Exhibit 99.2

October 19, 2006

Dear Shareholder:

We are pleased to announce that Far West Bancorporation and AmericanWest Bancorporation have signed a definitive agreement under which Far West Bancorporation, and its principal operating subsidiary Far West Bank, will be merged with and into AmericanWest Bancorporation and AmericanWest Bank, respectively. Far West Bancorporation and AmericanWest Bancorporation directors have approved the proposed transaction.

We view this as an excellent strategic merger that will provide opportunity for Far West shareholders, customers and employees, and the prospects for creating long-term shareholder value are greatly enhanced by the combination of our banks. Our similar cultures and relationship-oriented community bank focus create an opportunity through this merger to offer enhanced products and services, plus expanded lending capabilities, which should benefit our customers and provide for future growth.

This proposed merger will increase AmericanWest Bank’s total assets to approximately $1.8 billion, its deposits to approximately $1.4 billion and shareholders’ equity to approximately $270 million.

Far West shareholders may elect to exchange each share held for cash or stock, although elections may be subject to pro-ration if the result of aggregate elections differ from the prescribed stock-cash split of 80%/20%. The number of AmericanWest shares issued in exchange for each Far West share will be calculated based on the average closing price for AmericanWest common stock for the 20 trading days ending on the third business day before closing. Based on average closing price for the 20 day period ended on October 18, 2006 of $21.42, approximately 5.6 million shares of AmericanWest common stock would be issued in connection with the merger.

The current executive management team of AmericanWest will manage the combined company after closing, and Far West Bank will continue to operate in the state of Utah under its strong and respected name. Don Norton, President and Chief Executive Officer of Far West, has entered into a multi-year employment agreement with AmericanWest under which he will serve as Regional Director continuing to provide local leadership in the Far West markets. Two members of the current Far West board of directors will be appointed to the AmericanWest board upon completion of the merger.

We have enclosed with this letter a copy of our news announcement, which highlights the important details of this proposed merger, along with a questions-and-answers document. More information on the merger and shareholder meeting will follow shortly in a proxy statement.

Please contact Don at any time should you have questions about this proposed merger. Thank you for your continued support of Far West Bancorporation.

Regards,

| /s/ Don Norton | /s/ Ivan Call | |

| Don Norton | Ivan Call | |

| President & Chief Executive Officer | Chairman of the Board | |

| Far West Bancorporation | Far West Bancorporation |

This document and the attachments hereto contain comments and information that constitute “forward-looking statements” (within the meaning of the Private Securities Litigation Reform Act of 1995). The forward-looking statements herein are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in or implied by such statements. Factors that may cause actual results to differ materially from those contemplated by such forward-looking statements include, among

other things, the following possibilities: the ability of the companies to obtain the required shareholder or regulatory approvals for the transaction; the ability of the companies to consummate the transaction; the ability to successfully integrate the companies following the transaction; a material adverse change in the financial condition, results of operations or prospects of either company; the ability to fully realize the expected cost savings and revenues or the ability to realize them on a timely basis; the risk of borrower, depositor and other customer attrition after the transaction is completed; a change in general business and economic conditions; changes in the interest rate environment, deposit flows, loan demand, real estate values, and competition; changes in accounting principles, policies or guidelines; changes in legislation and regulation; other economic, competitive, governmental, regulatory, geopolitical and technological factors affecting the companies’ operations, pricing and services; and other risk factors referred to from time to time in filings made by the Company with the Securities and Exchange Commission. When used in this document, the words “believes,” “estimates,” “expects,” “should,” “anticipates” and similar expressions as they relate to either company or the proposed transaction are intended to identify forward-looking statements. Forward-looking statements speak only as to the date they are made. The Company does not undertake to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made.

This document may be deemed to be offering or solicitation materials of AmericanWest Bancorporation and Far West Bancorporation in connection with the proposed merger of Far West with and into AmericanWest.Shareholders are urged to read the joint proxy statement/prospectus that will be included in the registration statement on Form S-4, which AmericanWest will file with the SEC in connection with the proposed acquisition, because both will contain important information about AmericanWest, Far West, the acquisition and related matters.The directors and executive officers of AmericanWest and Far West may be deemed to be participants in the solicitation of proxies from their respective shareholders. Information regarding AmericanWest’s participants and their security holdings can be found in its most recent proxy statement filed with the SEC, and information for both AmericanWest and Far West participants in the joint proxy statement/prospectus when it is filed with the SEC. All documents filed with the SEC are or will be available for free, both on the SEC web site (http://www.sec.gov) and by directing requests to:

For AmericanWest:

AmericanWest Bancorporation

Attention: Investor Relations

41 West Riverside Avenue, Suite 400

Spokane, WA 99201

Email: investorinfo@awbank.net

509.232.1536

Attention: Investor Relations

41 West Riverside Avenue, Suite 400

Spokane, WA 99201

Email: investorinfo@awbank.net

509.232.1536

For Far West:

Far West Bancorporation

Attention: President

201 East Center Street, Provo, UT 84606

Email: donn@farwestbank.com

Phone: 801.342.6061

Attention: President

201 East Center Street, Provo, UT 84606

Email: donn@farwestbank.com

Phone: 801.342.6061

Questions and Answers for Shareholders about the

AmericanWest Bancorporation and Far West Bancorporation merger

AmericanWest Bancorporation and Far West Bancorporation merger

This question and answer document provides summary information only. Shareholders should read the proxy statement that will be mailed for complete information about the merger.

Who is AmericanWest Bancorporation?

AmericanWest Bancorporation, with its subsidiary AmericanWest Bank, is headquartered in Spokane, Washington and operates 43 full-service financial centers throughout Central and Eastern Washington and Northern Idaho with three more opening by the end of 2006, as well as a lending office in Salt Lake City. They offer a wide range of personal and business loans and accounts, including commercial and small business banking, private banking, mortgage and construction lending, and consumer products. AmericanWest Bancorporation is publicly traded on the NASDAQ under the symbol AWBC with assets in excess of $1.3 billion.

AmericanWest Bancorporation, with its subsidiary AmericanWest Bank, is headquartered in Spokane, Washington and operates 43 full-service financial centers throughout Central and Eastern Washington and Northern Idaho with three more opening by the end of 2006, as well as a lending office in Salt Lake City. They offer a wide range of personal and business loans and accounts, including commercial and small business banking, private banking, mortgage and construction lending, and consumer products. AmericanWest Bancorporation is publicly traded on the NASDAQ under the symbol AWBC with assets in excess of $1.3 billion.

Who is Far West Bancorporation?

Far West Bancorporation, with its subsidiary Far West Bank, was established in 1975, and is headquartered in Provo, Utah. They have sixteen branches throughout Central and Southern Utah, and they offer a wide range of personal and commercial products and services. Far West Bank is a privately-held company with assets of $405 million.

Far West Bancorporation, with its subsidiary Far West Bank, was established in 1975, and is headquartered in Provo, Utah. They have sixteen branches throughout Central and Southern Utah, and they offer a wide range of personal and commercial products and services. Far West Bank is a privately-held company with assets of $405 million.

How much will AmericanWest Bancorporation pay to merge Far West Bancorporation?

The transaction is valued at $150 million, or $1,172.46 per Far West share. The merger agreement also provides for Far West to pay a special cash dividend prior to closing, subject to certain restrictions. The dividend is expected to be approximately $6.9 million in the aggregate, or $54.20 per Far West share.

The transaction is valued at $150 million, or $1,172.46 per Far West share. The merger agreement also provides for Far West to pay a special cash dividend prior to closing, subject to certain restrictions. The dividend is expected to be approximately $6.9 million in the aggregate, or $54.20 per Far West share.

Will Far West Bank stock be exchanged or converted?

Far West shareholders may elect to exchange each share held for cash or stock, although elections are subject to pro-ration if the result of aggregate elections differ from the prescribed stock-cash split of 80%/20%. The number of AmericanWest shares issued in exchange for each Far West share will be calculated based on the average closing price for AmericanWest common stock for the 20 trading days ending on the third business day before closing. Based on average closing price for the 20 day period ended on October 18, 2006 of $21.42, approximately 5.6 million shares of AmericanWest common stock would be issued in connection with the merger. The companies anticipate that the transaction will qualify as a tax-free reorganization and, in general, expect that Far West shareholders will not recognize income to the extent they exchange all of their Far West stock for AmericanWest stock and do not receive cash in lieu of any fractional shares. Shareholders should consult their own tax advisors for the consequences of the merger to them.

Far West shareholders may elect to exchange each share held for cash or stock, although elections are subject to pro-ration if the result of aggregate elections differ from the prescribed stock-cash split of 80%/20%. The number of AmericanWest shares issued in exchange for each Far West share will be calculated based on the average closing price for AmericanWest common stock for the 20 trading days ending on the third business day before closing. Based on average closing price for the 20 day period ended on October 18, 2006 of $21.42, approximately 5.6 million shares of AmericanWest common stock would be issued in connection with the merger. The companies anticipate that the transaction will qualify as a tax-free reorganization and, in general, expect that Far West shareholders will not recognize income to the extent they exchange all of their Far West stock for AmericanWest stock and do not receive cash in lieu of any fractional shares. Shareholders should consult their own tax advisors for the consequences of the merger to them.

Will Far West Bank’s name change?

No. As AmericanWest Bank began the process of entering the Salt Lake City market, it became obvious that the AmericanWest Bank name would not work because of another bank in that market with a similar name (which is not affiliated with AmericanWest Bank). The Far West Bank name is synonymous with strength, stability and excellence, and we honor the value and recognition the name brings. The Far West Bank name will continue on as a division of AmericanWest Bank.

No. As AmericanWest Bank began the process of entering the Salt Lake City market, it became obvious that the AmericanWest Bank name would not work because of another bank in that market with a similar name (which is not affiliated with AmericanWest Bank). The Far West Bank name is synonymous with strength, stability and excellence, and we honor the value and recognition the name brings. The Far West Bank name will continue on as a division of AmericanWest Bank.

How can AmericanWest Bank remain a community bank as it continues to grow?

Like Far West Bank, personalized customer service and relationship banking are at the foundation of AmericanWest Bank and will continue to be following this merger. AmericanWest Bank provides a comfortable and relaxed environment where customers can take care of their banking and financial needs with responsive and reliable bankers who know them by name and go the extra mile to provide the best service. As AmericanWest grows, it continues to focus on the level of service that customers deserve and expect. Dedication to providing the best customer service and support for local communities has fueled AmericanWest Bank’s success and growth. AmericanWest has proven that no matter how much it grows, it will always be your community bank.

Like Far West Bank, personalized customer service and relationship banking are at the foundation of AmericanWest Bank and will continue to be following this merger. AmericanWest Bank provides a comfortable and relaxed environment where customers can take care of their banking and financial needs with responsive and reliable bankers who know them by name and go the extra mile to provide the best service. As AmericanWest grows, it continues to focus on the level of service that customers deserve and expect. Dedication to providing the best customer service and support for local communities has fueled AmericanWest Bank’s success and growth. AmericanWest has proven that no matter how much it grows, it will always be your community bank.

When will shareholders be able to vote on the proposed transaction?

Special shareholder meetings for both Far West Bancorporation and AmericanWest Bancorporation will take place for the shareholders to vote on the merger agreement and matters relating to the proposed transaction. More information on the dates and locations of those meetings will be provided to shareholders in the coming weeks.

Special shareholder meetings for both Far West Bancorporation and AmericanWest Bancorporation will take place for the shareholders to vote on the merger agreement and matters relating to the proposed transaction. More information on the dates and locations of those meetings will be provided to shareholders in the coming weeks.

What regulatory approvals must be received to complete the merger?

The merger will go through the standard regulatory approval process of, or waivers of jurisdiction from, the Federal Deposit Insurance Corporation and other federal and state government agencies.

The merger will go through the standard regulatory approval process of, or waivers of jurisdiction from, the Federal Deposit Insurance Corporation and other federal and state government agencies.

When will the merger take place?

Pending the approval of the shareholders of both holding companies and regulatory approval, management anticipates the merger to be finalized in early 2007. A proxy statement and prospectus will be sent to all shareholders approximately 30 to 45 days after the merger is announced.

Pending the approval of the shareholders of both holding companies and regulatory approval, management anticipates the merger to be finalized in early 2007. A proxy statement and prospectus will be sent to all shareholders approximately 30 to 45 days after the merger is announced.

Will Far West Bancorporation directors have positions on AmericanWest’s board?

The current executive management team of AmericanWest will manage the combined company after closing. Don Norton, President and Chief Executive Officer of Far West, has entered into a multi-year employment agreement with AmericanWest under which he will serve as Regional Director continuing to provide local leadership in the Far West markets. Two members of the current Far West board of directors will be appointed to the AmericanWest board upon completion of the merger.

The current executive management team of AmericanWest will manage the combined company after closing. Don Norton, President and Chief Executive Officer of Far West, has entered into a multi-year employment agreement with AmericanWest under which he will serve as Regional Director continuing to provide local leadership in the Far West markets. Two members of the current Far West board of directors will be appointed to the AmericanWest board upon completion of the merger.

For more information about this merger, who should one contact?

Customers, shareholders and other interested persons are encouraged to contact us at:

Customers, shareholders and other interested persons are encouraged to contact us at:

For AmericanWest:

AmericanWest Bancorporation

Attention: Investor Relations

41 West Riverside Avenue, Suite 400

Spokane, WA 99201

Email: investorinfo@awbank.net

Phone: 509.232.1536

AmericanWest Bancorporation

Attention: Investor Relations

41 West Riverside Avenue, Suite 400

Spokane, WA 99201

Email: investorinfo@awbank.net

Phone: 509.232.1536

For Far West:

Far West Bancorporation

Attention: President

201 East Center Street, Provo, UT 84606

Far West Bancorporation

Attention: President

201 East Center Street, Provo, UT 84606

Email: donn@farwestbank.com

Phone: 801.342.6061

Phone: 801.342.6061

This document contains comments and information that constitute “forward-looking statements” (within the meaning of the Private Securities Litigation Reform Act of 1995). The forward-looking statements herein are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in or implied by such statements. Factors that may cause actual results to differ materially from those contemplated by such forward-looking statements include, among other things, the following possibilities: the ability of the companies to obtain the required shareholder or regulatory approvals for the transaction; the ability of the companies to consummate the transaction; the ability to successfully integrate the companies following the transaction; a material adverse change in the financial condition, results of operations or prospects of either company; the ability to fully realize the expected cost savings and revenues or the ability to realize them on a timely basis; the risk of borrower, depositor and other customer attrition after the transaction is completed; a change in general business and economic conditions; changes in the interest rate environment, deposit flows, loan demand, real estate values, and competition; changes in accounting principles, policies or guidelines; changes in legislation and regulation; other economic, competitive, governmental, regulatory, geopolitical and technological factors affecting the companies’ operations, pricing and services; and other risk factors referred to from time to time in filings made by the Company with the Securities and Exchange Commission. When used in this document, the words “believes,” “estimates,” “expects,” “should,” “anticipates” and similar expressions as they relate to either company or the proposed transaction are intended to identify forward-looking statements. Forward-looking statements speak only as to the date they are made. The Company does not undertake to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made.

This document may be deemed to be offering or solicitation materials of AmericanWest Bancorporation and Far West Bancorporation in connection with the proposed merger of Far West with and into AmericanWest.Shareholders are urged to read the joint proxy statement/prospectus that will be included in the registration statement on Form S-4, which AmericanWest will file with the SEC in connection with the proposed acquisition, because both will contain important information about AmericanWest, Far West, the acquisition and related matters.The directors and executive officers of AmericanWest and Far West may be deemed to be participants in the solicitation of proxies from their respective shareholders. Information regarding AmericanWest’s participants and their security holdings can be found in its most recent proxy statement filed with the SEC, and information for both AmericanWest and Far West participants in the joint proxy statement/prospectus when it is filed with the SEC. All documents filed with the SEC are or will be available for free, both on the SEC web site (http://www.sec.gov) and by directing requests to:

For AmericanWest:

AmericanWest Bancorporation

Attention: Investor Relations

41 West Riverside Avenue, Suite 400

Spokane, WA 99201

Email: investorinfo@awbank.net

509.232.1536

Attention: Investor Relations

41 West Riverside Avenue, Suite 400

Spokane, WA 99201

Email: investorinfo@awbank.net

509.232.1536

For Far West:

Far West Bancorporation

Attention: President

201 East Center Street, Provo, UT 84606

Email: donn@farwestbank.com

Phone: 801.342.6061

Attention: President

201 East Center Street, Provo, UT 84606

Email: donn@farwestbank.com

Phone: 801.342.6061

Exhibit 99.2

| AmericanWest Bancorporation Investor Presentation - October 2006 |

| Safe Harbor Statement This document and the attachments hereto contain comments and information that constitute "forward- looking statements" (within the meaning of the Private Securities Litigation Reform Act of 1995). The forward-looking statements herein are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in or implied by such statements. Factors that may cause actual results to differ materially from those contemplated by such forward-looking statements include, among other things, the following possibilities: the ability of the companies to obtain the required shareholder or regulatory approvals for the transaction; the ability of the companies to consummate the transaction; the ability to successfully integrate the companies following the transaction; a material adverse change in the financial condition, results of operations or prospects of either company; the ability to fully realize the expected cost savings and revenues or the ability to realize them on a timely basis; the risk of borrower, depositor and other customer attrition after the transaction is completed; a change in general business and economic conditions; changes in the interest rate environment, deposit flows, loan demand, real estate values, and competition; changes in accounting principles, policies or guidelines; changes in legislation and regulation; other economic, competitive, governmental, regulatory, geopolitical and technological factors affecting the companies' operations, pricing and services; and other risk factors referred to from time to time in filings made by the Company with the Securities and Exchange Commission. When used in this document, the words "believes," "estimates," "expects," "should," "anticipates" and similar expressions as they relate to either company or the proposed transaction are intended to identify forward-looking statements. Forward-looking statements speak only as to the date they are made. The Company does not undertake to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made. |

| This press release may be deemed to be offering or solicitation materials of AmericanWest Bancorporation and Far West Bancorporation in connection with the proposed merger of Far West with and into AmericanWest. Shareholders are urged to read the joint proxy statement/prospectus that will be included in the registration statement on Form S-4, which AmericanWest will file with the SEC in connection with the proposed acquisition, because both will contain important information about AmericanWest, Far West, the acquisition and related matters. The directors and executive officers of AmericanWest and Far West may be deemed to be participants in the solicitation of proxies from their respective shareholders. Information regarding AmericanWest's participants and their security holdings can be found in its most recent proxy statement filed with the SEC, and information for both AmericanWest and Far West participants in the joint proxy statement/prospectus when it is filed with the SEC. All documents filed with the SEC are or will be available for free, both on the SEC web site (http://www.sec.gov) and by directing requests to: For AmericanWest: AmericanWest Bancorporation Attention: Investor Relations 41 West Riverside Avenue, Suite 400 Spokane, WA 99201 Email: investorinfo@awbank.net Phone: 509.232.1536 For Far West: Far West Bancorporation Attention: President 201 East Center Street, Provo, UT 84606 Email: donn@farwestbank.com Phone: 801.342.6061 Safe Harbor Statement (cont'd) |

| Strategic Opportunity Merger with a high performance, well established Utah institution Expansion into high growth markets Consistent with AWBC current strategic plan Significantly accelerates existing Utah expansion initiative Platform to enhance shareholder and franchise value Positions Company for long term growth |

| AWBC (43) Far West (16) > 10% population growth 5 - - 10% population growth > 10% population growth 5 - - 10% population growth > 10% Population growth 5 - - 10% Population growth 5 - - > 10% population growth 5 - - 10% population growth > 10% population growth 5 - - 10% population growth > 10% Population growth 5 - - 10% Population growth 5 - - Geographic Footprint High Growth Markets Source: SNL Financial, ESRI; Demographic and deposit data as of 6/30/05 |

| Far West (16) Utah High Growth Markets Source: SNL Financial, ESRI; Demographic and deposit data as of 6/30/05 > 10% population growth 5 - - 10% population growth > 10% population growth 5 - - 10% population growth > 10% Population growth 5 - - 10% Population growth 5 - - > 10% population growth 5 - - 10% population growth > 10% population growth 5 - - 10% population growth > 10% Population growth 5 - - 10% Population growth 5 - - |

| Projected Population Growth by MSA (2006-2011) Far West - High Growth Market AWBC Strategic Opportunity Strong Projected Growth in Major Markets National Average = 6.66% Source: SNL Financial, ESRI; Demographic data as of 6/30/05 |

| Far West Deposit Market Share Source: SNL Financial; Deposit data as of 6/30/05 |

| Source: SNL Financial, Financials as of and for the quarter ending 6/30/06 Note: Pro forma does not include merger adjustments Assets: $1,376,210 $405,339 $1,781,549 Loans: $1,180,229 $325,401 $1,505,630 Deposits: $1,065,625 $347,842 $1,413,467 Financial Centers: 43 16 59 AWBC Far West Pro Forma ($000s) Pro Forma Franchise |

| Consideration: $150 million Additional Consideration: One Time Special Dividend (to bring capital at close to $50M) Structure: 80% Stock / 20% Cash Exchange Ratio: Fixed (20 day average prior to the 3 days prior to close of transaction) Board of Directors: 2 Board Seats Termination Fee: $5 million Terms of the Transaction |

| Transaction Multiples Price/Book Value 2.75x 3.00x 3.28x Price/Tangible Book Value 2.91x 3.18x 3.35x Price/LTM Earnings Per Share 15.01x 20.82x Premium/Core Deposits 32.17% 33.64% 27.87% Western M&A Median Multiples** Source: SNL Financial; Financials as of and for the quarter ending 6/30/06 * Includes one time special dividend to bring capital at close to $50mln ** Western M&A Transactions $100-$250 in Deal Value, last 12 months as of 10/16/06 As Reported As Adjusted* |

| Transaction Overview Target accretion of $0.03 for 2007 Anticipated IRR in excess of 15% Assumptions: 15% cost savings or $2.5 million Core Deposit Intangible of 5% with accelerated amortization cost of $3.6 million Deal related costs of $2.3 million No modeled revenue enhancements |

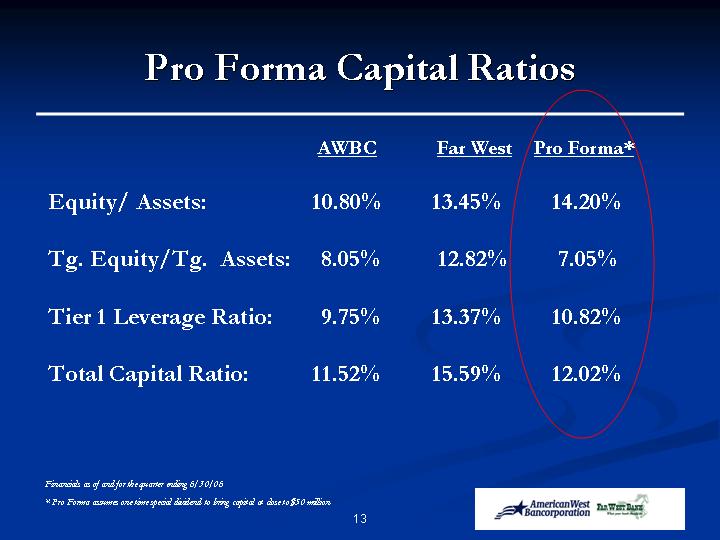

| Equity/ Assets: 10.80% 13.45% 14.20% Tg. Equity/Tg. Assets: 8.05% 12.82% 7.05% Tier 1 Leverage Ratio: 9.75% 13.37% 10.82% Total Capital Ratio: 11.52% 15.59% 12.02% AWBC Far West Pro Forma* Pro Forma Capital Ratios Financials as of and for the quarter ending 6/30/06 * Pro Forma assumes one time special dividend to bring capital at close to $50 million |

| ROAA: 0.82% 2.80% ROAE: 7.58% 20.50% Net Interest Margin: 5.07% 8.40% Efficiency Ratio: 69.33% 45.78% NCOs to Average Loans: 0.26% 0.18% NPAs to Assets 1.05% 0.55% Reserves to NPLs 107.00% 364.41% AWBC Far West Financial Highlights Financials as of and for the quarter ending 6/30/06 |

| Source: FFIEC as of 6/30/06 AWBC Far West Pro Forma Pro Forma Loan Composition |

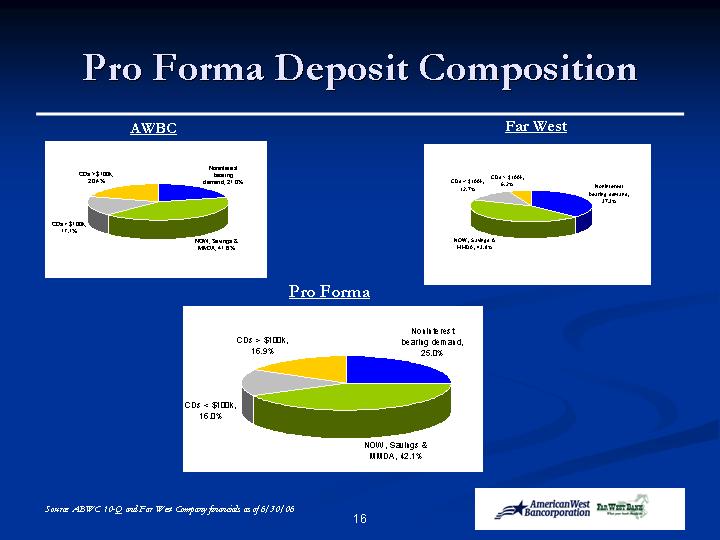

| AWBC Far West Pro Forma Pro Forma Deposit Composition Source: ABWC 10-Q and Far West Company financials as of 6/30/06 |

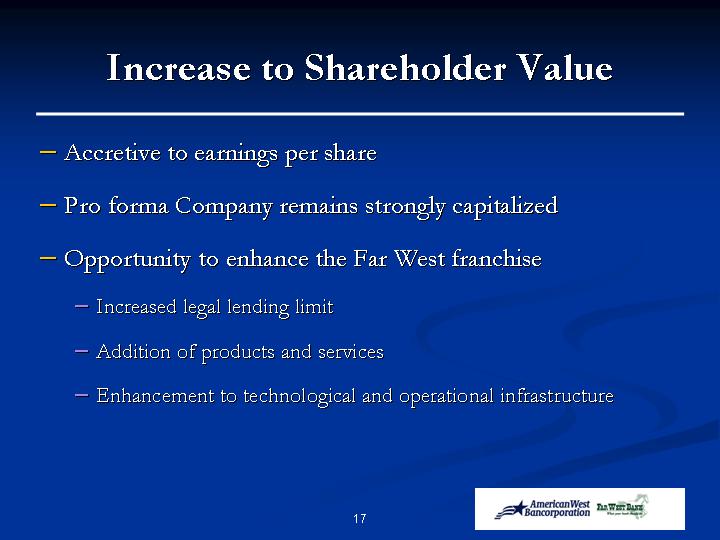

| Accretive to earnings per share Pro forma Company remains strongly capitalized Opportunity to enhance the Far West franchise Increased legal lending limit Addition of products and services Enhancement to technological and operational infrastructure Increase to Shareholder Value |

| Strong cultural compatibility Larger customer base through expanded branch network Executive management with in-market Utah experience Combined entities fill a community banking niche Far West brand to be retained in Utah Key Far West leadership, management and customer contacts to be retained Increase to Franchise Value |

| Appendix |

| Source: SNL Financial, reported financial data as of 6/30/06 * Select peer group companies in ID, MT, NV, OR, UT, WA * Far West Bancorporation Strong Operating Performance |

| Source: SNL Financial Appendix Far West Bancorporation Consolidated Balance Sheet ($ in thousands, unaudited) |

| Far West Bancorporation Income Statement ($ in thousands) Source: SNL Financial Appendix |