| ¢ | Value Line Centurion Fund, Inc. |

| | |

| Financial Highlights |

Selected data for a share of capital stock outstanding throughout each period:

| | | Six Months Ended | | | | | | | | | | | |

| | | June 30, 2011 | | Years Ended December 31, | |

| | | (Unaudited) | | 2010 | | 2009 | | 2008 | | 2007 | | 2006 | |

| Net asset value, beginning of period | | | $ | 11.96 | | | $ | 9.72 | | $ | 8.75 | | $ | 21.36 | | $ | 18.96 | | $ | 20.07 | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | | |

| Net investment income/(loss) | | | | — | (3) | | | — | (3) | | (0.01 | ) | | (0.03 | ) | | (0.02 | ) | | (0.05 | ) |

| Net gains or (losses) on securities (both realized and unrealized) | | | | 1.65 | | | | 2.48 | | | 0.98 | | | (9.09 | ) | | 3.89 | | | 0.63 | |

| Total from investment operations | | | | 1.65 | | | | 2.48 | | | 0.97 | | | (9.12 | ) | | 3.87 | | | 0.58 | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | | — | | | | (0.01 | ) | | — | | | — | | | — | | | — | |

| Distributions from net realized gains | | | | — | | | | (0.23 | ) | | — | | | (3.49 | ) | | (1.47 | ) | | (1.69 | ) |

| Total distributions | | | | — | | | | (0.24 | ) | | — | | | (3.49 | ) | | (1.47 | ) | | (1.69 | ) |

| Net asset value, end of period | | | $ | 13.61 | | | $ | 11.96 | | $ | 9.72 | | $ | 8.75 | | $ | 21.36 | | $ | 18.96 | |

| Total return* | | | | 13.99 | %(4) | | | 25.75 | % | | 11.09 | % | | (49.27 | ) % | | 20.72 | % | | 3.85 | % |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | | $ | 148,006 | | | $ | 134,719 | | $ | 124,701 | | $ | 127,166 | | $ | 291,949 | | $ | 283,836 | |

Ratio of expenses to average net assets(1) | | | | 1.02 | % (5) | | | 1.05 | % (6) | | 1.06 | % | | 1.00 | % | | 0.96 | % | | 0.98 | % |

Ratio of expenses to average net assets(2) | | | | 0.87 | % (5) | | | 0.85 | % (7) | | 0.91 | % | | 0.84 | % | | 0.79 | % | | 0.89 | % |

| Ratio of net investment income/(loss) to average net assets | | | | (0.04 | )% (5) | | | 0.09 | % | | (0.08 | ) % | | (0.19 | )% | | (0.09 | )% | | (0.24 | )% |

| Portfolio turnover rate | | | | 15 | % (4) | | | 27 | % | | 121 | % | | 272 | % | | 200 | % | | 220 | % |

| * | Total returns do not reflect the effects of charges deducted under the terms of Guardian Insurance and Annuity Company, Inc.’s (GIAC) variable contracts. Including such charges would reduce the total returns for all periods shown. |

| (1) | Ratio reflects expenses grossed up for custody credit arrangement and grossed up for the waiver of a portion of the service and distribution plan fees by the Distributor. The ratio of expenses to average net assets net of custody credits, but exclusive of the fee waivers, would have been 0.99% and 0.95% for the years ended December 31, 2008 and December 31, 2007, respectively, and would not have changed for the other periods shown. |

| (2) | Ratio reflects expenses net of the custody credit arrangement and net of the waiver of the service and distribution plan fees by the Distributor. |

| (3) | Amount is less than $.01 per share. |

| (4) | Not annualized. |

| (5) | Annualized. |

| (6) | Ratio reflects expenses grossed up for the reimbursement by Value Line, Inc. of certain expenses incurred by the Fund. |

| (7) | Ratio reflects expenses net of the reimbursement of Expenses by Value Line, Inc. |

| 8 | See Notes to Financial Statements. |

| ¢ | Value Line Centurion Fund, Inc. |

| | |

| Notes to Financial Statements |

| |

| June 30, 2011 (Unaudited) |

| 1. | Significant Accounting Policies |

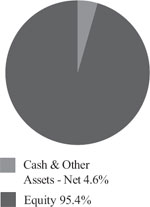

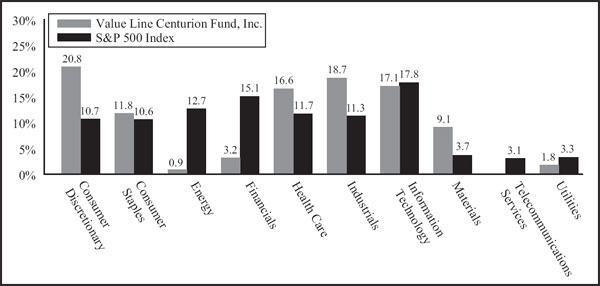

Value Line Centurion Fund, Inc. (the “Fund”) is an open-end diversified management investment company registered under the Investment Company Act of 1940, as amended, whose primary investment objective is long-term growth of capital. The Fund’s portfolio will usually consist of common stocks ranked 1, 2 or 3 for year-ahead performance by the Value Line Timeliness Ranking System.

The following significant accounting policies are in conformity with generally accepted accounting principles for investment companies. Such policies are consistently followed by the Fund in the preparation of its financial statements. Generally accepted accounting principles require management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results may differ from those estimates.

(A) Security Valuation

Securities listed on a securities exchange are valued at the closing sales prices on the date as of which the net asset value is being determined. Securities traded on the NASDAQ Stock Market are valued at the NASDAQ Official Closing Price. In the absence of closing sales prices for such securities and for securities traded in the over-the-counter market, the security is valued at the midpoint between the latest available and representative asked and bid prices. Short-term instruments with maturities 60 days or less at the date of purchase are valued at amortized cost, which approximates market value. Short-term instruments with maturities greater than 60 days at the date of purchase are valued at the midpoint between the latest available and representative asked and bid prices, and commencing 60 days prior to maturity such securities are valued at amortized cost. Securities for which market quotations are not readily available or that are not readily marketable and all other assets of the Fund are valued at fair value as the Board of Directors may determine in good faith. In addition, the Fund may use the fair value of a security when the closing market price on the primary exchange where the security is traded no longer accurately reflects the value of a security due to factors affecting one or more relevant securities markets or the specific issuer.

(B) Fair Value Measurements

The Fund follows fair valuation accounting standards (FASB ASC 820-10) which establish a definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion of changes in valuation techniques and related inputs during the period.

These inputs are summarized in the three broad levels listed below:

| | |

| ● | Level 1 — Inputs that reflect unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access at the measurement date; |

| Level 2 — Inputs other than quoted prices that are observable for the asset or liability either directly or indirectly, including inputs in markets that are not considered to be active; |

| Level 3 — Inputs that are unobservable. |

Transfers between investment levels may occur as the markets fluctuate and/or the availability of data used in an investment’s valuation changes. The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following table summarizes the inputs used to value the Fund’s investments in securities as of June 30, 2011:

| | | | | | | | | | | | | |

| Investments in Securities: | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Assets | | | | | | | | | | | | |

| Common Stocks | | $ | 141,224,309 | | | $ | 0 | | | $ | 0 | | | $ | 141,224,309 | |

| Short-Term Investments | | | 0 | | | | 4,000,000 | | | | 0 | | | | 4,000,000 | |

| Total Investments in Securities | | $ | 141,224,309 | | | $ | 4,000,000 | | | $ | 0 | | | $ | 145,224,309 | |

The Fund follows the updated provisions surrounding fair value measurements and disclosures on transfers in and out of all levels of the fair value hierarchy on a gross basis and the reasons for the transfers as well as to disclosures about the valuation techniques and inputs used to measure fair value for investments that fall in either Level 2 or Level 3 fair value hierarchy.

For the six months ended June 30, 2011, there was no significant transfer activity between Level 1 and Level 2.

For the six months ended June 30, 2011, there were no Level 3 investments. The Schedule of Investments includes a breakdown of the Schedule’s investments by category.

(C) Repurchase Agreements

In connection with transactions in repurchase agreements, the Fund’s custodian takes possession of the underlying collateral securities, the value of which exceeds the principal amount of the repurchase transaction, including accrued interest. To the extent that any repurchase transaction exceeds one business day, it is the Fund’s policy to mark-to-market on a daily basis to ensure the adequacy of the collateral. In the event of default of the obligation to repurchase, the Fund has the right to liquidate the collateral and apply the proceeds in satisfaction of the obligation. Under certain circumstances, in the event of default or bankruptcy by the other party to the agreement, realization and/or retention of the collateral or proceeds may be subject to legal proceedings.

| ¢ | Value Line Centurion Fund, Inc. |

| | |

| Notes to Financial Statements (Continued) |

| |

| June 30, 2011 (Unaudited) |

(D) Federal Income Taxes

It is the policy of the Fund to qualify as a regulated investment company by complying with the provisions available to regulated investment companies, as defined in applicable sections of the Internal Revenue Code, and to distribute all of its investment income and capital gains to its shareholders. Therefore, no provision for federal income tax is required.

(E) Dividends and Distributions

It is the Fund’s policy to distribute to its shareholders, as dividends and as capital gains distributions, all the net investment income for the year and all the net capital gains realized by the Fund, if any. Such distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. All dividends or distributions will be payable in shares of the Fund at the net asset value on the ex-dividend date. This policy is, however, subject to change at any time by the Board of Directors.

(F) Securities Transactions and Income

Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Interest income on investments, adjusted for amortization of discount and premium, if applicable, is earned from settlement date and recognized on the accrual basis. Dividend income is recorded on the ex-dividend date.

(G) Foreign Currency Translation

The books and records of the Fund are maintained in U.S. dollars. Assets and liabilities which are denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange on the valuation date. The Fund does not isolate changes in the value of investments caused by foreign exchange rate differences from the changes due to other circumstances.

Income and expenses are translated to U.S. dollars based upon the rates of exchange on the respective dates of such transactions.

Net realized foreign exchange gains or losses arise from currency fluctuations realized between the trade and settlement dates on securities transactions, the differences between the U.S. dollar amounts of dividends, interest, and foreign withholding taxes recorded by the Fund, and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities, other than investments, at the end of the fiscal period, resulting from changes in the exchange rates. The effect of the change in foreign exchange rates on the value of investments is included in realized gain/loss on investments and change in net unrealized appreciation/depreciation on investments.

(H) Representations and Indemnifications

In the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

(I) Foreign Taxes

The Fund may be subject to foreign taxes on income, gains on investments, or currency repatriation, a portion of which may be recoverable. The Fund will accrue such taxes and recoveries as applicable, based upon its current interpretation of tax rules and regulations that exist in the markets in which it invests.

(J) Subsequent Events

Management has evaluated all subsequent transactions and events through the date on which these financial statements were issued, and except as already included in the notes to these financial statements, has determined that no additional items require disclosure.

| ¢ | Value Line Centurion Fund, Inc. |

| | |

| Notes to Financial Statements (Continued) |

| | |

| June 30, 2011 (Unaudited) |

| 2. | Capital Share Transactions, Dividends and Distributions |

Shares of the Fund are available to the public only through the purchase of certain contracts issued by The Guardian Insurance and Annuity Company, Inc. (GIAC). Transactions in capital stock were as follows:

| | | | | | | |

| | | Six Months Ended June 30, 2011 (unaudited) | | | Year Ended December 31, 2010 | |

| Shares sold | | | 367,414 | | | | 409,296 | |

| Shares issued in reinvestment of distributions | | | — | | | | 282,239 | |

| Shares redeemed | | | (757,807 | ) | | | (2,254,801 | ) |

| Net decrease | | | (390,393 | ) | | | (1,563,266 | ) |

| Dividends per share from net investment income | | $ | — | | | $ | 0.0095 | |

| Distribution per share from net realized gain | | $ | — | | | $ | 0.2259 | |

| 3. | Purchases and Sales of Securities |

Purchases and sales of investment securities, excluding short-term securities, were as follows:

| | | | | |

| | | Six Months Ended June 30, 2011 (unaudited) | |

| PURCHASES: | | | | |

| Investment Securities | | $ | 20,115,038 | |

| SALES: | | | | |

| Investment Securities | | $ | 23,670,741 | |

At June 30, 2011, information on the tax components of capital is as follows:

| | | | | |

| Cost of investments for tax purposes | | $ | 93,214,881 | |

| Gross tax unrealized appreciation | | $ | 52,666,785 | |

| Gross tax unrealized depreciation | | ($ | 657,357 | ) |

| Net tax unrealized appreciation on investments | | $ | 52,009,428 | |

| 5. | Investment Advisory Fee, Service and Distribution Fees and Transactions With Affiliates |

An advisory fee of $353,273 was paid or payable to EULAV Asset Management (the “Adviser”) for the six months ended June 30, 2011. This was computed at an annual rate of 0.50% of the average daily net assets of the Fund during the period and paid monthly. The Adviser provides research, investment programs, supervision of the investment portfolio and pays costs of administrative services, office space, equipment and compensation of administrative, bookkeeping, and clerical personnel necessary for managing the affairs of the Fund. The Adviser also provides persons, satisfactory to the Fund’s Board of Directors, to act as officers and employees of the Fund and pays their salaries.

The Fund has a Service and Distribution Plan (the “Plan”), adopted pursuant to Rule 12b-1 under the Investment Company Act of 1940, which compensates EULAV Securities LLC (the “Distributor”) for advertising, marketing and distributing the Fund’s shares and for servicing the Fund’s shareholders at an annual rate of 0.40% of the Fund’s average daily net assets. For the six months ended June 30, 2011, fees amounting to $282,619, before fee waivers, were accrued under the Plan. Effective May 23, 2006 the Distributor waived 0.15% of the 12b-1 fee. Effective May 1, 2007 through April 30, 2012, the Distributor contractually agreed to reduce the fee under the Plan by 0.15% for one year periods. For the six months ended June 30, 2011, the fees waived amounted to $105,982. The Distributor has no right to recoup previously waived amounts.

For the six months ended June 30, 2011, the Fund’s expenses were reduced by $142 under a custody credit arrangement with the custodian.

Direct expenses of the Fund are charged to the Fund while common expenses of the Value Line Funds are allocated proportionately based upon the Funds’ respective net assets. The Fund bears all other costs and expenses.

Certain officers and a Trustee of the Adviser are also officers and a director of the Fund.

| ¢ | Value Line Centurion Fund, Inc. |

| | |

| Form N-Q |

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities, and information regarding how the Fund voted these proxies for the 12-month period ended June 30 is available through the Fund’s website at http://www.vlfunds.com and on the SEC’s website at http://www.sec.gov. The description of the policies and procedures is also available without charge, upon request, by calling 1-800-243-2729.