Exhibit 99.1

AmericanWest Bancorporation

Robert M. Daugherty

President and CEO

Diane L. Kelleher

Executive VP and CFO

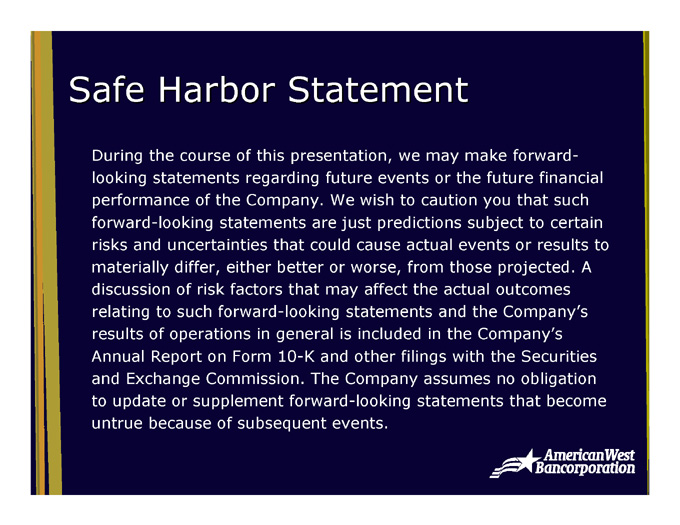

Safe Harbor Statement

During the course of this presentation, we may make forward-looking statements regarding future events or the future financial performance of the Company. We wish to caution you that such forward-looking statements are just predictions subject to certain risks and uncertainties that could cause actual events or results to materially differ, either better or worse, from those projected. A discussion of risk factors that may affect the actual outcomes relating to such forward-looking statements and the Company’s results of operations in general is included in the Company’s Annual Report on Form 10-K and other filings with the Securities and Exchange Commission. The Company assumes no obligation to update or supplement forward-looking statements that become untrue because of subsequent events.

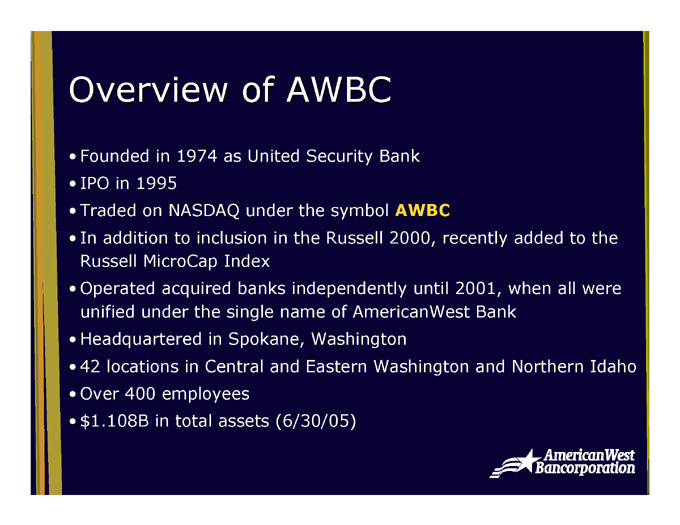

Overview of AWBC

Founded in 1974 as United Security Bank

IPO in 1995

Traded on NASDAQ under the symbol AWBC

In addition to inclusion in the Russell 2000, recently added to the Russell MicroCap Index

Operated acquired banks independently until 2001, when all were unified under the single name of AmericanWest Bank

Headquartered in Spokane, Washington

42 locations in Central and Eastern Washington and Northern Idaho

Over 400 employees

$1.108B in total assets (6/30/05)

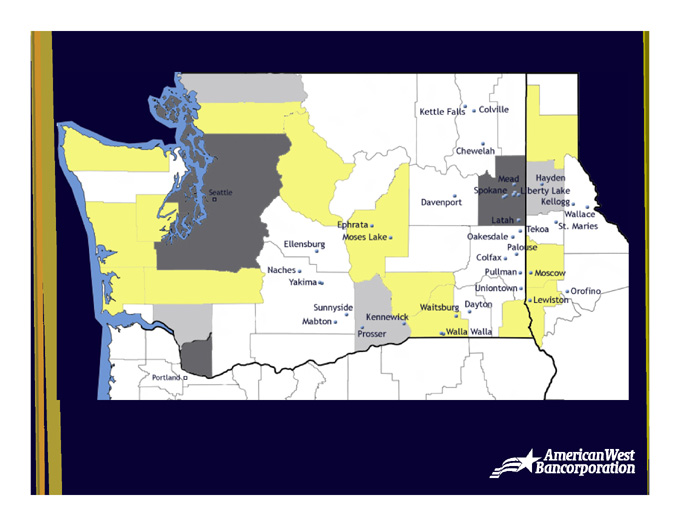

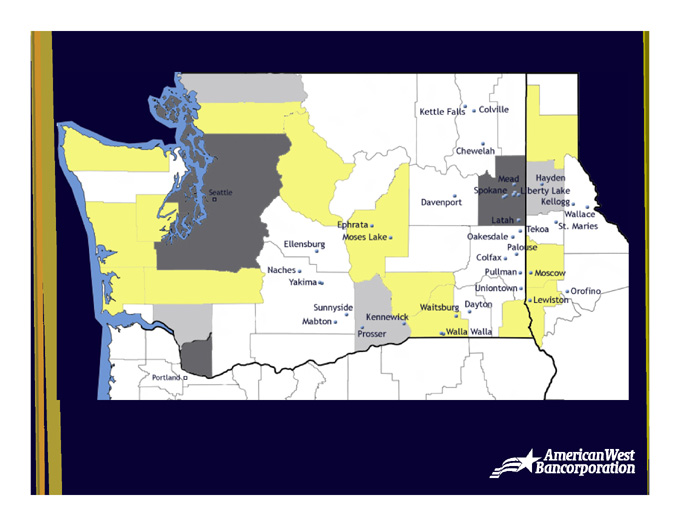

Kettle Falls

Colville

Chewelah

Mead

Spokane

Hayden

Liberty Lake

Kellogg

Davenport

Wallace

Latah

Seattle

Ephrata

Tekoa

St. Maries

Ellensburg

Moses Lake

Oakesdale

Palouse

Naches

Colfax

Pullman

Moscow

Yakima

Uniontown

Orofino

Sunnyside

Kennewick

Waitsburg

Dayton

Lewiston

Mabton

Prosser

Walla Walla

Portland

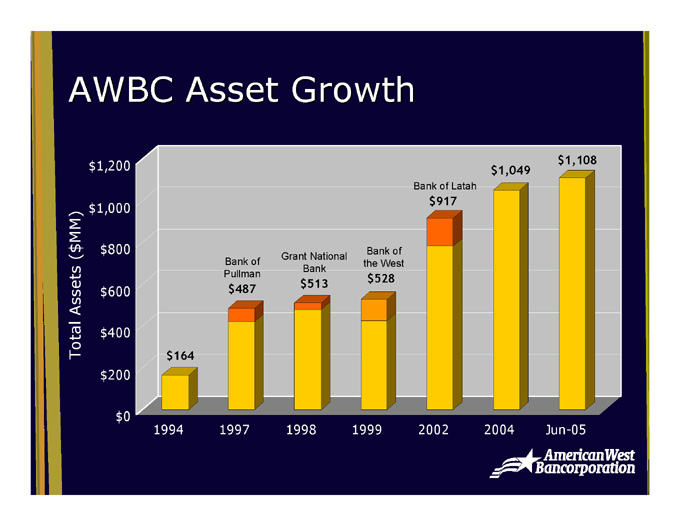

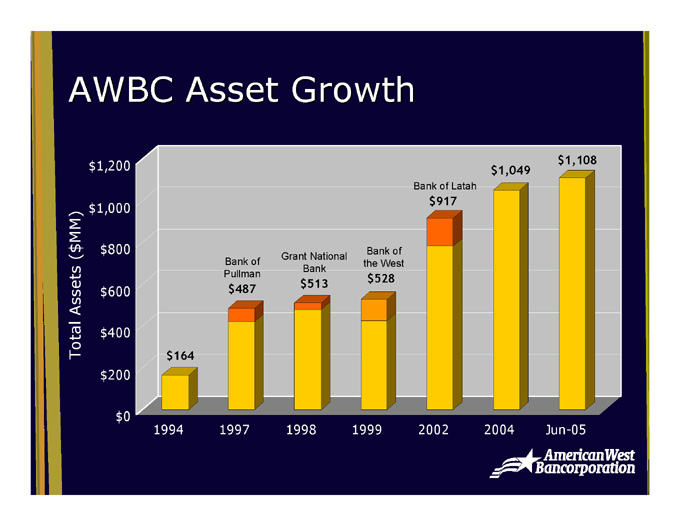

AWBC Asset Growth

$1,108

$1,049

$1,200

Bank of Latah

$917

$1,000

$800

Grant National Bank

Bank of the West

Bank of Pullman

$528

Total Assets ($MM)

$513

$600

$487

$400

$164

$200

$0

1998

1999

2002

2004

Jun-05

1994

1997

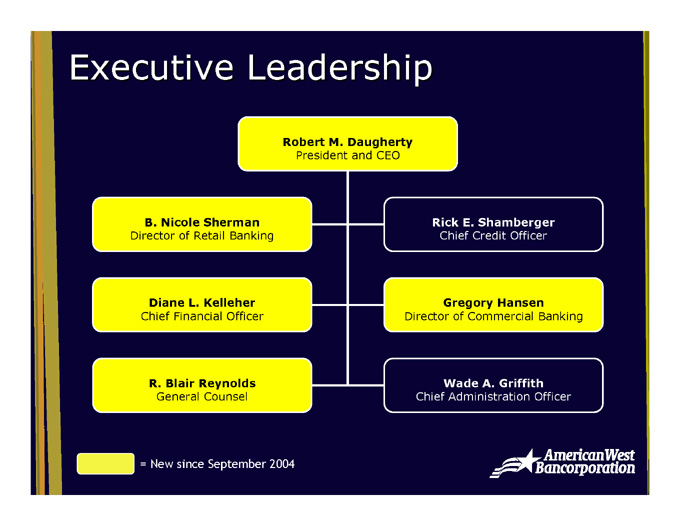

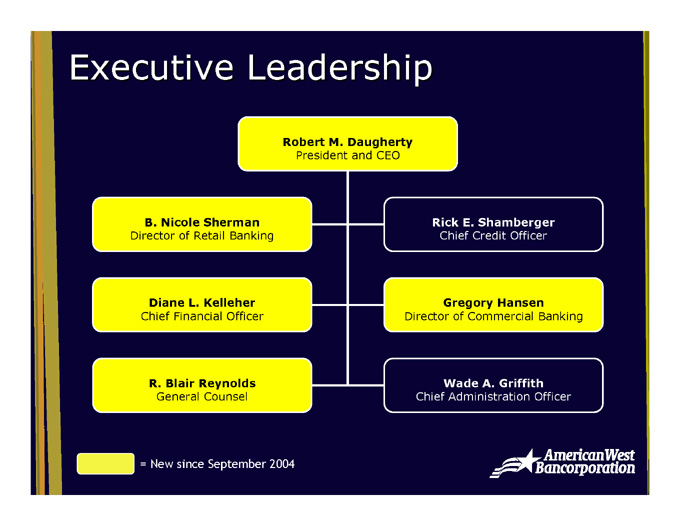

Executive Leadership

Robert M. Daugherty

President and CEO

B. Nicole Sherman

Director of Retail Banking

Diane L. Kelleher

Chief Financial Officer

R. Blair Reynolds

General Counsel

Rick E. Shamberger

Chief Credit Officer

Gregory Hansen

Director of Commercial Banking

Wade A. Griffith

Chief Administration Officer

= New since September 2004

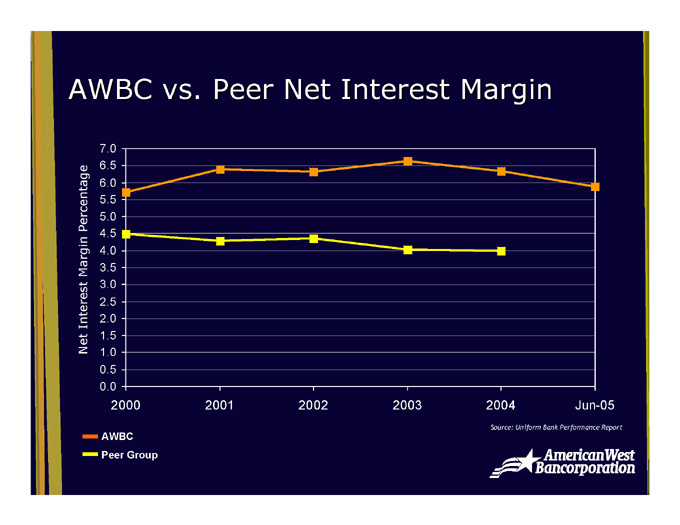

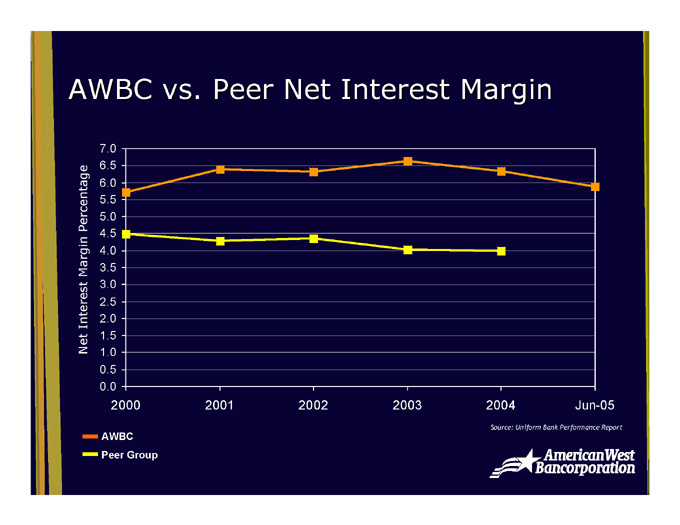

AWBC vs. Peer Net Interest Margin

7.0

6.5

6.0

5.5

5.0

4.5

4.0

Net Interest Margin Percentage

3.5

3.0

2.5

2.0

1.5

1.0

0.5

0.0

2004

2003

2002

2001

2000

Jun-05

AWBC

Peer Group

Source: Uniform Bank Performance Report

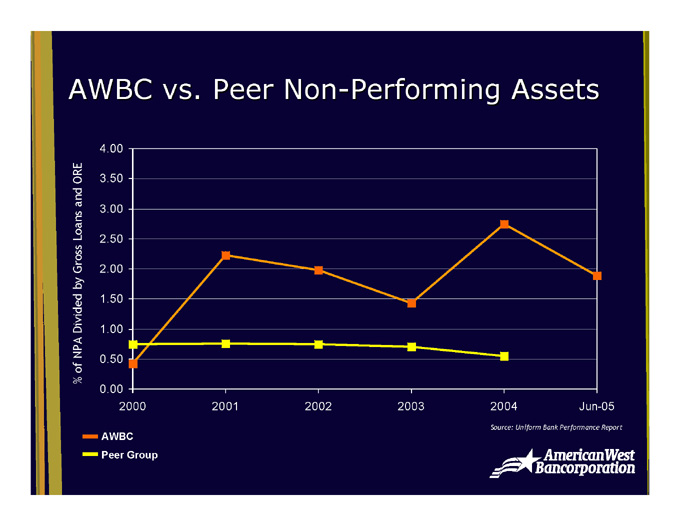

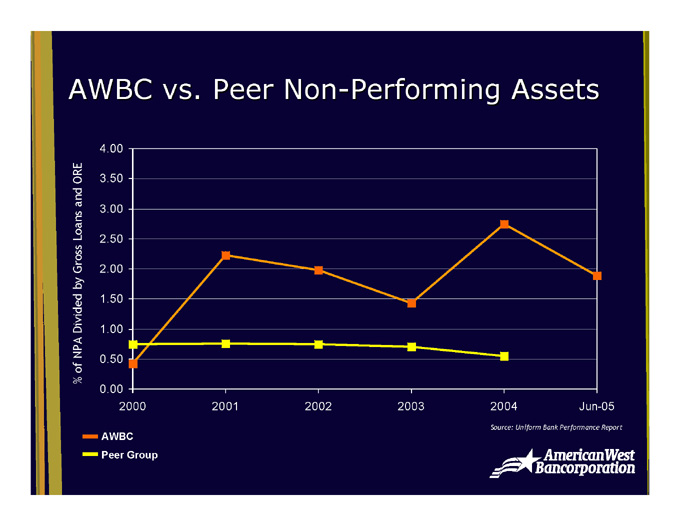

AWBC vs. Peer Non-Performing Assets

4.00

3.50

3.00

2.50

% of NPA Divided by Gross Loans and ORE

2.00

1.50

1.00

0.50

0.00

2004

2003

2002

2001

2000

Jun-05

AWBC

Peer Group

Source: Uniform Bank Performance Report

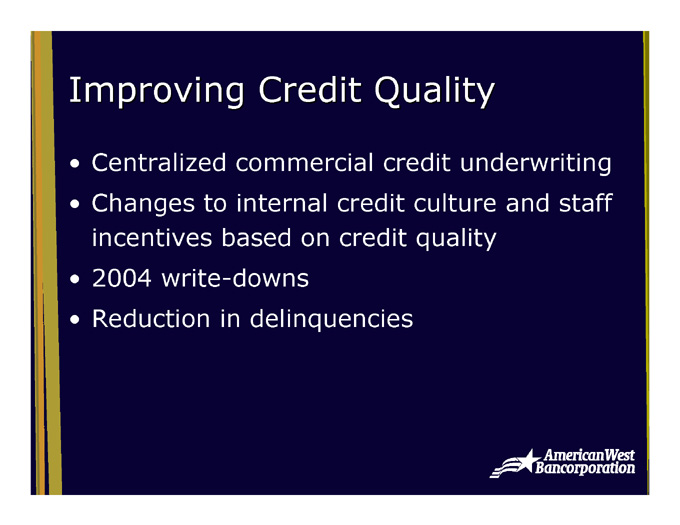

Improving Credit Quality

Centralized commercial credit underwriting

Changes to internal credit culture and staff incentives based on credit quality

2004 write-downs

Reduction in delinquencies

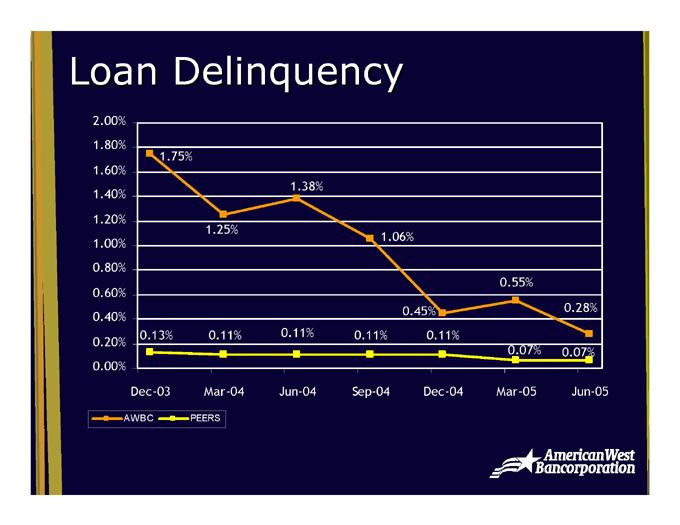

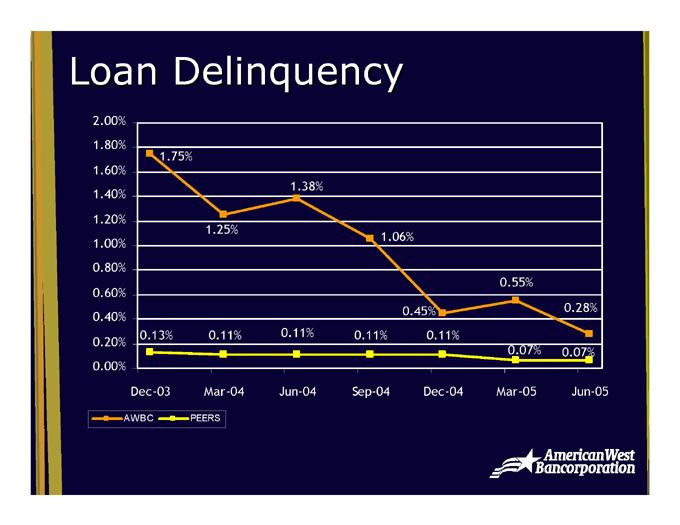

Loan Delinquency

2.00%

1.80%

1.75%

1.60%

1.38%

1.40%

1.20%

1.25%

1.06%

1.00%

0.80%

0.55%

0.60%

0.28%

0.40%

0.45%

0.11%

0.11%

0.11%

0.11%

0.13%

0.20%

0.07%

0.07%

0.00%

Mar-05

Dec-04

Sep-04

Jun-04

Mar-04

Dec-03

Jun-05

PEERS

AWBC

Fundamental Community Banking

Improved relationships

Focus on sales and service culture

Expanded target audience

Revised brand

Renewed emphasis on core values

Infrastructure Improvements

Technology investments

Internal training for all staff

In-house marketing team

Centralization of all operations

Centralized consumer lending center

Focus on internal communication

Retail Banking

Launched Retail Banking June 1, 2005, with 24 new products

Strong consumer lending emphasis (consumer, small business, mortgage)

Immediate focus on growing core deposits

Build relationships by focusing on the customer experience

Training at all levels

2nd Quarter 2005 Highlights

Net income of $3.5 million, or $0.34 per diluted share

ROA of 1.38% and ROE of 12.83%

Net interest margin of 5.88%

Non-performing assets of 1.69%, improved from 3.26% last quarter

Delinquencies of 0.28%, improved from 0.55% last quarter

Average trading volume increased 14% over the 1st quarter from 31,072 to 35,386

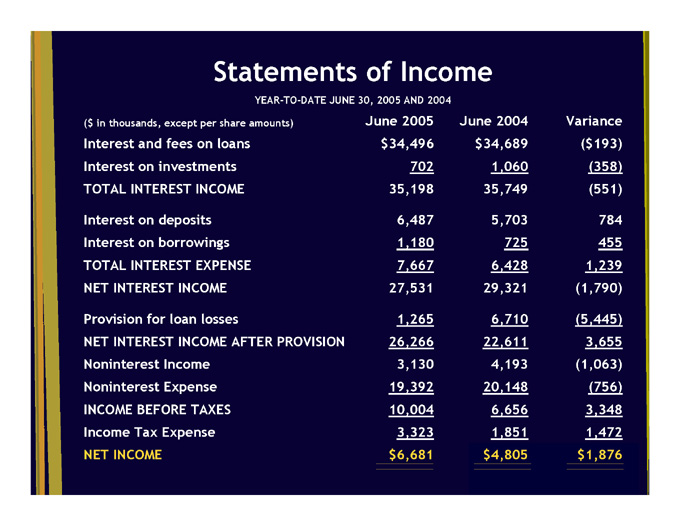

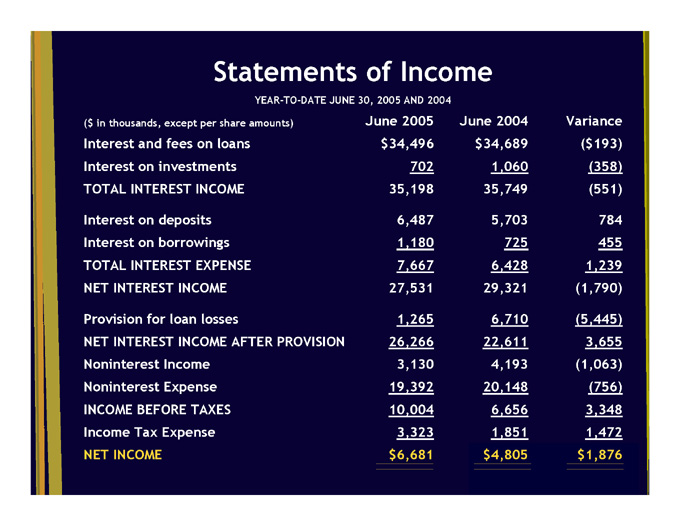

Statements of Income YEAR-TO-DATE JUNE 30, 2005 AND 2004 ($ in thousands, except per share amounts)

June 2005

June 2004

Variance

$34,496

$34,689

($193)

Interest and fees on loans

Interest on investments

702

1,060

(358)

TOTAL INTEREST INCOME

35,198

35,749

(551)

6,487

5,703

784

Interest on deposits

Interest on borrowings

1,180

725

455

TOTAL INTEREST EXPENSE

7,667

6,428

1,239

NET INTEREST INCOME

27,531

29,321

(1,790)

Provision for loan losses

1,265

6,710

(5,445)

NET INTEREST INCOME AFTER PROVISION

26,266

22,611

3,655

Noninterest Income

3,130

4,193

(1,063)

Noninterest Expense

19,392

20,148

(756)

INCOME BEFORE TAXES

10,004

6,656

3,348

Income Tax Expense

3,323

1,851

1,472

NET INCOME

$6,681

$4,805

$1,876

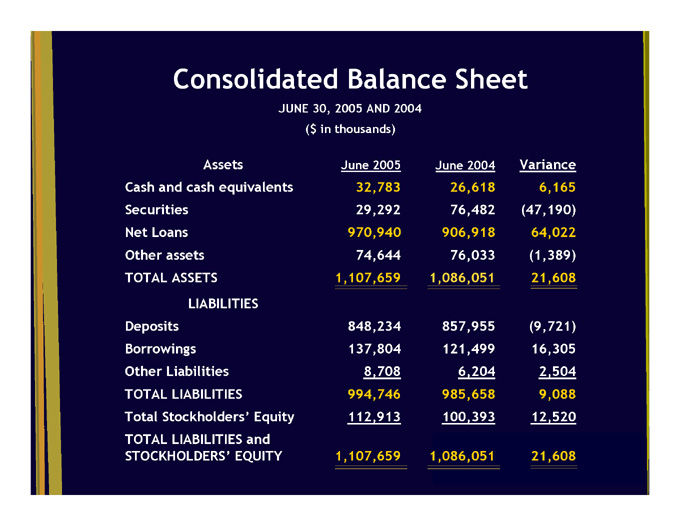

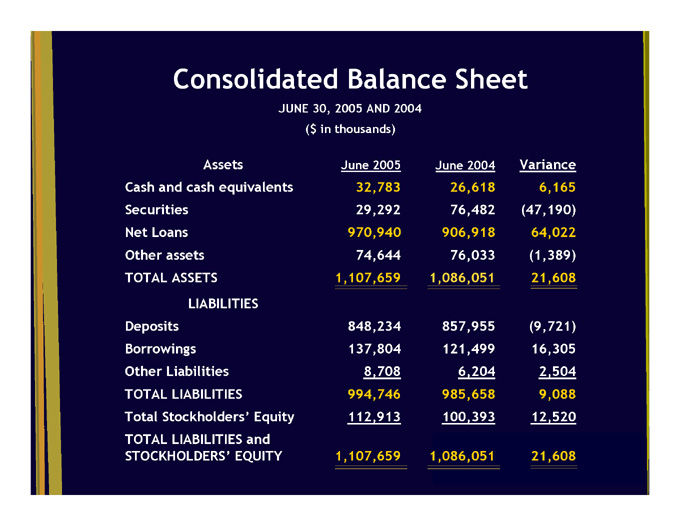

Consolidated Balance Sheet

JUNE 30, 2005 AND 2004

($ in thousands)

Assets

June 2005

June 2004

Variance

Cash and cash equivalents

32,783

26,618

6,165

Securities

29,292

76,482

(47,190)

970,940

906,918

64,022

Net Loans

Other assets

74,644

76,033

(1,389)

TOTAL ASSETS

1,107,659

1,086,051

21,608

LIABILITIES

Deposits

848,234

857,955

(9,721)

Borrowings

137,804

121,499

16,305

Other Liabilities

8,708

6,204

2,504

TOTAL LIABILITIES

994,746

985,658

9,088

Total Stockholders’ Equity

112,913

100,393

12,520

1,107,659

1,086,051

21,608

TOTAL LIABILITIES and STOCKHOLDERS’ EQUITY

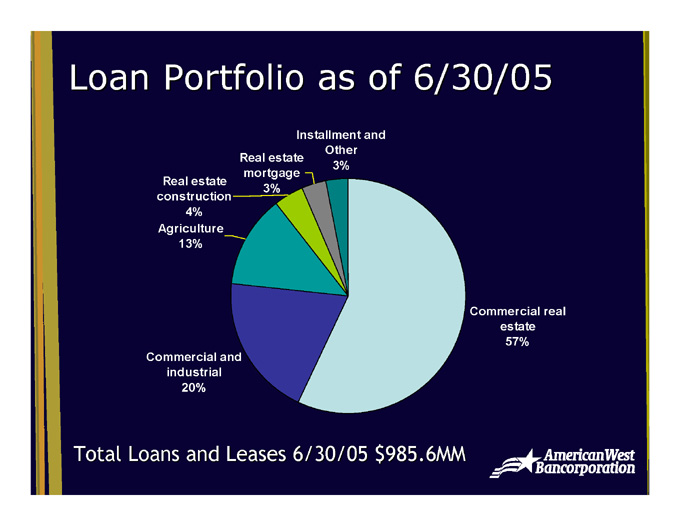

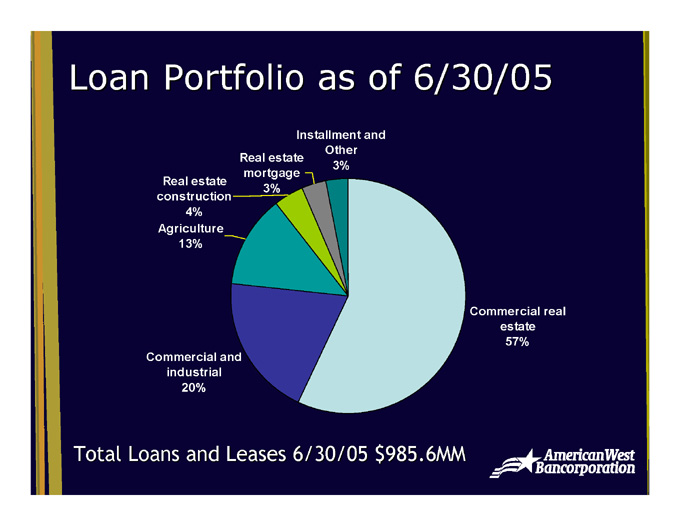

Loan Portfolio as of 6/30/05

Installment and Other

3%

Real estate mortgage

3%

Real estate

construction

4%

Agriculture

13%

Commercial real estate

57%

Commercial and industrial

20%

Total Loans and Leases 6/30/05 $985.6MM

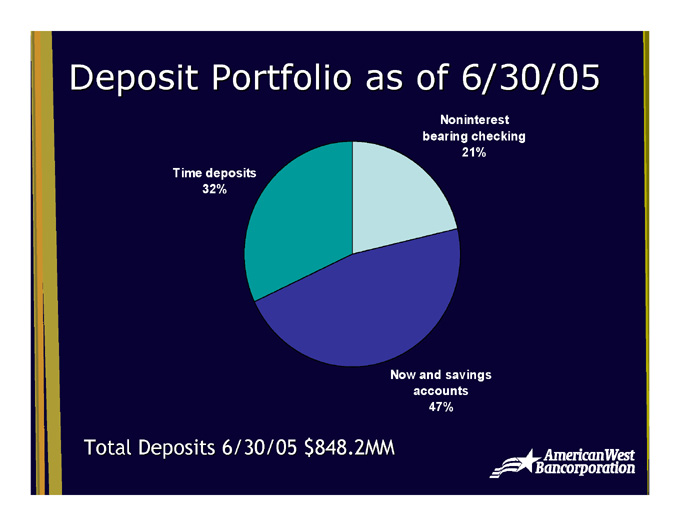

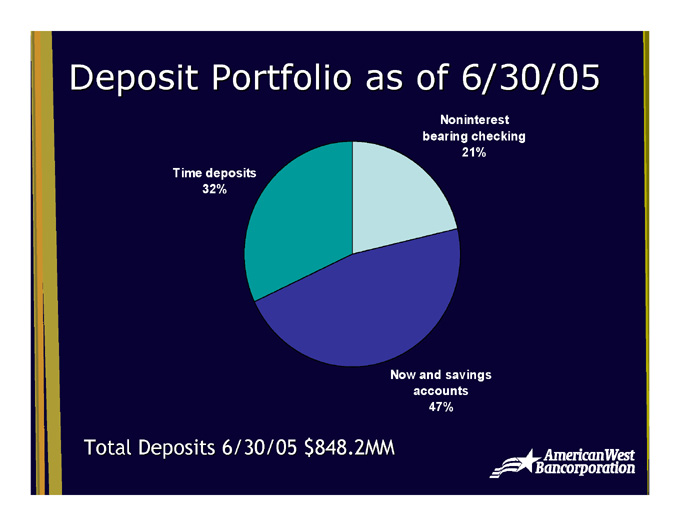

Deposit Portfolio as of 6/30/05

Noninterest bearing checking

21%

Time deposits

32%

Now and savings accounts

47%

Total Deposits 6/30/05 $848.2MM

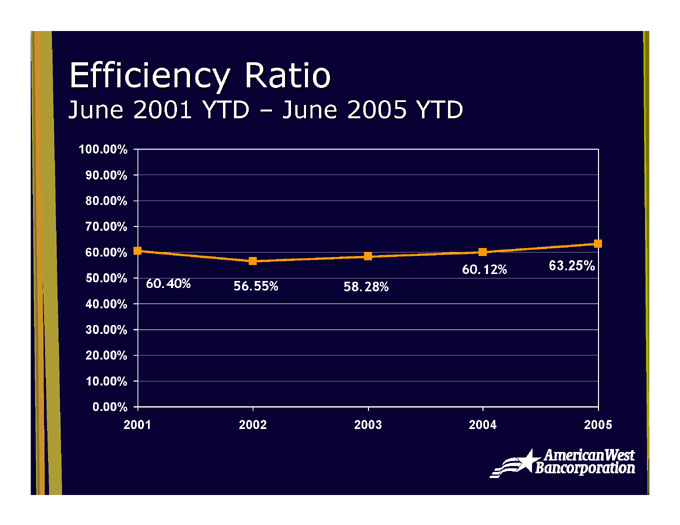

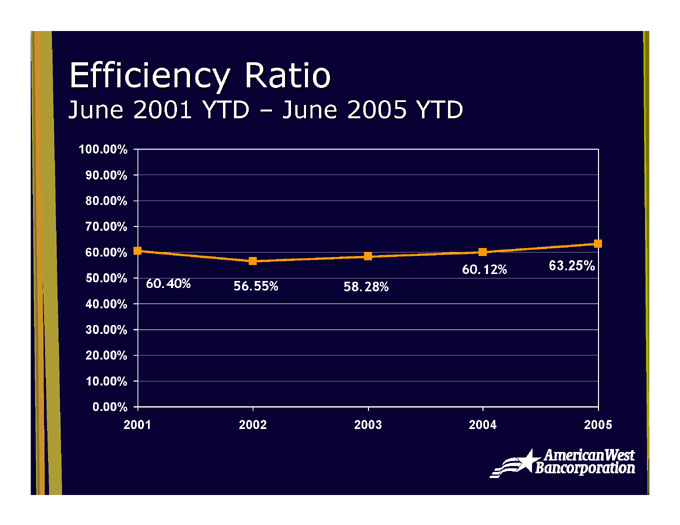

Efficiency Ratio

June 2001 YTD – June 2005 YTD

100.00%

90.00%

80.00%

70.00%

60.00%

63.25%

60.12%

60.40%

50.00%

58.28%

56.55%

40.00%

30.00%

20.00%

10.00%

0.00%

2005

2001

2002

2003

2004

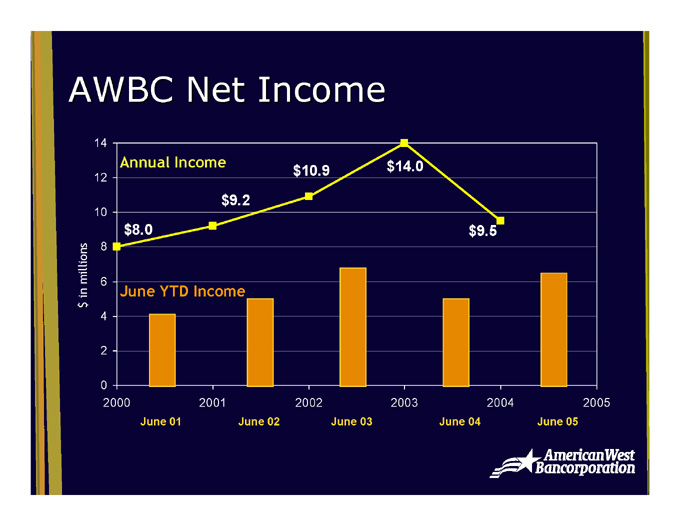

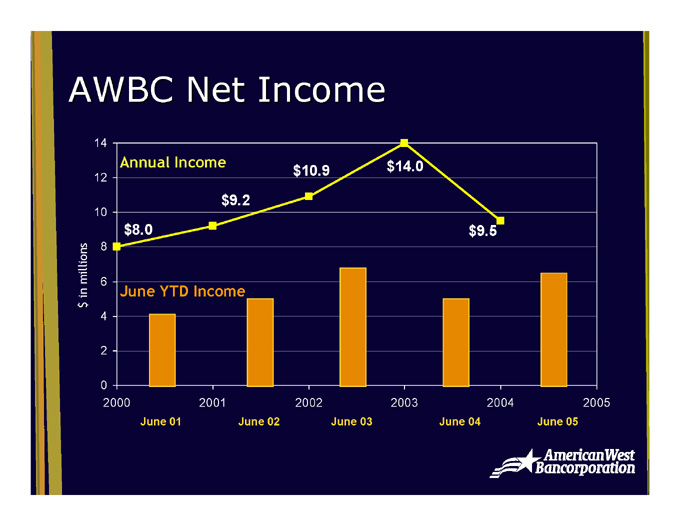

AWBC Net Income

14

Annual Income

$10.9

$14.0

12

$9.2

10

$9.5

$8.0

8

$ in millions

June YTD Income

6

4

2

0

2004

2003

2002

2001

2000

2005

June 04

June 03

June 02

June 01

June 05

Trends in ROAA and ROAE

16.00%

15.87%

14.00%

12.29%

13.87%

15.08%

12.00%

12.73%

10.00%

9.37%

8.00%

6.00%

4.00%

1.47%

1.41%

1.30%

0.88%

1.46%

1.44%

2.00%

0.00%

2004

2003

2002

2001

2000

6/30/2005

ROAE

ROAA

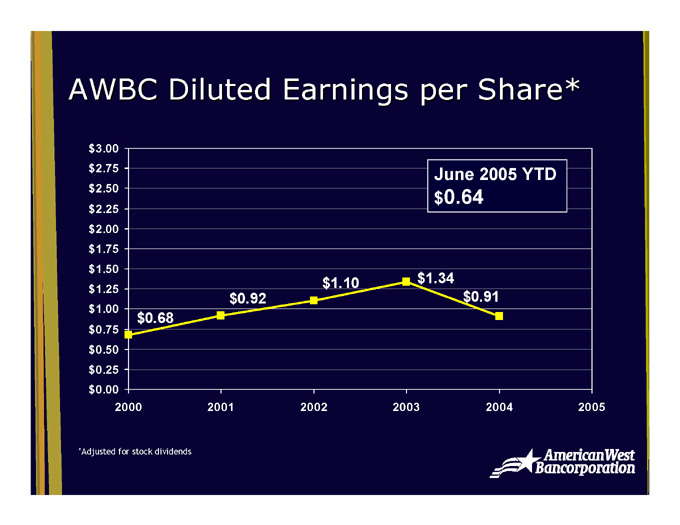

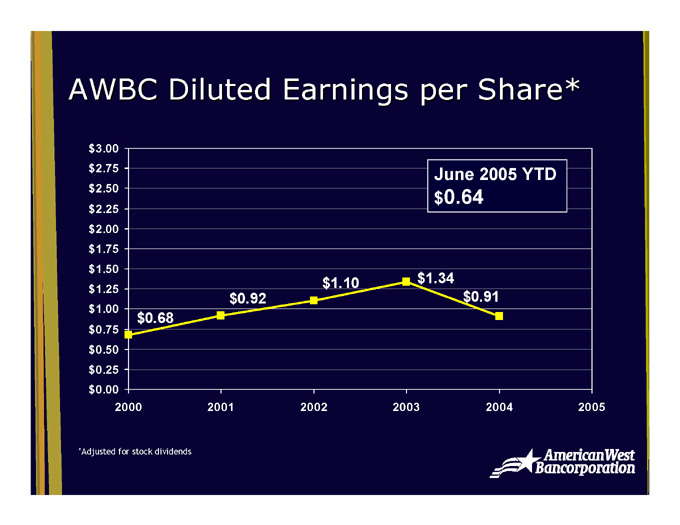

AWBC Diluted Earnings per Share*

$3.00

$2.75

June 2005 YTD

$0.64

$2.50

$2.25

$2.00

$1.75

$1.50

$1.34

$1.10

$1.25

$0.92

$0.91

$1.00

$0.68

$0.75

$0.50

$0.25

$0.00

2004

2003

2002

2001

2000

2005

*Adjusted for stock dividends

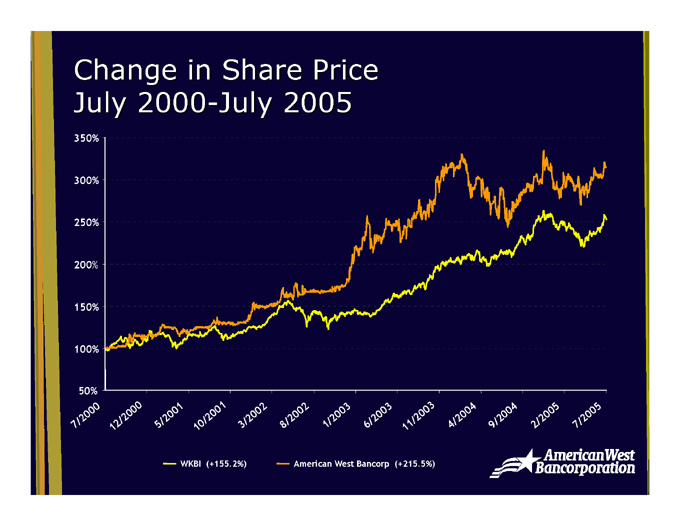

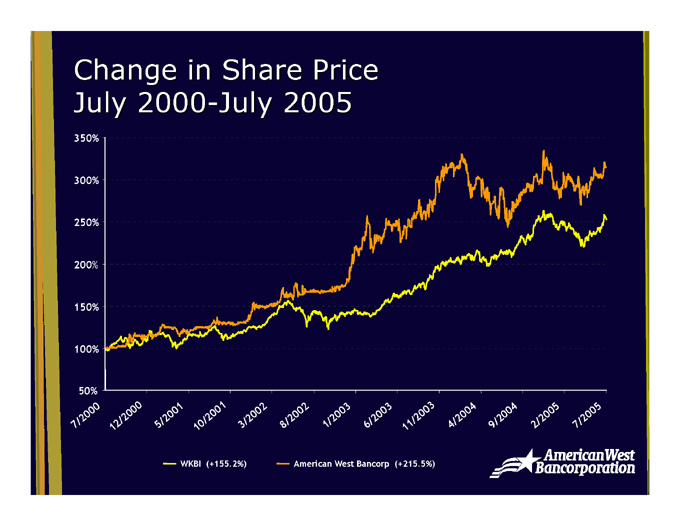

Change in Share Price

July 2000-July 2005

350%

300%

250%

200%

150%

100%

50%

2/2005

9/2004

4/2004

6/2003

1/2003

8/2002

3/2002

5/2001

7/2000

11/2003

10/2001

12/2000

7/2005

WKBI (+155.2%)

American West Bancorp (+215.5%)

Thank You.

AmericanWest Bancorporation

AmericanWest Bank Building

41 W Riverside, Suite 400

Spokane, Washington 99201

(509) 467-6993

www.awbank.net

InvestorInfo@awbank.net