As filed with the Securities and Exchange Commission on September 28, 2006

Registration No. 333-137363

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 1 TO FORM SB-2

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

ALONG MOBILE TECHNOLOGIES, INC.

(Name of small business issuer in its charter)

| NEVADA | | 7812 | | 94-2906927 |

(State or jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

No. 88, 9th Floor, Western Part of the 2nd South Ring Road,

Xi’an City, Shaanxi Province, PRC

011-86-29-88360097

(Address, including zip code, and telephone number, including area code,

of registrant’s principal executive offices)

Jianwei Li

President and Director

Along Mobile Technologies, Inc.

No. 88, 9th Floor, Western Part of the 2nd South Ring Road,

Xi’an City, Shaanxi Province, PRC

011-86-29-88360097

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies of communications to:

Fletcher A. Robbe, Esq.

F. Robbe International Attorneys at Law

19200 Von Karmen Avenue, Suite 350

Irvine, California 92612

Tel: (949) 222-0430 Fax: (949) 222-0431

Approximate date of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. o

CALCULATION OF REGISTRATION FEE

Title of each Class

of Securities | | Amount to be

Registered | | Proposed Maximum Offering

Price per share (1) | | Proposed Maximum Aggregate

Offering Price (1) | | Amount of

Registration Fee |

| Common Stock | | 6,900,000 | | $1.175 | | $8,107,500.00 | | $954.25 |

(1) Based on the average of the high and low prices for the Common Stock reported on the Pink Sheets on September 5, 2006 for the purpose of calculating the registration fee pursuant to Rule 457.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

PROSPECTUS

ALONG MOBILE TECHNOLOGIES, INC.

The Resale of 6,900,000 Shares of Common Stock

This prospectus relates to the resale of up to 6,900,000 shares of our common stock being offered by the selling stockholders. We will not receive any proceeds from any sale of shares of common stock by the selling stockholders.

Our common stock is quoted on the Pink Sheets under the symbol "AGMB" On September 5, 2006, the average of the high and low prices of our common stock was $1.175 per share.

INVESTING IN OUR COMMON STOCK INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD INVEST IN OUR COMMON STOCK ONLY IF YOU CAN AFFORD TO LOSE YOUR ENTIRE INVESTMENT. FOR A DISCUSSION OF SOME OF THE RISKS INVOLVED, SEE "RISK FACTORS" BEGINNING ON PAGE 8 OF THIS PROSPECTUS.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

THE DATE OF THIS PROSPECTUS IS SEPTEMBER 11, 2006

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

This prospectus shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities in any state in which, such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such stated.

The following table of contents has been designed to help you find important information contained in this prospectus. We have included subheadings to aid you in searching for particular information to which you might want to return. You should, however, read the entire prospectus carefully.

TABLE OF CONTENTS

PART I. | | | | |

| | | | | |

| PROSPECTUS SUMMARY | | | 6 | |

| | | | | |

| RISK FACTORS | | | 8 | |

| | | | | |

| USE OF PROCEEDS | | | 19 | |

| | | | | |

| DETERMINATION OF OFFERING PRICE | | | 19 | |

| | | | | |

| DILUTION | | | 19 | |

| | | | | |

| SELLING STOCKHOLDERS | | | 19 | |

| | | | | |

| PLAN OF DISTRIBUTION | | | 20 | |

| | | | | |

| LEGAL PROCEEDINGS | | | 22 | |

| | | | | |

| MANAGEMENT | | | 22 | |

| | | | | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS | | | | |

| AND MANAGEMENT | | | 23 | |

| | | | | |

| DESCRIPTION OF SECURITIES | | | 24 | |

| | | | | |

| EXPERTS | | | 24 | |

| | | | | |

| TRANSFER AGENT | | | 24 | |

| | | | | |

| LEGAL MATTERS | | | 24 | |

| | | | | |

| DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION | | | | |

| FOR SECURITIES ACT LIABILITIES | | | 25 | |

| | | | | |

| BUSINESS | | | 25 | |

| | | | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | | 34 | |

| | | | | |

| MARKET INFORMATION | | | 48 | |

| | | | | |

| DIVIDEND POLICY | | | 49 | |

| | | | | |

| DESCRIPTION OF PROPERTY | | | 49 | |

| | | | | |

| ADDITIONAL INFORMATION | | | 49 | |

| | | | | |

| FINANCIAL STATEMENTS | | | 50-F-25 | |

PART II. | | | | |

| | | | | |

| INDEMNIFICATION OF OFFICERS, DIRECTORS AND OTHERS | | | 51 | |

| | | | | |

| OTHER EXPENSES OF ISSUANCE AND DISTRIBUTION | | | 51 | |

| | | | | |

| RECENT SALES OF UNREGISTERED SECURITIES | | | 51 | |

| | | | | |

| EXHIBITS | | | 51 | |

| | | | | |

| UNDERTAKINGS | | | 52 | |

| | | | | |

SIGNATURES | | | 53 | |

PROSPECTUS SUMMARY

This prospectus summary contains information about our company, our finances and our products that we believe is most important. This summary is qualified in its entirety by the more detailed information on these and other topics appearing elsewhere in this prospectus, including the information under the heading "Risk Factors" and the information contained in the Financial Statements. This summary is not complete and does not contain all of the information you should consider before investing in our common stock. You should read the entire prospectus carefully for a complete understanding of our business. Federal and state securities laws require that we include in this prospectus all the important information that you will need to make an investment decision.

Certain financial information included in this prospectus has been derived from data originally prepared in Renminbi (RMB), the currency of the People's Republic of China. See “Currency fluctuations and restrictions on currency exchange may adversely affect our business, including limiting our ability to convert Chinese Renminbi into foreign currencies and, if Chinese Renminbi were to decline in value, reducing our revenues in U.S. dollar terms” in the Risk Factors.

As used in this prospectus, "we", "us", "our", "Along" or "our company" refers to Along Mobile Technologies, Inc. and all of its subsidiaries and affiliated companies.

ABOUT OUR COMPANY

Incorporated in the State of Nevada, Along Mobile Technologies Inc. (“Along”) is a Chinese based mobile value-added services (“MVAS”) provider of wireless interactive entertainment products and services in the People’s Republic of China (the “PRC” or “China”). Along has two subsidiaries, Shaanxi Jialong Hi-Tech Industries Co. Ltd was founded in the People’s Republic of China (PRC) in 2002 and is currently headquartered in Shaanxi Province, PRC and Main Glory Holdings Limited was incorporated in Hong Kong on July 13, 2005 and is headquartered there. Ring-tones, games, images, videos and e-books are amongst the Wireless Applications which Along designs, produces, publishes, manufacturers, provides and distributes. Additionally, Along designs, produces and distributes portable digital communication products such as MP3, MP4 and PMP’s (“Communication Products”). These products together with mobile communication devices manufactured and/or distributed by unaffiliated third party manufacturers and distributors, may also be used in conjunction with the Company’s proprietary Wireless Applications.

ABOUT OUR REVENUES

Revenue increased by $479,572 from $1,960,914 for the six months ended June 30, 2005 to $2,440,486 for the six months ended June 30, 2006 and by $181,579 from $962,748 for the three months ended June 30, 2005 to $1,144,327 for the three months ended June 30, 2006.

The increase was mainly attributable to the increase in sales of our Wireless Applications products which results from the continuing installation of additional downloading terminals in the north western part of the PRC and the success in enhancing our brand awareness through marketing activities. Sales of Hardware products decreased as the management of the Company decided to concentrate our efforts on Wireless Applications and ceased certain Hardware Products business.

ABOUT OUR PRODUCTS

Products are a major competitive factor in the service provider business. The most desirable products and services can accelerate our objective to attract customers and create a brand loyalty. Along continues to invest in its product development team (studio) as it broadens its product portfolio. Along’s interactive entertainment products allow users to personalize their phone features with a variety of ring tones and picture downloads. Along believes that it can control costs, diversify risk and maintain access to talent by using both internal and third-party development resources. Along’s studios employ software engineers, artists and designers to create innovative applications. Additionally, Along contracts with third-party developers to create applications while assigning in-house producers to coordinate production based on Along specifications while owning copyrights to the applications Along publishes. Along also offers a variety of hardware products, including MP3, MP4, and PMP (Portable Media Player). All the while focusing on its proprietary distribution channel Along continues to develop a vast network via its downloading terminals all in conjunction with the new OCC platform. As Along gives users continual access to other third parties products Along’s brand and service reputation are strengthened. Along’s studios also manage research and development activities which are continually developing and evaluating new technologies that enable Along to create even more compelling applications for its customers. Examples of this continual development are Along’s commitment in research and development of multi-player technologies and services, 3D graphics rendering engines and player community features.

Hardware

Along currently offers entertainment-related hardware such as PMP (Portable Media Player), MP3 and MP4.

The PMP (Portable Media Player) is designed to play games, movies, and music. Its size is 140X78.9X21.4 mm, and weighs 258 grams, uses LCD display. The PMP has USB download capability, has high playback time, and supports many formats such as: AVI; DIVX; MPEG1 (VCD); MPEG2 (DVD) and MPEG4 for video, MP3 WMA, AC3, AAC for music, JPG and JPEG for pictures.

Software and Services

Along offers a diverse portfolio of popular, fee-based software and services to mobile phone users. Its services include ring-tones, games, images, videos and e-books.

Ring-tones: Along currently provides high quality music and sounds that based on their types can be sub-divided into Midi, Adp, Mmf, Mp3, and Amr. Pop, classic, jazz rock and other types of music are downloadable.

Images: Along provides a variety of images in different formats, such as JPG and GIF.

Videos: users can download Entertainment Programs, Flash Cartoons, Sports, and other videos.

E-books: users can download a variety of books in different categories as sampled below. Some of these categories include books about Modern Life, Human Philosophy, Short Stories, and other e-books.

Games: Along offer many kinds of games of different types such as Adventure, Role Play, Action, Sports, Chess and Card games among others. Examples include:

Adventure

Benthal World

Elephant

Action

Spider Man

Thunder Spirits

Chess and card

Platinum Solitaire

Limit JUMP chess

Role playing

Hero

SimCity

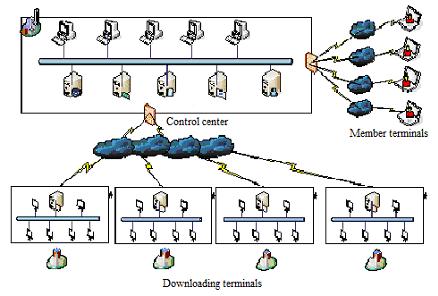

Downloading Terminals (OCC, Office, Community and Commerce-oriented)

Along’s terminals provide a unique way to expand Along’s proprietary distribution network. With over 700 of these terminals strategically located at high traffic zones such as shopping centers, universities, hotels and restaurants the terminals also serve to create as well as to enforce brand awareness. Along develops and manufactures the downloading terminals and in turn sell them to strategic partners who participate all the while expanding the Along network base. Most importantly, Along’s terminals provide direct access to the consumer for exploring and downloading Along’s software and services.

THE OFFERING

| Common stock being offered for sale to the public | | 6,900,000 |

| | | |

| Use of proceeds: | | The shares being registered have already been issued. The Company will not receive any proceeds of sale of the registering stock. |

RISK FACTORS

An investment in our common stock being offered for resale by the selling shareholders is very risky. You should carefully consider the risk factors described below, together with all other information in this prospectus before making an investment decision. Additional risks and uncertainties not presently foreseeable to us may also impair our business operations. If any of the following risks actually occurs, our business, financial condition or operating results could be materially and adversely affected. In such case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Because our operating history is limited and the revenue and income potential of our business and markets are unproven, we cannot predict whether we will meet internal or external expectations of future performance.

We believe that our future success depends on our ability to significantly increase revenue from our operations, of which we have a limited history. Accordingly, our prospects must be considered in light of the risks, expenses and difficulties frequently encountered by companies with a limited operating history. These risks include our ability to:

| | · | Offer new and innovative products; |

| | | Attract buyers for our MVAS; |

| | | Attract a larger audience to our network; |

| | | Derive revenue from our users from fee-based Internet services; |

| | | Respond effectively to competitive pressures and address the effects of strategic relationships or corporate combinations among our competitors; |

| | | Maintain our current, and develop new, strategic relationships |

| | | Increase awareness of our brand and continue to build user loyalty; |

| | | Attract and retain qualified management and employees; |

| | | Upgrade our technology to support increased traffic and expanded services; and |

| | | Expand the content and services on our network. |

We are relying on MVAS for a significant portion of our future revenue.

Our revenues are derived primarily from our MVAS services. If users do not adopt our MVAS at a sufficient rate our revenue growth could be negatively affected. Factors that may prevent us from maintaining or growing our MVAS revenues include:

| | | Our ability to develop new services that become accepted by the market. |

| | | Our ability to retain existing customers of our subscription services. |

| | | Our ability to attract new subscribers in a cost-effective manner. |

| | | Competitors, including mobile operators, may launch competing or better products that ours. |

| | | Changes in government regulations, which could restrict our MVAS offering and/or our ability to market our services. |

The markets for MVAS services are highly competitive, and we may be unable to compete successfully against new entrants and established industry competitors, some of which have greater financial resources than we do or currently enjoy a superior market position than we do.

There is significant competition among MVAS providers. A large number of independent MVAS providers compete against us. We may be unable to continue to grow our revenues from these services in this competitive environment. In addition, the major mobile operators in China, China Mobile and China Unicom, may potentially enter the business of content development. Any of our present or future competitors may offer MVAS which provide significant technology, performance, price, creativity or other advantages, over those offered by us, and therefore achieve greater market acceptance than ours.

The Chinese market for MVAS services is competitive and rapidly changing. Barriers to entry are relatively low, and current and new competitors can launch new websites or services at a relatively low cost. Many companies offer Chinese language content and services, including informational and community features, fee-based services and email and electronic commerce services in the Greater China market that may be competitive with our offerings. In addition, providers of Chinese language Internet tools and services may be acquired by, receive investments from or enter into other commercial relationships with large, well-established and well-financed Internet, media or other companies. In addition, entities that sponsor or maintain high-traffic websites or provide an initial point of entry for Internet users, such as ISPs, including large, well-capitalized entities such as Microsoft (MSN), Yahoo! Inc., eBay Inc., Google Inc. (“Google”) and America Online Inc, currently offer and could further develop or acquire content and services that compete with those that we offer. Companies such as these may have greater financial resources and assets, better brand recognition, more developed sales and other internal organizations, more customers and more extensive operating histories. As a result, such companies may be able to quickly provide competitive services and obtain a significant number of customers. We expect that as Internet usage in Greater China increases and the Greater China market becomes more attractive for conducting electronic commerce, large global competitors may increasingly focus their resources on the Greater China market.

In the areas of online games there is intense competition from domestic and international companies. These include domestic companies each focusing on one sector and large, international companies that intend to extend their businesses in the China market. The online gaming industry, for example, is dominated by domestic online game operators such as Shanda, Netease and The9. Many of our competitors have a longer history of providing these online services and currently offer a greater breadth of products which may be more popular than our offerings. These companies may therefore have a competitive advantage over us with respect to these business areas. A number of our current and potential future competitors have greater financial and other resources than we have, and may be able to more quickly react to changing consumer requirements and demands, deliver competitive services at lower prices and more effectively respond to new Internet technologies or technical standards.

Our investment in online games may not be successful.

Online games are currently some of the fastest growing online services in the PRC. We have invested and intend to expand in this area. Some of our competitors have entered this market ahead of us and have achieved significant market positions. Our main competitors in online games include Shanda, Netease, The9, Baidu, Yahoo!/Alibaba and Tencent’s QQ. Our competitors may have access to greater resources, which may give them a competitive advantage over us. We cannot assure you that we will succeed in this market despite our investments of time and funds to address this market. If we fail to achieve a significant position in this market, we will fail to realize our intended returns in this investment. Moreover, our competitors who succeed may enjoy increased revenues and profits from an increase in market share, and our results and share price could suffer as a result.

We may not be able to manage our expanding operations effectively, which could harm our business.

We have expanded rapidly by acquiring companies and entering into strategic agreements. We anticipate continuous expansion in our business, both through further acquisitions and internal growth, as we address growth in our customer base and market opportunities. In addition, the geographic dispersion of our operations as a result of acquisitions and overall internal growth requires significant management resources that our locally-based competitors do not need to devote to their operations. In order to manage the expected growth of our operations and personnel, we will be required to improve and implement operational and financial systems, procedures and controls, and expand, train and manage our growing employee base. Further, our management will be required to maintain and expand our relationships with various other third parties necessary to our business. We cannot assure you that our current and planned personnel, systems, procedures and controls will be adequate to support our future operations. If we are not successful in establishing, maintaining and managing our personnel, systems, procedures and controls, our business will be materially and adversely affected.

If we fail to successfully develop and introduce new products and services, our competitive position and ability to generate revenues could be harmed.

We are developing new products and services. The planned timing or introduction of new products and services is subject to risks and uncertainties. Actual timing may differ materially from original plans. Unexpected technical, operational, distribution or other problems could delay or prevent the introduction of one or more of our new products or services. Moreover, we cannot be sure that any of our new products and services will achieve widespread market acceptance or generate incremental revenue. If our efforts to develop a market and sell new products and services to the market are not successful, our financial position, results of operations and cash flows could be materially adversely affected, the price of our ordinary shares could decline and you could lose part or all of your investment.

Our strategy of acquiring complementary assets, technologies and businesses and entering into joint ventures may fail and may result in equity or earnings dilution.

As part of our business strategy, we have acquired and intend to continue to identify and acquire assets, technologies and businesses that are complementary to our existing business. In December 2005 we acquired Main Glory and its wholly owned subsidiary, Jialong, a MVAS company. We have significant potential ongoing financial obligations with respect to this transaction. Acquired businesses or assets may not yield the results we expected. In addition, acquisitions could result in the use of substantial amounts of cash, potentially dilutive issuances of equity securities, significant amortization expenses related to goodwill and other intangible assets and exposure to potential unknown liabilities of the acquired business. Moreover, the costs of identifying and consummating acquisitions, and integrating the acquired business into ours, may be significant. In addition, we may have to obtain approval from the relevant PRC governmental authorities for the acquisitions and have to comply with any applicable PRC rules and regulations, which may be costly. In the event our acquisitions are not successful, our financial conditions and results of operation may be materially adversely affected.

Our business and growth could suffer if we are unable to hire and retain key personnel that are in high demand.

We depend upon the continued contributions of our senior management and other key personnel, many of whom are difficult to replace. The loss of the services of any of our executive officers or other key employees could harm our business. Our future success will also depend on our ability to attract and retain highly skilled technical, managerial, editorial, marketing, and customer service personnel, especially qualified personnel for our international operations in Greater China. Qualified individuals are in high demand, and we may not be able to successfully attract, assimilate or retain the personnel we need to succeed.

Even if we are in compliance with Chinese governmental regulations relating to licensing and foreign investment prohibitions, the Chinese government may prevent us from distributing content that it believes is inappropriate and we may be liable for such content or we may have to stop profiting from such content.

China has enacted regulations governing Internet access and the distribution of news and other information. In the past, the Chinese government has stopped the distribution of information over the Internet or through MVAS that it believes to violate Chinese law, including content that it believes is obscene, incites violence, endangers national security, is contrary to the national interest or is defamatory. Even if we comply with Chinese governmental regulations relating to licensing and foreign investment prohibitions, if the Chinese government were to take any action to limit or prohibit the distribution of information through our MVAS, or to limit or regulate any current or future content or services available to users on our network, our business could be significantly harmed. Because the definition and interpretation of prohibited content is in many cases vague and subjective, it is not always possible to determine or predict what and how content might be prohibited under existing restrictions or restrictions that might be imposed in the future.

The law of the Internet remains largely unsettled, which subjects our business to legal uncertainties that could harm our business.

Due to the increasing popularity and use of the Internet and other online services, it is possible that a number of laws and regulations may be adopted with respect to the Internet or other online services including MVAS covering issues such as user privacy, pricing, content, copyrights, distribution, antitrust and characteristics and quality of products and services. Furthermore, the growth and development of the market for electronic commerce may prompt calls for more stringent consumer protection laws that may impose additional burdens on companies conducting business online. The adoption of any additional laws or regulations may decrease the growth of the Internet or other online services, which could, in turn, decrease the demand for our products and services and increase our cost of doing business.

Moreover, the applicability to the Internet and other online services of existing laws in various jurisdictions governing issues such as property ownership, sales and other taxes, libel and personal privacy is uncertain and may take years to resolve. For example, new tax regulations may subject us to additional sales and income taxes. Any new legislation or regulation, the application of laws and regulations from jurisdictions whose laws do not currently apply to our business, or the application of existing laws and regulations to the Internet and other online services could significantly disrupt our operations.

The Chinese legal system has inherent uncertainties that could limit the legal protections available to you.

Our operations in the PRC are governed by the laws of the People’s Republic of China. China’s legal system is based upon written statutes. Prior court decisions may be cited for reference but are not binding on subsequent cases and have limited value as precedents. Since 1979, the Chinese legislative bodies have promulgated laws and regulations dealing with economic matters such as foreign investment, corporate organization and governance, commerce, taxation and trade. However, because these laws and regulations are relatively new, and because of the limited volume of published decisions and their non-binding nature, the interpretation and enforcement of these laws and regulations involve uncertainties, and therefore you may not have legal protections for certain matters in China.

You may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing original actions in China based on United States or other foreign laws against us.

We conduct our operations in China and a significant portion of our assets are located in China. In addition, most of our directors and executive officers reside within China, and substantially all of the assets of these persons are located within China. As a result, it may not be possible to effect service of process within the United States or elsewhere outside China upon those directors or executive officers, including with respect to matters arising under U.S. federal securities laws or applicable state securities laws. Moreover, our Chinese counsel has advised us that China does not have treaties with the U.S. and many other countries that provide for the reciprocal recognition and enforcement of judgment of courts. As a result, recognition and enforcement in China of judgments of a court of the U.S. or any other jurisdiction in relation to any matter may be difficult or impossible.

We may have to register our encryption software with Chinese regulatory authorities, and if they request that we change our encryption software, our business operations could be disrupted as we develop or license replacement software.

Pursuant to the Regulations for the Administration of Commercial Encryption promulgated at the end of 1999, foreign and domestic Chinese companies operating in China are required to register and disclose to Chinese regulatory authorities the commercial encryption products they use. Because these regulations do not specify what constitutes encryption products, we are unsure as to whether or how they apply to us and the encryption software we utilize. We may be required to register, or apply for permits with the relevant Chinese regulatory authorities for, our current or future encryption software. If Chinese regulatory authorities request that we change our encryption software, we may have to develop or license replacement software, which could disrupt our business operations.

Concerns about the security of electronic commerce transactions and confidentiality of information on the Internet may reduce use of our network and impede our growth.

A significant barrier to electronic commerce and communications over the Internet in general has been a public concern over security and privacy, especially the transmission of confidential information. If these concerns are not adequately addressed, they may inhibit the growth of the Internet and other online services generally, especially as a means of conducting commercial transactions. If a well-publicized Internet breach of security were to occur, general Internet usage could decline, which could reduce traffic to our destination sites and impede our growth.

We may not be able to adequately protect our intellectual property, which could cause us to be less competitive.

We rely on a combination of copyright, trademark and trade secret laws and restrictions on disclosure to protect our intellectual property rights. Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy or otherwise obtain and use our technology. Monitoring unauthorized use of our products is difficult and costly, and we cannot be certain that the steps we have taken will prevent misappropriations of our technology, particularly in foreign countries where the laws may not protect our proprietary rights as fully as in the United States. From time to time, we may have to resort to litigation to enforce our intellectual property rights, which could result in substantial costs and diversion of our resources.

We may be exposed to infringement claims by third parties, which, if successful, could cause us to pay significant damage awards.

Third parties may initiate litigation against us alleging infringement of their proprietary rights. In the event of a successful claim of infringement and our failure or inability to develop non-infringing technology or license the infringed or similar technology on a timely basis, our business could be harmed. In addition, even if we are able to license the infringed or similar technology, license fees could be substantial and may adversely affect our results of operations.

We may be subject to claims based on the content we provide over our network and the products and services sold on our network, which, if successful, could cause us to pay significant damage awards.

As a publisher and distributor of content and a provider of services over the Internet and mobile telecommunications systems, we face potential liability for defamation, negligence, copyright, patent or trademark infringement and other claims based on the nature and content of the materials that we publish or distribute. We may incur significant costs in investigating and defending any potential claims, even if they do not result in liability.

We have contracted with third parties to provide content and services for our MVAS products and we may lose users and revenue if these arrangements are terminated.

We have arrangements with a number of third parties to provide content and services to our MVAS business and its various products. Although no single third party content provider is critical to our operations, if these parties fail to develop and maintain high-quality and successful products and services, or if a large number of our existing relationships are terminated, we could lose customers and market share and our business could be harmed.

Underdeveloped telecommunications infrastructure has limited, and may continue to limit, the growth of the MVAS market in China which, in turn, could limit our ability to grow our business.

The telecommunications infrastructure in China is not well developed. Although private sector ISPs exist in China, almost all access to the Internet is accomplished through ChinaNet, China’s primary commercial network, which is owned and operated by China Telecom and China Netcom under the administrative control and regulatory supervision of MII. The underdeveloped Internet infrastructure in China has limited the growth of Internet usage in China. If the necessary Internet infrastructure is not developed, or is not developed on a timely basis, future growth of the Internet in China could be limited and our business could be harmed.

We must rely on the Chinese government to develop China’s Internet infrastructure and, if it does not develop this infrastructure, our ability to grow our business could be hindered.

The Chinese government’s interconnecting, national networks connect to the Internet through government-owned international gateways, which are the only channels through which a domestic Chinese user can connect to the international Internet network. We rely on this backbone and China Telecom and China Netcom to provide data communications capacity primarily through local telecommunications lines. Although the Chinese government has announced plans to aggressively develop the national information infrastructure, we cannot assure you that this infrastructure will be developed. In addition, we have no guarantee that we will have access to alternative networks and services in the event of any disruption or failure. If the necessary infrastructure standards or protocols or complementary products, services or facilities are not developed by the Chinese government, the growth of our business could be hindered.

Future outbreaks of Severe Acute Respiratory Syndrome (“SARS”), Avian flu or other widespread public health problems could adversely affect our business.

Future outbreaks of SARS, Avian flu or other widespread public health problems in China and surrounding areas, where most of our employees work, could negatively impact our business in ways that are hard to predict. Prior experience with the SARS virus suggests that a future outbreak of SARS, Avian flu or other widespread public health problems may lead public health authorities to enforce quarantines, which could result in closures of some of our offices and other disruptions of our operations. A future outbreak of SARS, Avian flu or other widespread public health problems could result in reduction of our advertising and fee-based revenues.

Political and economic conditions in Greater China and the rest of Asia are unpredictable and may disrupt our operations if these conditions become unfavorable to our business.

We expect to derive a substantial percentage, if not all, of our revenues from the Greater China market. Changes in political or economic conditions in the region are difficult to predict and could adversely affect our operations which could reduce our revenues. We maintain a strong local identity and presence in each of the regions in the Greater China market in which we offer our products and we cannot be sure that we will be able to effectively maintain this local identity if political conditions were to change. Furthermore, many countries in Asia have experienced significant economic downturns since the middle of 1997, resulting in slower GDP growth for the entire region as a result of higher interest rates and currency fluctuations. If declining economic growth rates persist in these countries, expenditures for Internet and mobile telecommunications access could decrease, which could negatively affect our business and our profitability over time.

Economic reforms in the region could also affect our business in ways that are difficult to predict. For example, since the late 1970s, the Chinese government has been reforming the Chinese economic system to emphasize enterprise autonomy and the utilization of market mechanisms. Although we believe that these reform measures have had a positive effect on the economic development in China, we cannot be sure that they will be effective or that they will benefit our business.

Currency fluctuations and restrictions on currency exchange may adversely affect our business, including limiting our ability to convert Chinese renminbi into foreign currencies and, if Chinese renminbi were to decline in value, reducing our revenues in U.S. dollar terms.

Our reporting currency is the U.S. dollar and our operations in China and Hong Kong use their respective local currencies as their functional currencies. The majority of our revenues derived and expenses incurred are in Chinese renminbi with a relatively small amount in Hong Kong dollars and U.S. dollars. We are subject to the effects of exchange rate fluctuations with respect to any of these currencies. For example, the value of the renminbi depends to a large extent on Chinese government policies and China’s domestic and international economic and political developments, as well as supply and demand in the local market. Since 1994, the official exchange rate for the conversion of renminbi to U.S. dollars had generally been stable and the renminbi had appreciated slightly against the U.S. dollar. However, on July 21, 2005, the Chinese government changed its policy of pegging the value of Chinese renminbi to the U.S. dollar. Under the new policy, Chinese renminbi may fluctuate within a narrow and managed band against a basket of certain foreign currencies. As a result of this policy change, Chinese renminbi appreciated approximately 2.5% against the U.S. dollar in 2005. It is possible that the Chinese government could adopt a more flexible currency policy, which could result in more significant fluctuation of Chinese renminbi against the U.S. dollar. We can offer no assurance that Chinese renminbi will be stable against the U.S. dollar or any other foreign currency.

The income statements of our international operations are translated into U.S. dollars at the average exchange rates in each applicable period. To the extent the U.S. dollar strengthens against foreign currencies, the translation of these foreign currencies denominated transactions results in reduced revenues, operating expenses and net income for our international operations. Similarly, to the extent the U.S. dollar weakens against foreign currencies, the translation of these foreign currency denominated transactions results in increased revenues, operating expenses and net income for our international operations. We are also exposed to foreign exchange rate fluctuations as we convert the financial statements of our foreign subsidiaries into U.S. dollars in consolidation. If there is a change in foreign currency exchange rates, the conversion of the foreign subsidiaries’ financial statements into U.S. dollars will lead to a translation gain or loss which is recorded as a component of other comprehensive income. In addition, we have certain assets and liabilities that are denominated in currencies other than the relevant entity’s functional currency. Changes in the functional currency value of these assets and liabilities create fluctuations that will lead to a transaction gain or loss. We have not entered into agreements or purchased instruments to hedge our exchange rate risks, although we may do so in the future. The availability and effectiveness of any hedging transactions may be limited and we may not be able to successfully hedge our exchange rate risks.

Although Chinese governmental policies were introduced in 1996 to allow the convertibility of Chinese renminbi into foreign currency for current account items, conversion of Chinese renminbi into foreign exchange for capital items, such as foreign direct investment, loans or securities, requires the approval of the State Administration of Foreign Exchange, or SAFE, which is under the authority of the People’s Bank of China. These approvals, however, do not guarantee the availability of foreign currency. We cannot be sure that we will be able to obtain all required conversion approvals for our operations or that Chinese regulatory authorities will not impose greater restrictions on the convertibility of Chinese renminbi in the future. Because a significant amount of our future revenues may be in the form of Chinese renminbi, our inability to obtain the requisite approvals or any future restrictions on currency exchanges could limit our ability to utilize revenue generated in Chinese renminbi to fund our business activities outside China, or to repay foreign currency obligations, including our debt obligations, which would have a material adverse effect on our financial conditions and results of operation.

We may be required to record a significant charge to earnings if we must reassess our goodwill or amortizable intangible assets arising from acquisitions.

We are required under GAAP to review our amortizable intangible assets for impairment when events or changes in circumstances indicate the carrying value may not be recoverable. Goodwill is required to be tested for impairment at least annually. Factors that may be considered a change in circumstances indicating that the carrying value of our amortizable intangible assets may not be recoverable include a decline in stock price and market capitalization and slower growth rates in our industry. We may be required to record a significant charge to earnings in our financial statements during the period in which any impairment of our goodwill or amortizable intangible assets is determined.

While we believe that we currently have adequate internal control procedures in place, we are still exposed to potential risks from recent legislation requiring companies to evaluate controls under Section 404 of the Sarbanes-Oxley Act of 2002.

While we believe that we currently have adequate internal control procedures in place, we are still exposed to potential risks from recent legislation requiring companies to evaluate controls under Section 404 of the Sarbanes-Oxley Act of 2002. Under the supervision and with the participation of our management, we have evaluated our internal controls systems in order to allow management to report on, and our registered independent public accounting firm to attest to, our internal controls, as required by Section 404 of the Sarbanes-Oxley Act. We have performed the system and process evaluation and testing required in an effort to comply with the management certification and auditor attestation requirements of Section 404. As a result, we have incurred additional expenses and a diversion of management’s time. If we are not able to continue to meet the requirements of Section 404 in a timely manner or with adequate compliance, we might be subject to sanctions or investigation by regulatory authorities, such as the SEC. Any such action could adversely affect our financial results and the market price of our ordinary shares.

You should not place undue reliance on our financial guidance, nor should you rely on our quarterly operating results as an indication of our future performance because our results of operations are subject to significant fluctuations.

We may experience significant fluctuations in our quarterly operating results due to a variety of factors, many of which are outside of our control. Significant fluctuations in our quarterly operating results could be caused by any of the factors identified in this section, including but not limited to our ability to retain existing customers, attract new customers at a steady rate and maintain customer satisfaction; the announcement or introduction of new or enhanced services, content and products by us or our competitors; significant news events that increase traffic to our websites; technical difficulties, system downtime or Internet and mobile communications failures; the amount and timing of operating costs and capital expenditures relating to expansion of our business, operations and infrastructure; governmental regulation; seasonal trends in Internet and mobile telecommunications use; a shortfall in our revenues relative to our forecasts and a decline in our operating results due to our inability to adjust our spending quickly; and general economic conditions and economic conditions specific to the Internet, mobile telecommunications and the Greater China market. As a result of these and other factors, you should not place undue reliance on our financial guidance, nor should you rely on quarter-to-quarter comparisons of our operating results as indicators of likely future performance. Our quarterly revenue and earnings per share guidance is our best estimate at the time we provide guidance. Our operating results may be below our expectations or the expectations of public market analysts and investors in one or more future quarters. If that occurs, the price of our ordinary shares could decline and you could lose part or all of your investment.

Our stock price has been historically volatile and may continue to be volatile, which may make it more difficult for you to resell shares when you want at prices you find attractive.

The trading price of our ordinary shares has been and may continue to be subject to considerable daily fluctuations. Our stock price may fluctuate in response to a number of events and factors, such as quarterly variations in operating results, announcements of technological innovations and new products by us or our competitors, changes in financial estimates and recommendations by securities analysts, the operating and stock price performance of other companies that investors may deem comparable, new governmental restrictions or regulations and news reports relating to trends in our markets. In addition, the stock market in general, and the market prices for China-related and Internet-related companies in particular, have experienced extreme volatility that often has been unrelated to the operating performance of such companies. These broad market and industry fluctuations may adversely affect the price of our ordinary shares, regardless of our operating performance.

We may be classified as a passive foreign investment company, which could result in adverse U.S. tax consequences to U.S. investors.

Based upon the nature of our income and assets, we may be classified as a passive foreign investment company, or PFIC, by the United States Internal Revenue Service for U.S. federal income tax purposes. This characterization could result in adverse U.S. tax consequences to you. For example, if we are a PFIC, our U.S. investors will become subject to increased tax liabilities under U.S. tax laws and regulations and will become subject to more burdensome reporting requirements. The determination of whether or not we are a PFIC is made on an annual basis, and those determinations depend on the composition of our income and assets, including goodwill, from time to time. You should be aware that certain factors that could affect our classification as PFIC are out of our control. For example, the calculation of assets for purposes of the PFIC rules depends in large part upon the amount of our goodwill, which in turn is based, in part, on the then market value of our shares, which is subject to change. Similarly, the composition of our income and assets is affected by the extent to which we spend the cash we have raised on acquisitions and capital expenditures. In addition, the relevant authorities in this area are not clear and so we operate with less than clear guidance in our effort to minimize the risk of PFIC treatment. Therefore, we cannot be sure whether we are not and will not be a PFIC for the current or any future taxable year. In the event we are determined to be a PFIC, our stock may become less attractive to U.S. investors, thus negatively impacting the price of our stock.

RISKS RELATING TO THE OFFERING

This Prospectus contains forward-looking statements that are subject to risks, uncertainties, and assumptions; Our actual results may differ materially from those anticipated in the forward-looking statements.

This prospectus contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These include statements about our expectations, beliefs, intentions or strategies for the future, which we indicate by words or phrases such as "anticipate," "expect," "intend," "plan," "will," "we believe," "our company believes," "management believes" and similar language. The forward-looking statements are based on our current expectations and are subject to certain risks, uncertainties and assumptions, including those set forth in the discussion under "Management's Discussion and Analysis." Our actual results may differ materially from results anticipated in these forward-looking statements. We base the forward-looking statements on information currently available to us, and we assume no obligation to update or revise them, whether as a result of new information, future events or otherwise. In addition, our historical financial performance is not necessarily indicative of the results that may be expected in the future and we believe that such comparisons cannot be relied upon as indicators of future performance.

The market price for shares of our common stock could be volatile; you may be unable to resell your shares in the stock market.

The market price for the shares of our common stock may fluctuate in response to a number of factors, many of which are beyond our control. Such factors may include, without limitation, the general economic and monetary environment and the open-market trading of our shares in particular. Such market trading may include speculative short-selling by speculators. Investors may be unable to resell their shares in the stock market due to variations in trading volume or other market conditions.

The high and low price range for our shares of our common stock during the two most recent fiscal years and for the first two quarters of 2006 are as follows:

| | | High | | Low | |

| | | | | | |

Fiscal 2004 | | | | | |

| First Quarter | | $ | 0.05 | | $ | 0.001 | |

| Second Quarter | | $ | 0.125 | | $ | 0.001 | |

| Third Quarter | | $ | 0.125 | | $ | 0.08 | |

| Fourth Quarter | | $ | 0. 09 | | $ | 0.05 | |

| | | | | | | | |

Fiscal 2005 | | | | | | | |

| First Quarter | | $ | 0.10 | | $ | 0.05 | |

| Second Quarter | | $ | 0.07 | | $ | 0.015 | |

| Third Quarter | | $ | 0.015 | | $ | 0.01 | |

| Fourth Quarter | | $ | 0.02 | | $ | 0.01 | |

| | | | | | | | |

Fiscal 2006 | | | | | | | |

| First Quarter | | $ | 0.80 | | $ | 0.45 | |

| Second Quarter | | $ | 1.03 | | $ | 0.52 | |

We cannot guaranty the existence of an established public trading market.

Although our common stock is quoted on the Pink Sheets, a regular trading market for our securities may not be sustained in the future. The Pink Sheets is an inter-dealer, over-the-counter market that provides significantly less liquidity than the Over-the-Counter Bulletin Board quotation system (the “OTCBB”) or the NASD's automated quotation system (the "NASDAQ Stock Market"). Quotes for stocks included on the Pink Sheets are not listed in the financial sections of newspapers as are those for the NASDAQ Stock Market. Therefore, prices for securities traded solely on the Pink Sheets may be difficult to obtain and holders of common stock may be unable to resell their securities at or near their original offering price or at any price. Market prices for our common stock will be influenced by a number of factors, including:

| · | the issuance of new equity securities pursuant to this, or a future, offering; |

| · | changes in interest rates; |

| · | competitive developments, including announcements by competitors of new products or services or significant contracts, acquisitions, strategic partnerships, joint ventures or capital commitments; |

| · | variations in quarterly operating results; |

| · | change in financial estimates by securities analysts; |

| · | the depth and liquidity of the market for our common stock; |

| · | investor perceptions of our company and the aquaculture industry generally; and |

| · | general economic and other national conditions. |

There are short selling activities in the market where our common stock is quoted. Short-selling is market selling position not backed by any possession of the subject shares. Often such short sales are conducted by speculators. Short-selling may further depress our common stock price.

The Company is in the process of taking all actions necessary to move to the American Stock and Options Exchange (“the AMEX”).

Broker-Dealer requirements may affect the trading and liquidity of shares of our common stock.

Section 15(g) of the Securities Exchange Act of 1934, as amended, and Rule 15g-2 promulgated thereunder by the SEC require broker-dealers dealing in penny stocks to provide potential investors with a document disclosing the risks of penny stocks and to obtain a manually signed and dated written receipt of the document before effecting any transaction in a penny stock for the investor's account.

Potential investors in our common stock are urged to obtain and read such disclosure carefully before purchasing any shares that are deemed to be "penny stock." Moreover, Rule 15g-9 requires broker-dealers in penny stocks to approve the account of any investor for transactions in such stocks before selling any penny stock to that investor. This procedure requires the broker-dealer to (i) obtain from the investor information concerning his or her financial situation, investment experience and investment objectives; (ii) reasonably determine, based on that information, that transactions in penny stocks are suitable for the investor and that the investor has sufficient knowledge and experience as to be reasonably capable of evaluating the risks of penny stock transactions; (iii) provide the investor with a written statement setting forth the basis on which the broker-dealer made the determination in (ii) above; and (iv) receive a signed and dated copy of such statement from the investor, confirming that it accurately reflects the investor's financial situation, investment experience and investment objectives. Compliance with these requirements may make it more difficult for holders of our common stock to resell their shares to third parties or to otherwise dispose of them in the market.

The Sale of material amounts of our common stock could reduce the price of our common stock and encourage short sales.

Sales of significant amounts of shares held by our directors and executive officers, or the prospect of these sales, could adversely affect the market price of our common stock. See "Security Ownership of Certain Beneficial Owners and Management" for information about the ownership of common stock by our current executive officers, directors and principal shareholders. As we sell shares of our common stock the price may decrease due to the additional shares in the market.

Existing Shareholders May Experience Some Dilution.

The current trading price of our common stock is within a range between $1.03 and $0.52 for the most recent quarter. We may need to raise additional funds in the future to finance new developments or expand existing operations. If we raise additional funds through the issuance of new equity or equity-linked securities, other than on a pro rata basis to our existing shareholders, the percentage ownership of the existing shareholders may be reduced. Existing shareholders may experience subsequent dilution and/or such newly issued securities may have rights, preferences and privileges senior to those of the existing shareholders.

Our principal shareholders, current executive officers and directors own a significant percentage of our company and will be able to exercise significant influence over our company.

Our principal shareholders, current executive officers and directors together beneficially own over 81% of our common stock. Accordingly, if acting together, these shareholders may be able to determine the composition of our board of directors, may retain the effective voting power to approve all matters requiring shareholder approval, may prevail in matters requiring shareholder approval, including, in particular the election and removal of directors, and may continue to have significant influence over our business. As a result of their ownership and positions, our directors and executive officers collectively are able to influence all matters requiring shareholder action, including approval of significant corporate transactions. In addition, sales of significant amounts of shares held by our directors and executive officers, or the prospect of these sales, could adversely affect the market price of our common stock. See "Security Ownership of Certain Beneficial Owners and Management" for information about the ownership of common stock by our current executive officers, directors and principal shareholders.

USE OF PROCEEDS

The shares being registered are a resale of 6,900,000 shares of common stock being offered by the selling stockholders. The Company will not receive any proceeds from any sale of shares of common stock by the selling shareholders.

DETERMINATION OF OFFERING PRICE

The offering price will be determined by the average of the bid and asked price for the common stock reported on Pink Sheets on a given day in which the shares are sold.

DILUTION

There will be no dilution of shares due to the resale of already issued and outstanding shares of common stock.

SELLING STOCKHOLDERS

The following table sets forth as of September 11, 2006, information regarding the current beneficial ownership of our common stock by the person identified, based on information provided to us by them, which we have not independently verified. Although we have assumed for purposes of the table that the selling stockholders will sell all of the shares offered by this prospectus, because they may from time to time offer all or some of their shares under this prospectus or in another manner, no assurance can be given as to the actual number of shares that will be resold by the selling stockholders (or any of them), or that will be held after completion of the resales. In addition, a selling stockholder may have sold or otherwise disposed of shares in transactions exempt from the registration requirements of the Securities Act or otherwise since the date he or she provided information to us. The selling stockholders are not making any representation that the shares covered by this prospectus will be offered for sale.

Except as set forth below, no selling stockholder has held any position nor had any material relationship with us or our affiliates during the past three years.

Name of Selling Stockholder | | Shares Owned Prior to this Offering | | Total Number of Shares to be Offered for Selling Stockholders Account | | Total Number of Shares Owned Upon Completion of the Offering (1) (2) | | Percent Owned Upon Completion of this Offering (1) (2) | |

| Gold Hill Holdings, Inc. | | | 6,900,000 | | | 6,900,000 | | | -0- | | | -0- | |

| (1) | Based on 70,000,000 shares of our common stock issued and outstanding as of September 11, 2006 and assumes that all 6,900,000 shares of common stock offered in the Company Offering have been sold. |

| (2) | Because a selling stockholder may offer by this prospectus all or some part of the common shares which it holds, no estimate can be given as of the date hereof as to the number of shares of common stock actually to be offered for sale by a selling stockholder or as to the number of shares of common stock that will be held by a selling stockholder upon the termination of such offering. |

PLAN OF DISTRIBUTION

The selling stockholders of our common stock and any of their pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their shares of common stock on any stock exchange, market or trading facility on which the shares are traded or in private transactions. These sales may be at fixed or negotiated prices. The selling stockholders may use any one or more of the following methods when selling shares:

| · | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| · | block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| · | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| · | an exchange distribution in accordance with the rules of the applicable exchange; |

| · | privately negotiated transactions; |

| · | settlement of short sales entered into after the date of this prospectus; |

| · | broker-dealers may agree with the Selling Stockholders to sell a specified number of such shares at a stipulated price per share; |

| · | a combination of any such methods of sale; |

| · | through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; or |

| · | any other method permitted pursuant to applicable law. |

The selling stockholders may also sell shares under Rule 144 under the Securities Act of 1933, as amended, if available, rather than under this prospectus.

Broker-dealers engaged by the selling stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the selling stockholders (or, if any broker-dealer acts as agent for the purchaser of shares, from the purchaser) in amounts to be negotiated. Each selling stockholder does not expect these commissions and discounts relating to its sales of shares to exceed what is customary in the types of transactions involved.

In connection with the sale of our common stock or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the common stock in the course of hedging the positions they assume. The selling stockholders may also sell shares of our common stock short and deliver these securities to close out their short positions, or loan or pledge the common stock to broker-dealers that in turn may sell these securities. The selling stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The selling stockholders and any broker-dealers or agents that are involved in selling the shares may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. Each selling stockholder has informed the Company that it does not have any agreement or understanding, directly or indirectly, with any person to distribute the Common Stock.

The Company is required to pay certain fees and expenses incurred by the Company incident to the registration of the shares. The Company has agreed to indemnify the selling stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

Because Selling Stockholders may be deemed to be “underwriters” within the meaning of the Securities Act, they will be subject to the prospectus delivery requirements of the Securities Act. In addition, any securities covered by this prospectus which qualify for sale pursuant to Rule 144 under the Securities Act may be sold under Rule 144 rather than under this prospectus. Each selling stockholder has advised us that they have not entered into any agreements, understandings or arrangements with any underwriter or broker-dealer regarding the sale of the resale shares. There is no underwriter or coordinating broker acting in connection with the proposed sale of the resale shares by the selling stockholders.

We agreed to keep this prospectus effective until the earlier of (i) the date on which the shares may be resold by the selling stockholders without registration and without regard to any volume limitations by reason of Rule 144(e) under the Securities Act or any other rule of similar effect or (ii) all of the shares have been sold pursuant to the prospectus or Rule 144 under the Securities Act or any other rule of similar effect. The resale shares will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain states, the resale shares may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules and regulations under the Securities Exchange Act of 1934, as amended, any person engaged in the distribution of the resale shares may not simultaneously engage in market making activities with respect to our common stock for a period of two business days prior to the commencement of the distribution. In addition, the selling stockholders will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of shares of our common stock by the selling stockholders or any other person. We will make copies of this prospectus available to the selling stockholders and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale.

LEGAL PROCEEDINGS

We are currently not involved in any litigation that we believe could have a materially adverse effect on our financial condition or results of operations. There is no action, suit, proceeding, inquiry or investigation before or by any court, public board, government agency, self-regulatory organization or body pending or, to the knowledge of the executive officers of our company or any of our subsidiaries, threatened against or affecting our company, our common stock, any of our subsidiaries or of our company's or our company's subsidiaries' officers or directors in their capacities as such, in which an adverse decision could have a material adverse effect.

MANAGEMENT

DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth the names of our current directors and executive officers, their principal offices and positions. Our executive officers are elected annually by the board of directors. Our directors serve one-year terms until their successors are elected. The executive officers serve terms of one year or until their death, resignation or removal by the board of directors. There are no family relationships between any of the directors and executive officers. In addition, there was no arrangement or understanding between any executive officer and any other person pursuant to which any person was selected as an executive officer. The executive officers are all full time employees of Along.

The directors and executive officers of AGMB are as follows:

| Name | | Position |

| Jianwei Li | | Chief Executive Officer, |

| | | And Director |

| | | |

| Zhen Wang | | Chief Financial Officer |

| | | And Director |

| | | |

| Xu Lin | | Chief Accounting Officer |

| | | |

| Yeru Gao | | Chief Operations Officer |

| | | And Director |

Set forth below are the brief descriptions of the background and experience of each of our officers and directors:

Jianwei Li

Mr. Li is the Chief Executive Officer of Along. Prior to Along, Mr. Li worked as President of Fuzhou Extraterrestrial Computer Technology Co., Ltd.─Xi'an Filiale in 1994. Mr. Li was also responsible as the deputy for establishment of IBM’s sale network in the western part of China in 1992. Mr. Li graduated from the Computer Science Department of Northwestern Polytechnical University in Xi'an with a Bachelor's degree of Engineering in Computer Application in 1987.

Zhen Wang

Co-Founder of Along and Chief Financial Officer. Mr. Wang previously worked as a financial consultant for Jiangsu Zhongtian Tech. Co., Ltd. Mr. Wang was awarded the bachelor of law in the College of Xi’an Politics in 2000. He also obtained his Master of Economics from Shanghai University of Financing and Economics in 2002.

Xu Lin

Ms. Lin is the Chief Accounting Officer. From 1999 to 2005 she has worked as the Chief Accounting Officer of Topsun Sci-tech Co., Ltd. In mid-2005, she took on the role of Chief Accounting Officer with Along. Ms. Lin graduated from Shaanxi University of Finance & Economics with a Bachelor Degree in 1987. In 1997, she obtained her CPA qualifications in China.

Yeru Gao

Mr. Gao, joined Along Mobile Tech. in 1999, bringing his analytic expertise in Finance, Accounting and Market Strategies. Mr. Gao was formerly a principal in the industrial department of Northwestern Polytechnical University from 1996-1998 in Xi’an, P.R. China. He was also Vice President in the investment department of Guosen Securities. Mr. Gao graduated from the Shaanxi Normal University in Xi’an with a Bachelor's degree in Finance in 1989.

INDEMNIFICATION

Our articles of incorporation and by-laws limit the liability of directors to the maximum extent permitted by Nevada law. This limitation of liability is subject to exceptions including intentional misconduct, obtaining an improper personal benefit and abdication or reckless disregard of director duties. Our articles of incorporation and bylaws provide that we may indemnify our directors, officer, employees and other agents to the fullest extent permitted by law. Our bylaws also permit us to secure insurance on behalf of any officer, director, employee or other agent for any liability arising out of his or her actions in such capacity, regardless of whether the bylaws would permit indemnification. We currently do not have such an insurance policy.

EXECUTIVE COMPENSATION

Officers receive no compensation for such services.

DIRECTOR COMPENSATION

Members of our Board of Directors receive no compensation for such service, except that the directors are authorized to receive one hundred (100) shares of 144 Restricted Common Stock of the Company for each director’s meeting they attend. No such stock has been issued.

EMPLOYMENT AGREEMENTS

The Company has no employment agreements at this time.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

As used in this section, the term beneficial ownership with respect to a security is defined by Rule 13d-3 under the Securities Exchange Act of 1934, as amended, as consisting of sole or shared voting power (including the power to vote or direct the vote) and/or sole or shared investment power (including the power to dispose of or direct the disposition of) with respect to the security through any contract, arrangement, understanding, relationship or otherwise subject to community property laws where applicable.

As of August 31, 2006, we had a total of 70,000,000 shares of common stock issued and outstanding, which are the only issued and outstanding voting equity securities of Along.

The following table sets forth certain information regarding beneficial ownership of common stock as of August 31, 2006 by each person known to us to own beneficially more than 5% of our common stock, each of our directors, each of our named executive officers; and all executive officers and directors as a group.

Name of Beneficial Owner | | Amount of Shares Beneficially Owned | | Percentage of Shares Beneficially Owned | |

| Gold Hill Holdings, Inc. | | | 6,900,000 | | | 9.9 | % |

| | | | | | | | |

| Glory Luck International Ltd. | | | 39,500,000 | | | 56.4 | % |

| | | | | | | | |

| Jianwei Li | | | 5,000,000 | | | 7.1 | % |

| | | | | | | | |

| Yeru Gao | | | 3,000,000 | | | 4.3 | % |

| | | | | | | | |

| Zhen Wang | | | 2,500,000 | | | 3.6 | % |

DESCRIPTION OF SECURITIES

Our current authorized capital stock consists of 200,000,000 shares of common stock, par value $.001 per share, of which 70,000,000 shares were issued and outstanding as of August 31, 2006, and Common Stock.

Each common share entitles the holder to one vote on all matters submitted to a vote of the Company’s stockholders. When a dividend is declared by the Board, all stockholders are entitled to receive a fixed dividend. To date, no dividends have been declared. All shares issued in the company are of the same class, and have equal liquidation, preference, and adjustment rights.

EXPERTS

Our consolidated financial statements as of December 31, 2005 and 2004 and for the years then ended, have been included in this prospectus and in the registration statement of which this prospectus forms a part in reliance on the report of Jimmy C.H. Cheung & Co., independent accountants, given on authority of said firm as experts in auditing and accounting.

As disclosed in our Current Report on Form 8-K filed with the Commission on June 23, 2006, Child, Van Wagoner & Bradshaw, PLLC, our certifying accounting firm, was dismissed as our principal independent accountant on June 20, 2006. On June 23, 2006, we announced that we engaged Jimmy C.H. Cheung & Co. as the principal accounting firm to audit our financial statements. The decision to change the accountants was approved by our Board of Directors.

TRANSFER AGENT

Our transfer agent is Pacific Stock Transfer. The address is 500 E. Warm Springs Road, Suite 240, Las Vegas, Nevada 89119.

LEGAL MATTERS