- CASY Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Casey's General Stores (CASY) DEF 14ADefinitive proxy

Filed: 22 Jul 20, 4:34pm

Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No.)

| Filed by the Registrant ý Filed by a Party other than the Registrant o | ||

| Check the appropriate box: | ||

| o | Preliminary Proxy Statement | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ý | Definitive Proxy Statement | |

| o | Definitive Additional Materials | |

| o | Soliciting Material Pursuant to §240.14a-12 | |

| CASEY'S GENERAL STORES, INC. (Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

(1) | Title of each class of securities to which transaction applies: | |||

(2) | Aggregate number of securities to which transaction applies: | |||

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

(4) | Proposed maximum aggregate value of transaction: | |||

(5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

(2) | Form, Schedule or Registration Statement No.: | |||

(3) | Filing Party: | |||

(4) | Date Filed: | |||

July 22, 2020

Dear Shareholders:

I am pleased to invite you to attend the annual meeting of shareholders of Casey's General Stores, Inc., to be held at 9:00 a.m. Central Time on September 2, 2020. Due to the ongoing developments, concerns and uncertainty surrounding the COVID-19 pandemic, and in the interest of providing the safest environment possible, we will be holding this year's annual meeting in virtual format only, via live webcast at www.virtualshareholdermeeting.com/CASY2020.

The Notice of Annual Meeting and Proxy Statement describe the matters to be considered and voted upon at the annual meeting. At the virtual annual meeting, you will have an opportunity to submit your questions through the webcast site.

Whether or not you attend the virtual annual meeting, it is important that your shares are represented. If you request a paper copy of the proxy materials, please promptly complete and return the proxy card to ensure that your vote will be received and counted. Alternatively, you may vote by telephone or through the Internet (both before and during the virtual annual meeting) as described further below in the Proxy Statement.

On behalf of the Board of Directors and Casey's leadership, thank you for your support.

Sincerely,

Darren M. Rebelez

President and Chief Executive Officer

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

September 2, 2020

9:00 a.m. CT

www.virtualshareholdermeeting.com/CASY2020

To the Shareholders of Casey's General Stores, Inc.:

Due to the ongoing developments, concerns and uncertainty surrounding the COVID-19 pandemic, the annual meeting of shareholders of Casey's General Stores, Inc. (the "Annual Meeting") will be virtual only, conducted via live webcast at www.virtualshareholdermeeting.com/CASY2020 on September 2, 2020, at 9:00 a.m. Central Time, for the following purposes:

The above matters are described in the Proxy Statement. Please vote by using one of the following methods, whether or not you attend the virtual Annual Meeting: (i) vote by telephone, (ii) vote on the Internet, or (iii) request a paper copy of the proxy materials by following the instructions on the notice provided to you on or about July 22, 2020 entitled "Important Notice Regarding the Availability of Proxy Materials" ("Notice") and promptly return your completed proxy card in the envelope provided.

To participate in the virtual Annual Meeting, you will need the 16-digit control number included on your Notice, proxy card or voting instruction form. The meeting webcast will begin promptly at 9:00 a.m., Central Time, and we encourage you to access the meeting prior to the start time. You will be able to vote your shares electronically during the Annual Meeting and submit questions.

Only shareholders of record at the close of business on July 6, 2020 are entitled to notice of, and to vote at, the Annual Meeting. A list of registered shareholders is on file at the Company's office located at One SE Convenience Blvd., Ankeny, Iowa 50021, and will be made available electronically to shareholders on the virtual meeting website during the Annual Meeting.

| By Order of the Board of Directors, | ||

Julia L. Jackowski Chief Legal Officer and Secretary |

July 22, 2020

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Shareholders to be held on September 2, 2020

The Notice of Annual Meeting of Shareholders, the Proxy Statement and Annual Report to Shareholders

are available at http://materials.proxyvote.com/147528

About the Annual Meeting | 1 | |

Proposal 1: Election of Directors | 6 | |

Governance of the Company | 15 | |

The Board of Directors and Its Committees | 21 | |

Information About Our Executive Officers | 27 | |

Principal Shareholders | 29 | |

Beneficial Ownership of Shares of Common Stock by Directors and Executive Officers | 30 | |

Compensation Discussion and Analysis | 31 | |

Compensation Committee Report | 54 | |

Compensation Committee Interlocks and Insider Participation in Compensation Decisions | 55 | |

Compensation Programs and Risk Management | 55 | |

Executive Compensation | 56 | |

Potential Payments upon Termination or Change of Control | 71 | |

CEO Pay Ratio | 75 | |

Equity Compensation Plan Information | 76 | |

Director Compensation | 77 | |

Report of the Audit Committee of the Board of Directors | 80 | |

Proposal 2: Ratification of Appointment of Independent Registered Public Accounting Firm | 81 | |

Proposal 3: Advisory Vote on our Named Executive Officer Compensation | 83 | |

Annual Reports | 84 | |

Shareholders Sharing an Address | 84 | |

Submission of Shareholder Proposals | 84 | |

Proxy Solicitation | 86 | |

Other Matters | 86 |

Virtual Annual Meeting

The 2020 Casey's General Stores, Inc. annual shareholders' meeting will be held at 9:00 a.m. Central Time on September 2, 2020 (the "Annual Meeting"). Due to the ongoing developments, concerns and uncertainty surrounding the COVID-19 pandemic, the Annual Meeting will be a virtual meeting only, conducted via live webcast at www.virtualshareholdermeeting.com/CASY2020.

To participate in the virtual Annual Meeting, you will need the 16-digit control number included on your Notice, proxy card or voting instruction form. The meeting webcast will begin promptly at 9:00 a.m., Central Time, and we encourage you to access the meeting prior to the start time. We are committed to ensuring that shareholders will be afforded the same rights and opportunities to participate as they would at an in-person meeting, and as such, you will be able to vote your shares electronically during the virtual annual meeting and submit questions on the virtual meeting website.

We will also make the Annual Meeting accessible to anyone else who is interested, including team members and other constituents, by visiting www.virtualshareholdermeeting.com/CASY2020; however, non-shareholders guests will not be permitted to vote or submit questions at the Annual Meeting.

The Company's principal executive office mailing address is P.O. Box 3001, One SE Convenience Blvd., Ankeny, Iowa 50021.

This Proxy Statement and the proxy card are first being provided and/or made available on or about July 22, 2020 to each holder of record of common stock, no par value per share ("Common Stock"), of the Company at the close of business on July 6, 2020—the "Record Date". On the Record Date, there were 36,906,773 shares of Common Stock outstanding. Each share of Common Stock will be entitled to one vote on all matters.

Casey's Board of Directors (the "Board"), through the Notice of Internet Availability of Proxy Materials, the Notice of Annual Meeting of Shareholders, this Proxy Statement and the proxy card, is soliciting your vote on matters being submitted for shareholder approval at the Annual Meeting and any adjournments or postponements thereof.

At the Annual Meeting, shareholders will vote on the following matters:

The Board is not aware at this date of any other matters proposed to be presented at the Annual Meeting. The persons named on the proxy card will have discretionary authority to vote on any other matter that is properly presented at the meeting, according to their best judgment.

1

Securities Entitled to Vote

The only securities eligible to be voted at the Annual Meeting are shares of Common Stock. Only holders of Common Stock at the close of business on the Record Date—July 6, 2020—are entitled to vote. Each share of Common Stock represents one vote, and all shares vote together as a single class. There were 36,906,773 shares of Common Stock issued and outstanding on the Record Date.

Quorum; Vote Required

The presence in person or by proxy of shareholders entitled to cast a majority of all the votes entitled to be cast at the Annual Meeting constitutes a quorum. Shareholders are entitled to one vote per share. Shares of Common Stock held by shareholders abstaining from voting but otherwise present at the meeting in person or by proxy ("abstentions") are included in determining whether a quorum is present. Broker shares that are not voted on a particular proposal because the broker does not have discretionary voting power for that proposal and have not received voting instructions from the beneficial owner ("broker non-votes") are also included in determining whether a quorum is present.

The Company's Corporate Governance Guidelines, described further on page 15, provide that any director in an uncontested election who does not receive a Majority Vote is expected to tender his or her resignation as a director. All of the current directors have tendered irrevocable resignations to the Company that will be effective if that director does not receive a Majority Vote and the Board accepts such resignation. Further information on the resignation policy is on page 16 under the heading "Governance of the Company".

How to Vote; Submitting Your Proxy; Revoking Your Proxy

Your vote is very important to the Company. Whether or not you plan to attend the virtual Annual Meeting, we urge you to vote your shares today. You may vote your shares by either:

2

By submitting a proxy, you are legally authorizing another person to vote your shares. The proxy card designates H. Lynn Horak and Darren M. Rebelez to vote your shares in accordance with the voting instructions you indicate on your proxy card. If you submit your proxy card designating Mr. Horak and Mr. Rebelez as the individuals authorized to vote your shares, but you do not indicate how your shares are to be voted, your shares will be voted by these individuals in accordance with the Board's recommendations, which are described in this Proxy Statement. If any other matters are properly raised at the Annual Meeting—other than the proposals in this Proxy Statement—these individuals will have the authority to vote your shares on those matters in accordance with their discretion and judgment. The Board currently does not know of any matters to be raised at the Annual Meeting other than those in this Proxy Statement.

We urge you to vote by doing one of the following:

If you hold shares through the Company's 401(k) Plan (the "401K Plan"), such shares are not registered in your name, and your name will not appear in the Company's register of shareholders. Instead, your shares are registered in the name of a trust, which is administered by Principal Trust Company (the "Trustee"). Only the Trustee will be able to vote your shares, even if you attend the Annual Meeting virtually. You can direct the voting of the shares allocated to your accounts—including changing or revoking a previously submitted vote—on the Internet, by telephone or by mail on a proxy instruction card, but cannot direct the voting of your 401K Plan shares at the meeting. If voting instructions for shares in the 401K Plan are not returned, those shares will be voted by the Trustee in the same proportion as the shares for which voting instructions are returned by the other participants in the 401K Plan. To allow sufficient time for the Trustee to tabulate the vote of the 401K Plan shares, participant instructions must be received before 11:59 p.m. Eastern Time on August 28, 2020.

If you have previously submitted a proxy card, you may change any vote you may have cast by following the instructions on the proxy card to vote by telephone or on the Internet, or by completing, signing, dating and returning a new proxy card, or by attending the virtual Annual Meeting and voting your shares. If your shares are registered in the "street name" of a bank, broker or other holder of

3

record, please contact the applicable bank, broker or record holder for instructions on how to change or revoke your vote.

Your proxy is revocable. If you are a shareholder of record, after you have submitted your proxy card, you may revoke it by mail before the Annual Meeting by sending a written notice to Julia L. Jackowski, Chief Legal Officer and Secretary, Casey's General Stores, Inc., P.O. Box 3001, One SE Convenience Blvd., Ankeny, Iowa 50021. If you wish to revoke your submitted proxy card and submit new voting instructions by mail, then you must sign, date and mail a new proxy card with your new voting instructions. Please mail any new proxy card in sufficient time for it to be received by the morning of September 2, 2020. If you are a shareholder of record and you voted your proxy card by telephone or on the Internet, you may revoke your submitted proxy and/or submit new voting instructions by that same method, which must be received by 11:59 p.m. Eastern Time on September 1, 2020. You also may revoke your proxy card by attending the virtual Annual Meeting and voting your shares. Attending the virtual Annual Meeting without taking one of the actions above will not revoke your proxy. If you are a beneficial owner, or you hold your shares in "street name" as described below, please contact your bank, broker or other holder of record for instructions on how to change or revoke your vote.

If your shares are not registered in your name but in the "street name" of a bank, broker or other holder of record (a "Nominee"), your name will not appear in the Company's register of shareholders. Your Nominee, as the record holder of your shares, is required to vote those shares in accordance with your instructions. If you do not give instructions to your Nominee, your Nominee will be entitled to vote the shares with respect to "discretionary" items but will not be permitted to vote the shares with respect to "non-discretionary" items—those shares are treated as broker non-votes. Proposal 1—election of directors, and Proposal 3—executive officer compensation, are "non-discretionary" items for any Nominee holding shares on your behalf. As a result, if your shares are held in "street name" and you do not provide instructions as to how your shares are to be voted, your Nominee will not be able to vote your shares on these proposals. Note that even if you attend the virtual Annual Meeting, you cannot vote the shares that are held by your Nominee unless you have a proxy from your Nominee. If you do not provide instructions to your Nominee and your Nominee does not vote your shares on your behalf with respect to Proposal 2—ratification of the selection of the independent registered public accounting firm, which is a "discretionary" item, your shares will not be counted in determining whether a quorum is present for the Annual Meeting. If your Nominee exercises its "discretionary" authority to vote your shares on Proposal 2, your shares will be counted in determining whether a quorum is present for all matters presented at the Annual Meeting. We urge you to provide instructions to your Nominee so that your votes may be counted on these important matters. Please contact your Nominee for the deadlines for submission of your vote and for instructions on how to change or revoke your vote.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting

To attend the virtual Annual Meeting, visit www.virtualshareholdermeeting.com/CASY2020. Information on how to vote at the virtual Annual Meeting is available by contacting Julia L. Jackowski, Chief Legal Officer and Secretary at (515) 965-6579, or by writing to us at:

Casey's General Stores, Inc.

Corporate Secretary

P.O. Box 3001

One SE Convenience Blvd.

Ankeny, Iowa 50021

The Notice of Annual Meeting of Shareholders, this Proxy Statement and the Annual Report to Shareholders for the year ended April 30, 2020, are available at http://materials.proxyvote.com/147528.

4

The Company also makes available, free of charge through its website—www.caseys.com, under the "Investor Relations" link at the bottom of each page—this Proxy Statement, the Annual Report to Shareholders, the Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), as soon as reasonably practicable after these documents are electronically filed with, or furnished to, the Securities and Exchange Commission (the "SEC").

5

Introduction

Our Board consists of nine highly-qualified and experienced directors. The Board collectively brings a broad range of executive leadership, consumer/retail, digital marketing, operations, M&A, finance and accounting expertise, as well as broad gender and geographic diversity.

Certain highlights of our Board composition include the following:

| | | | | | | | | | | | | | | | | | | | | |

| | Board Leadership | | Independence | | Gender Diversity | | Average Tenure | | Average Age | | ||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| Independent Board Chair | 89% Independent (8 of 9 directors) | 56% Female (5 of 9 directors) | 4.7 Years of Service | 59.7 Years of Age | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| â | â | â | â | â | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| H. Lynn Horak (standing for election at the Annual Meeting) | Only non-independent director is Darren M. Rebelez, our President/CEO | Audit, Compensation, and Nominating and Corporate Governance Committee Chairs are all female | £ 4 = 6 directors 5-6 = 1 director 7+ = 2 directors | 51-60 = 5 directors 61-64 = 3 directors 65+ = 1 director | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

In addition, the table below summarizes certain core individual qualifications, experiences and skills of our directors that contribute to the Board's effectiveness as a whole. This high-level summary is not intended to be an exhaustive list of a director's expertise or contributions to the Board:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Senior Business Operations Leadership | | Consumer Products, Retail | | Real Estate, Development, Construction | | Digital Marketing, E-Commerce | | Marketing and Brand Management | | Supply Chain, Logistics and Distribution | | Capital Markets, Investment Banking, Asset Management and Investor Relations | | M&A | | IT and Security | | Public Policy, Government Affairs, Regulatory, Compliance, Legal | | Finance, Accounting and Financial Reporting | | Risk Management | | ||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| H. Lynn Horak | · | · | · | · | |||||||||||||||||||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Diane C. Bridgewater | · | · | · | · | · | ||||||||||||||||||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Donald E. Frieson | · | · | · | · | |||||||||||||||||||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cara K. Heiden | · | · | · | · | · | · | · | ||||||||||||||||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| David K. Lenhardt | · | · | |||||||||||||||||||||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Darren M. Rebelez | · | · | · | · | · | ||||||||||||||||||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Larree M. Renda | · | · | · | · | · | · | · | ||||||||||||||||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Judy A. Schmeling | · | · | · | · | · | · | · | ||||||||||||||||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Allison M. Wing | · | · | · | · | · | · | |||||||||||||||||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

6

Fiscal 2020 Board Updates

The Board is committed to building and maintaining a sound corporate governance structure that is the foundation of integrity, shareholder transparency and strong financial performance. As a result of this commitment and our outreach efforts to shareholders during the fiscal year, the following important actions were taken or approved:

Director Nominee Selection Process

Board Structure (and Phased Declassification)

The Board may consist of between seven and twelve persons, and individuals may be elected by the Board to fill any vacancies or to occupy any new directorships. The person filling a vacancy or

7

newly-created directorship is to serve until the next annual shareholders' meeting following their election and until their successor is elected and qualified.

The Company is incorporated in Iowa. Until January 1, 2019, under the Iowa Business Corporation Act, the Board was required to be classified. However, starting with last year's annual meeting, Iowa Code section 490.806B required that the Board begin a phased declassification over a three-year period. In particular, Iowa Code section 490.806B requires that the staggered terms of the previously-designated "Class I", "Class II" and "Class III" directors elected or appointed prior to January 1, 2019 cease at the expiration of their then current terms, and that the terms of directors elected or appointed after January 1, 2019 expire at the next annual shareholders' meeting following their election or appointment. As a result:

Therefore, by the 2021 annual shareholders' meeting, all of the Company's director nominees will stand for annual election, and directors will no longer be assigned to a "class".

8

Nominees for Election at the Annual Meeting

The Board believes that all seven director nominees—Mr. Horak, Ms. Bridgewater, Mr. Lenhardt, Mr. Rebelez, Ms. Renda, Ms. Schmeling, and Ms. Wing—have demonstrated outstanding achievement in their professional careers, possess personal and professional integrity and independent judgment, and have the necessary skills and qualifications to provide effective oversight, strategic guidance and contribute to the future success and growth of the Company.

It is intended that all proxies, unless contrary instructions are given thereon, will be voted FOR the election of the seven nominees. In the event of death or disqualification of any nominee, or the refusal or inability of any nominees to serve as a director, the proxy may be voted with discretionary authority for the election of a substitute nominee approved by the Board.

THE BOARD RECOMMENDS THAT YOU VOTE FOR THE ELECTION OF EACH OF THE DIRECTOR NOMINEES.

9

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | Key Experience and Qualifications: | | ||||||||||

| | | | | | | | | | | | | |

| Mr. Horak spent the majority of his 35-year banking career leading complex and growing business organizations, from which he brings over three decades of executive leadership experience to his position as independent Board Chair. In recognition for his years of outstanding accomplishments in the Wells Fargo organization, Mr. Horak was elected to the Iowa Business Hall of Fame in 2001. As a director of the Company since 2009, Mr. Horak has developed a deep understanding of the intricacies of the convenience store and quick-service restaurant industries and provides the Board with a wealth of knowledge related to acquisitions, credit markets, consumer behavior and retail analysis. | |||||||||||

| | | | | | | | | | | | | |

Director Since: 2009 | | Career Highlights: | | |||||||||

| | | | | | | | | | | | | |

| Committees: Nominating and Other Public Boards: None Other: Independent Board | Wells Fargo Bank - Midwest Region • Regional President (2004-2007) Wells Fargo Bank Iowa • Chairman of the Board and CEO (1991-2004) • President and COO (1986-1991) • Executive VP and CFO (1981-1986) • Various financial and leadership positions (1972-1981) | ||||||||||

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | Key Experience and Qualifications: | | ||||||||||

| | | | | | | | | | | | | |

| Ms. Bridgewater brings a wealth of finance, accounting, information technology and executive experience to the Board from LCS, a national leader in the planning, development and management of senior living communities. Her strategic and business operations leadership has helped LCS grow to managing more than $5 billion in assets and more than $1.5 billion in annual revenue with over 24,000 employees serving approximately 35,000 seniors. In addition to directing all financial aspects of LCS and serving on its board and investment committee, Ms. Bridgewater is also responsible for overseeing LCS's insurance business line, group purchasing, IT, compliance, regulatory and legal matters. | |||||||||||

| | | | | | | | | | | | | |

Director Since: 2007 | | Career Highlights: | | |||||||||

| | | | | | | | | | | | | |

Committees: Audit, Other Public Boards: None | LCS • Executive VP, Chief Financial and Administrative Officer (2011-Present) • Vice President, Treasurer and CFO (2006-2011) Pioneer Hi-Bred International, Inc. • VP and CFO, Pioneer Ag Business (2006) • VP and Business Director, North America Operations Pioneer Ag Business (2004-2006) • Global Customer and Sales Service Director-Dupont/Pioneer Ag Business (2001-2003) | |||||||||||

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

10

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | Key Experience and Qualifications: | | ||||||||||

| | | | | | | | | | | | | |

| Mr. Lenhardt spent more than 14 years with PetSmart, a specialty provider of products, services and solutions for pets, including three years as President and two years as CEO. During this time, he developed its e-commerce and digital business, including through the acquisition of online retailer Pet 360 and deployment of PetSmart's order online/pick-up in-store capabilities. Mr. Lenhardt also successfully completed PetSmart's strategic review process in 2014, which resulted in the sale of PetSmart to BC Partners for $8.7 billion in 2015, representing the highest equity valuation in its history. Prior to PetSmart, Mr. Lenhardt served as manager of Bain & Company, Inc., where he led consulting teams for retail, technology and e-commerce clients. | |||||||||||

| | | | | | | | | | | | | |

Director Since: 2018 | | Career Highlights: | | |||||||||

| | | | | | | | | | | | | |

Committees: Audit, Compensation Other Public Boards: | PetSmart, Inc. • President and CEO (2013-2015) • President and COO (2012-2013) • Various management and leadership positions (2000-2012) Bain & Company, Inc. • Manager (1996-2000) | |||||||||||

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | Key Experience and Qualifications: | | ||||||||||

| | | | | | | | | | | | | |

Director Since: 2019 | Mr. Rebelez, the Company's President and CEO, brings a wealth of experience as a senior executive in the convenience store and restaurant industries, most recently serving as the President of IHOP Restaurants, a unit of Dine Brands Global, Inc., which franchises and operates restaurants under the Applebee's Grill & Bar and IHOP brands. Prior to joining Dine Brands, Mr. Rebelez was employed by 7-Eleven, Inc., a convenience store chain, as Executive Vice President and Chief Operating Officer. Before 7-Eleven, Mr. Rebelez held numerous management roles within ExxonMobil, and before that, at Thornton Oil Corporation. In 2020, Mr. Rebelez was named by CSN as its Retailer Executive of the Year. His wide-ranging experience enables Mr. Rebelez to provide important insights to the Board regarding operations, marketing, digital engagement, product development, management and strategic planning. | |||||||||||

| | | | | | | | | | | | | |

Committees: None | | Career Highlights: | | |||||||||

| | | | | | | | | | | | | |

Other Public Boards: Globe Life (since 2010) | Casey's General Stores, Inc. • President and CEO (2019-Present) IHOP Restaurants (a unit of Dine Brands Global, Inc.) • President (2015-2019) 7-Eleven, Inc. • Executive VP and COO (2007-2014) | |||||||||||

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

11

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | Key Experience and Qualifications: | | ||||||||||

| | | | | | | | | | | | | |

Director Since: 2014 Committees: Compensation | Ms. Renda is a distinguished, 40-year veteran of the retail grocery industry, including over two decades in senior and executive leadership positions at Safeway, a supermarket chain in the United States. Her diverse responsibilities included retail strategy, labor relations, public affairs, communications, government relations, health initiatives, human resources, corporate social responsibility and sustainability, philanthropy, IT, construction and real estate. In her early career at Safeway, Ms. Renda earned the distinction of being the youngest store manager, district manager and retail operations manager in Safeway's history. She was also the first female and youngest person promoted to Senior VP, and subsequently became Safeway's first female Executive VP. Ms. Renda was twice voted as one of the "50 Most Influential Women in Business" by Fortune magazine. | |||||||||||

| | | | | | | | | | | | | |

| (Chair), Risk | | Career Highlights: | | |||||||||

| | | | | | | | | | | | | |

Other Public Boards: International Speedway Corp. | Safeway, Inc. • Executive VP (1999-2015) • Senior VP (1994-1999) • Various management and leadership positions (1974-1994) | |||||||||||

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | Key Experience and Qualifications: | | ||||||||||

| | | | | | | | | | | | | |

| Ms. Schmeling is a seasoned executive, bringing over 20 years of financial, operational and leadership experience with her from HSN, a leading interactive multichannel retailer and the first television shopping network. She has also served in various roles through multiple corporate transitions, including the spin-off of HSN from IAC and HSN's integration of additional businesses. Throughout her career as an executive and a director at other public companies, Ms. Schmeling has been at the forefront of new and emerging industries and has developed extensive expertise in accounting/finance, and has significant experience with operations, treasury functions, tax, investor relations and corporate strategy. | |||||||||||

| | | | | | | | | | | | | |

Director Since: 2018 | | Career Highlights: | | |||||||||

| | | | | | | | | | | | | |

Committees: Audit, Nominating and Corporate Governance (Chair) | HSN, Inc. • COO (2013-2017) • Executive VP and CFO (2008-2017) • Executive VP and CFO (2002-2008; when known as IAC Retailing) | |||||||||||

Other Public Boards: Constellation Brands, Inc. (since 2013), Canopy Growth Corporation (since 2018) | • Various financial and leadership positions (1994-2002) Cornerstone Brands (a division of HSN) • President (2016-2017) | |||||||||||

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

12

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | Key Experience and Qualifications: | | ||||||||||

| | | | | | | | | | | | | |

Director Since: 2018 Committees: Compensation, | Ms. Wing is an experienced retail and brand marketing executive, bringing years of digital, retail and customer insights experience to the Board, which is invaluable to the Company as it undergoes its digital transformation. She currently serves as Chief Consumer Officer of Bright Health, a health insurance company. Previously, at Ascena, a leading national specialty retailer of apparel for women, Ms. Wing successfully launched its loyalty program, developed its first customer insights data production platform and launched its enterprise-wide e-commerce platform. Previously, Ms. Wing was an entrepreneur as CEO and founder of giggle, Inc., a multichannel retailer, wholesaler and licenser of baby products. She started her career at Nike and later spent several years in Silicon Valley working for a variety of online, software and e-commerce companies. | |||||||||||

| | | | | | | | | | | | | |

Other Public Boards: | | Career Highlights: | | |||||||||

| | | | | | | | | | | | | |

| Bazaarvoice, Inc. (2017-2018), Christopher & Banks Corporation (since 2019) | Bright Health • Chief Consumer Officer (2019-Present) • Chief Marketing/Digital Officer (2018-2019) | |||||||||||

Ascena Retail Group, Inc. | ||||||||||||

| • Chief Marketing Officer and Executive VP of Digital (2014-2017) | |||||||||||

giggle, Inc. | ||||||||||||

| • Founder, CEO and Chairperson (2004-2014) | |||||||||||

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Directors Continuing in Office—Terms to Expire in 2021

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | Key Experience and Qualifications: | | ||||||||||

| | | | | | | | | | | | | |

Director Since: 2018 | Mr. Frieson is Executive VP, Supply Chain, of Lowe's Companies, Inc., the world's second largest home improvement retailer, responsible for its distribution centers, logistics, replenishment and planning, transportation and delivery services. Mr. Frieson brings over 30 years of operations, logistics and supply chain experience, including 19 years within the Walmart organization, one of the world's largest retailers. While at Walmart, he served as Executive Vice President of Operations at Sam's Club, responsible for all club operations, including supply chain, for more than 650 locations in the U.S. and Puerto Rico, and as Senior VP of Supply Chain, where he led more than 30 distribution centers that supplied nearly 1,600 stores, supercenters and neighborhood markets in the eastern United States. | |||||||||||

| | | | | | | | | | | | | |

Committees: Nominating | | Career Highlights: | | |||||||||

| | | | | | | | | | | | | |

| and Corporate Governance, Risk (Chair) | Lowe's Companies, Inc. • Executive Vice President, Supply Chain (2018-Present) | |||||||||||

Other Public Boards: None | Sam's Club (a division of Walmart, Inc.) | |||||||||||

| • Executive VP of Operations (2014-2017) • Senior VP—Replenishment, Planning & Real Estate (2012-2014) | |||||||||||

Massmart Holdings Limited (a subsidiary of Walmart, Inc.) | ||||||||||||

| • Chief Integration Officer (2011-2012) | |||||||||||

Walmart, Inc. | ||||||||||||

| • Senior VP—Supply Chain Eastern US (2010) • President—Central Division (2007-2010) • Various operational and management positions (1999-2007) | |||||||||||

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

13

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | Key Experience and Qualifications: | | ||||||||||

| | | | | | | | | | | | | |

| Ms. Heiden has over 20 years of executive leadership experience in the financial services industry, serving in both regional and national roles in the Wells Fargo organization. Her successful financial services career led to her being named multiple times to U.S. Banker magazine's list of "25 Most Powerful Women in Banking," and she was elected to the Iowa Business Hall of Fame in 2019. Ms. Heiden's extensive financial, strategy, marketing, operational, and consumer policy expertise will provide the Board with valuable insight in those key areas. | |||||||||||

| | | | | | | | | | | | | |

| Cara K. Heiden, 64 | | Career Highlights: | | |||||||||

| | | | | | | | | | | | | |

| Retired Co-President, Wells Fargo Home Mortgage Director Since: 2017 Committees: Audit (Chair), Other Public Boards: None | Wells Fargo Home Mortgage • Co-President (2004-2011) • Head of National Consumer Lending (1998-2004) • Head of Loan Administration (1994-1997) • VP and CFO (1992-1994) Wells Fargo Bank Iowa • Senior VP and CFO (1988-1992) • Various financial leadership positions (1981-1988) | |||||||||||

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

14

The Company is committed to strong corporate governance, which we believe promotes the long-term interests of our shareholders, strengthens Board and management accountability and fosters strong Company performance.

To help ensure the Company meets this commitment, the Board has approved Corporate Governance Guidelines (the "Guidelines") to address key governance practices and identify the framework for the operations of the Board and its committees. A copy of the current Guidelines is posted on the Company's website—www.caseys.com—under the "Investor Relations" link at the bottom of each page.

The Nominating and Corporate Governance Committee monitors developments in law and governance practices, including but not limited to those set forth by the Investor Stewardship Group, and recommends to the Board appropriate changes to the Guidelines and other governance practices. The Nominating and Corporate Governance Committee also maintains a focus on "ESG" (environmental, social, governance) issues, as they relate to the Company's business and industry.

Certain highlights of our corporate governance practices include the following (items with a "*" are described in more detail below the respective table):

| | | | | | | | | | | | | | | | | | | | | |

| Board Composition | | |||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| Independent Board Chair | 8 of 9 Directors are Independent | 56% Female Directors | Strong Female Board Leadership | Comprehensive Board Refreshment | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| â | â | â | â | â | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| H. Lynn Horak (standing for election at the Annual Meeting)* | Only non-independent director is Darren M. Rebelez, our President/CEO | 5 of 9 directors are female | Audit, Compensation, and Nominating and Corporate Governance Committee Chairs are all female | Six new directors since July 2017 | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

15

| | | | | | | | | | | | | | | | | | | | | |

| Shareholder Rights | | |||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| Phased Declassification | Majority Voting in Uncontested Director Elections | Proxy Access | Annual Say-On-Pay Advisory Vote | Single Voting Class of Securities | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| â | â | â | â | â | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| All nominees will stand for annual election by 2021* | The nominees at the Annual Meeting are subject to a majority voting standard* | 3/3/20/20 proxy access structure* | Last year's say-on-pay vote received over 97.5% approval | No dual class or other preferred voting | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

16

| | | | | | | | | | | | | | | | | |

| Accountability | | |||||||||||||||

| | | | | | | | | | | | | | | | | |

| Strong Anti-Hedging and Pledging Policy | Executive Officer Incentive Compensation Clawback Policy | Meaningful Stock Ownership Guidelines | Robust Code of Conduct/Ethics | |||||||||||||

| | | | | | | | | | | | | | | | | |

| â | â | â | â | |||||||||||||

| | | | | | | | | | | | | | | | | |

| Hedging and unapproved pledging is prohibited* | Seek reimbursement of annual and equity incentive payments in the case of certain financial restatements* | Director: 5x cash retainer CEO: 5x base salary Chief/SVP: 3x base salary VP: 2x base salary* | All directors and officers bound by a robust Code of Business Conduct and Ethics | |||||||||||||

| | | | | | | | | | | | | | | | | |

17

date. Restricted stock, unvested time-based restricted stock units (RSUs) and vested 401K Plan shares, as applicable, count towards the requirement, however performance-based restricted stock units (PSUs) and stock options do not count towards the requirement.

| | | | | | | | | | | | | | | | | | | | | |

| Board Practices | | |||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| Regular Board and Committee Self-Assessments | Meaningful Director Age/Tenure Limits | Director Over-Boarding Limits | Strong Corporate Governance Guidelines | Regular Executive Sessions | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| â | â | â | â | â | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| Comprehensive Board self-assessment during the 2020 fiscal year | No re-election after 15 years of service or 75 years of age* | May not serve on more than two other public company boards* | Key governance practices/framework for the Board and its committees | The Board held six executive sessions during the 2020 fiscal year* | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Shareholder Engagement | | |||||||||||

| | | | | | | | | | | | | |

| Regular and Direct Shareholder Engagement | 2020 Investor Day | Director Attendance at Annual Meetings | ||||||||||

| | | | | | | | | | | | | |

| â | â | â | ||||||||||

| | | | | | | | | | | | | |

| During the 2020 fiscal year, the Company directly engaged with shareholders representing more than 50% of our outstanding shares | In January 2020, the Company held a comprehensive "Investor Day" in New York City | All directors are required to attend the annual shareholders' meeting | ||||||||||

| | | | | | | | | | | | | |

18

| | | | | | | | | | | | | | | | | | | | | |

| ESG (Environmental, Social and Governance) | | |||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| Procurement and Sustainability Manager | ESG "Working Group" | Board-Level Oversight | Environmental | Social | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| â | â | â | â | â | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| Dedicated team member with ESG-focused duties and responsibilities | Dedicated cross-functional team focused on ESG initiatives* | Nominating and Corporate Governance Committee oversight of ESG program | Numerous practices and initiatives focused on minimizing environmental impact* | Broad efforts promoting the well-being of team members, guests and communities* | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

19

| Environmental | Social | |

|---|---|---|

| LED Lighting: Since 2016, have built all new stores, and upgraded over 930 existing stores, to LED lighting, including all interior lights, parking lot lights, exterior canopies, cooler/freezer lights and façade sign lighting, resulting in a significant energy savings. Electric Vehicle Charging Stations: Installed electric vehicle charging stations at over 20 stores, with plans to install more during the 2021 fiscal year. Ethanol Blended Fuel and Biodiesel: Ethanol blended fuel is available at 480 stores (E15—254 stores, E85—226 stores), with higher blend sales exceeding three million gallons per month. In addition, biodiesel is available at over 1,000 stores, and over half the diesel fuel sold is blended with 5% or more biodiesel. Water Reduction: Implemented a number of water-usage initiatives, including reduced and rain-sensing irrigation practices and low-flow faucet aerators, restroom equipment and other hardware. Transportation: Have reduced the emissions impact of our transportation fleet through a focus on mileage/route efficiencies, delivery schedules, vehicle idling and more fuel efficient vehicles. Industry Focus: Member of the C-Store Sustainability Consortium in partnership with NACS and founding member of the Iowa Sustainable Business Forum. | Casey's Charities: Each year, the Company provides financial support to a large number of local charities, schools and other organizations. In 2019 alone, the Company and Casey's Charities directly donated over $2M in monetary and in-kind donations to dozens of deserving groups. In addition, our combined guest/store contribution campaigns led to almost $9M in charitable donations. Team Member Environment: Implemented robust team member practices and policies, including comprehensive anti-harassment/discrimination and safety training and policies, robust health/welfare benefits for full- and part-time team members and a widely disseminated "ethics" hotline. COVID-19 Benefits: From the outset of the COVID-19 crisis, have provided expanded leave benefits and supplemental pay and bonuses to front-line and other team members. Cash for Classrooms: The Company's new loyalty/rewards program has a unique feature which allows guests' rewards points to be donated to a school of their choice. Since just December of 2019, donations have been made to 2,436 schools across the Company's territory. Partnership with Feeding America: Includes financial support, in-kind food donations and future in-store fund-raising campaigns to support 52 local food banks across Casey's 16-state territory. |

20

THE BOARD OF DIRECTORS AND ITS COMMITTEES

Members of the Board are kept informed of the Company's business through discussions with the CEO, the Company's senior management and other key employees, by reviewing materials provided to them, and by participating in regular Board and committee meetings, including closed and executive sessions. Between meetings, directors are provided with information regarding the Company's operations and are frequently consulted on an informal basis with respect to pending matters.

Directors are expected to attend all Board meetings, meetings of the committees on which they serve and each annual shareholders' meeting. The Board held fourteen meetings during the 2020 fiscal year. Each incumbent director attended at least 90% or more of the aggregate number of Board meetings and committee meetings on which the director served during the 2020 fiscal year, and all directors attended last year's annual shareholders' meeting.

Director Independence

In making independence determinations, the Board observes the criteria for independence set forth in the Nasdaq Listing Standards. Consistent with these criteria, the Board considers all relationships and material transactions between the Company and the director-nominees (and any affiliated companies), and has affirmatively determined that all of its current directors, other than Mr. Rebelez (as the CEO), are "independent" within the meaning of the Nasdaq Listing Standards. As such, a substantial majority of the Board is independent, as so defined.

In reaching this conclusion, the Board considered that both Mr. Horak and Ms. Heiden held executive leadership positions within the Wells Fargo organization during their careers, and concluded that each of them bring distinct and valuable skills to the Board, and that their prior employment experiences would not interfere with their exercise of independent judgment in carrying out their responsibilities as directors.

Board Committees

In September 2019, the Board, acting on a recommendation of the Nominating and Corporate Governance Committee, amended its Bylaws to eliminate the requirement for, and subsequently dissolved, the Executive Committee. As such, the Bylaws now provide for three standing committees of the Board:

In addition, the Bylaws authorize the Board to establish other committees for selected purposes, pursuant to which the Risk Committee has been established.

21

Certain details of the Board's committees are set forth below:

| | | | | | | | | | | | | | | | | | | | | |

| | Audit Committee | | Compensation Committee | | Nom.-Gov. Committee | | Risk Committee | | ||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| | H. Lynn Horak | · | ||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| | Diane C. Bridgewater | · | · | |||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| | Donald E. Frieson | · | Chair | |||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| | Cara K. Heiden | Chair | · | |||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| | David K. Lenhardt | · | · | |||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| | Darren M. Rebelez | |||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| | Larree M. Renda | Chair | · | |||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| | Judy A. Schmeling | · | Chair | |||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| | Allison M. Wing | · | · | |||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| | Number of Meetings in 2020 Fiscal Year | 7 (2 joint with Comp. and Risk) | 13 (2 joint with Audit and Risk) | 5 | 4 (2 joint with Audit and Comp.) | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

Audit Committee

The Audit Committee is directly responsible for the appointment, termination, compensation and oversight of the independent registered public accounting firm it retains to audit the Company's books and records. Under its written Charter, available on the Company's website—www.caseys.com, under the "Investor Relations" link at the bottom of each page—the Audit Committee also regularly reports to the Board on the audit and the non-audit activities of the auditors, approves all audit engagement fees, pre-approves any non-audit engagement and compensation of the independent registered public accounting firm and performs other duties as set forth in its Charter.

The Audit Committee meets regularly each year with financial management personnel, internal accounting and auditing staff and the independent registered public accounting firm. During these meetings, the Audit Committee also meets separately in executive sessions with the internal auditing staff and the independent registered public accounting firm.

All members of the Audit Committee are independent under the Nasdaq Listing Standards. The Board has approved the designation of all Audit Committee members—Ms. Bridgewater, Ms. Heiden, Mr. Lenhardt and Ms. Schmeling—as "audit committee financial experts" as defined under Item 407(d)(5) of SEC Regulation S-K.

The report of the Audit Committee is included on page 80.

Compensation Committee

The Compensation Committee oversees our executive compensation program and engages in succession planning for the CEO and other executive officer positions.

The Compensation Committee annually reviews the performance of the CEO and the CEO's evaluation of the Company's other executive officers and their compensation arrangements, and makes recommendations to the Board concerning the compensation of the CEO and the Company's other executive officers. Its determinations and deliberations of the CEO's compensation are done in executive session, without the presence of management, including the

22

CEO. The CEO may make recommendations regarding the compensation of the other executive officers, and participate in such deliberations, but shall not vote to approve any compensation for such executive officers. The Compensation Committee also administers the 2018 Stock Incentive Plan and may authorize awards of stock options, restricted stock units, performance-based restricted stock units, restricted stock and other awards to the executive officers and other key employees under that plan. In addition, the Compensation Committee engages in succession planning for the CEO and other executive officers and makes recommendations to the Board with respect to such matters. The Compensation Committee also makes recommendations to the Board regarding the compensation of directors.

Under its written Charter, available on the Company's website—www.caseys.com, under the "Investor Relations" link at the bottom of each page—the Compensation Committee has authority to retain and terminate executive compensation consulting firms to advise the Compensation Committee and, from time to time, retain compensation consultants to assist with the Compensation Committee's review and development of its compensation recommendations.

All members of the Compensation Committee are independent under the Nasdaq Listing Standards.

The report of the Compensation Committee is included on page 54.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee generally reviews and makes recommendations to the Board regarding the Board's composition and structure, establishes criteria for Board membership and evaluates corporate policies relating to the recruitment of Board members, recommends to the Board the corporate governance policies or guidelines, leads the Board in a periodic review of the Board's performance, and performs other duties set forth in its written Charter, available on the Company's website—www.caseys.com, under the "Investor Relations" link at the bottom of each page.

The Charter sets forth, among other things, the minimum qualifications that the Nominating and Corporate Governance Committee believes must be met by a Committee-recommended nominee, and the specific qualities or skills that the Nominating and Corporate Governance Committee believes are necessary for one or more of the Company's directors to possess.

In particular, the Nominating and Corporate Governance Committee Charter provides that because the Board depends both on (i) the character, judgment, objectivity and diverse experience of its individual directors and (ii) their collective strengths, the Board should be composed of:

23

Additionally, the Nominating and Corporate Governance Committee Charter provides that, in considering possible candidates for election as an outside director, the Nominating and Corporate Governance Committee and other directors should be guided by the following criteria:

In considering individuals for nomination as directors, the Nominating and Corporate Governance Committee typically solicits recommendations from the current directors and is authorized to engage search firms to assist in the process.

The Nominating and Corporate Governance Committee considers a number of factors in making its nominee recommendations to the Board, including, among other things, a candidate's employment and other professional experience, past expertise and involvement in areas which are relevant to the Company's business, business ethics and professional reputation, independence, other board experience and the Company's desire to have a Board that represents a diverse mix of backgrounds, perspectives and expertise. Although the Board evaluates a wide range of qualifications and experience, certain areas are of particular relevance to the Company, including experience in the restaurant and fuel industries, and the areas of senior business operations leadership; consumer products and retail; real estate, development and construction; digital marketing and e-commerce; marketing and brand management; supply chain, logistics and distribution; capital markets, investment banking, asset management and investor relations; M&A; information technology and security; public policy and governmental affairs, regulatory compliance and legal; finance, accounting and financial reporting; and, risk management.

The Company does not have a formal policy for considering diversity in identifying and recommending nominees for election to the Board, but the Nominating and Corporate Governance Committee considers diversity of viewpoint, experience, background and other qualities in its overall consideration of nominees qualified for election to the Board.

The Nominating and Corporate Governance Committee will consider nominees recommended by shareholders if they are submitted in accordance with the Bylaws. Briefly, the Bylaws contain specific advance notice procedures relating to shareholder nominations of directors and other business to be brought before an annual or special meeting of shareholders other than by or at the direction of the Board.

Under the Bylaws, a shareholder may nominate a director candidate for election at an annual shareholders' meeting by (i) complying with the Company's proxy access provision, as further described on page 16 and as set forth in the Bylaws, or (ii) delivering written notice thereof to the Corporate Secretary not less than 90 days, nor more than 120 days, prior to the first anniversary date of the date of the immediately preceding annual shareholders' meeting. In the case of shareholder nominations to be considered at the 2021 annual meeting under method (ii) of this paragraph, such notice must be received by the Corporate Secretary by no earlier than May 5, 2021, and no later than June 4, 2021. In addition, the notice must set forth certain information concerning such shareholder and the shareholder's nominee(s), including but not limited to their names and addresses, occupation, share ownership, rights to acquire shares and other derivative

24

securities or short interests held, a representation that the shareholder is entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice, a description of all arrangements or understandings between the shareholder and each nominee, such other information as would be required to be included in a proxy statement pursuant to the proxy rules of the SEC had the nominee(s) been nominated by the Board, and the consent of each nominee to serve as a director of the Company if so elected. The chair of the meeting may refuse to acknowledge the nomination of any person not made in compliance with the provisions of the Bylaws. A copy of the Bylaws may be obtained by request addressed to Julia L. Jackowski, Chief Legal Officer and Secretary, Casey's General Stores, Inc., P.O. Box 3001, One SE Convenience Blvd., Ankeny, Iowa 50021.

All members of the Nominating and Corporate Governance Committee are independent under the Nasdaq Listing Standards.

Risk Committee

The Risk Committee generally assists the Board in overseeing management's identification and evaluation of the Company's principal operational and business risks, including the Company's risk management framework and the policies, procedures and practices employed to manage those risks and other duties set forth in its written Charter, available on the Company's website—www.caseys.com, under the "Investor Relations" link at the bottom of each page. The Risk Committee also meets jointly at least once per year with the Audit Committee, which is intended to facilitate discussion of areas of common interest and significant matters, including but not limited to the Company's risk assessment and risk management policies and any major regulatory enforcement actions or litigation, and may also meet jointly with other Board committees as necessary.

All members of the Risk Committee are independent under the Nasdaq Listing Standards.

The Board's Role in Risk Oversight

Risk assessment and risk management are the responsibility of the CEO and the Company's management. The Board retains oversight responsibility over the Company's key strategic risks, information security risks and regulatory compliance risks. The Board meets regularly with the Company's executive officers to discuss strategy and risks facing the Company, and each quarter receives presentations from the executive officers and other key employees on business operations, financial results and strategic issues, including the identification, assessment and management of critical risks and management's risk mitigation strategies. In addition, annual strategic planning sessions are held to discuss strategies, key challenges and risks and opportunities for the Company. An Enterprise Risk Manager reports to the Chief Legal Officer and leads a working group comprised of senior management and other key employees to provide recommendations to the CEO for further action, with periodic progress reports on the same being provided to the Risk Committee and the Board. Areas of focus include, but are not limited to, cybersecurity, food safety, competitive, economic, operational, financial, personnel, legal, regulatory, compliance, health, safety and environment, political and reputational risks.

The Board committees also provide assistance to the Board in fulfilling its oversight responsibilities in certain areas of risk. The Risk Committee's responsibility is to provide oversight and to engage management and the Board with regard to the Company's principal operating and business risks. The Audit Committee assists the Board in fulfilling its oversight responsibilities with respect to financial reporting, internal controls, and financial risks. The Compensation Committee assists the Board in fulfilling its oversight responsibilities with respect to the management of risks arising from the Company's compensation policies and practices, including overseeing the development of stock

25

ownership guidelines, the annual incentive compensation program and clawback policies, in addition to CEO and executive officer succession planning risks. The Nominating and Corporate Governance Committee assists the Board in fulfilling its oversight responsibilities with respect to the management of risks associated with Board and committee membership, structure and succession, and the monitoring of corporate governance issues, and the development of recommendations to address evolving best practices in those areas. All of these committees report back to the full Board as to each committee's activities and matters discussed and reviewed at the committee meetings. In addition, all directors are encouraged to participate in external director education courses to keep apprised of current issues, including evolving areas of risk.

Regarding COVID-19, the Company has assembled a cross-functional "task-force," which includes executive officers and team members from a variety of departments/roles, for the continuous monitoring of the impact of COVID-19 on our team members and business operations and to implement measures to manage team member and guest safety, liquidity and other risks. The full Board is actively engaged in overseeing these risk management strategies and initiatives, and is working closely with management during this unprecedented situation to maintain information flow and timely review of issues, including mitigation of risk, arising from the pandemic.

Shareholder Communications

It is the general policy of the Board that management speaks for the Company. To the extent shareholders would like to communicate with a Company representative, they may do so by contacting Brian J. Johnson, Senior VP—Investor Relations and Business Development, Casey's General Stores, Inc., P.O. Box 3001, One SE Convenience Blvd., Ankeny, Iowa 50021. Mr. Johnson also can be reached by telephone at (515) 446-6587.

Any shareholder wishing to communicate with one or more Board members should address a written communication to H. Lynn Horak, Board Chair, or to Darren M. Rebelez, President and CEO, at P.O. Box 3001, One SE Convenience Blvd., Ankeny, Iowa 50021. Mr. Horak or Mr. Rebelez, as applicable, will forward such communication on to all of the members of the Board, to the extent such communications are deemed appropriate for consideration by the Board.

26

INFORMATION ABOUT OUR EXECUTIVE OFFICERS

The Company currently has ten executive officers and twelve other Vice Presidents. The current executive officers are as follows:

Name | Current Office Held | First Became Executive Officer | Age(1) | ||||||

|---|---|---|---|---|---|---|---|---|---|

Darren M. Rebelez | President and Chief Executive Officer | 2019 | 54 | ||||||

Stephen P. Bramlage, Jr. | Chief Financial Officer | 2020 | 49 | ||||||

Julia L. Jackowski | Chief Legal Officer and Secretary | 2010 | 54 | ||||||

Chris L. Jones | Chief Marketing Officer | 2018 | 51 | ||||||

Thomas P. Brennan | Chief Merchandising Officer | 2019 | 45 | ||||||

Chad M. Frazell | Chief Human Resources Officer | 2020 | 48 | ||||||

Adrian M. Butler | Chief Information Officer | 2020 | 50 | ||||||

Ena Williams | Chief Operating Officer | 2020 | 51 | ||||||

John C. Soupene | Senior Vice President—Operational Excellence | 2015 | 51 | ||||||

Brian J. Johnson | Senior Vice President—IR & Business Development | 2016 | 45 | ||||||

During the past five years, certain executive officers have served the Company in other positions, as follows:

During the past five years, certain executive officers were principally employed outside of the Company, as follows:

27

2006 through 2015, serving as Senior Vice President and Chief Financial Officer from 2012 through 2015.

28

The following table contains information with respect to each person, including any group, known to the Company to be the beneficial owner of more than 5% of the Common Stock as of July 6, 2020 (based on 36,906,773 shares of Common Stock outstanding as of such date). Except as otherwise indicated, the persons listed in the table have the voting and investment powers with respect to the shares indicated.

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class | |||||

|---|---|---|---|---|---|---|---|

T. Rowe Price Associates, Inc. | 4,490,489 | (1) | 12.1 | % | |||

100 E. Pratt Street | |||||||

Baltimore, MD 21202 | |||||||

The Vanguard Group-23-1945930 | 3,994,893 | (2) | 10.8 | % | |||

100 Vanguard Blvd. | |||||||

Malvern, PA 19355 | |||||||

BlackRock, Inc. | 3,312,688 | (3) | 8.9 | % | |||

55 East 52nd Street | |||||||

New York, NY 10055 | |||||||

T. Rowe Price Mid-Cap Growth Fund, Inc. | 1,927,400 | (4) | 5.2 | % | |||

100 E. Pratt Street | |||||||

Baltimore, MD 21202 | |||||||

29

BENEFICIAL OWNERSHIP OF SHARES OF COMMON STOCK

BY DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth, as of July 6, 2020 (other than with respect to the 401K Plan shares, which are as of April 30, 2020 as discussed in Footnote 2 below, and with respect to Mr. Handley's shares, which are as of June 23, 2019 as discussed in Footnote 6 below), the beneficial ownership of shares of Common Stock, the only class of capital stock outstanding, by the current directors (including the Board's nominees for election to the Board of Directors), the executive officers named in the Summary Compensation Table, and all current directors, director-nominees, and executive officers as a group (based on 36,906,773 shares of Common Stock outstanding as of such date). Except as otherwise indicated, the shareholders listed in the table have sole voting and investment powers with respect to the shares indicated.

Name of Beneficial Owner | Direct Ownership | Shares Subject to Vested Options and RSUs that Vest Within 60 Days(1) | 401K Plan Shares(2) | Total Amount and Nature of Beneficial Ownership(3) | Percent of Class | |||||

|---|---|---|---|---|---|---|---|---|---|---|

H. Lynn Horak(4) | 13,606 | 688 | — | 14,294 | * | |||||

Diane C. Bridgewater | 13,133 | 688 | — | 13,821 | * | |||||

Donald E. Frieson | 1,552 | 688 | — | 2,240 | * | |||||

Cara K. Heiden(5) | 6,041 | 688 | — | 6,729 | * | |||||

David K. Lenhardt | 1,552 | 688 | — | 2,240 | * | |||||

Larree M. Renda | 10,345 | 688 | — | 11,033 | * | |||||

Judy A. Schmeling | 1,486 | 688 | — | 2,174 | * | |||||

Allison M. Wing | 998 | 688 | — | 1,686 | * | |||||

Darren M. Rebelez | 5,559 | — | — | 5,559 | * | |||||

Terry W. Handley(6) | 35,472 | — | 12,187 | 47,659 | * | |||||

William J. Walljasper | 21,581 | 18,000 | 1,080 | 40,661 | * | |||||

Julia L. Jackowski | 21,035 | — | 4,712 | 25,747 | * | |||||

John C. Soupene | 9,457 | — | 1,049 | 10,506 | * | |||||

Chris L. Jones | 0 | — | 159 | 159 | * | |||||

All executive officers, directors and director-nominees as a group (20 persons) | 155,906 | 26,504 | 21,662 | 204,072 | * |

* Less than 1%

30

COMPENSATION DISCUSSION AND ANALYSIS

The focus of this discussion and analysis is on the Company's compensation philosophies and programs for its named executive officers ("NEOs") for the 2020 fiscal year:

Mr. Walljasper retired as Senior Vice President and Chief Financial Officer on May 31, 2020, and Mr. Bramlage succeeded him as Chief Financial Officer effective June 1, 2020. As a result, Mr. Bramlage is not considered a NEO for the 2020 fiscal year.

In this section, the word "Committee" refers to the Compensation Committee of the Board and "CEO" refers to Mr. Rebelez, unless specifically noted otherwise.

The 2020 fiscal year was a successful year for the Company. It included the addition of several talented individuals to its executive officer team, continued repositioning of the Company strategically, and the delivery of strong financial performance. The Committee continued our executive compensation practices with the fundamental objectives of motivating, attracting and retaining top executive talent and creating alignment with our business strategy and linkage to long-term value creation for our shareholders.

The Committee believes that in 2020 we achieved these objectives and have further positioned the Company for continued future success.

Executive Leadership Changes

At the beginning of the 2020 fiscal year, Mr. Rebelez, a highly-respected and experienced senior executive in the convenience, restaurant and oil industries, was appointed as President and CEO. In addition, the Company added executive officers Tom Brennan as Chief Merchandising Officer and Chad Frazell as Chief Human Resources Officer, each of whom bring a wealth of knowledge and experience in the convenience, restaurant and/or retail industries.

After the end of the 2020 fiscal year, the Company continued to add talented individuals to its executive officer team by appointing Ena Williams as Chief Operating Officer, Steve Bramlage as Chief Financial Officer (as noted above) and Adrian Butler as Chief Information Officer.

Alignment of Executive Compensation with 2020 Company Performance and Values

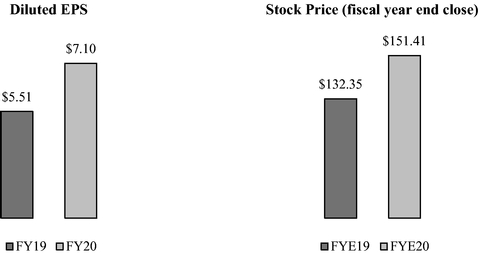

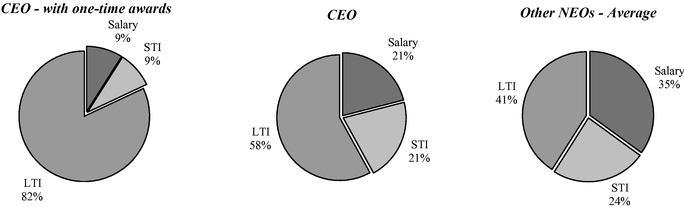

The Company finished the 2020 fiscal year with strong financial performance, highlighted in-part by a 29% increase in diluted earnings per share (EPS) and a 14.5% increase in stock price—see chart below. These industry leading results overcame the strong headwinds from the unprecedented challenges created by the COVID-19 crisis, which resulted in significant impacts in the Company's operating territory during its fourth fiscal quarter. During this time, the Company focused significant attention on our team members and guests to ensure their safety, health, and economic well-being. Further, we made significant progress on, and achieved excellent results from, our loyalty program and e-commerce platforms, price optimization, unit growth and other strategic initiatives.

31

Since both our annual and long-term incentive plans (including the performance-based strategic equity award to our CEO) are strongly aligned with our operating and strategic metrics, the most recent payouts for both plans were above target. The 2020 fiscal year annual incentive plan paid out at 113% of target and the 2018-2020 long-term incentive PSUs paid out at 125% of target for the ROIC PSUs, and 195% of target for the TSR PSUs. The Committee was very proud of our attention to the well-being of our team members and guests, and pleased with the operating results and associated payouts.

The Committee firmly believes that the executive compensation program is working as intended.

Additional 2020 Executive Compensation and Strategic Highlights

Based on the Company's strong performance during the 2020 fiscal year, in particular diluted EPS and gross profit margin in the fuel category, the NEOs achieved an annual incentive payout equal to 113% of their respective target.

32

vesting conditions in the form of performance-based restricted stock units ("PSUs"). The long-term incentive compensation program ("LTIP") includes annual equity awards with 75% in the form of PSUs, which are based on the Company's average return on invested capital ("ROIC") and total shareholder return ("TSR") over a three-year performance period. No PSUs are earned if minimum performance goals are not achieved and PSUs equal to 200% of target can be received if maximum goals levels are achieved.

Based on the Company's strong performance over its 2018-2020 fiscal years, in particular our TSR relative to the results of our performance peers, the NEOs received PSUs equal to 125% of target for ROIC PSUs and 195% of target for TSR PSUs (or, 160% of target PSUs in total). Further, the Company's stock price increased from approximately $105 to $151 per share over the three-year period (a 44% increase), resulting in the value of earned PSUs being well-above their target values but appropriately aligned with the Company's financial results and the results received by shareholders.

33

During the 2020 fiscal year, the Committee, in conjunction with WTW and through robust discussions with executive leadership, adopted an executive compensation "philosophy," which expanded-upon the Committee's prior objectives of attracting, motivating and retaining executives, emphasizing pay for performance, and focusing on long-term success and shareholder alignment, as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Executive Compensation Philosophy | | |||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Motivates and Rewards Strong Performance | Aligns with Shareholders | Attracts and Retains Talent | Reinforces Risk Management | Clear and Transparent | Strengthens Governance | |||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | |

| â | â | â | â | â | â | |||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Create rewards in the short-term and longer-term. | Ensure alignment of interests with Casey's investors. | Attract/retain a range of talent to deliver objectives. | Ensure programs are appropriately risk balanced. | Programs are understandable and simple when possible. | Satisfy the spirit of the law and the letter of the law. | |||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | |

The strategy for the Committee to execute on its updated compensation philosophy includes the following:

34

CORPORATE GOVERNANCE BEST PRACTICES

Our executive compensation practices support good governance and discourage excessive risk-taking. The Committee evaluates the program on an ongoing basis to ensure that it is consistent with short-term and long-term goals in combination with strong ties to our strategic direction. Highlights include:

| | | | | | | | | |

What we Do | | What we Don't Do | | |||||

| | | | | | | | | |