QuickLinks -- Click here to rapidly navigate through this documentAs filed with the Securities and Exchange Commission on December 12, 2003

Registration No. 333-84552

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Post-effective Amendment No. 3 on

FORM S-1

to Form S-3 Registration Statement

Under

The Securities Act of 1933

ELECTRO SCIENTIFIC INDUSTRIES, INC.

(Exact name of registrant as specified in its charter)

| Oregon | | 3690 | | 93-0370304 |

(State or other jurisdiction

of incorporation) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification Number) |

13900 NW Science Park Drive, Portland, Oregon 97229

(503) 641-4141

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices) |

J. Michael Dodson

Senior Vice President of Administration,

Chief Financial Officer and Secretary

Electro Scientific Industries, Inc.

13900 NW Science Park Drive

Portland, Oregon 97229

(503) 641-4141

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Robert J. Moorman

Steven H. Hull

Stoel Rives LLP

900 SW Fifth Avenue, Suite 2600

Portland, Oregon 97204

(503) 224-3380

Approximate date of commencement of proposed sale to the public:

as soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ý

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. o

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said section 8(a), may determine.

EXPLANATORY STATEMENT

The registrant entered into a registration rights agreement with the initial purchaser of the securities to be registered on this registration statement. Under that agreement, the registrant agreed to file a shelf registration statement under the Securities Act of 1933 for the resale of the securities and keep the shelf registration statement effective until January 8, 2004 or, if earlier, the date when the holders of the securities are able to sell their securities immediately pursuant to Rule 144(k) under the Securities Act. Such a shelf registration statement on Form S-3 was declared effective by the Securities and Exchange Commission on May 2, 2002. Under Commission rules, because the registrant did not timely file its quarterly report on Form 10-Q for the quarter ended March 31, 2003, it became ineligible to use the existing Form S-3 registration statement when the registrant's annual report on Form 10-K for the year ended May 31, 2003 was filed with the Commission on August 27, 2003. As a result, the registrant is amending the existing registration statement on Form S-3 with this post-effective amendment on Form S-1.

The registrant originally registered $150 million aggregate principal amount of convertible subordinated notes for resale. The registrant repurchased $5 million aggregate principal amount of the notes in the third quarter of fiscal 2003. Accordingly, this post-effective amendment relates to the resale of $145 million aggregate principal amount of convertible subordinated notes.

The information in this prospectus is not complete and may be changed. The selling securityholders may not sell these securities under this post-effective amendment until such amendment filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer is not permitted.

Subject to Completion, Dated December 12, 2003

ELECTRO SCIENTIFIC INDUSTRIES, INC.

$145,000,000

41/4% Convertible Subordinated Notes Due 2006 and the Common Stock Issuable upon Conversion of the Notes.

We issued the notes in a private placement in December 2001 and January 2002. This prospectus will be used by selling securityholders to resell the notes and the common stock issuable upon conversion of the notes.

The notes are convertible prior to maturity into common stock at an initial conversion price of $38.00 per share, subject to adjustment in certain events. We will pay interest on the notes on June 21 and December 21 of each year, beginning on June 21, 2002. The notes will mature on December 21, 2006, unless earlier converted or redeemed.

We may redeem all or a portion of the notes on or after December 21, 2004. In addition, the holders may require us to repurchase the notes upon certain changes in control prior to December 21, 2006.

Our common stock is traded on the Nasdaq National Market under the symbol "ESIO." On December 10, 2003, the last sale price for our common stock as reported on the Nasdaq National Market was $22.91 per share.

See "Risk Factors" on page 6 for a discussion of risks related to an investment in these securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

You should rely only on the information provided in this prospectus. We have not authorized anyone else to provide you with different information. Neither we, nor any other person on our behalf, is making an offer to sell or soliciting an offer to buy any of the securities described in this prospectus in any state where the offer is not permitted by law. You should not assume that the information in this prospectus is accurate as of any date other than the date on the front of this prospectus. There may have been changes in our affairs since the date of the prospectus.

The date of this prospectus is , 2003.

TABLE OF CONTENTS

| | Page

|

|---|

| Summary | | 2 |

The Offering |

|

4 |

Risk Factors |

|

6 |

Use of Proceeds |

|

16 |

Ratio of Earnings to Fixed Charges |

|

16 |

Common Stock Prices/Dividends |

|

16 |

Selected Financial Data |

|

17 |

Management's Discussion and Analysis of Financial Condition and Results of Operations |

|

18 |

Changes In and Disagreements With Accountants On Accounting and Financial Disclosure |

|

30 |

Quantitative and Qualitative Disclosures About Market Risk |

|

30 |

Business |

|

32 |

Management |

|

41 |

Employment Contracts and Severance Arrangements |

|

48 |

Compensation Committee Report On Executive Compensation |

|

49 |

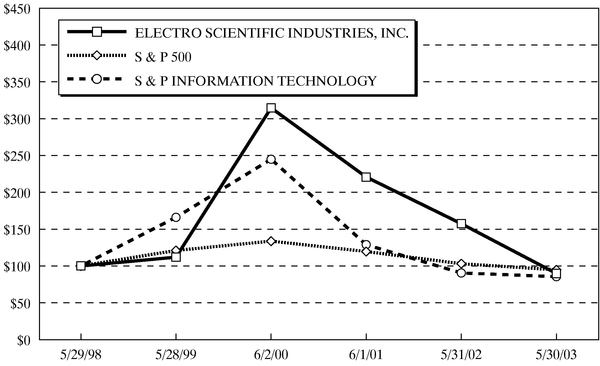

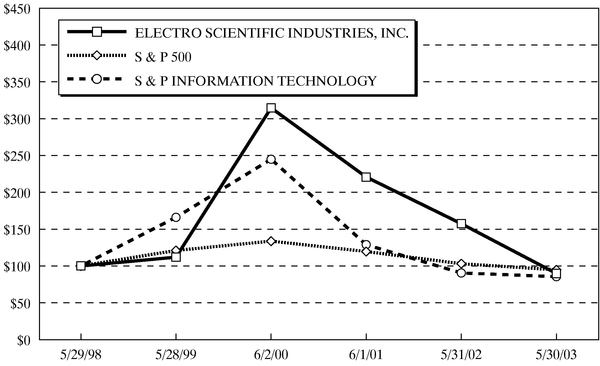

Performance Graph |

|

52 |

Security Ownership of Certain Beneficial Owners and Management |

|

53 |

Certain Relationships and Related Transactions |

|

54 |

Description of Notes |

|

55 |

Description of Capital Stock |

|

72 |

Material United States Federal Income Tax Considerations |

|

75 |

Selling Securityholders |

|

80 |

Plan of Distribution |

|

80 |

Legal Matters |

|

81 |

Experts |

|

82 |

Index to Financial Statements |

|

F-1 |

SUMMARY

This summary highlights selected information contained elsewhere in this prospectus and in the incorporated documents. This summary is not complete and does not contain all the information that you should consider before investing in our notes or common stock. You should read the entire prospectus carefully, including the risk of investing in our securities discussed under "Risk Factors" and our financial statements before making an investment decision.

Electro Scientific Industries, Inc.

Electro Scientific Industries, Inc. and its subsidiaries ("ESI") provide high technology manufacturing equipment to the global electronics market. Our customers are primarily manufacturers of semiconductors, passive electronic components and electronic interconnect devices. Our equipment enables these manufacturers to reduce production costs, increase yields and improve the quality of their products. The components and devices manufactured by our customers are used in a wide variety of end-use products in the computer, communications and automotive industries.

We believe we are the leading supplier of advanced laser systems used to improve the production yield of semiconductor devices; high-speed test and termination equipment used in the high-volume production of multi-layer ceramic passives (MLCPs) and other passive electronic components; and advanced laser systems used to fine tune electronic components and circuitry. Additionally, we produce a series of laser drilling systems for production of high-density interconnect (HDI) circuit boards and advanced semiconductor packaging, as well as passive component inspection systems and original equipment manufacturer (OEM) machine vision products.

2

Summary Financial Data

(in thousands, except per share data)

The following provides a summary of our statement of operations and balance sheet data. For a more detailed explanation of these financial data, see our financial statements located elsewhere in this prospectus.

| | Fiscal Year Ended

| | Three Months Ended

| |

|---|

| | June 2, 2001

| | June 1, 2002

| | May 31, 2003

| | August 31, 2002

| | August 30, 2003

| |

|---|

| |

| | (restated)

| |

| |

| |

| |

|---|

| Statement of Operations Data | | | | | | | | | | | | | | | | |

| Net sales | | $ | 471,853 | | $ | 162,885 | | $ | 136,885 | | $ | 39,360 | | $ | 20,876 | |

| Net income (loss)(1)(2)(3) | | | 99,933 | | | (17,777 | ) | | (50,086 | ) | | (3,394 | ) | | (9,367 | ) |

| Net income (loss) per share—basic(1)(2)(3) | | | 3.71 | | | (0.65 | ) | | (1.81 | ) | | (0.12 | ) | | (0.34 | ) |

| Net income (loss) per share—diluted(1)(2)(3) | | | 3.58 | | | (0.65 | ) | | (1.81 | ) | | (0.12 | ) | | (0.34 | ) |

|

|

|

|

|

|

May 31, 2003

|

|

|

|

August 30, 2003

|

|

|---|

| Balance Sheet Data | | | | | | | | | | | | | | | | |

| Cash, cash equivalents and marketable and restricted securities | | | | | | | | $ | 308,252 | | | | | $ | 297,663 | |

| Working capital | | | | | | | | | 340,162 | | | | | | 335,600 | |

| Property, plant and equipment, net | | | | | | | | | 36,592 | | | | | | 36,241 | |

| Total assets | | | | | | | | | 491,302 | | | | | | 487,545 | |

| Long-term debt | | | | | | | | | 141,891 | | | | | | 142,108 | |

| Shareholders' equity | | | | | | | | | 310,317 | | | | | | 299,830 | |

| | Fiscal Year Ended

| | Three Months Ended August 30, 2003

| |

|---|

| | May 31,

1999

| | June 3,

2000;

| | June 2,

2001

| | June 1,

2002

| | May 31,

2003

| |

|---|

| Ratio of earnings to fixed charges(4)(5)(6) | | 16 | x | 90 | x | 259 | x | (7 | )x | (9 | )x | (7 | )x |

- 1.

- Fiscal 2003 includes a pretax charge of $10.1 million related to the write-down of our Klamath Falls passive components consumable manufacturing site and related equipment and a parcel of land in Taiwan.

- 2.

- Fiscal 2002 includes a gain of $4.6 million related to research and development tax credits and pretax professional expenses directly related to receiving the credit of $0.8 million.

- 3.

- Fiscal 2001 includes a pretax gain of $13.9 million in connection with the litigation award from GSI Lumonics, net of $2.5 million of legal fees and expenses directly related to the award, and $1.4 million of interest received.

- 4.

- For the fiscal year ended May 31, 2003, we had a loss before taxes of $79.2 million and fixed charges of $7.9 million.

- 5.

- For the fiscal year ended June 1, 2002, we had a loss before taxes of $34.3 million and fixed charges of $4.1 million.

- 6.

- For the three months ended August 30, 2003, we had a loss before taxes of $15.4 million and fixed charges of $2.0 million.

We were incorporated in Oregon in April 1949. Our principal executive offices are located at 13900 NW Science Park Drive, Portland, Oregon 97229, our telephone number is (503) 641-4141 and our website is located at www.esi.com. Information on our website is not a part of this prospectus.

3

THE OFFERING

The following is a brief summary of some of the terms of this offering. For a more complete description of the terms of the notes, see "Description of Notes" in this prospectus.

| Issuer | | Electro Scientific Industries, Inc. |

Notes offered |

|

$145,000,000 aggregate principal amount of 41/4% convertible subordinated notes due 2006. |

Maturity |

|

December 21, 2006 |

Interest |

|

41/4% per year on the principal amount, payable semiannually on June 21 and December 21, beginning on June 21, 2002. |

Conversion rights |

|

The notes are convertible, at the option of the holder, at any time on or prior to maturity into shares of our common stock at a conversion price of $38.00 per share, which is equal to a conversion rate of approximately 26.3176 shares per $1,000 principal amount of notes. The conversion price is subject to adjustment. See "Description of Notes—Conversion Rights." |

Security |

|

When we initially sold the notes, we purchased and pledged to the trustee under the indenture, as security for the exclusive benefit of the holders of the notes, approximately $18.2 million of U.S. government securities, which will be sufficient upon receipt of scheduled principal and interest payments thereon, to provide for the payment in full of the first six scheduled interest payments due on the notes. The last of these six payments is in December 2004. The notes are not otherwise secured. See "Description of Notes—Security." |

Ranking |

|

Except as described above under "Security," the notes are unsecured and subordinated to all of our existing and future senior indebtedness and effectively subordinated to all existing and future indebtedness and other liabilities of our subsidiaries. At August 30, 2003 we had no senior indebtedness. Because the notes are subordinated, except as described above under "Security," in the event of bankruptcy, liquidation, dissolution or acceleration of payment on the senior indebtedness, holders of the notes will not receive any payment until holders of the senior indebtedness have been paid in full. The indenture does not limit the incurrence by us or our subsidiaries of senior indebtedness or other obligations. We do not have any debt obligations that limit the amount of indebtedness we or our subsidiaries may incur; future debt obligations, however, may contain such limitations. |

Optional redemption |

|

We may redeem the notes, in whole or in part, on or after December 21, 2004 at the redemption prices listed in this prospectus, plus accrued and unpaid interest up to, but not including, the redemption date. See "Description of Notes—Optional Redemption by ESI." |

4

Change in control |

|

Upon certain changes in control, each holder of the notes may require us to repurchase some or all of its notes at a purchase price equal to 100% of the principal amount of the notes plus accrued and unpaid interest. We may, at our option, instead of paying the change in control purchase price in cash, pay it in shares of our common stock valued at 95% of the average of the closing sales prices of our common stock for the five trading days immediately preceding and including the third trading day prior to the date we are required to repurchase the notes. We cannot pay the change in control purchase price in common stock unless we satisfy the conditions described in the indenture under which the notes will be issued. See "Description of Notes—Repurchase at Option of Holders Upon a Change in Control." |

DTC eligibility |

|

The notes are issued in fully registered form. The notes are represented by one or more global notes, deposited with the trustee as custodian for The Depository Trust Company, or DTC, and registered in the name of Cede & Co., DTC's nominee. Beneficial interests in the global notes are shown on, and transfers will be effected only through, records maintained by DTC and its participants. See "Description of Notes—Global Notes; Book-Entry; Form." |

Registration rights |

|

We agreed to file with the Commission within 90 days of original issuance of the notes a shelf registration statement for the resale of the notes and the common stock issuable upon conversion of the notes. We agreed to keep the shelf registration statement effective until two years after the latest date on which we issue notes in this offering (or such earlier date when the holders of the notes and the common stock issuable upon conversion of the notes are able to sell their securities immediately pursuant to Rule 144(k) under the Securities Act). If we do not comply with these registration obligations, we will be required to pay additional interest on the notes or an equivalent amount to any holders that have converted notes into common stock. See "Description of Notes—Registration Rights." |

Use of proceeds |

|

We will not receive any of the proceeds from the sale of the notes or the underlying common stock by any selling securityholder. |

Trading |

|

The notes are designated as eligible for trading in the PORTAL market; however, we cannot predict whether an active trading market for the notes will develop or, if such market develops, how liquid it will be. Our common stock is quoted on the Nasdaq National Market under the symbol "ESIO." |

Risk factors |

|

See "Risk Factors" and other information in this offering memorandum for a discussion of factors you should consider carefully before deciding to invest in the notes. |

5

RISK FACTORS

In addition to the other information in this prospectus, you should carefully consider the following risk factors in evaluating an investment in our company and its business.

RISKS RELATED TO OUR BUSINESS

The industries that comprise our primary markets are volatile and unpredictable.

Our business depends upon the capital expenditures of manufacturers of components and circuitry used in wireless communications, computers, automotive electronics and other electronic products. In the past, the markets for electronic devices have experienced sharp downturns. During these downturns, electronics manufacturers, including our customers, have delayed or canceled capital expenditures, which has had a negative impact on our financial results.

The current economic downturn has resulted in a reduction in demand for our products and significant reductions in our profitability and net sales. We had a net loss of $50.1 million during fiscal year 2003 on net sales of $136.9 million and a net loss of $17.8 million during fiscal 2002 on net sales of $162.9 million. We cannot assure you that demand for our products will increase. Even if demand for our products does increase, there may be significant fluctuations in our profitability and net sales.

During any downturn, including the current downturn, it will be difficult for us to maintain our sales levels. As a consequence, to maintain profitability we will need to reduce our operating expenses. However, because there is a lag between actions we take to reduce expense and the actual reductions of the costs, our ability to quickly reduce these fixed operating expenses is limited. Moreover, we may be unable to defer capital expenditures, and we will need to continue to invest in certain areas such as research and development. An economic downturn may also cause us to incur charges related to impairment of assets and inventory write-offs and we may also experience delays in payments from our customers. For example, in the fourth quarter of fiscal 2003, we wrote-down our Klamath Falls, Oregon facility by $9.1 million. The combined effect of asset impairments, inventory write-offs and payment delays could have a significant negative effect on our financial results.

Pending or future litigation could have a material adverse impact on our operating results and financial condition.

In addition to intellectual property litigation, we have been, from time to time, subject to legal proceedings and claims, including a putative securities class action lawsuit and other securities-related litigation. The class action lawsuit alleges that we and six of our current and/or former officers and directors violated the anti-fraud provisions of the securities laws by making false and misleading statements regarding our business prospects and operations. The other securities-related litigation is a shareholder derivative suit alleging that certain current and/or former officers and directors violated their fiduciary duties to us and were unjustly enriched. See "Business—Legal Proceedings."

We have entered into indemnification agreements in the ordinary course of business with our officers and directors and may be obligated throughout the class action and the derivative lawsuits to advance payment of legal fees and costs incurred by the defendant current and former officers and directors pursuant to the indemnification agreements and applicable Oregon law. We may also be obligated to indemnify any of those former and/or current directors and officers for judgments and amounts paid in settlement if the person acted in good faith and in a manner reasonably believed to be in or not opposed to our best interests.

Where we can make a reasonable estimate of the liability relating to pending litigation, we record a liability. As additional information becomes available, we assess the potential liability and revise estimates as appropriate. Because of uncertainties relating to litigation, however, the amount of our estimates could be wrong. Moreover, plaintiffs may not specify an amount of damages sought. In

6

addition to the direct costs of litigation and the use of cash, pending or future litigation could divert management's attention and resources from the operation of our business. Accordingly, our operating results and financial condition could suffer.

We face risks relating to governmental inquiries and the results of our internal investigation of accounting matters.

On March 20, 2003, we contacted the SEC in connection with our issuance of a press release announcing the need to restate our financial results for the quarters ended August 31, 2002 and November 30, 2002. In March 2003, the audit committee of our board of directors, with the assistance of outside legal counsel and independent forensic accountants, commenced an internal investigation of certain accounting matters. The investigation involved the review of (1) the circumstances surrounding the reversal of an accrual for employee benefits, (2) unsupported accounting adjustments and clerical errors primarily relating to inventory and cost of goods sold, and (3) certain other areas where potential accounting errors could have occurred, including revenue recognition and restructuring reserves. As a result of the investigation, we determined that our unaudited consolidated condensed financial statements for the three months ended August 31, 2002 and November 30, 2002, and our audited consolidated financial statements for the year ended June 1, 2002 (and the quarters contained therein) required restatement. We will continue to cooperate with any government investigation into the matters addressed by the internal investigation. Depending on the scope, timing and result of any governmental investigation, management's attention and our resources could be diverted from operations, which could adversely affect our operating results and contribute to future stock price volatility. Governmental investigations also could lead to further restatement of our prior period financial statements or require that we take other actions not currently contemplated.

Our management is implementing what it believes to be improvements in our internal accounting and disclosure controls and procedures. Nonetheless, future accounting restatements could occur because these controls and procedures prove to be ineffective or for other reasons.

In addition to any governmental investigation, the restatement of our previously issued financial statements may lead to new litigation, may expand the claims and the class periods in pending litigation, and may increase the cost of defending or resolving current litigation.

Our operating results could suffer as we have recently experienced significant changes in our senior management and plan to add new members to our management team.

Since June 2003, we have terminated our President and Chief Executive Officer and one of our Vice Presidents in connection with our internal investigation of accounting matters. In addition, since September 2002, six other members of senior management have resigned, including five vice presidents, one of whom was our Chief Financial Officer, and our General Counsel. In October 2003, two of our directors, David F. Bolender and Vernon B. Ryles, Jr., left the board in accordance with the board's retirement policy.

We have appointed four new members of senior management since January 2003: Barry L. Harmon, President and Chief Executive Officer; J. Michael Dodson, Senior Vice President of Administration, Chief Financial Officer and Secretary; Robert Chamberlain, Senior Vice President, Customer Operations; and Kerry Mustoe, Corporate Controller and Chief Accounting Officer. In April 2003 we appointed Jon D. Tompkins, who is a non-employee director, Chairman of the Board. Since June 2003 we have added three new independent directors to our board: Richard J. Faubert, Frederick A. Ball and Robert R. Walker.

We intend to continue to add new members to our senior management team. Changes in management may be disruptive to our business and negatively impact our operating results and may result in the departure of existing employees or customers. Further, it could take an extended period of time to locate, retain and integrate qualified management personnel.

7

Our inability to attract and retain sufficient numbers of managerial, financial, engineering and other technical personnel could have a material adverse effect upon our results of operations.

Our continued success depends, in part, upon key managerial, financial, engineering and technical personnel as well as our ability to continue to attract and retain additional personnel. The loss of key personnel could have a material adverse effect on our business or results of operations. In April 2003, Barry L. Harmon became President and Chief Executive Officer of ESI with the understanding that ESI would employ him in that capacity until a successor is hired. Recently, the Board of Directors decided to commence a search in the second quarter of fiscal 2004 for a new Chief Executive Officer to succeed Mr. Harmon. It may take longer than anticipated to hire a new Chief Executive Officer. Our Chief Financial Officer has been in that position since May 2003, and the position of Corporate Controller was vacant from March 2003 until filled in September 2003. In addition, there are several positions open in our finance department. We are in the process of recruiting highly skilled accounting and financial reporting personnel to fill these finance positions. It could take longer than anticipated, however, to hire and train the appropriately qualified professionals. Moreover, we cannot be certain that the employees hired to fulfill these duties will perform at the level necessary to ensure that our internal controls are not compromised. In addition, we may not be able to retain our key managerial, financial, engineering and technical employees. Our growth may be affected by our ability to hire new managerial personnel, highly skilled and qualified technical personnel, and personnel that can implement and monitor our financial controls and reporting systems. Attracting and retaining qualified personnel is difficult, and our recruiting efforts to attract and retain these personnel may not be successful.

Our ability to reduce costs is limited by our need to invest in research and development.

Our industry is characterized by the need for continued investment in research and development. Because of intense competition in the industries in which we compete, if we were to fail to invest sufficiently in research and development, our products could become less attractive to potential customers, and our business and financial condition could be materially and adversely affected. As a result of our need to maintain our spending levels in this area, our operating results could be materially harmed if our net sales fall below expectations. In addition, as a result of our emphasis on research and development and technological innovation, our operating costs may increase further in the future, and research and development expenses may increase as a percentage of total operating expenses and as a percentage of net sales.

We depend on a few significant customers and we do not have long-term contracts with any of our customers.

Our top ten customers for fiscal 2003 accounted for approximately 54% of total net sales in fiscal 2003, with one customer, Samsung, accounting for approximately 16% of total net sales. No other customer in fiscal 2003 accounted for more than 10% of total net sales. In fiscal 2002 and 2001, no customer exceeded 10% of total net sales. In addition, none of our customers has any long-term obligation to continue to buy our products or services, and any customer could delay, reduce or cease ordering our products or services at any time.

Delays in manufacturing, shipment or customer acceptance of our products could substantially decrease our sales for a period.

We derive a substantial portion of our revenues from the sale of a relatively small number of products with high average selling prices, some with prices in excess of $1.0 million per unit.

We depend on manufacturing flexibility to meet the changing demands of our customers. Any significant delay or interruption in receiving raw materials or of our manufacturing operations as a result of software deficiencies, natural disasters, or other causes could result in ineffective

8

manufacturing capabilities or delayed product deliveries, any or all of which could materially and adversely affect our results of operations.

Shipment and/or customer acceptance delays could significantly impact our recognition of revenue and could be further magnified by announcements from us or our competitors of new products and technologies, which announcements could cause our customers to defer purchases of our existing systems or purchase products from our competitors. Any of these delays could result in a material adverse change in our results of operations for any particular period.

Failure of critical suppliers of parts, components and manufacturing equipment to deliver sufficient quantities to us in a timely and cost-effective manner could negatively affect our business.

We use a wide range of materials in the production of our products, including custom electronic and mechanical components, and we use numerous suppliers for those materials. We generally do not have guaranteed supply arrangements with our suppliers. We seek to reduce the risk of production and service interruptions and shortages of key parts by selecting and qualifying alternative suppliers for key parts, monitoring the financial stability of key suppliers and maintaining appropriate inventories of key parts. Although we make reasonable efforts to ensure that parts are available from multiple suppliers, key parts may be available only from a single supplier or a limited group of suppliers. Operations at our suppliers' facilities are subject to disruption for a variety of reasons, including work stoppages, fire, earthquake, flooding or other natural disasters. Such disruption could interrupt our manufacturing. Our business may be harmed if we do not receive sufficient parts to meet our production requirements in a timely and cost-effective manner.

We may make acquisitions in the future, and these acquisitions may subject us to risks associated with integrating these businesses into our current business.

Although we have no commitments or agreements for any acquisitions, we have made, and plan in the future to make, acquisitions of, or significant investments in, businesses with complementary products, services or technologies.

Acquisitions involve numerous risks, many of which are unpredictable and beyond our control, including:

- •

- Difficulties and increased costs in connection with integration of the personnel, operations, technologies and products of acquired companies;

- •

- Diversion of management's attention from other operational matters;

- •

- The potential loss of key employees of acquired companies;

- •

- Lack of synergy, or inability to realize expected synergies, resulting from the acquisition;

- •

- The risk that the issuance of our common stock in a transaction could be dilutive to our shareholders if anticipated synergies are not realized; and

- •

- Acquired assets becoming impaired as a result of technological advancements or worse-than-expected performance by the acquired company.

Our inability to effectively manage these acquisition risks could materially and adversely affect our business, financial condition and results of operations. In addition, if we issue equity securities to pay for an acquisition the ownership percentage of our existing shareholders would be reduced and the value of the shares held by our existing shareholders could be diluted. If we use cash to pay for an acquisition the payment could significantly reduce the cash that would be available to fund our operations or to use for other purposes. In addition, the accounting for future acquisitions could result in significant charges resulting from amortization of intangible assets related to such acquisitions.

9

Our markets are subject to rapid technological change, and to compete effectively we must continually introduce new products that achieve market acceptance.

The markets for our products are characterized by rapid technological change and innovation, frequent new product introductions, changes in customer requirements and evolving industry standards. Our future performance will depend on the successful development, introduction and market acceptance of new and enhanced products that address technological changes as well as current and potential customer requirements. The introduction by us or by our competitors of new and enhanced products may cause our customers to defer or cancel orders for our existing products, which may harm our operating results. We have in the past experienced a slowdown in demand for our existing products and delays in new product development, and similar delays may occur in the future. We also may not be able to develop the underlying core technologies necessary to create new products and enhancements or, where necessary, to license these technologies from others. Product development delays may result from numerous factors, including:

- •

- Changing product specifications and customer requirements;

- •

- Difficulties in hiring and retaining necessary technical personnel;

- •

- Difficulties in reallocating engineering resources and overcoming resource limitations;

- •

- Difficulties with contract manufacturers;

- •

- Changing market or competitive product requirements; and

- •

- Unanticipated engineering complexities.

The development of new, technologically advanced products is a complex and uncertain process, requiring high levels of innovation and highly skilled engineering and development personnel, as well as the accurate anticipation of technological and market trends. We cannot assure you that we will be able to identify, develop, manufacture, market or support new or enhanced products successfully, if at all, or on a timely basis. Further, we cannot assure you that our new products will gain market acceptance or that we will be able to respond effectively to product announcements by competitors, technological changes or emerging industry standards. Any failure to respond to technological change would significantly harm our business.

We are exposed to the risks that others may violate our proprietary rights, and our intellectual property rights may not be well protected in foreign countries.

Our success is dependent upon the protection of our proprietary rights. In the high technology industry, intellectual property is an important asset that is always at risk of infringement. We incur substantial costs to obtain and maintain patents and defend our intellectual property. For example, we have initiated litigation alleging that certain parties have violated various patents of ours. We rely upon the laws of the United States and of foreign countries in which we develop, manufacture or sell our products to protect our proprietary rights. These proprietary rights may not provide the competitive advantages that we expect, however, or other parties may challenge, invalidate or circumvent these rights.

Further, our efforts to protect our intellectual property may be less effective in some foreign countries where intellectual property rights are not as well protected as in the United States. Many U.S. companies have encountered substantial problems in protecting their proprietary rights against infringement in foreign countries. If we fail to adequately protect our intellectual property in these countries, it could be easier for our competitors to sell competing products in foreign countries.

10

We may be subject to claims of intellectual property infringement.

Several of our competitors hold patents covering a variety of technologies, applications and methods of use similar to some of those used in our products. From time to time, we and our customers have received correspondence from our competitors claiming that some of our products, as used by our customers, may be infringing one or more of these patents. Competitors or others may assert infringement claims against our customers or us in the future with respect to current or future products or uses, and these assertions may result in costly litigation or require us to obtain a license to use intellectual property rights of others. If claims of infringement are asserted against our customers, those customers may seek indemnification from us for damages or expenses they incur.

If we become subject to infringement claims, we will evaluate our position and consider the available alternatives, which may include seeking licenses to use the technology in question or defending our position. These licenses, however, may not be available on satisfactory terms or at all. If we are not able to negotiate the necessary licenses on commercially reasonable terms or successfully defend our position, our financial condition and results of operations could be materially and adversely affected.

We are exposed to the risks of operating a global business, including risks associated with exchange rate fluctuations and legal and regulatory changes.

International shipments accounted for 80.1% of net sales for fiscal 2003, with 66.9% of our 2003 net sales to customers in Asia. We expect that international shipments will continue to represent a significant percentage of net sales in the future. Our non-U.S. sales and operations are subject to risks inherent in conducting business abroad, many of which are outside our control, including the following:

- •

- Periodic local or geographic economic downturns and unstable political conditions;

- •

- Price and currency exchange controls;

- •

- Fluctuation in the relative values of currencies;

- •

- Difficulties protecting intellectual property;

- •

- Unexpected changes in trading policies, regulatory requirements, tariffs and other barriers; and

- •

- Difficulties in managing a global enterprise, including staffing, collecting accounts receivable, managing distributors and representatives and repatriation of earnings.

None of these risks have materially impacted our operations to date.

In addition, our ability to address normal business transaction issues internationally is at risk due to outbreaks of serious contagious diseases. For example, in response to the recent Severe Acute Respiratory Syndrome outbreak in Asia, management limited travel to Asia in accordance with the World Health Organization's recommendations.

Our direct sales force in Asia exposes us to the risks related to employing persons in foreign countries.

We have established direct sales and service organizations in China, Taiwan, Korea and Singapore. Previously, we sold our products through a network of commission-based sales representatives in these countries. Our shift to a direct sales model in these regions involves risks. For example, we may encounter labor shortages or disputes that could inhibit our ability to effectively sell and market our products. We also are subject to compliance with the labor laws and other laws governing employers in these countries and we will incur additional costs to comply with these regulatory schemes. Additionally we will incur new fixed operating expenses associated with the direct sales organizations, particularly payroll related costs and lease expenses. If amounts saved on commission payments formerly paid to our sales representatives do not offset these expenses, our operating results may be adversely affected.

11

Our business is highly competitive, and if we fail to compete effectively, our business will be harmed.

The industries in which we operate are highly competitive. We face substantial competition from established competitors, some of which have greater financial, engineering, manufacturing and marketing resources than we do. If we are unable to compete effectively with these companies, our market share may decline and our business could be harmed. Our competitors can be expected to continue to improve the design and performance of their products and to introduce new products. Furthermore, our technological advantages may be reduced or lost as a result of technological advances by our competitors.

Their greater resources in these areas may enable them to:

- •

- Better withstand periodic downturns;

- •

- Compete more effectively on the basis of price and technology; and

- •

- More quickly develop enhancements to and new generations of products.

In addition, new companies may in the future enter the markets in which we compete, further increasing competition in those markets.

We believe that our ability to compete successfully depends on a number of factors, including:

- •

- Performance of our products;

- •

- Quality of our products;

- •

- Reliability of our products;

- •

- Cost of using our products;

- •

- Our ability to ship products on the schedule required;

- •

- Quality of the technical service we provide;

- •

- Timeliness of the services we provide;

- •

- Our success in developing new products and enhancements;

- •

- Existing market and economic conditions; and

- •

- Price of our products as compared to our competitors' products.

We may not be able to compete successfully in the future, and increased competition may result in price reductions, reduced profit margins, and loss of market share.

Possibilities of terrorist attacks have increased uncertainties for our business.

Like other U.S. companies, our business and operating results are subject to uncertainties arising out of the possibility of terrorist attacks, including the potential worsening or extension of the current global economic slowdown, the economic consequences of military action or additional terrorist activities and associated political instability, and the impact of heightened security concerns on domestic and international travel and commerce. In particular, due to these uncertainties we are subject to:

- •

- The risk that future tightening of immigration controls may adversely affect the residence status of non-U.S. engineers and other key technical employees in our U.S. facilities or our ability to hire new non-U.S. employees in such facilities;

- •

- The risk of more frequent instances of shipping delays; and

- •

- The risk that demand for our products may not increase or may decrease.

12

Our articles of incorporation, our bylaws, Oregon law and our shareholder rights plan may have anti-takeover effects.

Our board of directors has authority to issue up to 700,000 shares of preferred stock, exclusive of the shares of preferred stock authorized in connection with our shareholder rights plan, and to fix the rights, preferences, privileges and restrictions of those shares without any further vote or action by the shareholders. The potential issuance of preferred stock may have the effect of delaying, deferring or preventing a change in control of us, may discourage bids for our common stock at a premium over the market price of the common stock and may adversely affect the market price of, and the voting and other rights of the holders of, common stock and the notes. In addition, our bylaws provide for three classes of directors with staggered terms and require a supermajority shareholder vote to remove a director without cause. Further, the Oregon Control Share Act and the Business Combination Act limit the ability of parties who acquire a significant amount of voting stock to exercise control over us. These provisions may have the effect of lengthening the time required for a person to acquire control of us through a proxy contest or the election of a majority of the board of directors, and may deter efforts to obtain control of us.

In addition, we adopted a shareholder rights plan in May 1999. This plan has the effect of making it more difficult for a person to acquire control of us in a transaction not approved by our board of directors and may deter hostile efforts to obtain control of us.

You will not be able to recover against Arthur Andersen LLP under Section 11 of the Securities Act with respect to their report on our audited financial statements for fiscal 2001 contained in this prospectus.

Arthur Andersen LLP were our independent accountants until May 7, 2002. Representatives of Arthur Andersen LLP are not available to provide the consent required for the inclusion of their report on our financial statements for fiscal 2001 appearing in this prospectus. Accordingly, because Arthur Andersen LLP have not consented to the inclusion of their report, you will not be able to recover against Arthur Andersen LLP under Section 11 of the Securities Act for any untrue statements of material fact contained in the financial statements they audited or any failure to state a material fact required to be stated in those financial statements.

13

RISKS RELATED TO THE NOTES

Our stock price has been and may continue to be volatile.

The trading price of our common stock has been and may continue to be subject to large fluctuations and, therefore, the trading price of the notes may fluctuate significantly, which may result in losses to investors. Our stock price may increase or decrease in response to a number of events and factors, including:

- •

- trends in our industry and the markets in which we operate;

- •

- changes in the price of the products we sell;

- •

- changes in financial estimates and recommendations by securities analysts;

- •

- acquisitions and financings;

- •

- quarterly variations in operating results;

- •

- the operating and stock price performance of other companies that investors may deem comparable; and

- •

- purchases or sales of blocks of our common stock.

Part of this volatility is attributable to the current state of the stock market, in which wide price swings are common. This volatility may adversely affect the prices of our common stock and the notes regardless of our operating performance.

The notes are unsecured and subordinated.

Except as described in the "Description of Notes—Security" and "Description of Notes—Subordination of Notes" sections of this prospectus, the notes are unsecured and subordinated in right of payment to all of our existing and future senior indebtedness. As a result, in the event of bankruptcy, liquidation or reorganization or upon acceleration of the notes due to an event of default under the indenture and in specific other events, our assets will be available to pay obligations on the notes only after all senior indebtedness has been paid in full in cash or other payment satisfactory to the holders of senior indebtedness. There may not be sufficient assets remaining to pay amounts due on any or all of the notes then outstanding. The notes are also effectively subordinated to the indebtedness and other liabilities, including trade payables, of our subsidiaries. The indenture does not prohibit or limit the incurrence of senior indebtedness or the incurrence of other indebtedness and other liabilities by us. Our incurring additional indebtedness and other liabilities could adversely affect our ability to pay our obligations on the notes. We currently have no senior debt. We anticipate that from time to time we and our subsidiaries will incur additional indebtedness, including senior indebtedness.

The notes are not protected by restrictive covenants.

The indenture governing the notes does not contain any financial or operating covenants or restrictions on the payments of dividends, the incurrence of indebtedness or the issuance or repurchase of securities by us or any of our subsidiaries. The indenture contains no covenants or other provisions to afford protection to holders of the notes in the event of a change in control involving ESI, except to the extent described under "Description of Notes."

We may not be able to repurchase the notes in the event of a change of control.

Upon the occurrence of certain change in control events, holders of the notes may require us to repurchase all the notes. We may not have sufficient funds at the time of the change of control to make the required repurchases. The source of funds for any repurchase required as a result of any change of control will be our available cash or cash generated from operating activities or other

14

sources, including borrowings, sales of assets, sales of equity or funds provided by a new controlling entity. Sufficient funds may not be available at the time of any change of control to make any required repurchases of the notes tendered. Furthermore, the use of available cash to fund the potential consequences of a change of control may impair our ability to obtain additional financing in the future. Although we are permitted to pay the repurchase price in common stock if we so elect, we may not pay in common stock unless we satisfy certain conditions prior to the repurchase date as provided in the indenture. We may not be able to satisfy these conditions.

In addition, the occurrence of a change in control could cause an event of default under or be prohibited or limited by the terms of any future senior indebtedness. As a result, any repurchase would, absent a waiver, be prohibited under the subordination provisions of the indenture governing the notes until the senior indebtedness is paid in full.

We substantially increased our indebtedness.

As a result of the sale of the notes, we incurred $145.0 million of additional indebtedness (after taking into account our repurchase of $5 million aggregate principal amount of the notes in the third quarter of fiscal 2003), substantially increasing our ratio of debt to total capitalization. We may incur substantial additional indebtedness in the future. The level of our indebtedness, among other things, could:

- •

- make it difficult for us to make payments on the notes;

- •

- make it difficult for us to obtain any necessary future financing for working capital, capital expenditures, debt service requirements or other purposes;

- •

- limit our flexibility in planning for, or reacting to changes in, our business; and

- •

- make us more vulnerable in the event of a downturn in our business.

We may not be able to meet our debt service obligations, including our obligations under the notes.

Because there is no public market for the notes, you cannot be sure that an active trading market will develop.

The notes are eligible for trading on the PORTAL market. The initial purchaser has made a market in the notes. However, the initial purchaser may cease its market-making at any time. Accordingly, we cannot predict whether an active trading market for the notes will develop or, if such market develops, how liquid it will be. If an active market for the notes fails to develop or be sustained, the trading price of the notes could fall. Even if an active trading market develops, the notes could trade at prices that may be lower than the purchase price of the notes, or the holders could experience difficulty or an inability to resell the notes. Whether or not the notes will trade at lower prices depends on many factors, including:

- •

- prevailing interest rates and the markets for similar securities;

- •

- general economic conditions; and

- •

- our financial condition, historic financial performance and future prospects.

Additionally, in the third quarter of fiscal 2003, we repurchased $5 million aggregate principal amount of the notes on the open market. We may repurchase additional notes in the future. These repurchases may result in fluctuations in the trading price of the notes.

Any lower than expected rating of the notes may cause their trading price to fall.

One or more rating agencies may rate the notes. If the rating agencies rate the notes, they may assign a lower rating than expected by investors. Rating agencies may also lower ratings on the notes in the future. If the rating agencies assign a lower then expected rating or reduce their ratings in the future, the trading price of the notes could decline.

15

USE OF PROCEEDS

We will not receive any proceeds from the sale of the notes or the underlying common stock by any selling securityholder.

RATIO OF EARNINGS TO FIXED CHARGES

The ratio of earnings to fixed charges for each of the periods indicated is as follows:

| | Fiscal Year Ended

| |

|

|---|

| | Three Months

Ended

August 30,

2003

|

|---|

| | May 31,

1999

| | June 3,

2000

| | June 2,

2001

| | June 1,

2002

| | May 31,

2003

|

|---|

| Ratio of earnings to fixed charges | | 16x | | 90x | | 259x | | (7)x(1) | | (9)x(2) | | (7)x(3) |

- (1)

- For the fiscal year ended June 1, 2002, we had a loss before taxes of $34.3 million and fixed charges of $4.1 million.

- (2)

- For the fiscal year ended May 31, 2003, we had a loss before taxes of $79.2 million and fixed charges of $7.9 million.

- (3)

- For the three months ended August 30, 2003, we had a loss before taxes of $15.4 million and fixed charges of $2.0 million.

We have calculated the ratio of earnings to fixed charges by dividing (a) earnings before taxes adjusted for fixed charges by (b) fixed charges, which include interest expense and the portion of rent expense under operating leases deemed to be representative of the interest factor.

COMMON STOCK PRICES/DIVIDENDS

Our common stock trades on the Nasdaq National Market under the symbol ESIO. The following table shows, for the fiscal quarters indicated, the high and low last sale prices for the common stock as reported on the Nasdaq National Market.

Fiscal 2002

| | High

| | Low

|

|---|

| Quarter 1 | | $ | 40.92 | | $ | 27.64 |

| Quarter 2 | | | 29.80 | | | 19.66 |

| Quarter 3 | | | 35.43 | | | 28.21 |

| Quarter 4 | | | 38.25 | | | 26.36 |

Fiscal 2003

|

|

Hight

|

|

Low

|

|---|

| Quarter 1 | | $ | 26.20 | | $ | 16.50 |

| Quarter 2 | | | 24.72 | | | 13.51 |

| Quarter 3 | | | 24.30 | | | 16.75 |

| Quarter 4 | | | 16.83 | | | 12.41 |

Fiscal 2004

|

|

High

|

|

Low

|

|---|

| Quarter 1 | | $ | 20.29 | | $ | 13.77 |

| Quarter 2 | | | 26.25 | | | 19.60 |

We have not paid any cash dividends on our common stock during the last two fiscal years. We intend to retain any earnings for our business and do not anticipate paying any cash dividends in the foreseeable future. The number of shareholders of record at December 9, 2003 was 750. The last sale price for our stock on December 10, 2003 as reported on the Nasdaq National Market was $22.91.

16

SELECTED FINANCIAL DATA

You should read the following selected financial data in conjunction with our consolidated financial statements and notes and "Management's Discussion and Analysis of Financial Condition and Results of Operations" included elsewhere in this prospectus. The statement of operations data for the years ended May 31, 2003 and June 1, 2002 and the balance sheet data as of May 31, 2003 and June 1, 2002 are derived from our consolidated financial statements that have been audited by KPMG LLP and are included elsewhere in this prospectus. The statement of operations data for the year ended June 2, 2001 and the balance sheet data as of June 2, 2001 are derived from our consolidated financial statements that have been audited by Arthur Andersen LLP and are included elsewhere in this prospectus. The statement of operations data for the years ended June 3, 2000 and May 31, 1999 and the balance sheet data as of June 3, 2000 and May 31, 1999 are derived from our consolidated financial statements that have been audited by Arthur Andersen LLP and are not included in this prospectus. The statement of operations data and the balance sheet data for the fiscal quarter ended August 30, 2003 are derived from and qualified by reference to our unaudited financial statements included elsewhere in this prospectus. The statement of operations data for the fiscal quarter ended August 31, 2002 is derived from and qualified by unaudited financial statements included elsewhere in this prospectus.

| | Fiscal Year Ended

| | Three Months Ended

| |

|---|

| | May 31,

1999

| | June 3,

2000

| | June 2

2001

| | June 1,

2002

| | May 31,

2003

| | August 31,

2002

| | August 30,

2003

| |

|---|

| |

| |

| |

| | (restated)

| |

| |

| |

| |

|---|

| | (In thousands, except per share amounts)

| |

|---|

| Statement of Operations Data | | | | | | | | | | | | | | | | | | | | | | |

| Net sales | | $ | 197,118 | | $ | 299,419 | | $ | 471,853 | | $ | 162,885 | | $ | 136,885 | | $ | 39,360 | | $ | 20,876 | |

| Net income (loss)(1)(2)(3)(4) | | | 7,528 | | | 40,860 | | | 99,933 | | | (17,777 | ) | | (50,086 | ) | | (3,394 | ) | | (9,367 | ) |

| Net income (loss) per share—basic(1)(2)(3)(4) | | | 0.29 | | | 1.55 | | | 3.71 | | | (0.65 | ) | | (1.81 | ) | | (0.12 | ) | | (0.34 | ) |

| Net income (loss) per share—diluted(1)(2)(3)(4) | | | 0.28 | | | 1.49 | | | 3.58 | | | (0.65 | ) | | (1.81 | ) | | (0.12 | ) | | (0.34 | ) |

| |

| |

| |

| |

| |

| |

| | August 30,

2003

| |

|---|

Balance Sheet Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash, cash equivalents and marketable and restricted securities | | $ | 32,658 | | $ | 93,398 | | $ | 163,106 | | $ | 302,299 | | $ | 308,252 | | | | | $ | 297,663 | |

| Working capital | | | 153,139 | | | 204,800 | | | 264,644 | | | 340,774 | | | 340,162 | | | | | | 335,600 | |

| Property, plant and equipment, net | | | 33,462 | | | 36,017 | | | 54,946 | | | 58,046 | | | 36,592 | | | | | | 36,241 | |

| Total assets | | | 221,823 | | | 291,641 | | | 407,073 | | | 526,272 | | | 491,302 | | | | | | 487,545 | |

| Long-term debt | | | — | | | — | | | — | | | 145,897 | | | 141,891 | | | | | | 142,108 | |

| Shareholders' equity | | | 201,261 | | | 256,141 | | | 363,049 | | | 355,759 | | | 310,317 | | | | | | 299,830 | |

- 1.

- Fiscal 2003 includes a pretax charge of $10.1 million related to the write-down of our Klamath Falls passive components consumable manufacturing site and related equipment and a parcel of land in Taiwan.

- 2.

- Fiscal 2002 includes a gain of $4.6 million related to research and development tax credits and pretax professional expenses directly related to receiving the credit of $0.8 million.

- 3.

- Fiscal 2001 includes a pretax gain of $13.9 million in connection with the litigation award from GSI Lumonics, net of $2.5 million of legal fees and expenses directly related to the award, and $1.4 million of interest received.

- 4.

- Fiscal 1999 includes a pretax charge of $2.8 million associated with the acquisitions of Testec, Inc. and MicroVision Corp. and $1.4 million in non-recurring litigation expenses.

17

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

Overview

Electro Scientific Industries, Inc. and its subsidiaries ("ESI") provide high technology manufacturing equipment to the global electronics market. Our customers are primarily manufacturers of semiconductors, passive electronic components and electronic interconnect devices. Our equipment enables these manufacturers to reduce production costs, increase yields and improve the quality of their products. The components and devices manufactured by our customers are used in a wide variety of end-use products in the computer, communications and automotive industries.

We supply advanced laser systems used to improve the production yield of semiconductor devices; high-speed test and termination equipment used in the high-volume production of multi-layer ceramic passives (MLCPs) and other passive electronic components; and advanced laser systems used to fine tune electronic components and circuitry. Additionally, we produce a family of laser drilling systems for production of high-density interconnect (HDI) circuit boards and advanced electronic packaging, as well as inspection systems and original equipment manufacturer (OEM) machine vision products.

In fiscal 2001, the electronics industry, and in particular the semiconductor subset of this industry, were at the peak of an extended period of expansion. During fiscal year 2002, the slowing worldwide demand for electronics and semiconductors resulted in a rapid decline in demand for manufacturing equipment. This sudden and steep decline in demand for manufacturing equipment continued to deepen throughout fiscal 2003.

In response to this prolonged and continuing downturn, we initiated plans to better align our infrastructure and operating costs with expected business conditions. These plans have included discontinuing certain products, consolidating facilities, relocating employees, reducing headcount, freezing salaries and wages and reducing discretionary spending.

In the first quarter of fiscal year 2004, we began to see increases in demand, as evidenced by an increase in orders primarily from existing customers of our semiconductor and electronic interconnect product groups. Net orders for the latest quarter were $42.7 million, an increase of 67.2% compared with $25.5 million in the fourth quarter of fiscal 2003 and an increase of 36.4% compared with $31.3 million in the first quarter of 2003. Backlog increased to $23.9 million at August 30, 2003 compared to $11.0 million at June 1, 2003. Deferred revenue also increased this quarter to $21.7 million compared to $13.2 million at June 1, 2003, primarily due to shipments of new products to a few of our largest semiconductor customers. We believe order growth will continue during the second quarter.

Restructuring and Cost Management Plans

In response to the economic climate described above, we initiated restructuring and other cost management plans in fiscal 2003 and 2002.

The fiscal 2003 actions primarily related to relocating the manufacturing of our electronic component product line from Escondido, California to our headquarters in Portland, Oregon. This action resulted in a reduction of 68 employees and the relocation of 37 employees to our headquarters, which reductions and relocations were substantially completed by December 31, 2002. Severance, relocation and other employee related charges for these activities totaled approximately $4.4 million. Facilities consolidation costs related to these activities totaled approximately $3.4 million.

The fiscal 2002 actions reduced our work force by a total of 419 employees in June and August 2001, with an additional 97 employee reduction in October 2001. These reductions impacted all employee groups. The actions also included vacating buildings located in California, Massachusetts,

18

Michigan, Minnesota, and Texas, as well as exiting the mechanical drill business and discontinuing the manufacturing of certain other products. Severance, relocation and other employee related charges for these activities totaled approximately $4.6 million. Facilities consolidation and other charges related to the discontinuance of certain products totaled approximately $4.2 million.

Investigation and Restatements of Financial Statements

In March 2003, our Audit Committee commenced an internal investigation of the circumstances surrounding the reversal of an employee benefits accrual that occurred in the first quarter of 2003. The investigation also identified and addressed: (1) unsupported accounting adjustments and clerical errors primarily relating to inventory and cost of goods sold, and (2) certain other areas where potential accounting errors could have occurred, including revenue recognition and restructuring reserves.

Restatement of 2002 Financial Statements

We have restated our financial statements for the fiscal year ended June 1, 2002 (and the quarters contained therein) principally related to the deferral of revenue for certain transactions where customer specified acceptance criteria existed but were not properly considered in determining whether our criteria for revenue recognition had been met as of year-end. We also corrected our financial statements for other matters we identified, including: the failure to write-off fixed assets that were sold prior to year-end, but had not been removed from our books, the write-off of inventory due to a change in our accounting for defective parts being returned by customers, an unauthorized change in depreciation methods and the correction of a bank error related to amortization of bond premiums/discounts.

Following is a summary of the effects of the restatements on our results of operations for the year ended June 1, 2002 (in thousands, except per share amounts):

| | Net Sales

| | Net Loss

| | Net Loss

per Share

| |

|---|

| As originally reported | | $ | 166,545 | | $ | (15,961 | ) | $ | (0.58 | ) |

| Effect of restatements | | | (3,660 | ) | | (1,816 | ) | | (0.07 | ) |

| | |

| |

| |

| |

| As restated | | $ | 162,885 | | $ | (17,777 | ) | $ | (0.65 | ) |

| | |

| |

| |

| |

For a more complete analysis of the effects of the restatements on our results of operations for the year ended June 1, 2002 and on our balance sheet as of June 1, 2002, please refer to our amended annual report on Form 10-K/A as filed with the Securities and Exchange Commission on August 11, 2003.

Three Months Ended August 30, 2003 Compared to Three Months Ended August 31, 2002

Net Sales

Net sales were $20.9 million for the quarter ended August 30, 2003 compared to $39.4 million for the quarter ended August 31, 2002.

19

Certain information regarding our net sales by product group is as follows (net sales in thousands):

| | Quarter Ended

| |

|---|

| | August 30, 2003

| | August 31, 2002

| |

|---|

| | Net Sales

| | Percent of

Total Net Sales

| | Net Sales

| | Percent of

Total Net Sales

| |

|---|

| Semiconductor Group (SG) | | $ | 5,736 | | 27.5 | % | $ | 20,953 | | 53.2 | % |

| Passive Components Group (PCG) | | | 9,606 | | 46.0 | | | 14,675 | | 37.3 | |

| Electronic Interconnect Group (EIG) | | | 5,534 | | 26.5 | | | 3,732 | | 9.5 | |

| | |

| |

| |

| |

| |

| | | $ | 20,876 | | 100.0 | % | $ | 39,360 | | 100.0 | % |

| | |

| |

| |

| |

| |

The decreases in SG and PCG net sales are primarily due to decreases in unit volume. The decreases in volume are primarily due to softness in the global economy and competitive pressures. Deferred revenue for the SG systems increased $16.8 million to $18.5 million at August 30, 2003 compared to $1.7 million at August 31, 2002. The increase in SG deferred revenue is due primarily to shipments of substantially new products. Revenue is deferred on such shipments until acceptance has been received. Deferred revenue for the PCG systems was $0.9 million at August 30, 2003 compared to $1.7 million at August 31, 2002. Reductions in worldwide capacitor pricing and under utilization of production capacities both contributed to continued decreases in sales of the PCG group. The increase in EIG net sales compared to the three months ended August 31, 2002, is due primarily to the higher volume of shipments deferred during the quarter ended August 31, 2002. Deferred revenue of EIG products decreased $3.4 million to $2.3 million at August 30, 2003 from $5.7 million at August 31, 2002.

Net sales by geographic region were as follows (net sales in thousands):

| | Quarter Ended

| |

|---|

| | August 30, 2003

| | August 31, 2002

| |

|---|

| | Net Sales

| | Percent of

Total Net Sales

| | Net Sales

| | Percent of

Total Net Sales

| |

|---|

| United States | | $ | 6,698 | | 32.1 | % | $ | 9,204 | | 23.4 | % |

| Asia | | | 11,406 | | 54.6 | | | 27,500 | | 69.9 | |

| Europe | | | 2,340 | | 11.2 | | | 2,107 | | 5.3 | |

| Other | | | 432 | | 2.1 | | | 549 | | 1.4 | |

| | |

| |

| |

| |

| |

| | | $ | 20,876 | | 100.0 | % | $ | 39,360 | | 100.0 | % |

| | |

| |

| |

| |

| |

Percentage of net sales in Asia decreased to 54.6% for the quarter ended August 30, 2003 as compared to 69.9% for the quarter ended August 31, 2002. This percentage decline is a result of an increase in revenue deferral of SG products, a substantial portion of which are shipped into the Asian markets.

Gross Profit

Gross profit for the three months ended August 30, 2003 decreased by $11.0 million to $4.8 million as compared to the three months ended August 31, 2002. Gross profit as a percentage of sales, or gross margin, was 23.2% in the first quarter of fiscal year 2004 as compared to 40.3% in the same comparable period in fiscal year 2003. The gross margin decrease was due primarily to reduced production levels to absorb factory overhead and also to product mix. Charges totaling $0.1 million were recorded during the quarter related to our cost management plan that was implemented in the first quarter of fiscal year 2004.

In fiscal 2002 and 2003 we had $12.5 million and $17.2 million in inventory write-downs, respectively. The write-downs in fiscal 2002 were primarily related to the discontinuance of our

20

Advanced Packaging Mechanical Drilling product line. The associated inventory was reduced to an estimated recovery value of 5%. In fiscal 2003 we had $17.2 million in write-downs in the second fiscal quarter related to the following: the consolidation of our Escondido, California facility into our Portland, Oregon operation, which resulted in a number of discontinued product lines; downward revisions to previously projected product demand; and the discontinuance of certain products associated with our semiconductor product line.

At the end of fiscal 2003, approximately $11.4 million of the items subject to write-down had not yet been disposed of. We are actively working to dispose of these materials. These disposals have not materially affected gross margin and are not expected to do so in future quarters because the reduced value of these materials has been substantially reserved for and the current carrying value of the materials has approximated sale or disposal value.

Operating Expenses

Selling, service and administrative expenses were flat at $14.6 million in the first quarter of fiscal 2004 compared to $14.6 million in the first quarter of fiscal year 2003. The primary items included in selling, service and administrative expenses are labor and other employee-related expenses, travel expenses, professional fees and facilities costs. Other than professional fees, which are discussed below, there were no material changes in any of these categories between the first quarter of 2003 and the first quarter of 2004. Also, included in selling, service and administrative expenses for the first quarter of fiscal year 2004 was $0.7 million of severance and other employee-related expense and $0.1 million of facility consolidation expense. Included in selling, service and administrative expenses in the first quarter of fiscal year 2003 was facility consolidation expense of $0.2 million. Legal and other professional fees related to an audit committee investigation of certain accounting matters, which concluded in July 2003, lawsuits, regulatory filings, and compliance with the Sarbanes-Oxley Act were $2.1 million for the three months ended August 30, 2003. We expect to continue to incur significant legal and other professional fees related to these legal matters throughout fiscal year 2004.

Future operating results are highly dependent upon our ability to maintain a competitive advantage in the products and services we provide. To protect this advantage we continue to invest in research and development. Expenses associated with research, development and engineering decreased $1.9 million to $5.7 million in the first quarter of 2004 from $7.6 million in the first quarter of fiscal year 2003. Included in research and development expense in the first quarter of fiscal year 2004 were $0.2 million of severance and other employee-related expenses. We continue to invest in a number of development projects that we believe are important to our future.

Other Income (Expense)

Interest income for the first quarter of fiscal year 2004 was $2.6 million compared to $2.9 million in the first quarter of fiscal year 2003. This decrease is primarily due to lower interest rates earned in the first quarter of fiscal year 2004 compared to the first quarter of fiscal year 2003 on a slightly lower average volume of invested assets.

Interest expense decreased slightly to $1.9 million in the first quarter of fiscal year 2004 from $2.0 million in the first quarter of fiscal year 2003 due to lower outstanding balances on our $150 million aggregate principal amount of 41/4% convertible subordinated notes. In the third quarter of fiscal year 2003, we bought back $5.0 million principal amount of the convertible notes. Annual interest related to the convertible notes totals $6.3 million plus $0.9 million for the accretion of underwriting discounts.

Other net expense of $0.5 million in the first quarter of fiscal year 2004 and $0.4 million in the first quarter of fiscal year 2003 primarily represents realized losses on securities held for sale.

21

Income Taxes

The income tax rate for the first quarter of fiscal year 2004 was 39.0% compared to 42.1% for the first quarter of fiscal year 2003. The higher tax benefit for the three months ended August 31, 2002 as compared to the statutory federal tax rate is largely a result of tax refunds and the tax benefit related to research and development tax credits.

Net Loss