,614 | $27,977 | $278,591 | $320,000 | 15% |

(1) | Fiscal year 2021 NEO cash salaries were temporarily reduced from fiscal year 2020 and substituted with RSUs in the percentage amounts as follows, as one element of the Company's preemptive measures to ensure continued liquidity during the COVID-19 pandemic: Mr. Owens 15% and Messers. Sakys, DiNoia, and Archbold 10%. | |

| (2) | NEO salaries increased from fiscal year 2021 as a result of successful company performance and navigation through the COVID-19 pandemic and market adjustments. |

Short-Term Incentive Plan

The Compensation Committee believes it is in the best interest of our shareholders to have a substantial component of total compensation “at-risk” and dependent upon financial performance. The Short-Term Incentive Plan is our annual cash incentive program for employees at the management level and above and provides one type of “at-risk” compensation. Under the Short-Term Incentive Plan, target bonus amounts are set for each NEO, using input from Pay Governance, based on the NEO’s position in the Company and based on a competitive compensation analysis of our peer group and relevant survey data. In a typical year, the actual annual bonus amount earned under the Short-Term Incentive Plan ranges from 0% - 200% of the target bonus established for each individual, based on a company performance factor (“CPF”) that may be adjusted for individual performance. If our financial performance was poor, bonus payments could be at or near $0.

The company performance factor is measured by two variables: revenues growth, which was weighted 50%, and AOI growth, which was weighted 50%. These variables were approved by the Compensation Committee at the beginning of the year and are considered by the Compensation Committee to be a reliable indicator for the creation of long-term shareholder value. The Compensation Committee reserves the right to adjust payments under the Short-Term Incentive Plan in the case of unusual circumstances, events, or economic conditions in general.

For fiscal year 2022, the CPF targets set by the Board were considered appropriately rigorous based on the budgeted overall growth that was expected from our various product lines, giving consideration to uncertainty in the regulatory and macroeconomic environment at the time the budget was created. As depicted below, the company performance factor for fiscal year 2022 was achieved at 173% of target, based on a discretionary adjustment by the Compensation Committee.

Metric | Target (100% payout) | Actual | Achievement Percentage Points Over Target | Weighting | Board Discretion CPF Payout | |||||||||||||||

Revenue Growth (1) | 10.2 | % | 13.1 | % | 2.9 | % | 50 | % | 197 | % | ||||||||||

Adjusted Operating Income Growth (2) | 8.8 | % | 11.1 | % | 2.3 | % | 50 | % | 147 | % | ||||||||||

Company performance factor: | 173 | % | ||||||||||||||||||

(1) | Revenues growth excludes the results from Agena Biosciences Inc as it was acquired during fiscal year 2022. | |

| (2) | Adjusted operating income growth was adjusted by the Board to remove results associated with Agena Bioscience Inc as it was acquired during fiscal year 2022 and non-recurring costs, including: acquisition and integration-related costs pertaining to the acquisition of Agena Bioscience Inc during fiscal year 2022. |

Individual Performance

In addition to the company performance factor, an executive’s short-term incentive bonus may also depend on his or her achievement of individual objectives, which are reflected in the individual performance factor. After the fiscal year has ended, the CEO evaluates the individual performance of each of the other executive officers against his or her objectives and provides recommendations on individual performance to the Compensation Committee. The Compensation Committee considered Company performance and the performance of all NEOs in making an adjustment to the bonus payout for the CEO for the year. The Compensation Committee used the information gathered to recommend a bonus payout amount for each NEO for review and approval by the full Board.

Target bonus awards under the Short-Term Incentive Plan for the Company’s NEOs, as well as the actual amounts paid for performance in fiscal year 2022 were as follows:

Executive | Cash Bonus at 173% CPF | Actual Cash Payout | Adjustment % (+/- from 173% CPF) | |||||||||

Gary Owens | $ | 1,072,600 | $ | 1,072,600 | 0 | % | ||||||

John Sakys | 380,600 | 380,600 | 0 | % | ||||||||

Greg DiNoia | 266,420 | 213,136 | -20 | % | ||||||||

Brian Archbold | 250,850 | 200,680 | -20 | % | ||||||||

In determining the individual performance modifier for executive officers, the CEO considered each executive’s individual accomplishments that helped the Company achieve significant progress on its growth strategy, including growing the business both organically and through further acquisitions, improving operational efficiency, and continuing to hire, develop, and retain top talent.

Mr. Owens earned an award consistent with the company performance factor. The factors contributing to his achievement included: solid financial results and strong strategic progress, such as the acquisition of Agena Bioscience Inc. and execution of the strategic plan.

Mr. Sakys earned an award consistent with the company performance factor. The factors contributing to his achievement included: solid execution during the Agena acquisition, consistent progress with internal financial models and analysis, establishment of strong capital measures, including implementation of an at-the-market offering, and strong behaviors consistent with company values.