As filed with the Securities and Exchange Commission on April 17, 2018 Registration No. 333-213125

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

¾¾¾¾¾¾¾¾¾¾¾¾¾¾

POST-EFFECTIVE AMENDMENT NO. 4

TO

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

¾¾¾¾¾¾¾¾¾¾¾¾¾¾

Allianz Life Insurance Company of North America

(Exact name of Registrant as specified in its charter)

Minnesota (State or other jurisdiction of incorporation or organization) | 6311 (Primary Standard Industrial Classification Code Number) | 41-1366075 (I.R.S. Employer Identification No.) |

5701 Golden Hills Drive

Minneapolis, MN 55416

(800) 950-5872

(Address, including zip code, and telephone number, including area code, of Registrant's principal executive offices)

Stewart D. Gregg, Esq.

Allianz Life Insurance Company of North America

5701 Golden Hills Drive

Minneapolis, MN 55416

(763) 765-2913

(Name, address, including zip code, and telephone number, including area code, of agent for service)

¾¾¾¾¾¾¾¾¾¾¾¾¾¾

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this registration statement becomes effective.

As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] Accelerated filer [ ]

Non-accelerated filer [X] Smaller reporting company [ ]

(Do not check if a smaller reporting company)

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

PART I – PROSPECTUS

SUPPLEMENT DATED MAY 1, 2018

To the following variable annuity prospectuses:

Allianz Index Advantage®

Dated May 1, 2018

Allianz Index Advantage ADVSM

Allianz Index Advantage NFSM

Dated May 1, 2018

ISSUED BY

Allianz Life Insurance Company of North America and Allianz Life Variable Account B

This supplement updates certain information contained in the prospectus and should be

attached to the prospectus and retained for future reference.

Effective June 4, 2018 we are making the Russell 2000® Index, Nasdaq-100® Index and EURO STOXX 50® available under the Index Protection Strategy if your Contract was issued on or after August 24, 2015, has a Contact number starting with AV, and was not issued in Missouri or Washington.

Please discuss with your Financial Professional whether these new Index Protection Strategy Index Options are appropriate for your investment needs. If you would like to include these new Index Protection Strategy Index Options in your future allocation instructions, or your Index Anniversary transfer or optional rebalancing program instructions, you can do so by logging into your online account at allianzlife.com and selecting Index Rebalances under My Contract. You can also change your instructions by contacting your Financial Professional, or calling our Service Center at (800) 624-0197.

PRO-001-0518

ALLIANZ INDEX ADVANTAGE ADVSM VARIABLE ANNUITY CONTRACT

Issued by Allianz Life® Variable Account B and Allianz Life Insurance Company of North America (Allianz Life®, we, us, our)

Prospectus Dated: May 1, 2018

This prospectus describes all material rights and obligations of purchasers under an individual flexible purchase payment variable and index-linked deferred annuity contract (Contract). The Contract is designed to be used by purchasers who are working with a Financial Professional registered or affiliated with an investment adviser registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940, as amended, or under state securities law, as applicable. Allianz Life is not an investment adviser, does not provide investment advice with regard to the Contract, and is not a party to any agreement between you and your Financial Professional. The Contract offers both variable investment options (Variable Options) and index-linked investment options (Index Options). (The Variable Options and the Index Options together are referred to as Allocation Options.) You can allocate your money (Purchase Payments) to any or all of the Variable Options or Index Options. The Contract also offers various standard annuity features, including multiple fixed annuitization options (Annuity Options), a free withdrawal privilege, and a guaranteed death benefit (Traditional Death Benefit). For an individually owned Contract, the annuity can be a single or joint annuity. The Contract has a six-year withdrawal charge period applicable only to the Index Options. The Variable Options are not subject to a withdrawal charge. Amounts transferred from the Variable Options to the Index Options and subsequently withdrawn are subject to a Daily Adjustment (which may be negative) and a withdrawal charge. At issue, purchasers can select the optional Maximum Anniversary Value Death Benefit for an additional fee described in Fee Tables and section 8. The Maximum Anniversary Value Death Benefit is not available to Contracts issued before the date of this prospectus. The Maximum Anniversary Value Death Benefit locks in any annual Index Anniversary investment gains (Maximum Anniversary Value) to potentially provide an increased death benefit as described in section 11.

If you allocate Purchase Payments to the Variable Options, the value of your investment (Variable Account Value) increases and decreases based on your selected Variable Options' performance. The Variable Options do not provide any protection against loss of principal. You can lose money (including principal and previously applied positive Credits) you allocate to the Variable Options.

| Variable Options Currently Available | ||

AZL® MVP Growth Index Strategy Fund | AZL® MVP Balanced Index Strategy Fund | AZL® Government Money Market Fund |

If you allocate Purchase Payments to the Index Options, you receive annual returns (Credits) based on the performance of one or more nationally recognized third-party broad based securities indices (Index or Indices). Unlike the Variable Options, the Index Options do not involve a direct or indirect investment by you in any underlying Index and do not participate directly in the equity market. Instead, Credits are an obligation of Allianz Life, and are subject to the claims paying ability and financial strength of Allianz Life. These Credits are calculated by us based on annual changes in the Index's value.

All Index Credit calculation methods (Crediting Methods) provide a combination of a Credit that is calculated by reference to Index performance, a level of protection against negative Index performance, and a limit or Cap on participation in positive Index performance. The Crediting Methods are described in more detail in section 7, Index Options. The Indices are described in more detail in Appendix A.

| Crediting Methods | Indices |

| Index Protection Strategy | S&P 500® Index |

| Index Performance Strategy | Russell 2000® Index |

| Index Guard Strategy | Nasdaq-100® Index |

| Index Precision Strategy | EURO STOXX 50® |

NOTE:

| ● | The Index Protection Strategy is not available to Contracts issued in Missouri or Washington on or after the date of this prospectus. If in future years the renewal rates for the Index Performance Strategy, Index Guard Strategy or Index Precision Strategy are not acceptable to you, you will not be able to transfer into the Index Protection Strategy and take advantage of its principal protection. This would subject you to ongoing market risk. You could lose money and previously applied positive Credits. |

| ● | Availability restrictions for the Crediting Methods and Indices for Contracts issued before the date of this prospectus are detailed in section 7, Index Options. |

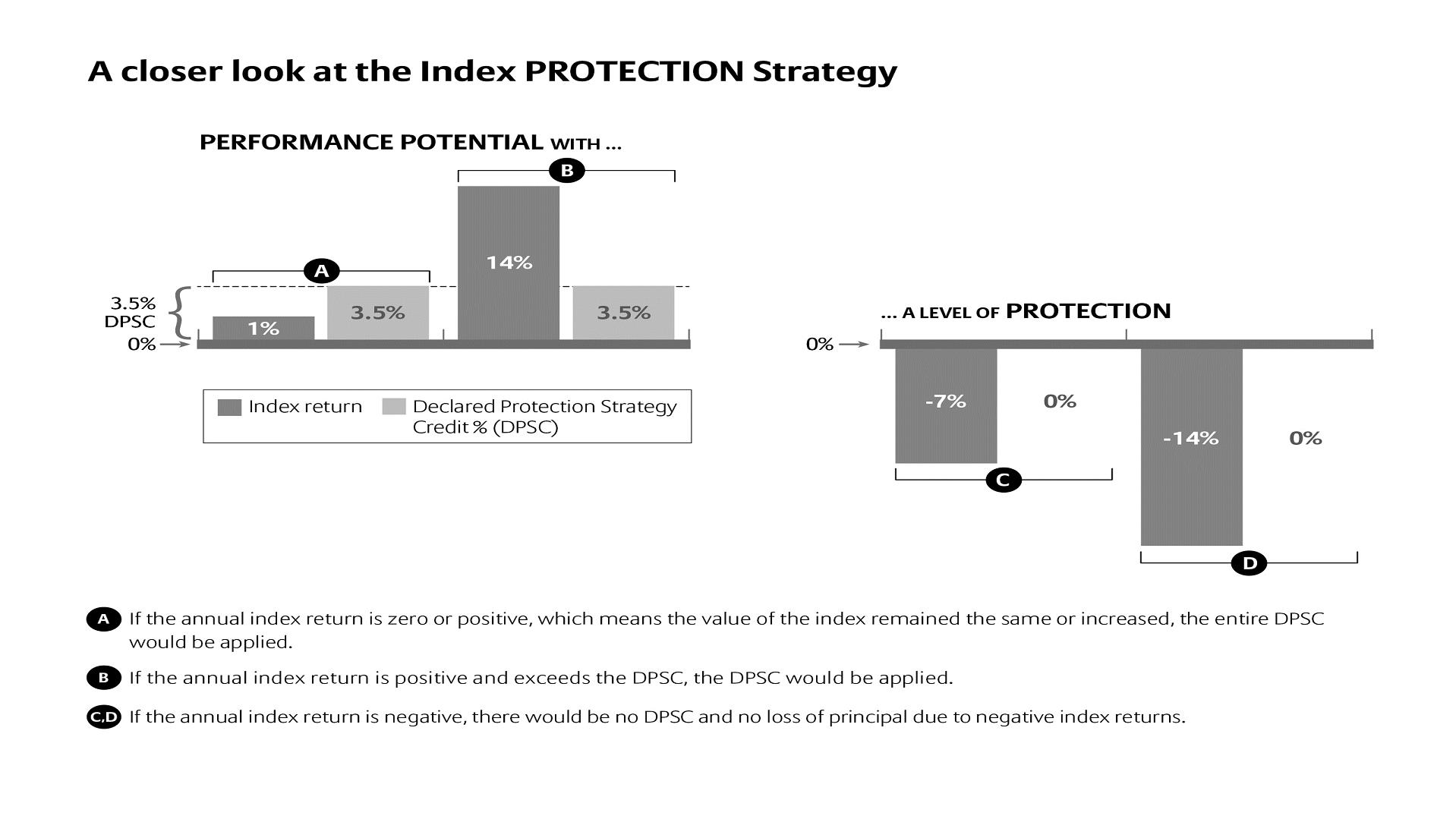

The Index Protection Strategy provides a Declared Protection Strategy Credit (DPSC) if the current Index Value (Index price at the end of the Business Day on the Index Anniversary as provided by Bloomberg or another market source) is equal to or greater than the Index Value on the last Index Anniversary. If the current Index Value is less than the Index Value on the last Index Anniversary you do not receive the DPSC, but you also do not receive a negative Credit. Amounts withdrawn from the Index Protection Strategy Index Options during the year do not receive the DPSC. We can change the DPSCs at the beginning of each Index Year. An Index Year is a twelve-month period beginning on the Index Effective Date and each subsequent Index Anniversary. An Index Anniversary is a twelve-month anniversary of the Index start date (Index Effective Date) and is the date we apply Credits.

The Index Performance Strategy, Index Guard Strategy, and Index Precision Strategy each provide a different form of Credit calculation. Under the Index Performance Strategy and Index Guard Strategy you receive a positive Performance Credit based on positive Index Return (annual percentage change in Index Value from one Index Anniversary to the next) subject to an upper limit called the Cap. If the Index Return is negative you will receive a negative Performance Credit under the Index Performance Strategy if the loss is greater than a specified percentage called the Buffer. Under the Index Guard Strategy, if the Index Return is negative, you will receive a negative Performance Credit down to the amount of a specified percentage called the Floor, but the negative Performance Credit will never exceed the Floor. Under the Index Precision Strategy you receive a positive Performance Credit equal to the Precision Rate if the current Index Value is equal to or greater than the Index Value on the last Index Anniversary. This is similar to the DPSCs under the Index Protection Strategy in that positive Performance Credits are equal to the rate set at the beginning of each Index Year. Precision Rates will generally be greater than the DPSCs, though they will generally be less than the Index Performance Strategy Caps. If the current Index Value is less than the Index Value on the last Index Anniversary you receive a negative Performance Credit under the Index Precision Strategy if the negative Index Return is greater than the Buffer, which is similar to negative Performance Credits under the Index Performance Strategy. Please note, since the Index Value is priced only on the Index Effective Date and subsequent Index Anniversaries, the Index Return does not account for changes in Index Value during the Index Year. A negative Performance Credit means that you can lose money, including principal and previously applied positive Performance Credits. For more information please see "How Do the Index-Linked Crediting Methods Compare?" on page 16.

We can change the Precision Rates and Caps at the beginning of each Index Year, but we generally establish the Buffers and Floors on the date we issue your Contract (Issue Date). However, if we add a new Index Option to a Contract after the Issue Date, we establish the Buffer or Floor for it on the date we add the Index Option to the Contract. We cannot change Buffers or Floors after they are established. DPSCs, Precision Rates, Caps, Buffers and Floors can all be different. For example, Caps for the Index Performance Strategy can be different between the S&P 500® Index and the Nasdaq-100® Index, and Caps for the S&P 500® Index can be different between the Index Performance Strategy and Index Guard Strategy. Amounts allocated to the Index Precision Strategy, Index Performance Strategy and Index Guard Strategy Index Options may fluctuate between Index Anniversaries. We base these interim values on a calculation called the Daily Adjustment, which reflects changes in market value of an Index Option. The Daily Adjustment does not apply to the Index Protection Strategy. You can lose money (including principal and previously applied positive Credits) that you allocate to the Index Precision Strategy and Index Performance Strategy if Index losses are greater than the Buffer, or the Index Guard Strategy for Index losses down to the Floor. This loss could be significant. If money is withdrawn or removed from an Index Precision Strategy, Index Performance Strategy or Index Guard Strategy Index Option before the Index Anniversary, you could lose money (including principal and previously applied positive Credits) even if the Index return is positive on the date of withdrawal due to the application of the Daily Adjustment.

Amounts allocated to the Index Options may also fluctuate based on the Alternate Minimum Value. The Alternate Minimum Value is the guaranteed minimum on the value of each Index Option (Index Option Value) if you take a withdrawal, annuitize the Contract, transfer out of Index Options to the Variable Options, or if we pay a death benefit. The Alternate Minimum Value applies to all Crediting Methods, including the Index Protection Strategy.

The Crediting Methods have different risk and return potentials. The Index Protection Strategy has the lowest return potential, but provides the most protection. Potential returns and risks are higher for the other Crediting Methods.

Positive returns for the Index Performance Strategy and Index Guard Strategy are limited by the Caps, and for the Index Precision Strategy by the Precision Rates. The Index Precision Strategy performs best in periods of small market movements because the Precision Rates will generally be greater than the DPSC, though they will generally be less than the Index Performance Strategy Caps. Negative returns are limited for the Index Precision Strategy and Index Performance Strategy by the Buffers, and for the Index Guard Strategy by the Floor. The Buffers have protection for smaller negative returns, but also have the potential for the largest loss in any one year. The Index Guard Strategy permits negative Performance Credits down to the Floor, and provides less risk of significant negative returns in any one year than the Buffers.

All guarantees under the Contract are the obligations of Allianz Life and are subject to the claims paying ability and financial strength of Allianz Life.

The Contract involves certain risks, as described in section 1, Risk Factors on page 25 of this prospectus.

Please read this prospectus before investing and keep it for future reference. It contains important information about your annuity and Allianz Life that you ought to know before investing. This prospectus is not an offering in any state, country, or jurisdiction in which we are not authorized to sell the Contracts. You should rely only on the information contained in this prospectus. We have not authorized anyone to give you different information.

Index-linked annuity contracts are complex insurance and investment vehicles. Purchasers should speak with a Financial Professional about the Contract's features, benefits, risks, and fees, and whether the Contract is appropriate based upon the purchaser's financial situation and objectives. The primary purpose of this prospectus is to offer the product for sale; it is not intended to constitute a suitability recommendation or fiduciary advice. Please consult your Financial Professional for a specific recommendation to purchase the Contract.

Allianz Life Variable Account B is the Separate Account that holds the assets allocated to the Variable Options. Additional information about the Separate Account has been filed with the Securities and Exchange Commission (SEC) and is available upon written or oral request without charge, or on the EDGAR database on the SEC's website (www.sec.gov). A Statement of Additional Information (SAI) dated the same date as this prospectus includes additional information about the annuity offered by this prospectus. The SAI is incorporated by reference into this prospectus. The SAI is filed with the SEC on Form N-4 and is available without charge by contacting us at the telephone number or address listed at the back of this prospectus. The SAI's table of contents appears after the Privacy and Security Statement in this prospectus. The prospectus, SAI and other Contract information are also available on the EDGAR database.

The SEC has not approved or disapproved these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense. An investment in this Contract is not a deposit of a bank or financial institution and is not federally insured or guaranteed by the Federal Deposit Insurance Corporation or any other federal government agency. An investment in this Contract involves investment risk including the possible loss of principal. Variable and index-linked annuity contracts are complex insurance and investment vehicles. Before you invest, be sure to ask your Financial Professional about the Contract's features, benefits, risks, and fees, and whether the Contract is appropriate for you based upon your financial situation and objectives.

TABLE OF CONTENTS

| Glossary | 6 | |

| Summary | 11 | |

| Who Should Consider Purchasing the Contract? | 12 | |

| What Are the Contract's Charges? | 13 | |

| What Are the Contract's Benefits? | 13 | |

| What Are the Index-Linked Crediting Methods and How Do They Work? | 14 | |

| When Do You Establish the Values Used to Determine Index-Linked Credits? | 14 | |

| What Factors Impact the DPSCs, Precision Rates and Caps? | 16 | |

| How Do the Index-Linked Crediting Methods Compare? | 16 | |

| How Can I Allocate My Purchase Payments? | 18 | |

| What Are the Different Values Within the Contract? | 18 | |

| How Do We Apply Credits to the Index Options? | 20 | |

| Can My Contract Lose Value Because of Negative Changes in an Index's Value? | 20 | |

| Can I Transfer Index Option Value Between the Allocation Options? | 20 | |

| How Can I Take Money Out of My Contract? | 20 | |

| What Are My Annuity Options? | 21 | |

| Does the Contract Provide a Death Benefit? | 21 | |

| What If I Need Customer Service? | 21 | |

| Fee Tables | 22 | |

| Owner Transaction Expenses | 22 | |

| Owner Periodic Expenses | 22 | |

| Annual Operating Expenses of the Variable Options | 23 | |

| Examples | 24 | |

| Condensed Financial Information | 25 | |

| 1. | Risk Factors | 25 |

| Liquidity Risk | 25 | |

| Risk of Investing in Securities | 26 | |

| Risk of Negative Returns | 27 | |

| Calculation of Credits | 27 | |

| Substitution of an Index | 28 | |

| Changes to Caps, Precision Rates, Declared Protection Strategy Credits (DPSCs), and Notice of Buffers and Floors | 28 | |

| Investment in Derivative Securities | 29 | |

| Variable Option Risk | 30 | |

| Our Financial Strength and Claims-Paying Ability | 30 | |

| Regulatory Protections | 30 | |

| 2. | The Variable Annuity Contract | 30 |

| State Specific Contract Restrictions | 31 | |

| When The Contract Ends | 31 | |

| 3. | Ownership, Annuitants, Determining Life, Beneficiaries, and Payees | 31 |

| Owner | 31 | |

| Joint Owner | 31 | |

| Annuitant | 32 | |

| Determining Life (Lives) | 32 | |

| Beneficiary | 33 | |

| Payee | 33 | |

| Assignments, Changes of Ownership and Other Transfers of Contract Rights | 33 | |

| 4. | Purchasing the Contract | 34 |

| Purchase Requirements | 34 | |

| Applications Sent Electronically | 35 | |

| Allocation of Purchase Payments and Transfers Between the Allocation Options | 35 | |

| Automatic Investment Plan (AIP) | 36 | |

| Free Look/Right to Examine Period | 36 | |

| 5. | Variable Options | 37 |

| Substitution of Variable Options and Limitation on Further Investments | 38 | |

| Transfers Between Variable Options | 39 | |

| Electronic Transfer and Allocation Instructions | 39 | |

| Excessive Trading and Market Timing | 39 | |

| Financial Adviser Fees | 41 | |

| Voting Privileges | 42 | |

| 6. | Valuing Your Contract | 42 |

| Accumulation Units | 42 | |

| Computing Variable Account Value | 43 | |

| 7. | Index Options | 43 |

| Determining Index Option Value for the Index Protection Strategy | 44 | |

| Determining Index Option Values for the Index Precision Strategy, Index Performance Strategy and Index Guard Strategy | 45 | |

| The Alternate Minimum Value | 48 | |

| Optional Rebalancing Program | 49 | |

| 8. | Expenses | 49 |

| Annual Contract Fees: Product Fee and Rider Fee | 49 | |

| Contract Maintenance Charge | 50 | |

| Withdrawal Charge | 50 | |

| Transfer Fee | 53 | |

| Premium Tax | 53 | |

| Income Tax | 53 | |

| Variable Option Expenses | 53 | |

| 9. | Access to Your Money | 53 |

| Free Withdrawal Privilege | 54 | |

| Systematic Withdrawal Program | 55 | |

| Minimum Distribution Program and Required Minimum Distribution (RMD) Payments | 55 | |

| Waiver of Withdrawal Charge Benefit | 56 | |

| Suspension of Payments or Transfers | 56 | |

| 10. | The Annuity Phase | 56 |

| Calculating Your Annuity Payments | 56 | |

| Annuity Payment Options | 57 | |

| When Annuity Payments Begin | 58 | |

| 11. | Death Benefit | 58 |

| Maximum Anniversary Value | 59 | |

| Death of the Owner and/or Annuitant | 60 | |

| Death Benefit Payment Options During the Accumulation Phase | 60 | |

| 12. | Taxes | 61 |

| Qualified and Non-Qualified Contracts | 61 | |

| Taxation of Annuity Contracts | 62 | |

| Tax-Free Section 1035 Exchanges | 62 | |

| 13. | Other Information | 63 |

| The Registered Separate Account | 63 | |

| Our General Account | 63 | |

| Our Unregistered Separate Account | 63 | |

| Distribution | 64 | |

| Additional Credits for Certain Groups | 65 | |

| Administration/Allianz Service Center | 65 | |

| Legal Proceedings | 66 | |

| Status Pursuant to Securities Exchange Act of 1934 | 66 | |

| 14. | Information on Allianz Life | 66 |

| Directors, Executive Officers and Corporate Governance | 66 | |

| Executive Compensation | 71 | |

| Security Ownership of Certain Beneficial Owners and Management | 83 | |

| Transactions with Related Persons, Promoters and Certain Control Persons | 83 | |

| Risks Associated with the Financial Services Industry | 83 | |

| 15. | Financial Statements | 99 |

| Auditor Update | 99 | |

| 16. | Privacy Notice | 100 |

| 17. | Table of Contents of the Statement of Additional Information (SAI) | 101 |

| Appendix A – Available Indices | 102 | |

| Standard & Poor's 500 Index | 102 | |

Russell 2000® Index | 103 | |

Nasdaq-100® Index | 103 | |

EURO STOXX 50® | 104 | |

| Appendix B – Daily Adjustment | 105 | |

| Appendix C – Buffers, Floors and Initial DPSCs, Precision Rates and Caps | 107 | |

| Index Protection Strategy | 107 | |

| Index Performance Strategy | 107 | |

| Index Guard Strategy | 108 | |

| Index Precision Strategy | 108 | |

| Appendix D – Annual Contract Fees Calculation Examples | 109 | |

| Traditional Death Benefit | 109 | |

| Maximum Anniversary Value Death Benefit | 110 | |

| Appendix E – Bar Chart Examples | 110 | |

| Appendix F – Selected Financial Data and Consolidated Financial Statements | 111 | |

| Management's Discussion and Analysis of Financial Condition and Results of Operations (For the 12 month period ended December 31, 2017) | 113 | |

| Consolidated Financial Statements and Supplemental Schedules | 113 | |

| For Service or More Information | 114 | |

| Our Service Center | 114 | |

GLOSSARY

This prospectus is written in plain English. However, there are some technical words or terms that are capitalized and are used as defined terms throughout the prospectus. For your convenience, we included this glossary to define these terms.

Accumulated Alternate Interest – the sum of alternate interest earned for the entire time you own your Contract. The alternate interest for each Index Year is equal to the Alternate Minimum Base multiplied by the alternate interest rate. The alternate interest rate is stated in your Contract and does not change for the entire time you own your Contract. We use the Accumulated Alternate Interest to calculate the Alternate Minimum Value.

Accumulation Phase – the initial phase of your Contract before you apply your Contract Value to Annuity Payments. The Accumulation Phase begins on the Issue Date.

Allocation Options – the Variable Options and Index Options available to you under the Contract.

Alternate Minimum Base – the Index Option Value at the beginning of an Index Year multiplied by the AMB Factor. We use the Alternate Minimum Base to determine the amount of interest earned on the Alternate Minimum Value.

Alternate Minimum Value – the guaranteed minimum Index Option Value we provide for each Crediting Method if you take a withdrawal, annuitize the Contract, transfer out of Index Options to the Variable Options, or if we pay a death benefit.

AMB Factor – the percentage of the Index Option Base that determines the Alternate Minimum Base on the Index Effective Date and each Index Anniversary. The AMB Factor is stated in your Contract and does not change for the entire time you own your Contract. We use the AMB Factor to calculate the Alternate Minimum Value.

AMV Factor – the percentage of the Index Option Base that determines the Alternate Minimum Value on the Index Effective Date and each Index Anniversary. The AMV Factor is stated in your Contract and does not change for the entire time you own your Contract.

Annuitant – the individual upon whose life we base the Annuity Payments. Subject to our approval, the Owner designates the Annuitant, and can add a joint Annuitant for the Annuity Phase. There are restrictions on who can become an Annuitant.

Annuity Date – the date we begin making Annuity Payments to the Payee from the Contract.

Annuity Options – the annuity income options available to you under the Contract.

Annuity Payments – payments made by us to the Payee pursuant to the chosen Annuity Option.

Annuity Phase – the phase the Contract is in once Annuity Payments begin.

Beneficiary – the person(s) the Owner designates to receive any death benefit, unless otherwise required by the Contract or applicable law.

Buffer – under the Index Precision Strategy and Index Performance Strategy, this is the negative Index Return that Allianz Life absorbs before applying a negative Performance Credit. We generally establish a Buffer for each Index Precision Strategy and Index Performance Strategy Index Option on the Issue Date. However, if we add a new Index Option to a Contract after the Issue Date, we establish the Buffer for it on the date we add the Index Option to your Contract. Buffers are stated in your Contract and do not change after they are established.

Business Day – each day on which the New York Stock Exchange is open for trading, except, with regard to a specific Variable Option, when that Variable Option does not value its shares. Allianz Life is open for business on each day that the New York Stock Exchange is open. Our Business Day closes when regular trading on the New York Stock Exchange closes, which is usually at 4:00 p.m. Eastern Time.

Cap – under the Index Performance Strategy and Index Guard Strategy, this is the maximum potential Performance Credit for an Index Option. We set a Cap for each Index Performance Strategy and Index Guard Strategy Index Option on the Index Effective Date and each Index Anniversary. The Caps applicable to your Contract are shown on the Index Options Statement.

Charge Base – the Contract Value on the preceding Quarterly Contract Anniversary (or the initial Purchase Payment received on the Issue Date if this is before the first Quarterly Contract Anniversary), adjusted for subsequent Purchase Payments and withdrawals. We use the Charge Base to determine the next product fee and rider fee (if applicable) we deduct.

Contract – the individual flexible purchase payment variable and index-linked deferred annuity contract described by this prospectus.

Contract Anniversary – a twelve-month anniversary of the Issue Date or any subsequent Contract Anniversary.

Contract Value – on any Business Day, the sum of your Index Option Value(s) and Variable Account Value. The Contract Value does not include any currently applicable withdrawal charge, final product fee, final rider fee, or final contract maintenance charge. The Variable Account Value component of the Contract Value fluctuates each Business Day. The Index Option Value component of the Contract Value is adjusted on each Index Anniversary to reflect Credits, which can be negative with the Index Precision Strategy, Index Performance Strategy and Index Guard Strategy. A negative Performance Credit means that you can lose money, including principal and previously applied positive Credits. The Index Precision Strategy, Index Performance Strategy and Index Guard Strategy Index Option Values also reflect the Daily Adjustment on every Business Day other than the Index Anniversary.

Contract Year – any period of twelve months beginning on the Issue Date or a subsequent Contract Anniversary.

Credit – the annual return you may receive when you allocate money to an Index Option. Credits may be positive, zero, or, in some instances, negative if you select the Index Precision Strategy, Index Performance Strategy or Index Guard Strategy. A negative Credit means that you can lose money, including principal and previously applied positive Credits.

Crediting Method – a method we use to calculate annual Credits if you allocate money to an Index Option.

Daily Adjustment – the change in the market value of an Index Option under the Index Precision Strategy, Index Performance Strategy and Index Guard Strategy as discussed in section 7, Index Options and Appendix B. Each Index Precision Strategy, Index Performance Strategy and Index Guard Strategy Index Option has a Daily Adjustment. We use the Daily Adjustment to calculate the Index Option Values for these Index Options on each Business Day during the Index Year other than the Index Effective Date or Index Anniversary. The Daily Adjustment can affect the amounts available for withdrawals, annuitizations, death benefits, and the Contract Value used to determine the Charge Base and contract maintenance charge.

Declared Protection Strategy Credit (DPSC) – the positive Credit we apply on an Index Anniversary under the Index Protection Strategy if the current Index Value is equal to or greater than the Index Value on the last Index Anniversary (or the Index Effective Date if this is the first Index Anniversary). We set the DPSCs on the Index Effective Date and each Index Anniversary. The DPSCs applicable to your Contract are shown on the Index Options Statement.

Determining Life (Lives) – the person(s) designated at Contract issue and named in the Contract on whose life we base the guaranteed Traditional Death Benefit or Maximum Anniversary Value Death Benefit.

Financial Professional – the person who advises you regarding the Contract. A Financial Professional may be a registered representative of a broker-dealer and/or an investment adviser representative of a registered investment adviser. However, we do not pay a commission to broker-dealers or their registered representatives in connection with sales of the Contract. The Contracts are intended to be used by purchasers who are working with a Financial Professional registered or affiliated with an investment adviser, offering advisory services for a fee.

Floor – under the Index Guard Strategy, this is the lowest potential negative Performance Credit for an Index Option. We generally establish a Floor for each Index Guard Strategy Index Option on the Issue Date. However, if we add a new Index Option to a Contract after the Issue Date, we establish the Floor for it on the date we add the Index Option to your Contract. Floors are stated in your Contract and do not change after they are established.

Good Order – a request is in "Good Order" if it contains all of the information we require to process the request. If we require information to be provided in writing, "Good Order" also includes providing information on the correct form, with any required certifications, guarantees and/or signatures, and received at our Service Center after delivery to the correct mailing, email, or website address, which are all listed at the back of this prospectus. If you have questions about the information we require, or whether you can submit certain information by fax, email or over the web, please contact our Service Center. If you send information by email or upload it to our website, we send you a confirmation number that includes the date and time we received your information.

Index (Indices) – one (or more) of the nationally recognized third-party broad based securities Indices available to you under the Crediting Methods in your Contract.

Index Anniversary – a twelve-month anniversary of the Index Effective Date or any subsequent Index Anniversary. If an Index Anniversary does not occur on a Business Day, we consider it to occur on the next Business Day for the purposes of determining Index Values and Index Returns, applying Credits, and setting the DPSCs, Precision Rates and Caps.

Index Effective Date – the date shown on the Index Options Statement that starts the first Index Year. When you purchase this Contract you select the Index Effective Date as discussed in section 4, Purchasing the Contract – Allocation of Purchase Payments and Transfers Between the Allocation Options.

Index Guard Strategy – one of the Index Crediting Methods described in section 7, Index Options. Section 7 also includes availability restrictions for the Index Guard Strategy. The Index Guard Strategy calculates Performance Credits based on Index Returns subject to a Cap and Floor. You can receive negative Performance Credits under this Crediting Method, which means you can lose money (including principal and previously applied positive Credits). The Index Guard Strategy is more sensitive to smaller negative market movements that persist over time because the Floor reduces the impact of large negative market movements. In an extended period of smaller negative market returns, the risk of loss is greater with the Index Guard Strategy than with the Index Performance Strategy and Index Precision Strategy.

Index Option – the index-linked investment options to which you can allocate money under the Contract. Each Index Option is the combination of an Index and a Crediting Method.

Index Option Base – an amount we use to calculate Credits and the Daily Adjustment. The Index Option Base is equal to the amounts you allocate to an Index Option adjusted for withdrawals, Contract expenses, transfers into or out of the Index Option, and the application of any Credits.

Index Option Value – on any Business Day it is equal to the value in an Index Option. We establish an Index Option Value for each Index Option you select. Each Index Option Value includes any Credits from previous Index Anniversaries and the deduction of any previously assessed contract maintenance charge, product fee, rider fee, and withdrawal charge. On each Business Day during the Index Year other than the Index Effective Date or an Index Anniversary, each Index Option Value under the Index Precision Strategy, Index Performance Strategy and Index Guard Strategy also includes the Daily Adjustment. If you take a withdrawal, annuitize the Contract, transfer Contract Value out of Index Options, or if we pay a death benefit each Index Option Value for each Crediting Method also includes any increase from the Alternate Minimum Value.

Index Options Statement – an account statement we mail to you on the Index Effective Date and each Index Anniversary thereafter. On the Index Effective Date, the statement shows the initial Index Values, DPSCs, Precision Rates and Caps for the Index Options you selected. On each Index Anniversary, the statement shows the new Index Values, Credits received, and renewal DPSCs, Precision Rates and Caps that are effective for the next year for the Index Options you selected.

Index Performance Strategy – one of the Index Crediting Methods described in section 7, Index Options. Section 7 also includes availability restrictions for Index Performance Strategy. The Index Performance Strategy calculates Performance Credits based on Index Returns subject to a Cap and Buffer. You can receive negative Performance Credits under this Crediting Method, which means you can lose money (including principal and previously applied positive Credits). The Index Performance Strategy is more sensitive to large negative market movements because small negative market movements are absorbed by the Buffer. In a period of extreme negative market performance, the risk of loss is greater with the Index Performance Strategy than with the Index Guard Strategy.

Index Precision Strategy – one of the Index Crediting Methods described in section 7, Index Options. Section 7 also includes availability restrictions for Index Precision Strategy. The Index Precision Strategy calculates Performance Credits based on Index Values and Index Returns subject to the Precision Rate and Buffer. You can receive negative Performance Credits under this Crediting Method, which means you can lose money (including principal and previously applied positive Credits). The Index Precision Strategy performs best in periods of small market movements because the Precision Rates will generally be greater than the DPSCs, though they will generally be less than the Index Performance Strategy Caps. The Index Precision Strategy is more sensitive to large negative market movements because small negative market movements are absorbed by the Buffer. In a period of extreme negative market performance, the risk of loss is greater with the Index Precision Strategy than with the Index Guard Strategy.

Index Protection Strategy – one of the Index Crediting Methods described in section 7, Index Options. Section 7 also includes availability restrictions for Index Protection Strategy. Under the Index Protection Strategy you receive the DPSCs if the current Index Value is equal to or greater than the Index Value on the last Index Anniversary (or the Index Effective Date if this is the first Index Anniversary). The Index Protection Strategy provides the most protection because you cannot receive a negative Credit under this Crediting Method.

Index Return – annual percentage change in Index Value on each Index Anniversary we use to determine the Performance Credits under the Index Performance Strategy and Index Guard Strategy, and negative Performance Credits under the Index Precision Strategy. The Index Return is an Index's current Index Value, minus its Index Value on the last Index Anniversary (or the Index Effective Date if this is the first Index Anniversary), divided by its Index Value on the last Index Anniversary (or the Index Effective Date if this is the first Index Anniversary).

Index Value – an Index's price at the end of the Business Day on the Index Effective Date and each Index Anniversary as provided by Bloomberg or another market source.

Index Year – any period of twelve months beginning on the Index Effective Date or a subsequent Index Anniversary.

Issue Date – the date shown on the Contract that starts the first Contract Year. Contract Anniversaries and Contract Years are measured from the Issue Date.

Joint Owners – two Owners who own a Contract.

Lock Date – under the Index Precision Strategy, Index Performance Strategy and Index Guard Strategy, this is the Business Day we process your request to lock in an Index Option Value (a Performance Lock) before the Index Anniversary.

Maximum Anniversary Value – the highest Contract Value on any Index Anniversary before age 91, adjusted for subsequent Purchase Payments and withdrawals, used to determine the Maximum Anniversary Value Death Benefit as discussed in section 11. Withdrawals include withdrawals under the free withdrawal privilege, withdrawal charges, but not amounts we withdraw for other Contract expenses.

Maximum Anniversary Value Death Benefit – an optional benefit described in section 11 that has an additional rider fee and is intended to potentially provide an increased death benefit.

Non-Qualified Contract – a Contract that is not purchased under a pension or retirement plan qualified for special tax treatment under sections of the Internal Revenue Code.

Owner – "you," "your" and "yours." The person(s) or entity designated at Contract issue and named in the Contract who may exercise all rights granted by the Contract.

Payee – the person or entity who receives Annuity Payments during the Annuity Phase.

Performance Lock – a feature under the Index Precision Strategy, Index Performance Strategy and Index Guard Strategy that allows you to lock in each of your current Index Option Values before the Index Anniversary. A Performance Lock applies to the total Index Option Value in an Index Option, and not just a portion of that Index Option Value. After the Lock Date, Daily Adjustments do not apply for the remainder of the Index Year and the Index Option Value will not receive a Performance Credit on the next Index Anniversary.

Performance Credit – the Credit we apply on the Index Anniversary under the Index Precision Strategy, Index Performance Strategy and Index Guard Strategy. We base Performance Credits on Index Values and Index Returns limited by the Precision Rate, Cap, Buffer and Floor. Performance Credits can be negative, which means you can lose money (including principal and previously applied positive Credits).

Precision Rate – the positive Performance Credit we apply under the Index Precision Strategy if the current Index Value is equal to or greater than the Index Value on the last Index Anniversary (or the Index Effective Date if this is the first Index Anniversary). We set a Precision Rate for each Index Precision Strategy Index Option on the Index Effective Date and each Index Anniversary. The Precision Rates applicable to your Contract are shown on the Index Options Statement.

Proxy Investment – an investment tracking mechanism we establish that is structured as a hypothetical set of call and put options designed to provide the same returns as the Performance Credits under the Index Precision Strategy, Index Performance Strategy and Index Guard Strategy on an Index Anniversary. We use the Proxy Investment to calculate the Daily Adjustment between Index Anniversaries. For more information, see Appendix B.

Proxy Value – the value of the Proxy Investment for an Index Precision Strategy, Index Performance Strategy or Index Guard Strategy Index Option used to calculate the Daily Adjustment as discussed in Appendix B.

Purchase Payment – the money you put into the Contract.

Qualified Contract – a Contract purchased under a pension or retirement plan qualified for special tax treatment under sections of the Internal Revenue Code (for example, 401(a) and 401(k) plans), Individual Retirement Annuities (IRAs), or Tax-Sheltered Annuities (referred to as TSA or 403(b) contracts). Currently, we issue Qualified Contracts that may include, but are not limited to Roth IRAs, Traditional IRAs and Simplified Employee Pension (SEP) IRAs. We may also issue an Inherited IRA and Inherited Roth IRA to make any required minimum distribution payments to a beneficiary of a previously held tax-qualified arrangement.

Quarterly Contract Anniversary – the day that occurs three calendar months after the Issue Date or any subsequent Quarterly Contract Anniversary.

Separate Account – Allianz Life Variable Account B is the Separate Account that issues the variable investment portion of your Contract. It is a separate investment account of Allianz Life. The Separate Account holds the Variable Options that underlie the Contracts. The Separate Account is divided into subaccounts, each of which invests exclusively in a single Variable Option. The Separate Account is registered with the SEC as a unit investment trust, and may be referred to as the Registered Separate Account.

Service Center – the area of our company that provides Contract maintenance and routine customer service. Our Service Center address and telephone number are listed at the back of this prospectus. The address for mailing applications and/or checks for Purchase Payments may be different and is also listed at the back of this prospectus.

Traditional Death Benefit – the death benefit provided by the Contract that is equal to the greater of Contract Value (after deduction of the final product fee), or total Purchase Payments adjusted for withdrawals. Withdrawals include withdrawals under the free withdrawal privilege, withdrawal charges, but not amounts we withdraw for other Contract expenses.

Valid Claim – the documents we require to be received in Good Order at our Service Center before we pay any death claim. This includes the death benefit payment option, due proof of death, and any required governmental forms. Due proof of death includes a certified copy of the death certificate, a decree of court of competent jurisdiction as to the finding of death, or any other proof satisfactory to us.

Variable Account Value – on any Business Day, the sum of the values in your selected Variable Options. The Variable Account Value includes the deduction of the Variable Option operating expenses, and any previously assessed transfer fee, contract maintenance charge, product fee, rider fee, and withdrawal charge.

Variable Options – the variable investments available to you under the Contract. Variable Option performance is based on the securities in which they invest.

Withdrawal Charge Basis – the total amount under your Contract that is subject to a withdrawal charge as discussed in section 8, Expenses – Withdrawal Charge.

SUMMARY

The Allianz Index Advantage ADV Variable Annuity is a variable and index-linked deferred annuity product. The product or certain product features may not currently be available in all states or on all Contracts, may vary in your state, or may not be available from all selling firms or from all Financial Professionals. When you purchase a Contract, you tell us how to allocate your money. You can select any or all of the available Variable Options and Index Options. Check with your Financial Professional regarding availability of Allocation Options. Your allocations must be in whole percentages and we only allow allocations to the Index Options once each Index Year. You can only reallocate money from the Index Options to the Variable Options on every sixth Index Anniversary. If you allocate money to the Variable Options offered through the Contract, the value of your investment (Variable Account Value) increases and decreases based on your selected Variable Options performance.

If you allocate money to an Index Option, we calculate an annual return or Credit, on each Index Anniversary. The Credit is based on the change in value of one or more nationally recognized third-party broad based securities Indices. Credits may be positive, zero, or, in some instances, negative, depending on the Index Option you select. Positive Credits are limited by the DPSCs under the Index Protection Strategy, the Precision Rates under the Index Precision Strategy, and the Caps under the Index Performance Strategy and Index Guard Strategy. Under the Index Precision Strategy and Index Performance Strategy, there are also Buffers on negative Credits, but there is no protection for negative Credits for losses greater than the Buffer. Under the Index Guard Strategy there is a Floor on negative Credits, which determines the minimum Performance Credit you can receive. Once we issue your Contract we can change the DPSCs, Precision Rates and Caps annually. We generally establish the Buffers and Floors on the Issue Date. However, if we add a new Index Option to a Contract after the Issue Date, we establish the Buffer or Floor for it on the date we add the Index Option to your Contract. Your Buffers and Floors are stated in your Contract and they cannot change after they are established. We publish any changes to the Buffers and Floors for newly issued Contracts, and changes to initial and renewal DPSCs, Precision Rates and Caps at least seven calendar days before they take effect on our website at www.allianzlife.com/indexratesadv.

NOTE:

| ● | You can lose money (including principal and previously applied positive Credits) that you allocate to the Index Precision Strategy and Index Performance Strategy if Index losses are greater than the Buffer, or the Index Guard Strategy for Index losses down to the Floor. You cannot lose money (or previously applied positive Credits) that you allocate to the Index Protection Strategy due to Index losses. The Index Precision Strategy, Index Performance Strategy and Index Guard Strategy include a risk of potential loss of principal and this loss could be significant. If money is withdrawn or removed from an Index Precision Strategy, Index Performance Strategy or Index Guard Strategy Index Option before the Index Anniversary, you could lose money (including principal and previously applied positive Credits) even if the current Index return is positive on the date of withdrawal. |

| ● | The Index Protection Strategy is not available to Contracts issued in Missouri or Washington on or after the date of this prospectus. If in future years the renewal rates for the Index Performance Strategy, Index Guard Strategy or Index Precision Strategy are not acceptable to you, you will not be able to transfer Index Option Value into the Index Protection Strategy and take advantage of its principal protection. This would subject you to ongoing market risk. You could lose money (including principal and previously applied positive Credits). |

| ● | Availability restrictions for the Crediting Methods and Indices for Contracts issued before the date of this prospectus are detailed in section 7, Index Options. |

During the Index Year, the Index Protection Strategy Index Option Values do not change for Index performance or the Daily Adjustment. Amounts withdrawn from the Index Protection Strategy during the Index Year will not receive a DPSC. On each Business Day during the Index Year, other than the Index Effective Date or Index Anniversary, the Index Precision Strategy, Index Performance Strategy and Index Guard Strategy Index Option Values change for Index performance through the Daily Adjustment. A Business Day is any day the New York Stock Exchange is open, except, with regard to a specific Variable Option, when that Variable Option does not value its shares. The Daily Adjustment is meant to approximate the Index Option Value on the next Index Anniversary, as adjusted for gains during the Index Year subject to the Precision Rate or Cap and either losses greater than the Buffer for the Index Precision Strategy and Index Performance Strategy, or losses down to the Floor for the Index Guard Strategy. Even if the current Index return during the Index Year is positive, the Daily Adjustment may be negative until the Index Anniversary. This means if money is withdrawn or removed from the Index Precision Strategy, Index Performance Strategy, or Index Guard Strategy, you could lose money (including principal and previously applied positive Credits) even if the current Index return is positive on that day. If the current Index return during the Index Year is negative, the Daily Adjustment could result in losses greater than the protection provided by the Buffer or the Floor.

The Contract has two phases: the Accumulation Phase and the Annuity Phase. During the Accumulation Phase your Contract Value (the total of your Variable Account Value and all Index Option Values) fluctuates based on the returns of your selected Variable Options and Index Options. During the Accumulation Phase you can add Purchase Payments to your Contract, take withdrawals, and we pay a death benefit if you die.

The Accumulation Phase of your Contract ends and the Annuity Phase starts once you begin Annuity Payments. For an individually owned Contract, Annuity Payments can be either single or joint. You can take Annuity Payments based on your Contract Value as discussed in section 10, The Annuity Phase.

Who Should Consider Purchasing the Contract?

We designed the Contract for people who are looking for a level of protection for their principal while providing potentially higher returns than are available on traditional fixed annuities. This Contract is not intended for someone who is seeking complete protection from downside risk, nor someone who is seeking unlimited investment performance.

We created the Contract for purchasers working with a Financial Professional who is registered as an investment adviser, or is an investment advisory representative of a registered investment adviser, and who is offering advisory services for a fee. A Financial Professional may also be a registered representative of a broker-dealer. However, we do not pay a sales commission to broker-dealers or their registered representatives in connection with sales of the Contract.

Your Financial Professional acts on your behalf, not ours. We are not party to any agreement between you and your Financial Professional, nor are we responsible for your Financial Professional's actions. We do not set your financial adviser's fee or receive any part of it. Any financial adviser fee you pay is in addition to this Contract's fees and expenses. You should ask your Financial Professional about compensation they receive in connection with this Contract. Allianz Life is not an investment adviser, and does not provide investment advice in connection with sales of the Contract. We are not a fiduciary to you, and do not make recommendations or assess suitability.

We do not allow you to instruct us to pay your financial adviser fees from this Contract. If you take withdrawals from this Contract to pay your financial adviser fees, these withdrawals will be subject to any applicable withdrawal charge. Also, if this is a Non-Qualified Contract this will be a taxable withdrawal to the extent that gain exists within the Contract. If any Owner is under age 59½, withdrawals may also be subject to a 10% additional federal tax. You should consult a tax adviser regarding the tax treatment of withdrawals.

We offer other annuity contracts that may address your investment and retirement needs. These contracts include variable annuities, registered index-linked annuities and fixed index annuities. These annuity products may offer different features and benefits more appropriate for your needs, including allocation options, fees and/or charges that are different from those in the Contract offered by this prospectus. Not every contract is offered through every Financial Professional. Some Financial Professionals or selling firms may not offer and/or limit offering of certain features and benefits, as well as limit the availability of the contracts based on criteria established by the Financial Professional or selling firm.

These alternative contracts may have different Index Options, and different rates and minimums for the DPSCs, Precision Rates, Caps, Buffers, and Floors. DPSCs and Caps may also be affected, positively or negatively, by expenses we incur in providing other contract features. For example, a contract that has a product fee may be able to set higher DPSCs, Precision Rates, and Caps than a contract without a product fee. The deduction of the product fee reduces Index Option Values, which may offset the effect of higher DPSCs, Precision Rates, and Caps. For more information about these contracts, please contact your Financial Professional or our Service Center.

What Are the Contract's Charges?

The Contract includes a product fee, contract maintenance charge, transfer fee, and withdrawal charge, and a rider fee if you select the Maximum Anniversary Value Death Benefit. These fees and charges are discussed in more detail in section 8, Expenses.

We assess a 0.25% annualized product fee for the Contract. Contracts with the Maximum Anniversary Value Death Benefit also have an additional annualized rider fee of 0.20%. The product and rider fees are deducted quarterly during the Accumulation Phase while your Contract Value is positive. We calculate and accrue the product and rider fees on a daily basis as a percentage of the Charge Base. The Charge Base is the Contract Value on the preceding Quarterly Contract Anniversary (or the initial Purchase Payment received on the Issue Date if this is before the first Quarterly Contract Anniversary), adjusted for subsequent Purchase Payments and withdrawals. A Quarterly Contract Anniversary is the day that occurs three calendar months after the Issue Date or any subsequent Quarterly Contract Anniversary.

We assess a $50 contract maintenance charge annually, but we waive this charge if your Contract Value is at least $100,000.

We assess a $25 transfer fee for each transfer in excess of 12 between the Variable Options in a Contract Year. A Contract Year is any period of twelve months beginning on the Issue Date or a subsequent Contract Anniversary (a twelve-month anniversary of the Issue Date).

The withdrawal charge is calculated based upon Purchase Payments. The withdrawal charge period applies separately to each Purchase Payment. The withdrawal charge starts at 6.5% and decreases to zero after we have had a Purchase Payment for six complete years. During the period that the withdrawal charge applies, if you withdraw more than is allowed from the Index Options under the free withdrawal privilege, we may deduct a withdrawal charge. The withdrawal charge does not apply to amounts withdrawn from the Variable Options. We only assess the withdrawal charge on and deduct the withdrawal charge from amounts withdrawn from the Index Options. Amounts transferred from the Variable Options to the Index Options and subsequently withdrawn are subject to a Daily Adjustment (which may be negative) and a withdrawal charge. (See section 9, Access to Your Money – Free Withdrawal Privilege.)

Contract charges and pro-rata fees are assessed on any full or partial withdrawal from either the Variable Options or the Index Options as discussed in more detail in section 8, Expenses.

What Are the Contract's Benefits?

The Contract offers a variety of variable and index-linked Allocation Options, each with different return and risk characteristics. The Contract has a free withdrawal privilege that allows you to withdraw up to 10% of your total Purchase Payments from the Index Options each Contract Year during the Accumulation Phase without incurring a withdrawal charge. The Contract includes a waiver of withdrawal charge benefit in most states that allows you to take money out of the Contract without incurring a withdrawal charge if you are confined to a nursing home for a period of time. Keep in mind that if you withdraw money from an Index Precision Strategy, Index Performance Strategy or Index Guard Strategy Index Option on any day other than an Index Anniversary, we first calculate the Index Option Value by adding the Daily Adjustment (which can be negative), even if the withdrawal is not subject to a withdrawal charge. The Contract has several Annuity Options which can provide guaranteed income for life, or life and term certain. (For more information see section 9, Access to Your Money and section 10, The Annuity Phase.) We also pay a death benefit to your Beneficiary(s) if you die before Annuity Payments begin.

What Are the Index-Linked Crediting Methods and How Do They Work?

The Contract offers four Index Crediting Methods: the Index Protection Strategy, Index Performance Strategy, Index Precision Strategy and Index Guard Strategy. However, all Crediting Methods may not currently be available in all states or on all Contracts. All of these Crediting Methods are compared as described later in this section under "How Do the Index-Linked Crediting Methods Compare?" A more detailed description of the Crediting Methods, including availability restrictions, is included in section 7, Index Options.

The Index Protection Strategy provides a DPSC on each Index Anniversary if the current Index Value is equal to or greater than the Index Value on the last Index Anniversary, regardless of the amount of actual Index Return. If the current Index Value is less than the Index Value on the last Index Anniversary you do not receive the DPSC, but you also do not receive a negative Credit.

The Index Performance Strategy provides a positive Performance Credit if the Index Return is positive, adjusted by an upper limit called the Cap. If the Index Return is negative, you will receive a negative Performance Credit if the loss is greater than a specified percentage called the Buffer. A negative Performance Credit means you can lose money (including principal and previously applied positive Credits). If the Index Return is negative, but the loss is less than or equal to the Buffer, your Performance Credit is zero.

The Index Precision Strategy provides a positive Performance Credit equal to the Precision Rate on each Index Anniversary if the current Index Value is equal to or greater than the Index Value on the last Index Anniversary. This is similar to the DPSC under the Index Protection Strategy in that a positive Performance Credit is equal to the rate set at the beginning of each Index Year. Precision Rates will generally be greater than the DPSCs, though they will generally be less than the Index Performance Strategy Caps. If the current Index Value is less than the Index Value on the last Index Anniversary you receive a negative Performance Credit if the negative Index Return is greater than the Buffer, which is similar to a negative Performance Credit under the Index Performance Strategy. A negative Performance Credit means you can lose money (including principal and previously applied positive Credits). If the Index Return is negative, but the loss is less than or equal to the Buffer, your Performance Credit is zero.

The Index Guard Strategy also provides a positive Performance Credit if the Index Return is positive, limited by the Cap. If the Index Return is zero, your Performance Credit is zero. You will receive a negative Performance Credit if the Index Return is negative down to the amount of a specified percentage called the Floor. A negative Performance Credit means you can lose money (including principal and previously applied positive Credits).

Please note, since the Index Value is priced only on the Index Effective Date and subsequent Index Anniversaries, the Index Return does not account for changes in Index Value during the Index Year.

We cannot eliminate or modify the four Crediting Methods; however, we can adjust the renewal DPSCs, Precision Rates and Caps each Index Year. We can replace or substitute an Index either on an Index Anniversary or during the Index Year. If we substitute an Index during an Index Year, we will combine the return of the previously available substituted Index with the return of the new Index. If we substitute an Index during an Index Year, we do not change the Buffers, Floors, current DPSCs, current Precision Rates, or current Caps. Changes to the DPSCs, Precision Rates, or Caps for the new Index, if any, occur at the next regularly scheduled Index Anniversary. For more information see section 1, Risk Factors – Substitution of an Index. We can add new Crediting Methods and Indices to your Contract in the future, and you can select these Crediting Methods and Indices if they are made available to you.

NOTE: For historical information on the Buffers, Floors and initial DPSCs, Caps and Precision Rates that we offered to newly issued Contracts please see Appendix C. This information is for historical purposes only; it is not a representation as to future Buffers, Floors, DPSCs, Precision Rates, or Caps.

When Do You Establish the Values Used to Determine Index-Linked Credits?

We generally establish the Buffers and Floors on the Issue Date. However, the Buffers and Floors we currently offer for newly issued Contracts may change before we issue your Contract. For information on the Buffers and Floors we currently offer for newly issued Contracts, see our website at www.allianzlife.com/indexratesadv. For newly issued Contracts, we publish any changes to the Buffers and Floors on our website at least seven calendar days before they take effect. If we add a new Index Option to a Contract after the Issue Date, we establish the Buffer or Floor for it on the date we add the Index Option to your Contract. Your actual Buffers and Floors are stated in your Contract and cannot change after they are established. The minimum Buffer that we can establish is 5%, and the minimum Floor is -25%. These minimums are the least amount of protection that you could receive from negative Index Returns. Any decline in Index Return in excess of the Buffer reduces your Contract Value. For example, if we set the Buffer at 5% we would absorb the

first 5% of any negative Index Return and you could lose up to 95% of the Contract Value in that Index Option. However, any decline in Index Return in excess of the Floor is absorbed by us. For example, if we set the Floor at ‑25% your maximum loss would be limited to 25% of the Contract Value in that Index Option due to negative Index Returns and we would absorb any remaining loss.

We can change the initial DPSCs, Precision Rates and Caps we currently offer for newly issued Contracts frequently at our discretion. However, once these rates are established for your Contract on the Index Effective Date they cannot change until the next Index Anniversary. For information on the initial DPSCs, Precision Rates and Caps we currently offer for newly issued Contracts, see our website at www.allianzlife.com/indexratesadv. For newly issued Contracts, we publish any changes to the initial DPSCs, Precision Rates and Caps on our website at least seven calendar days before they take effect. These initial DPSCs, Precision Rates and Caps may change before your Index Effective Date. The minimum DPSC, Precision Rate and Cap is 1.50% for the entire time you own your Contract. We inform you of the initial DPSCs, Precision Rates and Caps for your Contract in the Index Options Statement, which is the account statement we mail to you on the Index Effective Date and each Index Anniversary. The Index Options Statement also includes the Index Values on the Index Effective Date and each subsequent Index Anniversary. We use these Index Values to determine Index Returns and Credits.

DPSCs, Precision Rates, Caps, Buffers and Floors can all be different. For example, Caps for the Index Performance Strategy can be different between the S&P 500® Index and the Nasdaq-100® Index, and Caps for the S&P 500® Index can be different between the Index Performance Strategy and Index Guard Strategy.

Once we issue your Contract, we can change the renewal DPSCs, Precision Rates and Caps annually on each Index Anniversary, in our discretion. We will send you a letter at least 30 days before each Index Anniversary. This letter advises you that your current DPSCs, Precision Rates and Caps are expiring on the upcoming Index Anniversary, and the renewal DPSCs, Precision Rates and Caps for the next Index Year will be available for your review in your account on our website at least seven calendar days before the upcoming Index Anniversary. We also have a link to your Contract information with your renewal DPSCs, Precision Rates and Caps on our website at www.allianzlife.com/indexratesadv. Your Index Options Statement that we mail on each Index Anniversary will include the actual renewal DPSCs, Precision Rates and Caps you received for the current Index Year. The Index Anniversary letter also reminds you of your opportunity to transfer Contract Value from the Variable Options to the Index Options, or rebalance your Index Option Values, on the upcoming anniversary. We must receive your transfer instructions in Good Order at our Service Center by 4 p.m. Eastern Time on the Index Anniversary (or the next Business Day if the Index Anniversary is not a Business Day). If we do not receive transfer instructions from you, your Index Option Value will remain allocated to your existing Index Options at the renewal DPSCs, Precision Rates and Caps. A request is in "Good Order" when it contains all the information we require to process it. Our Service Center is the area of our company that issues Contracts and provides Contract maintenance and routine customer service.

NOTE:

| · | The DPSCs, Precision Rates and Caps may be different for newly issued Contracts and for inforce Contracts, even if the Contracts have Index Effective Dates with the same month and day. The initial DPSCs, Precision Rates and Caps for newly issued Contracts may be higher or lower than the renewal DPSCs, Precision Rates and Caps for inforce Contracts. However, all inforce Contracts with Index Effective Dates in the same date range will receive the same renewal DPSCs, Precision Rates and Caps. |

For example, if on January 1, 2019 we set initial and renewal Caps for the Index Performance Strategy Index Option using the S&P 500® Index for Contracts with Index Effective Dates of January 7 through February 3, these Caps might hypothetically be as follows: 13% for newly issued Contracts, 14% for inforce Contracts issued in 2018, and 12% for inforce Contracts issued in 2017.

| · | If your Contract is still within its Free Look/Right to Examine period you may be able to take advantage of any increase in initial DPSCs, Precision Rates or Caps for newly issued Contracts by cancelling your existing Contract and purchasing a new Contract. |

What Factors Impact the DPSCs, Precision Rates and Caps?

The DPSCs, Precision Rates and Caps will vary depending upon a variety of factors, including our hedging strategies and investment performance, your Index Effective Date, and the level of interest rates and volatility on your Index Effective Date and on Index Anniversaries. The DPSCs, Precision Rates, and Caps are also affected by the amount of money available to us through Contract charges to purchase hedging instruments.

While initial and renewal DPSCs, Precision Rates and Caps may be affected by a variety of factors (including, a change in the current level of interest rates), the effect of a change in interest rates or other market conditions on the DPSCs, Precision Rates and Caps may not be direct or immediate. There may be a lag in changes to DPSCs, Precision Rates and Caps. In a rising interest rate environment, increases in Caps, if any, may be substantially slower than increases in interest rates.

(For more information see section 7, Index Options.)

How Do the Index-Linked Crediting Methods Compare?

| Crediting Methods | Indices | Guaranteed Minimum Rates |

| Index Protection Strategy | S&P 500® Index, Russell 2000® Index, Nasdaq-100® Index and EURO STOXX 50® | DPSCs cannot be less than 1.50% |

| Index Performance Strategy | S&P 500® Index, Russell 2000® Index, Nasdaq-100® Index and EURO STOXX 50® | Caps cannot be less than 1.50% Buffers cannot be less than 5% |

| Index Guard Strategy | S&P 500® Index, Russell 2000® Index, Nasdaq-100® Index and EURO STOXX 50® | Caps cannot be less than 1.50% Floors cannot be less than -25% |

| Index Precision Strategy | S&P 500® Index, Russell 2000® Index, Nasdaq-100® Index and EURO STOXX 50® | Precision Rates cannot be less than 1.50% Buffers cannot be less than 5% |

Availability restrictions for the Crediting Methods and Indices are detailed in section 7, Index Options.

Crediting Methods have different risk and return potentials. The Index Protection Strategy has the lowest return potential, but provides the most protection. You cannot lose money (or previously applied positive Credits) that you allocate to the Index Protection Strategy due to negative Index performance. Potential returns and risks are higher for the other Crediting Methods.

Although the Index Performance Strategy, Index Guard Strategy and Index Precision Strategy offer higher potential returns than the Index Protection Strategy, you can lose money (including principal and previously applied positive Credits) that you allocate to these Crediting Methods due to negative Index performance and these losses could be significant. Positive returns for the Index Performance Strategy and Index Guard Strategy are limited by the Caps, and for the Index Precision Strategy by the Precision Rates. The Index Precision Strategy performs best in periods of small market movements because the Precision Rates will generally be greater than the DPSCs, but they will generally be less than the Index Performance Strategy Caps. However, in extreme market environments it is possible that all rates will be equal and reduced to the minimum of 1.50%. Negative returns are limited for the Index Precision Strategy and Index Performance Strategy by the Buffers, and for the Index Guard Strategy by the Floor. The Index Precision Strategy and Index Performance Strategy Buffers have protection for smaller negative market movements, but also have the potential for the largest loss in any one year that has a significant market decline. The Index Guard Strategy permits negative Performance Credits down to the Floor, and provides less risk of significant negative returns in any one year than the Buffers. The Index Guard Strategy is sensitive to smaller negative market movements that persist over time, but provides more certainty regarding the maximum loss in any one year.

Bar Chart examples depicting how the Crediting Methods perform under different Index Returns are included in Appendix E.

| Comparison of Crediting Methods | ||||

| Index Protection Strategy | Index Precision Strategy | Index Performance Strategy | Index Guard Strategy | |

| What is the growth opportunity? | Offers the least growth opportunity as the DPSCs will generally be less than the Precision Rate and the Index Performance Strategy Cap. You receive the DPSC if the current Index Value is equal to or greater than the Index Value on the last Index Anniversary. | Generally offers more growth opportunity than the Index Protection Strategy, but less than the Index Performance Strategy. Growth opportunity may be more or less than what is available with the Index Guard Strategy depending on Precision Rates and Caps. You receive a Performance Credit equal to the Precision Rate if the current Index Value is equal to or greater than the Index Value on the last Index Anniversary. | Generally offers more growth opportunity than the Index Protection Strategy or Index Precision Strategy. Growth opportunity may be more or less than what is available with the Index Guard Strategy depending on Caps. Positive Index Returns are limited by the Cap. | Generally offers more growth opportunity than the Index Protection Strategy. Growth opportunity may be more or less than what is available with the Index Precision Strategy or Index Performance Strategy depending on Precision Rates and Caps. Positive Index Returns are limited by the Cap. |

| What is the asset protection? | Offers the most protection. You cannot lose assets based on a loss in Index Value. If the Index loses value, you do not receive a Credit. | Offers protection from smaller negative market movements, but also has the potential for the largest loss in any one year. Asset protection may be more or less than what is available with the Index Performance Strategy depending on Buffers. A percentage of negative Index Return is absorbed by the Buffer, but you will receive a negative Performance Credit for losses greater than the Buffer. | Offers protection from smaller negative market movements, but also has the potential for the largest loss in any one year. Asset protection may be more or less than what is available with the Index Precision Strategy depending on Buffers. A percentage of negative Index Return is absorbed by the Buffer, but you will receive a negative Performance Credit for losses greater than the Buffer. | Offers protection from significant negative market movements, but is sensitive to smaller negative market movements that persist over time. Permits a negative Performance Credit down to the Floor. |