Exhibit 99.1

RBC Capital Markets

Financial Institutions Conference

September 19, 2003

FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements that are included pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995. Such information involves risks and

uncertainties that could result in the Company’s actual results differing from those projected in the forward-

looking statements. Important factors that could cause actual results to differ materially from those discussed in

such forward-looking statements include, but are not limited to, (1) the Company may incur additional loan loss

provision due to negative credit quality trends in the future that may lead to a deterioration of asset quality, or

conversely, the Company may incur less, or even negative, loan loss provision due to positive credit quality trends

in the future; (2) the Company may not continue to experience significant recoveries of previously charged-off

loans and the Company may incur increased charge-offs in the future; (3) the Company may experience

increases in the default rates on its retained interests in securitized mortgages causing it to take impairment

charges to earnings; (4) the Company may not realize the expected cash payments that it is presently accruing

from its retained interests in securitized mortgages; (5) the Company may experience either faster or slower rates

of amortization of its retained interests and loans previously securitized; (6) the Company could have adverse

legal actions of a material nature; (7) the Company may face competitive loss of customers associated with its

efforts to increase fee-based revenues; (8) the Company may be unable to maintain or improve upon current

levels of expense associated with managing its business; (9) rulings affecting, among other things, the Company's

and its banking subsidiaries' regulatory capital and required loan loss allocations may change, resulting in the

need for increased capital levels; (10) changes in the interest rate environment may have results on the

Company's operations materially different from those anticipated by the Company's market risk management

functions; (11) changes in general economic conditions and increased competition could adversely affect the

Company's operating results; (12) changes in other regulations and government policies affecting bank holding

companies and their subsidiaries, including changes in monetary policies, could negatively impact the Company's

operating results; (13) the planned purchase of Trust I and Trust II Capital Securities and the common stock may

not occur or may not have the effects anticipated; and (14) the Company may experience difficulties growing loan

and deposit balances. Forward-looking statements made herein reflect management’s expectations as of the date

such statements are made. Such information is provided to assist stockholders and potential investors in

understanding current and anticipated financial operations of the Company and is included pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act of 1995. The Company undertakes no obligation

to update any forward-looking statement to reflect events or circumstances that arise after the date

such statements are made.

$2.0 Billion Commercial Bank

headquartered in Charleston WV

55 Banking Offices

150,000 households; 275,000 accounts

16,636,000 common shares outstanding

$580 million market capitalization*

*As of 9/11/03

Prior History

Net loss of $54.4 million or $3.81 per share for

2000 & 2001

Formal Agreements with OCC and Federal

Reserve

$130 million in “problem loans”

Stock trading at $5.125 per share from a high of

$45 per share

Discontinued common share cash dividends and

deferred trust preferred dividends

Turnaround

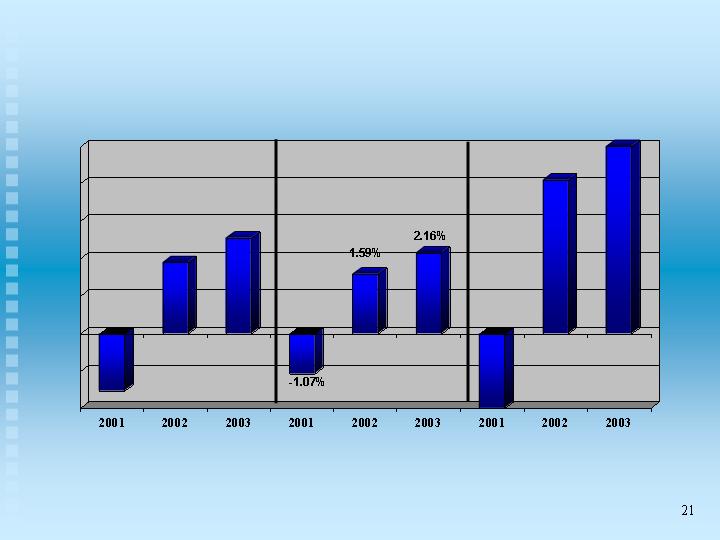

2002

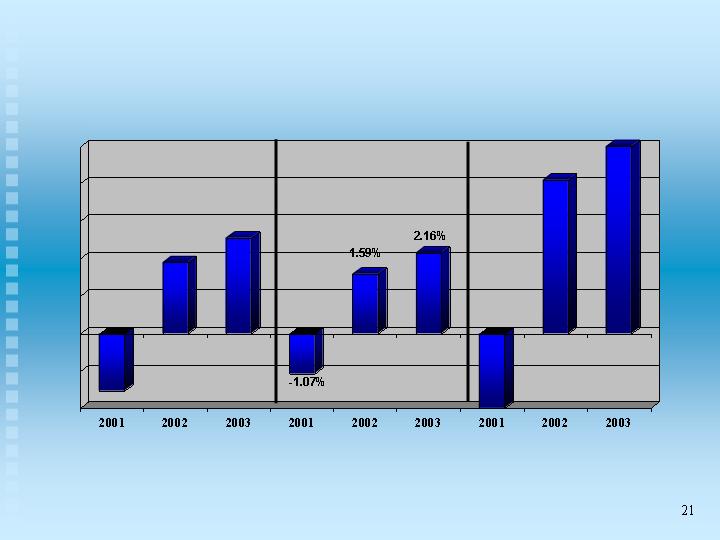

Net income $32.5 million or $1.90 per share with

ROA of 1.59% and ROE of 20.54%

Terminated Formal Agreements with OCC and

Federal Reserve

Fully restored common dividends to their historic

high and resumed Trust Preferred dividends

2003 (1st half)

Net income $21.5 million or $1.27 per share with

ROA of 2.16% and ROE of 25.16%

High Performance

7th best performing, publicly traded stock of 2002

by the Bloomberg 100 annual index

1st of all USA banks and 4th best of all US publicly

traded companies over the prior two years with

appreciation of 391%

37% improvement in share value since last year’s

RBC conference

*The “Bloomberg 100” lists the top 100 companies by total return for the period of November 2, 2001, to

November 1, 2002. Companies with share prices under $5 and market capitalization below $100 million were

excluded.

CHCO’s Value Proposition

Proven management team focused on

delivering shareholder value

Low risk/High returns

Highly visible near-term opportunities

CHCO’s Business Model

We are a retail bank

We focus on core deposit gathering

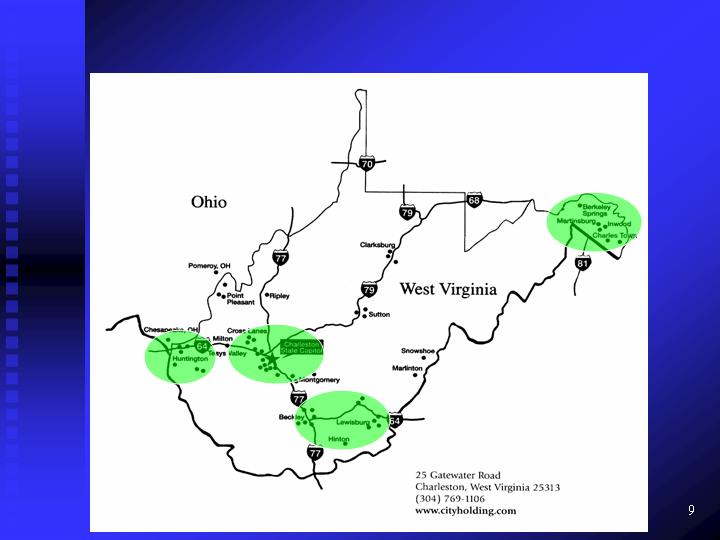

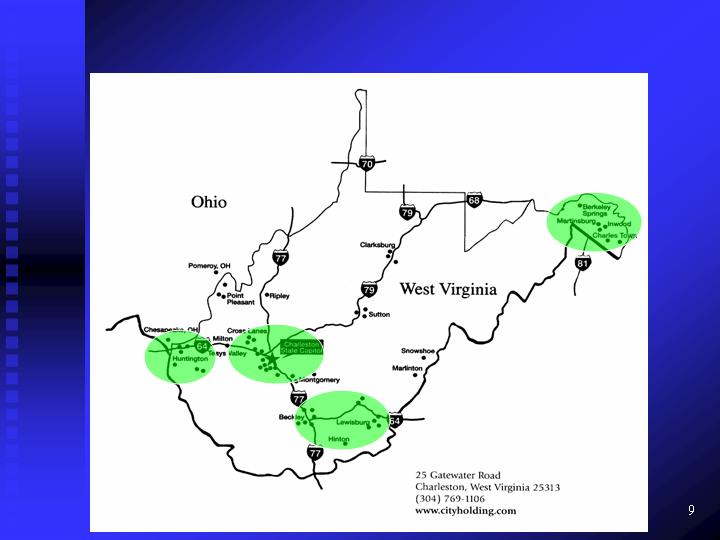

Key Markets

Key Markets

12% Market Share

in WV’s 2nd largest market

8% Market Share in DC suburbs

WV’s fastest growing market

30% Market Share

11% Market Share

in WV’s largest market

City National Bank

Customer Profile

Source: Internal data as of June 30, 2003

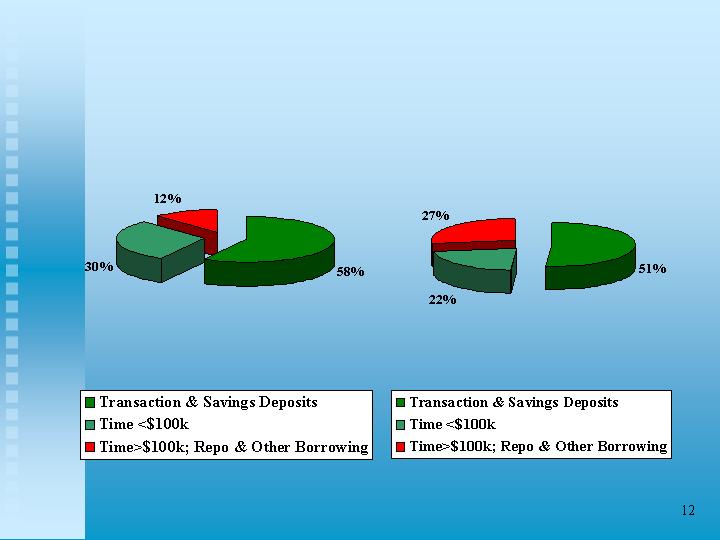

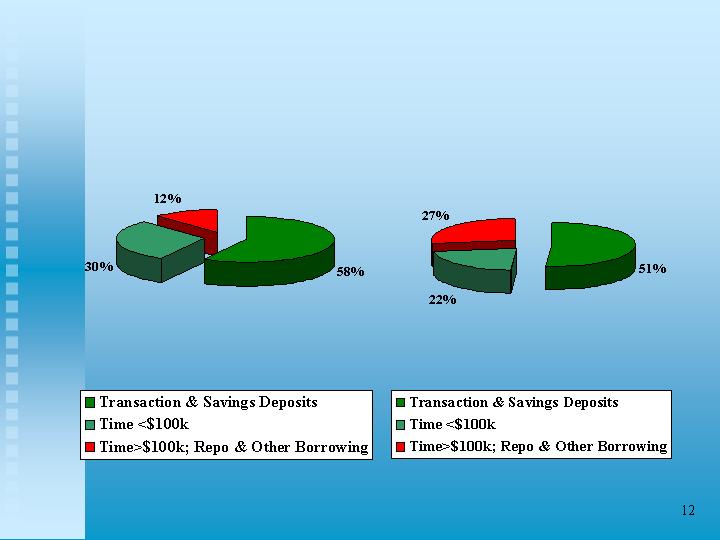

High Quality and Stable Funding Source

As of June 30, 2003

*$1-3 billion peer group as compiled by the FFIEC in their Uniform Bank Performance Reports

Peer Group*

City Holding Company

Conservative Loan Portfolio Mix

City Holding Company

Peer Group*

Loan to Core Deposits 78.7%

Loan to Core Deposits 99.9%

As of June 30, 2003

*$1-3 billion peer group as compiled by the FFIEC in their Uniform Bank Performance Reports

Real Estate Based Lending Focus

As of June 30, 2003

Other Loans

15.5%

Real Estate Secured Loans

84.5%

The Investment Portfolio represents 28% of

the bank’s total assets and are predominately

unpledged

The Company is unleveraged:

Only $15MM in FHLB advances

CD’s and Repo’s fund 9% of assets, half

of which are in accounts less than $250M

Strong Liquidity

Immediate Basis Estimated Increase or

Point Change in Decrease in Net

Interest Rates Income over 1 year

+300 Bp +12%

+100 Bp + 6%

- 50 Bp - 2%

Limited Interest Rate Risk

As of 6/30/03

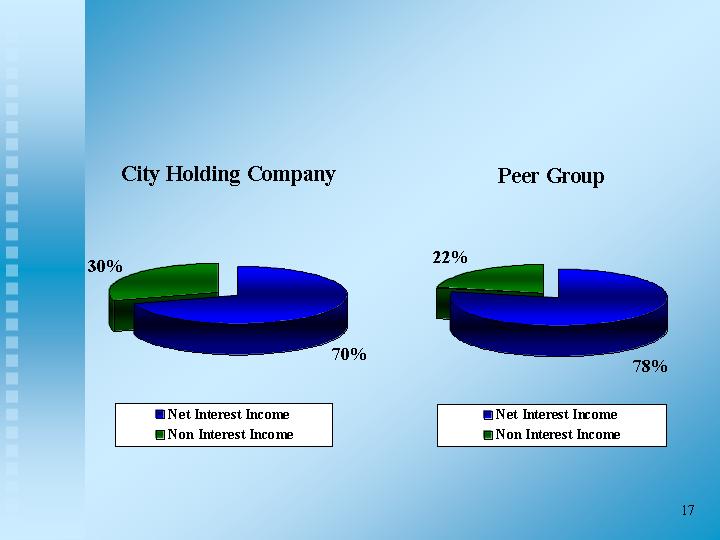

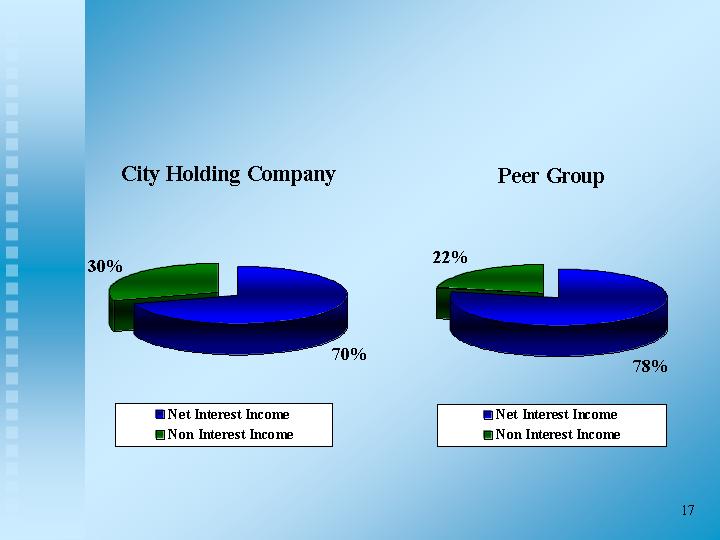

Favorable Revenue Profile

As of June 30, 2003

*$1-3 billion peer group as compiled by the FFIEC in their Uniform Bank Performance Reports

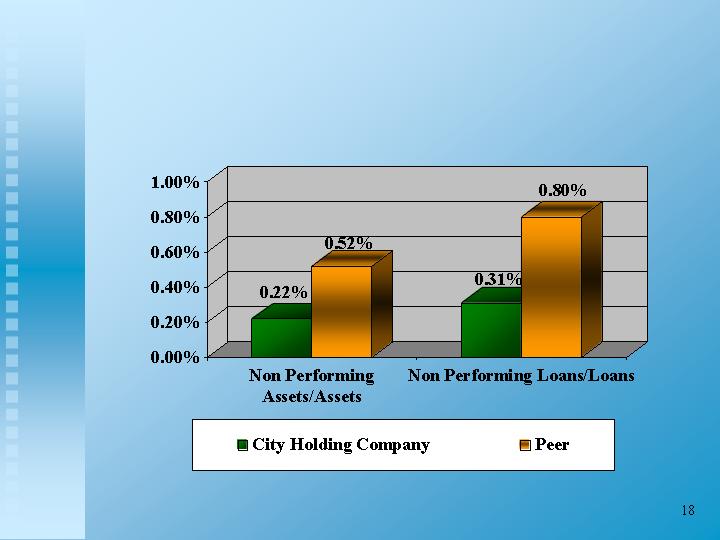

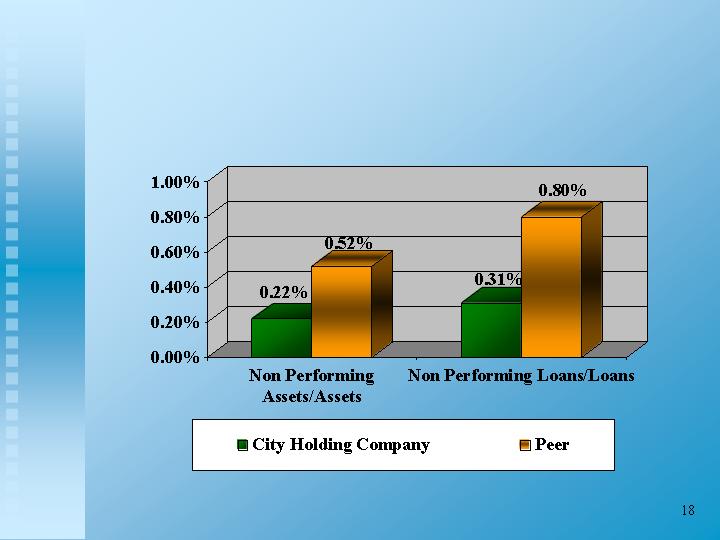

Strong Loan Quality

*$1-3 billion peer group as compiled by the FFIEC in their Uniform Bank Performance Reports 3/31/03

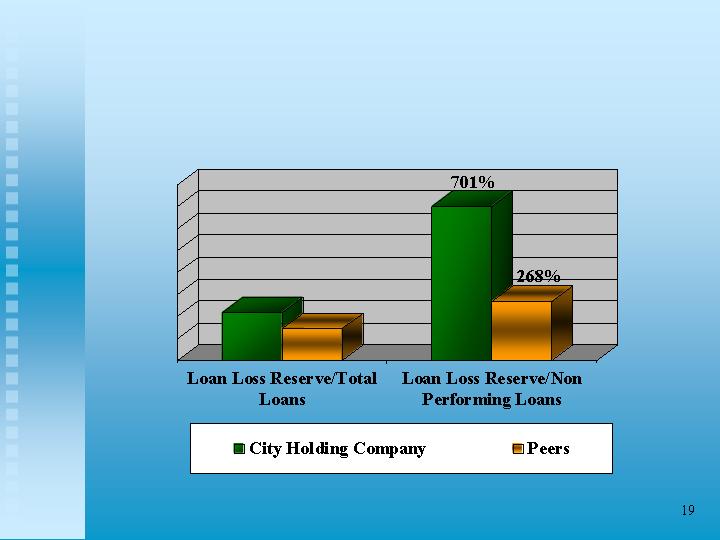

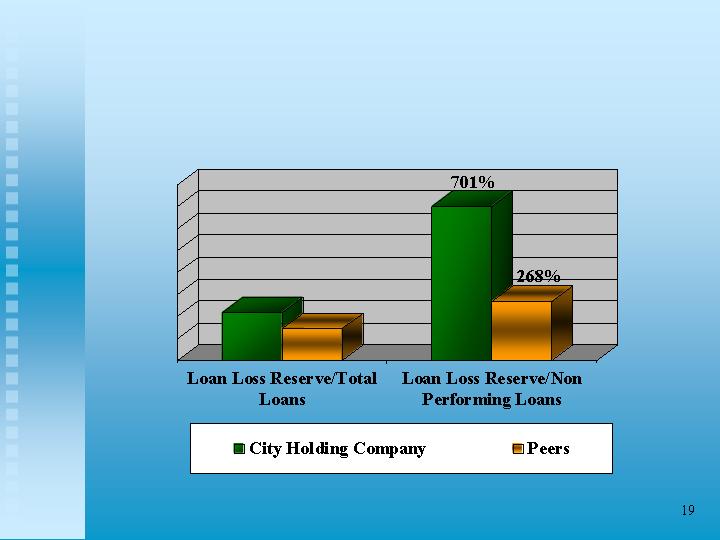

Strong Loan Loss Reserve

*$1-3 billion peer group as compiled by the FFIEC in their Uniform Bank Performance Reports 3/31/03

2.18%

1.45%

Net Charge-Offs/Opportunity?

The Company recorded a negative provision of

$3.3 million in Q2 2003

Performance Measures

2003 is 6/30/03 YTD annualized.

EPS (diluted)

ROA

ROE

-16.8%

20.5%

25.2%

-$1.54

$1.90

$2.54

While City Holding Company has benefited from low and

negative provision expense and from a high accrual rate on

its retained interests, in the absence of these factors CHCO

would still demonstrate:

high and growing profitability

strong and stable net interest margins

high operational efficiency

strong and rapidly growing equity capital

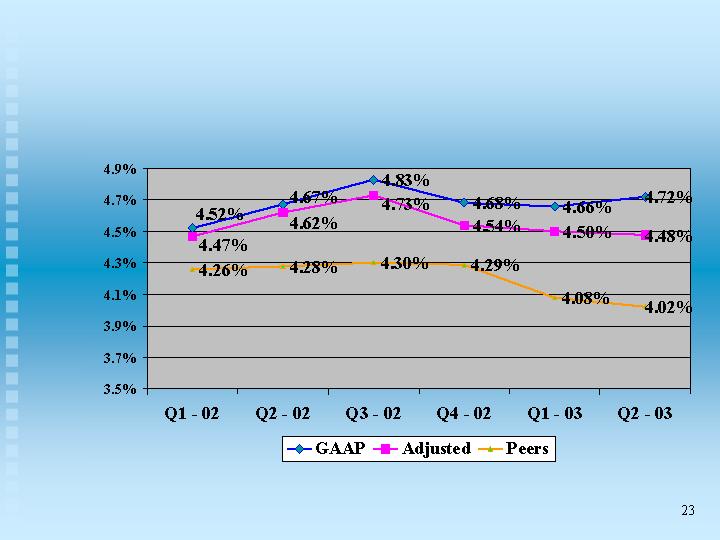

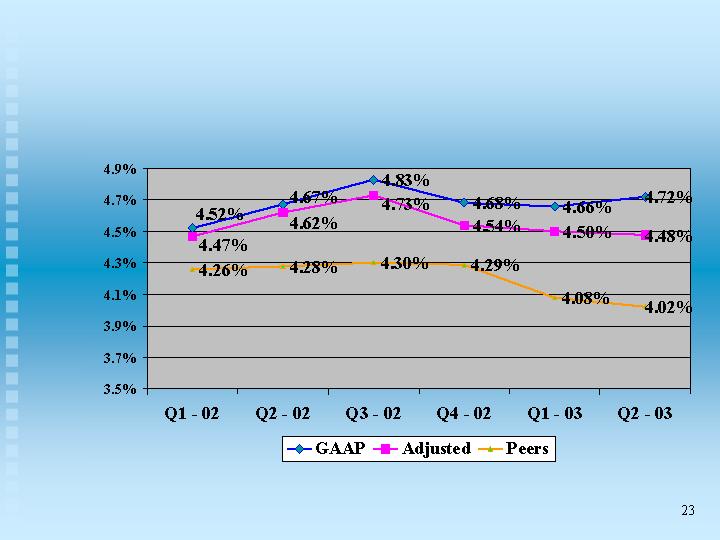

Strong Core Performance

Adjusted Net Interest Margin

Net interest margin adjusted by subtracting interest income on Retained Interests

and adding interest expense on an equivalent amount of Trust Preferred Debt used to fund the assets.

Performance Objectives

Maintain well-capitalized

status

Capital

1.50%

ROA

20%

ROE

10%

Earnings Per Share

Growth

Why Should You Own Our Stock?

Proven management team focused on

delivering shareholder value

Performance-based incentive plans

Value-vested stock options

Improved City’s shareholder value by 507%

since January 2001

Why Should You Own Our Stock?

Low Risk/High Returns

Fortress Balance Sheet

Pristine Loan Quality

High Liquidity

Strongly Capitalized

Retail Core Funded

Not reliant on Mortgage Banking Revenues

Why Should You Own Our Stock?

Highly visible near-term opportunities

$57.5 million of 9.125% Trust Preferred

callable on 10/31/2003

Potential low or negative loan loss provision in

future periods

Questions?