DATED: OCTOBER 10, 2013

CO-DEVELOPMENT AND REVENUE SHARING AGREEMENT II: Cervical Intraepithelial Neoplasia in HIV/HPV co-infected women (“CIN”)

BETWEEN

CEL-SCI Corporation

AND

Ergomed Clinical Research Limited

This Co-Development Agreement (hereinafter “the Agreement”) is made on October 10, 2013 between

CEL-SCI Corporation, a company duly established pursuant to the laws of Colorado, with the registered office at 8229 Boone Boulevard, Suite 802, Vienna, VA, 22182. USA, hereinafter: “CEL-SCI”)

AND

Ergomed Clinical Research, Ltd., a company duly established pursuant to the laws of England, with registered offices at The Surrey Research Park, 26-28 Frederick Sanger Road, Guildford, Surrey, GU2 7YD, England (hereinafter: “Ergomed”)

or separately referred as “the Party” or jointly as “the Parties”

PREAMBLE

WHEREAS CEL-SCI is, among other things, engaged in research and development of a Product for the treatment of multiple indications.

WHEREAS CEL-SCI has certain patent rights related to the compound having the chemical name Leucocyte Interleukin Inj. (“Multikine®”);

WHEREAS, Ergomed has experience and expertise in the business of clinical trial management, clinical development and regulatory matters with particular expertise in the provision of full clinical development services to enable the completion of all phases of clinical trials;

WHEREAS CEL-SCI wishes that Ergomed assists CEL-SCI in the clinical development program for Multikine® for the purpose of maximizing the Commercialization potential of the Product with the ultimate aim of selling or licensing the Product;

WHEREAS CEL-SCI and Ergomed have entered into a Master Services Agreement and intend to enter into Clinical Trial Order II to the Master Services Agreement (“CTO 2”), pursuant to which Ergomed will provide clinical development services with respect to the anticipated co-development of Multikine for cervical intraepithelial neoplasia (CIN) in HIV/HPV co-infected patients (hereafter called “CIN);

WHEREAS CEL-SCI and Ergomed would like to regulate by this Agreement and by the co-development agreements for other Indications their risk sharing and cooperation in the co-development of the Product as described in this Agreement, in the co-development agreements between the Parties for other Indications and in the Master Services Agreement, as amended from time to time and in any of the Clinical Trial Orders making an integral part of the Master Services Agreement.

WHEREAS CEL-SCI and Ergomed will jointly develop the Product in several Indications, each governed by separate co-development agreements.

WHEREAS CEL-SCI and Ergomed will use their best efforts to finalize a Co-Development Program 2, CTO 2 and the Program Budget for the CIN Indication within 12 months from the Effective Date of this Agreement.

WHEREBY IT IS AGREED as follows:

| 1.1. | For the purposes of this Agreement, the following terms shall have the following meaning (and all capitalized terms in this Agreement shall be defined according to these definitions): |

“Affiliate” - shall mean, with respect to an entity, any corporation or other entity that is directly or indirectly controlling, controlled by or under common control with such entity, as the case may be. As used in this definition, the term “control” will mean the direct or indirect ownership of fifty percent (50%) or more of the stock or other securities having the right to vote for directors thereof or the ability to otherwise control the management of the corporation or other business entity.

“Agreement” - this document, including any and all schedules, exhibits, appendices and other addenda to it as may be added and/or amended from time to time in accordance with the provisions of this document.

“Business Day” - a day that is not a Saturday, Sunday or a day on which banking institutions in either UK or USA are authorized by law to remain closed.

“Clinical Trial” – any of a phase I Clinical Trial, phase II Clinical Trial or Phase III Clinical Trial.

“Clinical Trial Order” or “CTO” – an agreement signed by the Parties containing specific tasks and budget for the Co-Developed Clinical Trial(s) under the MSA and this Agreement and / or any of the co-development agreements entered into by the Parties for the Development of the Product. For the avoidance of doubt, neither Party is required to enter into any CTO unless full agreement on its terms is achieved on a case by case basis.

“Co-Developed Clinical Trial” will mean any scheduled Clinical Trial developed together and jointly decided by the Parties , as described in further detail in CTO 2 or any other CTO entered into for the development of the Product in CIN Indication and attached to the Master Services Agreement (or any subsequently agreed amended versions of such CTO 2).

“Co-Development Program 2” - the program for the Development of the Product pursuant to the clinical development plans describing in detail the scope and budget for the Co-Developed Clinical Trial for the Product in CIN indication in accordance with CTO 2 to the Master Services Agreement which, when agreed upon will be made an integral part of this Agreement and signed by both Parties

“Commercialization”, “Commercializing”, or “Commercialize” – with respect to the Product, means all activities relating to the import, advertising, promotion, other marketing, pricing and reimbursement, detailing, distribution, storage, handling, offering for sale and selling, customer service and support, post-Marketing Authorization regulatory activities, including adverse event reporting, of such Product and any other activities or arrangements that amount to the commercial realization of such Product's value following receipt of Marketing Authorization in the relevant country.

“Competent Authority” - any multi-national, national, state, provincial or local agency, authority, department, inspectorate, minister, ministry official, parliament or public or statutory person (whether autonomous or not) of any government of any country having jurisdiction over any of the activities contemplated by this Agreement or over one or both of the Parties.

“Development” – with respect to the Product, clinical development, pursuant to the applicable Co-Developed Clinical Trial and related regulatory activities regarding such Product in any of the agreed upon Indications worldwide. “Development” shall include, without limitation, all conduct and project management of the applicable Co-Developed Clinical Trial(s), and related regulatory affairs activities,

including obtaining permissions from authorities for the conduct of such Co-Developed Clinical Trial(s), identification and management of clinical sites for recruitment of subjects, safety reporting report writing and all other related regulatory affairs activities, but expressly excluding Non-Clinical Development. When used as a verb, “Develop” shall mean to engage in Development.

“Effective Date” – the date set forth in the introductory paragraph of this Agreement.

"Encumbrance" - any liens, charges, encumbrances, equities, claims, options, proxies, pledges, security interests or other similar rights of any nature.

“FDA” - the United States Food and Drug Administration or any successor agency thereto.

"Field" - the administration to human patients by any and all routes of administration (including, for the avoidance of doubt, topical administration) of the Product for the treatment of Cervical Intraepithelial Neoplasia in HIV/HPV co-infected women and / or for the treatment of other Indications.

“Force Majeure” - in relation to either Party, any event or circumstance which is beyond the reasonable control of that Party which event or circumstance that Party could not reasonably be expected to have taken into account at the date of this Agreement and which results in or causes the failure of that Party to perform any or all of its obligations under this Agreement, which may include acts of God, lightning, fire, storm, flood, earthquake, accumulation of snow or ice, lack of water arising from weather or environmental problems, strike, lockout or other industrial or student disturbance, act of the public enemy, war declared or undeclared, threat of war, terrorist act, blockade, revolution, riot, insurrection, civil commotion, public demonstration, sabotage, act of vandalism, prevention from or hindrance in obtaining in any way materials, energy or other supplies, explosion, fault or failure of plant or machinery (which could not have been prevented by good industry practice), or Legal Requirement governing either Party, provided that lack of funds shall not be interpreted as a cause beyond the reasonable control of that Party.

“Good Industry Practice” – in relation to any undertaking and any circumstance, the exercise of that degree of skill, diligence, prudence and foresight which would reasonably and ordinarily be expected from a skilled and experienced person engaged in the same type of undertaking under the same or similar circumstances.

“Indications” – shall mean all of the indications together: Head and Neck Cancer and Cervical Intraepithelial Neoplasia in HIV/HPV co-infected patients, for which the Product will be developed under any of the co-development agreements between the Parties for such Product; “other Indication(s)” shall mean any remaining Indication(s) not specifically referred to in any respective sentence in the Agreement.

“Interest” – an annual rate of one-half percent (0.5%) above the three month LIBOR rate from time to time.

“Legal Requirement” - any present or future law, regulation, directive, instruction, direction or rule of any Competent Authority or Regulatory Authority applicable to the Co-Development Program or this Agreement, including any amendment, extension or replacement thereof which is from time to time in force.

“License Agreement” (including variations such as to “License”, “Licensing”, “Licensee” or

“Licensed”) – an agreement between CEL-SCI and a Third Party to whom CEL-SCI or its Affiliates (a) grants a license of rights under CEL-SCI’s Patents to develop, make (and have made), use, sell, offer for sale, and/or Commercialize the Product in one or more countries in the Territory and in respect of one or more Indications in the Field.

“Licensing Income and Other Income” – means, with respect to the Product, any payment or, any other consideration, including but not limited to any signature fee, license fee, sub-license fee, license option fee (whether in relation to the grant or exercise of any license fee) or other up-front fee, and any milestone payment, of any kind whatsoever received by CEL-SCI or any of its Affiliates in the Field.

“Marketing Authorization” – with respect to the Product, means any approval required from a Regulatory Authority to market and sell such Product in any country, including any form of pricing or reimbursement approval.

"Master Service Agreement" or "MSA" shall mean the Master Services Agreement entered into by the Parties on the Effective Date (as amended from time to time) pursuant to which Ergomed provides CRO services to CEL-SCI with respect to each of the Co-Developed Clinical Trials under any of the co-development agreements for the Product between the Parties.

“Net Income” – shall mean, with respect to the Product any payment or any other cash or non-cash consideration in a country in the Territory, received by CEL-SCI or its Affiliates for the Product from the Field including, without limitation, Licensing Income and Other Income, as well as Net Sales.

“Net Sales” – shall mean, with respect to the Product in a country in the Territory, and subject to the Combination Product adjustment set forth below (if applicable), the gross sales amount of such Product invoiced and actually received by CEL-SCI or its Affiliates on direct sales of such Product to Third Parties (which may include, without limitation, distributors and end-users), in each case less the following items (“Net Sales Adjustments”) as applicable to such Product to the extent actually included in the gross invoiced sales amount or deducted from the amount received:

| ● | credits or allowances granted upon returns, rejections or recalls (due to spoilage, damage, expiration of useful life or otherwise), retroactive price reductions, or billing corrections; |

| ● | invoiced freight, postage, shipping and insurance, handling and other transportation costs actually incurred by CEL-SCI or its Affiliates; |

| ● | credits or allowances actually granted, including, without limitation, quantity, cash and other trade discounts, provided, however, that discounts or allowances offered as part of a package of products that includes such Product (other than discounts included in the gross invoice sales amount for Combination Products) sold by CEL-SCI or its Affiliates shall be allocated to such Product on a pro rata basis based upon the sales value (i.e., the unit average selling price multiplied by the unit volume) of such Product relative to the sales value contributed by the other constituent products in the bundled set; |

| ● | taxes (including, without limitation, sales, value-added or excise taxes), tariffs, customs duties, surcharges and other governmental charges incurred in connection with the production, sale, transportation, delivery, use, exportation or importation of such Product that are incurred at time of sale or are directly related to the sale; |

| ● | any payments in respect of sales to any governmental authority in respect of any government subsidized program, including without limitation, Medicare and Medicaid rebates; |

| ● | amounts paid or credited to customers for inventory management, distribution, warehousing and related services; |

| ● | discounts, refunds, rebates, charge backs, fees, credits or allowances (including, without limitation, billing corrections, amounts incurred in connection with government-mandated rebate and discount programs, Third Party rebates and charge backs, hospital buying group/group purchasing organization administration fees and managed care organization rebates), distribution fees and sales commissions to Third Parties, actually paid or incurred and which effectively reduce the selling price; provided, however, that discounts or allowances offered as part of a package of products that includes such Product (other than discounts included in the gross invoice sales amount for Combination Products) sold by CEL-SCI or its Affiliates shall be allocated to such Product on a pro rata basis based upon the sales value (i.e., the unit average selling price multiplied by the unit volume) of such Product relative to the sales value contributed by the other constituent products in the bundled set; |

| ● | allowances for bad debts; and |

| ● | any reasonable deduction that is similar in nature and character to the above and is directly related to the sales of such Product; |

● | any payment that is meant to contribute to the future expenses of clinical development from the time of the license of the Product to a third party. |

all in accordance with standard allocation procedures, allowance methodologies and accounting methods consistently applied, which procedures and methodologies shall be in accordance with GAAP or IFRS. For the avoidance of doubt, the transfer of the Product by CEL-SCI or one of its Affiliates to another Affiliate of such Party shall not be considered a sale; in such cases, Net Sales shall be determined based on the gross sales amount of such Product invoiced and actually received by such Affiliate on sales to an independent Third Party, less the Net Sales Adjustments allowed under this Section and subject to the Combination Product adjustment below (as applicable). Net Sales shall not include distribution to a Third Party of such Product for research, testing, clinical trials or humanitarian purposes, including, without limitation, expanded access programs, patient assistance programs or charitable donations, in each case to the extent the Product is provided at no consideration.

If the Product is sold as part of a Combination Product (as defined below), the Net Sales of the Product shall be determined by multiplying the Net Sales of the Combination Product (as determined using the standard Net Sales definition, including the Net Sales Adjustments), during the applicable reporting period, by the fraction, A/(A+B), where A is the average sale price of such Product when sold separately in similar quantities in finished form and B is the average sales price of the other compounds having independent therapeutic activity included in the Combination Product when sold separately in similar quantities in finished form, in each case in the same country as the Combination Product during the applicable reporting period or, if sales of both such Product and the other compounds having independent therapeutic activity did not occur in such period, then in the most recent reporting period in which sales of both occurred in the same country as the Combination Product. If such average sale price cannot be determined for both such Product and all other compounds having independent therapeutic activity included in the Combination Product, Net Sales of such Product shall be calculated by multiplying the Net Sales of the Combination Product by the fraction of C/(C+D) where C is the fair market value of such Product and D is the fair market value of all other compounds having independent therapeutic activity included in the Combination Product, as determined by CEL-SCI in good faith. “Combination Product” means a pharmaceutical product containing a Product and one or more additional active pharmaceutical compounds (other than a Product) having independent therapeutic activity.

“Non-Clinical Development” – with respect to the Product, means all other activities related to the development of such Product which are not the applicable Co-Developed Clinical Trial or related regulatory activities, such as but not limited to preclinical testing, test method development and stability testing, toxicology, formulation, process development, manufacturing scale-up, qualification and validation, quality assurance/quality control, manufacturing clinical supplies and any pre-commercialization activity (including pricing and reimbursement activities).

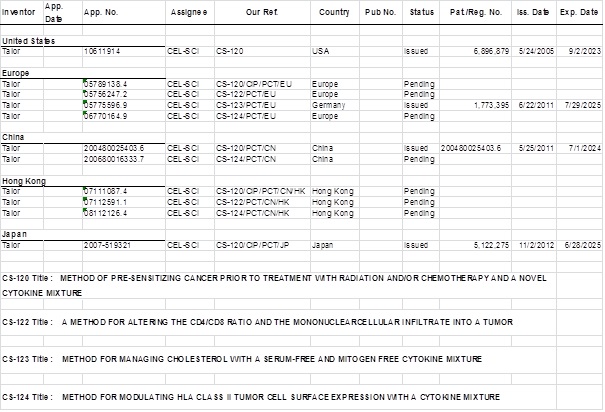

“Patents” - patent applications and patents, utility certificates, improvement patents and models and certificates of addition and all foreign counterparts of them in all countries, including any divisional applications and patents, refilings, renewals, re-examinations, continuations, continuations-in-part, patents of addition, extensions (including patent term extensions), reissues, substitutions, confirmations, registrations, revalidations, pipeline and administrative protections and additions, and any equivalents of the foregoing in any and all countries of or to any of them, as well as any

supplementary protection certificates and equivalent protection rights, e.g. in relation to pediatric extensions in respect of any of them. Patents to the Product are listed herein in Schedule A.

“Phase III Clinical Trial” - with respect to the Product, means a large scale, pivotal, multi-centre, human clinical trial to be conducted in a number of patients estimated to be sufficient to primarily establish efficacy of such Product in the medical indication being investigated and at a standard suitable to obtain Marketing Authorization anywhere in the Territory (excluding dose ranging studies), as described in in applicable laws and regulations.

"Product" – a biological identified by CEL-SCI as Multikine®, a compound having the chemical name Leucocyte Interleukin Inj.

“Program Budget” – with respect to the Product, means the budget for Program Costs in relation to the Co-Development Program 2 for such Product. The Program Budget for each Product Indication is set out in the relevant CTO to the MSA.

“Regulatory Authority” - any national, supranational, regional, state or local regulatory agency, department, bureau, commission, council or other governmental entity in any country involved in the granting of Marketing Authorization, including the FDA.

“Territory” – each country in the world.

“Third Party” – a person or entity other than either of the Parties or any of their respective Affiliates.

“Year” – any period of twelve (12) months commencing on 1 January and ending on 31 December.

| 2. | SUBJECT OF THE AGREEMENT |

| 2.1. | The primary objective of the Agreement is to regulate the funding of, and coordination of certain decision-making regarding the Development of the Product through the conduct of the Co-Developed Clinical Trial(s) and related regulatory submissions as contemplated in this and the Master Services Agreement. |

| 2.2. | CEL-SCI and Ergomed shall undertake their respective obligations under the Co-Development Program on a collaborative basis. CEL-SCI shall have the right to conduct, and, using commercially reasonable efforts, shall have sole responsibility for Non-Clinical Development as well as for Commercialization and intellectual property maintenance of the Product and shall bear all associated costs for such activities. Ergomed, performing in accordance with Good Industry Practice, shall have primary responsibility and bear the associated costs (subject to Sections 3 and 6) for Development of the Product by executing the clinical and regulatory activities under the Co-Development Program 2, as further stipulated in detail in the CTO 2. Accordingly, the Parties shall co-operate in good faith in performing such activities, particularly with respect to unknown problems or contingencies, and shall perform their respective obligations in good faith, in a commercially reasonable manner, and in accordance with the provisions of this Agreement and the MSA. |

| 2.3. | Notwithstanding any of the above or anything else in the Agreement, CEL-SCI shall at all times and for all purposes act as the sponsor of the Clinical Trial(s) under the applicable Legal Requirements. |

| 3. | CO-DEVELOPMENT INVESTMENT |

| 3.1. | Subject to the conclusion of CTO 2 and with respect to the Product Development in CIN Indication, Ergomed shall invest up to $3 million towards the clinical and regulatory costs |

determined in the Co-Development Program 2 for the execution of the Co-Developed Clinical Trial(s) for the Product in CIN Indication (the actual amount of such investment, determined in accordance with Section 6) (“Ergomed Co-Development Investment CIN”). The total of Ergomed investment into the Development of the Product in all Indications shall be referred to hereinafter as “Ergomed Total Co-Development Investment”). The Ergomed Co-Development Investment CIN shall not exceed US$3,000,000 (three million dollars) for Product Development in CIN Indication (the “Ergomed Co-Development Investment Cap CIN”) and shall not exceed US$13,000,000 (thirteen million dollars) for Product Development in head and neck cancer and CIN together (“the Ergomed Total Co-Development Investment Cap”).

| 3.2. | With respect to the Product, CEL-SCI shall be solely and fully responsible for all other Development, Non-Clinical Development and Commercialization costs. |

| 3.3. | Ergomed shall not be obligated to invest more in the Co-Development Program 2 than the amount set forth in clause 3.1. above. If CEL-SCI decides to increase the Program Budget with no agreement from Ergomed as to such increase, then CEL-SCI will bear such increase solely without affecting any of Ergomed’s rights herein. |

| 4. | CO-MANAGEMENT OF THE CO-DEVELOPMENT PROGRAM |

| 4.1. | The Parties shall, within ten (10) days of the Effective Date, establish a Joint Steering Committee (the “JSC”) to render strategic and policy decisions for the Development and registration of Product in the Field and to oversee the performance of the Co-Development Program 2. For the avoidance of doubt, and unless specifically agreed otherwise by the Parties in writing, the JSC already existing under the Co-Development Agreement for the Head and Neck Indication shall act also as the JSC under this Agreement. The responsibilities of the JSC shall be, without limitation to: |

4.1.1. approve changes to the Co-Development Program 2. For the avoidance of doubt, in no event shall the JSC have the power to extend the Co Development Program 2 beyond the completion of the planned Co-Developed Clinical Trial. This right shall solely remain with the Parties;

4.1.2. review selection of Third Party service providers in respect of the Co-Development Program 2;

4.1.3. review decisions regarding termination of the Co-Development Program 2 with respect to the Product for a safety, efficacy, product performance or regulatory reason. In addition, where the Co-Development Program 2 is terminated with respect to the Product either for a safety, efficacy, product performance or regulatory reason, the JSC shall agree in good faith on the provisions for the orderly wind-down of the Co-Development Program 2 with respect to such Product. The Parties agree that, under most circumstances, if the Co-Development Program 2 with respect to the Product is terminated for a reason other than a safety, efficacy, product performance or regulatory reason while a Co-Developed Clinical Trial is ongoing, it may be unethical to terminate the Co-Development Program 2 with respect to such Product or relevant part thereof until such Clinical Trial had been completed and, in such a case, the Parties shall co-ordinate the orderly wind-down provisions in such a way that they would not affect such Clinical Trial until it had completed;

4.1.4. report on progress of the Co-Development Program 2 to each Party within a reasonable period after each meeting of the JSC;

4.1.5. review actual and anticipated expenditures against the Program Budget for the Product in each Indication and to note any factors that may have an impact on such Program Budget; and

4.1.6. perform such other tasks and undertaking such other responsibilities as are expressly set forth as the JSC’s responsibility as set forth in this Agreement or an amendment thereto.

| 4.2. | The JSC shall consist of four (4) members with the requisite experience and authority to enable them to make decisions on behalf of the Parties, with equal numbers appointed by each respective Party. Each Party shall have the right to replace its respective representatives in JSC upon twenty (20) Business Days written notice to the other Party (or more quickly if such representative’s relationship with the appointing Party has terminated), provided that any such substitute representative shall have substantially the equivalent experience and authority as the representative that such person replaces. CEL-SCI will designate the chairman of the JSC. The JSC shall be run in accordance with the following provisions: |

4.2.1 The JSC shall have its first meeting within thirty (30) Business Days after the Effective Date, and thereafter shall hold regular meetings at intervals of not more than six (6) months. The venue for each meeting of the JSC shall alternate between Frankfurt, Germany, and Vienna, VA, USA or such other locations as may be agreed upon by the JSC Members. Meetings of the JSC may be held as a teleconference or video conference, provided that the JSC shall hold at least one face-to-face meeting during each Year. In addition, special meetings of the JSC may be called by any JSC member upon written request to and approval of the then-current chairman of the JSC.

4.2.2 The presence of at least one (1) JSC member representing each Party shall constitute a quorum. Each Party shall have one (1) vote on the JSC. All decisions by the JSC shall be made by unanimous vote. Both Parties must vote in the affirmative to allow the JSC to take any action that requires the vote of the JSC.

4.2.3 At least twenty one (21) days prior to each regularly scheduled meeting of the JSC, written notice shall be given to each JSC member by the chairman of the JSC. Ad hoc or special meetings of the JSC may be scheduled on shorter written notice.

4.2.4 The chairman of the JSC shall set meeting agendas for the JSC, which shall include any matter reasonably requested by either Party to be included and which is subject to the JSC’s purview pursuant to Section 4.1. Such agendas shall be circulated to all JSC members at least five (5) Business Days prior to the date of the relevant meeting. The JSC chairman shall be responsible for recording, preparing and, within five (5) Business Days, issuing draft minutes of the JSC meetings, which draft minutes shall be reviewed, modified and approved in writing by the JSC members within five (5) Business Days. Such minutes shall record all proposed decisions and all actions recommended or taken, including a copy of progress reports.

4.2.5 If the JSC cannot reach unanimous agreement on any particular matter properly before it, then such matters requiring resolution shall be referred to the Chief Executive Officer of CEL-SCI or equivalent position or his or her nominee, and the Chief Executive Officer of Ergomed or equivalent position or his or her nominee, for resolution, who together shall use reasonable and good faith efforts to resolve such matters within thirty (30) days of the date such matters are referred to them for resolution. If the Parties still fail to resolve the matter so referred, the Party having primary responsibility for the related activity, as stipulated in the Agreement, will have the right to break the deadlock unilaterally except as provided in Section 4.3. below.

| 4.3 | The specific decision to which the provision from Section 4.2.5. does not apply are: |

| 4.3.1 | changes to the Co-Development Program 2 including any extension of the scope of work therefore. If, following the meeting of Chief Executive Officers |

of CEL-SCI and Ergomed, the Parties cannot agree upon such changes the Co-Development Program 2 shall continue without amendment.

| 4.3.2 | the changes to the Program Budget of the Co-Development Program 2. If following the meeting of Chief Executive Officers of CEL-SCI and Ergomed, the Parties cannot agree upon such changes the respective Program Budget shall remain as agreed prior to such proposed change and the Co-Development Program 2 shall continue without amendment. |

Ergomed’s performance

| 5.1 | Ergomed shall be responsible for carrying out its part of the Co-Development Program 2, particularly carrying out the Development, all in accordance with the MSA, and the CTO 2. The MSA and CTO 2 shall govern the performance by Ergomed of any Clinical Trials to be carried out by Ergomed under the Co-Development Program 2. |

CEL-SCI’s performance

| 5.2 | CEL-SCI shall be responsible for carrying out its part of the Co-Development Program 2, particularly Non-Clinical Development. Commercialization, manufacturing and IP protection of the Product, all in accordance with the MSA and this Agreement, and all solely at its own cost and expense. |

| 6.1�� | CEL-SCI shall make payments to Ergomed for invoices submitted by Ergomed for Ergomed’s activities on the Co-Developed Clinical Trial in accordance with the MSA within the terms stipulated in the MSA and related CTO 2; provided, however, that Ergomed’s invoices pursuant to the MSA for each Co-Developed Clinical Trial in CIN Indication will be reduced by 50% (fifty percent) from the costs set forth in the MSA and the proposal attached to CTO 2 (“Ergomed Invoiced Costs 2”) until the cumulative total of such reductions reaches the Ergomed Co-Development Investment Cap CIN, following which the invoices with respect to the Co-Developed Clinical Trial for CIN Indication will be issued and payments will be made with no reduction, all in accordance with the payment schedule set forth in the MSA. The 50% reduction described in the foregoing shall be accrued as the Ergomed Co-Development Investment CIN for the Product and shall be tracked. Each invoice subject to the reduction shall clearly set forth, with respect to the Product, the fee schedule set forth in the MSA and CTO 2 and the relevant reduction to be applied toward the Ergomed Co-Development Investment CIN. |

| 6.2 | Notwithstanding anything in this Clause 6, in consideration for the applicable Ergomed Total Co-Development Investment, CEL-SCI shall pay to Ergomed an agreed percentage of any Net Income received by CEL-SCI for the Product in the Field in the Territory in the amount of 5% (five percent) of such Net Income until the total amount paid to Ergomed under this Section reaches four times (4x) Ergomed Total Co-Development Investment. |

| 6.3 | It is noted that Ergomed and CEL-SCI are jointly developing the Product for several Indications governed in two separate co-development agreements. The Ergomed Total Co-Development Investment shall be accrued collectively through the efforts in all Indications and the Revenues described in section 6.2 calculated on the basis of the Ergomed Total Co-Development Investment. As an illustration and for clarity, in the event that Ergomed invests $10 million in Head and Neck Cancer, and $3 million in CIN, the Total Ergomed Co-Development Investment will be $13 million and the maximum total Ergomed revenue will be $52 million, received from all Net Income from all Product sales from either or both Head and Neck Cancer and CIN. |

| 6.4 | Any payments under Clause 6.2 shall be due and payable by CEL-SCI to Ergomed within sixty (60) days from the date on which CEL-SCI actually records or receives the Net Income; provided, however, that CEL-SCI may, in its sole discretion, pay all or any portion of the amounts owed to Ergomed under this Agreement or any other co-development agreement for the Product at any time prior to CEL-SCI’s receipt of the relevant Net Income. |

| 6.5 | Records Retention; Audit |

| 6.5.1 | Ergomed shall keep or cause to be kept full, true and accurate records and books of account in accordance with internationally accepted accounting principles that, in reasonable detail, fairly reflect Ergomed’s program costs and the Ergomed Co-Development Investment for the Product. Such books and records shall be maintained by Ergomed for three (3) Years following the end of the Year to which they pertain. |

| 6.5.2 | Upon the written request of CEL-SCI (the “Requesting Party”), Ergomed (the “Disclosing Party”) shall permit a certified public accountant, or a person possessing similar professional status and associated with an independent accounting firm reasonably acceptable to the Requesting Party, to inspect during regular business hours and no more than once a Year and going back no more than three (3) Years following the end of the Year to which they pertain, all or any part of the records and books necessary to verify such invoices and reports. The accounting firm shall enter into appropriate obligations with the Disclosing Party to treat all information it receives during its inspection in confidence. The accounting firm shall disclose to the Parties only whether such invoices and reports are correct and details concerning any discrepancies, but no other information shall be disclosed to the Requesting Party. The charges of the accounting firm shall be paid by the Requesting Party, except that if the Ergomed Co-Development Investment for the Product have been overstated by more than five percent (5%), the charges shall be paid by the Disclosing Party. Ergomed shall, within forty-five (45) days after receipt of an invoice from CEL-SCI, pay to CEL-SCI the amount by which the Ergomed Co-Development Investment for the Product has been overstated, along with Interest from the date of the original invoice, and such overstated amount shall be excluded from the Ergomed Co-Development Investment for the Product. |

| 6.6 | CEL-SCI and its Affiliates shall keep full, true and accurate records and books of account in accordance with GAAP or IFRS containing all particulars that may be reasonably necessary for the purpose of calculating the share of Net Income payable to Ergomed under this Agreement. Such books and records shall be maintained for three (3) Years following the end of the Year to which they pertain. Upon the written request by Ergomed, Ergomed shall have the right to instruct an independent, internationally recognized, accounting firm reasonably acceptable to CEL-SCI, to perform an audit, conducted so far as appropriate in accordance with GAAP or IFRS, as applicable, during regular business hours and no more than once a Year, as is reasonably necessary to enable such accounting firm to report to Ergomed Net Income for the period or periods requested by Ergomed going back no more than three (3) Years following the end of the Year to which the records pertain. The accounting firm shall enter into appropriate obligations with CEL-SCI to treat all information it receives during its inspection in confidence. The accounting firm shall disclose to the Parties only whether CEL-SCI has paid to Ergomed the proper portion of Net Income with respect to the Product and details concerning any discrepancies, but no other information shall be disclosed to Ergomed. |

The cost of the accountant shall be the responsibility of CEL-SCI if the audit shows that CEL-SCI has underpaid Ergomed its proper portion of Net Income by more than five percent (5%) with respect to the Product and the responsibility of Ergomed otherwise. CEL-SCI shall, within forty-five (45) days after receipt of an invoice from Ergomed, pay to Ergomed the amount by which the portion of Net Income for the Product owed to Ergomed was underpaid, along with Interest from the date of CEL-SCI’s original receipt thereof.

| 6.7 | All payments made by CEL-SCI to Ergomed under this Agreement shall be made by wire transfer to the account of Ergomed that may be notified by Ergomed to CEL-SCI from time to time. |

| 6.8 | If CEL-SCI fails to make any payment due to Ergomed hereunder on the due date for payment, without prejudice to any other right or remedy available to Ergomed, Ergomed shall be entitled to charge CEL-SCI Interest (both before and after judgment, from the date payment was originally due through the date paid) without prejudice to Ergomed’s right to receive payment on the due date. If Ergomed overcharges CEL-SCI, without prejudice to any other right or remedy available to CEL-SCI, CEL-SCI shall be entitled to charge Ergomed Interest (both before and after judgment, from the date payment was originally made through the date refunded). |

| 7.1 | Warranties of CEL-SCI |

CEL-SCI hereby represents and warrants to Ergomed as of the Effective Date that:

| a) | CEL-SCI is a company duly incorporated and validly existing under the laws of Colorado and has the corporate power to own its assets, conduct its business as presently conducted and to enter into, and comply with its obligations under this Agreement; |

| b) | this Agreement has been duly authorized and executed by CEL-SCI and constitutes a valid and legally binding obligation of CEL-SCI, enforceable in accordance with its terms; |

| c) | CEL-SCI is not engaged in, and so far as CEL-SCI is aware (having made no enquiry) is not threatened by, any litigation, the outcome of which might adversely affect its financial position or the execution of the rights and obligations undertaken by this Agreement; |

| d) | the execution, delivery and performance by CEL-SCI of this Agreement and compliance with the provisions hereof by CEL-SCI will not: |

| (i) | violate any provision of applicable law, statute, rule or regulation or any ruling, writ, injunction, order, judgment or decree of any court, arbitrator, administrative agency or other governmental body applicable to CEL-SCI or any of its properties or assets; |

| (ii) | conflict with or result in any breach of any of the terms, conditions or provisions of, or constitute (with notice or lapse of time or both) a default (or give rise to any right of termination, cancellation or acceleration) under the organizational documents of CEL-SCI or any contract to which CEL-SCI is a party; or |

| (iii) | result in the creation of any Encumbrance of any nature granted to a Third Party upon any of the properties or assets of CEL-SCI; |

| e) | With respect to the Patents set forth on Schedule A pertaining to the Product, (i) CEL-SCI is the registered owner thereof, which rights are free of any Encumbrances, restrictions or Third Party rights, (ii) such Patents are in full force and effect, and (iii) there are no |

licenses or rights to use such Patents granted by CEL-SCI to any Third Party that are in effect as of the Effective Date that are in conflict with the terms of this Agreement; and

| f) | CEL-SCI has not received any written claim from a Third Party alleging that the manufacture or commercialization of the Product infringes a Patent of such Third Party; and |

| g) | CEL-SCI has obtained all necessary corporate approvals, including but not limited to the Board approval, and has obtained the funds necessary to carry out the Co-Development Program 2. |

| 7.2 | Warranties of Ergomed |

Ergomed hereby represents and warrants to CEL-SCI as of the Effective Date that:

| a) | Ergomed is a company duly incorporated and validly existing under the laws of the United Kingdom and has the corporate power to own its assets, conduct its business as presently conducted and to enter into, and comply with its obligations under this Agreement; |

| b) | this Agreement has been duly authorized and executed by Ergomed and constitutes a valid and legally binding obligation of Ergomed, enforceable in accordance with its terms; |

| c) | Ergomed is not engaged in, and so far as Ergomed is aware (having made no enquiry) is not threatened by, any litigation, the outcome of which might adversely affect its financial position or the execution of the rights and obligations undertaken by this Agreement; and |

| d) | the execution, delivery and performance by Ergomed of this Agreement and compliance with the provisions hereof by Ergomed will not: |

| (i) | violate any provision of applicable law, statute, rule or regulation or any ruling, writ, injunction, order, judgment or decree of any court, arbitrator, administrative agency or other governmental body applicable to Ergomed or any of its properties or assets; |

| (ii) | conflict with or result in any breach of any of the terms, conditions or provisions of, or constitute (with notice or lapse of time or both) a default (or give rise to any right of termination, cancellation or acceleration) under the organizational documents of Ergomed or any contract to which Ergomed is a party; or |

| (iii) | result in the creation of any Encumbrance of any nature granted to a Third Party upon any of the properties or assets of Ergomed. |

| 8.1.1 | Each Party shall inform the other Party of all relevant information which may be significant for the Product that the other Party has a need to know in connection with the Co-Development Program which it receives or develops independently of the other Party. This shall be accomplished through representatives on the JSC. |

| 5.1. | The Parties agree that the MSA shall govern with respect to “Confidential Information” (as defined in the MSA) that may be exchanged between the Parties under the MSA. Any Confidential Information of either Party (as defined below) that may be exchanged between the Parties under this Agreement and except to the extent expressly authorized by this Agreement or otherwise agreed in writing, the Parties agree that, during the validity of the Agreement and for ten (10) years thereafter, the receiving Party (the “Receiving Party”) shall keep confidential and shall not publish or otherwise disclose or use for any purpose other than as permitted under, or required to perform its obligations under, this Agreement any financial information and materials furnished to it by the other Party (the “Disclosing Party”) pursuant to this Agreement (collectively, “Confidential Information”), except to the extent that it can be established by the Receiving Party that such Confidential Information: |

| ● | was already known to the Receiving Party, other than under an obligation of confidentiality, at the time of disclosure by the Disclosing Party; |

| ● | was generally available to the public or otherwise part of the public domain at the time of its disclosure to the Receiving Party; |

| ● | became generally available to the public or otherwise part of the public domain after its disclosure to the Receiving Party and other than through any act or omission of the Receiving Party in breach of this Agreement; |

| ● | was disclosed to the Receiving Party, other than under an obligation of confidentiality, by a Third Party who had no obligation to the Disclosing Party not to disclose such information to others; or |

| ● | was subsequently developed by the Receiving Party without the aid, use or application of the Disclosing Party’s Confidential Information as demonstrated by competent written records. |

| 5.2. | Authorized Disclosure. Each Receiving Party may disclose the Disclosing Party’s Confidential Information hereunder to the extent such disclosure is reasonably necessary in prosecuting or defending litigation or complying with applicable governmental regulations, provided that if a Receiving Party is required by law or regulation to make any such disclosure of the Disclosing Party’s Confidential Information it will, where permitted by law, give reasonable advance written notice to the other Party of such disclosure requirement and will use its reasonable efforts to secure confidential treatment of such Confidential Information required to be disclosed. In addition, each Receiving Party shall be entitled to disclose, under obligations of confidentiality substantially as protective as this Article 9, the Disclosing Party’s Confidential Information to its Affiliates, consultants, clinical investigators, potential permitted sublicensees and other Third Parties only for any purpose provided for in this Agreement. |

| 5.3. | Return of Confidential Information. Upon the termination or expiration of this Agreement, any and all Confidential Information of a Disclosing Party possessed in tangible form by the Receiving Party, its Affiliates or any of their officers, directors, employees, agents or consultants shall, upon written request of the Disclosing Party, be immediately returned to the Disclosing Party (or destroyed if so requested) and not retained by the Receiving Party, its Affiliates or any of their officers, directors, employees, agents or consultants, provided that, each Receiving Party shall be entitled to retain any Confidential Information of the Disclosing Party that is reasonably required to exercise its rights under Clause 6 for so long as such rights survive. Notwithstanding the foregoing, each Receiving Party may retain one (1) copy of any Confidential Information of the Disclosing Party in appropriately secure legal files solely for record-keeping purposes. |

| | 9.4. | Public Disclosure; Use of Name. Except as required by an order from a court or governmental body, applicable law or regulation neither Party shall use the name of the other Party in any publicity or advertising without the prior written approval of the other Party, except that either Party may disclose the existence, but not the terms or conditions (including information contained in any Exhibit hereto), of this Agreement. Notwithstanding the foregoing, in the event that either Party seeks to disclose the terms of this Agreement in any legally required filing, such Party shall provide prompt written notice to the other Party and use reasonable efforts to maintain the confidential treatment of the material terms of this Agreement to the extent reasonably possible, provided however that COMPANY may disclose the details of the Agreement in public filings to the Securities Exchange Commission (SEC) and the New York Stock Exchange (NYSE). |

| 10.1. | This Agreement may not be assigned, transferred or subcontracted by either Party without the prior written consent of the other Party, which consent shall not be unreasonably withheld; provided, however, that either Party may assign this Agreement, in whole or in part, without the other Party’s consent to an Affiliate, or in connection with a merger, consolidation, acquisition or a sale or transfer of all or substantially all of such Party’s assets to which this Agreement relates. |

| 10.2. | Each Party shall as soon as practicable notify the other Party of an assignment to an Affiliate or of a Change of Control and shall provide the other Party with information reasonably requested by such Party with respect to such Affiliate or acquirer. “Change of Control” means: (a) the acquisition by any third party of beneficial ownership of fifty percent (50%) or more of the then-outstanding common shares or voting power of a Party; or (b) the consummation of a business combination involving a Party, unless, following such business combination, the stockholders of a Party immediately prior to such business combination beneficially own directly or indirectly more than fifty percent (50%) of the then-outstanding common shares or voting power of the entity resulting from such business combination. Any assignment not in accordance with the foregoing shall be void. |

| 11.1. | The Parties will not publicly disclose the nature or existence of this Agreement, through press releases, a web site, brochures, or written materials of any kind, unless differently agreed by both Parties in writing or unless required by the law or by the rules of any stock exchange which apply to a Party. |

| 12.1. | Any notices required or to be sent hereunder shall be in writing and delivered personally or sent by fax or mail or e-mail, at the sender’s choice. Notices delivered to the addresses, fax numbers or e-mail addresses indicated below (or such other address, fax number or e-mail address of which the receiving Party had notified the other Party in writing, in accordance with the procedures of this Section 12.1, at least 8 (eight) days prior to such delivery) shall be considered validly delivered and shall be considered received on the date of actual receipt; provided, however, that notices sent by fax shall be deemed given as of the date sent by fax properly addressed and transmitted. |

FOR CEL-SCI:

CEL-SCI Corporation

8229 Boone Boulevard,

Suite 802,

Vienna, VA 22182, USA

Attention: Geert Kersten

Fax: (703) 506-9471

grkersten@cel-sci.com

FOR Ergomed:

Ergomed Clinical Research Ltd.

c/o Ergomed Istraživanja, d.o.o.

Oreškovićeva 20A

10000 Zagreb, Croatia

Attn. Dr. Miroslav Reljanović

miroslav.reljanovic@ergomed-cro.com

with copy to neil.clark@ergomed-cro.com

| 13.1 | The term of this Agreement shall commence on the Effective Date and shall expire on the date on which both Parties have fulfilled all of their obligations contemplated herein. For the avoidance of doubt, the Agreement cannot be terminated by either of the Parties prior to its expiration unless specifically and expressly stipulated in the Agreement or unless agreed in writing by both Parties. |

| 13.2 | For the sake of clarity, the Parties agree and acknowledge that the expiration or termination of this Agreement shall not affect in any way the validity of the MSA or any of the relevant CTOs therein, which shall, to the extent applicable, continue in full force and effect unless terminated pursuant to the relevant clauses in the MSA or such CTO. |

| 13.3 | In case that either the MSA and / or any relevant CTO thereunder are terminated, this Agreement shall continue to apply to the Parties taking into account such fact of termination of MSA and / or the CTO and performance on any obligations of the Parties directly and solely related to the obligations under the MSA or the CTO shall no longer be required from either of the Parties. For the avoidance of doubt, in this case, the provisions stipulated in Sections 6, 9, 12 and 14 herein shall remain in full force and effect. |

| 14 | DISPUTE RESOLUTION AND GOVERNING LAW |

| 14.1 | General. The Parties recognize that disputes as to certain matters may from time to time arise which relate to either Party’s rights and/or obligations hereunder. It is the objective of the Parties to establish procedures to facilitate the resolution of disputes arising under this Agreement in an expedient manner by mutual dialogue and cooperation and, to extent possible, without resort to litigation. To accomplish this objective, the Parties agree to follow the procedures set forth in this Article 14 if and when a dispute arises under this Agreement. |

| 14.2 | Senior Management. Any disputes relating to this Agreement shall be first referred to the Chief Executive Officer of CEL-SCI and the Chief Executive Officer of Ergomed, or their respective senior-level designees, for resolution through good faith negotiations. In the event that such executives, or their respective designees, cannot resolve the dispute within thirty (30) days of being requested by a Party to resolve a dispute, either Party may, by written notice to the other, invoke the provisions of Section 14.3 hereinafter. |

Mediation. The Parties agree that any dispute, controversy or claim (except as to any issue relating to Confidential Information or intellectual property owned in whole or in part by Ergomed or CEL-SCI or any equitable claim) arising out of or relating to this Agreement, or the breach, termination, or invalidity thereof, shall be resolved through mediation and binding arbitration. If a dispute arises out of or relating to this Agreement between the Parties, and if such dispute cannot be resolved pursuant to Section 14.2 above, the Parties agree to try in good faith to resolve such dispute by mediation administered by the American Arbitration Association (AAA) in accordance with its Mediation Rules. Such mediation shall take place in New York, New York if personal appearance is required.

| 14.3 | Arbitration. If efforts at mediation pursuant to Section 14.3 are unsuccessful within sixty (60) days after the date that one Party notifies the other Party that it desires to resolve a dispute, controversy or claim through mediation, any unresolved dispute, controversy or claim between the Parties shall be resolved by binding arbitration in accordance with the International Arbitration Rules of the American Arbitration Association, by 1 (one) arbitrator appointed pursuant to such Rules, except as modified herein. A reasoned arbitration decision shall be rendered in writing within six (6) months of the conclusion of mediation and shall be binding on the Parties. The prevailing Party may enter such decision in any court having competent jurisdiction. The mediation and arbitration proceedings shall be conducted in the English language and shall be held in New York, New York. The Parties agree that they shall share equally the cost of the mediation and arbitration filing and hearing fees, and the cost of the mediator/arbitrator, except to the extent otherwise determined by the arbitrators. Each Party must bear its own attorneys’ fees and associated costs and expenses, except to the extent otherwise determined by the arbitrators. |

| 14.4 | Injunctive Relief, Collection of Amounts Due and Express Dispute Resolution Provisions. Notwithstanding the foregoing provisions of this Article 14, (a) either Party will have the right to seek injunctive relief and/or collection of any undisputed amount due under this Agreement in any court of competent jurisdiction as may be available to such Party under the laws and rules applicable in such jurisdiction, and (b) the provisions of Sections 14.1-14.4 shall not apply with respect to any decision described in Section 4.3. |

| 14.5 | Governing Law. This Agreement and all disputes thereof shall be governed by and construed in accordance with the substantive laws of the State of New York, USA other than any principle of conflict or choice of laws that would cause the application of the laws of any other jurisdiction. |

| 15.1 | If any provision of this Agreement should be deemed invalid or legally unenforceable, such provision shall not affect the validity and/or enforceability of any other provision(s) of this Agreement or the Agreement as a whole. The Parties shall, in such case, replace the invalid provision with a valid one that best expresses their original intent. |

| 15.2 | This Agreement (which includes its Schedules) and the MSA and the relevant CTO 2 to be entered into thereunder contain the entire and only agreement between the Parties with respect to the subject of the Agreement and wholly cancel, terminate and supersede any agreement or agreements, formal or informal, oral or written heretofore entered into pertaining to the subject matter, including the Confidentiality, Non-Disclosure and Non-Solicitation Agreement between the parties dated as of December 11, 2012. Notwithstanding the foregoing, the Parties agree and acknowledge that the Co-Development and Revenue Sharing Agreement dated April 19, 2013 for the Head & Neck Cancer Indication, the MSA and the CTO I thereunder, as each and every one of these may be amended from time to time shall survive the execution of this Agreement and continue in full force and effect in the full text stipulated by the Parties. |

| 15.3 | If a Party (the “Affected Party”) is unable to carry out any of its obligations under this Agreement due to Force Majeure this Agreement shall remain in effect but the Affected Party’s relevant obligations under this Agreement and the corresponding obligations of the other Party (“Non-Affected Party”) under this Agreement, shall be suspended for a period equal to the circumstance of Force Majeure provided that: |

| 15.3.1 | the suspension of performance is of no greater scope than is required by the Force Majeure; |

| 15.3.2 | the Affected Party immediately gives the Non-Affected Party prompt written notice describing the circumstance of Force Majeure, including the nature of the occurrence and its expected duration, and continues to furnish regular reports during the period of Force Majeure and notifies the Non-Affected Party immediately of the cessation of the Force Majeure; |

| 15.3.3 | the Affected Party uses all reasonable efforts to remedy its inability to perform and to mitigate the effects of the circumstance of Force Majeure; and |

| 15.3.4 | as soon as practicable after the event which constitutes Force Majeure the Parties discuss how best to continue their operations as far as possible in accordance with this Agreement. |

| 15.4 | The status of each Party under this Agreement shall be that of an independent contractor. Nothing contained in this Agreement shall be construed as creating a partnership, joint venture or agency relationship between the Parties or as granting either Party the authority to bind or contract any obligation in the name of or on the account of the other Party or to make any statements, representations, warranties or commitments on behalf of the other Party. All persons employed by a Party shall be employees of such Party and not of the other Party and all costs and obligations incurred by reason of any such employment shall be for the account and expense of such Party. |

| 15.5 | This Agreement is written and executed in the English language. |

| 15.6 | Any amendment or modification of this Agreement must be in writing and signed by authorized representatives of both Parties. |

| 15.7 | A Party’s failure to enforce, at any time or for any period of time, any provision of this Agreement, or to exercise any right or remedy shall not constitute a waiver of that provision, right or remedy or prevent such Party from enforcing any or all provisions of this Agreement and exercising any rights or remedies. To be effective any waiver must be in writing. All rights and remedies are cumulative and do not exclude any other right or remedy provided by law or otherwise available. |

| 15.8 | The provisions of this Agreement are for the sole benefit of the Parties and their successors and permitted assigns, and they shall not be construed as conferring any rights in any other Persons except as otherwise expressly provided. Except as expressly provided herein, no person who is not a party to this Agreement (including any employee, officer, agent, representative or subcontractor of either Party) shall have the right to enforce any term of this Agreement which expressly or by implication confers a benefit on that person without the express prior agreement in writing of the Parties, which agreement must refer to this Clause 15.8. |

| 15.9 | Each Party shall perform all further acts and things and execute and deliver such further documents as may be necessary or as the other Party may reasonably require to implement or give effect to this Agreement. |

| 15.10 | Except as otherwise expressly provided in this Agreement, each Party shall pay the fees and expenses of its respective lawyers and other experts and all other expenses and costs incurred by such Party incidental to the negotiation, preparation, execution and delivery of this Agreement. |

| 15.11 | This Agreement may be executed in any number of counterparts, each of which shall be deemed an original and all of which taken together shall be deemed to constitute one and the same instrument. An executed signature page of this Agreement delivered by facsimile transmission shall be as effective as an original executed signature page. Signatures to this Agreement transmitted by electronic mail in “portable document format” (“.pdf”) form, or by any other electronic means intended to preserve the originals graphic and pictorial appearance of a document, will have the same effect as physical delivery of the paper document bearing the original signatures, and shall be deemed original signatures by both Parties. |

| 15.12 | In construing this Agreement, unless expressly specified otherwise, (a) except where the context otherwise requires, use of any gender includes any other gender, and use of the singular includes the plural and vice versa; (b) any list or examples following the word “including” shall be interpreted without limitation to the generality of the preceding words; and (c) each Party represents that it has been represented by legal counsel in connection with this Agreement and acknowledges that it has participated in the drafting hereof. In interpreting and applying the terms and provisions of this Agreement, the Parties agree that no presumption will apply against the Party which drafted such terms and provisions. |

[Remainder of Page Intentionally Left Blank]

The Parties have indicated their acceptance of the terms of this Agreement by the signatures set forth below. Each individual signing on behalf of a corporate entity hereby personally represents and warrants his or her legal authority to legally bind that entity.

| CEL-SCI CORPORATION | | | ERGOMED CLINICAL RESEARCH LTD | |

| | | | | |

| /s/Geert Kersten | | | /s/ Dr. Miroslav Reljanovic | |

Print Name: Geert Kersten | | | Print Name: Dr. Miroslav Reljanovic | |

Title: Chief Executive Officer | | | Title: Chief Financial Officer | |

SCHEDULE A – CEL-SCI PATENTS