- CHCO Dashboard

- Financials

- Filings

- Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

City Holding (CHCO) 8-KFinancial statements and exhibits

Filed: 30 Apr 03, 12:00am

Exhibit 99.1

Welcome

Annual Shareholders Meeting

April 30, 2003

Our Business Model

| • | We are a retail bank |

| • | We focus on core deposit gathering |

| • | We employ a simple business model |

2

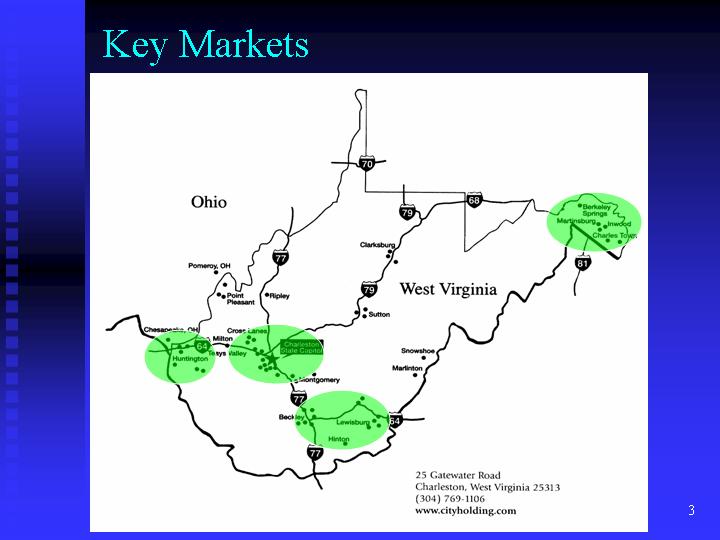

Key Markets

25 Gatewater Road

Charleston, West Virginia 25313

(304) 769-1106

www.cityholding.com

3

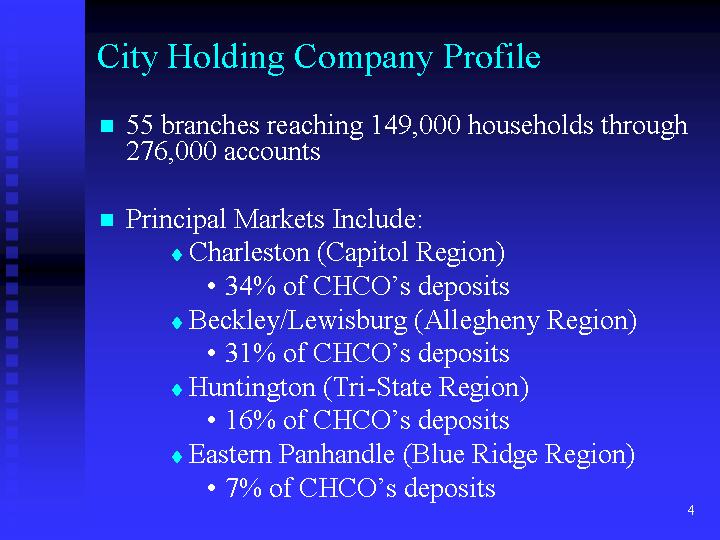

City Holding Company Profile

| n | 55 branches reaching 149,000 households through 276,000 accounts |

| n | Principal Markets Include: |

| ¨ | Charleston (Capitol Region) |

| • | 34% of CHCO’s deposits |

| ¨ | Beckley/Lewisburg (Allegheny Region) |

| • | 31% of CHCO’s deposits |

| ¨ | Huntington (Tri-State Region) |

| • | 16% of CHCO’s deposits |

| ¨ | Eastern Panhandle (Blue Ridge Region) |

| • | 7% of CHCO’s deposits |

4

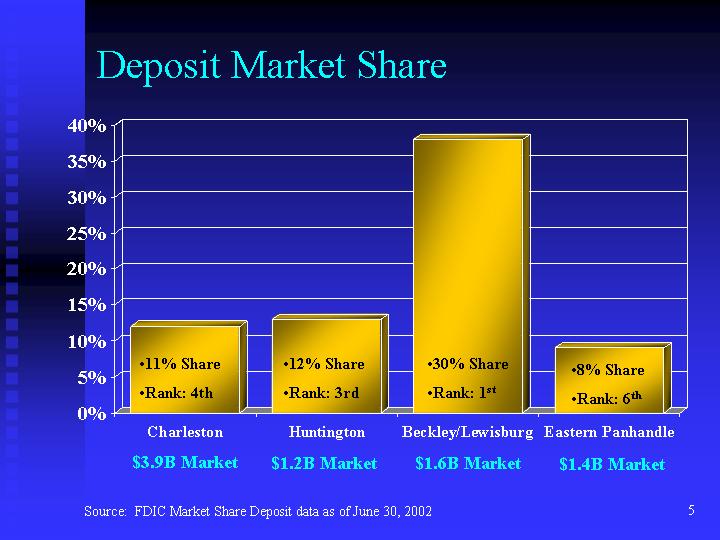

Deposit Market Share

Source: FDIC Market Share Deposit data as of June 30, 2002

5

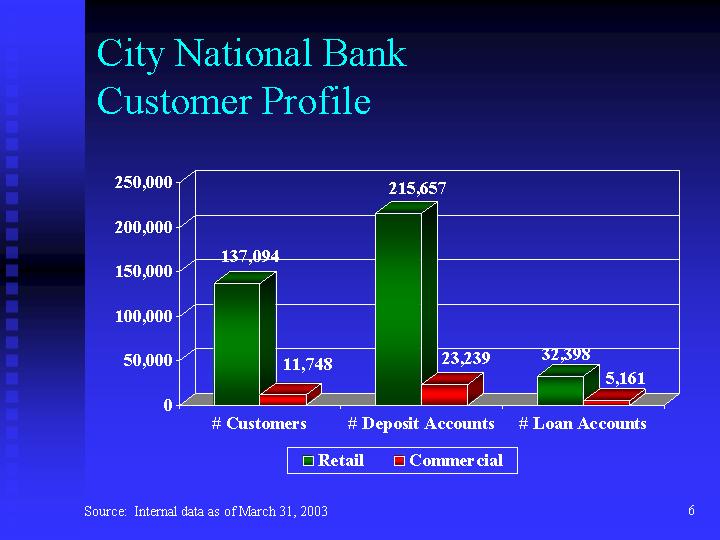

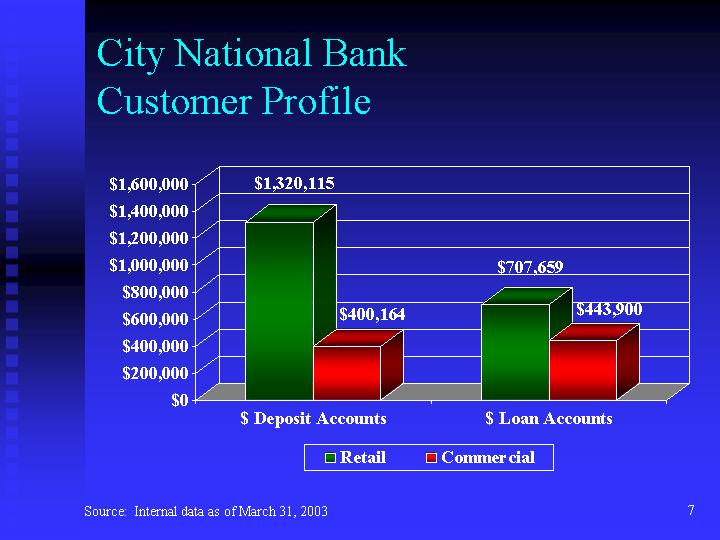

City National Bank

Customer Profile

Source: Internal data as of March 31, 2003

6

City National Bank

Customer Profile

Source: Internal data as of March 31, 2003

7

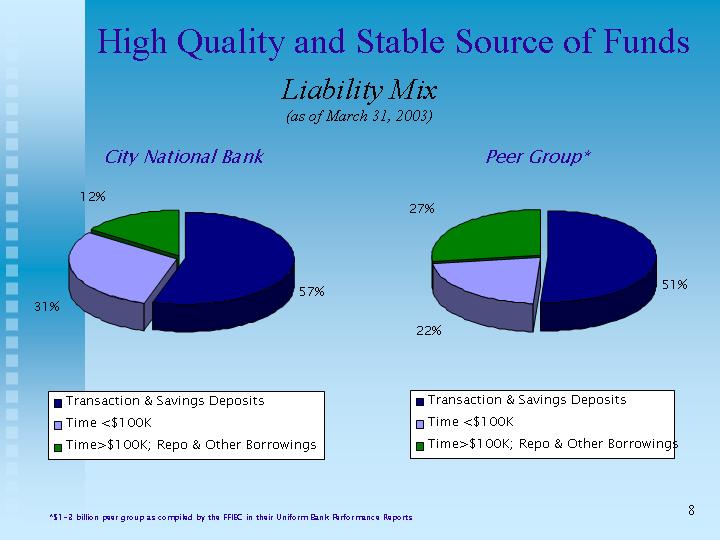

High Quality and Stable Source of Funds

Liability Mix

(as of March 31, 2003)

City National Bank | Peer Group* | |

n Transaction & Savings Deposits | n Transaction & Savings Deposits | |

n Time <$100K | n Time <$100K | |

n Time>$100K; Repo & Other Borrowings | n Time>$100K; Repo & Other Borrowings |

*$1-3 billion peer group as compiled by the FFIEC in their Uniform Bank Performance Reports

8

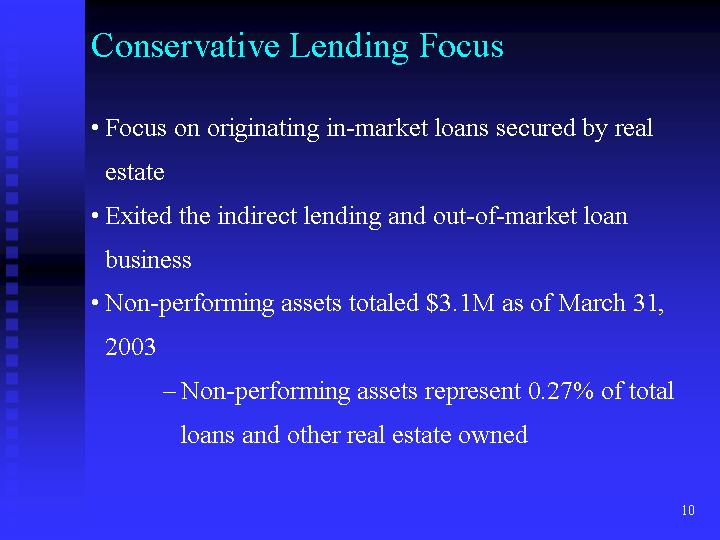

Conservative Lending Focus

| • | Focus on originating in-market loans secured by real estate |

| • | Exited the indirect lending and out-of-market loan business |

| • | Non-performing assets totaled $3.1M as of March 31, 2003 |

| – | Non-performing assets represent 0.27% of total loans and other real estate owned |

9

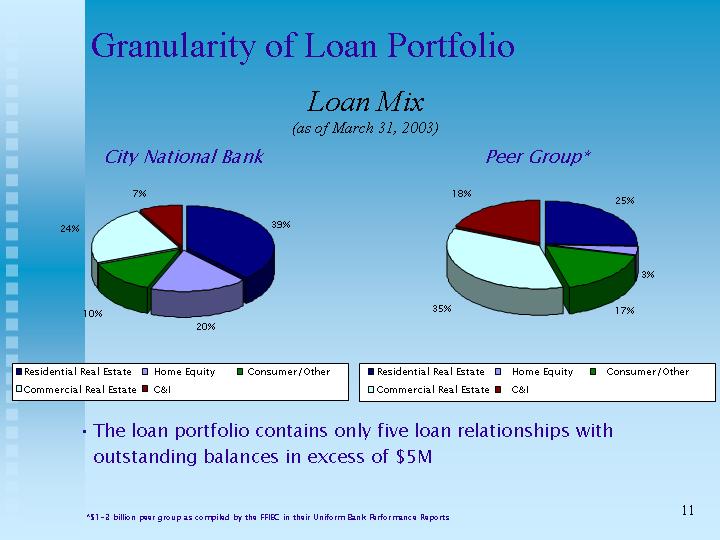

Granularity of Loan Portfolio

Loan Mix

(as of March 31, 2003)

City National Bank | Peer Group* |

n Residential Real Estate | n Home Equity | n Consumer/Other | n Residential Real Estate | n Home Equity | n Consumer/Other | |||||

¨ Commercial Real Estate | n C&I | ¨ Commercial Real Estate | n C&I |

| • | The loan portfolio contains only five loan relationships with outstanding balances in excess of $5M |

*$1-3 billion peer group as compiled by the FFIEC in their Uniform Bank Performance Reports

10

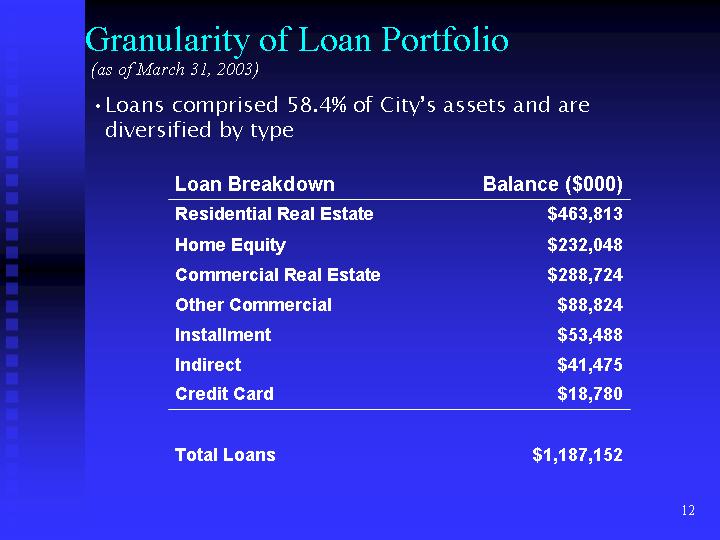

Granularity of Loans Portfolio

(as of March 31, 2003)

| • | Loan comprised 58.4% of City’s assets and are diversified by type |

Loan Breakdown | Balance ($000) | ||

Residential Real Estate | $ | 463,813 | |

Home Equity | $ | 232,048 | |

Commercial Real Estate | $ | 288,724 | |

Other Commercial | $ | 88,824 | |

Installment | $ | 53,488 | |

Indirect | �� | $ | 41,475 |

Credit Card | $ | 18,780 | |

Total Loans | $ | 1,187,152 | |

11

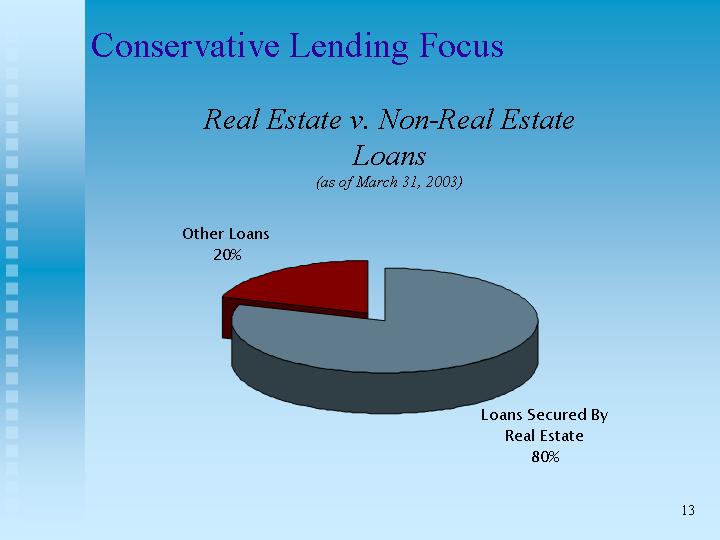

Conservative Lending Focus

Real Estate v. Non-Real Estate

Loans

(as of March 31, 2003)

Other Loans

20%

Loans Secured By

Real Estate

80%

12

High Level of Liquidity

| • | Loan-to-deposit ratio was 75% as of March 31, 2003 |

| • | Investment portfolio represents 25% of assets |

| • | $55 million in overnight investments, fed funds sold, and term fed funds sold |

| • | High level of liquidity is augmented by a primarily unpledged investment portfolio and a limited use of wholesale funding |

13

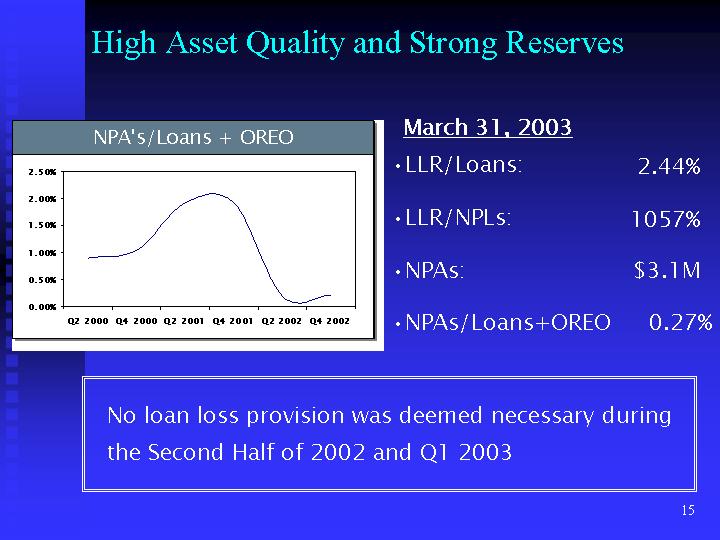

High Asset Quality and Strong Reserves

No loan loss provision was deemed necessary during the Second Half of 2002 and Q1 2003

14

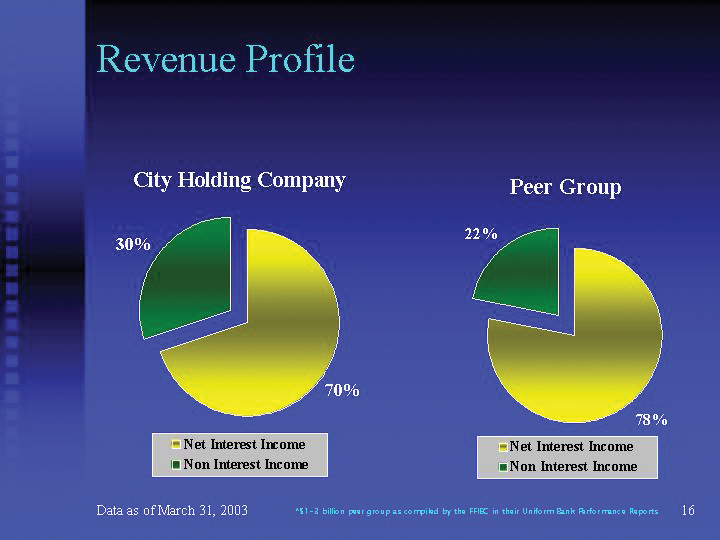

Revenue Profile

Data as of March 31, 2003

*$1-3 billion peer group as compiled by the FFIEC in their Uniform Bank Performance Reports

15

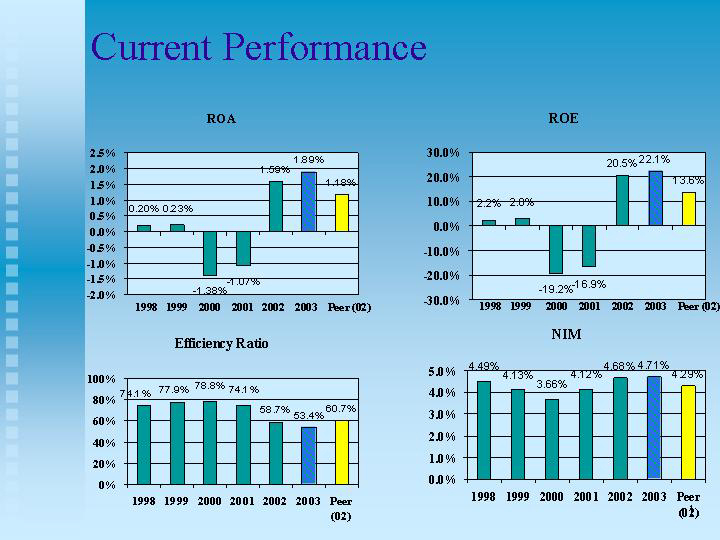

Current Performance

16

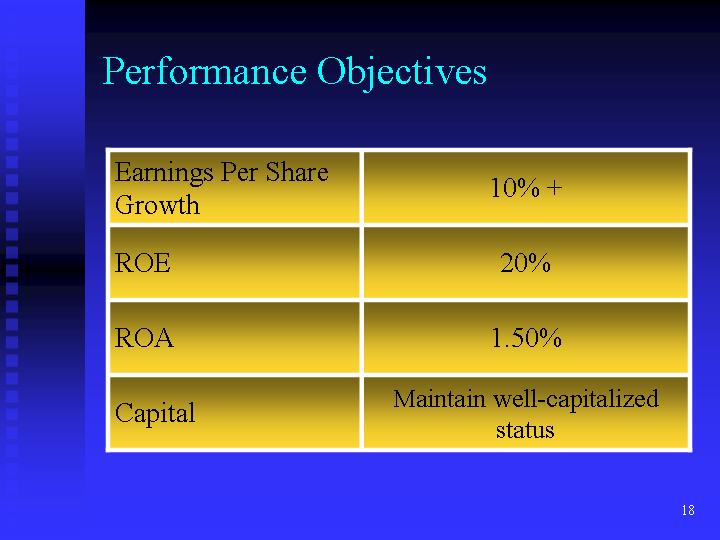

Performance Objectives

17

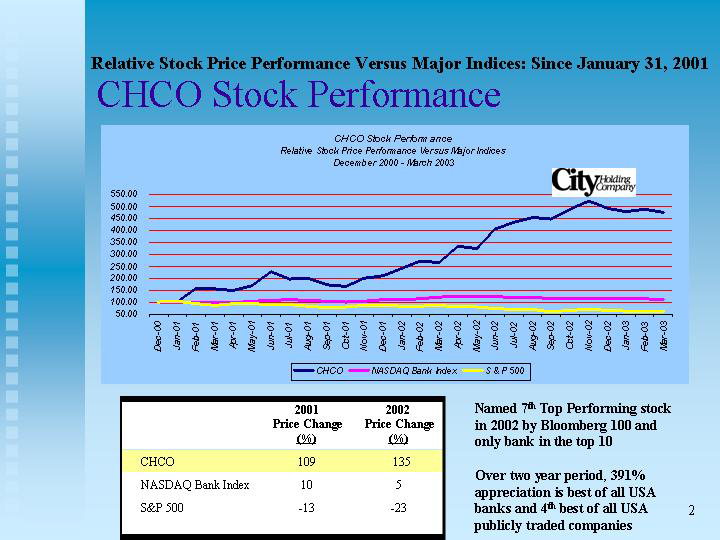

Named 7th Top Performing Stock in 2002 by Bloomberg 100 and only bank in the top 10

Over two year period, 391% appreciation is best of all USA banks and 4th best of all USA publicly traded companies

Questions?