SUPPLEMENT DATED MAY 1, 2023

To the following variable annuity prospectuses:

Allianz Index Advantage®

Allianz Index Advantage ADV®

Allianz Index Advantage NF®

Allianz Index Advantage Income®

Allianz Index Advantage Income ADV®

Allianz Index Advantage+ IncomeSM

Allianz Index Advantage+ NFSM

Allianz Index Advantage+SM

Dated May 1, 2023

Allianz Index Advantage ADV®

Allianz Index Advantage NF®

Allianz Index Advantage Income®

Allianz Index Advantage Income ADV®

Allianz Index Advantage+ IncomeSM

Allianz Index Advantage+ NFSM

Allianz Index Advantage+SM

Dated May 1, 2023

ISSUED BY

Allianz Life Insurance Company of North America and Allianz Life Variable Account B

This supplement updates certain information contained in the prospectus and should be

attached to the prospectus and retained for future reference.

The following is added to “Information on Allianz Life — Executive Compensation.”

CEO Pay Ratio

In accordance with SEC rules, we determined the annual total compensation of our median compensated employee and present a comparison of that annual total compensation to the annual total compensation of our President and Chief Executive Officer (“CEO”), Jasmine M. Jirele.

| • | The 2022 annual total compensation of our CEO was $3,221,935. |

| • | The 2022 annual total compensation of our median compensated employee was $114,713. |

Accordingly, we estimate the ratio of our CEO's annual total compensation to the annual total compensation of our median compensated employee for 2022 was 28 to 1.

Determining the Median Compensated Employee

In 2022, we determined the median compensated employee by collecting compensation data for all employees, including full-time, part-time, seasonal, and temporary employees, excluding our CEO, employed by the Company as of December 31, 2022. We selected December 31, 2022 as the date upon which we would identify the median employee because it enabled us to make such identification in a reasonably efficient manner and it aligns with the methodology used in the other compensation-based disclosures above. As of December 31, 2022, our employee population consisted of 2,214 individuals. We do not have any employees who work outside of the U.S.

We identified our median compensated employee, using total compensation as our compensation measure, which included annual base salary, cash-based incentive compensation, long-term incentive compensation, and sales-based incentive compensation earned for 2022, plus employer contributions to the Allianz Asset Accumulation Plan, life insurance premiums, and other compensation. Compensation for full-time employees hired after January 1, 2022, was annualized for the full year 2022. We did not make any cost of labor adjustments as the majority of our employees are compensated based upon the cost of labor in Minneapolis, MN, the location of our corporate headquarters. We did not include amounts representing employer medical and dental contributions. This methodology was consistently applied to all our employees included in the calculation and is consistent with the methodology we use for our NEOs as set forth in the 2022 Summary Compensation Table.

Our pay ratio and compensation amount have been calculated using methodologies and assumptions consistent with SEC rules. The ratio and compensation amount may not be directly comparable to those of other companies because the methodologies and assumptions used to identify the median employee and determine that employee's total compensation may vary significantly among companies.

PRO-001-0523

(IXA-003, IXA-003-ADV, IXA-003-NF, IAI-003, IAI-003-ADV, IXAP-003, INFP-003, IAIP-003)

ALLIANZ INDEX ADVANTAGE+ INCOMESM VARIABLE ANNUITY

Issued by

ALLIANZ LIFE INSURANCE COMPANY OF NORTH AMERICA AND ALLIANZ LIFE VARIABLE ACCOUNT B

Income Benefit Supplement dated May 1, 2023

to the

Prospectus dated May 1, 2023

to the

Prospectus dated May 1, 2023

This Income Benefit Supplement (this Supplement) should be read and retained with the prospectus for the Index Advantage+ IncomeSM. If you would like another copy of the current prospectus or the current Income Benefit Supplement, please call us at (800) 624-0197 or visit our website at www.allianzlife.com/RILAincomerates.

Current Income Benefit and Income Multiplier Benefit terms effective for

applications signed from May 1, 2023 to June 5, 2023.

applications signed from May 1, 2023 to June 5, 2023.

Income Benefit terms (Income Payment waiting period, Income Percentages, and Income Percentage Increases) and Income Multiplier Benefit terms (income multiplier factor and income multiplier benefit wait period) may be different from those listed below for applications signed on or after June 6, 2023. Income Benefit terms and Income Multiplier Benefit terms reflected in this Supplement shall remain in effect and will not be superseded until after June 5, 2023. Any revised terms on or after June 6, 2023 will be reflected in an updated Income Benefit Supplement. We will publish any changes to these Income Benefit terms and Income Multiplier terms for subsequent periods at least seven calendar days before they take effect on our website and on EDGAR at www.sec.gov under Form S-1 File Number 333- 268820. Please work with your Financial Professional or visit www.allianzlife.com/RILAincomerates to confirm the most current terms.

| Income Payment waiting period | 1 Index Year |

| Income multiplier factor | 2 |

| Income multiplier benefit wait period | 5 Contract Years |

| Eligible Person’s Age (or younger Eligible Person’s age for joint Income Payments) | Income Percentages | Income Percentage Increases | |||

| Level Income | Increasing Income | ||||

| Single Income Payments | Joint Income Payments | Single Income Payments | Joint Income Payments | ||

| 0-50 | 4.70% | 4.20% | 3.40% | 2.90% | 0.25% |

| 51 | 4.80% | 4.30% | 3.50% | 3.00% | 0.25% |

| 52 | 4.90% | 4.40% | 3.60% | 3.10% | 0.25% |

| 53 | 5.00% | 4.50% | 3.70% | 3.20% | 0.25% |

| 54 | 5.10% | 4.60% | 3.80% | 3.30% | 0.25% |

| 55 | 5.20% | 4.70% | 3.90% | 3.40% | 0.30% |

| 56 | 5.30% | 4.80% | 4.00% | 3.50% | 0.30% |

| 57 | 5.40% | 4.90% | 4.10% | 3.60% | 0.30% |

| 58 | 5.50% | 5.00% | 4.20% | 3.70% | 0.30% |

| 59 | 5.60% | 5.10% | 4.30% | 3.80% | 0.30% |

| 60 | 5.70% | 5.20% | 4.40% | 3.90% | 0.35% |

| 61 | 5.80% | 5.30% | 4.50% | 4.00% | 0.35% |

| 62 | 5.90% | 5.40% | 4.60% | 4.10% | 0.35% |

| 63 | 6.00% | 5.50% | 4.70% | 4.20% | 0.35% |

| 64 | 6.10% | 5.60% | 4.80% | 4.30% | 0.35% |

| 65 | 6.20% | 5.70% | 4.90% | 4.40% | 0.40% |

| 66 | 6.30% | 5.80% | 5.00% | 4.50% | 0.40% |

| 67 | 6.40% | 5.90% | 5.10% | 4.60% | 0.40% |

| 68 | 6.50% | 6.00% | 5.20% | 4.70% | 0.40% |

| 69 | 6.60% | 6.10% | 5.30% | 4.80% | 0.40% |

| 70 | 6.70% | 6.20% | 5.40% | 4.90% | 0.45% |

IAIP0523 (IAIP-003)

| Eligible Person’s Age (or younger Eligible Person’s age for joint Income Payments) | Income Percentages | Income Percentage Increases | |||

| Level Income | Increasing Income | ||||

| Single Income Payments | Joint Income Payments | Single Income Payments | Joint Income Payments | ||

| 71 | 6.80% | 6.30% | 5.50% | 5.00% | 0.45% |

| 72 | 6.90% | 6.40% | 5.60% | 5.10% | 0.45% |

| 73 | 7.00% | 6.50% | 5.70% | 5.20% | 0.45% |

| 74 | 7.10% | 6.60% | 5.80% | 5.30% | 0.45% |

| 75 | 7.20% | 6.70% | 5.90% | 5.40% | 0.50% |

| 76 | 7.30% | 6.80% | 6.00% | 5.50% | 0.50% |

| 77 | 7.40% | 6.90% | 6.10% | 5.60% | 0.50% |

| 78 | 7.50% | 7.00% | 6.20% | 5.70% | 0.50% |

| 79 | 7.60% | 7.10% | 6.30% | 5.80% | 0.50% |

| 80+ | 7.70% | 7.20% | 6.40% | 5.90% | 0.55% |

On the Index Effective Date we establish an initial Income Percentage for each Eligible Person’s current age, or the younger Eligible Person’s current age for joint payments. If you make additional Purchase Payments after the Index Effective Date, we use the Eligible Person’s current age on the next Index Anniversary after we receive the additional Purchase Payments to determine the Income Percentages for those payments. We establish an Income Percentage Increase for each Eligible Person based on their current age on the Index Effective Date. For joint Income Payments, we use the age of the younger Eligible Person. There are restrictions on which Eligible Person can become a Covered Person if you select single Income Payments, and joint Income Payments may not be available if the age difference between spouses is too great, as stated in prospectus section 2, Eligible Person(s) and Covered Person(s).

| • | To Receive the Income Benefit terms and Income Multiplier Benefit terms reflected in this Supplement: Your application must be signed within the time period stated above and we must also receive the initial Purchase Payment within 60 calendar days after the end of this time period. However, if these criteria are not met but the Income Benefit terms and Income Multiplier Benefit terms of the next-effective Supplement do not change, then you shall be subject to the terms of that next-effective Income Benefit Supplement, and we will extend the period for receiving the initial Purchase Payment to 60 days after the end of the time period of that Supplement. If these conditions are not met, you will receive the Income Benefit terms and Income Multiplier Benefit terms that are in effect on your Issue Date. Under certain circumstances we may extend these time periods in a nondiscriminatory manner. |

| • | We cannot change the Income Benefit terms or Income Multiplier Benefit terms for your Contract once they are established. If the Income Benefit terms and Income Multiplier Benefit terms you receive are unacceptable, you can cancel your Contract during the right to examine period. |

| • | The Income Benefit provides no payment before the first Index Anniversary and until the Index Anniversary that the younger Eligible Person reaches age 50. |

| • | The Income Multiplier Benefit is not available before the fifth Contract Anniversary. |

| • | If you begin Income Payments before age 59½ the payments will generally be subject to a 10% additional federal tax. |

IAIP0523 (IAIP-003)

ALLIANZ Index Advantage+ IncomeSM VARIABLE ANNUITY CONTRACT

Issued by Allianz Life Variable Account B and Allianz Life Insurance Company of North America (Allianz Life, we, us, our)

The variable annuity described in this prospectus is an individual flexible purchase payment index-linked variable deferred annuity contract (Contract). This prospectus describes the Contract between you, the Owner, and Allianz Life. Allianz Life Financial Services, LLC distributes the Contracts.

The Contract allows you to allocate your money (Purchase Payments) and any earnings among the Contract’s investment options, which currently include index-linked investment options (Index Options). The Contract also includes the AZL Government Money Market Fund, but you cannot allocate Purchase Payments to this fund.

•

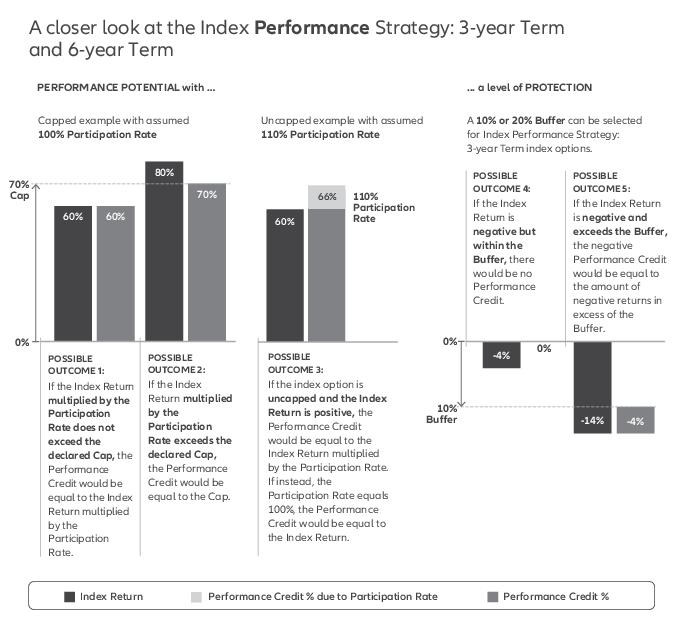

Index Options. Each Index Option is tied (or linked) to the performance of a specific market Index for a defined time period (Term). Each Index Option has a downside feature that provides limited protection against any negative Index rate of return (Index Return) that may be credited to your investment for a Term. Limited protection from negative Index Returns is provided by the Buffer for Index Precision Strategy and Index Performance Strategy, and by the Floor for the Index Guard Strategy. The maximum potential negative Performance Credit is: -90% with a 10% Buffer; -80% with a 20% Buffer; and -10% with the Floor. Such losses will be greater if you take a withdrawal (including any financial adviser fees that you choose to have us pay from this Contract) that is subject to a withdrawal charge, or is a deduction of Contract fees and expenses. The Index Protection Strategy with Trigger and Index Protection Strategy with Cap provide 100% protection against negative Index Returns. Each Index Option also has an upside feature that puts an upper limit on positive Index Return that may be credited for a Term. The upper limit on positive Index Return is provided by the Cap for Index Performance Strategy, Index Guard Strategy, and Index Protection Strategy with Cap; and the Trigger Rate for Index Precision Strategy and Index Protection Strategy with Trigger. Multi-year Term Index Options also have a Participation Rate that may allow you to receive more than the positive Index Return.

•

AZL Government Money Market Fund. The sole purpose of the AZL Government Money Market Fund is to hold Purchase Payments until they are transferred to the Index Options. The AZL Government Money Market Fund performance is based on the securities in which it invests.

We expect to add Index Options from time to time. We currently offer the following Index Options:

•

Index Protection Strategy with Trigger 1-year Term with 0.50% minimum Trigger Rate;

•

Index Protection Strategy with Cap 1-year Term with 0.50% minimum Cap;

•

Index Precision Strategy 1-year Term with 10% Buffer and 3% minimum Trigger Rate;

•

Index Guard Strategy 1-year Term with -10% Floor and 3% minimum Cap;

•

Index Performance Strategy 1-year Term with 10% Buffer and 3% minimum Cap;

•

Index Performance Strategy 3-year Term with 10% or 20% Buffer, 5% minimum Cap, and 100% minimum Participation Rate; and

•

Index Performance Strategy 6-year Term with 10% Buffer, 10% minimum Cap, and 100% minimum Participation Rate.

These Buffers, Floors, and minimum Trigger Rates, Caps, and Participation Rates for each Index Option, respectively, will not change for life of the Contract.

Index-linked and variable annuity contracts are complex insurance and investment vehicles. You may lose money, including your principal investment and previously credited earnings. Contract fees and expenses could cause your losses to be greater than the downside protection of the Index Options. Your losses may be significant. This Contract is not intended for someone who is seeking complete protection from downside risk, seeking unlimited investment potential, or expecting to take withdrawals that will not be subject to withdrawal charges or Daily Adjustments. Before investing, be sure to ask your Financial Professional about the Contract’s features, benefits, risks, fees and expenses, whether the Contract is appropriate for you based upon your financial situation and objectives, and for a specific recommendation to purchase the Contract. The Contract’s risks are described in Risk Factors on page 23 of this prospectus.

Before the end of an Index Option’s Term, if you take any type of withdrawal, execute the Performance Lock feature, begin Income Payments or Annuity Payments, or if we pay a death benefit or deduct a fee or expense, we base the transaction on the interim value of your Index Option investment, which includes the Daily Adjustment. The Daily Adjustment fluctuates daily. With the Index Precision Strategy, Index Guard Strategy, or Index Performance Strategy the Daily Adjustment can be positive or negative. In extreme circumstances the Daily

Allianz Index Advantage+ IncomeSM Variable Annuity Prospectus – May 1, 2023

1

Adjustment could result in a loss beyond the protection of the Buffer or Floor. The maximum potential loss from a negative Daily Adjustment is: -99% for the Index Precision Strategy and Index Performance Strategy, and -35% for the Index Guard Strategy. Although with the Index Protection Strategy with Trigger and Index Protection Strategy with Cap the Daily Adjustment cannot be negative, deductions of Contract fees and expenses could cause you to lose principal and previously credited earnings. The Daily Adjustment could reflect significantly less gain, or more loss than we would apply to an Index Option at the end of a Term. Such losses will be greater if you take a withdrawal (including any financial adviser fees that you choose to have us pay from this Contract) that is subject to a withdrawal charge, or is a deduction of Contract fees and expenses. If you have Index Options with different Term End Dates, there may be no time that any such transaction can be performed without the application of at least one Daily Adjustment.

A withdrawal charge also applies if you take a withdrawal within six years of your last Purchase Payment.

The Contract includes the Income Benefit which provides lifetime Income Payments for an additional charge. Income Payments are subject to a waiting period and are based on Contract Value, not a guaranteed value. Income Payments may be unavailable or end prematurely if you change ownership or Beneficiary(s). Negative earnings (including negative Performance Credits), withdrawals, and deductions of Contract fees and expenses (including any withdrawal charge) may cause Income Payments to be unavailable or end prematurely. You may pay for the Income Benefit without receiving any of its advantages.

The Contract may be available through third-party financial advisers who charge a financial adviser fee for their services. If you choose to pay financial adviser fees from this Contract, the deduction of this financial adviser fee is in addition to this Contract’s fees and expenses, and the deduction is treated the same as any other withdrawal under the Contract. As such, withdrawals to pay financial adviser fees are subject to withdrawal charges, and, if withdrawn on a day other than a Term End Date, we apply the Daily Adjustment (which can be negative) to the Contract Value before deducting the withdrawal.

Withdrawals will reduce the Contract Value, Cash Value, Guaranteed Death Benefit Value, and Income Payments (perhaps significantly and by more than the amount withdrawn), and are subject to federal and state income taxes (including a 10% additional federal tax). Please consult with your Financial Professional before requesting us to pay financial adviser fees from this Contract rather than from other assets you may have.

All obligations and guarantees under the Contract, including index-linked returns (Performance Credits), are the obligations of Allianz Life and are subject to our claims-paying ability and financial strength.

Please read this prospectus before investing and keep it for future reference. The prospectus describes all material rights and obligations of purchasers under the Contract. It contains important information about the Contract and Allianz Life that you ought to know before investing including material state variations. Availability of Index Options may vary by financial intermediary. You can obtain information on which Index Options are available to you by calling (800) 624-0197, or from your Financial Professional. This prospectus is not offered in any state, country, or jurisdiction in which we are not authorized to sell the Contracts. You should rely only on the information contained in this prospectus. We have not authorized anyone to give you different information.

If you are a new investor in the Contract, you may cancel your Contract within 10 days of receiving it without paying fees or penalties. In some states, this cancellation period may be longer. Upon cancellation, you will receive either a full refund of the amount you paid with your application or your total Contract Value. If you have an Individual Retirement Annuity Contract, we refund the greater of Purchase Payments less withdrawals, or total Contract Value. You should review this prospectus, or consult with your Financial Professional, for additional information about the specific cancellation terms that apply.

The Securities and Exchange Commission (SEC) has not approved or disapproved these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense. An investment in this Contract is not a deposit of a bank or financial institution and is not federally insured or guaranteed by the Federal Deposit Insurance Corporation or any other federal government agency. An investment in this Contract involves investment risk including the possible loss of principal.

This prospectus is not intended to constitute a suitability recommendation or fiduciary advice.

Additional information about certain investment products, including variable annuities, has been prepared by the Securities & Exchange Commission’s (SEC) staff and is available at investor.gov.

Allianz Index Advantage+ IncomeSM Variable Annuity Prospectus – May 1, 2023

2

TABLE OF CONTENTS

7 | ||

14 | ||

18 | ||

18 | ||

19 | ||

20 | ||

21 | ||

22 | ||

22 | ||

23 | ||

23 | ||

23 | ||

23 | ||

24 | ||

25 | ||

25 | ||

26 | ||

27 | ||

28 | ||

29 | ||

29 | ||

31 | ||

31 | ||

31 | ||

31 | ||

1. | 32 | |

33 | ||

33 | ||

35 | ||

2. | 35 | |

35 | ||

35 | ||

35 | ||

36 | ||

36 | ||

37 | ||

38 | ||

38 | ||

3. | 38 | |

38 | ||

39 | ||

39 | ||

41 | ||

41 | ||

4. | 42 | |

42 | ||

43 | ||

44 | ||

46 | ||

50 | ||

52 | ||

53 | ||

54 | ||

5. | 56 | |

56 | ||

56 | ||

58 | ||

6. | 58 | |

59 | ||

60 | ||

60 | ||

60 | ||

63 | ||

63 | ||

63 | ||

63 | ||

7. | 64 | |

65 | ||

65 | ||

66 | ||

66 | ||

8. | 66 | |

66 | ||

67 | ||

67 | ||

9. | 69 |

Allianz Index Advantage+ IncomeSM Variable Annuity Prospectus – May 1, 2023

4

TABLE OF CONTENTS

10. | 73 | |

73 | ||

74 | ||

75 | ||

76 | ||

77 | ||

79 | ||

81 | ||

82 | ||

83 | ||

84 | ||

84 | ||

84 | ||

84 | ||

11. | 84 | |

85 | ||

87 | ||

87 | ||

88 | ||

12. | 88 | |

88 | ||

89 | ||

90 | ||

90 | ||

90 | ||

90 | ||

91 | ||

92 | ||

92 | ||

92 | ||

92 | ||

93 | ||

93 | ||

93 | ||

93 | ||

95 | ||

95 | ||

96 | ||

96 | ||

96 | ||

96 | ||

96 | ||

96 |

13. | 97 | |

97 | ||

97 | ||

97 | ||

97 | ||

99 | ||

99 | ||

99 | ||

99 | ||

14. | 99 | |

100 | ||

104 | ||

115 | ||

115 | ||

115 | ||

15. | 122 | |

123 | ||

123 | ||

123 | ||

124 | ||

124 | ||

125 | ||

126 | ||

128 | ||

128 | ||

128 | ||

130 | ||

131 | ||

131 | ||

134 | ||

135 | ||

135 | ||

135 | ||

Allianz Index Advantage+ IncomeSM Variable Annuity Prospectus – May 1, 2023

5

TABLE OF CONTENTS

Back Cover | ||

Back Cover | ||

Allianz Index Advantage+ IncomeSM Variable Annuity Prospectus – May 1, 2023

6

Glossary

This prospectus is written in plain English. However, there are some technical words or terms that are capitalized and are used as defined terms throughout the prospectus. For your convenience, we included this glossary to define these terms.

Accumulation Phase – the first phase of your Contract before you request Annuity Payments. The Accumulation Phase begins on the Issue Date.

Annuitant – the individual upon whose life we base the Annuity Payments. Subject to our approval, the Owner designates the Annuitant, and can add a joint Annuitant for the Annuity Phase. There are restrictions on who can become an Annuitant.

Annuity Date – the date we begin making Annuity Payments to the Payee from the Contract. Your Annuity Date must occur on an Index Anniversary. The earliest available Annuity Date is the second Index Anniversary, and the latest possible Annuity Date is age 100.

Annuity Options – the annuity income options available to you under the Contract.

Annuity Payments – payments made by us to the Payee pursuant to the chosen Annuity Option.

Annuity Phase – the phase the Contract is in once Annuity Payments begin.

Beneficiary – the person(s) or entity the Owner designates to receive any death benefit, unless otherwise required by the Contract or applicable law.

Buffer – for each Index Option with the Index Precision Strategy and Index Performance Strategy, this is the negative Index Return that we absorb over the duration of a Term (which can be either one, three, or six years) before applying a negative Performance Credit. We do not apply the Buffer annually on a 3-year or 6-year Term Index Option. The Index Precision Strategy Buffers are 10%, and Index Performance Strategy Buffers are either 10% or 20%. Buffers do not change.

Business Day – each day on which the New York Stock Exchange is open for trading. Allianz Life is open for business on each day that the New York Stock Exchange is open. Our Business Day ends when regular trading on the New York Stock Exchange closes, which is usually at 4:00 p.m. Eastern Time.

Cap – for any Index Option with the Index Protection Strategy with Cap, Index Performance Strategy, or Index Guard Strategy, this is the upper limit on positive Index performance after application of any Participation Rate over the duration of a Term (which can be either one, three, or six years) and the maximum potential Performance Credit for an Index Option. We do not apply the Cap annually on a 3-year or 6-year Term Index Option. On each Term Start Date, we set a Cap for each Index Option with the Index Protection Strategy with Cap, Index Performance Strategy, and Index Guard Strategy. The Caps applicable to your Contract are shown on the Index Options Statement.

Cash Value – the amount available upon surrender (full withdrawal). It is the Contract Value less any final product and rider fees, contract maintenance charge, and withdrawal charge.

Charge Base – the Contract Value on the preceding Quarterly Contract Anniversary (or the initial Purchase Payment received on the Issue Date if this is before the first Quarterly Contract Anniversary), increased by the dollar amount of subsequent Purchase Payments, and reduced proportionately for subsequent withdrawals you take or financial adviser fees that you choose to have us pay from this Contract (including any withdrawal charge) and deductions we make for Contract fees and expenses. All withdrawals you take reduce the Charge Base, even Penalty-Free Withdrawals. We use the Charge Base to determine the next product and rider fees we deduct.

Contract – the individual flexible purchase payment index-linked and variable deferred annuity contract described by this prospectus. The Contract may also be referred to as a registered index-linked annuity, or “RILA”.

Contract Anniversary – a twelve-month anniversary of the Issue Date or any subsequent Contract Anniversary.

Contract Value – the current value of the Purchase Payments you invest. On any Business Day, your Contract Value is the sum of your Index Option Value(s) and Variable Account Value. Variable Account Value fluctuates each Business Day that money is held in the AZL Government Money Market Fund. Index Option Value is increased or decreased on each Term End Date to reflect Performance Credits, which can be negative with the Index Precision Strategy, Index Guard Strategy, and Index Performance Strategy. A negative Performance Credit means that you can lose principal and previous earnings. The Index Option Values also reflect the Daily Adjustment on every Business Day other than the Term

Allianz Index Advantage+ IncomeSM Variable Annuity Prospectus – May 1, 2023

7

Start Date or Term End Date. All withdrawals you take reduce Contract Value dollar for dollar, even Penalty-Free Withdrawals, and financial adviser fees that you choose to have us pay from this Contract. Contract Value is also reduced dollar for dollar for deductions we make for Contract fees and expenses. However, Contract Value does not reflect future fees and expenses we would apply on surrender. The Cash Value reflects all Contract fees and expenses we would apply on surrender (including any withdrawal charge).

Contract Year – any period of twelve months beginning on the Issue Date or a subsequent Contract Anniversary.

Covered Person(s) – the person(s) upon whose age and lifetime(s) we base Income Payments as discussed in section 2. Covered Person(s) are based on the Eligible Person(s) and the Income Payment type you select on the Income Benefit Date.

Crediting Method – a method we use to calculate Performance Credits for the Index Options.

Daily Adjustment – how we calculate Index Option Values on days other than the Term Start Date or Term End Date as discussed in section 4, Valuing Your Contract – Daily Adjustment; and Appendix B. The Daily Adjustment approximates the Index Option Value that will be available on the Term End Date. It is the estimated present value of the future Performance Credit that we will apply on the Term End Date. The Daily Adjustment for the Index Protection Strategy with Trigger and Index Protection Strategy with Cap cannot be negative.

Determining Life (Lives) – the person(s) designated at Contract issue and named in the Contract on whose life we base the guaranteed Traditional Death Benefit or Maximum Anniversary Value Death Benefit.

Early Reallocation – a feature that allows you to move assets out of a locked Index Option on days other than an Index Anniversary or a Term End Date.

Eligible Person(s) – the person(s) whose age determines each Income Percentage and Income Percentage Increase that we use to calculate the Lifetime Income Percentages and Income Payments, and on whose lifetime we base Income Payments. There are restrictions on who can become an Eligible Person as stated in section 2.

Excess Withdrawal – while you are taking Income Payments, this is the amount of any withdrawal you take during an Income Benefit Year (including any financial adviser fees that you choose to have us pay from this Contract) that causes the total amount withdrawn in that year to exceed the annual maximum Income Payment. However, we do not consider payments made under our minimum distribution program to be Excess Withdrawals. We treat any portion of a withdrawal you take during the Income Benefit Year that is not an Excess Withdrawal as an Income Payment. Excess Withdrawals reduce your Contract Value, future Income Payments, Guaranteed Death Benefit Value, and may end your Contract. The Income Benefit is discussed in section 10.

Financial Professional – the person who advises you regarding the Contract.

Floor – for any Index Option with the Index Guard Strategy, this is the maximum amount of negative Index Return you absorb as a negative Performance Credit. The Floors are -10% and do not change.

Good Order – a request is in “Good Order” if it contains all of the information we require to process the request. If we require information to be provided in writing, “Good Order” also includes providing information on the correct form, with any required certifications, guarantees and/or signatures, and received at our Service Center after delivery to the correct mailing, email, or website address, which are all listed at the back of this prospectus. If you have questions about the information we require, or whether you can submit certain information by fax, email or over the web, please contact our Service Center. If you send information by email or upload it to our website, we send you a confirmation number that includes the date and time we received your information.

Guaranteed Death Benefit Value – the guaranteed value that is available to your Beneficiary(s) on the first death of any Determining Life during the Accumulation Phase. The Guaranteed Death Benefit Value is either total Purchase Payments reduced proportionately for withdrawals you take (including any withdrawal charge) if you select the Traditional Death Benefit, or the Maximum Anniversary Value if you select the Maximum Anniversary Value Death Benefit. All withdrawals you take reduce the Guaranteed Death Benefit Value, even Penalty-Free Withdrawals, and any financial adviser fees that you choose to have us pay from this Contract. However, we do not reduce the Guaranteed Death Benefit Value for deductions we make for Contract fees and expenses. These deductions will, however, reduce the Contract Value we use to calculate the Maximum Anniversary Value.

Allianz Index Advantage+ IncomeSM Variable Annuity Prospectus – May 1, 2023

8

Income Benefit – a benefit that is automatically included in your Contract at issue which is described in section 10. The Income Benefit has an additional rider fee and is intended to provide a payment stream for life in the form of partial withdrawals.

Income Benefit Anniversary – a twelve-month anniversary of the Income Benefit Date or any subsequent Income Benefit Anniversary. It is the date we determine Income Payment increases. Income Benefit Anniversaries always occur on Index Anniversaries.

Income Benefit Date – the date you choose to begin receiving Income Payments under the Income Benefit and the Income Period begins. The Income Benefit Date must be on an Index Anniversary.

Income Benefit Supplement – the supplement that must accompany this prospectus which contains the terms used to determine Income Payments for your Contract. The Income Benefit Supplement includes the Income Payment waiting period and the table showing the Income Percentages and Income Percentage Increases. The supplement also includes the income multiplier factor and income multiplier benefit wait period for the Income Multiplier Benefit. We cannot change these terms for your Contract once they are established. We publish any changes to the Income Benefit Supplement at least seven calendar days before they take effect on our website at allianzlife.com/RILAincomerates. The Income Benefit Supplement is also filed on EDGAR at sec.gov under Form S-1 File Number 333-268820.

Income Benefit Year – a twelve-month period beginning on the Income Benefit Date or a subsequent Income Benefit Anniversary.

Income Multiplier Benefit – a benefit automatically included with the Income Benefit, which is described in the Summary of the Income Benefit and section 10. The Income Multiplier Benefit has no additional charge and after the required wait period can increase your income to help pay for care if you should need it.

Income Payments – the guaranteed payments we make to you under the Income Benefit for the lifetime(s) of the Covered Person(s) that are generally based on the Contract Value and Lifetime Income Percentage for the payment type you select. Payment types include single or joint payments under either the Level Income or Increasing Income payment options. However, if you choose the Level Income payment option and meet certain age requirements, your initial annual maximum Income Payment will not be less than the Level Income Guarantee Payment Percentage multiplied by your total Purchase Payments reduced proportionately for withdrawals you take (including any withdrawal charge). All withdrawals you take reduce your total Purchase Payments, even Penalty-Free Withdrawals, and any financial adviser fees that you choose to have us pay from this Contract. However, we do not reduce your total Purchase Payments for deductions we make for Contract fees and expenses. Income Payments are discussed in section 10.

Income Percentages – amounts we use to determine the Lifetime Income Percentages. We establish Income Percentages for each payment type. Income Percentages are generally higher for single payments compared to joint, and for the Level Income payment option compared to Increasing Income. The current Income Percentages are stated in the Income Benefit Supplement attached to the prospectus.

Income Percentage Increases – the amount that each Income Percentage can increase on each Index Anniversary up to and including the Income Benefit Date. We establish Income Percentage Increases for each Eligible Person based on their current age on the Index Effective Date. Income Percentage Increases are not available until the Eligible Person(s) reaches age 45. The current Income Percentage Increases are stated in the Income Benefit Supplement attached to the prospectus.

Income Period – the period your Contract is in if you take Income Payments. The Income Period occurs during the Accumulation Phase and starts on the Income Benefit Date.

Increasing Income – a payment option available under the Income Benefit. It provides Income Payment increases on each Income Benefit Anniversary during the Income Period if your selected Index Option(s) receives a positive Performance Credit, or you execute a Performance Lock during the prior Income Benefit Year. These increases can continue even if your Contract Value reduces to zero or if your Income Payments are converted to Annuity Payments.

Index (Indexes) – one (or more) of the nationally recognized third-party broad based equity securities price return Indexes or exchange-traded fund available to you under your Contract as described in Appendix A.

Index Anniversary – a twelve-month anniversary of the Index Effective Date or any subsequent Index Anniversary. It is the date we apply Income Percentage Increases.

Allianz Index Advantage+ IncomeSM Variable Annuity Prospectus – May 1, 2023

9

Index Effective Date – the first day we allocate assets to an Index Option and we establish Income Percentage Increases for each Eligible Person. The Index Effective Date is stated on the Index Options Statement and starts the first Index Year. When you purchase this Contract you select the Index Effective Date as discussed in section 3, Purchasing the Contract – Allocation of Purchase Payments and Contract Value Transfers.

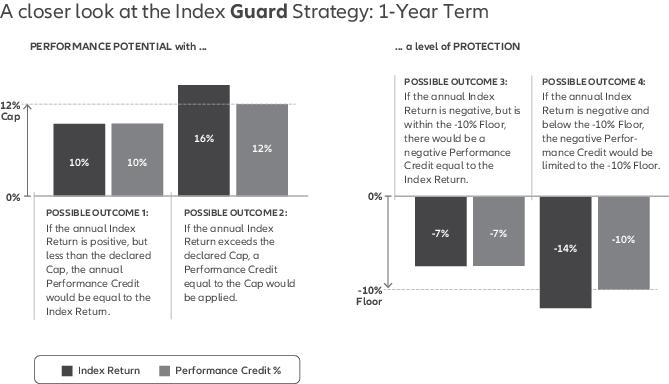

Index Guard Strategy – one of the Crediting Methods available before the Income Period described in section 4, Valuing Your Contract. The Index Guard Strategy calculates Performance Credits based on Index Returns subject to a Cap and -10% Floor. You can receive negative Performance Credits under this Crediting Method, which means you can lose principal and previous earnings. The Index Guard Strategy is more sensitive to smaller negative market movements that persist over time because the -10% Floor reduces the impact of large negative market movements. In an extended period of smaller negative market returns, the risk of loss is greater with the Index Guard Strategy than with the Index Performance Strategy and Index Precision Strategy.

Index Option – the index-linked investments available to you under the Contract. Each Index Option is the combination of an Index, a Crediting Method, a Term length, and any applicable Buffer or Floor amount.

Index Option Base – an amount we use to calculate Performance Credits and the Daily Adjustment. The Index Option Base is initially equal to the amounts you allocate to an Index Option. We reduce the Index Option Base proportionately for withdrawals you take and any financial adviser fees that you choose to have us pay from this Contract (including any withdrawal charge), and deductions we make for Contract fees and expenses; we increase/decrease it by the dollar amount of additional Purchase Payments allocated to, transfers into or out of the Index Option, and any Performance Credits.

Index Option Value – on any Business Day, it is equal to the portion of your Contract Value in a particular Index Option. We establish an Index Option Value for each Index Option you select. Each Index Option Value includes any Performance Credits from previous Term End Dates and reflects proportional reductions for previous partial withdrawals you take and any financial adviser fees that you choose to have us pay from this Contract (including any withdrawal charge), and previous deductions we made for Contract fees and expenses. On each Business Day, other than the Term Start Date or Term End Date, the Index Option Values also include an increase/decrease from the Daily Adjustment.

Index Options Statement – the account statement we mail to you on the Index Effective Date and each Index Anniversary thereafter. On the Index Effective Date, the statement shows the initial Index Values, Trigger Rates, Caps, and Participation Rates for the Index Options you selected. On each Index Anniversary, the statement shows the new Index Values, Performance Credits received, and renewal Trigger Rates, Caps, and Participation Rates that are effective for the next Term for the Index Options you selected that have reached their Term End Date. The Index Options Statement also shows any applicable Buffer or Floor for your selected Index Option(s). For any Index Option you selected that has not reached its Term End Date the statement shows the current Index Anniversary’s Index Option Value, which includes the Daily Adjustment. During the Accumulation Phase and before the Income Period, the statement will also show the current Lifetime Income Percentages for each payment type available under the Income Benefit. During the Income Period it will show the maximum Income Payment available for the next year.

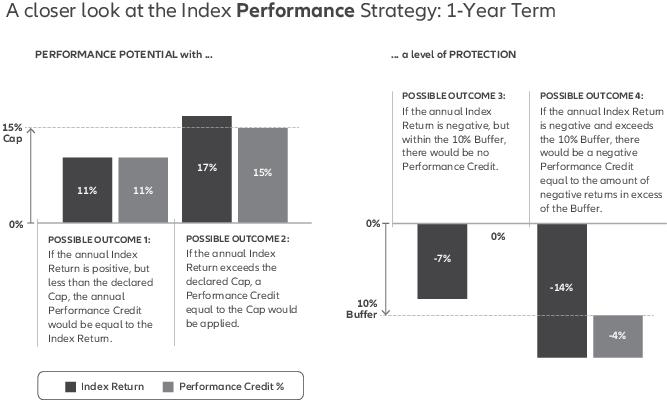

Index Performance Strategy – one of the Crediting Methods available before the Income Period described in section 4, Valuing Your Contract. This Crediting Method offers 1-year, 3-year, and 6-year Terms. The Index Performance Strategy calculates Performance Credits based on Index Returns subject to any applicable Participation Rate, Cap, and a 10% or 20% Buffer. You can receive negative Performance Credits under this Crediting Method, which means you can lose principal and previous earnings. The Index Performance Strategy is more sensitive to large negative market movements because small negative market movements are absorbed by the 10% or 20% Buffer. In a period of extreme negative market performance, the risk of loss is greater with the Index Performance Strategy than with the Index Guard Strategy.

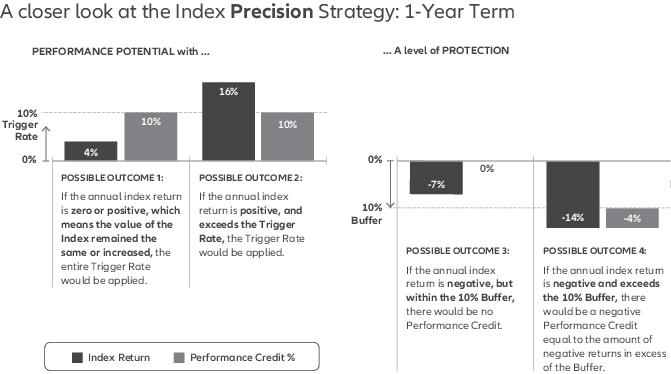

Index Precision Strategy – one of the Crediting Methods available before the Income Period described in section 4, Valuing Your Contract. The Index Precision Strategy calculates Performance Credits based on Index Values and Index Returns subject to the Trigger Rate and 10% Buffer. You can receive negative Performance Credits under this Crediting Method, which means you can lose principal and previous earnings. The Index Precision Strategy may perform best in periods of small positive market movements because the Trigger Rates will generally be greater than the Index Protection Strategy Trigger Rates, but less than the Index Performance Strategy Caps. The Index Precision Strategy is more sensitive to large negative market movements because small negative market movements are absorbed by the 10% Buffer. In a period of extreme negative market performance, the risk of loss is greater with the Index Precision Strategy than with the Index Guard Strategy.

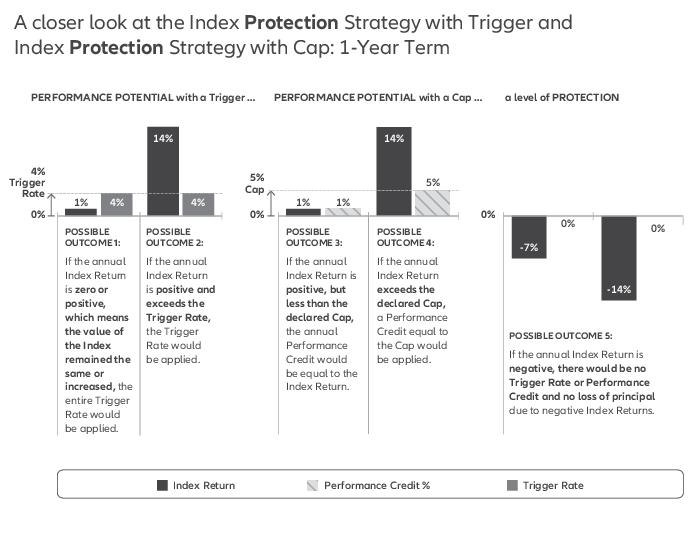

Index Protection Strategy with Cap – one of the Crediting Methods available during the entire Accumulation Phase, including the Income Period, described in section 4, Valuing Your Contract. The Index Protection Strategy with Cap

Allianz Index Advantage+ IncomeSM Variable Annuity Prospectus – May 1, 2023

10

provides a Performance Credit based on Index Returns subject to a Cap, but does not allow negative Performance Credits. The Index Protection Strategy with Cap offers more growth opportunity than Index Protection Strategy with Trigger, but less than Index Precision Strategy, Index Guard Strategy, or Index Performance Strategy.

Index Protection Strategy with Trigger – one of the Crediting Methods available during the entire Accumulation Phase, including the Income Period, described in section 4, Valuing Your Contract. The Index Protection Strategy with Trigger provides Performance Credits equal to the Trigger Rate on the Term End Date if the current Index Value is equal to or greater than the Index Value on the Term Start Date. The Index Protection Strategy with Trigger does not allow negative Performance Credits, and offers the least growth opportunity as Trigger Rates will generally be less than Caps, and the Trigger Rates available with the Index Precision Strategy.

Index Return – the percentage change in Index Value from the Term Start Date to the Term End Date, which we use to determine the Performance Credits. The Index Return is the Index Value on the Term End Date, minus the Index Value on the Term Start Date, divided by the Index Value on the Term Start Date.

Index Value – an Index’s closing market price at the end of the Business Day on the Term Start Date and Term End Date as provided by Bloomberg or another market source if Bloomberg is not available.

Index Year – a twelve-month period beginning on the Index Effective Date or a subsequent Index Anniversary.

Issue Date – the date we issue the Contract. The Issue Date is stated in your Contract and starts your first Contract Year. Contract Anniversaries and Contract Years are measured from the Issue Date.

Joint Owners – the two person(s) designated at Contract issue and named in the Contract who may exercise all rights granted by the Contract. Joint Owners must be spouses within the meaning of federal tax law.

Level Income – an Income Benefit payment option that provides an automatic annual increase to your Income Payments if your Contract Value increases from one Income Benefit Anniversary to the next during the Income Period.

Level Income Guarantee Payment Percentage – the minimum percentage of total Purchase Payments reduced proportionately for withdrawals you took (including any withdrawal charge) that you can receive as an Income Payment if you choose the Level Income payment option and meet certain age requirements as stated in section 10 – Calculating Your Income Payments.

Lifetime Income Percentage – the maximum percentage of Contract Value you can receive as an Income Payment on the Income Benefit Date. The Lifetime Income Percentages available to you before the Income Period are stated on the Index Options Statement.

Lock Date – this is the Business Day we execute a Performance Lock and capture an Index Option Value (which includes the Daily Adjustment) before the Term End Date.

Maximum Anniversary Value – the highest Contract Value on any Index Anniversary before age 91, increased by the dollar amount of subsequent Purchase Payments, and reduced proportionately for subsequent withdrawals you take (including any withdrawal charge), used to determine the Maximum Anniversary Value Death Benefit as discussed in section 11. All withdrawals you take reduce your Maximum Anniversary Value, even Penalty-Free Withdrawals, and any financial adviser fees that you choose to have us pay from this Contract. Deductions we make for Contract fees and expenses other than the withdrawal charge do not reduce the Maximum Anniversary Value. These deductions will, however, reduce the Contract Value we use to calculate the Maximum Anniversary Value.

Maximum Anniversary Value Death Benefit – an optional benefit described in section 11 that has an additional rider fee and is intended to potentially provide a death benefit greater than the Traditional Death Benefit. The Maximum Anniversary Value Death Benefit can only be added to a Contract at issue.

Non-Qualified Contract – a Contract that is not purchased under a pension or retirement plan that qualifies for special tax treatment under sections of the Code.

Owner – “you,” “your” and “yours.” The person(s) or entity designated at Contract issue and named in the Contract who may exercise all rights granted by the Contract.

Participation Rate – may allow you to receive more than the Index Return if the Index Return is positive, but the Participation Rate cannot boost Index Returns beyond any declared Cap. We do not apply the Participation Rate if the Index Return is zero or negative. We do not apply the Participation Rate annually. The Participation Rate is only available

Allianz Index Advantage+ IncomeSM Variable Annuity Prospectus – May 1, 2023

11

on the Index Performance Strategy 3-year and 6-year Terms. The Participation Rate is not available on Index Performance Strategy 1-year Terms. We set Participation Rates on each Term Start Date. The Participation Rates applicable to your Contract are shown on the Index Options Statement.

Payee – the person or entity who receives Annuity Payments during the Annuity Phase.

Penalty-Free Withdrawals – withdrawals you take that are not subject to a withdrawal charge. Penalty-Free Withdrawals include withdrawals you take under the free withdrawal privilege or waiver of withdrawal charge benefit, RMD payments you take under our minimum distribution program, and Income Payments.

Performance Credit – the return you receive on a Term End Date from the Index Options. We base Performance Credits on Index Values and Index Returns after application of any Participation Rate up to the Cap if returns are positive, or after application of any Trigger Rate if returns are flat or positive, or after application of any Buffer or Floor if returns are negative. Performance Credits cannot be negative with the Index Protection Strategy with Trigger or Index Protection Strategy with Cap Index Options. However, Performance Credits can be negative with the Index Precision Strategy, Index Guard Strategy, and Index Performance Strategy Index Options. If Performance Credits are negative, you can lose principal and previous earnings.

Performance Lock – a feature that allows you to capture the current Index Option Value during the Term. A Performance Lock applies to the total Index Option Value in an Index Option, and not just a portion of that Index Option Value. After the Lock Date, Daily Adjustments do not apply to a locked Index Option for the remainder of the Term and the locked Index Option Value will not receive a Performance Credit on the Term End Date. We will not execute a Performance Lock on Index Protection Strategy with Trigger or Index Protection Strategy with Cap Index Options if the Daily Adjustment is zero.

Proxy Investment – provides a current estimate of what the Performance Credit will be on the Term End Date taking into account any applicable Buffer, Floor, Trigger Rate, Cap, and/or Participation Rate. We use the Proxy Investment to calculate the Daily Adjustment on Business Days other than the Term Start Date or Term End Date. For more information, see Appendix B.

Proxy Value – the hypothetical value of the Proxy Investment used to calculate the Daily Adjustment as discussed in Appendix B.

Purchase Payment – the money you put into the Contract.

Qualified Contract – a Contract purchased under a pension or retirement plan that qualifies for special tax treatment under sections of the Code (for example, 401(a) and 401(k) plans), Individual Retirement Annuities (IRAs), or Tax-Sheltered Annuities (referred to as TSA/403(b) Contracts). Currently, we issue Qualified Contracts that may include, but are not limited to Roth IRAs, traditional IRAs and Simplified Employee Pension (SEP) IRAs.

Quarterly Contract Anniversary – the day that occurs three calendar months after the Issue Date or any subsequent Quarterly Contract Anniversary.

Separate Account – Allianz Life Variable Account B is the Separate Account that issues the variable investment portion of your Contract. It is a separate investment account of Allianz Life. The Separate Account holds the shares of the AZL Government Money Market Fund subaccount that underlies the Contracts. The Separate Account is divided into subaccounts, each of which invests exclusively in a variable investment option. The only currently available variable investment option is the AZL Government Money Market Fund. The Separate Account is registered with the SEC as a unit investment trust, and may be referred to as the Registered Separate Account.

Service Center – the area of our company that issues Contracts and provides Contract maintenance and routine customer service. Our Service Center address and telephone number are listed at the back of this prospectus. The address for mailing applications and/or checks for Purchase Payments may be different and is also listed at the back of this prospectus.

Term – The period of time, from the Term Start Date to the Term End Date, in which we measure Index Return to determine Performance Credits.

Term End Date – The day on which a Term ends and we apply Performance Credits. A Term End Date may only occur on an Index Anniversary. If a Term End Date does not occur on a Business Day, we consider it to occur on the next Business Day.

Term Start Date – The day on which a Term begins and we set the Trigger Rates, Caps, and Participation Rates for an Index Option. A Term Start Date may only occur on the Index Effective Date or an Index Anniversary. If a Term Start

Allianz Index Advantage+ IncomeSM Variable Annuity Prospectus – May 1, 2023

12

Date does not occur on a Business Day, we consider it to occur on the next Business Day. However, if you execute a Performance Lock and then request an Early Reallocation, the Term Start Date will be the Business Day we receive your Early Reallocation request in Good Order.

Traditional Death Benefit – the guaranteed death benefit automatically provided by the Contract for no additional fee described in section 11.

Trigger Rate – the positive Performance Credit you receive on a Term End Date if Index performance is zero or positive for any Index Option with the Index Protection Strategy with Trigger, or Index Precision Strategy. You receive a Performance Credit equal to the Trigger Rate on the Term End Date if the current Index Value is equal to or greater than the Index Value on the Term Start Date. For the Index Protection Strategy with Trigger, you will not receive a negative Performance Credit if the Index Value decreases from the Term Start Date to the Term End Date. For the Index Precision Strategy, you will receive a negative Performance Credit if the Index Value decreases from the Term Start Date to the Term End Date and the decrease is greater than the Buffer. On each Term Start Date, we set a Trigger Rate for each Index Option with the Index Protection Strategy with Trigger, and Index Precision Strategy. The Trigger Rates provide predefined upside potential. The Trigger Rates applicable to your Contract are shown on the Index Options Statement.

Valid Claim – the documents we require to be received in Good Order at our Service Center before we pay any death claim. This includes the death benefit payment option, due proof of death, and any required governmental forms. Due proof of death includes a certified copy of the death certificate, a decree of court of competent jurisdiction as to the finding of death, or any other proof satisfactory to us.

Variable Account Value – on any Business Day, it is the value of the shares in the AZL Government Money Market Fund subaccount which holds your Purchase Payments until the Index Effective Date or the next Index Anniversary. The Variable Account Value increases and decreases based on the performance of the AZL Government Money Market Fund and reflects deduction of the fund’s operating expenses, any previous deductions we made for Contract fees and expenses, and financial adviser fees that you choose to have us pay from this Contract.

Withdrawal Charge Basis – the total amount under your Contract that is subject to a withdrawal charge as discussed in section 6, Expenses – Withdrawal Charge.

Allianz Index Advantage+ IncomeSM Variable Annuity Prospectus – May 1, 2023

13

Important Information You Should Consider About the Contract

FEES AND EXPENSES | Prospectus Location | |||

Charges for Early Withdrawals | If you withdraw money from the Contract within six years of your last Purchase Payment, you will be assessed a withdrawal charge of up to 8.5% of the Purchase Payment withdrawn, declining to 0% over that time period. For example, if you invest $100,000 in the Contract and make an early withdrawal, you could pay a withdrawal charge of up to $8,500. In addition, if you take a full or partial withdrawal (including financial adviser fees that you choose to have us pay from this Contract) from an Index Option on a date other than the Term End Date, a Daily Adjustment will apply to the Index Option Value available for withdrawal. The Daily Adjustment also applies if before the Term End Date you execute a Performance Lock, annuitize the Contract, we pay a death benefit, or we deduct Contract fees and expenses. The Daily Adjustment may be negative depending on the applicable Crediting Method. You will lose money if the Daily Adjustment is negative. •Index Precision Strategy, Index Guard Strategy, and Index Performance Strategy. Daily Adjustments under these Crediting Methods may be positive, negative, or equal to zero. A negative Daily Adjustment will result in loss. In extreme circumstances, a negative Daily Adjustment could result in a loss beyond the protection of the 10% or 20% Buffer, or -10% Floor, as applicable. The maximum potential loss from a negative Daily Adjustment is: -99% for the Index Precision Strategy and Index Performance Strategy, and -35% for the Index Guard Strategy. •Index Protection Strategy with Trigger and Index Protection Strategy with Cap. Daily Adjustments under these Crediting Methods may be positive or equal to zero, but cannot be negative. | Fee Tables 4. Valuing Your Contract – Daily Adjustment 6. Expenses – Withdrawal Charge Appendix B – Daily Adjustment | ||

Transaction Charges | Other than withdrawal charges and Daily Adjustments that may apply to withdrawals and other transactions under the Contract, there are no other transaction charges. | Not Applicable | ||

Ongoing Fees and Expenses (annual charges) | The table below describes the fees and expenses that you may pay each year, depending on the options you choose. Please refer to your Contract specifications page for information about the specific fees you will pay each year based on the options you have elected. These ongoing fees and expenses do not reflect any financial adviser fees paid to a Financial Professional from your Contract Value or other assets of the Owner. If such charges were reflected, these ongoing fees and expenses would be higher. | Fee Tables 6. Expenses Appendix F – Variable Investment Option Under the Contract | ||

Annual Fee | Minimum | Maximum | ||

Base Contract(1) | 1.95% | 1.95% | ||

Investment Options(2) (Variable Investment Option fees and expenses) | 0.88% | 0.88% | ||

Optional Benefits Available for an Additional Charge(3) (for a single optional benefit, if elected) | 0.20% | 0.20% | ||

(1) Base Contract fee is comprised of two charges referred to as the “product fee” and the “rider fee for the Income Benefit” in the Contract and elsewhere in this prospectus. As a percentage of the Charge Base, plus an amount attributable to the estimated contract maintenance charge based on expected Contract sales. | ||||

(2) As a percentage of the AZL Government Money Market Fund’s average daily net assets. | ||||

(3) As a percentage of the Charge Base. This is the current charge for the Maximum Anniversary Value Death Benefit. | ||||

Allianz Index Advantage+ IncomeSM Variable Annuity Prospectus – May 1, 2023

14

FEES AND EXPENSES | Prospectus Location | |||

Because your Contract is customizable, the choices you make affect how much you will pay. To help you understand the cost of owning your Contract, the following table shows the lowest and highest cost you could pay each year, based on current charges. This estimate assumes that you do not take withdrawals from the Contract, which if taken from the Index Precision Strategy, Index Guard Strategy, and Index Performance Strategy Index Options could result in substantial losses due to the application of negative Daily Adjustments. | ||||

Lowest Annual Cost: $2,582 | Highest Annual Cost: $2,765 | |||

Assumes: •Investment of $100,000 in the AZL Government Money Market Fund (even though you cannot select the fund for investment) •5% annual appreciation •0.70% Income Benefit rider fee •Traditional Death Benefit •No additional Purchase Payments, transfers, or withdrawals •No financial adviser fees | Assumes: •Investment of $100,000 in the AZL Government Money Market Fund (even though you cannot select the fund for investment) •5% annual appreciation •0.70% Income Benefit rider fee •Maximum Anniversary Value Death Benefit with a 0.20% rider fee •No additional Purchase Payments, transfers, or withdrawals •No financial adviser fees | |||

RISKS | ||||

Risk of Loss | You can lose money by investing in the Contract, including loss of principal and previous earnings. | Risk Factors | ||

Not a Short-Term Investment | • This Contract is not a short-term investment and is not appropriate if you need ready access to cash. • Considering the benefits of tax deferral, long-term income, and living benefit guarantees, the Contract is generally more beneficial to investors with a long investment time horizon. • Withdrawals are subject to income taxes, including a 10% additional federal tax for withdrawals taken before age 59 1∕2. • If within six years after we receive a Purchase Payment you take a full or partial withdrawal (including financial adviser fees that you choose to have us pay from this Contract), withdrawal charges will apply. A withdrawal charge will reduce your Contract Value or the amount of money that you actually receive. Withdrawals may reduce or end Contract guarantees. • Amounts invested in an Index Option must be held in the Index Option for the full Term before they can receive a Performance Credit. We apply a Daily Adjustment if before the Term End Date you take a full or partial withdrawal (including financial adviser fees that you choose to have us pay from this Contract), annuitize the Contract, take Income Payments, execute a Performance Lock, we pay a death benefit, or we deduct Contract fees and expenses. • A minimum waiting period applies before Income Payments may be taken under the Income Benefit. In addition, even if the waiting period has expired, Income Payments cannot begin before age 50. • Withdrawals will reduce the initial annual maximum Income Payment. Withdrawals that exceed limits specified by the terms of the Income Benefit (Excess Withdrawals) will reduce your future annual maximum Income Payment. These reductions may be greater than the value withdrawn and could end the benefit. • The Traditional Death Benefit may not be modified, but it will terminate if you take withdrawals (including Income Payments) that reduce both the Contract Value and Guaranteed Death Benefit Value to zero. Withdrawals may reduce the Traditional Death Benefit’s Guaranteed Death Benefit Value by more than the value withdrawn and could end the Traditional Death Benefit. | Risk Factors 4. Valuing Your Contract 11. Death Benefit Appendix B – Daily Adjustment | ||

Allianz Index Advantage+ IncomeSM Variable Annuity Prospectus – May 1, 2023

15

RISKS | Prospectus Location | |||

Risks Associated with Investment Options | • An investment in the Contract is subject to the risk of poor investment performance and can vary depending on the performance of the AZL Government Money Market Fund and the Index Options available under the Contract. • The AZL Government Money Market Fund and each Index Option has its own unique risks. • You should review the AZL Government Money Market Fund prospectus and disclosures, including risk factors, before making an investment decision. | Risk Factors | ||

Insurance Company Risks | An investment in the Contract is subject to the risks related to us. All obligations, guarantees or benefits of the Contract are the obligations of Allianz Life and are subject to our claims-paying ability and financial strength. More information about Allianz Life, including our financial strength ratings, is available upon request by visiting allianzlife.com/about/financial-ratings, or contacting us at (800) 624-0197. | Risk Factors | ||

RESTRICTIONS | ||||

Investments | • Certain Index Options may not be available under your Contract. • You cannot allocate Purchase Payments to the AZL Government Money Market Fund. The sole purpose of the AZL Government Money Market Fund is to hold Purchase Payments until they are transferred to your selected Index Options. • We restrict additional Purchase Payments during the Accumulation Phase. Each Index Year before the Income Period, you cannot add more than your initial amount (i.e., all Purchase Payments received before the first Quarterly Contract Anniversary of the first Contract Year) without our prior approval. • We do not accept additional Purchase Payments during the Income Period (which is part of the Accumulation Phase) or the Annuity Phase. • We typically only allow assets to move into the Index Options on the Index Effective Date and on subsequent Index Anniversaries as discussed in section 3, Purchasing the Contract – Allocation of Purchase Payments and Contract Value Transfers. However, if you execute a Performance Lock and request Early Reallocation, we will move assets into an Index Option on the Business Day we receive your Early Reallocation request in Good Order. • You can typically transfer Index Option Value only on Term End Dates. However, you can transfer assets out of an Index Option Value before the Term End Date by executing a Performance Lock as discussed in section 4, Valuing Your Contract – Performance Locks. • We do not allow assets to move into an established Index Option until the Term End Date. If you request to allocate a Purchase Payment into an established Index Option on an Index Anniversary that is not a Term End Date, we will allocate those assets to the same Index Option with a new Term Start Date. • The Income Benefit terms stated in the Income Benefit Supplement may be modified before issue. After the Issue Date the Income Benefit may terminate under certain circumstances as stated in section 10, Income Benefit. • During the Income Period only the Index Options with the Index Protection Strategy with Trigger and Index Protection Strategy with Cap are available to you. • We reserve the right to substitute the AZL Government Money Market Fund. We also reserve the right to discontinue accepting new allocations into specific Index Options and to substitute Indexes either on a Term Start Date or during a Term. We also reserve the right to decline any or all Purchase Payments at any time on a nondiscriminatory basis. | Risk Factors 3. Purchasing the Contract 4. Valuing Your Contract 5. AZL Government Money Market Fund 10. Income Benefit Appendix A – Available Indexes | ||

Optional Benefits | • The optional Maximum Anniversary Value Death Benefit may not be modified. Withdrawals (including Income Payments) may reduce the Maximum Anniversary Value Death Benefit’s Guaranteed Death Benefit Value by more than the value withdrawn and will end the Maximum Anniversary Value Death Benefit if the withdrawals reduce both the Contract Value and Guaranteed Death Benefit Value to zero. | 11. Death Benefit | ||

Allianz Index Advantage+ IncomeSM Variable Annuity Prospectus – May 1, 2023

16

TAXES | Prospectus Location | |||

Tax Implications | • Consult with a tax professional to determine the tax implications of an investment in and withdrawals from or payments received under the Contract. • If you purchased the Contract through a tax-qualified plan or individual retirement account (IRA), you do not get any additional tax benefit under the Contract. • Earnings under a Non-Qualified Contract may be taxed at ordinary income rates when withdrawn, and you may have to pay a 10% additional federal tax if you take a full or partial withdrawal before age 59 1∕2. • Generally, distributions from Qualified Contracts are taxed at ordinary income tax rates when withdrawn, and you may have to pay a 10% additional federal tax if withdrawn before age 59 1∕2. | 12. Taxes | ||

CONFLICTS OF INTEREST | ||||

Investment Professional Compensation | Your Financial Professional may receive compensation for selling this Contract to you, in the form of commissions, additional cash benefits (e.g., cash bonuses), and non-cash compensation. We and/or our wholly owned subsidiary distributor may also make marketing support payments to certain selling firms for marketing services and costs associated with Contract sales. This conflict of interest may influence your Financial Professional to recommend this Contract over another investment for which the Financial Professional is not compensated or compensated less. | 13. Other Information – Distribution | ||

Exchanges | Some Financial Professionals may have a financial incentive to offer you a new contract in place of the one you already own. You should only exchange your contract if you determine, after comparing the features, fees, and risks of both contracts, that it is better for you to purchase the new contract rather than continue to own your existing contract. | 13. Other Information – Distribution | ||

Allianz Index Advantage+ IncomeSM Variable Annuity Prospectus – May 1, 2023

17

Overview of the Contract

What Is the Purpose of the Contract?

The Index Advantage+ IncomeSM is a product that offers Index Options and allows you to defer taking regular fixed periodic payments (Annuity Payments) to a future date. Under the Contract, you make one or more Purchase Payments. Each Purchase Payment is first invested for a limited time in the AZL Government Money Market Fund and then transferred to the Index Option(s) that you select for investment. Depending on several factors (e.g., Index Options you select, market conditions, and timing of any withdrawals), your Contract can gain or lose value. When you are ready to receive a guaranteed stream of income under your Contract, you can annuitize your accumulated assets and begin receiving Annuity Payments from us based on the payout option you select (Annuity Options). The Contract includes for no additional charge a standard death benefit (the Traditional Death Benefit), or for an additional rider fee you may select the optional death benefit (the Maximum Anniversary Value Death Benefit) to replace the standard death benefit. Both death benefits help to financially protect your beneficiaries. The Contract also includes a guaranteed lifetime income benefit (Income Benefit) that may help you achieve your financial goals.

We designed the Contract for people who are looking for guaranteed lifetime income with continued access to Contract Value, a death benefit for a period of time, and a level of protection for your principal investment while providing potentially higher returns than are available on traditional fixed annuities. In addition, you should have a long investment time horizon and your financial goals should be otherwise consistent with the terms and conditions of the Contract. This Contract is not intended for someone who is seeking complete protection from downside risk, seeking unlimited investment potential, or expecting to take withdrawals that will not be subject to withdrawal charges or Daily Adjustments (i.e., a person that does not need access to Contract Value within six years after we receive a Purchase Payment, or before an Index Option's Term End Date). If you have Index Options with different Term End Dates, there may be no time you can take a withdrawal without application of at least one Daily Adjustment.

We offer other annuity contracts that may address your investment and retirement needs. These contracts include other registered index-linked annuities and fixed index annuities. These annuity products offer different features and benefits that may be more appropriate for your needs, including allocation options, fees and/or expenses that are different from those in the Contract offered by this prospectus. Not every contract is offered through every Financial Professional. Some Financial Professionals or selling firms may not offer and/or limit offering of certain features and benefits, as well as limit the availability of the contracts based on criteria established by the Financial Professional or selling firm. For more information about other annuity contracts, please contact your Financial Professional.

The product or certain product features may not be available in all states, or may vary in your state (such as the free look). For more information see Appendix E - Material Contract Variations by State. Availability of Index Options may vary by financial intermediary. You can obtain information on which Index Options are available to you by calling (800) 624-0197, or from your Financial Professional.

Allianz Index Advantage+ IncomeSM Variable Annuity Prospectus – May 1, 2023

18

What Are the Phases of the Contract?

The Contract has two phases: (1) an Accumulation Phase, and (2) an Annuity Phase.

•

Accumulation Phase. This is the first phase of your Contract, and it begins on the Issue Date. During the Accumulation Phase, your money is invested under the Contract on a tax-deferred basis. Tax deferral may not be available for certain non-individually owned contracts. Tax deferral means you are not taxed on any earnings or appreciation on the assets in your Contract until you take money out of your Contract. In addition, during this phase, you can make additional Purchase Payments (until you request Income Payments under the Income Benefit), you can take withdrawals (including Income Payments), and if you die we pay a death benefit to your named Beneficiary(s). If you begin Income Payments, the Income Period occurs during the Accumulation Phase and starts on the Income Benefit Date.

Your Contract Value may fluctuate up or down during the Accumulation Phase based on the performance of your selected Index Options and the AZL Government Money Market Fund.

−

Index Options. You may allocate your Purchase Payments to any or all of the Index Options available under your Contract. There are currently 31 Index Options based on different combinations of five credit calculation methods (Crediting Methods), four nationally recognized third-party broad based equity securities price return Indexes and an exchange-traded fund, and three Term periods for measuring Index performance. Each Index Option is the combination of an Index, a Crediting Method, a Term length, and any applicable Buffer or Floor amount.

Currently Available Crediting Methods, Term Lengths, and Negative Index Performance Protection | Currently Available Indexes | Positive Index Performance Participation Limit |

Index Protection Strategy with Trigger 1-year Term with 100% downside protection | • S&P 500® Index • Russell 2000® Index • Nasdaq-100® Index • EURO STOXX 50® • iShares® MSCI Emerging Markets ETF | • 0.50% minimum Trigger Rate |

Index Protection Strategy with Cap 1-year Term with 100% downside protection | • S&P 500® Index • Russell 2000® Index • Nasdaq-100® Index • EURO STOXX 50® • iShares® MSCI Emerging Markets ETF | • 0.50% minimum Cap |

Index Precision Strategy 1-year Term with 10% Buffer | • S&P 500® Index • Russell 2000® Index • Nasdaq-100® Index • EURO STOXX 50® • iShares® MSCI Emerging Markets ETF | • 3% minimum Trigger Rate |

Index Guard Strategy 1-year Term with -10% Floor | • S&P 500® Index • Russell 2000® Index • Nasdaq-100® Index • EURO STOXX 50® • iShares® MSCI Emerging Markets ETF | • 3% minimum Cap |

Index Performance Strategy 1-year Term with 10% Buffer | • S&P 500® Index • Russell 2000® Index • Nasdaq-100® Index • EURO STOXX 50® • iShares® MSCI Emerging Markets ETF | • 3% minimum Cap • Can be “uncapped” (i.e., we do not declare a Cap for that Term) |

Index Performance Strategy 3-year Term with 10% Buffer | • S&P 500® Index • Russell 2000® Index | • 5% minimum Cap • Can be uncapped • 100% minimum Participation Rate |

Index Performance Strategy 3-year Term with 20% Buffer | • S&P 500® Index • Russell 2000® Index | • 5% minimum Cap • Can be uncapped • 100% minimum Participation Rate |

Allianz Index Advantage+ IncomeSM Variable Annuity Prospectus – May 1, 2023

19

Currently Available Crediting Methods, Term Lengths, and Negative Index Performance Protection | Currently Available Indexes | Positive Index Performance Participation Limit |

Index Performance Strategy 6-year Term with 10% Buffer | • S&P 500® Index • Russell 2000® Index | • 10% minimum Cap • Can be uncapped • 100% minimum Participation Rate |

Your initial and renewal Trigger Rates, Caps, and Participation Rates for your selected Index Options and their Buffer or Floor are stated in your Index Options Statement, which is the account statement we mail to you on the Index Effective Date and each Index Anniversary. The Index Options Statement also includes the Index Values on the Term Start Date and Term End Date for your selected Index Options. We use these Index Values to determine Index Returns and Performance Credits. The Buffer or Floor for all currently available Index Options are stated in your Contract. The Buffer or Floor for the currently available Index Options will not change for the life of the Contract. More detailed information about the Index Options is included in section 4, Valuing Your Contract.

−

AZL Government Money Market Fund. We hold your Purchase Payments in the AZL Government Money Market Fund until we transfer them to the Index Options in accordance with your instructions. You cannot choose to allocate Purchase Payments to the AZL Government Money Market Fund. The AZL Government Money Market Fund is an underlying mutual fund with its own investment objective, strategies, and risks. For more information, please see Appendix F - Variable Investment Option Under the Contract.

•