UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the year ended December 31, 2006

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File No. 0-12991

LANGER, INC.

(Exact name of registrant as specified in its charter)

Delaware | 11-2239561 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. employer identification number) |

450 Commack Road, Deer Park, New York 11729-4510

(Address of principal executive offices) (Zip code)

Registrant’s telephone number, including area code: (631) 667-1200

Securities registered pursuant to Section 12(b) of the Act: NONE

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.02 per share

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to section 13 or Section 15(d) of the Exchange Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer (as defined in Rule 12b-2 of the Exchange Act).

Large accelerated filer o Accelerated filer o Non-accelerated filer x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act):

Yes o No x

As of June 30, 2006 (i.e., the last day of registrant’s most recently completed second quarter), the aggregate market value of the common equity held by non-affiliates of the registrant was $31,706,555, as computed by reference to the closing sale price on the NASDAQ Global Market of such common stock ($4.10) multiplied by the number of shares of voting stock outstanding on June 30, 2007 held by non-affiliates (7,733,306 shares). Exclusion of shares from the calculation of aggregate market value does not signify that a holder of any such shares is an “affiliate” of the Company.

The number of shares of the registrant’s common stock outstanding at March 15, 2007 was 11,450,915 shares.

Explanatory Note: This Form 10-K/A, Amendment No. 1, is being filed in order to add additional information to Part II, Item 5, and to add the information required by Part III, which was originally intended to be incorporated into the Annual Report on Form 10-K for the year ended December 31, 2006, by reference to the information to be included in the Company's Proxy Statement for the 2007 Annual Meeting of Stockholders. Except as set forth herein, there are no further changes to the Company's previously filed Annual Report on Form 10-K for the year ended December 31, 2006.

PART II

Item 5. Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Item 5 is amended by adding the following information.

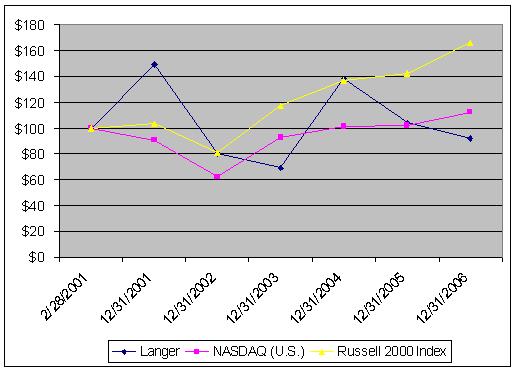

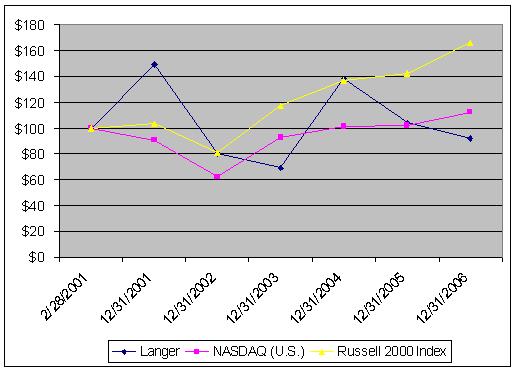

The following graph compares the cumulative total stockholder return (stock price appreciation) of our Common Stock with the cumulative return (including reinvested dividends) of the NASDAQ (U.S.) Index and the Russell 2000 Index, for the period from January 1, 2002, through December 31, 2006. The stock price performance shown on the graph is not necessarily indicative of future price performance. The Company considered providing a comparison consisting of a group of peer companies in an industry or line-of-business similar to ours, but we could not identify a group of reasonably comparable companies that we believe would provide our stockholders with a meaningful comparison. The comparisons in the chart below are based upon historical data and are not indicative of, nor intended to forecast, future performance of the Company’s common stock.

| | | 12/31/06 | | 12/31/05 | | 12/31/04 | | 12/31/03 | | 12/31/02 | | 12/31/01 | | 02/28/01 | |

Langer, Inc. | | $ | 92 | | $ | 104 | | $ | 138 | | $ | 69 | | $ | 80 | | $ | 149 | | $ | 100 | |

NASDAQ (U.S.) | | | 112 | | | 102 | | | 101 | | | 93 | | | 62 | | | 91 | | | 100 | |

Russell 2000 Index | | | 166 | | | 142 | | | 137 | | | 117 | | | 81 | | | 103 | | | 100 | |

PART III

Item 10. Directors, Executive Officers and Corporate Governance.

(i) Set forth below are the names of the persons who are the directors of Langer, Inc., their ages and respective business backgrounds, including directorships of other public companies:

Warren B. Kanders, 49, has been a Director and Chairman of our Board of Directors since November 12, 2004. Mr. Kanders is a Founder and has served as the chairman of the board of directors of Armor Holdings, Inc., a security and safety products company listed on the Nasdaq Global Market, since January 1996, and has served as its Chief Executive Officer since April 9, 2003. Mr. Kanders has served as a member of the Board of Directors of Clarus Corporation since June 2002 and as the Executive Chairman of Clarus Corporation’s Board of Directors since December 2002, as the Executive Chairman of the Board of Net Perceptions, Inc. since April 2004. From October 1992 to May 1996, Mr. Kanders served as Founder and Vice Chairman of the Board of Benson Eyecare Corporation. Mr. Kanders also serves as President of Kanders & Company, Inc., a private investment firm owned and controlled by Mr. Kanders that makes investments in and renders consulting services to public and private entities. Mr. Kanders received a B.A. degree in Economics from Brown University in 1979.

Peter A. Asch, 46, became a director of the Company on January 23, 2007, immediately following our acquisition of Twincraft, Inc., from Mr. Asch and the other former holders of the Twincraft capital stock. The appointment of Mr. Asch to the Board of Directors was a condition to the closing of the acquisition. Mr. Asch serves as the President of Twincraft and of our personal care products division, and has been the chief executive officer of Twincraft since 1995. Mr. Asch graduated with a B.S. in Political Science and International Relations from Queen’s University, located in Kingston, Ontario, in 1983.

Stephen M. Brecher, 67, has been a member of our Board of Directors since May 1, 2006 and is Chairman of our Audit Committee. In February 2006, he joined the certified public accounting firm of Weiser LLP as a Senior Advisor. Mr. Brecher was an independent consultant from April 2005 to January 2006 and was a principal of XRoads Solutions Group, an international consulting firm from September 2001 to March 2005. Prior thereto, he spent 33 years at KPMG LLP, a certified public accounting firm, 26 years as a tax partner specializing in international banking. Mr. Brecher is a CPA and attorney and a member of the New York State Bar. He also served as a member of the board of directors of Refco, Inc., a public company, from January 2006 through December 2006. Mr. Brecher also serves as a member of the Board of Directors and Chairman of the Audit Committee of Societe General, F.S.B. The Board of Directors has identified Mr. Brecher as the audit committee financial expert under the listing requirements of the Nasdaq Global Market and has determined that Mr. Brecher is independent of Langer based on the Nasdaq Global Market’s definition of "independence".

Burtt R. Ehrlich, 67, has been a member of our Board of Directors since February 13, 2001, and is a member of out Audit Committee, our Compensation Committee and our Nominating/Corporate Governance Committee. Mr. Ehrlich served as our Chairman of the Board of Directors from February 2001 until November 2004. Mr. Ehrlich has served as a member of the board of directors of Armor Holdings, Inc., a security and safety products company listed on the Nasdaq Global Market, since January 1996. Mr. Ehrlich has served as a member of the Board of Directors of Clarus Corporation since June 2002. Mr. Ehrlich served as Chairman and Chief Operating Officer of Ehrlich Bober Financial Corp. (the predecessor of Benson Eyecare Corporation) from December 1986 until October 1992, and as a director of Benson Eyecare Corporation from October 1992 until November 1995.

Arthur Goldstein, 74, has been a member of our Board of Directors since February 13, 2001, and is a member of our Audit Committee and our Nominating/Corporate Governance Committee. He is President of AGA Associates, investment advisors, which he founded in 1986.

Stuart P. Greenspon, 64, has been a member of our Board of Directors since November 8, 2005 and is a member of our Compensation Committee. Mr. Greenspon has been an independent business consultant for more than 10 years. Prior to that, he was an owner and operating officer of Call Center Services, Inc. from 1990 to 1995 and of Pandick Technologies, Inc. from 1982 to 1989.

W. Gray Hudkins, 31, became our Chief Operating Officer effective as of October 1, 2004 and our President and Chief Executive Officer effective January 1, 2006. He became a director of the Company in June 2006. Mr. Hudkins served as Director of Corporate Development for Clarus Corporation from December 2002 until September 2004, as a principal in Kanders & Company, Inc. from December 2003 until September 2004, and as Director of Corporate Development for Net Perceptions, Inc. from April 2004 until September 2004. Prior to this, from February 2002 until December 2002, Mr. Hudkins served as Manager of Financial Planning and Development for Bay Travelgear, Inc., a branded consumer products company based in New York and Chicago. From April 2000 until February 2002, Mr. Hudkins served as an associate at Chartwell Investments LLC, a New York based private equity firm, and from August 1999 until April 2000, Mr. Hudkins served as an associate at Saunder, Karp & Megrue L.P., a private merchant bank based in Stamford, Connecticut. Mr. Hudkins graduated cum laude with an A.B. in Economics and a Certificate in Germanic Language and Literature from Princeton University in 1997.

The terms of all directors expire at the time of the next annual meeting of stockholders of the Company, which is expected to be held on June 20, 2007. There are no family relationships among the directors and/or the executive officers identified in paragraph (ii) of this Item 10. Except as described above with respect to Mr. Asch, there are no arrangements pursuant to which any person is to be elected as a director.

(ii) The following table sets forth the name, age and position of each of our executive officers as of April 26, 2007. Our executive officers are appointed by and serve at the discretion of the Board of Directors of Langer.

Name | | Age | | Position |

| W. Gray Hudkins | | 31 | | President and Chief Executive Officer, and Director |

| Peter A. Asch | | 46 | | President of Twincraft, Inc., President of our personal care products division, and Director |

| Kathryn P. Kehoe | | 51 | | Senior Vice President |

Information about Messrs. Hudkins and Asch is set forth in paragraph (i) of this Item 10. Ms. Kehoe's business background is as follows:

Kathryn P. Kehoe joined the Company in January 2006 and became our Senior Vice President in June 2006. From January 2000 to January 2006, Ms. Kehoe owned and managed Kehoe Associates, of Fort Washington, Pennsylvania, a consulting firm which provided corporate strategic planning, organizational development, and acquisition due diligence and integration planning services. From May 1993 to January 2000, Ms. Kehoe was an officer of NovaCare, Inc., a national provider of rehabilitation and orthotic and prosthetic services based in King of Prussia, Pennsylvania, serving as Senior Vice President, Human Resources. From July 1984 to May 1993, she was at the Bristol Myers Squibb Company in Princeton, New Jersey, in various management roles.

(iii) Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors and executive officers and any persons who own more than 10% of our capital stock to file with the Commission (and, if such security is listed on a national securities exchange, with such exchange), various reports as to ownership of such capital stock. Such persons are required by Commission regulations to furnish us with copies of all Section 16(a) forms they file. Based solely upon reports and representations submitted by the directors, executive officers and holders of more than 10% of our capital stock, all Forms 3, 4 and 5 showing ownership of and changes of ownership in our capital stock during 2006 were timely filed with the Commission and the Nasdaq Global Market.

(iv) The Company has adopted a Code of Ethics for Senior Executive and Financial Officers, a copy of which may be accessed at the Company's website, LangerInc.com, by clicking on "Investor Relations," selecting "About Our Company," and then selecting "Corporate Governance."

(v) There have been no material changes in the procedures by which security holders may recommend nominees to the Company's Board of Directors since such procedures were last disclosed in the Company's proxy statement distributed (in May 2006) to its stockholders in connection with the 2006 Annual Meeting of Stockholders

Item 11. Executive Compensation.

Compensation Discussion and Analysis

Overview

The Compensation Committee of the Board of Directors (the “Compensation Committee”) assists the Board in establishing compensation packages for Langer's executive officers and non-employee directors and administering Langer's incentive plans. The Compensation Committee is generally responsible for setting and administering the policies which govern annual executive salaries, raises and bonuses and certain awards of stock options, restricted stock awards and other awards, under the Company's incentive plans and otherwise, and, where applicable, compliance with the requirements of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “IRC”) and such responsibility is generally limited to the actions taken by the Compensation Committee, although at times the full Board has determined annual executive salaries, raises and, where the Company has determined that compliance with the provisions of Section 162(m) is not required, bonuses as well as grants of stock options and common stock without having first received recommendations from the Compensation Committee. From time to time, the Compensation Committee reviews our compensation packages to ensure that they remain competitive with the compensation packages offered by similarly-situated companies and continue to incentivize management and align management’s interests with those of our stockholders.

The Compensation Committee is comprised of two directors, each of whom has experience in executive compensation issues. Each member of the Compensation Committee meets the independence requirements specified by the Nasdaq Global Market and by Section 162(m) of the Internal Revenue Code.

Executive Compensation Philosophy

The general philosophy of our executive compensation program is to attract and retain talented management while ensuring that our executive officers are compensated in a way that advances the interests of our stockholders. In pursuing these objectives, the Compensation Committee believes that it is critical that a substantial portion of each executive officer’s compensation be contingent upon our overall performance. The Compensation Committee is also guided by the principle that our compensation packages must be competitive, must support our overall strategy and objectives, and must provide significant rewards for outstanding financial performance while establishing clear consequences for underperformance. Annual bonuses and long-term awards for our executive officers should take into account not only objective financial goals, but also individual performance goals that reinforce our core values, which include leadership, accountability, ethics and corporate governance. It is the Compensation Committee’s responsibility to determine the performance goals for the performance-based compensation payable to our Named Executive Officers in compliance with section 162(m) of the IRC, subject to ratification by the Board. Subject to this limitation, the Compensation Committee may also make recommendations to the Board with respect to non-CEO compensation and, either alone or with the other independent members of our Board, to determine and approve our Chief Executive Officer’s compensation.

In determining the compensation packages for our executive officers and non-employee directors, the Compensation Committee and the Board of Directors have evaluated the history and performance of Langer, previous compensation practices and packages awarded to Langer's executive officers and non-employee directors, and compensation policies and packages awarded to executive officers and non-employee directors at similarly-situated companies.

Use of Outside Consultants

The Compensation Committee has the authority to retain and terminate any independent compensation consultant and to obtain independent advice and assistance from internal and external legal, accounting and other advisors. In 2006, the Compensation Committee did not engage any such consultants.

Compensation Program Components

Our executive compensation program emphasizes company performance, individual performance and an increase in stockholder value over time in determining executive pay levels. Our executive compensation program consists of three key elements: (i) annual base salaries; (ii) a performance-based annual bonus; and (iii) periodic grants of stock options, restricted stock and performance shares. The Compensation Committee believes that this three-part approach best serves our and our stockholders’ interests by motivating executive officers to improve our financial position, holding executives accountable for the performance of the organizations for which they are responsible and by attracting key executives into our service. Under our compensation program, annual compensation for executive officers is composed of a significant portion of pay that is “at risk” -- specifically, the annual bonus, stock options, restricted stock and performance shares.

Annual Cash Compensation

Base Salary. In reviewing and approving the base salaries of our executive officers, the Compensation Committee considers the scope of work and responsibilities, and other individual-specific factors; the recommendation of the Chief Executive Officer (except in the case of his own compensation); compensation for similar positions at similarly-situated companies; and the executive's experience. Except where an existing agreement establishes an executive’s salary, the Compensation Committee reviews executive officer salaries annually at the end of the year and establishes the base salaries for the upcoming year.

Performance-Based Annual Bonus. With regard to the compensation of the Named Executive Officers subject to section 162(m) of the IRC, the Compensation Committee establishes the performance goals and then certifies the satisfaction of such performance goals prior to the payment of the performance-based bonus compensation. In reviewing and approving the annual performance-based bonus for our executive officers, the Compensation Committee may also consider an executive’s contribution to the overall performance of Langer as well as annual bonuses awarded to persons holding similar positions at similarly-situated companies.

Equity Based Compensation

Executive officers of Langer and other key employees who contribute to the growth, development and financial success of Langer are eligible to be awarded stock options, shares of restricted common stock, bonuses of shares of common stock, and performance shares of common stock under our 2005 Stock Incentive Plan. Awards under these plans help relate a significant portion of an employee’s long-term remuneration directly to stock price appreciation realized by all our stockholders and aligns an employee’s interests with those of our stockholders. The Compensation Committee believes equity-based incentive compensation aligns executive and stockholder interests because (i) the use of a multi-year lock-up schedule for equity awards encourages executive retention and emphasizes long-term growth, and (ii) paying a significant portion of management’s compensation in our equity provides management with a powerful incentive to increase stockholder value over the long term. In connection with the Company’s prior acceleration of the vesting and issuance of certain stock options, the Company required the optionees who do not have employment agreements with the Company to execute lock-up, confidentiality and non-competition agreements as a condition to the acceleration of such stock options. Such lock-up, confidentiality and non-competition agreements executed with the Company’s employees provide the Company with added protection. In addition, the lock-up restrictions serve as an employee retention mechanism since the lock-up restrictions will be extended for an additional five year period in the event an employee terminates his/her employment with the Company while any of such lock-up restrictions are still in effect. The Compensation Committee determines appropriate individual long-term incentive awards in the exercise of its discretion in view of the above criteria and applicable policies.

Perquisites and Other Personal and Additional Benefits

Executive officers participate in other employee benefit plans generally available to all employees on the same terms as similarly situated employees.

The Company maintains a qualified 401(k) plan that provides for a Company contribution based on a matching schedule of a maximum of the lower of (i) 25% of each given employee’s annual 401(k) contribution, or (b) 4% of each given employee’s annual salary.

The Company also provides Named Executive Officers with perquisites and other personal benefits that the Company and the Compensation Committee believe are reasonable and consistent with its overall compensation program to better enable the Company to attract and retain superior employees for key positions. The Compensation Committee periodically reviews the levels of perquisites and other personal benefits provided to Named Executive Officers.

Accounting and Tax Considerations

Section 162(m) of the IRC generally disallows a tax deduction to public corporations for compensation, other than performance-based compensation, over $1,000,000 paid for any year to an individual who, on the last day of the taxable year, was (i) the Chief Executive Officer or (ii) among the four other highest compensated executive officers whose compensation is required to be reported in the Summary Compensation Table contained herein. Compensation programs generally will qualify as performance-based if (1) compensation is based on pre-established objective performance targets, (2) the programs’ material features have been approved by stockholders, and (3) there is no discretion to increase payments after the performance targets have been established for the performance period. The Compensation Committee desires to maximize deductibility of compensation under Section 162(m) of the IRC to the extent practicable while maintaining a competitive, performance-based compensation program. However, the Compensation Committee also believes that it must reserve the right to award compensation which it deems to be in our best interest and our stockholders but which may not be tax deductible under Section 162(m) of the IRC.

Post-Employment and Other Events

Retirement, death, disability and change-in-control events trigger the payment of certain compensation to the Named Executive Officers that is not available to all salaried members. Such compensation is discussed under the headings “Employment Agreements” and “Potential Payments Upon Termination or Change in Control.”

Role of Executive Officers in Compensation Decisions

The Compensation Committee determines the total compensation of our Chief Executive Officer and oversees the design and administration of compensation and benefit plans for all of the Company’s employees. Our Chief Executive Officer has met with the Compensation Committee to present topical issues for discussion and education as well as specific recommendations for review. The Chief Executive Officer and the President and Chief Operating Officer attends a portion of most regularly scheduled Compensation Committee meetings, excluding executive sessions. The Compensation Committee also obtains input from our legal, finance and tax functions, as appropriate.

Summary

The Compensation Committee believes that the total compensation package has been designed to motivate key management to improve the operations and financial performance of the Company, thereby increasing the market value of our Common Stock. The tables in this Executive Compensation section reflect the compensation structure established by the Compensation Committee.

Summary Compensation Table

| Name and Principal Position | | Year | | Salary ($) | | Bonus ($) | | Stock Awards ($) | | Option Awards ($)(1) | | Non-Equity Incentive Plan Compensation | | Changes in Pension Value and Nonqualified Deferred Compensation Earnings | | All Other Compensation ($) | | Total ($) | |

| | | | | | | | | | | | | | | | | | | | |

| W. Gray Hudkins, President and Chief Executive Officer | | | 2006 | | $ | 275,000 | | $ | 100,000 | | | - | | | - | | | | | | | | $ | | (5) | $ | 378,800 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Kathryn P. Kehoe, Senior Vice President | | | 2006 | | | 200,000 | | | 50,000 | | | - | | $ | 50,100 | | | | | | | | | | (5) | | 302,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Joseph P. Ciavarella, Chief Financial Officer and Vice President | | | 2006 | | | 190,000 | | | 50,000 | | | - | | | - | | | | | | | | | 112,500 4,800 | (2) (5) | | 397,300 | |

| | | | | | | | | | | | | | | | | | | | | | | | - | | | | |

| Sara Cormack, Chief Financial Officer | | | 2006 | | | 56,300 | (4) | | - | | | - | | | - | | | | | | | | | - | | | 56,300 | |

| (1) | The amounts in the “Option Awards” column are calculated based on Statement of Financial Accounting Standards No. 123 (revised 2004), “Share-Based Payments” (“FAS 123R”) (excluding any estimate for forfeitures). They equal the aggregate dollar amount of compensation expense related to stock options that was recognized in the Company’s financial statements contained on Form 10-K for the year ended December 31, 2006. Under FAS 123R, a pro rata portion of the total expense at the time of grant is recognized over the vesting schedule of the grant. The initial expense is based on the fair value of the stock option as estimated using the Black-Scholes option-pricing model. The assumptions used to arrive at the Black-Scholes values are disclosed in Note 12, Stock Options, to our consolidated financial statements included in Item 8 of our Annual Report on Form 10-K for the year ended December 31, 2006. |

| (2) | Mr. Ciavarella resigned on September 15, 2006. In connection with his resignation, Langer, Inc. accrued $112,500 in severance compensation payable to Mr. Ciavarella. For information about his Option Awards, see the table below headed "Outstanding Equity Awards and Fiscal Year-End, including the notes to that table. |

| (3) | Langer, Inc. paid Mr. Ciavarella $40,000 in accrued vacation pay upon his resignation from the Company. |

| (4) | Ms. Cormack joined the Company on September 18, 2006, as Chief Financial Officer and resigned on December 4, 2006. For information about her Option Awards, see the table below headed "Outstanding Equity Awards and Fiscal Year-End, including the notes to that table. |

| (5) | Langer, Inc. 401(K) defined contribution retirement plan contribution for 2006. |

Employment Agreement - W. Gray Hudkins. On November 16, 2004, Langer, Inc., entered into an employment agreement with W. Gray Hudkins, effective as of October 1, 2004, that provides that he will serve as an executive officer of the Company for a term expiring on October 1, 2007. The agreement provided for an annual base salary of $200,000, subject to increase in the Board's discretion, participation in incentive and bonus plans at the discretion of Langer, Inc.’s Board of Directors, ten-year options to purchase up to 150,000 shares of the Company’s common stock at an exercise price of $7.50 per share, vesting in three equal annual installments commencing on November 12, 2005, and maintenance of a $1 million life insurance policy payable to beneficiaries named by Mr. Hudkins. Mr. Hudkins also received 40,000 shares of restricted stock which originally was to vest in three equal annual installments commending November 12, 2005. Mr. Hudkins has also agreed to certain confidentiality , non-competition, and non-solicitation provisions. On June 23, 2005, Mr. Hudkins was granted options to purchase up to 137,500 shares of Langer, Inc.’s common stock at an exercise price of $6.52 per share originally scheduled to vest in three annual tranches beginning December 31, 2007. On November 8, 2005, Mr. Hudkins was granted options to purchase up to 50,000 shares of the Company’s common stock at an exercise price of $4.89 per share originally scheduled to vest in three annual tranches beginning April 1, 2008. On December 20, 2005, the Board of Directors accelerated the vesting of all unvested options and restricted stock awards, subject to a lock-up agreement. On January 1, 2006, Mr. Hudkins became President and Chief Executive Officer and his annual base salary was increased to $275,000. In the event Mr. Hudkins is terminated by Langer, Inc. without “cause,” he is entitled to receive his base compensation, which may be payable at the Company’s option in cash or shares of Langer, Inc.’s common stock, for a period of six months from the date of termination. On June 21, 2006 Langer, Inc.’s Shareholders elected Mr. Hudkins to the Company’s Board of Directors. The Board of Directors has approved a cash bonus for Mr. Hudkins for the year ended December 31, 2006, of $100,000.

Grants of Plan-Based Awards

Langer, Inc. did not make any grants of stock option awards to our Named Executive Officers during the year ended December 31, 2006.

Outstanding Equity Awards at Fiscal Year End

The following table sets forth information concerning stock options and stock awards held by the Named Executive Officers at December 31, 2006:

| | | Option Awards | | Stock Awards | |

| Name | | Number of Securities Underlying Unexercised Options (#) Exercisable | | Number of Securities Underlying Unexercised Options (#) Unexercisable | | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) | | Option Exercise Price ($) | | Option Expiration Date | | Number of Shares or Units of Stock That Have Not Vested (#) | | Market Value of Shares or Units of Stock That Have Not Vested ($) | | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($) | |

| W. Gray Hudkins | | | 50,000 137,500 150,000 | (1) (1) (1) | | — — — | | | — — — | | $ $ $ | 4.89 6.52 7.50 | | | 11/8/2015 6/23/2015 11/12/2014 | | | — — 13,333 | | $ | — — 61,200 | | | — — — | | $ | — — | |

| Kathryn P. Kehoe | | | 100,000 | | | 100,000 | | | — | | $ | 4.96 | | | 1/24/2016 | | | — | | | — | | | — | | | — | |

| Joseph P. Ciavarella (2) | | | 25,000 85,000 50,000 | (1) (1) (1) | | — — — | | | — — — | | $ $ $ | 4.89 6.52 5.94 | | | 11/8/2015 6/23/2015 3/24/2014 | | | — — — | | | — — — | | | — — — | | | — — — | |

| Sara Cormack | | | — | | | 100,000 | (3) | | — | | $ | 3.50 | | | 9/12/2016 | | | — | | | — | | | — | | | — | |

| (1) | On December 20, 2005 Langer, Inc. accelerated the vesting date of Unvested Options to December 31, 2005. Thus, the Options of Mr. Hudkins and Mr. Ciavarella became fully vested on December 31, 2005. Effective December 31, 2005, Langer, Inc. executed a Lock-up Release Schedule with Mr. Hudkins and Mr. Ciavarella under which such persons are prohibited from selling transferring, exchanging, hypothecating, granting a security interest in, pledging, or otherwise disposing of the shares subject to the Lock-up Release Schedule. On November 12, 2006 the Company released 50,000 of Mr. Hudkins’ shares from the Lock-up Release Schedule. In addition to 50,000 of Mr. Hudkins’ shares that had vested prior to execution of the Lock-up Agreement, Mr. Hudkins may now exercise 100,000 shares. |

| (2) | Mr. Ciavarella resigned from Langer, Inc. on September 15, 2006. Mr. Ciavarella’s Stock Option Agreements with the Company provide that if Mr. Ciavarella terminates his employment with Langer, Inc. for any reason, then his Options, to the extent that they are vested, may be exercised by Mr. Ciavarella no later than three (3) months after September 15, 2006, his termination date. Mr. Ciavarella has not exercised any of his options, and in accordance with the terms of the options, they expired 90 days after his resignation. |

| (3) | Ms. Cormack resigned from Langer, Inc. on December 4, 2006. Ms. Cormack’s Stock Option Agreement with the Company provided that none of her options vested prior to September 18, 2008. The options listed in the above table for Ms. Cormack expired upon her resignation from the Company on December 4, 2006. |

Option Exercises and Stock Vested During Fiscal 2006

There were no options exercised by any of the Company's Named Executive Officers, and no vesting of stock award held by the Company's Named Executive Officers, in the year ended December 31, 2006.

Pension Benefits - Fiscal 2006

There were no pension benefits earned by the Company's Named Executive Officers in the year ended December 31, 2006.

Nonqualified Defined Contribution and Other Nonqualified Deferred Compensation Plans.

The Company does not have any nonqualified defined contribution or other nonqualified deferred compensation plans covering its named executive officers.

Potential Payments Upon Termination or Change of Control

The tables below reflect the amount of compensation to each of the Named Executive Officers of the Langer, Inc. in the event of termination of such executive’s employment under the following circumstances: voluntary termination by the executive, termination for cause by the Company, termination without cause by the Company, termination following a change of control, and termination on account of disability or death of the executive. The amounts shown assume that such termination was effective as of December 31, 2006, and thus include amounts earned through such time and estimates of the amounts which would be paid out to the executives upon their termination under the circumstances indicated. The actual amounts to be paid out can only be determined at the time of such executive’s separation from the Company.

Payments Made Upon Termination. Regardless of the manner in which a Named Executive Officer’s employment terminates, he or she may be entitled to receive amounts earned during his term of employment.

Payments Made Upon a Change of Control. Mr. Hudkins was granted a restricted stock award in 2004 which would fully vest upon, among other things, a change in control of the Company. All lock-up agreements with respect to common stock acquirable upon exercise of Mr. Hudkins' options would automatically expire upon a change of control.

Generally, pursuant to the agreements, a change of control is deemed to occur in the event that:

| | | the current members of the Board cease to constitute a majority of the Board; |

| | | the Company shall have been sold by either (i) a sale of all or substantially all its assets, or (ii) a merger or consolidation, other than any merger or consolidation pursuant to which the Company acquires another entity, or (iii) a tender offer, whether solicited or unsolicited; or |

| | | any party, other than the Company, is or becomes the “beneficial owner” (as defined in the Securities Exchange Act of 1934, as amended (the “Exchange Act”)), directly or indirectly, of voting securities representing 50% or more of the total voting power of the Company. |

W. Gray Hudkins

The following table shows the potential payments upon termination or a change of control of the Company for W. Gray Hudkins, Langer, Inc.’s President, Chief Executive Officer, and member of the Company’s Board of Directors, as if such termination took place on December 31, 2006.

Executive Benefits upon Payments Upon Separation | | Expiration of Employment Agreement($) | | Voluntary Termination on 12/31/06 ($) | | For Cause Termination on 12/31/06 ($) | | Without Cause Termination on 12/31/06 ($) | | Change-in-Control and Termination on 12/31/06 ($) | | Disability on 12/31/06 ($) | | Death on 12/31/06 ($) | |

| (a) | | (b) | | (b) | | (d) | | (e) | | (f) | | (h) | | (i) | |

Compensation | | | | | | | | | | | | | | | |

| Cash Severance - Salary | | $ | 275,000 | | | - | | | - | | $ | 137,500 | (1) | $ | 137,500 | (1) | | - | | | - | |

| Stock Options | | | | | | | (2) | | - | | | | (2) | | | (3) | | | (2) | | | (2) |

| Restricted Stock | | | | | | | (4) | | (4 | ) | | | (4) | $ | | (5) | $ | | (5) | $ | 61,200 | (5) |

Benefits and Perquisites | | | | | | - | | | - | | | - | | | - | | | - | | | - | |

| Life Insurance | | | | | | - | | | - | | | - | | | - | | | - | | $ | 1,000,000 | (6) |

Total | | $ | 275,000 | | | | | | - | | $ | 137,500 | | $ | 198,700 | | $ | | | $ | 1,061,200 | |

| (1) | Mr. Hudkins would be entitled to receive his December 31, 2006 Annual Base Compensation of at the annual rate of $275,000 for a period of six (6) months ($137,500). |

| (2) | Mr. Hudkins’ unvested stock options and locked up stock options would be subject to a five (5) year extension of the lockup release period and have been valued in the above table using the December 31, 2006 closing common stock market price of $4.59 per share. Since all option exercise prices are above $4.59 at December 31, 2006, all compensation values are -0-. |

| (3) | Mr. Hudkins’ unvested stock options and locked up stock options would be accelerated and released from lockups and have been valued in the above table using the December 31, 2006 closing common stock market price of $4.59 per share. Since all option exercise prices are above $4.59 at December 31, 2006, the compensation value is -0-. |

| (4) | Mr. Hudkins’ unvested restricted stock upon termination or voluntary termination, to the extent that shares have not vested, would no longer continue to vest, and such unvested restricted shares would be forfeited as of the date Mr. Hudkins ceased to be employed by Langer, Inc. |

| (5) | Mr. Hudkins’ unvested restricted stock would be accelerated and has been valued in the above table using the December 31, 2006 closing common stock market price of $4.59 per share ($4.59 times 13,333 common shares equals $61,200). |

| (6) | Upon Mr. Hudkins’ death, his beneficiary would receive the proceeds of a $1 million life insurance policy. |

Kathryn P. Kehoe

Kathryn P. Kehoe, Langer, Inc.’s Senior Vice President, upon termination without cause, would receive severance pay at the rate of $200,000 per year, which was her base compensation in force at December 31, 2006, for a period of six (6) months ($100,000). Ms. Kehoe received, on January 24, 2006, a stock option award to purchase 100,000 shares of the Company's common stock, none of which were vested as of December 31, 2006, and so her options would have been forfeited as of her date of termination. Under the terms of her stock options, she is entitled to exercise her options after her termination by the Company without cause for a period of up to 90 days after such termination.

Director Summary Compensation Table

The following table summarizes the compensation paid to our non-employee directors for the fiscal year ended December 31, 2006:

| Name (1) | | Fees Earned or Paid in Cash ($) | | Stock Awards ($) | | Option Awards ($) | | Non-Equity Incentive Plan Compensation ($) | | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) | | All Other Compensation ($) | | Total ($) | |

| | | | | | | | | | | | | | | | |

| Stephen M. Brecher | | $ | 6,250 | | | - | | $ | 50,093 | | | - | | | - | | | - | | $ | 56,343 | |

| Burtt R. Ehrlich | | | - | | | - | | | - | | | - | | | - | | | - | | | - | |

| Arthur Goldstein | | | - | | | - | | | - | | | - | | | - | | | - | | | - | |

| Stuart P. Greenspon | | | - | | | - | | | - | | | - | | | - | | | - | | | - | |

| (1) | Warren B. Kanders, the Company’s Chairman of the Board of Directors, W. Gray Hudkins, the Company’s President and Chief Executive Officer, and Peter A. Asch, the President of Twincraft, Inc. and the Company’s personal care products division, are not included in this table. Messrs. Hudkins and Asch are employees of the Company and thus receive no compensation for their services as directors. Mr. Kanders is a principal of Kanders & Company, Inc., which is a consultant to the Company which receives consulting fees from the Company; see Item 13 below for additional information about payments to Kanders & Company. The compensation for Mr. Hudkins as an employee of the Company is shown in the Summary Compensation Table and other tables in Item 11 showing compensation of Named Executive Officers. Mr. Asch was not an employee or director of the Company prior to January 23, 2007. |

Compensation Committee Report

The Company’s Compensation Committee of the Board of Directors (the “Compensation Committee”) has submitted the following report for inclusion in this Annual Report:

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis contained in this Annual Report with management. Based on the Compensation Committee’s review of and the discussions with management with respect to the Compensation Discussion and Analysis, the Compensation Committee has recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this Annual Report and in the Company’s Annual Report on Form 10-K for the year ended December 31, 2006 for filing with the SEC.

MEMBERS OF THE COMPENSATION COMMITTEE

Burtt R. Ehrlich (Chair)

Stuart P. Greenspon

Compensation Committee Interlocks And Insider Participation

During 2006, none of the members of our Compensation Committee, (i) served as an officer or employee of Langer or its subsidiaries, (ii) was formerly an officer of Langer or its subsidiaries or (iii) entered into any transactions with Langer or its subsidiaries, other than stock option agreements and restricted stock awards. During 2006, none of our executive officers (i) served as a member of the Compensation Committee (or other board committee performing equivalent functions or, in the absence of any such committee, the board of directors) of another entity, one of whose executive officers served on our Compensation Committee, (ii) served as director of another entity, one of whose executive officers served on our Compensation Committee, or (iii) served as member of the compensation committee (or other board committee performing equivalent functions or, in the absence of any such committee, the board of directors) of another entity, one of whose executive officers served as a director of Langer.

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

The following table sets forth, as of April 26, 2007, certain information regarding beneficial ownership of our common stock by (a) each person or entity who is known to us owning beneficially 5% or more of our common stock, (b) each of our directors, (c) each of our named executive officers and (d) all named executive officers and directors as a group. Unless otherwise indicated, each of the stockholders shown in the table below has sole voting and investment power with respect to the shares beneficially owned. Unless otherwise indicated, the address of each person named in the table below is c/o 450 Commack Road, Deer Park, New York 11729. As used in this table, a beneficial owner of a security includes any person who, directly or indirectly, through contract, arrangement, understanding, relationship or otherwise has or shares (i) the power to vote, or direct the voting of, such security or (ii) investment power which includes the power to dispose, or to direct the disposition of, such security. In addition, a person is deemed to be the beneficial owner of a security if that person has the right to acquire beneficial ownership of such security within 60 days after April 26, 2007.

Name of Beneficial Owner | | Common Stock Beneficially Owned | | Percentage of Common Stock(1) | |

Warren B. Kanders, Chairman of the Board of Directors One Landmark Square, Stamford, Conn. | | 2,925,075 | (2) | 23.5 | % |

David M. Knott 485 Underlhill Road, Syosset, N.Y. | | 1,712,878 | (3) | 13.0 | % |

Kennedy Capital Management, Inc. 10829 Olive Blvd., St. Louis, Mo. | | 570,271 | (4) | 5.7 | % |

Ashford Capital Management, Inc. P.O. Box 4172, Wilmington, Del. | | 2,145,812 | (5) | 17.8 | % |

Millennium Partners, L.P. 666 Fifth Ave., New York, N.Y. | | 859,139 | (6) | 7.0 | % |

Bank of America Corporation 100 North Tryon Street, Charlotte , N.C. | | 580,450 | (7) | 5.1 | % |

Peter A. Asch, Director 2 Tigan Street, Winooski, Vt. | | 607,897 | (8) | 5.3 | % |

| Stephen M. Brecher, Director | | 12,500 | (9) | * | |

| Burtt R. Ehrlich, Director | | 254,405 | (10)(11) | 2.2 | % |

| Arthur Goldstein, Director | | 150,573 | (10)(12) | 1.3 | % |

| Stuart P. Greenspon, Director | | 199,816 | (13) | 1.7 | % |

| W. Gray Hudkins, Director, President and Chief Executive Officer | | 364,900 | (14) | 3.1 | % |

| Kathryn P. Kehoe, Senior Vice President | | 33,334 | (15) | * | |

| Directors and named executive officers as a group (8 persons) | | 4,598,500 | (16) | 34.9 | % |

* Less than 1%

| (1) | The applicable percentage of beneficial ownership is based on 11,450,915 shares of common stock outstanding as of April 26, 2007, plus, with respect to particular persons, shares of common stock that may be acquired by exercise of stock options, conversion of the Company's outstanding 5% convertible subordinated notes due December 7, 2011 (the “Notes”), or other rights to acquire common stock within 60 days after the date of this Annual Report. |

| (2) | Consists of 1,491,856 shares presently issued and outstanding held by Langer Partners, LLC, 375,000 shares presently issued and outstanding held by Kanders & Company, Inc. (“Kanders & Company”) (100,000 shares of which were issued pursuant to a stock award, the vesting of which was accelerated on December 20, 2005 and which are subject to a lock-up agreement that expires on September 1, 2008); 515,000 shares acquirable upon the exercise of options awarded to Mr. Kanders (435,000 of which are subject to a lock-up agreement that expires with respect to 80,000 shares on each of November 12, 2006 and 2007, 91,666 shares on April 1, 2008 and 91,667 shares on each of April 1, 2009 and 2010); 428,219 shares acquirable upon conversion of $2,000,000 in principal amount of the Notes held by Mr. Kanders as trustee for a member of his family; 15,000 shares acquirable under warrants held by Langer Partners, LLC; and 100,000 shares acquirable upon exercise of options held by Kanders & Company. Mr. Kanders, who is the Chairman of our Board of Directors, is the sole voting member and sole manager of Langer Partners, LLC, and the sole stockholder of Kanders & Company. Does not include 500,000 shares awarded to Mr. Kanders as a restricted stock award under the Company’s 2005 Stock Incentive Plan (the “2005 Plan”), which award is not presently vested and which cannot vest prior to January 1, 2008. The address for Mr. Kanders and Langer Partners, LLC is c/o Kanders & Company, Inc., One Landmark Square, Stamford, Connecticut 06901. |

| (3) | Based on information in Schedule 13G filed by Mr. Knott and certain affiliates, which gives their address as 485 Underhill Boulevard, Suite 205, Syosset, New York 11791. |

| (4) | Based upon information in the Schedule 13G, as amended, filed by Kennedy Capital Management, Inc., as last amended on February 13, 2007, which gives its address as 10829 Olive Boulevard, St. Louis, MO 63141. Kennedy Capital Management, Inc reports voting power over 515,916 shares, constituting 5.5% of the Company's outstanding common stock. The higher number in the table is the number of shares over which Kennedy Capital Management, Inc. reports dispositive power. |

| (5) | Includes 642,329 Conversion Shares. Based upon information in the Schedule 13G, as amended, filed by Ashford Capital Management, Inc. as amended on January 23, 2007, which gives its address as P.O. Box 4172, Wilmington, DE 19807. |

| (6) | Based upon information in the Schedule 13D filed by Millennium Partners, L.P. and certain of its affiliates on December 18, 2006. Such person's address is 666 Fifth Avenue, 8th Floor, New York, New York 10103. According to such information, the reporting persons own 2,700 shares which are issued and outstanding, and Notes which are convertible into 856,439 shares of common stock. Mr. Israel A. Englander is the managing member of the managing partner of Millennium Partners, L.P. |

| (7) | Based upon information in the Schedule 13G filed by Bank of America Corporation on February 8, 2006, which gives the reporting person’s address as 100 North Tryon Street, Floor 25, Charlotte, NC 28255. |

| (8) | Does not include 200,000 shares acquirable by Mr. Asch under options which vest in 3 equal annual consecutive tranches commencing on January 23, 2009, or shares which Mr. Asch may become entitled to receive in 2008 and 2009 under the terms of the agreement by which the Company acquired the capital stock of Twincraft, Inc., from Mr. Asch and the other former holders of Twincraft's capital stock. |

| (9) | Consists of 12,500 shares acquirable under options awarded to Mr. Brecher. Does not include (i) 25,000 shares acquirable under options which vest in equal annual tranches on May 1, 2008 and 2009, and (ii) 7,500 shares awarded to Mr. Brecher as a restricted stock award under the 2005 Plan, which award is not presently vested and which cannot vest prior to January 1, 2008. |

| (10) | Includes 96,376 options granted to each of Messrs. Ehrlich and Goldstein, of which 30,000 options granted to each of them are subject to lock-up agreements, which expire for each, on November 12, 2007 with respect to 5,000 shares, and on each of November 8, 2007 and 2008 with respect to 12,500 shares. |

| (11) | Includes 46,600 shares held in trust by Mrs. Burtt R. Ehrlich as Trustee for David Ehrlich, as to which Mr. Ehrlich disclaims beneficial ownership. |

| (12) | Includes 21,410 shares acquirable upon conversion of Notes held by Mr. Arthur Goldstein. |

| (13) | Includes 37,500 shares acquirable upon exercise of options granted to Mr. Greenspon, of which 25,000 are subject to a lock-up agreement, which expires with respect to 12,500 shares on each of November 8, 2007 and 2008, and 32,116 Conversion Shares. Does not include (i) 41,903 shares held by his wife, Ms. Camilla Trinshieri, as to which Mr. Greenspon disclaims beneficial ownership, (ii) 7,500 shares awarded to Mr. Greenspon as a restricted stock award under the 2005 Plan, which award is not presently vested and which cannot vest prior to January 1, 2008. |

| (14) | Includes 337,500 shares acquirable upon exercise of options granted to Mr. Hudkins. Of the outstanding shares of stock held by Mr. Hudkins, 7,600 shares are subject to a lock-up agreement that expires on November 12, 2007. Additionally, 237,500 shares acquirable under options held by Mr. Hudkins are subject to a lock-up agreement which expires with respect to 50,000 shares on November 12, 2007, with respect to 45,833 shares on each of December 31, 2007 and 2008, with respect to 45,834 shares on December 31, 2009, with respect to 16,667 shares on each of April 1, 2008 and 2009, and with respect to 16,666 shares on April 1, 2010. Does not include 275,000 shares awarded to Mr. Hudkins as a restricted stock award under the 2005 Plan, which award is not presently vested and which cannot vest prior to January 1, 2008. |

| (15) | Consists of 33,334 shares acquirable under an option granted to Ms. Kehoe under the 2005 Plan. Does not include (i) 66,666 shares acquirable under an option which vests as to 33,333 on each of January 24, 2008 and 2009, and (ii) 75,000 shares awarded to Ms. Kehoe as a restricted stock award under the 2005 Plan, which award is not presently vested and which cannot vest prior to January 1, 2008. |

| (16) | Consists of 2,873,169 shares presently issued and outstanding owned of record or beneficially by such persons, plus 1,725,331 shares acquirable upon exercise of stock options and warrants, or conversion of Notes, held by such persons. |

We are not aware of any material proceedings to which any of our directors, executive officers or affiliates or any security holder, including any owner of record or beneficially of more than 5% of any class of our voting securities, is a party adverse to us or has a material interest adverse to us.

Equity Compensation Plan Information

Plan category | | Number of securities to be issued upon exercise of outstanding options, warrants and rights | | Weighted-average exercise price of outstanding options, warrants and rights | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | |

| | | (a) | | (b) | | ( c ) | |

| Equity Compensation Plans approved by Security holders | | | 1,459,300 | | $ | 5.70 | | | 1,094,000 | |

| Equity Compensation Plans not approved Security holders | | | 250,000 | | | 5.10 | | | - | |

| Total | | | 1,709,300 | | $ | 5.60 | | | 1,094,000 | |

Item 13. Certain Relationships and Related Transactions, and Director Independence.

Consulting Agreement with Kanders & Company, Inc. On November 12, 2004, the Company entered into a consulting agreement (the “Consulting Agreement”) with Kanders & Company, Inc. ("Kanders & Company"), the sole stockholder of which is Warren B. Kanders, who on November 12, 2004, became the Company’s Chairman of the Board of Directors, and who is the sole manager and voting member of Langer Partners, LLC (“Langer Partners”), the Company’s largest stockholder. The Consulting Agreement provides that Kanders & Company will act as the Company’s non-exclusive consultant to provide the Company with strategic consulting and corporate development services for a term of three years. Kanders & Company will receive, pursuant to the Consulting Agreement, an annual fee of $200,000 ($300,000 commencing in the year ending December 31, 2007) and may receive separate compensation for assistance, at the Company’s request, with certain transactions or other matters to be determined by the Board from time to time. Additionally, through the Consulting Agreement, Kanders & Company was granted options to purchase 240,000 shares of the Company’s common stock at an exercise price of $7.50 per share (the market price of the stock on the date of the grant), vesting in three equal annual installments beginning on November 12, 2005. The Company accounted for 15,000 of such options as compensation for duties performed by Mr. Kanders in his capacity as Chairman of the Board under APB No. 25 and accounted for 225,000 of such options as being granted pursuant to the Consulting Agreement and accounted for in accordance with EITF No. 96-18, “Accounting for Equity Instruments That Are Issued to Other Than Employees for Acquiring, or in Conjunction with Selling, Goods and Services.” The Company recorded non-cash stock option compensation expense of approximately $1,257,000 for year ended December 31, 2005 with respect to the consulting options, of which approximately $882,000 relates to the acceleration of the vesting of such options. The Company has also agreed to provide Kanders & Company with indemnification protection, which survives the termination of the Consulting Agreement for six years, and extends to any actual or wrongfully attempted breach of duty, neglect, error, or misstatement by Kanders & Company alleged by any claimant. The Consulting Agreement replaced a previous agreement for similar consulting services, pursuant to which Kanders & Company received an annual fee of $100,000, options to purchase 100,000 shares of the Company’s common stock at an exercise price of $1.525 per share, and the indemnification protection described above. The Company paid $200,000, $200,000 and $113,611 with respect to the annual fee under the Consulting Agreement during the years ended December 31, 2006, 2005 and 2004, respectively.

4% Convertible Subordinated Notes. On October 31, 2001, we sold $14,589,000 of our 4% Convertible Subordinated Notes due August 31, 2006 in a private placement. The notes were convertible into approximately 2,431,500 shares of our common stock at a conversion price of $6.00 per share, subject to adjustment in certain circumstances. Langer Partners purchased $2,500,000 principal amount of our 4% Convertible Subordinated Notes. Additionally, several persons and entities that have family relationships with Warren Kanders purchased an aggregate of $590,000 principal amount of these notes. The 4% Convertible Subordinated Notes were paid in full in August 2006.

5% Convertible Subordinated Notes. On December 8, 2006, the Company sold an aggregate of $28,880,000 of its 5% Convertible Subordinated Notes due December 7, 2011, in a private placement. The 5% Convertible Subordinated Notes are presently convertible at a conversion price of $4.6706 per share into an aggregate of 6,183,359 shares of our common stock, subject to adjustment for stock splits, stock dividends and certain issuances of common stock hereafter at prices less than the current conversion price. Mr. Kanders purchased $2,000,000 of the 5% Convertible Subordinated Notes. The conversion price and number of shares acquirable upon conversion may be further adjusted for issuance of common stock in the adjustment of the Twincraft purchase price.

Acquisition of Capital Stock of Twincraft, Inc. Pursuant to a stock purchase agreement dated as of November 14, 2006 between the Company and the four individuals, including Mr. Peter A. Asch, one of the Company's directors and a nominee for election as a director, the Company acquired all the capital stock of Twincraft on January 23, 2007, for an initial purchase price of approximately $26,650,000, of which approximately 22,652,000 was paid in cash, and the balance was paid by the issuance of 999,375 shares of the Company's common stock. As the owner of approximately 61% of the Twincraft capital stock, Mr. Asch received approximately $13,779,000 of the cash proceeds and 607,897 shares of common stock in the transaction. As the result of a post-closing audit of the financial statements of Twincraft, the purchase price is subject to an adjustment in favor of the sellers (including Mr. Asch), which has not yet been determined. Under the terms of the acquisition, the sellers, including Mr. Asch, may become entitled to additional contingent consideration based on the EBITDA of Twincraft for each of the years ending December 31, 2007 and 2008. Mr. Asch became a director and officer of the Company on January 23, 2007, upon the closing of the Twincraft acquisition. He was not a director or officer of the Company at the time that the Company agreed to acquire the capital stock of Twincraft.

Registration Rights Agreement. In connection with consummation of the Twincraft acquisition, the Company entered into a Registration Rights Agreement with Mr. Asch and the other former stockholders of Twincraft, covering the shares of common stock issued or issuable to them in the Twincraft acquisition. The Registration Rights Agreement provides for the Company to register, under the Securities Act of 1933, as amended, on or before December 23, 2007, the shares of common stock issuable to the Mr. Asch and the other former stockholders of Twincraft they received or will receive pursuant to the acquisition.

Employment Agreement - Peter A. Asch. On January 23, 2007, in connection with the Twincraft acquisition, Twincraft, which is now a wholly owned subsidiary of the Company, entered into an employment agreement with Mr. Asch, who will serve as president of Twincraft. This agreement is for a term of three years and provides for initial base compensation of $294,000 per year (subject to increase in the discretion of Langer’s Board of Directors), plus annual discretionary bonuses. The agreement also provides that Mr. Asch will receive a non-accountable expense allowance at the rate of $20,000 per year, payable monthly. In addition, under the employment agreement, Mr. Asch received a stock option award under Langer’s 2005 Stock Incentive Plan to purchase 200,000 shares of Langer’s common stock having an exercise price equal to $4.20 per share, of which (i) 66,666 vest on January 23, 2009; (ii) 66,666 vest on January 23, 2010; and (iii) 66,667 vest on January 23, 2011. The employment agreement contains a non-competition covenant and non-solicitation provisions (relating to Twincraft’s and Langer’s employees and customers) effective during the term of his employment and for one year after any termination of Mr. Asch’s employment for cause, voluntarily or due to death or disability and for the duration of any extended severance period of up to 12 months in the event of termination of employment without cause due to failure to renew or extend this employment agreement.

Lease Agreement - Winooski, Vermont. On January 23, 2007, in connection with the Twincraft acquisition, Twincraft entered into a lease agreement (the “Winooksi Lease”) with Asch Partnership, a Vermont general partnership, the principals of which are the father and uncle of Mr. Asch. Pursuant to the Winooski Lease, Twincraft will lease approximately 90,500 square feet of space in Winooski, Vermont, for use as a manufacturing facility. The Winooski Lease will run for seven years, commencing January 23, 2007 (the “Initial Term”) and is subject to an additional seven year term at Twincraft’s option (the “Extended Term”). Base rent during year one of initial term is $362,000 per annum and is subject to annual escalations up to $452,500 in year seven of the Initial Term. Additionally, Twincraft has an option to purchase the property covered by the Winooski Lease for $4,000,000 during the third through seventh years of the Initial Term, and at fair market value during the Extended Term. Twincraft is also responsible for payments to cover taxes and operating expenses relating to the Winooksi Lease.

Lease Agreement - Essex, Vermont. On January 23, 2007, in connection with the Twincraft acquisition, Twincraft entered into an amendment to its existing sublease agreement dated October 1, 2003 (the “Essex Lease”) with Asch Enterprises, LLC (“Asch Enterprises”), a Vermont limited liability company, the principal of which is Mr. Asch, president of Twincraft and a member of Langer’s Board of Directors. Pursuant to the Essex Lease, Twincraft will lease approximately 76,000 square feet in Essex, Vermont, for use as a warehouse facility. The term of the Essex Lease expires on October 1, 2010. Base rent during the term of the Essex Lease is $303,600 per annum. In the event Asch Enterprises exercises its option under the prime lease to purchase the property covered by the Essex Lease (the “Essex Option”), Asch Enterprises will pay Twincraft 25% of the rent paid by Asch Enterprises to the over-landlord of the Essex Lease subsequent to the closing the Twincraft Acquisition. Twincraft is also responsible for payments to cover taxes and operating expenses relating to the Essex Lease.

Restricted Stock Awards. Effective as of January 23, 2007, Langer entered into a restricted stock award agreement (the "RSA Agreements") with each of Warren B. Kanders (500,000 shares), Chairman of the Board of Directors of Langer and a holder of more than 10% of the outstanding common stock of Langer; W. Gray Hudkins (275,000 shares), President and Chief Executive Officer and a Director of Langer; Kathryn P. Kehoe (75,000 shares), Senior Vice President of Langer; Stephen M. Brecher (7,500 shares), a Director of Langer and Chairman of the Audit Committee; Burtt R. Ehrlich, (7,500 shares), a Director of Langer and Chairman of the Compensation Committee; Arthur Goldstein (7,500 shares), a Director of Langer; and Stuart P. Greenspon (7,500 shares), a Director of Langer. The foregoing persons have been awarded restricted shares in the amounts set forth above under the terms of Langer's 2005 Stock Incentive Plan. Under the terms of the RSA Agreements, the shares are not presently vested and will vest in the event of change of control of Langer or if and when Langer achieves earnings (excluding non-recurring events in the discretion of Langer's Board of Directors) before interest, taxes, depreciation and amortization ("EBITDA") of at least an aggregate of $10,000,000 in any four consecutive calendar quarters, as reflected in Langer 's Quarterly Reports on Form 10-Q or Annual Report on Form 10-K, as applicable, commencing with the quarter beginning January 1, 2007. In the event of a divestiture of a business unit of Langer, EBITDA for any such period of four quarters that includes the date of the divestiture shall be the greater of (i) the actual EBITDA for the relevant four quarters, and (ii) the net sum of (a) the actual EBITDA for the relevant four quarters, minus (b) EBITDA attributable to the divested portion of the business, plus (c) an amount equal to 20% of the purchase price paid to Langer in the divestiture. The shares may not be transferred for a period of 18 months following the vesting of the shares.

Review of Transactions with Related Persons. The transactions described above involving Mr. Asch were the result of arm's length negotiations which were closed prior to Mr. Asch's becoming a director, officer or stockholder of the Company. The transactions with respect to the 4% Convertible Subordinated Notes and 5% Convertible Subordinated Notes were private placements of unregistered convertible debt securities, and the rates and terms of the transactions were set by the Board of Directors based on its estimates of the rates and other terms that would enable the Company to raise the targeted amounts of funds. The Board consulted with an independent investment banker who acted as a placement agent in connection with the private placements. Mr. Kanders purchased less than 18% of the 4% Convertible Subordinated Notes and less than 7% of the 5% Convertible Subordinated Notes. The grant of the Restricted Stock Awards were reviewed and approved by the Compensation Committee of the Board of Directors in accordance with the terms of the 2005 Stock Incentive Plan and the charter of the Compensation Committee. The Consulting Agreement with Kanders & Company, Inc., was approved by the Board of Directors immediately prior to Mr. Kanders' joining the Board and was based upon a review of compensation paid by other public companies for the kinds of services to be rendered under the Consulting Agreement. The Board of Directors has a general practice of requiring directors interested in a transaction not to participate in deliberations or to vote upon transactions in which they have an interest, and to be sure that transactions with directors, executive officers and major shareholders are on terms that align the interests of the parties to such agreements with the interests of the stockholders.

Item 14. Principal Accountant Fees and Services.

Aggregate fees for professional services rendered for Langer by BDO Seidman, LLP for the years ended December 31, 2006 and 2005 were:

| | | 2006 | | 2005 | |

| Audit Fees | | $ | 394,368 | | $ | 280,145 | |

| Audit Related Fees | | | 35,404 | | | — | |

| Tax Fees | | | 36,800 | | | 20,000 | |

| All Other Fees | | | — | | | — | |

| Total | | $ | 466,572 | | $ | 300,145 | |

Audit Fees. The Audit Fees for the years ended December 31, 2006 and 2005, respectively, were for professional services rendered for the audit of our consolidated financial statements for such years, and for the review of our unaudited interim consolidated financial statements included in our quarterly reports on Form 10-Q for 2006. BDO Seidman, LLP, was not engaged as the Company's independent registered public accountants until December 2005. Fees paid to the Company's prior independent registered public accountants for review of the Company's Quarterly Reports on Form 10-Q for periods ending in 2005 are therefore not included in the above table. In addition, Audit Fees for such years also include fees for services rendered to us by BDO Seidman, LLP for statutory audits and review of documents filed with the Commission.

Audit Related Fees. The Audit Related Fees for the year ended December 31, 2006 were for due diligence related to mergers and acquisitions. There were no such fees for the year ended December 31, 2005.

Tax Fees. Tax Fees as of the years ended December 31, 2006 and 2005 were for services related to tax compliance, including the preparation of tax returns and claims for refund, tax planning and advice, including assistance with and representation in tax audits and appeals, and advice related to mergers and acquisitions.

All Other Fees. There were no fees incurred for All Other Fees for the years ended December 31, 2006 and 2005.

Auditor Independence. The Audit Committee has considered the non-audit services provided by BDO Seidman, LLP and determined that the provision of such services had no effect on BDO Seidman, LLP's independence from Langer.

Audit Committee Pre-Approval Policy and Procedures. The Audit Committee must review and pre-approve all audit and non-audit services provided by BDO Seidman, LLP, our independent registered public accounting firm, and has adopted a Pre-approval Policy which requires all audit and non-audit services to be approved by the Audit Committee before services are rendered. In conducting reviews of audit and non-audit services, the Audit Committee will determine whether the provision of such services would impair the accountants' independence. The Audit Committee will only pre-approve services which it believes will not impair our accountants' independence. The term of any pre-approval is 12 months from the date of pre-approval, unless the Audit Committee specifically provides for a different period. Any proposed services exceeding pre-approved fee ranges or limits must be specifically pre-approved by the Audit Committee.

Each pre-approval request shall be accompanied by detailed back-up documentation regarding the specific services to be provided. The pre-approval request shall identify whether the proposed services was initially recommended by the auditor. Each pre-approval request for any non-audit service must be accompanied by a statement of the accountants (which may be in writing or given orally to the Audit Committee) as to whether, in the accountants' view, the request or application is consistent with the Commission’s rules on auditor independence.

Since the adoption of the Pre-approval Policy by the Audit Committee on March 24, 2004, the Audit Committee has not waived the pre-approval requirement for any services rendered by BDO Seidman, LLP or Langer's prior independent registered public accounting firm, Deloitte & Touche, LLP.

Item 15. Exhibits and Financial Statement Schedules.

Exhibit No. | | Description of Exhibit |

| 3.1 | | Agreement and Plan of Merger dated as of May 15, 2002, between Langer, Inc., a New York corporation, and Langer, Inc., a Delaware corporation (the surviving corporation), incorporated herein by reference to Appendix A of our Definitive Proxy Statement for the Annual Meeting of Stockholders held on June 27, 2002, filed with the Securities and Exchange Commission on May 31, 2002. |

| | | |

| 3.2 | | Certificate of Incorporation, incorporated herein by reference to Appendix B of our Definitive Proxy Statement for the Annual Meeting of Stockholders held on June 27, 2002, filed with the Securities and Exchange Commission on May 31, 2002. |

| | | |

| 3.3 | | By-laws, incorporated herein by reference to Appendix C of our Definitive Proxy Statement for the Annual Meeting of Stockholders held on June 27, 2002, filed with the Securities and Exchange Commission on May 31, 2002. |

| | | |

| 4.1 | | Specimen of Common Stock Certificate, incorporated herein by reference to our Registration Statement of Form S-1 (File No. 2- 87183). |

| | | |

| 10.1 | | Employment Agreement between Langer, Inc. and Andrew H. Meyers, dated as of February 13, 2001, incorporated herein by reference to, Exhibit 10.6 of our Annual Report on Form 10-K filed on May 29, 2001 (File No. 000-12991).+ |

| | | |

| 10.2 | | Employment Agreement between Langer, Inc. and Steven Goldstein, dated as of November 15, 2004.†+ |

| | | |

| 10.3 | | Consulting Agreement between Langer, Inc. and Kanders & Company, Inc., dated November 12, 2004.†+ |

| | | |

| 10.4 | | Option Agreement between Langer, Inc. and Kanders & Company, Inc., dated February 13, 2001, incorporated herein by reference to Exhibit (d)(1)(G) to the Schedule TO (File Number 005-36032).+ |

| | | |

| 10.5 | | Registration Rights Agreement between Langer, Inc. and Kanders & Company, Inc., dated February 13, 2001, incorporated herein by reference to Exhibit (d)(1)(I) to the Schedule TO (File Number 005-36032). |

| | | |

| 10.6 | | Indemnification Agreement between Langer, Inc. and Kanders & Company, Inc., dated February 13, 2001, incorporated herein by reference to Exhibit (d)(1)(J) to the Schedule TO (File Number 005-36032). |

| | | |

| 10.7 | | The Company’s 2001 Stock Incentive Plan incorporated herein by reference to Exhibit 10.18 of our Annual Report on Form 10-K for the fiscal year ended December 31, 2001.+ |

| | | |

| 10.8 | | Langer Biomechanics Group Retirement Plan, restated as of July 20, 1979 incorporated by reference to our Registration Statement of Form S-1 (File No. 2-87183). |

| | | |

| 10.9 | | Agreement, dated March 26, 1992, and effective as of March 1, 1992, relating to our 401(k) Tax Deferred Savings Plan incorporated by reference to our Form 10-K for the fiscal year ended February 29, 1992. |

| | | |

| 10.10 | | Form of Indemnification Agreement for Langer, Inc.’s executive officers and directors, incorporated by reference to Exhibit 10.23 of our Annual Report on Form 10-K for the fiscal year ended February 28, 2001. |

| | | |

| 10.11 | | Copy of Lease related to Langer, Inc.’s Deer Park, NY facilities incorporated by reference to Exhibit 10(f) of our Annual Report on Form 10-K for the fiscal year ended February 28, 1993. |

| | | |

| 10.12 | | Copy of Amendment to Lease of Langer, Inc.’s Deer Park, NY facility dated February 19, 1999.†† |

| | | |

| 10.13 | | Asset Purchase Agreement, dated May 6, 2002, by and among Langer, Inc., GoodFoot Acquisition Co., Benefoot, Inc., Benefoot Professional Products, Inc., Jason Kraus, and Paul Langer, incorporated herein by reference to Exhibit 2.1 of our Current Report on Form 8-K filed with the Securities and Exchange Commission on May 13, 2002. |

| | | |

| 10.14 | | Registration Rights Agreement, dated May 6, 2002, among Langer, Inc., Benefoot, Inc., Benefoot Professional Products, Inc., and Dr. Sheldon Langer, incorporated herein by reference to Exhibit 10.1 of our Current Report on Form 8-K, filed with the Securities and Exchange Commission on May 13, 2002. |

| | | |

| 10.15 | | Promissory Note, dated May 6, 2002, made by Langer, Inc. in favor of Benefoot, Inc., incorporated herein by reference to Exhibit 10.2 of our Current Report on Form 8-K, filed with the Securities and Exchange Commission on May 13, 2002. |

Exhibit No. | | Description of Exhibit |

| 10.16 | | Promissory Note, dated May 6, 2002, made by Langer, Inc. in favor of Benefoot Professional Products, Inc., incorporated herein by reference to Exhibit 10.3 of our Current Report on Form 8-K, filed with the Securities and Exchange Commission on May 13, 2002. |

| | | |

| 10.17 | | Stock Purchase Agreement, dated January 13, 2003, by and among Langer, Inc., Langer Canada Inc., Raynald Henry, Micheline Gadoury, 9117-3419 Quebec Inc., Bi-Op Laboratories Inc., incorporated herein by reference to Exhibit 2.1 of our Current Report on Form 8- K filed with the Securities and Exchange Commission on January 13, 2003. |

| | | |

| 10.18 | | Employment Agreement between Langer, Inc. and Joseph Ciavarella dated as of February 16, 2004, incorporated herein by reference to Exhibit 10.33 of our Annual Report on Form 10-K for the year ended December 31, 2003.+ |

| | | |

| 10.19 | | Option Agreement between Langer, Inc. and Joseph P. Ciavarella dated as of March 24, 2004, incorporated herein by reference to Exhibit 10.34 of our Annual Report on Form 10-K for the year ended December 31, 2003.+ |

| | | |