Allianz Index Advantage ADV® Variable Annuity Prospectus – April 29, 2022

Appendix C

| Standard Annuity Features | Available Investment Options | Optional Features |

| • Five fixed annuitization options (Annuity Options)• Free withdrawal privilege allows you withdraw up to 10% of your total purchase payments during the six-year withdrawal charge period for withdrawals from the index-linked investment options. Withdrawals from the variable investment options are not subject to a withdrawal charge.• Systematic withdrawal program• Minimum distribution program for certain tax-qualified Contracts• Waiver of withdrawal charge benefit (not available in all states)• Guaranteed death benefit (Traditional Death Benefit) | • 22 index-linked investment options (Index Options) based on different combinations of four credit calculation methods (Crediting Methods), four nationally recognized third-party broad based equity securities indexes and an exchange-traded fund (Index or Indexes), and two time periods for measuring Index performance (Term)• Three variable investment options (Variable Options) | • Maximum Anniversary Value Death Benefit: Locks in any annual investment gains to potentially provide a death benefit greater than the Traditional Death Benefit. This optional benefit has an additional rider fee. |

| Crediting Methods Currently Available Only the Index Performance Strategy offers 1-year and 3-year Terms. All other Crediting Methods only offer 1-year Terms. | Indexes Currently Available with 1-year Terms | Indexes Currently Available with 3-year Terms (Index Performance Strategy only) |

| • Index Protection Strategy • Index Precision Strategy • Index Guard Strategy • Index Performance Strategy | • S&P 500® Index • Russell 2000® Index • Nasdaq-100® Index • EURO STOXX 50® • iShares® MSCI Emerging Markets ETF | • S&P 500® Index • Russell 2000® Index |

| Crediting Methods, Indexes, and the 3-year Terms may not be available in all states as detailed in Appendix G. | ||

| Crediting Method Highlights All Crediting Methods provide a level of protection against negative Credits from negative Index performance, and a limit on positive Credits from positive Index performance. Credits are the return you receive on the Term End Date when you allocate assets to an Index Option. | ||

| Negative Index Performance Protection | Positive Index Performance Participation Limit | |

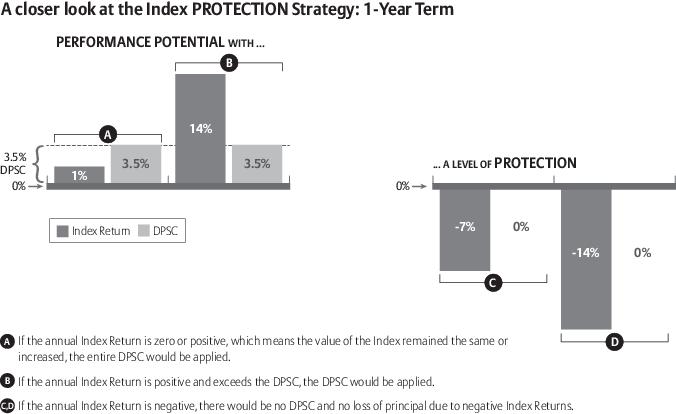

| Index Protection Strategy | • 100% – You will never receive a negative Credit | • Declared Protection Strategy Credits (DPSCs) (the return you receive if Index performance is zero or positive) – DPSCs cannot be less than 1.50% |

| Index Precision Strategy | • Buffers (the amount of negative Index performance we absorb over the duration of a Term before you receive a negative Credit) – Buffers are 10% | • Precision Rates (the return you receive if Index performance is zero or positive) – Precision Rates cannot be less than 1.50% |

| Index Guard Strategy | • Floors (the maximum amount of negative Index performance you absorb) – Floors are -10% | • Caps (the upper limit on positive Index performance) – Caps cannot be less than 1.50% |

| Crediting Method Highlights All Crediting Methods provide a level of protection against negative Credits from negative Index performance, and a limit on positive Credits from positive Index performance. Credits are the return you receive on the Term End Date when you allocate assets to an Index Option. | ||

| Negative Index Performance Protection | Positive Index Performance Participation Limit | |

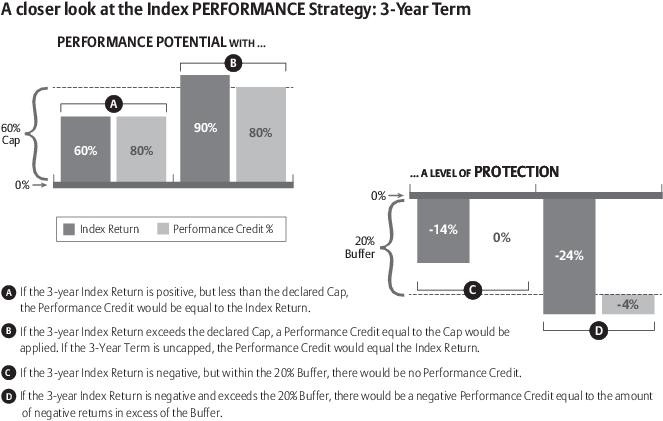

| Index Performance Strategy | • Buffers – Buffers for 1-year Terms are 10% – Buffers for 3-year Terms are 20% | • 1-year Term: Caps – Caps cannot be less than 1.50% |

| • 3-year Term: Caps – Caps cannot be less than 5% – Can be uncapped | ||

| Variable Options Currently Available | ||

| AZL® MVP Growth Index Strategy Fund | AZL® MVP Balanced Index Strategy Fund | AZL® Government Money Market Fund |

| 8 | ||

| 14 | ||

| 18 | ||

| 18 | ||

| 18 | ||

| 19 | ||

| 20 | ||

| 20 | ||

| 21 | ||

| 23 | ||

| 26 | ||

| 26 | ||

| 27 | ||

| 28 | ||

| 29 | ||

| 30 | ||

| 30 | ||

| 31 | ||

| 31 | ||

| 31 | ||

| 32 | ||

| 32 | ||

| 33 | ||

| 34 | ||

| 35 | ||

| 36 | ||

| 36 | ||

| 36 | ||

| 38 | ||

| 38 | ||

| 38 | ||

| 38 | ||

| 1. | 39 | |

| 39 | ||

| 41 | ||

| FEES AND EXPENSES | Prospectus Location | |||

| Charges for Early Withdrawals | If you withdraw money from the Index Options within 6 years of your last Purchase Payment, you may be assessed a withdrawal charge of up to 6.5% of the Purchase Payment withdrawn, declining to 0% over that time period. There is no withdrawal charge applicable to amounts withdrawn from the Variable Options. For example, if you invest $100,000 in the Contract and make an early withdrawal, you could pay a withdrawal charge of up to $6,500. In addition, if you take a full or partial withdrawal (including financial adviser fees that you choose to have us pay from this Contract) from an Index Precision Strategy, Index Guard Strategy, and Index Performance Strategy Index Option on a date other than the Term End Date, a Daily Adjustment will apply to the Index Option Value available for withdrawal. The Daily Adjustment also applies if before the Term End Date you execute a Performance Lock, annuitize the Contract, we pay a death benefit, or we deduct Contract fees and expenses. The Daily Adjustment may be negative, and you will lose money if the Daily Adjustment is negative. • Index Precision Strategy, Index Guard Strategy, and Index Performance Strategy. Daily Adjustments under these Crediting Methods may be positive, negative, or equal to zero. A negative Daily Adjustment will result in loss. In extreme circumstances, a negative Daily Adjustment could result in a loss beyond the protection of the 10% or 20% Buffer, or -10% Floor, as applicable, but it cannot result in a total loss of -100%. • Index Protection Strategy. This Crediting Method is not subject to the Daily Adjustment. | Fee Tables 4. Valuing Your Contract – Daily Adjustment 6. Expenses – Withdrawal Charge Appendix B – Daily Adjustment | ||

| Transaction Charges | In addition to withdrawal charges, and Daily Adjustments that may apply to withdrawals and other transactions from the Index Precision Strategy, Index Guard Strategy, and Index Performance Strategy Index Options, we will also charge you a fee of $25 per transfer after you exceed 12 transfers between Variable Options (the variable investments available to you) in a Contract Year. | Fee Tables 6. Expenses – Transfer Fee | ||

| Ongoing Fees and Expenses (annual charges) | The table below describes the fees and expenses that you may pay each year, depending on the options you choose. Please refer to your Contract specifications page for information about the specific fees you will pay each year based on the options you have elected. These ongoing fees and expenses do not reflect any financial adviser fees paid to a Financial Professional from your Contract Value or other assets of the Owner. If such charges were reflected, these ongoing fees and expenses would be higher. | Fee Tables 6. Expenses Appendix H – Variable Options Under the Contract | ||

| Annual Fee | Minimum | Maximum | ||

| Base Contract(1) | 0.26% | 0.26% | ||

| Investment Options(2) (Variable Option fees and expenses) | 0.65% | 0.71% | ||

| Optional Benefits Available for an Additional Charge(3) (for a single optional benefit, if elected) | 0.20% | 0.20% | ||

| (1) As a percentage of the Charge Base, plus an amount attributable to the contract maintenance charge. | ||||

| (2) As a percentage of the Variable Option’s average daily net assets. | ||||

| (3) As a percentage of the Charge Base. This is the current charge for the Maximum Anniversary Value Death Benefit. | ||||

| FEES AND EXPENSES | Prospectus Location | |||

| Because your Contract is customizable, the choices you make affect how much you will pay. To help you understand the cost of owning your Contract, the following table shows the lowest and highest cost you could pay each year, based on current charges. This estimate assumes that you do not take withdrawals from the Contract, which if taken from the Index Precision Strategy, Index Guard Strategy, and Index Performance Strategy Index Options could result in substantial losses due to the application of negative Daily Adjustments. | ||||

| Lowest Annual Cost: $1,104 | Highest Annual Cost: $1,418 | |||

| Assumes: • Investment of $100,000 • Least expensive Variable Option fees and expenses • 5% annual appreciation • Traditional Death Benefit • No additional Purchase Payments, transfers, or withdrawals • No financial adviser fees | Assumes: • Investment of $100,000 • Most expensive Variable Option fees and expenses • 5% annual appreciation • Maximum Anniversary Value Death Benefit with a 0.20% rider fee • No additional Purchase Payments, transfers, or withdrawals • No financial adviser fees | |||

| RISKS | ||||

| Risk of Loss | You can lose money by investing in the Contract, including loss of principal and previous earnings. | Risk Factors | ||

| Not a Short-Term Investment | • This Contract is not a short-term investment and is not appropriate if you need ready access to cash.• Considering the benefits of tax deferral and long-term income, the Contract is generally more beneficial to investors with a long investment time horizon.• If within six years after we receive a Purchase Payment you take a full or partial withdrawal from the Index Options (including financial adviser fees that you choose to have us pay from this Contract), withdrawal charges may apply. A withdrawal charge may reduce your Contract Value or the amount of money that you actually receive. Withdrawals may reduce or end Contract guarantees.• Withdrawals may be subject to income taxes, including a 10% additional federal tax that may apply to withdrawals taken before age 59 1⁄2.• Amounts invested in an Index Option must be held in the Index Option for the full Term before they can receive a Credit. For Index Precision Strategy, Index Guard Strategy, and Index Performance Strategy Index Options, we apply a Daily Adjustment if before the Term End Date you take a full or partial withdrawal (including financial adviser fees that you choose to have us pay from this Contract), annuitize the Contract, execute a Performance Lock, we pay a death benefit, or we deduct Contract fees and expenses. The Daily Adjustment takes into account any Index gains subject to the applicable Precision Rate or Cap, or either any Index losses greater than the 10% or 20% Buffer, or Index losses down to the -10% Floor, but in the form of the estimated present value. Therefore, the Daily Adjustment could result in a loss beyond the protection of the Buffer or Floor. In extreme circumstances, a negative Daily Adjustment could result in a loss beyond the protection of the 10% or 20% Buffer, or -10% Floor, as applicable, but it cannot result in a total loss of -100%. Any losses as a result of a Daily Adjustment will be greater if the amount withdrawn is also subject to a withdrawal charge, or is a deduction of Contract fees and expenses. The Daily Adjustment does not apply to the Index Protection Strategy. | Risk Factors Summary of the Index Options 4. Valuing Your Contract | ||

| RISKS | Prospectus Location | |||

| Risks Associated with Investment Options | • An investment in the Contract is subject to the risk of poor investment performance and can vary depending on the performance of the Variable Options and the Index Options available under the Contract.• Each Variable Option and Index Option has its own unique risks.• You should review each Variable Option’s prospectus and disclosures, including risk factors, for each Index Option before making an investment decision. | Risk Factors | ||

| Insurance Company Risks | An investment in the Contract is subject to the risks related to us. All obligations, guarantees or benefits of the Contract are the obligations of Allianz Life and are subject to our claims-paying ability and financial strength. More information about Allianz Life, including our financial strength ratings, is available upon request by visiting allianzlife.com/about/financial-ratings, or contacting us at (800) 624-0197. | Risk Factors | ||

| RESTRICTIONS | ||||

| Investments | • Certain Index Options may not be available under your Contract.• The first 12 transfers between Variable Options every Contract Year are free. After that, we deduct a $25 transfer fee for each additional transfer. Your transfers between the Variable Options are also subject to policies designed to deter excessively frequent transfers and market timing.• We only allow assets to move into the Index Options on the Index Effective Date and on subsequent Index Anniversaries. We hold Purchase Payments in the AZL Government Money Market Fund until we transfer them to your selected Index Options according to your Purchase Payment default instructions. On the Index Effective Date we rebalance or reallocate your total Contract Value among all of your selected Allocation Options according to your Purchase Payment default instructions. For additional Purchase Payments we receive after the Index Effective Date, we transfer the amounts held in the AZL Government Money Market Fund to your selected Index Options on the next Index Anniversary. Therefore, additional Purchase Payments we receive after the Index Effective Date that you allocate to a 1-year Term Index Option are not eligible to receive a Credit until the second Index Anniversary after we receive them, or the fourth Index Anniversary after we receive them for allocations to a 3-year Term Index Option.• For a 1-year Term Index Option, you can transfer Index Option Value only on the Term End Date.• For a 3-year Term Index Option, you can transfer Index Option Value only (a) on the Term End Date, or (b) before the Term End Date by executing a Performance Lock on or before the second Index Anniversary of a 3-year Term.• We do not allow assets to move into an established Index Option until the Term End Date. If you request to transfer into an established Index Option on an Index Anniversary that is not a Term End Date, we will transfer those assets into the same Index Option with a new Term Start Date.• The Traditional Death Benefit may not be modified, but it will terminate if you take withdrawals that reduce both the Contract Value and Guaranteed Death Benefit Value to zero. Withdrawals may reduce the Traditional Death Benefit’s Guaranteed Death Benefit Value by more than the value withdrawn and could end the Traditional Death Benefit.• We reserve the right to close or substitute the Variable Options, and to limit the amount of Purchase Payments that can be held in a Variable Option. We also reserve the right to substitute Indexes. | Summary of the Index Options 5. Variable Options 6. Expenses – Transfer Fee Appendix A – Available Indexes | ||

| Optional Benefits | • The optional Maximum Anniversary Value Death Benefit may not be modified. Withdrawals may reduce the Maximum Anniversary Value Death Benefit’s Guaranteed Death Benefit Value by more than the value withdrawn and will end the Maximum Anniversary Value Death Benefit if the withdrawals reduce both the Contract Value and Guaranteed Death Benefit Value to zero. | 10. Death Benefit | ||

| TAXES | Prospectus Location | |||

| Tax Implications | • Consult with a tax professional to determine the tax implications of an investment in and withdrawals from or payments received under the Contract.• If you purchased the Contract through a tax-qualified plan or individual retirement account (IRA), you do not get any additional tax benefit under the Contract.• Earnings under the Contract may be taxed at ordinary income rates when withdrawn, and you may have to pay a 10% additional federal tax if you take a full or partial withdrawal before age 59 1⁄2. | 11. Taxes | ||

| CONFLICTS OF INTEREST | ||||

| Investment Professional Compensation | We do not pay sales commissions in connection with sales of the Contracts. Rather, you pay an investment advisory fee to your Financial Professional. We do not set your investment advisory fee or receive any part of it. However, Financial Professionals and their managers may be eligible for benefits from us or our wholly-owned subsidiary distributor, such as production incentive bonuses, insurance benefits, and non-cash compensation items. We and/or our wholly owned subsidiary distributor may also make marketing support payments to certain selling firms for marketing services and costs associated with Contract sales. This conflict of interest may influence your Financial Professional to recommend this Contract over another investment. | 12. Other Information – Distribution | ||

| Exchanges | Some Financial Professionals may have a financial incentive to offer you a new contract in place of the one you already own. You should only exchange your contract if you determine, after comparing the features, fees, and risks of both contracts, that it is better for you to purchase the new contract rather than continue to own your existing contract. | 12. Other Information – Distribution | ||

| • | Accumulation Phase. This is the first phase of your Contract, and it begins on the Issue Date. During the Accumulation Phase, your money is invested under the Contract on a tax-deferred basis. Tax deferral may not be available for certain non-individually owned contracts. Tax deferral means you are not taxed on any earnings or appreciation on the assets in your Contract until you take money out of your Contract. In addition, during this phase, you can make additional Purchase Payments, you can take withdrawals, and if you die we pay a death benefit to your named Beneficiary(s). |

| Your Contract Value may fluctuate up or down during the Accumulation Phase based on the performance of your selected Allocation Options. |

| – | Index Options. You may allocate your Purchase Payments to any or all of the Index Options available under your Contract. There are currently 22 Index Options based on different combinations of four credit calculation methods (Crediting Methods), four nationally recognized third-party broad based equity securities indexes and an exchange-traded fund (Indexes), and two time periods for measuring Index performance (Term). Each Index Option is the combination of an Index, a Crediting Method, and a Term. |

| The available Crediting Methods, Indexes, and Terms are included on the cover page of this prospectus. Please see “Summary of the Index Options” for an overview of how the Index Options work. More detailed information about the Index Options is included in section 4, Valuing Your Contract. |

| – | Variable Options. You can allocate your Purchase Payments to any or all of the Variable Options available under your Contract. We only allow assets to move into the Index Options on the Index Effective Date and on subsequent Index Anniversaries. As a result, we hold Purchase Payments you allocate to the Index Options in the AZL Government Money Market Fund until we transfer them to the Index Options in accordance with your instructions. The Variable Options are underlying mutual funds with their own investment objectives, strategies, and risks. |

| Please see Appendix H for more information about the Variable Options. |

| • | Annuity Phase. If you request Annuity Payments, the Accumulation Phase ends and the Annuity Phase begins. Annuity Payments are fixed payments we make based on the Annuity Option you select and your Contract Value (which reflects any previously deducted Contract fees and expenses) less final product and rider fees. Annuity Payments can provide a guaranteed lifetime fixed income stream with certain tax advantages. We designed the Annuity Payments for Owners who no longer need immediate access to Contract Value to meet their short-term income needs. |

| During the Annuity Phase, you will receive a stream of regular income in the form of Annuity Payments. You will be unable to take withdrawals upon demand, your selected death benefit ends, and no amounts will be payable upon death during the Annuity Phase unless your Annuity Option provides otherwise. |

| • | Accessing Your Money. During the Accumulation Phase, you can surrender (take a full withdrawal) the Contract or take partial withdrawals. Withdrawals may be subject to a withdrawal charge, negative Daily Adjustments, and income taxes, including a 10% additional federal tax if taken before age 59 1⁄2. |

| • | Additional Purchase Payments. Subject to the limitations described in this prospectus, we continue to accept additional Purchase Payments under the Contracts during the Accumulation Phase. However, we may terminate your ability to make additional Purchase Payments in the future. We only allow additional Purchase Payments to move into Index Options on Index Anniversaries. As a result, we hold Purchase Payments we receive on days other than an Index Anniversary in the AZL Government Money Market Fund and such Purchase Payments are not available to receive Credits until we transfer them to your selected Index Options. We do not allow assets to move into an established Index Option until the Term End Date. If you request to allocate a Purchase Payment into an established Index Option on an Index Anniversary that is not a Term End Date, we will allocate those assets to the same Index Option with a new Term Start Date. |

| • | Death Benefits. The Contract’s death benefit is paid upon the first death of any Determining Life during the Accumulation Phase. The Contract includes for no additional charge a standard death benefit (the Traditional Death Benefit). At the time of purchase, you may select the optional death benefit (the Maximum Anniversary Value Death Benefit) to replace the standard death benefit for an additional rider fee. Either death benefit is the greater of Contract Value, or the Guaranteed Death Benefit Value. Unlike the Traditional Death Benefit, however, the Maximum Anniversary Value Death Benefit locks in any annual investment gains as part of the Guaranteed Death Benefit Value to potentially provide a death benefit greater than the Traditional Death Benefit (which is based on Purchase Payments). The Maximum Anniversary Value Death Benefit cannot be less than the Traditional Death Benefit, but they can be equal. |

| • | Withdrawal Charge Waivers. Under the free withdrawal privilege, you may withdraw up to 10% of your total Purchase Payments from the Index Options each Contract Year during the Accumulation Phase without incurring a withdrawal charge. Upon a full withdrawal, the free withdrawal privilege is not available to you. The withdrawal charge does not apply to withdrawals from the Variable Options. We do not apply a withdrawal charge to deductions we make for Contract fees or expenses. In most states, the waiver of withdrawal charge benefit allows you to take a withdrawal without incurring a withdrawal charge if you are confined to a nursing home for a period of at least 90 consecutive days. Also, if you own an Individual Retirement Annuity (IRA) or Simplified Employee Pension (SEP) IRA Contract, payments you take under our minimum distribution program (RMD payments) are not subject to a withdrawal charge. |

| • | Deduction of Financial Adviser Fees. If you have a financial adviser and want to pay their financial adviser fees from this Contract, you can instruct us to withdraw the fee from your Contract and pay it to your Financial Professional or Financial Professional’s firm as instructed. The deduction of financial adviser fees is in addition to this Contract’s fees and expenses, and the deduction is treated the same as any other withdrawal under the Contract. As such, withdrawals to pay financial adviser fees may be subject to withdrawal charges, will reduce the Contract Value and Guaranteed Death Benefit Value (perhaps significantly), and may be subject to income taxes (including tax penalties if you are younger than age 59 1⁄2). Please consult with your Financial Professional before requesting us to pay financial adviser fees from this Contract compared to other assets you may have. |

| • | If the Index Value on the Term End Date is equal to or greater than the Index Value on the Term Start Date, regardless of the amount of actual Index Return, the Performance Credit is equal to the Precision Rate. |

| • | If the Index Return is negative and the loss is: |

| – | less than or equal to the 10% Buffer, the Performance Credit is zero. We absorb any loss up to the 10% Buffer. |

| – | greater than the 10% Buffer, the negative Performance Credit is equal to the negative Index Return in excess of the 10% Buffer. You participate in any losses beyond the 10% Buffer. |

| • | If the Index Return is positive, the Performance Credit is equal to the Index Return up to the Cap. |

| • | If the Index Value on the Term End Date is equal to the Index Value on the Term Start Date, the Performance Credit is zero. |

| • | If the Index Return is negative, the negative Performance Credit is equal to the negative Index Return down to the -10% Floor. You participate in any losses down to the -10% Floor. We absorb any negative Index Return beyond the -10% Floor. |

| • | If the Index Return is positive, the Performance Credit is equal to: |

| – | the Index Return up to the Cap for a 1-year Term. |

| – | the Index Return up to the Cap for a 3-year Term. If a 3-year Term is uncapped, the Performance Credit is equal the Index Return. We apply the Cap for the entire Term length; we do not apply the Cap annually on a 3-year Term. |

| • | If the Index Value on the Term End Date is equal to the Index Value on the Term Start Date, the Performance Credit is zero. |

| • | If the Index Return is negative and the loss is: |

| – | less than or equal to the 10% or 20% Buffer, the Performance Credit is zero. We absorb any loss up to the 10% or 20% Buffer. We apply the Buffer for the entire Term length; we do not apply the Buffer annually on a 3-year Term Index Option. |

| – | greater than the 10% or 20% Buffer, the negative Performance Credit is equal to the negative Index Return in excess of the 10% or 20% Buffer. You participate in any losses beyond the 10% or 20% Buffer. |

| • The Index Precision Strategy, Index Guard Strategy, and Index Performance Strategy allow negative Performance Credits. A negative Performance Credit means you can lose principal and previous earnings. These losses could be significant. |

| • Because we calculate Index Returns only on a single date in time, you may experience negative or flat performance even though the Index you selected for a given Crediting Method experienced gains through some, or most, of the Term. |

| • If a 3-year Term Index Option is “uncapped” for one Term (i.e., we do not declare a Cap for that Term) it does not mean that we will not declare a Cap for it on future Term Start Dates. On the next Term Start Date we can declare a Cap for the next Term, or declare it to be uncapped. |

| What is the asset protection? | |

| Index Protection Strategy | • Most protection. • If the Index loses value, the Credit is zero. You do not receive a negative Credit. |

| Index Precision Strategy | • Less protection than the Index Protection Strategy and Index Guard Strategy. Protection may be equal to or less than what is available with the Index Performance Strategy depending on the Index Option. • Buffer absorbs 10% of loss, but you receive a negative Performance Credit for losses greater than 10%. • Potential for large losses in any Term. • More sensitive to large negative market movements because small negative market movements are absorbed by the 10% Buffer. In a period of extreme negative market performance, the risk of loss is greater with the Index Precision Strategy than with the Index Guard Strategy. |

| Index Guard Strategy | • Less protection than the Index Protection Strategy, but more than Index Precision Strategy and Index Performance Strategy. • Permits a negative Performance Credit down to the -10% Floor. • Protection from significant losses. • More sensitive to smaller negative market movements that persist over time because the -10% Floor reduces the impact of large negative market movements. • In an extended period of smaller negative market returns, the risk of loss is greater with the Index Guard Strategy than with the Index Performance Strategy and Index Precision Strategy. • Provides certainty regarding the maximum loss in any Term. |

| Index Performance Strategy | • Less protection than the Index Protection Strategy and Index Guard Strategy. 3-year Term Index Options with 20% Buffer have more protection than what is available with the Index Precision Strategy. • Buffer absorbs 10% or 20% of loss depending on the Index Option you select, but you receive a negative Performance Credit for losses greater than the Buffer. • Potential for large losses in any Term. • More sensitive to large negative market movements because small negative market movements are absorbed by the Buffer. In a period of extreme negative market performance, the risk of loss is greater with the Index Performance Strategy than with the Index Guard Strategy. • In extended periods of moderate to large negative market performance, 3-year Terms may provide less protection than the 1-year Terms because, in part, the Buffer is applied over a longer period of time. |

| What is the growth opportunity? | |

| Index Protection Strategy | • Growth opportunity limited by the DPSCs. • Least growth opportunity. • May perform best in periods of small positive market movements. • DPSCs will generally be less than the Precision Rates and Caps. |

| What is the growth opportunity? | |

| Index Precision Strategy | • Growth opportunity limited by the Precision Rates. • May perform best in periods of small positive market movements. • Generally more growth opportunity than the Index Protection Strategy, but less than the Index Performance Strategy. • Growth opportunity may be more or less than the Index Guard Strategy depending on Precision Rates and Caps. |

| Index Guard Strategy | • Growth opportunity limited by the Caps. • May perform best in a strong market. • Growth opportunity that generally may be matched or exceeded only by the Index Performance Strategy. However, growth opportunity may be more or less than the Index Precision Strategy or Index Performance Strategy depending on Precision Rates and Caps. |

| Index Performance Strategy | • Growth opportunity limited by the Caps. If we do not declare a Cap for a 3-year Term Index Option there is no maximum limit on the positive Index Return for that Index Option. • May perform best in a strong market. • Generally the most growth opportunity. However, growth opportunity may be less than the Index Precision Strategy or Index Guard Strategy depending on Precision Rates and Caps. |

| What can change within a Crediting Method? | |

| Index Protection Strategy | • Renewal DPSCs for existing Contracts can change on each Term Start Date. • DPSCs are subject to a 1.50% minimum. |

| Index Precision Strategy | • Renewal Precision Rates for existing Contracts can change on each Term Start Date. • The 10% Buffers for the currently available Index Options cannot change. However, if we add a new Index Option to your Contract after the Issue Date, we establish the Buffer for it on the date we add the Index Option to your Contract. • Precision Rates are subject to a 1.50% minimum. |

| Index Guard Strategy | • Renewal Caps for existing Contracts can change on each Term Start Date. • The -10% Floors for the currently available Index Options cannot change. However, if we add a new Index Option to your Contract after the Issue Date, we establish the Floor for it on the date we add the Index Option to your Contract. • Caps are subject to a 1.50% minimum. |

| Index Performance Strategy | • Renewal Caps for existing Contracts can change on each Term Start Date. • The 10% or 20% Buffers for the currently available Index Options cannot change. However, if we add a new Index Option to your Contract after the Issue Date, we establish the Buffer for it on the date we add the Index Option to your Contract. • Caps are subject to a 1.50% minimum for 1-year Terms, or 5% for 3-year Terms. |

| • For any Index Option with the Index Precision Strategy or Index Performance Strategy, you participate in any negative Index Return in excess of the Buffer, which reduces your Contract Value. For example, for a 10% Buffer we absorb the first -10% of Index Return and you could lose up to 90% of the Index Option Value. However, for any Index Option with the Index Guard Strategy, we absorb any negative Index Return in excess of the -10% Floor, so your maximum loss is limited to -10% of the Index Option Value due to negative Index Returns. |

| • DPSCs, Precision Rates, and Caps as set by us from time-to-time may vary substantially based on market conditions. However, in extreme market environments, it is possible that all DPSCs, Precision Rates, and Caps will be reduced to their respective minimums of 1.50%, or 5% as stated in the table above. |

| • DPSCs, Precision Rates, and Caps can be different from Index Option to Index Option. For example, Caps for the Index Performance Strategy 1-year Terms can be different between the S&P 500® Index and the Nasdaq-100® Index; and Caps for the S&P 500® Index can be different between 1-year and 3-year Terms on the Index Performance Strategy, and between the 1-year Terms for the Index Guard Strategy and Index Performance Strategy. They may also be different from Contract-to-Contract depending on the Index Effective Date and the state of issuance. |

| Historical information on the DPSCs, Precision Rates, and Caps is provided in Appendix C. This information is for historical purposes only and is not a representation as to future DPSCs, Precision Rates, and Caps. |

| • If your Contract is within its free look period you may be able to take advantage of any increase in initial DPSCs, Precision Rates, or Caps by cancelling your Contract and purchasing a new Contract. |

| • If the initial DPSCs, Precision Rates, or Caps available on the Index Effective Date are not acceptable you can: |

| – cancel your Contract if you are still within the free look period, |

| – request to extend your Index Effective Date if you have not reached your first Quarterly Contract Anniversary, |

| – on or before the Index Effective Date, cancel the Contract and request a full withdrawal of the money held in the AZL Government Money Market Fund and receive the Contract Value less final product and rider fees and contract maintenance charge; on or before the Index Effective Date you are not subject to the Daily Adjustment, or |

| – after the Index Effective Date, cancel the Contract and request a full withdrawal of the Contract Value less withdrawal charge, and final product and rider fees and contract maintenance charge; after the Index Effective Date, you will be subject to a withdrawal charge and the Daily Adjustment. |

| • DPSCs, Precision Rates, and Caps may be different between newly issued and existing Contracts, and between existing Contracts issued on the same month and day in different years. For example, assume that on May 3, 2019 we set Caps for the Index Performance Strategy 1-year Term with the S&P 500® Index as follows: |

| – 13% initial rate for new Contracts issued in 2019, |

| – 14% renewal rate for existing Contracts issued in 2018, and |

| – 12% renewal rate for existing Contracts issued in 2017. |

| • | The Contract Value is the sum of your Variable Account Value and Index Option Values. Contract Value reflects any previously deducted Contract fees and expenses, but does not reflect Contract fees and expenses that we would apply on liquidation. The cash surrender value reflects all Contract fees and expenses we would apply on liquidation. |

| • | Your Variable Account Value is the sum of the values in your selected Variable Options. It reflects deduction of Variable Option operating expenses, any previously assessed transfer fee, contract maintenance charge, product fee, and rider fee. It changes each Business Day based on the performance of the Variable Options. |

| • | Your total Index Option Value is the sum of the values in each of your selected Index Options. Each Index Option Value includes any Credits from previous Term End Dates, reduced proportionately for previous partial withdrawals you took and any financial adviser fees that you choose to have us pay from this Contract (including any withdrawal charges), and previous deductions we made for Contract fees and expenses. Amounts removed from the Index Options during the Term for withdrawals you take and deductions we make for fees and expenses do not receive a Credit on the Term End Date, but the amount remaining does receive a Credit subject to the applicable Buffer, Floor, DPSC, Precision Rate, or Cap. |

| – | On each Business Day during the Term other than the Term Start Date or Term End Date, we calculate the current Index Option Value for each Index Option with the Index Precision Strategy, Index Guard Strategy, and Index Performance Strategy by adding a Daily Adjustment to the Index Option Base. The Index Option Base is the amount you allocate to an Index Option. We reduce the Index Option Base proportionately for withdrawals you take and any financial adviser fees that you choose to have us pay from this Contract (including any withdrawal charges), and deductions we make for Contract fees and expenses; we increase/decrease it by the dollar amount of additional Purchase Payments allocated to, transfers into or out of the Index Option; and any Credit. |

| – | During the Term the Index Option Values for Index Options with the Index Protection Strategy do not change for Index performance, and do not receive the Daily Adjustment. |

| (i) | any Index gains during the Term subject to the applicable Precision Rate or Cap, |

| (ii) | either any Index losses greater than the 10% or 20% Buffer, or Index losses down to the -10% Floor, and |

| (iii) | the number of days until the Term End Date. |

| We will not provide advice or notify you regarding whether you should exercise a Performance Lock or the optimal time for doing so. We will not warn you if you exercise a Performance Lock at a sub-optimal time. We are not responsible for any losses related to your decision whether or not to exercise a Performance Lock. |

| Number of Complete Years Since Purchase Payment | Withdrawal Charge Amount | |

| 0 | 6.5% | |

| 1 | 6% | |

| 2 | 5% | |

| 3 | 4% | |

| 4 | 3% | |

| 5 | 2% | |

| 6 years or more | 0% |

Transfer Fee(3) | $25 |

| (for each transfer between Variable Options after twelve in a Contract Year) |

| Index Precision Strategy and Index Performance Strategy | Index Guard Strategy | ||

| Daily Adjustment Maximum Potential Loss | 99% | 35% | |

| (as a percentage of Index Option Value, applies for distributions from an Index Option before any Term End Date)(4) |

| (1) | The withdrawal charge does not apply to withdrawals from the Variable Options. The Contract provides a free withdrawal privilege that allows you to withdraw 10% of your total Purchase Payments annually from the Index Options without incurring a withdrawal charge, as discussed in section 7, Access to Your Money – Free Withdrawal Privilege. |

| (2) | The Withdrawal Charge Basis is the total amount under your Contract that is subject to a withdrawal charge, as discussed in section 6, Expenses – Withdrawal Charge. |

| (3) | We count all transfers made in the same Business Day as one transfer, as discussed in section 6, Expenses – Transfer Fee. The transfer fee does not apply to transfers to or from the Index Options and these transfers do not count against your free transfers. Transfers are subject to the policies discussed in section 5, Variable Options – Excessive Trading and Market Timing. |

| (4) | This shows the maximum potential loss due to the application of the Daily Adjustment (e.g., maximum loss could occur if there is a total distribution within a Term at a time when the Index price has declined to zero). The Daily Adjustment could result in a loss beyond the protection of the 10% or 20% Buffer, or -10% Floor. The Daily Adjustment applies if before the Term End Date you take a full or partial withdrawal (including any financial adviser fees that you choose to have us pay from this Contract), execute a Performance Lock, annuitize the Contract, we pay a death benefit, or when we deduct Contract fees or expenses. The actual Daily Adjustment calculation is determined by a formula described in Appendix B. |

| Administrative Expenses (or contract maintenance charge)(1) (per year) | $50 |

| Base Contract Expenses(2) (as a percentage of the Charge Base) | 0.25% |

| Optional Benefit Expenses – Maximum Anniversary Value Death Benefit (as a percentage of the Charge Base) | 0.20% |

| (1) | Referred to as the “contract maintenance charge” in the Contract and elsewhere in this prospectus. Waived if the Contract Value is at least $100,000. During the Annuity Phase, we deduct the contract maintenance charge proportionately from each Annuity Payment. See the section 6, Expenses – Contract Maintenance Charge (Administrative Expenses). |

| (2) | Referred to as the “product fee” in the Contract and elsewhere in this prospectus. See section 6, Expenses – Base Contract Expenses (Product Fee). |

| Minimum | Maximum | ||

| (expenses that are deducted from Variable Option assets, including management fees, distribution and/or service (12b-1) fees, and other expenses) | 0.65% | 0.71% |

| (1) | If you surrender your Contract (take a full withdrawal) at the end of the applicable time period: |

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Maximum Variable Option expense | $7,029 | $8,182 | $9,091 | $14,180 |

| Minimum Variable Option expense | $6,969 | $7,995 | $8,770 | $13,488 |

| (2) | If you annuitize your Contract at the end of the applicable time period. |

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Maximum Variable Option expense | N/A* | $3,682 | $6,391 | $14,180 |

| Minimum Variable Option expense | N/A* | $3,495 | $6,070 | $13,488 |

| * | The earliest available Annuity Date is the second Contract Anniversary. |

| (3) | If you do not surrender your Contract. |

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Maximum Variable Option expense | $1,179 | $3,682 | $6,391 | $14,180 |

| Minimum Variable Option expense | $1,119 | $3,495 | $6,070 | $13,488 |

| The COVID-19 pandemic has at times led to significant volatility and negative returns in the financial markets. These market conditions have impacted the performance of the Indexes to which the Index Options are linked, as well as securities held by the Variable Options. If these market conditions continue or reoccur, and depending on your individual circumstances (e.g., your selected Allocation Options and the timing of any Purchase Payments, transfers, or withdrawals), you may experience (perhaps significant) negative returns under the Contract. The COVID-19 pandemic has contributed to an uncertain and evolving economic environment. The impact of the COVID-19 pandemic and other interrelated factors (e.g., changes in interest rates, rising inflation, actions of governmental authorities) on the economic environment cannot be predicted with certainty, but they could negatively affect the returns of an Index and the level of DPSCs, Precision Rates, and Caps, and other product features, and the overall performance of your Contract. The military invasion of Ukraine initiated by Russia in February 2022 and the resulting response by the United States and other countries have led to economic disruptions, as well as increased volatility and uncertainty in the financial markets. It is not possible to predict the ultimate duration and scope of the conflict, or the future impact on U.S. and global economies and financial markets. The performance of the Indexes to which the Index Options are linked, as well as securities held by the AZL Government Money Market Fund, may be adversely affected. This risk could be higher for Indexes with exposure to European or Russian markets, including EURO STOXX 50® and iShares® MSCI Emerging Markets ETF. Depending on your individual circumstances (e.g., your selected Index Options and the timing of any Purchase Payments, transfers, or withdrawals), you may experience (perhaps significant) negative returns under the Contract. You should consult with a Financial Professional about how the recent market conditions may impact your future investment decisions related to the Contract, such as purchasing the Contract or making Purchase Payments, transfers, or withdrawals, based on your individual circumstances. |

| • | interest rate decreases, |

| • | dividend rate increases, |

| • | poor market performance, and |

| • | the expected volatility of Index prices. Increases in the expected volatility of Index prices negatively affect the Index Precision Strategy and Index Performance Strategy with 1-year Terms, while decreases in the expected volatility of Index prices negatively affect the Index Guard Strategy. For the Index Performance Strategy with 3-year Terms, the impact of changes in the expected volatility of Index prices is dependent on the market environment and the applicable Caps and Participation Rates. |

| January 1, 2011 through December 31, 2021 | |||||||||

| S&P 500® Index | Nasdaq-100® Index | Russell 2000® Index | EURO STOXX 50® | iShares® MSCI Emerging Markets ETF | |||||

| Returns without dividends | 14.84% | 22.67% | 12.57% | 7.03% | 3.79% | ||||

| Returns with dividends | 17.11% | 24.05% | 14.07% | 10.88% | 5.90% | ||||

| • | You will no longer participate in Index performance, positive or negative, for the remainder of the Index Year for the locked Index Option. This means that under no circumstances will your Index Option Value increase during the remainder of the Index Year. An Index Year is a twelve-month period beginning on the Index Effective Date or a subsequent Index Anniversary. |

| • | You will not receive a Performance Credit on any locked Index Option on the Term End Date. |

| • | We use the Daily Adjustment calculated at the end of the current Business Day on the Lock Date to determine your locked Index Option Value. This means you will not be able to determine in advance your locked Index Option Value, and it may be higher or lower than it was at the point in time you requested a manual Performance Lock, or that your Index Option reached its target for an automatic Performance Lock. Through your account on our website you can request a Performance Lock based on upper and/or lower targets you set using Index Option Value returns. |

| • | If a Performance Lock is executed when your Daily Adjustment has declined, you will lock in any loss. It is possible that you would have realized less of a loss or no loss if the Performance Lock occurred at a later time, or if the Index Option was not locked. |

| • | We will not provide advice or notify you regarding whether you should exercise a Performance Lock or the optimal time for doing so. We will not warn you if you exercise a Performance Lock at a sub-optimal time. We are not responsible for any losses related to your decision whether or not to exercise a Performance Lock. |

| • | the Index is discontinued, |

| • | we are unable to use the Index because, for example, changes to an Index make it impractical or expensive to purchase derivative hedging instruments to hedge the Index, or we are not licensed to use the Index, or |

| • | the method of calculation of the Index Values changes substantially, resulting in significantly different Index Values and performance results. This could occur, for example, if an Index altered the types of securities tracked, or the weighting of different categories of securities. |

| • | we do not change the Charge Base we use to calculate the product and rider fees, and |

| • | the Buffers, Floors, DPSCs, Precision Rates, and Caps for the replaced Index will apply to the new Index. We do not change the Buffers and Floors applicable to your Contract, or the current DPSCs, Precision Rates, and Caps that we set on the Term Start Date. |

| You can only transfer Index Option Value to a Variable Option on a sixth Index Anniversary. |

| • | market volatility, |

| • | our hedging strategies and investment performance, |

| • | the availability of hedging instruments, |

| • | the amount of money available to us through Contract fees and expenses to purchase hedging instruments, |

| • | your Index Effective Date, |

| • | the level of interest rates, |

| • | utilization of Contract benefits by Owners, and |

| • | our profitability goals. |

| As a result of the COVID-19 pandemic and interrelated market factors (e.g., market volatility changes in interest rates, rising inflation, actions by governmental authorities), economic uncertainties have arisen which could negatively impact Allianz Life’s net income and surplus. The extent to which the COVID-19 pandemic and these other market factors will impact our business, net income, and surplus, as well as our capital and liquidity position, will depend on future developments, which are highly uncertain. For more information see section 13, Information on Allianz Life – Business and Operational Risks Relevant to the Contract. |

| • | The Business Day before the Annuity Date. |

| • | The Business Day we process your request for a full withdrawal. |

| • | Upon the death of any Owner (or the Annuitant if the Owner is a non-individual), the Business Day we first receive a Valid Claim from any one Beneficiary, unless the surviving spouse/Beneficiary continues the Contract. If there are multiple Beneficiaries, the remaining Contract Value continues to fluctuate with the performance of the Allocation Options until the complete distribution of the death benefit. A Valid Claim is the documents we require to be received in Good Order at our Service Center before we pay any death claim. |

| Financial Adviser Fee Withdrawal | Contract Value | Guaranteed Death Benefit Value for a Contract with the Traditional Death Benefit | Guaranteed Death Benefit Value for a Contract with the Maximum Anniversary Value Death Benefit | |||

| Prior to 1st years withdrawal | $ 100,000 | $ 90,000 | $ 105,000 | |||

| $5,000 withdrawal (subject to an | ||||||

| 8.5% withdrawal charge) | – [($5,000 ÷ (1 – 8.5%)] |

| Financial Adviser Fee Withdrawal | Contract Value | Guaranteed Death Benefit Value for a Contract with the Traditional Death Benefit | Guaranteed Death Benefit Value for a Contract with the Maximum Anniversary Value Death Benefit | |||

| Amount withdrawn | – $5,465 | – [($5,465 ÷ 100,000) x 90,000] | – [($5,465 ÷ 100,000) x 105,000] | |||

| = - $4,919 | = - $5,739 | |||||

| After 1st years withdrawal | $ 94,535 | $ 85,081 | $ 99,261 | |||

| Prior to 2nd years withdrawal | $ 97,000 | $ 85,081 | $ 99,261 | |||

| $5,000 withdrawal (not subject to a | ||||||

| withdrawal charge) | – $5,000 | – [($5,000 ÷ 97,000) x 85,081] | – [($5,000 ÷ 97,000) x 99,261] | |||

| = - $4,386 | = - $5,117 | |||||

| After 2nd years withdrawal | $ 92,000 | $ 80,695 | $ 94,414 | |||

| Prior to 3rd years withdrawal | $ 80,0000 | $ 80,695 | $ 94,414 | |||

| $5,000 withdrawal (not subject to a | – $5,000 | – [($5,000 ÷ 80,000) x 80,695] | – [($5,000 ÷ 80,000) x 94,414] | |||

| withdrawal charge) | = - $5,044 | = - $5,844 | ||||

| After 3rd years withdrawal | $ 75,000 | $ 75,651 | $ 88,260 |

| • | $94,535 Contract Value under the Traditional Death Benefit, or the $99,261 Guaranteed Death Benefit Value under the Maximum Anniversary Value Death Benefit after the first adviser fee. |

| • | $92,000 Contract Value under the Traditional Death Benefit, or the $94,414 Guaranteed Death Benefit Value under the Maximum Anniversary Value Death Benefit after the second adviser fee. |

| • | $75,651 Guaranteed Death Benefit Value under the Traditional Death Benefit, or the $88,260 Guaranteed Death Benefit Value under the Maximum Anniversary Value Death Benefit after the third adviser fee. |

| • | all applicable phases of the Contract (Accumulation Phase and/or Annuity Phase) have ended, and/or |

| • | if we received a Valid Claim, all applicable death benefit payments have been made. |

| • | We pay a death benefit to the Beneficiary unless the Beneficiary is the surviving spouse and continues the Contract. |

| • | If the deceased Owner was a Determining Life and the surviving spouse Beneficiary continues the Contract: |

| – | we increase the Contract Value to equal the Guaranteed Death Benefit Value if greater and available, and the death benefit ends, |

| – | the surviving spouse becomes the new Owner, |

| – | the Accumulation Phase continues, and |

| – | upon the surviving spouse’s death, his or her Beneficiary(s) receives the Contract Value. |

| • | If the deceased Owner was not a Determining Life, the Traditional Death Benefit or Maximum Anniversary Value Death Benefit are not available and the Beneficiary(s) receives the Contract Value. |

| • | The Beneficiary becomes the Payee. If we are still required to make Annuity Payments under the selected Annuity Option, the Beneficiary also becomes the new Owner. |

| • | If the deceased was not an Annuitant, Annuity Payments to the Payee continue. No death benefit is payable. |

| • | If the deceased was the only surviving Annuitant, Annuity Payments end or continue as follows. |

| – | Annuity Option 1 or 3, payments end. |

| – | Annuity Option 2 or 4, payments end when the guaranteed period ends. |

| – | Annuity Option 5, payments end and the Payee may receive a lump sum refund. |

| – | For more information on Annuity Options, please see section 8. |

| • | If the deceased was an Annuitant and there is a surviving joint Annuitant, Annuity Payments to the Payee continue during the lifetime of the surviving joint Annuitant. No death benefit is payable. |

| • | you remove a Joint Owner due to divorce, then we also remove that person as a Determining Life, or |

| • | you establish a jointly owned Non-Qualified Contract and change ownership to a Trust, then we remove the prior Owner who is not the Annuitant as a Determining Life. |

| FOR JOINTLY OWNED CONTRACTS: The sole primary Beneficiary is the surviving Joint Owner regardless of any other named primary Beneficiaries. If both Joint Owners die simultaneously as defined by applicable state law or regulation, we pay the death benefit to the named contingent Beneficiaries or equally to the estate of the Joint Owners if there are no named contingent Beneficiaries. |

| • An assignment may be a taxable event. In addition, there are other restrictions on changing the ownership of a Qualified Contract and Qualified Contracts generally cannot be assigned absolutely or on a limited basis. You should consult with your tax adviser before assigning this Contract. |

| • An assignment will only change the Determining Life (Lives) if it involves removing a Joint Owner due to divorce, or replacing Joint Owners with a Trust. |

| • | age 80 or younger, or |

| • | age 75 or younger if you select the Maximum Anniversary Value Death Benefit. |

| • | The minimum initial Purchase Payment due on the Issue Date is $10,000. |

| • | You can make additional Purchase Payments of $50 or more during the Accumulation Phase. |

| • | We do not accept additional Purchase Payments on or after the Annuity Date. |

| • | The maximum total Purchase Payments we accept without our prior approval is $1 million. |

| On your application if you select… | Your Index Effective Date will be either… |

| the earliest Index Effective Date | • your Issue Date, or • the first Business Day of the next month if the Issue Date is the 29th, 30th, or 31st of a month |

| the deferred Index Effective Date | • your first Quarterly Contract Anniversary, or • the next Business Day if the first Quarterly Contract Anniversary occurs on a non-Business Day, or the first Business Day of the next month if the first Quarterly Contract Anniversary is the 29th, 30th, or 31st of a month |

| • In order to apply Purchase Payments we receive after the Index Effective Date to your selected Index Option(s) on the next Index Anniversary, we must receive them before the end of the Business Day on the Index Anniversary (or before the end of the prior Business Day if the anniversary is a non-Business Day). |

| • Variable Options are subject to Contract fees and expenses (e.g. product fee), and market risk and assets you allocate to them may lose value, including any Purchase Payments we hold in the AZL Government Money Market before transferring them to your selected Index Options. |

| For Owners of Qualified Contracts, AIP is not available if you have an Inherited IRA Contract, an Inherited Roth IRA Contract, or if your Contract is funding a plan that is tax qualified under Section 401 of the Code. |

| • | cancel your Contract during this time, we return the greater of Purchase Payments less withdrawals, or Contract Value. We do not assess a withdrawal charge or deduct any other Contract fees or expenses if you cancel your Contract during the free look period. |

| • | do not cancel your Contract during this time, we re-allocate your Contract Value according to your Purchase Payment default instructions after the free look period as follows: |

| – | if your instructions include the Variable Options, we re-allocate this portion of your Contract Value on the next Business Day after the free look period. |

| – | if your instructions include the Index Options, we re-allocate this portion of your Contract Value on the Index Effective Date. |

| Variable Account Value increases when…. | Variable Account Value decreases when…. |

| • you add assets to a Variable Option by Purchase Payment or Contract Value transfer, or • there is positive Variable Option performance | • you take assets out of a Variable Option by withdrawal (including any financial adviser fees that you choose to have us pay from this Contract) or Contract Value transfer, • there is negative Variable Option performance, or • we deduct Contract fees and expenses |

| Contract fees and expenses we deduct from the Variable Options include the product fee, rider fee, contract maintenance charge and transfer fee as described in section 6, Expenses. Financial adviser fees that you choose to have us pay from this Contract are described in section 1, The Contract. Variable Options include Purchase Payments we hold in the AZL Government Money Market Fund before transferring them to your selected Index Options. | |

| Index Option Values increase when…. | Index Option Values decrease when…. |

| • you add assets to an Index Option by Purchase Payment or Contract Value transfer, or • you receive a positive Credit or Daily Adjustment | • you take assets out of an Index Option by withdrawal (including any financial adviser fees that you choose to have us pay from this Contract) or Contract Value transfer, • you receive a negative Credit or Daily Adjustment, or • we deduct Contract fees and expenses |

| Contract fees and expenses we deduct from the Index Options include the product fee, rider fee, contract maintenance charge and withdrawal charge as described in section 6, Expenses. Financial adviser fees that you choose to have us pay from this Contract are described in section 1, The Contract. | |

| * | Does not apply to RMD payments under our minimum distribution program. |

| • | increase when you add assets to a Variable Option by Purchase Payment or Contract Value transfer, and |

| • | decrease when assets are removed from a Variable Option by transfer, withdrawals you request (including any financial adviser fees that you choose to have us pay from this Contract), or when we deduct Contract fees and expenses. |

| • | We receive at our Service Center an additional Purchase Payment of $3,000 from you before the end of the Business Day. |

| • | When the New York Stock Exchange closes on that Business Day, we determine that the accumulation unit value is $13.25 for the subaccount of your selected Variable Option. |

| • | We then divide $3,000 by $13.25 and credit your Contract that night with 226.415094 subaccount accumulation units for your selected Variable Option. |

| • | any Purchase Payment received that day which you allocated to that Index Option, and |

| • | any Contract Value transferred into that Index Option. |

| • | the Daily Adjustment if this is not the Term End Date and this is an Index Option with the Index Precision Strategy, Index Guard Strategy, or Index Performance Strategy, or |

| • | a Credit if this is the Term End Date. |

| • | We multiply each Index Option Base by its Credit and add this amount to its Index Option Base. |

| • | Then we set each Index Option Value equal to its Index Option Base. |

| • | Additional Purchase Payments received on the Term End Date and allocated to this Index Option, and transfers of Variable Account Value or Index Option Value into this Index Option, increase these values by the dollar amount allocated or transferred. |

| • | Transfers out of this Index Option reduce these values by the dollar amount removed from the Index Option. |

| • | Partial withdrawals you take or financial adviser fees that you choose to have us pay from this Contract (including any withdrawal charge), and deductions we make for Contract fees and expenses reduce these values by the dollar amount withdrawn from the Index Option. |

| – | We deduct partial withdrawals you take or financial adviser fees that you choose to have us pay from this Contract (including any withdrawal charge), and deductions we make for Contract fees and expenses from the Index Options proportionately based on the percentage of Contract Value in each Index Option using values determined at the end of the Business Day before we process the withdrawal or deduct the Contract expense. However, if you specifically direct us to take a partial withdrawal from a specific Index Option we reduce that Index Option Value by the dollar amount you specify (including any withdrawal charge). |

| – | We then reduce each Index Option Base by the same percentage that the amount withdrawn reduced its associated Index Option Value. |

| • | Your Contract Value is $100,000 and you selected two Index Options. The first Index Option has an Index Option Value of $75,000 and an Index Option Base of $72,000. The second Index Option has an Index Option Value of $25,000 and an Index Option Base of $22,000. You take a $10,000 partial withdrawal (including any withdrawal charge). |

| • | This partial withdrawal reduces your Index Option Value by the percentage of Contract Value in each Index Option (Index Option Value ÷ Contract Value). |

| – | For the first Index Option this percentage is 75% ($75,000 ÷ $100,000) and the $10,000 partial withdrawal reduces this value by $7,500 ($10,000 x 75%). For the second Index Option this percentage is 25% ($25,000 ÷ $100,000) and the $10,000 partial withdrawal reduces this value by $2,500 ($10,000 x 25%). |

| • | We then reduce each Index Option Base by the same percentage that the amount withdrawn reduced its associated Index Option Value (amount withdrawn from Index Option Value ÷ Index Option Value). |

| – | For the first Index Option this percentage is 10% ($7,500 ÷ $75,000) and the $10,000 partial withdrawal reduces this value by $7,200 ($72,000 x 10%). For the second Index Option this percentage is also 10% ($2,500 ÷ $25,000) and the $10,000 partial withdrawal reduces this value by $2,200 ($22,000 x 10%). |

| • | Deductions we make for Contract fees and expenses also reduce these values proportionately in the same way as a partial withdrawal. |

| First Index Option | Second Index Option | ||||||

| Index Option Value | Index Option Base | Index Option Value | Index Option Base | ||||

| Prior to partial withdrawal | $ 75,000 | $ 72,000 | $ 25,000 | $ 22,000 | |||

| $10,000 partial withdrawal | – $7,500 | – $7,200 | – $2,500 | – $2,200 | |||

| After partial withdrawal | $ 67,500 | $ 64,800 | $ 22,500 | $ 19,800 | |||

| • Amounts removed from the Index Options during the Term for partial withdrawals you take (including any financial adviser fees that you choose to have us pay from this Contract) and deductions we make for Contract fees and expenses do not receive a Credit on the Term End Date. However, the remaining amount in the Index Options is eligible for a Credit on the Term End Date. |

| • You cannot specify from which Allocation Option we deduct the product fee, rider fee, and contract maintenance charge; we deduct these Contract fees and expenses from each Allocation Option proportionately based on the percentage of Contract Value in each Allocation Option. However, you can specify from which Allocation Option we deduct a partial withdrawal and any financial adviser fees that you choose to have us pay from this Contract. Because the withdrawal charge only applies to amounts withdrawn from the Index Options, there is a financial disadvantage to taking a withdrawal from the Index Options, compared to taking a withdrawal from the Variable Options. |

| Crediting Method | If Index Value is less than it was on the Term Start Date (i.e., Index Return is negative): | If Index Value is equal to or greater than it was on the Term Start Date (i.e., Index Return is zero or positive): |

| Index Protection Strategy | Credit is zero | Credit is equal to the DPSC set on the Term Start Date |

| Index Precision Strategy | Performance Credit is equal to the negative Index Return in excess of the 10% BufferIf the Index Return is… • -8%, the Performance Credit is zero. • -12%, the Performance Credit is -2%. | Performance Credit is equal to the Precision Rate set on the Term Start Date |

| Crediting Method | If Index Value is less than it was on the Term Start Date (i.e., Index Return is negative): | If Index Value is equal to or greater than it was on the Term Start Date (i.e., Index Return is zero or positive): |

| Index Guard Strategy | Performance Credit is equal to the negative Index Return subject to the -10% FloorIf the Index Return is… • -8%, the Performance Credit is -8%. • -12%, the Performance Credit is -10%. | Performance Credit is equal to the Index Return up to the Cap set on the Term Start DateAssume the Cap is 8%. If the Index Return is… • 0%, the Performance Credit is zero. • 6%, the Performance Credit is 6%. • 12%, the Performance Credit is 8%. |

| Index Performance Strategy – 1-year Term | Performance Credit is equal to the negative Index Return in excess of the 10% Buffer.If the Index Return for the year is… • -8%, the Performance Credit is zero. • -12%, the Performance Credit is -2%. | Performance Credit is equal to the Index Return up to the Cap set on the Term Start Date Assume the Cap for the 1-year Term is 8%. If the Index Return for the year is… • 0%, the Performance Credit is zero. • 6%, the Performance Credit is 6%. • 12%, the Performance Credit is 8%. |

| Index Performance Strategy – 3-year Term | Performance Credit is equal to the negative Index Return in excess of the 20% Buffer.If the Index Return for the Term is… • -19%, the Performance Credit is zero. • -24%, the Performance Credit is -4%. | Performance Credit is equal to the Index Return up to any Cap set on the Term Start Date Assume the Cap for the 3-year Term is 80%. If the Index Return for the Term is… • 0%, the Performance Credit is zero. • 65%, the Performance Credit is 65%. • 90%, the Performance Credit is 80%. If instead, the 3-year Term were uncapped the Performance Credit would be 90%. |

| You cannot participate in the Optional Reallocation Program if you select a 3-year Term Index Option. If you are participating in this program and select a 3-year Term Index Option, on the Term Start Date your participation in this program ends and we will not reallocate your 1-year Term Index Option Values. |

| • | Your request for a transfer must clearly state the Variable Options involved and how much to transfer. |

| • | Your right to make transfers is subject to the Excessive Trading and Market Timing policy discussed later in this section. |

| • | Variable Account Value transfers between Variable Options do not change your Purchase Payment default instructions. |

| • | Dilution of the interests of long-term investors in a Variable Option, if market timers or others transfer into a Variable Option at prices that are below their true value, or transfer out at prices above their true value. |

| • | An adverse effect on portfolio management, such as causing a Variable Option to maintain a higher level of cash or causing a Variable Option to liquidate investments prematurely. |

| • | Increased brokerage and administrative expenses. |

| • | Limit transfer frequency (for example, prohibit more than one transfer a week, or more than two a month, etc.). |

| • | Restrict the transfer method (for example, requiring all transfers be sent by first-class U.S. mail and rescinding electronic transfer privileges). |

| • | Require a minimum time period between each transfer into or out of the same Variable Option. Our current Excessive Trading and Market Timing policy, which is subject to change without notice, prohibits “round trips” within 14 calendar days. We do not include transfers into and/or out of the AZL Government Money Market Fund when available in your Contract or any automatic transfers made under any of our programs or Contract features. Round trips are transfers into and back out of the same Variable Option, or transfers out of and back into the same Variable Option. |

| • | Refuse transfer requests made on your behalf by an asset allocation and/or market timing service. |

| • | Limit the dollar amount of any single Purchase Payment or transfer request to a Variable Option. |

| • | Prohibit transfers into specific Variable Options. |

| • | Impose other limitations or restrictions to the extent permitted by federal securities laws. |

| • | Our monitoring will be 100% successful in detecting all potentially disruptive trading activity. |

| • | Revoking electronic transfer privileges will successfully deter all potentially disruptive trading. |

| This Contract is not designed for professional market timing organizations, or other persons using programmed, large, or frequent transfers, and we may restrict excessive or inappropriate transfer activity. |

| • | You can provide voting instructions based on the dollar value of the Variable Option’s shares in your Contract’s subaccount. We calculate this value based on the number and value of accumulation units for your Contract on the record date. We count fractional units. |

| • | You receive proxy materials and a voting instruction form. |

| Base Contract Expenses (as a percentage of the Charge Base) | |

Product Fee(1) | 0.25% |

| (1) | Upon the death of the Owner, we continue to assess this product fee under death benefit payment Option B, and with optional payments under death benefit payment Option C, as noted in section 10, Death Benefit. |

| Issue Date | Non-Quarterly Contract Anniversaries | Quarterly Contract Anniversaries* |

| • The Charge Base is equal to your initial Purchase Payment.• We begin calculating and accruing the daily product fee, on the day after the Issue Date. | • First we calculate and accrue the daily product fee, using the Charge Base. If this is a non-Business Day we use the Charge Base from the end of the prior Business Day.• Then if this is a Business Day we increase/decrease the Charge Base as follows. – If we receive an additional Purchase Payment, we increase the Charge Base by the dollar amount we receive. – If you take a partial withdrawal or choose to have us pay financial adviser fees from this Contract, or we deduct Contract fees and expenses, we decrease the Charge Base by the percentage of Contract Value withdrawn (including any withdrawal charge). All withdrawals you take reduce the Charge Base, even Penalty-Free Withdrawals. | • First we process all daily transactions and determine your Contract Value. Daily transactions include any gains/losses due to Variable Option performance or application of any Daily Adjustment (or Credit if this is also the Term End Date), any additional Purchase Payment, any partial withdrawals you take or financial adviser fees that you choose to have us pay from this Contract (including any withdrawal charge), and deductions we make for Contract fees and expenses (including deduction of the accrued daily product fee for the prior quarter). All partial withdrawals you take reduce the Charge Base, even Penalty-Free Withdrawals. – We deduct the accrued product fee for the prior quarter on a dollar for dollar basis from the Contract Value, and proportionately from each Allocation Option.• Then we set the Charge Base equal to this Contract Value and we calculate and accrue the next quarter’s daily product fee using the newly set Charge Base.* Or the next Business Day if the Quarterly Contract Anniversary is a non-Business Day. |

| Example: Contract Value is $125,000; Charge Base is $127,000; a $10,000 partial withdrawal (including any withdrawal charge) would decrease the Charge Base by $10,160. [($10,000 ÷ $125,000) x $127,000] Any increase/decrease to the Charge Base will increase/decrease the daily product fee we calculate and accrue on the next day. | ||

| Examples of how we calculate the product fee are included in Appendix E. | ||

| We do not treat the deduction of the accrued product fee as a withdrawal when computing your Guaranteed Death Benefit Value (see section 10). |

| • | If you take a full withdrawal we deduct the final accrued product fee before processing the withdrawal. |

| • | If you annuitize the Contract, we deduct the final accrued product fee before calculating Annuity Payments. |

| • | Upon the death of an Owner (or Annuitant if the Owner is a non-individual), we deduct the final accrued product fee before calculating the death benefit if death benefit payment Option A or Annuity Payments under death benefit payment Option C is selected. For more information on the death benefit payment options see section 10, Death Benefit. |

| If on a Quarterly Contract Anniversary (or the next Business Day if the Quarterly Contract Anniversary is a non-Business Day) the Contract Value is less than the accrued product fee, we deduct your total remaining Contract Value to cover the accrued product fee and reduce your Contract Value to zero. If the deduction of the accrued product fee reduces your Contract Value to zero and your selected death benefit has ended, we treat this as a full withdrawal and your Contract ends. |

| When calculating the Maximum Anniversary Value, we deduct all Contract fees and expenses on the Index Anniversary (including the accrued product and rider fees if this is also a Quarterly Contract Anniversary) before we capture any annual investment gains. |

| • | During the Accumulation Phase, if the total Contract Value for all Allianz Index Advantage ADV® Contracts you own is at least $100,000 at the end of the last Business Day before the Contract Anniversary, or if the Contract Value for this single Allianz Index Advantage ADV® Contract is at least $100,000 on the Contract Anniversary. We determine the total Contract Value for all individually owned Allianz Index Advantage ADV® Contracts by using the Owner’s social security number, and for non-individually owned Allianz Index Advantage ADV® Contracts we use the Annuitant’s social security number. |

| • | During the Annuity Phase if the total Contract Value for all Allianz Index Advantage ADV® Contracts on the last Business Day before the Annuity Date is at least $100,000. |

| • | When paying death benefits. |

| • | on a dollar for dollar basis from the Contract Value on the Contract Anniversary (or the next Business Day if the Contract Anniversary is a non-Business Day), and |

| • | we deduct it proportionately from each Allocation Option. |

| Calculating a Withdrawal Charge | Example | |||

| For purposes of calculating any withdrawal charge for a withdrawal from the Index Options, we withdraw Purchase Payments on a “first-in-first-out” (FIFO) basis and we process withdrawal requests as follows. | You make an initial Purchase Payment of $30,000 and make another Purchase Payment in the first month of the second Contract Year of $70,000. All Purchase Payments are allocated to the Index Options. In the third month of the third Contract Year, your Contract Value is $110,000 and you request a $52,000 withdrawal. We withdraw money and compute the withdrawal charge as follows. | |||

| 1. First we withdraw from Purchase Payments that we have had for six or more complete years, which is your Contract’s withdrawal charge period. This withdrawal is not subject to a withdrawal charge and it reduces the Withdrawal Charge Basis dollar for dollar. | 1. Purchase Payments beyond the withdrawal charge period. All payments are still within the withdrawal charge period, so this does not apply. | |||