EQUITABLE

Equitable Financial Life Insurance Company

INVESTMENT EDGE ADV

Application for an Individual Annuity

Regular Mail: For Assistance, Equitable please call 888-517-9900

Retirement Service Solutions P.O. Box 1577 www.equitable.com Secaucus, NJ 07096-1577

Express Mail: Equitable

Retirement Service Solutions 500 Plaza Drive, 7th Floor Secaucus, NJ 07094-3619

PLEASE PRINT

1. Contract Series and Type

A. Contract Series:

Series ADV ($25,000 minimum contribution)

B. Choose a Contract Type: Inherited IRA BCO (Direct Transfer of Decedent IRA) Non-Qualified Inherited Roth IRA BCO (Direct Transfer of Decedent Traditional IRA Roth IRA) Roth IRA Inherited NQ (1035 Exchange of Decedent NQ) SEP IRA Non-Spousal Beneficiary QP Direct Rollover to an Qualified Plan Defined Contribution (DC) Inherited IRA BCO Non-Spousal Beneficiary QP Direct Rollover to an Qualified Plan Defined Benefit (DB) Inherited Roth IRA BCO

C. Total Initial Contribution(s): $ (Estimated Value Required In Case of Transfer or Exchange) Specify Method(s) of Payment:

Check or Wire (make check payable to: EQUITABLE) Rollover (IRA, Roth or SEP IRA)

1035 Exchange (NQ, Inherited NQ) IRA Regular Contribution for the year 20 __ (IRA or Roth IRA) CD or Mutual Fund Proceeds (NQ) Employer Contribution to SEP IRA

Direct Transfer (IRA, Roth IRA or SEP IRA) (Employee contributions not permitted) Registered Representative/Client will request funds Direct Rollover (Non-Spousal Beneficiary QP to (Equitable’s assistance in collecting funds not required) Inherited IRA only) (IRA or Roth IRA) Direct Rollover (Non-Spousal Beneficiary QP to an Inherited Roth IRA)

2. Account Registration (Must be legal resident of U.S. or U.S. Territories)

Please check one

Individual UGMA/UTMA (Child’s SSN )

The Owner types below require additional form(s). See the New Business Form Booklet for more information.

Trust Qualified Plan Trust (DC/DB) Other Non-Natural Owner

Beneficiary of Deceased IRA or NQ Owner Non-Spousal Beneficiary of Deceased QP Participant Custodian (IRA/ROTH)

A. Owner

Male Female Date of Birth (MM/DD/YYYY) Daytime Phone # Owner Name (First) (Middle Initial) (Last) Employer Name (for SEP IRA contracts only) Owner Taxpayer Identification Number (Check one) SSN EIN ITIN

U.S. Primary Residential Address only — No P.O. Box City State Zip Code

If your Mailing Address is different from the Primary Residential Address above, please provide your Mailing Address in Section 11. Fee Based Client Account Number at Your Broker-Dealer Email Address

Home Office: 1290 Avenue of the Americas, New York, NY 10104

Cat. No.162334

X04487_National

Series ADV

2021 App 02 IE ADV

Equitable Distributors, LLC

Page 1 of 10

REQUIRED

REQUIRED

REQUIRED

B. PATRIOT Act Information Owner must complete this section. If the owner is not an individual, the annuitant must complete this section.

U.S. Citizen Yes No

If no, check either: U.S. Visa (Complete below) or Permanent Resident (Green Card) (Copy of document required)

U.S. Visa Type (if applicable)

C. Joint Owner (Must be legal resident of U.S. or U.S. Territories) NQ Only

Male Female Date of Birth (MM/DD/YYYY) Daytime Phone #

Name

(First) (Middle Initial) (Last)

Taxpayer Identification Number (Check one) SSN ITIN

U.S. Primary Residential Address — No P.O. Box City State Zip Code

Email Address

Joint Owner Form of Identification (Check one) Valid Driver’s License Passport State Issued ID

Identification Number Exp. Date (MM/DD/YYYY)

D. Annuitant (If other than Owner.) Annuitant must complete the PATRIOT Act Information section 2B above if the owner is NOT an individual.

Male Female Date of Birth (MM/DD/YYYY) Daytime Phone # Name (First) (Middle Initial) (Last) Taxpayer Identification Number (Check one) SSN ITIN

U.S. Primary Residential Address only — No P.O. Box City State Zip Code

Annuity Commencement Date: The Annuity Commencement Date will be the Contract Date Anniversary following the Annuitant’s 95th Birthday. You may commence payments earlier by submitting a written request to our Processing Office in accordance with the Contract.

E. Joint Annuitant Only complete this section if this is a NQ 1035 Exchange of an existing contract with joint annuitants who are spouses.

Male Female Date of Birth (MM/DD/YYYY) Daytime Phone #

Name

(First) (Middle Initial) (Last)

Taxpayer Identification Number (Check one) SSN ITIN

U.S. Primary Residential Address only — No P.O. Box City State Zip Code

X04487_National Investment Edge — Series ADV

2021 App 02 IE ADV Page 2 of 10 REQUIRED

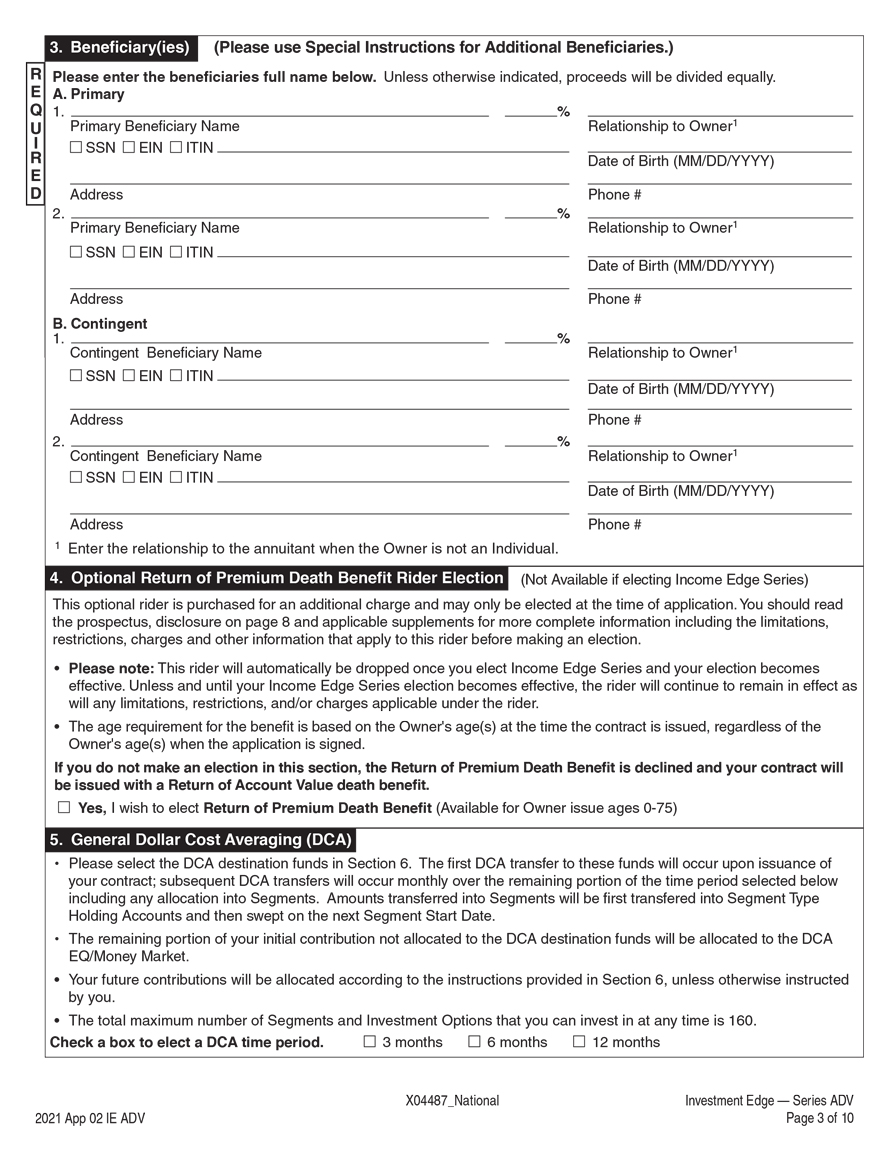

3. Beneficiary(ies) (Please use Special Instructions for Additional Beneficiaries.)

Please enter the beneficiaries full name below. Unless otherwise indicated, proceeds will be divided equally.

A. Primary

1. % Primary Beneficiary Name Relationship to Owner1 SSN EIN ITIN Date of Birth (MM/DD/YYYY) Address Phone #

2. % 1 Primary Beneficiary Name Relationship to Owner SSN EIN ITIN Date of Birth (MM/DD/YYYY) Address Phone #

B. Contingent

1. % Contingent Beneficiary Name Relationship to Owner1 SSN EIN ITIN Date of Birth (MM/DD/YYYY) Address Phone #

2. % Contingent Beneficiary Name Relationship to Owner1 SSN EIN ITIN Date of Birth (MM/DD/YYYY) Address Phone #

1 Enter the relationship to the annuitant when the Owner is not an Individual.

4. Optional Return of Premium Death Benefit Rider Election (Not Available if electing Income Edge Series)

This optional rider is purchased for an additional charge and may only be elected at the time of application. You should read the prospectus, disclosure on page 8 and applicable supplements for more complete information including the limitations, restrictions, charges and other information that apply to this rider before making an election.

• Please note: This rider will automatically be dropped once you elect Income Edge Series and your election becomes effective. Unless and until your Income Edge Series election becomes effective, the rider will continue to remain in effect as will any limitations, restrictions, and/or charges applicable under the rider.

• The age requirement for the benefit is based on the Owner’s age(s) at the time the contract is issued, regardless of the Owner’s age(s) when the application is signed.

If you do not make an election in this section, the Return of Premium Death Benefit is declined and your contract will be issued with a Return of Account Value death benefit.

Yes, I wish to elect Return of Premium Death Benefit (Available for Owner issue ages 0-75)

5. General Dollar Cost Averaging (DCA)

• Please select the DCA destination funds in Section 6. The first DCA transfer to these funds will occur upon issuance of your contract; subsequent DCA transfers will occur monthly over the remaining portion of the time period selected below including any allocation into Segments. Amounts transferred into Segments will be first transfered into Segment Type Holding Accounts and then swept on the next Segment Start Date.

• The remaining portion of your initial contribution not allocated to the DCA destination funds will be allocated to the DCA EQ/Money Market.

• Your future contributions will be allocated according to the instructions provided in Section 6, unless otherwise instructed by you.

• The total maximum number of Segments and Investment Options that you can invest in at any time is 160.

Check a box to elect a DCA time period. 3 months 6 months 12 months

X04487_National Investment Edge — Series ADV

2021 App 02 IE ADV Page 3 of 10

REQUIRED

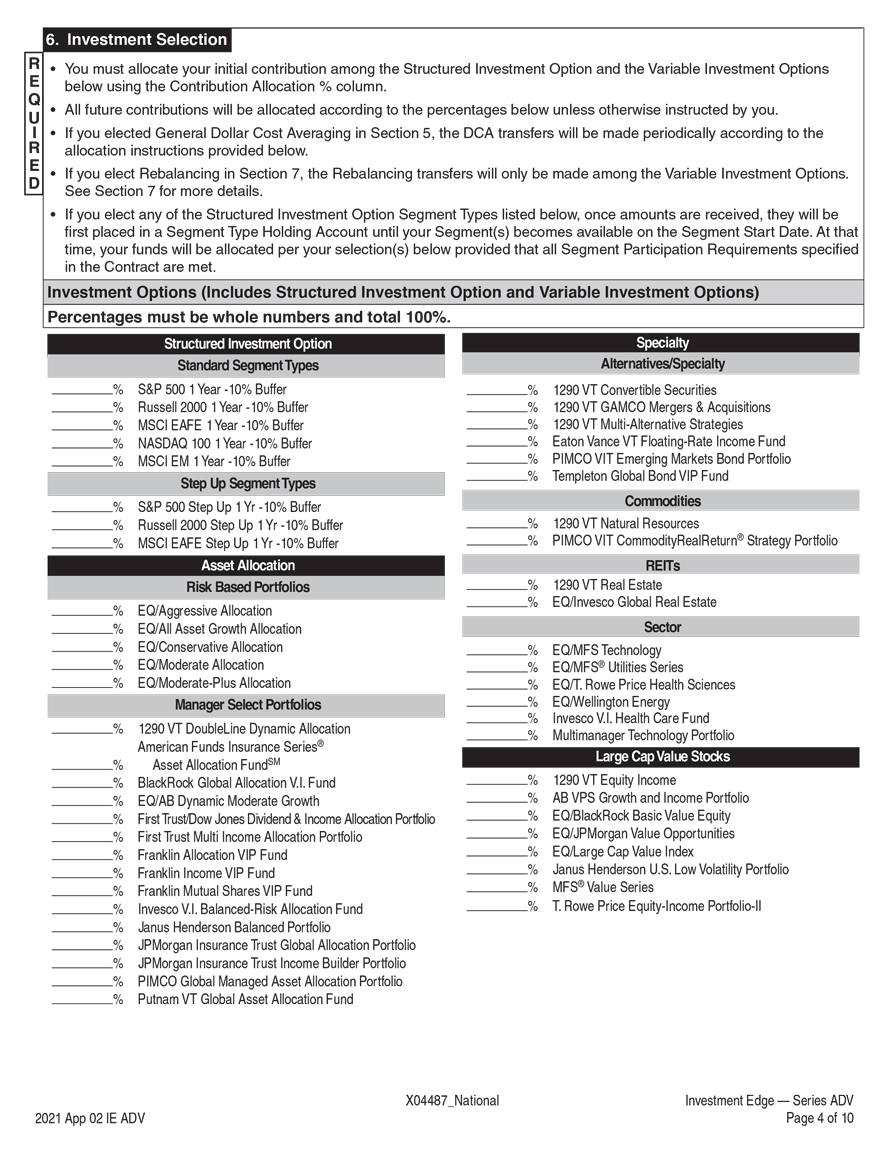

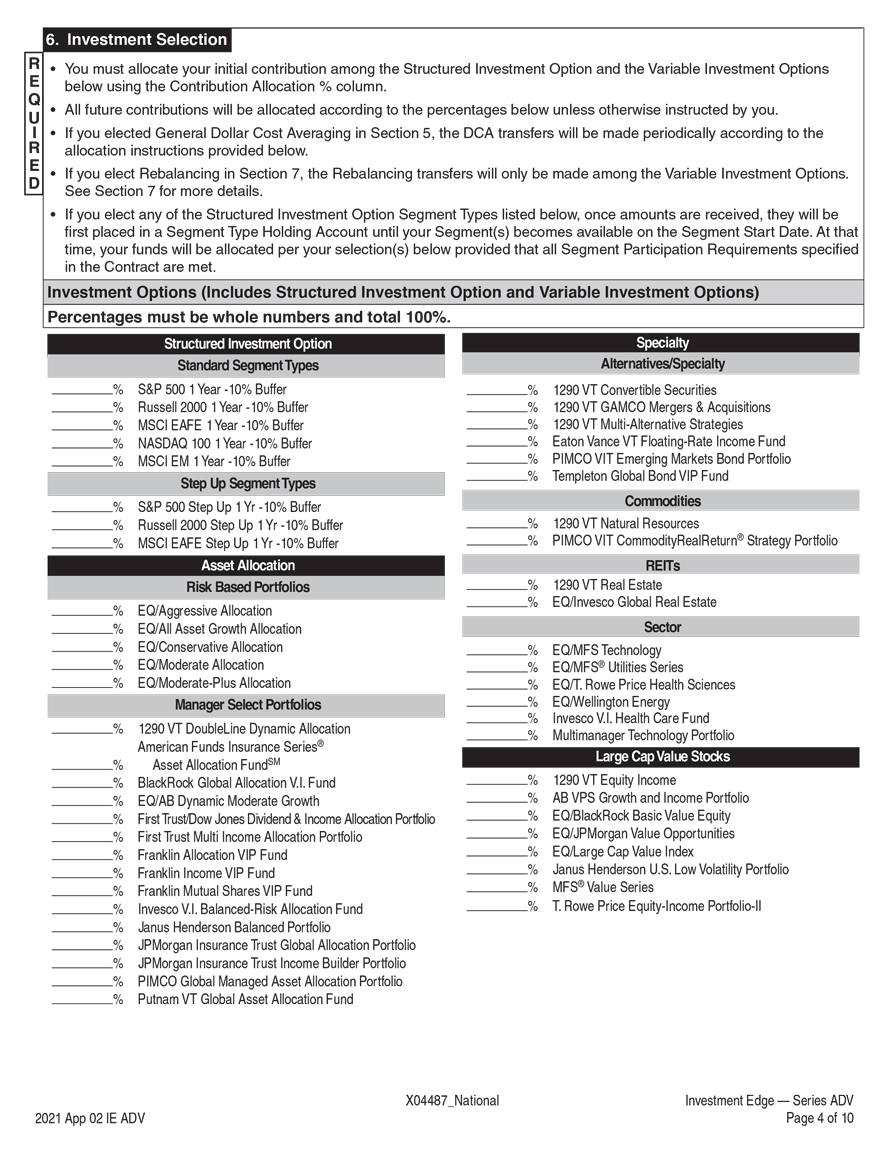

6. Investment Selection

• You must allocate your initial contribution among the Structured Investment Option and the Variable Investment Options below using the Contribution Allocation % column.

• All future contributions will be allocated according to the percentages below unless otherwise instructed by you.

• If you elected General Dollar Cost Averaging in Section 5, the DCA transfers will be made periodically according to the allocation instructions provided below.

• If you elect Rebalancing in Section 7, the Rebalancing transfers will only be made among the Variable Investment Options.

See Section 7 for more details.

• If you elect any of the Structured Investment Option Segment Types listed below, once amounts are received, they will be

first placed in a Segment Type Holding Account until your Segment(s) becomes available on the Segment Start Date. At that time, your funds will be allocated per your selection(s) below provided that all Segment Participation Requirements specified in the Contract are met.

Investment Options (Includes Structured Investment Option and Variable Investment Options) Percentages must be whole numbers and total 100%.

Structured Investment Option Specialty Standard Segment Types Alternatives/Specialty

% S&P 500 1 Year -10% Buffer % 1290 VT Convertible Securities

% Russell 2000 1 Year -10% Buffer % 1290 VT GAMCO Mergers & Acquisitions

% MSCI EAFE 1 Year -10% Buffer % 1290 VT Multi-Alternative Strategies

% NASDAQ 100 1 Year -10% Buffer % Eaton Vance VT Floating-Rate Income Fund

% MSCI EM 1 Year -10% Buffer % PIMCO VIT Emerging Markets Bond Portfolio

% Templeton Global Bond VIP Fund

Step Up Segment Types

% S&P 500 Step Up 1 Yr -10% Buffer Commodities

% Russell 2000 Step Up 1 Yr -10% Buffer % 1290 VT Natural Resources

% MSCI EAFE Step Up 1 Yr -10% Buffer % PIMCO VIT CommodityRealReturn® Strategy Portfolio

Asset Allocation REITs Risk Based Portfolios % 1290 VT Real Estate

% EQ/Invesco Global Real Estate

% EQ/Aggressive Allocation

% EQ/All Asset Growth Allocation Sector

% EQ/Conservative Allocation % EQ/MFS Technology

% EQ/Moderate Allocation % EQ/MFS® Utilities Series

% EQ/Moderate-Plus Allocation % EQ/T. Rowe Price Health Sciences

Manager Select Portfolios % EQ/Wellington Energy

% Invesco V.I. Health Care Fund

% 1290 VT DoubleLine Dynamic Allocation % Multimanager Technology Portfolio American Funds Insurance Series® Large Cap Value Stocks

% Asset Allocation FundSM

% BlackRock Global Allocation V.I. Fund % 1290 VT Equity Income

% EQ/AB Dynamic Moderate Growth % AB VPS Growth and Income Portfolio

% First Trust/Dow Jones Dividend & Income Allocation Portfolio % EQ/BlackRock Basic Value Equity

% First Trust Multi Income Allocation Portfolio % EQ/JPMorgan Value Opportunities

% Franklin Allocation VIP Fund % EQ/Large Cap Value Index

% Franklin Income VIP Fund % Janus Henderson U.S. Low Volatility Portfolio

% Franklin Mutual Shares VIP Fund % MFS® Value Series

% Invesco V.I. Balanced-Risk Allocation Fund % T. Rowe Price Equity-Income Portfolio-II

% Janus Henderson Balanced Portfolio

% JPMorgan Insurance Trust Global Allocation Portfolio

% JPMorgan Insurance Trust Income Builder Portfolio

% PIMCO Global Managed Asset Allocation Portfolio

% Putnam VT Global Asset Allocation Fund

X04487_National Investment Edge — Series ADV

2021 App 02 IE ADV Page 4 of 10 REQUIRED

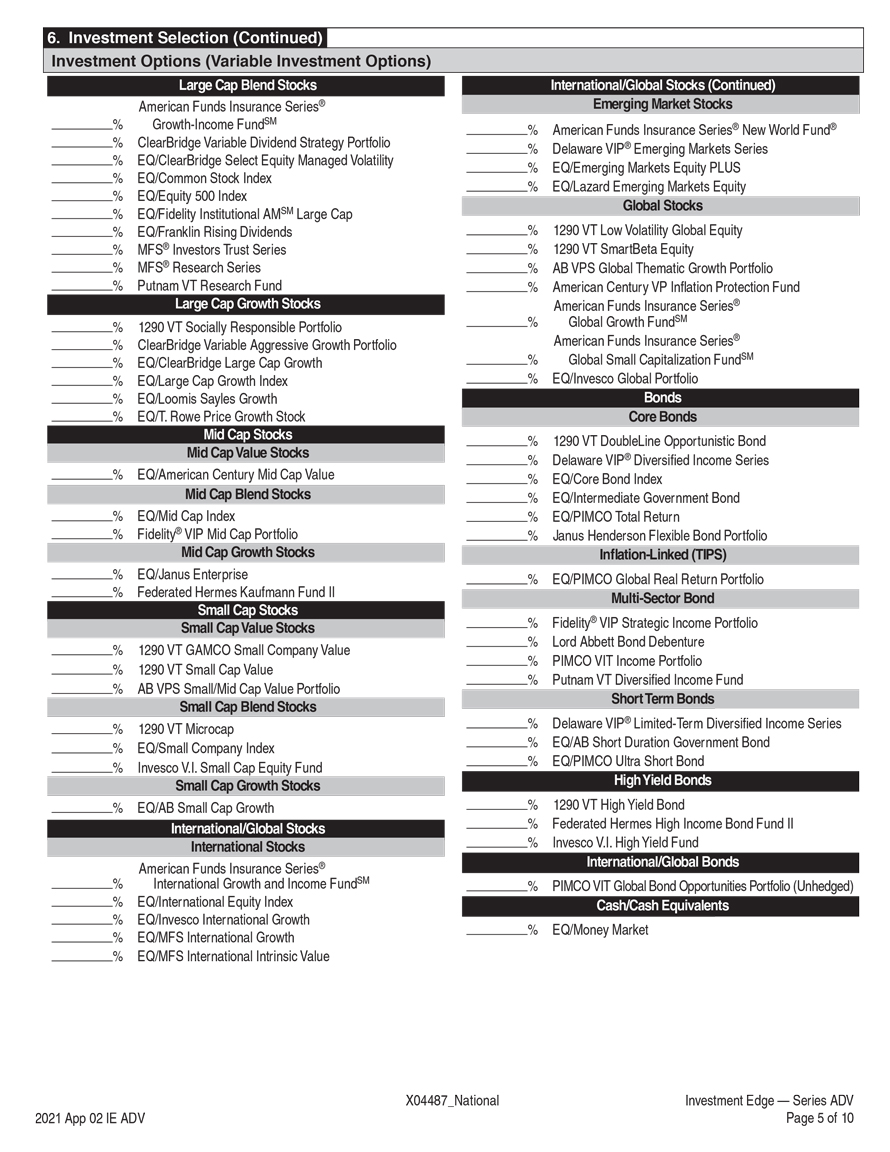

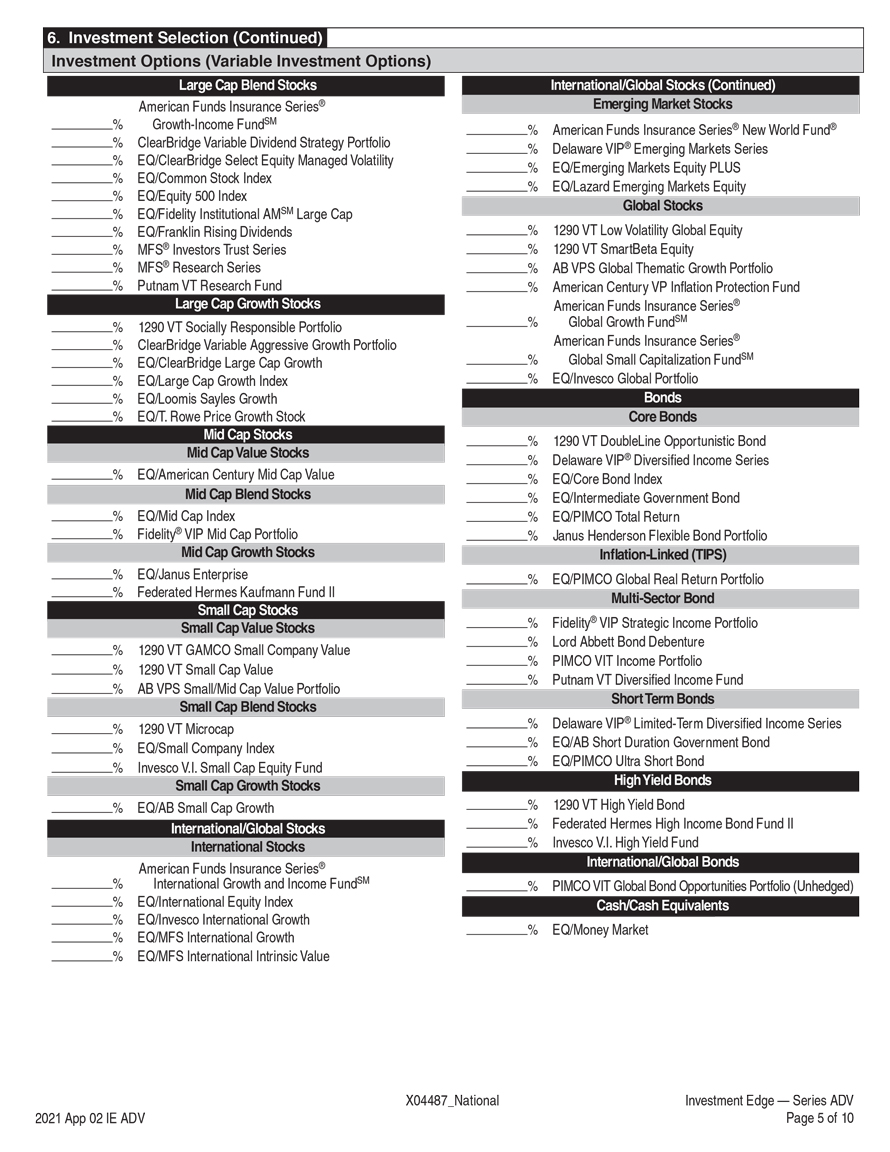

6. Investment Selection (Continued)

Investment Options (Variable Investment Options)

Large Cap Blend Stocks International/Global Stocks (Continued)

American Funds Insurance Series® Emerging Market Stocks

% Growth-Income FundSM

% American Funds Insurance Series® New World Fund®

% ClearBridge Variable Dividend Strategy Portfolio % Delaware VIP® Emerging Markets Series

% EQ/ClearBridge Select Equity Managed Volatility

% EQ/Emerging Markets Equity PLUS

% EQ/Common Stock Index

% EQ/Lazard Emerging Markets Equity

% EQ/Equity 500 Index

SM Global Stocks

% EQ/Fidelity Institutional AM Large Cap

% EQ/Franklin Rising Dividends % 1290 VT Low Volatility Global Equity

% MFS® Investors Trust Series % 1290 VT SmartBeta Equity

% MFS® Research Series % AB VPS Global Thematic Growth Portfolio

% Putnam VT Research Fund % American Century VP Inflation Protection Fund Large Cap Growth Stocks American Funds Insurance Series®

% Global Growth FundSM

% 1290 VT Socially Responsible Portfolio American Funds Insurance Series®

% ClearBridge Variable Aggressive Growth Portfolio SM

% EQ/ClearBridge Large Cap Growth % Global Small Capitalization Fund

% EQ/Large Cap Growth Index % EQ/Invesco Global Portfolio

% EQ/Loomis Sayles Growth Bonds

% EQ/T. Rowe Price Growth Stock Core Bonds

Mid Cap Stocks % 1290 VT DoubleLine Opportunistic Bond

Mid Cap Value Stocks ®

% Delaware VIP Diversified Income Series

% EQ/American Century Mid Cap Value % EQ/Core Bond Index

Mid Cap Blend Stocks % EQ/Intermediate Government Bond

% EQ/Mid Cap Index % EQ/PIMCO Total Return

% Fidelity® VIP Mid Cap Portfolio % Janus Henderson Flexible Bond Portfolio

Mid Cap Growth Stocks Inflation-Linked (TIPS)

% EQ/Janus Enterprise % EQ/PIMCO Global Real Return Portfolio

% Federated Hermes Kaufmann Fund II Multi-Sector Bond Small Cap Stocks

% Fidelity® VIP Strategic Income Portfolio Small Cap Value Stocks % Lord Abbett Bond Debenture

% 1290 VT GAMCO Small Company Value

% PIMCO VIT Income Portfolio

% 1290 VT Small Cap Value

% Putnam VT Diversified Income Fund

% AB VPS Small/Mid Cap Value Portfolio

Short Term Bonds Small Cap Blend Stocks

% Delaware VIP® Limited-Term Diversified Income Series

% 1290 VT Microcap % EQ/AB Short Duration Government Bond

% EQ/Small Company Index % EQ/PIMCO Ultra Short Bond

% Invesco V.I. Small Cap Equity Fund

Small Cap Growth Stocks High Yield Bonds

% EQ/AB Small Cap Growth % 1290 VT High Yield Bond

International/Global Stocks % Federated Hermes High Income Bond Fund II International Stocks % Invesco V.I. High Yield Fund

® International/Global Bonds

American Funds Insurance Series SM

% International Growth and Income Fund % PIMCO VIT Global Bond Opportunities Portfolio (Unhedged)

% EQ/International Equity Index Cash/Cash Equivalents

% EQ/Invesco International Growth

% EQ/Money Market

% EQ/MFS International Growth

% EQ/MFS International Intrinsic Value

X04487_National Investment Edge — Series ADV

2021 App 02 IE ADV Page 5 of 10

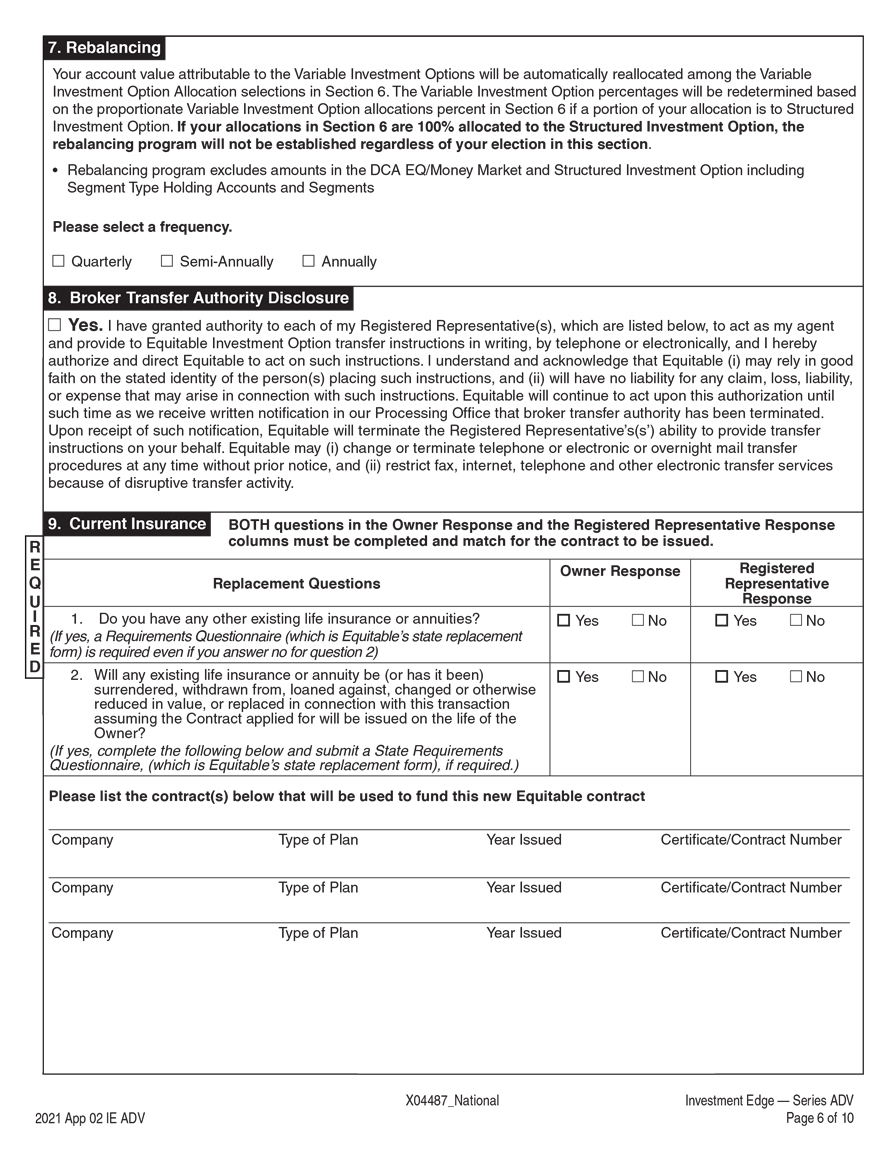

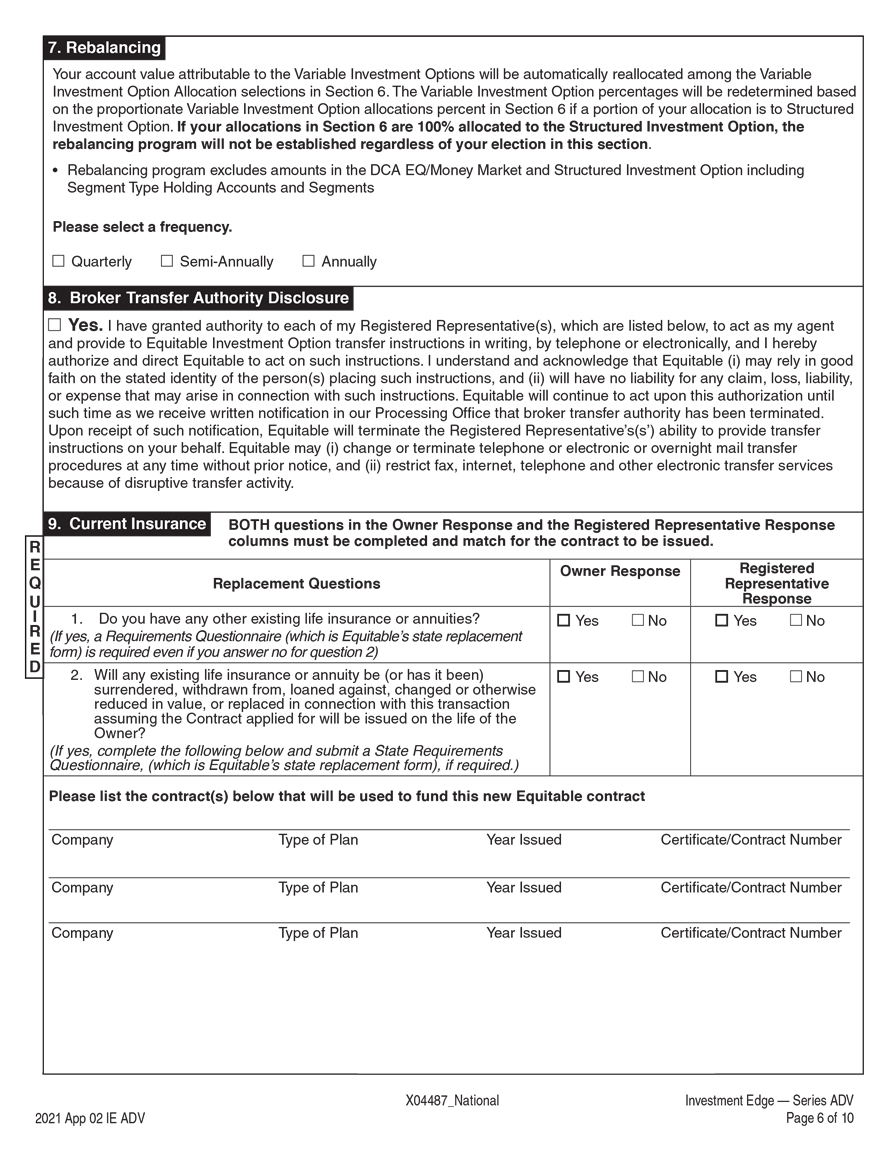

7. Rebalancing

Your account value attributable to the Variable Investment Options will be automatically reallocated among the Variable Investment Option Allocation selections in Section 6. The Variable Investment Option percentages will be redetermined based on the proportionate Variable Investment Option allocations percent in Section 6 if a portion of your allocation is to Structured rebalancing program will not be established regardless of your election in this section. Investment Option. If your allocations in Section 6 are 100% allocated to the Structured Investment Option, the

• Rebalancing program excludes amounts in the DCA EQ/Money Market and Structured Investment Option including

Segment Type Holding Accounts and Segments

Please select a frequency.

Quarterly Semi-Annually Annually

8. Broker Transfer Authority Disclosure

Yes. I have granted authority to each of my Registered Representative(s), which are listed below, to act as my agent and provide to Equitable Investment Option transfer instructions in writing, by telephone or electronically, and I hereby authorize and direct Equitable to act on such instructions. I understand and acknowledge that Equitable (i) may rely in good faith on the stated identity of the person(s) placing such instructions, and (ii) will have no liability for any claim, loss, liability, or expense that may arise in connection with such instructions. Equitable will continue to act upon this authorization until such time as we receive written notification in our Processing Office that broker transfer authority has been terminated. Upon receipt of such notification, Equitable will terminate the Registered Representative’s(s’) ability to provide transfer instructions on your behalf. Equitable may (i) change or terminate telephone or electronic or overnight mail transfer procedures at any time without prior notice, and (ii) restrict fax, internet, telephone and other electronic transfer services because of disruptive transfer activity.

9. Current Insurance columns must be completed and match for the contract to be issued. BOTH questions in the Owner Response and the Registered Representative Response Owner Response Registered Replacement Questions Representative Response

1. Do you have any other existing life insurance or annuities?Yes NoYes No form) (If yes, is a required Requirements even if Questionnaire you answer no (which for question is Equitable’s 2) state replacement

2. Will any existing life insurance or annuity be (or has it been)Yes NoYes No surrendered, withdrawn from, loaned against, changed or otherwise reduced in value, or replaced in connection with this transaction assuming the Contract applied for will be issued on the life of the Owner?

(If yes, complete the following below and submit a State Requirements Questionnaire, (which is Equitable’s state replacement form), if required.)

Please list the contract(s) below that will be used to fund this new Equitable contract

Company Type of Plan Year Issued Certificate/Contract Number Company Type of Plan Year Issued Certificate/Contract Number Company Type of Plan Year Issued Certificate/Contract Number

X04487_National Investment Edge — Series ADV

2021 App 02 IE ADV Page 6 of 10

REQUIRED

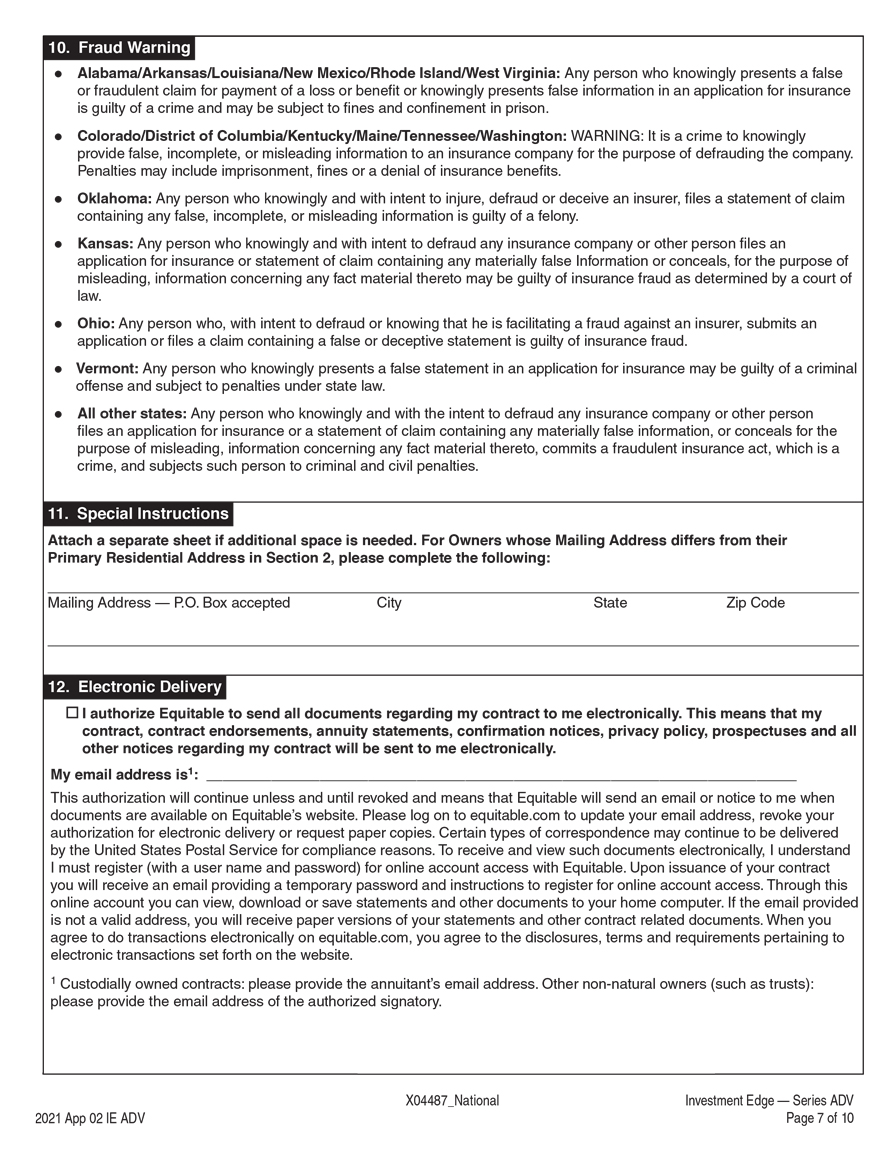

10. Fraud Warning

Alabama/Arkansas/Louisiana/New Mexico/Rhode Island/West Virginia: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

Colorado/District of Columbia/Kentucky/Maine/Tennessee/Washington: WARNING: It is a crime to knowingly provide false, incomplete, or misleading information to an insurance company for the purpose of defrauding the company.

Penalties may include imprisonment, fines or a denial of insurance benefits.

Oklahoma: Any person who knowingly and with intent to injure, defraud or deceive an insurer, files a statement of claim containing any false, incomplete, or misleading information is guilty of a felony.

Kansas: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false Information or conceals, for the purpose of misleading, information concerning any fact material thereto may be guilty of insurance fraud as determined by a court of law.

Ohio: Any person who, with intent to defraud or knowing that he is facilitating a fraud against an insurer, submits an application or files a claim containing a false or deceptive statement is guilty of insurance fraud.

Vermont: Any person who knowingly presents a false statement in an application for insurance may be guilty of a criminal offense and subject to penalties under state law.

All other states: Any person who knowingly and with the intent to defraud any insurance company or other person files an application for insurance or a statement of claim containing any materially false information, or conceals for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent insurance act, which is a crime, and subjects such person to criminal and civil penalties.

11. Special Instructions

Attach a separate sheet if additional space is needed. Primary Residential Address in Section 2, please complete the following: For Owners whose Mailing Address differs from their

Mailing Address — P.O. Box accepted City State Zip Code

12. Electronic Delivery

I authorize Equitable to send all documents regarding my contract to me electronically. contract, contract endorsements, annuity statements, confirmation notices, privacy policy, prospectuses and all This means that my other notices regarding my contract will be sent to me electronically.

My email address is1:

This authorization will continue unless and until revoked and means that Equitable will send an email or notice to me when documents are available on Equitable’s website. Please log on to equitable.com to update your email address, revoke your authorization for electronic delivery or request paper copies. Certain types of correspondence may continue to be delivered by the United States Postal Service for compliance reasons. To receive and view such documents electronically, I understand I must register (with a user name and password) for online account access with Equitable. Upon issuance of your contract you will receive an email providing a temporary password and instructions to register for online account access. Through this online account you can view, download or save statements and other documents to your home computer. If the email provided is not a valid address, you will receive paper versions of your statements and other contract related documents. When you agree to do transactions electronically on equitable.com, you agree to the disclosures, terms and requirements pertaining to electronic transactions set forth on the website.

1 Custodially owned contracts: please provide the annuitant’s email address. Other non-natural owners (such as trusts): please provide the email address of the authorized signatory.

X04487_National Investment Edge — Series ADV

2021 App 02 IE ADV Page 7 of 10

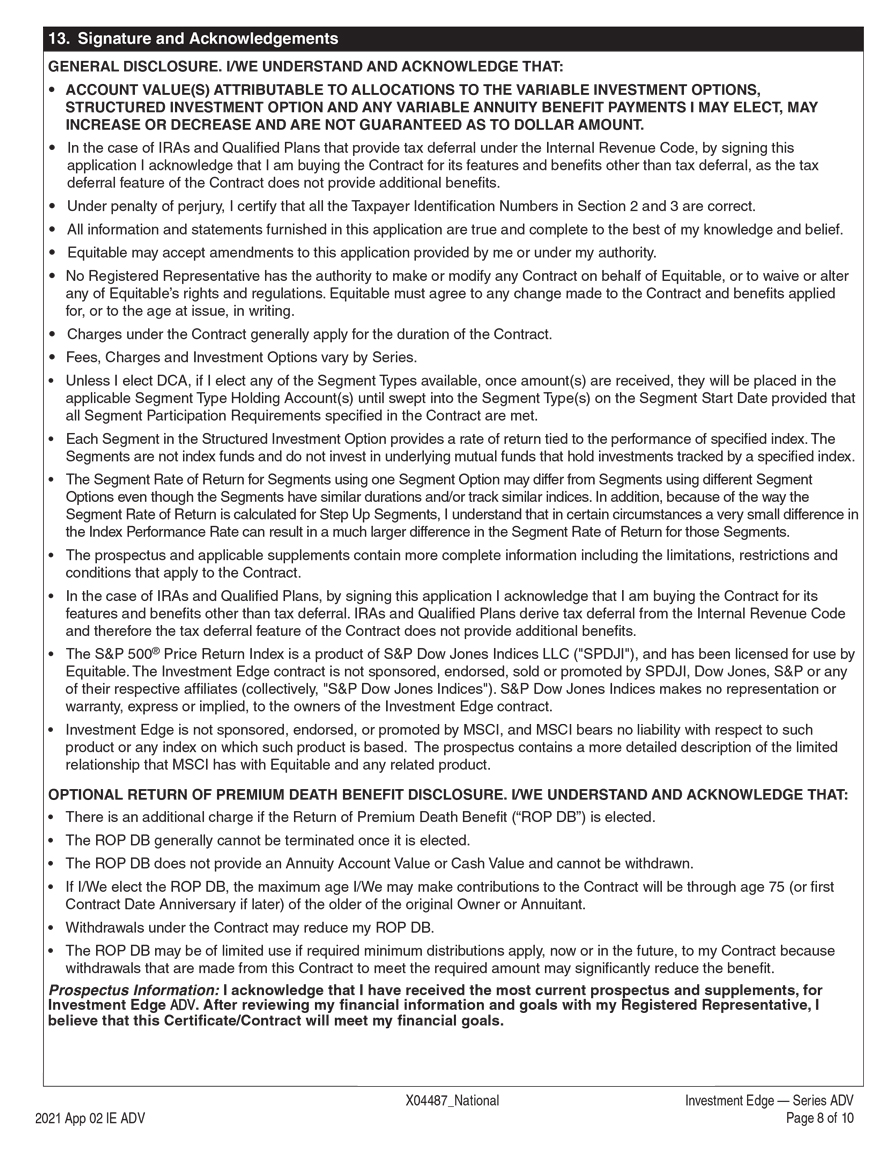

13. Signature and Acknowledgements

GENERAL DISCLOSURE. I/WE UNDERSTAND AND ACKNOWLEDGE THAT:

ACCOUNT VALUE(S) ATTRIBUTABLE TO ALLOCATIONS TO THE VARIABLE INVESTMENT OPTIONS, STRUCTURED INVESTMENT OPTION AND ANY VARIABLE ANNUITY BENEFIT PAYMENTS I MAY ELECT, MAY INCREASE OR DECREASE AND ARE NOT GUARANTEED AS TO DOLLAR AMOUNT.

• In the case of IRAs and Qualified Plans that provide tax deferral under the Internal Revenue Code, by signing this application I acknowledge that I am buying the Contract for its features and benefits other than tax deferral, as the tax deferral feature of the Contract does not provide additional benefits.

• Under penalty of perjury, I certify that all the Taxpayer Identification Numbers in Section 2 and 3 are correct.

• All information and statements furnished in this application are true and complete to the best of my knowledge and belief.

• Equitable may accept amendments to this application provided by me or under my authority.

• No Registered Representative has the authority to make or modify any Contract on behalf of Equitable, or to waive or alter any of Equitable’s rights and regulations. Equitable must agree to any change made to the Contract and benefits applied for, or to the age at issue, in writing.

• Charges under the Contract generally apply for the duration of the Contract.

• Fees, Charges and Investment Options vary by Series.

• Unless I elect DCA, if I elect any of the Segment Types available, once amount(s) are received, they will be placed in the applicable Segment Type Holding Account(s) until swept into the Segment Type(s) on the Segment Start Date provided that all Segment Participation Requirements specified in the Contract are met.

• Each Segment in the Structured Investment Option provides a rate of return tied to the performance of specified index. The

Segments are not index funds and do not invest in underlying mutual funds that hold investments tracked by a specified index.

• The Segment Rate of Return for Segments using one Segment Option may differ from Segments using different Segment

Options even though the Segments have similar durations and/or track similar indices. In addition, because of the way the Segment Rate of Return is calculated for Step Up Segments, I understand that in certain circumstances a very small difference in the Index Performance Rate can result in a much larger difference in the Segment Rate of Return for those Segments.

• The prospectus and applicable supplements contain more complete information including the limitations, restrictions and conditions that apply to the Contract.

• In the case of IRAs and Qualified Plans, by signing this application I acknowledge that I am buying the Contract for its features and benefits other than tax deferral. IRAs and Qualified Plans derive tax deferral from the Internal Revenue Code and therefore the tax deferral feature of the Contract does not provide additional benefits.

• The S&P 500® Price Return Index is a product of S&P Dow Jones Indices LLC (“SPDJI”), and has been licensed for use by Equitable. The Investment Edge contract is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P or any of their respective affiliates (collectively, “S&P Dow Jones Indices”). S&P Dow Jones Indices makes no representation or warranty, express or implied, to the owners of the Investment Edge contract.

• Investment Edge is not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to such product or any index on which such product is based. The prospectus contains a more detailed description of the limited relationship that MSCI has with Equitable and any related product.

OPTIONAL RETURN OF PREMIUM DEATH BENEFIT DISCLOSURE. I/WE UNDERSTAND AND ACKNOWLEDGE THAT:

• There is an additional charge if the Return of Premium Death Benefit (“ROP DB”) is elected.

• The ROP DB generally cannot be terminated once it is elected.

• The ROP DB does not provide an Annuity Account Value or Cash Value and cannot be withdrawn.

• If I/We elect the ROP DB, the maximum age I/We may make contributions to the Contract will be through age 75 (or first

Contract Date Anniversary if later) of the older of the original Owner or Annuitant.

• Withdrawals under the Contract may reduce my ROP DB.

• The ROP DB may be of limited use if required minimum distributions apply, now or in the future, to my Contract because withdrawals that are made from this Contract to meet the required amount may significantly reduce the benefit.

Prospectus Information: I acknowledge that I have received the most current prospectus and supplements, for Investment Edge ADV. After reviewing my financial information and goals with my Registered Representative, I believe that this Certificate/Contract will meet my financial goals.

X04487_National Investment Edge — Series ADV

2021 App 02 IE ADV Page 8 of 10

13. Signature and Acknowledgements (Continued)

Consent for Delivery of Initial Prospectus on CD-ROM:

☐ Yes. By checking this box and signing the enrollment form/application below, I acknowledge that I received the initial prospectus on computer readable compact disk ‘‘CD’’, and that my computer has a CD drive and I am able to access the CD information. In order to retain the prospectus indefinitely, I understand that I must print or download it. I also understand that I may request a prospectus in paper format at any time by calling Customer Service at [1-800-789-7771], and that all subsequent prospectus updates and supplements will be provided to me in paper format, unless I enroll in Equitable’s Electronic Delivery Service.

When you sign this application, you are agreeing to the elections that you have made in this application and acknowledge that you understand the terms and conditions set forth in this application.

Contract State:

We will issue and deliver a contract to you based upon your state of primary residence. If you sign the enrollment form/ application in a state other than your primary residence state: I certify that either: ☐ I have a second residence where the enrollment form/application was signed (the state of sale) or ☐ I work or maintain a business in the state where the enrollment form/application was signed (the state of sale).

(Please check one)

X Owner Signature City, State Date (MM/DD/YYYY)

X Joint Owner Signature City, State Date (MM/DD/YYYY)

X Annuitant Signature (if different than Owner) City, State Date (MM/DD/YYYY)

X Joint Annuitant Signature City, State Date (MM/DD/YYYY)

X04487_National Investment Edge — Series ADV

2021 App 02 IE ADV Page 9 of 10 REQUIRED

14. Registered Representative Section

A. Did you (i) verify the identity by reviewing the driver’s license/passport of the Owner, or in the case of an entity owner, obtain documentary evidence of entity’s existence (e.g. articles of incorporation, trust agreement, etc.), and (ii) inquire about the source of the customer’s assets and income? Yes No B. Is the Proposed Owner/Annuitant, or is their family member or close associate, a government, political official or foreign military official? Yes No If “Yes”, please provide explanation of position and relationship C. Is the Proposed Owner/Annuitant currently an Active Duty* Member of the Armed Forces? Yes No D. NORTH CAROLINA ONLY: I certify that I have truly and accurately recorded on the application the information provided by the Proposed Owner.

☐ ☐ ☐ ☐ ☐ ☐

(If ‘‘Yes’’, you must also submit a complete and signed LIFE INSURANCE/ANNUITY DISCLOSURE TO ACTIVE DUTY MEMBERS OF THE ARMED FORCES.)

* Active Duty means full-time in the active military service of the United States and includes members of the reserve component (National Guard and Reserve) while serving under published orders for active duty or full-time training. The term does not include members of the reserve component who are performing active duty or active duty for training under military calls or orders specifying periods of less than 31 calendar days.

X Primary Registered Representative Signature Social Security Number Rep Code

% Print Name Phone Number

Email Address Rep Location

X Registered Representative Signature Social Security Number Rep Code

% Print Name Phone Number

Cat No. 162334

X04487_National Investment Edge — Series ADV

2021 App 02 IE ADV Page 10 of 10 REQUIRED