Exhibit 99.1

AmericanWest Bancorporation

Robert M. Daugherty

President and CEO

C. Tim Cassels

Executive VP, Chief Financial Officer

Safe Harbor Statement

During the course of this presentation, we may make forward-looking statements regarding future events or the future financial performance of the Company. We wish to caution you that such forward-looking statements are just predictions subject to certain risks and uncertainties that could cause actual events or results to materially differ, either better or worse, from those projected. A discussion of risk factors that may affect the actual outcomes relating to such forward-looking statements and the Company’s results of operations in general is included in the Company’s Annual Report on Form 10-K and other filings with the Securities and Exchange Commission. The Company assumes no obligation to update or supplement forward-looking statements that become untrue because of subsequent events.

Overview of AWBC

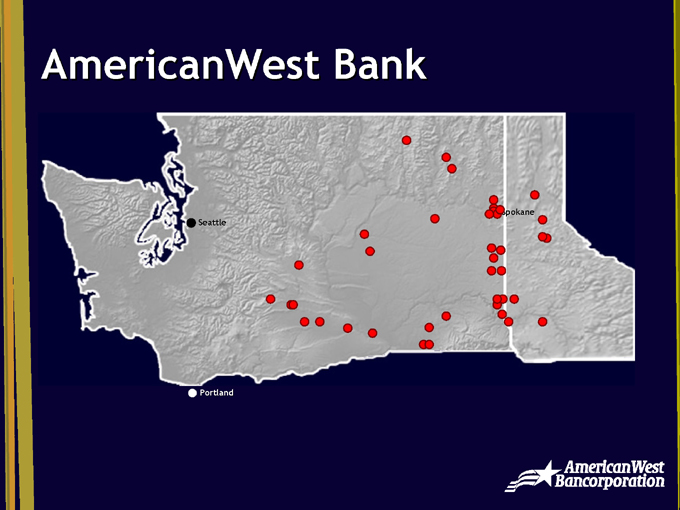

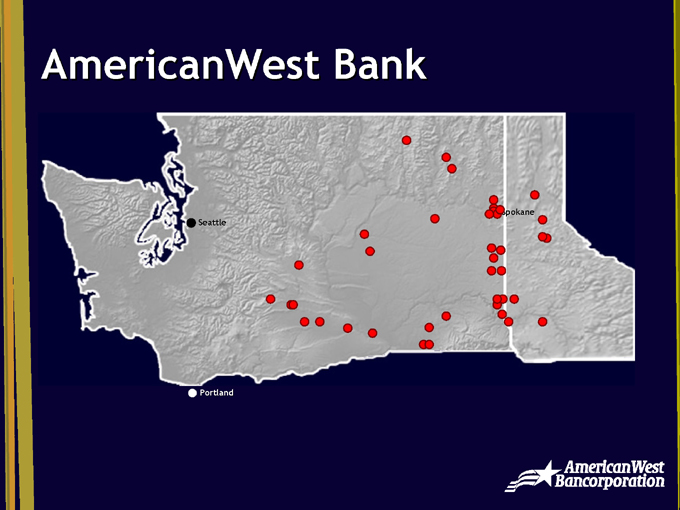

Founded in 1974 as United Security Bank IPO in 1995 Traded on NASDAQ under the symbol AWBC Operated under “Super-Community Banking” model until 2001 Headquartered in Spokane, Washington 42 financial centers in Central and Eastern Washington and Northern Idaho Over 400 employees $1.05B in total assets

Portland

Seattle

Spokane

United Security Bank

Spokane

Seattle

Portland

Founded 1974

Home Security Bank

Spokane

Portland

Founded 1989

Seattle

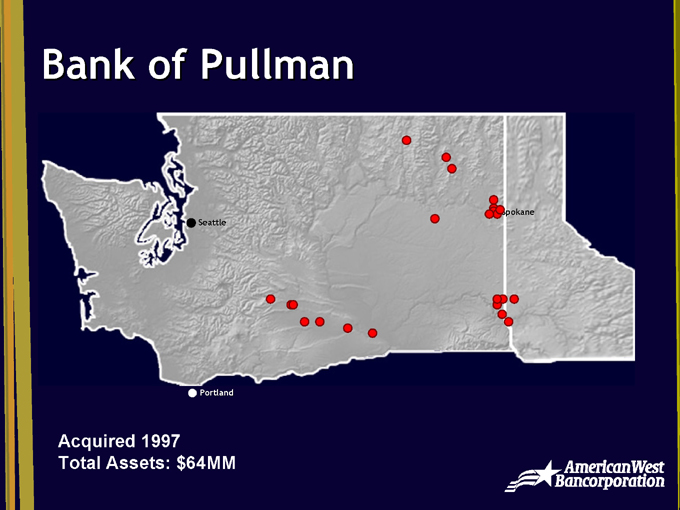

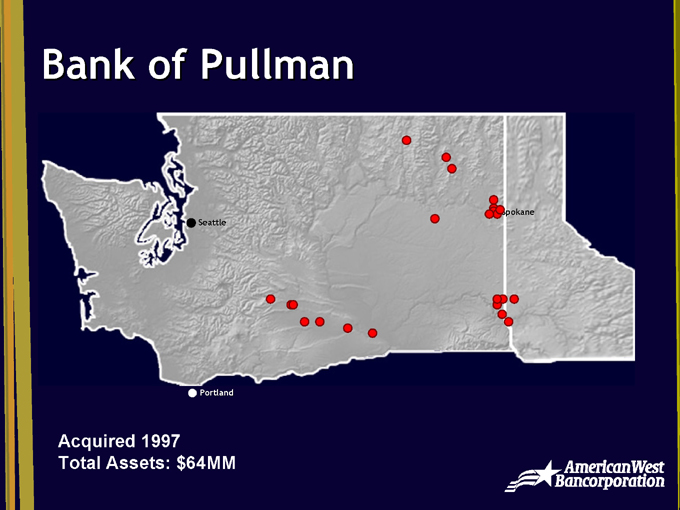

Bank of Pullman

Spokane

Seattle

Portland

Acquired 1997 Total Assets: $64MM

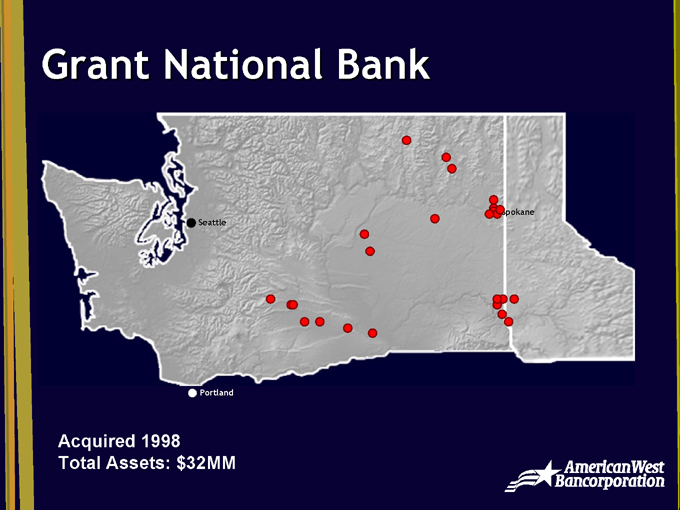

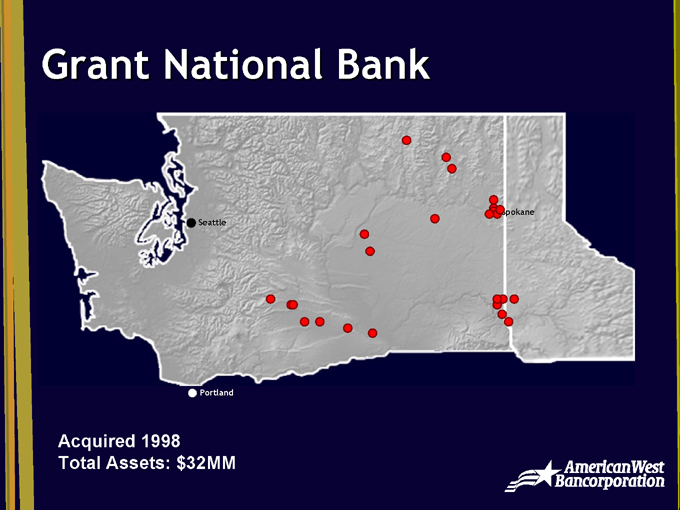

Grant National Bank

Spokane

Seattle

Portland

Acquired 1998 Total Assets: $32MM

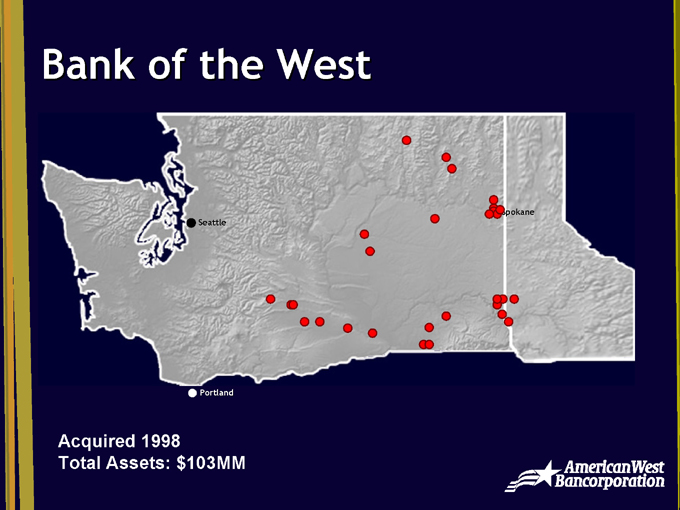

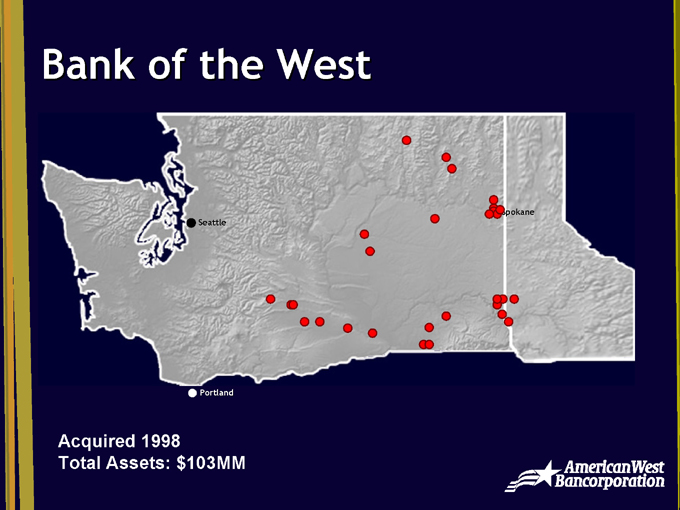

Bank of the West

Seattle

Spokane

Portland

Acquired 1998 Total Assets: $103MM

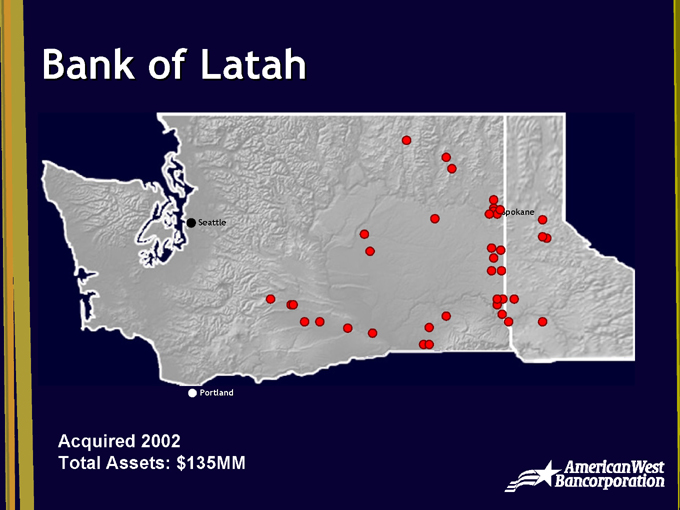

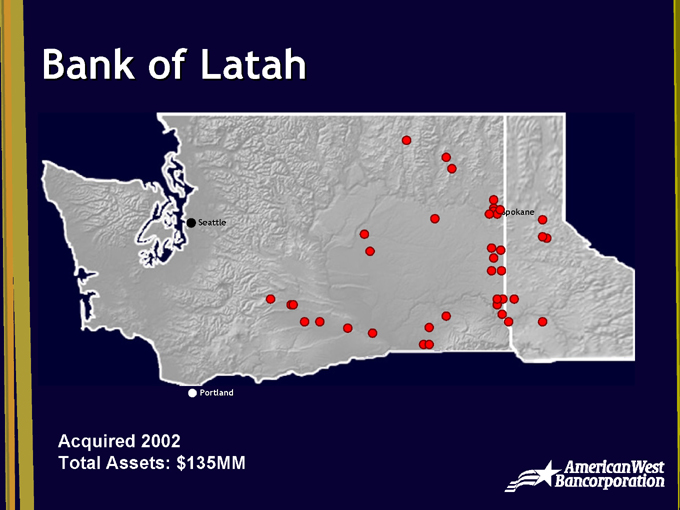

Bank of Latah

Seattle

Spokane

Portland

Acquired 2002 Total Assets: $135MM

AmericanWest Bank

Seattle

Spokane

Portland

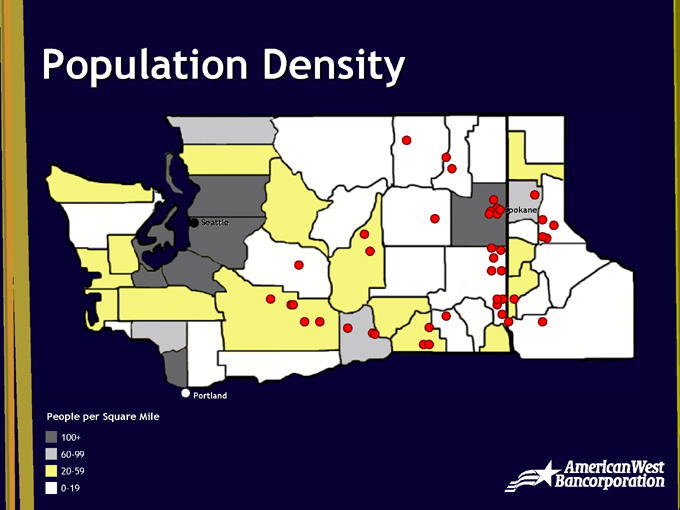

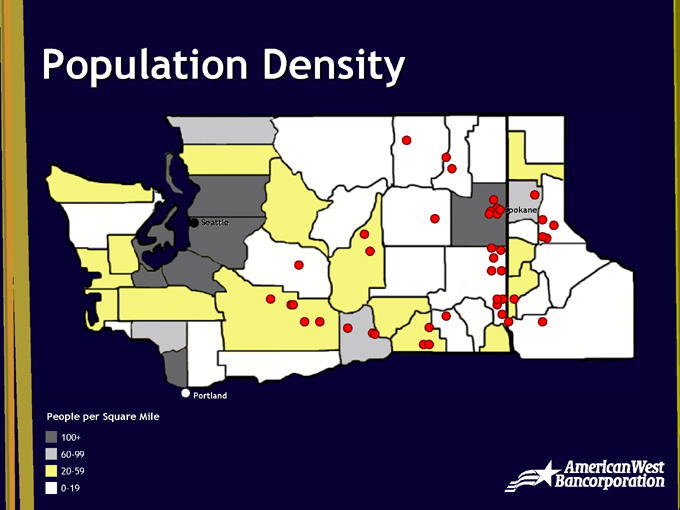

Population Density

Seattle

Spokane

Portland

People per Square Mile

100+ 60-99 20-59 0-19

Targeted Market Growth

Spokane, WA

Tri-Cities, WA (Kennewick, Richland, Pasco)

Yakima, WA

Kootenai County, ID

New Leadership

Bob Daugherty, President and CEO Nicole Sherman, EVP Retail Banking Blair Reynolds, SVP General Counsel Don Livingstone, Director

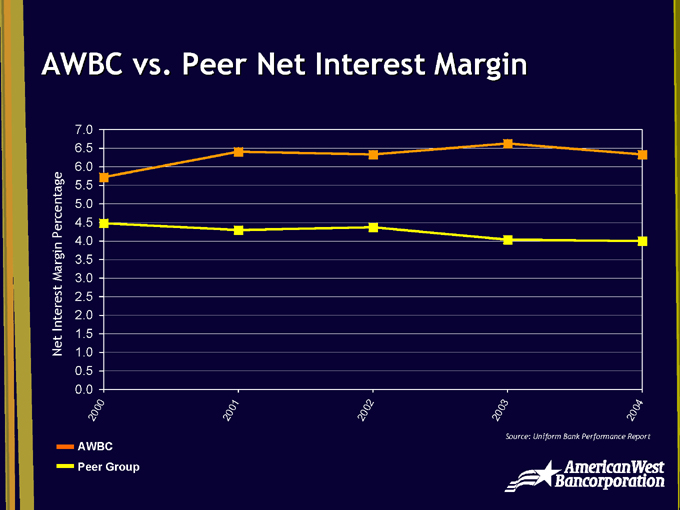

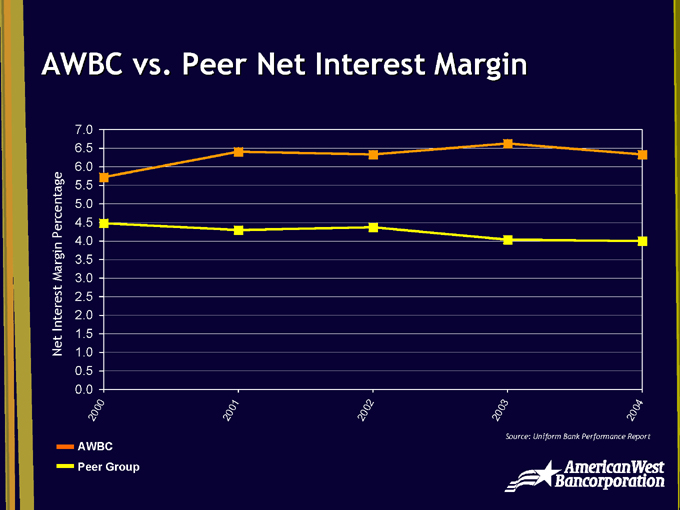

AWBC vs. Peer Net Interest Margin

Net Interest Margin Percentage

7.0

6.5

6.0

5.5

5.0

4.5

4.0

3.5

3.0

2.5

2.0

1.5

1.0

0.5

0.0

2000 2001 2002 2003 2004

AWBC Peer Group

Source: Uniform Bank Performance Report

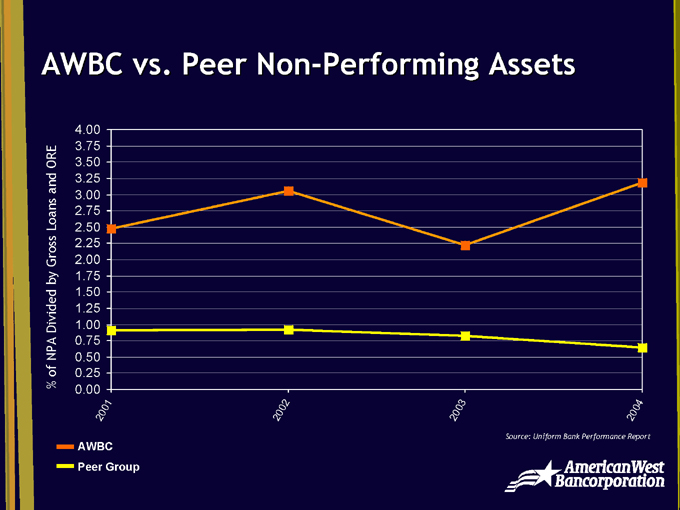

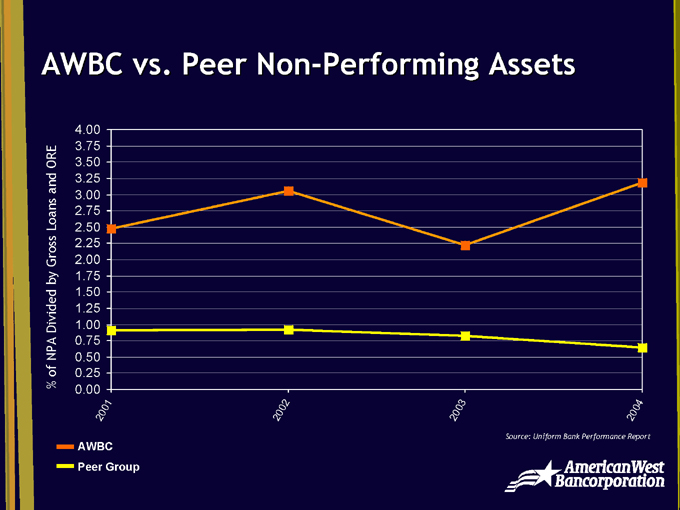

AWBC vs. Peer Non-Performing Assets

% of NPA Divided by Gross Loans and ORE

4.00

3.75

3.50

3.25

3.00

2.75

2.50

2.25

2.00

1.75

1.50

1.25

1.00

0.75

0.50

0.25

0.00

Source: Uniform Bank Performance Report

AWBC Peer Group

2001 2002 2003 2004

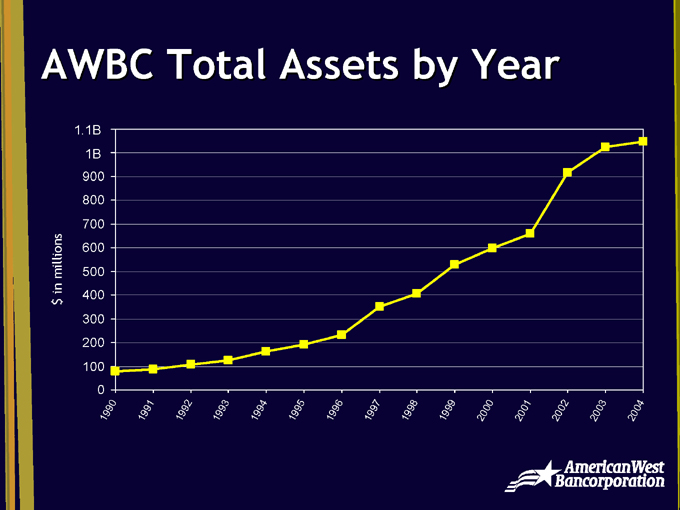

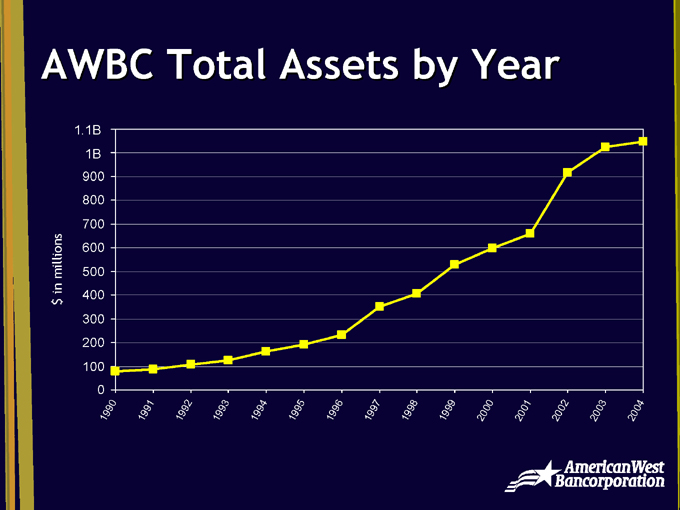

AWBC Total Assets by Year $ in millions

1.1B

1B

900 800 700 600 500 400 300 200 100 0

1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004

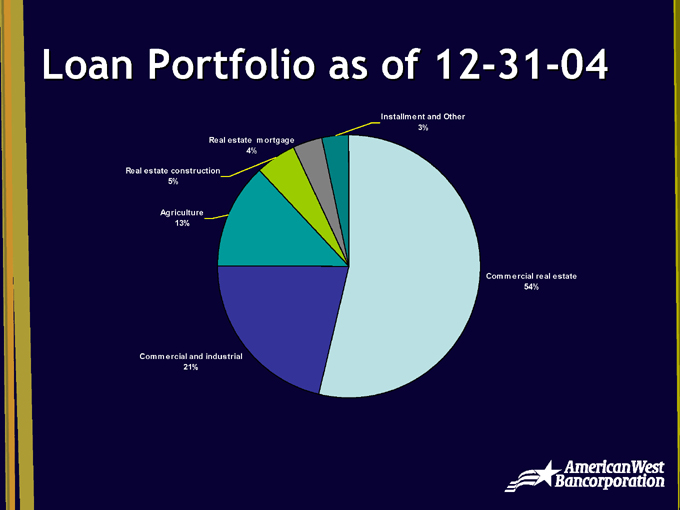

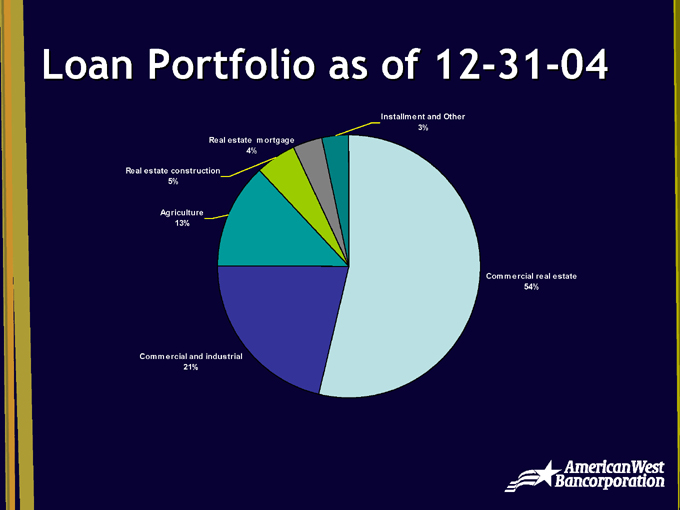

Loan Portfolio as of 12-31-04

Installment and Other 3% Real estate mortgage 4%

Real estate construction 5%

Agriculture 13%

Commercial real estate 54%

Commercial and industrial 21%

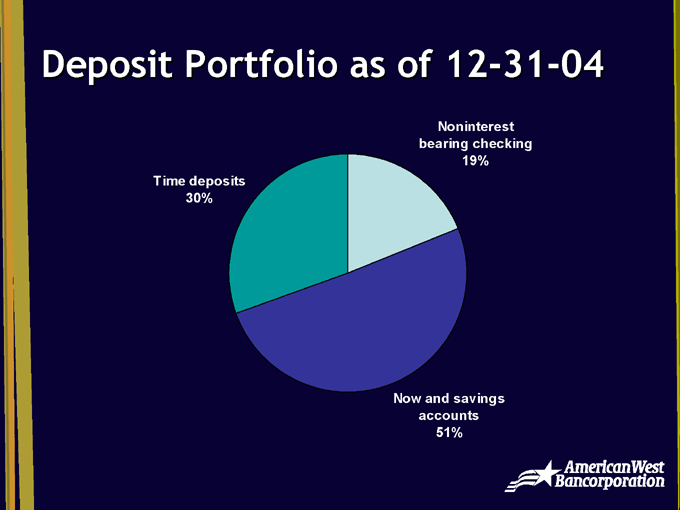

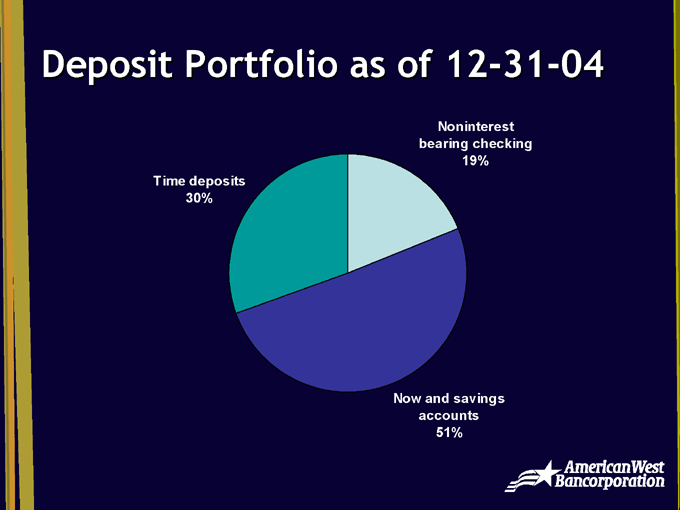

Deposit Portfolio as of 12-31-04

Noninterest bearing checking 19% Time deposits 30%

Now and savings accounts 51%

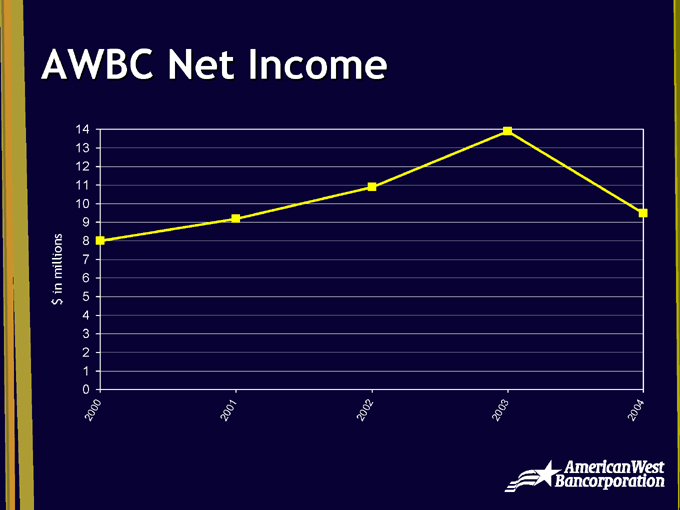

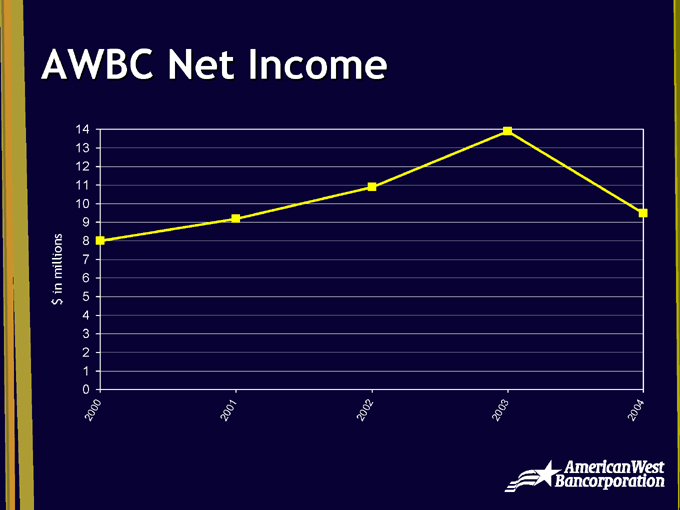

AWBC Net Income

$ in millions

14 13 12 11 10 9 8 7 6 5 4 3 2 1 0

2000 2001 2002 2003 2004

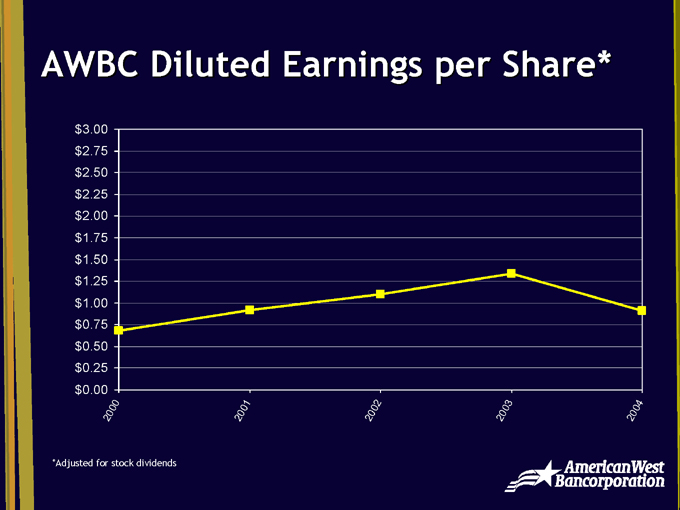

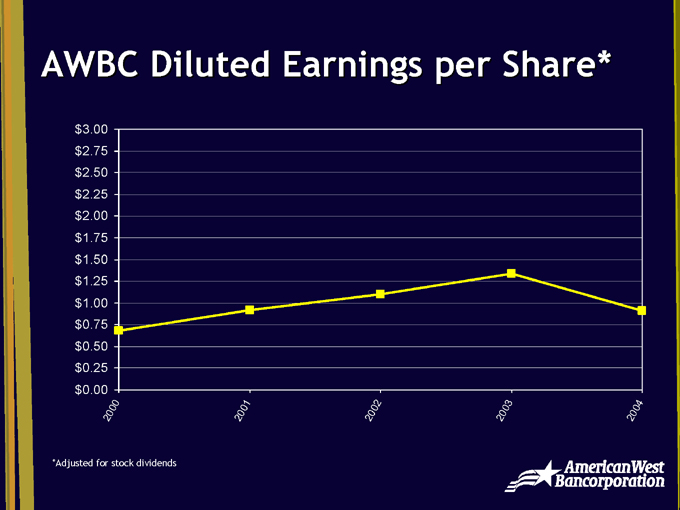

AWBC Diluted Earnings per Share*

$3.00 $2.75 $2.50 $2.25 $2.00 $1.75 $1.50 $1.25 $1.00 $0.75 $0.50 $0.25 $0.00

*Adjusted for stock dividends

2000 2001 2002 2003 2004

Improving Credit Quality

Centralized commercial credit underwriting Changes to internal credit culture and staff incentives based on credit quality 2004 write-downs Reduction in delinquencies

Fundamental Community Banking

Improved relationships

Focus on sales and service culture Expanded target audience Revised brand Renewed emphasis on core values

Infrastructure Improvements

Technology investments Internal training for all staff In-house marketing team Centralization of all operations Centralized consumer lending center Focus on internal communication

Retail Banking

Expanded product offerings Strong consumer lending emphasis (consumer, small business, mortgage) Increased core deposits Build relationships by focusing on the customer experience Implement a service & sales infrastructure Training at all levels