- CHCO Dashboard

- Financials

- Filings

- Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

City Holding (CHCO) 8-KRegulation FD Disclosure

Filed: 21 Jun 05, 12:00am

Exhibit 99.1

June 21/22, 2005

Forward Looking Statements

This news release contains certain forward-looking statements that are included pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such information involves risks and uncertainties that could result in the Company’s actual results differing from those projected in the forward-looking statements. Important factors that could cause actual results to differ materially from those discussed in such forward-looking statements include, but are not limited to, (1) the Company may incur additional loan loss provision due to negative credit quality trends in the future that may lead to a deterioration of asset quality, or conversely, the Company may incur less, or even negative, loan loss provision due to positive credit quality trends in the future; (2) the Company may not continue to experience significant recoveries of previously charged-off loans and the Company may incur increased charge-offs in the future; (3) the Company may experience increases in the default rates on its previously securitized loans causing the yields on these assets to decline; (4) the Company could have adverse legal actions of a material nature; (5) the Company may face competitive loss of customers; (6) the Company may be unable to manage its expense levels; (7) changes in the interest rate environment may have results on the Company’s operations materially different from those anticipated by the Company’s market risk management functions; (8) changes in general economic conditions and increased competition could adversely affect the Company’s operating results; (9) changes in other regulations and government policies affecting bank holding companies and their subsidiaries, including changes in monetary policies, could negatively impact the Company’s operating results; (10) the Company may experience difficulties growing loan and deposit balances. Forward-looking statements made herein reflect management’s expectations as of the date such statements are made. Such information is provided to assist stockholders and potential investors in understanding current and anticipated financial operations of the Company and is included pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances that arise after the date such statements are made.

$2.5 Billion Commercial Bank headquartered in Charleston, WV

67 Banking Offices

165,000 households

$635 million market capitalization*

*As of 6/17/05

City Holding Company:

Headquartered In Charleston WV

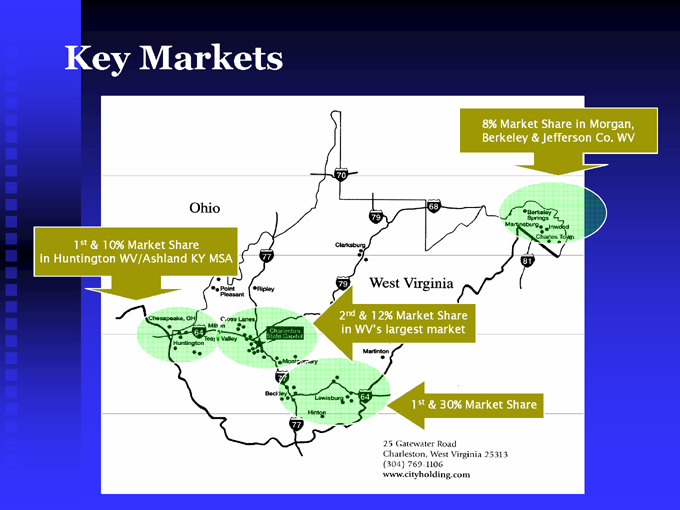

Key Markets

1st & 10% Market Share in Huntington WV/Ashland KY MSA

2nd & 12% Market Share in WV’s largest market

1st & 30% Market Share

8% Market Share in Morgan, Berkeley & Jefferson Co. WV

Themes:

CHCO: Under Continuing Management CHCO: Consistently superior results CHCO: Growth in slow-growth markets

CHCO: Under Continuing Leadership

Former CEO Jerry Francis engineered the turn-around of the Company

CFO Skip Hageboeck assumed the role of CEO on February 1, 2005

City has assembled a team of top-notch talent over the last three years capable of continuing City’s strong performance

Engineering the Turn-around: Starting from Ground Zero

$38 million loss reported in 2000

Formal Agreements with OCC and Federal Reserve

$130 million in “problem loans”

Stock trading at $5.125 per share from a high (in 1998) of $45 per share; discontinued common share cash dividends; deferred trust preferred dividends

Ownership of non-core businesses which diluted focus and earnings

Company terminated its CEO in June 2000; Hired Turn-around expert Jerry Francis in January 2001

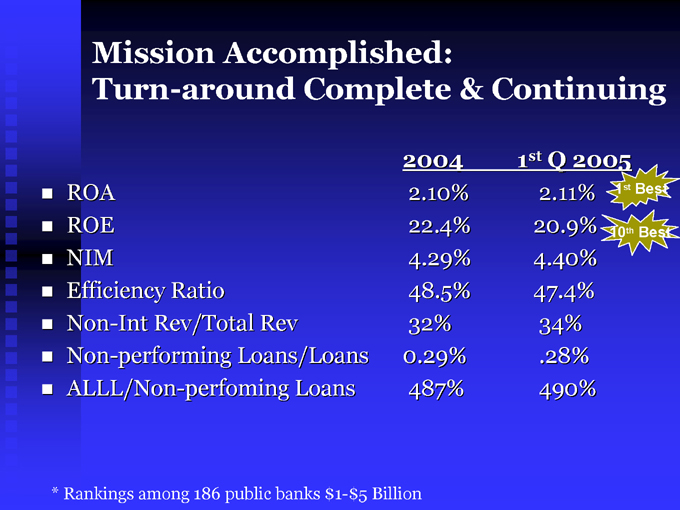

Mission Accomplished:

Turn-around Complete & Continuing

2004 1st Q 2005

ROA 2.10% 2.11% 1st Best

ROE 22.4% 20.9% 10th Best

NIM 4.29% 4.40%

Efficiency Ratio 48.5% 47.4%

Non-Int Rev/Total Rev 32% 34%

Non-performing Loans/Loans 0.29% .28%

ALLL/Non-perfoming Loans 487% 490%

* Rankings among 186 public banks $1-$5 Billion

A new Team focused on the future

CEO Skip Hageboeck

Ph.D. in Economics 42 years old Treasurer of $10B bank

CFO of $700MM community bank 1995-1999 CFO of City Holding Company 2001-2004

Why Own This Stock?

1. CHCO is highly profitable

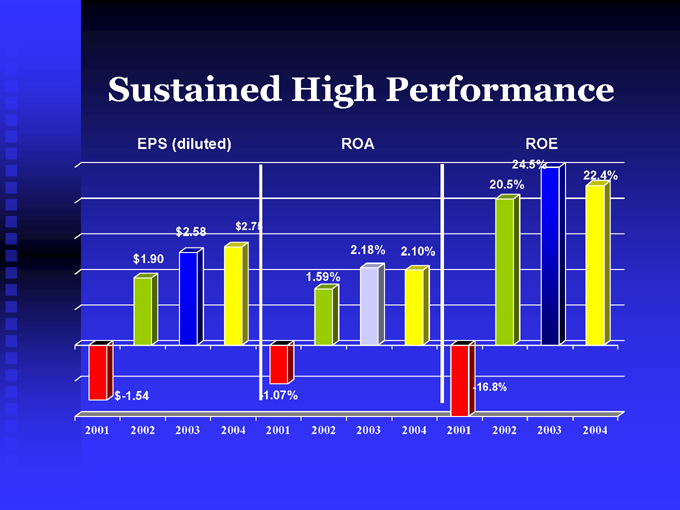

Sustained High Performance

EPS (diluted) $-1.54 $1.90 $2.58 $2.75

2001 2002 2003 2004

ROA

-1.07%

1.59%

2.18%

2.10%

2001 2002 2003 2004

ROE

-16.8%

20.5%

24.5%

22.4%

2001 2002 2003 2004

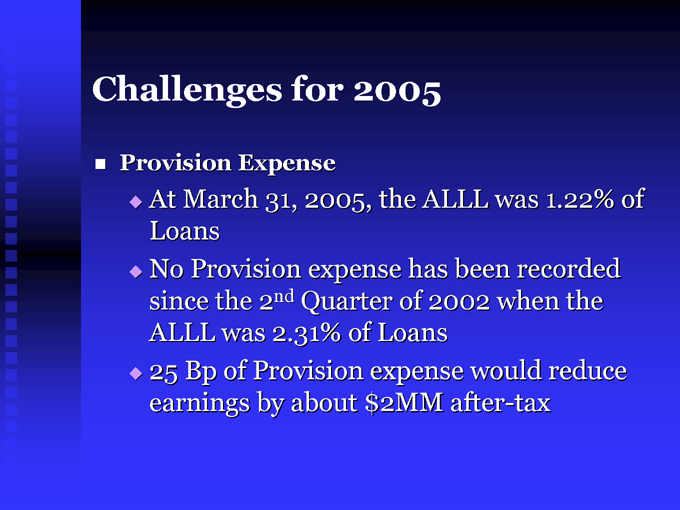

Challenges for 2005

Provision Expense

At March 31, 2005, the ALLL was 1.22% of Loans No Provision expense has been recorded since the 2nd Quarter of 2002 when the ALLL was 2.31% of Loans 25 Bp of Provision expense would reduce earnings by about $2MM after-tax

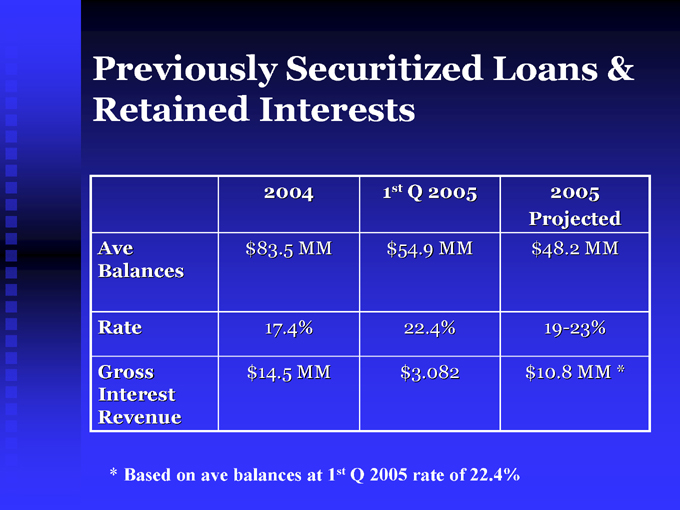

Previously Securitized Loans & Retained Interests

2004 1 st Q 2005 2005 Projected

Ave Balances $83.5 MM $54.9 MM $48.2 MM

Rate 17.4% 22.4% 19-23%

Gross Interest Revenue $14.5 MM $ 3.082 $ 10.8 MM *

* Based on ave balances at 1st Q 2005 rate of 22.4%

Why Own This Stock?

1. CHCO is highly profitable

2. CHCO is well-positioned for the future

Conservative Loan Portfolios

Strong Asset Quality

Exceptional Core Deposit Base

Highly Liquid

Very Efficient

Strongly Capitalized

Positioned to benefit from rising rates

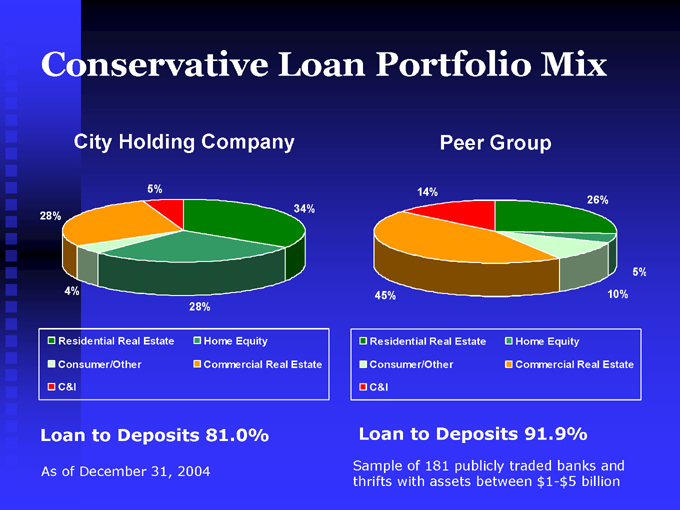

Conservative Loan Portfolio Mix

City Holding Company

28%

4%

28%

34%

5%

Residential Real Estate

Consumer/Other

C&I

Home Equity

Commercial Real Estate

Loan to Deposits 81.0%

As of December 31, 2004

Peer Group

14%

45%

10%

5%

26%

Residential Real Estate

Consumer/Other

C&I

Home Equity

Commercial Real Estate

Loan to Deposits 91.9%

Sample of 181 publicly traded banks and thrifts with assets between $1-$5 billion

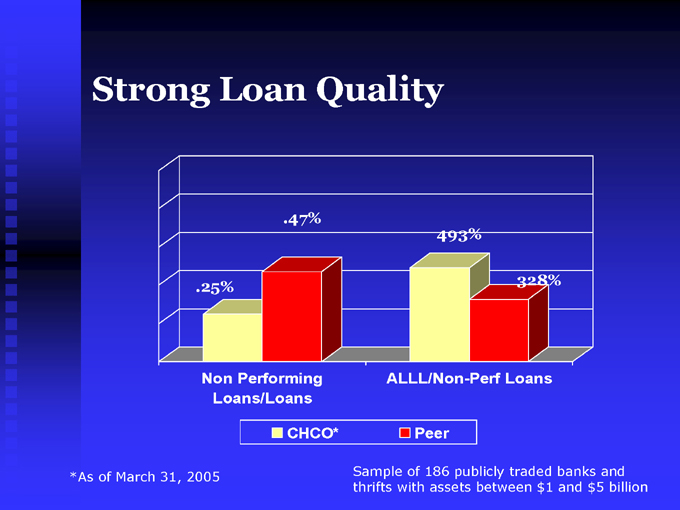

Strong Loan Quality

.25%

.47%

493%

328%

Non Performing Loans/Loans

ALLL/Non-Perf Loans

CHCO*

Peer

*As of March 31, 2005

Sample of 186 publicly traded banks and thrifts with assets between $1 and $5 billion

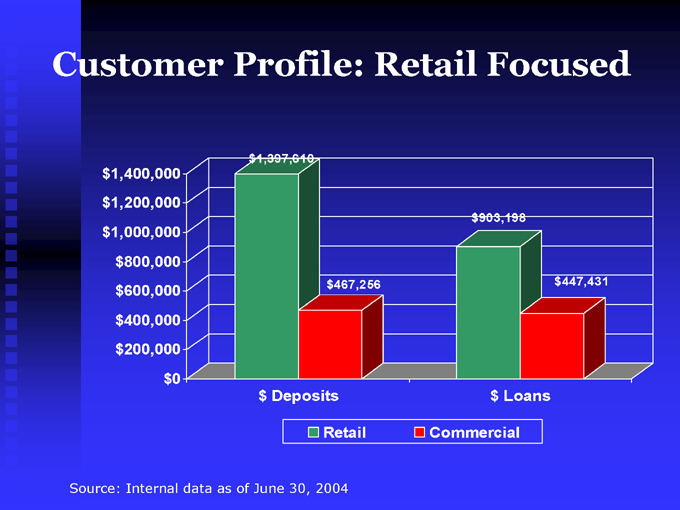

Customer Profile: Retail Focused $1,400,000 $1,200,000 $1,000,000 $800,000 $600,000 $400,000 $200,000 $0 $1,397,610 $467,256 $903,198 $447,431 $ Deposits $ Loans

Retail

Commercial

Source: Internal data as of June 30, 2004

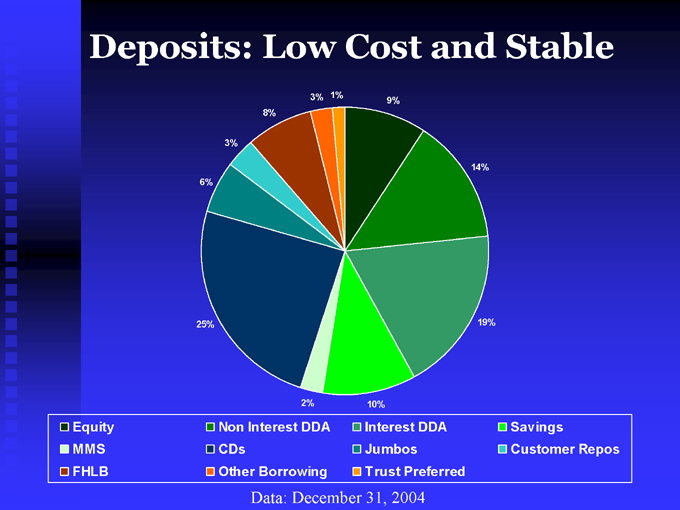

Deposits: Low Cost and Stable

6%

25%

2%

10%

19%

14%

9%

1%

3%

8%

3%

Equity

MMS

FHLB

Non Interest DDA

CDs

Other Borrowing

Interest DDA

Jumbos

Trust Preferred

Savings

Customer Repos

Data: December 31, 2004

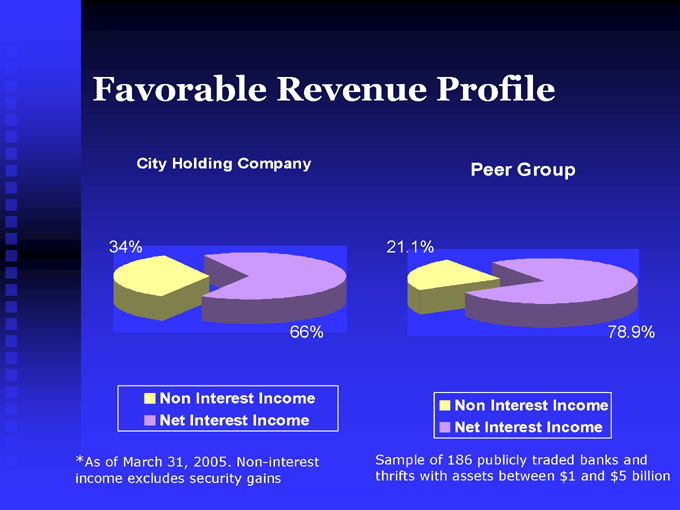

Favorable Revenue Profile

City Holding Company

34%

66%

Non Interest Income

Net Interest Income

*As of March 31, 2005. Non-interest income excludes security gains

Peer Group

21.1%

78.9%

Non Interest Income

Net Interest Income

Sample of 186 publicly traded banks and thrifts with assets between $1 and $5 billion

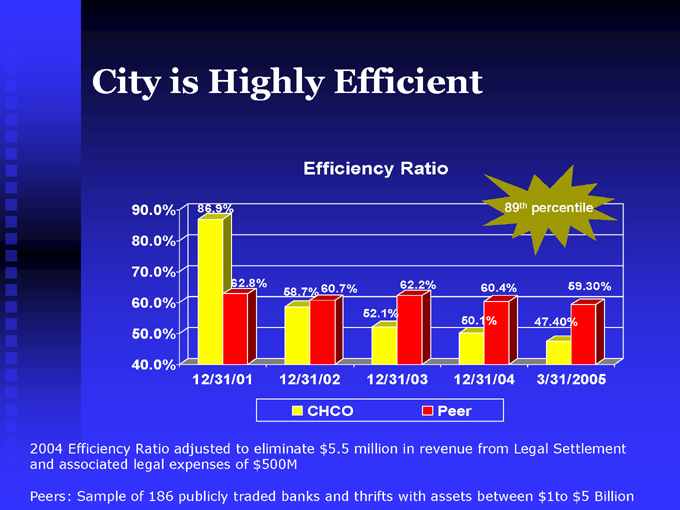

City is Highly Efficient

Efficiency Ratio

89(th)percentile

90.0%

80.0%

70.0%

60.0%

50.0%

40.0%

86.9%

62.8%

58.7%

60.7%

52.1%

62.2%

50.1%

60.4%

47.40%

59.30%

12/31/01 12/31/02 12/31/03 12/31/04 3/31/2005

CHCO

Peer

2004 Efficiency Ratio adjusted to eliminate $5.5 million in revenue from Legal Settlement and associated legal expenses of $500M

Peers: Sample of 186 publicly traded banks and thrifts with assets between $1to $5 Billion

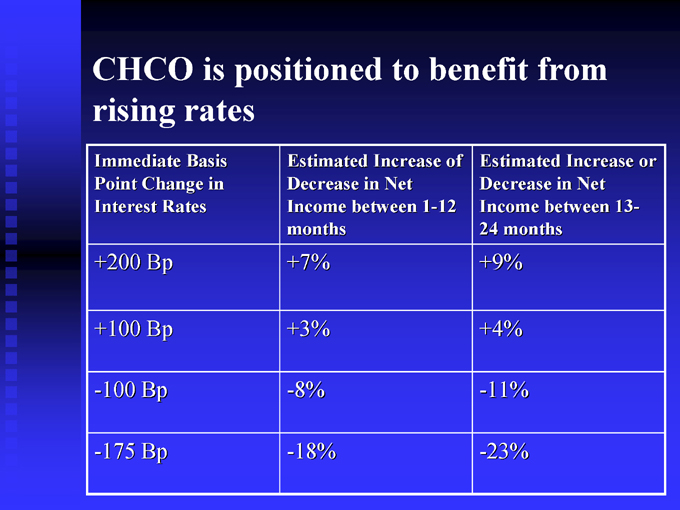

CHCO is positioned to benefit from rising rates

Immediate Basis Point Change in Interest Rates Estimated Increase of Decrease in Net Income between 1-12 months Estimated Increase or Decrease in Net Income between 13- 24 months

+200 Bp +7% +9%

+100 Bp +3% +4%

-100 Bp -8% -11%

-175 Bp -18% -23%

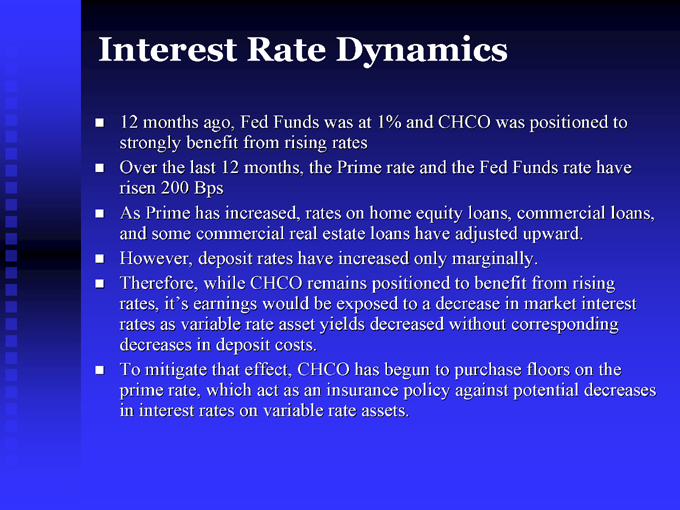

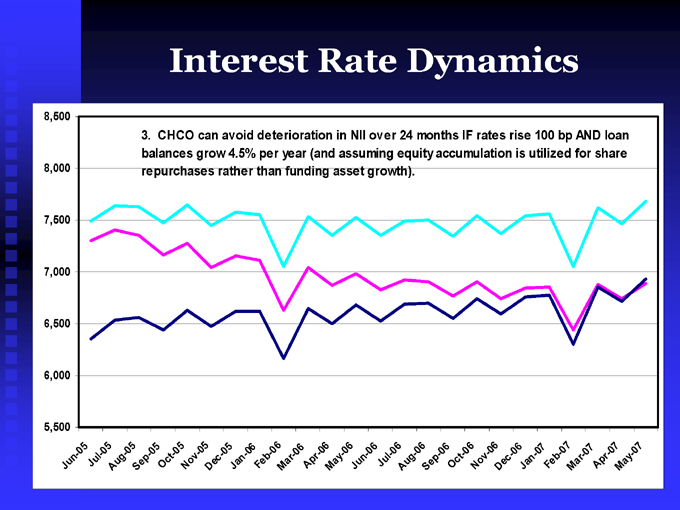

Interest Rate Dynamics

12 months ago, Fed Funds was at 1% and CHCO was positioned to strongly benefit from rising rates

Over the last 12 months, the Prime rate and the Fed Funds rate have risen 200 Bps

As Prime has increased, rates on home equity loans, commercial loans, and some commercial real estate loans have adjusted upward.

However, deposit rates have increased only marginally.

Therefore, while CHCO remains positioned to benefit from rising rates, it’s earnings would be exposed to a decrease in market interest rates as variable rate asset yields decreased without corresponding decreases in deposit costs.

To mitigate that effect, CHCO has begun to purchase floors on the prime rate, which act as an insurance policy against potential decreases in interest rates on variable rate assets.

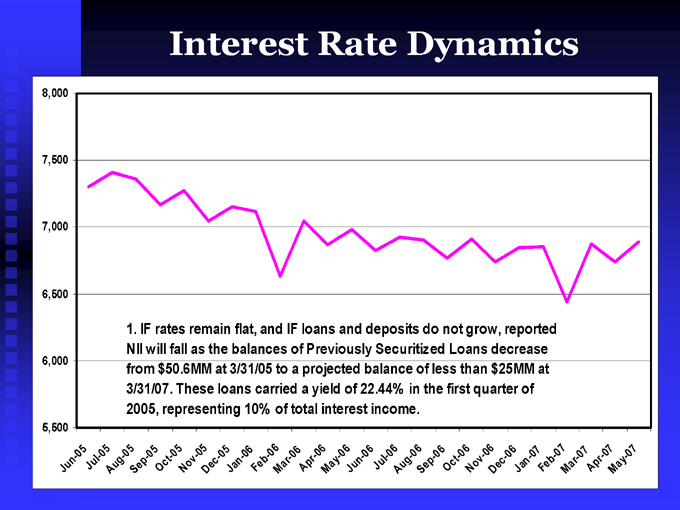

Interest Rate Dynamics

8,000 7,500 7,000 6,500 6,000 5,500

1. IF rates remain flat, and IF loans and deposits do not grow, reported NII will fall as the balances of Previously Securitized Loans decrease from $50.6MM at 3/31/05 to a projected balance of less than $25MM at 3/31/07. These loans carried a yield of 22.44% in the first quarter of 2005, representing 10% of total interest income.

Jun- 05

Jul- 05

Au g - 05

Sep - 05

Oc t - 05

Nov - 05

Dec - 05

Jan- 06

Feb - 06

Mar - 06

Apr- 06

May- 06

Ju n- 06

Jul- 06

Aug- 06

Sep- 06

Oc t - 06

Nov - 06

Dec- 06

Jan- 07

Fe b - 07

Ma r - 07

Ap r - 07

May- 07

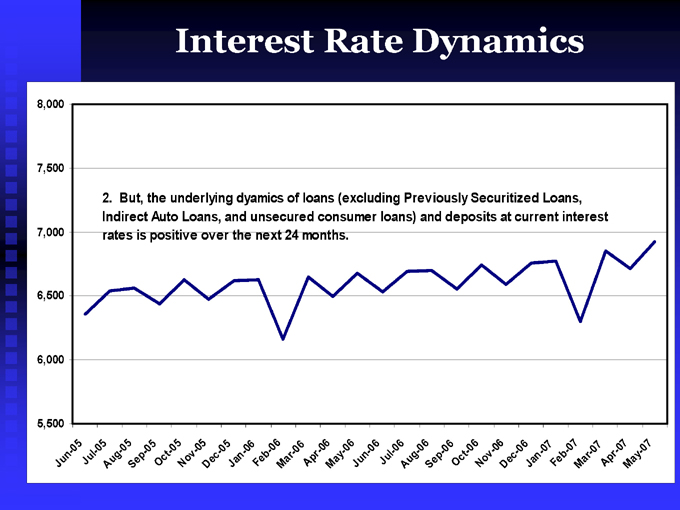

Interest Rate Dynamics

8,000 7,500 7,000 6,500 6,000 5,500

2. But, the underlying dyamics of loans (excluding Previously Securitized Loans,

Indirect Auto Loans, and unsecured consumer loans) and deposits at current interest rates is positive over the next 24 months.

Jun - 05

Jul - 05

Aug - 05

Sep - 05

Oct- 05

Nov - - 05

Dec - 05

Jan - 06

Feb - 06

Mar - 06

Apr - 06

May - 06

Jun - - 06

Jul- 06

Aug - 06

Sep - 06

Oct - 06

Nov - 06

Dec - 06

Jan - - 07

Feb - 07

Mar - 07

Apr - 07

May - 07

Interest Rate Dynamics

8,500 8,000 7,500 7,000 6,500 6,000 5,500

3. CHCO can avoid deterioration in NII over 24 months IF rates rise 100 bp AND loan balances grow 4.5% per year (and assuming equity accumulation is utilized for share repurchases rather than funding asset growth).

Jun - 05

Jul - 05

Au g- 05

Sep - 05

Oct- 05

Nov - 05

Dec - 05

Jan - 06

Feb - 06

Mar- 06

Apr- 06

May- 06

Jun - 06

Jul - 06

Au g - 06

Sep - 06

Oct - 06

Nov - 06

Dec - 06

Jan - 07

Feb - 07

Mar- 07

Apr - 07

May - 07

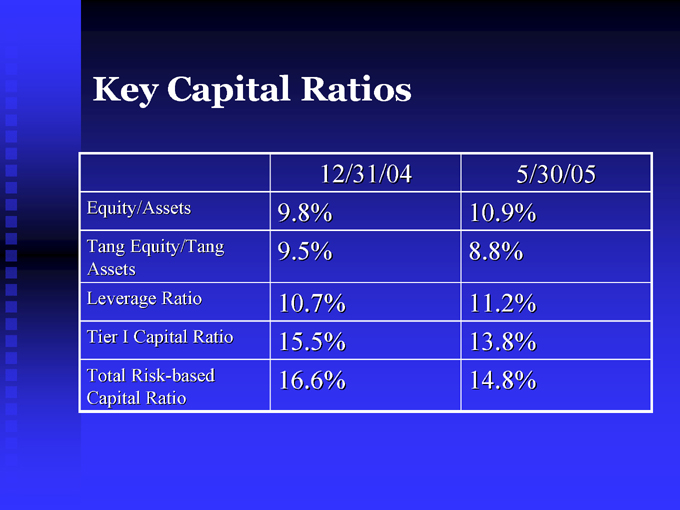

Key Capital Ratios

12/31/04 5/30/05

Equity/Assets 9.8% 10.9%

Tang Equity/Tang Assets 9.5% 8.8%

Leverage Ratio 10.7% 11.2%

Tier I Capital Ratio 15.5% 13.8%

Total Risk-based Capital Ratio 16.6% 14.8%

Strategic Opportunities

Capital Flexibility

Dividends

Increased 10% in April 2004

Increased 13.6% in April 2005

Share Repurchases

Acquisitions

Why Own This Stock?

1. CHCO is highly profitable

2. CHCO is well-positioned for the future

2. CHCO is growing

Internal Loan Growth

Internal Deposit Growth

Improvements to Retail Distribution System

Acquisition

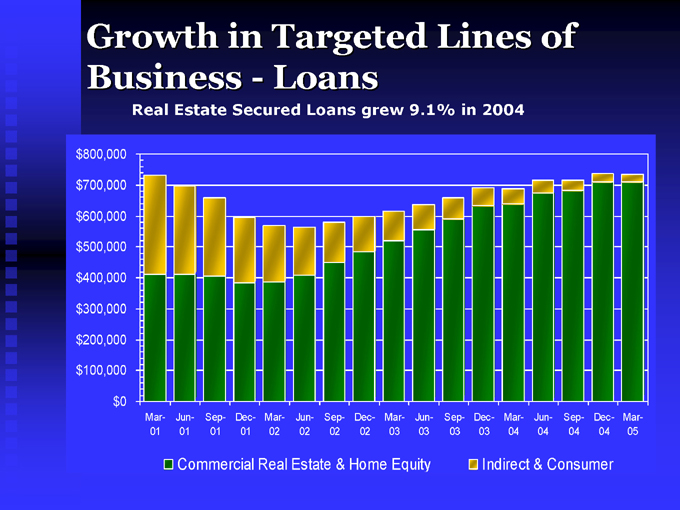

Growth in Targeted Lines of Business - Loans

Real Estate Secured Loans grew 9.1% in 2004 $800,000 $700,000 $600,000 $500,000 $400,000 $300,000 $200,000 $100,000 $0

Mar- Jun- Sep- Dec- Mar- Jun- Sep- Dec- Mar- Jun- Sep- Dec- Mar- Jun- Sep- Dec- Mar-

01 01 01 01 02 02 02 02 03 03 03 03 04 04 04 04 05

Commercial Real Estate & Home Equity

Indirect & Consumer

Growth in Deposits:

Totally Free Checking Accounts

2002-2004

130,000 125,000 120,000 115,000 110,000 105,000 100,000 95,000 90,000

7.7% CAGR

Jan-02 Mar-02 May-02 Jul-02 Sep-02 Nov-02 Jan-03 Mar-03 May-03 Jul-03 Sep-03 Nov-03 Jan-04 Mar-04 May-04 Jul-04 Sep-04 Nov-04

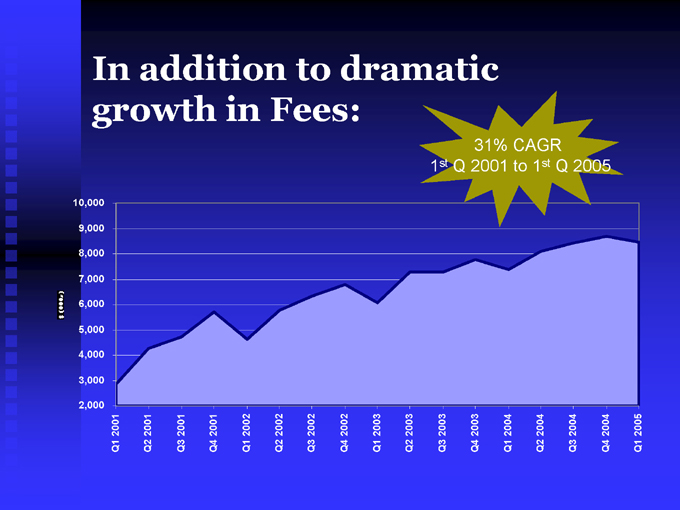

In addition to dramatic growth in Fees:

31% CAGR 1st Q 2001 to 1st Q 2005

10,000 9,000 8,000 7,000 6,000 5,000 4,000 3,000 2,000

Q1 2001 Q2 2001 Q3 2001 Q4 2001 Q1 2002 Q2 2002 Q3 2002 Q4 2002 Q1 2003 Q2 2003 Q3 2003 Q4 2003 Q1 2004 Q2 2004 Q3 2004 Q4 2004 Q1 2005

Restructuring the Retail Delivery System

City’s Retail Distribution can be Improved (In WV’s 60 densest markets, City is in only 33%)

Wal-Mart Strategy

Consolidations

New Branches in growing areas of existing markets

DeNovo entry into contiguous markets

City’s Wal-Mart Strategy

Inexpensive distribution

High-traffic Wal-Marts

Supports existing retail distribution outlets in City’s major Markets

Openings

Charleston – Sept 2004

Huntington – Sept 2004

Beckley – May 2005

Ashland – August 2005

Ripley – 2006

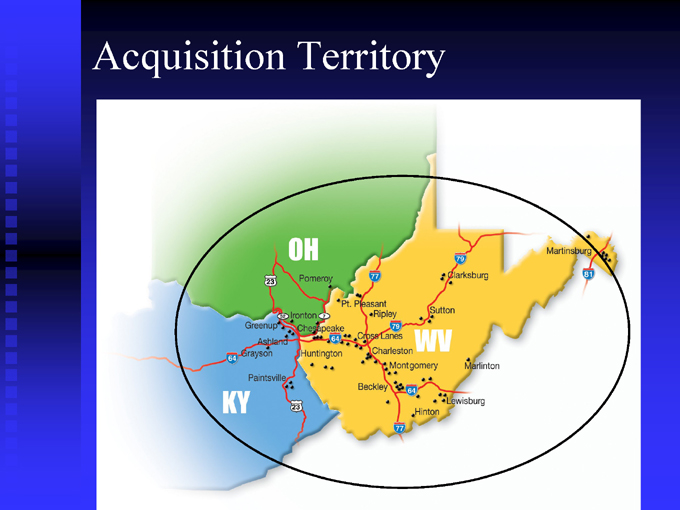

Acquisition Parameters $100MM to $500MM in assets

Markets in or adjacent to CHCO footprint

Retail Deposit Franchise

Accretive to EPS in first full year

Acquisition Territory

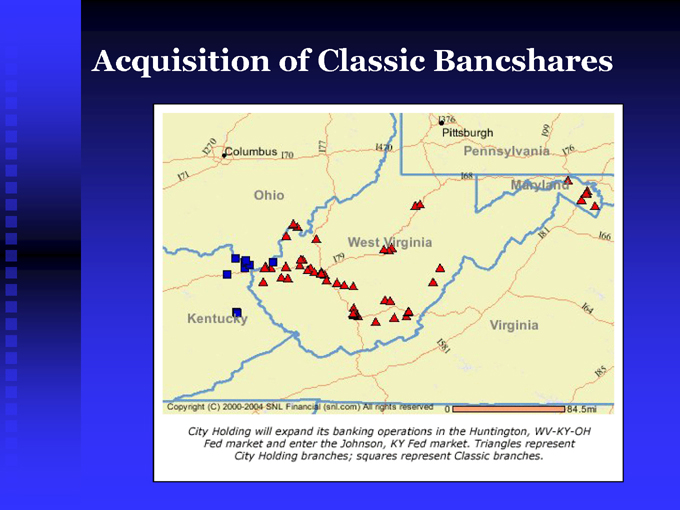

Acquisition of Classic Bancshares

Classic Bancshares Acquisition:

Accretive to 3rd Q 2005 earnings

Opportunity to build retail share:

Share CHCO County

Boyd Co. KY 9% $75MM $833M

Lawrence Co. Ohio 12% $59MM $490M

Greenup Co. KY 6% $21MM $350M

Johnson Co. KY 31% $102MM $329M

Carter Co. KY 4% $11MM $275M

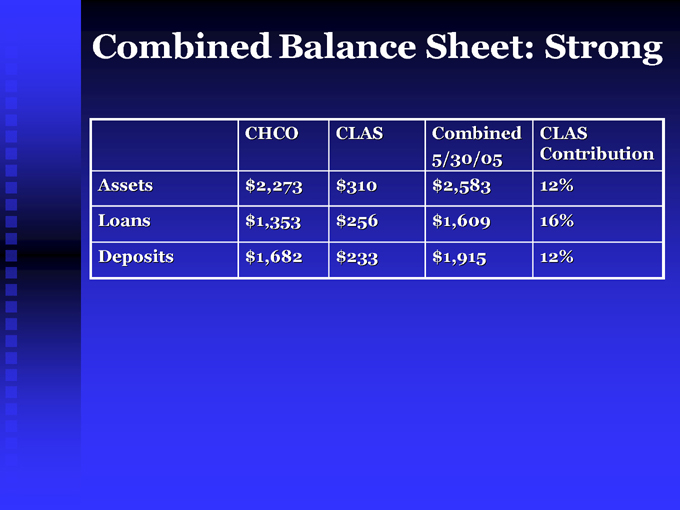

Combined Balance Sheet: Strong

CHCO CLAS Combined 5/30/05 CLAS Contribution

Assets $2,273 $310 $2,583 12%

Loans $1,353 $256 $1,609 16%

Deposits $1,682 $233 $1,915 12%

Why Own This Stock?

CHCO is highly profitable

CHCO earns high returns on a conservative platform

Retail bank with strong core deposits

Strong fee income

Conservative loan portfolio

Well capitalized

Liquid & positioned to benefit from rising rates

Extraordinary profitability

CHCO is growing in ordinary markets

Loans, Deposits, Improved Distribution, and Excess Capital Opportunities