Filed by Gammon Gold Inc.

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12 under the

Securities Exchange Act of 1934

Subject Company: Capital Gold Corporation

Commission File No.: 001-34618

This filing, which includes (i) materials used in a presentation held on February 28, 2011 for investors and (ii) materials posted on the website of Gammon Gold Inc. on February 28, 2011 regarding the general business and operations of Gammon Gold Inc. and its proposed acquisition of Capital Gold Corporation, may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and comparable “safe harbour” provisions of applicable Canadian legislation, including, but not limited to, statements relating to anticipated financial and operating results, the companies’ plans, objectives, expectations and intentions, cost savings and other statements, including words such as “anticipate,” “believe,” “plan,” “estimate,” “expect,” “intend,” “will,” “should,” “may,” and other similar expressions. Such statements are based upon the current beliefs and expectations of our management and involve a number of significant risks and uncertainties. Actual results may differ materially from the results anticipated in these forward-looking statements. The following factors, among others, could cause or contribute to such material differences: the ability to obtain the approval of the transaction by Capital Gold Corporation stockholders; the ability to realize the expected synergies resulting from the transaction in the amounts or in the timeframe anticipated; the ability to integrate Capital Gold Corporation’s businesses into those of Gammon Gold Inc. in a timely and cost-efficient manner; the ability to obtain governmental approvals of the transaction or to satisfy other conditions to the transaction on the proposed terms and timeframe; and the outcome of pending litigation related to the proposed acquisition of Capital Gold Corporation. Additional factors that could cause Gammon Gold Inc. and Capital Gold Corporation’s results to differ materially from those described in the forward-looking statements can be found in the 2009 Annual Report on Form 40-F, as amended by Amendment No. 1 to Annual Report on Form 40-F/A, for Gammon Gold Inc. and the Annual Report on Form 10-K, as amended by Form 10-K/A, of Capital Gold Corporation for the fiscal year ended July 31, 2010 filed with the Securities and Exchange Commission and available at the Securities and Exchange Commission’s Internet site (http://www.sec.gov).

The proposed merger transaction involving Gammon Gold Inc. and Capital Gold Corporation will be submitted to Capital Gold Corporation’s stockholders for their consideration. Gammon Gold Inc. has filed with the SEC a Registration Statement on Form F-4 containing a definitive proxy statement/prospectus and each of Gammon Gold Inc. and Capital Gold Corporation may file with the SEC other documents regarding the proposed transaction.Stockholders are encouraged to read the definitive proxy statement/prospectus regarding the proposed transaction, as well as other documents filed with the SEC because they contain important information.Stockholders may obtain a free copy of the definitive proxy statement/prospectus, as well as other filings containing information about Gammon Gold Inc. and Capital Gold Corporation, without charge, at the SEC’s Internet site (http://www.sec.gov). Copies of the definitive proxy statement/prospectus and the filings with the SEC that are incorporated by reference in the definitive proxy statement/prospectus can also be obtained

without charge, by directing a request to Gammon Gold, Inc., Investor Relations, 1701 Hollis Street, Suite 400, Founders Square, P.O. Box 2067, Halifax, Nova Scotia, B3J 2Z1, Canada, or to Capital Gold Corporation, Investor Relations, 76 Beaver Street, 14th floor, New York, New York 10005.

Gammon Gold Inc., Capital Gold Corporation, their respective directors and executive officers and other persons may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding Gammon Gold Inc.’s directors and executive officers is available in its Annual Report on Form 40-F for the year ended December 31, 2009, which was filed with the SEC on March 30, 2010, as amended by Amendment No. 1 to Annual Report on Form 40-F/A, which was filed with the SEC on May 13, 2010, in its notice of annual meeting and proxy circular for its most recent annual meeting, which was filed with the SEC on April 15, 2010, and the above-referenced Registration Statement on Form F-4, which was filed with the SEC on February 15, 2011. Information regarding Capital Gold Corporation’s directors and executive officers is available in Capital Gold Corporation’s Form 10-K/A, which was filed with the SEC on November 23, 2010. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, is contained in the definitive proxy statement/prospectus and other relevant materials filed with the SEC.

THE FOLLOWING ARE MATERIALS USED IN A PRESENTATION HELD ON FEBRUARY 28, 2011 FOR INVESTORS

Building a Leading Gold Company in Mexico

BMO Metals & Mining Conference

February 28? March 2, 2011

Operations Capital Gold Operations

Development & Exploration Properties Capital Gold Development &Exploration Properties

Gammon Gold Inc.

Forward Looking Statements

Gammon Gold Inc.

This presentation includes certain “forward? looking statements” or “forward? looking information”. All statements, other than statements of historical fact, included in this presentation are forward? looking statements that involve risks and uncertainties. The words “believe”, “expect”, “anticipate”, “contemplate”, “target”, “plan”, “intends”, “continue”, “budget”, “estimate”, “forecast”, “may”, “will”, “schedule” and similar expressions identify forward?looking statements. Forward? looking statements include, among other things, statements regarding targets, estimates and assumptions in respect of gold and silver and gold equivalent production and prices, cash and operating costs, results and capital expenditures, mineral reserves and mineral resources and anticipated grades, recovery rates, future financial or operating performance, margins, operating and exploration expenditures, costs and timing of the development of new deposits, costs and timing of construction, costs and timing of future exploration and reclamation expenses, anticipated 2010 year? end and 2011 results, our ability to fully fund our business model, including our capital and exploration program, internally, anticipated 2010 year? end and 2011 interim and annual gold and silver production and the cash and operating costs associated with the same, the ability to achieve productivity and operational efficiencies, the ability to achieve cash flow margin improvements, the ability to complete further reduction in the open pit stripping ratio, the ability to develop and put into production our exploration targets and the timing of each thereof, the ability to execute on our acquisition strategy, the acquisition of Capital Gold (the “Acquisition”) including whether the completion of the Acquisition will ultimately occur, whether the anticipated synergies of the proposed Acquisition will occur, incorrect assessment of the value of the properties of Capital Gold and failure to obtain the required security holder, regulatory, third party and other approvals and the outcome of any pending litigation related to the Acquisition. Forward? looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by Gammon Gold, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Important factors that could cause actual results to differ materially from Gammon Gold’s expectations include, among others, risks related to international operations, the actual results of current exploration activities, conclusions of economic evaluations and changes in project parameters as plans continue to be refined, future prices of gold and silver, known and unknown uncertainties and risks relating to additional funding requirements, reserve and resource estimates, hedging activities, development and operating risks, illegal miners, uninsurable risks, competition, limited mining operations, production risks, environmental regulation and liability, government regulation, currency fluctuations, recent losses and write? downs, restrictions in Gammon Gold’s loan facility, dependence on key employees, possible variations of ore grade or recovery rates, failure of plant, equipment or process to operate as anticipated, accidents and labour disputes as well as those factors discussed in the section entitled “Risk Factors” in Gammon Gold’s Form 40? F/A as filed with the United States Securities and Exchange Commission. Although Gammon Gold has attempted to identify important factors that could cause actual results

to differ materially, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Forward? looking statements are not guarantees of future performance. Accordingly, readers should not place undue reliance on forward? looking statements.

Cautionary Note to US Investors Concerning Estimates of Measured, Indicated and Inferred Resources

This presentation uses the terms “Measured”, “Indicated” and “Inferred” Resources. U.S. investors are advised that while such terms are recognized and required by Canadian regulations, the Securities and Exchange Commission does not recognize them. “Inferred Resources” have a great amount of uncertainty as to their existence and as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Resources may not form the basis of feasibility or other economic studies. U.S. investors are cautioned not to assume that all or any part of Measured or Indicated Resources will ever be converted into reserves. U.S. investors are also cautioned not to assume that all or any part of an Inferred mineral Resource exists, or is economically or legally mineable.

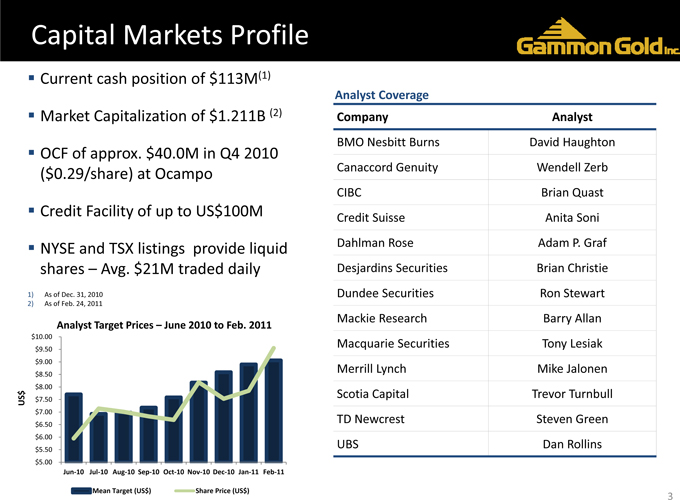

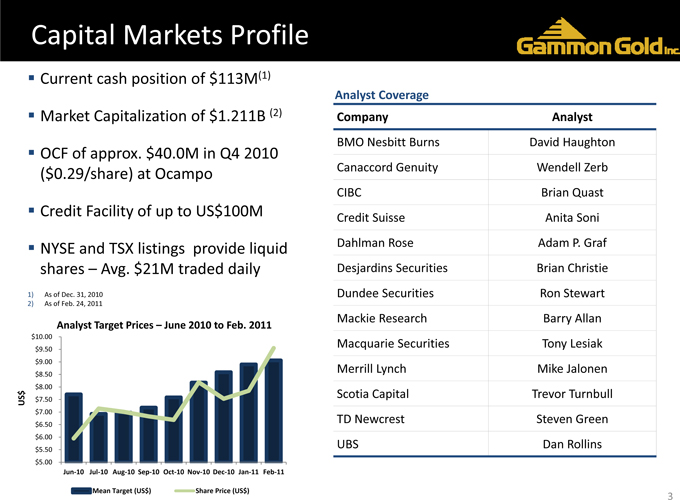

Capital Markets Profile

?Current cash position of $113M(1)

?Market Capitalization of $1.211B (2)

?OCF of approx. $40.0M in Q4 2010

($0.29/share) at Ocampo ?Credit Facility of up to US$100M

?NYSE and TSX listings provide liquid shares – Avg. $21M traded daily

1) As of Dec. 31, 2010

2) As of Feb. 24, 2011

Analyst Target Prices – June 2010 to Feb. 2011

$10.00

$9.50

$9.00

$8.50

$8.00

$

US $7.50

$7.00

$6.50

$6.00

$5.50

$5.00

Jun? 10 Jul? 10 Aug? 10 Sep? 10 Oct? 10 Nov? 10 Dec? 10 Jan? 11 Feb? 11

MeanTarget (US$) Share Price (US$)

Analyst Coverage

Company Analyst

BMO Nesbitt Burns David Haughton

Canaccord Genuity Wendell Zerb

CIBC Brian Quast

Credit Suisse Anita Soni

Dahlman Rose Adam P. Graf

Desjardins Securities Brian Christie

Dundee Securities Ron Stewart

Mackie Research Barry Allan

Macquarie Securities Tony Lesiak

Merrill Lynch Mike Jalonen

Scotia Capital Trevor Turnbull

TD Newcrest Steven Green

UBS Dan Rollins

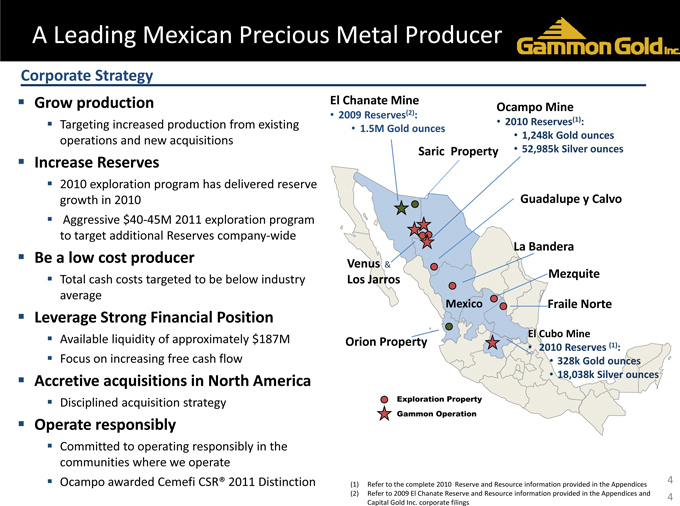

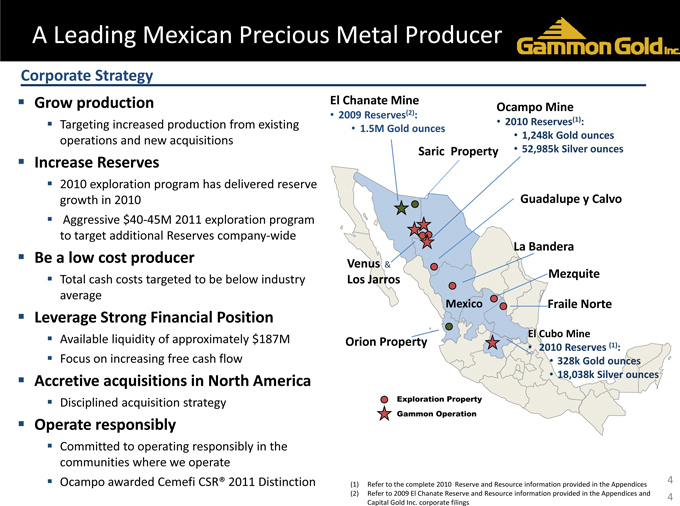

A Leading Mexican Precious Metal Producer

?Grow production

?Targeting increased production from existing operations and new acquisitions

?Increase Reserves

?2010 exploration program has delivered reserve growth in 2010 ?Aggressive $40? 45M 2011 exploration program to target additional Reserves company? wide

?Be a low cost producer

?Total cash costs targeted to be below industry average

?Leverage Strong Financial Position

?Available liquidity of approximately $187M ?Focus on increasing free cash flow

?Accretive acquisitions in North America

?Disciplined acquisition strategy

?Operate responsibly

?Committed to operating responsibly in the communities where we operate ?Ocampo awarded Cemefi CSR® 2011 Distinction

El Chanate Mine

Ocampo Mine

• 2009 Reserves(2):

• ��� 2010 Reserves(1): 1.5M Gold ounces

• 1,248k Gold ounces Saric Property • 52,985k Silver ounces

Guadalupe y Calvo

La Bandera Venus & Mezquite Los Jarros

Mexico Fraile Norte

El Cubo Mine Orion Property (1)

• 2010 Reserves :

• 328k Gold ounces

• 18,038k Silver ounces

Exploration Property Gammon Operation

4

(1) Refer to the complete 2010 Reserve and Resource information provided inthe Appendices

(2) Refer to 2009 El Chanate Reserve and Resource information provided inthe Appendices and 4 Capital Gold Inc. corporate filings

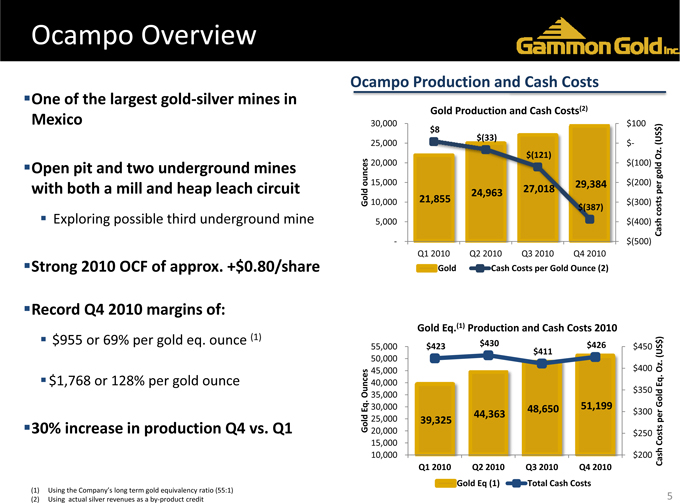

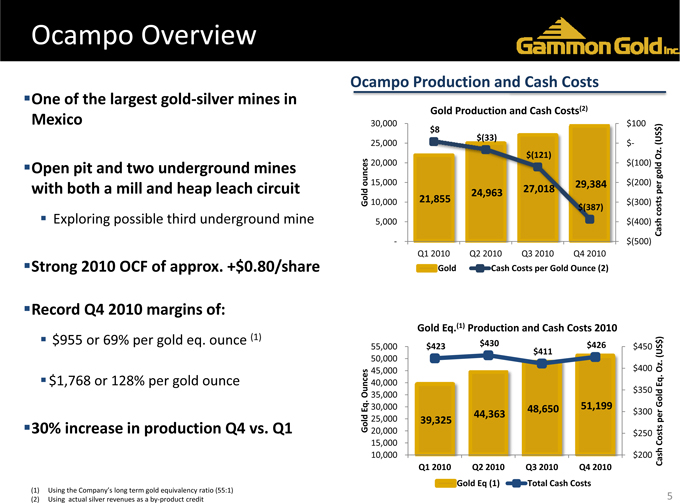

Ocampo Overview

??One of the largest gold? silver mines in Mexico

??Open pit and two underground mines with both a mill and heap leach circuit

?Exploring possible third underground mine

??Strong 2010 OCF of approx. +$0.80/share

??Record Q4 2010 margins of:

?$955 or 69% per gold eq. ounce (1)

?$1,768 or 128% per gold ounce

??30% increase in production Q4 vs. Q1

(1) Using theCompany’s longterm gold equivalency ratio (55:1) (2) Using actualsilver revenues asa by? product credit

Ocampo Production and Cash Costs

Gold Production and Cash Costs(2)

30,000 $100 $ ) $8 $(33) (US

25,000 $?

. $(121) Oz

20,000 $(100) gold ounces 15,000 29,384 $(200)

24,963 27,018 per Gold 10,000 21,855 $(300) $(387) costs

5,000 $(400) Cash

? $(500) Q1 2010 Q2 2010 Q3 2010 Q4 2010

Gold Cash Costs per Gold Ounce (2)

Gold Eq.(1) Production and Cash Costs 2010 $430 $ )

55,000 $423 $426 $450 50,000 $411 (US

45,000 $400 Oz .

40,000 $350 Eq Ounces 35,000 Eq .. 30,000 51,199 Gold 48,650 $300 44,363 Gold 25,000 39,325 per

20,000 $250 Costs 15,000 10,000 $200 Cash Q1 2010 Q2 2010 Q3 2010 Q4 2010

Gold Eq (1) Total Cash Costs

5

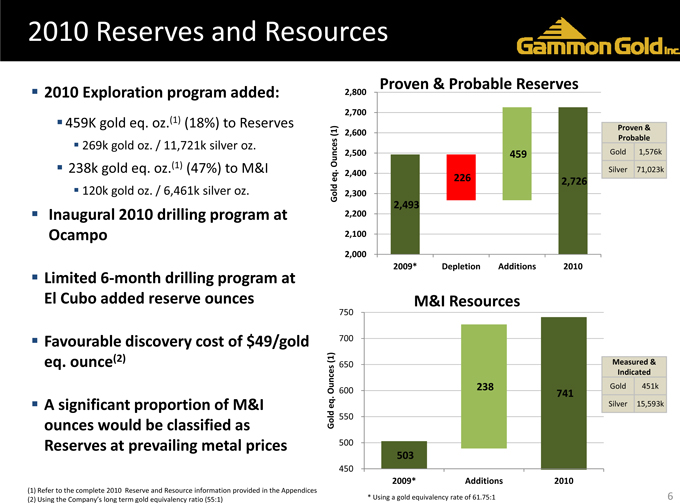

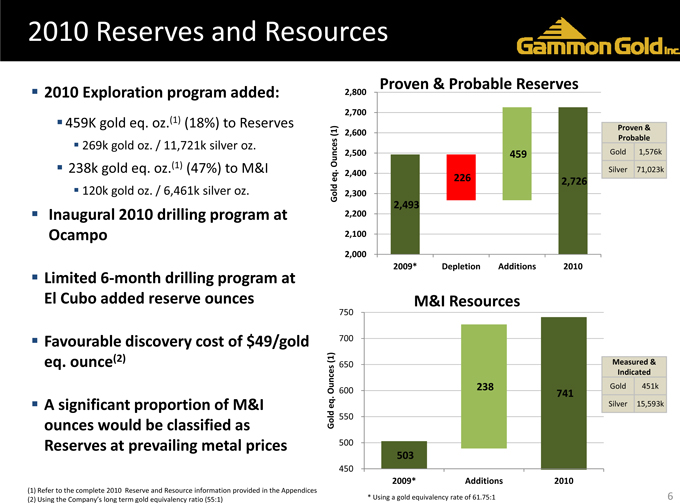

2010 Reserves and Resources

?2010 Exploration program added:

?459K gold eq. oz.(1) (18%) to Reserves

?269k gold oz. / 11,721k silver oz.

?238k gold eq. oz.(1) (47%) to M&I

?120k gold oz. / 6,461k silver oz.

?Inaugural 2010 drilling program at Ocampo

?Limited 6? month drilling program at El Cubo added reserve ounces

?Favourable discovery cost of $49/gold eq. ounce(2)

?A significant proportion of M&I ounces would be classified as Reserves at prevailing metal prices

(1) Refer to the complete 2010 Reserve and Resource information provided inthe Appendices (2) Usingthe Company’s longterm gold equivalency ratio (55:1)

Proven & Probable Reserves

2,800

2,700

Proven & (1) 2,600 Probable Ounces 2,500 459 Gold 1,576k

. 2,400 Silver 71,023k

eq 226 2,726 Gold 2,300 2,493 2,200

2,100

2,000

2009* Depletion Additions 2010

M&I Resources

750

700

(1) Measured &

650

Indicated 238 Gold 451k

Ounces 600 741 . eq Silver 15,593k

Gold 550 500

503

450

2009* Additions 2010

* Usinga gold equivalency rate of61.75:1 6

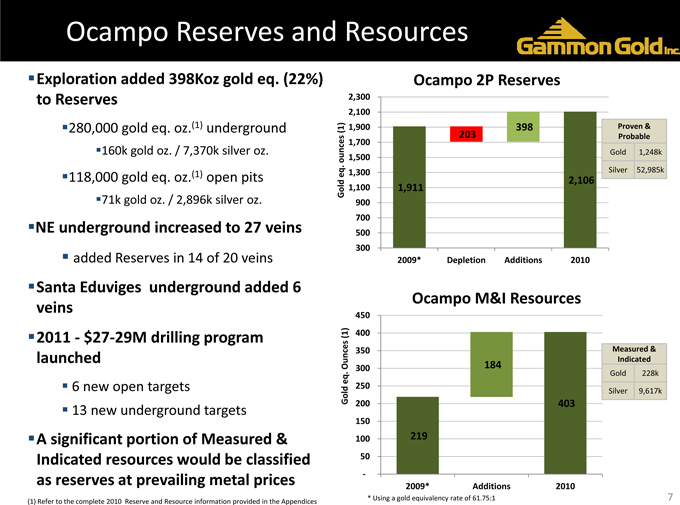

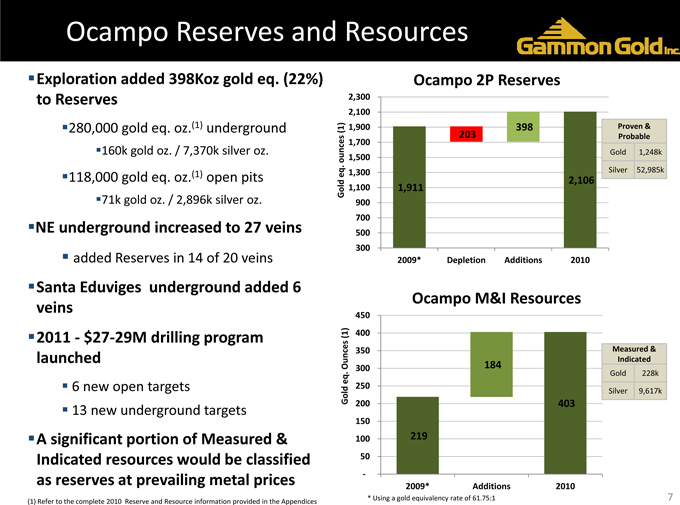

Ocampo Reserves and Resources

?Exploration added 398Koz gold eq. (22%) to Reserves

??280,000 gold eq. oz.(1) underground

??160k gold oz. / 7,370k silver oz.

??118,000 gold eq. oz.(1) open pits

??71k gold oz. / 2,896k silver oz.

??NE underground increased to 27 veins

?added Reserves in 14 of 20 veins

?Santa Eduviges underground added 6 veins ?2011 $ ? 27? 29M drilling program launched

?6 new open targets

?13 new underground targets

?A significant portion of Measured & Indicated resources would be classified as reserves at prevailing metal prices

(1) Refer to the complete 2010 Reserve and Resource information provided inthe Appendices

Ocampo 2P Reserves

2,300 2,100

(1) 1,900 398 Proven & 1,700 203 Probable

Gold 1,248k ounces 1,500

. Silver 52,985k eq 1,300 2,106 Gold 1,100 1,911 900 700 500 300 2009* Depletion Additions 2010

Ocampo M&I Resources

450

(1) 400

350 Measured & Indicated Ounces 300 184 eq . Gold 228k

250

Gold Silver 9,617k

200 403 150 100 219 50

?

2009* Additions 2010

* Usinga gold equivalency rate of61.75:1 7

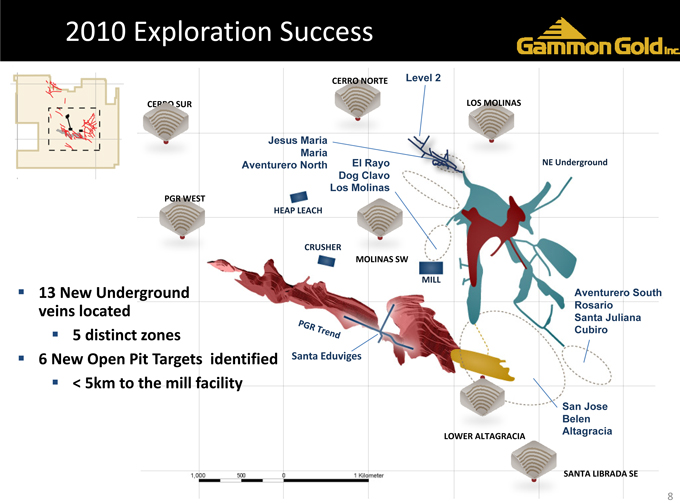

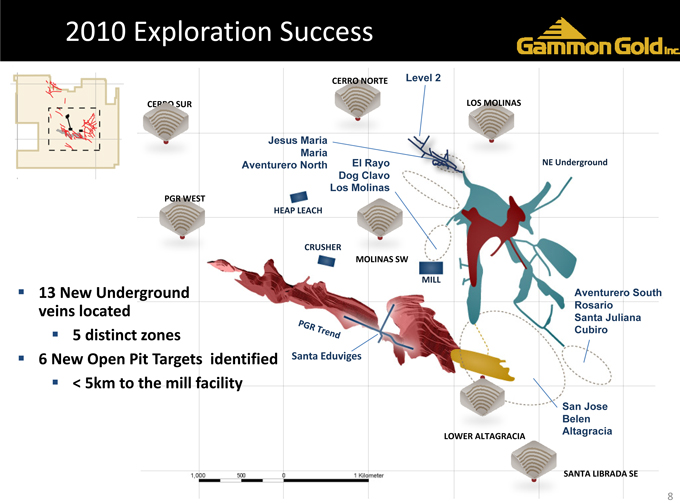

2010 Exploration Success

CERRO NORTE Level 2

CERRO SUR LOS MOLINAS

Jesus Maria

Maria

Aventurero North El Rayo NE Underground

Dog Clavo

Los Molinas

PGR WEST

HEAP LEACH

CRUSHER

MOLINAS SW

MILL

13 New Underground Aventurero South

veins located Rosario

Santa Juliana

5 distinct zones Cubiro

6 New Open Pit Targets identified Santa Eduviges

< 5km to the mill facility

San Jose

Belen

LOWER ALTAGRACIA Altagracia SANTA LIBRADA SE

8

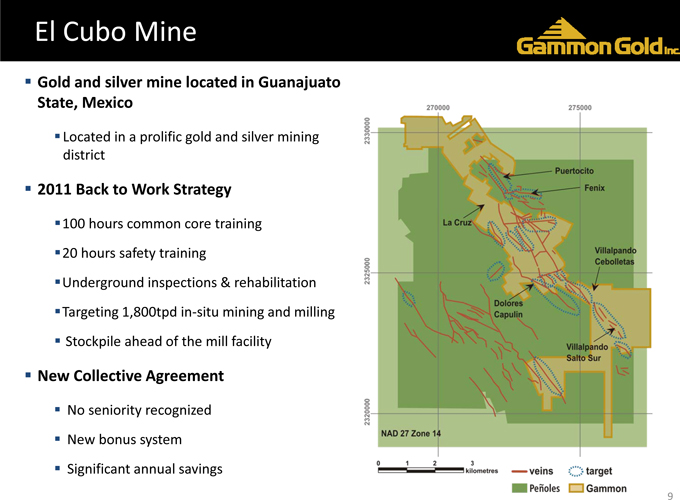

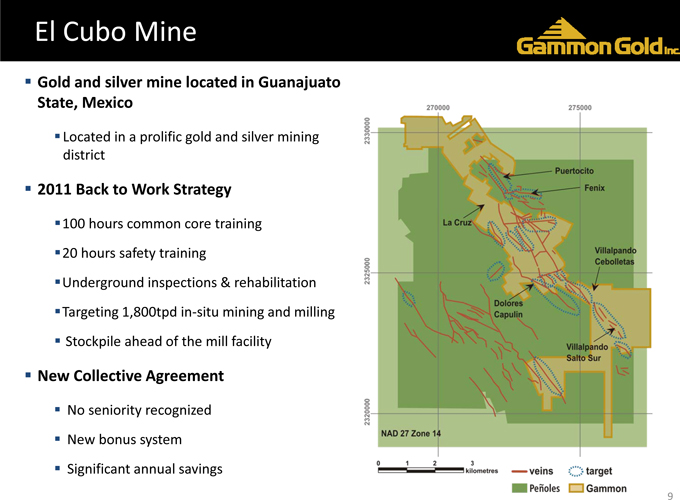

El Cubo Mine

?Gold and silver mine located in Guanajuato State, Mexico

?Located in a prolific gold and silver mining district

?2011 Back to Work Strategy

?100 hours common core training ?20 hours safety training

?Underground inspections & rehabilitation ?Targeting 1,800tpd in? situ mining and milling ?Stockpile ahead of the mill facility

?New Collective Agreement

?No seniority recognized ?New bonus system ?Significant annual savings

2320000

2325000

2330000

270000

275000

La Cruz

Puertocito

Fenix

Dolores Capulin

Villapando

Cebolietas

Villapando

Saltosur

NAD 27 Zone 14

Kilometers

Veins

Target

Penoles

Gammon

9

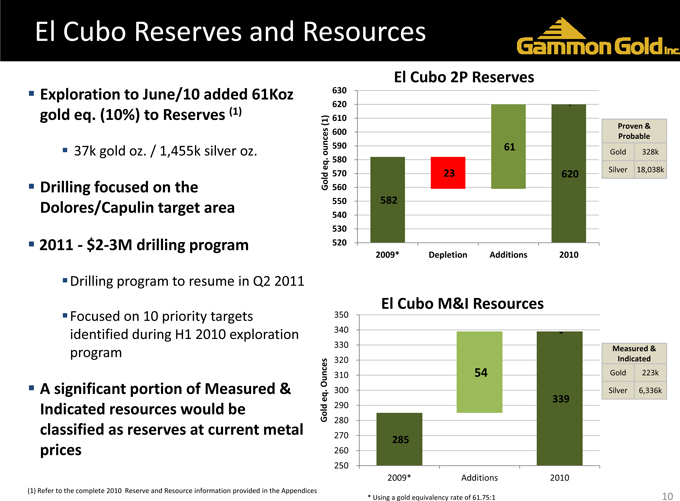

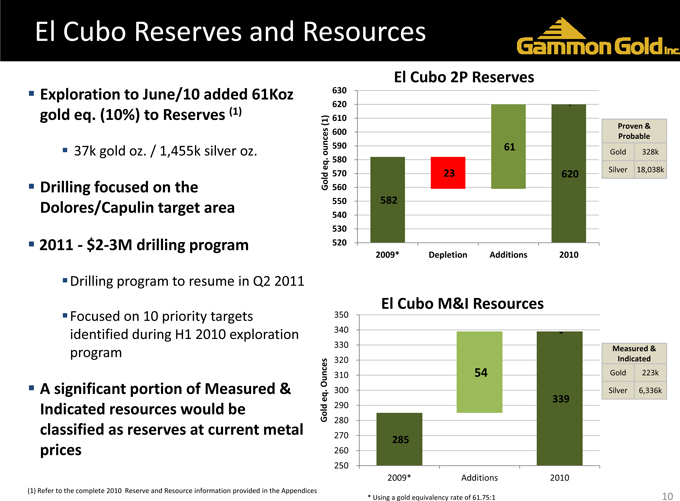

El Cubo Reserves and Resources

El Cubo 2P Reserves Exploration to June/10 added 61Koz 630

620 ?

gold eq. (10%) to Reserves (1)

(1) 610

Proven & 600 Probable

37k gold oz. / 1,455k silver oz. ounces 590 61 Gold 328k

eq . 580

Silver 18,038k

570 23 620

Drilling focused on the Gold 560

550 582

Dolores/Capulin target area

540 530

2011 $ ? 2? 3M drilling program 520

2009* Depletion Additions 2010

Drilling program to resume in Q2 2011

El Cubo M&I Resources

Focused on 10 priority targets 350 identified during H1 2010 exploration 340 ?

330 program Measured & 320 Indicated Ounces 310 54 Gold 223k

A significant portion of Measured & . eq 300 Silver 6,336k

339

Indicated resources would be Gold 290

280

classified as reserves at current metal

270 285

prices 260

250

2009* Additions 2010

(1) Refer to the complete 2010 Reserve and Resource information provided inthe Appendices

* Usinga gold equivalency rate of61.75:1 10

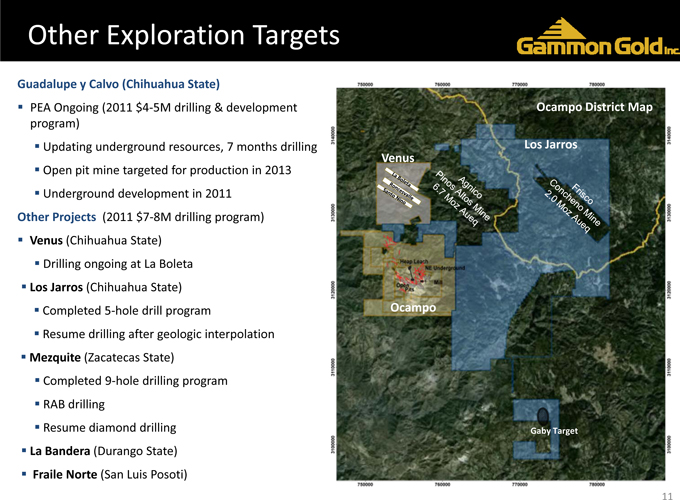

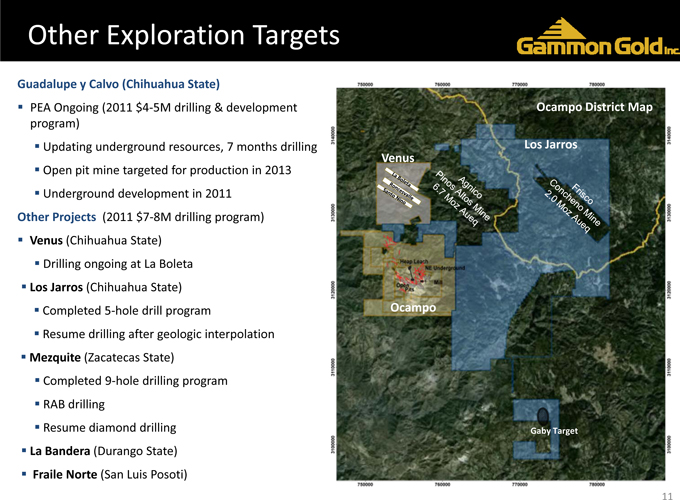

Other Exploration Targets

Guadalupe y Calvo (Chihuahua State)

PEA Ongoing (2011 $4? 5M drilling & development Ocampo District Map program) Updating underground resources, 7 months drilling Los Jarros

Venus

Open pit mine targeted for production in 2013 Underground development in 2011 Other Projects (2011 $7? 8M drilling program) Venus (Chihuahua State) Drilling ongoing at La Boleta Los Jarros (Chihuahua State)

Completed 5? hole drill program Ocampo Resume drilling after geologic interpolation Mezquite (Zacatecas State) Completed 9? hole drilling program RAB drilling

Resume diamond drilling Gaby Target La Bandera (Durango State) Fraile Norte (San Luis Posoti)

Agnico Pinos Altos Mine 6.7 Moz Aueq

Frisco Concheno Mine 2.0 Moz Aueq

11

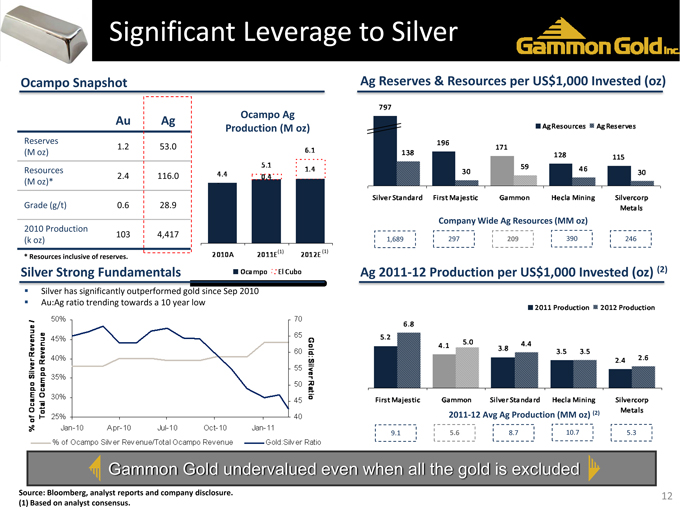

Significant Leverage to Silver

Ocampo Snapshot Ag Reserves & Resources per US$1,000 Invested (oz)

Ocampo Ag Au Ag Production (M oz)

Reserves

1.2 53.0 (M oz)

Resources

2.4 116.0 (M oz)*

Grade (g/t) 0.6 28.9

Company Wide Ag Resources (MM oz)

2010 Production

103 4,417

(k oz) 1,689 297 209 390 246

* Resources inclusiveof reserves. (1) (1)

Silver Strong Fundamentals Ag 2011? 12 Production per US$1,000 Invested (oz) (2)

Silver has significantly outperformed gold since Sep 2010 Au:Ag ratio trending towards a 10 year low

2011? 12 Avg Ag Production (MM oz) (2)

9.1 5.6 8.7 10.7 5.3

Gammon Gold undervalued even when all the gold is excluded

Source: Bloomberg, analyst reports and company disclosure. 12 (1) Based on analyst consensus.

4.4 5.1 0.4 6.1 1.4 2010A 2011E (1) 2012E(1)

Ocampo EICubo

% of Ocampo Silver Revenue / Total Ocampo Revenue

50% 45% 40% 35% 30% 25%

Jan-10 Apr-10 Jul-10 Oct-10 Jan-11

40 45 50 55 60 65 70

Gold:Silver Ratio

797 138 196 30 171 59 128 46 115 30

Silver Sandard

First Majestic

Gammon

Hecla Mining Silvercorp Metals

5.2 6.8 4.1 5.0 3.8 4.4 3.53.5 2.4 2.6

Capital Gold Acquisition

Gold Reserves (M oz) 2010 Gold Production (1) (koz)

Gammon Bid Highlights 2010 Gold Revenue Contribution (2)

Shareholder vote: March 18th (Capital Gold)

Strong cash position can fund immediate operational enhancements at El Chanate

Proven management team

Strong quarter over quarter production growth at Ocampo Significant increase in 2010 Reserves No Gammon shareholder approval required Gammon liquidity

(1) Pro forma production based on F2010 Gammon Gold and CGC gold production.

(2) Pro forma contribution based on F2010 production and an average gold price of US$1,227/oz and silver price of US$20.24/oz.

Probale

Proven

1.6 0.8 0.8

3.1 1.8 1.3

Gammon Pro Forma Gammon

114 170 49%increase in production

15% increase

Pro Forma Position

Market Capitalization (US$ M) (1) Gold Reserves (M oz)

2011? 2012 Average Gold Production (koz) 2011? 2012 Average Gold Cash Cost (US$/oz)(3)

Street Consensus Average Cash Cost (4) Cash Cost Based on Spot Ag Price

(2)

(2)

Source: Company disclosure and analyst consensus. (1) Market capitalization as at February 24, 2011. (2) Minefinders production and cash cost in gold eq.

(3) Net of silver by? products. 14 (4) Average cash cost based on silver price of US$32/oz.

$343 $854 $1,183 $1.525 $1,622 $2,073 $2,622

0.8 2.0 2.4 2.4 .2.8 3.1

104 140 155 169 188 199 235

$382 $443 $466 $471 $472 $499

($125)

($212)

Timmins

Minefinders

Aurizon

Pro Forma Gammon

Lake shore

Alamos

Allied Nevada

Key Highlights

Quarter over Quarter improvements at

Consensus CF/PS Ocampo on most KPI’s

Announced Capital Gold merger agreement, shareholder vote March 18th

El Cubo labour disruption successfully concluded

Consensus P/NAV Increased land position in Mexico by +90% in 2010 (pre? Capital Gold transaction)

Excellent progress on exploration, 19 new discoveries identified in Ocampo district

Secured $100MM credit facility

4 new independent Directors and Senior Mexican Advisor to the Board

Source: Bloomberg and analyst consensus. 15

8.8x 7.0x 21.3x 6.9x 9.6x 14.6x 13.2x

0.7x 0.8x 0.9x 0.9x 1.0x 1.1x 1.1x

Timmins

Minefinders

Aurizon

Pro Forma Gammon

Lake shore

Alamos

Allied Nevada

Investment Highlights

Strengthened management team

Committed to building Reserves

Accretive business development opportunities

Focused on precious metals in North America

Growing production

Low cost producer

Growing portfolio of operating and developing properties

Leveraging strong cash flow profile

Gammon Gold inc

APPENDICES

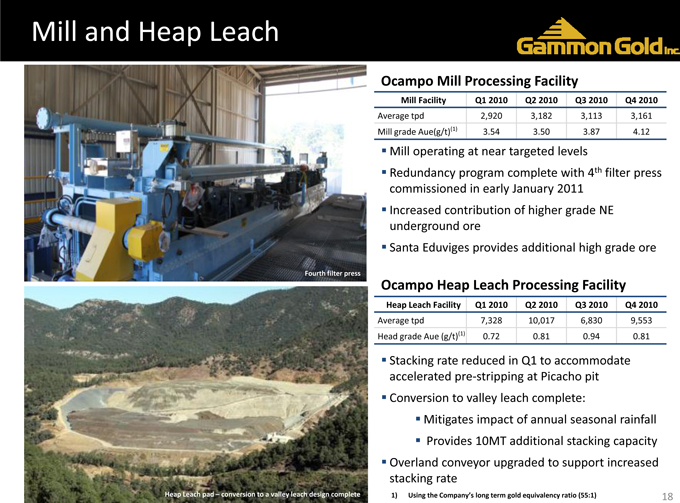

Mill and Heap Leach

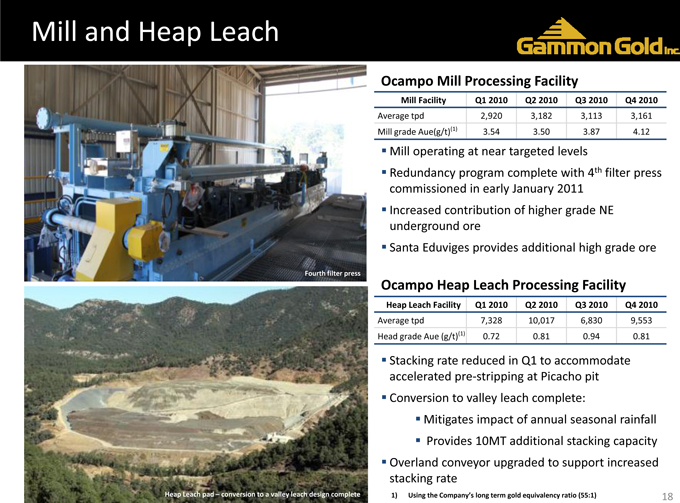

Ocampo Mill Processing Facility

Mill Facility Q1 2010 Q2 2010 Q3 2010 Q4 2010

Average tpd 2,920 3,182 3,113 3,161 Mill grade Aue(g/t)(1) 3.54 3.50 3.87 4.12

Mill operating at near targeted levels

Redundancy program complete with 4th filter press commissioned in early January 2011 Increased contribution of higher grade NE underground ore Santa Eduviges provides additional high grade ore

Ocampo Heap Leach Processing Facility

Heap Leach Facility Q1 2010 Q2 2010 Q3 2010 Q4 2010

Average tpd 7,328 10,017 6,830 9,553 Head grade Aue (g/t)(1) 0.72 0.81 0.94 0.81

Stacking rate reduced in Q1 to accommodate accelerated pre? stripping at Picacho pit Conversion to valley leach complete: Mitigates impact of annual seasonal rainfall Provides 10MT additional stacking capacity Overland conveyor upgraded to support increased stacking rate

1) Usingthe Company’s long termgold equivalency ratio(55:1) 18

Fourth filterpress

Heap Leachpad – conversion to avalley leachdesign complete

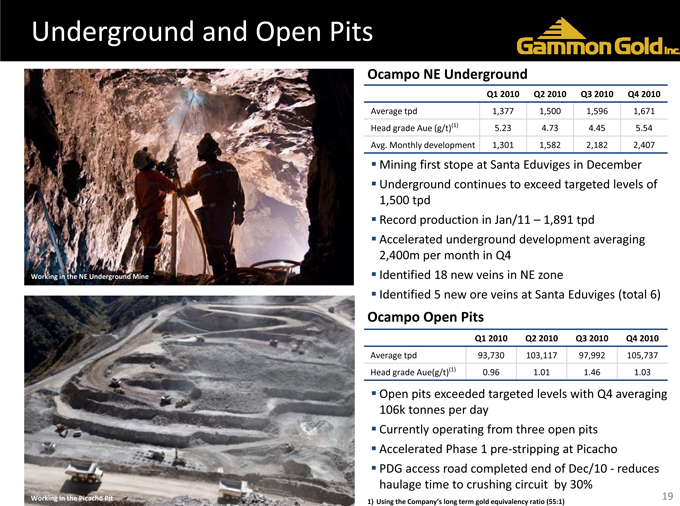

Underground and Open Pits

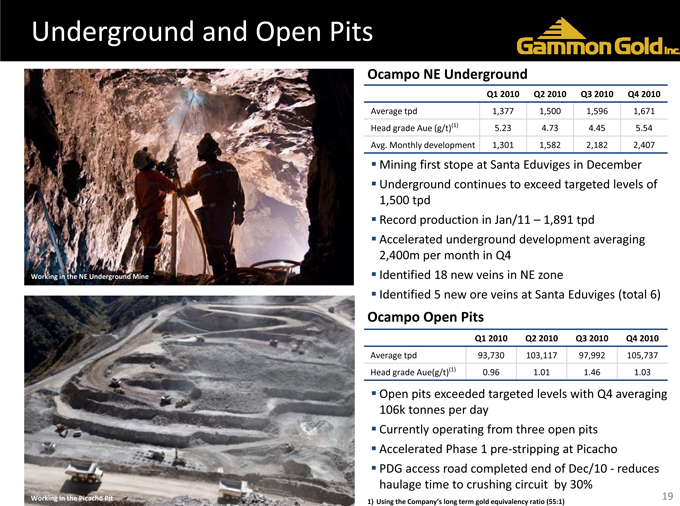

Ocampo NE Underground

Q1 2010 Q2 2010 Q3 2010 Q4 2010

Average tpd 1,377 1,500 1,596 1,671 Head grade Aue (g/t)(1) 5.23 4.73 4.45 5.54 Avg. Monthly development 1,301 1,582 2,182 2,407

Mining first stope at Santa Eduviges in December Underground continues to exceed targeted levels of 1,500 tpd Record production in Jan/11 – 1,891 tpd Accelerated underground development averaging 2,400m per month in Q4

Working in the NE Underground Mine Identified 18 new veins in NE zone

Identified 5 new ore veins at Santa Eduviges (total 6)

Ocampo Open Pits

Q1 2010 Q2 2010 Q3 2010 Q4 2010

Average tpd 93,730 103,117 97,992 105,737 Head grade Aue(g/t)(1) 0.96 1.01 1.46 1.03

Open pits exceeded targeted levels with Q4 averaging 106k tonnes per day Currently operating from three open pits Accelerated Phase 1 pre? stripping at Picacho PDG access road completed end of Dec/10 reduces ? haulage time to crushing circuit by 30%

Working in the Picacho Pit 19

1) Usingthe Company’s long termgold equivalency ratio(55:1)

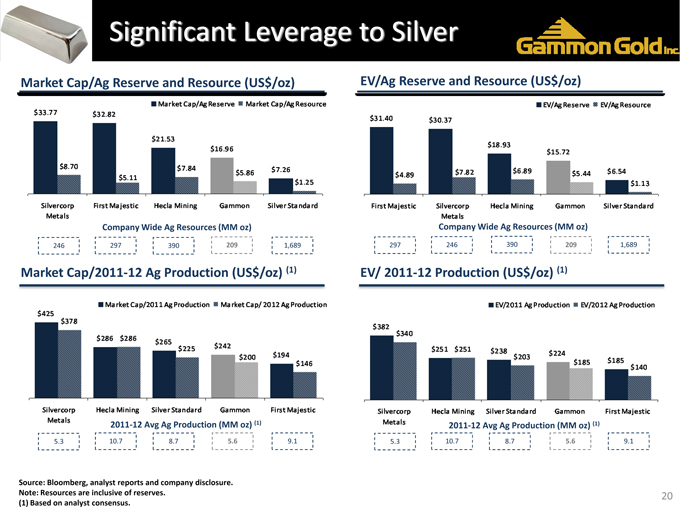

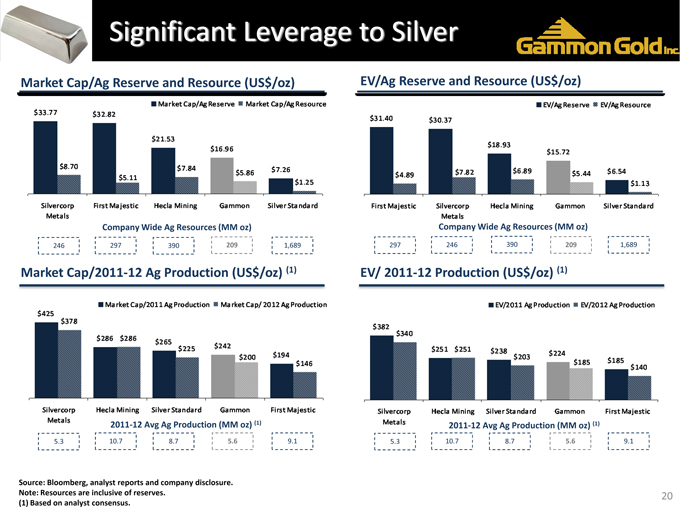

Significant Leverage to Silver

Market Cap/Ag Reserve and Resource (US$/oz) EV/Ag Reserve and Resource (US$/oz)

Company Wide Ag Resources (MM oz) Company Wide Ag Resources (MM oz)

246 297 390 209 1,689 297 246 390 209 1,689

Market Cap/2011? 12 Ag Production (US$/oz) (1) EV/ 2011? 12 Production (US$/oz) (1)

2011? 12 Avg Ag Production (MM oz) (1) 2011? 12 Avg Ag Production (MM oz) (1)

5.3 10.7 8.7 5.6 9.1 5.3 10.7 8.7 5.6 9.1

Source: Bloomberg, analyst reports and company disclosure.

Note: Resources are inclusive of reserves. 20 (1) Based on analyst consensus.

Market cap/Ag Reserve Market cap/Ag Resource

Silvercorp Metals

First Majestic

Hecla Minig Gammon

Silver Standard

Market Cap/Ag Reserve

Market Cap/Ag Resource

EV/Ag Reserve

EV/Ag Resource

Market Cap/2011 Ag Production

Market Cap/2012 Ag Production

EV/2011 Ag Production

EV/2012 Ag Production

$33.77

$8.70

$32.82 $5.11 $21.53 $7.84 $16.95 $5.86 $7.26 $1.25

$31.40 $4.89 $30.37 $7.82 $18.93 $6.89 $15.72 $5.44 $6.54 $1.13

$425 $378 $286 $286 $265 $225 $242 $200 $194 $146

$382 $340 $251 $251 $238 $203 $224 $185 $185 $140

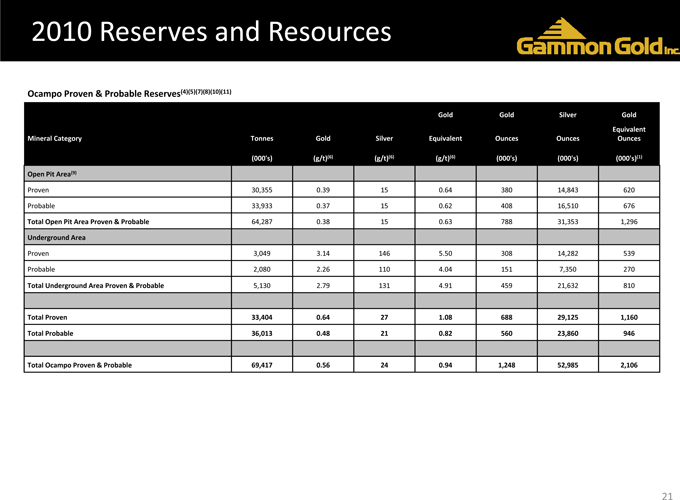

2010 Reserves and Resources

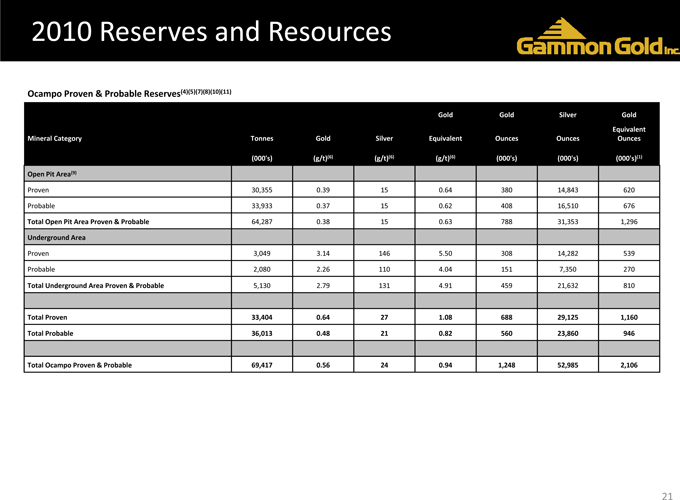

Ocampo Proven & Probable Reserves(4)(5)(7)(8)(10)(11)

Gold Gold Silver Gold

Equivalent Mineral Category Tonnes Gold Silver Equivalent Ounces Ounces Ounces

(000’s) (g/t)(6) (g/t)(6) (g/t)(6) (000’s) (000’s) (000’s)(1)

Open Pit Area(9)

Proven 30,355 0.39 15 0.64 380 14,843 620

Probable 33,933 0.37 15 0.62 408 16,510 676

Total Open Pit AreaProven & Probable 64,287 0.38 15 0.63 788 31,353 1,296

Underground Area

Proven 3,049 3.14 146 5.50 308 14,282 539

Probable 2,080 2.26 110 4.04 151 7,350 270

Total Underground Area Proven & Probable 5,130 2.79 131 4.91 459 21,632 810

Total Proven 33,404 0.64 27 1.08 688 29,125 1,160

Total Probable 36,013 0.48 21 0.82 560 23,860 946

Total Ocampo Proven & Probable 69,417 0.56 24 0.94 1,248 52,985 2,106

21

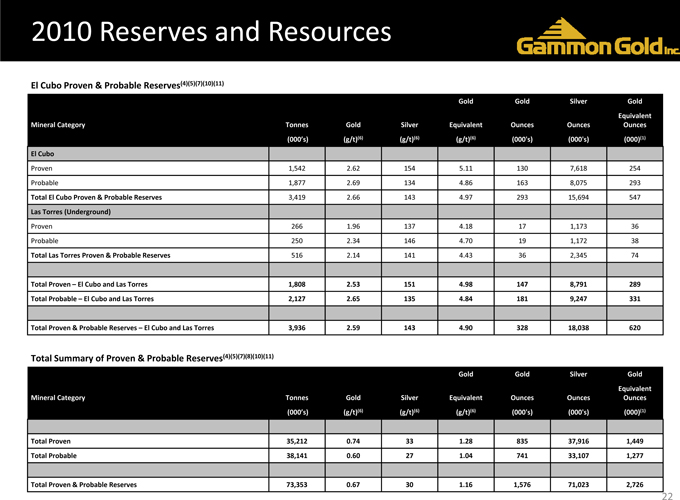

2010 Reserves and Resources

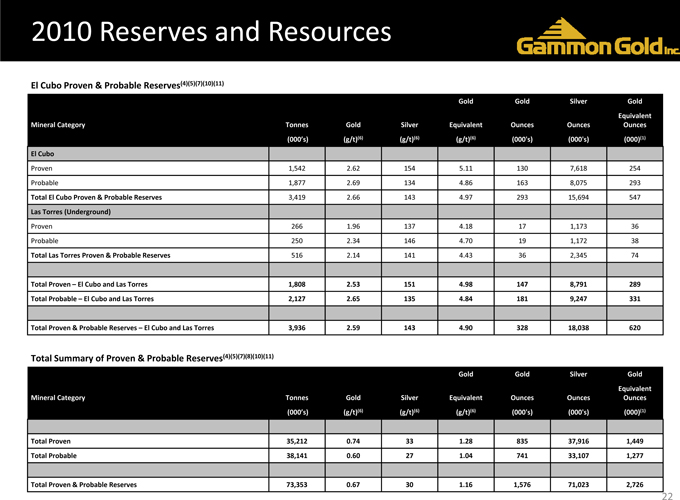

El Cubo Proven & Probable Reserves(4)(5)(7)(10)(11)

Gold Gold Silver Gold

Equivalent Mineral Category Tonnes Gold Silver Equivalent Ounces Ounces Ounces

(000’s) (g/t)(6) (g/t)(6) (g/t)(6) (000’s) (000’s) (000)(1)

El Cubo

Proven 1,542 2.62 154 5.11 130 7,618 254

Probable 1,877 2.69 134 4.86 163 8,075 293

Total El Cubo Proven & Probable Reserves 3,419 2.66 143 4.97 293 15,694 547

LasTorres (Underground)

Proven 266 1.96 137 4.18 17 1,173 36

Probable 250 2.34 146 4.70 19 1,172 38

Total Las Torres Proven & Probable Reserves 516 2.14 141 4.43 36 2,345 74

Total Proven – El Cubo and Las Torres 1,808 2.53 151 4.98 147 8,791 289

Total Probable – ElCubo andLas Torres 2,127 2.65 135 4.84 181 9,247 331

Total Proven & Probable Reserves – El Cubo and Las Torres 3,936 2.59 143 4.90 328 18,038 620

Total Summary of Proven & Probable Reserves(4)(5)(7)(8)(10)(11)

Gold Gold Silver Gold

Equivalent Mineral Category Tonnes Gold Silver Equivalent Ounces Ounces Ounces

(000’s) (g/t)(6) (g/t)(6) (g/t)(6) (000’s) (000’s) (000)(1)

Total Proven 35,212 0.74 33 1.28 835 37,916 1,449

Total Probable 38,141 0.60 27 1.04 741 33,107 1,277

Total Proven & Probable Reserves 73,353 0.67 30 1.16 1,576 71,023 2,726

22

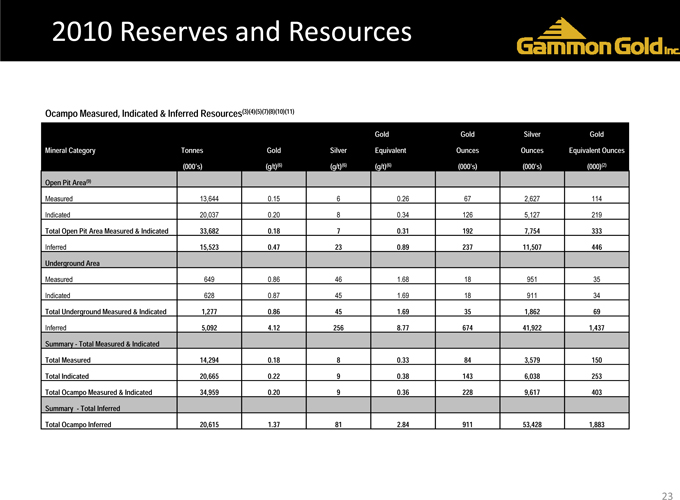

2010 Reserves and Resources

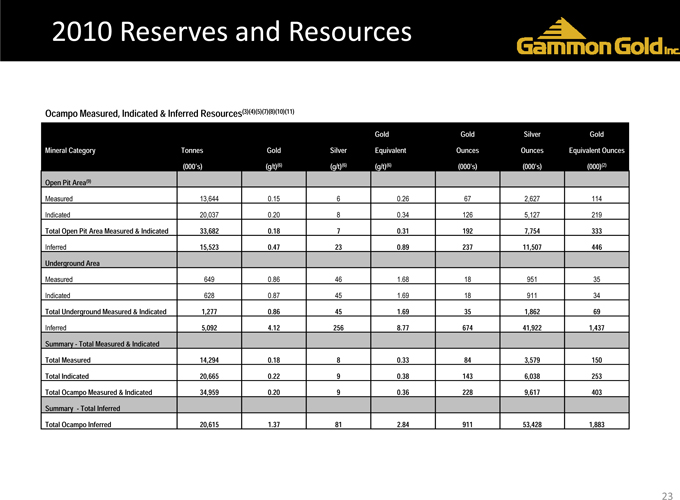

Ocampo Measured, Indicated & Inferred Resources(3)(4)(5)(7)(8)(10)(11)

Gold Gold Silver Gold Mineral Category Tonnes Gold Silver Equivalent Ounces Ounces Equivalent Ounces (000’s) (g/t)(6) (g/t)(6) (g/t)(6) (000’s) (000’s) (000)(2) Open Pit Area(9)

Measured 13,644 0.15 6 0.26 67 2,627 114

Indicated 20,037 0.20 8 0.34 126 5,127 219

Total Open Pit Area Measured & Indicated 33,682 0.18 7 0.31 192 7,754 333 Inferred 15,523 0.47 23 0.89 237 11,507 446 Underground Area

Measured 649 0.86 46 1.68 18 951 35

Indicated 628 0.87 45 1.69 18 911 34

Total Underground Measured & Indicated 1,277 0.86 45 1.69 35 1,862 69 Inferred 5,092 4.12 256 8.77 674 41,922 1,437 Summary—Total Measured & Indicated Total Measured 14,294 0.18 8 0.33 84 3,579 150 Total Indicated 20,665 0.22 9 0.38 143 6,038 253 Total Ocampo Measured & Indicated 34,959 0.20 9 0.36 228 9,617 403 Summary —Total Inferred Total Ocampo Inferred 20,615 1.37 81 2.84 911 53,428 1,883

23

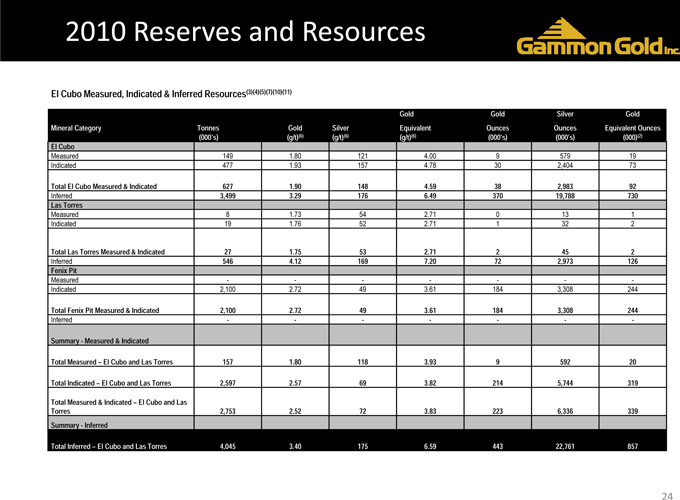

2010 Reserves and Resources

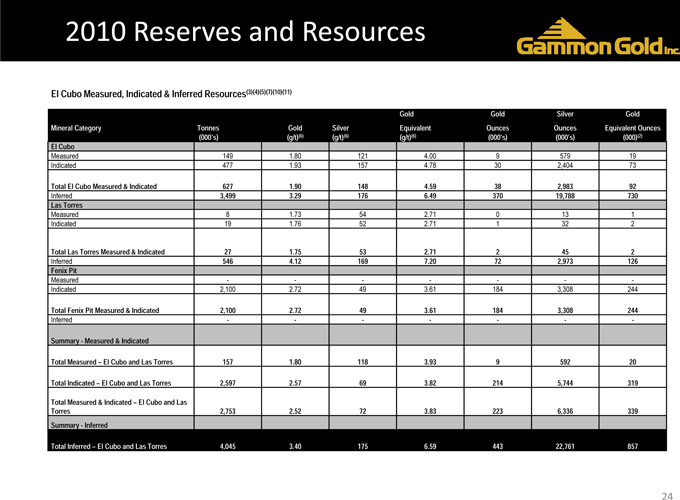

El Cubo Measured, Indicated & Inferred Resources(3)(4)(5)(7)(10)(11)

Gold Gold Silver Gold Mineral Category Tonnes Gold Silver Equivalent Ounces Ounces Equivalent Ounces (000’s) (g/t)(6) (g/t)(6) (g/t)(6) (000’s) (000’s) (000)(2) El Cubo

Measured 149 1.80 121 4.00 9 579 19 Indicated 477 1.93 157 4.78 30 2,404 73

Total El Cubo Measured & Indicated 627 1.90 148 4.59 38 2,983 92 Inferred 3,499 3.29 176 6.49 370 19,788 730 Las Torres

Measured 8 1.73 54 2.71 0 13 1 Indicated 19 1.76 52 2.71 1 32 2

Total Las Torres Measured & Indicated 27 1.75 53 2.71 2 45 2 Inferred 546 4.12 169 7.20 72 2,973 126 Fenix Pit

Measured———— -Indicated 2,100 2.72 49 3.61 184 3,308 244

Total Fenix Pit Measured & Indicated 2,100 2.72 49 3.61 184 3,308 244

Inferred———— -

Summary—Measured & Indicated

Total Measured – El Cubo and Las Torres 157 1.80 118 3.93 9 592 20

Total Indicated – El Cubo and Las Torres 2,597 2.57 69 3.82 214 5,744 319

Total Measured & Indicated – El Cubo and Las

Torres 2,753 2.52 72 3.83 223 6,336 339 Summary—Inferred

Total Inferred – El Cubo and Las Torres 4,045 3.40 175 6.59 443 22,761 857

24

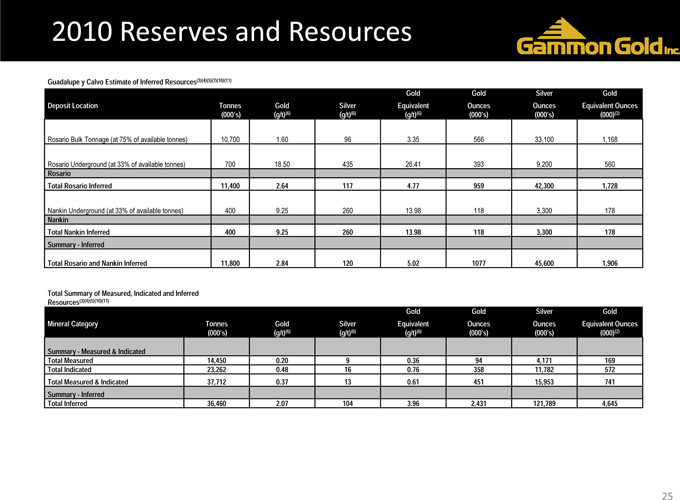

2010 Reserves and Resources

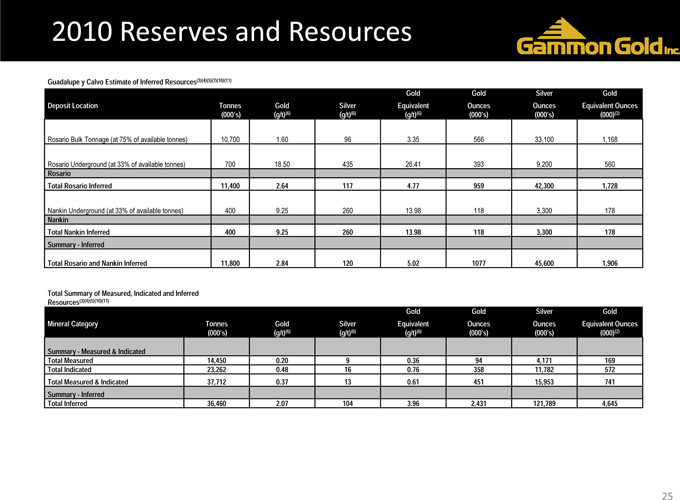

Guadalupe y Calvo Estimate of Inferred Resources(3)(4)(5)(7)(10)(11)

Gold Gold Silver Gold Deposit Location Tonnes Gold Silver Equivalent Ounces Ounces Equivalent Ounces (000’s) (g/t)(6) (g/t)(6) (g/t)(6) (000’s) (000’s) (000)(2)

Rosario Bulk Tonnage (at 75% of available tonnes) 10,700 1.60 96 3.35 566 33,100 1,168

Rosario Underground (at 33% of available tonnes) 700 18.50 435 26.41 393 9,200 560

Rosario

Total Rosario Inferred 11,400 2.64 117 4.77 959 42,300 1,728

Nankin Underground (at 33% of available tonnes) 400 9.25 260 13.98 118 3,300 178

Nankin

Total Nankin Inferred 400 9.25 260 13.98 118 3,300 178 Summary—Inferred

Total Rosario and Nankin Inferred 11,800 2.84 120 5.02 1077 45,600 1,906

Total Summary of Measured, Indicated and Inferred

Resources(3)(4)(5)(10)(11)

Gold Gold Silver Gold Mineral Category Tonnes Gold Silver Equivalent Ounces Ounces Equivalent Ounces (000’s) (g/t)(6) (g/t)(6) (g/t)(6) (000’s) (000’s) (000)(2)

Summary—Measured & Indicated

Total Measured 14,450 0.20 9 0.36 94 4,171 169 Total Indicated 23,262 0.48 16 0.76 358 11,782 572 Total Measured & Indicated 37,712 0.37 13 0.61 451 15,953 741 Summary—Inferred Total Inferred 36,460 2.07 104 3.96 2,431 121,789 4,645

25

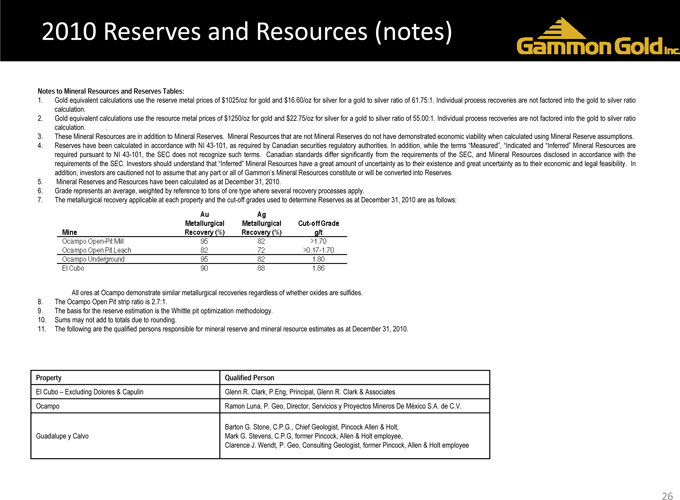

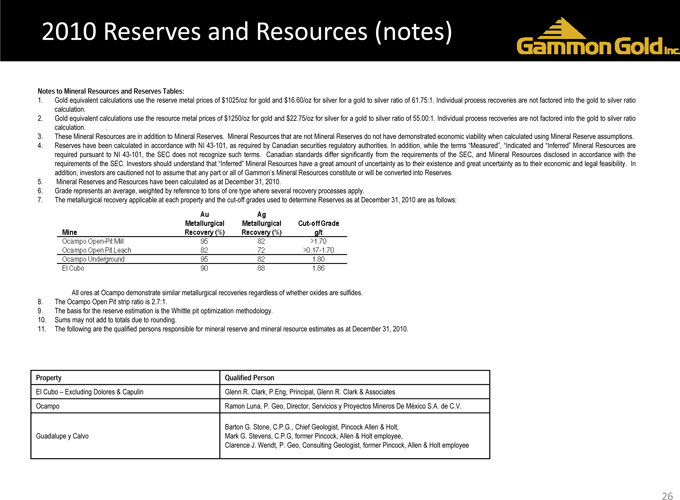

2010 Reserves andResources (notes)

Notes to Mineral Resources and Reserves Tables:

1. Gold equivalent calculations use the reserve metal prices of $1025/oz for gold and $16.60/oz for silver for a gold to silver ratio of 61.75:1. Individual process recoveries are not factored into the gold to silver ratio calculation.

2. Gold equivalent calculations use the resource metal prices of $1250/oz for gold and $22.75/oz for silver for a gold to silver ratio of 55.00:1. Individual process recoveries are not factored into the gold to silver ratio calculation. .

3. These Mineral Resources are in addition to Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability when calculated using Mineral Reserve assumptions.

4. Reserves have been calculated in accordance with NI 43-101, as required by Canadian securities regulatory authorities. In addition, while the terms “Measured”, “Indicated and “Inferred” Mineral Resources are required pursuant to NI 43-101, the SEC does not recognize such terms. Canadian standards differ significantly from the requirements of the SEC, and Mineral Resources disclosed in accordance with the requirements of the SEC. Investors should understand that “Inferred” Mineral Resources have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. In addition, investors are cautioned not to assume that any part or all of Gammon’s Mineral Resources constitute or will be converted into Reserves.

5. Mineral Reserves and Resources have been calculated as at December 31, 2010.

6. Grade represents an average, weighted by reference to tons of ore type where several recovery processes apply.

7. The metallurgical recovery applicable at each property and the cut-off grades used to determine Reserves as at December 31, 2010 are as follows:

All ores at Ocampo demonstrate similar metallurgical recoveries regardless of whether oxides are sulfides.

8. The Ocampo Open Pit strip ratio is 2.7:1.

9. The basis for the reserve estimation is the Whittle pit optimization methodology.

10. Sums may not add to totals due to rounding.

11. The following are the qualified persons responsible for mineral reserve and mineral resource estimates as at December 31, 2010.

Property Qualified Person

El Cubo – Excluding Dolores & Capulin Glenn R. Clark, P.Eng, Principal, Glenn R. Clark & Associates

Ocampo Ramon Luna, P. Geo, Director, Servicios y Proyectos Mineros De México S.A. de C.V.

Barton G. Stone, C.P.G., Chief Geologist, Pincock Allen & Holt, Guadalupe y Calvo Mark G. Stevens, C.P.G, former Pincock, Allen & Holt employee,

Clarence J. Wendt, P. Geo, Consulting Geologist, former Pincock, Allen & Holt employee

Mine Au Metallurgical Recovery(%) Cut-off Grade git

Ocampo Open-Pit Mill 95 82 >1.70

Ocampo Open-Pit Leach 82 72 >0.17-1.70

Ocampo Underground 95 82 1.80

EI Cubo 90 88 1.86

26