UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material under Rule 14a-12 |

TRIBUNE MEDIA COMPANY

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how much it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

TRIBUNE MEDIA COMPANY

435 North Michigan Avenue

Chicago, Illinois 60611

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 20, 2015

To Our Stockholders:

NOTICE IS HEREBY GIVEN that the 2015 Annual Meeting of Stockholders of Tribune Media Company will be held at the JW Marriott Los Angeles L.A. LIVE, located at 900 West Olympic Boulevard, Los Angeles, CA 90015, on Wednesday, May 20, 2015, at 8:30 a.m., local time, for the following purposes:

1. To elect the two Class II directors named in the accompanying proxy statement to serve until the 2018 Annual Meeting of Stockholders and until their successors have been elected and qualified.

2. To hold a non-binding advisory vote approving executive compensation.

3. To hold a non-binding advisory vote on the frequency of future advisory votes approving executive compensation.

4. To ratify the selection of PricewaterhouseCoopers LLP as Tribune Media Company’s independent registered public accounting firm for the 2015 fiscal year.

5. To transact such other business as may properly come before the Annual Meeting of Stockholders or any reconvened meeting following any adjournment or postponement thereof.

The foregoing items of business are more fully described in the proxy statement accompanying this notice.

Only stockholders of record of our outstanding common shares of Class A common stock at the close of business on April 15, 2015 are entitled to notice of, and to vote at, the Annual Meeting of Stockholders or any adjournment or postponement thereof. This notice and the accompanying proxy statement are first being mailed to stockholders on or about April 20, 2015.

By Order of the Board of Directors,

Peter Liguori

President and Chief Executive Officer

April 20, 2015

Whether or not you expect to attend the Annual Meeting in person, to assure that your shares will be represented, please promptly complete your proxy. Your proxy will not be used if you are present at the Annual Meeting and desire to vote your shares personally.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 20, 2015:

The proxy statement and the 2014 annual report are available at www.proxyvote.com.

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 20, 2015

TABLE OF CONTENTS

TRIBUNE MEDIA COMPANY

435 North Michigan Avenue

Chicago, Illinois 60611

PROXY STATEMENT

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND ANNUAL MEETING

This proxy statement and proxy card are furnished on behalf of the Board of Directors of Tribune Media Company, a Delaware corporation (referred to as “Tribune Media,” “Tribune,” the “Company,” “we,” “us,” or “our”), in connection with the solicitation of proxies to be voted at our annual meeting of stockholders, which will be held at the JW Marriott Los Angeles L.A. LIVE, located at 900 West Olympic Boulevard, Los Angeles, CA 90015, on Wednesday, May 20, 2015, at 8:30 a.m., local time (the “Annual Meeting”). On or about April 20, 2015, we began mailing to stockholders of record this proxy statement and proxy card.

Why am I receiving this proxy statement and proxy card?

You have received these proxy materials because our Board of Directors is soliciting your proxy to vote your shares at the Annual Meeting. As a stockholder, you are invited to attend the Annual Meeting and are requested to vote on the items of business described in this proxy statement. This proxy statement includes information that we are required to provide to you under Securities and Exchange Commission (“SEC”) rules and describes issues on which we would like you to vote at our Annual Meeting of stockholders. It also gives you information on these issues so that you can make an informed decision. The proxy materials include our proxy statement for the Annual Meeting, our annual report to stockholders, which includes our annual report on Form 10-K for the year ended December 28, 2014, and the proxy card or a voting instruction card for the Annual Meeting.

Our Board of Directors has made this proxy statement and proxy card available to you on the Internet because you own shares of Class A common stock of the Company, par value $0.001 per share (“Class A common stock”), in addition to delivering printed versions of this proxy statement and proxy card to certain stockholders by mail.

If you submit a proxy by using the Internet, by calling or by signing and returning the proxy card, you will appoint Edward Lazarus, Executive Vice President, General Counsel and Corporate Secretary of Tribune Media Company (with full power of substitution) as your representative at the Annual Meeting. He will vote your shares at the Annual Meeting as you have instructed him or, if an issue that is not on the proxy card comes up for vote, in accordance with his best judgment. By submitting a proxy, you can ensure your shares will be voted whether or not you attend the Annual Meeting. Even if you plan to attend the Annual Meeting, we encourage you to submit a proxy in advance by using the Internet, by calling or by signing and returning your proxy card. If you vote by Internet or by calling, you do not need to return your proxy card.

Who is entitled to vote at the Annual Meeting?

The record date for holders of our Class A common stock entitled to notice of, and to vote at, the Annual Meeting is April 15, 2015. At the close of business on that date, we had 94,771,725 shares of Class A common stock outstanding and entitled to vote at the Annual Meeting. If a quorum is present, we can hold the Annual

1

Meeting and conduct business. In accordance with Delaware law and our amended and restated bylaws (the “Bylaws”), a list of stockholders entitled to vote at the meeting will be available at the place of the Annual Meeting on May 20, 2015 and will be accessible for ten days before the meeting at our principal place of business, 435 North Michigan Avenue, Chicago, Illinois 60611, between the hours of 9:00 a.m. and 5:00 p.m. Each outstanding share of Class A common stock is entitled to one vote per share. The presence, in person or by proxy, of the holders of a majority of the votes entitled to be cast at the Annual Meeting will constitute a quorum.

By granting a proxy, you authorize the persons named in the proxy to represent you and vote your shares at the Annual Meeting. Those persons will also be authorized to vote your shares to adjourn the Annual Meeting from time to time and to vote your shares at any adjournments or postponements of the Annual Meeting.

Registered Stockholders. If your shares are registered directly in your name with our transfer agent, Computershare Trust Company, N.A., you are considered the stockholder of record with respect to those shares, and the proxy materials were provided to you directly by us. As the stockholder of record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card in one of the manners listed on the proxy card or to vote in person at the Annual Meeting.

Beneficial Stockholders. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in “street name” and the proxy materials were forwarded to you by your broker or nominee, who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker or nominee how to vote your shares using the methods prescribed by your broker or nominee on the voting instruction card you received with the proxy materials. Beneficial owners are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you follow your broker’s or nominee’s procedures for obtaining a legal proxy.

How do I vote?

Stockholders of record may ensure their shares are voted at the Annual Meeting by submitting a proxy by using the Internet, by calling the toll-free number listed on the proxy card or by mail as described below. Stockholders also may attend the meeting and vote in person. If you hold shares through a bank or broker, please refer to your proxy card or other information forwarded by your bank or broker to see which voting options are available to you.

| | • | | You may submit your proxy by using the Internet. The address of the website for submitting your proxy via the Internet is www.proxyvote for both registered holders and beneficial owners of Class A common stock holding in street name. Internet proxy submission is available 24 hours a day and will be accessible until 11:59 p.m. Eastern Time on May 19, 2015. Easy-to-follow instructions allow you to submit your proxy and confirm that your instructions have been properly recorded. |

| | • | | You may submit your proxy by calling. The phone number for submitting your proxy by phone is1-800-652-VOTE (8683). Submitting your proxy by phone is available 24 hours a day and will be accessible until 11:59 p.m. Eastern Time on May 19, 2015. |

| | • | | You may submit your proxy by mail. Simply mark your proxy card, date and sign it, and return it in the postage-paid envelope. |

Submitting your proxy will not limit your right to vote at the Annual Meeting if you decide to attend in person. Written ballots will be passed out to anyone who wants to vote at the Annual Meeting. If you hold your shares in “street name,” you must obtain a proxy, executed in your favor, from the holder of record to be able to vote in person at the Annual Meeting.

2

How do I change or revoke my proxy?

You may revoke your proxy and submit a new proxy at any time before your proxy is voted at the Annual Meeting. You may do this by:

| | • | | submitting a subsequent proxy by using the Internet, by calling or by mail with a later date; |

| | • | | sending written notice of revocation to our Corporate Secretary, Tribune Media Company, 435 North Michigan Avenue, Chicago, Illinois 60611; or |

| | • | | voting in person at the Annual Meeting. |

If you hold shares through a bank or broker, please refer to your proxy card or other information forwarded by your bank or broker to see how you can revoke your proxy and change your vote.

Attendance at the meeting will not by itself revoke a proxy.

What items will be voted on at the Annual Meeting?

The items of business scheduled to be voted on at the Annual Meeting are:

| | • | | Proposal 1: The election of two Class II directors for a term expiring at the 2018 Annual Meeting of Stockholders; |

| | • | | Proposal 2: A non-binding advisory vote approving executive compensation; |

| | • | | Proposal 3: A non-binding advisory vote on the frequency of future advisory votes approving executive compensation; |

| | • | | Proposal 4: The ratification of the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the 2015 fiscal year; and |

| | • | | Any other business that may properly come before the Annual Meeting. |

No cumulative voting rights are authorized, and appraisal rights are not applicable to these matters.

How does the Board of Directors recommend that I vote on these proposals?

The Board of Directors recommends that you vote as follows:

| | • | | FOR both director nominees; |

| | • | | FOR the approval of executive compensation; |

| | • | | EVERY 1 YEAR on the frequency of future advisory votes approving executive compensation; and |

| | • | | FOR the ratification of the appointment of our independent registered public accounting firm. |

As of the date hereof, our Board of Directors is not aware of any other such matter or business to be transacted at our Annual Meeting. If other matters requiring a vote of the stockholders arise, the persons designated as proxies will vote the shares of Class A common stock represented by the proxies in accordance with their judgment on those matters.

How may I vote in the election of directors, and how many votes must the nominees receive to be elected?

With respect to the election of directors, you may:

| | • | | vote FOR the two nominees for director; |

| | • | | vote FOR one nominee for director and WITHHOLD from voting on the other nominee for director; or |

| | • | | WITHHOLD from voting on both of the nominees for director. |

3

Our Bylaws provide for the election of directors by a plurality of the votes cast. This means that the two individuals nominated for election to the Board of Directors who receive the most “FOR” votes (among votes properly cast in person, electronically or by proxy) will be elected. If you sign and return the accompanying proxy card, your shares will be voted for the election of the two nominees recommended by the Board of Directors unless you choose to “WITHHOLD” from voting on either of the nominees.

What happens if a nominee is unable to stand for election?

If a nominee is unable to stand for election, the Board of Directors may designate a substitute nominee, or, if not, then there will remain a vacancy on the Board of Directors. If the Board of Directors designates a substitute nominee, shares represented by proxies voted for the nominee who is unable to stand for election will be voted for the substitute nominee.

How may I vote for the non-binding advisory vote approving executive compensation, and how many votes must this proposal receive to pass?

With respect to this proposal, you may:

| | • | | vote FOR the approval of executive compensation; |

| | • | | vote AGAINST the approval of executive compensation; or |

| | • | | ABSTAIN from voting on the proposal. |

In accordance with applicable law, this vote is “advisory”, meaning it will serve as a recommendation to our Board of Directors, but will not be binding. However, our Board of Directors and the Compensation Committee thereof will consider the outcome of the vote when making future compensation decisions for our executive officers.

How may I vote for the non-binding advisory vote on the frequency of future advisory votes approving executive compensation, and how many votes must this proposal receive to pass?

With respect to this proposal, you may:

| | • | | vote EVERY 3 YEARS on the frequency of future advisory votes approving executive compensation; |

| | • | | vote EVERY 2 YEARS on the frequency of future advisory votes approving executive compensation; |

| | • | | vote EVERY 1 YEAR on the frequency of future advisory votes approving executive compensation; or |

| | • | | ABSTAIN from voting on the proposal. |

The non-binding advisory vote on the frequency of future advisory votes approving executive compensation will be determined by a plurality of the votes cast of the outstanding shares of Class A common stock present in person or represented by proxy at the Annual Meeting and entitled to vote, which means that the option receiving the highest number of votes will be determined to be the preferred frequency. In addition, as an advisory vote, this proposal is not binding. In light of the foregoing, our Board of Directors and Compensation Committee will consider the choice that receives the most votes in making future decisions regarding the frequency of future advisory votes approving executive compensation.

How may I vote for the proposal to ratify the appointment of our independent registered public accounting firm, and how many votes must this proposal receive to pass?

With respect to this proposal, you may:

| | • | | vote FOR the ratification of the accounting firm; |

4

| | • | | vote AGAINST the ratification of the accounting firm; or |

| | • | | ABSTAIN from voting on the proposal. |

In order to pass, the proposal must receive the affirmative vote of a majority of the votes entitled to be cast by holders of Class A common stock at the Annual Meeting by the holders who are present in person, electronically or by proxy.

What happens if I sign and return my proxy card but do not provide voting instructions?

If you return a signed card but do not provide voting instructions, your shares will be voted as follows:

| | • | | FOR both director nominees; |

| | • | | FOR the approval of executive compensation; |

| | • | | EVERY 1 YEAR on the frequency of future advisory votes approving executive compensation; |

| | • | | FOR the ratification of the appointment of our independent registered public accounting firm; and |

| | • | | At the discretion of the proxy holders, either FOR or AGAINST any other matter or business that may properly come before the Annual Meeting. |

Will my shares be voted if I do not submit a proxy by using the Internet, by calling, or by signing and returning my proxy card?

If you do not submit a proxy by using the Internet, by calling or by signing and returning your proxy card, then your shares will not be voted and will not count in deciding the matters presented for stockholder consideration at the Annual Meeting unless you attend the Annual Meeting and vote in person.

If your shares are held in street name through a bank or broker, your bank or broker may vote your shares under certain limited circumstances if you do not provide voting instructions before the Annual Meeting. These circumstances include voting your shares on “routine matters,” such as the ratification of the appointment of our independent registered public accountants described in this proxy statement. With respect to the proposal to ratify the appointment of our independent public account, therefore, if you do not vote your shares, your bank or broker may vote your shares on your behalf or leave your shares unvoted.

The election of directors, the non-binding advisory vote approving executive compensation and the non-binding advisory vote on the frequency of future advisory votes approving executive compensation are not considered routine matters. When a proposal is not a routine matter and the brokerage firm has not received voting instructions from the beneficial owner of the shares with respect to that proposal, the brokerage firm cannot vote the shares on that proposal. This is called a “broker non-vote.” Broker non-votes that are represented at the Annual Meeting will be counted for purposes of establishing a quorum, but cannot vote for or against a non-routine matter.

We encourage you to provide voting instructions to your bank or brokerage firm. This action ensures your shares will be voted at the Annual Meeting in accordance with your wishes.

5

What is the vote required for each proposal to pass, and what is the effect of abstentions and broker non-votes on the proposals?

The following table summarizes the Board of Directors’ recommendation on each proposal, the vote required for each proposal to pass and the effect of abstentions and broker non-votes on each proposal.

| | | | | | | | | | |

Proposal

Number | | Item | | Board Voting

Recommen-

dation | | Votes Required for Approval | | Abstentions/

Withheld Votes | | Broker Non-Votes |

| 1 | | Election of Directors | | FOR | | The two nominees who receive the most FOR votes properly cast in person, electronically or by proxy and entitled to vote will be elected | | No effect | | No effect |

| | | | | |

| 2 | | Advisory vote approving executive compensation | | FOR | | Majority of the voting power of the shares of Class A common stock present in person, electronically or by proxy and entitled to vote | | Vote against | | No effect |

| | | | | |

| 3 | | Advisory vote on the frequency of future advisory votes approving executive compensation | | EVERY 1 YEAR | | The option receiving the most FOR votes properly cast in person, electronically or by proxy and entitled to vote | | No effect | | No effect |

| | | | | |

| 4 | | Ratification of independent registered public accounting firm | | FOR | | Majority of the voting power of the shares of Class A common stock present in person, electronically or by proxy and entitled to vote | | Vote against | | Discretionary voting by broker permitted |

What do I need to show to attend the Annual Meeting in person?

If you are a registered stockholder, you will need proof of your share ownership (such as a recent brokerage statement or letter from your broker showing that you owned shares of Class A common stock as of April 15, 2015) and a form of government-issued photo identification. If you are a beneficial stockholder, you will need to bring proof of beneficial ownership as of April 15, 2015, such as the most recent account statement reflecting your stock ownership prior to such date, a copy of the voting instruction card provided by your broker, bank, trustee or other nominee or similar evidence of ownership. If you do not have the required proof of ownership and valid photo identification, you may not be admitted to the Annual Meeting. All bags, briefcases and packages will be held at registration and will not be allowed in the meeting.

Who pays for the cost of proxy preparation and solicitation?

The accompanying proxy is solicited by our Board of Directors. Any costs of the solicitation of proxies will be borne by us. We pay for the cost of proxy preparation and solicitation, including the reasonable charges and expenses of brokerage firms, banks, trusts or nominees for forwarding proxy materials to street name holders. We are soliciting proxies primarily by mail. In addition, our directors, officers and employees may solicit proxies by telephone or other means of communication personally. Our directors, officers and employees will receive no additional compensation for these services other than their regular compensation.

6

I share an address with another stockholder. Why did we receive only one copy of the proxy materials and how may I obtain an additional copy of the proxy materials?

We are sending only one copy of our proxy statement and annual report to stockholders who share the same last name and address, unless they have notified us that they want to continue receiving multiple copies. This practice, known as “householding,” is designed to reduce duplicate mailings and save significant printing and postage costs.

If you received a householded mailing this year and you would like to have additional copies of our proxy materials mailed to you or you would like to opt out of this practice for future mailings, we will promptly deliver such additional copies to you if you submit your request in writing to our Corporate Secretary at Tribune Media Company, 435 North Michigan Avenue, Chicago, Illinois 60611, or call us at 312-994-9300. You may also contact us in the same manner if you received multiple copies of the proxy materials and would prefer to receive a single copy in the future.

Can I receive future proxy materials and annual reports electronically?

Yes. This proxy statement and the annual report are available by accessing the website located at www.proxyvote.com. Instead of receiving future paper copies in the mail, you can elect to receive an email that provides a link to our future annual reports and proxy materials on the Internet. Opting to receive your proxy materials electronically will save us the cost of producing and mailing documents to your home or business, will reduce the environmental impact of our annual meetings, and will give you an automatic link to the proxy voting site.

If you are a stockholder of record and wish to enroll in the electronic proxy delivery service for future meetings, you may do so by going to www.proxyvote.com and following the prompts.

How can I make a proposal or make a nomination for director for next year’s annual meeting?

You may present proposals for action at a future meeting or submit nominations for election of directors only if you comply with the requirements of the proxy rules established by the SEC and our Bylaws, as applicable. In order for a stockholder proposal or nomination for director to be considered for inclusion in our proxy statement and form of proxy relating to our annual meeting of stockholders to be held in 2016, the proposal or nomination must be received by us at our principal executive offices no later than Tuesday, December 22, 2015 pursuant to SEC Rule 14a-8. Stockholders wishing to nominate a director or bring a proposal not included in next year’s proxy statement at the 2016 annual meeting must provide written notice of such nomination or proposal to our Corporate Secretary, Tribune Media Company, 435 North Michigan Avenue, Chicago, Illinois 60611 between Thursday, January 21, 2016 and Saturday, February 20, 2016 and comply with the other provisions of our Bylaws, except that if the date of the 2016 annual meeting of stockholders is not within 30 days before or after the anniversary of the 2015 Annual Meeting, such notice must be delivered at the address above no later than the close of business on the 10th day following the day on which notice of the date of the 2016 annual meeting was first mailed or public disclosure of the date of the 2016 annual meeting was first made, whichever occurs first.

7

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Our Board Structure

In accordance with the terms of our second amended and restated certificate of incorporation (the “Certificate of Incorporation”), our Board of Directors is divided into three classes, Class I, Class II, and Class III, with members of each class serving staggered three-year terms. Under our Bylaws, except as may otherwise be provided in our Certificate of Incorporation, our Board of Directors consists of such number of directors as may be determined from time to time by resolution of the Board of Directors, but in no event may the number of directors be less than seven or more than nine. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. Our Certificate of Incorporation and Bylaws provide that any vacancy on our Board of Directors, including a vacancy resulting from any increase in the authorized number of directors, may be filled only by the affirmative vote of a majority of our directors then in office, even if less than a quorum, or by a sole remaining director, provided that any vacancy created by any of the initial members of our Board of Directors designated by any of Oaktree Tribune, L.P., entities affiliated with JPMorgan Chase Bank, N.A. and investment funds managed by Angelo, Gordon & Co., L.P. (collectively, the “Stockholders”) pursuant to the Fourth Amended Joint Plan of Reorganization for Tribune Company and its Subsidiaries (subsequently amended and modified, the “Plan”) during their initial term, may be filled only by such Stockholder that designated such initial director. Any director elected to fill a vacancy will hold office until such director’s successor shall have been elected and qualified or until such director’s earlier death, resignation or removal. Our classified Board of Directors could have the effect of delaying or discouraging an acquisition of us or a change in our management.

Our Board of Directors is currently composed of seven members. We have two directors in Class I, two directors in Class II and three directors in Class III. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors.

| | | | | | |

Director | | Age | | Position | | Director

Since |

| Class I Directors for election at the 2017 Annual Meeting |

Craig A. Jacobson | | 62 | | Director | | 2012 |

Laura R. Walker | | 57 | | Director | | 2014 |

|

| Class II Directors for election at the 2015 Annual Meeting |

Michael Kreger | | 33 | | Director | | n/a |

Peter Liguori | | 54 | | Director, President and Chief Executive Officer | | 2012 |

|

| Class III Directors for election at the 2016 Annual Meeting |

Bruce A. Karsh | | 59 | | Chairman of the Board | | 2012 |

Ross Levinsohn | | 51 | | Director | | 2012 |

Peter E. Murphy | | 52 | | Director | | 2012 |

At each annual meeting of stockholders, the successors of the directors whose term expires at that meeting are elected to hold office for a term expiring at the annual meeting of stockholders held in the third year following the year of their election. The term of our two current Class II directors expires at this year’s Annual Meeting. The Board of Directors is therefore asking you to elect the two nominees to serve as Class II directors. Peter Liguori, currently a Class II director, has been nominated for reelection at the Annual Meeting. Kenneth Liang currently serves as a Class II director, but has declined to stand for reelection at the Annual Meeting and, assuming that our nominee is elected at the Annual Meeting, will resign from the Board of Directors effective immediately upon the election of Michael Kreger. See “Proposal 1: Election of Directors.”

Set forth below is biographical information as well as background information relating to each nominee’s and continuing director’s business experience, qualifications, attributes and skills that underlie the Board of

8

Directors’ and Nominating and Corporate Governance Committee’s belief that each individual is a valuable member of the Board of Directors. The persons who have been nominated for election and are to be voted upon at the Annual Meeting are listed first, with continuing directors following thereafter.

Class II Nominees

Michael Kreger is a vice president in the opportunities funds of Oaktree Capital Management, L.P., formerly Oaktree Capital Management, LLC, a Los Angeles-based investment management firm. Prior to joining Oaktree in 2014, Mr. Kreger was most recently a director at Madison Dearborn Partners having joined the firm in 2010 following graduation from Harvard Business School. Prior to business school, Mr. Kreger was an analyst in the Industrials group at UBS Investment Bank from 2004 to 2006 and an Associate with Madison Dearborn from 2006 to 2008. Mr. Kreger is currently a member of the board of directors and audit committee of Aleris Corporation. Mr. Kreger also previously served on the boards of directors of Bway Corporation from August 2010 to November 2012, Schrader International, Inc. from April 2012 to January 2014, and Multi Packaging Solutions, Inc. from August 2013 to January 2014.

Specific qualifications, experience, skills and expertise include:

| | • | | Expertise in corporate finance and investment management; and |

| | • | | Core business skills, including strategic planning. |

Peter Liguori has been a director since December 31, 2012 and has been our President and Chief Executive Officer since January 2013. From July 2012 to January 2013, Mr. Liguori served as an operating executive for The Carlyle Group’s telecommunications and media team. Mr. Liguori previously served as chief operating officer of Discovery Communications, Inc., a global media and entertainment company, from January 2010 to December 2012. Before joining Discovery in 2009, Mr. Liguori served as chairman of entertainment for the Fox Broadcasting Company, a commercial broadcast television network. Prior to assuming that position in 2005, Mr. Liguori was president and chief executive officer of News Corporation’s FX Networks since 1998, overseeing business and programming operations for FX and Fox Movie Channel. Mr. Liguori joined Fox/Liberty Networks in 1996 as senior vice president, marketing, for a new joint venture, which now includes Fox Sports Net, FX, Fox Sports World, SPEED and National Geographic Channel. Prior to joining Fox, Mr. Liguori was vice president, consumer marketing, at HBO, a cable and satellite television network. He also held several positions in HBO’s Home Video Division, including vice president, marketing, and senior vice president, marketing. Liguori also has experience as a producer of the widely acclaimed independent feature film, “Big Night.” Prior to HBO, he worked in advertising at Ogilvy & Mather and Saatchi & Saatchi. Mr. Liguori previously served on the boards of directors of Yahoo! Inc. from May 2012 to May 2014, and Metro-Goldwyn-Mayer Studios Inc. from March 2012 to January 2014.

Specific qualifications, experience, skills and expertise include:

| | • | | Signficant operating and management experience; |

| | • | | Core business skills, including operations and strategic planning; and |

| | • | | Deep understanding of the media industry. |

Continuing Directors

Class I Directors—Terms Expiring at the 2017 Annual Meeting:

Craig A. Jacobson has been a director since December 31, 2012 and is a member of the Audit Committee and the Compensation Committee. Mr. Jacobson is a founding partner at the law firm of Hansen, Jacobson, Teller, Hoberman, Newman, Warren, Richman, Rush & Kaller, L.L.P., where he has practiced entertainment law since June 1987. Mr. Jacobson is a member of the board of directors and audit committee of Expedia, Inc. and

9

presently serves on the board of directors of Charter Communications, Inc., where he previously served as a member of its audit committee until 2013. Mr. Jacobson was a director of Ticketmaster Entertainment, Inc. from August 2008 until its merger with Live Nation, Inc. in January 2010. Mr. Jacobson also previously served on the boards of Aver Media LP, a privately held Canadian lending institution, and Eventful, Inc., a digital media company.

Specific qualifications, experience, skills and expertise include:

| | • | | Extensive familiarity with the creative and business aspects of the cable and syndicated television industries; |

| | • | | Extensive previous public company board experience; and |

| | • | | Deep understanding of the media industry, including the motion picture, television and digital businesses. |

Laura R. Walker has been a director since July 14, 2014 and is a member of the Compensation Committee. Since December 1995, Ms. Walker has been the president and chief executive officer of New York Public Radio, which owns and operates WNYC-FM, WNYC-AM, WQXR, WQXW, New Jersey Public Radio, The Jerome L. Greene Performance Space and a variety of digital properties, including wnyc.org, wqxr.org and thegreenespace.org. Ms. Walker began her professional career as a journalist and producer at National Public Radio, where she received a Peabody Award for Broadcast Excellence. In 1983, she joined the staff of Carnegie Hall, where she launched the award-winning series AT&T Presents Carnegie Hall Tonight. She joined the Sesame Workshop (formerly Children’s Television Workshop) in 1987, where for eight years she worked on programming and development initiatives, and led the organization’s efforts to establish a cable television channel (now Noggin). In addition to the New York Public Radio Board of Trustees, Ms. Walker sits on the boards of Saint Ann’s School, the Yale Center for Customer Insights, Claims Processing Facility, Inc. and Eagle Picher Industries Asbestos Trust, where she also serves as the chair of the audit committee. She is the chair of the Station Resource Group. Previously, Ms. Walker sat on the Board of Advisors for the Yale School of Management, the Board of Trustees for Education Development Center and on the board of directors for Public Radio International, the Women’s Forum of New York, Inc. and the Hudson Square Connection.

Specific qualifications, experience, skills and expertise include:

| | • | | Operating and management experience; |

| | • | | Core business skills, including operations and marketing; and |

| | • | | Deep understanding of the media and radio industry. |

Class III Directors—Terms Expiring at the 2016 Annual Meeting:

Bruce A. Karsh has been a director since December 31, 2012 and is a member of the Compensation Committee and the Nominating and Corporate Governance Committee. Mr. Karsh is a co-founder of Oaktree Capital Management, L.P., formerly Oaktree Capital Management, LLC, a Los Angeles-based institutional money management firm where he is currently co-chairman and chief investment officer, as well as a portfolio manager for Oaktree’s distressed opportunities and value opportunities strategies. Prior to co-founding Oaktree, Mr. Karsh was a managing director of the TCW Asset Management Company and the portfolio manager of its Special Credits Funds for seven years. Prior to joining TCW, Mr. Karsh worked as assistant to the chairman of Sun Life Insurance Company of America and of SunAmerica, Inc., its parent. Prior to that, Mr. Karsh was an attorney with the law firm of O’Melveny & Myers LLP. Mr. Karsh currently serves on the board of directors of Oaktree Capital Group, LLC and previously served as a director of Charter Communications, Inc. and LBI Media Holdings, Inc. Mr. Karsh also serves on the Duke University Board of Trustees.

Specific qualifications, experience, skills and expertise include:

| | • | | Expertise in corporate finance and investment management; |

10

| | • | | Core business skills, including operations and strategic planning; and |

| | • | | Deep understanding of the media industry. |

Ross Levinsohn has been a director since December 31, 2012 and is a member of the Audit Committee and the Nominating and Corporate Governance Committee. Mr. Levinsohn serves as Executive Chairman and a member of the Board of Directors of Scout Media, a multi-channel, male-focused media network owned by The Pilot Group. Previously, Mr. Levinsohn served as chief executive officer at Guggenheim Digital Media, a financial services and asset management firm, from January 2013 to June 2014. Mr. Levinsohn served as interim chief executive officer and executive vice president, head of global media at Yahoo! Inc., a multinational internet company, from October 2010 to August 2012. Prior to that post he was executive vice president of the Americas region for Yahoo!. Mr. Levinsohn co-founded Fuse Capital, an investment and strategic equity management firm focused on investing in and building digital media and communications companies. Prior to Fuse Capital, Mr. Levinsohn spent six years at News Corporation, serving as senior vice president and then president of Fox Interactive Media. Mr. Levinsohn also held senior management positions with AltaVista, CBS Sportsline and HBO. Mr. Levinsohn currently serves on the board and audit committee of Millennial Media, Inc., and on the board of Zefr, Inc., which provides solutions for professional content owners on YouTube, and the National Association of Television Program Executives (NATPE), and previously held board positions with Freedom Communications, Inc., Napster, Inc., Generate, BBE Sound, Crowd Fusion and True/Slant.

Specific qualifications, experience, skills and expertise include:

| | • | | Operating and management experience; |

| | • | | Core business skills, including operations and strategic planning; and |

| | • | | Deep understanding of the media industry. |

Peter E. Murphy has been a director since December 31, 2012 and is a member of the Audit Committee and the Nominating and Corporate Governance Committee. Mr. Murphy is the chief executive officer of Wentworth Capital Management, which he founded in January 2007, a private investment and venture capital firm focused on media, technology, and branded consumer businesses. Mr. Murphy previously served as president, strategy & development of Caesars Entertainment Corp., an Apollo-TPG portfolio company and the world’s largest gaming company, from August 2009 to July 2011. Prior to Caesars, Mr. Murphy was an operating partner at Apollo Global Management, LLC focused on media and entertainment investing. Previously, Mr. Murphy spent 18 years at The Walt Disney Company in senior executive roles, serving as Disney’s senior executive vice president, chief strategic officer, senior advisor to the chief executive officer, a member of Disney’s executive management committee, and chief financial officer of ABC, Inc. Mr. Murphy currently serves on the board of directors of Malibu Boats, LLC, where he also serves as chairman of the compensation committee, and Revel Entertainment Group, where he also serves as chairman of the board, and he also serves as a board advisor to DECA TV. He previously served on the board of directors of Fisher Communications and Dial Global.

Specific qualifications, experience, skills and expertise include:

| | • | | Operating and management experience; |

| | • | | Core business skills, including financial and strategic planning; and |

| | • | | Deep understanding of the media and entertainment industry. |

Selecting Nominees for Director

Our Board of Directors has delegated to the Nominating and Corporate Governance Committee the responsibility for reviewing and recommending to the board nominees for director. In accordance with our Nominating and Corporate Governance Committee Charter and Corporate Governance Guidelines, the Nominating and Corporate Governance Committee, in evaluating director candidates, recommends to the Board

11

of Directors appropriate criteria for the selection of new directors based on the strategic needs of the Company and the Board of Directors, and periodically reviews the criteria adopted by the Board of Directors and, if deemed desirable, recommends changes to such criteria.

The Board of Directors seeks members from diverse professional backgrounds who combine a broad spectrum of experience and expertise with a reputation for integrity. The Board of Directors does not have a formal policy with respect to diversity and inclusion; however, it affirms the value placed on diversity within the Company. Diversity of experience is one of many factors the Nominating and Corporate Governance Committee considers when recommending director nominees to the Board of Directors. The Board of Directors seeks members that have experience in positions with a high degree of responsibility or are, or have been, leaders in the companies or institutions with which they are, or were, affiliated, but may seek other members with different backgrounds, based upon the contributions they can make to the Company.

The Nominating and Corporate Governance Committee is responsible for recommending to the Board of Directors nominees for election to the Board of Directors at each annual meeting of stockholders and for identifying one or more candidates to fill any vacancies that may occur on the Board of Directors. New candidates may be identified through recommendations from existing directors or members of management, search firms, discussions with other persons who may know of suitable candidates to serve on the Board of Directors, and shareholder recommendations. Evaluations of prospective candidates typically include a review of the candidate’s background and qualifications by the Nominating and Corporate Governance Committee, interviews with the committee as a whole, one or more members of the committee, or one or more other board members, and discussions within the committee and the full board. The Nominating and Corporate Governance Committee then recommends candidates to the full board, with the full Board of Directors selecting the candidates to be nominated for election by the stockholders or to be elected by the Board of Directors to fill a vacancy. In addition, any vacancy created by any of the initial members of our Board of Directors designated by any of the Stockholders pursuant the Plan during their initial term may be filled only by such Stockholder that designated such initial director.

The Nominating and Corporate Governance Committee will consider director candidates proposed by shareholders as well as recommendations from other sources. Any stockholder who wishes to recommend a prospective candidate for the Board of Directors for consideration by the Nominating and Corporate Governance Committee may do so by submitting the name and qualifications of the prospective candidate in writing, in care of the Corporate Secretary, to Tribune Media Company, 435 North Michigan Avenue, Chicago, Illinois 60611. Any such submission should also describe the experience, qualifications, attributes and skills that make the prospective candidate a suitable nominee for the Board of Directors. Our Bylaws set forth the requirements for direct nomination of an individual by a shareholder for election to the Board of Directors.

Director Independence

Our Board of Directors has determined, after considering all of the relevant facts and circumstances, that all directors and director nominees other than Messrs. Levinsohn and Liguori are considered “independent” directors within the meaning of the listing standards of the NYSE.

Executive Sessions of Our Non-Management Directors

The non-management directors will meet at regularly scheduled executive sessions without management not less frequently than two times per year. The independent directors will meet at least once a year in an executive session without management. At least once a year, the non-management directors will meet with the Chief Executive Officer without the other executive officers being present. The Chairman of the Board shall act as chair at such meetings. If the Chairman of the Board is not an independent director, the Board will either designate an independent director to preside at the meetings of independent directors or a procedure by which a presiding director is selected for these meetings.

12

Communications with the Board

Stockholders and other interested parties who wish to contact our Board of Directors as a whole, the independent directors or any individual member of the Board of Directors or any committee therefore may email at BoardofDirectors@Tribunemedia.com or send written correspondence to Tribune Media Board of Directors, Tribune Media Company, 435 North Michigan Avenue, Chicago, Illinois 60611. The Board of Directors has designated the Corporate Secretary as its agent to receive and review written communications addressed to the Board of Directors, any of its committees or any director. Depending on the subject matter, the Corporate Secretary will either (i) promptly forward to the Chairman of the Audit Committee and the Office of the General Counsel any communication alleging legal, ethical or compliance issues by management or any other matter deemed by the Corporate Secretary to be potentially material to the Company or (ii) not forward to the Board of Directors, any committee or any director, any communications of a personal nature or not related to the duties of the Board of Directors, including, without limitation, junk mail and mass mailings, business solicitations, routine customer service complaints, new product or service suggestions, opinion survey polls or any other communications deemed by the Corporate Secretary to be immaterial to the Company and the Board of Directors.

Board Leadership Structure

As noted in our Corporate Governance Guidelines, the Board of Directors has no policy with respect to the separation of the offices of Chairman and Chief Executive Officer. The Board of Directors believes it is important to retain its flexibility to allocate the responsibilities of the offices of the Chairman and Chief Executive Officer in any way that is in the best interests of the Company at a given point in time. Mr. Karsh currently serves as the Chairman of the Board of Directors and Mr. Liguori currently serves as Chief Executive Officer. The Board of Directors believes this governance structure currently promotes a balance between the Board’s independent authority to oversee our business and the Chief Executive Officer and his management team who manage the business on a day-to-day basis. If the Board of Directors chooses to combine the offices of Chairman and Chief Executive Officer in the future, a lead director will be appointed annually by the independent directors.

Board’s Role in Risk Oversight

Our Board of Directors as a whole has responsibility for overseeing our risk management. The Board of Directors exercises this oversight responsibility directly and through its committees. The oversight responsibility of the Board of Directors and its committees is informed by reports from our management team and from our internal audit department that are designed to provide visibility to the Board of Directors about the identification and assessment of key risks and our risk mitigation strategies. Our Chief Executive Officer oversees our management succession planning. The full Board of Directors has primary responsibility for evaluating strategic and operational risk management. Our Audit Committee has the responsibility for overseeing our major financial and accounting risk exposures and the steps our management has taken to monitor and control these exposures, including policies and procedures for assessing and managing risk. Our Compensation Committee evaluates risks arising from our compensation policies and practices, as more fully described below. The Audit and Compensation Committees and our Chief Executive Officer provide reports to the full Board of Directors regarding these and other matters.

Corporate Governance Guidelines and Code of Business Conduct and Ethics

Our Board of Directors has adopted Corporate Governance Guidelines and a Code of Business Conduct and Ethics for directors, officers and employees. The Corporate Governance Guidelines set forth our policies and procedures relating to corporate governance and cover topic including, but not limited to, director qualification and responsibilities, Board composition and management and succession planning. Our Corporate Governance Guidelines are available on the corporate governance section of our investor relations website at http://www.tribunemedia.com.

13

Our Board of Directors has adopted a Code of Ethics and Business Conduct that applies to all of the Company’s officers, employees and directors, and a Code of Ethics for CEO and Senior Financial Officers that applies to our Chief Executive Officer, Chief Financial Officer, Vice President and Controller, Vice President/Internal Audit, Vice President and Treasurer, Vice President/Corporate Finance & Investor Relations and any person performing similar functions. A copy of both codes is available on the corporate governance section of our investor relations website at http://www.tribunemedia.com.

Committees of the Board

Our Board of Directors has the following committees: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. The charters for each of the Audit, Compensation and Nominating and Corporate Governance Committees are available on the corporate governance section of our investor relations website at http://www.tribunemedia.com. The following table shows the current members of each committee and the number of meetings held during fiscal 2014.

| | | | | | |

Director | | Audit | | Compensation | | N&CG |

Craig A. Jacobson | | ü | | ü* | | |

Bruce A. Karsh | | | | ü | | ü |

Ross Levinsohn | | ü | | | | ü |

Kenneth Liang | | | | ü | | |

Peter E. Murphy | | ü* | | | | ü |

Laura R. Walker | | | | ü | | |

Number of meetings | | 5 | | 5 | | 3 |

ü = current committee member; * = chair

Audit Committee. As more fully described in its charter, our Audit Committee has the responsibility for, among other things, assisting the Board of Directors in reviewing our financial reporting and other internal control processes, our financial statements, the independent auditors’ qualifications and independence, the performance of our internal audit function and independent auditors and our compliance with legal and regulatory requirements and our code of business conduct and ethics.

Our Board of Directors has determined that Mr. Murphy is an “audit committee financial expert” as that term is defined in the rules and regulations of the SEC and that each of the three Audit Committee members, Messrs. Jacobson, Levinsohn and Murphy, is “financially literate” under the NYSE rules. Each member of our Audit Committee (other than Mr. Levinsohn) is independent under applicable NYSE listing standards and meets the standards for independence required by U.S. securities law requirements applicable to public companies, including Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), with such independence requirements to be satisfied by all members of the Audit Committee no later than December 4, 2015, one year from the date of effectiveness of the registration statement filed with the SEC in connection with the listing of our Class A common stock on the NYSE.

Compensation Committee. As more fully described in its charter, our Compensation Committee has the responsibility for reviewing and approving the compensation and benefits of our employees, directors and consultants, administering our employee benefits plans, authorizing and ratifying stock option grants and other incentive arrangements and authorizing employment and related agreements. Each member of our Compensation Committee is independent under applicable NYSE listing standards.

The Compensation Committee has the authority to retain compensation consultants, outside counsel and other advisers. During 2014, the committee engaged Exequity LLP (“Exequity”) as its independent compensation consultant. Pursuant to our policy, Exequity provides no services to us other than consulting services provided at the direction of the Compensation Committee. In 2014, the Compensation Committee reviewed Exequity’s independence and confirmed Exequity’s independence and that no conflicts of interest exist.

14

During 2014, our Compensation Committee consisted of Messrs. Jacobson, Karsh and Liang and Ms. Walker. There are no members of the Compensation Committee who serve as an officer or employee of the Company or any of its subsidiaries. In addition, no executive officer of the Company serves as a director or as a member of the compensation committee of a company (i) whose executive officer served as a director or as a member of the Compensation Committee of the Company and (ii) which employs a director of the Company.

Nominating and Corporate Governance Committee. As more fully described in its charter, our Nominating and Corporate Governance Committee has the responsibility, among its other duties and responsibilities, for identifying and recommending candidates to the Board of Directors for election to our Board of Directors, reviewing the composition of the Board of Directors and its committees, developing and recommending to the Board of Directors corporate governance guidelines that are applicable to us, and overseeing Board of Directors evaluations. Each member of our Nominating and Corporate Governance Committee (other than Mr. Levinsohn) is independent under applicable NYSE listing standards, with such independence requirements to be satisfied by all members of the Nominating and Corporate Governance Committee no later than December 4, 2015, one year from the date of effectiveness of the registration statement filed with the SEC in connection with the listing of our Class A common stock on the NYSE.

Meetings of the Board of Directors and Attendance at the Annual Meeting

Our Board of Directors held 16 meetings during fiscal 2014. Each of our directors attended at least 75% of the total number of meetings of the board and any committees of which he or she was a member. Directors are encouraged to attend our annual meetings. The Annual Meeting is the Company’s first annual meeting since becoming a public company during fiscal 2014.

Plurality Voting for Directors

The Company’s Bylaws provide for the election of directors by a plurality of the votes validly cast. This means that the two individuals nominated for election to the Board of Directors who receive the most “FOR” votes (among votes properly cast in person, electronically or by proxy) will be elected.

Executive Officers

Our executive officers are designated by, and serve at the discretion of, our Board of Directors. There are no family relationships among any of our directors or executive officers. Our executive officers are as follows:

| | | | |

Executive Officer | | Age | | Position |

Peter Liguori | | 54 | | Director, President and Chief Executive Officer |

Steven Berns | | 50 | | Executive Vice President and Chief Financial Officer |

Chandler Bigelow | | 46 | | Executive Vice President, Chief Business Strategies and Operations Officer |

Melanie Hughes | | 52 | | Executive Vice President, Human Resources |

Edward P. Lazarus | | 55 | | Executive Vice President, General Counsel and Corporate Secretary |

John Batter | | 52 | | Chief Executive Officer, Gracenote and Executive Vice President, Tribune Media |

Matthew Cherniss | | 42 | | President and General Manager, WGN America & Tribune Studios |

Lawrence Wert | | 58 | | President, Broadcast Media |

Mr. Liguori’s biography and related information may be found above at “Directors, Executive Officers and Corporate Governance—Class II Nominees.” The following is biographical information for each of our other executive officers:

Steven Berns has served as Executive Vice President and Chief Financial Officer since July 2013. From May 2009 to May 2013, Mr. Berns served as the executive vice president and chief financial officer of Revlon, Inc., a worldwide cosmetics and beauty products company. Prior to that time, Mr. Berns was chief financial officer of Tradeweb Markets, LLC, a leading over-the-counter, multi-asset class online marketplace, and a

15

pioneer in the development of electronic trading and trade processing, since November 2007. From November 2005 until July 2007, Mr. Berns served as president, chief financial officer and director of MDC Partners Inc. and from September 2004 to November 2005, Mr. Berns served as vice chairman and executive vice president of MDC Partners. Prior to that, Mr. Berns was the senior vice president and treasurer of Interpublic Group of Companies, Inc., an organization of advertising agencies and marketing services companies from August 1999 until September 2004. Before that, Mr. Berns held a variety of positions in finance at Revlon, Inc. from April 1992 until August 1999, becoming vice president and treasurer in 1996. Prior to joining Revlon in 1992, Mr. Berns worked at Paramount Communications, Inc. and at a predecessor public accounting firm of Deloitte & Touche LLP. Mr. Berns is a Certified Public Accountant. Mr. Berns currently serves as a director and chairman of the audit committee of Shutterstock, Inc., a global marketplace for licensed imagery. He served as a director and member of the audit and compensation committees for LivePerson, Inc. from April 2002 until June 2011.

Chandler Bigelow has served as Executive Vice President, Chief Business Strategies and Operations Officer since July 2013. Mr. Bigelow helps lead the ongoing transformation of our traditional media businesses, and oversees our equity investments and real estate portfolio. Mr. Bigelow served as our Executive Vice President, Chief Financial Officer from April 2008 to July 2013, overseeing all corporate finance functions, including financial reporting, tax, audit and treasury, during which period we and 110 of our direct and indirect wholly-owned subsidiaries filed voluntary petitions for relief under chapter 11 of title 11 of the United States Code in the United States Bankruptcy Court of the District of Delaware. Prior to that, he served as Vice President, Treasurer with responsibility for our financing activities, cash management, short-term and retirement fund investments and risk-management programs beginning in 2003. Previously, Mr. Bigelow was Assistant Treasurer since 2001 and served as director/corporate finance from 2000 to 2001. He joined Tribune in 1998 as part of the Tribune Financial Development Program and became corporate finance manager in 1999. Prior to Tribune, Bigelow was manager of investor relations for Spyglass, Inc., an internet software company, from 1996 to 1997. In 1994, he co-founded Brainerd Communicators, Inc., an investor relations firm, where he served as vice president through 1995. He is a board member for the Guild of the Chicago Botanic Garden and of the Springboard Foundation in Chicago.

Melanie Hughes has served as Executive Vice President, Human Resources since May 2013. From August 2012 to May 2013, she was president of Org4Change, an organizational consulting firm. She previously served as chief administrative officer for Gilt Groupe, an online shopping website, from April 2009 to August 2012, where she was responsible for customer service, creative services, human resources, facilities and sales operations.

Edward P. Lazarus has served as Executive Vice President, General Counsel and Corporate Secretary since January 2013. From February 2012 to January 2013, he worked as an independent consultant and attorney. He previously served as chief of staff to the chairman of the Federal Communications Commission, Julius Genachowski, from July 2009 to February 2012. In that capacity, he oversaw policy development and implementation, strategic planning, communications, legislative and intergovernmental affairs, and agency management. From 2000 to 2009, Mr. Lazarus practiced law at Akin Gump Strauss Hauer & Feld LLP, where he launched the firm’s appellate section, chaired the national litigation steering committee, and was elected to the management committee.

John Batter has served as Chief Executive Officer, Gracenote and Executive Vice President, Tribune Media since August 2014. From August 2011 to August 2014, Mr. Batter was chief executive officer and a member of the board of directors of M-Go, a digital TV and movie streaming service offered jointly by DreamWorks Animation SKG, Inc. and Technicolor SA. Prior to M-Go, Mr. Batter served as president, production of DreamWorks Animation from January 2006 to August 2011.

Matthew Cherniss has served as President and General Manager, WGN America & Tribune Studios since April 2013. Mr. Cherniss previously served as senior vice president, production for Warner Bros. Entertainment Inc., a film, television and music entertainment company from April 2011 to April 2013. From September 2008 to April 2011, Mr. Cherniss served as executive vice president, programming for Fox Broadcasting Company, a commercial broadcast television network.

16

Lawrence Wert has served as President, Broadcast Media since February 2013. Mr. Wert, who has over 30 years of experience in the broadcasting industry, is responsible for overseeing the strategy and day-to-day activities of our 42 owned or operated television stations and our Chicago radio station, WGN. From 1998 to 2011, he was the president and general manager of WMAQ-TV, the NBC-owned and operated station in Chicago. From 2008 to 2011, he additionally served as president of NBC Local Media’s central and western region. From 2011 to 2013, Mr. Wert was executive vice president of station initiatives for 10 NBC-owned stations. Mr. Wert serves on the board of directors for several charities, including the Museum of Broadcast Communications, the Children’s Brittle Bond Foundation, Catholic Charities, and Chicagoland Chamber of Commerce.

17

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

This Compensation Discussion and Analysis (“CD&A”) describes material elements of our compensation philosophy, summarizes our compensation programs, and reviews compensation decisions for the following Named Executive Officers (the “NEOs”):

| | |

Name | | Title |

Peter Liguori | | Chief Executive Officer |

Steven Berns | | Executive Vice President, Chief Financial Officer |

Lawrence Wert | | President, Broadcast Media |

Chandler Bigelow | | Executive Vice President, Chief Business Strategies and Operations Officer |

Edward P. Lazarus | | Executive Vice President, General Counsel and Corporate Secretary |

2014 Accomplishments

2014 was a year of strategic, operational, and organizational repositioning. Key actions and milestones accomplishments in 2014 included the following:

| | • | | Converted 50% of WGN America subscriber base from superstation to cable; |

| | • | | Integrated Local TV into our existing Television and Entertainment business, which added 19 TV stations in 16 markets; |

| | • | | Acquired Gracenote, What’s on India, Baseline and HWW to further establish the Company as a leading metadata company; |

| | • | | Secured significant retransmission consent agreements, which increased revenue and profits of the Television and Entertainment business; |

| | • | | Launched two original series on WGN America, Salem and Manhattan; |

| | • | | Completed the spin-off of the Company’s publishing operations into an independent publicly-traded company in a tax-free transaction; |

| | • | | Implemented a $400 million share repurchase program; |

| | • | | In a series of transactions, monetized the Company’s interest in Classified Ventures for total net proceeds after taxes of approximately $525 million; and |

| | • | | Completed the registration of the Company’s Class A common stock on the New York Stock Exchange (“NYSE”). |

Contributions of the NEOs in 2014

Peter Liguori

Mr. Liguori presided over our business transformation in 2014. Through Mr. Liguori’s leadership, we achieved strong performance results, even while navigating the complexities of acquisitions, spin-offs and the Company’s registration on the NYSE. Mr. Liguori’s contributions in 2014 included strategic input and oversight of all activities associated with:

| | • | | Integration of the acquisitions of Local TV, Gracenote, What’s on India, Baseline and HWW; |

| | • | | Completed the spin-off of the Company’s publishing operations into an independent publicly-traded company in a tax-free transaction; |

| | • | | Completed the registration of the Company’s Class A common stock on the NYSE; |

18

| | • | | Launched two original series on WGN America, Salem and Manhattan; and |

| | • | | In a series of transactions, monetized the Company’s interest in Classified Ventures for total net proceeds after taxes of approximately $525 million. |

Steven Berns

Mr. Berns presides over the finance and information technology functions of the Company, as well as its restructuring activities. Mr. Berns’ contributions in 2014 included:

| | • | | Leadership over the spin-off of the Company’s publishing operations into an independent publicly-traded company in a tax-free transaction; |

| | • | | Leadership of the Company’s financial reporting, corporate finance and investor relations efforts leading to the Company becoming an SEC registrant and its Class A common stock being listed on the NYSE; |

| | • | | Building the leadership teams in finance and technology to execute on the transformation of Tribune Media into a leading diversified media company; and |

| | • | | Leading the selection and commencing the implementation of new business applications as a foundation for the Company’s future cost reductions and increased operating efficiencies. |

Lawrence Wert

In 2014, Mr. Wert had broad oversight over day-to-day activities of our owned or operated television stations and our radio station, WGN. Mr. Wert’s contributions in 2014 included:

| | • | | Securing long-term agreements with ABC and CBS, including acquisition of the CBS affiliation in Indianapolis and the subsequent launch of a fully functional television station by year-end 2014; |

| | • | | Integration of the Local TV acquisition, including the recruitment of senior management and other key leadership positions within our Television and Entertainment segment; |

| | • | | Closing significant sports deals for the broadcasting group, including the New York Mets and the Chicago Blackhawks; and |

| | • | | Consolidation of all national sales with TeleRep, a division of Cox Reps, and execution of strategic partnerships with both Nielsen and Rentrak. |

Chandler Bigelow

Mr. Bigelow is responsible for the Company’s long-term strategy as well as its equity investments, including its minority stakes in Television Food Network and CareerBuilder and its real estate. Mr. Bigelow’s contributions in 2014 included strategic input and oversight over all activities associated with:

| | • | | Acquisitions of Gracenote, What’s on India, Baseline and HWW; |

| | • | | In a series of transactions, monetized the Company’s interest in Classified Ventures for total net proceeds after taxes of approximately $525 million; and |

| | • | | Oversight of the ongoing development of our real estate assets to maximize their value. |

Edward P. Lazarus

Mr. Lazarus is responsible for all of our legal affairs, including transactions, regulatory matters, and litigation, as well as employment, compliance, and other legal policy matters. Mr. Lazarus’s contributions in 2014 included:

| | • | | Completed the spin-off of the Company’s publishing operations into an independent publicly-traded company in a tax-free transaction, including public policy matters related to the congressional inquiry associated with the spin-off; |

19

| | • | | Registration of the Company’s Class A common stock on the NYSE; and |

| | • | | Contributions related to the renewal of retransmission consent agreements with the major MVPDs. |

Overview of the Compensation Program

2014 Compensation Highlights

Highlights of compensation actions taken in 2014 include:

| | • | | Creation of a performance share unit (“PSU”) plan design which incorporates both internal financial metrics and alignment with the interests of shareholders; |

| | • | | Establishment of a new pay benchmarking peer group of companies which will be used for 2015 compensation determinations to reflect the make-up of the Company following the completed the spin-off of the Company’s publishing operations and the continued growth of the Company’s Digital and Data business for purposes of aligning pay practices and pay levels with relevant talent market and industry standards; |

| | • | | Supplemental equity awards to NEOs to further tighten and align compensation opportunities and shareholder value creation; and |

| | • | | Adoption of executive share ownership guidelines of 5 times annual base salary for our Chief Executive Officer, 3 times base salary for the Presidents of our businesses, 1 times base salary for all other direct reports to the Chief Executive Officer and 3 times the annual retainer for Directors. |

Pay Philosophy

Our executive compensation program is designed to promote attainment of short-term operating imperatives and long-term enterprise strategies that create shareholder value. The Compensation Committee and management developed our executive pay program in support of the fundamental pay philosophy guidelines described below.

In furtherance of our strategic operating imperatives and the executive pay philosophy, the pay program was designed to:

| | • | | Establish a tight linkage between total compensation received and business results and shareholder value creation; |

| | • | | Encourage the profitable realignment of core businesses; |

| | • | | Support the attraction and retention of a highly capable leadership team; and |

| | • | | For 2014, facilitate the spin-off of the Company’s publishing operations and the registration of the Company’s Class A common stock on the NYSE. |

Peer Group Development

In anticipation of the spin-off of the Company’s publishing operations, the Compensation Committee engaged Exequity to review the relevance of the then-current peer group. Exequity was asked to develop a new peer group for purposes of benchmarking executive compensation. The peer community was selected to reflect the post-Publishing Spin-off breadth of the Company’s business portfolio in each of the following industries: broadcasters (Cumulus Media Inc., Gannett Co., Inc., iHeartMedia, Inc., Meredith Corporation and Sinclair Broadcast Group, Inc.); content creation (AMC Networks Inc., Cablevision Systems Corp., Discovery Communications, Inc., Dreamworks Animation SKG, Inc., Lions Gate Entertainment Corp., Live Nation Entertainment Inc., The Madison Square Garden Company, Scripps Networks Interactive, Inc. and Starz Inc.); and data/digital (AOL Inc., IAC/Interactive Corp., Pandora Media, Inc., Rovi Corporation, United Online, Inc., and WebMD Health Corp.).

Comparability of the peer group was assessed in part by conducting a “peer of peer” analysis in addition to review of other talent market and operating characteristics. The peer group had median revenues and other financial and operating characteristics similar to the Company.

20

Pay Mix and Competitive Targeting

NEO compensation is weighted towards variable compensation (annual and long-term incentives), where actual amounts earned may differ from targeted amounts based on the Company’s success and individual performance. Each NEO has a target total compensation opportunity that is assessed annually by the Compensation Committee to ensure alignment with our compensation objectives and market practice. In general, total targeted annualized pay (as well as each major component of pay) is sought to be aligned with the median levels among similarly situated executives at the peer companies.

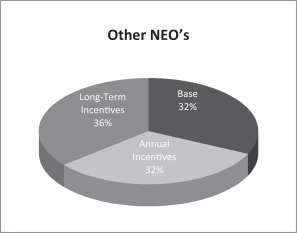

In addition to the desire to generally align with the median total targeted compensation of the peer companies, the Compensation Committee sought to achieve relative parity of pay opportunity and incentive mix among the NEOs. While some differences exist due primarily to individualized hiring negotiations with NEOs, the pay philosophy generally provides for an equal split of compensation value between base pay, targeted bonus, and long-term incentive grant value (other than for the Chief Executive Officer, whose pay mix is more heavily weighted toward long-term incentives).

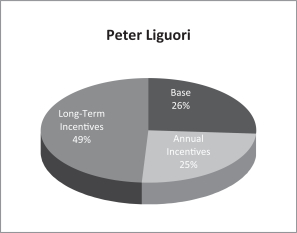

The employment agreement of each of the NEOs defines a specific breakdown of intended base pay, targeted bonus, and long-term incentive grant values. As the following charts reflect, 74% of Chief Executive Officer’s intended annual target compensation and 68% of the other NEOs’ intended target annual compensation is variable with performance, including stock price performance.

In 2014, the NEOs received supplemental equity awards to more strongly align their ownership with that of the peer group. If these values had been included in the pie charts, the percentage of total targeted pay represented by incentive vehicles would be significantly higher than that reflected in the above graphics.

Components of the Compensation Program

The target total compensation opportunity for NEOs is comprised of both fixed (base salary) and variable (annual and long-term incentive) compensation. In addition, each NEO is eligible for benefits applicable to employees generally. Perquisites are not a material aspect of our compensation program.

Base Salary

Base salaries are reviewed and established annually, upon promotion, or following a change in job responsibilities based on market data, internal pay equity and each NEO’s level of responsibility, experience, expertise and performance. The NEOs’ base salaries are generally targeted at median peer levels in

21

order to facilitate recruiting and retention through our period of business realignment. Some variances around median peer levels exist with respect to new hires as part of the negotiation process in recruiting senior talent. The employment agreements for certain executives established initial base salaries that can be adjusted upward each year based on any of the above-referenced criteria. See “—Narrative Disclosure to Summary Compensation Table and Grants of Plan-Based Awards Table.”