UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN

PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ¨

Filed by a Party other than the Registrant x

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| x | Soliciting Material Pursuant to § 240.14a-12 |

Casey’s General Stores, Inc.

(Name of Registrant as Specified in its Charter)

Alimentation Couche-Tard Inc.

ACT Acquisition Sub, Inc.

(Name of Persons Filing Proxy Statement, if other than Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

On June 2, 2010, Alimentation Couche-Tard Inc. issued the following press release:

PRESS RELEASE

ALIMENTATION COUCHE-TARD COMMENCES CASH TENDER OFFER FOR

CASEY’S GENERAL STORES AT $36.00 PER SHARE

Couche-Tard Intends to Nominate Full Slate of Independent Directors at the

Annual Shareholder Meeting of Casey’s

ATD.A, ATD.B / TSX

Laval, Québec—June 2, 2010—Alimentation Couche-Tard Inc. (“Couche-Tard”) today announced that it commenced a tender offer, through an indirect wholly owned subsidiary, to acquire all of the outstanding shares of common stock of Casey’s General Stores, Inc. (“Casey’s”) (NASDAQ: CASY) for $36.00 per share in cash. Couche-Tard’s all-cash offer represents a 14% premium over the closing price of $31.59 per share of Casey’s on April 8, 2010, the last trading day prior to the public disclosure of Couche-Tard’s proposal, a 17% premium over the 90-calendar day average closing share price of Casey’s as of April 8, 2010, and a 24% premium over the one-year average closing share price of Casey’s as of April 8, 2010. The offer also implies a last twelve months (as of January 31, 2010) EBITDA multiple of 7.4x and a price of $1.3 million per store, which compares favorably to corresponding metrics of publicly-traded companies and precedent transactions in the convenience store industry. The transaction has a total enterprise value of approximately $1.9 billion on a fully diluted basis, including net debt of Casey’s of approximately $29 million.

The tender offer is scheduled to expire at 12:00, midnight, New York City time, on Friday, July 9, 2010, unless extended.

“We continue to believe that a combination of Casey’s and Couche-Tard is compelling and would deliver superior value to our respective shareholders, employees, business partners and other constituencies,” said Alain Bouchard, President and Chief Executive Officer of Couche-Tard. “It remains our strong preference to enter into a negotiated transaction with Casey’s and it is unfortunate that the Casey’s Board has rejected our $36.00 per share all-cash offer without any discussion or negotiation. We are committed to making this combination a reality and, to that end, are taking our offer directly to the shareholders of Casey’s. We are confident that the shareholders of Casey’s will recognize the seriousness of our interest and send a strong message to the Casey’s Board that they should sit down with us immediately to negotiate a mutually acceptable transaction.”

Unless the Board of Directors of Casey’s is willing to negotiate and enter into a merger agreement with Couche-Tard, Couche-Tard intends to, among other things, nominate, and solicit proxies for the election of, a slate of nine independent directors for election to the Board of Directors of Casey’s at the 2010 annual meeting of shareholders of Casey’s. Couche-Tard intends to provide formal notice to Casey’s today or shortly thereafter of its plan to make such nomination.

The tender offer documents, including the Offer to Purchase and the Letter of Transmittal, will be filed today with the Securities and Exchange Commission (“SEC”). The shareholders of Casey’s may obtain copies of the tender offer documents at www.sec.gov. Free copies of such documents can also be obtained by calling Innisfree M&A Incorporated, toll-free at (877) 717-3930.

Credit Suisse Securities (USA) LLC is acting as financial advisor to Couche-Tard and dealer manager for Couche-Tard’s offer and Dewey & LeBoeuf LLP is acting as legal counsel. Innisfree M&A Incorporated is acting as information agent for Couche-Tard’s offer.

About Alimentation Couche-Tard Inc.

Alimentation Couche-Tard Inc. is the leader in the Canadian convenience store industry. In North America, Couche-Tard is the largest independent convenience store operator (whether integrated with a petroleum company or not) in terms of number of company-operated stores. Couche-Tard operates a network of 5,883 convenience stores, 4,142 of which include motor fuel dispensing, located in 11 large geographic markets, including eight in the United States covering 43 states and the District of Columbia, and three in Canada covering all ten provinces. More than 53,000 people are employed throughout Couche-Tard’s retail convenience network and service centers. For more information, please visit: http://www.couchetard.com.

Forward-looking Statements

The statements set forth in this communication, which describes Couche-Tard’s objectives, projections, estimates, expectations or forecasts, may constitute forward-looking statements within the meaning of securities legislation. Positive or negative verbs such as “plan”, “evaluate”, “estimate”, “believe” and other related expressions are used to identify such statements. Couche-Tard would like to point out that, by their very nature, forward-looking statements involve risks and uncertainties such that its results, or the measures it adopts, could differ materially from those indicated or underlying these statements, or could have an impact on the degree of realization of a particular projection. Major factors that may lead to a material difference between Couche-Tard’s actual results and the projections or expectations set forth in the forward-looking statements include the possibility that Couche-Tard will not be able to complete the tender offer as expected; Couche-Tard’s ability to achieve the synergies and value creation contemplated by the proposed transaction; Couche-Tard’s ability to promptly and effectively integrate the businesses of Casey’s; expected trends and projections with respect to particular products, services, reportable segment and income and expense line items; the adequacy of Couche-Tard’s liquidity and capital resources and expectations regarding Couche-Tard’s financial condition and liquidity as well as future cash flows and earnings; anticipated capital expenditures; the successful execution of growth strategies and the anticipated growth and expansion of Couche-Tard’s business; Couche-Tard’s intent, beliefs or current expectations, primarily with respect to future operating performance; expectations regarding sales growth, gross margins, capital expenditures and effective tax rates; expectations regarding the outcome of various pending legal proceedings; seasonality and natural disasters; and such other risks as described in detail from time to time in the reports filed by Couche-Tard with securities authorities in Canada and the United States. Unless otherwise required by applicable securities laws, Couche-Tard disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. The forward-looking information in this communication is based on information available as of the date of the communication.

Important Additional Information

This communication does not constitute an offer to buy or solicitation of an offer to sell any securities. The tender offer (the “Tender Offer”) is being made pursuant to a tender offer statement on Schedule TO (including the Offer to Purchase, Letter of Transmittal and other related tender offer materials) that will be filed today by Alimentation Couche-Tard Inc. and ACT Acquisition Sub, Inc. (“ACT Acquisition Sub”) with the SEC.These materials, as they may be amended from time to time, contain important information, including the terms and conditions of the Tender Offer, that should be read carefully before any decision is made with respect to the Tender Offer.Investors and security holders of Casey’s will be able to obtain free copies of these documents and other documents filed with the SEC by Couche-Tard through the web site maintained by the SEC at http://www.sec.gov or by directing a request to the Corporate Secretary of Alimentation Couche-Tard Inc., 4204 Industriel Blvd., Laval, Québec, Canada H7L 0E3. Free copies of any such documents (when available) can also be obtained by directing a request to Couche-Tard’s information agent, Innisfree M&A Incorporated, at (877) 717-3930.

In connection with the proposed transaction, Couche-Tard may file a proxy statement with the SEC. Any definitive proxy statement will be mailed to shareholders of Casey’s.Investors and security holders of Casey’s

are urged to read these and other documents filed with the SEC carefully in their entirety when they become available because they will contain important information. Investors and security holders of Casey’s will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by Couche-Tard through the web site maintained by the SEC at http://www.sec.gov or by directing a request to the Corporate Secretary of Alimentation Couche-Tard Inc., 4204 Industriel Blvd., Laval, Québec, Canada H7L 0E3. Free copies of any such documents (when available) can also be obtained by directing a request to Couche-Tard’s information agent, Innisfree M&A Incorporated, at (877) 717-3930.

Certain Information Regarding Participants

Couche-Tard and ACT Acquisition Sub, its indirect wholly owned subsidiary, and certain of their respective directors and executive officers may be deemed to be participants in the proposed transaction under the rules of the SEC. As of the date of this press release, Couche-Tard is the beneficial owner of 362 shares of common stock of Casey’s (which includes 100 shares of common stock of Casey’s owned beneficially by ACT Acquisition Sub). Security holders may obtain information regarding the names, affiliations and interests of Couche-Tard’s directors and executive officers in Couche-Tard’s Annual Report on Form 40-F for the fiscal year ended April 26, 2009, which was filed with the SEC on July 24, 2009, and its proxy circular for the 2009 annual general meeting, which was furnished to the SEC on a Form 6-K on July 24, 2009. These documents can be obtained free of charge from the sources indicated above. Additional information regarding the interests of these participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will also be included in any proxy statement and other relevant materials to be filed with the SEC if and when they become available.

# # #

| Contacts: | ||

| Raymond Paré | Joele Frank, Wilkinson Brimmer Katcher | |

| Vice-President and Chief Financial Officer | Matthew Sherman / Eric Brielmann / Eric Bonach | |

| Tel: (450) 662-6632 ext. 4607 | Tel: (212) 355-4449 | |

| investor.relations@couche-tard.com | ||

| Innisfree M&A Incorporated | ||

| Alan Miller / Jennifer Shotwell / Scott Winter | ||

| Tel: (212) 750-5833 | ||

On June 2, 2010, Alimentation Couche-Tard Inc. gave the following investor presentation:

Alimentation Couche-Tard Offer to Acquire Casey’s General Stores June 2010 |

1 |

2 Transaction highlights Consideration Premium and valuation Financing • All-cash offer at $36.00 per Casey’s share • Implies a total enterprise valuation of $1.9 billion • Implied multiples of 7.4x EV / LTM EBITDA and $1.3 million EV per store are above historical average multiples of 6.3x and $662 thousand for precedent c-store transactions • 24% premium to Casey’s pre-announcement 1-year average share price • 14% premium to Casey’s pre-announcement share price • Transaction not contingent on due diligence review • Financing through cash on hand, borrowings under existing credit facilities and new bank or bond financing |

3 Compelling strategic rationale • Creates largest independent corporate-store operator in North America with ~ 7,400 locations • Expands geographic footprint across North America • Enhances scale and efficiency • Uniquely positions Couche-Tard to generate more cash flow • Delivers immediate premium to Casey’s shareholders • Casey’s stakeholders become part of bigger organization with benefits of a decentralized business model empowering its employees |

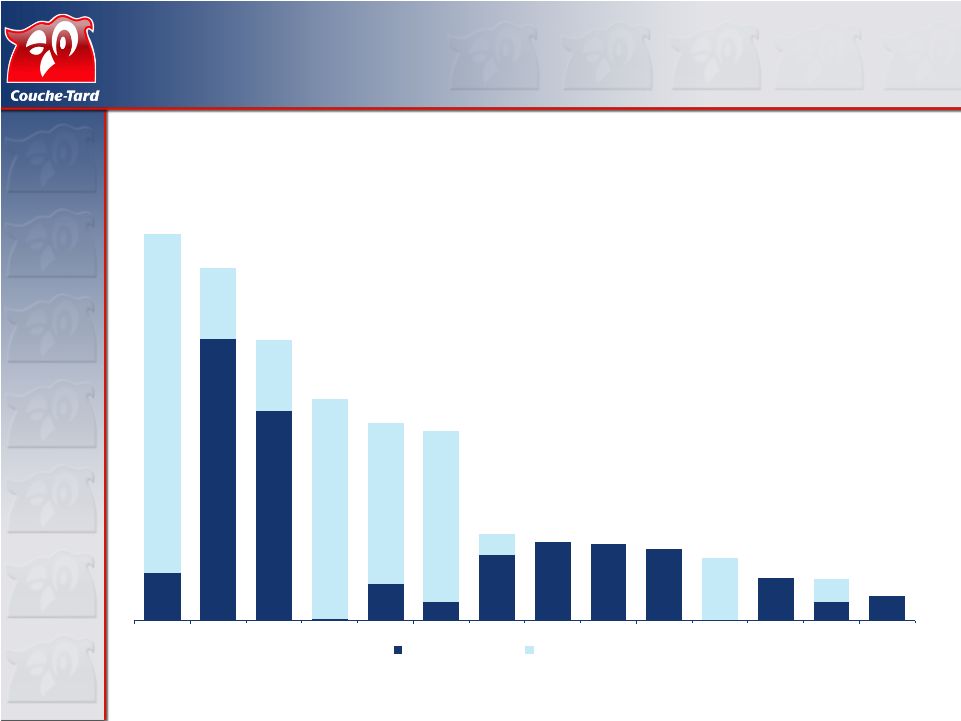

4 1,000 4,396 383 1,387 1,649 1,598 1,507 900 386 527 7,100 1,487 4,596 3,367 3,601 428 1,302 498 8,100 7,390 5,883 4,639 4,144 3,984 1,815 1,649 1,598 1,507 1,305 900 884 527 43 777 5,903 1,487 7-Eleven Pro forma Couche-Tard Couche-Tard Shell ExxonMobil Chevron Valero Pantry Marathon Casey's ConocoPhillips Cumberland Farms Tesoro Susser Company-operated Affiliated / Franchises Creates the largest independent corporate-store operator in North America Source: Public filings / data, websites, press releases. Note: Most recent data as of June 1, 2010. (1) Denotes U.S. locations. (1) (1) (1) (1) |

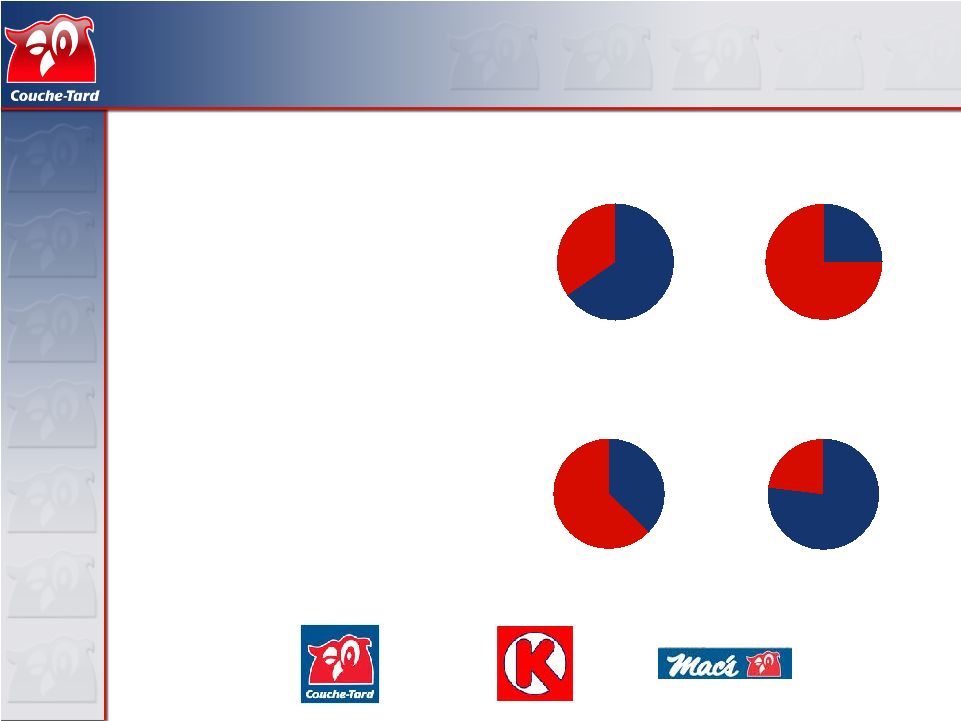

5 Alimentation Couche-Tard at a glance • Largest independent convenience store operator in North America by company- operated stores • #1 Canadian convenience store operator • Alain Bouchard, CEO, started the chain in 1980 with one store • Strong network of 5,883 convenience stores in U.S. and Canada • Owns real estate for 1,300+ sites • Attractive in-store merchandise mix • Highly decentralized operations with less than 20 people at corporate offices • Strong financial performance in challenging economic environment • Focus on expense reduction and deleveraging • Management owns approximately 22% of the company Total stores – by geography Canada 35% US 65% Total stores – by channel LTM Sales LTM Gross profit Merchandise 37% Motor Fuel 63% Motor Fuel 23% Merchandise 77% Affiliated 25% Company 75% 5,883 stores 5,883 stores $15.4 billion $2.5 billion |

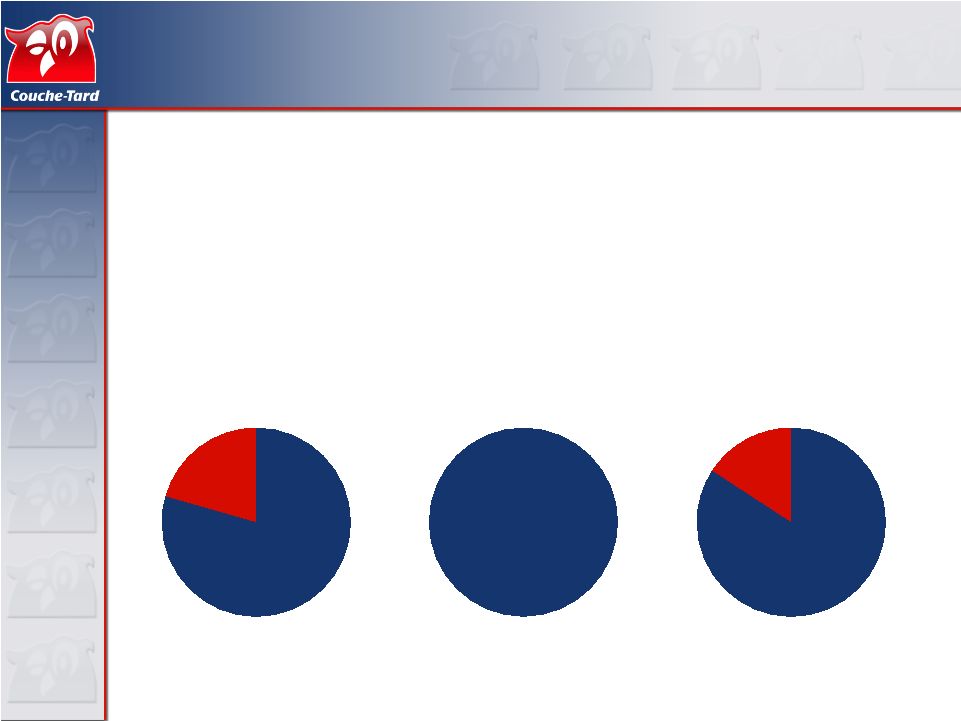

6 Couche-Tard has a large presence in the U.S. • 3,846 stores in the U.S. – 65% of total stores • Presence in 43 states and Washington D.C. • 8 out of 11 divisions in the U.S. • 36,000 employees out of 53,000 are in the U.S. – 68% of total • 79% of revenues come from U.S. divisions US 100% US 79% Canada 21% US 84% Canada 16% Couche-Tard Casey’s Pro-forma Couche-Tard Note: Based on LTM sales as of January 31, 2010. + = |

7 History of Couche-Tard IPO 34 Store Network 3rd Public Offering Acquired 245 Provi-Soir Stores and 50 Wink’s Stores Alain Bouchard Started the Chain with one store 2nd Public Offering 304 Store Network Entry into Ontario, Western Canada 976 Stores under Mac’s, Mike’s Mart and Becker’s Banners as part of Silcorp Acquisition Added to U.S. Midwest 287 Dairy Mart Stores 4th Public Offering Entry into U.S. Midwest 225 Bigfoot Stores as part of Johnson Oil Acquisition - Further Penetration of U.S. Midwest 92 Dairy Mart 43 Clark Retail Stores - Acquired Dunkin’ Donuts Quebec Master Franchise - Acquired Circle K, 2nd largest independent convenience store in U.S. Franchise agreement with Grupo Kaltex, S.A. de C.V. for 250 stores in Mexico within the next five years Acquisition of 236 sites from Shell Oil Products US and its affiliate Motiva Enterprises LLC Couche-Tard and Irving Oil Limited expand partnership to include 252 stores across Atlantic Canada and New England Couche-Tard offers to acquire Casey’s at $36.00 per share Added a total of 496 stores Acquisition of 43 company- operated and 444 franchises from Exxon Mobil |

8 2.3x 1.4x 0.8x 0.4x 1.5x 1.3x 1.0x 1.2x At Circle K transaction close 2004 2005 2006 2007 2008 2009 LTM Longstanding history of successful acquisitions and de-leveraging Couche-Tard rapidly de-leveraged following its successful acquisition of Circle K Total net debt / EBITDA Recent acquisitions Note: 2004 figures are pro forma for Circle K transaction. (1) Represents 50% interest in RDK Ventures LLC, a joint venture with Shell Oil Products US (100 stores). Couche-Tard already operated 32 of these stores prior to entering into the JV. Adjusted net debt / EBITDAR 3.7x 2.9x 2.5x 3.2x 3.2x 2.9x 3.0x 4.2x FYE April 2004 Banner # stores 2,279 43 Total 2,333 FYE April 2005 Banner # stores 21 Pump N Stop 19 Total 40 FYE April 2006 Banner # stores 53 Winners Banner 16 26 7 Total 102 FYE April 2007 Banner # stores All Star 53 Groovin Noovin 13 236 24 56 24 Spectrum Stores 90 Total 496 FYE April 2008 Banner # stores Sterling Stores 28 Others 18 Total 46 FYE April 2009 Banner # stores 7 Exploitation Quali-T 13 Spirit Energy 70 15 Others 2 Total 107 LTM Banner # stores 43 444 RDK joint venture (1) 50 Total 537 |

9 Enhanced store network International Locations: China, Guam, Hong Kong, Indonesia, Japan, Macao, Mexico, Vietnam Company operated: 4,396 Affiliated: 1,487 Total stores: 5,883 Owned real estate: 1,300+ locations Source: Company information. Note: Store count in each region as of January 31, 2010. Casey’s portfolio is geographically complementary to Couche-Tard Total stores: 1,507 IL IA MN MO NE SD WI IN 63 370 418 94 284 105 37 97 10 ND Casey’s retail footprint Couche-Tard’s retail footprint GREAT LAKES REGION Corporate stores: 459 Affiliated stores: 258 MIDWEST REGION Corporate stores: 423 Affiliated stores: 69 SOUTHEAST REGION Corporate stores: 267 Affiliated stores: 56 SOUTHWEST REGION Corporate stores: 225 Affiliated stores: 198 ARIZONA REGION Corporate stores: 626 Affiliated stores: 24 WEST COAST REGION Corporate stores: 163 Affiliated stores: 320 CENTRAL CANADA Corporate stores: 572 Affiliated stores: 203 WESTERN CANADA Corporate stores: 282 Affiliated stores: 0 EASTERN CANADA Corporate stores: 676 Affiliated stores: 304 FLORIDA REGION Corporate stores: 405 Affiliated stores: 4 GULF REGION Corporate stores: 298 Affiliated stores: 51 |

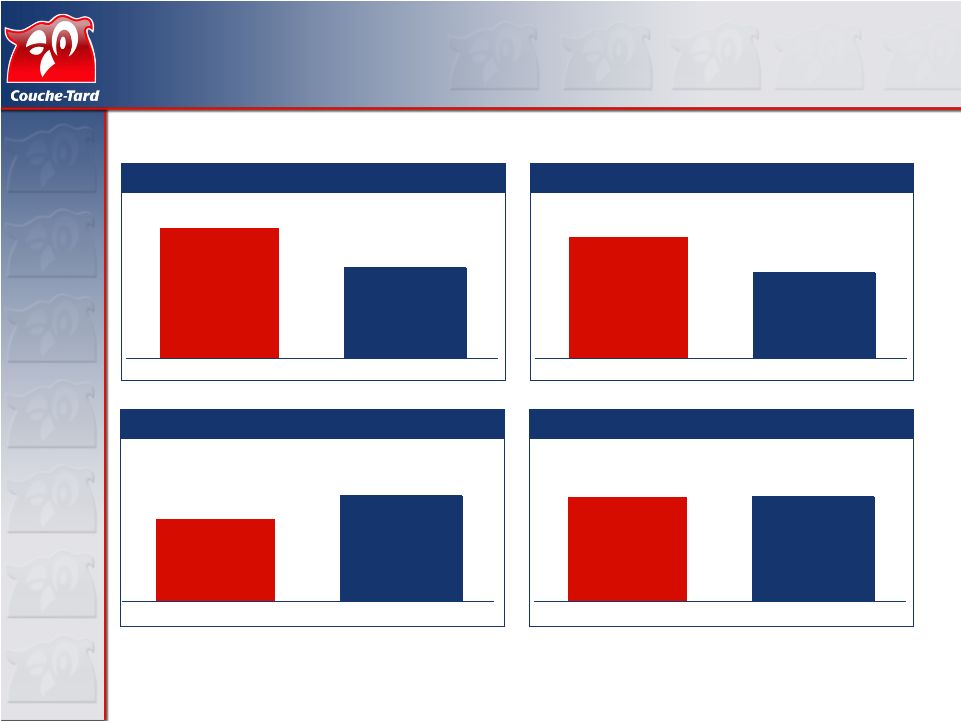

10 Combined company with enhanced scale and efficiency Merchandise sales / company-operated store Gasoline gallons / company-operated store 1,199 840 Couche-Tard Casey's ($ in 000) Merchandise margin Gasoline margin – cpg 32.9% 42.1% Couche-Tard Casey's 13.8¢ 13.7¢ Couche-Tard Casey's (Gallons in 000) $949 $1,375 Couche-Tard Casey's Note: Represent LTM figures as of January 31, 2010. U.S. operations only for Couche-Tard. Gasoline margins before deduction of credit card fees. |

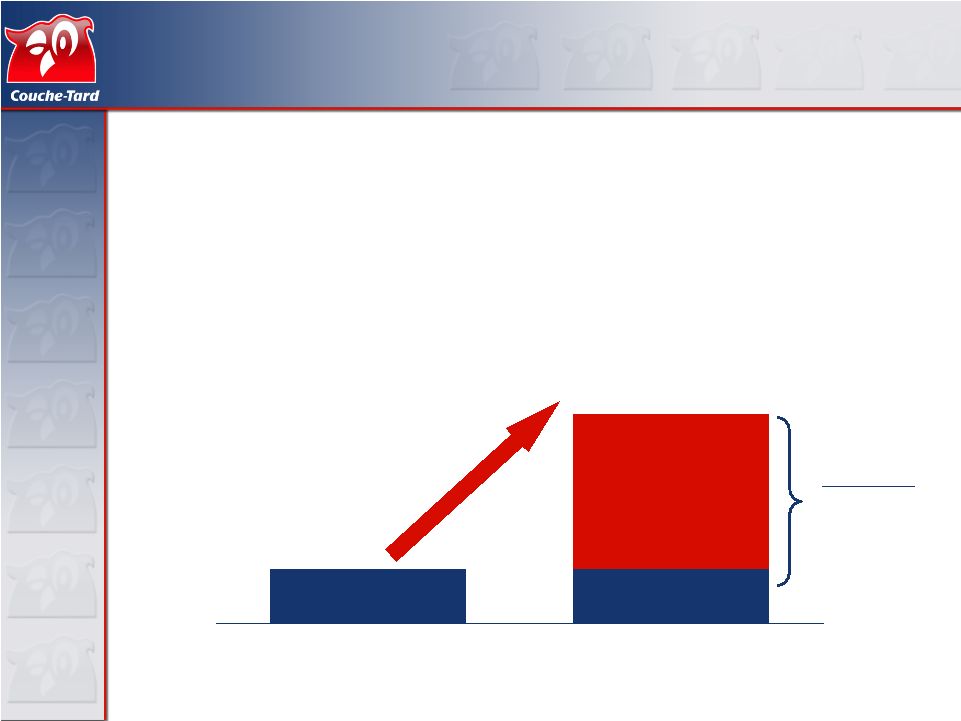

11 $30.00 $32.00 $34.00 $36.00 Trading Value (Pre-Announcement) Offer Price Couche-Tard’s offer presents a compelling value for Casey’s shareholders • Couche-Tard’s all-cash offer of $36.00 per share represents: • 7.4x EV / LTM EBITDA and $1.26 million per store • 24% premium to Casey’s pre-announcement 1-year average share price and 9% premium to its pre-announcement all-time high share price • Immediate liquidity for Casey’s shareholders in an uncertain economic environment and removes any uncertainty with respect to future stock performance Immediate Shareholder Premium |

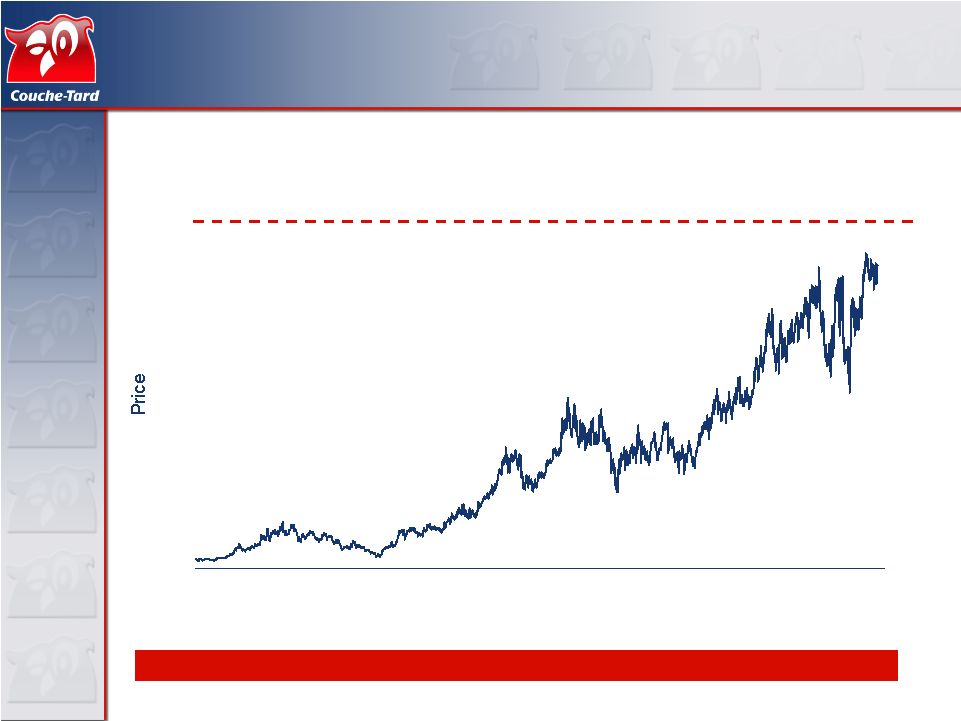

12 1983 1986 1989 1992 1995 1998 2001 2004 2007 2010 $0 $9 $18 $27 $36 Casey’s stock price performance since IPO Cash offer of $36 per share Source: FactSet Research Systems. Prior to Couche-Tard’s offer, Casey’s had never traded at or above $36 per share Casey’s stock price performance prior to Couche-Tard offer |

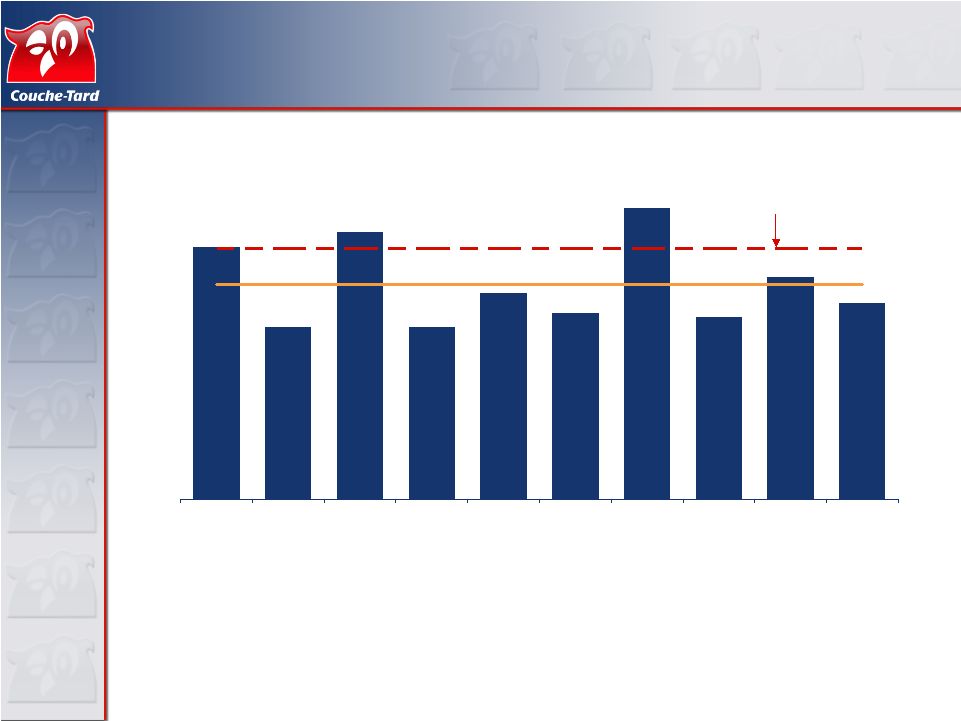

13 Couche-Tard’s offer is at a premium multiple to precedent c-store transactions 7.5x 5.1x 7.9x 5.1x 5.5x 8.6x 5.4x 5.8x 6.1x 6.6x Susser / Town & Country Wellspring Capital / Susser Green Valley Acquisition / Uni-Mart Couche-Tard / Circle K The Pantry / Golden Gallon (Ahold) Sunoco / Speedway SuperAmerica Uni-mart / Orloski Services Station Tosco / Exxon Apollo / Clark USA Tosco / Circle K Enterprise Value / LTM EBITDA Implied transaction multiple: 7.4x Average 6.3x Source: Public filings, press releases and research reports. Note: Purchase price multiple of the squeeze-out of 7-Eleven by its Japanese parent IYG Holding in 2005 is not included – not comparable as the purchase price included very valuable 7-11 licenses, plus 7-11 has a different model due to its high number of franchised stores. Announce date: 09/07/07 12/25/05 07/04/04 10/03/03 08/03/03 02/03/03 04/21/00 12/01/99 05/01/99 02/01/96 EV ($MM) $361 $277 $90 $830 $187 $140 $41 $860 $230 $921 LTM EBITDA $49 $54 $11 $163 $31 $25 $5 $160 $35 $159 ($MM) |

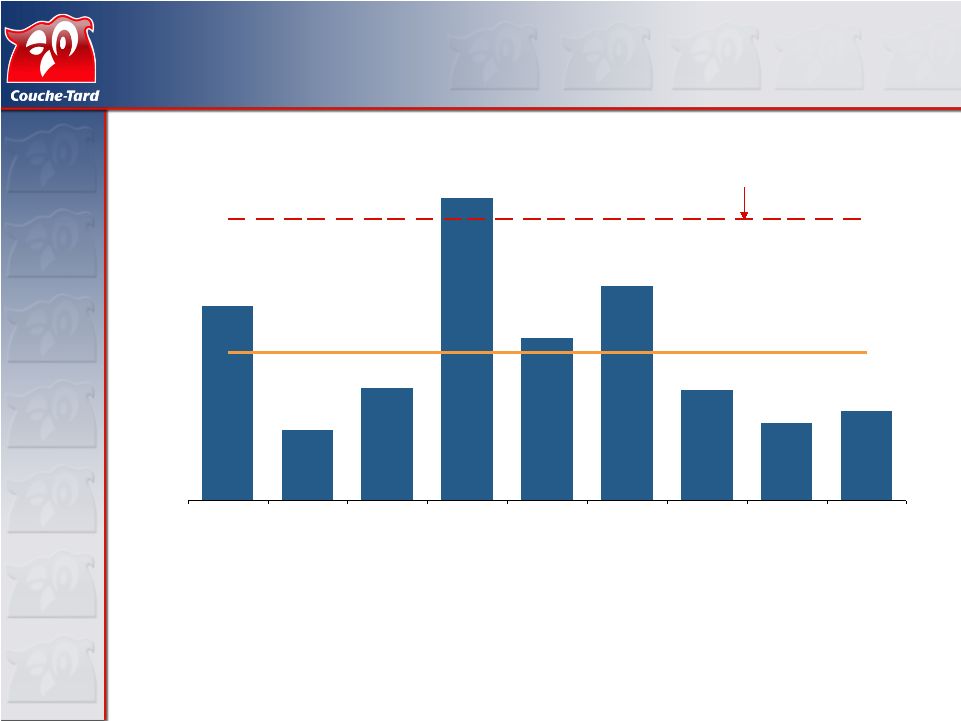

14 Couche-Tard’s offer is at a premium multiple to precedent c-store transactions (cont’d) Implied transaction multiple: $1,260 Average $662 Enterprise Value / Store ($ thousands) Announce date 12/25/05 07/04/04 10/03/03 08/03/03 02/03/03 04/21/00 12/01/99 05/01/99 02/01/96 EV ($MM) $277 $90 $830 $187 $140 $41 $860 $230 $921 No. of Stores 319 285 1,663 138 193 43 1,740 672 2,300 Source: Public flings, press releases and research reports. Note: Store count includes all stores regardless of owned vs. leased and operated vs. dealer. Purchase price multiple of the squeeze-out of 7-Eleven by its Japanese parent IYG Holding in 2005 is not included – not comparable as the purchase price included very valuable 7-11 licenses, plus 7-11 has a different model due to its high number of franchised stores. Susser / Town & Country EV/store multiple excluded from average as Town & Country stores generated significantly higher volume and profitability and therefore are not comparable to Casey's. $868 $315 $499 $1,355 $725 $494 $342 $400 $958 Wellspring Capital / Susser Green Valley Acquisition / Uni- Mart Couche-Tard / Circle K The Pantry / Golden Gallon (Ahold) Sunoco / Speedway SuperAmerica Uni-mart / Orloski Services Station Tosco / Exxon Mobil Apollo / Clark USA Tosco / Circle K |

15 Limited potential interlopers • Limited interest from other potential strategic buyers • Many potential strategic buyers lack the financial wherewithal for an all-cash offer • Couche-Tard has the most compelling strategic rationale for acquiring Casey’s due to complementary geographic presence and potential synergies • A financial buyer would not achieve adequate investment returns at a premium to Couche-Tard’s offer • No potential synergies – Casey’s is not a turn-around story; currently a well operated business • Historically hesitant to invest in C-store space given the volatility of the gas business • Limited capacity to monetize Casey’s real estate with a sale-leaseback transaction • Assuming aggressive revenue growth and EBITDA margins, sponsor returns are in the mid-to-high teens • Previous sponsor investments in C-store sector didn’t create value for the buyers |

16 Why has Couche-Tard commenced a tender offer? • Couche-Tard has repeatedly expressed its openness to working with Casey’s to negotiate a transaction, but Casey’s has refused • Couche-Tard believes shareholders should have the opportunity to decide on its offer for themselves • We believe Couche-Tard’s offer benefits Casey’s – Shareholders – Employees – Customers – Communities |

17 Financing considerations • This all-cash offer is expected to be funded through cash on hand, borrowings under existing credit facilities and new bank or bond financing • We believe financing commitments can be secured, as necessary • At transaction close, Couche-Tard is expected to have pro forma leverage of 3.3x debt/EBITDA and will generate significant free cash flow to reduce leverage substantially within two years |

18 Integration strategy Couche-Tard expects that: • Couche-Tard’s decentralized business model will allow it to run Casey’s as a stand-alone business unit • No significant capital expenditures will be required to integrate Casey’s • Casey’s store banner will remain in place (no re-branding / remodels required) and will continue to be grown as a rural store format in the U.S. Midwest region • There is a possibility to leverage Casey’s wholesale and distribution capabilities • There is a possibility to implement best practices from Casey’s and Couche-Tard |

19 Path forward Launch tender offer File HSR Nominate Directors to Casey’s Board Shareholder vote at Casey’s annual meeting Couche-Tard is committed to completing the transaction |

20 Appendix |

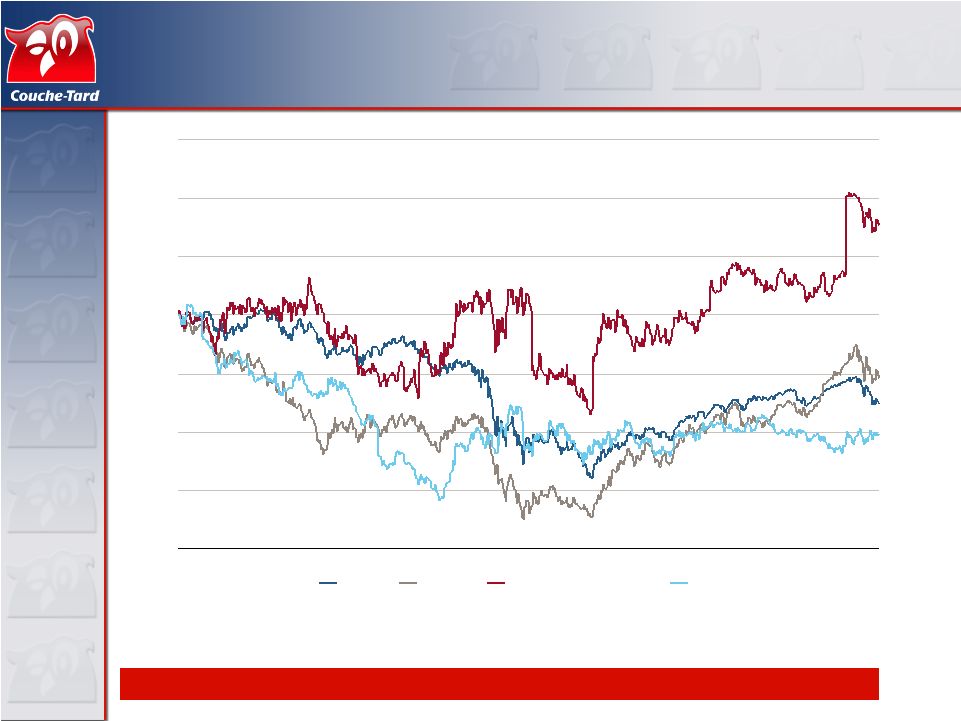

21 Casey’s relative trading performance Source: FactSet Research Systems. Note: C-Stores index includes Couche-Tard, Pantry and Susser. Casey’s stock price is not depressed relative to other convenience stores 30.6% (21.5%) (41.2%) (30.3%) 6/1/07 2/29/08 11/28/08 8/31/09 6/1/10 20 40 60 80 100 120 140 160 S&P 500 S&P Retail Casey's General Stores, Inc. C-Stores |