Exhibit 99.2 An S&P 500 SUPPLEMENTAL OPERATING company S&P 500 & FINANCIAL DATA Dividend Aristocrats® Q1 2020 index member

Table Of Contents Corporate Overview 3 Financial Summary Consolidated Statements Of Income 4 Funds From Operations (FFO) 5 Adjusted Funds From Operations (AFFO) 6 Consolidated Balance Sheets 7 Debt Summary 8 Debt Maturities 9 Capitalization & Financial Ratios 10 Adjusted EBITDAre & Coverage Ratios 11 Debt Covenants 12 Transaction Summary Investment Summary 13 Disposition Summary 14 Development Pipeline 15 Real Estate Portfolio Summary Tenant Diversification 16 Top 10 Industries 17 Industry Diversification 18 Geographic Diversification 20 Property Type Composition 22 Same Store Rental Revenue 23 Leasing Data Occupancy 24 Leasing Activity 25 Lease Expirations 26 COVID-19 Summary of COVID-19 Impact 27 April Rent Collections by Industry 28 Analyst Coverage 29 This Supplemental Operating & Financial Data should be read in connection with the company's first quarter 2020 earnings press release (included as Exhibit 99.1 of the company's Current Report on Form 8-K, filed on May 4, 2020) as certain disclosures, definitions, and reconciliations in such announcement have not been included in this Supplemental Operating & Financial Data. Q1 2020 Supplemental Operating & Financial Data 2

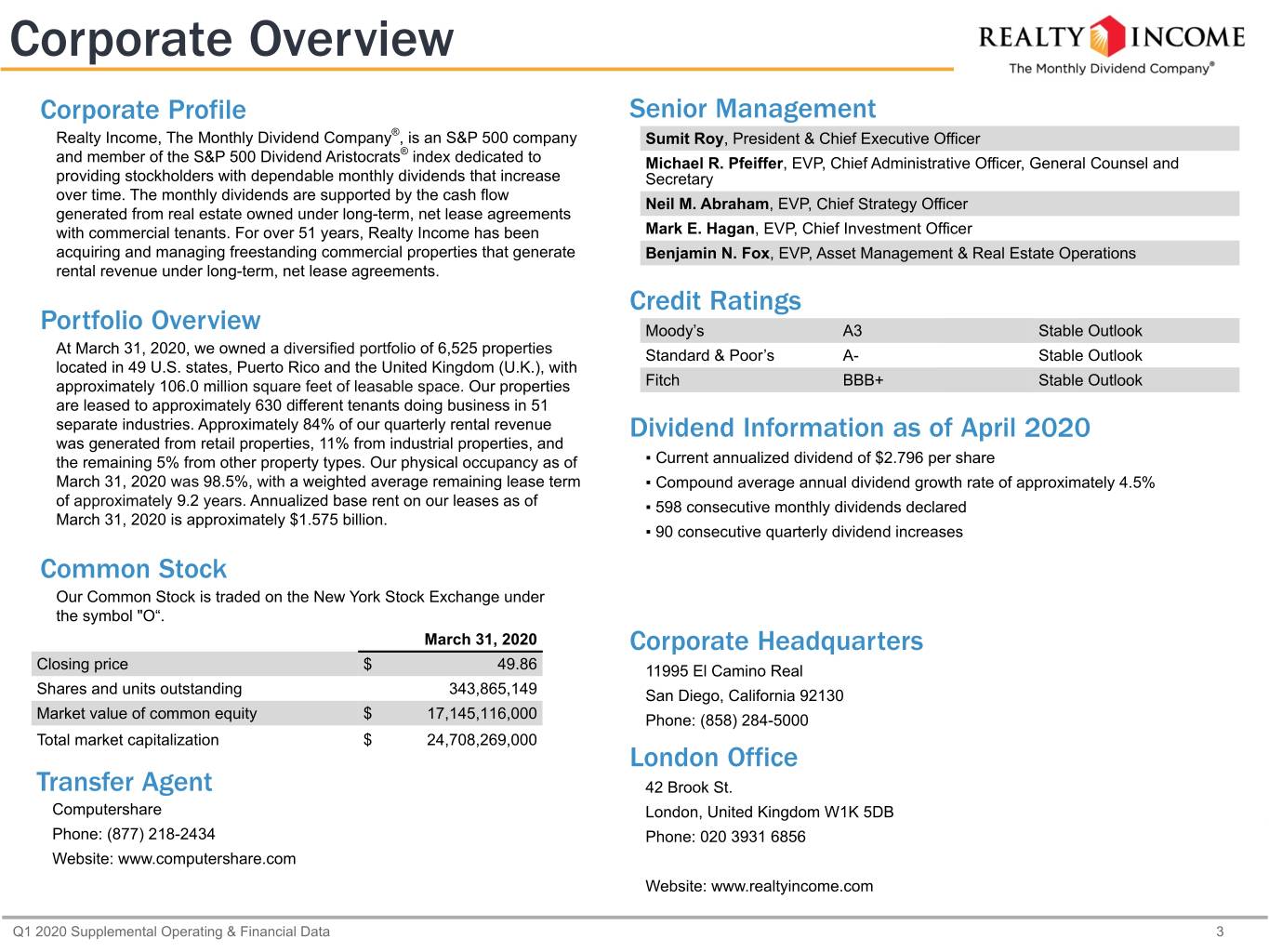

Corporate Overview Corporate Profile Senior Management Realty Income, The Monthly Dividend Company®, is an S&P 500 company Sumit Roy, President & Chief Executive Officer ® and member of the S&P 500 Dividend Aristocrats index dedicated to Michael R. Pfeiffer, EVP, Chief Administrative Officer, General Counsel and providing stockholders with dependable monthly dividends that increase Secretary over time. The monthly dividends are supported by the cash flow Neil M. Abraham, EVP, Chief Strategy Officer generated from real estate owned under long-term, net lease agreements with commercial tenants. For over 51 years, Realty Income has been Mark E. Hagan, EVP, Chief Investment Officer acquiring and managing freestanding commercial properties that generate Benjamin N. Fox, EVP, Asset Management & Real Estate Operations rental revenue under long-term, net lease agreements. Credit Ratings Portfolio Overview Moody’s A3 Stable Outlook At March 31, 2020, we owned a diversified portfolio of 6,525 properties Standard & Poor’s A- Stable Outlook located in 49 U.S. states, Puerto Rico and the United Kingdom (U.K.), with approximately 106.0 million square feet of leasable space. Our properties Fitch BBB+ Stable Outlook are leased to approximately 630 different tenants doing business in 51 separate industries. Approximately 84% of our quarterly rental revenue Dividend Information as of April 2020 was generated from retail properties, 11% from industrial properties, and the remaining 5% from other property types. Our physical occupancy as of ▪ Current annualized dividend of $2.796 per share March 31, 2020 was 98.5%, with a weighted average remaining lease term ▪ Compound average annual dividend growth rate of approximately 4.5% of approximately 9.2 years. Annualized base rent on our leases as of ▪ 598 consecutive monthly dividends declared March 31, 2020 is approximately $1.575 billion. ▪ 90 consecutive quarterly dividend increases Common Stock Our Common Stock is traded on the New York Stock Exchange under the symbol "O“. March 31, 2020 Corporate Headquarters Closing price $ 49.86 11995 El Camino Real Shares and units outstanding 343,865,149 San Diego, California 92130 Market value of common equity $ 17,145,116,000 Phone: (858) 284-5000 Total market capitalization $ 24,708,269,000 London Office Transfer Agent 42 Brook St. Computershare London, United Kingdom W1K 5DB Phone: (877) 218-2434 Phone: 020 3931 6856 Website: www.computershare.com Website: www.realtyincome.com Q1 2020 Supplemental Operating & Financial Data 3

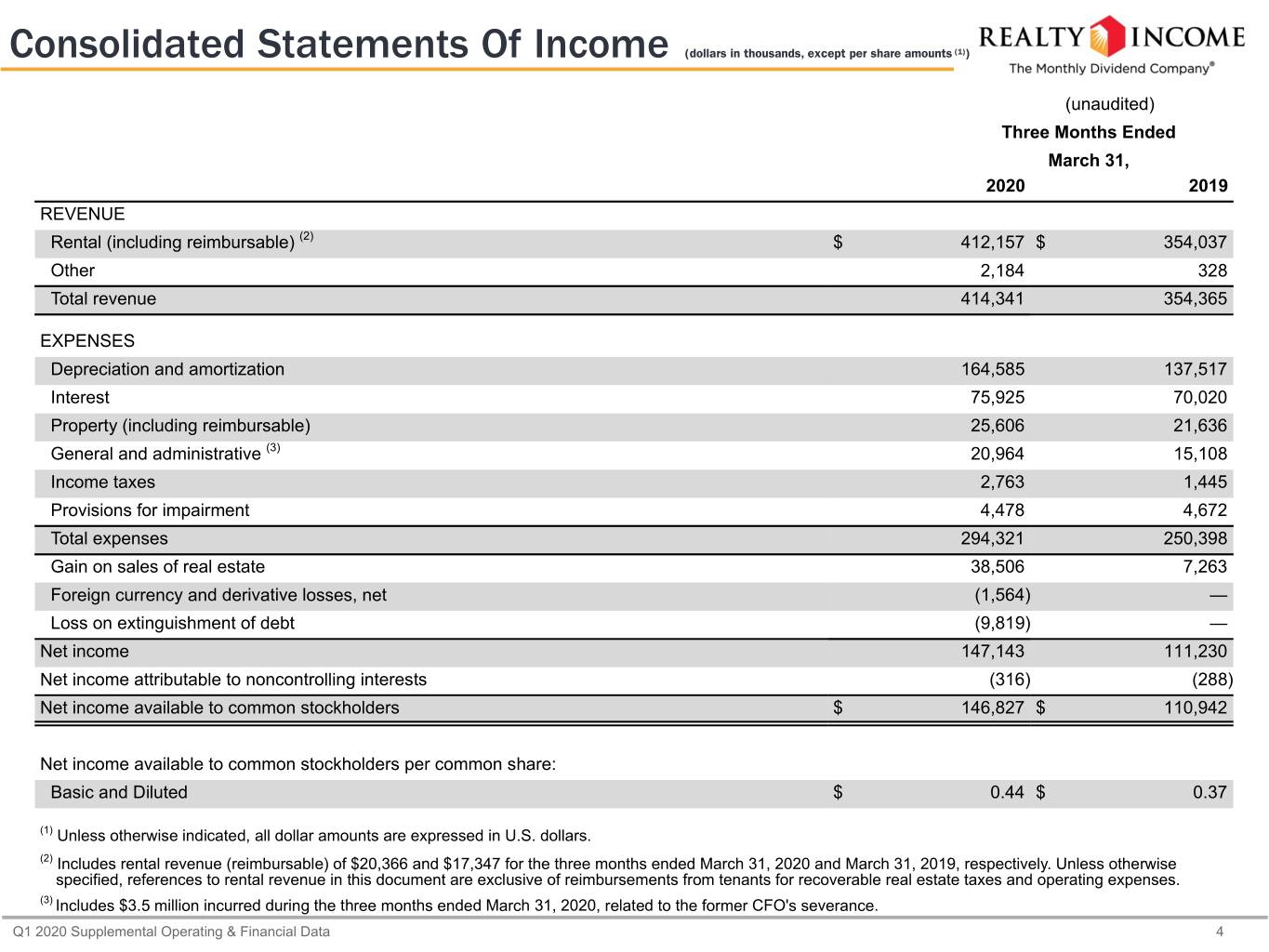

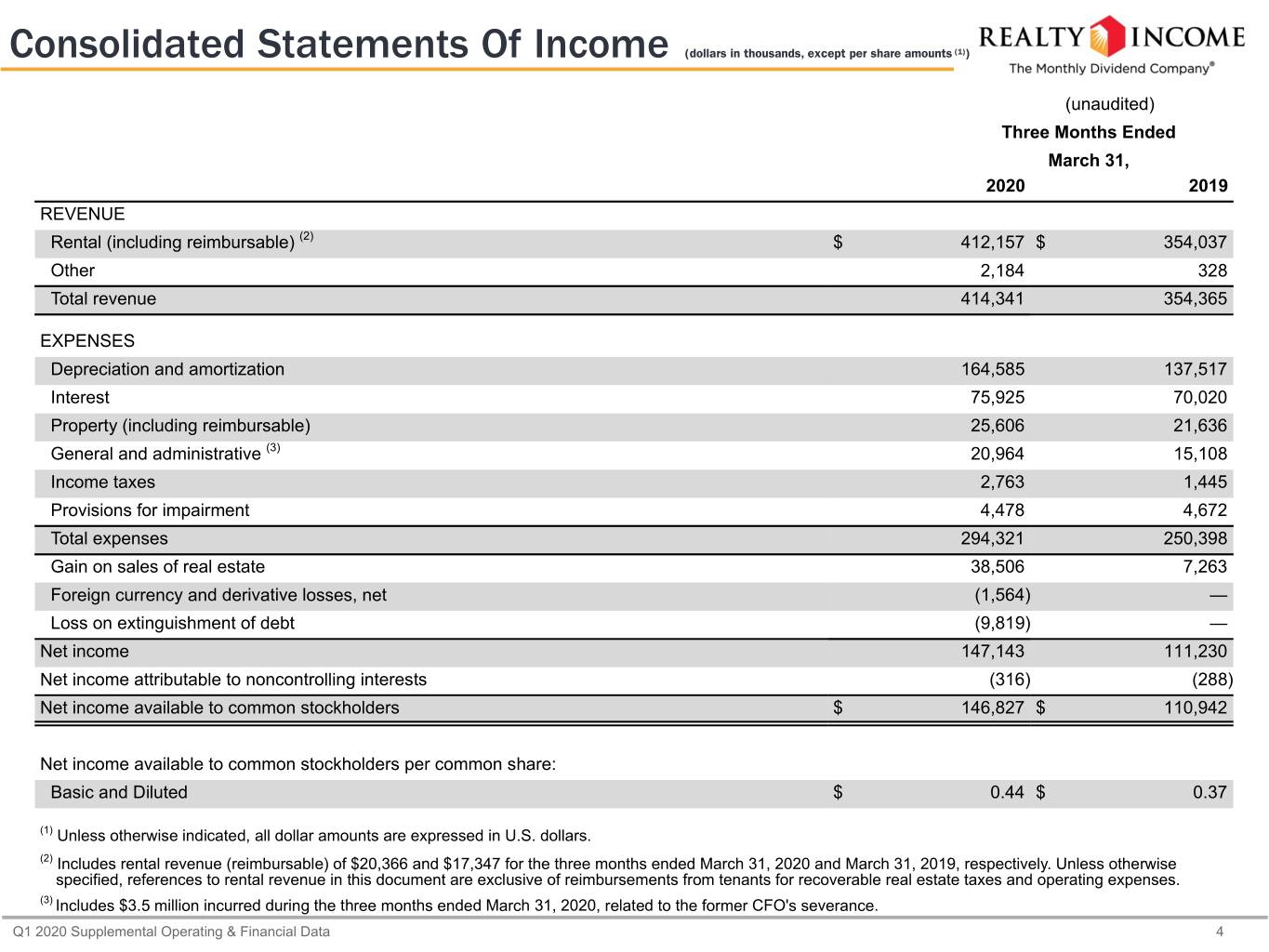

Consolidated Statements Of Income (dollars in thousands, except per share amounts (1)) (unaudited) Three Months Ended March 31, 2020 2019 REVENUE Rental (including reimbursable) (2) $ 412,157 $ 354,037 Other 2,184 328 Total revenue 414,341 354,365 EXPENSES Depreciation and amortization 164,585 137,517 Interest 75,925 70,020 Property (including reimbursable) 25,606 21,636 General and administrative (3) 20,964 15,108 Income taxes 2,763 1,445 Provisions for impairment 4,478 4,672 Total expenses 294,321 250,398 Gain on sales of real estate 38,506 7,263 Foreign currency and derivative losses, net (1,564) — Loss on extinguishment of debt (9,819) — Net income 147,143 111,230 Net income attributable to noncontrolling interests (316) (288) Net income available to common stockholders $ 146,827 $ 110,942 Net income available to common stockholders per common share: Basic and Diluted $ 0.44 $ 0.37 (1) Unless otherwise indicated, all dollar amounts are expressed in U.S. dollars. (2) Includes rental revenue (reimbursable) of $20,366 and $17,347 for the three months ended March 31, 2020 and March 31, 2019, respectively. Unless otherwise specified, references to rental revenue in this document are exclusive of reimbursements from tenants for recoverable real estate taxes and operating expenses. (3) Includes $3.5 million incurred during the three months ended March 31, 2020, related to the former CFO's severance. Q1 2020 Supplemental Operating & Financial Data 4

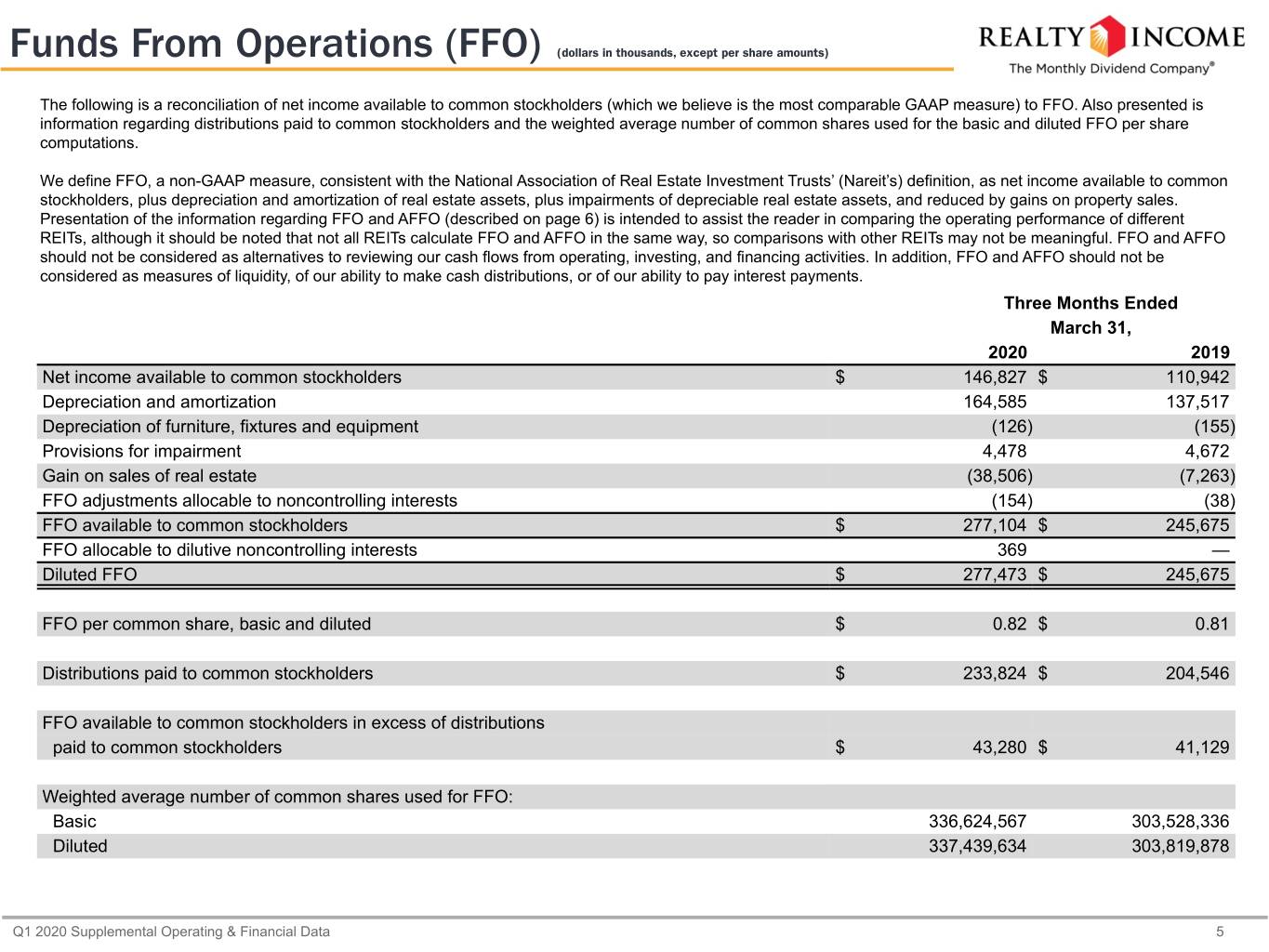

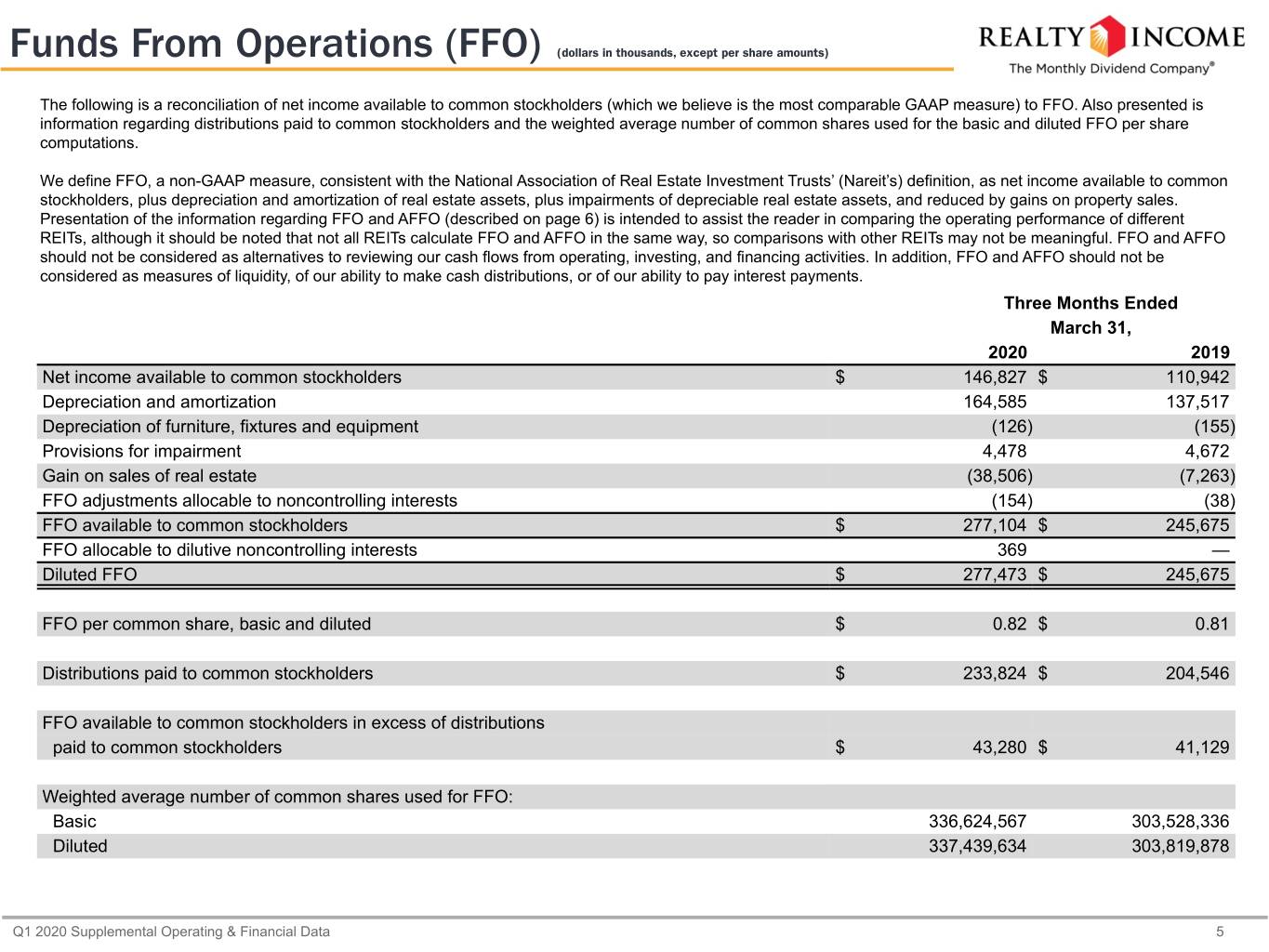

Funds From Operations (FFO) (dollars in thousands, except per share amounts) The following is a reconciliation of net income available to common stockholders (which we believe is the most comparable GAAP measure) to FFO. Also presented is information regarding distributions paid to common stockholders and the weighted average number of common shares used for the basic and diluted FFO per share computations. We define FFO, a non-GAAP measure, consistent with the National Association of Real Estate Investment Trusts’ (Nareit’s) definition, as net income available to common stockholders, plus depreciation and amortization of real estate assets, plus impairments of depreciable real estate assets, and reduced by gains on property sales. Presentation of the information regarding FFO and AFFO (described on page 6) is intended to assist the reader in comparing the operating performance of different REITs, although it should be noted that not all REITs calculate FFO and AFFO in the same way, so comparisons with other REITs may not be meaningful. FFO and AFFO should not be considered as alternatives to reviewing our cash flows from operating, investing, and financing activities. In addition, FFO and AFFO should not be considered as measures of liquidity, of our ability to make cash distributions, or of our ability to pay interest payments. Three Months Ended March 31, 2020 2019 Net income available to common stockholders $ 146,827 $ 110,942 Depreciation and amortization 164,585 137,517 Depreciation of furniture, fixtures and equipment (126) (155) Provisions for impairment 4,478 4,672 Gain on sales of real estate (38,506) (7,263) FFO adjustments allocable to noncontrolling interests (154) (38) FFO available to common stockholders $ 277,104 $ 245,675 FFO allocable to dilutive noncontrolling interests 369 — Diluted FFO $ 277,473 $ 245,675 FFO per common share, basic and diluted $ 0.82 $ 0.81 Distributions paid to common stockholders $ 233,824 $ 204,546 FFO available to common stockholders in excess of distributions paid to common stockholders $ 43,280 $ 41,129 Weighted average number of common shares used for FFO: Basic 336,624,567 303,528,336 Diluted 337,439,634 303,819,878 Q1 2020 Supplemental Operating & Financial Data 5

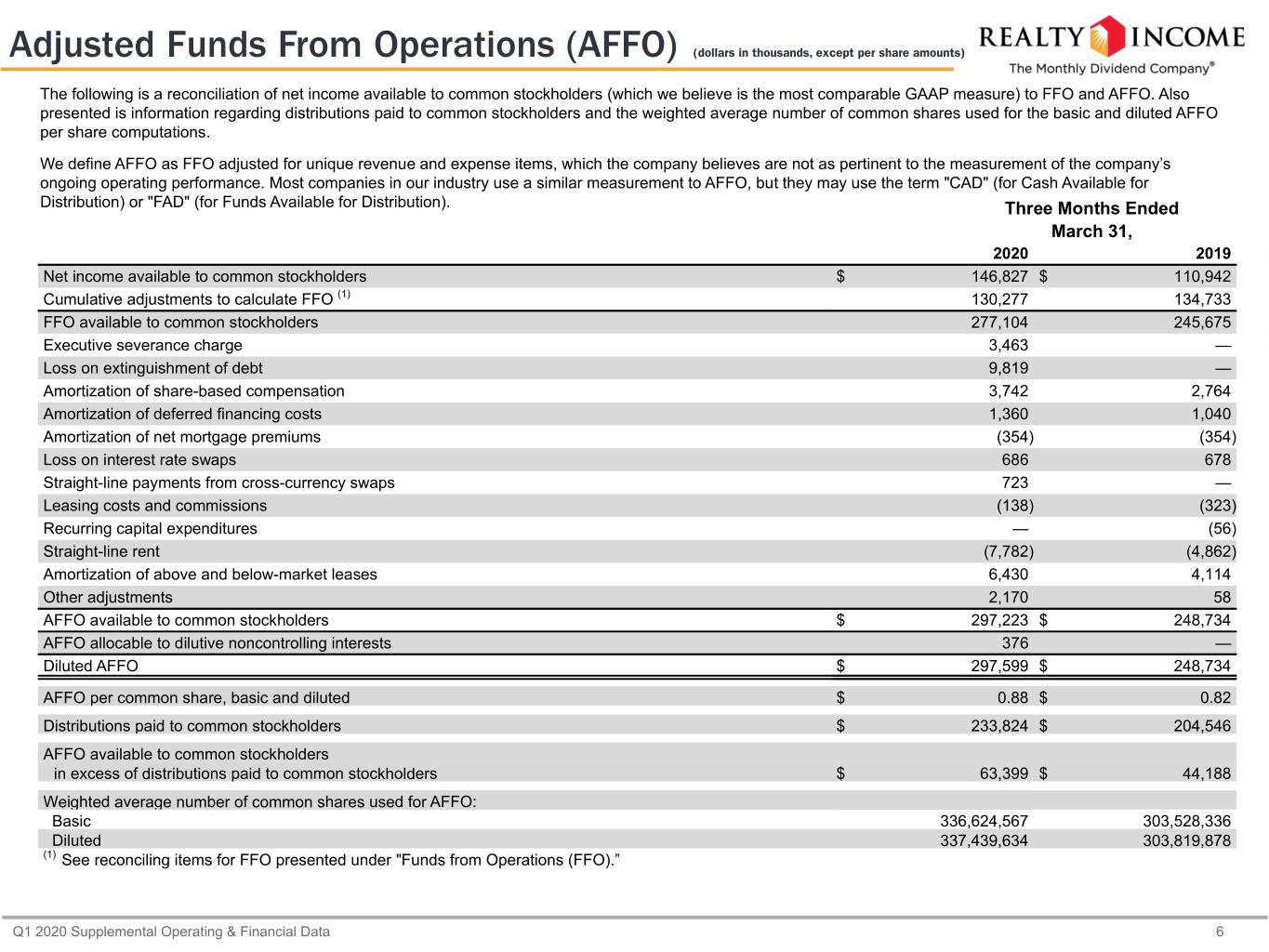

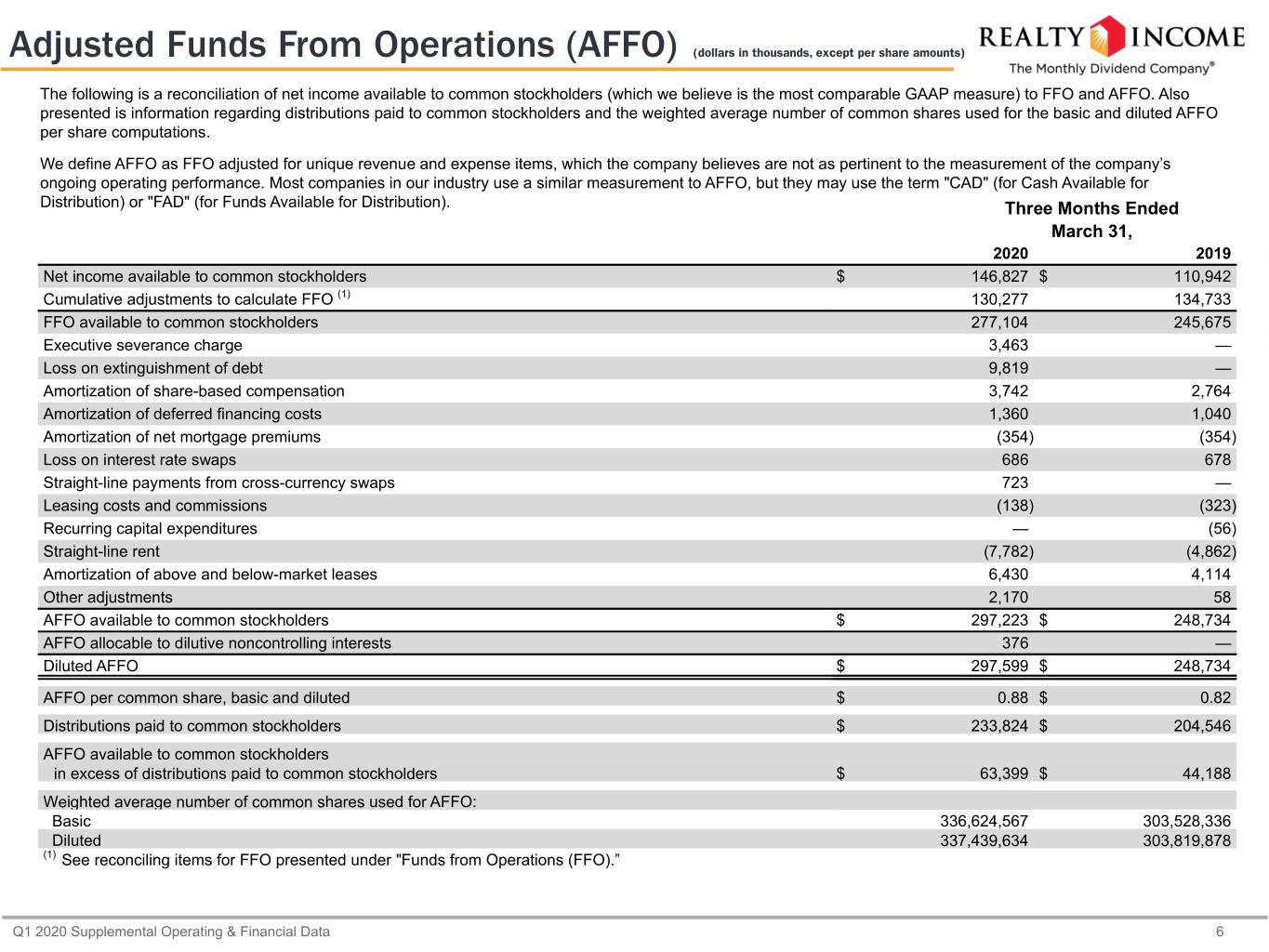

Adjusted Funds From Operations (AFFO) (dollars in thousands, except per share amounts) The following is a reconciliation of net income available to common stockholders (which we believe is the most comparable GAAP measure) to FFO and AFFO. Also presented is information regarding distributions paid to common stockholders and the weighted average number of common shares used for the basic and diluted AFFO per share computations. We define AFFO as FFO adjusted for unique revenue and expense items, which the company believes are not as pertinent to the measurement of the company’s ongoing operating performance. Most companies in our industry use a similar measurement to AFFO, but they may use the term "CAD" (for Cash Available for Distribution) or "FAD" (for Funds Available for Distribution). Three Months Ended March 31, 2020 2019 Net income available to common stockholders $ 146,827 $ 110,942 Cumulative adjustments to calculate FFO (1) 130,277 134,733 FFO available to common stockholders 277,104 245,675 Executive severance charge 3,463 — Loss on extinguishment of debt 9,819 — Amortization of share-based compensation 3,742 2,764 Amortization of deferred financing costs 1,360 1,040 Amortization of net mortgage premiums (354) (354) Loss on interest rate swaps 686 678 Straight-line payments from cross-currency swaps 723 — Leasing costs and commissions (138) (323) Recurring capital expenditures — (56) Straight-line rent (7,782) (4,862) Amortization of above and below-market leases 6,430 4,114 Other adjustments 2,170 58 AFFO available to common stockholders $ 297,223 $ 248,734 AFFO allocable to dilutive noncontrolling interests 376 — Diluted AFFO $ 297,599 $ 248,734 AFFO per common share, basic and diluted $ 0.88 $ 0.82 Distributions paid to common stockholders $ 233,824 $ 204,546 AFFO available to common stockholders in excess of distributions paid to common stockholders $ 63,399 $ 44,188 Weighted average number of common shares used for AFFO: Basic 336,624,567 303,528,336 Diluted 337,439,634 303,819,878 (1) See reconciling items for FFO presented under "Funds from Operations (FFO).” Q1 2020 Supplemental Operating & Financial Data 6

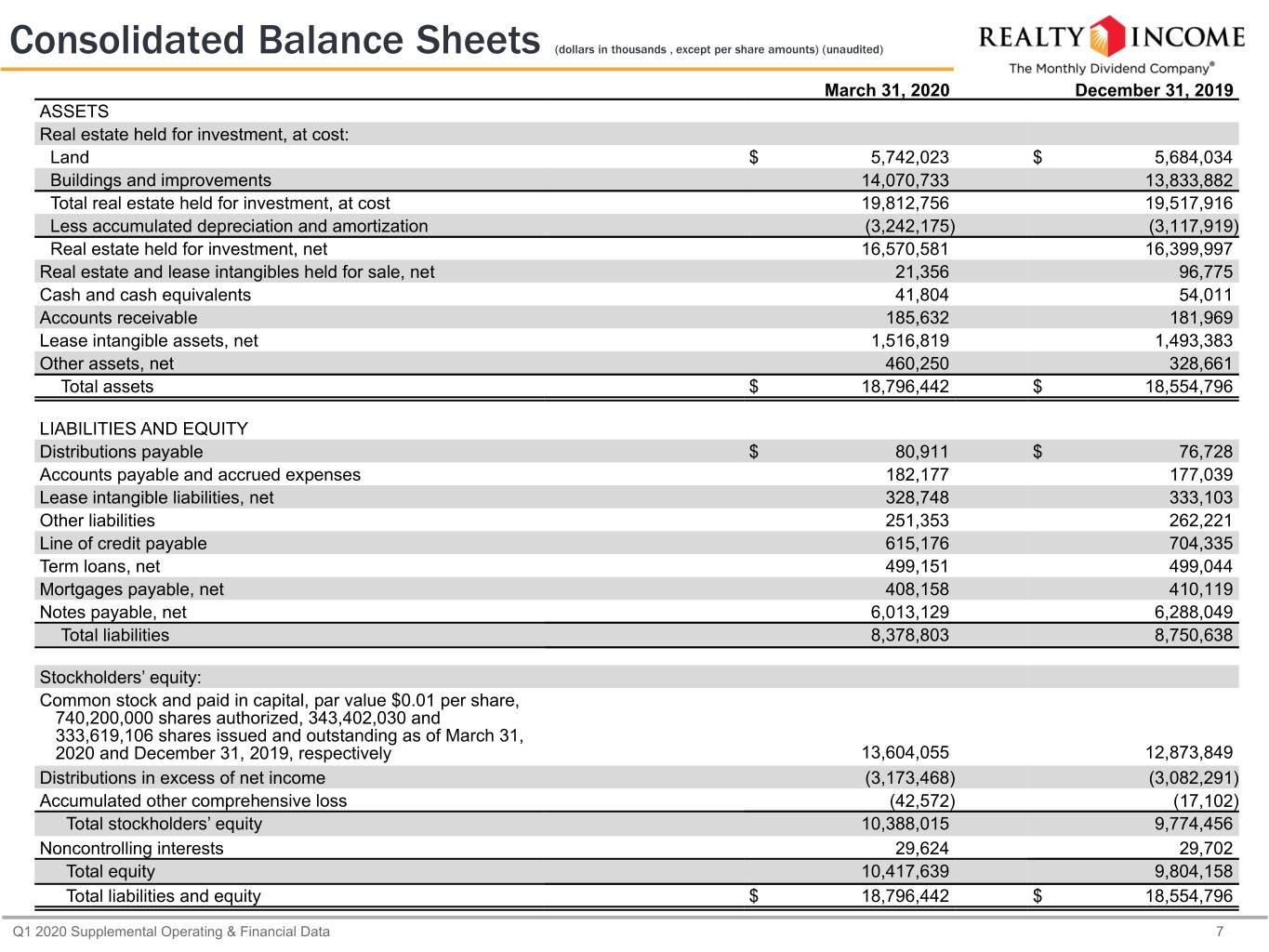

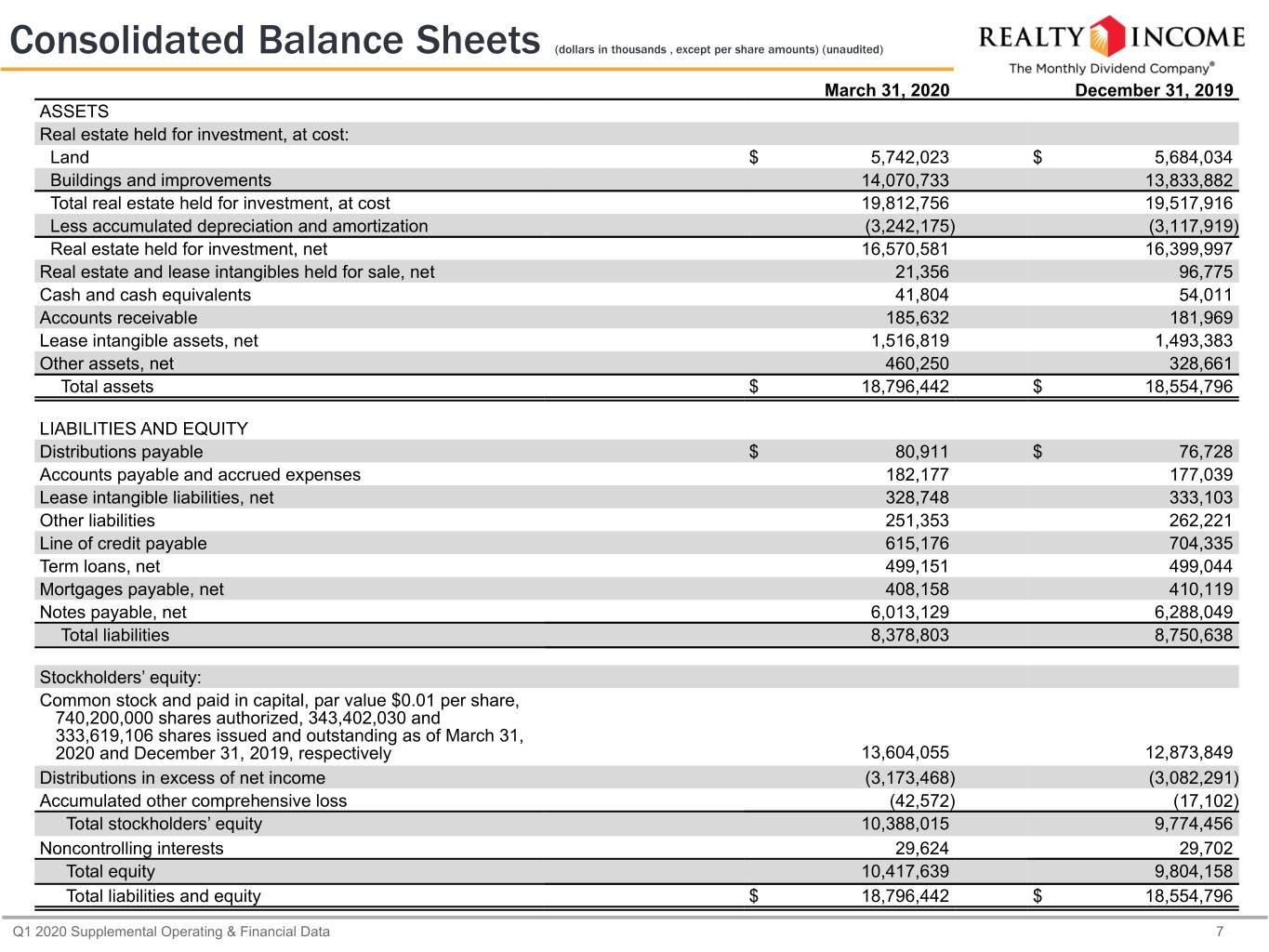

Consolidated Balance Sheets (dollars in thousands , except per share amounts) (unaudited) March 31, 2020 December 31, 2019 ASSETS Real estate held for investment, at cost: Land $ 5,742,023 $ 5,684,034 Buildings and improvements 14,070,733 13,833,882 Total real estate held for investment, at cost 19,812,756 19,517,916 Less accumulated depreciation and amortization (3,242,175) (3,117,919) Real estate held for investment, net 16,570,581 16,399,997 Real estate and lease intangibles held for sale, net 21,356 96,775 Cash and cash equivalents 41,804 54,011 Accounts receivable 185,632 181,969 Lease intangible assets, net 1,516,819 1,493,383 Other assets, net 460,250 328,661 Total assets $ 18,796,442 $ 18,554,796 LIABILITIES AND EQUITY Distributions payable $ 80,911 $ 76,728 Accounts payable and accrued expenses 182,177 177,039 Lease intangible liabilities, net 328,748 333,103 Other liabilities 251,353 262,221 Line of credit payable 615,176 704,335 Term loans, net 499,151 499,044 Mortgages payable, net 408,158 410,119 Notes payable, net 6,013,129 6,288,049 Total liabilities 8,378,803 8,750,638 Stockholders’ equity: Common stock and paid in capital, par value $0.01 per share, 740,200,000 shares authorized, 343,402,030 and 333,619,106 shares issued and outstanding as of March 31, 2020 and December 31, 2019, respectively 13,604,055 12,873,849 Distributions in excess of net income (3,173,468) (3,082,291) Accumulated other comprehensive loss (42,572) (17,102) Total stockholders’ equity 10,388,015 9,774,456 Noncontrolling interests 29,624 29,702 Total equity 10,417,639 9,804,158 Total liabilities and equity $ 18,796,442 $ 18,554,796 Q1 2020 Supplemental Operating & Financial Data 7

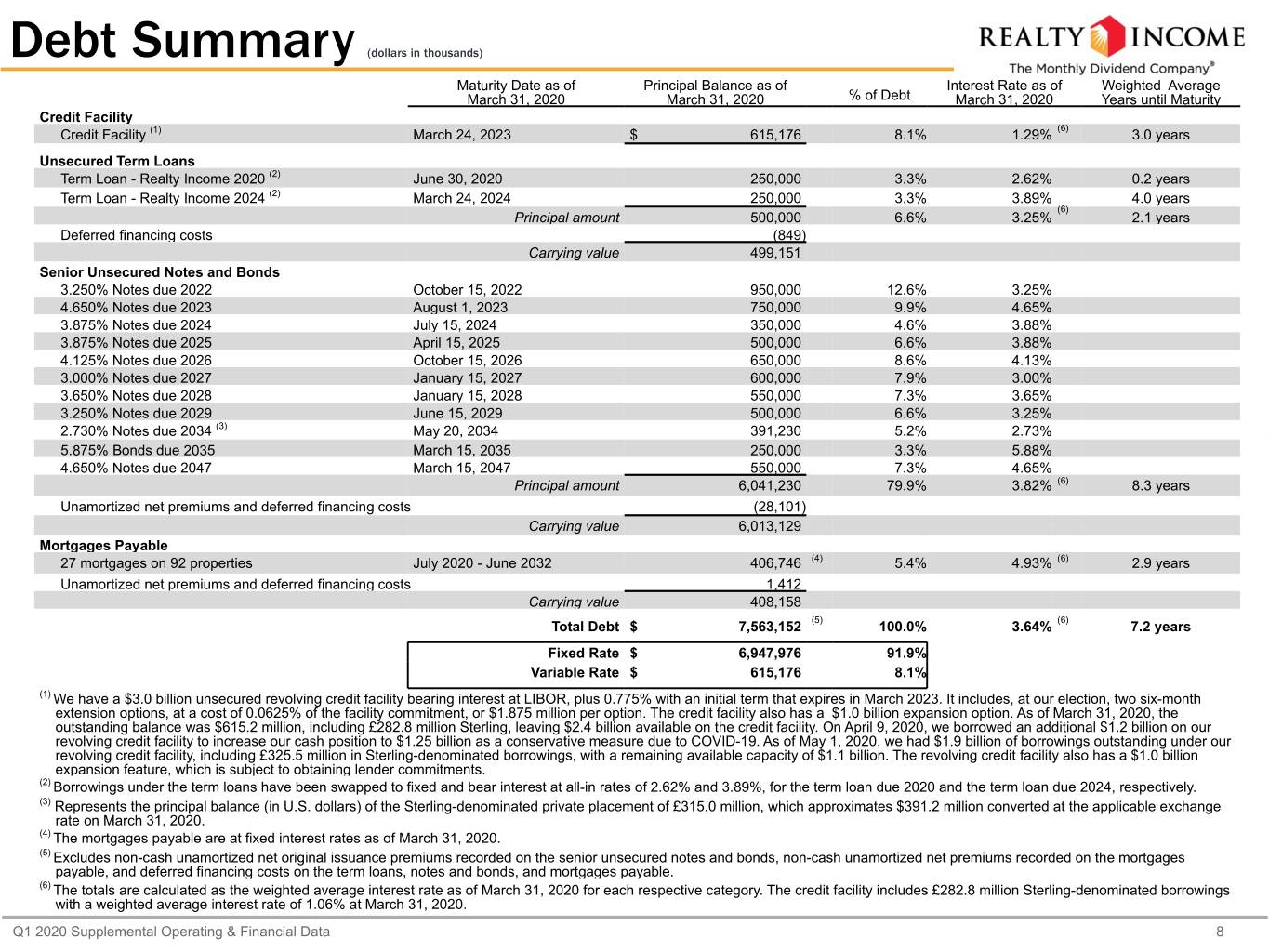

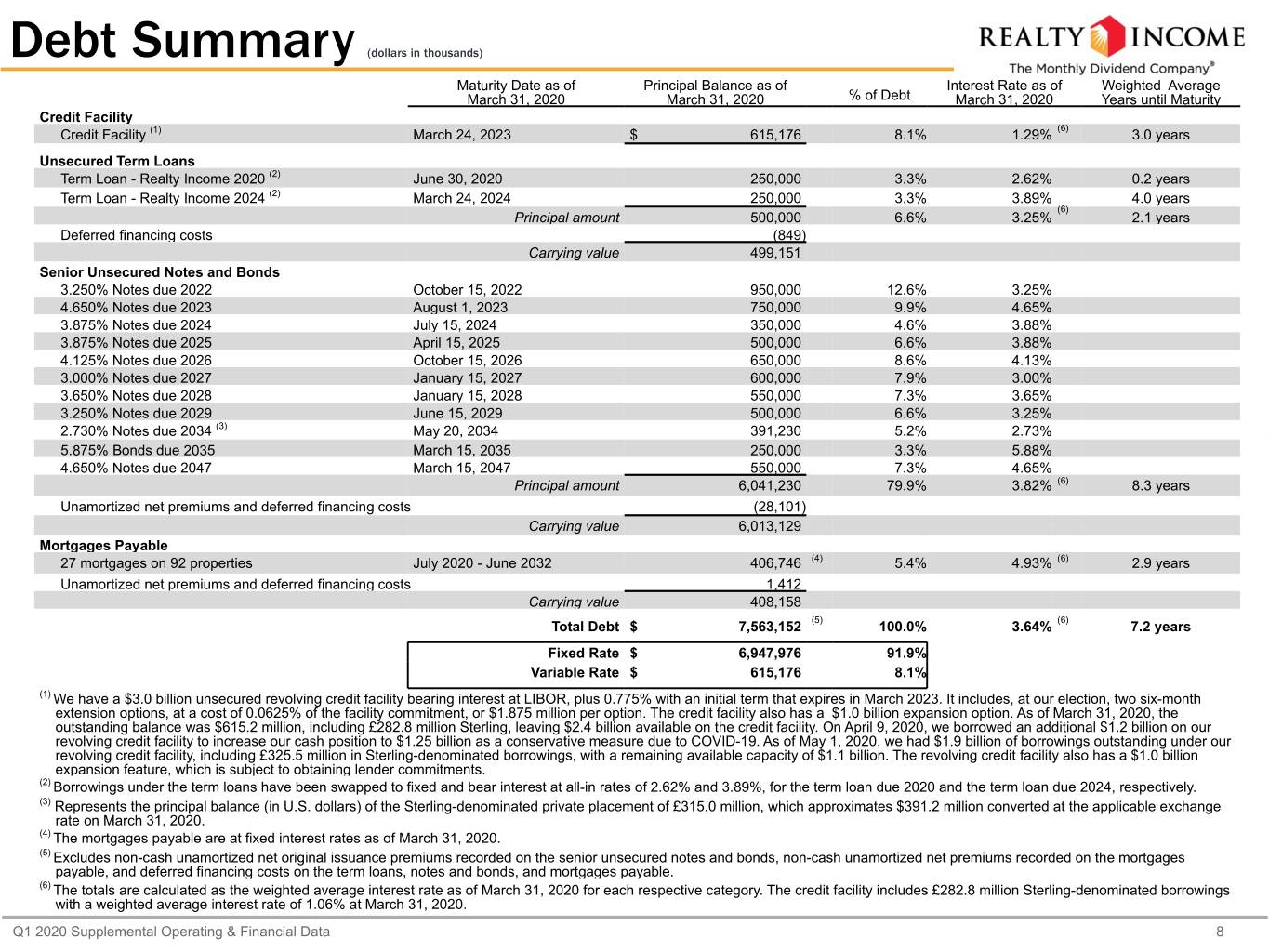

Debt Summary (dollars in thousands) Maturity Date as of Principal Balance as of Interest Rate as of Weighted Average March 31, 2020 March 31, 2020 % of Debt March 31, 2020 Years until Maturity Credit Facility Credit Facility (1) March 24, 2023 $ 615,176 8.1% 1.29% (6) 3.0 years Unsecured Term Loans Term Loan - Realty Income 2020 (2) June 30, 2020 250,000 3.3% 2.62% 0.2 years Term Loan - Realty Income 2024 (2) March 24, 2024 250,000 3.3% 3.89% 4.0 years (6) Principal amount 500,000 6.6% 3.25% 2.1 years Deferred financing costs (849) Carrying value 499,151 Senior Unsecured Notes and Bonds 3.250% Notes due 2022 October 15, 2022 950,000 12.6% 3.25% 4.650% Notes due 2023 August 1, 2023 750,000 9.9% 4.65% 3.875% Notes due 2024 July 15, 2024 350,000 4.6% 3.88% 3.875% Notes due 2025 April 15, 2025 500,000 6.6% 3.88% 4.125% Notes due 2026 October 15, 2026 650,000 8.6% 4.13% 3.000% Notes due 2027 January 15, 2027 600,000 7.9% 3.00% 3.650% Notes due 2028 January 15, 2028 550,000 7.3% 3.65% 3.250% Notes due 2029 June 15, 2029 500,000 6.6% 3.25% 2.730% Notes due 2034 (3) May 20, 2034 391,230 5.2% 2.73% 5.875% Bonds due 2035 March 15, 2035 250,000 3.3% 5.88% 4.650% Notes due 2047 March 15, 2047 550,000 7.3% 4.65% Principal amount 6,041,230 79.9% 3.82% (6) 8.3 years Unamortized net premiums and deferred financing costs (28,101) Carrying value 6,013,129 Mortgages Payable 27 mortgages on 92 properties July 2020 - June 2032 406,746 (4) 5.4% 4.93% (6) 2.9 years Unamortized net premiums and deferred financing costs 1,412 Carrying value 408,158 Total Debt $ 7,563,152 (5) 100.0% 3.64% (6) 7.2 years Fixed Rate $ 6,947,976 91.9% Variable Rate $ 615,176 8.1% (1) We have a $3.0 billion unsecured revolving credit facility bearing interest at LIBOR, plus 0.775% with an initial term that expires in March 2023. It includes, at our election, two six-month extension options, at a cost of 0.0625% of the facility commitment, or $1.875 million per option. The credit facility also has a $1.0 billion expansion option. As of March 31, 2020, the outstanding balance was $615.2 million, including £282.8 million Sterling, leaving $2.4 billion available on the credit facility. On April 9, 2020, we borrowed an additional $1.2 billion on our revolving credit facility to increase our cash position to $1.25 billion as a conservative measure due to COVID-19. As of May 1, 2020, we had $1.9 billion of borrowings outstanding under our revolving credit facility, including £325.5 million in Sterling-denominated borrowings, with a remaining available capacity of $1.1 billion. The revolving credit facility also has a $1.0 billion expansion feature, which is subject to obtaining lender commitments. (2) Borrowings under the term loans have been swapped to fixed and bear interest at all-in rates of 2.62% and 3.89%, for the term loan due 2020 and the term loan due 2024, respectively. (3) Represents the principal balance (in U.S. dollars) of the Sterling-denominated private placement of £315.0 million, which approximates $391.2 million converted at the applicable exchange rate on March 31, 2020. (4) The mortgages payable are at fixed interest rates as of March 31, 2020. (5) Excludes non-cash unamortized net original issuance premiums recorded on the senior unsecured notes and bonds, non-cash unamortized net premiums recorded on the mortgages payable, and deferred financing costs on the term loans, notes and bonds, and mortgages payable. (6) The totals are calculated as the weighted average interest rate as of March 31, 2020 for each respective category. The credit facility includes £282.8 million Sterling-denominated borrowings with a weighted average interest rate of 1.06% at March 31, 2020. Q1 2020 Supplemental Operating & Financial Data 8

Debt Maturities as of March 31, 2020 (dollars in millions) Debt Maturities Year of Credit Term Mortgages Senior Unsecured Weighted Average Maturity Facility Loans Payable Notes and Bonds Total Interest Rate(1) 2020 $ — $ 250.0 $ 82.6 $ — $ 332.6 3.20% 2021 — — 68.8 — 68.8 5.61% 2022 — — 111.8 950.0 1,061.8 3.43% 2023 615.2 — 20.6 750.0 1,385.8 4.64% 2024 — 250.0 112.1 350.0 712.1 3.97% Thereafter — — 10.8 3,991.2 4,002.0 3.80% Totals $ 615.2 $ 500.0 $ 406.7 $ 6,041.2 $ 7,563.1 (1) Weighted average interest rate for 2023 excludes the credit facility. On April 9, 2020, we borrowed an additional $1.2 billion on our revolving credit facility to increase our cash position to $1.25 billion as a conservative measure due to COVID-19. Mortgages Payable Maturities by Quarter Year of First Second Third Fourth Weighted Average Maturity Quarter Quarter Quarter Quarter Total Interest Rate 2020 $ — $ 1.7 $ 13.1 $ 67.8 $ 82.6 4.97% 2021 18.7 18.2 31.0 0.9 68.8 5.61% 2022 0.9 10.5 62.2 38.2 111.8 4.97% 2023 0.9 6.5 12.4 0.8 20.6 4.44% 2024 0.8 0.8 0.8 109.7 112.1 4.47% Thereafter — — — 10.8 10.8 5.64% Totals $ 21.3 $ 37.7 $ 119.5 $ 228.2 $ 406.7 Q1 2020 Supplemental Operating & Financial Data 9

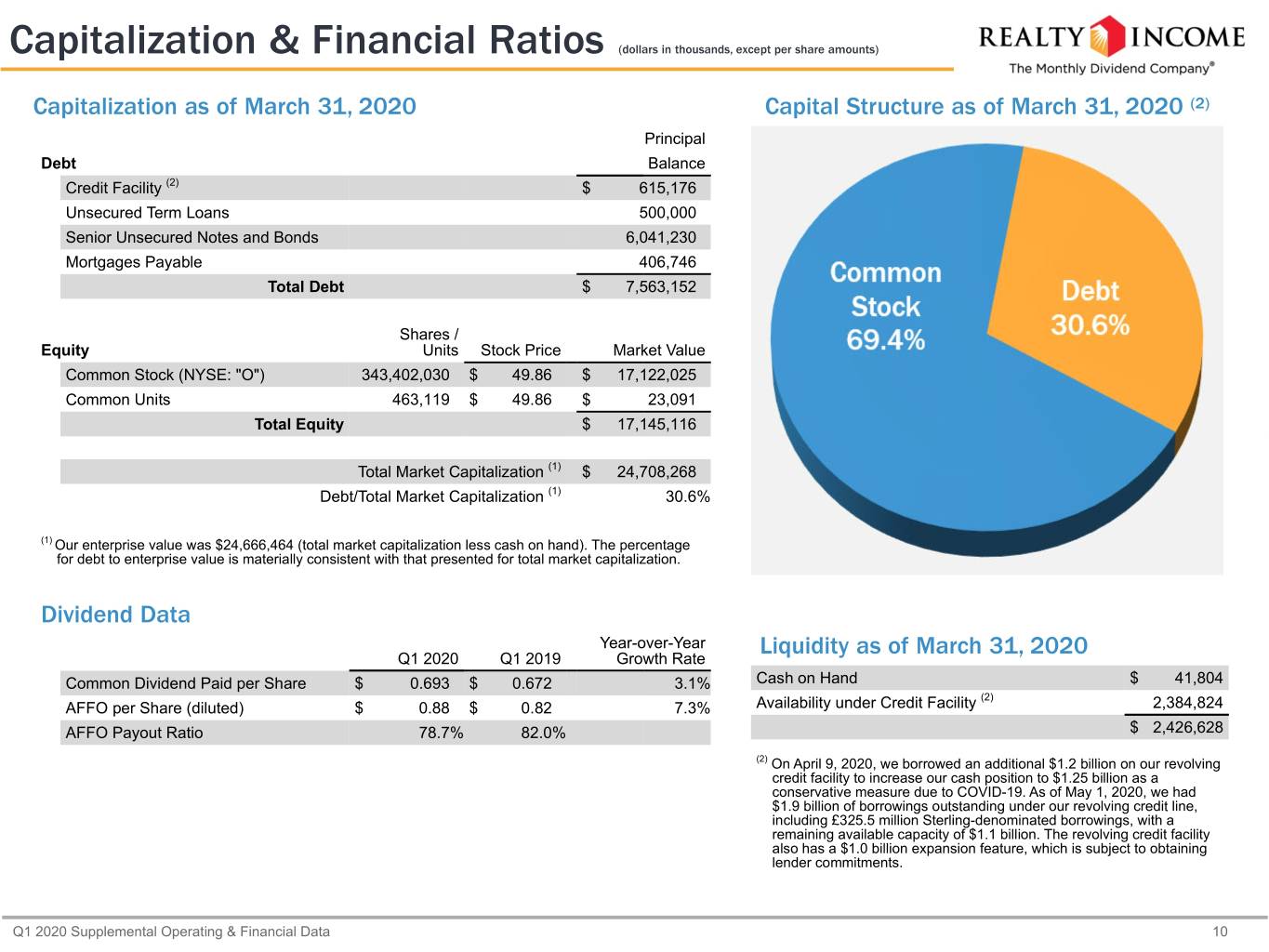

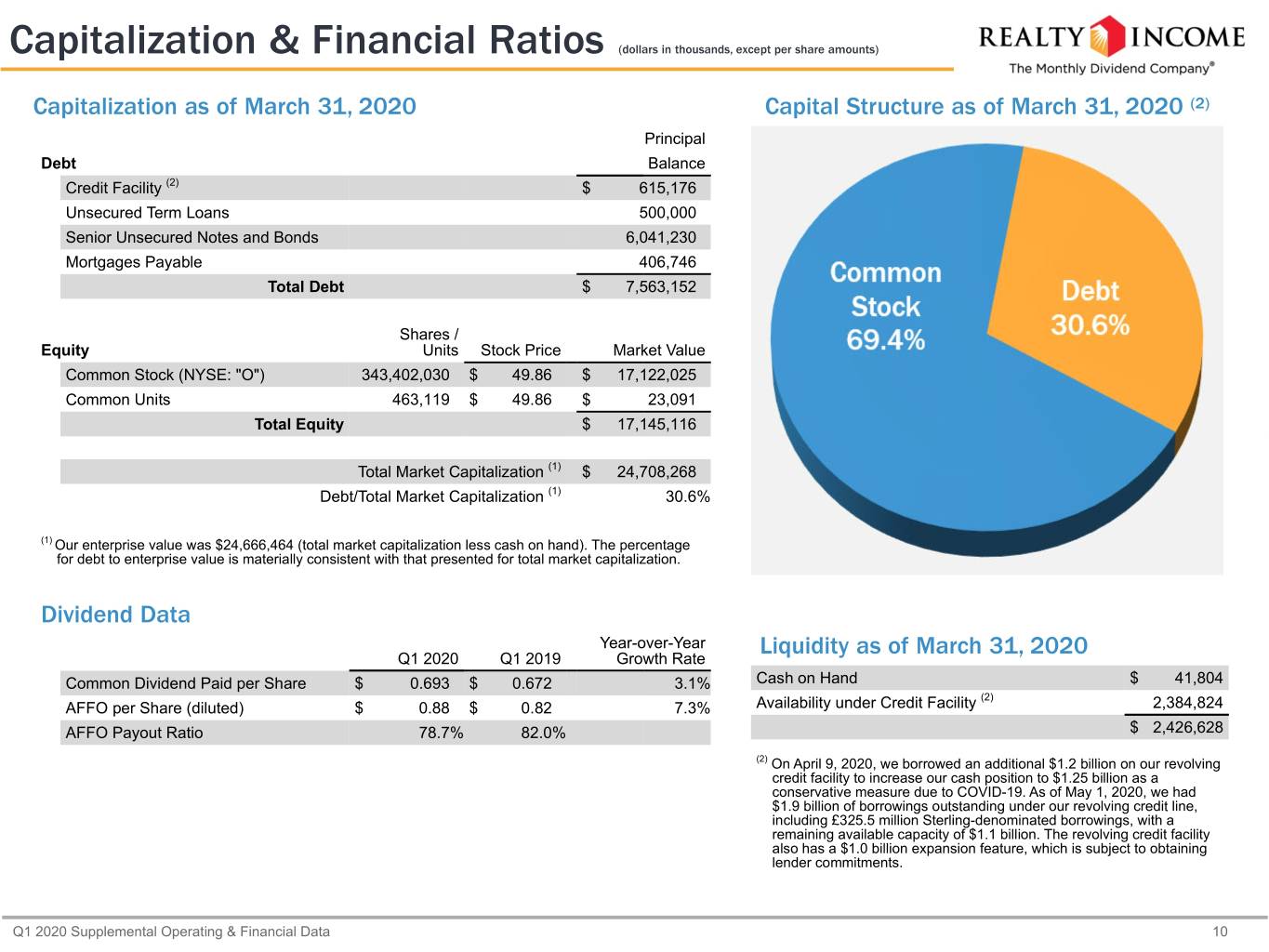

Capitalization & Financial Ratios (dollars in thousands, except per share amounts) Capitalization as of March 31, 2020 Capital Structure as of March 31, 2020 (2) Principal Debt Balance Credit Facility (2) $ 615,176 Unsecured Term Loans 500,000 Senior Unsecured Notes and Bonds 6,041,230 Mortgages Payable 406,746 Total Debt $ 7,563,152 Shares / Equity Units Stock Price Market Value Common Stock (NYSE: "O") 343,402,030 $ 49.86 $ 17,122,025 Common Units 463,119 $ 49.86 $ 23,091 Total Equity $ 17,145,116 Total Market Capitalization (1) $ 24,708,268 Debt/Total Market Capitalization (1) 30.6% (1) Our enterprise value was $24,666,464 (total market capitalization less cash on hand). The percentage for debt to enterprise value is materially consistent with that presented for total market capitalization. Dividend Data Year-over-Year Liquidity as of March 31, 2020 Q1 2020 Q1 2019 Growth Rate Common Dividend Paid per Share $ 0.693 $ 0.672 3.1% Cash on Hand $ 41,804 (2) AFFO per Share (diluted) $ 0.88 $ 0.82 7.3% Availability under Credit Facility 2,384,824 AFFO Payout Ratio 78.7% 82.0% $ 2,426,628 (2) On April 9, 2020, we borrowed an additional $1.2 billion on our revolving credit facility to increase our cash position to $1.25 billion as a conservative measure due to COVID-19. As of May 1, 2020, we had $1.9 billion of borrowings outstanding under our revolving credit line, including £325.5 million Sterling-denominated borrowings, with a remaining available capacity of $1.1 billion. The revolving credit facility also has a $1.0 billion expansion feature, which is subject to obtaining lender commitments. Q1 2020 Supplemental Operating & Financial Data 10

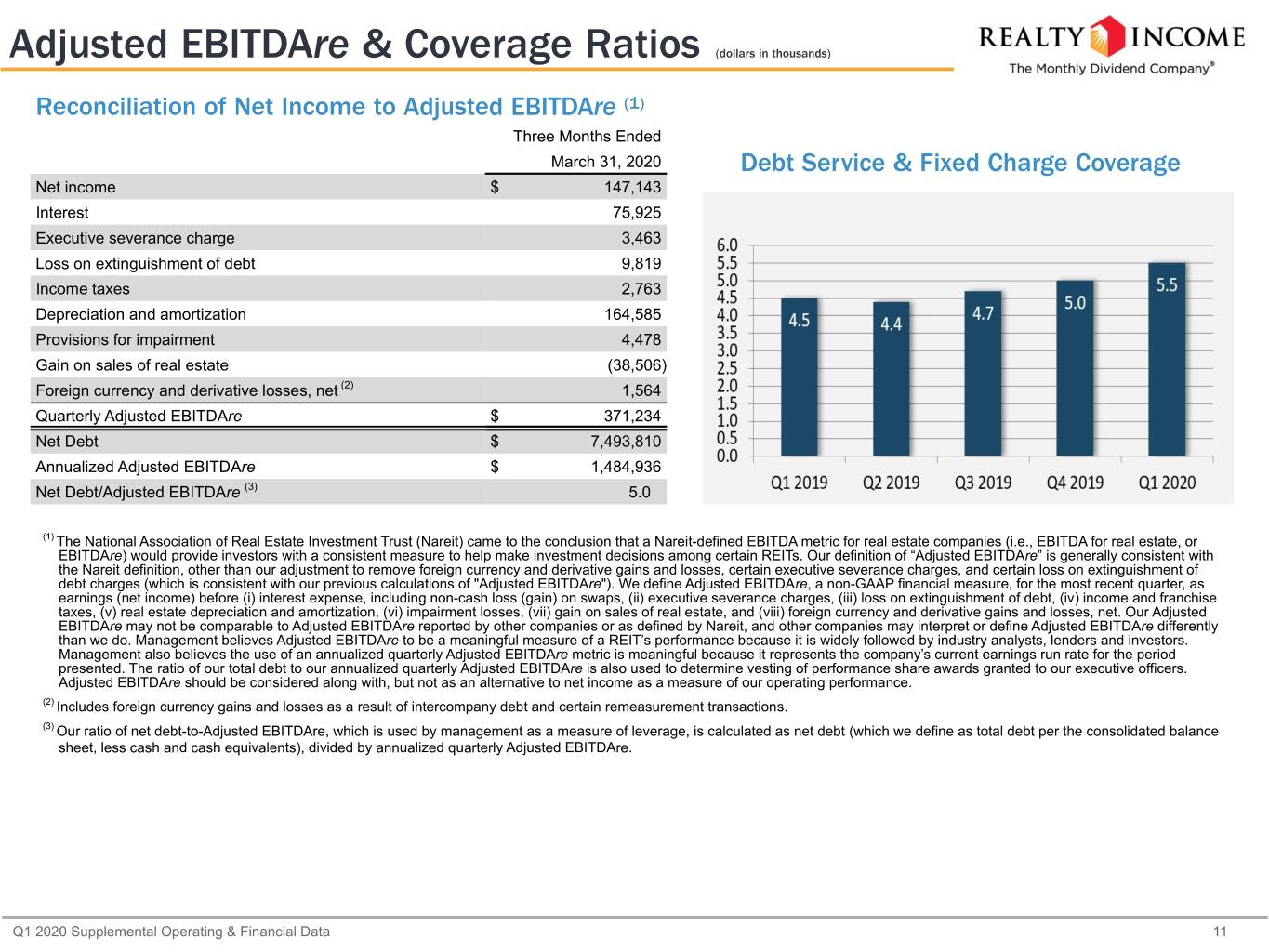

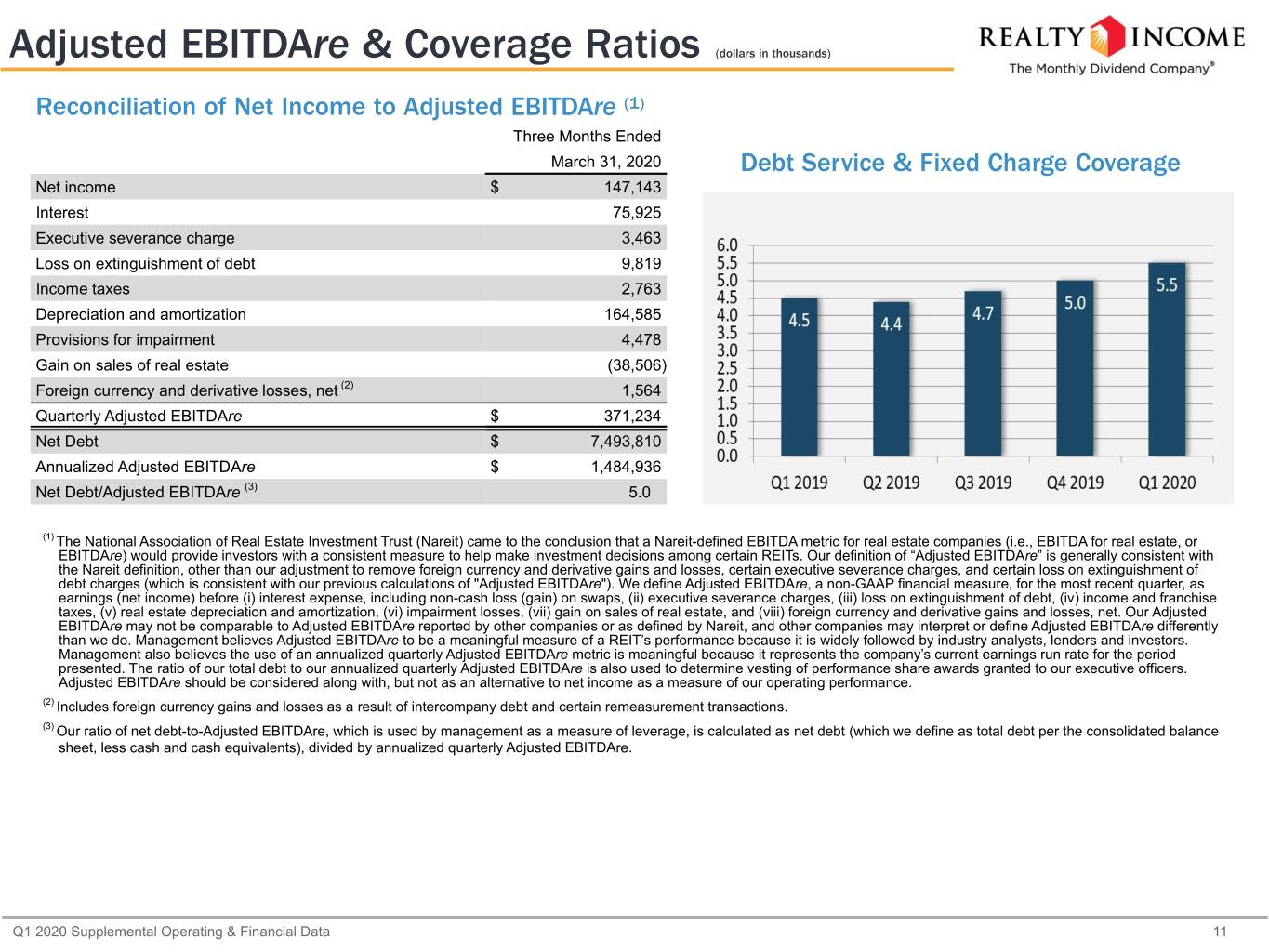

Adjusted EBITDAre & Coverage Ratios (dollars in thousands) Reconciliation of Net Income to Adjusted EBITDAre (1) Three Months Ended March 31, 2020 Debt Service & Fixed Charge Coverage Net income $ 147,143 Interest 75,925 Executive severance charge 3,463 Loss on extinguishment of debt 9,819 Income taxes 2,763 Depreciation and amortization 164,585 Provisions for impairment 4,478 Gain on sales of real estate (38,506) Foreign currency and derivative losses, net (2) 1,564 Quarterly Adjusted EBITDAre $ 371,234 Net Debt $ 7,493,810 Annualized Adjusted EBITDAre $ 1,484,936 Net Debt/Adjusted EBITDAre (3) 5.0 (1) The National Association of Real Estate Investment Trust (Nareit) came to the conclusion that a Nareit-defined EBITDA metric for real estate companies (i.e., EBITDA for real estate, or EBITDAre) would provide investors with a consistent measure to help make investment decisions among certain REITs. Our definition of “Adjusted EBITDAre” is generally consistent with the Nareit definition, other than our adjustment to remove foreign currency and derivative gains and losses, certain executive severance charges, and certain loss on extinguishment of debt charges (which is consistent with our previous calculations of "Adjusted EBITDAre"). We define Adjusted EBITDAre, a non-GAAP financial measure, for the most recent quarter, as earnings (net income) before (i) interest expense, including non-cash loss (gain) on swaps, (ii) executive severance charges, (iii) loss on extinguishment of debt, (iv) income and franchise taxes, (v) real estate depreciation and amortization, (vi) impairment losses, (vii) gain on sales of real estate, and (viii) foreign currency and derivative gains and losses, net. Our Adjusted EBITDAre may not be comparable to Adjusted EBITDAre reported by other companies or as defined by Nareit, and other companies may interpret or define Adjusted EBITDAre differently than we do. Management believes Adjusted EBITDAre to be a meaningful measure of a REIT’s performance because it is widely followed by industry analysts, lenders and investors. Management also believes the use of an annualized quarterly Adjusted EBITDAre metric is meaningful because it represents the company’s current earnings run rate for the period presented. The ratio of our total debt to our annualized quarterly Adjusted EBITDAre is also used to determine vesting of performance share awards granted to our executive officers. Adjusted EBITDAre should be considered along with, but not as an alternative to net income as a measure of our operating performance. (2) Includes foreign currency gains and losses as a result of intercompany debt and certain remeasurement transactions. (3) Our ratio of net debt-to-Adjusted EBITDAre, which is used by management as a measure of leverage, is calculated as net debt (which we define as total debt per the consolidated balance sheet, less cash and cash equivalents), divided by annualized quarterly Adjusted EBITDAre. Q1 2020 Supplemental Operating & Financial Data 11

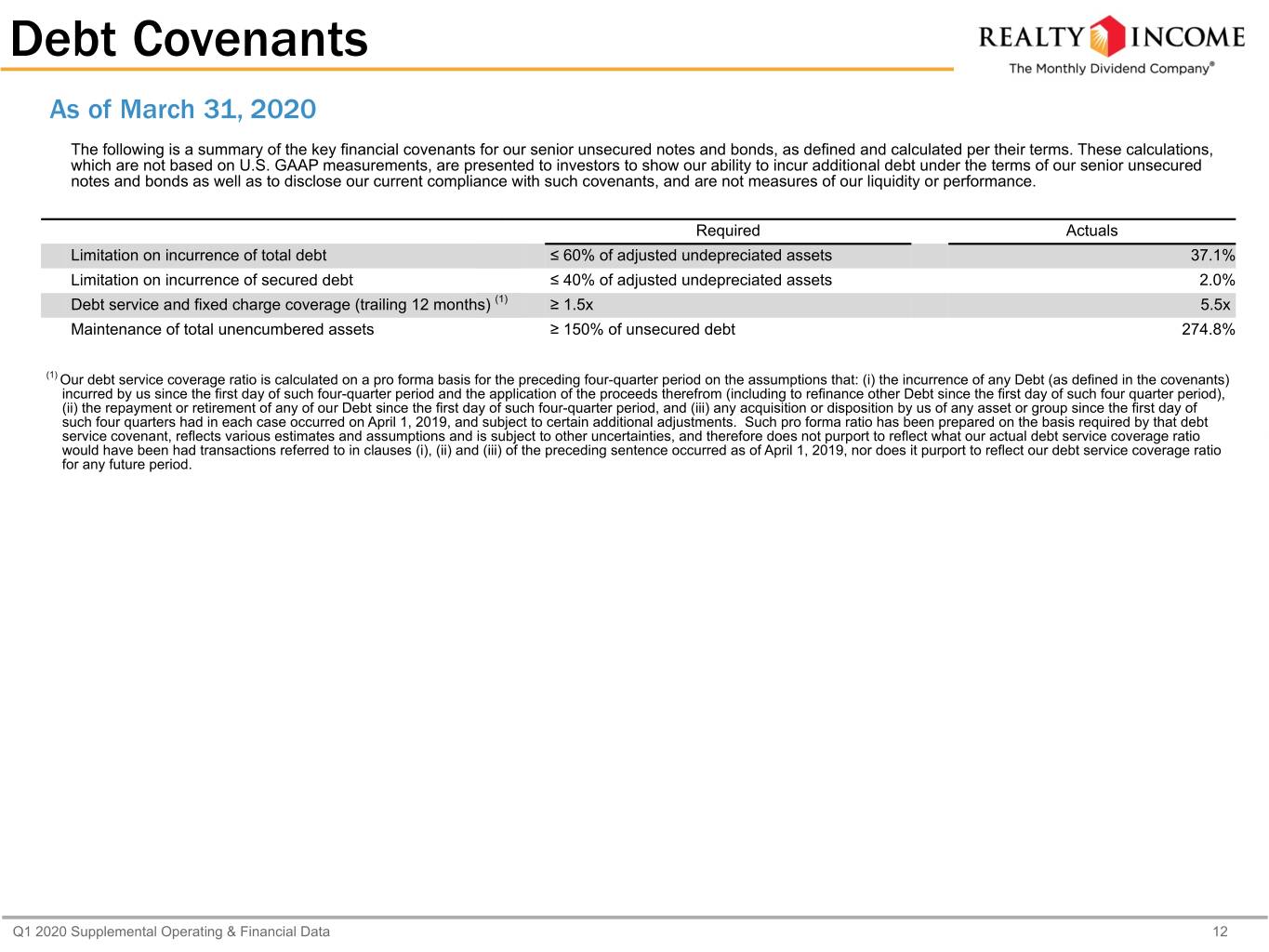

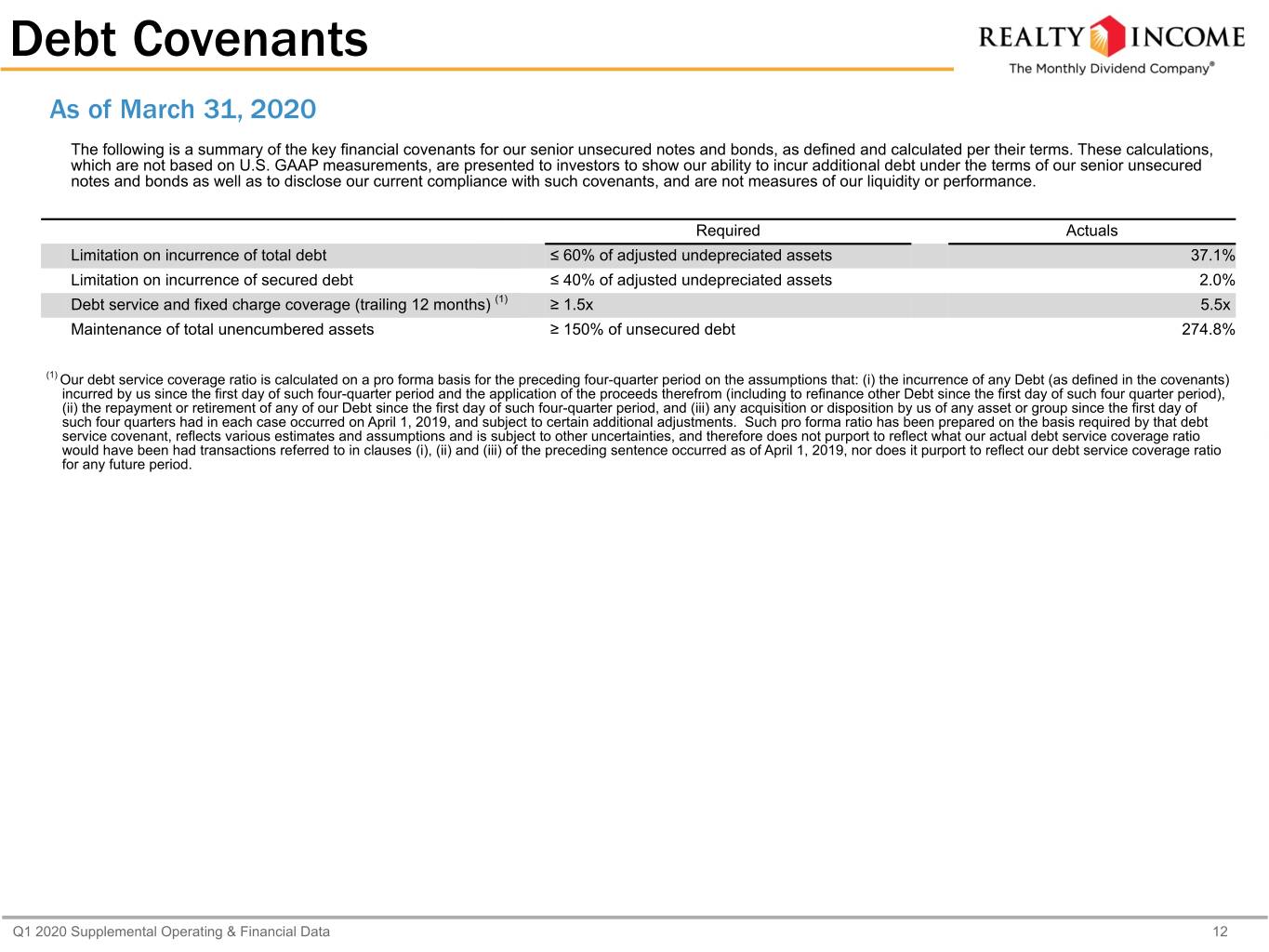

Debt Covenants As of March 31, 2020 The following is a summary of the key financial covenants for our senior unsecured notes and bonds, as defined and calculated per their terms. These calculations, which are not based on U.S. GAAP measurements, are presented to investors to show our ability to incur additional debt under the terms of our senior unsecured notes and bonds as well as to disclose our current compliance with such covenants, and are not measures of our liquidity or performance. Required Actuals Limitation on incurrence of total debt ≤ 60% of adjusted undepreciated assets 37.1% Limitation on incurrence of secured debt ≤ 40% of adjusted undepreciated assets 2.0% Debt service and fixed charge coverage (trailing 12 months) (1) ≥ 1.5x 5.5x Maintenance of total unencumbered assets ≥ 150% of unsecured debt 274.8% (1) Our debt service coverage ratio is calculated on a pro forma basis for the preceding four-quarter period on the assumptions that: (i) the incurrence of any Debt (as defined in the covenants) incurred by us since the first day of such four-quarter period and the application of the proceeds therefrom (including to refinance other Debt since the first day of such four quarter period), (ii) the repayment or retirement of any of our Debt since the first day of such four-quarter period, and (iii) any acquisition or disposition by us of any asset or group since the first day of such four quarters had in each case occurred on April 1, 2019, and subject to certain additional adjustments. Such pro forma ratio has been prepared on the basis required by that debt service covenant, reflects various estimates and assumptions and is subject to other uncertainties, and therefore does not purport to reflect what our actual debt service coverage ratio would have been had transactions referred to in clauses (i), (ii) and (iii) of the preceding sentence occurred as of April 1, 2019, nor does it purport to reflect our debt service coverage ratio for any future period. Q1 2020 Supplemental Operating & Financial Data 12

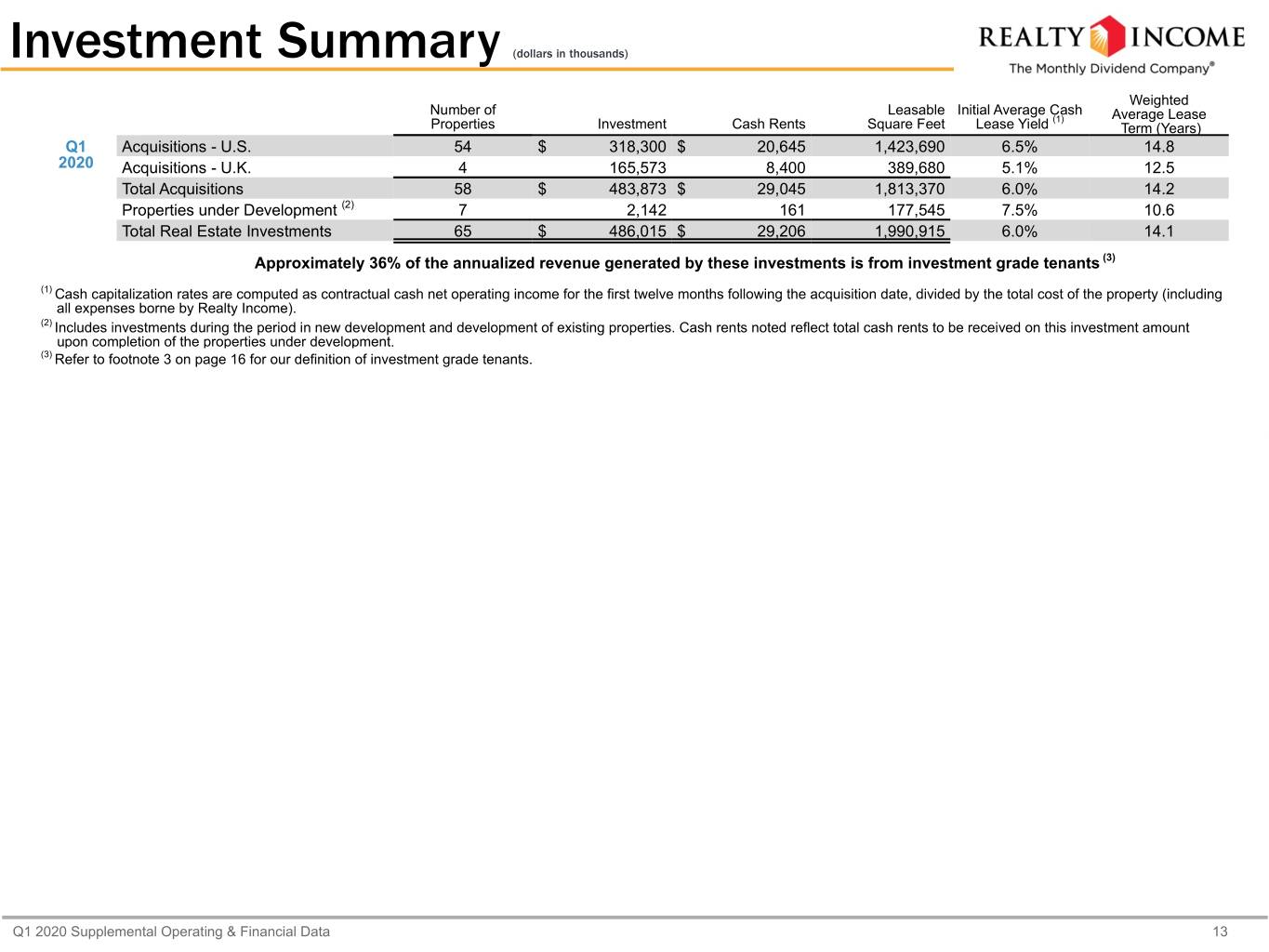

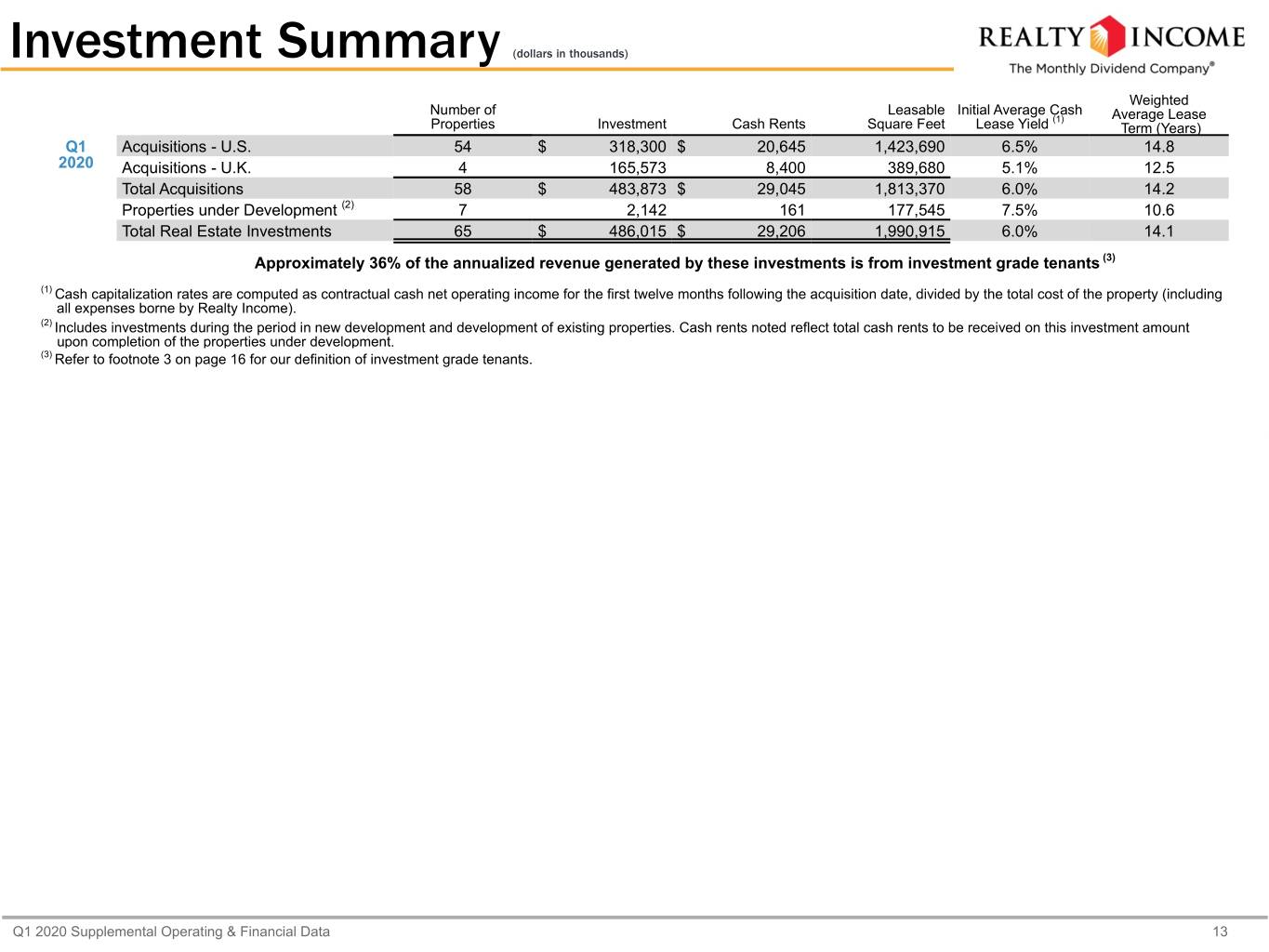

Investment Summary (dollars in thousands) Weighted Number of Leasable Initial Average Cash (1) Average Lease Properties Investment Cash Rents Square Feet Lease Yield Term (Years) Q1 Acquisitions - U.S. 54 $ 318,300 $ 20,645 1,423,690 6.5% 14.8 2020 Acquisitions - U.K. 4 165,573 8,400 389,680 5.1% 12.5 Total Acquisitions 58 $ 483,873 $ 29,045 1,813,370 6.0% 14.2 Properties under Development (2) 7 2,142 161 177,545 7.5% 10.6 Total Real Estate Investments 65 $ 486,015 $ 29,206 1,990,915 6.0% 14.1 Approximately 36% of the annualized revenue generated by these investments is from investment grade tenants (3) (1) Cash capitalization rates are computed as contractual cash net operating income for the first twelve months following the acquisition date, divided by the total cost of the property (including all expenses borne by Realty Income). (2) Includes investments during the period in new development and development of existing properties. Cash rents noted reflect total cash rents to be received on this investment amount upon completion of the properties under development. (3) Refer to footnote 3 on page 16 for our definition of investment grade tenants. Q1 2020 Supplemental Operating & Financial Data 13

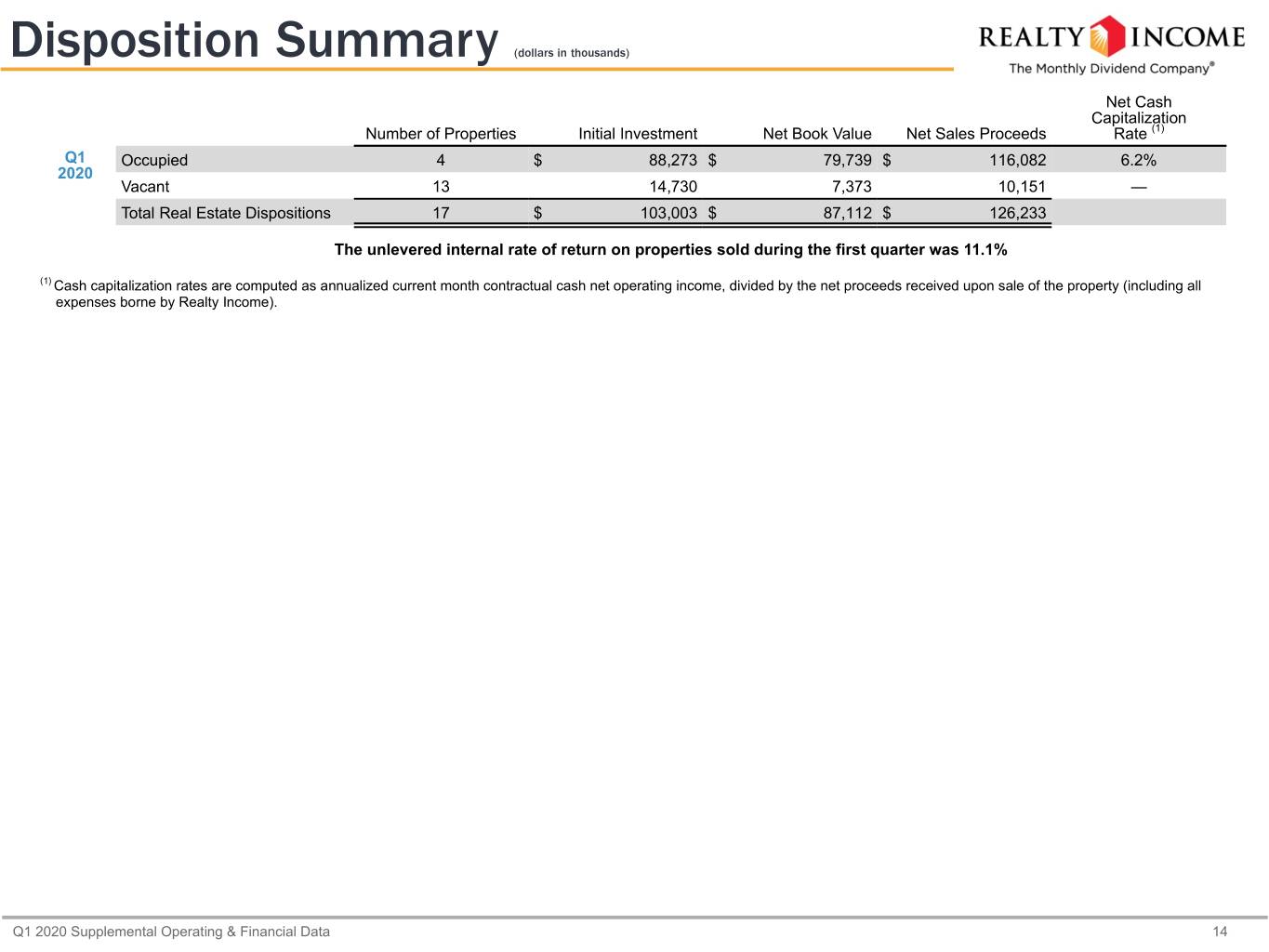

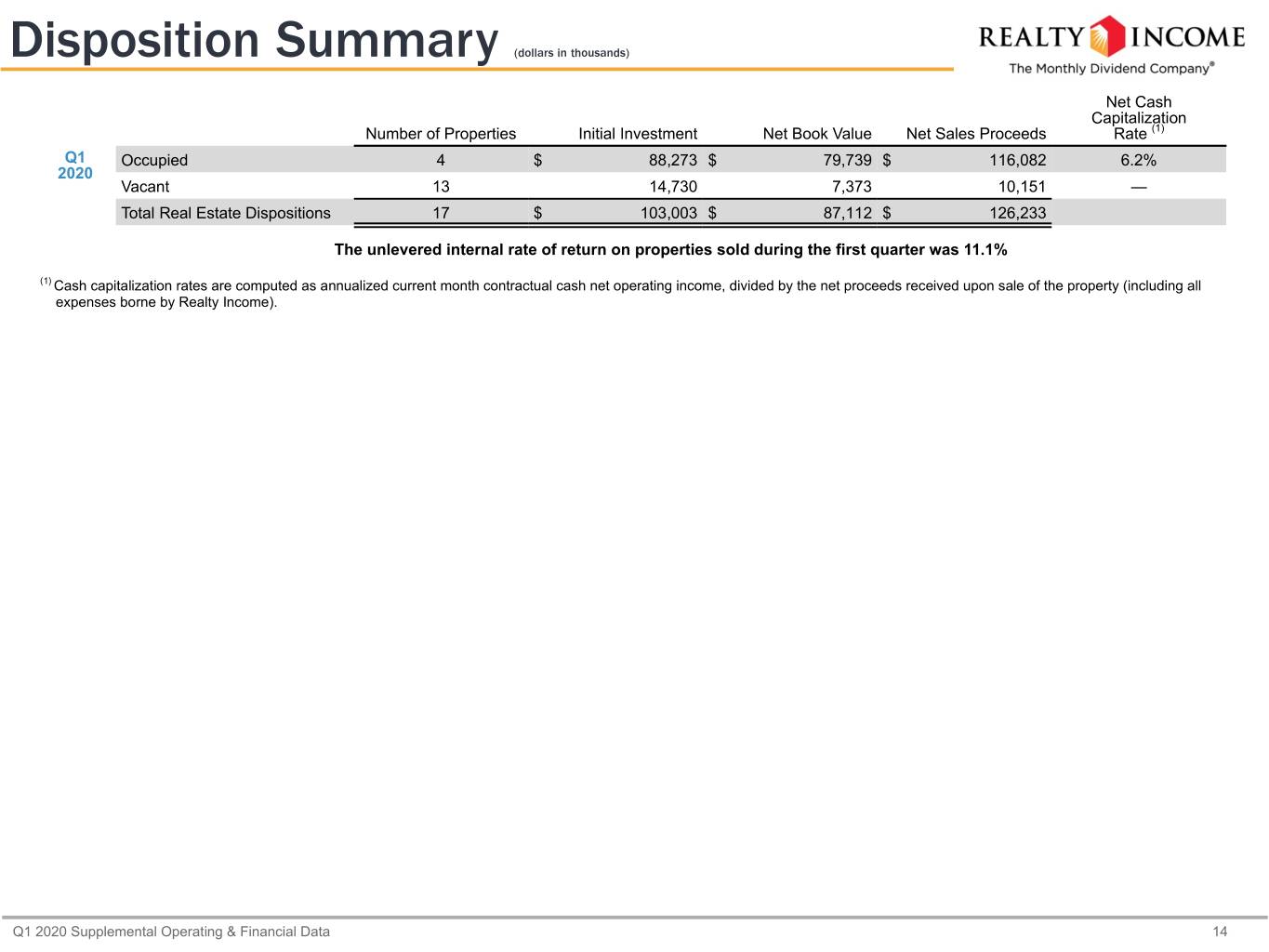

Disposition Summary (dollars in thousands) Net Cash Capitalization Number of Properties Initial Investment Net Book Value Net Sales Proceeds Rate (1) Q1 Occupied 4 $ 88,273 $ 79,739 $ 116,082 6.2% 2020 Vacant 13 14,730 7,373 10,151 — Total Real Estate Dispositions 17 $ 103,003 $ 87,112 $ 126,233 The unlevered internal rate of return on properties sold during the first quarter was 11.1% (1) Cash capitalization rates are computed as annualized current month contractual cash net operating income, divided by the net proceeds received upon sale of the property (including all expenses borne by Realty Income). Q1 2020 Supplemental Operating & Financial Data 14

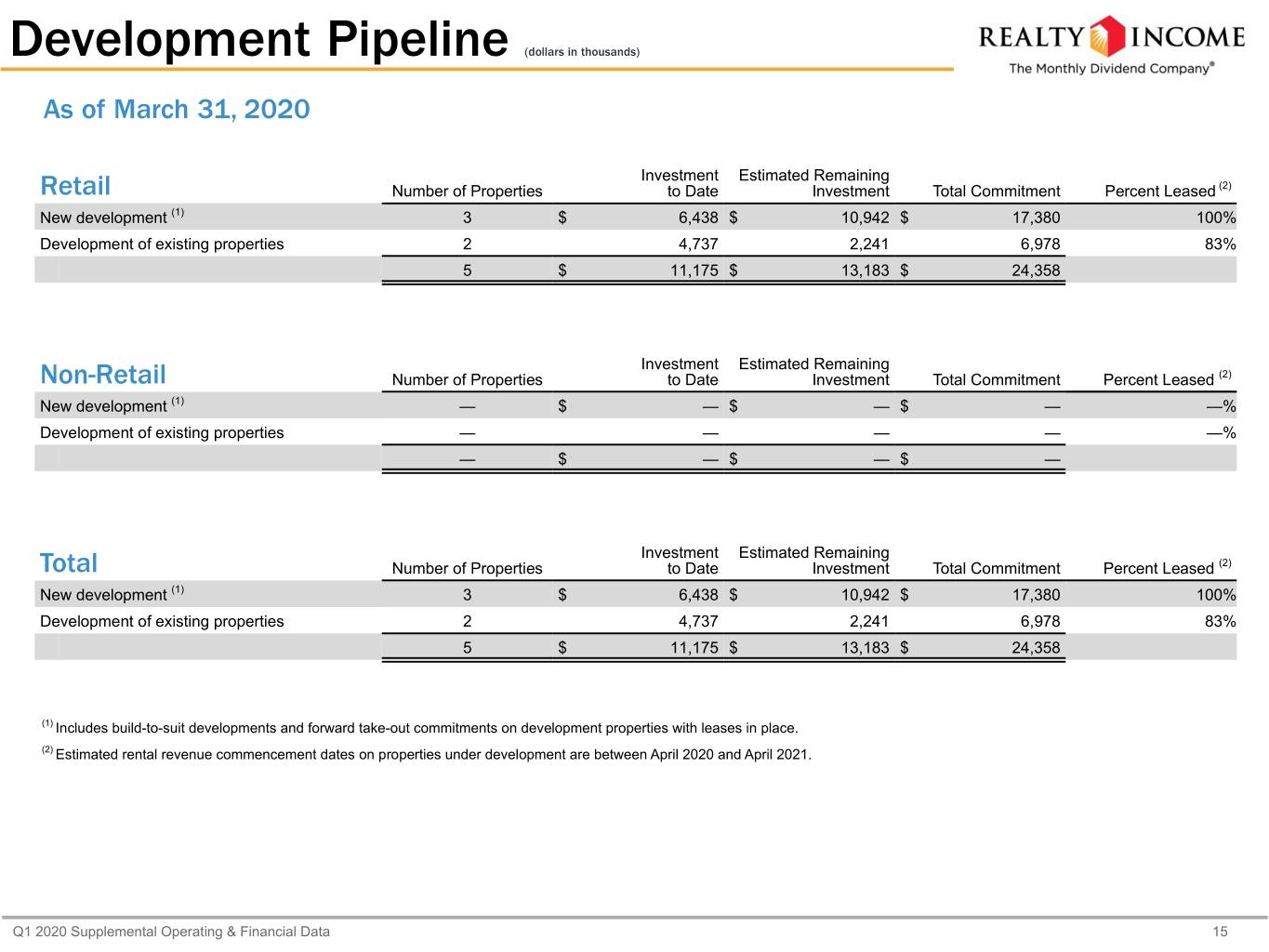

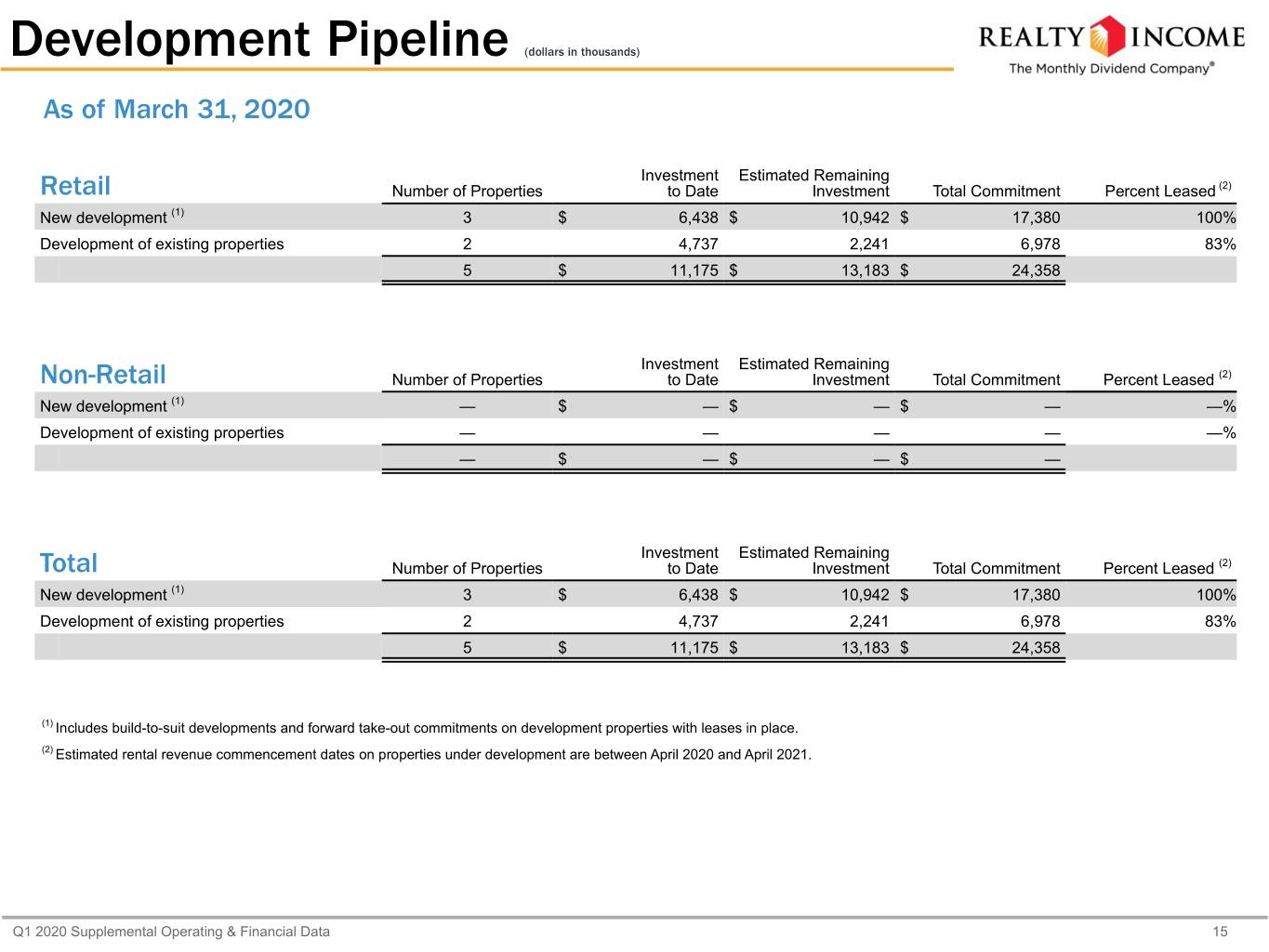

Development Pipeline (dollars in thousands) As of March 31, 2020 Investment Estimated Remaining Retail Number of Properties to Date Investment Total Commitment Percent Leased (2) New development (1) 3 $ 6,438 $ 10,942 $ 17,380 100% Development of existing properties 2 4,737 2,241 6,978 83% 5 $ 11,175 $ 13,183 $ 24,358 Investment Estimated Remaining Non-Retail Number of Properties to Date Investment Total Commitment Percent Leased (2) New development (1) — $ — $ — $ — —% Development of existing properties — — — — —% — $ — $ — $ — Investment Estimated Remaining Total Number of Properties to Date Investment Total Commitment Percent Leased (2) New development (1) 3 $ 6,438 $ 10,942 $ 17,380 100% Development of existing properties 2 4,737 2,241 6,978 83% 5 $ 11,175 $ 13,183 $ 24,358 (1) Includes build-to-suit developments and forward take-out commitments on development properties with leases in place. (2) Estimated rental revenue commencement dates on properties under development are between April 2020 and April 2021. Q1 2020 Supplemental Operating & Financial Data 15

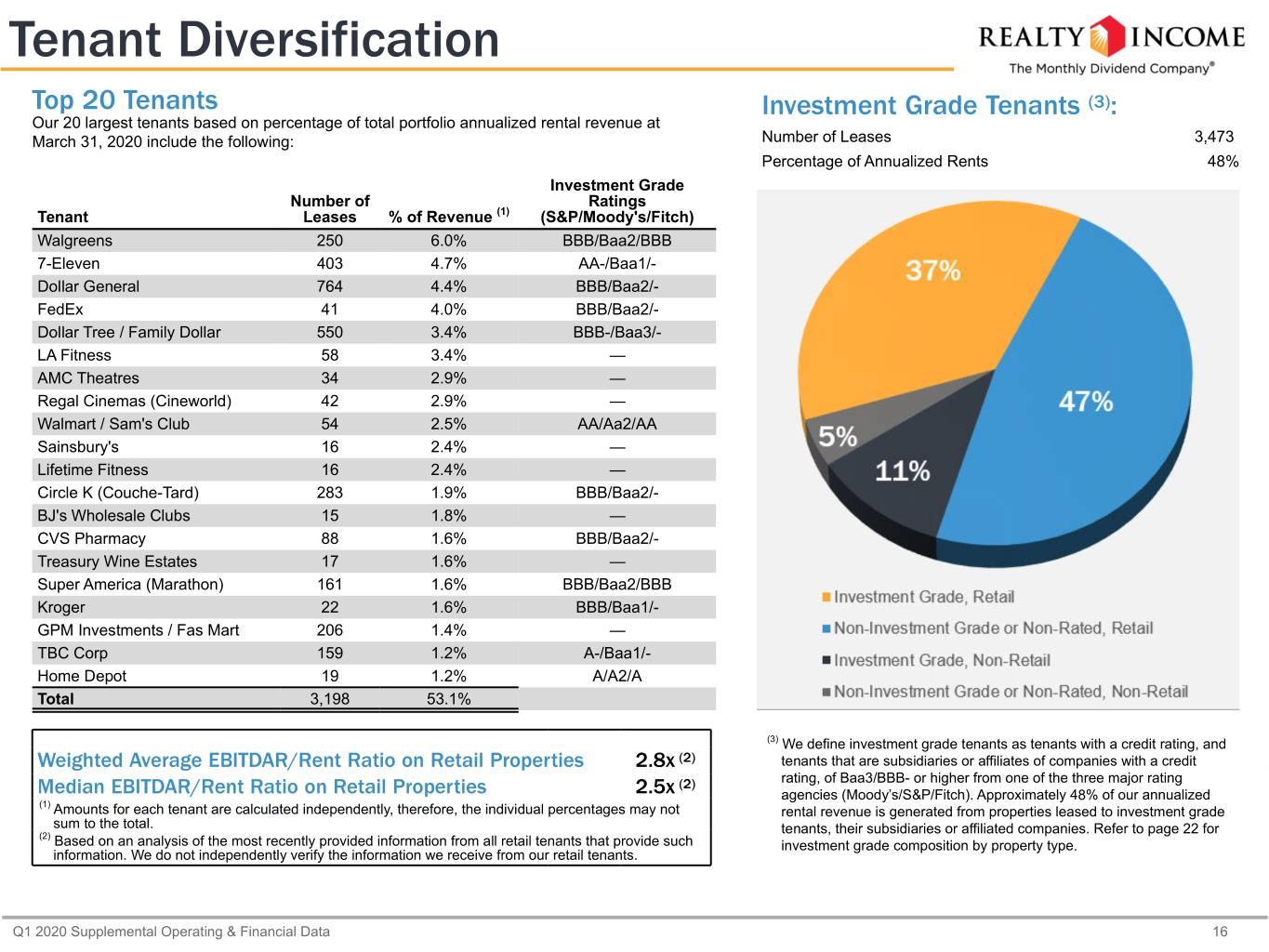

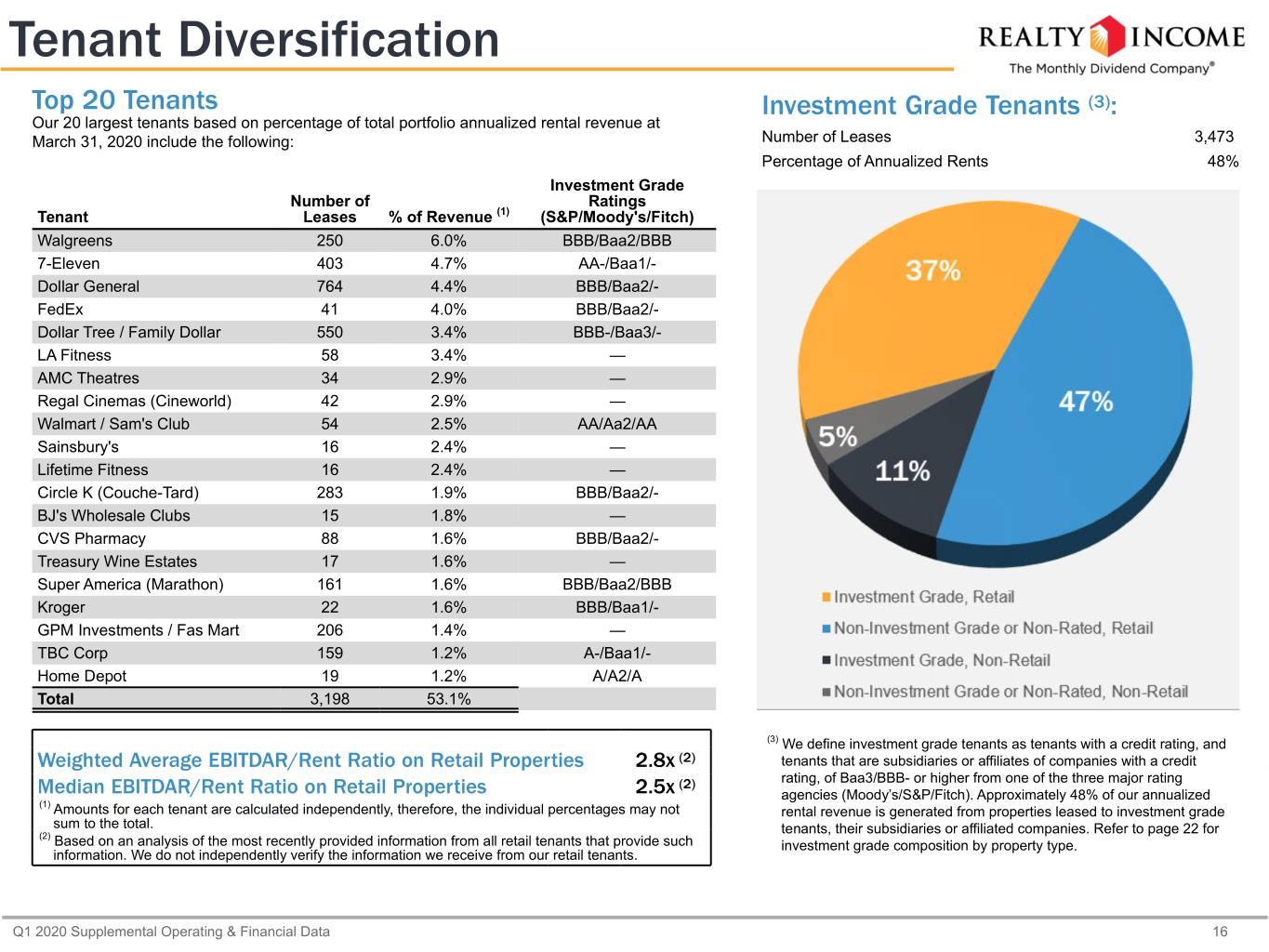

Tenant Diversification Top 20 Tenants Investment Grade Tenants (3): Our 20 largest tenants based on percentage of total portfolio annualized rental revenue at March 31, 2020 include the following: Number of Leases 3,473 Percentage of Annualized Rents 48% Investment Grade Number of Ratings Tenant Leases % of Revenue (1) (S&P/Moody's/Fitch) Walgreens 250 6.0% BBB/Baa2/BBB 7-Eleven 403 4.7% AA-/Baa1/- Dollar General 764 4.4% BBB/Baa2/- FedEx 41 4.0% BBB/Baa2/- Dollar Tree / Family Dollar 550 3.4% BBB-/Baa3/- LA Fitness 58 3.4% — AMC Theatres 34 2.9% — Regal Cinemas (Cineworld) 42 2.9% — Walmart / Sam's Club 54 2.5% AA/Aa2/AA Sainsbury's 16 2.4% — Lifetime Fitness 16 2.4% — Circle K (Couche-Tard) 283 1.9% BBB/Baa2/- BJ's Wholesale Clubs 15 1.8% — CVS Pharmacy 88 1.6% BBB/Baa2/- Treasury Wine Estates 17 1.6% — Super America (Marathon) 161 1.6% BBB/Baa2/BBB Kroger 22 1.6% BBB/Baa1/- GPM Investments / Fas Mart 206 1.4% — TBC Corp 159 1.2% A-/Baa1/- Home Depot 19 1.2% A/A2/A Total 3,198 53.1% (3) We define investment grade tenants as tenants with a credit rating, and Weighted Average EBITDAR/Rent Ratio on Retail Properties 2.8x (2) tenants that are subsidiaries or affiliates of companies with a credit (2) rating, of Baa3/BBB- or higher from one of the three major rating Median EBITDAR/Rent Ratio on Retail Properties 2.5x agencies (Moody’s/S&P/Fitch). Approximately 48% of our annualized (1) Amounts for each tenant are calculated independently, therefore, the individual percentages may not rental revenue is generated from properties leased to investment grade sum to the total. (2) tenants, their subsidiaries or affiliated companies. Refer to page 22 for Based on an analysis of the most recently provided information from all retail tenants that provide such investment grade composition by property type. information. We do not independently verify the information we receive from our retail tenants. Q1 2020 Supplemental Operating & Financial Data 16

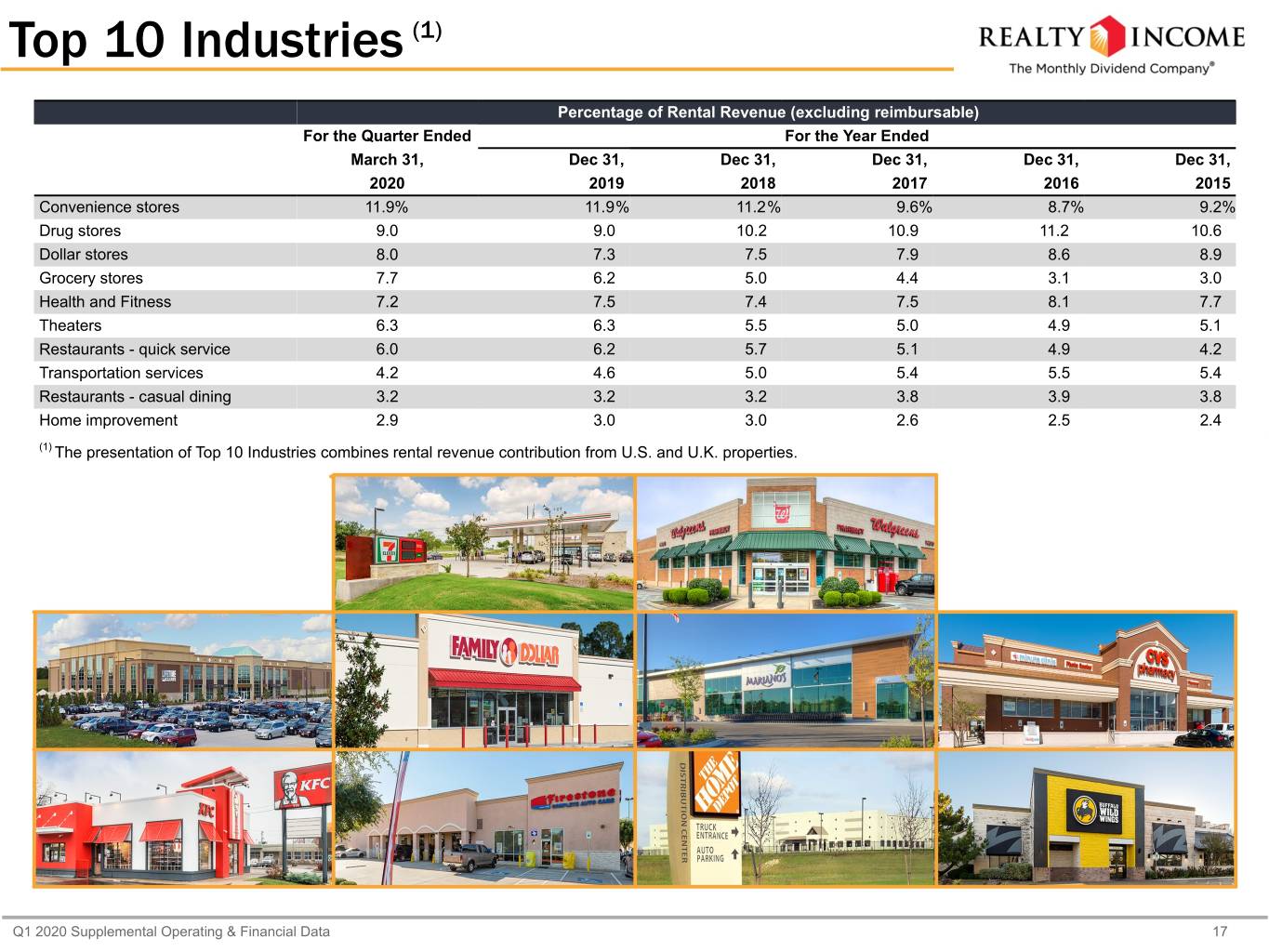

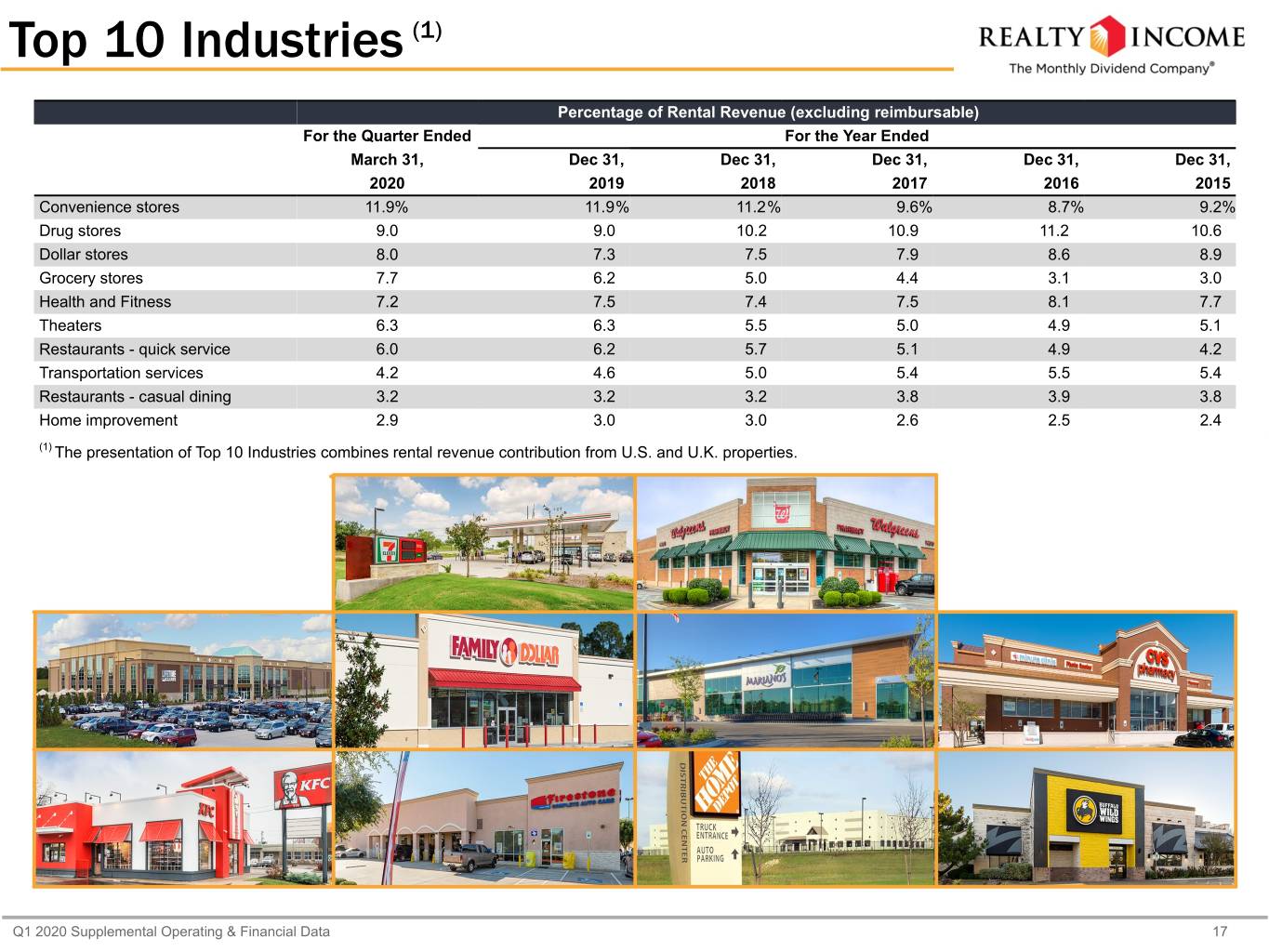

Top 10 Industries (1) Percentage of Rental Revenue (excluding reimbursable) For the Quarter Ended For the Year Ended March 31, Dec 31, Dec 31, Dec 31, Dec 31, Dec 31, 2020 2019 2018 2017 2016 2015 Convenience stores 11.9% 11.9% 11.2% 9.6% 8.7% 9.2% Drug stores 9.0 9.0 10.2 10.9 11.2 10.6 Dollar stores 8.0 7.3 7.5 7.9 8.6 8.9 Grocery stores 7.7 6.2 5.0 4.4 3.1 3.0 Health and Fitness 7.2 7.5 7.4 7.5 8.1 7.7 Theaters 6.3 6.3 5.5 5.0 4.9 5.1 Restaurants - quick service 6.0 6.2 5.7 5.1 4.9 4.2 Transportation services 4.2 4.6 5.0 5.4 5.5 5.4 Restaurants - casual dining 3.2 3.2 3.2 3.8 3.9 3.8 Home improvement 2.9 3.0 3.0 2.6 2.5 2.4 (1) The presentation of Top 10 Industries combines rental revenue contribution from U.S. and U.K. properties. Q1 2020 Supplemental Operating & Financial Data 17

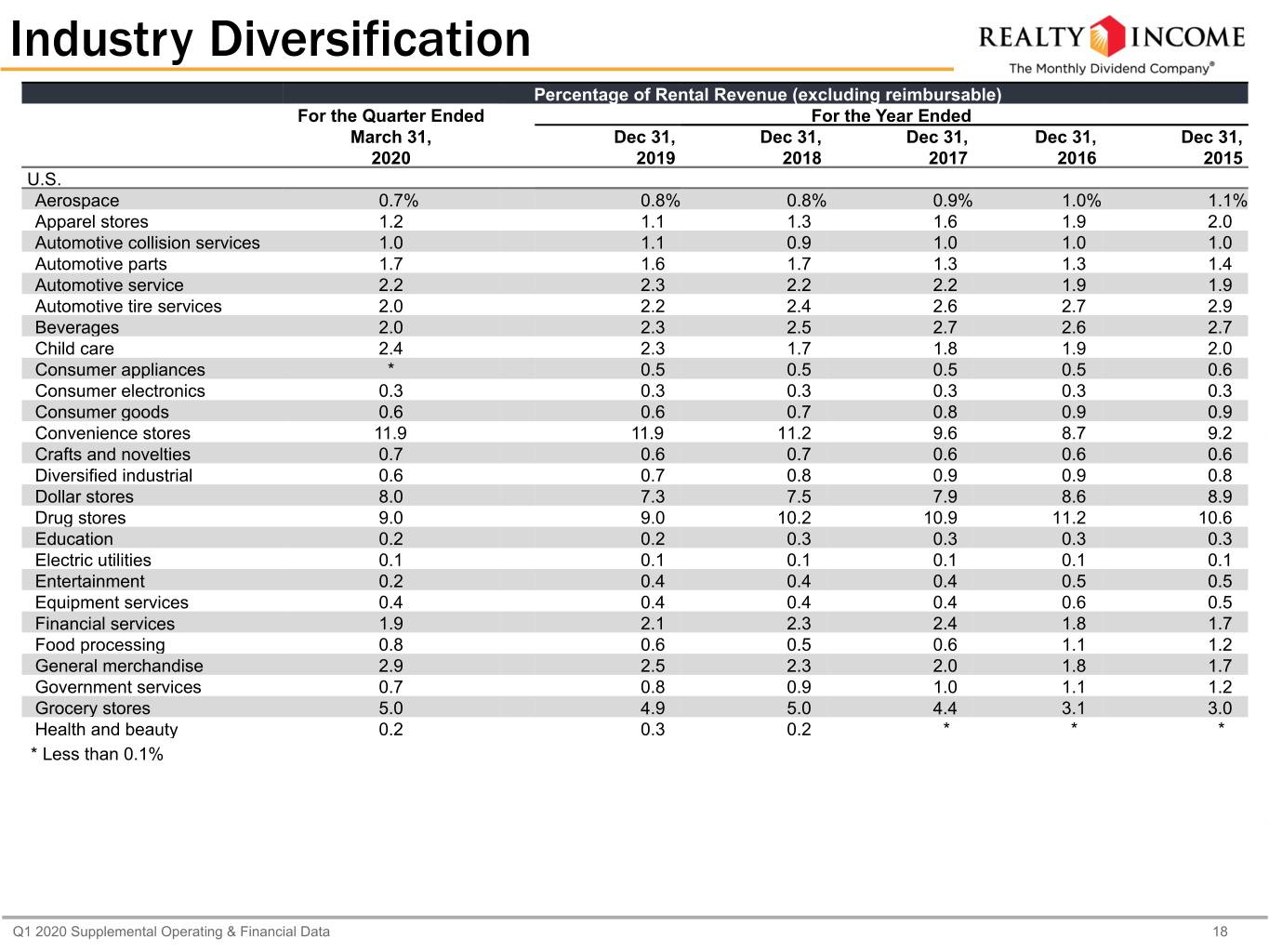

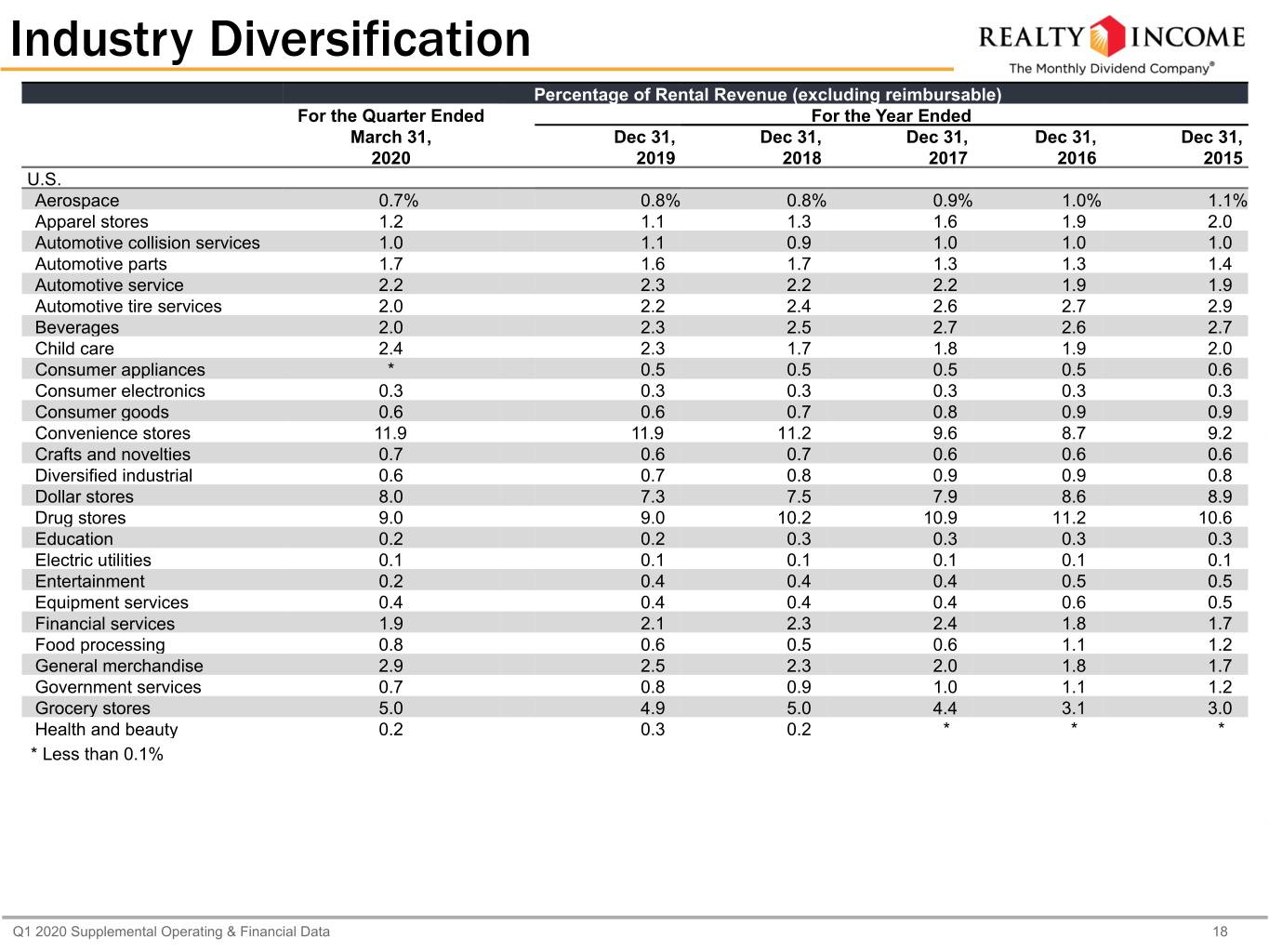

Industry Diversification Percentage of Rental Revenue (excluding reimbursable) For the Quarter Ended For the Year Ended March 31, Dec 31, Dec 31, Dec 31, Dec 31, Dec 31, 2020 2019 2018 2017 2016 2015 U.S. Aerospace 0.7% 0.8% 0.8% 0.9% 1.0% 1.1% Apparel stores 1.2 1.1 1.3 1.6 1.9 2.0 Automotive collision services 1.0 1.1 0.9 1.0 1.0 1.0 Automotive parts 1.7 1.6 1.7 1.3 1.3 1.4 Automotive service 2.2 2.3 2.2 2.2 1.9 1.9 Automotive tire services 2.0 2.2 2.4 2.6 2.7 2.9 Beverages 2.0 2.3 2.5 2.7 2.6 2.7 Child care 2.4 2.3 1.7 1.8 1.9 2.0 Consumer appliances * 0.5 0.5 0.5 0.5 0.6 Consumer electronics 0.3 0.3 0.3 0.3 0.3 0.3 Consumer goods 0.6 0.6 0.7 0.8 0.9 0.9 Convenience stores 11.9 11.9 11.2 9.6 8.7 9.2 Crafts and novelties 0.7 0.6 0.7 0.6 0.6 0.6 Diversified industrial 0.6 0.7 0.8 0.9 0.9 0.8 Dollar stores 8.0 7.3 7.5 7.9 8.6 8.9 Drug stores 9.0 9.0 10.2 10.9 11.2 10.6 Education 0.2 0.2 0.3 0.3 0.3 0.3 Electric utilities 0.1 0.1 0.1 0.1 0.1 0.1 Entertainment 0.2 0.4 0.4 0.4 0.5 0.5 Equipment services 0.4 0.4 0.4 0.4 0.6 0.5 Financial services 1.9 2.1 2.3 2.4 1.8 1.7 Food processing 0.8 0.6 0.5 0.6 1.1 1.2 General merchandise 2.9 2.5 2.3 2.0 1.8 1.7 Government services 0.7 0.8 0.9 1.0 1.1 1.2 Grocery stores 5.0 4.9 5.0 4.4 3.1 3.0 Health and beauty 0.2 0.3 0.2 * * * * Less than 0.1% Q1 2020 Supplemental Operating & Financial Data 18

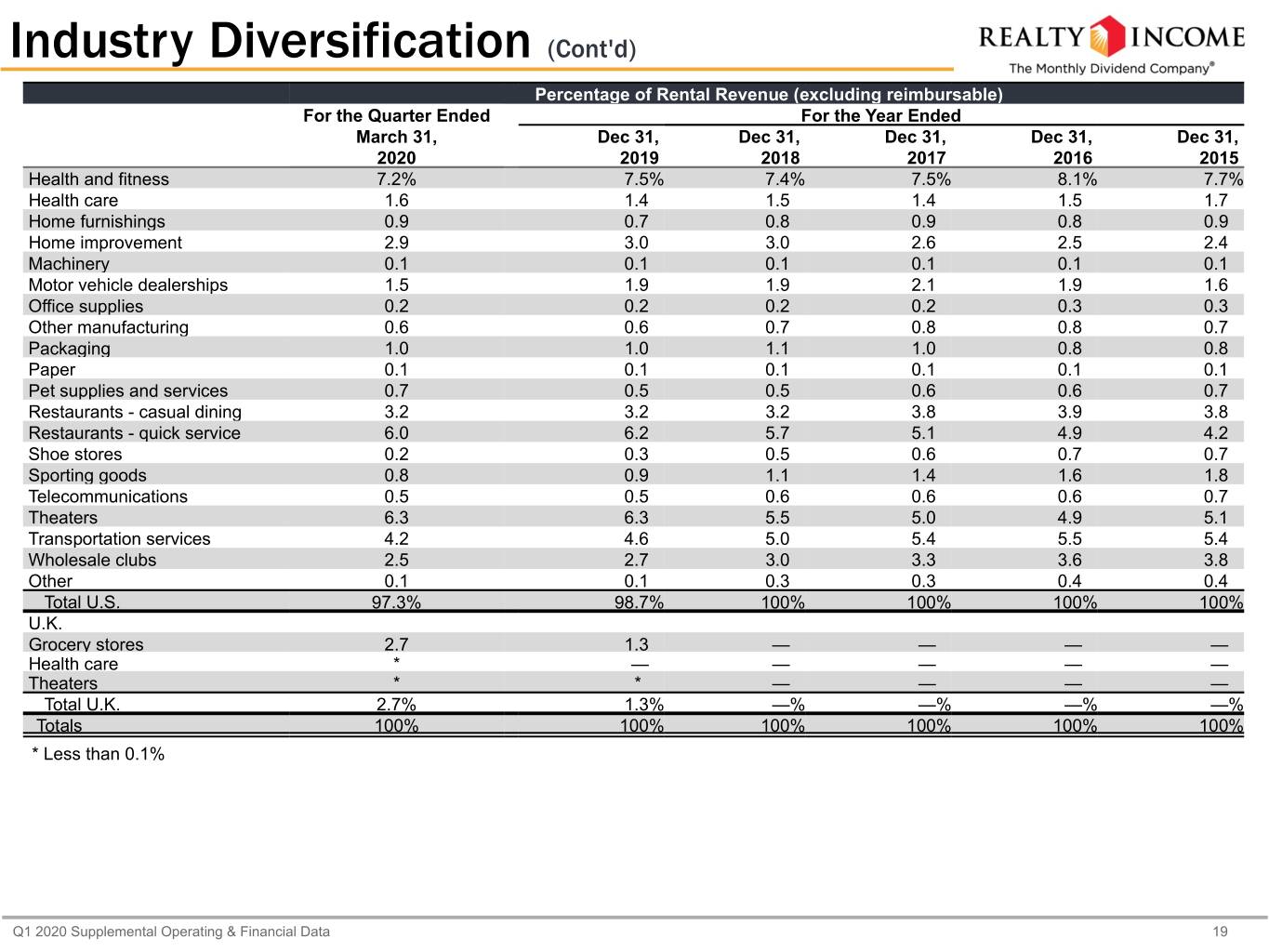

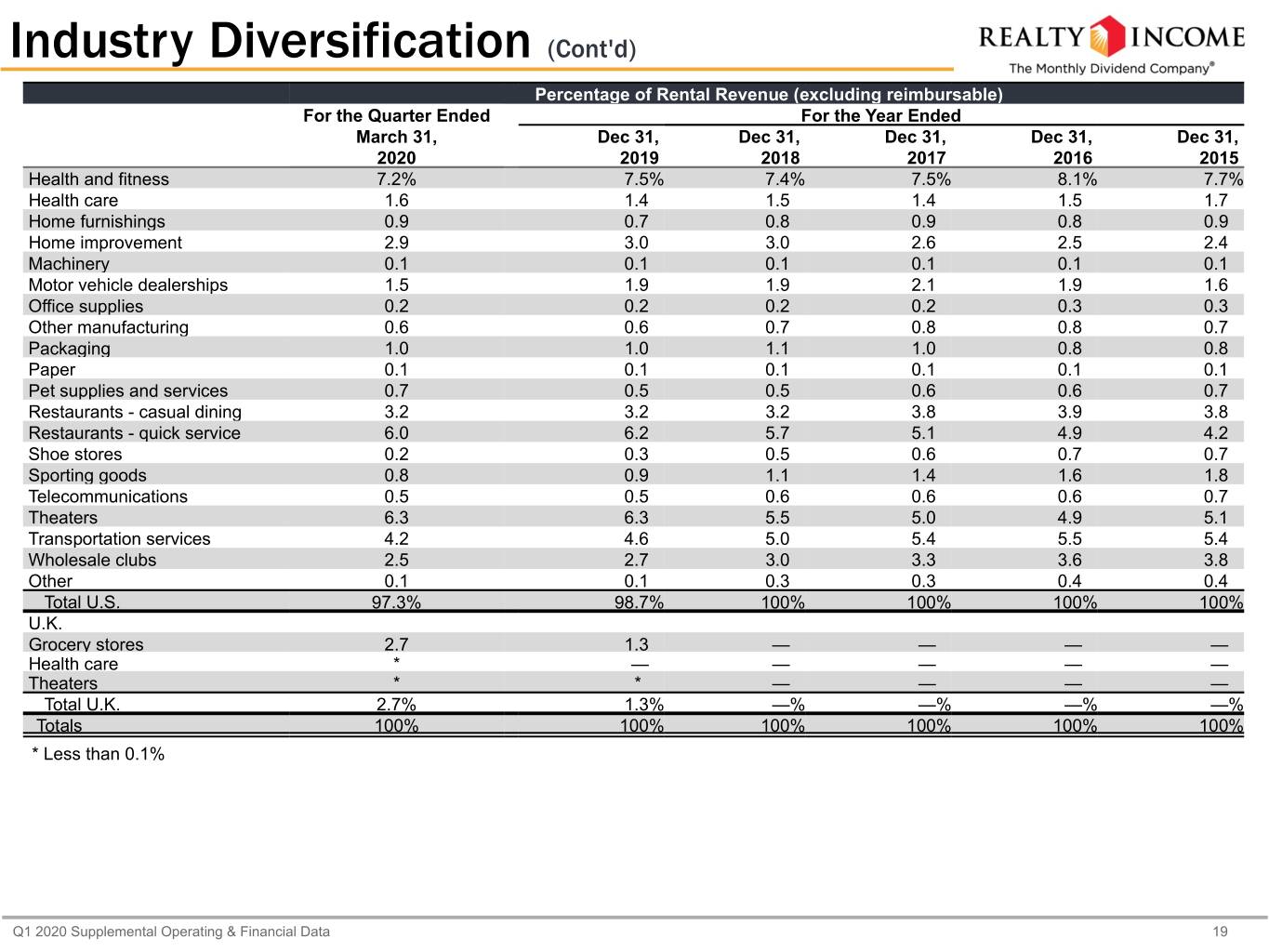

Industry Diversification (Cont'd) Percentage of Rental Revenue (excluding reimbursable) For the Quarter Ended For the Year Ended March 31, Dec 31, Dec 31, Dec 31, Dec 31, Dec 31, 2020 2019 2018 2017 2016 2015 Health and fitness 7.2% 7.5% 7.4% 7.5% 8.1% 7.7% Health care 1.6 1.4 1.5 1.4 1.5 1.7 Home furnishings 0.9 0.7 0.8 0.9 0.8 0.9 Home improvement 2.9 3.0 3.0 2.6 2.5 2.4 Machinery 0.1 0.1 0.1 0.1 0.1 0.1 Motor vehicle dealerships 1.5 1.9 1.9 2.1 1.9 1.6 Office supplies 0.2 0.2 0.2 0.2 0.3 0.3 Other manufacturing 0.6 0.6 0.7 0.8 0.8 0.7 Packaging 1.0 1.0 1.1 1.0 0.8 0.8 Paper 0.1 0.1 0.1 0.1 0.1 0.1 Pet supplies and services 0.7 0.5 0.5 0.6 0.6 0.7 Restaurants - casual dining 3.2 3.2 3.2 3.8 3.9 3.8 Restaurants - quick service 6.0 6.2 5.7 5.1 4.9 4.2 Shoe stores 0.2 0.3 0.5 0.6 0.7 0.7 Sporting goods 0.8 0.9 1.1 1.4 1.6 1.8 Telecommunications 0.5 0.5 0.6 0.6 0.6 0.7 Theaters 6.3 6.3 5.5 5.0 4.9 5.1 Transportation services 4.2 4.6 5.0 5.4 5.5 5.4 Wholesale clubs 2.5 2.7 3.0 3.3 3.6 3.8 Other 0.1 0.1 0.3 0.3 0.4 0.4 Total U.S. 97.3% 98.7% 100% 100% 100% 100% U.K. Grocery stores 2.7 1.3 — — — — Health care * — — — — — Theaters * * — — — — Total U.K. 2.7% 1.3% —% —% —% —% Totals 100% 100% 100% 100% 100% 100% * Less than 0.1% Q1 2020 Supplemental Operating & Financial Data 19

Geographic Diversification (dollars in thousands) Approximate Rental Revenue for Percentage of Number of Percent Leasable the Quarter Ended Rental Location Properties Leased Square Feet March 31, 2020 (1) Revenue Alabama 228 98% 2,148,700 $ 7,883 2.0% Alaska 3 100 274,600 536 0.1 Arizona 153 100 2,085,300 8,821 2.3 Arkansas 102 100 1,183,200 3,562 0.9 California 230 99 6,598,300 34,206 8.8 Colorado 100 96 1,582,900 6,025 1.5 Connecticut 21 90 1,378,200 2,862 0.7 Delaware 19 100 101,400 690 0.2 Florida 432 98 4,697,800 21,186 5.4 Georgia 300 98 4,612,100 14,622 3.7 Idaho 14 93 103,200 436 0.1 Illinois 296 98 6,396,500 22,580 5.8 Indiana 204 99 2,565,600 10,389 2.7 Iowa 46 96 2,472,400 4,424 1.1 Kansas 122 96 2,256,800 6,307 1.6 Kentucky 93 100 1,826,100 5,347 1.4 Louisiana 139 96 1,917,100 6,254 1.6 Maine 27 100 277,800 1,473 0.4 Maryland 38 100 1,494,000 6,477 1.7 Massachusetts 59 95 942,800 4,554 1.2 Michigan 215 100 2,583,400 9,185 2.3 Minnesota 173 98 2,355,400 11,132 2.8 Mississippi 183 98 1,985,000 5,782 1.5 Missouri 188 96 3,023,000 9,780 2.5 (1) Includes rental revenue for all properties owned at March 31, 2020. Excludes revenue of $919 from sold properties and rental revenue (reimbursable) of $20,366. Q1 2020 Supplemental Operating & Financial Data 20

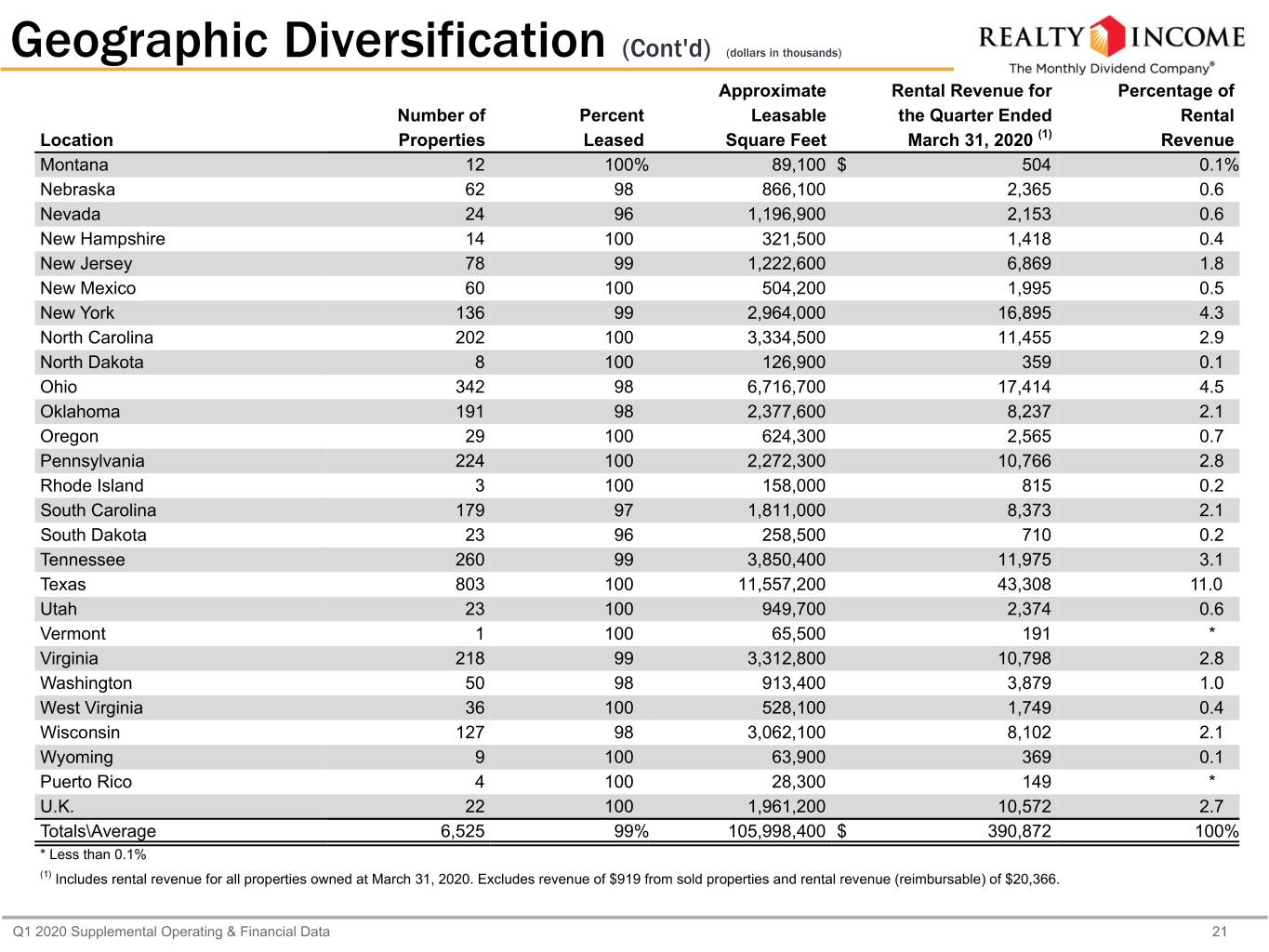

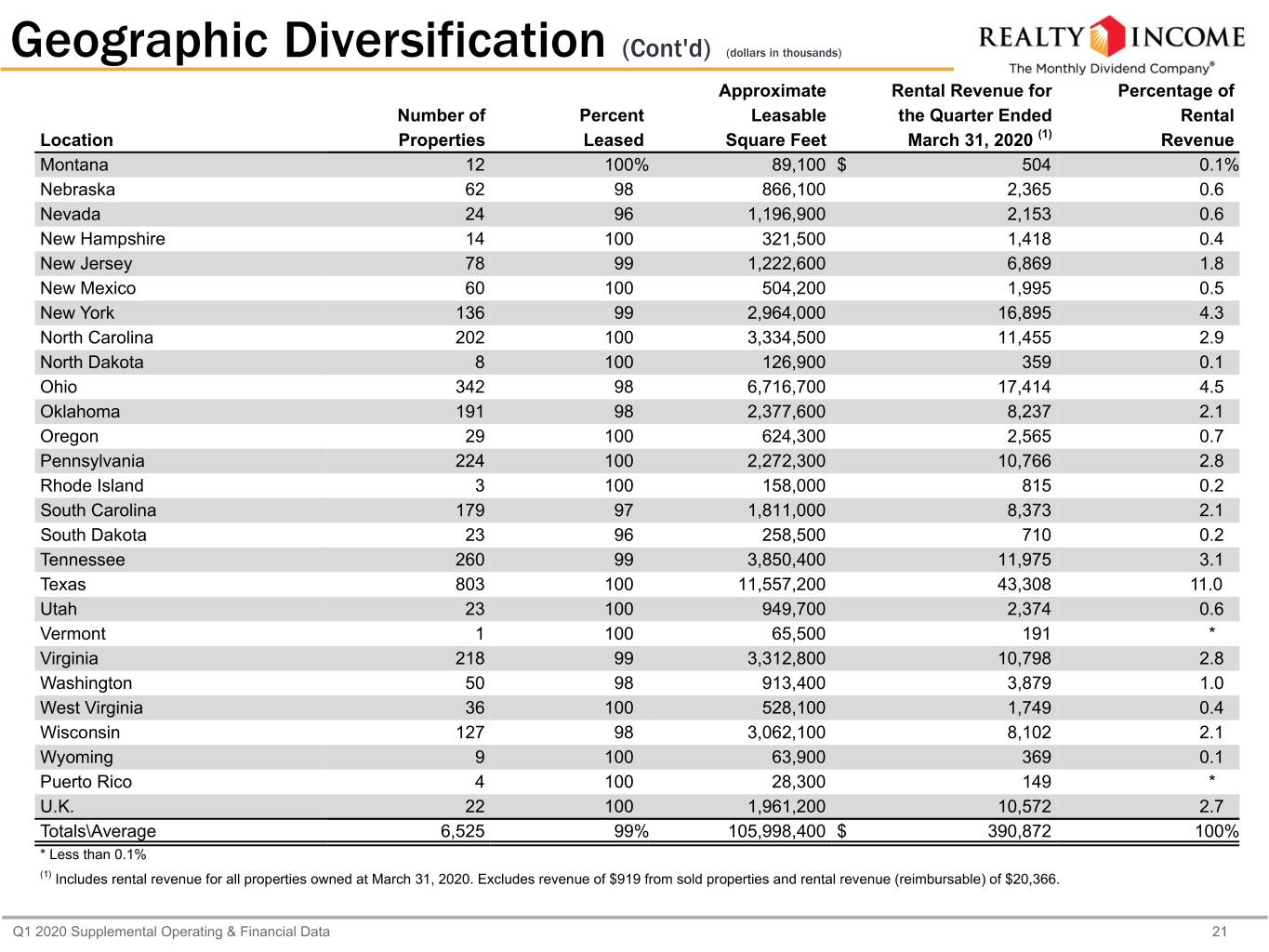

Geographic Diversification (Cont'd) (dollars in thousands) Approximate Rental Revenue for Percentage of Number of Percent Leasable the Quarter Ended Rental Location Properties Leased Square Feet March 31, 2020 (1) Revenue Montana 12 100% 89,100 $ 504 0.1% Nebraska 62 98 866,100 2,365 0.6 Nevada 24 96 1,196,900 2,153 0.6 New Hampshire 14 100 321,500 1,418 0.4 New Jersey 78 99 1,222,600 6,869 1.8 New Mexico 60 100 504,200 1,995 0.5 New York 136 99 2,964,000 16,895 4.3 North Carolina 202 100 3,334,500 11,455 2.9 North Dakota 8 100 126,900 359 0.1 Ohio 342 98 6,716,700 17,414 4.5 Oklahoma 191 98 2,377,600 8,237 2.1 Oregon 29 100 624,300 2,565 0.7 Pennsylvania 224 100 2,272,300 10,766 2.8 Rhode Island 3 100 158,000 815 0.2 South Carolina 179 97 1,811,000 8,373 2.1 South Dakota 23 96 258,500 710 0.2 Tennessee 260 99 3,850,400 11,975 3.1 Texas 803 100 11,557,200 43,308 11.0 Utah 23 100 949,700 2,374 0.6 Vermont 1 100 65,500 191 * Virginia 218 99 3,312,800 10,798 2.8 Washington 50 98 913,400 3,879 1.0 West Virginia 36 100 528,100 1,749 0.4 Wisconsin 127 98 3,062,100 8,102 2.1 Wyoming 9 100 63,900 369 0.1 Puerto Rico 4 100 28,300 149 * U.K. 22 100 1,961,200 10,572 2.7 Totals\Average 6,525 99% 105,998,400 $ 390,872 100% * Less than 0.1% (1) Includes rental revenue for all properties owned at March 31, 2020. Excludes revenue of $919 from sold properties and rental revenue (reimbursable) of $20,366. Q1 2020 Supplemental Operating & Financial Data 21

Property Type Composition (dollars in thousands) Percentage of Rental Percentage of Rental Revenue for Revenue for the Annualized Revenue Approximate Leasable the Quarter Ended Quarter Ended from Investment Property Type Number of Properties Square Feet (1) March 31, 2020 (2) March 31, 2020 Grade Tenants (3) Retail 6,348 75,922,800 $ 328,627 84.1% 43.8% Industrial 119 26,715,400 41,887 10.7 77.8 Office 43 3,175,700 13,642 3.5 86.7 Agriculture 15 184,500 6,716 1.7 — Totals 6,525 105,998,400 $ 390,872 100.0% (1) Includes leasable building square footage. Excludes 3,300 acres of leased land categorized as agriculture at March 31, 2020. (2) Includes rental revenue for all properties owned at March 31, 2020. Excludes revenue of $919 from sold properties and rental revenue (reimbursable) of $20,366. (3) Refer to footnote 3 on page 16 for our definition of investment grade tenants. Q1 2020 Supplemental Operating & Financial Data 22

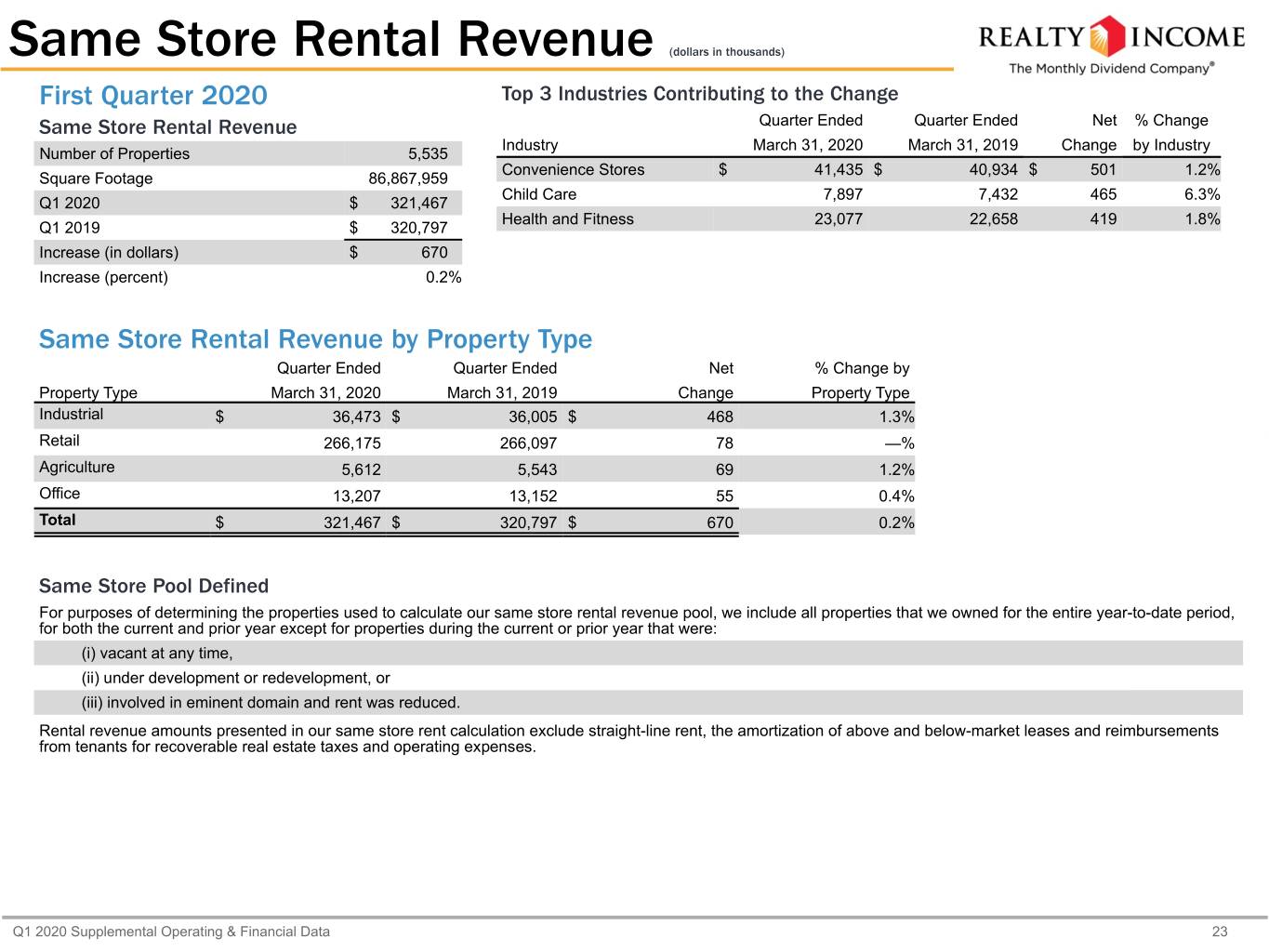

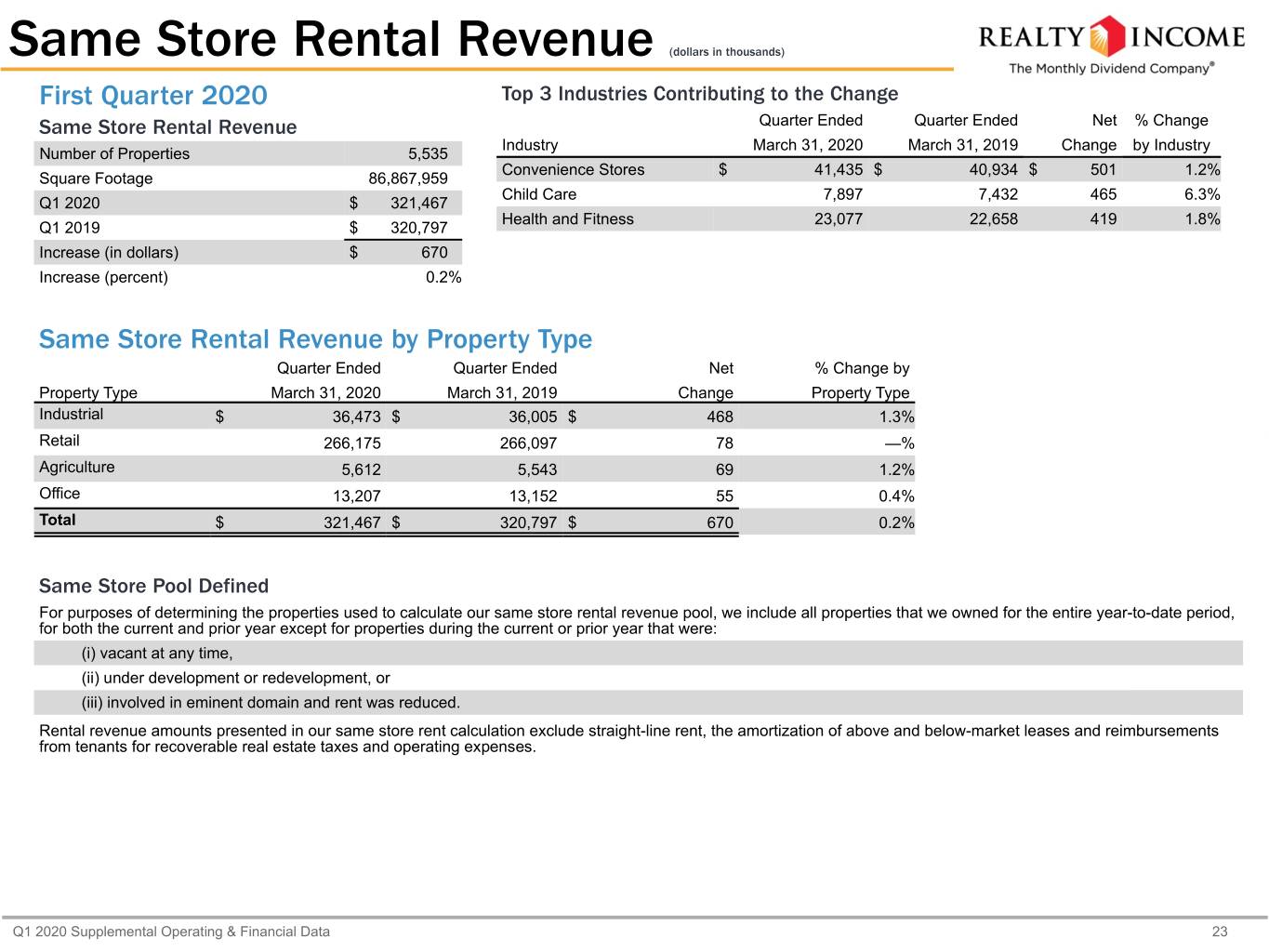

Same Store Rental Revenue (dollars in thousands) First Quarter 2020 Top 3 Industries Contributing to the Change Same Store Rental Revenue Quarter Ended Quarter Ended Net % Change Industry March 31, 2020 March 31, 2019 Change by Industry Number of Properties 5,535 Convenience Stores $ 41,435 $ 40,934 $ 501 1.2% Square Footage 86,867,959 Child Care 7,897 7,432 465 6.3% Q1 2020 $ 321,467 Health and Fitness 23,077 22,658 419 1.8% Q1 2019 $ 320,797 Increase (in dollars) $ 670 Increase (percent) 0.2% Same Store Rental Revenue by Property Type Quarter Ended Quarter Ended Net % Change by Property Type March 31, 2020 March 31, 2019 Change Property Type Industrial $ 36,473 $ 36,005 $ 468 1.3% Retail 266,175 266,097 78 —% Agriculture 5,612 5,543 69 1.2% Office 13,207 13,152 55 0.4% Total $ 321,467 $ 320,797 $ 670 0.2% Same Store Pool Defined For purposes of determining the properties used to calculate our same store rental revenue pool, we include all properties that we owned for the entire year-to-date period, for both the current and prior year except for properties during the current or prior year that were: (i) vacant at any time, (ii) under development or redevelopment, or (iii) involved in eminent domain and rent was reduced. Rental revenue amounts presented in our same store rent calculation exclude straight-line rent, the amortization of above and below-market leases and reimbursements from tenants for recoverable real estate taxes and operating expenses. Q1 2020 Supplemental Operating & Financial Data 23

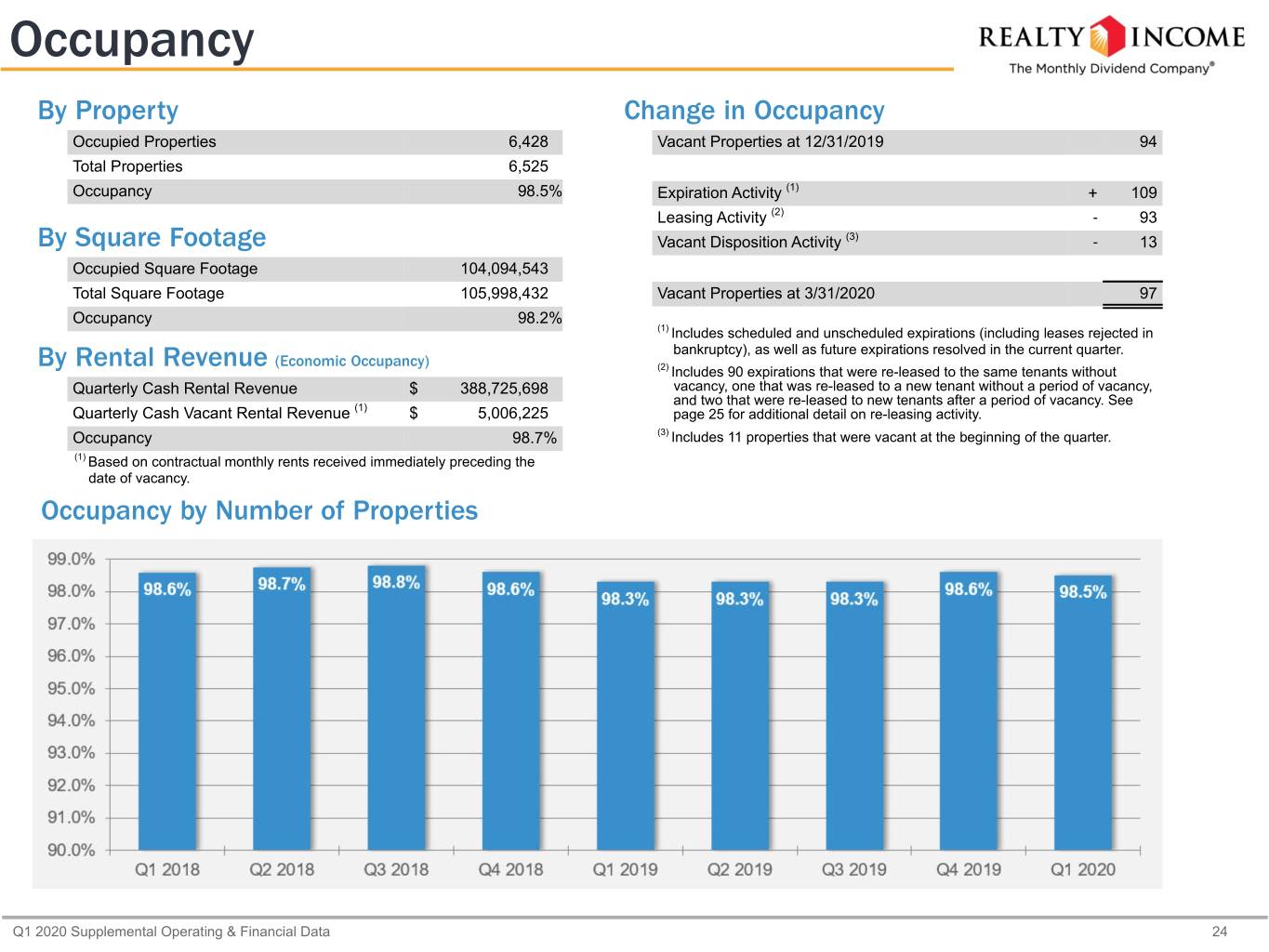

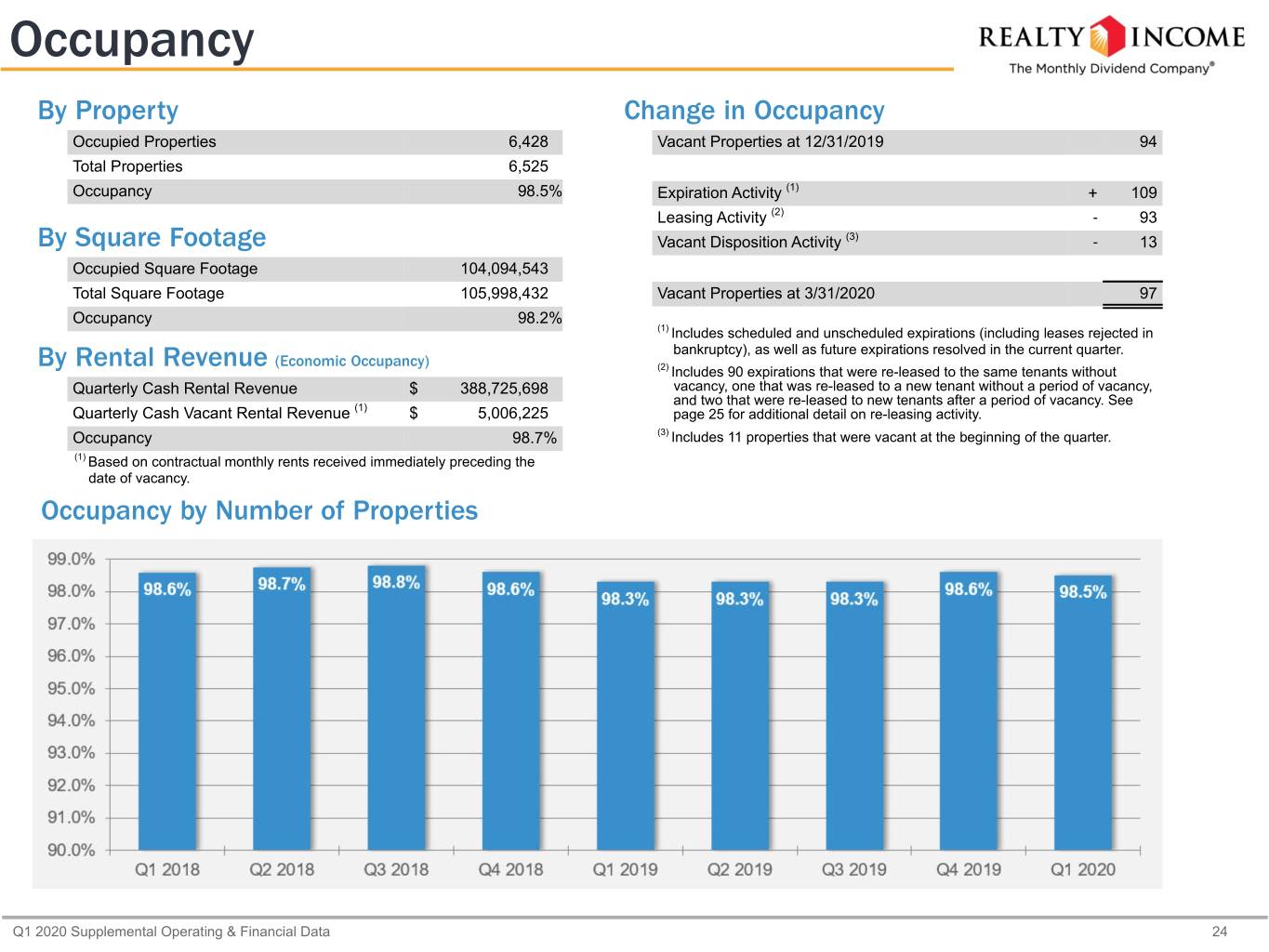

Occupancy By Property Change in Occupancy Occupied Properties 6,428 Vacant Properties at 12/31/2019 94 Total Properties 6,525 Occupancy 98.5% Expiration Activity (1) + 109 Leasing Activity (2) - 93 By Square Footage Vacant Disposition Activity (3) - 13 Occupied Square Footage 104,094,543 Total Square Footage 105,998,432 Vacant Properties at 3/31/2020 97 Occupancy 98.2% (1) Includes scheduled and unscheduled expirations (including leases rejected in bankruptcy), as well as future expirations resolved in the current quarter. By Rental Revenue (Economic Occupancy) (2) Includes 90 expirations that were re-leased to the same tenants without Quarterly Cash Rental Revenue $ 388,725,698 vacancy, one that was re-leased to a new tenant without a period of vacancy, and two that were re-leased to new tenants after a period of vacancy. See Quarterly Cash Vacant Rental Revenue (1) $ 5,006,225 page 25 for additional detail on re-leasing activity. Occupancy 98.7% (3) Includes 11 properties that were vacant at the beginning of the quarter. (1) Based on contractual monthly rents received immediately preceding the date of vacancy. Occupancy by Number of Properties Q1 2020 Supplemental Operating & Financial Data 24

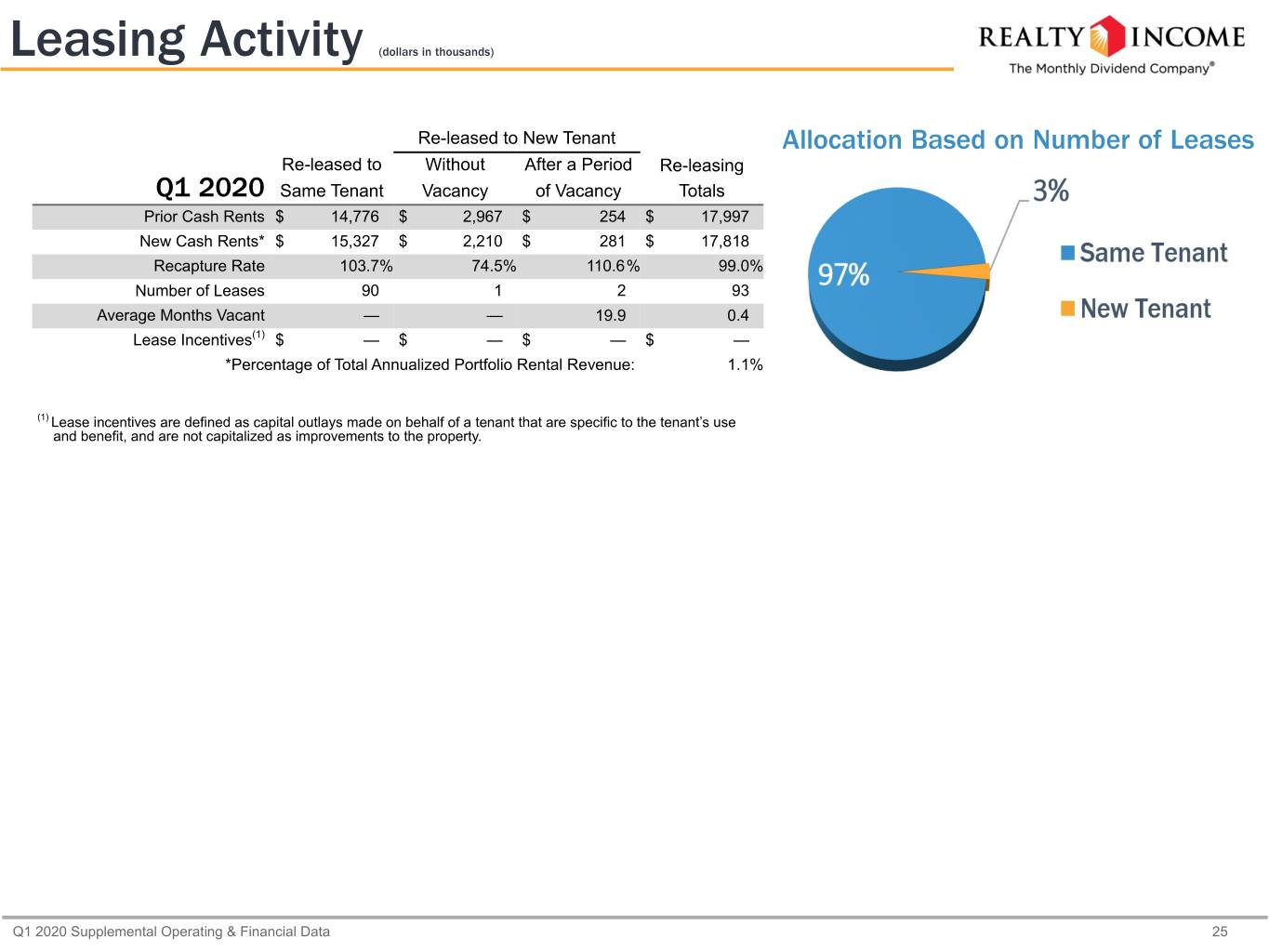

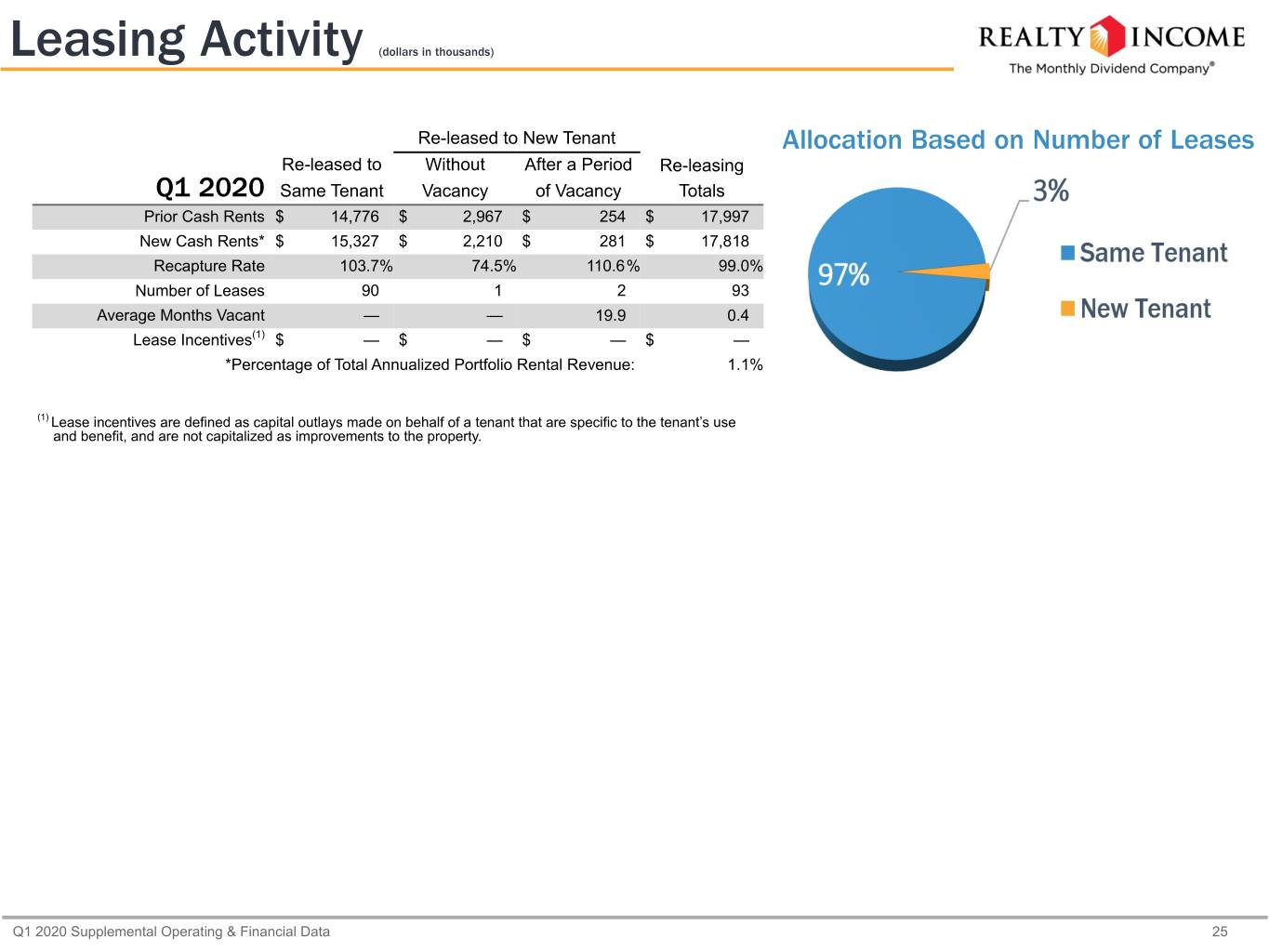

Leasing Activity (dollars in thousands) Re-leased to New Tenant Allocation Based on Number of Leases Re-leased to Without After a Period Re-leasing Q1 2020 Same Tenant Vacancy of Vacancy Totals Prior Cash Rents $ 14,776 $ 2,967 $ 254 $ 17,997 New Cash Rents* $ 15,327 $ 2,210 $ 281 $ 17,818 Recapture Rate 103.7% 74.5% 110.6% 99.0% Number of Leases 90 1 2 93 Average Months Vacant — — 19.9 0.4 Lease Incentives(1) $ — $ — $ — $ — *Percentage of Total Annualized Portfolio Rental Revenue: 1.1% (1) Lease incentives are defined as capital outlays made on behalf of a tenant that are specific to the tenant’s use and benefit, and are not capitalized as improvements to the property. Q1 2020 Supplemental Operating & Financial Data 25

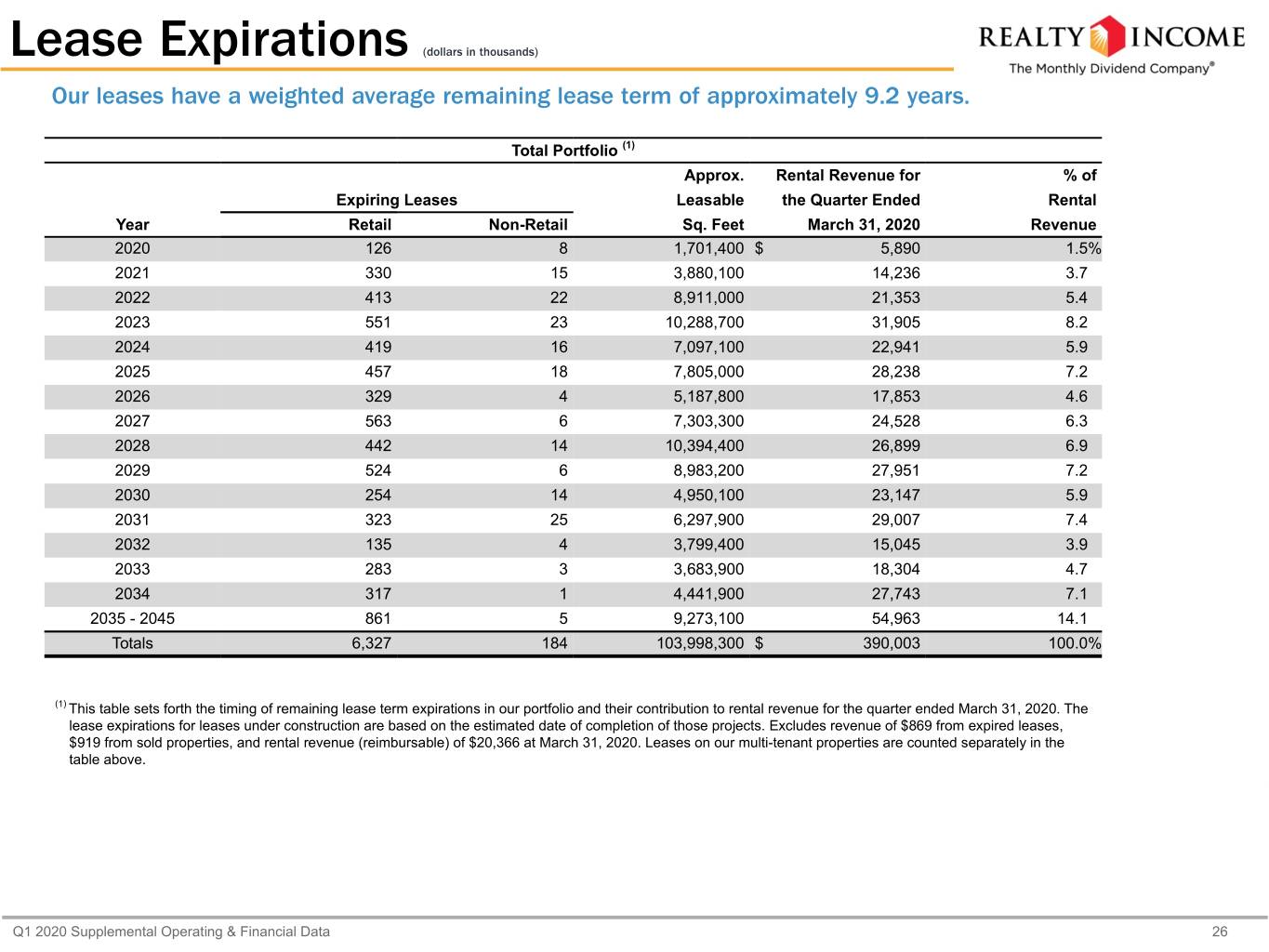

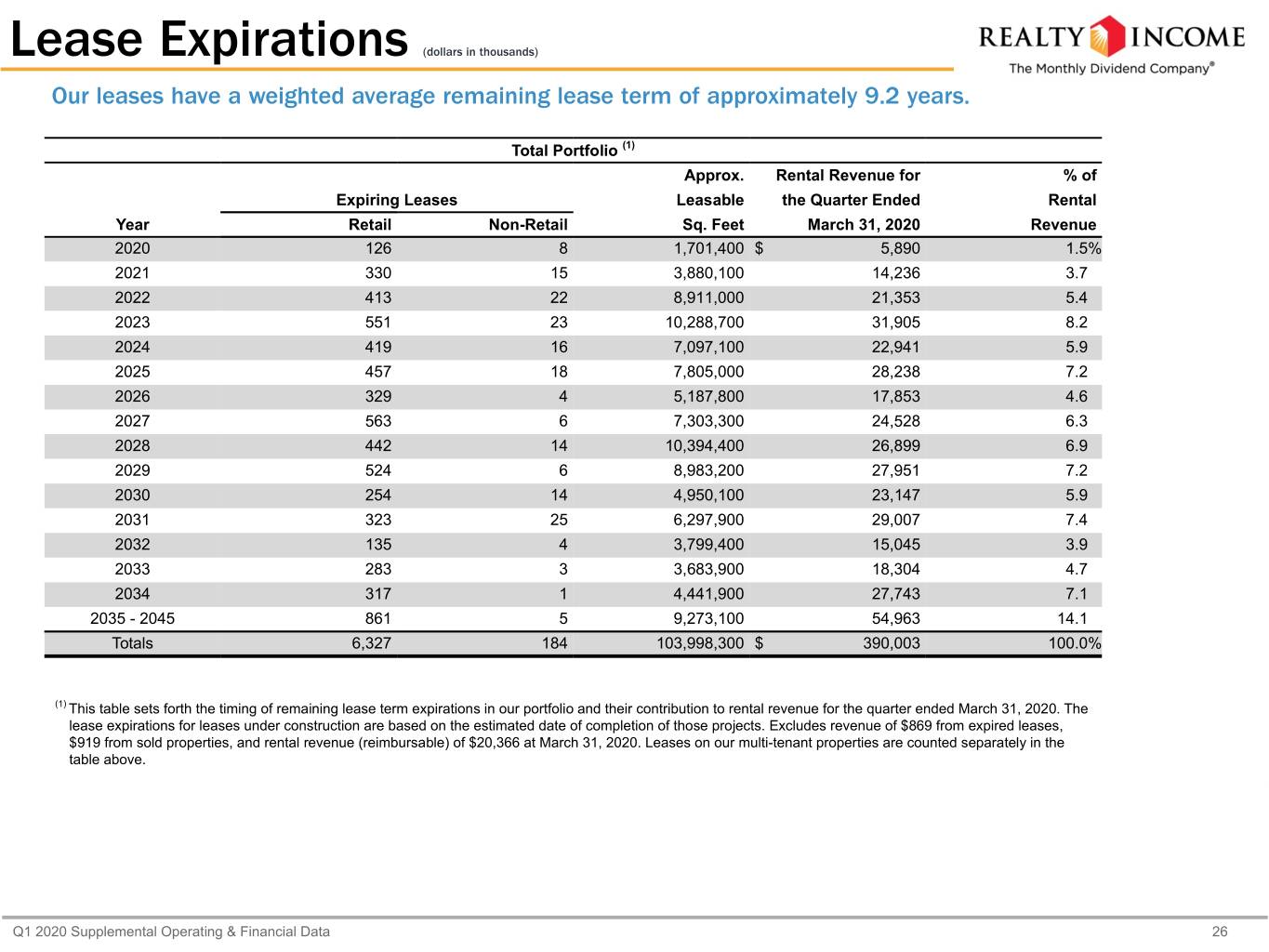

Lease Expirations (dollars in thousands) Our leases have a weighted average remaining lease term of approximately 9.2 years. Total Portfolio (1) Approx. Rental Revenue for % of Expiring Leases Leasable the Quarter Ended Rental Year Retail Non-Retail Sq. Feet March 31, 2020 Revenue 2020 126 8 1,701,400 $ 5,890 1.5% 2021 330 15 3,880,100 14,236 3.7 2022 413 22 8,911,000 21,353 5.4 2023 551 23 10,288,700 31,905 8.2 2024 419 16 7,097,100 22,941 5.9 2025 457 18 7,805,000 28,238 7.2 2026 329 4 5,187,800 17,853 4.6 2027 563 6 7,303,300 24,528 6.3 2028 442 14 10,394,400 26,899 6.9 2029 524 6 8,983,200 27,951 7.2 2030 254 14 4,950,100 23,147 5.9 2031 323 25 6,297,900 29,007 7.4 2032 135 4 3,799,400 15,045 3.9 2033 283 3 3,683,900 18,304 4.7 2034 317 1 4,441,900 27,743 7.1 2035 - 2045 861 5 9,273,100 54,963 14.1 Totals 6,327 184 103,998,300 $ 390,003 100.0% (1) This table sets forth the timing of remaining lease term expirations in our portfolio and their contribution to rental revenue for the quarter ended March 31, 2020. The lease expirations for leases under construction are based on the estimated date of completion of those projects. Excludes revenue of $869 from expired leases, $919 from sold properties, and rental revenue (reimbursable) of $20,366 at March 31, 2020. Leases on our multi-tenant properties are counted separately in the table above. Q1 2020 Supplemental Operating & Financial Data 26

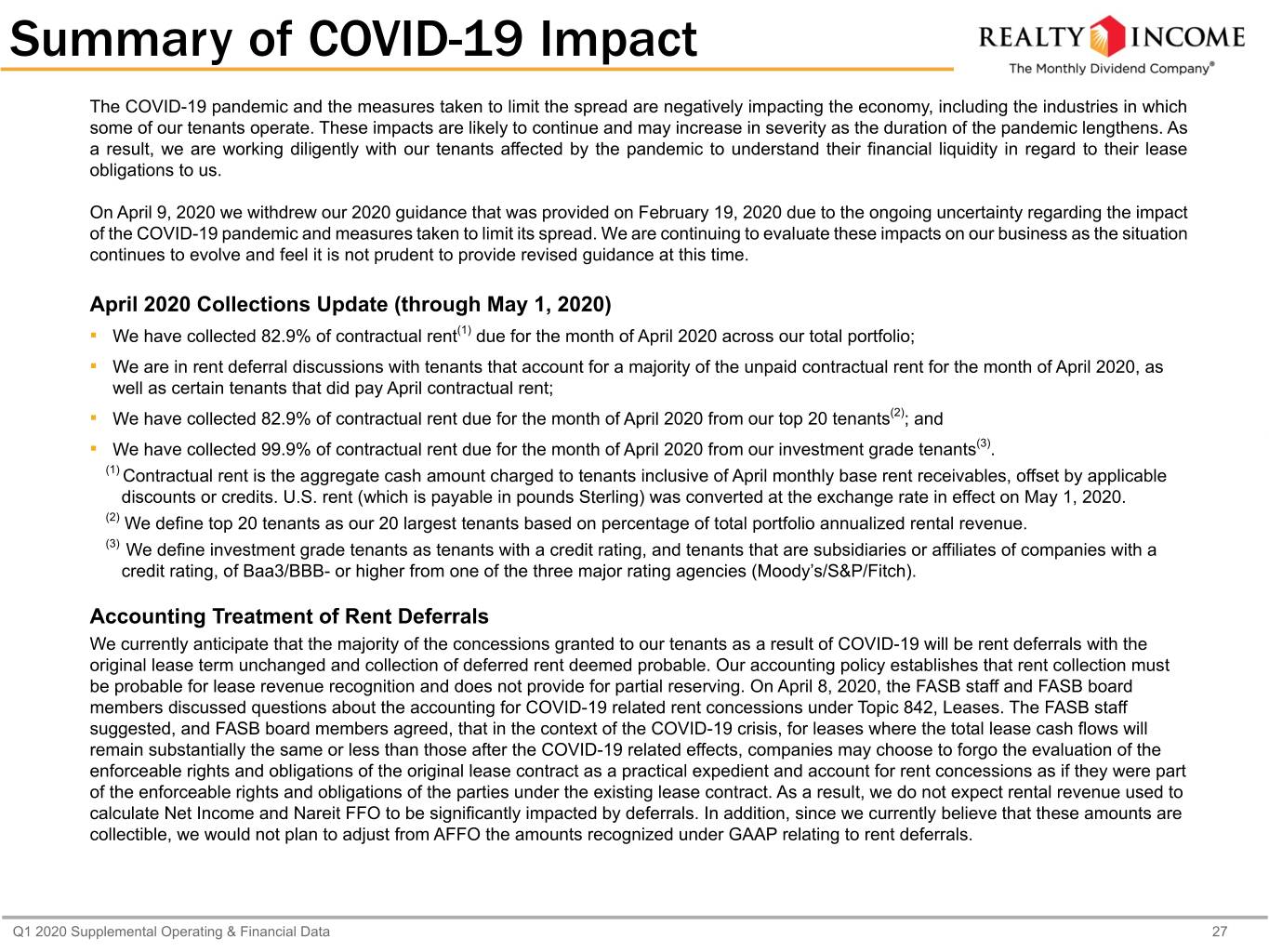

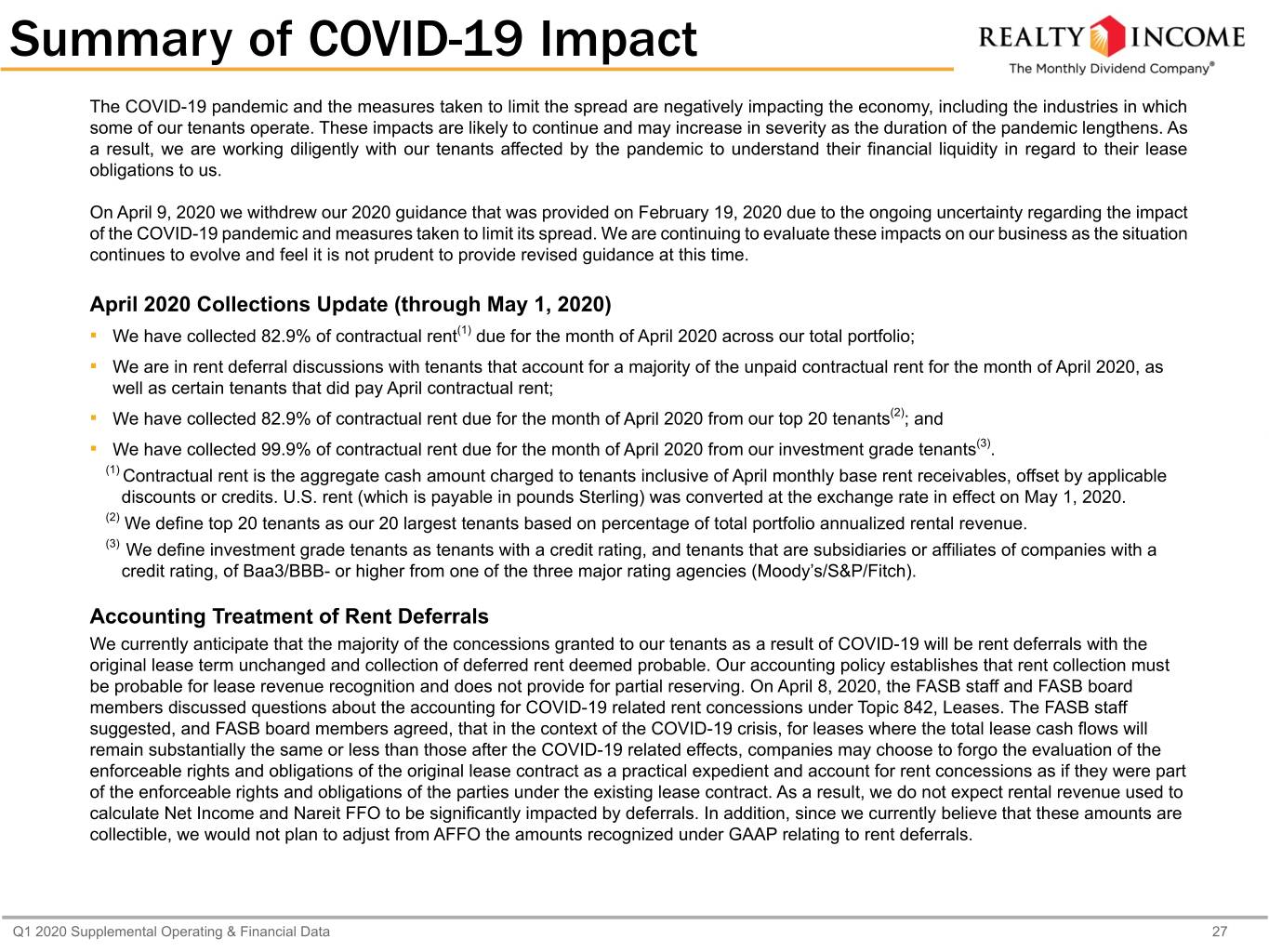

Summary of COVID-19 Impact The COVID-19 pandemic and the measures taken to limit the spread are negatively impacting the economy, including the industries in which some of our tenants operate. These impacts are likely to continue and may increase in severity as the duration of the pandemic lengthens. As a result, we are working diligently with our tenants affected by the pandemic to understand their financial liquidity in regard to their lease obligations to us. On April 9, 2020 we withdrew our 2020 guidance that was provided on February 19, 2020 due to the ongoing uncertainty regarding the impact of the COVID-19 pandemic and measures taken to limit its spread. We are continuing to evaluate these impacts on our business as the situation continues to evolve and feel it is not prudent to provide revised guidance at this time. April 2020 Collections Update (through May 1, 2020) ▪ We have collected 82.9% of contractual rent(1) due for the month of April 2020 across our total portfolio; ▪ We are in rent deferral discussions with tenants that account for a majority of the unpaid contractual rent for the month of April 2020, as well as certain tenants that did pay April contractual rent; ▪ We have collected 82.9% of contractual rent due for the month of April 2020 from our top 20 tenants(2); and ▪ We have collected 99.9% of contractual rent due for the month of April 2020 from our investment grade tenants(3). (1) Contractual rent is the aggregate cash amount charged to tenants inclusive of April monthly base rent receivables, offset by applicable discounts or credits. U.S. rent (which is payable in pounds Sterling) was converted at the exchange rate in effect on May 1, 2020. (2) We define top 20 tenants as our 20 largest tenants based on percentage of total portfolio annualized rental revenue. (3) We define investment grade tenants as tenants with a credit rating, and tenants that are subsidiaries or affiliates of companies with a credit rating, of Baa3/BBB- or higher from one of the three major rating agencies (Moody’s/S&P/Fitch). Accounting Treatment of Rent Deferrals We currently anticipate that the majority of the concessions granted to our tenants as a result of COVID-19 will be rent deferrals with the original lease term unchanged and collection of deferred rent deemed probable. Our accounting policy establishes that rent collection must be probable for lease revenue recognition and does not provide for partial reserving. On April 8, 2020, the FASB staff and FASB board members discussed questions about the accounting for COVID-19 related rent concessions under Topic 842, Leases. The FASB staff suggested, and FASB board members agreed, that in the context of the COVID-19 crisis, for leases where the total lease cash flows will remain substantially the same or less than those after the COVID-19 related effects, companies may choose to forgo the evaluation of the enforceable rights and obligations of the original lease contract as a practical expedient and account for rent concessions as if they were part of the enforceable rights and obligations of the parties under the existing lease contract. As a result, we do not expect rental revenue used to calculate Net Income and Nareit FFO to be significantly impacted by deferrals. In addition, since we currently believe that these amounts are collectible, we would not plan to adjust from AFFO the amounts recognized under GAAP relating to rent deferrals. Q1 2020 Supplemental Operating & Financial Data 27

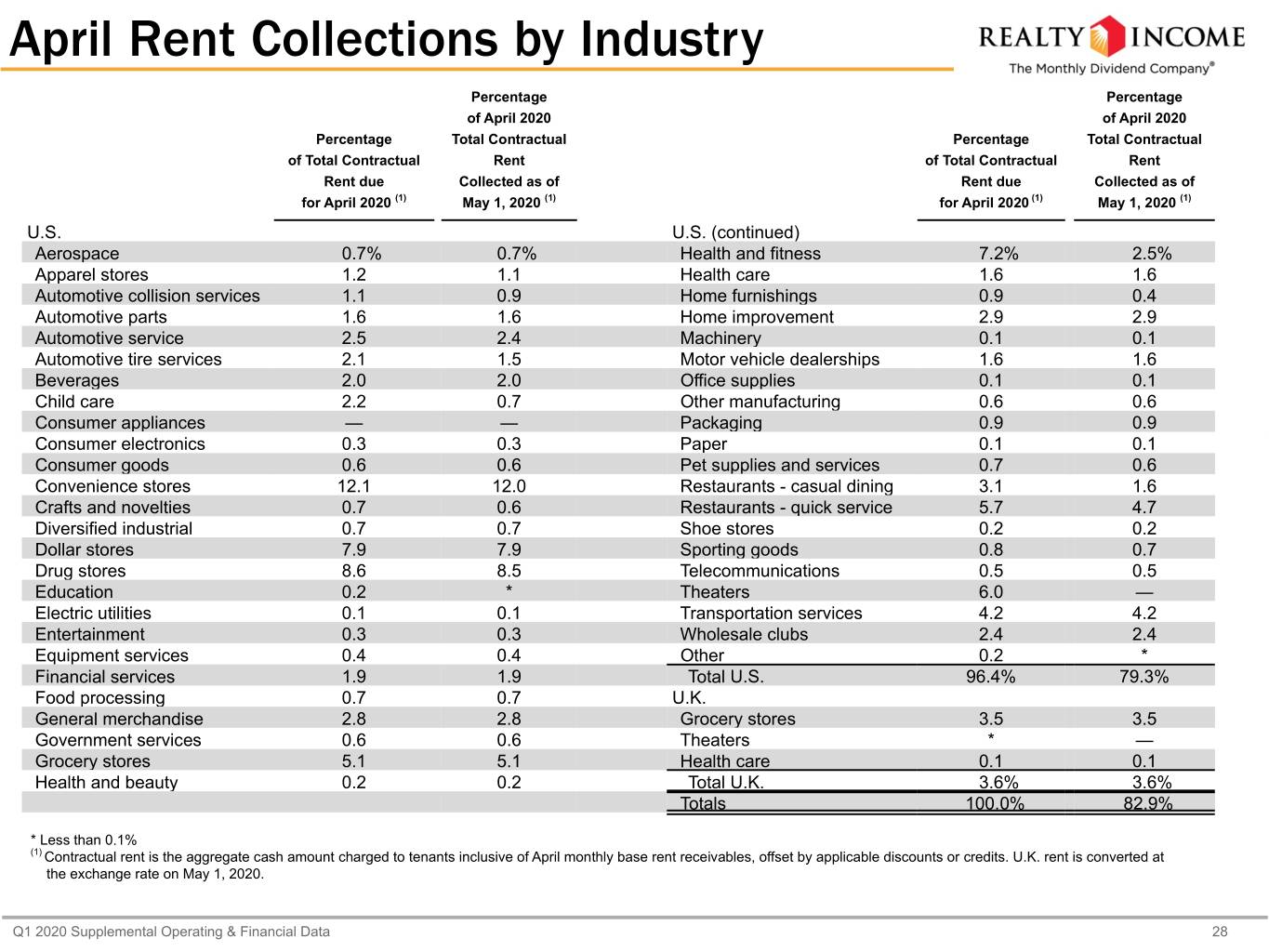

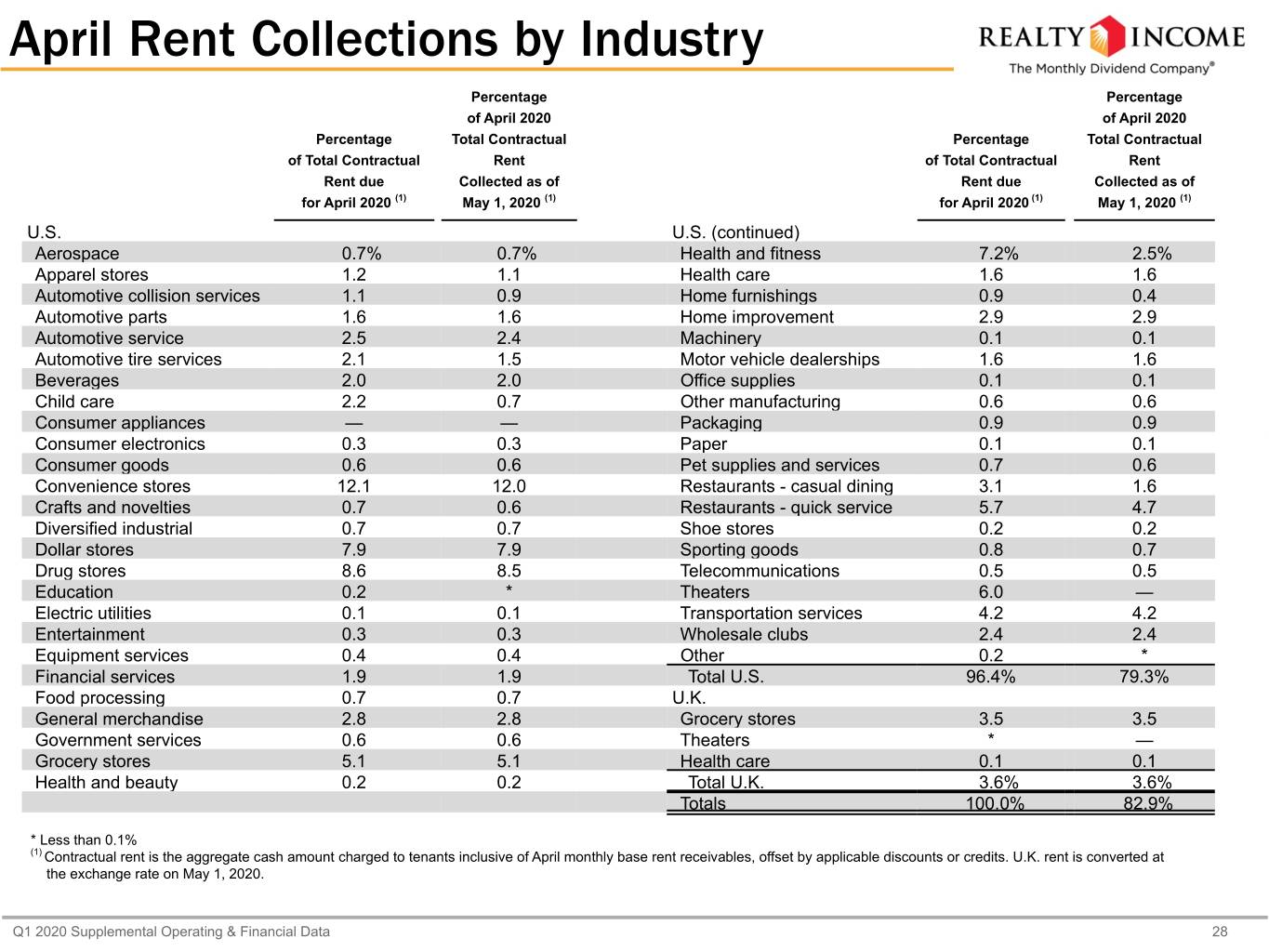

April Rent Collections by Industry Percentage Percentage of April 2020 of April 2020 Percentage Total Contractual Percentage Total Contractual of Total Contractual Rent of Total Contractual Rent Rent due Collected as of Rent due Collected as of for April 2020 (1) May 1, 2020 (1) for April 2020 (1) May 1, 2020 (1) U.S. U.S. (continued) Aerospace 0.7% 0.7% Health and fitness 7.2% 2.5% Apparel stores 1.2 1.1 Health care 1.6 1.6 Automotive collision services 1.1 0.9 Home furnishings 0.9 0.4 Automotive parts 1.6 1.6 Home improvement 2.9 2.9 Automotive service 2.5 2.4 Machinery 0.1 0.1 Automotive tire services 2.1 1.5 Motor vehicle dealerships 1.6 1.6 Beverages 2.0 2.0 Office supplies 0.1 0.1 Child care 2.2 0.7 Other manufacturing 0.6 0.6 Consumer appliances — — Packaging 0.9 0.9 Consumer electronics 0.3 0.3 Paper 0.1 0.1 Consumer goods 0.6 0.6 Pet supplies and services 0.7 0.6 Convenience stores 12.1 12.0 Restaurants - casual dining 3.1 1.6 Crafts and novelties 0.7 0.6 Restaurants - quick service 5.7 4.7 Diversified industrial 0.7 0.7 Shoe stores 0.2 0.2 Dollar stores 7.9 7.9 Sporting goods 0.8 0.7 Drug stores 8.6 8.5 Telecommunications 0.5 0.5 Education 0.2 * Theaters 6.0 — Electric utilities 0.1 0.1 Transportation services 4.2 4.2 Entertainment 0.3 0.3 Wholesale clubs 2.4 2.4 Equipment services 0.4 0.4 Other 0.2 * Financial services 1.9 1.9 Total U.S. 96.4% 79.3% Food processing 0.7 0.7 U.K. General merchandise 2.8 2.8 Grocery stores 3.5 3.5 Government services 0.6 0.6 Theaters * — Grocery stores 5.1 5.1 Health care 0.1 0.1 Health and beauty 0.2 0.2 Total U.K. 3.6% 3.6% Totals 100.0% 82.9% * Less than 0.1% (1) Contractual rent is the aggregate cash amount charged to tenants inclusive of April monthly base rent receivables, offset by applicable discounts or credits. U.K. rent is converted at the exchange rate on May 1, 2020. Q1 2020 Supplemental Operating & Financial Data 28

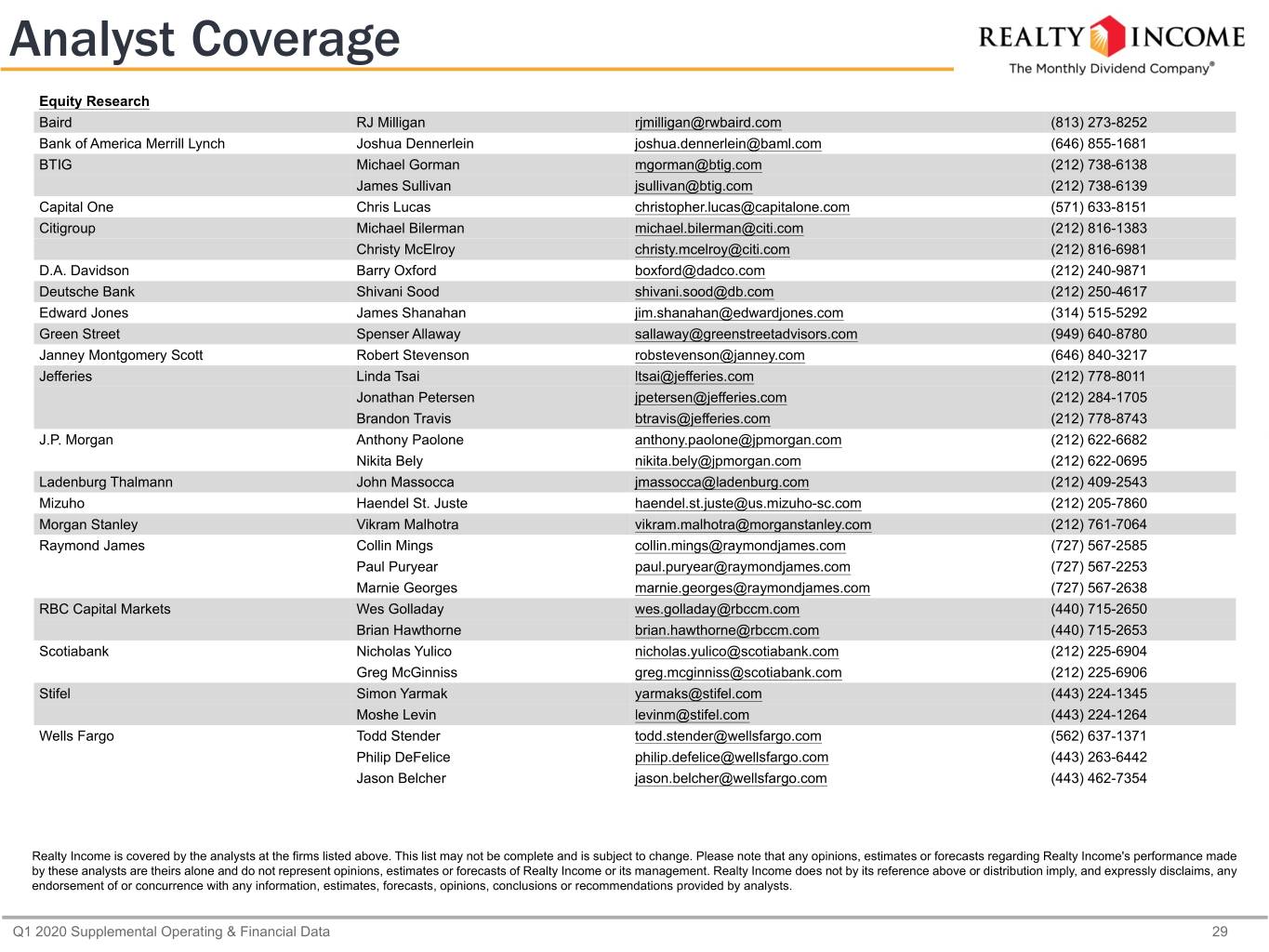

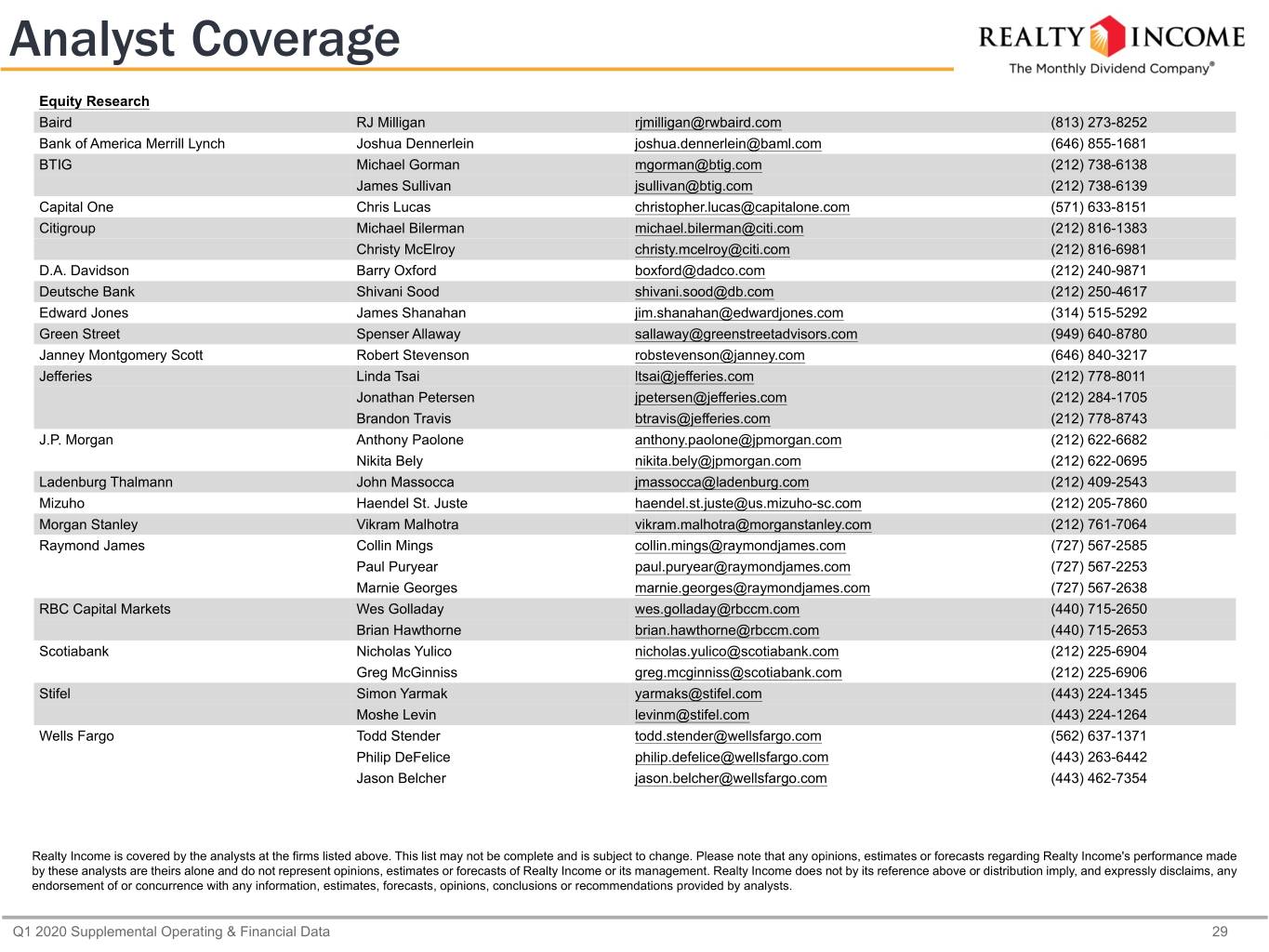

Analyst Coverage Equity Research Baird RJ Milligan rjmilligan@rwbaird.com (813) 273-8252 Bank of America Merrill Lynch Joshua Dennerlein joshua.dennerlein@baml.com (646) 855-1681 BTIG Michael Gorman mgorman@btig.com (212) 738-6138 James Sullivan jsullivan@btig.com (212) 738-6139 Capital One Chris Lucas christopher.lucas@capitalone.com (571) 633-8151 Citigroup Michael Bilerman michael.bilerman@citi.com (212) 816-1383 Christy McElroy christy.mcelroy@citi.com (212) 816-6981 D.A. Davidson Barry Oxford boxford@dadco.com (212) 240-9871 Deutsche Bank Shivani Sood shivani.sood@db.com (212) 250-4617 Edward Jones James Shanahan jim.shanahan@edwardjones.com (314) 515-5292 Green Street Spenser Allaway sallaway@greenstreetadvisors.com (949) 640-8780 Janney Montgomery Scott Robert Stevenson robstevenson@janney.com (646) 840-3217 Jefferies Linda Tsai ltsai@jefferies.com (212) 778-8011 Jonathan Petersen jpetersen@jefferies.com (212) 284-1705 Brandon Travis btravis@jefferies.com (212) 778-8743 J.P. Morgan Anthony Paolone anthony.paolone@jpmorgan.com (212) 622-6682 Nikita Bely nikita.bely@jpmorgan.com (212) 622-0695 Ladenburg Thalmann John Massocca jmassocca@ladenburg.com (212) 409-2543 Mizuho Haendel St. Juste haendel.st.juste@us.mizuho-sc.com (212) 205-7860 Morgan Stanley Vikram Malhotra vikram.malhotra@morganstanley.com (212) 761-7064 Raymond James Collin Mings collin.mings@raymondjames.com (727) 567-2585 Paul Puryear paul.puryear@raymondjames.com (727) 567-2253 Marnie Georges marnie.georges@raymondjames.com (727) 567-2638 RBC Capital Markets Wes Golladay wes.golladay@rbccm.com (440) 715-2650 Brian Hawthorne brian.hawthorne@rbccm.com (440) 715-2653 Scotiabank Nicholas Yulico nicholas.yulico@scotiabank.com (212) 225-6904 Greg McGinniss greg.mcginniss@scotiabank.com (212) 225-6906 Stifel Simon Yarmak yarmaks@stifel.com (443) 224-1345 Moshe Levin levinm@stifel.com (443) 224-1264 Wells Fargo Todd Stender todd.stender@wellsfargo.com (562) 637-1371 Philip DeFelice philip.defelice@wellsfargo.com (443) 263-6442 Jason Belcher jason.belcher@wellsfargo.com (443) 462-7354 Realty Income is covered by the analysts at the firms listed above. This list may not be complete and is subject to change. Please note that any opinions, estimates or forecasts regarding Realty Income's performance made by these analysts are theirs alone and do not represent opinions, estimates or forecasts of Realty Income or its management. Realty Income does not by its reference above or distribution imply, and expressly disclaims, any endorsement of or concurrence with any information, estimates, forecasts, opinions, conclusions or recommendations provided by analysts. Q1 2020 Supplemental Operating & Financial Data 29