QuickLinks -- Click here to rapidly navigate through this document| | | | | Filed Pursuant to Rule 424(b)(3)

File No. 333-101419 |

Prospectus

Jefferson Smurfit Corporation (U.S.)

A subsidiary of Smurfit-Stone Container Corporation

Offer to Exchange

$700,000,000 of Our 81/4%

Senior Notes due 2012

- •

- The notes mature on October 1, 2012.

- •

- The notes are guaranteed by JSCE, Inc., our sole stockholder and a wholly-owned subsidiary of Smurfit-Stone Container Corporation.

- •

- The notes and the guarantee are (1) our and JSCE, Inc.'s senior, unsecured obligations, (2) rank equal in right of payment with all of our and JSCE, Inc.'s unsecured senior debt, and (3) rank junior to our and JSCE, Inc.'s secured debt.

- •

- The notes bear interest at the rate of 81/4% per year, payable April 1 and October 1 of each year.

- •

- The terms of the notes that we will issue in the exchange offer will be substantially identical to the outstanding notes, except that transfer restrictions and registration rights relating to the outstanding notes will not apply to the registered notes.

- •

- The exchange offer expires at 5:00 p.m., New York City time, on Friday, January 10, 2003, unless we extend it.

- •

- All outstanding notes that are validly tendered in the exchange offer and not withdrawn will be exchanged.

- •

- Tenders of outstanding notes may be withdrawn at any time before the expiration of the exchange offer.

- •

- There is no public market for the registered notes.

- •

- We will not receive any proceeds from the exchange offer, and we will pay the expenses of the exchange offer.

Before participating in this exchange offer, please refer to the section in this prospectus entitled "Risk Factors" beginning on page 12.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these notes or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is December 11, 2002.

TABLE OF CONTENTS

| | Page

|

|---|

| Summary | | 1 |

| Risk Factors | | 12 |

| Use of Proceeds | | 20 |

| Capitalization | | 20 |

| Selected Consolidated Financial Data | | 21 |

| Management's Discussion and Analysis of Financial Condition and Results of Operations | | 22 |

| The Exchange Offer | | 36 |

| Business | | 47 |

| Management | | 54 |

| Executive Compensation | | 57 |

| Security Ownership of Certain Beneficial Owners and Management | | 63 |

| Certain Relationships and Related Party Transactions | | 64 |

| Description of the Notes | | 65 |

| Description of Certain Indebtedness | | 108 |

| Certain United States Federal Tax Considerations | | 110 |

| Plan of Distribution | | 111 |

| Legal Matters | | 113 |

| Experts | | 113 |

| Where You Can Find More Information | | 113 |

| Index to Consolidated Financial Statements | | F-1 |

This prospectus does not constitute an offer to sell, or a solicitation of an offer to buy, any note offered by this prospectus by any person in any jurisdiction in which it is unlawful for that person to make an offer or solicitation. Neither the delivery of this prospectus nor any sale made under this prospectus will under any circumstances imply that there has been no change in our affairs or that the information set forth in this prospectus is correct as of any date subsequent to the date of this prospectus.

INCORPORATION OF DOCUMENTS BY REFERENCE

JSCE, Inc.'s Annual Report on Form 10-K for the year ended December 31, 2001, Quarterly Reports on Form 10-Q for the periods ended March 31, 2002, June 30, 2002 and September 30, 2002, Current Reports on Form 8-K filed with the SEC on July 24, 2002, August 27, 2002, September 9, 2002, September 11, 2002 and September 26, 2002 and any future filings we make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934 before the expiration of the exchange offer are incorporated in this prospectus by reference.

Any statement contained in a document incorporated or deemed to be incorporated by reference in this prospectus shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus modifies or supersedes that statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

We will provide without charge to each person, including any person to whom a prospectus is delivered, upon written or oral request of that person, a copy of any and all of the information that has been referenced in this prospectus other than exhibits to these documents.Requests for these copies should be directed to the Corporate Secretary, Jefferson Smurfit Corporation (U.S.), 150 North Michigan Avenue, Chicago, Illinois 60601, telephone number (312) 346-6600 and should be made no later than five business days before the expiration of the exchange offer.

i

SUMMARY

This summary highlights information contained elsewhere in this prospectus. It does not contain all the information that you may consider important in making your decision to tender your outstanding notes in the exchange offer. Therefore, you should read the entire prospectus carefully, including in particular the "Risk Factors" section and the consolidated financial statements and the related notes appearing at the back of this prospectus. You should also carefully read our annual report on Form 10-K for the year ended December 31, 2001 and our quarterly report on Form 10-Q for the period ended September 30, 2002, which are incorporated by reference into this prospectus, before making your decision. In this prospectus, unless the context requires otherwise, "we," "us" and "our" refers to Jefferson Smurfit Corporation (U.S.), its parent, JSCE, Inc., and its other subsidiaries on a consolidated basis.

THE EXCHANGE OFFER

The following summary is provided solely for your convenience. This summary is not intended to be complete. You should read the full text and more specific details contained elsewhere in this prospectus. For a more detailed description of the notes, see "Description of the Notes."

The Exchange Offer |

|

We are offering to exchange up to $700,000,000 in aggregate principal amount of our 81/4% Senior Notes due 2012. We issued and sold the notes on September 26, 2002, in reliance on an exemption from registration under the Securities Act. |

|

|

We believe that the registered notes may be offered for resale, resold and otherwise transferred by you without compliance with the registration or prospectus delivery provisions of the Securities Act if: |

|

|

• |

|

you are acquiring the registered notes in the ordinary course of your business; |

|

|

• |

|

you are not participating, do not intend to participate, and have no arrangement or understanding with any person to participate, in the distribution of the registered notes issued to you; and |

|

|

• |

|

you are not an affiliate, under Rule 405 of the Securities Act, of ours. |

Expiration Date |

|

The exchange offer, once commenced, will remain open for at least 20 business days and will expire at 5:00 p.m., New York City time, on Friday, January 10, 2003, unless we decide to extend the expiration date, but in no event will we extend the expiration date past March 25, 2003. |

Conditions to the Exchange Offer |

|

We may end or amend the exchange offer if: |

|

|

• |

|

any legal proceeding, government action or other adverse development materially impairs our ability to complete the exchange offer; |

|

|

• |

|

any SEC rule, regulation or interpretation materially impairs the exchange offer; or |

|

|

|

|

|

1

|

|

• |

|

we have not obtained all necessary governmental approvals with respect to the exchange offer. |

|

|

Please refer to the section in this prospectus entitled "The Exchange Offer—Conditions to the Exchange Offer" for a complete discussion of these conditions. We may waive any or all of these conditions. At this time, there are no adverse proceedings, actions or developments pending or, to our knowledge, threatened against us. Furthermore, no federal or state governmental approvals are necessary to complete the exchange offer. |

Withdrawal Rights |

|

You may withdraw the tender of your outstanding notes at any time before 5:00 p.m., New York City time, on the expiration date. |

Procedures for Tendering Outstanding Notes |

|

To participate in the exchange offer, you must: |

|

|

• |

|

complete, sign and date the accompanying letter of transmittal, or a facsimile copy of the letter of transmittal; or |

|

|

• |

|

tender outstanding notes following the procedures for book-entry transfer described on pages 38 to 40. |

|

|

You must mail or otherwise deliver the documentation and your outstanding notes to The Bank of New York, as exchange agent, at one of the addresses listed on the letter of transmittal. |

Special Procedures for Beneficial Owners |

|

If you hold outstanding notes registered in the name of a broker, dealer, commercial bank, trust company or other nominee, you should contact that person promptly if you wish to tender outstanding notes. Please refer to the section in this prospectus entitled, "The Exchange Offer—Procedures for Tendering Outstanding Notes" for more specific instructions on tendering your outstanding notes. |

Guaranteed Delivery

Procedures |

|

If you wish to tender your outstanding notes and you cannot get required documents to the exchange agent on time, or you cannot complete the procedure for book-entry transfer on time, you may tender your outstanding notes according to the guaranteed delivery procedures described in this prospectus under the heading "The Exchange Offer—Procedures for Tendering Outstanding Notes." |

Use of Proceeds |

|

We will not receive any proceeds from the exchange offer. |

Federal Income Tax Consequences |

|

The exchange of notes will not be a taxable event to you for United States federal income tax purposes. Please refer to the section in this prospectus entitled "Certain United States Federal Tax Considerations" for a more complete discussion of the tax consequences of tendering your outstanding notes in the exchange offer. |

|

|

|

|

|

2

Exchange Agent |

|

The Bank of New York is serving as exchange agent in the exchange offer. Please refer to the section in this prospectus entitled "The Exchange Offer—Exchange Agent" for more information on the exchange agent. |

3

THE REGISTERED NOTES

We use the term "notes" when describing provisions that apply to both the outstanding notes and the registered notes. The registered notes will evidence the same debt as the outstanding notes. The same indenture will govern both the outstanding notes and the registered notes. Please refer to the section in this prospectus entitled "Description of the Notes" for a more complete description of the terms of the notes.

Issuer |

|

Jefferson Smurfit Corporation (U.S.). |

Securities Offered |

|

$700,000,000 aggregate principal amount of senior notes due 2012. |

Maturity |

|

October 1, 2012. |

Interest |

|

8.250% per annum, payable semi-annually in arrears on April 1 and October 1, commencing on April 1, 2003. |

Optional Redemption |

|

We may redeem some or all of the notes beginning on October 1, 2007. The initial redemption price is 104.125% of the principal amount plus accrued interest. The redemption price will decline each year after 2007 and beginning on October 1, 2010 will be 100.000% of the principal amount, plus accrued and unpaid interest on the notes. In addition, before October 1, 2005, we may redeem up to 35% of the notes using the proceeds from sales of specified kinds of capital stock, as set forth in the section entitled "Description of the Notes—Optional Redemption." |

Ranking |

|

The notes will be unsecured and will rank equal in right of payment to all our senior debt. The notes will be junior to our secured debt and all existing and future liabilities, including trade payables, of our subsidiaries. At September 30, 2002, we had $2,947 million in total liabilities, including $1,674 million in debt (which includes $917 million in secured debt). |

Change of Control |

|

Upon a change of control, as defined under the section entitled "Description of the Notes," you will have the right, as a holder of notes, to require us to repurchase all or part of your notes at the repurchase price set forth in the section entitled "Description of the Notes," plus accrued and unpaid interest, if any, to the date of repurchase. |

Guarantee |

|

The notes will be guaranteed on a senior basis by our parent, JSCE, Inc. The guarantee will be a general, unsecured obligation of JSCE, and will be effectively junior to JSCE's senior secured debt. JSCE is a holding company with no material assets other than its ownership of 100% of our capital stock and the stock of certain liability management subsidiaries, which stock is pledged to the lenders under our bank credit agreement. See "Risk Factors—Risk Factors Related to the Registered Notes." |

Covenants |

|

We will issue the notes under an indenture between us and The Bank of New York, as trustee. Among other things, the indenture limits our ability to: |

|

|

• |

|

incur more debt; |

|

|

|

|

|

4

|

|

• |

|

repurchase stock, repurchase subordinated debt and make certain investments; |

|

|

• |

|

pay dividends, make loans or transfer property or assets; |

|

|

• |

|

transfer or dispose of substantially all of our assets; and |

|

|

• |

|

engage in transactions with affiliates. |

|

|

These covenants are subject to a number of important exceptions and qualifications that are described under the heading "Description of the Notes—Covenants," including specific exceptions to accommodate a merger or similar transaction with Smurfit-Stone or its other subsidiaries. |

5

JEFFERSON SMURFIT CORPORATION (U.S.)

General

Jefferson Smurfit Corporation (U.S.), a Delaware corporation, is an integrated producer of containerboard, corrugated containers and other packaging products. We have operations primarily in the United States. Our primary products include:

- •

- corrugated containers;

- •

- containerboard;

- •

- solid bleached sulfate;

- •

- folding cartons; and

- •

- coated recycled boxboard.

As of September 30, 2002, we had 9 paper mills, 55 container plants, 31 consumer packaging plants, 23 reclamation plants and two wood products plants. Our plants are primarily located in the United States. In 2001, we had net sales of $3,344 million, EBITDA of $374 million and net income of $108 million.

Our containerboard mills produce a full line of containerboard, which for 2001 included 803,000, 276,000 and 255,000 tons of unbleached kraft linerboard, white top linerboard and recycled medium, respectively. Our containerboard mills and corrugated container operations are highly integrated, with the majority of our containerboard used internally by our corrugated container operations or the corrugated container operations of our sister company, Stone Container Corporation. In 2001, our corrugated container plants consumed 1,620,000 tons of containerboard.

We are a wholly-owned subsidiary of JSCE, Inc. JSCE, Inc. is a wholly-owned subsidiary of Smurfit-Stone Container Corporation and has no material operations other than its investment in us. Smurfit-Stone, a Delaware corporation, is an integrated producer of containerboard, corrugated containers and other packaging products. Smurfit-Stone is the industry's leading manufacturer of paperboard and paper-based packaging, including containerboard, corrugated containers, multiwall bags, and coated recycled boxboard, and is a leading producer of solid bleached sulfate, folding cartons and labels. Smurfit-Stone is the world's largest paper recycler.

Competitive Strengths

We believe we have the following competitive strengths:

We are a leading manufacturer, supplier and converter of high quality, value-added paperboard products. Together with the affiliated companies of Smurfit-Stone, we are the largest North American producer of corrugated containers, containerboard, multiwall bags and coated recycled boxboard and the world's largest paper recycler.

We seek to minimize our cost base through our strategy of consolidation with rationalization. Since the merger with Stone Container in November 1998, we have closed higher cost facilities, sold non-core assets, significantly reduced headcount and improved our procurement process. Smurfit-Stone rationalized its containerboard mill system, eliminating approximately 2.0 million tons of containerboard capacity and 400,000 tons of market pulp capacity. These efforts have improved our cost-competitive position and we believe our low cost manufacturing base is an important strategic advantage.

6

Our marketing strategy is to sell a broad range of paper-based packaging products to marketers of industrial and consumer products. Our converting plants focus on supplying both specialized packaging with high value graphics that enhance a product's market appeal and high-volume commodity products. We serve a broad customer base of thousands of customers from our plants.

Together with the affiliated operations of Smurfit-Stone, we provide broad geographic reach with approximately 300 U.S. and international facilities.

Smurfit-Stone's Strategy

Smurfit-Stone's objective is to be the premier paper-based packaging company in North America. References in this "—Smurfit-Stone's Strategy" section to "we," "us" and "our" are references to Smurfit-Stone and its subsidiaries, on a consolidated basis. We will focus on the following strategic objectives in order to achieve our goal:

We have one of the industry's broadest ranges of packaging substrates with the ability to produce a full range of containerboard weights from feather-weight medium grades used for mini-flute production to 90-pound heavy-weight linerboard. This enhances our flexibility to serve our customers and grow our business profitably. We intend to develop innovative ways to grow our business by using these substrates to provide higher margin, value-added packaging and graphics solutions for our customers.

We believe there continues to be significant opportunities to acquire quality North American paper-based packaging assets at attractive prices. Our recent acquisition of the Stevenson, Alabama medium mill from MeadWestvaco Corporation solidifies our position in the containerboard marketplace and presents further rationalization opportunities within our system. Additionally, we are continuing to reposition and organically grow our product lines. We are refocusing our marketing effort with an evaluation of our local and national account business. Targeting new areas of growth and cultivating new sales from existing customers should enable us to grow profitably in both national and local account business.

Historically, the containerboard industry has operated to maximize utilization of its production facilities. We have strategically decided to depart from this traditional approach to instead produce products to meet customer demand. These and other operating decisions are designed to better serve our customers and improve profits.

We continue to seek additional opportunities to improve our cost structure. As we grow our business both organically and through acquisitions, we will continue to rationalize our existing capacity. Since the November 1998 merger with Stone Container, we have reduced our containerboard capacity by 2.0 million tons and pulp capacity by 400,000 tons through the closure of inefficient production facilities, and have undertaken measures to reduce our corporate overhead, thereby enhancing our competitive position from a cost perspective.

7

Financial flexibility is critical to responding to industry opportunities and conditions. We will continue to manage our finances to maximize cash flow and apply free cash flow to pay down debt.

Recent Developments

On September 3, 2002, Jefferson Smurfit Group plc, a publicly-traded company headquartered in Dublin, Ireland, completed the distribution to its shareholders of all of its 71,638,462 shares of Smurfit-Stone common stock, which represented approximately 29.3% of the outstanding Smurfit-Stone common stock. The distribution was a condition to the consummation of a cash offer by an affiliate of Madison Dearborn Partners, Inc. for the purchase of all the outstanding shares of capital stock of Jefferson Smurfit Group.

On September 26, 2002, we completed (1) a tender offer repurchase of $473.7 million aggregate principal amount of our 93/4% Senior Notes due April 1, 2003 and (2) a solicitation of consents to certain proposed amendments to the indenture governing the 93/4% senior notes, which amendments eliminated substantially all of the restrictive covenants and related events of default from the indenture. We used a portion of the proceeds from the offering of the outstanding notes to repurchase the 93/4% senior notes. See "Use of Proceeds" for a more detailed discussion of the application of the proceeds from the offering of the outstanding notes.

In September 2002, we purchased a corrugating medium mill that has an annual capacity of 830,000 tons, seven corrugated container plants, one hardwood sawmill and approximately 82,000 acres of timberland from MeadWestvaco Corporation (we refer to this acquisition as the "Stevenson Mill Acquisition"). We paid $350 million for the assets (subject to a working capital adjustment) and will pay an additional $25 million within a twelve month period in connection with certain financing arrangements. In November 2002, we announced the closure of three of the corrugated container facilities acquired as part of the Stevenson Mill Acquisition.

In September 2002, we sold our industrial packaging operations to a third party for approximately $80 million. We retained approximately $12 million of accounts receivable from this business. The assets included 17 tube and core manufacturing facilities, three fiber partition plants and three uncoated recycled boxboard mills. These operations employed approximately 700 hourly and 150 salaried employees. Net sales for the year ended December 31, 2001 for these operations were $122 million and EBITDA was approximately $9 million. We used the proceeds from the sale to reduce borrowings outstanding under the Jefferson Smurfit (U.S.) revolving credit facility.

On August 23, 2002, we amended our credit agreement to permit the distribution of Smurfit-Stone common stock by Jefferson Smurfit Group to its shareholders, which otherwise would have constituted a change of control event of default. In addition, this amendment permitted us to refinance all or any portion of our 93/4% Senior Notes due 2003 and incur the indebtedness represented by the outstanding notes to the extent necessary for such refinancing.

8

On September 26, 2002, we amended and restated our credit agreement to, among other things, permit (1) the incurrence of the indebtedness represented by the notes (with respect to the amount of indebtedness in excess of the indebtedness permitted to be incurred under the amendment to our credit agreement of August 23, 2002 as described above) and (2) the use of a portion of the proceeds from the sale of the outstanding notes to fund the Stevenson Mill Acquisition. In addition, the amended and restated credit agreement permits us to obtain an incremental loan facility of up to $140 million, subject to lender syndication, to be used for the issuance of letters of credit to support environmental improvement revenue bonds that are expected to be assumed by us within one year of the Stevenson Mill Acquisition. The amended and restated credit agreement also permits the merger of Stone Container Corporation and Jefferson Smurfit (U.S.) under certain circumstances.

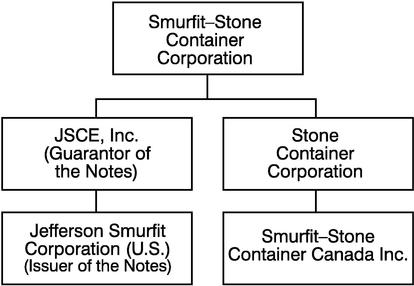

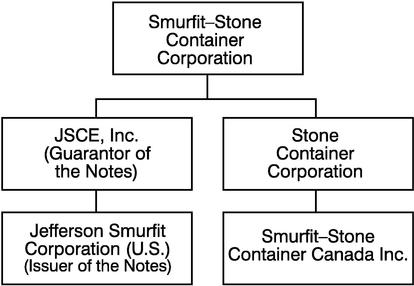

Corporate Structure

Smurfit-Stone is a holding company with no business operations of its own. Smurfit-Stone conducts its business operations through two wholly-owned subsidiaries: JSCE, Inc. and Stone Container Corporation. Smurfit-Stone is not guaranteeing the notes.

Our principal executive offices are located at 150 N. Michigan Avenue, Chicago, Illinois 60601, telephone: (312) 346-6600.

RISK FACTORS

See "Risk Factors" immediately following this summary for a discussion of risks relating to us, our business and participating in the exchange offer.

9

SUMMARY FINANCIAL DATA

The consolidated financial data presented below as of and for each of the periods indicated through December 31, 2001 was derived from the audited consolidated financial statements of JSCE, Inc. Certain prior year amounts have been restated to conform to current year presentation. The unaudited consolidated financial data for the nine-month periods ended September 30, 2001 and 2002 was derived from our unaudited consolidated financial statements. The unaudited consolidated financial data reflect all normal recurring adjustments necessary for a fair presentation of these results. Our results of operations for the nine-month period ended September 30, 2002 are not necessarily indicative of the results which may be expected for the full fiscal year 2002. This information is only a summary and should be read in conjunction with our consolidated historical financial statements appearing at the back of this prospectus.

| | Year Ended December 31,

| | Nine Months Ended September 30,

| |

|---|

| | 1997

| | 1998

| | 1999

| | 2000

| | 2001

| | 2001

| | 2002

| |

|---|

| |

| |

| |

| |

| |

| | (Unaudited)

| |

|---|

| |

(In millions, except ratios)

| |

|---|

| Consolidated Statement of Operations Data:(a) | | | | | | | | | | | | | | | | | | | | | | |

| Net sales | | $ | 2,948 | | $ | 3,036 | | $ | 3,293 | | $ | 3,739 | | $ | 3,344 | | $ | 2,537 | | $ | 2,532 | |

| Income (loss) from continuing operations(b)(c) | | | 157 | | | (97 | ) | | 619 | | | 333 | | | 236 | | | 175 | | | 130 | |

| Interest income from Smurfit-Stone | | | | | | 6 | | | 48 | | | 53 | | | 65 | | | 48 | | | 54 | |

| Interest expense | | | 196 | | | 202 | | | 223 | | | 156 | | | 125 | | | 99 | | | 69 | |

| Income (loss) from continuing operations before extraordinary item and cumulative effect of accounting change | | | (31 | ) | | (183 | ) | | 267 | | | 138 | | | 106 | | | 75 | | | 69 | |

| Net income (loss) | | | 1 | | | (160 | ) | | 272 | | | 151 | | | 108 | | | 77 | | | 84 | |

| Other Financial Data: | | | | | | | | | | | | | | | | | | | | | | |

| EBITDA (unaudited)(d) | | $ | 301 | | $ | 331 | | $ | 399 | | $ | 464 | | $ | 374 | | $ | 273 | | $ | 223 | |

| Income (loss) from continuing operations before extraordinary item and cumulative effect of accounting change, adjusted to exclude goodwill amortization(e) | | | (24 | ) | | (176 | ) | | 274 | | | 145 | | | 113 | | | 80 | | | | |

| Net income (loss), adjusted to exclude goodwill amortization(e) | | | 8 | | | (153 | ) | | 279 | | | 158 | | | 115 | | | 82 | | | | |

| Expenditures for property, plant and equipment | | | 191 | | | 265 | | | 69 | | | 116 | | | 86 | | | 60 | | | 61 | |

| Ratio of earnings to fixed charges (unaudited)(f) | | | | | | | | | 2.89 | x | | 2.38 | x | | 2.31 | x | | 2.12 | x | | 2.44 | x |

| Consolidated Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | | | |

| Total assets | | $ | 2,771 | | $ | 3,174 | | $ | 2,736 | | $ | 2,667 | | $ | 2,544 | | $ | 2,643 | | $ | 2,986 | |

| Total debt | | | 2,040 | | | 2,570 | | | 1,636 | | | 1,529 | | | 1,427 | | | 1,466 | | | 1,674 | |

| Stockholder's equity (deficit) | | | (374 | ) | | (538 | ) | | (235 | ) | | (84 | ) | | (44 | ) | | (19 | ) | | 39 | |

- (a)

- In September 2002, we sold our industrial packaging division to a third party. The sale resulted in a gain on disposition of discontinued operations of $22 million, net of tax of $17 million. The results of operations of the industrial packaging division have been reclassified as discontinued operations for all periods presented.

- (b)

- We recorded a gain of $407 million on the sale of our timberlands in 1999.

- (c)

- In connection with the November 1998 Stone Container merger, we recorded charges of $310 million in the fourth quarter of 1998, including $257 million of restructuring charges, $30 million for settlement of our Cladwood® litigation and $23 million of merger-related costs. We recorded additional restructuring charges of $9 million and $4 million in 1999 and 2001,

10

respectively, and $4 million and $4 million in the nine months ended September 30, 2001 and 2002, respectively.

- (d)

- EBITDA is defined as income (loss) from continuing operations before income taxes and extraordinary item, interest expense, interest income, depreciation and amortization, equity in income (loss) of affiliates, restructuring charges, merger related costs, and gains (losses) on sale or writedown of assets and investments. EBITDA is presented in order to provide an indication of our ability to service debt and is an important measurement to us because of our highly leveraged position. It is presented to enhance an understanding of our operating results and is not intended to represent cash flow or results of operations for the periods presented. EBITDA is not a measurement under accounting principles generally accepted in the United States and may not be similar to EBITDA measures of other companies.

- (e)

- Effective January 1, 2002, we adopted Statement of Financial Accounting Standards (SFAS) No. 142, "Goodwill and Other Intangible Assets." SFAS No. 142 requires that goodwill no longer be amortized, but instead be tested for impairment at least annually.

- (f)

- For purposes of calculating the ratio of earnings to fixed charges, earnings include income (loss) from continuing operations before income taxes and extraordinary items, plus fixed charges. Fixed charges consist of interest on indebtedness, amortization of deferred debt issuance costs and that portion of lease rental expense considered to be representative of the interest factors therein. Earnings were inadequate to cover fixed charges for the years ended December 31, 1997 and 1998 by $27 million and $281 million, respectively.

11

RISK FACTORS

You should carefully consider the specific factors listed below, as well as the other information included in this prospectus, before deciding to tender your outstanding notes in the exchange offer.

Risk Factors Related to Our Business

The cyclicality of our industry could negatively impact our sales volume and revenues and our ability to respond to competition or take advantage of business opportunities.

Our operating results reflect the industry's general cyclical pattern. The majority of our products are commodities subject to extreme price competition. The industry in which we compete has had substantial overcapacity for several years. Production overcapacity and weak demand for products causes companies in the paper industry to take downtime periodically to reduce inventory levels. In addition, the industry is capital intensive, which leads to high fixed costs and generally results in continued production as long as prices are sufficient to cover marginal costs. These conditions have contributed to substantial price competition and volatility in the industry. In the event of a recession, demand and prices are likely to drop substantially. Increased production by our competitors will also depress prices for our products. From time to time, we have closed certain of our facilities or have taken downtime based on prevailing market demand for our products and may continue to do so. Certain of our competitors have also temporarily closed or reduced production at their facilities, but can reopen and/or increase production capacity at any time.

Our sales and profitability have historically been more sensitive to price changes than changes in volume. Future decreases in prices for our products would adversely affect our operating results. These factors, coupled with our highly leveraged financial position, may adversely impact our ability to respond to competition and to other market conditions or to otherwise take advantage of business opportunities.

Our industry is highly competitive and price fluctuations could diminish our sales volume and revenues.

The paperboard and packaging products industries are highly competitive, and no single company is dominant. Our competitors include large, vertically integrated paperboard and packaging products companies and numerous smaller companies. Because these products are globally traded commodities, the industries in which we compete are particularly sensitive to price fluctuations as well as other factors including innovation, design, quality and service, with varying emphasis on these factors depending on the product line. To the extent that one or more of our competitors become more successful with respect to any key competitive factor, our ability to attract and retain customers could be materially adversely affected.

Many of our competitors are less leveraged and have financial and other resources greater than ours and are able to better withstand the adverse nature of the business cycle. If our facilities are not as cost efficient as those of our competitors, we may need to temporarily or permanently close such facilities and suffer a consequent reduction in our revenues.

If we are unable to maintain all or a substantial majority of the sales volume to our customers, due in part to the tendency of certain customers to diversify their suppliers, our sales volume and revenues could diminish.

Price fluctuations in raw materials and energy costs could adversely affect our ability to obtain the materials needed to manufacture our products and could adversely affect our manufacturing costs.

Wood fiber and recycled fiber, the principal raw materials used in the manufacture of our products, are purchased in highly competitive, price sensitive markets. These raw materials have historically exhibited price and demand cyclicality. In particular, the supply and price of wood fiber

12

depends on a variety of factors over which we have no control, including environmental and conservation regulations, natural disasters and weather. A decrease in the supply of wood fiber has caused, and likely will continue to cause, higher wood fiber costs in some of the regions in which we procure wood. In addition, the increase in demand of products manufactured, in whole or in part, from recycled fiber has caused an occasional tightness in the supply of recycled fiber. It may also cause a significant increase in the cost of such fiber used in the manufacture of recycled containerboard and related products. Recycled fiber supplies, primarily old corrugated containers, tightened during the second quarter of 2002. For the nine months ended September 30, 2002, the average price of OCC was higher than last year by approximately $35 per ton. Markets eased somewhat in July and August due to lower export demand and prices have declined. Such costs are likely to continue to fluctuate based upon demand/supply characteristics.

The cost of producing our products is sensitive to the price of energy. Energy prices, in particular oil and natural gas, have experienced significant volatility in recent years, with a corresponding effect on our production costs. In January 2001, natural gas prices reached a high of nearly $10.00 per million British thermal units ("mmBtu"), compared to a historical ten-year average of $2.61/mmBtu. Though natural gas prices normalized in the second half of 2001, energy prices may not remain at current rates and may rise to higher levels, in which case our production costs, competitive position and results of operations could be adversely affected thereby.

We may encounter difficulties arising from integrating acquisitions, restructuring our operations or closing or disposing of facilities.

We have completed acquisitions, closed higher cost facilities, sold non-core assets, and otherwise restructured our operations to improve our cost competitiveness. Some of these activities are ongoing, and may divert the attention of management or disrupt our ordinary operations or those of our subsidiaries. Moreover, our production capacity or the actual amount of products we produce may be reduced as a result of these activities.

On September 30, 2002, we completed the Stevenson Mill Acquisition. We expect to achieve certain synergies from this acquisition, but these synergies and other expected benefits may not be realized or may be lower than expected. In addition, this acquisition may pose integration risks.

Our substantial leverage may require us to seek additional sources of capital to satisfy our capital needs.

We have a highly leveraged capital structure. As of September 30, 2002, we had approximately $1,674 million of outstanding debt.

Our level of debt could have significant consequences for us, including the following:

- •

- we may be required to seek additional sources of capital, including additional borrowings under our existing credit facilities, other private or public debt or equity financings to service or refinance our indebtedness, which borrowings may not be available on favorable terms;

- •

- a substantial portion of our cash flow from operations will be necessary to meet the payment of principal and interest on our indebtedness and other obligations and will not be available for our working capital, capital expenditures and other general corporate purposes;

- •

- our level of debt makes us more vulnerable to economic downturns, and reduces our operational and business flexibility in responding to changing business and economic conditions and opportunities; and

- •

- we will be more highly leveraged than some of our competitors, which may place us at a competitive disadvantage.

13

In addition, borrowings under our bank credit agreement are at variable rates of interest, which expose us to the risk of increased interest rates.

Factors beyond our control could hinder our ability to service our debt and meet our operating requirements.

As of September 30, 2002, we had scheduled principal payments on our debt of approximately $2 million in the remainder of 2002, $300 million in 2003 and $78 million in 2004. We will continue to have substantial interest expense during these periods.

Our ability to meet our obligations and to comply with the financial covenants contained in our debt instruments will largely depend on our future performance. Our performance will be subject to financial, business and other factors affecting us. Many of these factors will be beyond our control, such as:

- •

- the state of the economy;

- •

- the financial markets;

- •

- demand for and selling prices of our products;

- •

- costs of raw materials and energy; and

- •

- legislation and other factors relating to the paperboard and packaging products industries generally or to specific competitors.

If the net proceeds from operating cash flows and financing activities such as borrowings and any divestitures and amounts from other financing sources do not provide us with sufficient liquidity to meet our operating and debt service requirements, we will be required to pursue other alternatives to repay debt and improve liquidity. Such alternatives may include:

- •

- sales of assets;

- •

- cost reductions;

- •

- deferral of certain discretionary capital expenditures; and

- •

- seeking amendments or waivers to our debt instruments.

Such measures may not be successfully completed or may not generate the liquidity required by us to operate our business and service our obligations. If we

- •

- are not able to generate sufficient cash flow or otherwise obtain funds necessary to make required debt payments, or

- •

- fail to comply with the various covenants in our various debt instruments,

we would be in default under the terms of our various debt instruments, which would permit our debtholders to accelerate the maturity of such debt and would cause defaults under our other debt.

Restrictive covenants in our debt could limit our corporate activity.

Our ability to incur additional debt, and in certain cases refinance outstanding debt, is significantly limited or restricted under the agreements relating to our existing debt. The agreements contain covenants that restrict, among other things, our ability to:

- •

- incur debt;

- •

- pay dividends;

- •

- repurchase or redeem capital stock;

14

- •

- engage in transactions with affiliates;

- •

- issue capital stock;

- •

- create liens;

- •

- sell assets;

- •

- engage in mergers and consolidations; and

- •

- make investments in unrestricted subsidiaries.

In addition, we are limited in our ability to move capital freely among us, JSCE, Smurfit-Stone and our subsidiaries and affiliates. The limitations contained in such agreements, together with our and our affiliates' highly leveraged capital structure, could limit our ability to effect future debt or equity financings. These limitations also may otherwise restrict our corporate activities, including our ability to avoid defaults, provide for capital expenditures, take advantage of business opportunities or respond to market conditions.

We are subject to environmental regulations and liabilities that could weaken our operating results.

Federal, state, provincial, foreign and local environmental requirements, particularly those relating to air and water quality, are a significant factor in our business. In the past we have had, and in the future may face, environmental liability for the costs of remediating soil or groundwater that is or was contaminated by us or a third party at various sites which are now or were previously owned or operated by us. We are also engaged in legal proceedings with federal and state authorities concerning alleged violations of various discharge and emission standards. These proceedings may result in the imposition of fines or penalties as well as mandated remediation programs that require substantial, and in some instances, unplanned capital expenditures. There also may be similar liability at sites with respect to which either we have received, or in the future may receive, notice that we may be a potentially responsible party and which are the subject of cleanup activity under the Comprehensive Environmental Response, Compensation and Liability Act, analogous state laws and other laws concerning hazardous substance contamination.

We have incurred in the past, and may incur in the future, civil and criminal fines and penalties relating to environmental matters and costs relating to the damage of natural resources, lost property values and toxic tort claims. We have made significant expenditures to comply with environmental regulations and expect to make significant expenditures in the future. As of September 30, 2002, we had approximately $14 million reserved for environmental liabilities. However, we could incur additional significant expenditures due to changes in law or the discovery of new information, and those expenditures could have a material adverse effect on our operating results. In addition, we are required to make significant environmental capital expenditures on an annual basis. We expect those expenditures to increase significantly in the next several years.

The United States Environmental Protection Agency has finalized significant portions of its comprehensive rule governing the pulp, paper and paperboard industry, known as the "Cluster Rule". Phase I of the Cluster Rule required us to convert our bleached linerboard mill at Brewton, Alabama to an elemental chlorine free bleaching process, to install systems at several of our mills for the collection and destruction of low volume, high concentration gases and to implement best management practices, such as spill controls. These projects were substantially completed at a cost of approximately $85 million as of September 30, 2002 (of which approximately $7 million was spent in 2002). Phase II of the Cluster Rule will require the implementation of systems to collect high volume, low concentration gases at various mills and has a compliance date of 2006. Phase III of the Cluster Rule will require control of particulate from recovery boilers, smelt tanks and lime kilns and has a compliance date of 2005. We continue to study possible means of compliance with Phases II and III of

15

the Cluster Rule. Based on currently available information, we estimate that the compliance cost of Phases II and III of the Cluster Rule is likely to be in the range of $30 million to $35 million and that such cost will be incurred over the next five years.

Risk Factors Related to the Exchange Offer

If you do not exchange your outstanding notes for registered notes, your notes will continue to have restrictions on transfer.

If you do not exchange your outstanding notes for registered notes in the exchange offer, or if your outstanding notes are tendered but not accepted, your notes will continue to have restrictions on transfer. In general, you may offer or sell any outstanding notes only if the notes are registered under the Securities Act and applicable state laws, or resold under an exemption from these laws. We do not intend to register the outstanding notes under the Securities Act, other than in the limited circumstances in the registration rights agreement discussed in the section "Description of the Notes—Registration Rights."

The issuance of the registered notes may adversely affect the market for outstanding notes.

If outstanding notes are tendered for exchange, the trading market for untendered and tendered but unaccepted outstanding notes could be adversely affected. Please refer to the section in this prospectus entitled "The Exchange Offer—Consequences of Failure to Exchange."

Risk Factors Related to the Registered Notes

You may find it difficult to sell your registered notes because no public trading market for the registered notes exists.

The registered notes are a new issue of securities for which there is currently no active trading market. The registered notes will be registered under the Securities Act, but will constitute a new issue of securities with no established trading market. We do not intend to list the registered notes on any national securities exchange or to seek the admission of the registered notes for quotation through the Nasdaq Stock Market, Inc. In addition, the registered notes will not be eligible for trading on the Private Offerings, Resales, and Trading through Automatic Linkages Market, also known as the PORTAL Market. PORTAL is a computerized communications facility for primary offering and secondary trading of securities that are eligible for resale pursuant to Rule 144A and that are (1) restricted securities, as defined in Rule 144(a)(3), or (2) contractually required to be resold only in compliance with Rule 144, Rule 144A, Regulation S or in secondary private placements. If the registered notes are traded after their initial issuance, they may trade at a discount from their initial offering price, depending on prevailing interest rates, the market for similar securities and other factors, including general economic conditions and our financial condition, performance and prospects.

Accordingly,

- •

- a market for the registered notes may not develop;

- •

- you may not be able to sell your registered notes; and

- •

- you may not be able to sell your registered notes at any particular price.

We have substantial debt outstanding that could negatively impact our business and prevent us from fulfilling our obligations under the registered notes.

After we completed the offering of the outstanding notes, we had significant debt outstanding. As of September 30, 2002, we had total consolidated debt outstanding of $1,674 million.

16

Our high level of debt could:

- •

- make it difficult for us to satisfy our obligations, including making interest payments under the registered notes and our other debt obligations;

- •

- limit our ability to obtain additional financing to operate our business;

- •

- limit our financial flexibility in planning for and reacting to industry changes;

- •

- place us at a competitive disadvantage as compared to less leveraged companies;

- •

- increase our vulnerability to general adverse economic and industry conditions, including changes in interest rates; and

- •

- require us to dedicate a substantial portion of our cash flow to payments on our debt, reducing the availability of our cash flow for other purposes.

We may borrow additional amounts to fund our capital expenditures and working capital needs. We also may incur additional debt to finance future acquisitions. The incurrence of additional debt could make it more likely that we will experience some or all of the risks described above.

Because the registered notes effectively rank junior to our secured debt and all liabilities of our subsidiaries, if we are in default on these obligations you may not receive full payment on your registered notes.

Because the registered notes effectively rank junior to our secured debt and all existing and future liabilities, including trade payables, of our subsidiaries and affiliates, if we are in default on these obligations, you may not receive principal and/or interest payments in respect of the registered notes. At September 30, 2002, we had $2,947 million in total liabilities, including $1,674 million in debt (which includes $917 million in secured indebtedness.

The obligations under our bank credit agreement are guaranteed by Smurfit-Stone, JSCE and our material subsidiaries. The obligations under our bank credit agreement are secured by a security interest in substantially all of our assets and the assets of our material subsidiaries (with the exception of certain trade receivables and proceeds thereof), a pledge of all of the capital stock of JSCE, Jefferson Smurfit (U.S.) and the material U.S. subsidiaries of Jefferson Smurfit (U.S.) and a pledge of 65% of the capital stock of certain foreign subsidiaries of Jefferson Smurfit (U.S.).

Federal and state statutes allow courts, under specific circumstances, to void indebtedness and guarantees thereof and require noteholders to return payments received from debtors and guarantors.

Under federal bankruptcy and comparable provisions of state fraudulent transfer laws, the registered notes and the guarantee could be voided or subordinated if, at the time the indebtedness under the registered notes and the guarantee were incurred, among other things, we or JSCE, as the case may be:

- •

- were insolvent or were rendered insolvent by reason of the indebtedness incurred and payments made in connection herewith;

- •

- were engaged in a business or transaction for which our remaining assets constituted unreasonably small capital; or

- •

- intended to, or believed that we would, incur debts beyond our ability to pay such debts as they matured.

17

The measure of insolvency for purposes of the fraudulent transfer laws vary depending upon the law of the jurisdiction being applied. Generally, however, a company would be considered insolvent if:

- •

- the sum of its debts, including contingent liabilities, was greater than the fair saleable value of all of its assets;

- •

- if the present fair saleable value of its assets was less than the amount that would be required to pay its probable liability on its existing debts, including contingent liabilities, as they become absolute and mature; or

- •

- it could not pay its debts as they become due.

On the basis of historical financial information, recent operating history and other factors, we believe that the issuance of the registered notes and the guarantee will not constitute fraudulent transfers. However, we cannot assure you that a court passing on such issue would agree with our conclusions.

In addition, JSCE is a holding company with no material assets other than 100% of our capital stock and certain liability management subsidiaries, which stock is pledged to the lenders under our bank credit agreement. In the event of a default, holders may be unable to recover from JSCE their investment in the registered notes.

If we do not generate positive cash flows, we may be unable to service our debt.

Our ability to pay principal and interest on the registered notes and on our other debt depends on our future operating performance. Future operating performance is subject to market conditions and business factors that are beyond our control. Consequently, we cannot assure you that we will have sufficient cash flows to pay the principal, premium, if any, and interest on our debt.

If our cash flows and capital resources are insufficient to allow us to make scheduled payments on our debt, we may have to reduce or delay capital expenditures, sell assets, seek additional capital or restructure or refinance our debt. We cannot assure you that the terms of our debt will allow these alternative measures or that such measures would satisfy our scheduled debt service obligations.

If we cannot make scheduled payments on our debt, we will be in default and, as a result:

- •

- our debtholders could declare all outstanding principal and interest to be due and payable;

- •

- our senior debt lenders could terminate their commitments and commence foreclosure proceedings against our assets; and

- •

- we could be forced into bankruptcy or liquidation.

The terms of our debt may severely limit our ability to plan for or respond to changes in our business.

Our ability to incur additional debt, and in certain cases refinance outstanding debt, is significantly limited or restricted under the agreements relating to our existing debt. Our bank credit agreement and the indenture governing the outstanding notes restrict, among other things, our ability to take specific actions, even if such actions may be in our best interest. These restrictions limit our ability to:

- •

- incur liens or make negative pledges on our assets;

- •

- merge, consolidate or sell our assets;

- •

- issue additional debt;

- •

- pay dividends or repurchase or redeem capital stock and prepay other debt;

- •

- make investments and acquisitions;

18

- •

- enter into transactions with affiliates;

- •

- make capital expenditures;

- •

- materially change our business;

- •

- amend our debt and other material agreements;

- •

- issue and sell capital stock;

- •

- make investments in unrestricted subsidiaries; or

- •

- allow distributions from our subsidiaries.

Our bank credit agreement requires us to maintain specified financial ratios and meet specific financial tests. Our failure to comply with these covenants could result in an event of default that, if not cured or waived, could result in us being required to repay these borrowings before their due date. If we were unable to make this repayment or otherwise refinance these borrowings, our lenders could foreclose on our assets. If we were unable to refinance these borrowings on favorable terms, our costs of borrowing could increase significantly.

In addition, we are limited in our ability to move capital freely among us, JSCE, Smurfit-Stone and their subsidiaries. The limitations contained in such agreements, together with our highly leveraged capital structure, could limit our ability to effect future debt or equity financings. These limitations also may otherwise restrict our corporate activities, including our ability to avoid defaults, provide for capital expenditures, take advantage of business opportunities or respond to market conditions.

Furthermore, our senior debt bears interest at fixed and floating rates. As of September 30, 2002, approximately $902 million, or 54% of our total debt, bears interest at floating rates. Our floating interest rates currently are not capped at a maximum interest rate. If interest rates rise, our senior debt interest payments also will increase. Although we may enter into agreements to hedge our interest rate risk, these agreements may be inadequate to protect us fully against our interest rate risk.

19

USE OF PROCEEDS

We will not receive any proceeds from the exchange offer. In consideration for issuing the registered notes, we will receive in exchange outstanding notes of like principal amount, the terms of which are substantially identical in all material respects to the registered notes. The outstanding notes surrendered in exchange for registered notes will be retired and canceled and cannot be reissued. Accordingly, issuance of the registered notes will not result in any increase in our indebtedness. We have agreed to bear the expenses of the exchange offer. No underwriter is being used in connection with the exchange offer.

The net proceeds we received from the sale of the outstanding notes (after deduction of discounts and commissions, fees and other expenses associated with the sale of the notes) were approximately $688 million. We used

- •

- approximately $492 million of the net proceeds to repurchase $473.7 million aggregate principal amount of our 93/4% Senior Notes due 2003 and pay related tender fees and premiums (including consent payments) and

- •

- the remaining proceeds of $196 million to fund a portion of the purchase price relating to the Stevenson Mill Acquisition.

CAPITALIZATION

The following table sets forth our consolidated cash and cash equivalents, current portion of long-term debt and capitalization as of September 30, 2002 on a historical basis, which includes the September 26, 2002 offering of the outstanding notes.

| | As of

September 30, 2002

| |

|---|

| | (Unaudited)

(In millions)

| |

|---|

| Cash and cash equivalents | | $ | 18 | |

| | |

| |

| Current portion of long-term debt | | $ | 85 | |

| | |

| |

| Long-term debt, net of current portion: | | | | |

| | Bank credit facilities | | $ | 636 | |

| | Senior notes | | | 700 | |

| | Accounts receivable securitization program | | | 213 | |

| | Other | | | 40 | |

| | |

| |

| | | Long-term debt, net of current portion | | | 1,589 | |

| | |

| |

| Stockholder's equity (deficit): | | | | |

| | Common stock and additional paid-in capital | | | 1,130 | |

| | Retained earnings (deficit) | | | (1,035 | ) |

| | Accumulated other comprehensive income (loss) | | | (56 | ) |

| | |

| |

| | | Total stockholder's equity (deficit) | | | 39 | |

| | |

| |

| | | Total capitalization | | $ | 1,628 | |

| | |

| |

20

SELECTED CONSOLIDATED FINANCIAL DATA

The following financial data (not including statistical data) as of and for the periods indicated (other than the nine month periods) was derived from our audited consolidated financial statements. Certain prior year accounts have been restated to conform to current year presentation. The following financial data (not including statistical data) as of and for each of the nine-month periods ended September 30, 2002 and September 30, 2001 was derived from our unaudited consolidated financial statements. The financial data as of and for the nine months ended September 30, 2002 and September 30, 2001, includes all adjustments, consisting only of normal recurring adjustments, necessary to present fairly the information included therein. You should not regard the results of operations for the nine months ended September 30, 2002 as indicative of the results that may be expected for the full year.

You should read all of this information in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our financial statements for the year ended December 31, 2001 and for the nine months ended September 30, 2002, contained elsewhere in this prospectus.

| | Year Ended December 31,

| | Nine Months Ended

September 30,

| |

|---|

| | 1997

| | 1998

| | 1999

| | 2000

| | 2001

| | 2001

| | 2002

| |

|---|

| |

| |

| |

| |

| |

| | (Unaudited)

| |

|---|

| | (In millions, except statistical data)

| |

|---|

| Summary of Operations | | | | | | | | | | | | | | | | | | | | | | |

| Net sales | | $ | 2,948 | | $ | 3,036 | | $ | 3,293 | | $ | 3,739 | | $ | 3,344 | | $ | 2,537 | | $ | 2,532 | |

| Income (loss) from continuing operations(a)(b) | | | 157 | | | (97 | ) | | 619 | | | 333 | | | 236 | | | 175 | | | 130 | |

| Interest income from Smurfit-Stone | | | | | | 6 | | | 48 | | | 53 | | | 65 | | | 48 | | | 54 | |

| Interest expense | | | 196 | | | 202 | | | 223 | | | 156 | | | 125 | | | 99 | | | 69 | |

| Income (loss) from continuing operations before extraordinary item and cumulative effect of accounting change | | | (31 | ) | | (183 | ) | | 267 | | | 138 | | | 106 | | | 75 | | | 69 | |

| Discontinued operations, net of income tax provision(c) | | | 32 | | | 39 | | | 15 | | | 8 | | | 4 | | | 4 | | | 27 | |

| Net income (loss) | | | 1 | | | (160 | ) | | 272 | | | 151 | | | 108 | | | 77 | | | 84 | |

Other Financial Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) from continuing operations before extraordinary item and cumulative effect of accounting change, adjusted to exclude goodwill amortization(d) | | $ | (24 | ) | $ | (176 | ) | $ | 274 | | $ | 145 | | $ | 113 | | $ | 80 | | $ | | |

| Net income (loss), adjusted to exclude goodwill amortization(d) | | | 8 | | | (153 | ) | | 279 | | | 158 | | | 115 | | | 82 | | | | |

| Net cash provided by operating activities | | | 88 | | | 117 | | | 103 | | | 247 | | | 183 | | | 109 | | | 122 | |

| Net cash provided by (used for) investing activities | | | (175 | ) | | (595 | ) | | 829 | | | (129 | ) | | (75 | ) | | (51 | ) | | (326 | ) |

| Net cash provided by (used for) financing activities | | | 87 | | | 484 | | | (939 | ) | | (108 | ) | | (118 | ) | | (73 | ) | | 211 | |

| Depreciation, depletion and amortization | | | 127 | | | 134 | | | 134 | | | 120 | | | 124 | | | 92 | | | 89 | |

| Expenditures for property, plant and equipment | | | 191 | | | 265 | | | 69 | | | 116 | | | 86 | | | 60 | | | 61 | |

| Working capital, net | | | 71 | | | 145 | | | 41 | | | 104 | | | (12 | ) | | (1 | ) | | 129 | |

| Property, plant, equipment and timberland, net | | | 1,788 | | | 1,760 | | | 1,309 | | | 1,262 | | | 1,223 | | | 1,231 | | | 1,459 | |

| Total assets | | | 2,771 | | | 3,174 | | | 2,736 | | | 2,667 | | | 2,544 | | | 2,643 | | | 2,986 | |

| Total debt | | | 2,040 | | | 2,570 | | | 1,636 | | | 1,529 | | | 1,427 | | | 1,466 | | | 1,674 | |

| Stockholder's equity (deficit) | | | (374 | ) | | (538 | ) | | (235 | ) | | (84 | ) | | (44 | ) | | (19 | ) | | 39 | |

Statistical Data (tons in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Containerboard production (tons) | | | 2,024 | | | 1,978 | | | 1,592 | | | 1,433 | | | 1,334 | | | 1,001 | | | 989 | |

| Solid bleached sulfate production (tons) | | | 190 | | | 185 | | | 189 | | | 190 | | | 187 | | | 143 | | | 138 | |

| Coated boxboard production (tons) | | | 585 | | | 582 | | | 581 | | | 590 | | | 569 | | | 427 | | | 438 | |

| Corrugated containers sold (billion sq. ft.) | | | 31.7 | | | 29.9 | | | 29.1 | | | 28.7 | | | 27.1 | | | 20.4 | | | 21.0 | |

| Folding cartons sold (tons) | | | 463 | | | 507 | | | 549 | | | 561 | | | 523 | | | 399 | | | 380 | |

| Fiber reclaimed and brokered (tons) | | | 4,832 | | | 5,155 | | | 6,560 | | | 6,768 | | | 6,714 | | | 5,025 | | | 4,945 | |

| Number of employees | | | 15,800 | | | 15,000 | | | 14,400 | | | 14,100 | | | 13,800 | | | 13,800 | | | 12,800 | |

- (a)

- We recorded a gain of $407 million on the sale of our timberlands in 1999.

- (b)

- In connection with the Stone Container merger, we recorded charges of $310 million in the fourth quarter of 1998, including $257 million of restructuring charges, $30 million for settlement of our Cladwood® litigation and $23 million of merger-related costs. We recorded additional restructuring charges of $9 million and $4 million in 1999 and 2001, respectively, and $4 million and $4 million in the nine months ended September 30, 2001 and 2002, respectively.

- (c)

- In September 2002, we sold our industrial packaging division to a third party. The sale resulted in a gain on disposition of discontinued operations of $22 million, net of tax of $17 million. The results of operations of the industrial packaging division have been reclassified as discontinued operations for all periods presented. Our subsidiary, Smurfit Newsprint, completed its exit from the newsprint business in May 2000. Accordingly, the newsprint operations are presented as a discontinued operation.

- (d)

- Effective January 1, 2002, we adopted SFAS No. 142, "Goodwill and Other Intangible Assets." SFAS No. 142 requires that goodwill no longer be amortized, but instead be tested for impairment at least annually.

21

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

General

Market conditions and demand for containerboard and corrugated containers, our primary products, have historically been subject to cyclical changes in the economy and changes in industry capacity, both of which can significantly impact selling prices and our profitability.

Market conditions were generally strong in 1999 and the first half of 2000. Linerboard prices increased to $480 per ton during this period and held through the end of 2000. Corrugated container shipments for the industry in 1999 increased approximately 2% compared to 1998. Domestic economic growth began to slow in the second half of 2000, however, and corrugated container shipments for the industry in 2000 declined 1% compared to 1999. Market conditions continued to deteriorate in 2001 and industry demand for corrugated containers declined 6% compared to 2000, the worst performance since 1975. The slowdown in the U.S. economy, in addition to weak export markets, exerted downward pressure on containerboard demand. In order to maintain a balance between supply and demand, we and other companies in the containerboard industry took extensive market related downtime in 2000 and 2001. Linerboard prices decreased $55 per ton (11%) in 2001 and an additional $5 per ton in the first quarter of 2002. Markets have gradually improved in 2002, however, and prices have increased. We implemented a $25 per ton price increase for linerboard effective July 1, 2002 and began implementing a corresponding price increase for corrugated containers. We do not expect a sustained recovery in demand for corrugated containers until the U.S. economy strengthens.

Market conditions in the folding carton and recycled boxboard mill industry were strong in 1999 and 2000 and sales price increases were implemented in the fourth quarter of 1999 and the second quarter of 2000. For 2000, coated recycled boxboard prices were higher than 1999 by $40 per ton. Industry shipments of folding cartons increased 3% in 2000. Recycled boxboard mill operating rates were lower, however, and production of recycled folding grades decreased 1% compared to 1999. Markets were steady in the first half of 2001, but weakened in the second half. Industry prices for folding cartons were higher in 2001 by 1%. Industry shipments of folding cartons declined by 1% and recycled boxboard mill production declined by 5% in 2001. Industry shipments of folding cartons and production at recycled boxboard mills for the nine months ended September 30, 2002 were flat compared to the same period in 2001.

Wood fiber and reclaimed fiber are the principal raw materials used in the manufacture of our products. Demand for reclaimed fiber was strong in 1999 primarily as a result of strong export demand. As demand weakened in the second half of 2000, we and other companies in the containerboard industry took extensive market related downtime. Prices declined in 2000 and continued to be depressed throughout 2001 as more paper mills took downtime to manage their inventories. The average price of old corrugated containers, commonly known as OCC, the principal grade used in recycled containerboard mills, was $51 per ton in 2001, or 40% lower than the average for 2000. Demand for OCC tightened in the second quarter of 2002 and prices increased, averaging $113 per ton for the third quarter. Markets eased in July and August due primarily to lower export demand and prices have declined. The average price for September was $83 per ton. Wood fiber prices, in areas where we procure wood, increased 1% in 2001 compared to 2000, but have declined in 2002 by 6% compared to 2001.

Recent Developments

In September 2002, we purchased a corrugating medium mill that has an annual capacity of 830,000 tons, seven corrugated container plants, one hardwood sawmill and approximately 82,000 acres

22

of timberland from MeadWestvaco Corporation (we refer to this acquisition as the "Stevenson Mill Acquisition"). We paid $350 million for the assets (subject to a working capital adjustment) and will pay an additional $25 million within a twelve month period in connection with certain financing arrangements. In November 2002, we announced the closure of three of the corrugated container facilities acquired as part of the Stevenson Mill Acquisition.

In September 2002, we sold our industrial packaging operations to a third party for approximately $80 million. We retained approximately $12 million of accounts receivable from this business. The assets included 17 tube and core manufacturing facilities, three fiber partition plants and three uncoated recycled boxboard mills. These operations employed approximately 700 hourly and 150 salaried employees. Net sales for the year ended December 31, 2001 for these operations were $122 million and EBITDA was approximately $9 million. We used the proceeds from the sale to reduce borrowings outstanding under our revolving credit facility.

Results of Operations for the Nine Months ended September 30, 2002 and September 30, 2001

Segment Data

| | Nine months ended September 30,

| |

|---|

| | 2002

| | 2001

| |

|---|

| | Net

Sales

| | Profit/

(Loss)

| | Net

Sales

| | Profit/

(Loss)

| |

|---|

| | (In millions)

| |

|---|

| Containerboard and corrugated containers | | $ | 1,396 | | $ | 88 | | $ | 1,447 | | $ | 119 | |

| Consumer packaging | | | 767 | | | 59 | | | 792 | | | 68 | |

| Reclamation | | | 359 | | | 15 | | | 285 | | | 3 | |

| Other operations | | | 10 | | | | | | 13 | | | 2 | |

| | |

| |

| |

| |

| |

| | Total operations | | $ | 2,532 | | | 162 | | $ | 2,537 | | | 192 | |

| | |

| | | | |

| | | | |

| Restructuring charges | | | | | | (4 | ) | | | | | (4 | ) |

| Gain on sale of assets | | | | | | 1 | | | | | | | |

| Goodwill amortization | | | | | | | | | | | | (5 | ) |

| Interest income from SSCC | | | | | | 54 | | | | | | 48 | |

| Interest expense | | | | | | (69 | ) | | | | | (99 | ) |

| Corporate expenses and other | | | | | | (28 | ) | | | | | (6 | ) |

| | | | | |

| | | | |

| |

| | Income from continuing operations before income taxes and extraordinary item | | | | | $ | 116 | | | | | $ | 126 | |

| | | | | |

| | | | |

| |

Consolidated net sales of $2,532 million in 2002 were comparable to 2001. The higher pricing for reclaimed fiber products and the higher shipments of containerboard and corrugated containers offset the declines due to lower pricing in our major product lines. Income from continuing operations before income taxes and extraordinary item in 2002 was $116 million, a decrease of $10 million compared to 2001. The decrease was due primarily to the decline in earnings of our operating segments, particularly in the Containerboard and Corrugated Containers segment. Lower interest expense and the elimination of goodwill amortization in 2002 partially offset the decline in earnings of our segments.

23

The increase (decrease) in net sales for each of our segments is summarized in the chart below:

| | Container-

board &

Corrugated

Containers

| | Consumer

Packaging

| | Reclamation

| | Other

Operations

| | Total

| |

|---|

| | (In millions)

| |

|---|

| Sales prices and product mix | | $ | (90 | ) | $ | (10 | ) | $ | 81 | | $ | | | $ | (19 | ) |

| Sales volume | | | 41 | | | (15 | ) | | (5 | ) | | | | | 21 | |

| Closed or sold facilities | | | (2 | ) | | | | | (2 | ) | | (3 | ) | | (7 | ) |

| | |

| |

| |

| |

| |

| |

| | Total | | $ | (51 | ) | $ | (25 | ) | $ | 74 | | $ | (3 | ) | $ | (5 | ) |

| | |

| |

| |

| |

| |

| |

Consolidated cost of goods sold increased due primarily to the higher cost of reclaimed fiber ($70 million). Cost of goods sold was favorably impacted by lower energy cost ($21 million) and the elimination of goodwill amortization ($5 million). Cost of goods sold as a percent of net sales in 2002 was 87% compared to 85% in 2001 due primarily to the lower average sales prices.

Selling and administrative expenses increased by 1% compared to last year. Selling and administrative expense as a percent of net sales was 8% in 2002, comparable to 2001.

During 2002, we recorded restructuring charges of $4 million related to the disposition of our Cladwood® operations.

Interest expense declined $30 million due to the favorable impacts from lower overall average interest rates ($21 million) and from lower average borrowings ($9 million). The overall average effective interest rate in 2002 was lower than 2001 by approximately 200 basis points. Interest income for 2002 increased by $6 million due to accrued interest on our intercompany notes receivable from Smurfit-Stone.

The effective income tax rate for 2002 was 41%, comparable to 2001. Provision for income taxes in 2002 differed from the federal statutory tax rate due primarily to state income taxes.

Containerboard and Corrugated Containers Segment

Net sales decreased by 4% due primarily to lower average sales prices. On average, corrugated container sales prices decreased by 6% and linerboard sales prices were lower by 6%. Shipments of corrugated containers increased 3%. Containerboard production decreased 1% compared to last year. We continued to take market related downtime in order to maintain a lower level of inventory. We incurred approximately 160,000 tons of containerboard market related downtime in 2002. For solid bleached sulfate, the average sales price decreased 6% and production was lower by 3%.

Profits decreased by $31 million due primarily to the lower average sales prices. Profits were favorably impacted by lower energy cost compared to 2001. Cost of goods sold as a percent of net sales increased to 88% in 2002 compared to 85% in 2001 due to the lower average sales prices.

Consumer Packaging Segment

Net sales decreased by 3% due primarily to lower sales volumes and lower average sales prices. Folding carton shipments decreased 5%. Sales prices of flexible packaging products were lower than last year by approximately 22%. On average, folding carton and coated boxboard sales prices were comparable to 2001. Production of coated boxboard in 2002 was 3% higher compared to 2001.

Profits decreased by $9 million due primarily to the lower average sales prices and higher reclaimed fiber cost. Reclaimed fiber cost was higher than last year by approximately $7 million. Profits were favorably impacted by lower energy cost. Cost of goods sold as a percent of net sales in 2002 increased to 84% compared to 83% in 2001 due primarily to the lower average sales prices.

24

Reclamation Segment