- CHCO Dashboard

- Financials

- Filings

- Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

City Holding (CHCO) 8-KRegulation FD Disclosure

Filed: 15 Sep 09, 12:00am

Orig. Cost | Other than Temporary Impairment Charges (Cumm) | Unrealized Gains/ (Losses) | Carrying Value | |

FNMA & FHLMC Pfd | $22.7 | ($21.1) | ($1.0) | $0.6 |

Municipals | $ 49.3 | $0 | ($0.4) | $48.8 |

MBS | $292.8 | $0 | $6.2 | $299.0 |

Pool Bank Trust Pfd | $ 27.1 | ($18.3) | ($5.4) | $3.4 |

Single Issue Bank Trust Pfd; Bank Holding Company Pfd; Sub-debt of FI’s | $110.8 | ($1.0) | ($14.0) | $95.8 |

Money Markets & Mutual Funds | $64.8 | $0 | $0 | $64.8 |

Fed & FHLB Stock | $ 13.0 | $0 | $0 | $13.0 |

Bank Equities | $ 8.9 | $0 | ($3.0) | $5.9 |

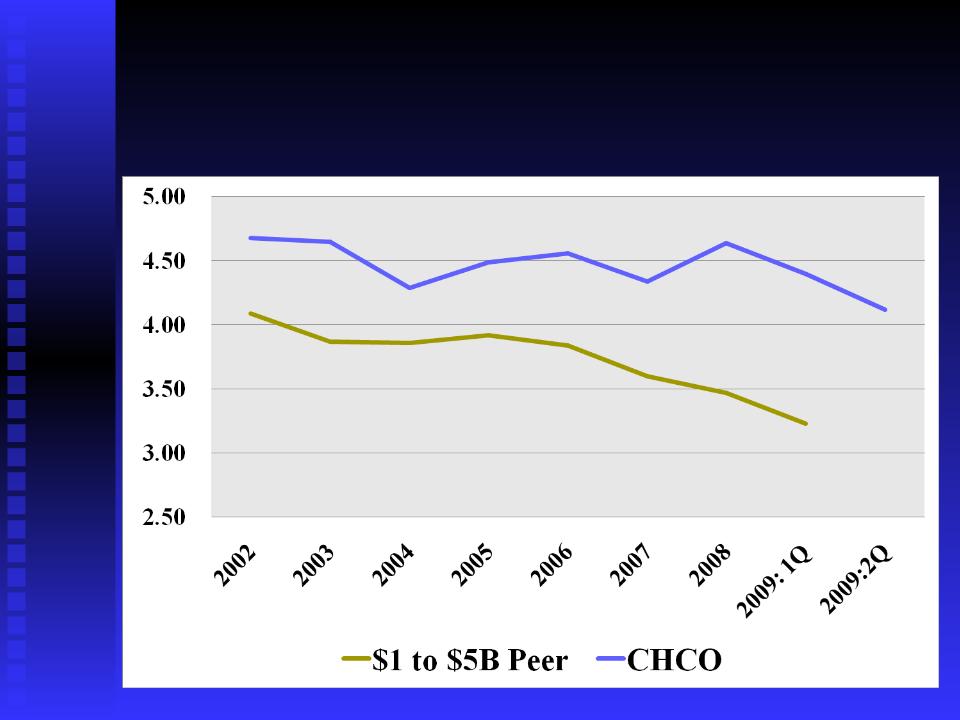

2005 | 2006 | 2007 | 2008 | 2008 Peers Median | 2009 1st Half | |

Reported ROA | 2.09% | 2.11% | 2.03% | 1.12% | 0.58% - 87th %ile | 1.63% |

ROTE | 22.3% | 22.4% | 21.0% | 11.4% | 8.5% - 69st %ile | 18.4% |

Tangible Common Equity/TA | 9.5% | 10.1% | 9.7% | 8.83% | 6.4% - 90th %ile | 9.11% |

NIM | 4.49% | 4.56% | 4.34% | 4.64% | 3.67%- 92nd %ile | 4.29% |

Efficiency Ratio | 46.7% | 44.5% | 45.9% | 46.3% | 63.1% - 92nd %ile | 50.4% |

Non-Int Rev/Total Rev | 34% | 34% | 34% | 36% | 23% - 94th %ile | 37.7% |

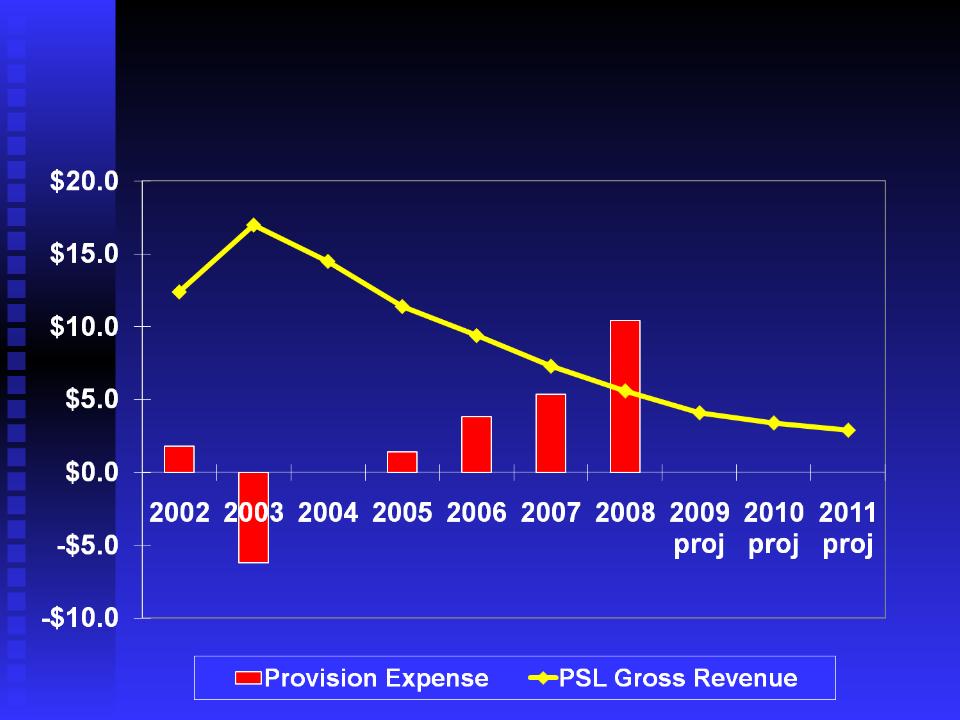

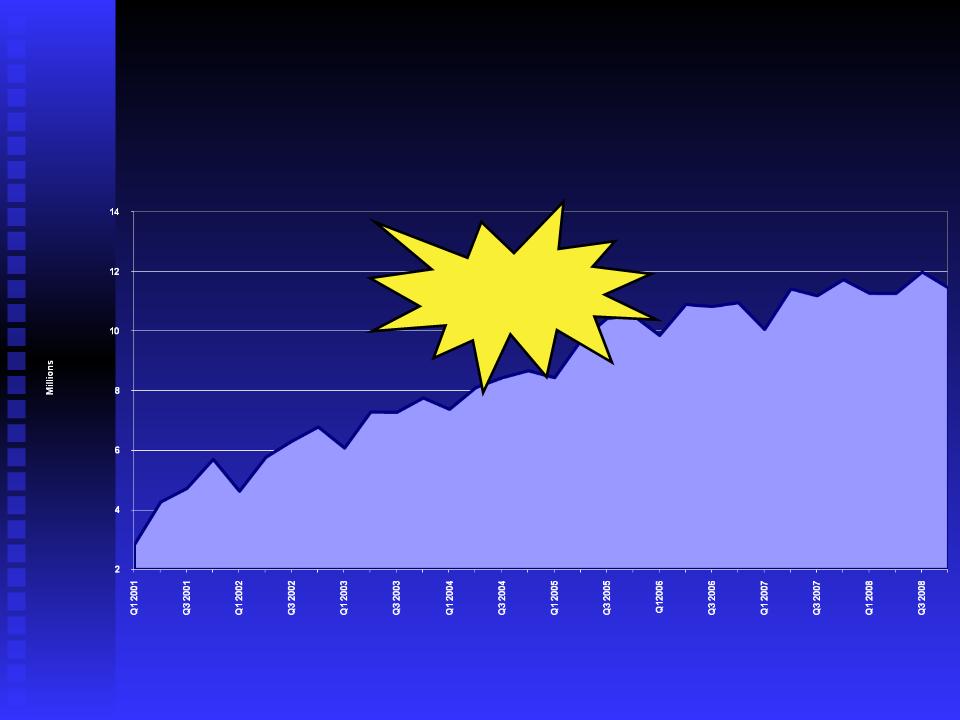

2004 | 2005 | 2006 | 2007 | 2008 | 2009 Projected | |

Average Balances | $83.5 MM | $42.9 MM | $22.3 MM | $10.5 MM | $5.2 MM | $3.6MM |

Rate | 17.4% | 26.6% | 42.2% | 69.1% | 108% | 120% |

Gross Interest Revenue | $14.5 MM | $11.4 MM | $9.4 MM | $7.3 MM | $5.6MM | $4.0MM |

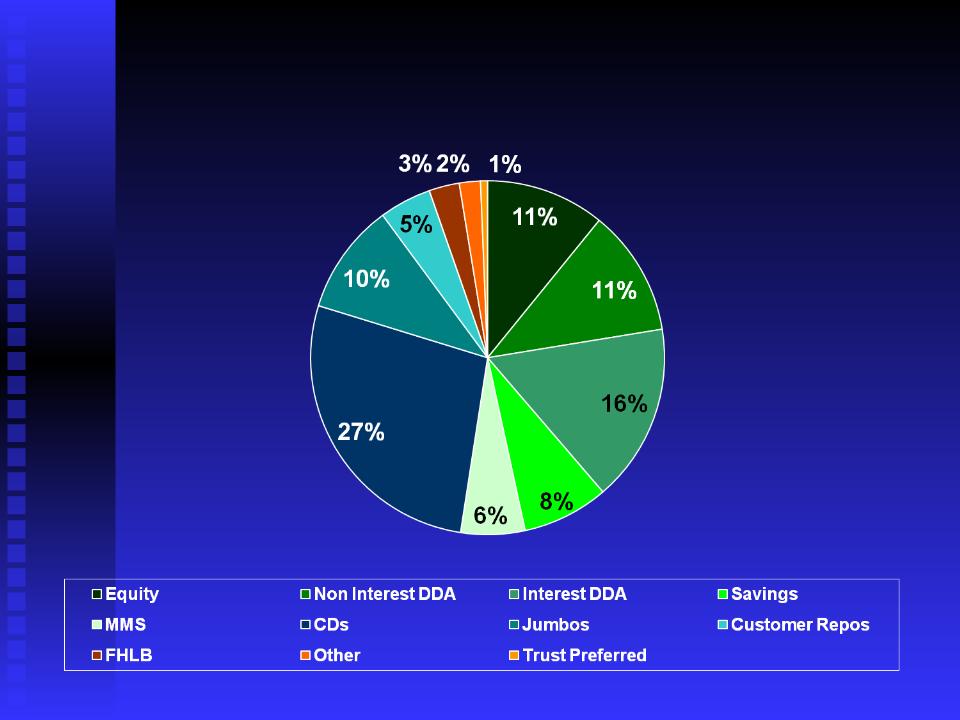

CHCO | Peers | Advantage | |

CD’s | 3.87% | 3.81% | -6 Bps |

Interest Bearing Deposits | 2.48% | 2.74% | 26 Bps |

Total Deposits | 2.08% | 2.33% | 25 Bps |

Interest Bearing Liabilities | 2.48% | 2.90% | 52 Bps |

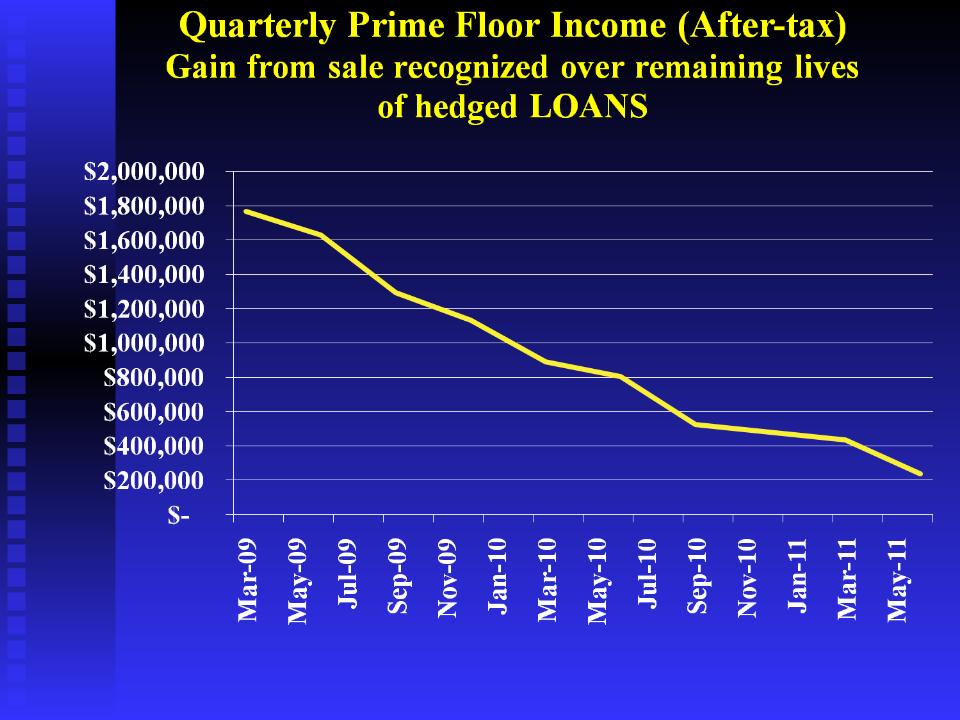

Notional | Prime Rate | Term Date |

$100MM | 8% | June 2011 |

$100MM | 7.75% | May 2011 |

$50MM | 6.75% | Nov 2009 |

$100MM | 6% | June 2010 |

$100MM | 6% | June 2009 |

Immediate Basis Point Change in Interest Rates | Estimated Increase of Decrease in Net Income between 1-12 months |

+300 Bp | +9.7% |

+200 Bp | 5.9% |

+100 Bp | 2.2% |