UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrantþ

Filed by a Party other than the Registrant¨

Check the appropriate box:

| | | | |

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

PANERA BREAD COMPANY |

| (Name of Registrant as Specified In Its Charter) |

|

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

þ | | No fee required. |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | (5) | | Total fee paid: |

| | |

| | | | |

| | | | |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | | | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | | | |

| | (3) | | Filing Party: |

| | | | |

| | (4) | | Date Filed: |

| | | | |

PANERA BREAD COMPANY

3630 South Geyer Road, Suite 100

St. Louis, Missouri 63127

April 18, 2013

Dear Stockholder:

You are cordially invited to attend the 2013 Annual Meeting of Stockholders of Panera Bread Company on Wednesday, May 22, 2013 at 10:30 a.m., Central Time. The Annual Meeting will be held at our corporate offices, located at 3630 South Geyer Road, St. Louis, Missouri.

At the Annual Meeting, you will be asked to (i) elect three directors nominated by our Board of Directors, (ii) approve an advisory resolution on executive compensation and (iii) ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm. Our Board of Directors recommends that you vote in favor of each of the director nominees and each of the proposals to be presented at the Annual Meeting.

YOUR VOTE IS VERY IMPORTANT. Whether or not you plan to attend the Annual Meeting, we urge you to promptly vote your shares on the Internet, by telephone or by completing, signing, dating and returning the enclosed proxy card in accordance with the instructions.

On behalf of all of our team members and directors, I thank you for your continuing support and confidence.

Sincerely,

RONALD M. SHAICH

Chairman and Co-Chief Executive Officer

TABLE OF CONTENTS

i

PANERA BREAD COMPANY

3630 South Geyer Road, Suite 100

St. Louis, Missouri 63127

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 22, 2013

The 2013 Annual Meeting of Stockholders of Panera Bread Company will be held on Wednesday, May 22, 2013 at 10:30 a.m., Central Time, at our offices, located at 3630 South Geyer Road, St. Louis, Missouri. At the Annual Meeting, stockholders will consider and act upon the following matters:

1. To elect three directors nominated by our Board of Directors, each to serve for a term ending in 2016, or until his or her successor has been duly elected and qualified;

2. To approve, on a non-binding advisory basis, the compensation of our named executive officers, as described in the “Compensation Discussion and Analysis,” executive compensation tables and accompanying narrative disclosures in this proxy statement;

3. To ratify the appointment of PricewaterhouseCoopers LLP, an independent registered accounting firm, as our independent auditors for the fiscal year ending December 31, 2013; and

4. To transact such other business as may properly come before the 2013 Annual Meeting or any adjournment or postponement thereof.

Stockholders of record on our books at the close of business on March 28, 2013, the record date for the Annual Meeting, are entitled to notice of, and to vote at, the Annual Meeting or any adjournment thereof. If you are a stockholder of record, please vote in one of these three ways:

| | • | | Vote over the Internet, by going to the website of our tabulator, Computershare Trust Company, N.A., atwww.investorvote.com/PNRA and following the instructions for Internet voting shown on the enclosed proxy card; |

| | • | | Vote by Telephone, by calling (800) 652-VOTE (8683) and following the recorded instructions; or |

| | • | | Vote by Mail, by completing and signing your enclosed proxy card and mailing it in the enclosed postage prepaid envelope. If you vote over the Internet or by telephone, please do not mail your proxy card. |

If your shares are held in “street name,” that is, held for your account by a broker or other nominee, you will receive instructions from the holder of record that you must follow for your shares to be voted.

You may obtain directions to the location of the Annual Meeting by contacting our Investor Relations Coordinator at (800) 301-5566, ext. 6500.Whether or not you plan to attend the Annual Meeting in person, we urge you to take the time to vote your shares.

By Order of the Board of Directors,

SCOTT G. BLAIR

Secretary

April 18, 2013

PANERA BREAD COMPANY

3630 South Geyer Road, Suite 100

St. Louis, Missouri 63127

PROXY STATEMENT

For the Annual Meeting of Stockholders on May 22, 2013

This proxy statement and the enclosed proxy card are being furnished in connection with the solicitation of proxies by our Board of Directors for use at the 2013 Annual Meeting of Stockholders to be held on Wednesday, May 22, 2013 at 10:30 a.m., Central Time, at our offices, located at 3630 South Geyer Road, St. Louis, Missouri, and at any adjournment or postponement thereof.

All proxies will be voted in accordance with the instructions contained in those proxies. If no choice is specified, the proxies will be voted in favor of the director nominees and in favor of the proposals set forth in the accompanying Notice of Annual Meeting of Stockholders.

We are first mailing this proxy statement and the accompanying proxy card to stockholders on or about April 18, 2013 in conjunction with the mailing of our 2012 Annual Report to Stockholders.

|

| |

Important Notice Regarding availability of Proxy Materials for the 2013 Annual Meeting of Stockholders on May 22, 2013 This proxy statement and the 2012 Annual Report to Stockholders are available for viewing, printing and downloading atwww.panera.com/2013AnnualMeeting. A copy of our Annual Report on Form 10-K (including financial statements and schedules) for the fiscal year ended December 25, 2012, as filed with the Securities and Exchange Commission, or SEC, except for exhibits, will be furnished without charge to any stockholder upon written or oral request to: Investor Relations Coordinator Panera Bread Company 3630 South Geyer Road, Suite 100 St. Louis, Missouri 63127 Telephone: (800) 301-5566, ext. 6500 This proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 25, 2012 are also available on the SEC’s website,www.sec.gov. |

IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

| | | | | | |

Q. Why did I receive these proxy materials? | | | A. | | | We are providing these proxy materials to you in connection with the solicitation by our Board of Directors, or Board, of proxies to be voted at our 2013 Annual Meeting of Stockholders, or Annual Meeting, to be held at our offices at 3630 South Geyer Road, St. Louis, Missouri on Wednesday, May 22, 2013 at 10:30 a.m., Central Time. |

| | |

Q. Who can vote at the Annual Meeting? | | | A. | | | Our Board has fixed March 28, 2013 as the record date for the Annual Meeting. If you were a stockholder of record on the record date, you are entitled to vote (in person or by proxy) all of the shares that you held on that date at the Annual Meeting and at any postponement or adjournment thereof. On the record date, we had 28,099,789 shares of Class A Common Stock outstanding (each of which entitles its holder to one vote per share) and 1,383,687 shares of Class B Common Stock outstanding (each of which entitles its holder to three votes per share). Unless indicated otherwise, we refer to our Class A Common Stock and Class B Common Stock in this proxy statement collectively as our Common Stock. Holders of Common Stock do not have cumulative voting rights. |

| | |

Q. How do I vote? | | | A. | | | If your shares are registered directly in your name, you may vote: |

| | |

| | | | | | (1) Over the Internet: Go to the website of our tabulator, Computershare Trust Company, N.A., atwww.investorvote.com/PNRA. Use the vote control number printed on your enclosed proxy card to access your account and vote your shares. You must specify how you want your shares voted or your Internet vote cannot be completed and you will receive an error message. Your shares will be voted according to your instructions. You must submit your Internet proxy before 11:59 p.m., Eastern Time, on May 21, 2013, the day before the Annual Meeting, for your proxy to be valid and your vote to count. |

| | |

| | | | | | (2) By Telephone: Call 1-800-652-VOTE (8683), toll free from the United States, Canada and Puerto Rico, and follow the recorded instructions. You must specify how you want your shares voted and confirm your vote at the end of the call or your telephone vote cannot be completed. Your shares will be voted according to your instructions. You must submit your telephonic proxy before 11:59 p.m., Eastern Time, on May 21, 2013, the day before the Annual Meeting, for your proxy to be valid and your vote to count. |

| | |

| | | | | | (3) By Mail: Complete and sign your enclosed proxy card and mail it in the enclosed postage prepaid envelope to Computershare. Computershare must receive the proxy card not later than May 21, 2013, the day before the Annual Meeting, for your proxy to be valid and your vote to count. Your shares will be voted according to your instructions. If you do not specify how you want your shares voted, they will be voted as recommended by our Board. |

| | |

| | | | | | (4) In Person at the Meeting: If you attend the Annual Meeting, you may deliver your completed proxy card in person or you may vote by completing a ballot, which we will provide to you at the meeting. |

2

| | | | | | |

| | |

| | | | | | If your shares are held in “street name,” meaning they are held for your account by a broker or other nominee, you may vote: |

| | |

| | | | | | (1) Over the Internet or by Telephone: You will receive instructions from your broker or other nominee if they permit Internet or telephone voting. You should follow those instructions. |

| | |

| | | | | | (2) By Mail: You will receive instructions from your broker or other nominee explaining how you can vote your shares by mail. You should follow those instructions. |

| | |

| | | | | | (3) In Person at the Meeting: Contact your broker or other nominee who holds your shares to obtain a broker’s proxy and bring it with you to the Annual Meeting. A broker’s proxy isnotthe form of proxy enclosed with this proxy statement.You will not be able to vote shares you hold in street name in person at the Annual Meeting unless you have a proxy from your broker or other nominee issued in your name giving you the right to vote your shares. |

| | |

Q. Can I change my vote? | | | A. | | | If your shares are registered directly in your name,you may revoke your proxy and change your vote at any time before the Annual Meeting. To do so, you must do one of the following: |

| | |

| | | | | | (1) Vote over the Internet or by telephone as instructed above. Only your latest Internet or telephone vote is counted. You may not change your vote over the Internet or by telephone after 11:59 p.m., Eastern Time, on May 21, 2013. |

| | |

| | | | | | (2) Sign a new proxy and submit it as instructed above. Only your latest dated proxy, received by Computershare not later than May 21, 2013, will be counted. |

| | |

| | | | | | (3) Attend the Annual Meeting, request that your proxy be revoked and vote in person as instructed above. Attending the Annual Meeting will not revoke your Internet vote, telephone vote or proxy, as the case may be, unless you specifically request it. |

| | |

| | | | | | If your shares are held in street name, you may submit new voting instructions by contacting your broker or other nominee. You may also vote in person at the Annual Meeting if you obtain a broker’s proxy as described in the answer above. |

| | |

Q. Will my shares be voted if I do not return my proxy? | | | A. | | | If your shares are registered directly in your name, your shares will not be voted if you do not vote over the Internet, by telephone, by returning your proxy or by ballot at the Annual Meeting. |

| | |

| | | | | | If your shares are held in street name, your broker or other nominee may, under certain circumstances, vote your shares if you do not timely return your proxy.Brokers can vote their customers’ unvoted shares on discretionary matters but cannot vote such shares on non-discretionary matters.If you do not timely return a proxy to your broker to vote your shares, your broker may, on discretionary matters, either vote your shares or leave your shares unvoted. The election of directors (Proposal 1) and the non-binding advisory vote on executive compensation (Proposal 2) are non-discretionary matters. The ratification of the appointment of our independent auditors (Proposal 3) is a discretionary matter. |

3

| | | | | | |

| | |

| | | | | | We encourage you to provide voting instructions to your broker or other nominee by giving your proxy to them. This ensures that your shares will be voted at the Annual Meeting according to your instructions. |

| | |

Q. How many shares must be present to hold the Annual Meeting? | | | A. | | | A majority in interest of the combined voting power of the Common Stock issued, outstanding and entitled to vote must be present to hold the Annual Meeting and conduct business. This is called a quorum. For purposes of determining whether a quorum exists, we count as present any shares that are voted over the Internet, by telephone, by completing and submitting a proxy or that are represented in person at the meeting. Further, for purposes of establishing a quorum, we will count as present shares that a stockholder holds even if the stockholder votes to abstain or only votes on one of the proposals and broker non-votes (as described below). If a quorum is not present, we expect to adjourn the Annual Meeting until we obtain a quorum. |

| | |

Q. What vote is required to approve each proposal and how are votes counted? | | | A. | | | Proposal 1 – Election of Three Class III Directors The three nominees for director receiving the highest number of votes FOR election will be elected as directors. This is called a plurality. Proposal 1 is a non-discretionary matter. Therefore, if your shares are held in street name and you do not vote your shares, your broker or other nominee cannot vote your shares on Proposal 1. Shares held in street name by brokers or nominees who indicate on their proxies that they do not have authority to vote the shares on Proposal 1 will not be counted as votes FOR or WITHHELD from any nominee and will be treated as “broker non-votes.” Broker non-votes will have no effect on the voting on Proposal 1. With respect to Proposal 1, you may: |

| | |

| | | | | | • vote FOR all nominees; |

| | |

| | | | | | • vote FOR one or more nominees and WITHHOLD your vote from the other nominees; or |

| | |

| | | | | | • WITHHOLD your vote from all nominees. |

| | |

| | | | | | Votes that are withheld will not be included in the vote tally for the election of directors and will not affect the results of the vote. |

| | |

| | | | | | Proposal 2 – Non-binding Advisory Vote on the Compensation of Our Named Executive Officers To approve Proposal 2, stockholders holding a majority of the votes cast on the matter must vote FOR the approval of the compensation of our named executive officers, as described in the “Compensation Discussion and Analysis,” executive compensation tables and accompanying narrative disclosures in this proxy statement.Proposal 2 is a non-discretionary matter. Therefore, if your shares are held in street name and you do not vote your shares, your broker or other nominee cannot vote your shares on Proposal 2. Shares held in street name by brokers or nominees who indicate on their proxies that they do not have authority to vote the shares on Proposal 2 will not be counted as votes FOR or AGAINST Proposal 2 and will be treated as broker non-votes. Broker non-votes will have no effect on the voting on Proposal 2. If you vote to ABSTAIN on this Proposal 2, your shares will not be voted FOR or AGAINST the proposal and will not be counted as votes cast or shares withheld on Proposal 2. Voting to ABSTAIN will have no effect on the voting on Proposal 2. |

4

| | | | |

| | |

| | | | As an advisory vote, this proposal is not binding. The outcome of this advisory vote will not overrule any decision by us or our Board (or any committee thereof). However, our Compensation Committee and our Board value the opinions expressed by our stockholders in their vote on this proposal and will consider the outcome of the vote when making future compensation decisions for our named executive officers. |

| | |

| | | | Proposal 3 – Ratification of Appointment of Independent Auditors |

| | |

| | | | To approve Proposal 3, stockholders holding a majority of the votes cast on the matter must vote FOR the proposal.Proposal 3 is a discretionary matter.If your shares are held in street name and you do not vote your shares, your broker or other nominee may vote your unvoted shares on Proposal 3. If you vote to ABSTAIN on Proposal 3, your shares will not be voted FOR or AGAINST the proposal and will also not be counted as votes cast or shares voting on the proposal. Voting to ABSTAIN will have no effect on the voting on Proposal 3. |

| | |

| | | | Although stockholder approval of our Audit Committee’s appointment of PricewaterhouseCoopers LLP as our independent auditors for the year ending December 31, 2013 is not required, we believe that it is advisable to give stockholders an opportunity to ratify this appointment. If this proposal is not approved at the Annual Meeting, our Audit Committee may reconsider its appointment of PricewaterhouseCoopers LLP as our independent auditors for the year ending December 31, 2013. |

| | |

Q. Are there other matters to be voted on at the Annual Meeting? | | A. | | We do not know of any matters that may come before the Annual Meeting other than the election of three Class III directors, the advisory vote on the compensation of our named executive officers and the ratification of the appointment of our independent auditors. If any other matters are properly presented at the Annual Meeting, the persons named in the accompanying proxy intend to vote, or otherwise act, in accordance with their judgment on the matter. |

| | |

Q. Where can I find the voting results? | | A. | | We will report the voting results in a Current Report on Form 8-K within four business days following the adjournment of our Annual Meeting. |

| | |

Q. What are the costs of soliciting these proxies? | | A. | | We will bear the cost of soliciting proxies. In addition to these proxy materials, our directors, officers and employees may solicit proxies without additional compensation. We have also retained MacKenzie Partners, Inc. to solicit proxies and to request brokers and other nominees to forward proxy soliciting materials to the owners of stock held in their names. For these services, we have paid a fee of $12,500, plus expenses. We may reimburse brokers or persons holding stock in their names, or in the names of their nominees, for their expenses in sending proxies and proxy material to beneficial owners. |

5

BOARD OF DIRECTORS AND MANAGEMENT

Information Regarding Directors and Director Nominees

Our certificate of incorporation provides for the classification of our Board into three classes, each having as nearly an equal number of directors as possible. The terms of service of the three classes are staggered so that the term of one class expires each year.

Our Board currently consists of seven directors. Class I consists of Fred K. Foulkes and Ronald M. Shaich, each with a term ending in 2014. Class II consists of Domenic Colasacco and Thomas E. Lynch, each with a term ending in 2015. Class III consists of Larry J. Franklin, Diane Hessan and William W. Moreton, each with a term ending in 2013.

At each annual meeting of stockholders, directors are elected for a full term of three years to continue or succeed those directors whose terms are expiring. Upon the recommendation of our Committee on Nominations and Corporation Governance, our Board has nominated Ms. Hessan and Messrs. Franklin and Moreton for re-election at the Annual Meeting as Class III directors, each to serve until 2016.

Director Qualifications

The following table and biographical descriptions provide information as of March 31, 2013 relating to each director and director nominee, including his or her age and period of service as a director of our company; his or her committee memberships; his or her business experience during the past five years, including directorships at other public companies; his or her community activities; and the other experience, qualifications, attributes or skills that led our Board to conclude he or she should serve as a director of our company.

| | | | | | |

Name | | Age | | | Board Tenure, Principal Occupation, Other Business Experience

During the Past Five Years and Other Directorships |

| | |

Class III Directors to be elected at the 2013 Annual Meeting

(terms expiring in 2016) | | | | | | |

| | |

Larry J. Franklin Audit Committee Compensation and Management Development Committee Committee on Nominations and Corporate Governance (Chair) | | | 64 | | | Mr. Franklin has served as a member of our Board since June 2001. He has served as the President and Chief Executive Officer of Franklin Sports, Inc., a branded sporting goods manufacturer and marketer, since 1986. Mr. Franklin joined Franklin Sports in 1970 and served as its Executive Vice President from 1981 until 1986. Mr. Franklin currently serves on the board of directors of Bradford Soap International, Inc., a private manufacturer of private label soaps. He also has served as Chairman of the board of directors of the Sporting Goods Manufacturers Association, a global trade association in the sports product industry since October 2009, and as a member of its Executive Committee since 2000. Mr. Franklin’s leadership experience, particularly as a chief executive officer for 27 years, and broad functional skill set give him a valuable perspective on the business practices that are critical to the success of a large, growing company such as ours. During his 12-year tenure on our Board, Mr. Franklin has developed significant company and industry-specific experience. |

6

| | | | | | |

Name | | Age | | | Board Tenure, Principal Occupation, Other Business Experience

During the Past Five Years and Other Directorships |

| | |

Diane Hessan | | | 58 | | | Ms. Hessan has served as a member of our Board since November 2012. She has served as President and Chief Executive Officer of Communispace, a market research company that she founded, since its inception in 1999. Ms. Hessan has also served on the board of directors of numerous organizations, including the Advertising Research Foundation, The Business Innovation Factory, Horizons for Homeless Children, The Boston Philharmonic and the Tufts University Board of Trustees. Through her work as a senior executive and service on numerous boards, Ms. Hessan brings to our Board valuable leadership and oversight experience and a keen understanding of consumer research and marketing. |

| | |

William W. Moreton President and Co-Chief Executive Officer | | | 53 | | | Mr. Moreton has served as our President and Co-Chief Executive Officer since March 2012 and a member of our Board since May 2010. Mr. Moreton previously served as our President and Chief Executive Officer from May 2010 until March 2012, our Executive Vice President & Co-Chief Operating Officer from November 2008 until May 2010 and our Executive Vice President and Chief Financial Officer from October 1998 until March 2003. Prior to rejoining us in 2008, Mr. Moreton served as President and Chief Financial Officer of Potbelly Sandwich Works LLC, a restaurant chain, from April 2005 until January 2007. From January 2004 until April 2005, Mr. Moreton served as Chief Executive Officer of Baja Fresh, a subsidiary of Wendy’s International, Inc. Prior to Baja Fresh, Mr. Moreton served as Executive Vice President, Subsidiary Brand Management for Wendy’s, and Executive Vice President and Chief Financial Officer of Quality Dining, Inc., a leading national franchisee restaurant company. Mr. Moreton brings to our Board more than 20 years of expertise and leadership experience in the restaurant industry. |

7

| | | | | | |

Name | | Age | | | Board Tenure, Principal Occupation, Other Business Experience

During the Past Five Years and Other Directorships |

| | |

Class I Directors

(terms expiring in 2014) | | | | | | |

| | |

Fred K. Foulkes, D.B.A. Audit Committee Compensation and Management Development Committee (Chair) Committee on Nominations and Corporate Governance | | | 71 | | | Dr. Foulkes has served as a member of our Board since June 2003. Dr. Foulkes is a professor of organization behavior at the Boston University School of Management, a position he has held since 1980, and he founded its Human Resources Policy Institute in 1981. Dr. Foulkes served on the Board of Directors and was chairman of the Compensation Committee of Bright Horizons Family Solutions, a provider of employer-sponsored child care and work/life consulting services, from July 1998 until its acquisition in May 2008. Dr. Foulkes has authored numerous publications on human resources management, including executive compensation. Dr. Foulkes brings to our Board significant experience in business strategy and human resources management. During his tenure as a member of our Board, Dr. Foulkes has gained additional expertise in the restaurant industry. |

| | |

Ronald M. Shaich Chairman and Co-Chief Executive Officer | | | 59 | | | Mr. Shaich is the founder of our company and has served as a member of our Board since 1981. Mr. Shaich has led our Board since 1988, serving as Chairman since May 1999 and Co-Chairman from 1988 until 1999. Mr. Shaich has served as our Co-Chief Executive Officer since March 2012, and he previously served as our Chief Executive Officer from May 1994 until May 2010 and our Co-Chief Executive Officer from January 1988 until May 1994. Mr. Shaich also serves as a director of the non-profit Lown Cardiovascular Research Foundation and as a trustee of the non-profit Rashi School. Mr. Shaich has over 30 years of leadership experience in the restaurant industry and has provided the strategic vision that has driven our company’s growth and performance. |

8

| | | | | | |

Name | | Age | | | Board Tenure, Principal Occupation, Other Business Experience

During the Past Five Years and Other Directorships |

| | |

Class II Directors

(terms expiring in 2015) | | | | | | |

| | |

Domenic Colasacco Lead Independent Director Audit Committee (Chair) Compensation and Management Development Committee | | | 64 | | | Mr. Colasacco has served as a member of our Board since March 2000 and as our Lead Independent Director since January 2008. Since 1992, he has served as President and Chief Executive Officer of Boston Trust & Investment Management, a banking and trust company. He also serves as Chairman of its Board of Directors. Mr. Colasacco joined Boston Trust in 1974 after beginning his career in the research division of Merrill Lynch & Co. Mr. Colasacco brings to our Board over 20 years of business and executive experience as well as a broad knowledge of public companies. Mr. Colasacco, our longest serving independent director, has 13 years of board experience and extensive knowledge of our business and industry. |

| | |

Thomas E. Lynch Committee on Nominations and Corporate Governance | | | 53 | | | Mr. Lynch has served as a member of our Board since March 2010, and he previously served as a member of our Board from June 2003 until December 2006. Mr. Lynch has served as a Senior Managing Director of Mill Road Capital, a private equity firm, since January 2005. From 2000 until December 2004, Mr. Lynch served as a Senior Managing Director of Mill Road Associates, a financial advisory firm that he founded in 2000. Prior to founding Mill Road Associates, he served as the Managing Director of Lazard Capital Partners, a private equity firm that he founded, as a Managing Director at the Blackstone Group, an investment and advisory firm, and as a senior consultant at the Monitor Company, a strategic consulting firm. Mr. Lynch’s extensive experience as a director includes service on the board of directors of Rubio’s Restaurants Inc., a privately held restaurant company, since August 2010, and Physicians Formula Holdings, Inc., a public cosmetics company, from April 2010 until December 2012. Mr. Lynch brings to our Board 23 years of experience as an investor in and manager of publicly traded companies in the retail and restaurant industries. |

Corporate Governance Matters

Our Board has long believed that good corporate governance is important to ensure that our company is managed for the long-term benefit of our stockholders. This section describes key corporate governance guidelines and practices that we have adopted. Complete copies of the corporate governance guidelines, committee charters and code of conduct described below are available on the Corporate Governance page of the About Us — Investor Relations section of our website,www.panerabread.com. Alternatively, you can request a copy of any of these documents by writing to our Investor Relations Coordinator, Panera Bread Company, 3630 South Geyer Road, Suite 100, St. Louis, Missouri 63127.

9

Corporate Governance Guidelines

Our Board has adopted Corporate Governance Principles and Practices to assist it in the exercise of its duties and responsibilities and to serve the best interests of our company and our stockholders. These principles, which provide a framework for the conduct of our Board’s business, provide that:

| | • | | the principal responsibility of the directors is to oversee our management and to hold our management accountable for the pursuit of our corporate objectives; |

| | • | | a majority of the members of our Board shall be independent directors; |

| | • | | the independent directors meet regularly in executive session; |

| | • | | directors have full and free access to management and, as necessary and appropriate, independent advisors; |

| | • | | new directors participate in an orientation program and all directors are encouraged to attend director education programs; and |

| | • | | at least annually, our Board and its committees will conduct a self-evaluation to determine whether they are functioning effectively. |

Stock Ownership Guidelines

Our Board believes that each non-employee director should acquire and hold shares of our stock in an amount that is meaningful and appropriate to such director. Accordingly, our Board has adopted stock ownership guidelines that require each non-employee director to own shares of our Class A common stock having a total value of five times the annual cash retainer paid to such director for service on our Board, which does not include fees paid for service as a committee chairman or Lead Independent Director. Each non-employee director is required to attain such ownership by the fifth annual meeting following their election to the Board.

Board Determination of Independence

Under the applicable rules of the Nasdaq Stock Market, or Nasdaq, a director will only qualify as an “independent director” if, in the opinion of our Board, that person does not have a relationship which would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Our Board has determined that none of Ms. Hessan or Messrs. Colasacco, Foulkes, Franklin or Lynch has a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is an “independent director” as defined under Rule 5605(a)(2) of the Nasdaq Marketplace Rules.

Director Nomination Process

The process followed by the Committee on Nominations and Corporate Governance to identify and evaluate director candidates includes requests to Board members and others for recommendations, meetings from time to time to evaluate biographical information and background material relating to potential candidates, and interviews of selected candidates by members of the Committee on Nominations and Corporate Governance and the Board.

Criteria and Diversity

In considering whether to recommend any particular candidate for inclusion in the Board’s slate of recommended director nominees, the Committee on Nominations and Corporate Governance applies the criteria specified in our Corporate Governance Principles and Practices. These criteria include the candidate’s integrity, business acumen, knowledge of our business and industry, experience, diligence, conflicts of interest and ability to act in the interests of stockholders. The Committee on Nominations and Corporate Governance does not assign specific weights to particular criteria and no particular criterion is a prerequisite for any prospective nominee.

10

Our Board does not have a formal policy with respect to diversity, but our Corporate Governance Principles and Practices provide that an objective of Board composition is to bring to our company a variety of perspectives and skills derived from high quality business and professional experience. Our Board recognizes its responsibility to ensure that nominees for our Board possess appropriate qualifications and reflect a reasonable diversity of personal and professional experience, skills, backgrounds and perspectives, including those backgrounds and perspectives with respect to age, gender, culture, race and national origin. We believe that the backgrounds and qualifications of our directors, considered as a group, should provide a composite mix of experience, knowledge and abilities that will allow the Board to promote our strategic objectives and to fulfill its responsibilities to our stockholders.

The director biographies on pages 6 to 9 indicate each nominee’s experience, qualifications, attributes and skills that led the Board to conclude that he should continue to serve as a member of our Board. Our Board believes that each of the nominees has had substantial achievement in his professional and personal pursuits, and possesses the background, talents and experience that our Board desires and that will contribute to the best interests of our company and to long-term stockholder value.

Stockholder Nominations

Stockholders may recommend individuals to the Committee on Nominations and Corporate Governance for consideration as potential director candidates by submitting their names, together with appropriate biographical information and background materials and a statement as to whether the stockholder or group of stockholders making the recommendation has beneficially owned more than 5% of our Common Stock for at least a year as of the date such recommendation is made, to the Committee on Nominations and Corporate Governance, c/o Secretary, Panera Bread Company, 3630 South Geyer Road, Suite 100, St. Louis, Missouri 63127. Assuming that appropriate biographical and background material has been provided on a timely basis, the Committee on Nominations and Corporate Governance will evaluate stockholder-recommended candidates by following substantially the same process, and applying substantially the same criteria, as it follows for candidates submitted by others.

Stockholders also have the right under our by-laws to directly nominate director candidates, without any action or recommendation on the part of the Committee on Nominations and Corporate Governance or the Board, by following the procedures set forth under “Stockholder Proposals for 2014 Annual Meeting.” If the Board determines to nominate a stockholder-recommended candidate and recommends his or her election, then his or her name will be included in our proxy statement and proxy card for the next annual meeting. Otherwise, candidates nominated by stockholders in accordance with the procedures set forth in the by-laws will not be included in our proxy statement and proxy card for the next annual meeting.

Board Meetings and Attendance

Our Board met seven times during the fiscal year ended December 25, 2012, which we refer to as fiscal 2012, either in person or by teleconference. During fiscal 2012, each of our directors attended at least 75% of the Board meetings and at least 75% of the meetings of the committees on which he or she then served.

Director Attendance at Annual Meeting of Stockholders

Our Corporate Governance Principles and Practices provide that our directors are expected to attend the Annual Meeting. All of the members of our Board attended the 2012 Annual Meeting of Stockholders.

Board Leadership Structure

Mr. Shaich serves as Chairman of our Board and Co-Chief Executive Officer. Our Board believes that combining the Chairman and Co-Chief Executive Officer positions fosters clear accountability, effective decision-making and alignment of corporate strategy and is the appropriate leadership structure for us at this

11

time. Additionally, our Board believes this leadership structure is particularly appropriate for our company given Mr. Shaich’s long history with our company, his extensive knowledge of and experience with our business and industry and his ability to effectively identify strategic priorities for our company. Our Board also believes that Mr. Shaich’s combined role of Chairman and Co-Chief Executive Officer promotes effective execution of strategic goals and facilitates information flow between management and our Board. Nevertheless, from time to time, our Board intends to evaluate whether the Chairman and Co-Chief Executive Officer positions should continue to be combined based on what our Board believes is best for our company and stockholders.

As Mr. Shaich is not an independent director, our Board elected Mr. Colasacco as Lead Independent Director, a position to which he was initially elected in January 2008 and to which he was re-elected in each year since then. The Lead Independent Director Position Duty Statement adopted by our Board is posted on the Corporate Governance page of the About Us — Investor Relations section of our website,www.panerabread.com.

Pursuant to our Corporate Governance Principles and Practices and the Lead Independent Director Position Duty Statement, the Lead Independent Director is responsible for, among other matters:

| | • | | advising the Chairman regarding Board meeting schedules; |

| | • | | approving the agendas for Board meetings; |

| | • | | advising the Chairman regarding information sent to the Board; |

| | • | | interviewing Board candidates and assisting the Board and the company with compliance with and implementation of our Corporate Governance Principles and Practices; |

| | • | | presiding at all meetings of the Board at which the Chairman is not present, including executive sessions of the independent directors; |

| | • | | calling meetings of and presiding at executive sessions of the Board’s independent directors; |

| | • | | acting as a principal liaison between the independent directors and the Chairman; and |

| | • | | participating with the Compensation and Management Development Committee in its evaluation of our Co-Chief Executive Officers, and discussing with them their performance. |

Our Board believes that its leadership structure is appropriate because it strikes an effective balance between strategy development, independent leadership and management oversight.

Board Committees

Our Board has established three standing committees — the Audit Committee, the Compensation and Management Development Committee and the Committee on Nominations and Corporate Governance, each of which operates under a charter that has been approved by our Board. Current copies of each committee’s charter are posted on the Corporate Governance page of the About Us — Investor Relations section of our website,www.panerabread.com.

12

Our Board has determined that all of the members of each of its three committees are independent as defined under the rules of Nasdaq, including, in the case of all members of the Audit Committee, the independence requirements contemplated by Rule 10A-3 under the Securities Exchange Act of 1934, as amended, or the Exchange Act. Current committee memberships are set forth in the table below:

| | | | | | | | | | | | |

| | | Audit Committee | | | Compensation and Management

Development Committee | | | Committee on Nominations

and Corporate Governance | |

Domenic Colasacco** | | |  | | | |  | | | | | |

Fred K. Foulkes | | |  | | | |  | | | |  | |

Larry J. Franklin | | |  | | | |  | | | |  | |

Diane Hessan | | | | | | | | | | | | |

Thomas E. Lynch | | | | | | | | | | |  | |

William W. Moreton | | | | | | | | | | | | |

Ronald M. Shaich | | | | | | | | | | | | |

| ** | Lead Independent Director |

| Chairperson |

| Member |

Audit Committee

The responsibilities of our Audit Committee include:

| | • | | selecting, approving the compensation of, and assessing the independence of our independent registered public accounting firm; |

| | • | | overseeing the work of our independent registered public accounting firm, including through the receipt and consideration of certain reports from such firm; |

| | • | | reviewing with management and our independent registered public accounting firm the effect of regulatory and accounting initiatives as well as off-balance sheet structures on our financial statements; |

| | • | | reviewing and discussing with management and the independent registered public accounting firm our annual and quarterly financial statements and related disclosures; |

| | • | | monitoring our internal control over financial reporting and disclosure controls and procedures; |

| | • | | overseeing our internal audit function; |

| | • | | reviewing and discussing with management our risk management policies; |

| | • | | establishing policies regarding hiring employees from the independent registered public accounting firm and procedures for the receipt and retention of accounting related complaints and concerns; |

| | • | | meeting independently with our internal auditing staff, independent registered public accounting firm and management; |

| | • | | advising the Board with respect to our policies and procedures regarding compliance with the applicable laws and regulations and with our Standards of Business Conduct; |

| | • | | reviewing and approving or ratifying any related person transactions; and |

| | • | | preparing the audit committee report required by the rules of the SEC (which report is included on pages 17 and 18 of this proxy statement). |

The members of the Audit Committee are Mr. Colasacco (Chair), Dr. Foulkes and Mr. Franklin. Our Board has determined that Mr. Colasacco is an “audit committee financial expert” as defined in Item 407(d)(5) of Regulation S-K. The Audit Committee met nine times during fiscal 2012.

13

Compensation and Management Development Committee

The responsibilities of our Compensation and Management Development Committee, which we refer to as the Compensation Committee, include:

| | • | | annually reviewing and approving corporate goals and objectives relevant to compensation of our Chairman and Co-Chief Executive Officer and our President and Co-Chief Executive Officer; |

| | • | | reviewing and making recommendations to the Board with respect to the compensation of our Chairman and Co-Chief Executive Officer and our President and Co-Chief Executive Officer; |

| | • | | determining the compensation of our other executive officers; |

| | • | | reviewing and making recommendations to the Board with respect to management succession planning; |

| | • | | in its sole discretion, retaining or obtaining the advice of compensation consultants, legal counsel or other advisors, and overseeing such consultants, legal counsel or advisors; and |

| | • | | overseeing and administering our cash and equity incentive plans. |

The processes and procedures followed by our Compensation Committee in considering and determining executive and director compensation are described below under the heading “Executive Compensation Processes.”

The members of the Compensation Committee are Dr. Foulkes (Chair) and Messrs. Colasacco and Franklin. The Compensation Committee met six times during fiscal 2012.

Committee on Nominations and Corporate Governance

The responsibilities of the Committee on Nominations and Corporate Governance include:

| | • | | determining the skills and qualifications required of directors and developing criteria to be considered in selecting potential candidates for Board membership; |

| | • | | identifying individuals qualified to become Board members; |

| | • | | recommending to the Board the persons to be nominated for election as directors and to each of the Board’s committees; |

| | • | | reviewing and making recommendations to the Board with respect to director compensation; |

| | • | | reviewing and making recommendations to the Board with respect to our Corporate Governance Principles and Practices; and |

| | • | | overseeing an annual evaluation of the Board. |

The processes and procedures followed by the Committee on Nominations and Corporate Governance in identifying and evaluating director candidates are described above under the heading “Director Nomination Process.”

The members of the Committee on Nominations and Corporate Governance are Mr. Franklin (Chair), Dr. Foulkes and Mr. Lynch. The Committee on Nominations and Corporate Governance met four times during fiscal 2012.

Risk Oversight

Role of Our Board in Management of Risk

Our Board administers its risk oversight function directly and through its Audit Committee and receives regular reports from members of senior management, including our Director of Internal Audit, on areas of material risk to the company, including operational, financial, legal and regulatory, and strategic and reputational

14

risks. As part of its charter, our Audit Committee regularly discusses with management and our Director of Internal Audit our major risk exposures, their potential financial impact on our company and the steps we take to manage them. In addition, our Compensation Committee assists the Board in fulfilling its oversight responsibilities with respect to the management and risks arising from our compensation policies and programs. Our Committee on Nominations and Corporate Governance assists the Board in fulfilling its oversight responsibilities with respect to the management of risks associated with board organization, membership and structure, succession planning for our directors and executive officers and corporate governance.

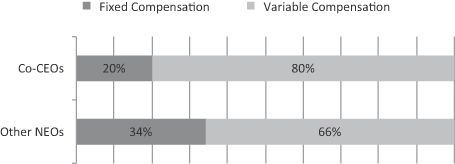

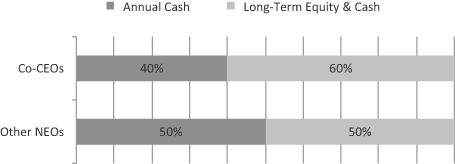

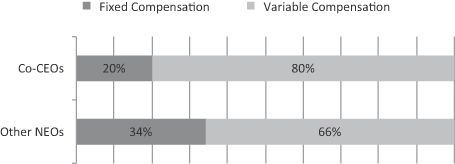

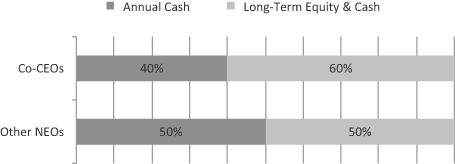

Risk Considerations in Executive Compensation

Our Compensation Committee has discussed the concept of risk as it relates to our compensation programs, including our executive compensation program, and our Compensation Committee does not believe that our compensation programs encourage excessive or inappropriate risk taking. As described more fully below in “Compensation Discussion and Analysis,” we structure our pay to consist of both fixed and variable compensation. The fixed (or salary) portion of compensation is designed to provide a steady income regardless of our stock price performance so that executives do not feel pressured to focus exclusively on stock price performance to the detriment of other important business metrics. The variable (cash bonus and equity) portions of compensation are designed to reward both intermediate- and long-term corporate performance and generally are tied to the achievement of company-wide and, in some instances, department specific goals. Additionally, with respect to the variable portions of compensation, if department specific measurements are included, company-specific measurements, must represent at least 50% of the total for our annual incentive bonuses and in all cases must represent 100% of the measurements for our 3-Year Performance Awards. We believe that applying company-wide metrics encourages decision-making by our executives that is in the best long-term interest of our company and stockholders. Further, we believe that these variable elements of compensation constitute a sufficient percentage of overall compensation to motivate our executives to produce superior short-, intermediate- and long-term corporate results, while the fixed element of compensation is sufficiently high that our executives are not encouraged to take unnecessary or excessive risks in doing so.

Compensation Committee Interlocks and Insider Participation in Compensation Decisions

None of the members of the Compensation Committee had interlocking or other relationships with other boards or with us during fiscal 2012 that require disclosure under the proxy rules and regulations promulgated by the SEC.

Policies and Procedures for Related Person Transactions

Our Board has adopted written policies and procedures for the review of any transaction, arrangement or relationship in which we are a participant, the amount involved exceeds $120,000, and one of our executive officers, directors, director nominees or 5% stockholders (or their immediate family members), each of whom we refer to as a “related person,” has a direct or indirect material interest.

If a related person proposes to enter into such a transaction, arrangement or relationship, which we refer to as a “related person transaction,” the related person must report the proposed related person transaction to our Chief Legal Officer. The policy calls for the proposed related person transaction to be reviewed and, if deemed appropriate, approved by the Audit Committee. Whenever practicable, the reporting, review and approval will occur prior to entry into the transaction. The policy also permits the Chairman of the Audit Committee and the Chief Legal Officer to review proposed related person transactions that arise between committee meetings, subject to review, approval and ratification by the committee at its next meeting. Any related person transactions that are ongoing in nature will be reviewed annually.

A related person transaction reviewed under the policy will be considered approved or ratified if it is authorized by the committee after full disclosure of the related person’s interest in the transaction. The committee will review and consider such information regarding the related person transaction as it deems appropriate under the circumstances.

15

The Audit Committee may approve or ratify the transaction only if it determines that, under all of the circumstances, the transaction is in, or is not inconsistent with, our best interests. The Audit Committee may impose any conditions on the related person transaction that it deems appropriate.

In addition to the transactions that are excluded by the instructions to the SEC’s related person transaction disclosure rule, our Board has determined the following interests are not material, and, accordingly, a transaction or arrangement with an entity in which the related person’s sole interest is one of the following will not be considered a related person transaction:

| | • | | Interests arising only because a related person is a director of an entity that is involved in the transaction or arrangement; or |

| | • | | Interests arising only from the ownership by one or more related persons of less than a 10% equity interest in the entity involved in the transaction, excluding general partnership interests; or |

| | • | | Interests arising only because a related person is an executive officer of an entity involved in the transaction, and (1) all related persons hold less than a 10% equity interest of the entity involved in the transaction, (2) the related person and immediate family members have and are not negotiating the transaction and have and will not receive any related special benefits, and (3) the transaction amount involves less than the greater of (A) $200,000 or (B) 5% of the annual gross revenues of the company receiving payment in the transaction; or |

| | • | | Interests arising only from the ownership of a class of our company’s stock if all stockholders of that class receive the same benefit on a pro rata basis; or |

| | • | | Interests arising only because a significant stockholder or an immediate family member is indebted to us. |

In addition, our Board has determined that the following transactions are not related person transactions for purposes of this policy:

| | • | | A transaction that involves compensation to an executive officer if the compensation has been approved by the Compensation Committee or our Board, as applicable; or |

| | • | | A transaction that involves compensation to a director for services as a director of our company if such compensation is reported pursuant to applicable law; or |

| | • | | A transaction that is specifically contemplated by provisions of our certificate of incorporation or by-laws; or |

| | • | | A transaction awarded under a competitive bid process. |

The policy provides that transactions involving compensation of executive officers shall be reviewed and approved by the Board or the Compensation Committee in the manner specified in its charter and consistent with our policies.

Related Person Transactions

Since December 28, 2011 (the beginning of our most recently completed fiscal year), we have not been a party to, and we have no plans to be a party to, any transaction or series of similar transactions in which the amount involved exceeded or will exceed $120,000 and in which any current director, executive officer, holder of more than 5% of our Common Stock, or any member of the immediate family of any of the foregoing, had or will have a direct or indirect material interest, other than in connection with the compensation of our directors and executive officers, employment agreements and other agreements described above under “Compensation of Directors,” “Employment Arrangements with Executive Officers” and “Executive Compensation.”

16

Communicating with the Independent Directors

Our Board will give appropriate attention to written communications that are submitted by stockholders, and will respond if and as appropriate. The Lead Independent Director and the Chairman of the Committee on Nominations and Corporate Governance, with the assistance of our Chief Legal Officer, are primarily responsible for monitoring communications from stockholders and for providing copies or summaries to the other directors as they consider appropriate.

Under procedures approved by a majority of the independent directors, communications are forwarded to all directors if they relate to important substantive matters and include suggestions or comments that our Chief Legal Officer considers to be important for the directors to know. In general, communications relating to corporate governance and corporate strategy are more likely to be forwarded than communications relating to ordinary business affairs, personal grievances and matters that are duplicative communications.

Stockholders who wish to send communications on any topic to the Board should address such communications to: Board of Directors, c/o Secretary, Panera Bread Company, 3630 South Geyer Road, Suite 100, St. Louis, Missouri 63127.

Additionally, we have established a confidential process for reporting, investigating and resolving employee and other third party concerns related to accounting, auditing and similar matters under the Sarbanes-Oxley Act of 2002. Stockholders may confidentially provide information to one or more of our directors by contacting a representative at our Ethics Hotline who will forward the information to the appropriate director. The Ethics Hotline is operated by an independent, third party service. Within the United States and Canada, the Ethics Hotline can be reached by dialing toll-free (888) 840-4151 or by email atPaneraEthicsHotline@tnwinc.com.

Standards of Business Conduct

We have adopted a written Standards of Business Conduct, a code of ethics that applies to our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. We have posted a current copy of the Standards of Business Conduct on the Corporate Governance page of the About Us — Investor Relations section of our website,www.panerabread.com. In addition, we intend to post on our website all disclosures that are required by law or Nasdaq’s listing standards concerning any amendments to, or waivers from, any provision of the Standards of Business Conduct.

Report of the Audit Committee of the Board of Directors

The Audit Committee has reviewed our audited financial statements for fiscal 2012 and has discussed these financial statements with our management and PricewaterhouseCoopers LLP, our independent registered public accounting firm.

The Audit Committee has also received from, and discussed with, our independent registered public accounting firm various communications that our independent registered public accounting firm is required to provide to the Audit Committee, including the matters required to be discussed by the Public Company Accounting Oversight Board, or PCAOB, AU Section 380 (Communication with Audit Committees) as modified or supplemented.

Our independent registered public accounting firm also provided the Audit Committee with the written disclosures and the letter from the independent auditor required by PCAOB Rule 3526 (Communicating with Audit Committees Concerning Independence), as modified or supplemented. The Audit Committee has discussed with the independent registered public accounting firm its independence from us.

17

Based on its discussions with management and the independent registered public accounting firm, and its review of the representations and information provided by management and the independent registered public accounting firm, the Audit Committee recommended to our Board that the audited financial statements be included in our Annual Report on Form 10-K for the year ended December 25, 2012.

By the Audit Committee of the Board of Directors of Panera Bread Company.

|

| Domenic Colasacco (Chair) |

| Fred K. Foulkes |

| Larry J. Franklin |

Executive Officers of the Company

Certain information regarding our executive officers, as of March 31, 2013, is set forth below. Generally, our Board appoints our officers annually, although our Board or an authorized committee of our Board may appoint officers at other times. Biographical information for Messrs. Shaich and Moreton, who are both directors and executive officers of the Company, may be found in the section entitled “Board of Directors and Management.”

| | | | | | |

Name | | Age | | | Position(s) |

Ronald M. Shaich | |

| 59

|

| | Chairman and Co-Chief Executive Officer |

William W. Moreton | | | 53 | | | President and Co-Chief Executive Officer |

Roger C. Matthews, Jr. | | | 43 | | | Executive Vice President, Chief Financial Officer |

Charles J. Chapman III | | | 50 | | | Executive Vice President, Chief Operating Officer |

Scott G. Davis | | | 49 | | | Executive Vice President, Chief Concept and Innovation Officer |

Michael D. Simon | | | 54 | | | Executive Vice President, Chief Marketing Officer |

Scott G. Blair | | | 55 | | | Senior Vice President, Chief Legal Officer, General Counsel and Secretary |

Mark A. Borland | | | 60 | | | Senior Vice President, Chief Supply Chain Officer |

Irene E. Cook | | | 54 | | | Senior Vice President, Chief Company and Joint Venture Operations Officer |

Elizabeth A. Dunlap | | | 51 | | | Senior Vice President, Chief People Officer |

Blaine E. Hurst | | | 56 | | | Senior Vice President, Technology and Transformation |

Thomas C. Kish | | | 47 | | | Senior Vice President, Chief Technology Officer |

William H. Simpson | | | 50 | | | Senior Vice President, Chief Franchise Officer |

Mark D. Wooldridge | | | 38 | | | Vice President of Accounting, Associate Controller and Chief Accounting Officer |

Roger C. Matthews, Jr. Mr. Matthews has served as our Executive Vice President, Chief Financial Officer since March 2013. Prior to joining us, Mr. Matthews served in various positions at Goldman Sachs & Company & Co. from 1996 until March 2013, including Managing Director, Investment Banking Division and Sector Head, US Restaurant Industry since 2006 and a member of its Consumer/Retail Group and Mergers & Strategic Advisory from 2000 until 2006.

Charles J. (Chuck) Chapman III. In November 2011, Mr. Chapman, joined our management team as Executive Vice President, Chief Operating Officer. Mr. Chapman served on our Board from January 2008 until November 2011. From January 2001 until October 2011, Mr. Chapman served in several leadership positions at Dairy Queen, a subsidiary of Berkshire Hathaway, including most recently as Chief Operating Officer. Mr. Chapman also previously served as Chief Operating Officer of Bruegger’s Bagels Inc. and as President and co-Owner of Beantown Bagels, a Bruegger’s franchise. Additionally, he has held various marketing and operations positions with Darden Restaurants and began his career with the consulting firm Bain & Company.

18

Scott G. Davis. Mr. Davis has served as our Executive Vice President, Chief Concept and Innovation Officer since May 2010, prior to which he served as our Senior Vice President, Chief Concept Officer since May 1999. Mr. Davis joined us in 1987, and from May 1996 until May 1999, he served as our Director of Concept Services and Customer Experience.

Michael D. Simon. Mr. Simon has served as our Executive Vice President, Chief Marketing Officer since March 2013, prior to which he served as our Senior Vice President, Chief Marketing Officer from October 2009 until February 2013. Prior to joining us, Mr. Simon served in various positions at Campbell Soup Company and its subsidiaries from 1992 until October 2009, including Senior Vice President/General Manager of the Snacks Division at Pepperidge Farm, Inc., as well as senior marketing positions within Pepperidge Farm’s Bakery Division and Godiva Chocolatier, Inc.

Scott G. Blair. Mr. Blair has served as our Senior Vice President, Chief Legal Officer, General Counsel and Secretary since January 2008. From March 2003 until January 2008, Mr. Blair served as our Special Counsel for Employee Relations and also maintained a sole proprietorship law firm concentrating on employment law.

Mark A. Borland. Mr. Borland has served as our Senior Vice President, Chief Supply Chain Officer since August 2002. Mr. Borland joined our company in 1986 and held management positions with Au Bon Pain and Panera Bread until 2000, including Executive Vice President, Vice President of Retail Operations, Chief Operating Officer and President of Manufacturing Services. From March 2000 until March 2001, Mr. Borland served as Senior Vice President of Operations at RetailDNA, a provider of sales and marketing products.

Irene E. Cook. Ms. Cook has served as our Senior Vice President, Chief Company and Joint Venture Operations Officer since May 2012. Ms. Cook joined our management team in 2004 as Vice President of Learning and Development, then served as Vice President, Operations from January 2006 until May 2012. Prior to joining Panera, Ms. Cook served as Vice President, Training and Recruiting, and Director of Training at Bertucci’s Corporation. She also previously served in training and management roles at Nutri-System, Inc. and Boston Chicken, Inc.

Elizabeth A. Dunlap. Ms. Dunlap has served as our Senior Vice President, Chief People Officer since June 2011. Ms. Dunlap previously served as Chief Human Resources Officer for Christie’s International, a global art business, from March 2008 until May 2010. From March 1997 until March 2008, she held several positions at Campbell Soup Company, including Vice President of Human Resources for Campbell’s Away From Home division and Vice President for Godiva Chocolatier. She has also held human resources positions at Sizzler Restaurants, Disney Consumer Products, Taco Bell and Carnation/Nestle.

Blaine E. Hurst. Mr. Hurst has served as our Senior Vice President, Technology and Transformation since January 2011. From October 2002 until January 2011, Mr. Hurst was an entrepreneur and independent consultant, assisting numerous restaurant, retail and distribution companies. From January 2001 until October 2002, Mr. Hurst served as President of eMac Digital, LLC — Restaurant Technology Solutions. He also served as Vice Chairman and President, Executive Vice President — Chief Administrative Officer and Vice President — Information Services, at Papa John’s International Inc., a chain restaurant operator, from February 1995 until December 2000.

Thomas C. Kish. Mr. Kish has served as our Senior Vice President, Chief Technology Officer since September 2012. From December 2004 until September 2012, Mr. Kish served as our Senior Vice President, Chief Information Officer. From April 2001 until December 2004, Mr. Kish served as our Vice President, Chief Information Officer. Prior to joining us, Mr. Kish served as Vice President, Information and Support Services for Papa John’s International, a chain restaurant operator, from 1995 until 2001.

William H. Simpson. Mr. Simpson has served as our Senior Vice President and Chief Franchise Officer since October 2012. Since 2002, Mr. Simpson has served in various positions with us, including Senior Vice

19

President and Chief Development Officer from May 2012 until September 2012, Senior Vice President, Chief Company and Joint Venture Operations Officer from April 2006 until April 2012 and Vice President, Retail Operations from February 2005 until April 2006. From June 1998 until November 2002, Mr. Simpson served as Vice President of Franchise Operations and Regional Vice President of Company Operations for Bennigan’s Restaurants, a chain restaurant operator

Mark D. Wooldridge. Mr. Wooldridge has served as our Vice President of Accounting, Associate Controller since January 2012, as our Chief Accounting Officer since April 2007, our Assistant Controller from March 2010 until January 2012, and as our Director, External Reporting and Accounting from August 2006 until March 2010. Prior to joining us, Mr. Wooldridge served as Director, Financial Reporting and Manager, Financial Reporting for Solutia, Inc., a manufacturer of specialty chemicals and performance materials, from August 2003 until August 2006. Prior to Solutia, Inc., Mr. Wooldridge served in the Audit and Assurance Business Services practice with Ernst & Young from September 1997 until August 2003.

20

EXECUTIVE AND DIRECTOR COMPENSATION AND RELATED MATTERS

Compensation Discussion and Analysis

This Compensation Discussion and Analysis is designed to provide our stockholders with an understanding of our compensation philosophy, objectives, programs and process, as well as the compensation paid to our named executive officers, or NEOs, in fiscal 2012. For fiscal 2012, our NEOs were:

| | • | | Ronald M. Shaich, our Chairman and Co-Chief Executive Officer; |

| | • | | William W. Moreton, our President and Co-Chief Executive Officer; |

| | • | | Jeffrey W. Kip, our former Executive Vice President, Chief Financial Officer, who resigned and ceased serving as an executive officer and employee on March 15, 2012; |

| | • | | Mark D. Wooldridge, our Vice President of Accounting, Associate Controller and Chief Accounting Officer, who served as our Principal Financial Officer from March 16, 2012 to April 8, 2012; |

| | • | | Thomas P. Kelly, who served as our Interim Chief Financial Officer from April 9, 2012 until March 17, 2013; |

| | • | | Charles J. Chapman III, our Executive Vice President, Chief Operating Officer; |

| | • | | Scott G. Davis, our Executive Vice President, Chief Concept and Innovation Officer; and |

| | • | | Michael D. Simon, our Executive Vice President, Chief Marketing Officer. |

Executive Summary

Compensation Objectives and Philosophy

Our executive compensation program is designed to meet the following primary objectives:

| | (1) | Management Recruitment and Retention.Attract, retain and motivate qualified and talented executive officers by offering an executive compensation package that is reasonable and competitive within the industries within which we compete for talent; |

| | (2) | Performance-Based Compensation.Incent our executive officers to achieve our short-, intermediate- and longer-term performance objectives; and |

| | (3) | Long-Term Focus on Stockholder Value.Align our executive officers’ interests with those of our stockholders in order to attain our ultimate objective of increasing stockholder value through the use of mid- and long-term cash and equity compensation. |

Say-on-Pay Feedback from Stockholders

In 2012, we submitted our executive compensation program to an advisory vote of our stockholders and it received the support of over 90% of the total votes cast at our 2012 annual meeting of stockholders. Annually, our Compensation Committee intends to review the results of the advisory stockholder vote and will consider this feedback as it reviews and determines the total compensation packages for our NEOs.

21

Elements of Compensation

Our executive compensation program is comprised of three basic elements:

| | | | |

Element | | Fixed or

Variable | | Objectives |

| | |

Base Salary | | Fixed | | To attract and retain executives by offering fixed compensation that is generally competitive with market opportunities and that recognizes each executive’s position, role, responsibility and experience. |

| | |

| Annual Cash Incentive | | Variable | | To motivate and reward the achievement of our annual performance objectives. |

| | |

| Long-Term Incentives | | Variable | | To motivate and reward the achievement of mid- and long-term performance objectives, align our executive officer’s interests with those of our stockholders by focusing on the creation of long-term stockholder value and to promote the retention of our executives and key management personnel. |

We provide benefits to our executive officers at levels that are generally comparable to those offered to all our full-time management employees. Perquisites are not a significant part of our executive compensation program. Both benefits and the limited perquisites we offer to our NEOs are described in more detail below.

Executive Compensation Processes and Roles of Management, the Compensation Committee, and Compensation Consultant

Our executive compensation is based in part to the organization levels of our executive officers, which are comprised of Co-Chief Executive Officer, Executive Vice President and two Senior Vice President levels. Each component of the compensation of our Chairman and Co-Chief Executive Officer, Mr. Shaich, and our President and Co-Chief Executive Officer, Mr. Moreton, is established by our Board upon the recommendation of our Compensation Committee, with third party advisory support as determined appropriate by our Compensation Committee. Each component of compensation of our other executive officers is established by our Compensation Committee, upon the recommendation of our Co-Chief Executive Officers and any third party advisers as determined appropriate.

The Compensation Committee has implemented an annual performance review program for our executives under which annual performance goals are determined early in each calendar year for each of our executive officers. These goals may include both corporate goals and individual department specific goals that facilitate the achievement of corporate performance. Annual bonuses are tied to the achievement of these performance goals.

During the first quarter of each fiscal year, we evaluate corporate and, as applicable, individual performance against the goals for the recently completed fiscal year. Our Co-Chief Executive Officers present to the Compensation Committee an evaluation of each of the other executive officers’ performance, as well as a recommendation for annual executive salary increases and annual bonus awards, if any. These evaluations and recommendations are then discussed by the Compensation Committee, which approves salary increases and annual bonus awards for the executives. In the case of each of our President and Co-Chief Executive Officer and our Chairman and Co-Chief Executive Officer, their individual performance evaluations are conducted by the Compensation Committee, which recommends salary increases and annual bonus awards, if any, to the Board for consideration and approval.

During the third quarter of each year, the Compensation Committee and Board grant long-term equity and performance awards under our 2005 Long Term Incentive Program to our executive officers based on long-term incentive compensation targets that have been established. Newly hired and promoted executives may be granted supplemental awards, if any, at a committee meeting following their hiring or promotion dates.

22

The Compensation Committee has the authority to retain compensation consultants and other outside advisors to assist in the evaluation of executive officer compensation. In fiscal 2012, our Compensation Committee retained an independent compensation consultant, W.T. Haigh & Company, Inc., or W.T. Haigh, to assist the Compensation Committee with updating our peer group for competitive analysis, conducting a market total compensation review for executive officers, and reviewing this Compensation Discussion and Analysis disclosure. In addition, at the request of the Committee on Nominations and Corporate Governance and with the approval of the Compensation Committee, W.T. Haigh conducted a market total compensation review for non-employee directors. W.T. Haigh reports directly to the Compensation Committee and does not provide any other services to us. In fiscal 2012, W.T. Haigh participated in three meetings of the Compensation Committee.

Market Surveys and Competitive Analysis

In fiscal 2012, in connection with its evaluation of the compensation of our executive officers, the Compensation Committee engaged W.T. Haigh to conduct a survey of the direct compensation, including base salary and short- and long-term incentives, paid to executive officers of a peer group of publicly traded companies in the restaurant industry. The peer companies were selected based primarily on the balance of the following criteria:

| | • | | companies in the restaurant industry whose organizational structure, number of employees and market capitalization are similar, though not necessarily identical, to ours; |

| | • | | companies with similar executive positions to ours; |

| | • | | companies against which we believe we compete for executive talent; and |

| | • | | public companies based in the United States whose compensation and financial data are publicly available. |

Based on these criteria, our peer group for 2012 was comprised of the following companies:

| | | | |

Bob Evans Farms, Inc. | | Chipotle Mexican Grill, Inc. | | Papa John’s International Inc. |

Brinker International, Inc. | | Cracker Barrel Old Country Store | | P.F. Chang’s China Bistro, Inc. |

Buffalo Wild Wings, Inc. | | Darden Restaurants, Inc. | | Red Robin Gourmet Burgers, Inc. |

The Cheesecake Factory Incorporated | | DineEquity, Inc. | | Ruby Tuesday, Inc. |

CEC Entertainment, Inc. | | Domino’s Pizza, Inc. | | Texas Roadhouse, Inc. |