- ES Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Eversource Energy (ES) DEF 14ADefinitive proxy

Filed: 23 Mar 18, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

| Eversource Energy | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

![]()

2018 ANNUAL MEETING OF SHAREHOLDERS

Dear Fellow Shareholders:

On behalf of the Board of Trustees and employees of Eversource Energy, it is my pleasure to invite you to attend the 2018 Annual Meeting of Shareholders of Eversource Energy, which will be held on Wednesday, May 2, 2018, at 10:30 a.m., at the Sheraton Boston Hotel, 39 Dalton Street, Boston, Massachusetts 02199.

Please see the accompanying Notice of Annual Meeting of Shareholders and proxy statement for information on the matters to be acted upon at the meeting. Our meeting agenda will also include a discussion of the operations of the Eversource Energy system companies and an opportunity for your questions.

In 2017, we continued to achieve very positive financial and operating performance results:

Three of our Trustees, John S. Clarkeson, Charles K. Gifford, and Paul A. La Camera, will retire from the Board effective on the date of our Annual Meeting. We thank them for their exceptional service to the Board and the Company.

When I became your Chief Executive Officer in 2016, I set a goal for Eversource Energy to be known as the best energy company in the country by the year 2020. We made great progress last year toward achieving that goal, and intend to continue to make great progress in 2018.

On behalf of your Board of Trustees, I thank you for your continued support of Eversource Energy.

| Very truly yours,

James J. Judge |

March 23, 2018

![]()

Notice of Annual Meeting of Shareholders |

| DATE: | Wednesday, May 2, 2018 | |

| TIME: | 10:30 a.m. | |

| PLACE: | Sheraton Boston Hotel, 39 Dalton Street, Boston, Massachusetts 02199 |

Business Items/Agenda

Adjournments and Postponements

The business items to be considered at the Annual Meeting may be considered at the meeting or following any adjournment or postponement of the meeting.

Record Date

You are entitled to vote at the Annual Meeting or at any adjournment or postponement if you were an Eversource Energy shareholder at the close of business on March 6, 2018.

Voting

Whether or not you plan to attend the Annual Meeting, it is important that your shares be represented at the meeting. For specific instructions on how to vote your shares, please refer to the section entitled "Questions and Answers About the Annual Meeting and Voting" beginning on page 73. This Notice of Annual Meeting of Shareholders and our proxy statement are first being made available to shareholders on or about March 23, 2018.

Meeting Admission

You or your proxy are entitled to attend the Annual Meeting or any adjournment or postponement if you were an Eversource Energy shareholder at the close of business on March 6, 2018 or hold a valid proxy to vote at the Annual Meeting. Please be prepared to present photo identification to be admitted to the meeting. If your shares are not registered in your name but are held in "street name" through a bank, broker or other nominee, and you plan to attend, please bring proof of ownership.

| By Order of the Board of Trustees, | ||

| Richard J. Morrison Secretary |

March 23, 2018

Important Notice Regarding the Availability of Proxy Statement Materials for the Annual Meeting of Shareholders to be held on May 2, 2018. The Proxy Statement for the Annual Meeting of Shareholders to be held on May 2, 2018 and the 2017 Annual Report are available on the Internet at www.envisionreports.com/ES

2018 Proxy Statement i

ii 2018 Proxy Statement

Proxy Statement Summary |

This summary highlights information contained elsewhere in this proxy statement. This is only a summary, and we encourage you to review the entire proxy statement, as well as our 2017 Annual Report. A Notice of Internet Availability of Proxy Materials or

paper copy of this proxy statement, our 2017 Annual Report and a form of proxy or voting instruction card is first being mailed or made available to shareholders on or about March 23, 2018.

| | | | | | |||||

|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | |

| Annual Meeting of Shareholders | |||||||||

Time and Date: | 10:30 a.m., Eastern Time, on Wednesday, May 2, 2018 | ||||||||

Location: | Sheraton Boston Hotel 39 Dalton Street Boston, Massachusetts 02199 | ||||||||

Record Date: | March 6, 2018 | ||||||||

| | | | | | | | | | |

Items to be Voted on and Board Voting Recommendations |

2018 Business Items

The Board of Trustees of Eversource Energy is asking you to vote on four items:

Item 1 – Election of Trustees |

The Board has nominated ten Trustees, nine of whom are independent, for reelection to our Board of Trustees. John Y. Kim was elected to the Board by the Trustees effective January 1, 2018. Each of the other nominees

was elected to the Board by at least 90% of the shares voted at the 2017 Annual Meeting. The following table provides summary information about each nominee:

| | | | | Board Committees | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Trustee | Age | Trustee Since | Independent | Audit | Compensation | Corporate Governance | Executive | Finance | ||||||||

| | | | | | | | | | | | | | | | | |

Cotton M. Cleveland | 65 | 1992 | Y | | | M | | M | ||||||||

Sanford Cloud, Jr. * | 73 | 2000 | Y | M | C | M | ||||||||||

James S. DiStasio | 70 | 2012 | Y | | M | | M | C | ||||||||

Francis A. Doyle | 69 | 2012 | Y | C | M | M | ||||||||||

James J. Judge | 62 | 2016 | N | | | | C | | ||||||||

John Y. Kim | 57 | 2018 | Y | M | M | |||||||||||

Kenneth R. Leibler | 69 | 2006 | Y | M | | | | M | ||||||||

William C. Van Faasen | 69 | 2012 | Y | M | M | |||||||||||

Frederica M. Williams | 59 | 2012 | Y | M | | | | M | ||||||||

Dennis R. Wraase | 73 | 2010 | Y | M | M | |||||||||||

| | | | | | | | | | | | | | | | | |

2018 Proxy Statement �� 1

PROXY STATEMENT SUMMARY |

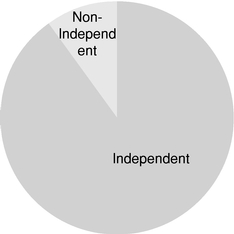

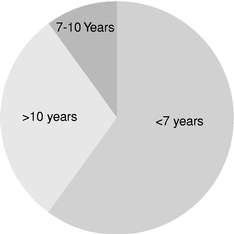

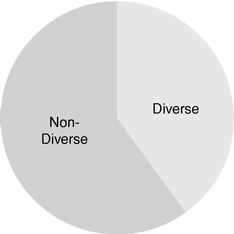

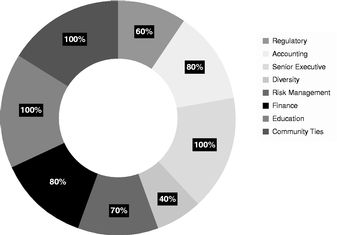

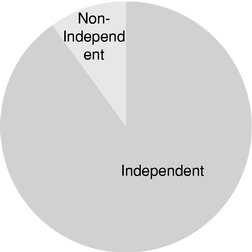

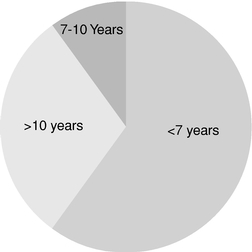

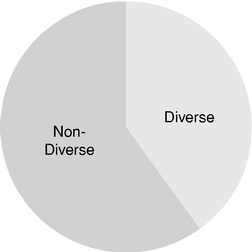

Independence, Tenure and Diversity

Of our ten nominees, six have served on the Board for seven or fewer years, four are women and/or persons of color, and nine are independent. Please see the sections

marked "Selection of Trustees," "Trustee Qualifications, Skills and Experience" and "Evaluation of Board and Board Refreshment" beginning on page 12.

| Independence | Tenure | Diversity | ||

|  |  |

Item 2 – Advisory Vote to Approve the Compensation of our Named Executive Officers |

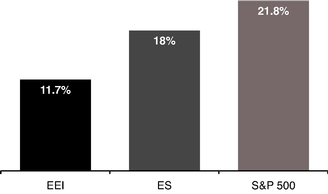

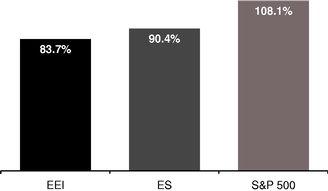

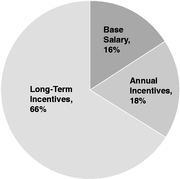

We are asking shareholders to approve the compensation of the Company's Named Executive Officers, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission (SEC). We achieved excellent financial and operating performance results in 2017, and our total shareholder return has consistently outperformed the utility industry over time. Our Board is committed to executive compensation programs that reflect market-based incentive compensation and that align the interests of our executives with those of our shareholders, and we believe that the compensation paid to our Named Executive Officers in 2017 reflects that alignment between pay and performance. Please see pages 61 - 62.

We met or exceeded challenging goals established for 2017 and achieved very positive results, including:

2 2018 Proxy Statement

| PROXY STATEMENT SUMMARY |

Item 3 – Approve the 2018 Eversource Energy Incentive Plan |

We are asking shareholders to approve the 2018 Eversource Energy Incentive Plan (2018 Plan). Our Board of Trustees and our Compensation Committee approved the 2018 Plan, subject to shareholder approval. Grants under the 2018 Plan will not become effective unless and until the 2018 Plan is approved by our shareholders. The material features of the 2018 Plan are

described under "Summary of the 2018 Plan" in Item 3 on pages 63 - 68.

Our Board believes that the 2018 Plan will promote the interests of our shareholders and is consistent with principles of good corporate and executive compensation governance. Please see pages 63 - 68 andAppendix A.

Item 4 – Ratify the Selection of the Independent Registered Public Accounting Firm for 2018 |

Our Audit Committee has selected Deloitte & Touche LLP to serve as our independent registered public accounting firm for the year ending December 31, 2018. The Board is seeking shareholder ratification of this selection. Please see pages 69 - 71.

The Board of Trustees recommends that shareholders vote FOR Items 1, 2, 3 and 4.

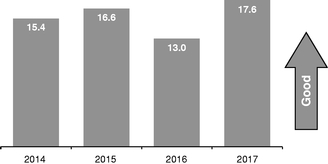

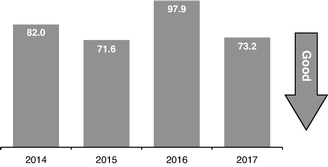

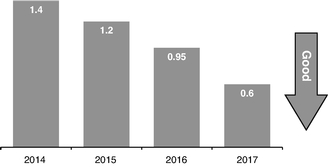

Summary of 2017 Performance |

In 2017, we continued to achieve very positive financial and operational performance results. The following are highlights of some of our most important accomplishments in 2017:

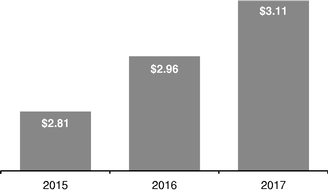

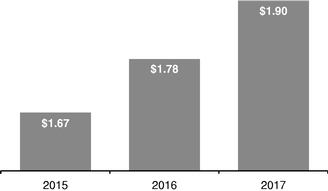

2017 Financial Summary

2017 Operational Summary

2018 Proxy Statement 3

PROXY STATEMENT SUMMARY |

What we DO:

What we DON'T do:

4 2018 Proxy Statement

![]()

Proxy Statement

Annual Meeting of Shareholders

May 2, 2018

Introduction |

We are furnishing this proxy statement in connection with the solicitation of proxies by the Board of Trustees of Eversource Energy for use at the Annual Meeting of Shareholders (the Annual Meeting). We are holding the Annual Meeting on Wednesday, May 2, 2018, at 10:30 a.m., at the Sheraton Boston Hotel, 39 Dalton Street, Boston, Massachusetts 02199.

We have provided to our shareholders a Notice of Internet Availability of our proxy materials or paper copy with instructions on how to access our proxy materials online and how to vote. We will continue to provide printed materials to those shareholders who have requested them. If you would like to change the method of delivery of your proxy materials, please contact our transfer agent, Computershare Investor Services, P. O. Box 43078, Providence, Rhode Island 02940-3078; Toll free: 800-999-7269; or at www.computershare.com. You may do the same as a beneficial owner by contacting the bank, broker, or other nominee where your shares are held.

We are making this proxy statement available to solicit your proxy to vote on the matters presented at the Annual Meeting. We first made this proxy statement available on March 23, 2018. Our Board requests that you submit your proxy by the Internet, telephone, or mail so that your shares will be represented and voted at our Annual Meeting. The proxies will vote your common shares as you direct. For each item, you may vote "FOR"

or "AGAINST" the item, or you may abstain from voting on the item.

If you submit a signed proxy card without any instructions, the proxies will vote your common shares consistent with the recommendations of our Board of Trustees as stated in this proxy statement and in the Notice of Internet Availability of Proxy Materials. If any other matters are properly presented at the Annual Meeting for consideration, the proxies will have discretion to vote your common shares on those matters. As of the date of this proxy statement, we did not know of any other matters to be presented at the Annual Meeting.

Only holders of common shares of record at the close of business on March 6, 2018 (the record date) are entitled to receive notice of and to vote at the Annual Meeting or any adjournment thereof. On the record date, there were 37,219 holders of record and 316,885,808 common shares outstanding and entitled to vote. You are entitled to one vote on each matter to be voted on at the Annual Meeting for each common share that you held on the record date.

The principal office of Eversource Energy is located at 300 Cadwell Drive, Springfield, Massachusetts 01104. The general offices of Eversource Energy are located at 800 Boylston Street, Boston, Massachusetts 02199 and 56 Prospect Street, Hartford, Connecticut 06103-2818.

2018 Proxy Statement 5

Item 1: Election of Trustees |

Our Board of Trustees oversees the business affairs and management of Eversource Energy. The Board currently consists of ten Trustees, only one of whom, James J. Judge, our Chairman, President and Chief Executive Officer, is a member of management.

The Board has nominated ten Trustees for reelection at the Annual Meeting to hold office until the next Annual Meeting and until the succeeding Board of Trustees has been elected, and until at least a majority of the succeeding Board is qualified to act. The number of Trustees was last set at 14; this provides the Board with flexibility to add Trustees when appropriate. Shareholders may vote for up to ten nominees. Unless you specify otherwise, we will vote the enclosed proxy to elect the ten nominees named on pages 7 - 11 as Trustees.

We describe below and on the following pages each nominee's name, age, and date first elected as a Trustee; Committees served on; and a brief summary of the nominee's business experience, including the nominee's particular qualifications, skills and experience that led the Board to conclude that the nominee should continue to serve as a Trustee. Please see the Trustees' biographies below and the sections captioned "Selection

of Trustees", "Trustees Qualifications, Skills and Experience" and "Evaluation of the Board and Board Refreshment" beginning on page 12. Each nominee has indicated to our Lead Trustee that he or she will stand for election and will serve as a Trustee if elected. The affirmative vote of the holders of a majority of the common shares outstanding as of the record date will be required to elect each nominee. This means that each nominee must receive the affirmative vote of the holders of more than 50% of the total common shares outstanding. You may either vote "FOR" or "AGAINST" all, some, or none of the Trustees, or you may abstain from voting. Broker non-votes and abstentions will be counted in the determination of a quorum and will have the same effect as a vote against a nominee.

The Board of Trustees recommends that shareholders vote FOR the election of the nominees listed below.

6 2018 Proxy Statement

| ITEM 1: ELECTION OF TRUSTEES |

Cotton M. Cleveland

BACKGROUND

Ms. Cleveland is President of Mather Associates, a firm specializing in leadership and organizational development for business, public and nonprofit organizations. She is a director of The National Grange Mutual Insurance Company and Ledyard National Bank, and was the founding Executive Director of the state-wide Leadership New Hampshire program. She served on the Board of Directors of the Bank of Ireland from 1986 to 1996, and as Interim President and Chief Executive Officer of the New Hampshire Women's Foundation for 2016. She was elected and served as the Moderator of the Town of New London, New Hampshire and The New London/Springfield Water Precinct from 2000 to 2010. Ms. Cleveland has also served as Chair, Vice Chair and a member of the Board of Trustees of the University System of New Hampshire, as Co-Chair of the Governor's Commission on New Hampshire in the 21st Century, and as an incorporator for the New Hampshire Charitable Foundation. Ms. Cleveland received a B.S. degree magna cum laude from the University of New Hampshire, Whittemore School of Business and Economics. She is a certified and practicing Court Appointed Special Advocate/Guardian ad Litem (CASA/GAL) volunteer for abused and neglected children.

QUALIFICATIONS, SKILLS AND EXPERIENCE

Ms. Cleveland founded and serves as President of her own consulting firm. She has experience serving on the boards of directors of numerous companies. She also benefits from her policy-making level experience in education at the university level as the Chair, Vice Chair and member of the Board of Trustees of the University System of New Hampshire. In addition, she has policy-making level experience in financial and capital markets as a result of her service as a director of Ledyard National Bank and Bank of Ireland. Her ties to the State of New Hampshire also provide the Board with valuable perspective. Based on these qualifications, skills and experience, the Board of Trustees determined that Ms. Cleveland should continue to serve as a Trustee.

Sanford Cloud, Jr.

BACKGROUND

Mr. Cloud has been Chairman and Chief Executive Officer of The Cloud Company, LLC, a real estate development and business investment firm, since 2005. Mr. Cloud served as past President and Chief Executive Officer of the National Conference for Community and Justice from 1994 to 2004, was a former partner at the law firm of Robinson and Cole from 1993 to 1994, and served for two terms as a state senator of Connecticut. He was Vice President of Corporate Public Involvement and Executive Director of the Aetna Foundation from 1986 to 1992 and has served as Chairman of the Connecticut Health Foundation and continues as a member of its Board. Mr. Cloud served as a director of The Phoenix Companies, Inc. from 2001 to 2016 and is currently a director of Ironwood Mezzanine Fund, L.P. He is also a director of the MetroHartford Alliance, Inc. and the University of Connecticut Health Center. In addition, Mr. Cloud is a member of the Board of Trustees of the University of Connecticut and serves as director of its Thomas J. Dodd Center for Human Rights. Mr. Cloud received a B.A. degree from Howard University, a J.D. degree cum laude from the Howard University Law School, and an M.A. degree in Religious Studies from the Hartford Seminary.

QUALIFICATIONS, SKILLS AND EXPERIENCE

Mr. Cloud has significant policy-making level experience in business and financial affairs as a business executive and as a director of several publicly-traded and privately-held companies. He provides the Board with great benefits from his experience as a law firm partner and Connecticut state senator and through his significant ties and service to the City of Hartford and the State of Connecticut. Based on these qualifications, skills and experience, the Board of Trustees determined that Mr. Cloud should continue to serve as a Trustee.

2018 Proxy Statement 7

ITEM 1: ELECTION OF TRUSTEES |

James S. DiStasio

BACKGROUND

Mr. DiStasio served as Senior Vice Chairman and Americas Chief Operating Officer at Ernst & Young, a registered public accounting firm, from 2003 until his retirement in 2007. Mr. DiStasio joined Ernst & Young in 1969 and became a partner in 1977. He served as a director of EMC Corporation from 2010 until its sale to Dell Technologies, Inc. in 2016. He served as a trustee of NSTAR from 2009 until 2012. He has served as a director of the United Way of Massachusetts Bay and Merrimack Valley and as trustee of each of Catholic Charities of Boston, the Boston Public Library Foundation and the Wang Center for the Performing Arts. Mr. DiStasio received a B.S. degree in Accounting from the University of Illinois at Chicago.

QUALIFICATIONS, SKILLS AND EXPERIENCE

Mr. DiStasio has significant experience overseeing the accounting and financial reporting processes of major public companies, derived from his service as a senior executive at one of the largest public accounting firms in the world. In his position as Senior Vice Chairman and Americas Chief Operating Officer, Mr. DiStasio also acquired important management and leadership skills that provide additional value and support to the Board. He has served on several boards of for-profit and non-profit companies and their committees. Based on these qualifications, skills and experience, the Board of Trustees determined that Mr. DiStasio should continue to serve as a Trustee.

Francis A. Doyle

BACKGROUND

Mr. Doyle has served as President and Chief Executive Officer of Connell Limited Partnership, whose businesses produce components and related supplies for the automotive, power, mining, appliance, farm equipment, warehouse automation, and medical and food packaging industries, since 2001. Prior to that, he was Vice Chairman of PricewaterhouseCoopers LLP, where he was Global Technology Leader and a member of the firm's Global Leadership Team. He has served as lead director and chairman of the audit committee and a member of the executive and compensation committees of Tempur Sealy International, Inc. and as chairman of the audit committee and a member of the executive committee, nominating and governance committee and investment committee of Liberty Mutual Holding Company, Inc. (policyholder owned) since 2003. Mr. Doyle has served as a director of Citizens Financial Group, where he was a member of the executive committee and chaired the compensation committee, as a trustee of the Joslin Diabetes Center, where he chaired the finance committee, and as a trustee of Boston College. Mr. Doyle is a certified public accountant and holds a B.S. degree and an M.B.A. degree from Boston College.

QUALIFICATIONS, SKILLS AND EXPERIENCE

Mr. Doyle has significant financial, accounting and financial reporting and risk management experience and an in-depth understanding of finance and capital markets through his years at PricewaterhouseCoopers LLP. He also has extensive senior management experience as the President and Chief Executive Officer of a global manufacturer. Mr. Doyle has served on the boards of directors of several companies and on various committees of those boards. Based on these qualifications, skills and experience, the Board of Trustees determined that Mr. Doyle should continue to serve as a Trustee.

8 2018 Proxy Statement

| ITEM 1: ELECTION OF TRUSTEES |

James J. Judge

BACKGROUND

Mr. Judge is Chairman, President and Chief Executive Officer of Eversource Energy. He also is Chairman and a director of The Connecticut Light and Power Company, NSTAR Electric Company, NSTAR Gas Company, Public Service Company of New Hampshire and Yankee Gas Services Company. Previously, Mr. Judge was Executive Vice President and Chief Financial Officer of Eversource Energy, and Executive Vice President, Chief Financial Officer and a director of The Connecticut Light and Power Company, NSTAR Electric Company, NSTAR Gas Company, Public Service Company of New Hampshire and Yankee Gas Services Company from April 2012 until May 2016. Mr. Judge serves as a director of Analogic Corporation and as chairman of its audit committee. He serves on the Board of Directors of the Edison Electric Institute and the Massachusetts Competitive Partnership. He has also served on the Board of Directors of the United Way of Massachusetts Bay and Merrimack Valley. Mr. Judge received both a B.S. degree magna cum laude and an M.B.A. degree magna cum laude from Babson College.

QUALIFICATIONS, SKILLS AND EXPERIENCE

Mr. Judge is Chairman, President and Chief Executive Officer. His extensive experience in the energy industry and diverse financial and management skills provide the necessary background to lead the Company. He is an experienced public company director and audit committee chair. He also serves our customer community through his service on and work with many non-profit boards. Mr. Judge represents management on the Board as the sole management Trustee. Based on these qualifications, skills and experience, the Board of Trustees determined that Mr. Judge should continue to serve as a Trustee.

John Y. Kim

BACKGROUND

Mr. Kim has served as President of New York Life Insurance Company since 2015 and served in a variety of other management positions at New York Life, including as the company's Chief Investment Officer, since 2008. Mr. Kim served as President of Prudential Retirement and its predecessor CIGNA Retirement and Investment Services from 2002 to 2007 and served as the Chief Executive Officer of Aeltus Investment Management, a subsidiary of Aetna, Inc., from 2001 to 2004. Mr. Kim serves as a director of Fiserv, Inc. and is a member of its audit committee. He has served as the vice chair of the Connecticut Business and Industry Association, as a member of the MetroHartford Alliance, Inc. and as chairman of the University of Connecticut Foundation. He has also been active with the Greater Hartford Arts Council, The Hartford Stage Co., and the Connecticut Opera Association. Mr. Kim received his B.A. degree from the University of Michigan in 1983 and his M.B.A. degree from the University of Connecticut in 1987.

QUALIFICATIONS, SKILLS AND EXPERIENCE

Mr. Kim has more than 30 years of experience in the financial services area. His varied and comprehensive experience acquired at several nationally known insurance companies, including New York Life Insurance Company, Prudential Retirement, CIGNA Retirement and Investment Services and Aetna, provides the Board and its Committees with valuable insight and perspective. He also is closely associated with several important Connecticut business and non-profit groups. He is an experienced public company director. Based on these qualifications, skills and experience, the Board of Trustees determined that Mr. Kim should continue to serve as a Trustee.

2018 Proxy Statement 9

ITEM 1: ELECTION OF TRUSTEES |

Kenneth R. Leibler

BACKGROUND

Mr. Leibler currently serves as Vice Chairman of the Board of The Putman Mutual Funds. He has served as a trustee of The Putnam Mutual Funds since 2006. He serves as Trustee Emeritus of Beth Israel Deaconess Medical Center and served as both a trustee and as vice chairman of Beth Israel Medical Center from 2009 to 2012. He is a founding partner of the Boston Options Exchange and served as its chairman from 2004 to February 2007. He is a past vice chairman of the Board of Directors of ISO New England, Inc., the independent operator of New England's bulk electric transmission system, where he served until 2006. He also served as a director of The Ruder Finn Group from 2005 to 2010. Mr. Leibler received a B.A. degree magna cum laude from Syracuse University.

QUALIFICATIONS, SKILLS AND EXPERIENCE

Mr. Leibler has considerable senior executive level experience in business and management, including experience in financial markets and risk assessment, as the former Chairman of the Boston Options Exchange, former Chairman and CEO of the Boston Stock Exchange, and former President, Chief Operating Officer and Chief Financial Officer of the American Stock Exchange, as well as through his current service as a Trustee of The Putnam Mutual Funds, where he serves on the contract, executive, nominating and investment oversight committees. He also has policy-making level experience in the electric utility industry through his service as the Vice Chairman of ISO New England. Based on these qualifications, skills and experience, the Board of Trustees determined that Mr. Leibler should continue to serve as a Trustee.

William C. Van Faasen

BACKGROUND

Mr. Van Faasen served as Chief Executive Officer of Blue Cross Blue Shield of Massachusetts, Inc. (BCBSMA), a health care services provider, from 1992 until his retirement in 2007. He is Chairman Emeritus of BCBSMA and also served as interim Chief Executive Officer in 2010. He has served as a director of Liberty Mutual Holding Company, Inc. (policyholder owned) since 2002 and as Lead Director since April 2012. He served as a director of IMS Health, Inc. from 1996 - 2010 and as Lead Director from 2006 to 2010. He also served as a director of PolyMedica Corporation from 2005 to 2008 and served as a trustee of NSTAR from 2002 until 2012. He is an honorary director of the Greater Boston Chamber of Commerce and previously served as a director of the United Way of Massachusetts Bay and Merrimack Valley. Mr. Van Faasen received a B.A. degree from Hope College and an M.B.A. degree from Michigan State University.

QUALIFICATIONS, SKILLS AND EXPERIENCE

Mr. Van Faasen brings to the Board extensive management, leadership, and financial experience derived from leading a large company in a regulated industry. He also brings in-depth experience and insight as a director of several public companies, including service as a lead director and on board committees, and has also served on area non-profit boards. Based on these qualifications, skills and experience, the Board of Trustees determined that Mr. Van Faasen should continue to serve as a Trustee.

10 2018 Proxy Statement

| ITEM 1: ELECTION OF TRUSTEES |

Frederica M. Williams

BACKGROUND

Ms. Williams has served as President and Chief Executive Officer of Whittier Street Health Center in Boston, an urban community health care facility serving residents of Boston and surrounding communities, since 2002. Prior to joining Whittier Street Health Center, she served as the Senior Vice President of Administration and Finance and Chief Financial Officer of the Dimock Center, a large health care and human services facility in Boston. She was elected as a trustee of NSTAR in March 2012 and served as a trustee until April 2012. Ms. Williams is a member of the Board of Trustees of Dana Farber Cancer Institute, the Massachusetts League of Community Health Centers and Boston Health Net. She is a Fellow of the National Association of Corporate Directors, a member of the Massachusetts Women's Forum, International Women's Forum, and Women Business Leaders of the U.S. Health Care Industry Foundation. Ms. Williams attended the London School of Accountancy, passed the examinations of the Institute of Chartered Secretaries and Financial Administrators, (United Kingdom) (ICSA) and of the Institute of Administrative Management (United Kingdom), with distinction, and was elected a Fellow of the ICSA in 2000. She obtained a graduate certificate in Administration and Management from the Harvard University Extension School and an M.B.A. degree with a concentration in Finance from Anna Maria College in Paxton, Massachusetts.

QUALIFICATIONS, SKILLS AND EXPERIENCE

Ms. Williams has more than 20 years of experience in a regulated industry, and has served as the President and Chief Executive Officer of Whittier Street Health Center, a national model for providing equitable access to high quality and cost effective health care, for more than fifteen years. This service has provided her with a broad base of financial, leadership, management and community experience and skills. She also has significant experience serving on several non-profit boards. Based on these qualifications, skills and experience, the Board of Trustees determined that Ms. Williams should continue to serve as a Trustee.

Dennis R. Wraase

BACKGROUND

Mr. Wraase served as Chairman of the Board, Chief Executive Officer and a director of Pepco Holdings, Inc. (PHI), an energy delivery company in the mid-Atlantic region, until his retirement in June 2009. He was elected chairman of PHI in 2004, became Chief Executive Officer in 2003 and served as a director from 1998 to his retirement. He previously served as the President of PHI from 2001 to 2008 and Chief Operating Officer from 2002 to 2003. He is a member of the Financial Executives Institute and the American Institute of Certified Public Accountants. Mr. Wraase currently serves as the Executive-In-Residence at the Center for Social Value Creation at the Robert H. Smith School of Business, University of Maryland. He is also currently a director of the University of Maryland System Foundation. Mr. Wraase previously served as director of the Edison Electric Institute, The Association of Edison Illuminating Companies and the Institute for Electric Efficiency, and as the President of the Southeastern Electric Exchange. Mr. Wraase received a B.S. degree in Accounting from the University of Maryland and an M.S. degree in Business Financial Management from The George Washington University.

QUALIFICATIONS, SKILLS AND EXPERIENCE

Mr. Wraase brings to the Company considerable utility industry knowledge and experience gained through his career of service at PHI. He has significant policy-making level experience in regulated businesses as well as in capital and financial markets, credit markets, financial reporting and accounting, and risk assessment. He is also a certified public accountant. Based on these qualifications, skills and experience, the Board of Trustees determined that Mr. Wraase should continue to serve as a Trustee.

2018 Proxy Statement 11

Governance of Eversource Energy |

Board's Leadership Structure |

James J. Judge is our Chairman, President and Chief Executive Officer. Sanford Cloud, Jr. serves as our Lead Trustee.

As Lead Trustee, Mr. Cloud presides at executive sessions of the independent Trustees; facilitates communication between the Chief Executive Officer and

the Board members; participates with the Compensation Committee in its evaluation of the Chief Executive Officer; and provides ongoing information to the Chief Executive Officer about his or her performance. He also attends all Committee meetings.

Selection of Trustees |

This section and the next two sections discuss how we select individuals to become Trustees and how we continually ensure that we have a fully-qualified, effective Board.

As set forth in its charter, it is the responsibility of the Corporate Governance Committee to identify individuals qualified to become a Trustee and to recommend to the Board a slate of Trustee candidates to be submitted to a vote of our shareholders at the Annual Meeting of Shareholders. The Committee has from time to time retained the services of a third party executive search firm to assist it in identifying and evaluating such individuals.

As provided in our Corporate Governance Guidelines, the Corporate Governance Committee seeks nominees with the following qualifications:

Trustees should possess the highest personal and professional ethics, integrity and values, and be committed to representing the long-term interests of our shareholders. They must also have an inquisitive and objective perspective, practical wisdom and mature judgment. The Board should represent diverse experience at policy-making levels in business, government, education, community and charitable organizations, as well as areas that are relevant to our business activities. The Corporate Governance Committee also seeks diversity in gender, ethnicity and personal background when considering Trustee candidates.

Applying these criteria and those noted elsewhere in this proxy statement, the Corporate Governance Committee considers Trustee candidates suggested by its members as well as by management and shareholders. In anticipation of three Trustee retirements in 2018, and

acting on the recommendation of the Corporate Governance Committee, the Board of Trustees elected John Y. Kim to the Board effective January 1, 2018.

As part of the annual nomination process for re-election, the Corporate Governance Committee reviews the qualifications, experience, attributes and skills of each nominee for Trustee and reports its findings to the Board. At its February 7, 2018 meeting, the Corporate Governance Committee determined that each Trustee possesses the highest personal and professional ethics, integrity and values, and that each Trustee remains committed to representing the long-term interests of our shareholders. The Committee's review also focused on each Trustee's experience at policy-making levels in business, government, education, community and charitable organizations, and other areas relevant to our business activities, as described below. Based on this review, the Committee advised the Board on February 7, 2018 that each of the Trustees was qualified to serve on the Board under the Corporate Governance Guidelines.

The Corporate Governance Committee and the Board annually review the skills and qualifications that they determine are necessary for the proper oversight of the Company by the Trustees in furtherance of their fiduciary duties. The Committee and the Board remain focused on ensuring that the individual and collective abilities of the Trustees continue to meet the needs of the Company. The Board is committed to nominating individuals who satisfy the applicable criteria for outstanding service to our Company and who together comprise the appropriate Board composition in light of evolving business demands. The Board evaluates the effectiveness of each Trustee in contributing to the Board's work and the potential contributions of each new nominee.

12 2018 Proxy Statement

| GOVERNANCE OF EVERSOURCE ENERGY |

Trustee Qualifications, Skills and Experience |

Eversource Energy is a multi-state electric, gas and water utility providing service to customers in Connecticut, Massachusetts and New Hampshire. The Company is taking a lead role in the development of clean energy, which when combined with our successful and effective energy efficiency programs puts us at the forefront in the fight against climate change. We stress great reliability and customer service for our customers, solid financial performance for our shareholders, a safe, respectful workplace for our employees, and continuous involvement with and support of our communities. Our Chairman, President and Chief Executive Officer has set a very clear goal for the Company: to be the best energy company in the nation by the year 2020. To accomplish this, we seek Trustees with both overall skills and experience and some that are specialized. We describe here and in the Trustee biographies the qualifications, skills and experience that we feel are necessary and that our Trustees possess.

Set forth below is a list and description of the qualifications, skills and experience we seek, followed by a description noting how these qualifications, skills and experience are particularly important to our Board:

Regulatory Experience. Each of our utility subsidiaries is regulated in virtually all aspects of its business by various federal and state agencies, including the SEC, the Federal Energy Regulatory Commission, and various state and/or local regulatory authorities with jurisdiction over the industry and the service areas in which each subsidiary operates. Accordingly, the Board values the policy-making level experience in a heavily regulated industry that several of our Trustees possess.

Accounting Experience. As a publicly-traded electric, gas and water holding company whose companies are subject to very substantial federal, state and accounting industry rules, it is especially important that the Board have significant accounting experience. Several of our

Trustees are career accounting and financial executives and provide us with superior strength in the Board's oversight of this important element of the Board's responsibilities.

Senior Executive and Director Experience. Many of our Trustees serve or have served as senior executives or directors of other companies, providing us with unique insights. These individuals possess extraordinary leadership qualities as well as the ability to identify and develop those qualities in others. They demonstrate a practical understanding of organizations, processes, long-term strategic planning, risk management and corporate governance, and know how to drive change and growth.

Diversity. The Corporate Governance Committee seeks diversity in gender, ethnicity and personal background when considering Trustee candidates. Diverse thoughts and views emanating from different backgrounds, life experiences, gender and race, career experiences and skills are critical to a well-functioning Board and essential to embracing opportunities and confronting challenges in the future. To ensure the success of our business strategy, the Board of Trustees strives to identify and pursue Trustee candidates with diverse skills, knowledge, background and experience that complement the skills, knowledge and experience of our current Trustees. Following the Annual Meeting, our refreshed Board will be one of the most diverse in the industry. Of the ten nominees, two are women, two are African-American, and one is Asian-American.

Risk Management Experience. Assessing and managing risk in a rapidly changing clean energy environment is critical to our success. Several of our Trustees have served in leadership positions have the experience to understand and evaluate the most significant risks we face and the experience and leadership to provide effective oversight of risk management processes.

Finance Experience. The vast majority of our ongoing capital program is expected to be funded through cash flows provided by operating activities as well as new debt issuances and, less frequently, equity issuances. As a result, the Board highly values the policy-making level experience and understanding of capital and financial markets, accounting and financial reporting, and credit markets that many of our Trustees have acquired.

Education/Community and Charitable Organization Involvement. Public utility companies have a unique position and role in the communities they serve beyond

2018 Proxy Statement 13

GOVERNANCE OF EVERSOURCE ENERGY |

that of most corporations. The Board supports and encourages educational opportunities, community involvement and development, and philanthropic goals and activities. The Eversource Energy Foundation, Inc. was established in 1998 to focus on our community investments and to provide grants to our nonprofit community partners. Consistent with our business strategy and core values, the Foundation invests primarily in projects that address issues of economic and community development and the environment. Each Trustee has experience in one or more community or charitable organizations.

Community Ties. We operate New England's largest energy delivery system in three different states. Because a majority of our Trustees also reside in our service territory, they not only have ties to local communities, but they understand our customers' needs.

Our Board's Qualifications, Skills and Experience

Independence, Tenure and Diversity

Of our ten nominees, six have served on the Board for seven or fewer years, four are women and/or persons of color, and nine are independent.

14 2018 Proxy Statement

| GOVERNANCE OF EVERSOURCE ENERGY |

Evaluation of Board and Board Refreshment |

The Corporate Governance Committee annually reviews and evaluates the performance of the Board of Trustees, Board Committees and individual Board Members. The Committee periodically assesses the Board's contribution as a whole and identifies areas in which the Board or senior management believes a better contribution may be made. The Committee also reviews the attributes and skills of the Board Members as a way to refresh and continually ensure that the Board has the proper mix of skills. The Board and each of the Committees, other than the Executive Committee, also conduct annual performance self-evaluations to increase the effectiveness of the Board and its Committees; the results of these are reviewed and discussed with the Board. Our self-evaluation program includes the completion of Board and Committee questionnaires, interviews by the Lead Trustee with each Board member, and discussions by the Board and each Committee of any issues raised by our Board Members during the self-evaluation process. In addition to the Committee reviews and the annual self-evaluations conducted by the Committee and the Board, the Committee and the

Board also annually review the performance and qualifications of each Trustee prior to nominations being made for an additional term. These reviews are discussed by the Committee, following which it makes recommendations to the Board regarding nominees for election as Trustees.

Our Board has an average tenure of nine years. We believe that the mix of longer tenured Trustees and recently elected Trustees provides for the kind of balance that contributes to the overall effectiveness of the Board, and that strict restrictions on the length of time a Trustee serves on the Board are not warranted.

Shareholders who desire to suggest potential candidates for membership on the Board of Trustees may address such information, in writing, to our Secretary at the mailing address set forth on page 72 of this proxy statement. The communication must identify the writer as a shareholder of the Company and provide sufficient detail about the nominee for the Corporate Governance Committee to consider the individual's qualifications. Our Declaration of Trust also provides for proxy access.

Board Committees and Responsibilities |

The Board of Trustees has five standing committees: Audit, Compensation, Corporate Governance, Executive, and Finance. The Corporate Governance Committee performs the functions of a nominating committee. None of the Committee Members in 2017 was employed by Eversource Energy or its subsidiaries except for Mr. Judge, who as Chairman of the Board is also Chair of the Executive Committee. All other Committee Members are independent. The Board has adopted a written charter for each standing committee, as well as written Corporate Governance Guidelines.

The Corporate Governance Guidelines are available on our website at the Internet address appearing in the Trustee Independence section on page 24. The committee charters are available on our website at the Internet addresses appearing in the committee descriptions below. Copies of these documents are available to any shareholder upon written request to our Secretary at the address set forth on page 72 of this proxy statement. The functions of these Committees are described in the paragraphs following the table. The table below shows the current committee membership:

2018 Proxy Statement 15

GOVERNANCE OF EVERSOURCE ENERGY |

Board Committees |

Trustee | Audit | Compensation | Corporate Governance | Executive | Finance | |||||

| | | | | | | | | | | |

John S. Clarkeson | M | M | | | | |||||

Cotton M. Cleveland | M | M | ||||||||

Sanford Cloud, Jr.* | | M | C | M | | |||||

James S. DiStasio | M | M | C | |||||||

Francis A. Doyle | C | | M | M | | |||||

Charles K. Gifford | C | M | M | |||||||

James J. Judge | | | | C | | |||||

John Y. Kim | M | M | ||||||||

Paul A. La Camera | | | M | | M | |||||

Kenneth R. Leibler | M | M | ||||||||

William C. Van Faasen | M | M | | | | |||||

Frederica M. Williams | M | M | ||||||||

Dennis R. Wraase | | M | M | | | |||||

| | | | | | | | | | | |

Audit Committee |

The Audit Committee consists of Mr. Clarkeson, Mr. Doyle (Chair), Mr. Kim, Mr. Leibler, Mr. Van Faasen and Ms. Williams. The Audit Committee meets independently with the internal audit staff, the independent registered public accounting firm and management at least quarterly.

Following each Committee meeting, the Audit Committee reports to the full Board. The Audit Committee reviews and evaluates the independent registered public accounting firm's activities, procedures and recommendations to assist the Board in monitoring the integrity of our financial statements, the independent registered public accounting firm's qualifications and independence, the performance of our internal audit function and independent registered public accounting firm, and our compliance with legal and regulatory requirements. The Committee periodically discusses the guidelines and policies that govern management's processes for assessing, monitoring and mitigating major financial risk exposures. The Audit Committee also reviews the Company's significant accounting policies, management judgments and accounting estimates, earnings releases, financial statements and systems of internal control. The

Audit Committee has the sole authority to select and replace the independent registered public accounting firm and is directly responsible for their compensation and Board oversight of their work. Each member of the Audit Committee meets the financial literacy requirements of the New York Stock Exchange (NYSE), the SEC and our Corporate Governance Guidelines. The Board has affirmatively determined that Mr. Doyle is an "audit committee financial expert," as defined by the SEC. Each member of the Audit Committee also meets the independence requirements of the NYSE, SEC and our Corporate Governance Guidelines. No member of the Audit Committee is employed by Eversource Energy or its subsidiaries. Additional information regarding the Audit Committee is contained in Item 4 of this proxy statement. A copy of the Committee's charter is available on our website at www.eversource.com/Content/general/about/investors/corporate-governance/board-committee-charters/audit-committee. The Audit Committee met five times during 2017, and also met once with the Finance Committee in a meeting held in April 2017 at which the Committees discussed several issues relating to risk, and in particular, enterprise, cyber and system security risk.

16 2018 Proxy Statement

| GOVERNANCE OF EVERSOURCE ENERGY |

Compensation Committee |

The Compensation Committee consists of Mr. Clarkeson, Mr. Cloud, Mr. DiStasio, Mr. Gifford (Chair), Mr. Kim, Mr. Van Faasen and Mr. Wraase. The Compensation Committee is responsible for the compensation and benefit programs for all executive officers of Eversource Energy and has overall authority to establish and interpret our executive compensation programs. The Committee reviews our executive compensation strategy, evaluates components of total compensation, and assesses performance against goals, market competitive data and other appropriate factors, and makes compensation related decisions based upon Company and executive performance. The Committee has the sole authority to select and retain experts and consultants in the field of executive compensation to provide advice to the Committee with respect to market data, competitive information, and executive compensation trends. The Compensation Committee also reviews and recommends to the Board of Trustees the compensation of the non-employee members of the Board.

In carrying out its charter responsibilities, the Compensation Committee reviews and approves corporate goals and objectives relevant to the Chief Executive Officer's compensation and, with the participation of the Lead Trustee and subject to the further review and approval of the independent Trustees, evaluates the performance of the Chief Executive Officer in light of those goals and objectives. The Committee establishes performance criteria for the Chief Executive Officer and approves the Chief Executive Officer's total compensation based on the annual evaluation, subject to further approval by the independent Trustees. In addition, in collaboration with

the Chief Executive Officer, the Committee oversees the evaluation of those executive officers who under the SEC's regulations are deemed "executives," and it engages in the succession planning process for the Chief Executive Officer and other executives.

The Compensation Committee has retained Pay Governance LLC to provide compensation consulting services. Pay Governance LLC has been engaged to perform work only for the Compensation Committee, and as noted in the Compensation Discussion and Analysis section of this proxy statement, the Compensation Committee has determined that Pay Governance LLC is independent and that no conflict of interest exists that would prevent Pay Governance LLC from independently advising the Committee.

The Compensation Committee has delegated some of its administrative responsibilities to the Chief Executive Officer and the Executive Vice President — Human Resources and Information Technology. The Compensation Committee has not delegated any of its responsibilities to any other persons. The Board has affirmatively determined that each member of the Compensation Committee meets the independence requirements of the NYSE, the SEC, and our Corporate Governance Guidelines. A copy of the Compensation Committee's charter is available on our website at www.eversource.com/Content/general/about/investors/corporate-governance/board-committee-charters/compensation-committee. The Compensation Committee met four times during 2017. The Compensation Committee reports to the full Board following each Committee meeting.

Corporate Governance Committee |

The Corporate Governance Committee consists of Ms. Cleveland, Mr. Cloud (Chair), Mr. Doyle, Mr. Gifford, Mr. La Camera and Mr. Wraase. The Corporate Governance Committee is responsible for developing, overseeing and regularly reviewing our Corporate Governance Guidelines and related policies. The Corporate Governance Committee also serves as a nominating committee, establishing criteria for new Trustees and identifying and recommending prospective Board candidates. The Corporate Governance Committee annually reviews the independence and qualifications of the Trustees, recommends nominees for election to the Board and for appointment to Board Committees, and annually recommends to the Board

appointments of the Lead Trustee and Chairman and the election of officers of the Company. In addition, the Corporate Governance Committee evaluates the performance of the Board and its committees. Following each meeting the Corporate Governance Committee reports to the full Board. No member of the Corporate Governance Committee is employed by Eversource Energy or its subsidiaries. The Board of Trustees has determined that each member of the Corporate Governance Committee meets the independence requirements of the NYSE, the SEC, and our Corporate Governance Guidelines. A copy of the Committee's charter is available on our website at

2018 Proxy Statement 17

GOVERNANCE OF EVERSOURCE ENERGY |

www.eversource.com/Content/general/about/investors/corporate-governance/board-committee-charters/corporate-governance. The Corporate Governance Committee met six times during 2017.

Executive Committee |

The Executive Committee consists of Mr. Cloud, Mr. DiStasio, Mr. Doyle, Mr. Gifford and Mr. Judge (Chair). The Executive Committee is empowered to exercise all the authority of the Board, subject to certain limitations set forth in our Declaration of Trust, during the intervals between meetings of the Board. A copy of

the Committee's charter is available on our website at www.eversource.com/Content/general/about/investors/corporate-governance/board-commitee-charters/executive. The Executive Committee did not meet during 2017.

Finance Committee |

The Finance Committee consists of Ms. Cleveland, Mr. DiStasio (Chair), Mr. La Camera, Mr. Leibler and Ms. Williams. The Finance Committee assists the Board in fulfilling its fiduciary responsibilities relating to financial plans, policies and programs for Eversource Energy and its subsidiaries. The Finance Committee reviews the Company's plans and actions to assure liquidity; proposed financing programs; plans and recommendations regarding common share repurchase programs; early extinguishment and refunding of debt and preferred stock obligations; and other proposals that modify the Company's capital structure. The Finance Committee is responsible for reviewing the Company's Enterprise Risk Management (ERM) program, including practices to monitor and mitigate cyber, physical security and other risk exposures, as further described below under the caption "Board's Oversight of Risk." The Finance Committee is also responsible for

reviewing and recommending the Company's dividend policy, as well as new business ventures and initiatives which may result in substantial expenditures, commitments and exposures. In addition, the Finance Committee conducts an annual review of counter party credit policy, insurance coverages and pension plan performance. Following each meeting, the Finance Committee reports to the full Board. No member of the Finance Committee is employed by Eversource Energy or its subsidiaries. A copy of the Committee's charter is available on our website at www.eversource.com/Content/general/about/investors/corporate-governance/board-committee/charters/finance. The Finance Committee met four times during 2017, and also met once with the Audit Committee in April 2017, at which the Committees discussed several issues relating to risk, and in particular enterprise, cyber and system security risk.

Compensation Committee Interlocks and Insider Participation |

No member of the Compensation Committee is employed by Eversource Energy or any of its subsidiaries. No executive officer of Eversource Energy serves as a member of the compensation committee or

on the board of directors of any company at which a Member of the Eversource Energy Compensation Committee or Board of Trustees serves as an executive officer.

Meetings of the Board and its Committees |

In 2017, the Board of Trustees held eight meetings, three of which included executive sessions attended only by the independent Trustees, and the Board and the Committees held a total of 28 meetings. In 2017, each Trustee attended at least 94% of the aggregate number

of the Board and Committee meetings, and all Trustees attended the Annual Meeting of Shareholders held on May 3, 2017. Our Trustees are expected to attend our Annual Meetings of Shareholders, but we do not have a formal policy addressing this subject.

18 2018 Proxy Statement

| GOVERNANCE OF EVERSOURCE ENERGY |

Board's Oversight of Risk |

The Board of Trustees, both as a whole and through its Committees, is responsible for the oversight of the Company's risk management processes and programs. The Board believes that this approach is appropriate to carry out its risk oversight responsibilities and is in the best interests of the Company and its shareholders. Each year, the Board evaluates its risk assessment function as part of its Board evaluation process.

As set forth below, each Committee reviews management's assessment of risk for that Committee's respective area of responsibility. Each Committee member has expertise on risks relative to the nature of the Committee on which he or she sits. With each Committee Chair reporting to the Board following each Committee meeting, the entire Board is able to discuss risk related issues, assess their implications and provide oversight on appropriate actions for management to take. All Board Committees meet periodically with members of senior management to discuss the relevant risks and challenges facing the Company.

The Board of Trustees oversees the Company's comprehensive operating and strategic planning. The operating plan, which is reviewed and formally approved by the Board in February following review by the Finance Committee, consists of the goals and objectives for the year, key performance indicators, and financial forecasts. The strategic planning process consists of long-term corporate objectives, specific strategies to achieve those goals, and plans designed to implement each strategy. The ERM program is integrated with the annual operating and strategic planning processes. The top enterprise-wide financial risks are identified during the development of the annual operating plan and are tracked throughout the year. Enterprise strategic risks are identified and presented to the Board of Trustees during development of the long-term strategic plans. Detailed risk mitigation plans for the principal enterprise-wide risks are updated periodically and presented to the Finance Committee.

The Finance Committee is responsible for oversight of the Company's ERM program and enterprise-wide risks, as well as specific risks associated with insurance, credit, financing and pension investments. Our ERM program involves the application of a well-defined, enterprise-wide methodology designed to allow our executives to identify, categorize, prioritize, and mitigate the principal risks to the Company. The ERM program is integrated with other assurance functions throughout

the Company, including compliance, auditing, and insurance to ensure appropriate coverage of risks that could impact the Company. In addition to known risks, the ERM program identifies emerging risks to the Company, through participation in industry groups, discussions with management, and in consultation with outside advisors. Our management then analyzes risks to determine materiality, likelihood and impact, and develops mitigation strategies. Management broadly considers our business model, the utility industry, the global economy and the current environment to identify risks. The findings of this process are discussed with the Finance Committee and the full Board, including reporting on an individual risk-by-risk basis on how these issues are being measured and managed.

In addition to the regularly scheduled reports by ERM of all of the Company's enterprise-wide risks and the results of the ERM program, management reports periodically to both the Board of Trustees and the Finance Committee in depth on specific top enterprise risks at the Company. ERM also reports regularly to the Finance Committee on the activities of the Company's Risk Committee. The Company's Risk Committee consists of senior officers of the Company, and is responsible for ensuring that the Company is managing its principal enterprise-wide risks, as well as other key risk areas such as environmental, information technology, compliance and business continuity.

The Audit Committee is responsible for the oversight of the integrity of the Company's financial statements, including oversight of the guidelines, policies and controls that govern management's processes for assessing, monitoring and mitigating major financial risk exposures. The Corporate Governance Committee is responsible for the oversight of compliance with various governance regulations as required by the SEC, the NYSE and other regulators. The Executive Vice President and General Counsel reports on any changes in regulations and best practices as part of the annual review of Committee charters and the Board's Corporate Governance Guidelines and also at Committee and Board meetings. The Board of Trustees administers its compensation risk oversight function primarily through its Compensation Committee. The process by which the Board and the Compensation Committee oversee executive compensation risk is described in greater detail within the Compensation Discussion and Analysis beginning on page 32.

2018 Proxy Statement 19

GOVERNANCE OF EVERSOURCE ENERGY |

Cyber and Physical Security Risk |

The Company continues to devote substantial resources to protecting its cyber and operational assets. Simultaneously, the Board and its Committees continue to provide substantial and focused attention to cyber and system security. At the Board and Committee level, comprehensive cyber security reports are provided and discussed at each meeting of the Finance Committee, which has primary responsibility for cyber and system security oversight at the Committee level. These reports are provided to all members of the Board and discussed by the Board at the time the Finance Committee Chair reports on the Committee's meetings. The reports focus on the Company's most critical assets, describe cyber security drills and exercises, any attempted breaches, and mitigation strategies, including insurance. In

addition, assessments by third-party experts of cyber and physical security risks to the utility industry and the Company in particular are provided periodically. The Company constantly reviews and updates its cyber and system security program and the Board and its Committees continue to enhance their strong oversight activities, including joint meetings of the Audit and Finance Committees at which cyber and system security programs and issues that might affect the Company's financial statements and operational systems can be discussed by both Committees with financial, information technology, legal and accounting management, together with representatives of the Company's independent registered public accounting firm and other outside advisors.

Environmental Sustainability and Corporate Social Responsibility |

Eversource is engaged primarily in the energy delivery business through five wholly-owned electric and natural gas utility subsidiaries. Eversource is also engaged in the water delivery business through its newly acquired, wholly-owned subsidiary, Aquarion Water Company. Our mission to provide superior customer service, and reliability is engrained into the fabric of all that we do for our four million customers in Connecticut, Massachusetts and New Hampshire.

Environmental, social and governance (ESG) initiatives are integrated into the policies and principles that govern our Company and reflect our commitment to sustainable growth. We are committed to reliability, effective corporate governance, expanding energy options for our region, and environmental stewardship. Our goal is to be the best energy company in the nation, which includes being the leading clean energy utility and providing transparency and clarity about our position on these topics.

In 2017, we released Eversource's Commitment to Environmental Sustainability, which underscores our environmental priorities and highlights our role as a key catalyst for clean energy development in New England. This statement is an important component of our vision for how we conduct our business today; it is posted on our website at www.eversource.com/content/ema-c/about/investors/investor-relations/sustainability-the-environment/commitment-to-environmental-sustainability. We have also been a leader within our trade group, the Edison Electric Institute, in standardizing ESG disclosures. This standardization was completed in 2017 following significant consultation

with institutional investors. In December 2017, the nation's electric companies became the first industry in the country to adopt a common set of ESG disclosures, and Eversource Energy was one of the first electric companies to post such disclosures related to 2016 performance on our website at www.eversource.com/content/ema-c/about/investors/investor-relations/sustainability-the-environment/eei-esg-initiative. We expect to post our 2017 ESG performance by mid-2018.

Set forth below is a list of the considerations and topics that we feel are important to our comprehensive Sustainability and Corporate Social Responsibility policies and practices, followed by a description of each and how we integrate them into our Company:

20 2018 Proxy Statement

| GOVERNANCE OF EVERSOURCE ENERGY |

Sustainability Governance. Sustainability reporting at Eversource is managed by a sustainability team, which is overseen by executive level management. Our team meets regularly throughout the year to assess current practices and identify improvement opportunities. All operational and business disciplines are engaged in our sustainability reporting process.

Electric Transmission. Since 2001, Eversource has sited and built complex and varied projects in densely populated, congested areas in our service territory. These projects have enhanced the reliability of the electric grid, eased congestion, accelerated retirement of older, higher emission coal and oil-fueled power plants, and helped to provide greater access to new, environmentally-friendly renewable power sources. Over the next four years, Eversource Energy plans to invest approximately $4.1 billion in projects and upgrades to modernize our electric transmission system and meet the region's renewable energy needs. A more reliable, more efficient electric grid will provide New England with the infrastructure that is critical to help the region meet its aggressive greenhouse gas reduction goals. If approved, our proposed $1.6 billion Northern Pass project will allow New England to import up to 1,090 megawatts of clean energy for 40 years beginning in late 2020.

Natural Gas. Our Distribution Integrity Management Programs are designed to improve service for our customers by mitigating potential risks and identifying and prioritizing operational and infrastructure enhancements. Replacement of aging natural gas infrastructure is an example of a top priority to minimize the potential for natural gas emissions and to prevent the release of greenhouse gases into the atmosphere. Over the past five years, we have doubled the pace at which we are replacing older natural gas pipelines in both Massachusetts and Connecticut.

Our natural gas utilities have adopted natural gas expansion initiatives designed to increase the number of new natural gas heating customers, as well as providing residential and business customers currently heating with fuel oil and electricity with an opportunity to convert to natural gas. Burning natural gas reduces greenhouse gas emissions, because natural gas emits about 27 percent less carbon than fuel oil when used for space heating. Gas expansion is also expected to create numerous new jobs.

Water. Aquarion Water Company provides water services to residential, commercial, industrial, fire protection and other customers in Connecticut, Massachusetts and New Hampshire. Our water utilities obtain their water supplies from wholly-owned surface water sources and groundwater supplies, as well as water purchased from other water suppliers. Approximately 98 percent of our

annual production is self-supplied and processed at ten surface water treatment plants and numerous well stations, all wholly-owned and located in Connecticut, Massachusetts and New Hampshire.

Energy Efficiency. Delivering clean, efficient energy is one of our primary goals. We work with our customers to improve their energy efficiency. We are currently investing approximately $500 million a year in energy efficiency, and consider these investments to be the most economical way to reduce our region's emissions and improve its competitiveness. Eversource's recent rankings confirm the success of our programs. Eversource was ranked first for incremental energy efficiency as a percentage of overall sales in the last study performed by the Coalition for Environmentally Responsible Economies (Ceres), a leading sustainability advocacy organization. The design and deployment of our energy-saving programs and services has contributed to our consistent top — tier ranking in both Massachusetts and Connecticut by the American Council for an Energy-Efficient Economy (ACEEE), with Eversource retaining the top spot in Massachusetts for the past seven years.

Our nationally recognized energy efficiency portfolio of services provides energy solutions for all Eversource customers — residential (including low-income), municipal, commercial and industrial. These solutions address energy-efficient new construction, weatherization, lighting, appliances, heating, cooling, mechanical and process equipment replacement that go beyond code compliance and are transforming the marketplace. Combined with online customer engagement tools and on-site education, green-job training and community outreach services, energy efficiency is generating savings that go back into our region's economy. These investments are expected to continue to reduce carbon emissions by millions of tons per year.

Corporate and Compensation Governance. We remain committed to effective corporate governance and executive compensation standards. Please see the Corporate Governance and Executive Compensation Highlights on page 4 of this proxy statement.

Our Employees. We are dedicated to ensuring that all of our employees receive good pay, are given the tools to perform their jobs safely, have access to affordable healthcare, and can look forward to a happy and comfortable retirement. We also are committed to diversity in the workplace; Ceres recently commended us for our progress and commitment to diversity, which includes linking executive compensation to increasing leadership-level position diversity.

2018 Proxy Statement 21

GOVERNANCE OF EVERSOURCE ENERGY |

Our Communities. Eversource is committed to the health and economic well-being of the residents, businesses and institutions of Connecticut, Massachusetts and New Hampshire. We recognize and value our role as a corporate citizen in the cities and towns across our service territory. We are helping to build healthier, stronger communities through strategic charitable partnerships, local giving, employee volunteerism and economic development opportunities. We have a dedicated team responsible for all philanthropy, working to ensure our continued commitment to community outreach and corporate giving.

We have a long history of partnering with local and regional community organizations. Through grants, we support economic and community development, the environment, and initiatives that address local, high-priority concerns and needs. We provided nearly $16.1 million in grants to nonprofit organizations and worthwhile regional activities across our tri-state service area in 2017. We have strong partnerships with key community organizations across New England, including our continued support of the Eversource Walk for Boston Children's Hospital, the Eversource Hartford Marathon, the Eversource Walk and 5K Run for Easter Seals New Hampshire, the United Way, and Special Olympics.

Environmental Stewardship. At Eversource, we value our native resources and take great care to promote conservation and manage natural and cultural resources. We dedicate professional resources to maintain the integrity and long-term vitality of the land we manage. Examples include the Eversource Land Trust, which was created to promote the preservation of open space, and our focus on rights-of-way maintenance practices that promote critical diverse habitats. Our vegetation management program is an industry best-practice plan to balance the needs of our customers and communities with the goal of providing safe, reliable electric service for our customers, while monitoring growth of trees around power lines. We partner with state Historic Preservation and Tribal Historic Preservation offices to identify and protect cultural resources of significance during construction projects. In addition, Eversource was again recognized in 2017 by Newsweek magazine for its leadership in corporate sustainability and environmental performance, placing 20th among 500 companies in Newsweek's annual Green Rankings list.

Climate Leadership. We have developed meaningful strategies to reduce our carbon footprint, and are proud

to be one of the greenest utilities in the nation. We are a founding partner of the EPA's Natural Gas STAR Methane Challenge Program, and have committed to specific targets to reduce fugitive emissions from our natural gas system. We collaborate with other utilities and industry partners across the country to better understand storm hazards and develop solutions to improve our system reliability. Our employees are committed to ensuring that our comprehensive emergency preparedness and resiliency plans will keep our communities safe. We lead by example, operating Eversource facilities and fleet in a sustainable, responsible manner. In January 2018, we completed the sale of our fossil fuel generating assets in New Hampshire, further reducing Eversource's overall carbon emissions. At the same time, we have formed a partnership with the world's leader in off-shore wind development to build at least 2,000 megawatts of off-shore wind turbines southeast of the Massachusetts coast, and we are building 62 megawatts of solar generation in Massachusetts.

Accountability. We hold ourselves accountable for the impact our business might have on the environment, meeting, and in many cases exceeding, all environmental laws and regulatory commitments and requirements. We actively work with customers, community members, environmental groups, regulatory agencies, and civic and business partners to promote transparent operations. Our employees, as well as vendors, suppliers, and contractors, are expected to adhere to all environmental laws as stated in our Code of Business Conduct, Supplier Code of Conduct and RFP process. We are committed to tracking and monitoring our progress via a set of metrics, which receive regular executive leadership review. We work every day to ensure that our operations have minimal impact on the environment, including project permitting, spill response, and emissions reporting.