QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A/A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. 1)

| Filed by the Registrant ý |

Filed by a Party other than the Registrant o |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

Langer, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

(1) |

|

Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

LANGER, INC.

450 Commack Road

Deer Park, New York 11729-4510

May 24, 2005

To Our Stockholders:

On behalf of your Company's Board of Directors, I cordially invite you to attend the Annual Meeting of Stockholders to be held on June 23, 2005, at 10:30 a.m., local time, at One Landmark Square, 22nd floor, Stamford, Connecticut 06901.

The accompanying Notice of Meeting and Proxy Statement cover the details of the matters to be presented.

A copy of the Company's annual report for the year ended December 31, 2004, is included with this mailing.

Regardless of whether you plan to attend the Annual Meeting, I urge that you participate by completing and returning your proxy card as soon as possible. Your vote is important and will be greatly appreciated. You may revoke your proxy and vote in person if you decide to attend the Annual Meeting.

LANGER, INC.

Notice of Annual Meeting of Stockholders

to be held June 23, 2005

To Our Stockholders:

You are cordially invited to attend the Annual Meeting of Stockholders, and any adjournments or postponements thereof (the "Meeting"), of Langer, Inc., a Delaware corporation (the "Company"), which will be held on June 23, 2005 at 10:30 a.m., local time, at One Landmark Square, 22nd floor, Stamford, Connecticut 06901, for the following purposes:

1. To elect six members to serve on the Board of Directors until the next annual meeting of stockholders and until their successors are duly elected and qualified (Proposal 1);

2. To consider and vote upon a proposal to adopt a new long-term incentive plan (the "2005 Stock Incentive Plan") pursuant to which an aggregate of 2,000,000 million shares of the Company's common stock will be reserved for issuance and available under such plan (Proposal 2); and

3. To transact such other business as may properly be brought before the Meeting.

Stockholders of record at the close of business on May 11, 2005 shall be entitled to notice of and to vote at the Meeting. A copy of the Annual Report of the Company for the year ended December 31, 2004, is included herewith.

YOUR VOTE IS IMPORTANT. PLEASE SIGN AND DATE THE ENCLOSED PROXY CARD AND RETURN IT PROMPTLY IN THE ENCLOSED RETURN ENVELOPE, WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING. YOU MAY REVOKE YOUR PROXY AND VOTE IN PERSON IF YOU DECIDE TO ATTEND THE MEETING.

May 24, 2005

LANGER, INC.

450 Commack Road

Deer Park, New York 11729-4510

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 23, 2005

INTRODUCTION

Proxy Solicitation And General Information

This Proxy Statement and the enclosed form of proxy (the "Proxy Card") are being furnished to the holders of common stock, par value $0.02 per share (the "Common Stock"), of Langer, Inc., a Delaware corporation (the "Company"), in connection with the solicitation of proxies by the Board of Directors (the "Board" or "Board of Directors") of the Company for use at the Annual Meeting of Stockholders to be held on June 23, 2005 10:30 a.m., local time, at One Landmark Square, 22nd Floor, Stamford, Connecticut 06901, and at any adjournment or postponement thereof (the "Meeting"). This Proxy Statement and the Proxy Card are first being sent to stockholders on or about May 25, 2005.

At the Meeting, holders of Common Stock (the "Stockholders") will be asked:

1. To elect six members to serve on the Board of Directors until the next annual meeting of stockholders and until their successors are duly elected and qualified (Proposal 1);

2. To consider and vote upon a proposal to adopt a new long-term incentive plan (the "2005 Stock Incentive Plan") pursuant to which an aggregate of 2,000,000 million shares of the Company's common stock will be reserved for issuance and available under such plan (Proposal 2); and

3. To transact such other business as may properly be brought before the Meeting.

The Board of Directors has fixed the close of business on May 11, 2005 as the record date for the determination of Stockholders entitled to notice of and to vote at the Meeting. Each such Stockholder will be entitled to one vote for each share of Common Stock held on all matters to come before the Meeting and may vote in person or by proxy authorized in writing.

Stockholders are requested to complete, sign, date and promptly return the Proxy Card in the enclosed envelope. Common Stock represented by properly executed proxies received by the Company and not revoked will be voted at the Meeting in accordance with instructions contained therein. If the Proxy Card is signed and returned without instructions, the shares will be votedFOR the election of each nominee for director named herein (Proposal 1), andFOR the approval of the 2005 Stock Incentive Plan (Proposal 2). A Stockholder who so desires may revoke its proxy at any time before it is voted at the Meeting by: (i) delivering written notice to the Company (attention: Secretary); (ii) duly executing and delivering a proxy bearing a later date; or (iii) casting a ballot at the Meeting. Attendance at the Meeting will not in and of itself constitute a revocation of a proxy.

A Stockholder may designate a person or persons other than those persons designated on the Proxy Card to act as the stockholder's proxy. The Stockholder may use the Proxy Card to give another person authority by striking out the names appearing on the Proxy Card, inserting the name(s) of another person(s) and delivering the signed card to such person(s). The person(s) designated by the stockholder must present the signed Proxy Card at the meeting in order for the shares to be voted.

Where the Stockholder is not the record holder, such as where the shares are held through a broker, nominee, fiduciary or other custodian, the Stockholder must provide voting instructions to the record holder of the shares in accordance with the record holder's requirements in order to ensure that the shares are properly voted.

The Board of Directors knows of no other matters that are to be brought before the Meeting other than as set forth in the Notice of Meeting. If any other matters properly come before the Meeting, the persons named in the enclosed form of proxy, or their substitutes, will vote in accordance with their discretion on such matters.

Record Date; Shares Outstanding And Entitled To Vote; Quorum

Only Stockholders as of the close of business on May 11, 2005 (the "Record Date") are entitled to notice of and to vote at the Meeting. As of the April 19, 2005, there were 4,397,933 shares of Common Stock outstanding and entitled to vote, with each share entitled to one vote. See "Security Ownership of Certain Beneficial Owners and Management." The presence at the Meeting, in person or by duly authorized proxy, of the holders of a majority of the shares of Common Stock entitled to vote constitute a quorum for this Meeting.

Required Votes

The affirmative vote of a plurality of the votes cast in person or by proxy is necessary for the election of directors (Proposal 1). The affirmative vote of a majority of the votes cast in person or by proxy is necessary for the approval of the 2005 Stock Incentive Plan (Proposal 2).

An inspector of elections appointed by us will tabulate votes at the meeting. Since the affirmative vote of a plurality of votes cast is required for the election of directors (Proposal 1), abstentions and "broker non-votes" will have no effect on the outcome of such election. Since the affirmative vote of a majority of the votes cast is necessary for the approval of the 2005 Stock Incentive Plan (Proposal 2), an abstention will have the same effect as a negative vote, but "broker non-votes" will have no effect on the outcome of the voting for Proposal 2.

Brokers holding shares for beneficial owners must vote those shares according to the specific instructions they receive from beneficial owners. If specific instructions are not received, brokers may be precluded from exercising their discretion, depending on the type of proposal involved. Shares as to which brokers have not exercised discretionary authority or received instructions from beneficial owners are considered "broker non-votes," and will be counted for purposes of determining whether there is a quorum.

Proxy Solicitation

The Company will bear the costs of the solicitation of proxies for the Meeting. Directors, officers and employees of the Company may solicit proxies from Stockholders by mail, telephone, personal interview or otherwise. Such directors, officers and employees will not receive additional compensation but may be reimbursed for out-of-pocket expenses in connection with such solicitation. Brokers, nominees, fiduciaries and other custodians have been requested to forward soliciting material to the beneficial owners of Common Stock held of record by them, and such custodians will be reimbursed for their reasonable expenses.

It is desirable that as large a proportion as possible of the Stockholders' interests be represented at the Meeting. Therefore, even if you intend to be present at the Meeting, you are requested to sign and return the enclosed Proxy Card to ensure that your stock will be represented. If you are present at the Meeting and desire to do so, you may withdraw your proxy and vote in person by giving written notice to the secretary of the Company prior to the vote. Please return your executed proxy promptly.

2

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of the Record Date, certain information regarding beneficial ownership of our common stock by (a) each person or entity who is known to us owning beneficially 5% or more of our common stock, (b) each of our directors, (c) each of the executive officers listed in the summary compensation table under "Management—Executive Compensation" and (d) all executive officers and directors as a group. Unless otherwise indicated, each of the stockholders shown in the table has sole voting and investment power with respect to the shares beneficially owned. Unless otherwise indicated, the address of each person named in the table below is c/o 450 Commack Road, Deer Park, New York 11729-4510.

Name of Beneficial Owner

| | Common Stock

Beneficially Owned

| | Percentage of

Common Stock(1)

| |

|---|

| Warren B. Kanders | | 2,008,523 | (2) | 40.9 | % |

| Andrew H. Meyers | | 1,077,580 | (3) | 23.6 | % |

| Gregory R. Nelson | | 241,597 | (6) | 5.4 | % |

| Oracle Partners, L.P. | | 666,667 | (4) | 13.2 | % |

| Narragansett Partners, L.P. | | 333,333 | (5) | 7.0 | % |

| Burtt R. Ehrlich | | 190,283 | (6,7) | 4.3 | % |

| Arthur Goldstein | | 84,996 | (6,8) | 1.9 | % |

| Jonathan R. Foster | | 132,236 | (6) | 3.0 | % |

| Steven Goldstein | | 100,072 | (9) | 2.2 | % |

| Joseph P. Ciavarella | | 16,666 | (10) | * | |

| Anthony J. Puglisi | | 0 | (11) | * | |

| W. Gray Hudkins | | 0 | (12) | * | |

| Directors, nominees and current and named executive officers as a group (10 persons) | | 3,851,953 | (13) | 71.6 | % |

- *

- Less than 1%

- (1)

- The applicable percentage of beneficial ownership is based on 4,397,933 shares of common stock outstanding as of the Record Date, plus, with respect to particular individuals, shares of common stock that may be acquired by exercise of stock options or other rights to acquire common stock within 60 days after the date of this proxy statement.

- (2)

- Includes 100,000 options granted to Kanders & Company, Inc., exercisable immediately, 1,491,856 shares held by Langer Partners, LLC and 416,667 shares of common stock acquirable upon conversion of notes held by Langer Partners, LLC. Mr. Kanders is the sole voting member and sole manager of Langer Partners, LLC and the sole stockholder of Kanders & Company, Inc. Does not include 240,000 options awarded to Kanders & Company, Inc., which vest in three equal annual tranches commencing November 12, 2005, or 100,000 shares of restricted stock granted to Kanders & Company, Inc., which do not vest until November 12, 2007 (or upon certain events prior to that date,see "Certain Relationships and Related Party Transactions—Consulting Agreement with Kanders & Company, Inc."), or warrants to purchase 15,000 shares which are not exercisable within the next 60 days. Does not include 98,333 shares of common stock acquirable upon conversion of $590,000 principal amount of our 4% Convertible Notes held by members of Mr. Kanders' extended family, as to which he disclaims beneficial ownership.

- (3)

- Includes 175,000 options held by Mr. Meyers which are exercisable immediately.

- (4)

- Includes 666,667 shares of common stock acquirable upon conversion of notes held in the aggregate by Oracle Partners, L.P. and its affiliates, SAM Oracle Investments, Inc., SAM Oracle Fund, Inc., Oracle Investment Management, Inc., Oracle Associates, LLC, and Larry N. Feinberg,

3

as a group. This information has been obtained from the Schedule 13G filed by Oracle Partners, L.P. and its affiliates on November 13, 2001. Excludes 2,008,523 shares of common stock beneficially owned by Warren Kanders. The entities owning the shares beneficially owned by Mr. Kanders have agreed not to sell their shares unless and until Oracle Partners, L.P. have sold 222,222 shares of common stock or $1,333,333 of 4% Convertible Subordinated Notes. The address for each of Oracle Partners, L.P. and its affiliates named above is c/o Oracle Investment Management, Inc., 200 Greenwich Avenue, Greenwich, CT 06830. Mr. Feinberg controls the entities named in this footnote.

- (5)

- Includes 333,333 shares of common stock acquirable upon conversion of notes held in the aggregate by Narragansett Partners, L.P. and its affiliates, Narragansett Offshore Ltd., Leo Holdings, LLC, and Joseph L. Dowling III, as a group. This information has been obtained from the Schedule 13G filed by Narragansett Partners, L.P. and its affiliates on November 13, 2001. The address for each of Narragansett Partners, L.P. and the affiliates named above is c/o Narragansett Asset Management, LLC, 153 East 53rd Street, New York, NY 10022. Mr. Dowling controls the entities named in this footnote.

- (6)

- Includes 43,876 options granted to each of four outside directors,i.e., Messrs. Ehrlich, Foster, Arthur Goldstein, and Nelson, which are currently exercisable. Excludes 15,000 options granted to such persons which vest in three equal annual tranches commencing November 12, 2005.

- (7)

- Includes 46,600 shares held in trust, and 8,333 shares acquirable upon conversion of notes held in trust, by Mrs. Burtt Ehrlich as Trustee for David Ehrlich, as to which Mr. Ehrlich disclaims beneficial ownership.

- (8)

- Includes 8,333 shares acquirable upon conversion of notes held by Mr. Goldstein.

- (9)

- Includes 80,000 options held by Mr. Goldstein which are exercisable immediately. Excludes 100,000 options granted to Mr. Steven Goldstein which vest in three equal annual tranches commencing November 12, 2005.

- (10)

- Includes 16,666 options held by Mr. Ciavarella which are exercisable immediately. Excludes 33,334 options granted to Mr. Ciavarella which vest in two equal annual installments commencing March 24, 2006.

- (11)

- Mr. Puglisi's employment commenced April 15, 2002, and Mr. Puglisi resigned effective February 6, 2004. Mr. Puglisi does not beneficially own any shares of our common stock.

- (12)

- Excludes 150,000 options and 40,000 shares of restricted stock granted to Mr. Hudkins, each of which vests in three equal annual tranches commencing November 12, 2005.

- (13)

- Consists of 2,871,450 shares owned of record directly or indirectly by such persons, plus 980,503 shares issuable upon exercise of stock options or conversion of notes held directly or indirectly by such persons. Excludes an aggregate of options to purchase 583,334 shares of common stock, 15,000 warrants to purchase common stock and stock awards totaling 140,000 shares that are presently unexercisable and unexercisable within the next 60 days.

We are unaware of any material proceedings to which any of our directors, executive officers or affiliates or any security holder, including any owner of record or beneficially of more than 5% of any class of our voting securities, is a party adverse to us or has a material interest adverse to us.

4

STOCK OPTION PLANS

The following table sets forth certain information regarding our equity plans at December 31, 2004.

| | (A)

| | (B)

| | (C)

| |

|---|

Plan Category

| | Number of securities to be

issued upon exercise of

outstanding options,

warrants and rights

| | Weighted-average exercise

price per share of

outstanding options,

warrants and rights

| | Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding securities

reflected in column (A))

| |

|---|

| Equity compensation plans approved by security holders | | 643,504 | (1) | $ | 3.66 | | 1,106,333 | (2) |

| Equity compensation plans not approved by security holders(3) | | 550,000 | | $ | 6.41 | | — | |

| | |

| |

| |

| |

| | Total | | 1,193,504 | | $ | 4.93 | | 1,106,333 | |

| | |

| |

| |

| |

- (1)

- Consists of stock options issued under the 1992 Stock Option Plan and the 2001 Stock Incentive Plan of the Company.

- (2)

- Consists of the shares of our common stock reserved for future issuance under the 2001 Stock Incentive Plan; if the 2005 Stock Option Plan is approved by the stockholders at the 2005 Annual Meeting and implemented, these shares will not be issued under the 2001 Stock Incentive Plan. See "Proposal 2—Approval of 2005 Stock Incentive Plan—Effective Date."

- (3)

- Consists of 10-year options granted to an affiliate of the Chairman of the Board of Directors and largest stockholder, and two executive officers. Options for 100,000 shares have fully vested, and the balance of the options vest in three equal annual tranches commencing in November 2005. The exercise prices under the options equaled the market price of the shares on the respective dates of grant.

PROPOSAL 1

ELECTION OF DIRECTORS

Number of Directors

Our Board of Directors currently consists of six directors. Our By-laws provide that our Board of Directors will consist of not less than three nor more than seven members the precise number to be determined from time to time by the Board of Directors. The number of directors has been set at six by the Board of Directors.

Our directors are elected annually at the Annual Meeting of Stockholders. Their respective terms of office continue until the next Annual Meeting of Stockholders and until their successors have been elected and qualified in accordance with our By-laws. There are no family relationships among any of our directors or executive officers. All directors were present at last year's Annual Meeting of Stockholders, but attendance of the directors at the Annual Meeting of Stockholders is not required.

Voting

Unless otherwise specified, each proxy received will be voted for the election as directors of the six nominees named below to serve until the next Annual Meeting of Stockholders and until their successors shall have been duly elected and qualified. Each of the nominees has consented to be named a nominee in this Proxy Statement and to serve as a director if elected. If any nominee becomes unable or unwilling to accept a nomination for election, the persons named in the enclosed Proxy Card will vote for the election of a nominee designated by the Board of Directors or will vote for such lesser number of directors as may be prescribed by the Board of Directors in accordance with our By-laws.

5

Biographical Information for Directors

The age and principal occupation for at least the past five years of each director nominee is set forth below.

Nominees for Director

Warren B. Kanders, 47, has been the Chairman of our Board of Directors since November 12, 2004, the date on which he became a member of our Board of Directors. Mr. Kanders is a Founder and has served as the chairman of the board of directors of Armor Holdings, Inc., a security and safety products company, which is listed on the New York Stock Exchange, since January 1996 and as its chief executive officer since April 2003. Mr. Kanders has served as a member of the board of directors of Clarus Corporation since June 2002 and as the executive chairman of Clarus Corporation's board of directors since December 2002. Mr. Kanders has also served as the executive chairman of the board of directors of Net Perceptions, Inc., since April 2004. From October 1992 to May 1996, Mr. Kanders served as Founder and Vice Chairman of the Board of Benson Eyecare Corporation, which was listed on the New York Stock Exchange. Mr. Kanders also serves as President of Kanders & Company, Inc., a private investment firm owned and controlled by Mr. Kanders that makes investments in and renders consulting services to public and private entities. Mr. Kanders received a B.A. degree in Economics from Brown University in 1979.

Andrew H. Meyers, 48, has been our President and Chief Executive Officer and a member of our Board of Directors since February 13, 2001, and initially became employed on December 28, 2000 as an advisor to the Board of Directors. He has been an executive in the orthotics and musculoskeletal industry since 1979. In the two years prior to becoming an advisor to our Board of Directors, he was an executive officer responsible for marketing, sales and strategic planning for Hanger Orthopedic Group ("Hanger"), a national provider of orthotic and prosthetic services; for more than three years prior to joining Hanger, Mr. Meyers was an executive officer responsible for clinical programs, marketing and sales of the orthotics and prosthetics division of NovaCare, Inc., an orthopedic rehabilitation company. Mr. Meyers received a Bachelor of Science degree with a major in prosthetics and orthotics from New York University in 1979 and is a Certified Orthotist/Prosthetist of the American Board for Certification in Prosthetics and Orthotics. He is a member of the American Academy of Orthotists and Prosthetists, and the International Society of Prosthetists and Orthotists.

Burtt R. Ehrlich, 65, has been a member of our Board of Directors since February 13, 2001, and is a member of our Audit Committee and our Nominating/Corporate Governance Committee. Mr. Ehrlich served as our Chairman of the Board of Directors from February 2001 until November 2004. Mr. Ehrlich has been an independent consultant for more than five years. He is a director of two other public companies, Armor Holdings, Inc. which is listed on the New York Stock Exchange, and Clarus Corporation. Mr. Ehrlich served as Chairman and Chief Operating Officer of Ehrlich Bober Financial Corp. (the predecessor of Benson Eyecare Corporation) from December 1986 until October 1992, and as a director of Benson Eyecare Corporation from October 1992 until November 1995.

Jonathan R. Foster, 46, has been a member of our Board of Directors since February 13, 2001, and is Chairman of our Compensation Committee and a member of our Audit Committee. He was President of Howard Capital Management, a money management company, from 1994 through 2004, overseeing the firm's operations and strategic development, and managing Howard Capital Management's West Coast operations. In January 2005, Howard Capital Management became a wholly owned subsidiary of E-Trade Financial, Inc. Mr. Foster is currently Vice President, Wealth Management of E-Trade Financial, Inc. In addition, he has retained his client responsibilities at Howard Capital Management.

6

Arthur Goldstein, 72, has been a member of our Board of Directors since February 13, 2001, is Chairman of our Audit Committee and a member of our Nominating/Corporate Governance Committee. He is President of AGA Associates, investment advisors, which he founded in 1986.

Gregory R. Nelson, 54, has been a member of our Board of Directors since February 13, 2001, and is a member of the Compensation Committee. Mr. Nelson is currently a financial consultant and investor. Mr. Nelson was a director of BREG, Inc., which he co-founded in 1990, until March 2004, when it was acquired by Orthofix International NV, an orthopedic device company. BREG is a diversified orthopedic products company with product lines including cold therapy, pain care products, knee bracing and soft goods. Mr. Nelson is also a co-founder of DonJoy Orthopedics, which is now known as dj Orthopedics and is a medical company specializing in rehabilitation and regeneration products.

The Board recommends that stockholders vote FOR each of the above-named Director Nominees.

CORPORATE GOVERNANCE

Corporate Governance

Our Board of Directors has a long-standing commitment to sound and effective corporate governance practices. In the first quarter of 2004, the Company's management and our Board of Directors reviewed our corporate governance practices in light of the Sarbanes-Oxley Act of 2002 and the revised listing requirements of The Nasdaq Stock Market. Based on that review, and to the extent necessary, the Board of Directors adopted codes of ethics and conduct, corporate governance guidelines, committee charters, complaint procedures for accounting and auditing matters and an Audit Committee pre-approval policy.

Corporate Governance Guidelines and Documents

Our codes of ethics and conduct, the Complaint Procedures for Accounting and Auditing Matters, the Corporate Governance Guidelines, the Audit Committee Pre-Approval Policy, and the Charters of our Audit, Compensation and Nominating/Corporate Governance Committees were adopted by the Company for the purpose of promoting honest and ethical conduct, promoting full, fair, accurate, timely and understandable disclosure in periodic reports required to be filed by the Company, and promoting compliance with all applicable rules and regulations that apply to the Company and its officers and directors. Stockholders may request, without charge, a copy of our codes of ethics and conduct, corporate governance guidelines, committee charters, complaint procedures for accounting and auditing matters and the Audit Committee pre-approval policy by submitting a written request for any of such materials to Langer, Inc., at 450 Commack Road, Deer Park, New York 11729-4510, Attn: Stockholder Communications Department.

Board of Directors

Our Board of Directors is currently comprised of the following six members: Warren B. Kanders, Andrew H. Meyers, Burtt R. Ehrlich, Jonathan R. Foster, Arthur Goldstein and Gregory R. Nelson. During fiscal 2004, the Board of Directors held four meetings. During fiscal 2004 the Board of Directors had standing Audit, Compensation and Nominating/Corporate Governance Committees. During fiscal 2004, all of the directors then in office attended at least 75% of the total number of meetings of the Board of Directors and the Committees of the Board of Directors on which they served. All members of the Company's Board of Directors attended last year's annual stockholders meeting, which was held on June 23, 2004.

7

Director Independence

In accordance with the revised listing requirements of The Nasdaq Stock Market, the Board of Directors has evaluated each of its directors' independence from the Company based on the definition of "independence" established by The Nasdaq Stock Market. Based on the Board's review and The Nasdaq Stock Market definition of "independence", the Board has determined that the Board is currently comprised of a majority of independent directors, consisting of each of the following directors: Messrs. Ehrlich, Foster, Goldstein and Nelson. The Board has also determined that each of the members of our Audit Committee is "independent" for purposes of Section 10A(m)(3) of the Securities Exchange Act of 1934, as amended (the "Exchange Act").

Audit Committee

The functions of the Audit Committee are to recommend to the Board of Directors the appointment of independent auditors, pre-approve all services to be performed by the Company's independent auditors and to analyze the reports and recommendations of such auditors. The committee also monitors the adequacy and effectiveness of our financial controls and reporting procedures and the performance of our internal audit staff and independent auditors. During fiscal 2004, the Audit Committee consisted of Messrs. Arthur Goldstein (Chairman), Ehrlich and Foster, all of whom were determined by the Board to be independent of the Company based on The Nasdaq Stock Market's definition of "independence." The Board of Directors has determined that it currently does not have an audit committee financial expert (as such term is defined under the Sarbanes-Oxley Act of 2002 and the rules and regulations promulgated thereunder) serving on its Audit Committee. However, the Board of Directors is actively looking for and considering candidates to appoint to the Board of Directors and the Audit Committee who will serve on the Audit Committee as an audit committee financial expert. The Audit Committee met 4 times and acted 7 times by unanimous written consent during fiscal 2004. The Board of Directors revised the Audit Committee charter in March 2004, and a complete copy of the charter is available for inspection at our website, LangerInc.com, at the "Investor Relations" tab.

Compensation Committee

The purpose of the Compensation Committee is to recommend to the Board of Directors the compensation and benefits of our executive officers and other key managerial personnel, and to administer our 2001 Stock Incentive Plan. During fiscal 2004, the Compensation Committee consisted of Messrs. Foster and Nelson. All of the current members of the Committee are non-management directors who meet applicable independence requirements under the rules of The Nasdaq Stock Market and qualify as "non-employee directors" within the meaning of Exchange Act Rule 16b-3 and as "outside directors" for purposes of Section 162(m) of the Internal Revenue Code. The Compensation Committee does not meet on a regular basis, but only as circumstances require. The Compensation Committee met once in 2004. A copy of the Compensation Committee's Charter is available at the Company's website, LangerInc.com, by clicking on the "Investor Relations" tab.

Nominating/Corporate Governance Committee

The purpose of the Nominating/Corporate Governance Committee is to identify, evaluate and nominate candidates for election to the Board of Directors as well as review the Company's corporate governance guidelines and other related documents for compliance with applicable laws and regulations such as the Sarbanes-Oxley Act of 2002 and The Nasdaq Stock Market's listing requirements. The Nominating/Corporate Governance Committee will consider nominees recommended by stockholders. The names of such nominees should be forwarded to Langer, Inc., c/o the Secretary, at 450 Commack Road, Deer Park, New York 11729-4510, who will submit them to the committee for its consideration. See "Requirements For Submission Of Stockholder Proposals, Nomination Of Directors And Other

8

Business Of Stockholders" for information on certain procedures that a stockholder must follow to nominate persons for election as directors.

The Nominating/Corporate Governance was established in March 2004 and replaced the Nominating Committee. Prior to the establishment of our Nominating/Corporate Governance Committee, we had a Nominating Committee consisting of Messrs. Ehrlich, Meyers and Foster. The members of the Nominating/Corporate Governance Committee are Messrs. Ehrlich, Foster and Goldstein. A copy of the Nominating/Corporate Governance Committee's Charter is available at the Company's website, LangerInc.com, by clicking on the "Investor Relations" tab.

Candidates for the Board of Directors should possess fundamental qualities of intelligence, honesty, perceptiveness, good judgment, maturity, high ethics and standards, integrity, fairness and responsibility; have a genuine interest in the Company; have no conflict of interest or legal impediment which would interfere with the duty of loyalty owed to the Company and its stockholders; and have the ability and willingness to spend the time required to function effectively as a director of the Company. The Nominating/Corporate Governance Committee may engage third-party search firms from time to time to assist it in identifying and evaluating nominees for director. The Nominating/Corporate Governance Committee evaluates nominees recommended by stockholders, by other individuals and by the search firms in the same manner, as follows. The Nominating/Corporate Governance Committee reviews biographical information furnished by or about the potential nominees to determine whether they have the experience and qualities discussed above.

Compensation of Directors

Directors who are not executive officers of the Company are compensated through the issuance of stock and stock options. However, during the year ended December 31, 2003, the directors who are not executive officers did not receive any stock or stock options except for Thomas Strauss, who received 16,330 options at an exercise price of $6.50 per share. In March 2004, each director who is not an employee of the Company received options to purchase 3,876 shares of common stock at an exercise price of $5.94 per share. In June 2004, each director who is not an employee of the Company received options to purchase 10,000 shares of common stock at an exercise price of $6.28 per share. In November 2004, each director who is not an employee or consultant, or affiliate of a consultant to the Company, received options to purchase 15,000 shares of common stock at an exercise price of $7.50 per share. On November 12, 2004, the Company entered into a consulting agreement with Kanders & Company, Inc., of which Mr. Warren B. Kanders is the principal stockholder and executive officer. On that same date, Mr. Kanders was elected to our Board of Directors and elected Chairman of the Board. For information about the compensation payable to Kanders & Company, Inc., under the consulting agreement, see "Certain Relationships and Related Transactions—Consulting Agreement with Kanders & Company, Inc." Mr. Ehrlich received compensation of $8,369 for his services as non-executive Chairman of the Board for the period from January 1, 2004 to November 12, 2004, at which time he resigned as non-executive Chairman. All Directors are reimbursed for their out-of-pocket expenses in connection with their attendance at meetings.

In December 2000, we entered into an employment agreement with Mr. Meyers, President and Chief Executive Officer of the Company, which is described in greater detail below under the heading "Employment Agreements."

Involvement in Certain Legal Proceedings

No director, executive officer, or person nominated to become a director or executive officer has, within the last five years: (i) had a bankruptcy petition filed by or against, or a receiver, fiscal agent or similar officer appointed by a court for, any business of such person or entity with respect to which such person was a general partner or executive officer either at the time of the bankruptcy or within

9

two years prior to that time; (ii) been convicted in a criminal proceeding or is currently subject to a pending criminal proceeding (excluding traffic violations or similar misdemeanors); (iii) been subject to any order, judgment or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities or practice; (iv) been found by a court of competent jurisdiction (in a civil action), the Securities and Exchange Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended or vacated.

Stockholder Communications

Stockholders may send communications to the Board by writing to the Board of Directors or any committee thereof at Langer, Inc., c/o the Secretary, 450 Commack Road, Deer Park, New York 11729-4510. The Secretary will distribute all stockholder communications to the intended recipients and/or distribute to the entire Board, as appropriate.

Other communications to the non-management directors as a group or any individual director should be in writing and addressed to the attention of the non-management directors or the individual director, as applicable, and mailed to Langer, Inc., 450 Commack Road, Deer Park, New York 11729-4510, Attn: Chairman of the Board.

Complaints, Accounting, Internal Accounting or Auditing or Related Matters.

Complaints and concerns about accounting, internal accounting controls or auditing or related matters pertaining to the Company may be submitted by writing to the Chairman of the Audit Committee as follows: Langer, Inc., 450 Commack Road, Deer Park, New York 11729-4510, c/o Chairman, Audit Committee. Complaints may be submitted on a confidential and anonymous basis by sending them in a sealed envelope marked "Confidential."

10

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The Board of Directors has appointed an Audit Committee consisting of three directors. Each of the members of the Audit Committee is independent from the Company and is financially literate as that qualification is interpreted by the Board of Directors. In 2004, the Board of Directors adopted a new written charter with respect to the Audit Committee's roles and responsibilities, a copy of which is available for inspection at the Company's website, LangerInc.com, at the "Investor Relations" tab. This charter superseded the Audit Committee charter adopted in 2001.

Management is responsible for the Company's internal controls and the financial reporting process. The external auditor is responsible for performing an independent audit of the Company's consolidated financial statements in accordance with generally accepted auditing standards and to issue a report thereon. The Audit Committee's responsibility is to monitor and oversee these processes.

- 1.

- The Audit Committee has reviewed and discussed the Company's audited financial statements as of and for the year ended December 31, 2004, with management and with Deloitte & Touche LLP, the Company's independent auditors.

- 2.

- The Audit Committee has discussed with Deloitte & Touche LLP the matters required to be discussed by SAS 61 (Codification of Statements on Auditing Standards).

- 3.

- The Audit Committee has received the written disclosures from Deloitte & Touche LLP required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and has discussed with Deloitte & Touche LLP its independence from the Company.

- 4.

- Based on the reviews and discussions referred to in paragraphs (1) through (3) above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2004 for filing with the Securities and Exchange Commission.

AUDIT COMMITTEE

Arthur Goldstein (Chair)

Burtt R. Ehrlich

Jonathan R. Foster

Principal Accountant Fees and Services

The Company is not asking the stockholders to approve the selection of the Company's principal accountants at the Annual Meeting, as the Company has not yet selected an accounting firm to serve as the Company's independent auditor for the year ending December 31, 2005.

Aggregate fees for professional services rendered for the Company by Deloitte & Touche LLP, the principal accountants of the Company for the fiscal years ended December 31, 2004 and 2003 were:

| | 2004

| | 2003

|

|---|

| Audit Fees | | $ | 242,606 | | $ | 260,398 |

| Audit Related Fees | | | 436,476 | | | 168,530 |

| Tax Fees | | | 5,009 | | | 4,624 |

| | |

| |

|

| Total | | $ | 684,091 | | $ | 433,552 |

| | |

| |

|

Audit Fees. The Audit Fees for the years ended December 31, 2004 and 2003, respectively, were for professional services rendered for the audit of the Company's consolidated financial statements for

11

the fiscal years ended December 31, 2003 and 2002, as applicable, and for the review of the Company's consolidated financial statements included in the Company's quarterly reports on Form 10-Q for fiscal 2003 and 2002, as applicable. In addition, the Audit Fees also include fees for services rendered to us by Deloitte & Touche LLP for statutory and subsidiary audits, issuance of comfort letters, consents, income tax provision procedures and assistance with review of documents filed with the Commission.

Audit Related Fees. The Audit Related Fees as of the fiscal years ended December 31, 2004 and 2003, respectively, were for assurance and related services related to employee benefit plan audits, due diligence related to proposed or completed mergers and acquisitions, accounting consultations and audits in connection with acquisitions, due diligence in connection with the filing of a Registration Statement on Form S-1, internal control reviews, attest services that are not required by statute or regulation, and consultations concerning financial accounting and reporting standards.

Tax Fees. Tax Fees for the fiscal years ended December 31, 2004 and 2003, respectively, were for services related to tax compliance, including the preparation of tax returns and claims for refund, tax planning and advice, including assistance with and representation in tax audits and appeals, advice related to proposed or completed mergers and acquisitions, tax services for employee benefit plans, and requests for rulings or technical advice from tax authorities.

All Other Fees. All Other Fees as of the years ended December 31, 2004 and 2003, respectively, were for services rendered for information technology consulting.

Auditor Independence. The Audit Committee has considered the non-audit services provided by Deloitte & Touche LLP and determined that the provision of such services had no effect on Deloitte & Touche LLP's independence from the Company.

Audit Committee Pre-approval Policy and Procedures. The Audit Committee has adopted a Pre-approval Policy for all Audit Services, Audit Related Services, Tax Services and All Other Services to be rendered by Deloitte & Touche LLP to the Company. Pursuant to the Pre-approval Policy, all services to be performed by the Company's independent auditor must be pre-approved by the Audit Committee. Any proposed services exceeding the pre-approved cost levels or other limitations must be specifically pre-approved by the Audit Committee. The Audit Committee may delegate to a majority of the Audit Committee authority to grant pre-approvals of audit and permitted non-audit services, provided that decisions of such subcommittee to grant pre-approvals shall be presented to the full Audit Committee at its next scheduled meeting. Since the adoption of the Pre-approval Policy by the Audit Committee on March 24, 2004, the Audit Committee has not waived the pre-approval requirement for any service other than audit, review or attest services rendered to the Company by Deloitte & Touche LLP. All Audit Related Fees, Tax Fees and All Other Fees for 2004 and 2003 were pre-approved by the Audit Committee.

12

EXECUTIVE OFFICERS OF THE COMPANY

The following table sets forth the name, age and position of each of the Company's executive officers and significant employees as of April 19, 2005. The executive officers of the Company are appointed by and serve at the discretion of the Board of Directors of the Company.

Name

| | Age

| | Position

|

|---|

| Andrew H. Meyers | | 48 | | President and Chief Executive Officer |

| W. Gray Hudkins | | 29 | | Chief Operating Officer |

| Steven Goldstein | | 39 | | Executive Vice President |

| Joseph P. Ciavarella | | 49 | | Vice President, Chief Financial Officer and Secretary |

See the table of nominees for election as directors for biographical information about Mr. Meyers.

W. Gray Hudkins became our Chief Operating Officer effective as of October 1, 2004. Mr. Hudkins served as Director of Corporate Development for Clarus Corporation from December 2002 until September 2004, as a Principal in Kanders & Company, Inc. from December 2003 until September 2004, and as Director of Corporate Development for Net Perceptions, Inc. from April 2004 until September 2004. Prior to this, from February 2002 until December 2002, Mr. Hudkins served as Manager of Financial Planning and Development for Bay Travelgear, Inc., a branded consumer products company based in New York and Chicago. From April 2000 until February 2002, Mr. Hudkins served as an Associate at Chartwell Investments LLC, a New York based private equity firm, and from August 1999 until April 2000, Mr. Hudkins served as an Associate at Saunder, Karp & Megrue L.P., a private merchant bank based in Stamford, CT. Mr. Hudkins graduated cum laude with an A.B. in Economics and a Certificate in Germanic Language and Literature from Princeton University in 1997.

Steven Goldstein has been Executive Vice President since June 2003, Vice President since February 13, 2001, and has been an employee of ours since December 28, 2000. As Executive Vice President, Mr. Goldstein is primarily responsible for sales and marketing. Mr. Goldstein was a Vice President of Clinical Sales and Marketing for Hanger Orthopedic Group, a national provider of orthotic and prosthetic services, from July 1999 until he joined us in December 2000. Mr. Goldstein received a Certificate in Orthotics from the Northwestern University Prosthetics-Orthotics Center in 1987, and a Certificate in Prosthetics from the Northwestern University Prosthetics-Orthotics Center in 1988. He received a degree of Associate in Applied Science in Orthotic Technology from Dutchess Community College in New York in 1988, and he became a Certified Orthotist of the American Board for Certification in Orthotics and Prosthetics, Inc., in 1990.

Joseph P. Ciavarella became our Vice President and Chief Financial Officer on February 16, 2004 and became our Secretary on March 25, 2005. From August 2002 until he joined us, Mr. Ciavarella was the Chief Financial Officer of New York Medical, Inc., a medical practice management company, and from 1998 through July 2002, he was Senior Vice President—Finance of Aviation Capital Group, an independent aircraft leasing and finance company that became a subsidiary of Pacific Life Insurance Company. Mr. Ciavarella received a Bachelor of Business Administration degree from Hofstra University, Hempstead, New York, in 1977, and became a Certified Public Accountant in 1979.

13

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth information with respect to the compensation paid or awarded by us to the Chief Executive Officer and our other most highly compensated executive officers whose annual salary and bonus for the year ended December 31, 2004 exceeded $100,000 (collectively, the "Named Executive Officers"). During 2004, we named Mr. W. Gray Hudkins as our Chief Operating Officer and Mr. Joseph P. Ciavarella succeeded Mr. Anthony Puglisi as our Chief Financial Officer. Our employment agreements with each of our executive officers are described below.

| |

| | Annual Compensation

| | Long-Term Compensation:

|

|---|

Name and Principal Position

| | Fiscal Year

Ended Dec. 31,

| | Salary ($)

| | Bonus ($)

| | Other Annual

Compensation

(3) ($)

| | Restricted

Stock

Awards ($)

| | Common Stock

Underlying

Options (#)

|

|---|

Andrew H. Meyers(1)

President and Chief Executive Officer | | 2004

2003

2002 | | 175,000

178,365

173,664 | | 50,000

—

115,000 |

(2)

| —

—

— | | —

—

— | | —

—

— |

Steven Goldstein(4)

Vice President |

|

2004

2003

2002 |

|

254,519

166,827

151,331 |

|

—

75,000

60,000 |

|

—

—

— |

|

—

—

— |

|

100,000

—

— |

Anthony J. Puglisi(5)

Vice President and Chief Financial Officer |

|

2004

2003

2002 |

|

27,849

178,365

117,945 |

|

—

25,000 |

|

—

—

— |

|

—

—

— |

|

—

—

90,000 |

W. Gray Hudkins(6)

Chief Operating Officer |

|

2004 |

|

50,000 |

|

— |

|

— |

|

300,000 |

|

150,000 |

Joseph P. Ciavarella(7)

Vice President, Secretary and Chief Financial Officer |

|

2004 |

|

134,135 |

|

60,000 |

|

— |

|

— |

|

50,000 |

- (1)

- Mr. Meyers' employment commenced on December 28, 2000 in an unpaid capacity as an advisor to the Board of Directors, and his official duties as President and Chief Executive Officer, and his compensation, commenced on February 13, 2001.

- (2)

- We may make a bonus payment to Mr. Meyers for the year ended December 31, 2003 of up to $150,000, which has been accrued for such year; however, the amount of such bonus to be paid has not yet been determined.

- (3)

- In accordance with the rules of the SEC, the annual compensation described in this table does not include various perquisites and other personal benefits received by our named executive officers that do not exceed, in the aggregate, the lesser of $50,000 or 10% of any such officer's salary and bonus disclosed in this table.

- (4)

- Mr. Goldstein's employment commenced December 28, 2000. Mr. Goldstein became Executive Vice President in June 2003.

- (5)

- Mr. Puglisi's employment commenced April 15, 2002, and Mr. Puglisi resigned effective February 6, 2004.

- (6)

- Pursuant to Mr. Hudkins' employment agreement, he receives an annual base salary of $200,000.

- (7)

- Pursuant to Mr. Ciavarella's employment agreement, he received a base salary at the annual rate of $155,000 in 2004. Effective January 1, 2005, his annual base salary is $200,000.

14

Employment Agreements

On November 16, 2004, we agreed to extend our employment agreement with Andrew H. Meyers, our President and Chief Executive Officer, for an additional year to December 31, 2005, and to modify certain other provisions of his employment agreement. The agreement, as amended, provides for a base salary of $175,000, participation in incentive or bonus plans at the discretion of our Board of Directors and maintenance of a $1 million life insurance policy for Mr. Meyers' beneficiary. Mr. Meyers would be entitled to receive payment of $300,000 over a period of one year in addition to any accrued and unpaid obligations of Langer if we terminate his agreement without "cause", he terminates for "good reason", or in the event of a "change of control" of Langer, as such terms are defined in the agreement. Mr. Meyers also agreed to certain confidentiality and non-competition provisions and certain limitations on his ability to sell or transfer his shares of common stock or options for the purchase of common stock.

On November 16, 2004, we entered into an employment agreement with W. Gray Hudkins, effective as of October 1, 2004, that provides that he will serve as our Chief Operating Officer for a term expiring on October 1, 2007. The agreement provides for a base salary of $200,000, participation in incentive and bonus plans at the discretion of our Board of Directors, ten-year options to purchase up to 150,000 shares of our common stock at an exercise price of $7.50 per share, vesting in three equal annual installments commencing on November 12, 2005, and maintenance of a $1 million life insurance policy for Mr. Hudkins' beneficiary. Mr. Hudkins also received 40,000 shares of restricted stock which vest in three equal annual installments commencing November 12, 2005. Mr. Hudkins has also agreed to certain confidentiality, non-competition, and non-solicitation provisions. In the event Mr. Hudkins is terminated by us without "cause," he is entitled to receive his base compensation, which may be payable at our option in cash or shares of our common stock, for a period of six months from the date of such termination.

On November 16, 2004, we entered into a new employment agreement with Steven Goldstein, effective as of January 1, 2004, that provides that he will serve as our Executive Vice President for a term expiring on January 1, 2007. The agreement provides for a base salary of $250,000, participation in incentive and bonus plans at the discretion of our Board of Directors, ten-year options to purchase up to 100,000 shares of our common stock at an exercise price of $7.50 per share, vesting in three equal annual installments commencing on November 12, 2005, and maintenance of a $1 million life insurance policy for Mr. Goldstein's beneficiary. Mr. Goldstein also receives a car allowance of $500 a month. Mr. Goldstein has also agreed to certain confidentiality, non-competition, and non-solicitation provisions. In the event Mr. Goldstein is terminated by us without "cause", he is entitled to receive his base compensation, which may be payable at our option in cash or shares of our common stock, for a period of six months from the date of such termination.

We entered into an employment agreement with Joseph P. Ciavarella, effective as of February 16, 2004, that provides he will serve as our Chief Financial Officer. The agreement initially provided for a base salary of $155,000, participation in incentive and bonus plans at the discretion of our Board of Directors, ten-year options to purchase up to 50,000 shares of our common stock at an exercise price of $5.94 per share, vesting in three equal annual installments commencing on March 24, 2005. Effective January 1, 2005, his annual base salary was increased to $200,000 per year. The agreement may be terminated by either Mr. Ciavarella or us upon 30 days' prior written notice. Mr. Ciavarella has also agreed to certain confidentiality, non-competition, and non-solicitation provisions. In the event Mr. Ciavarella is terminated by us without "cause" following the first anniversary of his agreement, he will be entitled to receive his base compensation for period of six months from the date of termination.

15

2001 Stock Incentive Plan

Our 2001 Stock Incentive Plan was adopted by our Board of Directors on February 23, 2001 and was approved by our stockholders on July 17, 2001. The purpose of the plan is to attract and retain valuable employees by giving them the opportunity to acquire a proprietary interest in our common stock and thereby strengthen their commitment to the company and align their interests with our stockholders. The plan provides for the grant of incentive stock options, nonqualified stock options, restricted stock awards and stock bonuses to our and our subsidiaries' and affiliates' employees, officers, directors, consultants, independent contractors and advisors. The maximum number of shares of our common stock available for issuance under the plan is 1,500,000 shares. However, we may not grant awards under the plan to the extent that the total outstanding awards granted under the plan plus the total number of outstanding awards granted under our 1992 Stock Incentive Plan exceeds 15% of our total number of shares of common stock outstanding.

The plan provides for its administration by either a committee consisting solely of two or more outside directors or the Board of Directors. Such administrator, in its sole discretion, determines which eligible employees, officers, directors, consultants, independent contractors and advisors may participate in the plan and the type, extent and terms of the equity-based awards to be granted to them.

The exercise price of incentive stock options must be at least equal to the fair market value of our common stock on the date of grant. The exercise price of incentive stock options granted to 10% stockholders must be at least equal to 110% of that value. The exercise price of nonqualified stock options may be above or below the fair market value of our common stock on the date of grant as determined by the plan administrator. The maximum term of options granted under the plan is ten years. Awards granted under the plan may not be transferred in any manner other than by will or by the laws of descent and distribution, except as determined by the plan administrator, and may be exercised during the lifetime of the optionee only by the optionee (unless otherwise determined by the plan administrator and set forth in the award agreement with respect to awards that are nonqualified stock options). Options granted under the plan generally expire three months after the termination of the optionee's service, except in the case of death or disability, in which case the options generally may be exercised up to 12 months following the date of death or termination of service. Options will generally terminate immediately upon termination for cause.

The plan administrator may make grants of restricted stock for cash or other consideration, as the plan administrator determines in its discretion. The number of shares of common stock granted to each grantee will be determined by the plan administrator. Grants of restricted stock will be made subject to such restrictions and conditions as the plan administrator may determine in its sole discretion, including periods of restriction on transferability during which time the stock certificates representing the shares subject to the award may be required to be deposited with an escrow agent.

A stock bonus is an award of shares of common stock (which may consist of restricted stock) for past or future services rendered. Stock bonuses and the criteria they are based upon will be determined by the plan administrator in its discretion.

Upon a "change of control event" (as defined in the plan), all outstanding awards under the plan may be substituted by the successor corporation (if any). In addition, the plan administrator may, in its discretion, provide for the accelerated vesting of awards granted under the plan to occur immediately prior to the consummation of a change of control transaction. In the event of a stock dividend, recapitalization, stock split, reclassification or other specified events affecting us or shares of our common stock, appropriate and equitable adjustments may be made to the number and kind of shares of our common stock available for grant, as well as to the maximum share limitation under the plan, and the number and kind of shares of our common stock or other rights and prices under outstanding awards.

16

The Board has the right to amend or terminate the plan at any time, provided that no amendment or change in the plan that requires stockholder approval will be effective until such approval is obtained.

As of March 31, 2005, there were 386,167 shares of our common stock issued and outstanding or otherwise reserved for issuance pursuant to awards granted under the plan, leaving 1,113,833 shares remaining available, subject to plan limitations, for issuance pursuant to future grants under the plan.

As discussed in "Proposal 2—Approval and Adoption of 2005 Stock Incentive Plan," if the 2005 Stock Incentive Plan is approved by the stockholders at the Annual Meeting and thereafter becomes effective, the Company's 2001 Plan will be frozen and no further awards will be made under the 2001 Plan. The 381,104 shares of Common Stock subject to or reserved for issuance pursuant to outstanding options or other awards granted under the 2001 Plan prior to the effective date of the 2005 Incentive Plan will remain available or reserved for issuance under the 2001 Plan, and the 2001 Plan will remain in effect after the effective date of the 2005 Incentive Plan to the extent necessary to administer options and other awards previously granted under the 2001 Plan. If and when the 2005 Stock Incentive Plan is approved and becomes effective, the other 1,113,833 shares of Common Stock reserved for grant under the 2001 Plan but not reserved for outstanding options and other outstanding awards will be released from reserve.

Aggregate Option Exercises in 2004 Year and 2004 Year End Option Values

The table below sets forth information regarding unexercised options held by our Named Executive Officers as of December 31, 2004. There were no options exercised by our executive officers during the year ended December 31, 2004.

| | Number of Shares

of Common Stock

Underlying Unexercised

Options At Fiscal Year End

| |

| |

|

|---|

| | Value of Unexercised

In-The-Money Options

At Fiscal Year End(1)

|

|---|

Name

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Andrew H. Meyers | | 175,000 | | — | | $ | 942,375 | | $ | — |

| Joseph P. Ciavarella | | — | | 50,000 | | $ | — | | $ | 48,500 |

| W. Gray Hudkins | | — | | 150,000 | | $ | — | | $ | — |

| Steven Goldstein | | 80,000 | | 100,000 | | $ | 430,800 | | $ | — |

| Anthony J. Puglisi | | — | | — | | $ | — | | $ | — |

- (1)

- The closing bid price of the Company's Common Stock as reported by The Nasdaq SmallCap Market on December 31, 2004 was $6.91. Value is calculated on the difference between the option exercise price of in-the-money options and such closing price, multiplied by the number of shares of Common Stock underlying the option.

17

Options Granted in Fiscal 2004

We granted the following options to our Named Executive Officers during fiscal 2004.

| | Individual Grants

| | Potential Realizable

Value at Assumed

Annual Rates

of Stock Price

Appreciation for

Option Term

|

|---|

| | Number of

Securities

Underlying

Options

Granted (#)

| | Percent of

Total Options

Granted to

Employees in

Fiscal Year

| |

| |

|

|---|

Name

| | Exercise or

Base Price

($/Share)

| | Expiration

Date

|

|---|

| | 5% ($)

| | 10% ($)

|

|---|

| Joseph P. Ciavarella | | 50,000 | (1) | 14.8 | % | 5.94 | | 3/24/14 | | 186,782 | | 473,342 |

| Steven Goldstein | | 100,000 | (2) | 29.6 | % | 7.50 | | 11/12/14 | | 471,671 | | 1,195,307 |

| W. Gray Hudkins | | 150,000 | (3) | 44.4 | % | 7.50 | | 11/12/14 | | 707,506 | | 1,792,960 |

- (1)

- Options to purchase 50,000 shares of common stock become exercisable in three equal annual installments commencing March 24, 2005.

- (2)

- Options to purchase 100,000 shares of common stock become exercisable in three equal annual installments commencing November 12, 2005.

- (3)

- Options to purchase 150,000 shares of common stock become exercisable in three equal annual installments commencing November 12, 2005.

Compensation Committee Interlocks and Insider Participation

Messrs. Foster and Nelson served on the Compensation Committee in the year ended December 31, 2004. Mr. Meyers, as our President and Chief Executive Officer, was not "independent" as required by the standards for independence of The Nasdaq Stock Market, and resigned from the Committee in March 2004, before the Committee held any meetings or took any action in 2004. During the year ended December 31, 2004, none of our executive officers (a) served as a member of the Compensation Committee (or other board of directors committee performing similar functions or, in the absence of any such committee, the board of directors) of another entity, one of whose executive officers served on our Compensation Committee, (b) served as director of another entity, one of whose executive officers served on our Compensation Committee, or (c) served as member of the Compensation Committee (or other board of directors committee performing similar functions or, in the absence of any such committee, the board of directors) of another entity, one of whose executive officers served as one of our directors.

18

REPORT ON EXECUTIVE COMPENSATION

BY THE COMPENSATION COMMITTEE

Overview

The Compensation Committee of the Board of Directors assists the Board in establishing compensation packages for the Company's executive officers and non-employee directors and administering the Company's incentive plans. The Compensation Committee has the authority to retain and terminate any independent compensation consultant and to obtain independent advice and assistance from internal and external legal, accounting and other advisors. From time to time, the Compensation Committee reviews our compensation packages to ensure that they remain competitive with the compensation packages offered by similarly-situated companies and continue to incentivize management and align management's interests with those of our stockholders. The Compensation Committee is comprised of two independent directors. Each member of the Compensation Committee meets the independence requirements specified by the NASDAQ and by Section 162(m) of the Internal Revenue Code of 1986, as amended.

Compensation Policy

The Compensation Committee of the Board of Directors is responsible for setting and administering the policies which govern annual executive salaries, raises and bonuses and certain awards of stock options, restricted stock and common stock, and such responsibility is generally limited to the actions taken by the Compensation Committee of the Board of Directors, although a majority of the Board's independent directors may determine and recommend annual executive salaries, raises and bonuses as well as grants of stock options and common stock without having first received recommendations from the Compensation Committee. The general philosophy of our executive compensation program is to attract and retain talented management while ensuring that our executive officers are compensated in a way that advances the interests of our stockholders. In pursuing this objective, the Compensation Committee believes that it is critical that a substantial portion of each executive officer's compensation be contingent upon our overall performance. The Compensation Committee is also guided by the principle that our compensation packages must be competitive, must support our overall strategy and objectives, and must provide significant rewards for outstanding financial performance while establishing clear consequences for underperformance. Annual bonuses and long-term awards for our executive officers should take into account not only objective financial goals, but also individual performance goals that reinforce our core values, which include leadership, accountability, ethics and corporate governance. It is the Compensation Committee's responsibility to make recommendations to the Board with respect to Chief Executive Officer compensation and either alone or with the other independent members of our Board, to determine and approve our Chief Executive Officer's compensation. In addition, the Compensation Committee periodically reviews our incentive compensation and other stock-based compensation programs and recommends changes in such plans to the Board as needed.

In determining the compensation packages for our executive officers, and non-employee directors, the Compensation Committee and the Board of Directors have evaluated the history and performance of the Company, previous compensation practices and packages awarded to the Company's executive officers and non-employee directors, and what other companies might pay the executive officers and non-employee directors for his or her services.

Compensation Program Components

Our executive compensation program emphasizes company performance, individual performance and an increase in stockholder value over time in determining executive pay levels. Our executive compensation program consists of three key elements: (i) annual base salaries; (ii) a performance-based

19

annual bonus; and (iii) periodic grants of stock options and restricted stock. The Compensation Committee believes that this three-part approach best serves our stockholders' interests by motivating executive officers to improve our financial position, holding executives accountable for the performance of the organizations for which they are responsible and by attracting key executives into our service. Under our compensation program, annual compensation for executive officers are composed of a significant portion of pay that is "at risk"—specifically, the annual bonus and stock options and restricted stock. The Compensation Committee believes that these "at risk" awards align the interests of our executive officers with the interests of our stockholders since the grant of these awards relate directly to stock price appreciation realized by all our stockholders.

Base Salary. In reviewing and approving the base salaries of our executive officers, the Compensation Committee considers the scope of work and responsibilities, past and current contributions and performance to the Company, and other individual-specific factors; the recommendation of the Chief Executive Officer (except in the case of his own compensation); a determination of what other companies might pay the executive for his or her services; and the executive's experience. Except where an existing agreement establishes an executive's salary, the Compensation Committee reviews executive officer salaries annually at the end of the fiscal year and establishes the base salaries for the upcoming fiscal year.

Annual Cash Bonus. In reviewing and approving the performance-based annual bonus for our executive officers, the Compensation Committee considers an executive's contribution to the overall performance of the Company and attainment of any milestones or performance targets which may be set by the Board from time to time.

Stock Options and Restricted Stock. Executive officers of the Company and other key employees who contribute to the growth, development and financial success of the Company are eligible to be awarded stock options and restricted stock to purchase our common stock, shares of restricted common stock, and bonuses of shares of common stock under our 2001 Stock Incentive Plan (and, if approved by the stockholders at the 2005 Annual Meeting and implemented, under the 2005 Stock Incentive Plan (see "Proposal 2—Consideration and Approval of 2005 Stock Incentive Plan")). Awards under our 2001 Stock Incentive Plan help relate a significant portion of an employee's long-term remuneration directly to stock price appreciation realized by all our stockholders and aligns an employee's interests with that of our stockholders. The Compensation Committee believes equity-based incentive compensation aligns executive and stockholder interests because (i) the use of a multi-year vesting schedule for equity awards encourages executive retention and emphasizes long-term growth, and (ii) paying a significant portion of management's compensation in our equity provides management with a powerful incentive to increase stockholder value over the long term. The Compensation Committee determines appropriate individual long-term incentive awards in the exercise of its discretion in view of the above criteria and applicable policies.

Compensation of Chief Executive Officer and President

As Chief Executive Officer and President, Mr. Meyers is compensated pursuant to an employment agreement entered into in December 2000, as amended to date. Under the terms of his employment agreement, Mr. Meyers is entitled, at the discretion of the Board of Directors, to performance bonuses which may be based upon a variety of factors and to participate in our stock incentive plans and other bonus plans based on his performance and the Company's performance. For the year ended December 31, 2004, Mr. Meyers received a base salary of $175,000 pursuant to his employment agreement. In addition, the Company awarded Mr. Meyers a cash bonus of $50,000 in recognition of his efforts throughout the year.

20

Section 162(m) of the Internal Revenue Code

Section 162(m) of the Internal Revenue Code generally disallows a tax deduction to public corporations for compensation, other than performance-based compensation, over $1,000,000 paid for any fiscal year to an individual who, on the last day of the taxable year, was (i) the chief executive officer or (ii) among the four other highest compensated executive officers whose compensation is required to be reported in the Summary Compensation Table contained in the company's proxy statement. Compensation programs generally will qualify as performance-based if (1) compensation is based on pre-established objective performance targets, (2) the programs' material features have been approved by stockholders, and (3) there is no discretion to increase payments after the performance targets have been established for the performance period. The Compensation Committee desires to maximize deductibility of compensation under Section 162(m) of the Internal Revenue Code to the extent practicable while maintaining a competitive, performance-based compensation program. However, the Compensation Committee also believes that it must reserve the right to award compensation which it deems to be in our best interest and our stockholders' best interest but which may not be tax deductible under Section 162(m) of the Internal Revenue Code.

21

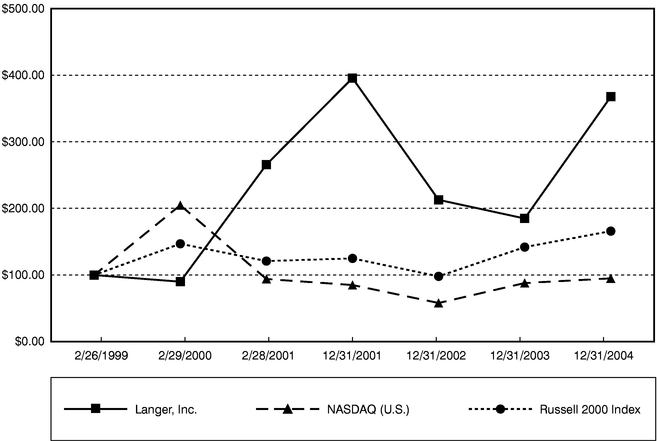

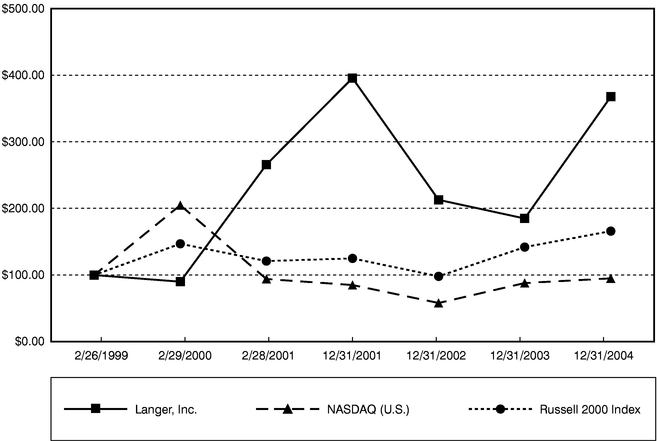

Performance Graph

The following graph compares the performance of an investment of $100 in the Company's Common Stock with the performance of an investment of $100 in the NASDAQ (U.S.) Index and the Russell 2000 Index, for the period from February 26, 1999, through December 31, 2004. The stock price performance shown on the graph is not necessarily indicative of future price performance.

The comparisons in the chart below are based upon historical data and are not indicative of, nor intended to forecast, future performance of the Company's common stock.

| | 12/31/04

| | 12/31/03

| | 12/31/02

| | 12/31/01

| | 2/28/01

| | 2/29/00

| | 2/26/99

|

|---|

| Langer, Inc. | | $ | 368 | | $ | 185 | | $ | 213 | | $ | 396 | | $ | 266 | | $ | 90 | | $ | 100 |

| NASDAQ (U.S.) | | | 95 | | | 88 | | | 58 | | | 85 | | | 94 | | | 205 | | | 100 |

| Russell 2000 Index | | | 166 | | | 142 | | | 98 | | | 125 | | | 121 | | | 147 | | | 100 |

22

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS