| | |

| OMB APPROVAL |

OMB Number: | | 3235-0570 |

Expires: | | January 31, 2017 |

Estimated average burden |

hours per response: | | 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03826

AIM Sector Funds (Invesco Sector Funds)

(Exact name of registrant as specified in charter)

11 Greenway Plaza, Suite 1000 Houston, Texas 77046

(Address of principal executive offices) (Zip code)

Philip A. Taylor 11 Greenway Plaza, Suite 1000 Houston, Texas 77046

(Name and address of agent for service)

Registrant’s telephone number, including area code: (713) 626-1919

Date of fiscal year end: 4/30

Date of reporting period: 4/30/14

Item 1. Report to Stockholders.

| | | | |

| | |

| | Annual Report to Shareholders | | April 30, 2014 |

| | |

| | Invesco American Value Fund |

| | Nasdaq: |

| | A: MSAVX n B: MGAVX n C: MSVCX n R: MSARX n Y: MSAIX n R5: MSAJX n R6: MSAFX |

Letters to Shareholders

| | | | |

Philip Taylor | | | | Dear Shareholders: This annual report includes information about your Fund, including performance data and a complete list of its investments as of the close of the reporting period. Inside, your Fund’s portfolio managers discuss how they managed your Fund and the factors that affected its performance during the reporting period. I hope you find this report of interest. During the reporting period covered by this report, major US and global equity market indexes hit multiyear or all-time highs.1 This was the result of generally improving economic conditions, relatively healthy corporate profits and a return of individual investors to stocks - due in part to monetary policies that kept interest rates and yields on many fixed income securities low. Despite some volatility in the summer of 2013, overseas equity market indexes in developed and emerging nations generally rose during the reporting period – although developed markets |

generally outpaced emerging markets. In January 2014, amid widespread signs of an improving economy, the US Federal Reserve began a long-anticipated reduction in its bond-buying program, reducing uncertainty for fixed income investors even as volatility returned to the stock market in the first few months of the year.

Extended periods of strong market performance can lull some investors into a false sense of security – just as extended periods of volatility or market weakness can discourage some investors from undertaking disciplined, long-term investment plans. That’s why Invesco believes it can often be helpful to work with a skilled and trusted financial adviser; he or she can emphasize the importance of adhering to an investment plan designed to achieve long-term goals like a first home, a college education for a child or a comfortable retirement. A financial adviser who is familiar with your individual financial situation, investment goals and risk tolerance can be an invaluable partner as you work toward your financial goals. He or she can provide insight and perspective when markets are volatile; encouragement and reassurance when times are uncertain; and advice and guidance when your financial situation or investment goals change.

Timely information when and where you want it

Invesco’s efforts to help investors achieve their financial objectives include providing individual investors and financial professionals with timely information about the markets, the economy and investing – whenever and wherever they want it.

Our website, invesco.com/us, offers a wide range of market insights and investment perspectives. On the website, you’ll find detailed information about our funds, including prices, performance, holdings and portfolio manager commentaries. You can access information about your individual Invesco account whenever it’s convenient for you; just complete a simple, secure online registration. Use the “Login” box on our home page to get started.

Invesco’s mobile app for iPad® (available free from the App StoreSM) allows you to obtain the same detailed information about your Fund and the same investment insights from our investment leaders, market strategists, economists and retirement experts on the go. You also can watch portfolio manager videos and have instant access to Invesco news and updates wherever you may be.

In addition to the resources accessible on our website and through our mobile app, you can obtain timely updates to help you stay informed about the markets, the economy and investing by connecting with Invesco on Twitter, LinkedIn or Facebook. You can access our blog at blog.invesco.us.com or by visiting the “Intentional Investing Forum” on our home page. Our goal is to provide you the information you want, when and where you want it.

Have questions?

For questions about your account, feel free to contact an Invesco client services representative at 800 959 4246. For Invesco-related questions or comments, please email me directly at phil@invesco.com.

All of us at Invesco look forward to serving your investment management needs for many years to come. Thank you for investing with us.

Sincerely,

Philip Taylor

Senior Managing Director, Invesco Ltd.

1 Source: Reuters

iPad is a trademark of Apple Inc., registered in the US and other countries. App Store is a service mark of Apple Inc. Invesco Distributors, Inc. is not affiliated with Apple Inc.

2 Invesco American Value Fund

| | | | |

Bruce Crockett | | | | Dear Fellow Shareholders: Members of the Invesco Funds Board work continually to oversee how the Invesco Funds are performing in light of ever-changing and often unpredictable economic and market conditions. One of the ways we do this is by verifying that the teams that manage funds understand the risks associated with the investments they make in the funds they manage. In light of market conditions over the last few years, the financial news media of late have given increased attention to “alternative investment strategies.” Despite this increased attention, many investors don’t know very much about these types of investment strategies. Let me put alternative investment strategies and the new focus on them in some perspective. First, these types of investment strategies have been used predominately by institutional investors and investment professionals for decades to increase diversification – in |

an effort to dampen portfolio volatility (risk) with the goal of increasing returns. The focal point of the increased news coverage is that these types of strategies are now being made more widely available to individual investors.

Alternative investment strategies generally seek to provide measured exposure to various asset classes whose performance, historically, has not been highly correlated with one another. These strategies may help mitigate the impact to a portfolio from severe or prolonged market downturns while potentially providing reasonable returns over time. After a careful and thorough examination of the potential risks and potential benefits of alternative investment strategies, the Invesco Funds Board has approved the launch of several new alternative funds for the Invesco product lineup, to be managed by teams we determined have the depth and experience to pursue the funds’ investment objectives.

While no single investment product can provide complete downside protection in falling markets and full upside participation in rising markets, your Board believes alternative funds can be a prudent tool to work in concert with more traditional mutual funds and other investments to build well diversified portfolios. Your financial adviser can determine whether or not such investments are appropriate for your individual needs, goals and risk tolerance. Also, he or she can explain the risks associated with alternative investment strategies. This type of professional guidance is why Invesco believes it’s so important that individual investors work with trusted, experienced financial advisers.

Whether you’re invested in equity, fixed income, cash management or alternative investment funds, be assured that the Invesco Funds Board will continue working on your behalf and on behalf of all our fund shareholders, keeping your needs and interests uppermost in our minds.

As always, please contact me at bruce@brucecrockett.com with any questions or concerns you may have. On behalf of the Board, we look forward to continuing to represent your interests and serving your needs.

Sincerely,

Bruce L. Crockett

Independent Chair

Invesco Funds Board of Trustees

Asset allocation/diversification does not guarantee a profit or eliminate the risk of loss.

Alternative products typically hold more non-traditional investments and employ more complex trading strategies, including hedging and leveraging through derivatives, short selling and opportunistic strategies that change with market conditions. Investors considering alternatives should be aware of their unique characteristics and additional risks from the strategies they use. Like all investments, performance will fluctuate. You can lose money.

3 Invesco American Value Fund

Management’s Discussion of Fund Performance

Performance summary

For the fiscal year ended April 30, 2014, Invesco American Value Fund, at net asset value (NAV), produced positive returns that slightly lagged the Russell Midcap Value Index, the Fund’s style-specific benchmark. Holdings in the financials, industrials and materials sectors contributed to Fund results, both on a relative and absolute basis. The largest detractors from relative returns were the consumer discretionary and consumer staples sectors. The Fund’s cash allocation also tempered returns during the reporting period.

Your Fund’s long-term performance appears later in this report.

Fund vs. Indexes

Total returns, 4/30/13 to 4/30/14, at net asset value (NAV). Performance shown does not include applicable contingent deferred sales charges (CDSC) or front-end sales charges, which would have reduced performance.

| | | | | |

| Class A Shares | | | | 20.62 | % |

| Class B Shares | | | | 20.67 | |

| Class C Shares | | | | 19.76 | |

| Class R Shares | | | | 20.34 | |

| Class Y Shares | | | | 20.94 | |

| Class R5 Shares | | | | 21.10 | |

| Class R6 Shares | | | | 21.19 | |

| S&P 500 Index‚ (Broad Market Index) | | | | 20.44 | |

| Russell Midcap Value Index¢ (Style-Specific Index) | | | | 22.10 | |

| Lipper Mid-Cap Value Funds Indext (Peer Group Index) | | | | 22.74 | |

Source(s): ‚Invesco, S&P-Dow Jones via FactSet Research Systems Inc.;

nInvesco, Russell via FactSet Research Systems Inc.; tLipper Inc.

How we invest

The Fund invests, under normal circumstances, at least 80% of its net assets (plus any borrowings for investment purposes) in securities of US issuers, and in derivatives and other instruments that have economic characteristics similar to such securities. Under normal market conditions, the Fund invests at least 65% of its net assets in equity securities of small- to mid-cap companies.

We call our investment philosophy “value with a catalyst.” We believe undervalued companies that are experiencing positive changes (i.e., “catalysts”) have the potential to generate long-term stock price appreciation for shareholders. We generally seek to identify companies that are out of favor with investors, earning

below their potential and attractively valued. For these companies, we attempt to identify catalysts that may improve the financial results and/or correct the undervaluation. Typical examples of catalysts include improved operational efficiency, changing industry dynamics or a change in management.

We initially identify potential investments through a series of quantitative screens that look at valuation and rate of return metrics. We then conduct fundamental research on the most attractive opportunities. The research process includes a thorough review of a company’s financial statements, an evaluation of its competitive position and an assessment of its stability. During the research process, we also value the company under various scenarios to determine if

the investment is an attractive opportunity relative to its risks. This is also where we typically identify the positive catalyst, a prerequisite for a potential investment. Finally, we set price targets for each of the Fund’s holdings by applying historical and/or peer group valuation multiples to our estimate of normalized earnings.

In short, our goal is to capitalize on perceived market skepticism toward a company’s stock by analyzing the company’s operations in the context of a cyclical environment and identifying one or more catalysts that may improve the company’s financial performance. Improved financial performance, in turn, may have the potential to drive the company’s stock price higher.

We typically sell an investment when it reaches our estimate of fair value or when we identify a more attractive investment opportunity.

Market conditions and your Fund

The US equity market rose to multiyear or all-time highs during the fiscal year ended April 30, 2014.1 Corporate earnings were resilient in the face of modest economic growth, driven by strong profit-ability across many sectors. Fundamentals for corporations and consumers remained relatively stable following significant recovery in prior years.

However, the fiscal year began with capital markets in the US declining. In May and June 2013, equity and fixed income markets fell following then-US Federal Reserve (the Fed) Chairman Ben Bernanke’s comments suggesting that the time was approaching to reduce, or “taper,” the size of its bond buying economic stimulus program. This sell-off was brief but broad, and few asset classes were immune. Markets stabilized in mid-summer and generally rose, with some brief interruptions, through the end of 2013. The Fed’s announcement in December that tapering of its bond purchases would begin in early 2014 had little effect on equities as the

| | | | | |

Portfolio Composition | | | | | |

By sector | | | | | |

| Financials | | | | 24.3 | % |

| Consumer Discretionary | | | | 13.2 | |

| Industrials | | | | 12.6 | |

| Information Technology | | | | 10.2 | |

| Health Care | | | | 9.6 | |

| Energy | | | | 6.7 | |

| Materials | | | | 5.8 | |

| Utilities | | | | 4.7 | |

| Consumer Staples | | | | 3.9 | |

| Telecommunication Services | | | | 2.4 | |

| Money Market Funds | | | | | |

| Plus Other Assets Less Liabilities | | | | 6.6 | |

| | | | | |

Top 10 Equity Holdings* |

| | | | | |

| |

| 1. ConAgra Foods, Inc. | | | | 3.3 | % |

| 2. Snap-on Inc. | | | | 2.9 | |

| 3. Marsh & McLennan Cos., Inc. | | | | 2.9 | |

| 4. ACE Ltd. | | | | 2.8 | |

| 5. Citrix Systems, Inc. | | | | 2.8 | |

| 6. Johnson Controls, Inc. | | | | 2.7 | |

| 7. Cadence Design Systems, Inc. | | | | 2.7 | |

| 8. Ascena Retail Group, Inc. | | | | 2.5 | |

| 9. Comerica Inc. | | | | 2.5 | |

| 10. Williams Cos., Inc. (The) | | | | 2.5 | |

| | | | | |

Total Net Assets | | | | $1.9 billion | |

| |

| Total Number of Holdings* | | | | 48 | |

The Fund’s holdings are subject to change, and there is no assurance that the Fund will continue to hold any particular security.

*Excluding money market fund holdings.

4 Invesco American Value Fund

announcement was widely anticipated. After strong performance in the second half of 2013, the US equity market turned volatile in the first four months of 2014 as investors worried that stocks may have risen too far, too fast in 2013. Adding to investor uncertainty was political upheaval in Ukraine and signs of economic sluggishness in the US and China.

In this environment, major domestic equity market indexes delivered positive returns, and all sectors of the Russell Midcap Value Index posted double-digit returns.

Stock selection and an underweight position in the financials sector were the largest contributors to the Fund’s relative results during the reporting period. The Fund benefited from its substantial underweight exposure to real estate investment trusts (REITs) relative to the Russell Midcap Value Index. REITs comprise a large portion of the financials sector within the Russell Midcap Value Index, yet these securities had negative returns, and materially underperformed both the financials sector and overall index.

Strong stock selection and an overweight position in the industrials sector also contributed to results. A number of holdings within this sector were among the top performers for the Fund, including toolmaker Snap-on, global construction and engineering firm Foster Wheeler, and transportation services and trucking company Swift Transportation. Based on strong moves in its stock price and subsequently higher valuations, we eliminated Swift Transportation during the reporting period. Foster Wheeler received an acquisition offer from oil and gas engineering firm AMEC during the reporting period. In our view, Foster Wheeler is a complement to AMEC’s business, and as such, we sold our position in Foster Wheeler and purchased AMEC following the announcement of the impending merger.

Stock selection in the materials sector made a positive contribution to absolute and relative performance. Within the sector, packaging company Sealed Air was the largest individual contributor for the reporting period. The company made continued progress during the reporting period on improving its operating profit margins and its cash flow under the direction of new management.

An underweight position in the utilities sector was also a contributor to relative Fund performance, as it had the lowest return of all 10 sectors within the Russell Midcap Value Index.

Stock selection in the consumer staples sector was the largest detractor from results during the reporting period, on both a relative and absolute basis. Avon was the largest detractor within the

sector and one of the largest individual detractors overall. Shares of Avon sold off sharply in the fourth quarter of 2013 after the company missed its earnings estimates and warned investors that a larger-than-expected fine to settle a bribery probe could materially impact its business. In addition, shares of ConAgra Foods sold off when the company reduced its earnings guidance for 2014 citing weakness in its private label business as well as consumer brands.

Though the consumer discretionary sector generated a positive absolute return, poor stock selection in the sector detracted from relative Fund performance during the reporting period. Detractors in the sector included retailers Express and Family Dollar Stores, which both reported disappointing sales for the 2013 holiday season and were negatively impacted by severe winter weather in the first quarter of 2014.

The health care sector made a positive contribution to performance, but the Fund’s holdings lagged the style-specific benchmark on a relative basis, primarily due to a number of pharmaceutical companies that we did not own, but that did very well within the Russell Midcap Value Index.

Though the Fund’s energy holdings also had a positive absolute return, they lagged those of the style-specific index and detracted from results on a relative basis. The sector also contained a number of the Fund’s best and worst performing holdings. Newfield Exploration was among the Fund’s top individual contributors, while Noble was the largest detractor. Newfield Exploration divested international assets and made progress on growing its domestic oil production. Noble’s shares came under pressure due to concerns about utilization rates and pricing on the company’s offshore rigs. We eliminated our position in Noble during the reporting period.

We used forward foreign currency contracts during the reporting period for the purpose of hedging currency exposure of non-US-based companies held in the Fund. Derivatives were used for the purpose of hedging and not for speculative purposes or leverage. The use of forward foreign currency contracts had a slight negative impact on the Fund’s performance relative to the Russell Mid Cap Value Index for the reporting period.

As bottom-up stock pickers, we are focused on a stock’s valuation relative to the remaining upside in the stock’s price. This discipline becomes more crucial in a rapidly rising market, as we attempt to protect investor returns through an entire market cycle. As such, during the reporting period, we harvested a number of well-

performing holdings with limited upside potential. This activity increased the Fund’s cash position and tempered Fund performance relative to the style-specific index.

Despite providing investors strong absolute returns, equity markets experienced continued volatility during the reporting period, based on the anticipation of extremely low interest rates beginning to rise. We believe that market volatility can create opportunities to invest in companies with attractive valuations and strong fundamentals. We believe that ultimately those valuations and fundamentals can be reflected in those companies’ stock prices.

We are committed to working to achieve positive returns for the Fund’s shareholders through an entire market cycle. Thank you for your continued investment in the Invesco American Value Fund.

The views and opinions expressed in management’s discussion of Fund performance are those of Invesco Advisers, Inc. These views and opinions are subject to change at any time based on factors such as market and economic conditions. These views and opinions may not be relied upon as investment advice or recommendations, or as an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but Invesco Advisers, Inc. makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

See important Fund and, if applicable, index disclosures later in this report.

| | |

| | Tom Copper Chartered Financial Analyst, portfolio manager, is co-lead manager of Invesco American Value Fund. |

| He joined Invesco in 2010. Mr. Copper earned a BA in economics and political science from Tulane University and an MBA from Baylor University. |

|

| | |

| | John Mazanec Portfolio manager, is co-lead manager of Invesco American Value Fund. He joined Invesco in 2010. Mr. Mazanec |

| earned a BS from DePauw University and an MBA from Harvard University. |

|

| | |

| | Sergio Marcheli Portfolio manager, is manager of Invesco American Value Fund. He joined Invesco in 2010. Mr. Marcheli |

| earned a BBA from the University of Houston and an MBA from the University of St. Thomas. |

|

5 Invesco American Value Fund

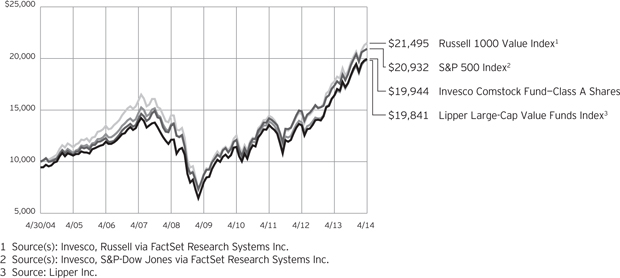

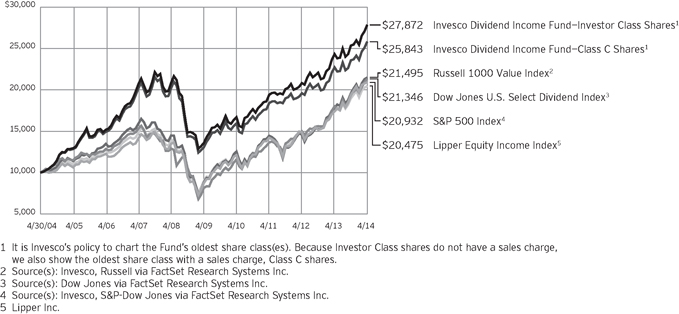

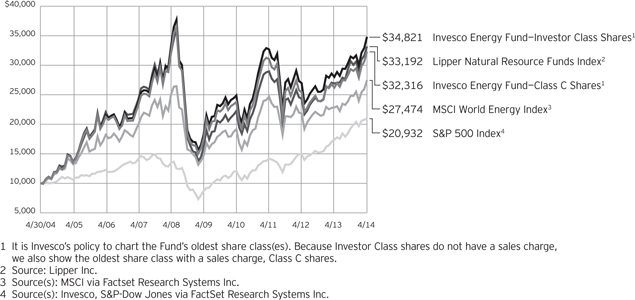

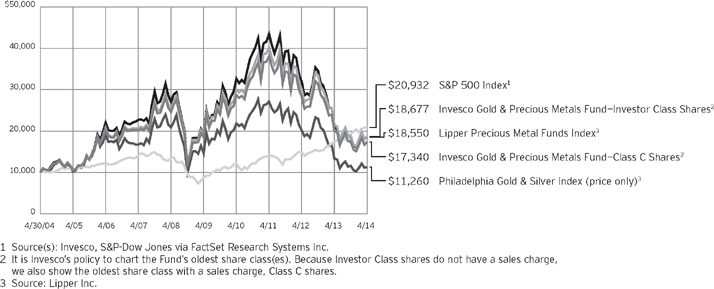

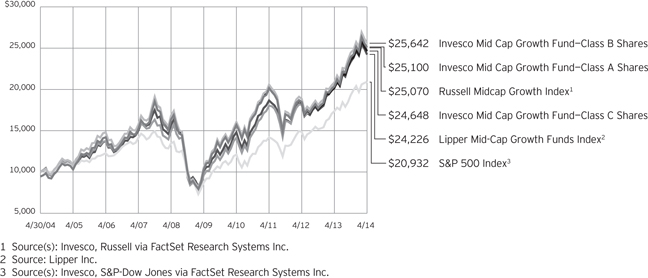

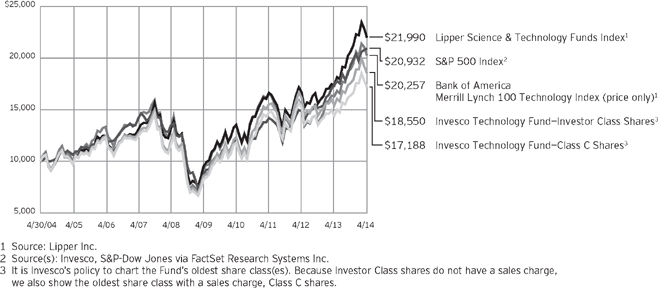

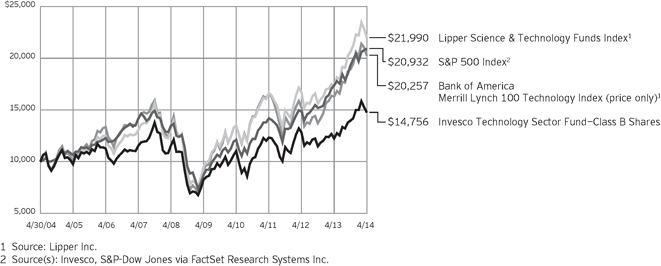

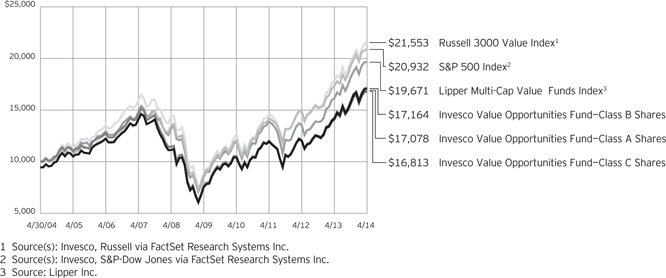

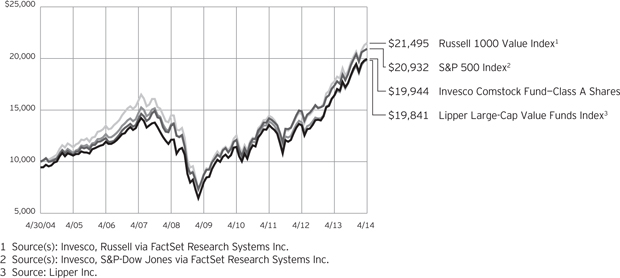

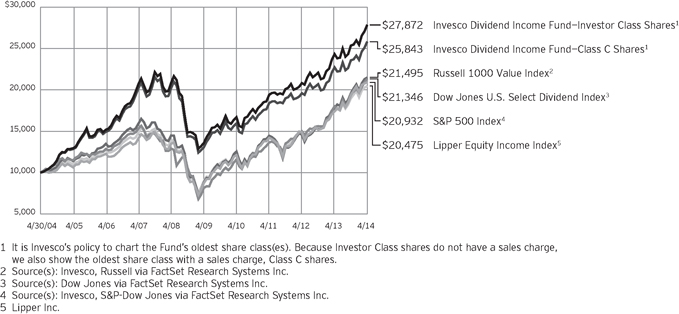

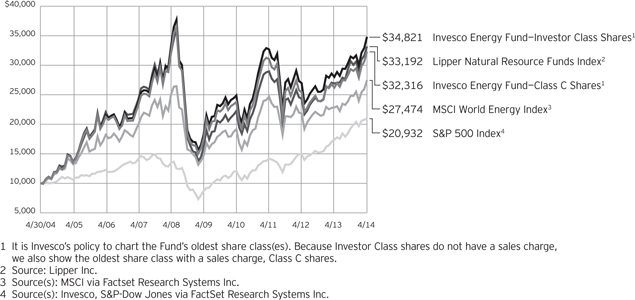

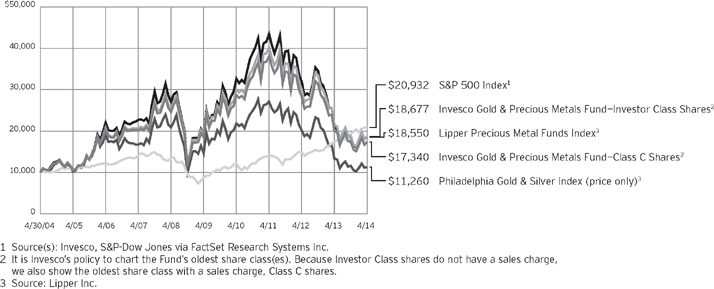

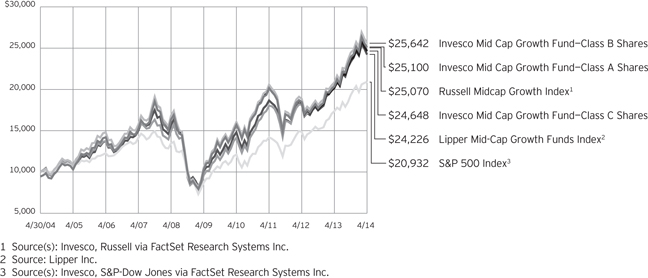

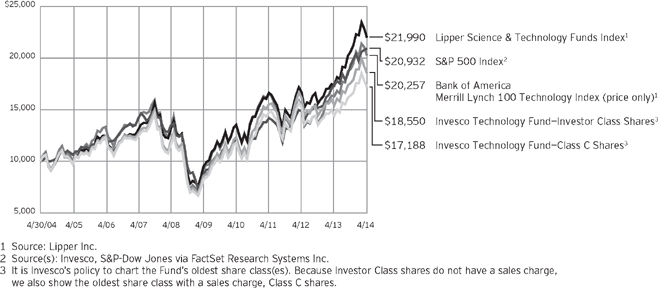

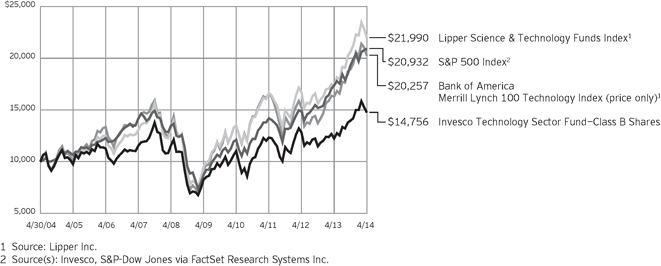

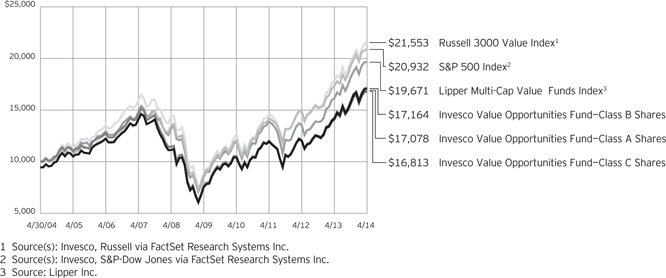

Your Fund’s Long-Term Performance

Results of a $10,000 Investment

Fund and index data from 4/30/04

Past performance cannot guarantee comparable future results.

The data shown in the chart include reinvested distributions, applicable sales charges and Fund expenses including

management fees. Index results include reinvested dividends, but they do not reflect sales charges. Performance of the peer group, if applicable, reflects fund expenses and management fees;

performance of a market index does not. Performance shown in the chart and table(s) does not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

continued from page 8

About indexes used in this report

| n | | The S&P 500® Index is an unmanaged index considered representative of the US stock market. |

| n | | The Russell Midcap Value Index is an unmanaged index considered representative of mid-cap value stocks. The Russell Midcap Value Index is a trademark/ service mark of the Frank Russell Co. Russell® is a trademark of the Frank Russell Co. |

| n | | The Lipper Mid-Cap Value Funds Index is an unmanaged index considered representative of mid-cap value funds tracked by Lipper. |

| n | | The Fund is not managed to track the performance of any particular index, |

including the index(es) described here, and consequently, the performance of the Fund may deviate significantly from the performance of the index(es).

| n | | A direct investment cannot be made in an index. Unless otherwise indicated, index results include reinvested dividends, and they do not reflect sales charges. Performance of the peer group, if applicable, reflects fund expenses; performance of a market index does not. |

Other information

| n | | The returns shown in management’s discussion of Fund performance are based on net asset values (NAVs) calculated |

for shareholder transactions. Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes, and as such, the NAVs for shareholder transactions and the returns based on those NAVs may differ from the NAVs and returns reported in the Financial Highlights.

| n | | Industry classifications used in this report are generally according to the Global Industry Classification Standard, which was developed by and is the exclusive property and a service mark of MSCI Inc. and Standard & Poor’s. |

6 Invesco American Value Fund

| | | | | |

| Average Annual Total Returns |

As of 4/30/14, including maximum applicable sales charges | |

| |

| Class A Shares | | | | | |

| Inception (10/18/93) | | | | 9.86 | % |

| 10 Years | | | | 9.60 | |

| 5 Years | | | | 19.81 | |

| 1 Year | | | | 13.99 | |

| |

| Class B Shares | | | | | |

| Inception (8/1/95) | | | | 9.86 | % |

| 10 Years | | | | 9.98 | |

| 5 Years | | | | 20.91 | |

| 1 Year | | | | 15.67 | |

| |

| Class C Shares | | | | | |

| Inception (10/18/93) | | | | 9.37 | % |

| 10 Years | | | | 9.41 | |

| 5 Years | | | | 20.30 | |

| 1 Year | | | | 18.76 | |

| |

| Class R Shares | | | | | |

| Inception (3/20/07) | | | | 7.39 | % |

| 5 Years | | | | 20.88 | |

| 1 Year | | | | 20.34 | |

| |

| Class Y Shares | | | | | |

| Inception (2/7/06) | | | | 9.20 | % |

| 5 Years | | | | 21.48 | |

| 1 Year | | | | 20.94 | |

| |

| Class R5 Shares | | | | | |

| 10 Years | | | | 10.39 | % |

| 5 Years | | | | 21.57 | |

| 1 Year | | | | 21.10 | |

| |

| Class R6 Shares | | | | | |

| 10 Years | | | | 10.29 | % |

| 5 Years | | | | 21.35 | |

1 Year | | | | 21.19 | |

Effective June 1, 2010, Class A, Class B, Class C, Class I and Class R shares of the predecessor fund, Van Kampen American Value Fund, advised by Van Kampen Asset Management were reorganized into Class A, Class B, Class C, Class Y and Class R shares, respectively, of Invesco Van Kampen American Value Fund (renamed Invesco American Value Fund). Returns shown above for Class A, Class B, Class C, Class R and Class Y shares are blended returns of the predecessor fund and Invesco American Value Fund. Share class returns will differ from the predecessor fund because of different expenses.

Class R5 shares incepted on June 1, 2010. Performance shown prior to that date is that of the predecessor fund’s Class A shares and includes the 12b-1 fees applicable to Class A shares. Class

| | | | | |

| Average Annual Total Returns |

As of 3/31/14, the most recent calendar quarter end, including maximum applicable sales charges | |

| |

| Class A Shares | | | | | |

| Inception (10/18/93) | | | | 9.95 | % |

| 10 Years | | | | 9.48 | |

| 5 Years | | | | 23.40 | |

| 1 Year | | | | 15.09 | |

| |

| Class B Shares | | | | | |

| Inception (8/1/95) | | | | 9.97 | % |

| 10 Years | | | | 9.86 | |

| 5 Years | | | | 24.54 | |

| 1 Year | | | | 16.78 | |

| |

| Class C Shares | | | | | |

| Inception (10/18/93) | | | | 9.47 | % |

| 10 Years | | | | 9.30 | |

| 5 Years | | | | 23.89 | |

| 1 Year | | | | 19.89 | |

| |

| Class R Shares | | | | | |

| Inception (3/20/07) | | | | 7.64 | % |

| 5 Years | | | | 24.50 | |

| 1 Year | | | | 21.47 | |

| |

| Class Y Shares | | | | | |

| Inception (2/7/06) | | | | 9.43 | % |

| 5 Years | | | | 25.12 | |

| 1 Year | | | | 22.10 | |

| |

| Class R5 Shares | | | | | |

| 10 Years | | | | 10.27 | % |

| 5 Years | | | | 25.19 | |

| 1 Year | | | | 22.20 | |

| |

| Class R6 Shares | | | | | |

| 10 Years | | | | 10.17 | % |

| 5 Years | | | | 24.97 | |

1 Year | | | | 22.32 | |

A share performance reflects any applicable fee waivers or expense reimbursements.

Class R6 shares incepted on September 24, 2012. Performance shown prior to that date is that of the Fund’s and the predecessor fund’s Class A shares and includes the 12b-1 fees applicable to Class A shares. Class A share performance reflects any applicable fee waivers or expense reimbursements.

The performance data quoted represent past performance and cannot guarantee comparable future results; current performance may be lower or higher. Please visit invesco.com/performance for the most recent month-end performance. Performance figures reflect reinvested distributions, changes in net asset

value and the effect of the maximum sales charge unless otherwise stated. Investment return and principal value will fluctuate so that you may have a gain or loss when you sell shares.

The total annual Fund operating expense ratio set forth in the most recent Fund prospectus as of the date of this report for Class A, Class B, Class C, Class R, Class Y, Class R5 and Class R6 shares was 1.23%, 1.23%, 1.98%, 1.48%, 0.98%, 0.87% and 0.78%, respectively. The expense ratios presented above may vary from the expense ratios presented in other sections of this report that are based on expenses incurred during the period covered by this report.

Class A share performance reflects the maximum 5.50% sales charge, and Class B and Class C share performance reflects the applicable contingent deferred sales charge (CDSC) for the period involved. For shares purchased prior to June 1, 2010, the CDSC on Class B shares declines from 5% at the time of purchase to 0% at the beginning of the sixth year. For shares purchased on or after June 1, 2010, the CDSC on Class B shares declines from 5% at the time of purchase to 0% at the beginning of the seventh year. The CDSC on Class C shares is 1% for the first year after purchase. Class R, Class Y, Class R5 and Class R6 shares do not have a front-end sales charge or a CDSC; therefore, performance is at net asset value.

The performance of the Fund’s share classes will differ primarily due to different sales charge structures and class expenses.

7 Invesco American Value Fund

Invesco American Value Fund’s investment objective is total return through growth of capital and current income.

| n | | Unless otherwise stated, information presented in this report is as of April 30, 2014, and is based on total net assets. |

| n | | Unless otherwise noted, all data provided by Invesco. |

| n | | To access your Fund’s reports/prospectus, visit invesco.com/fundreports. |

About share classes

| n | | Class B shares may not be purchased for new or additional investments. Please see the prospectus for more information. |

| n | | Class R shares are generally available only to employer sponsored retirement and benefit plans. Please see the prospectus for more information. |

| n | | Class Y shares are available only to certain investors. Please see the prospectus for more information. |

| n | | Class R5 shares and Class R6 shares are primarily intended for employer sponsored retirement and benefit plans that meet certain standards and for institutional investors. Please see the prospectus for more information. |

Principal risks of investing in the Fund

| n | | Depositary receipts risk. Depositary receipts involve many of the same risks as those associated with direct investment in foreign securities. In addition, the underlying issuers of certain depositary receipts, particularly unsponsored or unregistered depositary receipts, are under no obligation to distribute shareholder communications to the holders of such receipts or to pass through to them any voting rights with respect to the deposited securities. |

| n | | Derivatives risk. The value of a derivative instrument depends largely on (and is derived from) the value of an underlying security, currency, commodity, interest rate, index or other asset (each referred to as an underlying asset). In addition to risks relating to the underlying assets, the use of derivatives may include other, possibly greater, risks, including counterparty, leverage and liquidity risks. Counter-party risk is the risk that the counter-party to the derivative contract will default on its obligation to pay the Fund the amount owed or otherwise perform under the derivative contract. Derivatives create leverage risk because they do not require payment up front equal |

to the economic exposure created by owning the derivative. As a result, an adverse change in the value of the underlying asset could result in the Fund sustaining a loss that is substantially greater than the amount invested in the derivative, which may make the Fund’s returns more volatile and increase the risk of loss. Derivative instruments may also be less liquid than more traditional investments and the Fund may be unable to sell or close out its derivative positions at a desirable time or price. This risk may be more acute under adverse market conditions, during which the Fund may be most in need of liquidating its derivative positions. Derivatives may also be harder to value, less tax efficient and subject to changing government regulation that could impact the Fund’s ability to use certain derivatives or their cost. Also, derivatives used for hedging or to gain or limit exposure to a particular market segment may not provide the expected benefits, particularly during adverse market conditions.

| n | | Foreign securities risk. The Fund’s foreign investments may be affected by changes in a foreign country’s exchange rates, political and social instability, changes in economic or taxation policies, difficulties when enforcing obligations, decreased liquidity, and increased volatility. Foreign companies may be subject to less regulation resulting in less publicly available information about the companies. |

| n | | Management risk. The investment techniques and risk analysis used by the Fund’s portfolio managers may not produce the desired results. |

| n | | Market risk. The prices of and the income generated by the Fund’s securities may decline in response to, among other things, investor sentiment, general economic and market conditions, regional or global instability, and currency and interest rate fluctuations. |

| n | | REIT/real estate risk. Investments in real estate related instruments may be affected |

by economic, legal, cultural, environmental or technological factors that affect property values, rents or occupancies of real estate related to the Fund’s holdings. Real estate companies, including REITs or similar structures, tend to be small- and mid-cap companies, and their shares may be more volatile and less liquid. The value of investments in real estate related companies may be affected by the quality of management, the ability to repay loans, the utilization of leverage and financial covenants related thereto, whether the company carries adequate insurance and environmental factors. If a real estate related company defaults, the Fund may own real estate directly, which involves the following additional risks: environmental liabilities; difficulty in valuing and selling the real estate; and economic or regulatory changes.

| n | | Small- and mid-capitalization risk. Stocks of small- and mid-sized companies tend to be more vulnerable to adverse developments and may have little or no operating history or track record of success, and limited product lines, markets, management and financial resources. The securities of small- and mid-sized companies may be more volatile due to less market interest and less publicly available information about the issuer. They also may be illiquid or restricted as to resale, or may trade less frequently and in smaller volumes, all of which may cause difficulty when establishing or closing a position at a desirable price. |

| n | | Value investing style risk. The Fund emphasizes a value style of investing, which focuses on undervalued companies with characteristics for improved valuations. This style of investing is subject to the risk that the valuations never improve or that the returns on value equity securities are less than returns on other styles of investing or the overall stock market. Value stocks also may decline in price, even though in theory they are already underpriced. |

continued on page 6

This report must be accompanied or preceded by a currently effective Fund prospectus, which contains more complete information, including sales charges and expenses. Investors should read it carefully before investing.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

8 Invesco American Value Fund

Schedule of Investments(a)

April 30, 2014

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks–93.40% | |

| Aerospace & Defense–2.03% | |

Textron Inc. | | | 947,979 | | | $ | 38,772,341 | |

|

| Air Freight & Logistics–1.03% | |

UTi Worldwide, Inc. | | | 2,000,293 | | | | 19,582,868 | |

|

| Alternative Carriers–2.43% | |

tw telecom inc.(b) | | | 1,513,040 | | | | 46,435,198 | |

|

| Apparel Retail–4.17% | |

Ascena Retail Group, Inc.(b) | | | 2,824,622 | | | | 48,583,498 | |

Express, Inc.(b) | | | 2,118,794 | | | | 30,870,829 | |

| | | | | 79,454,327 | |

|

| Application Software–5.45% | |

Cadence Design Systems, Inc.(b) | | | 3,241,664 | | | | 50,440,292 | |

Citrix Systems, Inc.(b) | | | 901,855 | | | | 53,489,020 | |

| | | | | 103,929,312 | |

|

| Asset Management & Custody Banks–2.02% | |

Northern Trust Corp. | | | 639,885 | | | | 38,553,071 | |

|

| Auto Parts & Equipment–4.52% | |

Dana Holding Corp. | | | 1,683,228 | | | | 35,633,937 | |

Johnson Controls, Inc. | | | 1,121,956 | | | | 50,645,094 | |

| | | | | 86,279,031 | |

|

| Automotive Retail–1.78% | |

Advance Auto Parts, Inc. | | | 279,703 | | | | 33,925,177 | |

|

| Communications Equipment–1.18% | |

Ciena Corp.(b) | | | 1,138,528 | | | | 22,508,698 | |

|

| Diversified Banks–2.54% | |

Comerica Inc. | | | 1,005,520 | | | | 48,506,285 | |

|

| Diversified Chemicals–2.48% | |

Eastman Chemical Co. | | | 543,460 | | | | 47,373,408 | |

|

| Electric Utilities–2.03% | |

Edison International | | | 684,445 | | | | 38,712,209 | |

|

| Electronic Manufacturing Services–0.28% | |

Flextronics International Ltd.(b) | | | 603,596 | | | | 5,426,328 | |

|

| General Merchandise Stores–1.76% | |

Family Dollar Stores, Inc. | | | 571,623 | | | | 33,582,851 | |

|

| Health Care Equipment–1.78% | |

CareFusion Corp.(b) | | | 869,638 | | | | 33,968,060 | |

|

| Health Care Facilities–6.41% | |

Brookdale Senior Living Inc.(b) | | | 1,135,544 | | | | 36,155,721 | |

HealthSouth Corp. | | | 1,309,571 | | | | 45,363,540 | |

Universal Health Services, Inc.–Class B | | | 499,260 | | | | 40,834,475 | |

| | | | | 122,353,736 | |

| | | | | | | | |

| | | Shares | | | Value | |

| Heavy Electrical Equipment–2.18% | |

Babcock & Wilcox Co. (The) | | | 1,195,196 | | | $ | 41,580,869 | |

|

| Housewares & Specialties–0.99% | |

Newell Rubbermaid Inc. | | | 625,589 | | | | 18,836,485 | |

|

| Human Resource & Employment Services–2.24% | |

Robert Half International, Inc. | | | 955,640 | | | | 42,812,672 | |

|

| Industrial Machinery–5.11% | |

Ingersoll-Rand PLC | | | 718,824 | | | | 42,985,675 | |

Snap-on Inc. | | | 469,392 | | | | 54,449,472 | |

| | | | | 97,435,147 | |

| | |

| Insurance Brokers–5.22% | | | | | | | | |

Arthur J. Gallagher & Co. | | | 370,525 | | | | 16,681,035 | |

Marsh & McLennan Cos., Inc. | | | 1,103,316 | | | | 54,404,512 | |

Willis Group Holdings PLC | | | 694,707 | | | | 28,476,040 | |

| | | | | 99,561,587 | |

|

| Investment Banking & Brokerage–2.20% | |

Stifel Financial Corp.(b) | | | 896,906 | | | | 41,948,294 | |

|

| IT Consulting & Other Services–2.46% | |

Teradata Corp.(b) | | | 1,034,651 | | | | 47,035,234 | |

|

| Life Sciences Tools & Services–1.41% | |

PerkinElmer, Inc. | | | 642,346 | | | | 26,959,262 | |

|

| Multi-Utilities–1.43% | |

CenterPoint Energy, Inc. | | | 1,103,197 | | | | 27,315,158 | |

|

| Oil & Gas Equipment & Services–1.85% | |

AMEC PLC (United Kingdom) | | | 1,686,525 | | | | 35,245,320 | |

|

| Oil & Gas Exploration & Production–2.40% | |

Newfield Exploration Co.(b) | | | 1,352,998 | | | | 45,798,982 | |

|

| Oil & Gas Storage & Transportation–3.75% | |

ONEOK, Inc. | | | 380,569 | | | | 24,059,572 | |

Williams Cos., Inc. (The) | | | 1,125,539 | | | | 47,463,980 | |

| | | | | 71,523,552 | |

|

| Packaged Foods & Meats–3.25% | |

ConAgra Foods, Inc. | | | 2,032,060 | | | | 61,998,151 | |

|

| Paper Packaging–1.40% | |

Sealed Air Corp. | | | 778,959 | | | | 26,726,083 | |

|

| Personal Products–0.61% | |

Avon Products, Inc. | | | 762,253 | | | | 11,647,226 | |

|

| Property & Casualty Insurance–4.31% | |

ACE Ltd. | | | 528,807 | | | | 54,107,532 | |

Fidelity National Financial, Inc.–Class A | | | 871,885 | | | | 28,057,259 | |

| | | | | 82,164,791 | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

9 Invesco American Value Fund

| | | | | | | | |

| | | Shares | | | Value | |

| Real Estate Operating Companies–2.44% | |

Forest City Enterprises, Inc.–Class A(b) | | | 2,460,727 | | | $ | 46,532,348 | |

|

| Regional Banks–5.57% | |

BB&T Corp. | | | 1,162,186 | | | | 43,384,403 | |

Wintrust Financial Corp. | | | 877,701 | | | | 39,338,559 | |

Zions Bancorp. | | | 815,201 | | | | 23,575,613 | |

| | | | | 106,298,575 | |

|

| Specialty Chemicals–1.93% | |

W.R. Grace & Co.(b) | | | 399,897 | | | | 36,830,514 | |

|

| Technology Hardware, Storage & Peripherals–0.76% | |

Diebold, Inc. | | | 386,198 | | | | 14,524,907 | |

Total Common Stocks

(Cost $1,442,514,932) | | | | 1,782,138,057 | |

| |

Money Market Funds–5.88% | | | | | |

Liquid Assets Portfolio–

Institutional Class(c) | | | 56,114,749 | | | | 56,114,749 | |

Premier Portfolio–

Institutional Class(c) | | | 56,114,749 | | | | 56,114,749 | |

Total Money Market Funds

(Cost $112,229,498) | | | | 112,229,498 | |

TOTAL INVESTMENTS–99.28%

(Cost $1,554,744,430) | | | | 1,894,367,555 | |

OTHER ASSETS LESS LIABILITIES–0.72% | | | | 13,798,015 | |

NET ASSETS–100.00% | | | $ | 1,908,165,570 | |

Notes to Schedule of Investments:

| (a) | Industry and/or sector classifications used in this report are generally according to the Global Industry Classification Standard, which was developed by and is the exclusive property and a service mark of MSCI Inc. and Standard & Poor’s. |

| (b) | Non-income producing security. |

| (c) | The money market fund and the Fund are affiliated by having the same investment adviser. |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

10 Invesco American Value Fund

Statement of Assets and Liabilities

April 30, 2014

| | | | |

Assets: | | | | |

Investments, at value (Cost $1,442,514,932) | | $ | 1,782,138,057 | |

Investments in affiliated money market funds, at value and cost | | | 112,229,498 | |

Total investments, at value (Cost $1,554,744,430) | | | 1,894,367,555 | |

Receivable for: | | | | |

Investments sold | | | 16,263,017 | |

Fund shares sold | | | 10,914,610 | |

Dividends | | | 1,044,321 | |

Investment for trustee deferred compensation and retirement plans | | | 160,144 | |

Other assets | | | 52,365 | |

Total assets | | | 1,922,802,012 | |

| |

Liabilities: | | | | |

Payable for: | | | | |

Investments purchased | | | 11,334,751 | |

Fund shares reacquired | | | 1,799,012 | |

Forward foreign currency contracts outstanding | | | 82,694 | |

Accrued fees to affiliates | | | 1,136,155 | |

Accrued trustees’ and officers’ fees and benefits | | | 3,238 | |

Accrued other operating expenses | | | 95,242 | |

Trustee deferred compensation and retirement plans | | | 185,350 | |

Total liabilities | | | 14,636,442 | |

Net assets applicable to shares outstanding | | $ | 1,908,165,570 | |

| |

Net assets consist of: | | | | |

Shares of beneficial interest | | $ | 1,471,254,918 | |

Undistributed net investment income | | | (130,589 | ) |

Undistributed net realized gain | | | 97,500,810 | |

Net unrealized appreciation | | | 339,540,431 | |

| | | $ | 1,908,165,570 | |

| | | | |

Net Assets: | | | | |

Class A | | $ | 1,086,505,705 | |

Class B | | $ | 32,126,760 | |

Class C | | $ | 111,455,267 | |

Class R | | $ | 67,420,457 | |

Class Y | | $ | 452,580,220 | |

Class R5 | | $ | 72,752,582 | |

Class R6 | | $ | 85,324,579 | |

|

Shares outstanding, $0.01 par value per share,

with an unlimited number of shares authorized: | |

Class A | | | 27,087,427 | |

Class B | | | 885,456 | |

Class C | | | 3,147,952 | |

Class R | | | 1,683,180 | |

Class Y | | | 11,240,073 | |

Class R5 | | | 1,806,395 | |

Class R6 | | | 2,118,449 | |

Class A: | | | | |

Net asset value per share | | $ | 40.11 | |

Maximum offering price per share | | | | |

(Net asset value of $40.11 ¸ 94.50%) | | $ | 42.44 | |

Class B: | | | | |

Net asset value and offering price per share | | $ | 36.28 | |

Class C: | | | | |

Net asset value and offering price per share | | $ | 35.41 | |

Class R: | | | | |

Net asset value and offering price per share | | $ | 40.06 | |

Class Y: | | | | |

Net asset value and offering price per share | | $ | 40.26 | |

Class R5: | | | | |

Net asset value and offering price per share | | $ | 40.28 | |

Class R6: | | | | |

Net asset value and offering price per share | | $ | 40.28 | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

11 Invesco American Value Fund

Statement of Operations

For the year ended April 30, 2014

| | | | |

Investment income: | |

Dividends | | $ | 21,890,712 | |

Dividends from affiliated money market funds | | | 54,722 | |

Interest | | | 112,252 | |

Total investment income | | | 22,057,686 | |

| |

Expenses: | | | | |

Advisory fees | | | 11,405,074 | |

Administrative services fees | | | 394,147 | |

Custodian fees | | | 43,578 | |

Distribution fees: | | | | |

Class A | | | 2,397,323 | |

Class B | | | 90,766 | |

Class C | | | 995,674 | |

Class R | | | 292,165 | |

| Transfer agent fees — A, B, C, R and Y | | | 3,085,034 | |

| Transfer agent fees — R5 | | | 40,311 | |

| Transfer agent fees — R6 | | | 4,687 | |

| Trustees’ and officers’ fees and benefits | | | 91,137 | |

Other | | | 411,752 | |

Total expenses | | | 19,251,648 | |

Less: Fees waived and expense offset arrangement(s) | | | (149,743 | ) |

Net expenses | | | 19,101,905 | |

Net investment income | | | 2,955,781 | |

| |

Realized and unrealized gain (loss) from: | | | | |

Net realized gain (loss) from: | | | | |

Investment securities (includes net gains from securities sold to affiliates of $252,317) | | | 180,366,126 | |

Foreign currencies | | | (42,914 | ) |

Option contracts written | | | 127,123 | |

| | | | 180,450,335 | |

Change in net unrealized appreciation (depreciation) of: | | | | |

Investment securities | | | 114,716,743 | |

Forward foreign currency contracts | | | (82,694 | ) |

| | | | 114,634,049 | |

Net realized and unrealized gain | | | 295,084,384 | |

Net increase in net assets resulting from operations | | $ | 298,040,165 | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

12 Invesco American Value Fund

Statement of Changes in Net Assets

For the years ended April 30, 2014 and 2013

| | | | | | | | |

| | | 2014 | | | 2013 | |

Operations: | | | | | | | | |

Net investment income | | $ | 2,955,781 | | | $ | 6,856,602 | |

Net realized gain | | | 180,450,335 | | | | 95,435,689 | |

Change in net unrealized appreciation | | | 114,634,049 | | | | 96,750,899 | |

Net increase in net assets resulting from operations | | | 298,040,165 | | | | 199,043,190 | |

| | |

Distributions to shareholders from net investment income: | | | | | | | | |

Class A | | | (2,921,288 | ) | | | (3,822,291 | ) |

Class B | | | (115,678 | ) | | | (195,689 | ) |

Class C | | | (59,002 | ) | | | — | |

Class R | | | (67,746 | ) | | | (138,193 | ) |

Class Y | | | (2,059,394 | ) | | | (2,146,482 | ) |

Class R5 | | | (260,647 | ) | | | (203,300 | ) |

Class R6 | | | (482,829 | ) | | | (127,345 | ) |

Total distributions from net investment income | | | (5,966,584 | ) | | | (6,633,300 | ) |

| | |

Distributions to shareholders from net realized gains: | | | | | | | | |

Class A | | | (65,262,898 | ) | | | — | |

Class B | | | (2,667,870 | ) | | | — | |

Class C | | | (7,911,290 | ) | | | — | |

Class R | | | (3,994,256 | ) | | | — | |

Class Y | | | (26,375,247 | ) | | | — | |

Class R5 | | | (2,761,945 | ) | | | — | |

Class R6 | | | (4,498,288 | ) | | | — | |

Total distributions from net realized gains | | | (113,471,794 | ) | | | — | |

| | |

Share transactions–net: | | | | | | | | |

Class A | | | 134,319,718 | | | | 30,057,143 | |

Class B | | | (8,668,383 | ) | | | (12,181,227 | ) |

Class C | | | 13,048,376 | | | | 800,155 | |

Class R | | | 2,790,913 | | | | 12,849,721 | |

Class Y | | | 125,795,105 | | | | (20,335,981 | ) |

Class R5 | | | 42,142,923 | | | | 10,347,634 | |

Class R6 | | | 24,677,701 | | | | 52,695,698 | |

Net increase in net assets resulting from share transactions | | | 334,106,353 | | | | 74,233,143 | |

Net increase in net assets | | | 512,708,140 | | | | 266,643,033 | |

| | |

Net assets: | | | | | | | | |

Beginning of year | | | 1,395,457,430 | | | | 1,128,814,397 | |

End of year (includes undistributed net investment income of $(130,589) and $2,633,301, respectively) | | $ | 1,908,165,570 | | | $ | 1,395,457,430 | |

Notes to Financial Statements

April 30, 2014

NOTE 1—Significant Accounting Policies

Invesco American Value Fund (the “Fund”) is a series portfolio of AIM Sector Funds (Invesco Sector Funds) (the “Trust”). The Trust is a Delaware statutory trust registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end series management investment company consisting of ten separate portfolios, each authorized to issue an unlimited number of shares of beneficial interest. The assets, liabilities and operations of each portfolio are accounted for separately. Information presented in these financial statements pertains only to the Fund. Matters affecting each portfolio or class will be voted on exclusively by the shareholders of such portfolio or class.

The Fund’s investment objective is total return through growth of capital and current income.

The Fund currently consists of seven different classes of shares: Class A, Class B, Class C, Class R, Class Y, Class R5 and Class R6. Class A shares are sold with a front-end sales charge unless certain waiver criteria are met and under certain circumstances load waived shares may be subject to

13 Invesco American Value Fund

contingent deferred sales charges (“CDSC”). Class C shares are sold with a CDSC. Class R, Class Y, Class R5 and Class R6 shares are sold at net asset value. Effective November 30, 2010, new or additional investments in Class B shares are no longer permitted. Existing shareholders of Class B shares may continue to reinvest dividends and capital gains distributions in Class B shares until they convert to Class A shares. Also, shareholders in Class B shares will be able to exchange those shares for Class B shares of other Invesco Funds offering such shares until they convert to Class A shares. Generally, Class B shares will automatically convert to Class A shares on or about the month-end, which is at least eight years after the date of purchase. Redemption of Class B shares prior to the conversion date will be subject to a CDSC.

The following is a summary of the significant accounting policies followed by the Fund in the preparation of its financial statements.

| A. | Security Valuations — Securities, including restricted securities, are valued according to the following policy. |

A security listed or traded on an exchange (except convertible securities) is valued at its last sales price or official closing price as of the close of the customary trading session on the exchange where the security is principally traded, or lacking any sales or official closing price on a particular day, the security may be valued at the closing bid price on that day. Securities traded in the over-the-counter market are valued based on prices furnished by independent pricing services or market makers. When such securities are valued by an independent pricing service they may be considered fair valued. Futures contracts are valued at the final settlement price set by an exchange on which they are principally traded. Listed options are valued at the mean between the last bid and ask prices from the exchange on which they are principally traded. Options not listed on an exchange are valued by an independent source at the mean between the last bid and ask prices. For purposes of determining net asset value per share, futures and option contracts generally are valued 15 minutes after the close of the customary trading session of the New York Stock Exchange (“NYSE”).

Investments in open-end and closed-end registered investment companies that do not trade on an exchange are valued at the end of day net asset value per share. Investments in open-end and closed-end registered investment companies that trade on an exchange are valued at the last sales price or official closing price as of the close of the customary trading session on the exchange where the security is principally traded.

Debt obligations (including convertible securities) and unlisted equities are fair valued using an evaluated quote provided by an independent pricing service. Evaluated quotes provided by the pricing service may be determined without exclusive reliance on quoted prices, and may reflect appropriate factors such as institution-size trading in similar groups of securities, developments related to specific securities, dividend rate (for unlisted equities), yield (for debt obligations), quality, type of issue, coupon rate (for debt obligations), maturity (for debt obligations), individual trading characteristics and other market data. Debt obligations are subject to interest rate and credit risks. In addition, all debt obligations involve some risk of default with respect to interest and/or principal payments.

Foreign securities’ (including foreign exchange contracts) prices are converted into U.S. dollar amounts using the applicable exchange rates as of the close of the NYSE. If market quotations are available and reliable for foreign exchange-traded equity securities, the securities will be valued at the market quotations. Because trading hours for certain foreign securities end before the close of the NYSE, closing market quotations may become unreliable. If between the time trading ends on a particular security and the close of the customary trading session on the NYSE, events occur that the Adviser determines are significant and make the closing price unreliable, the Fund may fair value the security. If the event is likely to have affected the closing price of the security, the security will be valued at fair value in good faith using procedures approved by the Board of Trustees. Adjustments to closing prices to reflect fair value may also be based on a screening process of an independent pricing service to indicate the degree of certainty, based on historical data, that the closing price in the principal market where a foreign security trades is not the current value as of the close of the NYSE. Foreign securities’ prices meeting the approved degree of certainty that the price is not reflective of current value will be priced at the indication of fair value from the independent pricing service. Multiple factors may be considered by the independent pricing service in determining adjustments to reflect fair value and may include information relating to sector indices, American Depositary Receipts and domestic and foreign index futures. Foreign securities may have additional risks including exchange rate changes, potential for sharply devalued currencies and high inflation, political and economic upheaval, the relative lack of issuer information, relatively low market liquidity and the potential lack of strict financial and accounting controls and standards.

Securities for which market prices are not provided by any of the above methods may be valued based upon quotes furnished by independent sources. The last bid price may be used to value equity securities. The mean between the last bid and asked prices is used to value debt obligations, including corporate loans.

Securities for which market quotations are not readily available or became unreliable are valued at fair value as determined in good faith by or under the supervision of the Trust’s officers following procedures approved by the Board of Trustees. Issuer specific events, market trends, bid/ask quotes of brokers and information providers and other market data may be reviewed in the course of making a good faith determination of a security’s fair value.

The Fund may invest in securities that are subject to interest rate risk, meaning the risk that the prices will generally fall as interest rates rise and, conversely, the prices will generally rise as interest rates fall. Specific securities differ in their sensitivity to changes in interest rates depending on their individual characteristics. Changes in interest rates may result in increased market volatility, which may affect the value and/or liquidity of certain of the Fund’s investments.

Valuations change in response to many factors including the historical and prospective earnings of the issuer, the value of the issuer’s assets, general economic conditions, interest rates, investor perceptions and market liquidity. Because of the inherent uncertainties of valuation, the values reflected in the financial statements may materially differ from the value received upon actual sale of those investments.

| B. | Securities Transactions and Investment Income — Securities transactions are accounted for on a trade date basis. Realized gains or losses on sales are computed on the basis of specific identification of the securities sold. Interest income is recorded on the accrual basis from settlement date. Dividend income (net of withholding tax, if any) is recorded on the ex-dividend date. |

The Fund may periodically participate in litigation related to Fund investments. As such, the Fund may receive proceeds from litigation settlements. Any proceeds received are included in the Statement of Operations as realized gain (loss) for investments no longer held and as unrealized gain (loss) for investments still held.

Brokerage commissions and mark ups are considered transaction costs and are recorded as an increase to the cost basis of securities purchased and/or a reduction of proceeds on a sale of securities. Such transaction costs are included in the determination of net realized and unrealized gain (loss) from investment securities reported in the Statement of Operations and the Statement of Changes in Net Assets and the net realized and unrealized gains (losses) on securities per share in the Financial Highlights. Transaction costs are included in the calculation of the

14 Invesco American Value Fund

Fund’s net asset value and, accordingly, they reduce the Fund’s total returns. These transaction costs are not considered operating expenses and are not reflected in net investment income reported in the Statement of Operations and Statement of Changes in Net Assets, or the net investment income per share and ratios of expenses and net investment income reported in the Financial Highlights, nor are they limited by any expense limitation arrangements between the Fund and the investment adviser.

The Fund allocates income and realized and unrealized capital gains and losses to a class based on the relative net assets of each class.

| C. | Country Determination — For the purposes of making investment selection decisions and presentation in the Schedule of Investments, the investment adviser may determine the country in which an issuer is located and/or credit risk exposure based on various factors. These factors include the laws of the country under which the issuer is organized, where the issuer maintains a principal office, the country in which the issuer derives 50% or more of its total revenues and the country that has the primary market for the issuer’s securities, as well as other criteria. Among the other criteria that may be evaluated for making this determination are the country in which the issuer maintains 50% or more of its assets, the type of security, financial guarantees and enhancements, the nature of the collateral and the sponsor organization. Country of issuer and/or credit risk exposure has been determined to be the United States of America, unless otherwise noted. |

| D. | Distributions — Distributions from income, if any, are declared and paid quarterly and are recorded on the ex-dividend date. Distributions from net realized capital gain, if any, are generally declared and paid annually and recorded on the ex-dividend date. The Fund may elect to treat a portion of the proceeds from redemptions as distributions for federal income tax purposes. |

| E. | Federal Income Taxes — The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), necessary to qualify as a regulated investment company and to distribute substantially all of the Fund’s taxable earnings to shareholders. As such, the Fund will not be subject to federal income taxes on otherwise taxable income (including net realized capital gain) that is distributed to shareholders. Therefore, no provision for federal income taxes is recorded in the financial statements. |

The Fund recognizes the tax benefits of uncertain tax positions only when the position is more likely than not to be sustained. Management has analyzed the Fund’s uncertain tax positions and concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions. Management is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next 12 months.

The Fund files tax returns in the U.S. Federal jurisdiction and certain other jurisdictions. Generally, the Fund is subject to examinations by such taxing authorities for up to three years after the filing of the return for the tax period.

| F. | Expenses — Fees provided for under the Rule 12b-1 plan of a particular class of the Fund are charged to the operations of such class. Transfer agency fees and expenses and other shareholder recordkeeping fees and expenses attributable to Class R5 and Class R6 are allocated to each share class based on relative net assets. Sub-accounting fees attributable to Class R5 are charged to the operations of the class. Transfer agency fees and expenses and other shareholder recordkeeping fees and expenses relating to all other classes are allocated among those classes based on relative net assets. All other expenses are allocated among the classes based on relative net assets. Prior to June 1, 2010, incremental transfer agency fees which were unique to each class of shares were charged to the operations of such class. |

| G. | Accounting Estimates — The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period including estimates and assumptions related to taxation. Actual results could differ from those estimates by a significant amount. In addition, the Fund monitors for material events or transactions that may occur or become known after the period-end date and before the date the financial statements are released to print. |

| H. | Indemnifications — Under the Trust’s organizational documents, each Trustee, officer, employee or other agent of the Trust is indemnified against certain liabilities that may arise out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts, including the Fund’s servicing agreements, that contain a variety of indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. The risk of material loss as a result of such indemnification claims is considered remote. |

| I. | Foreign Currency Translations — Foreign currency is valued at the close of the NYSE based on quotations posted by banks and major currency dealers. Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at date of valuation. Purchases and sales of portfolio securities (net of foreign taxes withheld on disposition) and income items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions. The Fund does not separately account for the portion of the results of operations resulting from changes in foreign exchange rates on investments and the fluctuations arising from changes in market prices of securities held. The combined results of changes in foreign exchange rates and the fluctuation of market prices on investments (net of estimated foreign tax withholding) are included with the net realized and unrealized gain or loss from investments in the Statement of Operations. Reported net realized foreign currency gains or losses arise from (1) sales of foreign currencies, (2) currency gains or losses realized between the trade and settlement dates on securities transactions, and (3) the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign currency gains and losses arise from changes in the fair values of assets and liabilities, other than investments in securities at fiscal period end, resulting from changes in exchange rates. |

The Fund may invest in foreign securities which may be subject to foreign taxes on income, gains on investments or currency repatriation, a portion of which may be recoverable.

| J. | Forward Foreign Currency Contracts — The Fund may enter into forward foreign currency contracts to manage or minimize currency or exchange rate risk. The Fund may also enter into forward foreign currency contracts for the purchase or sale of a security denominated in a foreign currency in order to “lock in” the U.S. dollar price of that security. A forward foreign currency contract is an obligation to purchase or sell a specific currency for an agreed-upon price at a future date. The use of forward foreign currency contracts does not eliminate fluctuations in the price of the underlying securities the Fund owns or intends to acquire but establishes a rate of exchange in advance. Fluctuations in the value of these contracts are measured by the difference in the contract date and reporting date exchange rates and are recorded as unrealized appreciation (depreciation) until the contracts are closed. When the contracts are closed, realized gains (losses) are recorded. Realized and unrealized gains (losses) on the contracts are included in the Statement of Operations. The primary risks associated with forward foreign currency |

15 Invesco American Value Fund

| | contracts include failure of the counterparty to meet the terms of the contract and the value of the foreign currency changing unfavorably. These risks may be in excess of the amounts reflected in the Statement of Assets and Liabilities. |

| K. | Call Options Written and Purchased — The Fund may write covered call options and/or buy call options. A covered call option gives the purchaser of such option the right to buy, and the writer the obligation to sell, the underlying security at the stated exercise price during the option period. Options written by the Fund normally will have expiration dates between three and nine months from the date written. The exercise price of a call option may be below, equal to, or above the current market value of the underlying security at the time the option is written. |

When the Fund writes a covered call option, an amount equal to the premium received by the Fund is recorded as an asset and an equivalent liability in the Statement of Assets and Liabilities. The amount of the liability is subsequently “marked-to-market” to reflect the current market value of the option written. If a written covered call option expires on the stipulated expiration date, or if the Fund enters into a closing purchase transaction, the Fund realizes a gain (or a loss if the closing purchase transaction exceeds the premium received when the option was written) without regard to any unrealized gain or loss on the underlying security, and the liability related to such option is extinguished. If a written covered call option is exercised, the Fund realizes a gain or a loss from the sale of the underlying security and the proceeds of the sale are increased by the premium originally received. Realized and unrealized gains and losses on these contracts are included in the Statement of Operation. A risk in writing a covered call option is that the Fund gives up the opportunity for profit if the market price of the security increases and the option is exercised.

When the Fund buys a call option, an amount equal to the premium paid by the Fund is recorded as an investment on the Statement of Assets and Liabilities. The amount of the investment is subsequently “marked-to-market” to reflect the current value of the option purchased. Realized and unrealized gains and losses on these contracts are included in the Statement of Operations. A risk in buying an option is that the Fund pays a premium whether or not the option is exercised. In addition, there can be no assurance that a liquid secondary market will exist for any option purchased.

| L. | Put Options Purchased — The Fund may purchase put options including options on securities indexes and/or futures contracts. By purchasing a put option, the Fund obtains the right (but not the obligation) to sell the option’s underlying instrument at a fixed strike price. In return for this right, the Fund pays an option premium. The option’s underlying instrument may be a security, securities index, or a futures contract. Put options may be used by the Fund to hedge securities it owns by locking in a minimum price at which the Fund can sell. If security prices fall, the put option could be exercised to offset all or a portion of the Fund’s resulting losses. At the same time, because the maximum the Fund has at risk is the cost of the option, purchasing put options does not eliminate the potential for the Fund to profit from an increase in the value of the securities hedged. Realized and unrealized gains and losses on these contracts are included in the Statement of Operations. A risk in buying an option is that the Fund pays a premium whether or not the option is exercised. In addition, there can be no assurance that a liquid secondary market will exist for any option purchased. |

NOTE 2—Advisory Fees and Other Fees Paid to Affiliates

The Trust has entered into a master investment advisory agreement with Invesco Advisers, Inc. (the “Adviser” or “Invesco”). Under the terms of the investment advisory agreement, the Fund pays an advisory fee to the Adviser based on the annual rate of the Fund’s average daily net assets as follows:

| | | | | | |

| Average Daily Net Assets | | Rate |

First $500 million | | | 0 | .72% | | |

Next $535 million | | | 0 | .715% | | |

Next $31.965 billion | | | 0 | .65% | | |

Over $33 billion | | | 0 | .64% | | |

Under the terms of a master sub-advisory agreement between the Adviser and each of Invesco Asset Management Deutschland GmbH, Invesco Asset Management Limited, Invesco Asset Management (Japan) Limited, Invesco Australia Limited, Invesco Hong Kong Limited, Invesco Senior Secured Management, Inc. and Invesco Canada Ltd. (collectively, the “Affiliated Sub-Advisers”) the Adviser, not the Fund, may pay 40% of the fees paid to the Adviser to any such Affiliated Sub-Adviser(s) that provide(s) discretionary investment management services to the Fund based on the percentage of assets allocated to such Sub-Adviser(s).

Effective July 1, 2013, the Adviser has contractually agreed, through at least June 30, 2015, to waive advisory fees and/or reimburse expenses of all shares to the extent necessary to limit total annual fund operating expenses after fee waiver and/or expense reimbursement (excluding certain items discussed above) of Class A, Class B, Class C, Class R, Class Y, Class R5 and Class R6 shares to 2.00%, 2.75%, 2.75%, 2.25%, 1.75%, 1.75% and 1.75%, respectively, of average daily net assets. Prior to July 1, 2013, the Adviser had contractually agreed to waive advisory fees and/or reimburse expenses of all shares to the extent necessary to limit total annual fund operating expenses after fee waiver and/or expense reimbursement (excluding certain items discussed below) of Class A, Class B, Class C, Class R, Class Y, Class R5 and Class R6 shares to 1.25%, 2.00%, 2.00%, 1.50%, 1.00%, 1.00% and 1.00%, respectively, of average daily net assets. In determining the Adviser’s obligation to waive advisory fees and/or reimburse expenses, the following expenses are not taken into account, and could cause the total annual fund operating expenses after fee waiver and/or expense reimbursement to exceed the numbers reflected above: (1) interest; (2) taxes; (3) dividend expense on short sales; (4) extraordinary or non-routine items, including litigation expenses; and (5) expenses that the Fund has incurred but did not actually pay because of an expense offset arrangement. Unless Invesco continues the fee waiver agreement, it will terminate on June 30, 2015. The fee waiver agreement cannot be terminated during its term. The Adviser did not waive fees and/or reimburse expenses during the period under this expense limitation.

Further, the Adviser has contractually agreed, through at least June 30, 2016, to waive the advisory fee payable by the Fund in an amount equal to 100% of the net advisory fees the Adviser receives from the affiliated money market funds on investments by the Fund of uninvested cash in such affiliated money market funds.

For the year ended April 30, 2014, the Adviser waived advisory fees of $147,846.

16 Invesco American Value Fund

The Trust has entered into a master administrative services agreement with Invesco pursuant to which the Fund has agreed to pay Invesco for certain administrative costs incurred in providing accounting services to the Fund. For the year ended April 30, 2014, expenses incurred under the agreement are shown in the Statement of Operations as Administrative services fees.