Exhibit 99.1

Office of the US Trustee—Region 18

Seattle, Washington

Monthly Reporting Requirements

Corporations and Partnerships

All Chapter 11 debtors (other than individuals) must serve the U.S. Trustee with the documents and reports identified below no later than the 15th day of the month following the end of the month covered by the report.

Debtor Name: AmericanWest Bancorporation

Case Number: 10-06097-PCW11

For the month of: April 2011

| | | | | | | | |

| | | Required Documents | | Document

Attached | | Previously

Submitted | | Explanation

Attached |

| 1. | | Income Statement (profit and loss statement). | | ( X ) | | ( ) | | ( ) |

| 2. | | Comparative Balance Sheet. | | ( X ) | | ( ) | | ( ) |

| 3. | | Statement of Cash Receipts and Disbursements. | | ( X ) | | ( ) | | ( ) |

| 4. | | Statement of Aged Receivables. | | ( X ) | | ( ) | | ( ) |

| 5. | | Statement of Aged Payables. | | ( X ) | | ( ) | | ( ) |

| 6. | | Statement of Operations, Taxes, Insurance and Personnel. | | ( X ) | | ( ) | | ( ) |

| 7. | | Other documents/reports as required by the U.S. Trustee: None | | ( ) | | ( ) | | ( ) |

The undersigned certifies under penalty of perjurty (28 U.S.C. § 1746) that the information contained in this and accompanying reports is complete, true and correct to the best of my knowledge, information and belief.

| | | | | | |

| | | |

| By: | | /s/ Shelly L. Krasselt | | | | Dated: May 6, 2011 |

| | Principal Accounting Officer Title of Debtor Representative | | | | |

| | | |

Office of the US Trustee—Region 18

Seattle, Washington

Debtor Name: AmericanWest Bancorporation

Case Number: 10-06097-PCW11

For the period: Refer to dates below

Basis of Accounting: Accrual

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Month Ending | |

| | | | | | November 30,

2010 | | | December 31,

2010 | | | January 31,

2011 | | | February 29,

2011 | | | March 31,

2011 | | | April 30,

2011 | |

| | | 10/28/10-10/31/10 | | | | | | | |

Income | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gain on sale of assets | | $ | — | | | $ | — | | | $ | 37,020 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | | | | | | |

Expenses | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Payroll/Officer Expenses | | $ | 1,909 | | | $ | 3,215 | | | $ | 1,970 | | | $ | 5,750 | | | $ | 3,660 | | | $ | 5,477 | | | $ | 3,069 | |

Occupancy | | | — | | | | 971 | | | | 595 | | | | | | | | — | | | | — | | | | — | |

Director Fees | | | — | | | | — | | | | 750 | | | | 2,500 | | | | 3,500 | | | | 2,500 | | | | 2,500 | |

Investor Relations | | | 692 | | | | 234 | | | | — | | | | — | | | | — | | | | — | | | | — | |

Service Contracts | | | — | | | | 89 | | | | — | | | | — | | | | — | | | | — | | | | — | |

Ongoing Professional costs | | | — | | | | 1,646 | | | | 2,334 | | | | 12,298 | | | | 5,529 | | | | 3,995 | | | | 3,922 | |

Professionals | | | — | | | | — | | | | 65,179 | | | | | | | | — | | | | — | | | | — | |

Interest Expense DIP loan | | | — | | | | 1,700 | | | | 4,038 | | | | — | | | | — | | | | — | | | | — | |

Loan Fee | | | — | | | | 100,000 | | | | — | | | | — | | | | — | | | | — | | | | — | |

Special Cousel | | | — | | | | 332,726 | | | | 162,000 | | | | 16,000 | | | | 15,381 | | | | 2,000 | | | | 5,689 | |

Debtor’s Counsel | | | — | | | | 75,540 | | | | 50,854 | | | | 24,139 | | | | 20,549 | | | | 17,217 | | | | 12,196 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Expenses | | $ | 2,601 | | | $ | 516,121 | | | $ | 287,719 | | | $ | 60,687 | | | $ | 48,620 | | | $ | 31,189 | | | $ | 27,375 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Loss | | $ | (2,601 | ) | | $ | (516,121 | ) | | $ | (250,699 | ) | | $ | (60,687 | ) | | $ | (48,620 | ) | | $ | (31,189 | ) | | $ | (27,375 | ) |

Office of the US Trustee—Region 18

Seattle, Washington

Debtor Name: AmericanWest Bancorporation

Case Number: 10-06097-PCW11

Comparative Balance Sheet

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 10/31/2010 | | | 11/30/2010 | | | 12/31/2010 | | | 1/31/2011 | | | 2/28/2011 | | | 3/31/2011 | | | 4/30/2011 | |

Assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Current Assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cash | | $ | 97,345 | | | $ | 6,988,798 | | | $ | 6,098,902 | | | $ | 5,910,113 | | | $ | 5,896,209 | | | $ | 5,827,500 | | | $ | 5,812,289 | |

Investment in WIN Partners | | $ | 100,000 | | | $ | 100,000 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Current Assets | | $ | 197,345 | | | $ | 7,088,798 | | | $ | 6,098,902 | | | $ | 5,910,113 | | | $ | 5,896,209 | | | $ | 5,827,500 | | | $ | 5,812,289 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Accounts/Dividend Receivable | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Accrued Dividend Receivable—TRUPS prepetition | | $ | 184,842 | | | $ | 184,842 | | | $ | 184,842 | | | $ | 184,842 | | | $ | 184,842 | | | $ | 184,842 | | | $ | 184,842 | |

Accrued Dividend Receivable—TRUPS postpetition | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Accounts Receivable | | $ | 184,842 | | | $ | 184,842 | | | $ | 184,842 | | | $ | 184,842 | | | $ | 184,842 | | | $ | 184,842 | | | $ | 184,842 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Other Assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Dashiell Insurance Policy Assignment of Benefits | | $ | 160,797 | | | $ | 160,797 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

Real Property—Prosser Building and Land | | $ | 202,184 | | | $ | 202,184 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

Investment in AmericanWest Bank | | $ | 6,000,000 | | | $ | 6,000,000 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

Investment in TRUPS | | $ | 1,239,000 | | | $ | 1,239,000 | | | $ | 1,239,000 | | | $ | 1,239,000 | | | $ | 1,239,000 | | | $ | 1,239,000 | | | $ | 1,239,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Other Assets | | $ | 7,601,981 | | | $ | 7,601,981 | | | $ | 1,239,000 | | | $ | 1,239,000 | | | $ | 1,239,000 | | | $ | 1,239,000 | | | $ | 1,239,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Assets | | $ | 7,984,167 | | | $ | 14,875,621 | | | $ | 7,522,744 | | | $ | 7,333,956 | | | $ | 7,320,051 | | | $ | 7,251,343 | | | $ | 7,236,131 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Liabilities | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Postpetition Liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Accounts Payable | | $ | 692 | | | $ | 408,266 | | | $ | 306,089 | | | $ | 177,988 | | | $ | 212,703 | | | $ | 175,184 | | | $ | 187,347 | |

Debtor in Possession Loan to SKBHC Hawks Nest | | $ | — | | | $ | 850,000 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

Stalking Horse Bid Deposit | | $ | — | | | $ | 6,150,000 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Postpetition

Liabilities | | $ | 692 | | | $ | 7,408,266 | | | $ | 306,089 | | | $ | 177,988 | | | $ | 212,703 | | | $ | 175,184 | | | $ | 187,347 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Prepetition Liabilities | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Accounts Payable | | $ | 1,337 | | | $ | 1,337 | | | $ | 1,337 | | | $ | 1,337 | | | $ | 1,337 | | | $ | 1,337 | | | $ | 1,337 | |

Notes Payable | | $ | 41,239,000 | | | $ | 41,239,000 | | | $ | 41,239,000 | | | $ | 41,239,000 | | | $ | 41,239,000 | | | $ | 41,239,000 | | | $ | 41,239,000 | |

Accrued Dividend Payable | | $ | 6,152,827 | | | $ | 6,152,827 | | | $ | 6,152,827 | | | $ | 6,152,827 | | | $ | 6,152,827 | | | $ | 6,152,827 | | | $ | 6,152,827 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Prepetition Liabilities | | $ | 47,393,164 | | | $ | 47,393,164 | | | $ | 47,393,164 | | | $ | 47,393,164 | | | $ | 47,393,164 | | | $ | 47,393,164 | | | $ | 47,393,164 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Liabilities | | $ | 47,393,856 | | | $ | 54,801,430 | | | $ | 47,699,253 | | | $ | 47,571,152 | | | $ | 47,605,867 | | | $ | 47,568,348 | | | $ | 47,580,511 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Owner Equity | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Preferred Stock | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

Common Stock | | $ | 253,482,472 | | | $ | 253,482,472 | | | $ | 253,482,472 | | | $ | 253,482,472 | | | $ | 253,482,472 | | | $ | 253,482,472 | | | $ | 253,482,472 | |

Retained Deficit | | $ | (292,892,160 | ) | | $ | (293,408,281 | ) | | $ | (293,658,981 | ) | | $ | (293,719,668 | ) | | $ | (293,768,288 | ) | | $ | (293,799,477 | ) | | $ | (293,826,852 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Owner Equity | | $ | (39,409,689 | ) | | $ | (39,925,809 | ) | | $ | (40,176,509 | ) | | $ | (40,237,196 | ) | | $ | (40,285,816 | ) | | $ | (40,317,005 | ) | | $ | (40,344,380 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Liabilities and Equity | | $ | 7,984,167 | | | $ | 14,875,621 | | | $ | 7,522,744 | | | $ | 7,333,956 | | | $ | 7,320,051 | | | $ | 7,251,343 | | | $ | 7,236,131 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Office of the US Trustee—Region 18

Seattle, Washington

Debtor Name: AmericanWest Bancorporation

Case Number: 10-06097-PCW11

Statement of Cash Receipts

For the Month Ending: April 30, 2011

Cash Receipts

| | | | | | |

Date | | Description (Source) | | Amount | |

| | Beginning Cash Balance | | $ | 5,827,500.42 | |

| | | | $ | — | |

| | | | | | |

| | Total Cash Receipts | | $ | — | |

| | | | | | |

Office of the US Trustee—Region 18

Seattle, Washington

Debtor Name: AmericanWest Bancorporation

Case Number: 10-06097-PCW11

Statement of Cash Disbursements

For the Month Ending: April 30, 2011

Cash Disbursements

| | | | | | | | | | |

Date | | Check No. | | Payee | | Description | | Amount | |

| 4/1/2011 | | 1031 | | Patrick J. Rusnak | | Dec - Feb Services Rendered | | $ | 2,053.81 | |

| 4/1/2011 | | 1032 | | Shelly L. Krasselt | | Dec - mid March Services Rendered | | $ | 2,312.45 | |

| 4/1/2011 | | 1033 | | Jay B. Simmons | | Dec - Feb Services Rendered | | $ | 3,392.86 | |

| 4/1/2011 | | 1034 | | Denise Sloon | | Payroll Services Rendered | | $ | 175.00 | |

| 4/8/2011 | | 1035 | | RR Donnelley | | EDGAR Preparation and Transmission Fees | | $ | 443.00 | |

| 4/8/2011 | | 1036 | | IST Shareholder Services | | Transfer Agent Service Fees for April | | $ | 1,333.88 | |

| 4/9/2011 | | 1037 | | US Trustee - 8021006097 | | Quarterly Trustee Payment | | $ | 1,950.00 | |

| 4/29/2011 | | 1038 | | J. Frank Armijo | | April Retainer Board of Director Fees | | $ | 500.00 | * |

| 4/29/2011 | | 1039 | | Kay C. Carnes | | April Retainer Board of Director Fees | | $ | 500.00 | * |

| 4/29/2011 | | 1040 | | Craig D. Eerkes | | April Retainer Board of Director Fees | | $ | 500.00 | * |

| 4/29/2011 | | 1041 | | Donald H. Swartz | | April Retainer Board of Director Fees | | $ | 500.00 | * |

| 4/29/2011 | | 4042 | | P. Mike Taylor | | April Retainer Board of Director Fees | | $ | 500.00 | * |

| 4/29/2011 | | Wire | | Morrison Foerester | | March Services Rendered | | $ | 1,030.80 | |

| 4/29/2011 | | Wire | | AmericanWest Bank | | Wire Transfer Fees | | $ | 20.00 | |

| | | | | | | | | | |

Total Cash Disbursements | | $ | 15,211.80 | |

| | | | | | | | | | |

| |

Adjustments (explain) | | $ | — | |

| |

Ending Cash Balance (must be reconcile to the bank statement for account cited above) | | $ | 5,812,288.62 | |

* Noted amounts have not yet cleared the bank statement. Items below remain outstanding from prior months:

| | | | | | | | | | |

Date | | Check No. | | Payee | | Description | | Amount | |

| 1/25/2011 | | 1009 | | J. Frank Armijo | | January 2011 Board Fees | | | 500.00 | |

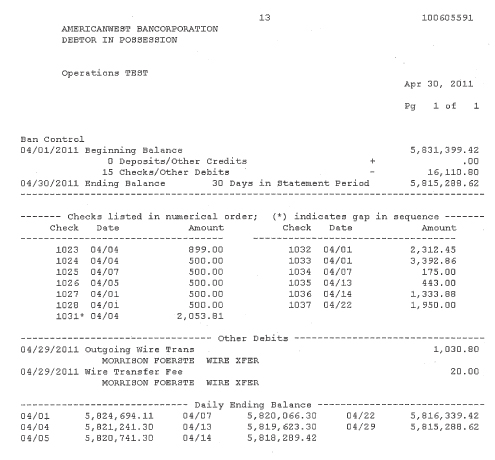

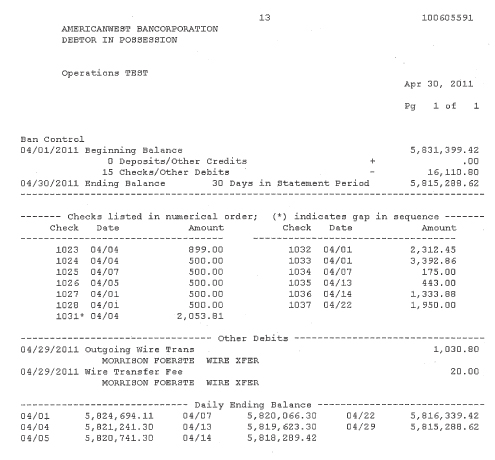

AMERICANWEST BANCORPORATION

100605591

DEBTOR IN POSSESSION

Operations TEST

Apr 30, 2011

Pg 1 of 1

Ban Control

04/01/2011 Beginning Balance 5,831,399.42

0 Deposits/Other Credits + .00

15 Checks/Other Debits – 16,110.80

04/30/2011 Ending Balance 30 Days in statement Period 5,815,288.62

Checks listed in numerical order; (*) indicates gap in sequence

Check Date Amount Check Date Amount

1023 04/04 899.00 1032 04/01 2,312.45

1024 04/04 500.00 1033 04/01 3,392.86

1025 04/07 500.00 1034 04/07 175.00

1026 04/05 500.00 1035 04/13 443.00

1027 04/01 500.00 1036 04/14 1,333.88

1028 04/01 500.00 1037 04/22 1,950.00

1031* 04/04 2,053.81

Other Debits

04/29/2011 Outgoing Wire Trans 1,030.80

MORRISON FOERSTE WIRE XFER

04/29/2011 Wire Transfer fee 20.00

MORRISON FOERSTE WIRE XFER

Daily Ending Balance

04/01 5,824,694.11 04/07 5,820,066.30 04/22 5,816,339.42

04/04 5,821,241.30 04/13 5,819,623.30 04/29 5,815,288.62

04/05 5,820,741.30 04/14 5,818,289.42

Office of the US Trustee—Region 18

Seattle, Washington

Debtor Name: AmericanWest Bancorporation

Case Number: 10-06097-PCW11

Statement of Aged Receivables

For the month ending April 30, 2011

| | | | | | | | | | | | | | | | | | |

Total Due | | | Current

(0-30 Days) | | | Past Due

(31-60 Days) | | | Past Due

(61-90 Days) | | | Past Due

(91 & Over) | |

| | Prepetition | | | | | | | | | | | | | | | | | |

| $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | Postpetition | | | | | | | | | | | | | | | | | |

| $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | Totals | | | | | | | | | | | | | | | | | |

| $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | |

| Accounts Receivable Reconciliation | | | | | | | | | |

| Opening Balance | | | $ | — | | | | | |

| New Accounts this Month | | | $ | — | | | | | |

| Balance | | | $ | — | | | | | |

| Amount Collected on Prior Accounts | | | $ | — | | | | | |

| Closing Balance | | | $ | — | | | | | |

| Check Figure | | | $ | — | | | | | |

Office of the US Trustee—Region 18

Seattle, Washington

Debtor Name: AmericanWest Bancorporation

Case Number: 10-06097-PCW11

Statement of Aged Payables

For the month ending April 30, 2011

NOTE: Schedule only includes postpetition debts.

| | | | | | | | | | | | | | | | | | | | | | |

Account Name | | Description | | Total Due | | | Current

(0-30 Days) | | | Past Due

(31-60 Days) | | | Past Due

(61-90 Days) | | | Past Due

(91 & Over) | |

| | Foster Pepper | | $ | 62,232 | | | $ | 12,196 | | | $ | 17,218 | | | $ | 3,970 | | | $ | 28,847 | |

| | Morrison Foerster | | $ | 102,521 | | | $ | 6,400 | | | $ | 258 | | | $ | 3,210 | | | $ | 92,654 | |

| | Sandler O’Neil | | $ | 13,000 | | | $ | — | | | $ | — | | | $ | — | | | $ | 13,000 | |

| | Taxing authorities for payroll taxes withheld and accrued | | $ | 2,634 | | | $ | 2,634 | | | $ | — | | | $ | — | | | $ | — | |

| | Patrick J. Rusnak Services Performed | | $ | 700 | | | $ | 25 | | | $ | 675 | | | $ | — | | | $ | — | |

| | Jay Simmons Services Performed | | $ | 4,100 | | | $ | 700 | | | $ | 3,400 | | | $ | — | | | $ | — | |

| | Shelly L. Krasselt Services Performed | | $ | 2,160 | | | $ | 1,360 | | | $ | 800 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | | | | | | | |

| | Totals | | $ | 187,347 | | | $ | 23,315 | | | $ | 22,351 | | | $ | 7,180 | | | $ | 134,501 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | Accounts Payable Reconciliation | | | | | | | | | | | | | | | | | | | | |

| | Opening Balance | | $ | 175,184 | | | | | | | | | | | | | | | | | |

| | Total New Indebtedness Incurred this Month | | $ | 20,708 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | Balance | | $ | 195,892 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | Amount paid on Prior Accounts Payable | | $ | 8,545 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | Closing Balance | | $ | 187,347 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

Office of the US Trustee—Region 18

Seattle, Washington

Statement of Operations, Taxes, Insurance and Personnel

For the Month Ending: April 30, 2011

Debtor Name: AmericanWest Bancorporation

Case Number: 10-06097-PCW11

1. What efforts have been made toward presentation of a plan to the creditors?

AmericanWest Bancorporation filed its proposed Plan and Disclosure Statement on March 15, 2011. The one objection to the disclosure statement has been resolved and Court approval of the disclosure statement is scheduled for May 12, 2011. The tentative date for the hearing on confirmation of the plan is June 30, 2011.

2. Has the Debtor in Possession, subsequent to the filing of the petition, made any payments on its prepetition unsecured debt, except as have been authorized by the Court?

: Yes

X : No Identify amount, who was paid and the date paid: N/A

3. Provide a narrative report of significant events and events out of the ordinary course of business:

Sandler O’Neil, the debtor’s financial advisor, has filed a motion for allowance of administrative claim in an unspecified amount. If allowed, such a claim could delay or reduce distribution to other creditors under the plan. This situation is discussed in the disclosure statement.

4. List any payments during this period on debt that has been personally guaranteed by any principal, partner or officer of the business.

None

5. If assets have been sold in other than the ordinary course of business, please provide details as to the asset sold, date of sale, total sales price, deductions (i.e. commissions), and net amount received.

None

6. STATUS OF TAXES

| | | | | | | | | | | | | | | | |

| �� | | AMOUNT

WITHHELD OR

ACCRUED | | | AMOUNT

PAID | | | DATE

PAID | | POSTPETITION

TAXES PAST

DUE | |

FEDERAL TAXES | | | | | | | | | | | |

| | | | |

FICA | | $ | 1,284 | | | $ | — | | | N/A | | $ | — | |

Withholding | | $ | 1,123 | | | $ | — | | | N/A | | $ | — | |

Unemployment | | $ | — | | | $ | — | | | N/A | | $ | — | |

Income | | $ | — | | | $ | — | | | N/A | | $ | — | |

Other | | $ | — | | | $ | — | | | N/A | | $ | — | |

| | | |

STATE TAXES | | | | | | | | | | | |

| | | | |

Dept. of Labor and Industries | | $ | — | | | $ | — | | | N/A | | $ | — | |

Income | | $ | 227 | | | $ | — | | | N/A | | $ | — | |

Employment Sec. | | $ | — | | | $ | — | | | N/A | | $ | — | |

Dept. of Revenue | | $ | — | | | $ | — | | | N/A | | $ | — | |

B&O | | $ | — | | | $ | — | | | N/A | | $ | — | |

Sales | | $ | — | | | $ | — | | | N/A | | $ | — | |

Excise | | $ | — | | | $ | — | | | N/A | | $ | — | |

| | | | |

OTHER TAXES | | | | | | | | | | | | | | |

| | | | |

City Business/License | | $ | — | | | $ | — | | | N/A | | $ | — | |

Personal Property | | $ | — | | | $ | — | | | N/A | | $ | — | |

Real Property | | $ | — | | | $ | — | | | N/A | | $ | — | |

Other (List) | | $ | — | | | $ | — | | | N/A | | $ | — | |

Explain reason for any past due postpetition taxes:

N/A

7. SCHEDULE OF SALARY AND OTHER PAYMENTS TO PRINCIPALS / EXECUTIVES / INSIDERS*

| | | | | | | | |

Payee Name | | Position | | Nature of Payment | | Amount** | |

Patrick J. Rusnak | | CEO and President | | Services Performed | | $ | 25 | |

Jay Simmons | | EVP, General Counsel and Secretary | | Services Performed | | $ | 700 | |

Shelly L. Krasselt | | Principal Accounting Officer | | Services Performed | | $ | 1,360 | |

*List accrued salaries whether or not paid and any draws of any kind or perks such as car, etc. made to or for the benefit of any proprietor, owner, partner, shareholder, officer, director or insider.

** Amounts shown are for the month ending April 30, 2011.

8. SCHEDULE OF PAYMENTS TO ATTORNEYS AND OTHER PROFESSIONALS

| | | | | | | | | | | | | | | | | | | | |

| | | Appointment Date | | | Amount Paid This Month | | | Date of

Court

Approval | | | Aggregate

Received | | | Estimated

Balance Due | |

Debtor’s Counsel | | | 11/17/2010 | | | $ | — | | | | * | | | $ | 137,568 | | | $ | 62,232 | |

Counsel For Unsecured Creditors’ Committee | | | | | | $ | — | | | | | | | $ | — | | | $ | — | |

Trustee’s Counsel | | | | | | $ | — | | | | | | | $ | — | | | $ | — | |

Accountant | | | | | | $ | — | | | | | | | $ | — | | | $ | — | |

Special Counsel | | | 11/2/2010 | | | $ | 1,031 | | | | * | | | $ | 431,971 | | | $ | 102,521 | |

Financial Advisor | | | 11/2/2010 | | | $ | — | | | | * | | | $ | 52,179 | | | $ | 13,000 | |

*Paid per 12/14/2010 interim payment order.

Identify fees accrued but not paid during the month: Debtors Counsel $12,196; Special Counsel $6,400.

9. Please explain any changes in insurance coverage that took place this month.

None

10. Personnel

| | | | | | |

| | | Full Time | | Part Time | |

Total number of employees at beginning of period | | 0 | | | 3 | |

Number hired during the period | | 0 | | | 0 | |

Number terminated or resigned during the period | | 0 | | | 0 | |

Total number of employees on payroll at period end | | 0 | | | 3 | |

| | |

Total payroll for the period | | $2,085 | | | | |