Merchants Bancshares, Inc. South Burlington, VT Acquisition of NUVO Bank & Trust Company April 27, 2015 Exhibit 99.2

2 Disclaimer This presentation contains some statements that may constitute forward - looking statements . Forward - looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts . The forward - looking statements reflect Merchants’ current views about future events and are subject to risks, uncertainties, assumptions and changes in circumstances that may cause Merchants’ actual results to differ significantly from those expressed in any forward - looking statement . Forward - looking statements should not be relied on since they involve known and unknown risks, uncertainties and other factors that are, in some cases, beyond Merchants’ control and which could materially affect actual results . The factors that could cause actual results to differ materially from current expectations include changes in general economic conditions, changes in interest rates, changes in competitive product and pricing pressures among financial institutions within Merchants’ markets, and changes in the financial condition of Merchants’ borrowers . The forward - looking statements contained herein represent Merchants’ judgment as of the date of this release, and Merchants cautions readers not to place undue reliance on such statements . For further information, please refer to Merchants’ reports filed with the Securities and Exchange Commission .

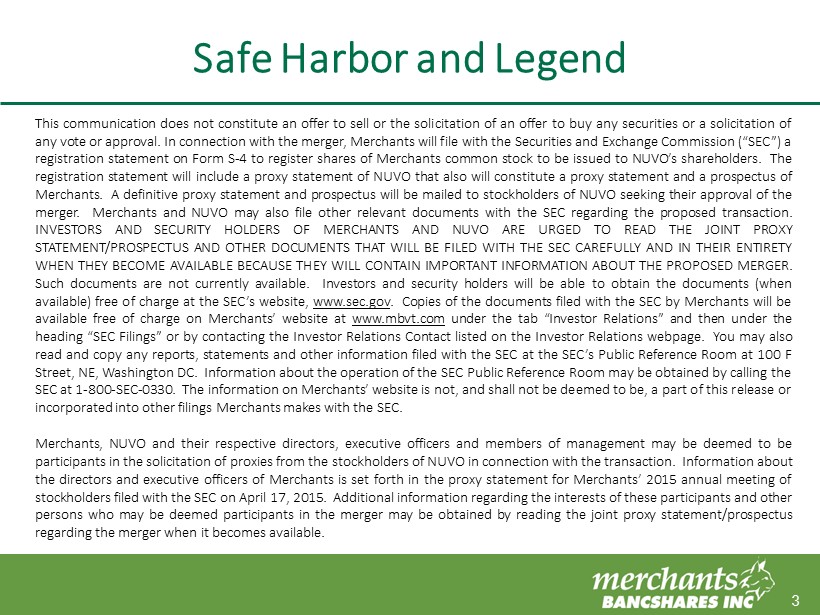

3 This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval . In connection with the merger, Merchants will file with the Securities and Exchange Commission (“SEC”) a registration statement on Form S - 4 to register shares of Merchants common stock to be issued to NUVO’s shareholders . The registration statement will include a proxy statement of NUVO that also will constitute a proxy statement and a prospectus of Merchants . A definitive proxy statement and prospectus will be mailed to stockholders of NUVO seeking their approval of the merger . Merchants and NUVO may also file other relevant documents with the SEC regarding the proposed transaction . INVESTORS AND SECURITY HOLDERS OF MERCHANTS AND NUVO ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER . Such documents are not currently available . Investors and security holders will be able to obtain the documents (when available) free of charge at the SEC’s website, www . sec . gov . Copies of the documents filed with the SEC by Merchants will be available free of charge on Merchants’ website at www . mbvt . com under the tab “Investor Relations” and then under the heading “SEC Filings” or by contacting the Investor Relations Contact listed on the Investor Relations webpage . You may also read and copy any reports, statements and other information filed with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington DC . Information about the operation of the SEC Public Reference Room may be obtained by calling the SEC at 1 - 800 - SEC - 0330 . The information on Merchants’ website is not, and shall not be deemed to be, a part of this release or incorporated into other filings Merchants makes with the SEC . Merchants, NUVO and their respective directors, executive officers and members of management may be deemed to be participants in the solicitation of proxies from the stockholders of NUVO in connection with the transaction . Information about the directors and executive officers of Merchants is set forth in the proxy statement for Merchants’ 2015 annual meeting of stockholders filed with the SEC on April 17 , 2015 . Additional information regarding the interests of these participants and other persons who may be deemed participants in the merger may be obtained by reading the joint proxy statement/prospectus regarding the merger when it becomes available . Safe Harbor and Legend

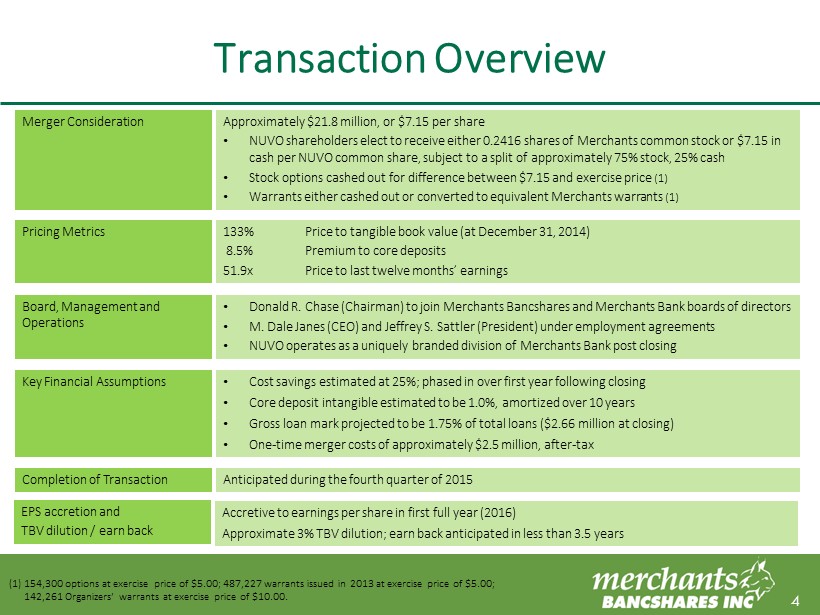

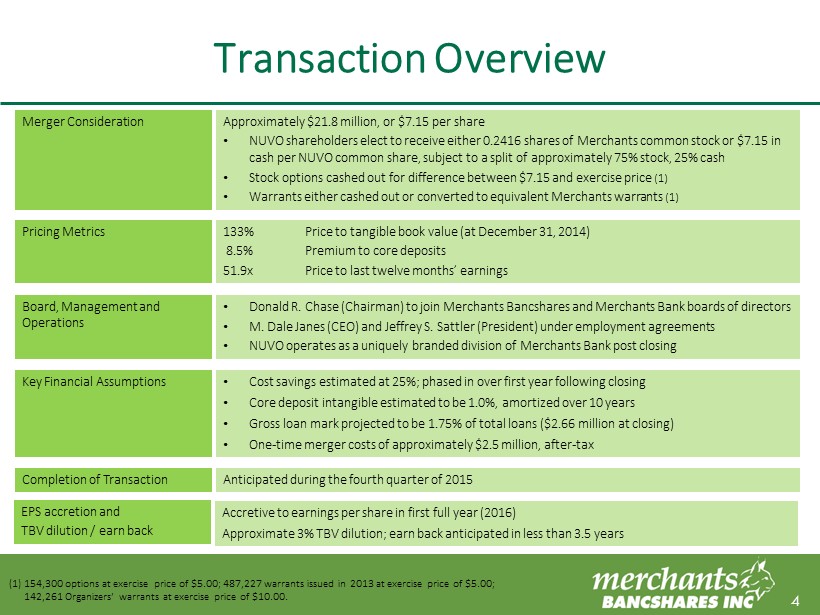

4 Transaction Overview Merger Consideration Approximately $21.8 million, or $7.15 per share • NUVO shareholders elect to receive either 0.2416 shares of Merchants common stock or $7.15 in cash per NUVO common share, subject to a split of approximately 75% stock, 25% cash • Stock options cashed out for difference between $7.15 and exercise price (1) • Warrants either cashed out or converted to equivalent Merchants warrants (1) Pricing Metrics 133% Price to tangible book value (at December 31, 2014) 8.5% Premium to core deposits 51.9x Price to last twelve months’ earnings Board, Management and Operations • Donald R. Chase (Chairman) to join Merchants Bancshares and Merchants Bank boards of directors • M. Dale Janes (CEO) and Jeffrey S. Sattler (President) under employment agreements • NUVO operates as a uniquely branded division of Merchants Bank post closing Key Financial Assumptions • Cost savings estimated at 25%; phased in over first year following closing • Core deposit intangible estimated to be 1.0%, amortized over 10 years • Gross loan mark projected to be 1.75% of total loans ($2.66 million at closing) • One - time merger costs of approximately $2.5 million, after - tax Completion of Transaction Anticipated during the fourth quarter of 2015 EPS accretion and TBV dilution / earn back Accretive to earnings per share in first full year (2016) Approximate 3% TBV dilution; earn back anticipated in less than 3.5 years (1) 154,300 options at exercise price of $5.00; 487,227 warrants issued in 2013 at exercise price of $5.00; 142,261 Organizers’ warrants at exercise price of $10.00.

5 NUVO Bank & Trust Company Company Description : • Founded in 2008 , NUVO operates 1 branch in Springfield, MA and emphasizes small to medium sized businesses and professionals . • Strong commercial lending platform with Commercial Real Estate and Commercial & Industrial loans comprising 64 % of their total loans . Key Leadership : • Donald Chase (Chairman) • Former President and CEO of Westbank Corporation, $ 800 million multi - state public bank headquartered in West Springfield, MA ( 1 ) ; • Experienced in executing transactions including two acquisitions . • Dale Janes (CEO) • 24 years of banking industry experience, with the majority spent in Western Massachusetts . Previous lending and leadership positions at Shawmut, BayBank, BankBoston and Sovereign . • Jeffrey Sattler (President) • 30 years of banking experience in the Western Massachusetts market including lending and leadership positions at Third National Bank, BayBank and TD Bank . Merchants Bancshares, Inc. (32 branches) NUVO Bank & Trust Company (1 branch) ________ Source: SNL Financial (1) Westbank was acquired by NewAlliance in 2007.

6 NUVO Financial Summary ________ Source: SNL Financial as of 12/31/2014 based on bank regulatory data Financial Summary Total Assets ($000s) Total Loans ($000s) Total Deposits ($000s) Total Equity ($000s) Loans/ Deposits (%) LTM ROAA (%) LTM ROAE (%) Net Interest Margin (%) Noninterest Income/ Avg Assets (%) Noninterest Expense/ Avg Assets (%) YoY Loan Growth Rate (%) FTE Employees Leverage Ratio (%) Total Risk Based Capital Ratio (%) NPAs/ Assets (%) 153,480 138,757 133,756 15,189 103.74 0.28 2.83 3.64 0.23 2.69 16.87 17 9.05 11.10 0.00 Loan Composition Deposit Composition Owner Occupied CRE, 28% Non - Owner Occupied CRE, 10% Multi - Family, 5% C&I, 26% Consumer/ Other, 8% Residential Mortgages, 19% Home Equity, 4% Non - interest bearing, 12% NOW & MMDA, 37% Retail Time, 38% Jumbo Time, 13%

7 0 5,000 10,000 15,000 20,000 25,000 30,000 35,000 40,000 Springfield City, MA Hampden County, MA Vermont 0 10,000 20,000 30,000 40,000 50,000 60,000 70,000 Springfield City, MA Hampden County, MA Vermont Springfield, MA Expansion Opportunity ________ Source: SNL Financial, U.S. Census Bureau 2015 Population 2015 Median Household Income ($) 0 100,000 200,000 300,000 400,000 500,000 600,000 700,000 Springfield City, MA Hampden County, MA Vermont 0 10,000 20,000 30,000 40,000 50,000 60,000 70,000 Springfield City, MA Hampden County, MA Vermont Businesses Business Sales ($ millions)

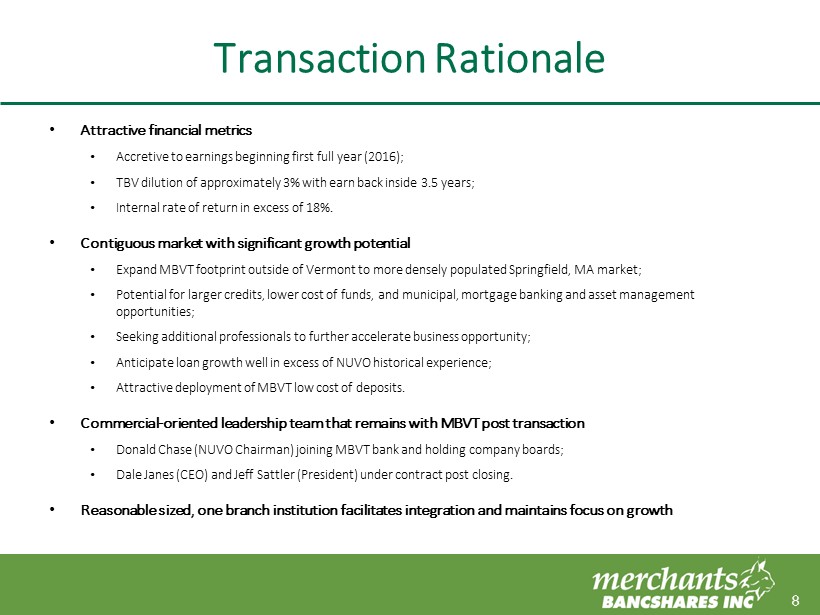

8 Transaction Rationale • Attractive financial metrics • Accretive to earnings beginning first full year (2016); • TBV dilution of approximately 3% with earn back inside 3.5 years; • Internal rate of return in excess of 18%. • Contiguous market with significant growth potential • Expand MBVT footprint outside of Vermont to more densely populated Springfield, MA market; • Potential for larger credits, lower cost of funds, and municipal, mortgage banking and asset management opportunities; • Seeking additional professionals to further accelerate business opportunity; • Anticipate loan growth well in excess of NUVO historical experience; • Attractive deployment of MBVT low cost of deposits. • Commercial - oriented leadership team that remains with MBVT post transaction • Donald Chase ( NUVO Chairman) joining MBVT bank and holding company boards; • Dale Janes (CEO) and Jeff Sattler (President) under contract post closing. • Reasonable sized, one branch institution facilitates integration and maintains focus on growth