UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

|

|

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

|

Filed by the Registrant ☒ |

Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under § 240.14a-12 |

Merchants Bancshares, Inc.

(Name of the Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

1. Title of each class of securities to which transaction applies: 2. Aggregate number of securities to which transaction applies: 3. Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): 4. Proposed maximum aggregate value of transaction: 5. Total fee paid: |

☐ Fee paid previously with preliminary materials. |

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

1. Amount Previously Paid: 2. Form, Schedule or Registration Statement No.: 3. Filing Party: 4. Date Filed: |

MERCHANTS BANCSHARES, INC.

275 Kennedy Drive

South Burlington, Vermont 05403

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Notice is hereby given that the Annual Meeting of Stockholders of Merchants Bancshares, Inc. (“Merchants”), a Delaware corporation, will be held in the Atrium of The Essex Resort & Spa, 70 Essex Way, Essex Junction, Vermont, on Thursday, May 26, 2016, at 10:00 a.m. for the following purposes:

| 1. | | To elect four directors, each of whom will serve for a three-year term and until his or her successor is duly elected and qualified, all as more fully described in the proxy statement for the meeting; |

| 2. | | To consider a non-binding resolution to approve the compensation of Merchants’ named executive officers; |

| 3. | | To ratify the appointment of Crowe Horwath LLP as Merchants’ independent registered public accounting firm for 2016; and |

| 4. | | To transact any other business as may properly come before the meeting or at any adjournments of the meeting. |

The close of business on March 28, 2016 has been fixed as the record date for determination of stockholders entitled to notice of, and to vote at, the Annual Meeting. You may vote if you were a stockholder of record as of the close of business on March 28, 2016.

Your vote is very important. If you do not plan to attend the meeting and vote your shares of common stock in person, we urge you to vote your shares as instructed in the Proxy Statement.

If your shares of common stock are held by a broker, bank or other nominee, please follow the instructions you receive from your broker, bank or other nominee to have your shares of common stock voted.

Any proxy may be revoked at any time prior to its exercise at the Annual Meeting.

| | |

| By order of the Board of Directors, | |

| | |

|

|

|

| Jeffrey L. Davis

Chairman of the

Board of Directors | Geoffrey R. Hesslink

President and

Chief Executive Officer |

South Burlington, Vermont

April 15, 2016

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting of Stockholders to be Held on Thursday, May 26, 2016

Merchants has adopted the Securities and Exchange Commission rule allowing companies to furnish proxy materials to their stockholders over the Internet. We believe that this expedites stockholders’ receipt of proxy materials and lowers the costs of our Annual Meeting. On April 15, 2016, we mailed a Notice of Internet Availability of Proxy Materials (the “Notice”) to all stockholders of record as of March 28, 2016, containing instructions on how to access our Proxy Statement and Annual Report, as well as vote your shares. The Notice also contains instructions on how you can (i) receive a paper copy of the proxy materials, if you only received a Notice by mail, or (ii) elect to receive your proxy materials over the Internet.

The Proxy Statement and our Annual Report to stockholders are available at www.mbvt.com on the

“Investor Relations” page under the “SEC Filings-Proxy Materials/Annual Reports” link.

MERCHANTS BANCSHARES, INC.

275 Kennedy Drive

South Burlington, Vermont 05403

PROXY STATEMENT

for the Annual Meeting of Stockholders

to be held on Thursday, May 26, 2016

This Proxy Statement is furnished by the Board of Directors of MERCHANTS BANCSHARES, INC. (“Merchants”, “we”, “us”, “our” or the “Company”) in connection with the solicitation of proxies to be used at the Annual Meeting of Stockholders to be held on Thursday, May 26, 2016, and at any adjournments of the meeting. Our Board of Directors has fixed March 28, 2016 as the record date for determining those stockholders entitled to receive notice of, and to vote at, the Annual Meeting. Only stockholders of record at the close of business on March 28, 2016 will be entitled to vote at the Annual Meeting. We have adopted the Securities and Exchange Commission (the “SEC”) rule allowing companies to furnish proxy materials to their stockholders over the Internet. We believe that this expedites stockholders’ receipt of proxy materials and lowers the costs of our Annual Meeting. On April 15, 2016, we began mailing to our stockholders a Notice of Internet Availability of Proxy Materials (“Notice”) containing instructions on how to access this Proxy Statement and our Annual Report online, as well as instructions on how to vote. Also on April 15, 2016, this Proxy Statement was first made available to stockholders.

Proxies in the form enclosed are solicited by our Board of Directors. Any proxy, if received in time for voting and not revoked, will be voted at the Annual Meeting in accordance with the stockholder’s instructions on the proxy card. If no instructions are given on the proxy card, the proxy will be voted: FOR the election of each director nominee named in this Proxy Statement; FOR the non-binding resolution to approve the compensation of Merchants’ named executive officers; and FOR the ratification of the appointment of Crowe Horwath LLP as our independent registered public accounting firm for 2016. At present, management knows of no additional matters to be presented at the Annual Meeting, but if other matters are presented, the persons named in the proxy card and acting under the proxy card will vote or refrain from voting in accordance with their best judgment pursuant to the discretionary authority conferred by the proxy.

General Information

Revocability of Proxies

A proxy may be revoked at any time prior to its exercise by:

| 1. | | submitting a written revocation to our Corporate Secretary at 275 Kennedy Drive, South Burlington, Vermont 05403; |

| 2. | | submitting a new proxy after the time and date of the previously submitted proxy; or |

| 3. | | appearing in person at the Annual Meeting and voting by ballot. |

Any stockholder entitled to vote at the Annual Meeting may attend the Annual Meeting and vote in person on any matter presented for a vote to our stockholders at the Annual Meeting, whether or not that stockholder has previously given a proxy. The presence of a stockholder at the Annual Meeting (without further action) will not constitute revocation of a previously given proxy.

Solicitation of Proxies

The cost of solicitation of proxies will be borne by us. In an effort to have as large a representation at the Annual Meeting as possible, special solicitation of proxies may, in certain instances, be made personally or by mail, telephone, e-mail or facsimile transmission by our directors, officers and other employees. We also may reimburse brokers, custodians,

nominees and other fiduciaries for postage and reasonable clerical expenses of forwarding the proxy material to their principals who are beneficial owners of shares of our common stock.

Householding of Meeting Materials

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This means that only one copy of the proxy materials may have been sent to multiple stockholders in each household. We will promptly deliver a separate copy of these proxy materials to any stockholder upon written or verbal request to our Corporate Secretary at 275 Kennedy Drive, South Burlington, Vermont 05403, telephone: (802) 865-1807. Any stockholder who wants to receive separate copies of proxy materials in the future, or any stockholder who is receiving multiple copies and would like to receive only one copy per household, should contact that stockholder’s bank, broker, or other nominee record holder, or that stockholder may contact us at the above address and phone number.

Voting Securities

As of March 28, 2016, the record date for the Annual Meeting, there were 7,172,043 shares of common stock issued and outstanding, all of which are entitled to vote at the Annual Meeting. Fractional shares will not be entitled to vote. Our common stock is the only class of our capital stock that is issued and outstanding.

Vote Required

Each common stockholder is entitled to one vote on each matter properly brought before the Annual Meeting for each share held by that stockholder on March 28, 2016. The representation in person or by proxy of at least a majority of the shares of common stock entitled to vote at the Annual Meeting is necessary to establish a quorum for the transaction of business. Abstentions and “broker non-votes” (i.e. shares represented at the meeting held by brokers or nominees as to which instructions have not been received from the beneficial owners or persons entitled to vote such shares, and with respect to one or more issues, the broker or nominee does not have discretionary voting power to vote such shares) will be counted for purposes of determining whether a quorum is present for the transaction of business at the Annual Meeting.

The affirmative vote of a plurality of the votes cast at the Annual Meeting is necessary for the election of directors. With regard to the election of directors, abstentions and broker non-votes will have no effect on the outcome. The affirmative vote of the majority of shares cast on those matters is required for approval of the other proposals described in this Proxy Statement. With regard to these proposals, abstentions and broker non-votes will have no effect on the outcome.

ELECTION OF DIRECTORS

(Proposal Number 1)

Our charter and bylaws provide that the size of our Board of Directors shall be determined by the Board or stockholders at the Annual Meeting. Our Board of Directors currently consists of fourteen directors and is divided into three classes. Our Board of Directors has nominated Donald R. Chase, Karen J. Danaher, Jeffrey L. Davis, and Geoffrey R. Hesslink for election to serve as Class II directors, each to serve for a three-year term until the Annual Meeting of Stockholders to be held in 2019 and until his or her successor is duly elected and qualified. Mr. Chase, Ms. Danaher, Mr. Davis, and Mr. Hesslink are Class II directors whose terms expire at this year’s Annual Meeting and each has consented to being named as a nominee in this Proxy Statement and to serve as a director if elected. On February 17, 2016, Bruce M. Lisman, Raymond C. Pecor, Jr., and Patrick S. Robins, all of whom serve as Class II directors, notified the Company of their intention not to stand for re-election.

Based on its review of the relationships between the directors and our company and our subsidiaries, our Board of Directors has determined that a majority of our directors are independent under the Nasdaq Listing Rules and in accordance with the Principles of Governance adopted by our Board of Directors.

Information About Our Board of Directors

Nominees for Directors of Merchants

The following table sets forth information about the four nominees for election to our Board of Directors, and independence status, as determined in accordance with the Nasdaq Listing Rules. Information regarding their ownership of shares of Merchants’ common stock as of March 28, 2016 may be found at “Security Ownership of Certain Beneficial Owners and Management” on page 31.

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Term of | |

| | | | | | | | | Independence | | | | | | Office to | |

Class | Name | | | Age | | | Principal Occupation | | Status | | | Director Since | | | Expire | |

II | Donald R. Chase | | | 69 | | | Owner of Central New England Ag Services, Inc., Chase Ranch LLC, and Chase Enterprises Corp. | | Y | | | 2015 | | | 2019 | |

II | Karen J. Danaher | | | 60 | | | Partner, Danaher Attig & Plante PLC | | Y | | | 2010 | | | 2019 | |

II | Jeffrey L. Davis | | | 63 | | | President, J.L. Davis, Inc. | | Y | | | 1993 | | | 2019 | |

II | Geoffrey R. Hesslink | | | 51 | | | President and Chief Executive Officer, Merchants and Merchants Bank | | N | | | 2016 | | | 2019 | |

The biographical description below for each nominee includes the specific experience, qualifications, attributes and skills that led to the conclusion by the Board of Directors that such person should be nominated to serve as a director of Merchants. Except where otherwise noted below the table, all of the directors listed have been employed in their principal occupations for the last five years.

Donald R. Chase was appointed to our Board and the Board of Merchants Bank in 2015. Mr. Chase was Chairman of the Board of NUVO Bank and Trust Company in Springfield, Massachusetts. He also served as President and Chief Executive Officer, Vice Chairman, and Director of Westbank Corporation and its wholly-owned subsidiary, Westbank. Mr. Chase is the owner of Central New England Ag Services, Inc. in West Halifax, Vermont, Chase Ranch LLC, in Midland, South Dakota, and Chase Enterprises Corporation in Northampton, Massachusetts. Mr. Chase is Chairman of the Board of Trustees for the Eastern States Exposition in West Springfield, Massachusetts, and also serves on the Board of Public Safety for the City of West Springfield, Massachusetts. Mr. Chase brings a finance background, business and management experience, industry knowledge, leadership experience and credit knowledge to the Board.

Karen J. Danaher was elected to our Board of Directors in 2010 and has served as a Director of Merchants Bank since 2008. She is a partner in Danaher Attig & Plante PLC, a public accounting firm located in South Burlington, Vermont. Ms. Danaher is a certified public accountant and brings accounting and finance experience, business management experience, industry knowledge, customer-based experience, crisis and risk management experience and leadership experience to the Board.

Jeffrey L. Davis has served as a member of our Board and the Board of Merchants Bank since 1993, and has served as Chairman of our Board of Directors since February 2015. He is President of J.L. Davis, Inc., a construction and development firm, President of The Champlain Valley Exposition and President of Taft Corners Associates, a development firm. He is also a trustee emeritus of the University of Vermont in Burlington, Vermont, and a former president of the Vermont Special Olympics. Mr. Davis brings business and management experience, industry knowledge, customer-based experience, knowledge of credit, crisis and risk management experience, leadership experience and strategic planning experience to the Board.

Geoffrey R. Hesslink was appointed to our Board in 2016 and the Board of Merchants Bank in 2015. He serves as President, Chief Executive Officer and Director of Merchants and Merchants Bank. Mr. Hesslink joined Merchants Bank in 1995 as Vice President and Commercial Banker working on business development and problem loan resolution. Mr. Hesslink was promoted to Senior Vice President and Senior Lender, managing Commercial Banking, Problem Loan Resolution, Government Banking and Mortgage Banking in 2006. He was promoted to Chief Operating Officer in 2013, to President and Chief Executive Officer of Merchants Bank in 2015 and was appointed to his current role as President and Chief Executive Officer of Merchants effective January 1, 2016. He serves on the board of the Greater Burlington Industrial Corporation and is a member of the Vermont Business Roundtable. Mr. Hesslink brings experience in business management, finance and accounting, industry knowledge, customer service, crisis response, leadership, strategic planning, credit and risk management to the Board.

If any nominee is unable to serve or should decline to serve at the time of the Annual Meeting, the discretionary authority provided in the proxies may be exercised to vote for a substitute, who would be designated by our Board of Directors, and would be elected to the same class as the nominee for whom he or she is substituted. Neither our bylaws nor any applicable law restricts the nomination of other individuals to serve as directors, and any stockholder present at the Annual Meeting may nominate another candidate. Unless authority to do so has been withheld or limited in the proxy, it is the intention of the persons named in the proxy to vote the shares represented by the proxy against any such other candidates not designated by our Board of Directors.

Vote Required

The affirmative vote of a plurality of the votes cast at the Annual Meeting is necessary for the election of the individuals named above. There is no cumulative voting in the elections of directors. Unless otherwise specified, proxies will be voted in favor of the four nominees described above.

Recommendation

Our Board of Directors recommends that stockholders vote “FOR” the election of each of Donald R. Chase, Karen J. Danaher, Jeffrey L. Davis, and Geoffrey R. Hesslink as directors.

Continuing Directors

The following table sets forth certain information about those directors whose terms of office do not expire at the Annual Meeting and who, consequently will continue to serve as directors following the Annual Meeting. Except where otherwise noted below the table, all of the directors listed have been employed in their principal occupations for the last five years.

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Term of | |

| | | | | | | | | Independence | | | | | | Office to | |

Class | Name | | | Age | | | Principal Occupation | | Status | | | Director Since | | | Expire | |

I | Scott F. Boardman | | | 56 | | | President, Hickok & Boardman, Inc. | | Y | | | 2008 | | | 2018 | |

I | Janette K. Bombardier | | | 57 | | | Director of Site Operations and Senior Location Manager, GlobalFoundries | | Y | | | 2013 | | | 2018 | |

I | Raymond C. Pecor, III | | | 46 | | | President, Lake Champlain Transportation Company | | Y | | | 2012 | | | 2018 | |

III | Michael G. Furlong | | | 65 | | | Attorney, Sheehey Furlong & Behm P.C. | | Y | | | 1991 | | | 2017 | |

III | Joseph F. Larkin | | | 37 | | | Vice President, Larkin Realty | | Y | | | 2016 | | | 2017 | |

III | Lorilee A. Lawton | | | 68 | | | Owner & President, Firetech Sprinkler Corporation | | Y | | | 2003 | | | 2017 | |

III | Michael R. Tuttle | | | 61 | | | Former President and Chief Executive Officer, Merchants | | N | | | 2007 | | | 2017 | |

The biographical descriptions below for each director who is not standing for election include the specific experience, qualifications, attributes and skills that the Board of Directors would expect to consider if it were making a conclusion currently as to whether such person should serve as a director. The Board of Directors did not currently evaluate whether these directors should serve as directors, as the terms for which they have been previously elected continue beyond the Annual Meeting.

Scott F. Boardman was elected to our Board in 2008. He has been a member of the Board of Directors of Merchants Bank since 2004. Mr. Boardman is the President of Hickok & Boardman, Inc., a retail insurance agency in Burlington, Vermont. He serves on the boards of A.N. Deringer, Inc., the Lake Mansfield Trout Club, and PC Construction Company. Mr. Boardman is a former trustee of Trinity College in Burlington, Vermont, and is a former board member and past president of the Vermont Insurance Agents Association. He is also past president of the Vermont chapter of the Casualty & Property Insurance Underwriters Society. Mr. Boardman brings experience in business management, credit, risk management, customer service and leadership, as well as industry knowledge to the Board.

Janette K. Bombardier has served as a member of our Board, and the Board of Directors of Merchants Bank, since February 2013. She is the GlobalFoundries Vice President of Facilities Engineering for the Vermont and East Fishkill Semiconductor Manufacturing Locations, as well as Senior Location Executive for the GlobalFoundries Vermont facility. She is a licensed Professional Engineer in the State of Vermont. Prior to joining GlobalFoundries in 2015 she worked for IBM and held a variety of positions including construction management, manufacturing engineering, product development and quality, as well as positions in cost reduction and continuous improvement. Ms. Bombardier brings experience in business management, leadership, risk management and strategic planning to the Board.

Raymond C. Pecor, III was elected to our Board in 2012. He has served as a member of the Board of Directors of Merchants Bank since 2009. He is President of Lake Champlain Transportation Company in Burlington, Vermont, and serves on the board of the Champlain Valley Expo. Mr. Pecor, III brings experience in business management, customer service, crisis response, leadership, credit and risk management to the Board.

Michael G. Furlong has served as a member of our Board and the Board of Merchants Bank since 1991. Mr. Furlong has served as Chairman of Merchants Bank's Board of Directors since 2001. He is a member of the Burlington, Vermont law firm of Sheehey Furlong & Behm P.C., and is a former President of the Chittenden County Bar Association. He is a director of Lake Champlain Transportation Company, an emeritus director of Wake Robin Corporation and has served on the boards of several Vermont nonprofit organizations. Mr. Furlong brings experience in business management, customer service, crisis response, leadership, credit and risk management to the Board.

Joseph F. Larkin was appointed to our Board and the Board of Merchants Bank in 2016. He has been Vice President of Larkin Realty since 2010. From 2007 to 2010, he was Vice President of Credit Research at Dwight Asset Management, a Fixed Income Asset Manager. Mr. Larkin currently serves as the Chairman of the Advisory Board at Rice Memorial High School. He was a 2nd Lieutenant in the United States Air Force. Mr. Larkin brings credit and risk management experience, industry knowledge, accounting and finance experience, customer based experience, strategic planning experience and leadership to the Board.

Lorilee A. Lawton has been a member of our Board since 2003 and has served as a Director of Merchants Bank since 1995. Ms. Lawton is the owner and President of Firetech Sprinkler Corporation, a contractor specializing in the design, fabrication and installation of fire sprinkler systems, located in Colchester, Vermont. Ms. Lawton brings experience in

business management, finance and accounting, customer service, crisis response, leadership, strategic planning and risk management to the Board.

Michael R. Tuttle has served as a member of our Board since 2007 and the Board of Merchants Bank since 2006. He is the former President and Chief Executive Officer of Merchants (2007-2015) and Merchants Bank (2006-2014). Mr. Tuttle also serves on the board of the Federal Home Loan Bank of Boston. He is a former Director of Vermont Banker’s Association, Vermont Business Roundtable, Flynn Center for the Performing Arts and Fairpoint Communications, Inc. Mr. Tuttle brings experience in business management, finance and accounting, industry knowledge, customer service, crisis response, leadership, strategic planning, credit and risk management to the Board.

Role of the Board: Corporate Governance Matters

Board Leadership Structure

Jeffrey L. Davis has served as a member of our Board of Directors since 1993 and as Chairman of the Board since February 2015. Mr. Hesslink has served as a member of our Board of Directors and as President and Chief Executive Officer of Merchants since January 1, 2016. As reflected in the Principles of Governance adopted by our Board of Directors, our Board encourages the separation of the oversight and supervisory function from the executive function. Thus, our Board believes that the Chairman should be an independent director and that the roles of Chairman and Chief Executive Officer should be separated.

The independent Chairman’s role is to lead the Board, including working with the Chief Executive Officer, to determine Board agenda items and foster contributions of other directors during the Board’s deliberations. Our Board of Directors encourages strong communication among all of our independent directors and the independent Chairman. Our Board of Directors also believes that it is able to effectively provide independent oversight of Merchants’ business and affairs, including risks facing Merchants, through the composition of our Board of Directors, the independent Chairman, the strong leadership of the independent directors and the independent committees of our Board of Directors, and other corporate governance structures and processes in place. Thirteen of the fourteen members of our Board of Directors are non-management directors. In 2015, all of the non-management directors were independent under the independence standards set forth in the Nasdaq Listing Rules. After his retirement in January 2016, Mr. Tuttle joined the Board of Directors as a non-management director. He is not an independent director. All of our directors are free to suggest the inclusion of items on the agenda for meetings of our Board of Directors or raise subjects that are not on the agenda for that meeting. In addition, our Board of Directors and each committee has complete and open access to any member of management and the authority to retain independent legal, financial and other advisors as they deem appropriate without consulting or obtaining the approval of any member of management. Our Board of Directors holds executive sessions of non-management directors in order to promote discussion among the non-management directors and assure independent oversight of management. Moreover, our Audit and Risk Management Committee, our Nominating and Governance Committee, and our Compensation Committee, each of which are comprised entirely of independent directors, also perform oversight functions independent of management.

Risk Oversight

The Board of Directors plays an important role in our risk oversight, but the Board recognizes that it is not possible to identify all risks that may affect the Company and its subsidiaries or to develop processes and controls to eliminate or mitigate fully their occurrence or effects. The Board of Directors is involved in risk oversight through direct decision‑making authority with respect to significant matters and the oversight of management by the Board of Directors and its committees. The Board of Directors and its committees are also each directly responsible for consideration and oversight of risks relating to decisions within their respective areas of focus.

In particular, the Board of Directors administers its risk oversight function through: (1) the review and discussion of regular reports provided to the Board of Directors and its committees on topics relating to the risks that we face, including, among others, market risk, interest rate risk, credit risk, regulatory risk and various other matters relating to our business; (2) the required approval by the Board of Directors (or a committee thereof) of significant transactions and other decisions, including, among others, extensions of credit above a certain size, material contracts with vendors, investment decisions above a certain size and new hires and promotions to our executive officer positions; (3) the direct oversight of specific

areas of our business by the Audit and Risk Management Committee, the Nominating and Governance Committee, and the Compensation Committee; and (4) regular reports from our internal and external auditors and other outside consultants regarding various areas of potential risk, including, among others, those relating to our internal controls over financial reporting. The Board of Directors also relies on management to bring significant matters impacting the Company to the Board’s attention.

Pursuant to the Audit and Risk Management Committee’s charter, the Audit and Risk Management Committee is specifically responsible for reviewing and discussing with management and our external and internal auditors matters and activities relating to our financial reporting and internal controls, audit and loan review, regulatory compliance and risk management plans.

Other Information about the Board and its Committees

Attendance of Directors

In 2015, our Board of Directors met eleven times. During 2015, our Audit and Risk Management Committee met six times; our Compensation Committee met seven times; and our Nominating and Governance Committee met five times. All directors other than Janette K. Bombardier and Raymond C. Pecor, III attended at least 75% of the total number of meetings of the Board and the committees of our Board of Directors on which they serve. All directors attended at least 92% of the total number of meetings of the Merchants Bank Board and committees on which they serve. Additional information about these committees is set forth below.

The following eleven directors attended the Annual Meeting held on May 28, 2015: Scott F. Boardman, Janette K. Bombardier, Karen J. Danaher, Jeffrey L. Davis, Michael G. Furlong, Lorilee A. Lawton, Bruce M. Lisman, Raymond C. Pecor, Jr., Raymond C. Pecor, III, Patrick S. Robins and Michael R. Tuttle. Our directors are encouraged, but not required, to attend annual meetings.

Director Independence

Our Board of Directors has determined that all of the following directors and director nominees are independent under the Nasdaq Listing Rules and in accordance with the Principles of Governance adopted by our Board of Directors: Scott F. Boardman, Janette K. Bombardier, Donald R. Chase, Karen J. Danaher, Jeffrey L. Davis, Michael G. Furlong, Joseph F. Larkin, Lorilee A. Lawton, Bruce M. Lisman, Raymond C. Pecor, Jr., Raymond C. Pecor, III and Patrick S. Robins.

Committees of the Boards of Directors

Our Board of Directors has designated the following committees: Audit and Risk Management Committee, Compensation Committee, and Nominating and Governance Committee. The composition and objectives of each committee are described below. Our Board of Directors continues to review its committees and the independence and qualifications of its current committee members in light of rules and regulations of the SEC and The Nasdaq Stock Market.

Audit and Risk Management Committee

The Audit and Risk Management Committee held six meetings in 2015. As described in the Audit and Risk Management Committee’s charter, a copy of which is available on our website at www.mbvt.com under “Investor Relations,” the primary function of the Audit and Risk Management Committee is to promote quality and reliable financial reporting and adequate and effective internal controls for our company and its subsidiaries. It promotes the adequacy, independence and objectivity of the internal and external audit and loan review functions and the effective identification and management of risks throughout the organization. The Audit and Risk Management Committee assists our Board of Directors in overseeing the integrity of our financial statements; our compliance with legal and regulatory requirements; the external auditor’s performance, qualifications and independence; and the performance of our internal audit function. In doing so, it is the goal of the Audit and Risk Management Committee to maintain free and open communication among the Audit and Risk Management Committee, external auditors and our management.

The Audit and Risk Management Committee currently consists of five members: Donald R. Chase, Karen J. Danaher (Chair), Jeffrey L. Davis, Lorilee A. Lawton, and Patrick S. Robins. Each member of the Audit and Risk Management Committee is independent under the Nasdaq Listing Rules. No member of the Audit and Risk Management Committee is an employee of our company or any of its subsidiaries. We have not relied on exemptions for Audit and Risk Management Committee independence requirements contained in Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The members of the Audit and Risk Management Committee are required to have extensive business and financial experience. They are also required to have a good understanding of financial statements, including our balance sheet, income statement, cash flow statement, and related financial statements and disclosures. Our Board of Directors has determined that Ms. Danaher qualifies as an “audit committee financial expert” as defined by the SEC rules.

The Audit and Risk Management Committee meets with our external and internal auditors and principal financial personnel to review quarterly financial results and the results of the annual audit (in both regular and executive sessions). The Audit and Risk Management Committee reviews and approves annual external auditor engagement plans, scopes and fees. The Audit and Risk Management Committee approves all fees and terms related to the annual independent audit as well as all permissible non-audit engagements of the external auditors. The Audit and Risk Management Committee pre-approves all audit and permissible non-audit services to be performed by the external auditors, giving effect to the “de minimis” exception for non-audit services set forth in Section 10A(i)(1)(B) of the Exchange Act.

Compensation Committee

The Compensation Committee held seven meetings during 2015. As described in the Compensation Committee’s charter, a copy of which is available on our website at www.mbvt.com under “Investor Relations,” the Compensation Committee oversees the administration and performance of executive compensation plans and reviews director compensation plans. The Compensation Committee is also responsible for reviewing and approving the compensation of our executive officers, including salaries, incentives, bonuses, benefit plans, commissions, the grant of restricted stock and other forms of, or matters relating to, executive compensation, and regarding incentive plans and benefit programs for our employees, and reviewing and making recommendations to the Board of Directors regarding the compensation of our Chief Executive Officer and directors. This process includes review of an incentive compensation risk assessment performed by a multi-disciplinary team composed of representatives from our human resources, risk management and senior management teams. The risk assessment process includes development of a framework to examine incentive plans and practices, assessment of current incentive plans and identification of any needed refinements and communication of the results. The Compensation Committee reviews the Compensation Discussion and Analysis (“CD&A”) each year, discusses it with management and recommends to the Board of Directors that the CD&A be included in the Company’s annual meeting Proxy Statement.

The Compensation Committee currently consists of five directors: Janette K. Bombardier, Donald R. Chase, Karen J. Danaher, Jeffrey L. Davis (Chair), and Lorilee A. Lawton, each of whom is independent under the Nasdaq Listing Rules. No member of the committee is an employee of our company or any of its subsidiaries.

The Compensation Committee has the authority to hire, dismiss or otherwise seek the services of consulting and advisory firms as it deems appropriate. These advisors serve as independent counsel and report directly to the committee. As a matter of general policy, the Compensation Committee does not prohibit its advisors from providing services to management, but any such engagements must be requested or approved by the Compensation Committee.

In 2015, the Compensation Committee selected and retained an independent outside consulting firm, Pearl Meyer & Partners (“Pearl Meyer”), which specializes in executive and board compensation. Pearl Meyer reports directly to the Compensation Committee and carries out its responsibilities to the Compensation Committee in coordination with both the President and Chief Executive Officer and the Director of Human Resources as requested by the Compensation Committee. The Compensation Committee reviewed all services provided by the compensation consultant in 2015 and determined that the consultant did not provide services to management in 2015 and is independent with respect to SEC standards as well as our policy.

Nominating and Governance Committee

The Nominating and Governance Committee met five times in 2015. As described in the Nominating and Governance Committee’s charter, a copy of which is available on our website at www.mbvt.com under “Investor Relations,” the Nominating and Governance Committee is responsible for nominating directors for membership on committees and ensuring effective recruiting of directors as well as establishing and monitoring corporate governance guidelines.

The Nominating and Governance Committee currently consists of five directors: Donald R. Chase, Janette K. Bombardier, Karen J. Danaher, Jeffrey L. Davis (Chair), and Lorilee A. Lawton, each of whom is independent under Nasdaq Listing Rules. No member of the Nominating and Governance Committee is an employee of our company or any of its subsidiaries.

The Nominating and Governance Committee will consider director candidates recommended by our stockholders. Any submissions for director candidates must be sent to our Corporate Secretary, 275 Kennedy Drive, South Burlington, VT 05403, for submission to the Nominating and Governance Committee. Submissions must be made in accordance with the instructions included in the Nominating and Governance Committee’s charter and will be considered on the basis of the same considerations applied to internally-nominated candidates.

The Nominating and Governance Committee’s goal is to nominate directors who bring diverse perspectives and skills derived from business and professional experience to our company. Our Principles of Governance provide that our Board will identify the desired diversity of backgrounds, mix of skills, experience and other qualifications of members required in order for the Board to function competently and efficiently. Each director should also have the other necessary qualifications, professional background and core competencies to discharge his or her duties. Additionally, each director should be able to contribute sufficient time to his or her duties, and each should possess certain core competencies, including a combination of several of the following:

| · | | accounting or finance background; |

| · | | business or management experience; |

| · | | customer-based experience or perspective; |

| · | | crisis response experience; |

| · | | strategic planning experience; |

| · | | knowledge of the fundamentals of credit; |

| · | | risk management experience; and |

| · | | decision-making skills and expertise that may not otherwise be available to Merchants. |

The Nominating and Governance Committee has the authority to hire, dismiss or otherwise seek the services of consulting and advisory firms as it deems appropriate. These advisors serve as independent counsel and report directly to the Nominating and Governance Committee. As a matter of general policy, the Nominating and Governance Committee does not prohibit its advisors from providing services to management, but any such engagements must be requested or approved by the Nominating and Governance Committee.

Executive Sessions

Our independent directors met in executive session without our management four times during 2015.

Communications with Directors

Our Board of Directors provides a means for our stockholders to send communications to our Board of Directors, which can be found on our website at www.mbvt.com under “Investor Relations – Corporate Information – Officers & Directors.”

Compensation of Directors

Only non-employee members of our Board of Directors received fees with respect to their services on our Board of Directors in 2015. The following table reflects the fee schedule for our Board of Directors for 2015:

| | | | | | | | | | | | | | | | | |

| | | Chairperson | | | Member | | | Fee per Meeting | | | Fee per Meeting | |

| | | Retainer | | | Retainer | | | (in person) | | | (via telephone) | |

Board of Directors | | | $ | 5,000 | | | $ | 5,000 | | | $ | 500 | | | $ | 250 | |

Audit and Risk Management Committee | | | $ | 4,000 | | | | – | | | $ | 600 | | | $ | 250 | |

Compensation Committee | | | $ | 3,000 | | | | – | | | $ | 500 | | | $ | 250 | |

Nominating and Governance Committee | | | $ | 2,000 | | | | – | | | $ | 400 | | | $ | 250 | |

Other Committees | | | $ | 1,000 | | | | – | | | $ | 250 | | | $ | 250 | |

Committee meeting on the same day as a Board meeting | | | | – | | | | – | | | $ | 125 | | | $ | 125 | |

The following table reflects the fee schedule for Merchants Bank’s Board of Directors for 2015:

| | | | | | | | | | | | | | | | | |

| | | Chairperson | | | Member | | | Fee per Meeting | | | Fee per Meeting | |

| | | Retainer | | | Retainer | | | (in person) | | | (via telephone) | |

Board of Directors | | | $ | 5,000 | | | $ | 10,000 | | | $ | 800 | | | $ | 250 | |

Audit and Risk Management Committee | | | | – | | | | – | | | | – | | | | – | |

Compensation Committee | | | | – | | | | – | | | | – | | | | – | |

Nominating and Governance Committee | | | | – | | | | – | | | | – | | | | – | |

Other Committees | | | $ | 1,000 | | | | – | | | $ | 250 | | | $ | 250 | |

Committee meeting on the same day as a Board meeting | | | | – | | | | – | | | $ | 125 | | | $ | 125 | |

Although our Audit and Risk Management Committee, Nominating and Governance Committee, and Compensation Committee also act as Merchants Bank-level committees, the committee chairperson and members are paid at the holding company level only. All retainers and chairperson fees are paid in quarterly installments.

In 2008, our Board of Directors and stockholders voted to adopt the 2008 Compensation Plan for Non-Employee Directors and Trustees. This plan permits non-employee directors to defer receipt of their annual retainer and meeting fees by receiving those fees at a later date in the form of our common stock. If a participating director elects to have all or a specified percentage of his or her compensation for a given year deferred, that director is credited with a number of shares of our common stock equal in value to the amount deferred.

Director Compensation

The following table sets forth information about fees earned by our directors for their service during 2015. The table includes compensation paid to directors who serve on our Board of Directors, as well as compensation paid for service on the board of our subsidiary, Merchants Bank.

| | | | | | | | | | |

| | | Fees Earned | | | | | | |

| | | or Paid in | | | | | | |

Name | | | Cash (1) | | | | Total | |

Michael R. Tuttle | | | $ | – | | | | $ | – | |

Scott F. Boardman | | | $ | 31,775 | | | | $ | 31,775 | |

Janette K. Bombardier | | | $ | 31,950 | | | | $ | 31,950 | |

Peter A. Bouyea | | | $ | 15,950 | | | | $ | 15,950 | |

Donald R. Chase | | | $ | 2,014 | | | | $ | 2,014 | |

Karen J. Danaher | | | $ | 43,950 | | | | $ | 43,950 | |

Jeffrey L. Davis | | | $ | 54,025 | | | | $ | 54,025 | |

Michael G. Furlong | | | $ | 39,925 | | | | $ | 39,925 | |

Lorilee A. Lawton | | | $ | 36,800 | | | | $ | 36,800 | |

Bruce M. Lisman | | | $ | 30,600 | | | | $ | 30,600 | |

Raymond C. Pecor, Jr. | | | $ | 25,550 | | | | $ | 25,550 | |

Raymond C. Pecor, III | | | $ | 31,875 | | | | $ | 31,875 | |

Patrick S. Robins | | | $ | 32,350 | | | | $ | 32,350 | |

TOTAL | | | | | | | | $ | 376,764 | |

| (1) | | Includes all fees earned, whether paid in cash or deferred under the 2008 Compensation Plan for Non-Employee Directors and Trustees. |

Stock Ownership Guidelines

Our directors are required to own and hold 4,000 shares of our stock within five years of being nominated to the Board. All directors are in compliance with these guidelines. The Board reserves the discretion to change this requirement as appropriate.

Corporate Governance Guidelines

Our Board of Directors has adopted Principles of Governance. These principles serve as guidelines for the conduct of our Board of Directors. They reflect our Board’s commitment to ensuring adherence to good corporate governance principles. The Principles of Governance address a number of topics, including, among other things, director qualifications and responsibilities, the functioning of the Board of Directors, the responsibilities and composition of the Board committees, director compensation and annual Board review and self-evaluations. The Principles of Governance are available on our website at www.mbvt.com, under “Investor Relations.” You may obtain a printed copy of The Principles of Governance free of charge by submitting a request to our Corporate Secretary at 275 Kennedy Drive, South Burlington, Vermont 05403, or by telephone at (802) 865-1807.

Code of Business Conduct and Ethics Policy

We have adopted a Code of Business Conduct and Ethics Policy (“Code”) for all employees and directors. Part of the Code includes additional rules for the Chief Executive Officer, Chief Financial Officer and other senior financial officers. This Code is available on our website at www.mbvt.com, under “Investor Relations” and any waivers under it will also be available on our website. We have a confidential telephone and Internet hotline system for anonymous reporting of complaints and concerns regarding financial reporting. This system may be accessed by telephone at 1-866-850-1442 or via the Internet at www.ethicspoint.com.

Executive Officers

The names, ages and positions of our current executive officers are listed below.

| | | | | | | |

Name | | | Age | | | Positions | |

Geoffrey R. Hesslink | | | 51 | | | President and Chief Executive Officer, Merchants and Merchants Bank | |

Marie A. Thresher | | | 49 | | | Executive Vice President and Chief Operating Officer, Merchants Bank | |

Eric A. Segal | | | 58 | | | Interim PFO, PAO and Treasurer, Merchants and Merchants Bank | |

Laura M. Abbott | | | 51 | | | Senior Vice President and Senior Credit Officer, Merchants Bank | |

Bruce A. Bernier | | | 47 | | | Senior Vice President and Senior Lender, Merchants Bank | |

Michael J. Cataldo | | | 65 | | | Senior Vice President and Director of Operations, Merchants Bank | |

Jacqueline S. Dragon | | | 52 | | | Senior Vice President and Director of Human Resources, Merchants Bank | |

Jonathan D. Watson | | | 36 | | | Senior Vice President and Chief Risk Officer, Merchants Bank | |

Mr. Hesslink serves as President, Chief Executive Officer and Director of Merchants and Merchants Bank. Mr. Hesslink joined Merchants Bank in 1995 as Vice President and Commercial Banker working on business development and problem loan resolution. Mr. Hesslink was promoted to Senior Vice President and Senior Lender, managing Commercial Banking, Problem Loan Resolution, Government Banking and Mortgage Banking in 2006. He was promoted to Chief Operating Officer in 2013, to President and Chief Executive Officer of Merchants Bank in 2015 and was appointed to his current role as President and Chief Executive Officer of Merchants effective January 1, 2016. He serves on the board of the Greater Burlington Industrial Corporation and is a member of the Vermont Business Roundtable. Mr. Hesslink graduated cum laude, with a bachelor’s degree in business administration-finance from the University of Vermont in 1987 and completed a management training program at Manufacturers Hanover Trust Company in 1989.

Ms. Thresher joined the Company in December 2013 and currently serves as the Chief Operating Officer, responsible for operations, information technology, human resources, risk management and marketing. Prior to this role Ms. Thresher served as Senior Vice President and Chief Risk Officer. Ms. Thresher brings over 20 years of experience in financial services and risk management at regional and national financial institutions. Prior to joining Merchants Bank, she was the Senior Vice President and Chief Auditor for People’s United Bank (acquired Chittenden Corporation). She began her banking career at Fleet Financial Group (now Bank of America) holding various positions, including Vice President of Retail Delivery and Consumer/Small Business Lending, Audit in 1999. Ms. Thresher holds a Bachelor of Science degree in Finance from Central Connecticut University. She serves on the board of directors of Vermont CARES.

Mr. Segal is the Interim Principal Financial Officer, Interim Principal Accounting Officer and Interim Treasurer of Merchants Bank and Merchants Bancshares. He is a partner in CFO Consulting Partners LLC and heads the firm’s Banking and Financial Institutions practice. Mr. Segal has more than twenty-five years of experience in senior financial management positions with companies ranging from the Fortune 500 to community banks. He was Senior Vice President and Chief Financial Officer of Spencer Savings Bank, a $2 billion community bank in New Jersey, and is a 17 year veteran of American Express and Ameriprise Financial. Mr. Segal holds a BA degree from Carnegie-Mellon University and an MBA in Finance from Pace University.

Ms. Abbott has served as Senior Credit Officer since December 2012 and was appointed to her current role as Senior Vice President and Senior Credit Officer in January 2015. Ms. Abbott previously served as Vice President and Credit Operations and Loan Compliance Officer from 2001 through 2012 and has been with Merchants Bank for over 25 years. Ms. Abbott holds a Bachelor of Science degree in Business from the University of Vermont.

Mr. Bernier is Senior Lender and Senior Vice President of Merchants Bank. Mr. Bernier joined Merchants Bank in 2007 as a Corporate Banking Officer, and was promoted to the position of Northern Regional Manager Commercial Banking in 2011. Mr. Bernier has over 20 years in commercial banking experience with local banking institutions and holds a Bachelor of Science degree in business administration with a concentration in accounting from University of Maine at Orono. Mr. Bernier was appointed to his current role as Senior Lender effective January 1, 2015.

Mr. Cataldo was appointed Senior Vice President, Director of Operations in June 2015. Mr. Cataldo came to Merchants with over 30 years’ experience in the financial services industry, specializing in Bank Operations. Prior to joining Merchants Bank, Mr. Cataldo worked for Webster Bank where he was responsible for operating and managing back office operations for the $17 billion bank. He attended Sacred Heart University and is a graduate of Penn State’s executive management program.

Ms. Dragon has served as Senior Vice President and Director of Human Resources since June 2013. She has over 25 years of human resources management and organizational development experience. Prior to joining Merchants Bank, she operated her own independent consulting business. Ms. Dragon holds a Master of Science degree from Springfield College and currently serves on the Board of Technology for Tomorrow.

Mr. Watson was appointed Senior Vice President and Chief Risk Officer in March 2015. Mr. Watson has over 11 years of internal audit and risk advisory services experience at regional financial institutions. Prior to joining Merchants Bank as Vice President, Audit Director in September 2014, he worked at People’s United Bank (acquired Chittenden Corporation) for 10 years. Mr. Watson holds a Bachelor of Science degree in Business Administration from the University of Vermont.

Compensation Discussion and Analysis

The Compensation Committee of our Board of Directors, which is comprised entirely of independent directors, oversees our executive compensation program and approves all compensation for our Executive Officers other than the Chief Executive Officer and reviews Chief Executive Officer compensation for approval by our Board. The term “Named Executive Officers” (“NEOs”) refers to those individuals who served as our Chief Executive Officer, our Chief Financial Officer and our next three highest paid executive officers in 2015.

Effective January 1, 2016, Mr. Hesslink, President and Chief Executive Officer of Merchants Bank, was appointed President and Chief Executive Officer of Merchants. Mr. Tuttle retired as the Company’s President and Chief Executive Officer as of December 31, 2015. Separately, in January 2016, Thomas J. Meshako resigned as Chief Financial Officer and Treasurer of Merchants and Merchants Bank, and Molly Dillon resigned as Senior Vice President, Trust for Merchants Bank.

This Compensation Discussion and Analysis describes our executive compensation program for 2015, and certain elements of the 2016 executive compensation program. In particular, this section explains how the Compensation Committee made decisions related to compensation for our executives, including our NEOs, during 2015.

Executive Summary

Performance Summary

Our results for 2015 represent a year in transition and growth and the following summarizes the year’s key performance highlights:

| · | | completion of Chief Executive Officer succession, with the promotion of Mr. Hesslink to President and Chief Executive Officer of Merchants Bank in 2015, and then to President and Chief Executive Officer of Merchants in 2016. Other key senior management appointments in 2015 further strengthen the leadership team, contributing to successful 2015 results; |

| · | | completed the acquisition of NUVO Bank & Trust Company, which expands our presence in New England; |

| · | | Return on Average Equity (“ROAE”) was over 13% for the last 16 years ending in 2013. Expenses related to the core operating system conversion in 2014 and the NUVO acquisition in 2015 reduced ROAE in those years. The ROAE for 2014 and 2015 were 9.84% and 9.69% respectively; |

| · | | continued commitment to drive value for our stockholders – we declared our 77th consecutive quarterly dividend in January 2016 and our 41st consecutive quarter at the existing level of $0.28; and |

| · | | eight-year total stockholder return of over 100%. |

These accomplishments are significant given the slow economic recovery, sustained low interest rate environment and declining credit spreads.

Creation of Stockholder Value

We prioritize building stockholder value. Dividends paid per share during each of the past ten years totaled $1.12 per share, and we have maintained a quarterly cash dividend since 1997.

Effect of 2015 Advisory Vote on NEO Compensation

We provide our stockholders with the opportunity to cast an annual advisory vote on executive compensation (“say-on-pay”). At our 2015 Annual Meeting of Stockholders, 74% of the votes cast on the say-on-pay proposal at that meeting were voted in favor of the proposal. The Compensation Committee believes this affirms stockholders’ support of our approach to executive compensation, and therefore did not significantly change its approach in 2015. The Compensation Committee will continue to consider the outcome of our say-on-pay vote, regulatory changes and emerging best practices when making future recommendations regarding compensation for the NEOs.

2015 Compensation Highlights

We develop our programs to attract, motivate and retain the talent necessary to help us achieve our objectives. Ultimately our compensation programs are designed to achieve overarching goals that motivate and reward performance, ensure sound risk management, and deliver long-term value to our stockholders. To achieve these objectives, the Compensation Committee regularly reviews and modifies our compensation and incentive programs to ensure they align with these core objectives. We assess our program from the perspective of our stockholders and regulators, considering best practices and making improvements as appropriate.

Highlights of Compensation Program and 2015 Results:

| · | | our NEOs received base salary increases in 2015 ranging between 28% and 33%. These increases were made to recognize various promotions among the executive team as well as market adjustments in order to align base salaries closer to market in light of executives’ experience, performance and contributions; |

| · | | for 2015 performance, our NEOs earned annual cash incentives at the threshold (minimum) level. While net income fell below the minimum level to activate the plan (80% of budget), the Compensation Committee at their discretion approved the exclusion of unbudgeted one-time costs and gains related to the merger and acquisition of NUVO and the expense of Mr. Tuttle’s severance agreement when calculating the year-end net income figure and the other plan metrics. The Committee recognized that senior management did not earn incentive awards last year and have contributed significantly by improving core earnings, completing the acquisition of NUVO and successfully managing key senior management transitions during 2015; and |

| · | | in May 2015, the Compensation Committee recommended restricted stock grants for key executives for approval by the Board with values ranging from 10% to 20% of base salary. These grants will cliff vest (100%) at the end of three years, subject to continued employment. Executives are required to hold 40% or, in the case of the Chief Executive Officer, 60% of the after-tax value of the restricted stock until, at least, the date that the executive’s employment with the company terminates. |

Our Executive Compensation Program

The Compensation Committee strives to ensure our executive compensation program reflects evolving executive compensation best practices while ensuring it attracts, motivates and retains the talent that will help us achieve our objectives. Ultimately, our compensation programs are designed to (1) ensure sound risk management, (2) motivate and reward performance, and (3) deliver long-term value to our stockholders. Our programs provide a balanced and risk appropriate view of performance across our short and long-term incentive plans and provide a significant portion of executive compensation in performance-based pay.

The Executive Annual Incentive Plan was implemented in 2009 and continues to appropriately reward and motivate our executives while incorporating various risk-mitigating features:

| · | | plan activation is tied to achievement of an established net income target and acceptable ratings on internal and regulatory agency audits; |

| · | | target incentive opportunities for executives are aligned with market; |

| · | | various risk mitigation features are used, including balanced financial performance metrics and appropriate maximum caps on incentive earnings; and |

| · | | a comparable index of banks (commercial banks located in the Northeast with assets ranging between approximately $900 million to $4.0 billion) has been established that will be used to measure our relative performance to peers in regards to ROAE. |

Our long-term incentive plan strategy and equity grant allocation guidelines for key executives continues to be based upon their role and our desired total compensation philosophy. The objectives of our long-term incentive plan are to:

| · | | create strong alignment with stockholder interests; |

| · | | enable us to retain and motivate key executive officers who will contribute to our long-term growth and profitability; |

| · | | ensure awards are properly focused on long-term performance and do not encourage inappropriate risk taking; and |

| · | | enhance equity retention and ownership throughout the executive team (through holding requirements for Chief Executive Officer and key executives). |

Compensation Philosophy

Our compensation program and philosophy for executive officers was developed by the Compensation Committee and approved by our Board of Directors. The objectives of our executive compensation program are to:

| · | | attract, motivate and retain highly qualified and dedicated executive officers with competitive levels of compensation aligned with banks of similar size and complexity in our region; |

| · | | reward above-average corporate performance and recognize individual initiative and achievements; |

| · | | integrate pay with our strategic annual and long-term performance goals; |

| · | | align executive officers’ incentive with the promotion of stockholder value; and |

| · | | provide a balanced approach that helps mitigate the influence of any one element of compensation which might be considered to drive excessive risk taking. |

To meet our executive compensation objectives, our program is designed to provide the following:

| · | | competitive base salaries that are targeted at the market median (50th percentile), while allowing the flexibility to recognize each executive’s individual role, responsibilities, experience and performance; |

| · | | a short-term cash incentive program which focuses our executives on critical annual goals and objectives aligned with our strategic plan. Target incentive opportunities (as a percent of base salary) are structured to be competitive with the market median with the ability to pay above market for superior performance; |

| · | | long-term incentives, delivered in restricted stock, that align our executives’ interests with those of stockholders, reward stock price appreciation and provide a means for retaining our top performers; and |

| · | | benefits that are, by design, conservatively competitive. While they do not comprise a major part of our total compensation program, they allow us to attract and retain key executives. |

Executive Compensation Mix

In summary, we strive to provide a total compensation program that is competitive, performance oriented, stockholder aligned, balanced, and reflects sound risk management practices. We set specific performance goals that align with our strategy and support our annual plans, but also recognize the need to be responsive and flexible in today’s challenging

environment. We believe this approach also helps to ensure our program does not motivate our executives to take undue risks.

Our Principles of Governance, which are approved by our Board of Directors, require compensation for the Chief Executive Officer to be linked to the achievement of strategic goals that improve our long-term performance. Accordingly, a meaningful portion of the Chief Executive Officer’s compensation depends upon the Bank’s performance.

The Compensation Committee will continue to review, evaluate, and revise the compensation philosophy as appropriate to meet its desired objectives and adhere to emerging regulations.

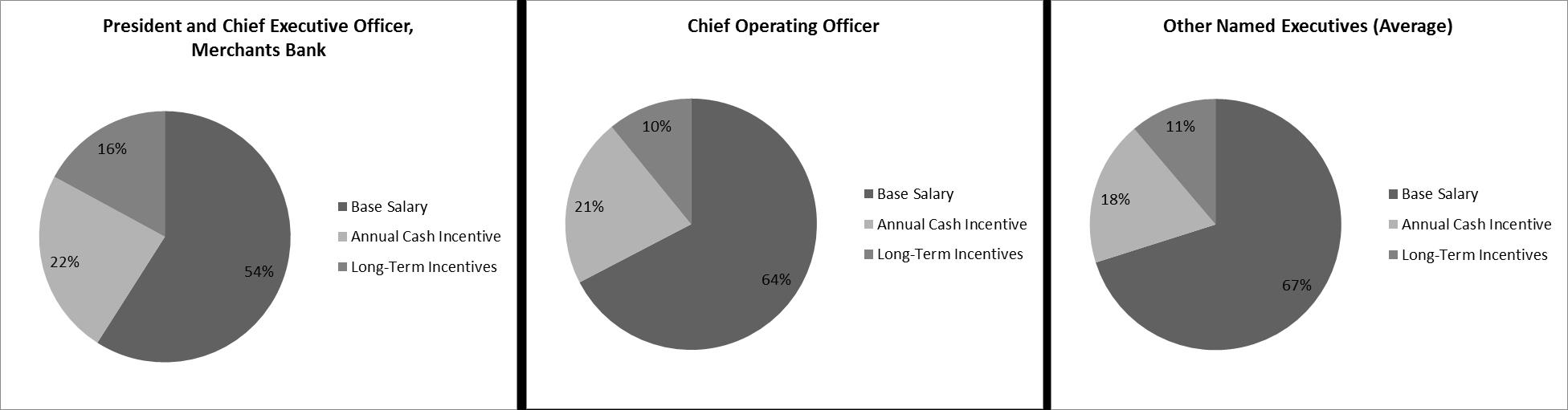

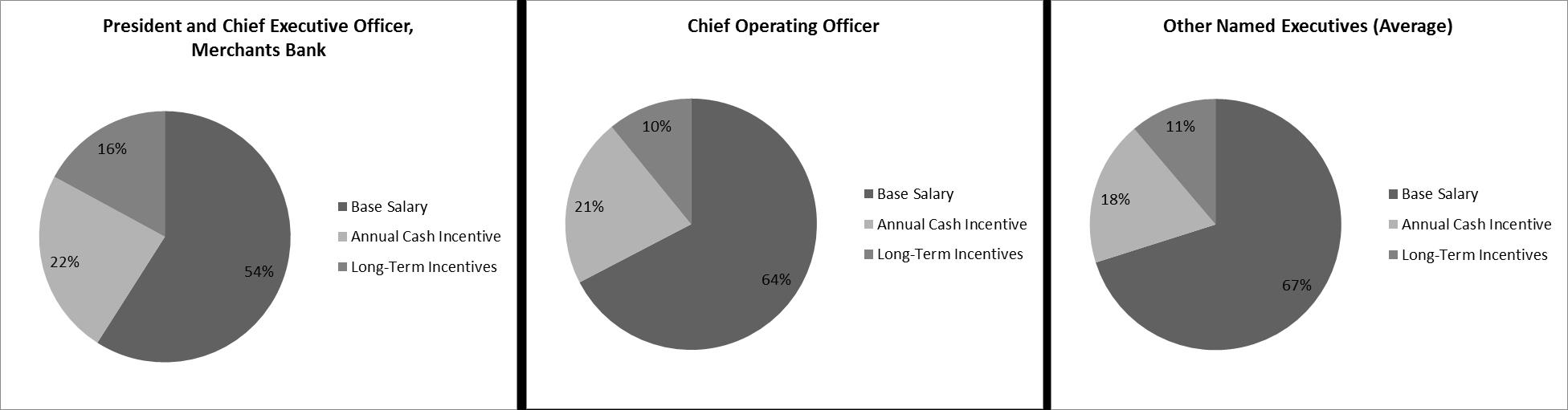

The pie charts below summarize our 2016 target total direct compensation mix for Mr. Hesslink and Ms. Thresher and the other NEOs as a group. The pie chart illustrates the mix of pay expressed as a percentage of total direct compensation (base pay + annual cash incentives + long-term incentives). Mr. Tuttle was not eligible to participate in the annual cash and long-term incentive plans.

2016 Total Compensation Mix at Target

Role of the Compensation Consultant

The Compensation Committee has the sole authority to retain and terminate a compensation consultant and to approve the consultant’s fees and all other terms of the engagement. The Compensation Committee has direct access to outside advisors and consultants throughout the year as they relate to executive compensation. The Compensation Committee has direct access to and meets periodically with the compensation consultant independently of management.

In 2015, the Compensation Committee retained the services of Pearl Meyer, an independent outside consulting firm specializing in executive and board compensation, to assist the Committee. Pearl Meyer reports directly to the Compensation Committee and carries out its responsibilities to the Compensation Committee in coordination with both the Chief Executive Officer and the Human Resources Director. Services include conducting benchmarking studies, establishing compensation guidelines, designing incentive programs, assisting with the proxy disclosure and providing insight on emerging regulations and best practices.

The Compensation Committee regularly reviews the services provided by its outside consultants and believes that Pearl Meyer is independent in providing executive compensation consulting services. The Committee conducted a specific review of its relationship with Pearl Meyer in 2015, and determined that Pearl Meyer’s work for the Committee did not raise any conflicts of interest. In making this determination, the Compensation Committee noted that during 2015:

| · | | Pearl Meyer did not provide any services to the Company or our management other than services to the Compensation Committee and its services were limited to executive compensation consulting; |

| · | | fees paid by the Company were less than 1% of Pearl Meyer’s total revenue for 2015; |

| · | | Pearl Meyer maintains a Conflicts Policy which details specific policies and procedures designed to ensure independence; |

| · | | none of the Pearl Meyer consultants had any business or personal relationship with Committee members; |

| · | | none of the Pearl Meyer consultants had any business or personal relationship with executive officers of the Company; and |

| · | | none of the Pearl Meyer consultants directly own our stock. |

The Compensation Committee continues to monitor the independence of Pearl Meyer and its other compensation advisers on a periodic basis.

Role of Management

Although the Compensation Committee makes independent recommendations to the Board of Directors on all matters related to compensation of the NEOs, certain members of management are requested to attend and provide input to the Compensation Committee throughout the year. Input may be sought from the Chief Executive Officer, Chief Financial Officer, Human Resources Director, Chief Risk Officer and others as needed to ensure the Compensation Committee has the information and perspective it needs to carry out its duties.

The Compensation Committee meets with the Chief Executive Officer for input regarding his performance and compensation package, but ultimately decisions regarding his package are made based upon the Compensation Committee’s deliberations, as recommended and reported to the Board, as well as input from the compensation consultant, as requested. The Compensation Committee considers recommendations from the Chief Executive Officer, as well as input from the compensation consultant as requested, to make compensation package decisions for other executives.

Inputs to Committee Decision Making

Performance Evaluation

The Compensation Committee evaluates the performance of the Chief Executive Officer annually in the following four categories:

1.Development of specific strategic plan objectives;

2.Operational impact on company morale, customer satisfaction, public image, company efficiency and flexibility, and research and development of leading edge products, services and technologies;

3.Management style and effectiveness in relation to customers, stockholders, employees, executive officers, board and committee members, and the media and community;

4.Effectiveness of leadership in:

a.developing appropriate strategies and gaining support from our Board of Directors and its committees to achieve these strategies;

b.setting the “tone at the top” for ethics, customer relations, reputation and ensuing results; fostering an environment for leadership development at all levels within the company;

c.working collaboratively with our Board of Directors and committees and communicating information in a timely manner to ensure full and informed consent regarding matters of governance.

The Chief Executive Officer evaluates the performance of our other executive officers annually. Each executive officer’s annual performance review serves as the basis for adjustments to his or her base salary. Individual performance evaluations are tied closely to achievement of short and long-term goals and objectives, individual initiative, team-building skills, level of responsibility and above average corporate performance.

The Chief Executive Officer makes annual recommendations to the Compensation Committee for changes to executive officer salaries (other than his own) for the following year. These recommendations are based on individual performance within their respective areas of expertise, the Chief Executive Officer’s assessment of their contributions to our earnings and growth during the year, as well as their management style and effectiveness in relation to our customers, stockholders, employees, fellow executive officers, board and committee members and the community. The Compensation Committee reviews these recommendations and makes its final decisions regarding compensation for executive officers. Decisions regarding compensation for the Chief Executive Officer are approved by our Board of Directors based on recommendations from the Compensation Committee.

Benchmarking

The Compensation Committee typically engages Pearl Meyer to conduct a competitive review of our executive compensation program every two years. A primary data source used in setting market-competitive guidelines for the executive officers is the information publicly disclosed by a peer group of other publicly traded banks and thrifts. Our peer group is developed by Pearl Meyer using objective parameters that reflect banks of similar asset size and region. When developing the peer group, Pearl Meyer includes financial institutions ranging from approximately one half to two times our asset size that are located in the New England and New York region of the United States (excluding Boston and the New York City metro area, as well as banks with unique business models). The peer group is also designed to position us at approximately the 50th percentile in regards to assets.

In 2015, Pearl Meyer was engaged to update the peer group in order to assess the effectiveness of our executive compensation programs and provide input for the 2016 programs.

The following is the 2015 peer group used by the Compensation Committee to make decisions related to 2016 executive compensation.

| |

Arrow Financial Corporation | First Bancorp, Inc. |

Bar Harbor Bankshares, Inc. | First Connecticut Bancorp, Inc. |

Camden National Corporation | Hingham Institution for Savings |

Century Bancorp, Inc. | Lake Sunapee Bank Group+ |

Chemung Financial Corporation | Meridian Bancorp, Inc.* |

Enterprise Bancorp, Inc. | SI Financial Group, Inc. |

Evans Bancorp, Inc. | Washington Trust Bancorp, Inc. |

Financial Institutions, Inc. | Westfield Financial, Inc. |

+Lake Sunapee Bank Group was formerly named New Hampshire Thrift Bancshares

The updated peer group did not change materially from the peer group developed in 2013 which was used to make pay decisions for 2014 – 2015. One new bank was included (Meridian Bancorp, Inc.) and three banks were excluded due to merger/acquisitions (Alliance Financial Corporation, Rockville Financial Inc. and United Financial Bancorp, Inc.).

In addition to the peer group data, Pearl Meyer uses additional banking compensation surveys as part of the analysis focusing on banks similar to us in asset size and region.

Information from the competitive analysis is used by the consultant to provide market-competitive guidelines that support our total compensation philosophy. Guidelines for base salary, short and long-term incentive targets and estimated total direct compensation are provided with ranges for performance. This allows the Compensation Committee to see the potential pay, and range of pay, for each executive role. These guidelines provided a framework for consideration by the Compensation Committee in setting pay levels.

Risk Oversight of Compensation Programs

We believe that the compensation program is structured to be reasonably unlikely to present a material adverse risk to us based on the following factors:

| · | | as a community bank regulated by the Federal Deposit Insurance Corporation and the Commissioner of the Vermont Department of Financial Regulation, among others, our main operating subsidiary, Merchants Bank, adheres to defined risk guidelines, practices and controls to ensure the safety and soundness of the organization; |

| · | | our management and Board of Directors conduct regular reviews of our business to ensure we remain within appropriate regulatory guidelines and practices that are monitored and supplemented by our internal audit function, as well as our external auditors; |

| · | | our incentive plan provides a maximum cap on payment and does not have highly leveraged payout curves and steep payout cliffs at specific performance levels that could encourage short-term actions to meet payout thresholds; and |

| · | | our restricted stock grants are subject to clawbacks in the event of accounting restatement due to fraud or misconduct or in the event of material violations of our Code. |

Components of Executive Compensation and 2015 Decisions

Our compensation program for all executive officers, including the Chief Executive Officer, consists of four key components, which are reviewed regularly by the Committee:

| · | | long-term incentive/equity; and |

| · | | employment contracts/other benefits. |

We offer no perquisites of any kind to any of our executive officers. Executive officers are not entitled to severance or change-in-control payments beyond those described in the “Employment Agreements” section on page 24 of this document.

The following section summarizes the role of each component, how decisions are made and the resulting 2015 decision process as it relates to the executive officers.

Base Salary

We believe the purpose of base salary is to provide competitive and fair base compensation that recognizes the executives’ role, responsibilities, experience and performance. Base salary represents fixed compensation that is targeted to be competitive with our peer group.

Typically, the Compensation Committee reviews and sets base pay for each executive in December of each year following the performance evaluation process. Competitive markets for similar roles are considered, as well as each individual’s experience, performance and contributions. Promotional pay increases are also considered by the Compensation Committee. In order to facilitate the Chief Executive Officer succession, Mr. Hesslink was promoted to President and Chief Executive Officer of Merchants Bank on January 1, 2015. During 2015, Mr. Tuttle was President & Chief Executive Officer of Merchants and worked with Mr. Hesslink to support him in his new role and prepare him to take over the role of President & Chief Executive Officer of both Merchants and Merchants Bank upon Mr. Tuttle’s retirement. In addition, Ms. Thresher was promoted to Executive Vice President, Chief Operating Officer on January 1, 2015.

The Compensation Committee approved the following 2015 and 2016 base salary adjustments for the NEOs that were intended to recognize each executive’s contribution and performance and, if needed, bring salaries more in line with market.

The 2015 adjustments reflect the organizational changes discussed in the preceding paragraph. In determining 2016 pay adjustments, the Compensation Committee utilized the competitive pay analysis conducted by Pearl Meyer for the Chief Executive Officer and other key executive officers. The results for this study indicated that base pay levels for many of the key officers, including the Chief Executive Officer and Chief Operating Officer, were below or at the 25th percentile of the market. As a result, the Committee recommended that the Chief Executive Officer and other key officer base salaries be increased to competitive market pay levels consistent with our compensation philosophy and to ensure retention of these key senior executive positions which are integral to the continued success of the organization.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Percent | | | | | | | | |

| | | | January | | | January | | | Increase in | | | January | | | Percent | |

| | | | 2014 Base | | | 2015 Base | | | January | | | 2016 Base | | | Increase in | |

Name | Title | | | Salary | | | Salary | | | 2015 | | | Salary | | | January 2016 | |

Michael R. Tuttle | President and Chief Executive Officer of Merchants (retired December 2015) | | | $ | 345,000 | | | $ | 305,000 | | | (11.59) | % | | $ | — | | | — | % |