EXHIBIT 8.2

January 23, 2006

Columbia Trust Bancorp

3945 West Court

Pasco, WA 99302

| | Re: | Bank Merger/Tax Consequences |

Ladies and Gentlemen:

This letter responds to your request for our opinion as to certain of the federal income tax consequences of the proposed merger (the “Merger”) of Columbia Trust Financial Corporation (“Columbia Trust”) into AmericanWest Bancorporation (“AmericanWest”) in exchange for cash and the common stock of AmericanWest. This opinion is delivered pursuant to Section 7.02(c) of the Merger Agreement.

We have acted as legal counsel to Columbia Trust and Columbia Trust Bank in connection with the Merger. For the purpose of rendering this opinion, we have examined and relied upon originals, certified copies, or copies otherwise identified to our satisfaction as being true copies of the originals of the following documents, including all exhibits and schedules attached to them:

| | A. | The Agreement and Plan of Merger dated as of November 29, 2005, between AmericanWest, AmericanWest Bank, Columbia Trust and Columbia Trust Bank (the “Merger Agreement”). |

| | B. | Form S-4 Registration Statement of AmericanWest filed with the Securities and Exchange Commission on or about December 27, 2005. |

| | C. | The Proxy Statement of Columbia Trust (included as part of the Registration Statement). |

| | D. | Such other documents, instruments, records and information pertaining to the Merger as we have deemed necessary for rendering our opinion. |

We have assumed, without independent investigation or review, the accuracy and completeness of the facts and representations and warranties contained in those documents or otherwise made known to us, and that the Merger will be effected in accordance with the terms of the Merger Agreement.

In connection with the Merger and pursuant to the Merger Agreement, each share of AmericanWest common stock outstanding on the effective date of the Merger will be exchanged for either (1) shares of AmericanWest common stock based on the per share Stock Consideration determined pursuant to the Merger Agreement, or (2) cash based on the per share Cash Consideration determined pursuant to the Merger Agreement. The Columbia Trust shareholders may elect to receive payment in cash, AmericanWest common

| | |

Columbia Trust Bancorp January 23, 2006 Page 2 | | KELLER ROHRBACKL.L.P. |

stock or a combination of cash and AmericanWest common stock pursuant to election procedures specified in the Agreement, as a result of which approximately 50% of the Merger Consideration will be received in cash and approximately 50% in AmericanWest common stock. Cash will be paid in exchange for fractional shares. Columbia Trust shareholders who perfect their dissenter’s rights under state law will be paid by AmericanWest the cash value for their Columbia Trust shares.

The following opinion sets forth the material United States federal income tax consequences of the Merger to holders of Columbia Trust common stock who are citizens of, reside in or are organized under the laws of the United States. This opinion does not address any tax consequences arising under the laws of any state, locality or foreign jurisdiction. This discussion is based upon the Internal Revenue Code (“Code”), the regulations of the Internal Revenue Service (“IRS”) and court and administrative rulings and decisions in effect on the date of this document. These laws may change, possibly retroactively, and any change could affect the continuing validity of this opinion.

This opinion assumes that the Columbia Trust shareholders hold their shares of Columbia Trust common stock as a capital asset within the meaning of Section 1221 of the Code. Further, the discussion does not address all aspects of federal income taxation that may be relevant to the Columbia Trust shareholders in light of their particular circumstances or that may be applicable to them if they are subject to special treatment under the Code, including, without limitation, shareholders who are:

| | • | | financial institutions, mutual funds or insurance companies; |

| | • | | tax-exempt organizations; |

| | • | | S corporations or other pass-through entities; |

| | • | | Columbia Trust shareholders whose shares are qualified small business stock for purposes of Section 1202 of the Code or who may otherwise be subject to the alternative minimum tax provisions of the Code; or |

| | • | | Columbia Trust shareholders who received their Columbia Trust common stock through the exercise of employee stock options or otherwise as compensation or through a tax-qualified retirement plan. |

Based upon our review of the facts described above and our analysis of the law, and subject to the qualifications and limitations set forth herein, and the completion of the transactions described in the manner contemplated by the Merger Agreement, it is our opinion that:

A. TAX STATUS OF MERGER

Reorganization. The Merger will be treated as a reorganization under Section 368(a)(1)(A) of the Code and Columbia Trust and AmericanWest will each be a party to that reorganization within the meaning of Section 368(b) of the Code.

B. TAX CONSEQUENCES TO PARTIES/COLUMBIA TRUST SHAREHOLDERS

It is further our opinion that the material federal income tax consequences of the Merger will be:

Parties. No gain or loss will be recognized by Columbia Trust or AmericanWest as a result of the Merger.

Exchange Solely for Cash. In general, if pursuant to the Merger a holder exchanges all of his or her shares of Columbia Trust common stock solely for cash, that holder will recognize gain or loss equal to the difference between the amount of cash received and his adjusted tax basis in the shares of Columbia Trust common stock surrendered, which gain or loss generally will be long-term capital gain or loss if the holder’s holding period with

| | |

Columbia Trust Bancorp January 23, 2006 Page 3 | | KELLER ROHRBACKL.L.P. |

respect to the Columbia Trust common stock surrendered is more than one year. If, however, the holder constructively owns shares of Columbia Trust common stock that are exchanged for shares of AmericanWest common stock in the Merger or owns shares of AmericanWest common stock actually or constructively after the Merger, the consequences to that holder may be similar to the consequences described below under the heading “Exchange for AmericanWest Common Stock and Cash,” except that the amount of consideration, if any, treated as a dividend may not be limited to the amount of that holder’s gain.

Exchange Solely for AmericanWest Common Stock. If pursuant to the Merger a holder exchanges all of his or her shares of Columbia Trust common stock solely for shares of AmericanWest common stock, that holder will not recognize any gain or loss except in respect of cash received in lieu of any fractional share of AmericanWest common stock (as discussed below). The aggregate adjusted tax basis of the shares of AmericanWest common stock received in the Merger will be equal to the aggregate adjusted tax basis of the shares of Columbia Trust common stock surrendered for the AmericanWest common stock (reduced by the tax basis allocable to any fractional share of AmericanWest common stock for which cash is received), and the holding period of the AmericanWest common stock will include the period during which the shares of Columbia Trust common stock were held. If a holder has differing bases or holding periods in respect of his or her shares of Columbia Trust common stock, the holder should consult his or her tax advisor prior to the exchange with regard to identifying the bases or holding periods of the particular shares of AmericanWest common stock received in the exchange.

Exchange for AmericanWest Common Stock and Cash. If pursuant to the Merger a holder exchanges all of his shares of Columbia Trust common stock for a combination of AmericanWest common stock and cash, the holder will generally recognize gain (but not loss) in an amount equal to the lesser of (1) the amount of gain realized (i.e., the excess of the sum of the amount of cash and the fair market value of the AmericanWest common stock received pursuant to the Merger over that holder’s adjusted tax basis in his or her shares of Columbia Trust common stock surrendered) and (2) the amount of cash received pursuant to the Merger. For this purpose, gain or loss must be calculated separately for each identifiable block of shares surrendered in the exchange, and a loss realized on one block of shares may not be used to offset a gain realized on another block of shares. Any recognized gain will generally be long-term capital gain if the holder’s holding period with respect to the Columbia Trust common stock surrendered is more than one year. If, however, the cash received has the effect of the distribution of a dividend, the gain would be treated as a dividend to the extent of the holder’s ratable share of accumulated earnings and profits as calculated for federal income tax purposes. See “Possible Treatment of Cash as a Dividend” below.

The aggregate tax basis of AmericanWest common stock received by a holder that exchanges his or her shares of Columbia Trust common stock for a combination of AmericanWest common stock and cash pursuant to the Merger will be equal to the aggregate adjusted tax basis of the shares of Columbia Trust common stock surrendered for AmericanWest common stock and cash, reduced by the amount of cash received by the holder pursuant to the Merger, and increased by the amount of gain (including any portion of the gain that is treated as a dividend as described below), if any, recognized by the holder on the exchange. The holding period of the AmericanWest common stock will include the holding period of the shares of Columbia Trust common stock surrendered. If a holder has differing bases or holding periods in respect of his or her shares of Columbia Trust common stock, the holder should consult his or her tax advisor prior to the exchange with regard to identifying the bases or holding periods of the particular shares of AmericanWest common stock received in the exchange.

Possible Treatment of Cash as a Dividend. In general, the determination of whether the gain recognized in the exchange will be treated as capital gain or has the effect of a distribution of a dividend depends upon whether and to what extent the exchange reduces the holder’s deemed percentage stock ownership of AmericanWest. For purposes of this determination, the holder is treated as if he or she first exchanged all of his or her shares of Columbia Trust common stock solely for AmericanWest common stock and then AmericanWest immediately

| | |

Columbia Trust Bancorp January 23, 2006 Page 4 | | KELLER ROHRBACKL.L.P. |

redeemed (the “deemed redemption”) a portion of the AmericanWest common stock in exchange for the cash the holder actually received. The gain recognized in the exchange followed by a deemed redemption will be treated as capital gain if the deemed redemption is (1) “substantially disproportionate” with respect to the holder or (2) “not essentially equivalent to a dividend.”

The deemed redemption, generally, will be “substantially disproportionate” with respect to a holder if the percentage described in (2) below is less than 80% of the percentage described in (1) below. Whether the deemed redemption is “not essentially equivalent to a dividend” with respect to a holder will depend upon the holder’s particular circumstances. At a minimum, however, in order for the deemed redemption to be “not essentially equivalent to a dividend,” the deemed redemption must result in a “meaningful reduction” in the holder’s deemed percentage stock ownership of AmericanWest. In general, that determination requires a comparison of (1) the percentage of the outstanding stock of AmericanWest that the holder is deemed actually and constructively to have owned immediately before the deemed redemption and (2) the percentage of the outstanding stock of AmericanWest that is actually and constructively owned by the holder immediately after the deemed redemption. In applying the above tests, a holder may, under the constructive ownership rules, be deemed to own stock that is owned by other persons or otherwise in addition to the stock actually owned by the holder. As these rules are complex, each holder that may be subject to these rules should consult his or her tax advisor. The IRS has ruled that a minority shareholder in a publicly held corporation whose relative stock interest is minimal and who exercises no control with respect to corporate affairs is considered to have a “meaningful reduction” if that shareholder has a relatively minor reduction in his or her percentage stock ownership under the above analysis.

Cash Received in Lieu of a Fractional Share. Cash received by a holder in lieu of a fractional share of AmericanWest common stock generally will be treated as received in redemption of the fractional share, and gain or loss generally will be recognized based on the difference between the amount of cash received in lieu of the fractional share and the portion of the holder’s aggregate adjusted tax basis of the share of Columbia Trust common stock surrendered allocable to the fractional share. Such gain or loss generally will be long-term capital gain or loss if the holding period for such shares of Columbia Trust common stock is more than one year.

Dissenting Shareholders. Holders of Columbia Trust common stock who dissent with respect to the Merger as discussed in “Dissenters’ Rights” beginning on page 71 of the Proxy Statement, and who receive cash in respect of their shares of Columbia Trust common stock will recognize capital gain equal to the difference between the amount of cash received and their aggregate tax basis in their shares.

Backup Withholding. Non-corporate shareholders of Columbia Trust may be subject to information reporting and backup withholding on any cash payments they receive. Shareholders will not be subject to backup withholding, however, if they:

| | • | | furnish a correct taxpayer identification number and certify that they are not subject to backup withholding on the substitute Form W-9 or successor form included in the election form/letter of transmittal they will receive; or |

| | • | | are otherwise exempt from backup withholding. |

Any amounts withheld under the backup withholding rules will be allowed as a refund or credit against a shareholder’s federal income tax liability, provided he or she furnishes the required information to the IRS.

Reporting Requirements. Shareholders who receive AmericanWest common stock as a result of the Merger will be required to retain records pertaining to the Merger and each shareholder will be required to file with his federal income tax return for the year in which the Merger takes place a statement setting forth certain facts relating to the Merger.

| | |

Columbia Trust Bancorp January 23, 2006 Page 5 | | KELLER ROHRBACKL.L.P. |

Columbia Trust and AmericanWest have not and will not seek any ruling from the IRS regarding any matters relating to the Merger, and as a result, there can be no assurance that the IRS will not disagree with or challenge any of the conclusions described herein.

THIS DISCUSSION DOES NOT ADDRESS TAX CONSEQUENCES THAT MAY VARY WITH, OR ARE CONTINGENT ON, INDIVIDUAL CIRCUMSTANCES. MOREOVER, IT DOES NOT ADDRESS ANY NON-INCOME TAX OR ANY FOREIGN, STATE OR LOCAL TAX CONSEQUENCES OF THE MERGER. TAX MATTERS ARE VERY COMPLICATED, AND THE TAX CONSEQUENCES OF THE MERGER TO AN COLUMBIA TRUST SHAREHOLDER WILL DEPEND UPON THE FACTS OF HIS OR HER PARTICULAR SITUATION. ACCORDINGLY, WE STRONGLY URGE YOU TO CONSULT WITH A TAX ADVISOR TO DETERMINE THE PARTICULAR FEDERAL, STATE, LOCAL OR FOREIGN INCOME OR OTHER TAX CONSEQUENCES TO YOU OF THE MERGER.

Our opinion is intended solely for the benefit of Columbia Trust and its respective shareholders, and may not be relied upon for any other purpose or by any other person or entity or made available to any other person or entity without our prior written consent.

We hereby consent to the filing of this opinion as an exhibit to the Proxy Statement/Prospectus and the reference to us in the certain Proxy Statement/Prospectus under the heading “THE MERGER – Certain Federal Income Tax Consequences.” By giving the foregoing consent, we do not admit that we come within the category of persons whose consent is required under Section 7 of the Securities Act of 1933, as amended, or the rules and regulations of the Securities and Exchange Commission thereunder.

Sincerely,

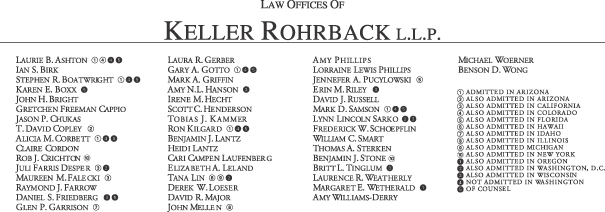

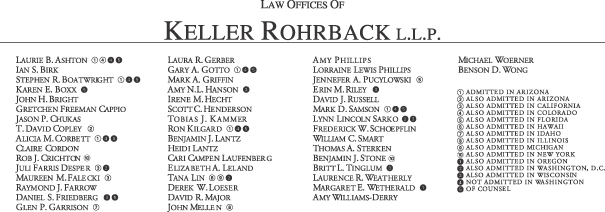

KELLER ROHRBACK L.L.P.